Академический Документы

Профессиональный Документы

Культура Документы

Jithin-Strategic Management-Case-Ford Motors

Загружено:

rajanityagi23100%(1)100% нашли этот документ полезным (1 голос)

354 просмотров40 страницThe largest family-controlled company in the world, The Ford Motor Company has been in continuous family control for over 110 years. The Company sells automobiles and commercial vehicles under the Ford brand and luxury cars under the Lincoln brand. Ford once owned 5 other luxury brands; they were Volvo, Land Rover, Jaguar, Aston Martin and Mercury.

Исходное описание:

Оригинальное название

Jithin-Strategic Management-Case-Ford Motors.docx

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe largest family-controlled company in the world, The Ford Motor Company has been in continuous family control for over 110 years. The Company sells automobiles and commercial vehicles under the Ford brand and luxury cars under the Lincoln brand. Ford once owned 5 other luxury brands; they were Volvo, Land Rover, Jaguar, Aston Martin and Mercury.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

354 просмотров40 страницJithin-Strategic Management-Case-Ford Motors

Загружено:

rajanityagi23The largest family-controlled company in the world, The Ford Motor Company has been in continuous family control for over 110 years. The Company sells automobiles and commercial vehicles under the Ford brand and luxury cars under the Lincoln brand. Ford once owned 5 other luxury brands; they were Volvo, Land Rover, Jaguar, Aston Martin and Mercury.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 40

1

Name Jithin Joice

Madonna ID 228834

Subject Business Policy

Subject Code: MGT_4950_WB_58_00_2014_30

Date October 2014

Ford Motor Company.

Case Analysis

2

Ford Motor Company.

Executive Summary

In 1903 with $28,000 in cash, Henry Ford started the Ford Motor Company, whose

automobiles changed how the world moved. The Ford Motor Company is an American

multinational automaker headquartered in Dearborn, Michigan, a suburb of Detroit. The largest

family-controlled company in the world, the Ford Motor Company has been in continuous family

control for over 110 years. Ford now encompasses two brands: Ford and Lincoln. The company

sells automobiles and commercial vehicles under the Ford brand and luxury cars under the

Lincoln brand. Ford once owned 5 other luxury brands; they were Volvo, Land Rover, Jaguar,

Aston Martin and Mercury. But over time those brands were sold to other companies and

Mercury was discontinued.

The Companys industry and market share measures focus on 19 markets in Europe: Austria,

Belgium, Britain, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary,

Ireland, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, and Switzerland. Ford

Europe's wholesales are more inclusive, tracking Ford-brand vehicles in every market in the

region, including wholesales in Turkey and Russia from its unconsolidated affiliates Ford Otosan

and FordSollers. Ford Asia Pacific Africa industry sales and market share data focus on its 12

major markets in the region; wholesales are more inclusive, tracking every market in the region.

Of the markets the Company tracks in this region, ASEAN, Australia, China, India, and South

Africa are its principal markets.

3

The Company sells vehicles to its dealerships for sale to fleet customers, including

commercial fleet customers, daily rental car companies, and governments. Ford also sells parts

and accessories, primarily to its dealerships (which in turn sells these products to retail

customers) and to authorized parts distributors (which in turn primarily sells these products to

retailers). Through its dealerships, it also offers extended service contracts to retail customers.

Brief Profile:

Ford Motor Company was founded in 1903 by Henry Ford in Detroit, MI. Not only did Ford

revolutionize the development of the automobile as a product, he is also the visionary behind the

idea of mass production. Ford's ability to make automobiles affordable for the masses is cited as

a driving force behind both the automobile industry and the creation of a middle class in

America.

Ford Motor Company (Ford), incorporated on July 9, 1919, is a producer of automobiles.

The Company together with its subