Академический Документы

Профессиональный Документы

Культура Документы

Capital Budetting - Docx2

Загружено:

Saggam RaviОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Capital Budetting - Docx2

Загружено:

Saggam RaviАвторское право:

Доступные форматы

A STUDY ON

CAPITAL BUDGETING

AT

PENNAR INDUSTRIES LTD

A Project Report Submitted i p!rti!" #u"#i""met o# t$e

Re%uiremet& #or t$e !'!rd o# t$e De(ree

)ASTER O* BUSINESS AD)INISTRATION

+A,A-ARLAL NE-RU TEC-NOLOGICAL UNI.ERSITY

Project report &ubmitted b/

DONOOR 0S-I.A 1U)AR

234L53E55356

Uder t$e E&teem (uid!ce o#

)r0)0DORAS,A)Y NAI1

A&&t0 Pro#0 Dept0 o# )BA

TRR COLLEGE O* ENGINEERING

2APPRO.ED BY AICTE 7 A**ILIATED TO +NTU-6

Io"e2869 P!t!c$eru2)69 )ed!:2Di&t69

-YDERABAD

24534;453<6

CERTI*ICATE

TRR COLLEGE O* ENGINEERING

2Appro8ed b/ AICTE9 Reco(i=ed b/ Go8t0 o# A0P !d A##"i!ted to +0N0T0U0-0 -/der!b!d6

Io"e2.69 P!t!c$eru2)69 )ed!:2Di&t6

DEPART)ENT O* )ANAGE)ENT STUDIES

This is to certify that the project work entitled CAPITAL BUDGETING is authentic record of

the research work carried out by DONOOR0 S-I.A 1U)AR (12L01E0010) in partial

fulfillent of the award of the de!ree of )ASTER O* BUSINESS AD)INISTRATION is a

bonafide work carried out by hi"

The inforation ebodied in this report has not been subitted to any other uni#ersity for the

award of the de!ree"

$nternal %uide &ead of the 'epartent

)R0)0DORAS,A)Y NAI1 )r0 P0 1RIS-NA D,AIPAYANA )0CO)

A&&t0pro#0 Pro#e&&or

'ept"of ()* 'ept" of ()*

E>TERNAL E>A)INER

DECLARATION

$ hereby declare that the project work entitled CAPITAL BUDGETING at PENNAR

INDUSTRIES LTD is an authentic record of the research of the work carried out by e for the

award of partial fulfillent for the award of the de!ree )ASTER O* BUSINESS

AD)INISTRATION fro TRR COLLEGE O* ENGINEERING is a bonafied work carried

out by e"

The inforation ebodied in this report has not been subitted to any other uni#ersity for the

award of de!ree"

D!te?

P"!ce? DONOOR 0S-I.A 1U)AR

2 34L53E55356

AC1NO,LEDGE)ENT

*part fro the efforts of e+ the success of this project depends lar!ely on the encoura!eent

and !uidelines of any others" $ take this opportunity to e,press y !ratitude to the people who

ha#e been instruental in the successful copletion of this project"

$ a hi!hly obli!ed to our respected principal prof" 10SRINI.AS RAO for his #aluable support

and interest throu!hout the in#esti!ation"

$ a also #ery uch thankful to )r0P01RIS-NA D,AIPAYANA 2-OD6 for their kind help

durin! y project"

$ would like to e,tent y sincere thanks to )r010Aj!/ ('ept ana!er) of PENNAR

INDUSTRIES LTD" *nd to the ana!eent who helped e a lot in the project work and who

!a#e e an opportunity to do this project in their corporation"

$ a hi!hly indebted to y respected super#isor )r0)0DORAS,A)Y NAI1+ *ssistant

professor ()* departent under whose constant super#ision+ eticulous !uidance and

encoura!eent+ this work has been carried out to copletion" $ thank hi for the freedo of

thou!ht+ e,pression and hi trust+ which was !reatly bestowed upon e"

Last but not least $ thank all other staff ebers and technical staff+ friends who directly or

indirectly assisted us in this project work"

-roject *ssociate

DONOOR S-I.A 1U)AR

235L53E554@6

ABSTRACT

The project titled CAPITAL BUD+ETING IN PENNAR INDUSTRIES LTD ais

at e#aluatin! the capital bud!etin! or in#estent decisions to set up a facility at

-E..*/$.'01T/$E1 LT' for anufacturin! the dru!s for supplies directly fro bulk units"

The followin! capital bud!etin! techni2ues are used for e#aluation assuin! 34 as discountin!

factor"

.on5'iscountin! Techni2ues like -*6 )*78 -E/$9' (-)-)+ *:E/*%E /*TE 9;

/ET0/. (*//)"

'iscountin! Techni2ues like .ET -/E1E.T :*L0E (.-:)+ $.TE/.*L /*TE 9;

/ET0/. ($//)+ and -/9;$T*)$L$T6 $.'E< (-$)"

7apital bud!etin! or in#estent decisions are of considerable iportance to the fir"

1ince they tend to deterine its #alue by influencin! its !rowth+ profitability and risk"

STABLE O* CONTENTS

C$!pter Tit"e P!(e No0

1

$.T/9'07T$9.

9)=E7T$:E1 9; T&E 1T0'6

-0/-91E 9; T&E 1T0'6

(ET&9'9L9%6

L$($T*T$9.1 9; T&E 1T0'6

2

$.'01T/6 -/9;$LE

79(-*.6 -/9;$LE

> L$TE/*T0/E /E:$E?

@ '*T* *.*L61$1 *.' $.TE/-/ET*T$9.

A

;$.'$.%1

B

10%%E1T$9.1

C

79.7L01$9.

B

)$)L9%/*-&6

C-APTER 3? INTRODUCTION

INTRODUCTION

The ter capital bud!etin! refers to lon!5ter plannin! for proposed capital outlays and

their financin!" Thus+ it includes both risin! of lon!5ter funds as well as their utiliDation" $t ay

this be defined as The firEs decision to in#est its current funds ost efficiently in the lon!5

ter assets in anticipation of an e,pected flow of benefits o#er a series of years" The priary

objecti#e of financial analysis is to assist in decision akin!"

*n efficient allocation of capital is the ost iportant finance function in the odern

ties" $t in#ol#es decision to coit the firEs funds to the lon!5ter assets" The in#estent

decisions of a fir are !enerally known as the 7apital )ud!etin! or 7apital E,penditure

'ecisions" * 7apital )ud!etin! 'ecisions aybe defined as the firEs decision to in#est its

current funds ost efficiently in the lon!5ter assets in anticipation of an e,pected flow of

benefits o#er a series of years"

I8e&tmet Deci&io&

9ne of the basic 2uestions faced by the financial ana!er is &ow should the scarce

resources of the fir is allocated to !et the a,iu #alue for the firF This refers to

in#estent decisions+ which deal with in#estent of firEs resources in lon!5ter (fi,ed)

assets and short ter (current) assets or 7apital )ud!etin! 'ecisions and ?orkin!

7apital (ana!eent"

7apital )ud!etin! is a decision akin! process for in#estent in assets that ha#e lon!

ter iplication+ affect the future !rowth and profitably of the fir and basic

coposition and assets i, of the fir"

(easurin! the benefits and costs associated with each alternati#e option in ters of

increental cash flows"

E#aluatin! different proposals in the li!ht of return e,pected by the in#estors of the fir

and the return proised by the proposal

*pplyin! different techni2ues to select an alternati#e with objecti#e of a,iiDation of

#alue of the fir"

Typically+ capital bud!etin! decision in#ol#es rather lar!e cash outlays and coits the

fir to a particular course of action o#er a relati#ely lon! period and conse2uently+ e#ery

care should be taken care of" The future risks and uncertainties should be incorporated in

the e#aluation procedure so the future cash flows occur as they are intended to be"

T/pe& o# i8e&tmet deci&io&?

The followin! are the #arious types of in#estent decisions

Idepedet I8e&tmetG These are proposals+ which do not copete with one another

in a way that acceptance of one precludes the possibility of acceptance of another" The

case of such proposals the fir ay strai!htway accept or reject a proposals+ which

!i#e a hi!her+ return than a certain desired rate of return+ are accepted and the rest are

rejected"

Coti(et i8e&tmet? These are proposals whose acceptance depends on the

acceptance of one or ore other proposals" ;or e,aple a new achine has to be

purchased on account of substantial upon e,pansion of plant" ?hen a contin!ent

in#estent proposal is ade+ it should also contain the proposal on which it is dependent

in order to hate a better perspecti#e of the situation"

)utu!""/ EAc"u&i8e I8e&tmet? These are proposals+ which copete with each other in

a way that the acceptance of one precludes the acceptance of other or others" ;or

e,aple+ if a copany is considerin! in#estent in one of two teperature control

systes+ acceptance of one syste will rule out the acceptance of another" Thus two or

ore utually e,clusi#e proposals cannot be accepted" 1oe techni2ue has to be used

for selectin! the better or the best one" 9nce this is done other alternati#es !et

autoatically !et eliinated"

)!:e Or Bu/ Deci&io? (ake or buy decision is no lon!er a short run operatin!

decision and it becoes a proble of capital e,penditure which necessitates

consideration of re2uired rate of return" * copany has to take this decision+ when it has

to face the followin! choice"

)uy certain part or sub5asseblies fro outside suppliersH or

0se a#ailable capacity to produce the ite within the factory"

$n this decision+ the followin! are ajor considerationsG

7osts that will be incurred under both alternati#es are not rele#ant to the analysis

-otential uses of a#ailable capacity should be considered"

-ertinent 2uantitati#e factors ust be e#aluated in the decision process" These

considerations include price stability fro suppliers+ reliability of deli#ery and 2uality

specifications of aterials or coponents in#ol#ed"

*!ctor& !##ecti( c!pit!" i8e&tmet deci&io&?

The followin! are the four iportant factors+ which are !enerally taken into account while

akin! a capital in#estent decisionG

T$e Amout O# I8e&tmet? $n case a fir has unliited funds for in#estent it can

accept all capital in#estent proposals which !i#e a rate of return hi!her than the

iniu acceptable or cut5off rate" &owe#er+ ost firs ha#e liited funds and

therefore capital rationin! has to be iposed" $n such an e#ent a fir can take only such

projects which are within its eans" $n order to deterine which project should be taken

up on the basis the projects should be arran!ed in an ascendin! order accordin! to the

aount of capital in#estent re2uired"

Comput!tio O# C!pit!" I8e&tmet Re%uired? The ter capital in#estent re2uired

refers to the net cash outflow+ which is the su of all outflows and inflows occurrin! at

Dero tie period" The net outflow it deterined by takin! into account the followin!

factors"

7ost of the new project

$nstallation cost

?orkin! capital

Proceed& #rom &!"e o# !&&et? * new asset ay be purchased for replaceent of an old asset" The

old asset ay therefore be sold away" The cash realiDed on account of such sale will reduce the

cost of new in#estent"

T!A E##ect&?the aount of profit or loss on the sale of assets ay affect the cash flows on

account of ta, affects" The profit or loss is ascertained by takin! into account the cost of

assets+ it book #alue and the aount realiDed on its sale" The ta, liability will be different

in each of the followin! case

?hen the asset is sold at its book #alue"

?hen the asset is sold at a price hi!her than the book #alue but lower than its cost

?hen the asset is sold at a price hi!her than its cost" ?hen the asses is sold lower

than its book #alue"

I8e&tmet A""o'!ce?This is allowed to encoura!e capital in#estent in achinery and

e2uipent" 1uch allowance thus reduces the cost of the initial in#estent of the project"

)iimum R!te O# Retur O I8e&tmet? The ana!eent e,pects a iniu rate

of return on the capital in#estent" The iniu rate of return usually decides on the

basis of the cost of capital" ;or e,aple+ if the cost of capital is 104 the ana!eent

will not like to accept a proposal+ which yields a rate of return less than 104" The project

is !i#in! yield below the desired rate of return will therefore be rejected"

Cut;O## Poit? The cut5off point refers to the point below which a project would not be

accepted" ;or e,aple+ if 104 is the desired rate of return the cut5off point to 104" The

cut5off point ay also be in ters of period" ;or e,aple if the ana!eent desire that

the in#estent in the project should be recouped in three years+ the period of three years

would be taken as the cut5off period"

Retur EApected *orm T$e I8e&tmet? 7apital in#estent decisions are ade in

anticipation of incre>ased return in the future" $t is therefore #ery necessary to estiate

the future the return or benefits accruin! fro the in#estent proposals" There are two

proposals a#ailable for 2uantifyin! benefits fro capital in#estent decisions" They areG

*ccountin! profitG the ter accountin! profit is identical with incoe concept used in

accountin!"

7ash flowsG in this depreciation char!es and other aortiDation char!es on the fi,ed

assets are not subtracted fro !ross re#enue because no cash e,penditure is in#ol#ed"

OB+ECTI.ES O* T-E STUDY?

The followin! objecti#es of the present study are

To study the in#estent decisions in the select or!aniDation"

To understand the #arious ethods for deterinin! the siDe of the 7apital )ud!et and

e#aluatin! in#estent proposals"

To !i#e appropriate su!!estions on capital bud!etin! techni2ues for the de#elopent of

the select or!aniDation"

NEED *OR T-E STUDY

7apital bud!etin! decisions are the in#estent decisions of the fir !enerally known as

the capital bud!etin!+ or capital e,penditure decisions" * capital bud!etin! decision ay be

defined as the firEs decision to in#est in current funds ost efficiently in the lon! ter assets in

anticipation of an e,pected flow or benefits o#er a series of years" The lon!5ter assets are those

that effect the firEs operations beyond the one year period" The firEs in#estent decision

would !enerally include e,pansion+ ac2uisition+ oderniDation and replaceent of the lon!5ter

assets" 1ale of a di#ision or business is also an in#estent decision" 'ecisions like the chan!e in

the ethods of sales distribution+ or an ad#ertiseent capai!n or research and de#elopent

pro!rae ha#e lon!5ter iplications for the firEs e,penditures and benefits+ and therefore

they should also be e#aluated as in#estent decision" &ence+ the project ais at e#aluatin! the

in#estent proposal for settin! up different facilities in -ennar $ndustries Liited+ &yderabad"

)ET-ODOLOGY

The study has been collected throu!h secondary sources" The secondary data has been

collected fro the A years annual reports (200A50C to 2010511) of the -ennar $ndustries+ )ooks+

=ournals+ (a!aDines+ -eriodicals and copany websites"

SCOPE O* T-E STUDY

The scope and period of study is restricted to the followin!

The scope is liited to the operations of the -ennar"

The inforation obtained fro the priary and secondary data was liited to -ennar"

The 8ey inforation perforances indicated were taken fro 200A50C to 2010511

The -BL+ The )alance sheet was on the last fi#e years"

7oparison analysis was done in coparison of sisters units"

LI)ITATIONS O* T-E STUDY

The followin! are the liitations of the study

The study is conducted with the data a#ailable and analysis is ade accordin!ly"

'ue to the confidential financial records+ the data is not e,posed so the study ay not be

detailed and full5fled!ed"

1ince the study is based on financial data that are obtained fro the financial stateents+

the liitations of financial stateent shall be e2ually applicable"

The analysis ay not be accurate as the a#ailable data is liited"

C-APTER;4

PRO*ILE O* T-E ORGANIBATION

INDUSTRY PRO*ILE

$ndia is the I

th

lar!est producer of steel in the world" $ron and steel for a key coponent

of econoic de#elopent of the country" Econoic de#elopent of $ndia re#ol#es around the

$ron and 1teel $ndustry" $tEs an industry with century old history" 'ue iportance has been !i#en

to $ron and 1teel industry by the !o#ernent policy o#er the last decade"

$tEs a historical fact+ that $ndia occupied a pre5einent position in $ron and 1teel akin! a

day of year" &owe#er+ the era of odern 1teel $ndustry of $ndia be!an only in 130J with a

launchin! of T*T* $ron B 1teel 7opany in =ashedpur+ )ihar" This plant went into operation

in sta!es by 1311512" $n 1330+ the $ron B 1teel copany in )urnpur+ near *sansol in ?est

)en!al" $n 132>+ The (ysore $ron B 1teel work+ the first public sector effort+ coenced

operations in )hadra#ai in 8arnataka"

$n the pre5independence day+ these three units were the ain steel producers in country+

turnin! out 0"1J illion tonnes pi! iron and a illion tonnes steel per year" Today+ the industry

with C inte!rated plants+ J

th

under construction and 1C0 odd any steel plants has coe a lon!

way"

The $ndustrial -olicy stateent of 13AC placed $ron and 1teel in schedule5*+ which

eant that all new units in the industry would setup only by the !o#ernent"

The pri#ate units already in e,istence+ would howe#er be peritted to e,pand their

capacities" *s the policy akers decided to accept the (ahalanobis a odel for de#elopent+

and all5out effort was ade durin! second plant period to lay a stron! industrial base" $n line

with these+ three inte!rated steel plants each with one illion tonne steel in!ot capacity were

setup in /aukela+ )hilai+ and 'ur!apur" These plants cae into operation in sta!es between 13AC

and 13C2" 'urin! this period+ Tata $ron and 1teel 7opany (T$179.) and $$179 doubled their

capacities and the total in !ot capacity rose to C illion tonnes" The steel industry in !eneral is on

the upswin!+ due to stron! !rowth in deand propelled particularly by the deand of steel in

7hina" The world scenario coupled with strin! doestic deand has benefited the $ndia 1teel

$ndustry"

'urin! *pril5'eceber 200A+ production of finished steel recorded a !rowth of @4 o#er

the correspondin! period of the pre#ious year to reach 2I"> illion tonnes" This !rowth rate

howe#er+ was lower that the !rowth rate in precedin! two years" 7onsuption of finished steel

!rew by A"34 and increased to 2@"3 illion tonnes+ durin! the sae period"

The faster !rowth of doestic consuption relati#e to production was reflected in a

declined in the e,port of finished steel by 1I"24 in copared to the correspondin! period of

pre#ious production of $ron bein! consued as a raw aterial in the process itself"

?orld steel prices are risin! fro 'eceber 2001 onwards" The price increase of hot

rolled coils+ durin! =an 2002 to 'ec 2002 fro 01 K1@051JA per tonne to about 01 KAA05CA0 per

tonne" The prices of steel eltin! scrap rose fro a low of 01 K3>53@ per tonnes to 01 K2JA5

2IA per tonne as part of buildin! infrastructureH $ndia has started a treendous pro!rae of

hi!hway construction across the country" *s a result+ doestic steel deand has risen" The

increased production of steel turned led to raise in prices of raw aterials like scraps+ cookin!

coals and etallur!ical coke" The wholesale price inde, of iron and steel has increased by >A4

to 2024 in 200> and 200@ and further to 2>J"I4 in 200@ upto 'ec >1+ 200@"

$ndiaEs 1teel $ndustry is ore than a century old" )efore the econoic refors of the

earlyE 1330Es the $ndia 1teel industry was a predoinantly re!ulated one with the public sector

doinatin! the industry" Tata 1teel was the only ajor pri#ate sector copany in#ol#ed the

production of steel in $ndia" 1ail and Tata 1teel ha#e traditionally been the ajor steel producers

of $ndia" $n 1332+ the liberaliDation of the $ndia econoy led to the openin! up of #arious

industries includin! the steel industry" This led to the increase in the nuber of producer+

increased in#estents in the steel industry and increased production capacity" 1ince 1330+ ore

than /s"13+000crores (01 K@@J0"AI illion) has been in#ested in the steel industry of $ndia"

)A+OR PLAYERS AND +OINT .ENTURES

1teel authority of $ndia Ltd" is the leadin! steel akin! copany in $ndia+ itEs a fully

inte!rated $ron and 1teel aker+ producin! both basic and special steel for doestic construction+

en!ineerin! power+ autooti#e and defense industries and for sale an in e,port arket"

%o#ernent of $ndia owns about IC4 of 1$*LEs e2uity and retains #otin! control of the

copany" &owe#er 1*$L by the #irtue of .a#aratna status+ enjoys ai!nificant operational and

financial autonoy"

)!jor uit& o# SAIL !re !& uder

Ite(r!ted Stee" P"!t&

)hilal 1teel -lant located at 7hhattis!arh"

'ur!apur 1teel -lant located at ?est )en!al"

/ourkela 1teel -lant located at 9rissa"

)okaro 1teel -lant located at =harkhand"

Speci!" Stee" P"!t&

*lloy 1teel -lant in ?est )en!al"

1ale 1teel -lant in Tail .adu"

:is#es#arya $ron 1teel plant in 8arnataka"

Sub&id!rie&

$ndian $ron and 1teel 7opany in ?est )en!al

(aharashtra Electro 1elt Ltd" in (aharashtra"

)hilai 9,y!en Ltd"+ in .ew 'elhi"

+OINT .ENTURES

1*$L has prooted a joint #enture in different are ran!in! fro power plants to e5coerce

.T-7 1*$L -ower 7opany -#t" Ltd setup in arch 2001+ this A05A0 =oint #enture

between 1*$L and national Theral -ower 7orporation operates and ana!es the

capti#e power plant to 'ur!apur and /ourkela"

)okaro -ower 1upply 7opany -#t" Ltd" These A05A0 joint #enture between 1*$L and

the 'aodar :alley corporation fored in =an 2002 in ana!in! the >02 (? power

!eneration and 1II0 tonnes per hours

)hilai electric 1upply copany -#t" Ltd" *nother 1*$L5.T-7 =oint #enture on A05A0

fored in arch 2002 ana!es the JA (? power plants of )ilai 1teel plants which has

additional capacity of producin! 1A0 tonnes of steel per year"

1*$L )ased 1er#ice 7enter -#t" Ltd" 1*$L has fored a joint #enture with )(?

$ndustries Ltd" on @05C0 bases to proote us ser#ices center of )okaro with objecti#es of

addin! #alue to steel"

/oelt51*$L ($ndia) Ltd" * join! #enture between 1*$L+ .ational (ineral 'e#elopent

7orporation and /ussian propter for akin! /oelt technolo!y de#eloped by /ussia

of reducin! of $ron bearin! aterials+ this is carried out with carbon in sin!le sta!e

reactor with the use of o,y!en"

GO.ERN)ENT POLICY

1ince 1331532 the !o#ernent has announced and ipleented followin! ajor chan!es in the

$ron and 1teel $ndustry"

/eo#al of $ron and 1teel fro the list of industries of reser#ed for he public sector"

E,eption of $ron and 1teel $ndustry fro the pro#isions of copulsory licensin!"

$nclusion of $ron and 1teel in the list of hi!h priority industry for the purpose of forei!n

in#estent"

'ere!ulation of pricin! and distribution of iron and steel"

/eduction of duty on iport of capital !oods"

LiberaliDation of iport and e,port policy"

CO)PANY PRO*ILE?

*n industrial and ser#ices business !roup based in &yderabad stri#in! to eet the

challen!es of a new $ndia" $nspired by !lobal #ision+ propelled by entrepreneurial dri#e and

oti#ated to achie#e+ the -E..*/ !roup is sur!in! a head akin! an in#aluable contribution to

industry+ with a ajor presence in steel+ aluinu+ profiles and cheicals"

L-ennar $ndustries Ltd"L+ the fla!ship copany of the -ennar %roup had its be!innin!s in

13IJ+ in the for of -ennar 1teel Ltd as a stand5alone 7old /ollin! unit+ which has since

e#ol#ed into ulti location enterprises" The Turno#er of the copany has !rown to o#er /s">"C

billion in 133I fro a odest /s"0"@ billion ten years a!o and now present turno#er is /s"@I0

crore per annu"

The coercial production at -ennar $ndustries Ltd was started in ;eb 13II at $snapur in

(edak district at a distance of about @0ks fro &yderabad+ with a capacity of 12+000 tonnes

per annu+ and takin! ad#anta!e of deand and supply isatch in cold rolled steel coils"

*on! A0 cold rolled steel units in $ndia+ -ennar stands aon! the first three" The copany

ade profits in the #ery first year of operation" The capacity has been increased fro 12+000

T-* to >C+000 T-* in (arch" 1331" The capacity a!ain has been enhanced fro >C+000 T-* to

C0+000 T-* durin! 133J to fully e,ploit the deand for the product with total outlay of /s" 2A

crore+ funded by $')$ and ;$7$ to the e,tent of /s" 1I"A crore and throu!h internal accruals of

/s" C"A crore" -resent capacity (200A) is 1+ 20+000 (T per annu"

-ennar $ndustries has recei#ed 1A053002 2uality certification fro /?T0:+ %erany

and has reaffired its coitent to achie#in! e,cellence in the 2uality of products and aiin!

for coplete custoer satisfaction"

-ennar $ndustry Ltd" has been specialiDin! in the anufacture of world class cold rolled

steel in 'eep 'rawin! and E,tra 'eep 'rawin! #arieties" 1ince+ 133> -ennar $ndustries Ltd" has

also focusin! on anufacturin! and arketin! special steel such as 1T @2+ (ediu carbon+

sprin! steels etc" 'urin! 133A+ -ennar $ndustry Ltd" setup press coponents di#ision in line with

its coitent to supply custoers with #alue added products" This di#ision is successfully

caterin! to both auto and white !oods industries" -ennar $ndustries Ltd" finds e,tensi#e

application in the autoobile+ autooti#e coponents+ custoer durables+ bearin! and !eneral

en!ineerin! se!ents" The arketin! offices located at (ubai+ -une+ 7hennai+ )an!alore+

7oibatore+ &yderabad+ ;aridabad and .ew 'elhi caters to a wide custoer base"

$ts one of the ost odern 7old /ollin! (ill cople,es in the country with e2uipent

such as @ &i57old /ollin! (ill L-M%as 'iesel fi,ed annealin! furnaces" 7/ 1ittin! lines+ 7r 7ut5

to5len!th lines etc" 1upplied by anufacturers with in the country with know5howMcollaboration

fro world faous copanies such as wean united 01*+ L9$5%erany+ 1taco501*+ 1ieens5

%erany+ ;lakt51weden etc" The copany is professionally ana!ed by people with

considerable e,perience in the 7old /olled 1teel strips $ndustry" -ennar 1teel has established

itself as a anufacturer of world5class cold rolled coils and sheets of deep drawin! and e,tra

deep drawin! #arieties"

NSL )ERGES INTO PSL

9n the e#enin! of .o#eber 23+ 133J (r" 8"1" /aju+ 7hairan+ .a!arjuna !roup and

(r" ." /ao+ 7hairan of -ennar %roup addressed joint counication eetin! at .1L factory

to forally announce the er!er of .1L factory into -ennar 1teels Ltd to e,tent their business in

the !rowth of steel production B now has been reco!niDed as L-ennar $ndustries LtdL"

.1L was ;la!ship 7opany of .a!arjuna %roup+ fro a cold rolled steel strips

anufacture in 133J+.1L has e,panded its production capacity si, fold and has di#ersified into

hi!h profile !rowth area as cold rolled fored section and leather products in association with

the under license fro world leaders :oest5*lpine $ndustrial 1er#ices (T*$1)+*ustria"

PRODUCT )ANU*ACTURE

-ennar $ndustries Ltd is a ulti5product and ulti5location enterprise" The 7opany

anufactured #ariety of product" -ennar is $195300152000 certified copany fro /?5T0:+

%erany and coitted to achie#in! e,cellence in followin! products"

7old /olled 1teel 1trips"

7old /olled ;ored 1ections"

En!ineerin! 7oponents"

-recision Tubes"

The ;abrication

The anufacturin! facilities of -ennar $ndustries Ltd" are located near &yderabad

($snapurB-atancheru)+ which is considered as !eo!raphical center of $ndia" These facilities

e,peditious ser#icin! of custoers in the arkets located in .orth+ ?est+ 1outh $ndia+ national

le#el and also at international le#el+

COLD ROLLED STEEL STRIPS 2CRSS6

7/11 di#ision with its uni2ue units at -atancheru+ $snapur and 7hennai has cobined an

annual 7old /ollin! capacity of 1"20"000 etric tonnes" -ennar anufactures steel strips fro

C"00 to J"A0 width and thickness ran!e of 0"2A to A both in cold coil and steel fored"

This cold rolled steel strips is applicable inG5

Two5?heeler

;our5?heeler

/efri!erator

*ir conditioner

En!ineerin! -roducts

Proce&& O# )!u#!cturi( O# CRSS A&?;

/aw (aterial

$nspection

&/51littin!

-ickilin!

/ollin!

*nnealin!

1kin -ass

Co"d Ro""ed *ormed Sectio& 2CR*S6

* strate!ic anne,ure of Tarapur based press etal unit of $T !roup of copanies in 133I

has ensured" The eer!ence of -ennar as the undisputed leader of 7old /olled ;orin! (ills+

tools and work force of $T unit at Tarapur ha#e been absorbed in full" $n addition+ 7old /olled

;orin! (ills and all tools e,cludin! work force ha#e been connected fulltie in $T 7hennai

unit" -ennar now ha#e a anufacturin! capacity of ore than about @0+000 (T of 7old /olled

;ored 1ections per annu+ the lar!est in the country"

This 7/;1 is applicable inG

*utoobile

/ailway

7onstruction

-ollution control

%eneral en!ineerin!

(aterial

7/ 1littin!

7ut to len!th

-ackin! B 'ispatch

/oll

;orin!

/"(

/ecei#in!

/aw

(aterials

-ost

;orin!

9ilin! B

-aintin!

;inal

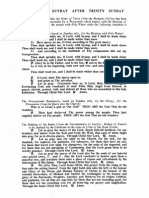

;i!ure 2"1 (anufacturin! -rocess

ENGINEERING CO)PONENT DI.ISION

$n this di#ision the en!ineered ites are produced in press shock operations feedin! to different

industries" This di#ision is e2uipped with hydraulic+ echanical and pneuatic presses+ shearin!+

laths and buffin! achines+ for production operations"

The en!ineerin! coponent is applicable toG5

/efri!erator

Two5?heeler

$ndustrial 7opressor

%eneral en!ineerin! ites

7onstruction

;our5?heeler

DISTRIBUTION O* PRODUCTS )ANU*ACTURED

'ispatch

-ackin!

)L*.8$.%

'/*?$.%51

T/$(($.%

T0/.$.%

)0;;$.%

'/*?$.%52

.9T7&$.%

-$E/7$.%

;L*/$.%

7&*(;E//$.%

$.1-E7T$9.

-*78$.%

'$1-T*7&

-ennar has an e,tensi#e sales network spread all o#er $ndia" $n doestic arket -ennar

supplies their 2uality aterial product to the #arious field such asG

7onstruction sector

*uto5sector

Two5wheeler

;our wheeler sector

Electrical appliances

/ailway sector

So9 t$eir cu&tomer& !re?;

Tata (otor

LBT

*shok Leyland

T:1 (otor

*lston -ower

Eicher (otor

(ahindra B (ahindra

Thera, Ltd

8irloskar 7opeland

:oltas

/eliance

&arsha En!ineerin!

)harath Earth (o#ers

Tecuesh

)-L

Electolu, $ndia

:ijay Electricals

Lucas T:1

&industan 7onstruction

&ero &onda

.ISION

-ennarNs :ision it to be a !lobally reputed en!ineered etal product copany+ -ennar endea#ors

to ha#e stron! and endurin! relationship with its custoers based on 2uality and ser#ice"

)ISSION

-ennarNs ission is to le#era!e its ode infrastructure+ technical e,pertise and decades of

e,perience to pro#ide hi!h 2uality and cost effecti#e etal product to its custoers" -ennar is

coitted to ensurin! rewardin! e,perience to its custoers" -ennar works closely with

shareholders+ suppliers+ custoers and eployees to ensure attracti#e econoic returns for all

the stake holders"

CUALITY POLICY

L?e+ at -ennar are coitted to producin! and pro#idin! 1teel based products and associated

ser#ices for custoers all o#er the world" ?e stri#e to achie#e e,cellence in the 2uality of

product" ?e anufacture and the ser#ice we pro#e to our custoer" $t is out endea#ors to create a

workin! en#ironent where oti#ated eployees counicate freely and where inno#ation is

encoura!ed to enable continual ipro#eent in all areasL"

?e work to!ether to achie#e 79(-LETE 701T9(E/ 1*T$1;*7T$9. T&/90%& T9T*L

O0*L$T6 (*.*%E(E.T"

ORGANISATION CULTURE

$n -ennar 1teel $ndustry Ltd" all the eployees are sincere+ honest+ hardworkin! and loyal with

the or!aniDation" They !i#e ephasis to aintain discipline in $ndustry"

-ennarNs people are well5known for tie punctuality" They produce royal 2uality product and

deli#er on the desired tie"

CO)PETITOR *OR PENNAR INDUSTRY LTD

The (ajor 1teel producers in $ndia and ajor copetitor to -ennar $ndustries Ltd"+ are as

followsG5

T$179

Essar 1teel

=indal :ijayna!ar 1teel Ltd

=indal 1trips Ltd

=$179

1aw -ipes

0tta 1teel Ltd

$spat $ndustries Ltd

(ukund $ndustries Ltd

Tata 11L Ltd

1esa %oa Ltd

AC-IE.E)ENT AND A,ARDS

)est supplier award fro *'9. en!ineerin!+ 87L+ TEL79"

;irst 7old /olled ;ored sections business to be awarded $19 3001 certification in

$ndia by /?T0:+ %erany"

9ne of the best 7/11 suppliers+ awarded fro E$7&E/

*utoobile supplier award fro T:1"

,EL*ARE *ACILITIES AT PENNAR INDUSTRIES LTD0

-ennar $ndustries Ltd" is considered bein! one of the hu!e anpower consistin! industries in

&yderabad" 1oe eployees workin! as a peranent and soe as a contract basis" *ll welfare

facilities would coe under different acts like ;actories *ct 13@I+ The 7ontract Labour

(/e!ulation B *bolition) *ct+ 13J0"

This copany appointed a special welfare officer -"/*:$ inside the copany preises to take

the eployees and to sol#e their proble related to work or faily atter"

-ennar $ndustries offers followin! outstandin! welfare facilities to their eployees"

This or!aniDation offers e,cellent edical facilities"

This or!aniDation pro#ides fine transportation ser#ices"

This or!aniDation akes a#ailable tea or coffee at eployeeNs work place"

7opany pro#ides !ood drinkin! water facilities"

9r!aniDation !i#es clean toilet B superior washin!5bathin! aenities"

This or!aniDation pro#ides re!ular health check5up of the eployees" This or!aniDation

affords the housin! facilities"

This copany akes a#ailable trainin! pro!ras"

This or!aniDation supplies the facilities of -";+ $nsurance to secure the future of the

eployees of the copany"

This or!aniDation offers the aternity benefit facilities to the woan eployees"

This copany akes a#ailable well unifor and protecti#e cloth for the eployees"

This copany pro#ides rest roo facilities"

This or!aniDation supply chan!in! roo and locker facilities to their eployees"

This copany pro#ides first5aid bo,es"

This or!aniDation pro#ides all safety e2uipent to the eployees"

This or!aniDation supply facilities of li!htin! and #entilation"

This copany pro#ides spittoon and sittin! facilities" This -ennar $ndustries offer the

facilities of Eployee /eferral 1chee"

ORGANIBATION STRUCTURE

The or!aniDation structure of -ennar $ndustries Ltd (-$L) is #ery wide and deep rooted so as to

ser#e the clients and to fulfill the set tar!ets by the ana!eent" $f we !o throu!h the

or!aniDational chart of -$L+ we can understand the structure+ coponents and way of

adinistration" ;or the benefit of the study+ one has to see the or!aniDational chart with

eticulous thinkin!"

(r".rupender/ao (E,ecuti#e 7hairan)

-rof" La,i.arain

(r" 7" /an!aani (%$7 .oinee)

(r" -" )haskara/ao

(r" :ijaya 7handra -uljal

(r" 7h" *nantha /eddy (E,ecuti#e 'irector)

CO)PANY SECRETARY

(r" -" :" :araprasad

AUDITORS

(Ms /ababuB 7o"+

7hartered *ccountants"

BAN1ERS

1tate )ank of $ndia

1tate )ank of &yderabad

The $')$ )ank Ltd"

)ank of )ahrain B 8uwait )"1"7

STA** )ANAGER

7 ABO.E

D) 7

BELO,

O**ICE SUP0

7 DRI.ERS

TOTAL

7/11 @ 2A .$L 23

7/;1 @ 1C .$L 20

E7' 2 2I .$L >0

7/11 ($1.) > C0 .$L C>

(arketin! C 2A .$L >1

;inance B *ccountin! 2 1I .$L 20

(aterial 1 1 .$L 2

-ersonnel B*dn 1 I 2 11

1yste B $nforation .$L C .$L C

7orporate 2 2 1 A

T9T*L 2A 1I3 > 21J

CRSS PTCR CR*S PTCR ECD TOTAL

9-E/*T9/1 1@I >A > 1IC

*--/E.T$7E1 12 12 nil 2@

OUTLOO1 *OR *UTURE

?ith the fundaentals of the econoy !rowin! stron!er and the auto and buildin!

industries set to !row further+ deand for -ennar products is #ery encoura!in!"

?ith financial reconstruction and association tit strate!ic forei!n in#estor" -ennar is said

to di#ersity further" ?hile also for!in! international linka!es to take copany beyond the $ndian

shores"

Pe!rD& &tr!te(ie& #or di8er&i#ic!tio !d (ro't$ !re?;

a) (anufacturin! auto coponents"

b) ;ocusin! on pre5en!ineered steel industries"

c) *chie#e annual sales of /s" 1000 crore in three yearsE tie"

d) %rowin! e,port #olue"

e) $nor!anic !rowth throu!h ac2uisition of copanies in allied sectors"

-ennar industries+ a copany with a #inta!e of alost two decades in anufacture of cold rolled

steel strips+ cold rolled fored profiles+ en!ineerin! coponents+ E/? tubes+ is plannin! to

#enture into precision tube anufacturin!(7'?) and capacity enhanceent of E/? tube with

wide ran!e co#ered up to 9"' 11@ and thickness up to Cin at -atancheru+ &yderabad" The

project tea has carried out a Techno Econoic ;easibility /eport for the proposed project" The

study findin!s are suariDed as belowG

PRODUCT

* -E) consist of different coponents which are desi!ned in a anner which akes

each of these copatible with other parts" *s nae iplies+ fabrication of these coponents is

carried out in factory under strict 2uality control as per detailed shop drawin! and then these

coponents are transported to the project site with proper arkin!s and assebled as per

erection drawin!s" These features pro#ide -E) an ed!e o#er the con#entional steel structures in

ters of 2uicker output and deli#ery+ reduction in project cost+ fle,ibility and 2uality control and

a one stop solution fro 2ualified professionals throu!h or!aniDed copanies"

(ajor coponents of -E)s are priary fraes+ secondary ebers and sheetin! ade

out of different raw aterial inputs as detailed"

)!r:et A&&e&&met

The use of -E)s in $ndia is considered to be in introductory phase" The present

consuption in $ndia is estiated to be A"A0 $akh (T-* which has !rown at an a#era!e annual

rate of >04 since 2001502 a!ainst this deand the supply is around A"JA lakh (T-* with about

si, ajor players" /e!ionally west leads @14 of the doestic total capacity with south and north

$ndia at >04 and 234 respecti#ely"

Lookin! at the user sectors+ industryN sector leads with a consuption of C04 9f the o#erall

deand followed but a!riculture and a#iation sector rest consued by others"

;or the near future the deand tor -E)s is e,pected to !row at a rate of >05>A4 which will

ipro#e penetration le#el in doestic arket as copared to the present @"A4 le#el" The ajor

dri#ers for future deand are identified asG

a) %rowth in nuber of 1EPs

b) &i!h !rowth in infrastructureM construction sector ass transport projects planned for

future in ultiple cities

*bout J+ @0+000 (Ts of -E)s anufacturin! capacity is e,pected to be added in the ne,t four

years" The clients propose to set up a >0+000 (T-* with one bea line and other supportin!

lines+ achinery and e2uipentEs" Throu!h this project the client plans to offer inte!rated ser#ice

fro desi!nin! the buildin!s to supply and erection ser#ices" The detailed process at each sta!e"

C-APTER;@

T-EORETICAL *RA)E,OR1

C!pit!" Bud(eti(

C!pit!" bud(eti( (or in#estent appraisal) is the plannin! process used to deterine whether

an or!aniDationNs lon! ter in#estents such as new achinery+ replaceent achinery+ new

plants+ new products+ and research de#elopent projects are worth pursuin!" $t is bud!et for

ajor capital+ or in#estent+ e,penditures"

(any foral ethods are used in capital bud!etin!+ includin! the techni2ues such as

*ccountin! /ate of /eturn (*//)

.et -resent :alue (.-:)

-rofitability $nde, (-$)

$nternal /ate of /eturn ($//)

These ethods use the increental cash flows fro each potential in#estent+ or project"

Techni2ues based on accountin! earnin!s and accountin! rules are soeties used 5 thou!h

econoists consider this to be iproper 5 such as the accounting rate of return+ and Lreturn on

in#estent"L 1iplified and hybrid ethods are used as well+ such as payback period discounted

payback period"

Net pre&et 8!"ue

$n finance+ the Net Pre&et .!"ue 2NP.6 or Net Pre&et ,ort$ 2NP,6 of a tie series of cash

flows+ both incoin! and out!oin!+ is defined as the su of the present #alues (-:s) of the

indi#idual cash flows of the sae entity" $n the case when all future cash flows are incoin!

(such as coupons and principal of a bond) and the only outflow of cash is the purchase price+ the

.-: is siply the -: of future cash flows inus the purchase price (which is its own -:)" .-:

is a central tool in 'iscounted 7ash ;low ('7;) analysis+ and is a standard ethod for usin! the

tie #alue of oney to appraise lon!5ter projects" 0sed for capital bud!etin!+ and widely

throu!hout econoics+ finance+ and accountin!+ it easures the e,cess or shortfall of cash flows+

in present #alue ters+ once financin! char!es are et"

The .-: of a se2uence of cash flows takes as input the cash flows and a discount rate or

discount cur#e and outputs a priceH the con#erse process in '7; analysis 5 takin! a se2uence of

cash flows and a price as input and inferrin! as output a discount rate (the discount rate which

would yield the !i#en price as .-:) 5 is called the yield+ and is ore widely used in bond

tradin!"

*ormu"!

Each cash inflowMoutflow is discounted back to its present #alue (-:)" Then they are sued"

therefore .-: is the su of all ters

R

t

23 E i6

t

?here

t Q The tie of the cash flow

i Q The discount rate (the rate of return that could be earned on an in#estent in

the financial arkets with siilar risk)H opportunity cost of capital

/t Q The net cash flow (the aount of cash+ inflow inus outflow) at tie t" ;or

educational purposes+ /0 is coonly placed to the left of the su to ephasiDe

its role as (inus) the in#estent

Iter!" R!te O# Retur

T$e Iter!" R!te o# Retur 2IRR6 is a rate of return used in capital bud!etin! to easure and

copare the profitability of in#estents" $t is also called the discounted 7ash ;lo#@+ /ate of

/eturn ('7;/9/) or the rate of return (/9/)" $n the conte,t of sa#in!s and loans the $// is

also called the effecti#e interest rate" The ter internal refers to the fact that its calculation does

not incorporate en#ironental factors (e"!"+ the interest rate or inflation)"

The internal rate of return on an in#estent or project is the LannualiDed effecti#e copounded

return rateL or L/ate of /eturnL that akes the net present #alue (.-: as .ETR$M($S$//) year)

of all cash flows (both positi#e and ne!ati#e) fro a particular in#estent e2ual to Dero"

$n ore specific ters+ the $// of an in#estent is the discount rate at which the net present

#alue of costs (ne!ati#e cash flows) of the in#estent e2uals the net present #alue of the benefits

(positi#e cash flows) of the in#estent"

$nternal rates of return are coonly used to e#aluate the desirability of in#estents or projects"

The hi!her a projectNs internal rate of return+ the ore desirable it is to undertake the project"

*ssuin! all projects re2uire the sae aount of up5front in#estent+ the project with the

hi!hest $// would be considered the best and undertaken first"

* fir (or indi#idual) should+ in theory+ undertake all projects or in#estents a#ailable with

$//s that e,ceed the cost of capital" $n#estent ay be liited by a#ailability of funds to the

fir andMor by the firNs capacity or ability to ana!e nuerous projects"

*ormu"!e

%i#en a collection of pairs (tie+ cash flow) in#ol#ed in a project+ the internal rate of return

follows fro the net present #alue as a function of the rate of return" * rate of return for which

this function is Dero is an internal rate of return"

%i#en the (period+ cash flow) pairs (n+ 7n) where n is a positi#e inte!er+ the total nuber of

periods N+ and the net present #alue .-:+ the internal rate of return is !i#en by r inG

The period is usually !i#en in years+ but the calculation ay be ade sipler if r is calculated

usin! the period in which the ajority of the proble is defined (e"!"+ usin! onths if ost of

the cash flows occur at onthly inter#als) and con#erted to a yearly period thereafter"

*ny fi,ed tie can be used in place of the present (e"!"+ the end of one inter#al of an annuity)H

the #alue obtained is Dero if and only if the .-: is Dero"

$n the case that the cash flows are rando #ariables+ such as in the case of a life annuity+ the

e,pected #alues are put into the abo#e forula"

9ften+ the #alue of r cannot be found analytically" $n this case+ nuerical ethods or !raphical

ethods ust be used"

P!/b!c: Period )et$od

(ethod of e#aluatin! in#estent opportunities and product de#elopent projects on the basis of

the tie taken to recoup the in#estent" This period is copared to the re2uired payback period

to deterine the acceptability of the in#estent proposal" $n contrast to return on in#estent and

net present #alue ethods+ the cash inflows occurrin! after the payback period are not included

in this ethod"

;orulaG -ayback period (in years) T $nitial capital in#estent U *nnual cash5flow fro the

in#estent"

Pro#it!bi"it/ IdeA met$od

-rofitability $nde, is a ratio of discounted benefits o#er the discounted costs" $t is a easure of

profitability of an in#estent that we can copare with that of other in#estents that are under

consideration" *lternati#e in#estents ay #ary in siDe a life span and these ay pro#ide ore

or less net benefits" 6et by usin! profitability inde, ethod+ we can see for oursel#e1 which one

of these in#estents is ore profitable when copared to the rest"

-rofitability $nde, T (-: of future cash flows) U $nitial in#estentG This of course bein! where

-:T the present #alue of the future cash flows in 2uestion"

9r T (.-: S $nitial in#estent) U $nitial $n#estentG *s one would e,pect+ the .-: stands for

the .et -resent :alue of the initial in#estent"

*ormu"!e o# Pro#it!bi"it/ IdeA

The -rofitability inde, shows the nuerator which is the discounted su of benefits and the

denoinator that is the discounted su of costs associated with a particular project" This

particular e2uation ay also be used to infer the internal rate of return which occurs when

profitability inde, is e2ual to 1" ?e will lea#e that discussion to another tutorial+ here we will

ephasiDe the profitability inde, ethod

C-APTER F <

DATA ANALYSIS

7

INTERPRETATION

CONCEPTUAL ISSUES O* CAPITAL BUDGETING

)usiness firs ha#e scares resources that ust be allocated aon! copetiti#e uses" The

financial ana!eent pro#ides a fraework for firs to take these decisions wisely"

The in#estents decisions include not only those that create re#enues and profits but also those

that reduce cost" 1o+ the in#estents decisions and the decisions relatin! to assets coposition of

the fir"

* capital e,penditure+ fro the accountin! point of #iew+ is an e,penditure that is shown as an

asset on the balance sheet" This asset+ e,cept in the case of a non5depreciable asset like land+ is

depreciated o#er its life" $n accountin!+ the classification of an e,penditure as capital e,penditure

or re#enue e,penditure is !o#erned by certain con#entions+ by soe pro#isions of law+ and by

the ana!eentNs desire to enhatice and depress reported profits" 9ften+ outlays on / B '+ aja+

ad#ertisin! canipai!n+ aild reconditionin! of plant and achinery ay be treated as re#enue

e,penditute for accountin! purposes+ e#en thou!h they are e,pected to !enerate a strea of

benefits in future and+ therefore+ 2ualify for bein! capital e,penditures"

*EATURES

V $t in#ol#es e,chan!e of current funds for the benefits to be achie#ed in future"

V ;uture benefits are e,pected to be realiDpd o#er a series of years"

V There is relati#ely hi!h de!ree of risk"

V They are in#isible decisions"

V They ha#e lon!5ter and si!nificant effect on profitability of the concern"

V They !enerally in#ol#e hu!e funds"

SIGNI*ICANCE O* CAPITAL BUDGETING

7apital )ud!etin! is of paraount iportance in financial decision akin!" 7apital

bud!etin! decisions affect the profitability of the fir" They also ha#e a bearin! on the

copetiti#e position of the enterprise" 7apital bud!etin! decision deterines the future destiny

of the copany"

V *n opportunity in#estent decision can yield spectacular returns where as an ill5ad#ised

and incorrect in#estent decisions can endan!er the #ery sur#i#al e#en of the lar!e siDed

firs"

V * capital e,penditure decisions has its effect o#er a lon!5ter tie span and ine#itably

affects the copaniesfuire cost structure"

V 7apital in#estent decisions are not easily re#ersible+ without uch financial loss to the

fir"

V 7apital in#estent in#ol#es cost and the ajority of the firs ha#e scares capital

resources"

V 7apital in#estent decisions are of rational iportance because it deterines

eployent+ econoic acti#ities and econoic !rowth"

LThis underlines the need for thou!htful+ wise and correct in#estent decisionsL

NEED *OR CAPITAL BUDGETING

7apital bud!etin! decisions are thai to an or!aniDation as they include the decisions as to"

V ?hether or not funds should be in#ested in lon!5ter projects such as settin! rstei of an

industry" purchase of plant and achinery etc"

V To analyDe the proposal for e,pansion or creatin! additional capac hies

V To decidethe replaceent of peranent asset such as buildin! and e2uipents"

V To ake financial analysis of #arious proposals re!ardin! capital in#estent so as to

hoose the best out of any alternati#e proposals"

CAPITAL BUDGETING DECISION )A1ING PROCESS

The followin! dia!ra indicates the decision akin! process of 7apital )ud!etin!"

-/9=E7T %E.E/*T$9.

'E:EL9-$.% T&E *LTE/.*T$:E1

TYPES O* CAPITAL BUDGETING DECISION

30 Accept;Reject deci&io&

This is a fundeental decision capital bud!etin!" $f the project is accepted+ the fir in#ests in it"

$f the proposal is rejected+ the fir does not in#est in it so+ by applyin! this criterion+ all

independent projects are accepted" $ndependent projects are projects that do not copete with

one another in such a way the acceptance a project preclude the possibility of acceptance of

another

40 )utu!""/ eAc"u&i8e project deci&io?

These are the projects+ which+ copete with other projects in such a way that the acceptance of

one will e,clusi#e and only one (ay ye chosen" (utually e,clusi#e in#estent acceptable under

accept5reject criterion"

@0 C!pit!" r!tioi( deci&io&?

7apital rationin! refers to situation in which the fir has ore acceptable in#estents re2uirin!

!reater aount of finance then is a#ailable with the fir" $t is concerned with selection of !roup

of in#estent proposals out of any in#estent proposals actable under accept5reject criterion

under financial constraints"

E.ALUATION O* IN.EST)ENT PROPOSAL

:*L0*T$9. 9; *LTE/.*T$:E1

1ELE7T$9. 9; T&E -/9=E7T

$(-LE(E.T*T$9.

-E/;9/(*.7E /E:$E?

*t each point of tie a business fir has a nuber of proposals re!ardin! #arious nuber of

projects in which it can in#est funds" )ut funds a#ailable with the firs are always liited and it

is not possible to in#est in all the proposals at a tie"

$n selectin! the criterion+ the followin! two fundaental principles ust be kept into #iew"

The bi!!er+ the better principleG The+ principle eans that other thin!s bein! e2ual cr

bi!!er are preferable to sall ones"

1o The bird in hand principlesG This principle eans other thin!s bein! e2ual+ early

benefits as other thin!s are seldo e2ual"

)oth the abo#e principles ha#e to be applied to take the ri!ht decisions"

IN.EST)ENT CRITERIA

TEC-NICUES O* CAPITAL BUDGETING

The ethods of appraisin! capital e,penditure proposals can be classed into two broad

cate!oriesG

1" Traditional or un discounted cash flow techni2ues

2" 'iscounted or tie adjusted cash flow techni2ues

DISCOUNTED CAS- *LO, )ET-ODS

The distin!uishin! characteristics of discounted cash flow capital bud!etin! techni2ues are that

they takin! into consideration the tie #alue of oney while e#aluatin! the cost and benefits of

the projects" They also take into consideration the benefits and costs occurin! durin! the entire

life of the project

NET PRESENT .ALUE )ET-OD

$n finance+ the Net Pre&et .!"ue 2NP.6 or Net Pre&et ,ort$ 2NP,6 of a tie series of cash

flows+ both incoin! and out!oin!+ is defined as the su of the present #alues (-:s) of the

indi#idual cash flows of the sae entity" $n the case when all future cash flows are incoin!

(such as coupons and principal of a bond) and the only outflow of cash is the purchase price+ the

.-: is siply the -: of future cash flows inus the purchase price (which is its own -:)" .-:

is a central tool in 'iscounted 7ash ;low ('7;) analysis+ and is a standard ethod for usin! the

tie #alue of oney to appraise lon!5ter projects" 0sed for capital bud!etin!+ and widely

throu!hout econoics+ finance+ and accountin!+ it easures the e,cess or shortfall of cash flows+

in present #alue ters+ once financin! char!es are et"

The .-: of a se2uence of cash flows takes as input the cash flows and a discount rate or

discount cur#e and outputs a priceH the con#erse process in '7; analysis 5 takin! a se2uence of

cash flows and a price as input and inferrin! as output a discount rate (the discount rate which

would yield the !i#en price as .-:) 5 is called the yield+ and is ore widely used in bond

tradin!"

*ormu"!

Each cash inflowMoutflow is discounted back to its present #alue (-:)" Then they are sued"

therefore .-: is the su of all ters+

Rt

23 E i6

t

?here

t Q The tie of the cash flow

i Q The discount rate (the rate of return that could be earned on an in#estent in

the financial arkets with siilar risk)H opportunity cost of capital

/t Q The net cash flow (the aount of cash+ inflow inus outflow) at tie t" ;or

educational purposes+ /0 is coonly placed to the left of the su to ephasiDe

its role as (inus) the in#estent

T$e &tep& to be #o""o'ed #or !dopti( t$e NP. met$od

'eterine an appropriate rate of interest that should be selected as a iniu re2uired

rate of return" This rate should be the iniu rate of return below which the in#estor

considers that does not pay hi the in#ested aount"

7opute the present #alue of total in#estent outlayH if the total in#estent is to be

ade in the initial year+ the present #alue sall is the sae as the cost of in#estent"

7opute the present #alue of total in#estent proceeds i"e"+ each in flows at the abo#e

deterined discount rate"

7alculate the .-: of each project by subtractin! the present #alue of cash outflow for

each project"

The present #alue of rupee ldue in any nuber of years can be found by usin! the followin!

forula"

P. G 3H 2IEr6t

?here+ PV Tpresent #alue

rTrate of interest

tTnuber of years

ACCEPT OR RE+ECT CRITERION

$f .-: W PE/9+ *77E-T

$f .-: X PE/9+ /E=E7T

$n case of utually e,clusi#e projects+ the #arious proposal would be ranked in order of

descendin! order" The proposal with hi!her .-: is to be accepted"

)ERITS?

$t reco!niDes the tie #alue of oney"

$t is sound ethod of appraisal as it considers the total benefits arisin! out of the proposal

o#er its lifetie"

7han!in! discount rate can be built in to the .-: calculation by alterin! the

denoinator" This rate norally chan!es because lon!er the tie span+ lower the #alue of

oney and hi!her the discount rate"

This ethod is #ery useful for selection of naturally e,clusi#e projects"

DE)ERITS?

$t is difficult to calculate as understand"

This present #alue ethod in#ol#es the calculation of re2uired rate of return to discount

the cash flows+ which present serious probles"

$t is an absolute easure"

This ethod ay not !i#en satisfactory results in case of projects ha#e different effecti#e

li#es"

INTERNAL RATE O* RETURN 2IRR6

T$e Iter!" R!te o# Retur 2IRR6 is a rate of return used in capital bud!etin! to easure and

copare the profitability of in#estents" $t is also called the discounted 7ash ;low /ate of

/eturn ('7;/9/) or the rate of return (/9/)"E11 $n the conte,t of sa#in!s and loans the $// is

also called the effecti#e interest rate" The ter internal refers to the fact that its calculation does

not incorporate en#ironental factors (e"!"+ the interest rate or inflation)"

The internal rate of return on an in#estent or project is the LannualiDed effecti#e e'

copounded return rate or L/ate of /eturnL that akes the net present #alue (.-: as 7r

.ETR1M(1S$//) year) of all cash flows (both positi#e and ne!ati#e) fro a particular s

in#estent e2ual to Dero"

$n ore specific ters+ the $// of an in#estent is the discount rate at which the net present

#alue of costs (ne!ati#e cash flows) of the in#estent e2uals the net present #alue of the benefits

(positi#e cash flows) of the in#estent"

$nternal rates of return are coonly used to e#aluate the desirability of in#estents or projects"

The hi!her a projects internal rate of return+ the ore desirable it is to undertake the project"

*ssuin! all projects re2uire the sae aount of up5front in#estent+ the -roject with the

hi!hest $// would be considered the best and undertaken first"

* fir (or indi#idual) should+ in theory+ undertake all projects or in#estents a#ailable with

$//s that e,ceed the cost of capital" $n#estent ay be liited by a#ailability of funds to the

fir andMor by the firNs capacity or ability to ana!e nuerous projects"

*ormu"!e

%i#en a collection of pairs (tie+ cash flow) in#ol#ed in a project+ the internal rate of return

follows fro the net present #alue as a function of the rate of return" * rate of return for which

this function is Dero is an internal rate of return"

%i#en the (period+ cash flow) pairs (n+ 7n) where n is a positi#e inte!er+ the total nuber of

periods N+ and the net present #alue .-:+ the internal rate of return is !i#en by r inG

The period is usually !i#en in years+ but the calculation ay be ade sipler if r is calculated

usin! the period in which the ajority of the proble is defined (e"!"+ usin! onths if ost of

the cash flows occur at onthly inter#als) and con#erted to a yearly period thereafter"

*ny fi,ed tie can be used in place of the present (e"!"+ the end of one inter#al of an annuity)H

the #alue obtained is Dero if and only if the .-: is Dero"

$n the case that the cash flows are rando #ariables+ such as in the case of a life annuity+ the

e,pected #alues are put into the abo#e forula"

9ften+ the #alue of r cannot be found analytically" $n this case+ nuerical ethods or !raphical

ethods ust be used"

ACCEPT OR RE+ECT CRITERION?

*77E-TG $f the $// is !reater than the cost of the capital" /E=E7TG $f the $// is less than the

cost of capital"

)ERITS

$t reco!niDes the tie #alue of oney

$t considers all cash flows occurrin! o#er the entire life of the project to calculate its

return or risk

$t is consistent with the shareholders wealth a,iiDations objecti#e

DE)ERITS

$t !i#es isleadin! and inconsistent results when the .-: of a project does not decline

with discount rates

$t also fails to indicate a correct choice between utually e,clusi#e projects under certain

situations

1. PRO*ITABILITY INDE> )ET-OD 2PI6?

$t is the ratio of the present #alue of cash inflow at the re2uired rate of return to the initial cash

outflow of the in#estent" 0sin! the -rofitability $nde, (-$) or )enefit 7ost /atio ()7/) a

project will 2ualify for acceptance if its -$ e,ceeds one" The .-: will be positi#e when the -$ is

!reater than one will ne!ati#e when the -$ is less than one" Thus+ .-:B -$ approaches !i#e the

sae results re!ardin! the in#estent proposal" The selection of project with the -$ ethod can

also be done on the basis of rankin!" -$ depends up on cash flows before depreciation and after

ta," $t takes into consideration the scrap #alue" The forula to calculate -$ or )7/ is as follows"

PI G Tot!" pre&et 8!"ue o# c!&$ I#"o'&

Tot!" pre&et 8!"ue o# c!&$ out#"o'&

)ERITS?

$ts !i#es due consideration to the tie #alue of oney"

1ince the present #alue cash inflows is di#ided by initial cash outflows it is a relati#e

easure of the projects profitability"

DE)ERITS?

$tEs difficult to understand"

$t in#ol#es ore coputation the traditional ethods"

TRADITIONAL OR NON;DISCOUNTED TEC-NICUES?

"6 PAY BAC1 PERIOD )ET-OD?

-ay back easures the nuber of years re2uired for the cash flow after ta, to payback the

ori!inal outlay re2uired is an in#estent proposal" it depends upon cash inflows before

depreciation and after ta," -ayback period does not consider the scrap #alue" There two ways of

calculatin! the -)-"

The first ethod can be applied when the cash inflows are unifor"

PBP G Ori(i!" I8e&tmet

Co&t!t Au!" C!&$ I#"o'&

The annual cash flows represent i"e" estiated cash sa#in!s resultin! fro the proposed

in#estent"

$f the calculated -)- is less than the standard+ project is accepted and #ice #ersa"

The second ethod is used when projects cash flow are not e2ual and #ery fro year to year"

-ay back period is calculated"

DISCOUNTED PAY BAC1 )ET-OD

This de#eloped due to the liitation of the -)- ethod that i!nores tie #alue of oney" &ence+

an ipro#eent is ade where the present #alues of all inflows are cuulated in order of tie"

The tie period at which the cuulated present #alue of cash in flows e2ual the present #alue of

cash outflows is known as discounted -)-" The project+ which !i#es a shorter discounted pay

back period+ is accepted"

REASONS *OR POPULARITY O* PBP

'espite its serious shortcoin! the -)- is widely used in appraisin! in#estents"

The -)- ay be re!arded rou!hly as the reciprocal for the $// when the annual cash

flow is constant and the life of the project fairly lon!"

The -)- is soewhat akin to the breake#en point" * rule of thub+ it th ser#es as a

useful shortcut in e process of inforation of !eneration and e#aluation"

ACCEPT OR RE+ECT CRITERION

The pay back period ethod can be used as a decision criterion or reject in#estent proposal" $f

a sin!le in#estent is bein!" 7onsidered+ if the annual pay back period is less than the pre5

deterined pay back period is the project will be accepted if not it would be rejected"

?hen the utually e,clusi#e projects consideration they ay be ranked ac endin! to the len!th

of the pay back period" The project the shortest payback ay be assi!ned rank one and so on"

)ERITS

$t the best ethod in case of e#aluation of sin!le project"

$t is easy to calculate and siple to understand"

$t is based on the cash flow analysis"

DE)ERITS

$t copletely i!nores all cash flows after the payback period

$t copletely i!nores tie #alue of oney"

$n case the cash flow are une2ual the pay back period can be found by addin! up the cash flows

until the total is e2ual to the initial cash out lay of project"

2) ACCOUNTING RATE O* RETURN 2ARR6

*#era!e rate of return is also known as accountin! rate of return ethod" $t is based an

accountin! inforation (profit) rather than cash flows" *// is techni2ue that helps us in

knowin! the particular project+ fro which decision can be ade to accept or reject the

in#estent proposal"

*ccordin! to *//+ as an acceptMreject criterion+ the actual *// would be copared with the

predeterined or a iniu re2uired rate of return or cut off rate" * project can be accepted

if the actual *// is hi!her than the iniu+ desired *//+ otherwise it is liable to rejected"

*// depends upon profit depreciation and ta, (-*T)" *// ne!lects the scrap #alue" The

tie #alue of oney is not taken into consideration"

ARR G A8er!(e Au!" Pro#it A#ter T!A A 355

A8er!(e I8e&tmet

A8er!(e I8e&tmet G Net !dditio!" 'or:i( c!pit!" ES!"8!(e 8!"ue E I

2Ori(i!" i8e&tmet;S!"8!(e 8!"ue6

A8er!(e Au!" Pro#it A#ter T!A G Tot!" C!&$ *"o' A#ter T!A

Li#e O# T$e project

ACCEPT OR RE+ECT CRITERION

The actual a#era!e rate of return is copared with predeterined or iniu re2uired rate of

return or cut off rate" * project would 2ualify to be acceptedH if the actual rate of return is hi!her

then the iniu desired a#era!e return"

$f ore than one alternati#e proposal are under consideration+ the a#era!e rate of return ay be

arran!ed in descendin! order 7onsideration+ the a#era!e rate of return ay be arran!ed in

descendin! order of a!nitude startin! with the proposal with the hi!hest a#era!e rate of return"

)ERITS

$t is siple to understand and easy to calculate"

The entire strea of incoes is used to calculate the a#era!e rate of return"

RIS1 AND DUNCERTAINTY IN CAPITAL BUDGETING

*ll the techni2ues of capital bud!etin! re2uire estiation of future cash inflow and cash out

flow" The cash flows are estiated+ based on the followin! factors"

E,pected econoics life of the projects

1al#a!e #alue of the asset at the end of the econoic life

7apacity of the product

1ellin! price of the product

-roduction cost

'epreciation rate

/ate of ta,ation

;uture deand of the product+ etc"

)ut due to uncertainties about the future+ the estiates of deand+ production+ sale costs+ sellin!

price+ etc" cannot be e,act" ;or e,aple a product ay becoe obsolete uch earlier than

anticipated due to une,pected technolo!ical de#elopents" *ll these eleents of uncertainties

ha#e to be taken into account in the for of forcible risk while takin! a decision on in#estent

proposals" $t is perhaps the ost difficult task while akin! an in#estent decision" )ut soe

allowances for the leent of risk ha#e to be pro#ed"

*ACTORS IN*LUENCING CAPITAL E>PENDITURE DECISIONS

There are any factors financial as well as non5financial which influence the capital e,penditure

decisions and the profitability of the proposal" 6et there are any others factors which ha#e to be

taken in to consideration while takin! a capital e,penditure decision+ They are

1" 0/%E.76G 1oe tie an in#estent is to be ade due to ur!ency for the sur#i#al of

the fir or to a#oid hea#y loses" $n such circustances+ proper e#olution cannot be ade

throu!h profitability tests" E,aples of each an ur!ency are breakdown of soe plant and

achinery fir accident etc"

2" 'E%/EE 9; 0.7E/T*$.T6G -rofitability is directly related to risk+ hi!her the profits+

!reater is the risk uncertainty"

>" $.T*.%$)LE ;*7T9/1G *s the capital e,penditure has to ake due to certain

eotional and intan!ible factors such as safety and welfare of the workers+ presti!ious

project+ social welfare+ !oodwill of the fir etc"

@" *:*$L)$L$T6 9; ;0.'1G *s the capital e,penditure !enerally re2uires the pro#isions

of lows solely influence by this factor and althou!h the project ay not be profitable" 6et

the in#est haste be ade"

A" ;0T0/E E*/.$.%1G a project ay not be profitable as copared to another today+ but

it ay be preferred to increase future earnin!s"

C" 1oeties+ project with sonic lower profitability ay be selected due to constant flow of

incoe as copared to another project with an irre!ular and uncertain inflow of incoe"

CAPITAL E>PENDITURE CONTROL

7apital e,penditure in#ol#es non5fle,ible lon!5ter coitent of funds" The success of an

enterprise in the lon! run depends upon the effecti#eness with which the ana!eent akes

capital e,penditure decision" 7apital e,penditure decision is #ery iportant as there ipact is

ore or less peranent on the well5bein! and econoic health of the enterprise" )ecause of it

lar!e5scale echaniDation and autoation and iportance of capital e,penditure for increase in

the profitability of a concern" $t has becoe essential to aintain an effecti#e syste of capital

e,penditure control"

OB+ECTI.ES O* CONTROL O* CAPITAL E>PENDITURE

To ake an estiate of capital e,penditure and to see that the total cash outlay is within

the financial resources of the enterprise"

To ensure tiely cash inflows for the projects so that non a#ailability of a cash ay not

be proble in the ipleentation of the proble"

To ensure that all capital e,penditure is properly sanctioned"

To properly coordinates the projects of #arious departents"

To fi, priorities aon! #arious projects and ensure their follow up"

To copare periodically actual e,penditure with the bud!eted ones so as to a#oid any

e,cess e,penditure"

To easure the perforance of the project"

To ensure that sufficient aount of capital e,penditure is incurred to keep pact with the

rapid technolo!ical de#elopent

STEPS IN.OL.ED IN CONTROL O* CAPITAL E>PENDITURE?

-reparation of capital e,penditure bud!et

-roper authoriDation of capital e,penditure

/ecordin! and control of e,penditure

E#aluation of perforance of the projects"

STEPS IN.OL.ED

i" $dentifyin! the need of the project

ii" -reparation of the project repot with respect to

a" 0tiliDation

b" Efficiency

c" 7apacity of the particular project

d" ;uture projected arket

iii" -reparation of feasibility report based $// B .-7

i#" =ustification based on

a" (oney earnin!s

b" Loss of arket

c" Loss of !oodwill

d" Technolo!ical re2uireent

#" The dele!ation of powers

T$e project propo&!"& !re &!ctioed i t$e #o""o'i( b!&i&

1l" .o -/9=E7T

$.:E1T(E.T

'ELE%*T$9. 9;

-9?E/

-E/ *..0(

1" 20 L*8&1 E"'M0.$T @ 7/9/E1

2" W20 L*8&1 5 X A

7/9/E1

7(' 5.$L5

>" WA 7/9/E1 5 X A0

7/9/E1

)9*/' 5.$L5

@" W A0 7/9/E1 %9:E/.(E.T 5.$L5

E.ALUATION O* NE, SC-E)E PRO+ECT

7alculation of cash flows after ta, (2"1 centraliDed blade shop)

'epreciation rate T 1C4 Ta, T .il $n#estent T /s" @+1@AM5 (in Lakhs)

6E*/ 7;)'T 'E- 1;)T T*< 7;)'T E*T

200I503 1000 CC>"2 >>C"2 55 1000 >>C"I

2003510 1>2I CC>"2 CC@"I 55 1>2I CC@"I

2010511 2C@2 CC>"2 13JI"I 55 2C@2 13JI"I

2011512 2C@2 CC>"2 13JI"I 55 2C@2 13JI"I

201251> 2C@2 CC>"2 13JI"I 55 2C@2 13JI"I

T9T*L 55 102A@ C3>I"00

Iterpret!tio?

The abo#e table re#eals that earnin! after ta, (E*T)" The copany has earned E*T 13JI"I in

2010511" *fter that soethin! followed

7alculation of pay back period ethod

6E*/ 7;*T 70(0L*T$:E 7;*T

200I503 1000 1000

2003510 1>2I 2>2I

2010511 2C@2 @3J0

2011512 2C@2 JC12

201251> 2C@2 102A@

7alculation of payback period

-)- T 2S1I1JM2C@2 T 2 S 0"C3 T 2 years and J onths

Iterpret!tio?

The abo#e table re#eals the -)- cost of the project is @+@1A lakhs" The initial in#estent can be

recorded in 2 years and J onths+ since the cutoff point is > years

7alculation of *//

*#era!e incoe T C3>IMA T 1>IJ"C0

*#era!e in#estent T @1@AM2 T 20J2"A

*// T 1>IJ"CM20J2"AR100 T CC"3A4

Iterpret!tio

The a#era!e incoe of the project is 1>IJ"C0 lakhs and the a#era!e in#estent of the project is

20J2"A0 lakhs" *ccountin! rate of return of the project is CC"3A4

C!"cu"!tio o# NP. J KI

6E*/ 7;*T -: Y 34 -:7;

200I503 1000 "31J 31J"00

2003510 1>2I "I@2 111I"1I

2010511 2C@2 "JJ2 20@0"00

2011512 2C@2 "J0I 1IJ0"A@

201251> 2C@2 "C@3 1J1@"CC

T9T*L JCC0">I

(5)$nitial $n#estent @1@A

.-: S>A1A">I

Iterpret!tio?

The abo#e table re#eals that .ET -resent :alues (.-:) Y 34" The present #alue of annuity 9ne

rupee for present #alue of one rupee Y34 discountin! factor+ because the cash inflows occurs

J+CC0">A lakhs+ on this #alue subtract with the initial in#estent /s @+1@A lakhs" &ence+ the

decision role associated with the net present #alues is accepted the project+ i"e"+ positi#e #alue of

the project"

7alculation of cash flows after ta, ( 2"2 0p !radation of e,itin! %T test facilities)

'epreciation /ate T 124 Ta, T .il $n#estent T 2CI (in lakhs)

6E*/ 7;)'T 'E- 7;)T T*< 7;*T E*T

200I503 >A >2"1C 2"I@ 55 >A 2"I@

2003510 @0 >2"1C J"I@ 55 @0 J"I@

2010511 10> >2"1C J0"I@ 55 10> J0"I@

2011512 10> >2"1C J0"I@ 55 10> J0"I@

201251> A0C >2"1C @J>"I@ 55 A0C @J>"I@

T9T*L JIJ C2C"20

Iterpret!tio?

$n the abo#e table re#eals that Earnin! *fter Ta, (E*T)" The copany has earned J0"I@ in 20115

12" *fter ne,t year as follow the sae ta,"

7alculation of pay back period ethod

6E*/ 7;*T 70(0L*T$:E 7;*T

200I503 >A >A

2003510 @0 JA

2010511 10> 1JI

2011512 10> 2I1

201251> A0C JIJ

-)- T > S 30M10> T > years and 3 onths

Iterpret!tio?

The abo#e table re#eals that -)- payback period cost of the project is 2CI lakhs" The initial

in#estent can be recorded in > years and 3 onths+ since the cutoff point is @ years"

7alculation of *//

*#era!e $ncoe T C2C"2MA T 12A"2@

*#era!e in#estent T 2CIM2 T 1>@

*// T 12A"2@M1>@R100 T 3>"@C4

Iterpret!tio?

The a#era!e incoe of the project is 12A"2@ lakhs and the a#era!e in#estent of the project is

1>@ lakhs" *ccountin! rate of return of the project is 3>"@C4

C!"cu"!tio o# NP. J KI

YEAR C*AT P. J KI P.C*

200I503 >A "31J >2"03

2003510 @0 "I@2 >>"CI

2010511 10> "JJ2 J3"A2

2011512 10> "J0I J2"32

201251> A0C "C@3 >2I">3

T9T*L A@C"C

(5)$nitial $n#estent 2CI"0

.-: S2JI"C

Iterpret!tio?

The abo#e table re#eals that .ET -resent :alues (.-:) Y 34" The present #alue of annuity 9ne

rupee for present #alue of one rupee Y34 discountin! factor+ because the cash inflows occurs

A@C"C lakhs+ on this #alue subtract with the initial in#estent /s 2CI"0 lakhs" &ence+ the decision

role associated with the net present #alues is accepted the project+ i"e"+ positi#e #alue of the

project"

C!"cu"!tio o# c!&$ #"o'& !#ter t!A 2 40@ *!ci"itie& #or m!u#!cturi( &peci!" too"&6

'epreciation /ate T I4 Ta, T .il $n#estent T 221"00 (in lakhs)

6E*/ 7;)'T 'E- 7;)T T*< 7;*T E*T

200I503 20 1J"CI 2">2 55 20 2">2

2003510 @A 1J"CI 2J">2 55 @A 2J">2

2010511 C0 1J"CI @2">2 55 C0 @2">2

2011512 >A 1J"CI 1J">2 55 >A 1J">2

201251> @2 1J"CI 2@">2 55 @2 2@">2

T9T*L 202 11>"C

Iterpret!tioG5

$n the abo#e table re#eals that Earnin! *fter Ta, (E*T)" The copany has earned E*T

2@">2 in 201251>"

7alculation of pay back period ethod

6E*/ 7;*T 70(0L*T$:E 7;*T

200I503 20 20

2003510 @A CA

2010511 C0 12A

2011512 >A 1C0

201251> @2 202

Iterpret!tio?

The abo#e table re#eals that -)- payback period cost of the project is 221 lakhs" The initial

in#estent can be recorded in the year 201251> i"e"+ A

th

year

C!"cu"!tio o# ARR

*#era!e $ncoe T 11>"C2MA T 22"J2

*#era!e in#estent T 221M2 T 110"A

*// T 22"J2M110"AR100 T 20"A34

$nterpretationG

The a#era!e incoe of the project is 22"J2 lakhs and the a#era!e in#estent of the project is

110"A lakhs" *ccountin! rate of return of the project is 20"A34

C!"cu"!tio o# NP. J KI

6E*/ 7;*T -: Y 34 -:7;

200I503 20 "31J 1I">@

2003510 @A "I@2 >J"I3

2010511 C0 "JJ2 @C">2

2011512 >A "J0I 2@"JI

201251> @2 "C@3 2J"2C

T9T*L 1A@"A3

(5)$nitial $n#estent 221"00

.-: 5CC"J1

Iterpret!tio?

The abo#e table re#eals that .ET -resent :alues (.-:) Y 34" The present #alue of cash flow

221" The re2uired rate of return and copared with the ori!inal in#estent" &ence the present

#alue 1A@"A3 inus the ori!inal in#estent 221" The loss is 5CC"J1" 1o the project is rejected"

7alculation of cash flows after ta, ( 2"@ 3; %T% and *u!" of new ;acilities)

'epreciation /ate T 124 Ta, T .il $n#estent T >1I"00 (in lakhs)

6E*/ 7;)'T 'E- 7;)T T*< 7;*T E*T

200I503 >00 >I"1C 2C1"I@ 55 >00 2C1"I@

2003510 1A00 >I"1C 1@C1"I@ 55 1A00 1@C1"I@

2010511 1A00 >I"1C 1@C1"I@ 55 1A00 1@C1"I@

2011512 1A00 >I"1C 1@C1"I@ 55 1A00 1@C1"I@

201251> 1A00 >I"1C 1@C1"I@ 55 1A00 1@C1"I@

T9T*L C>00 C103"20

Iterpret!tio?;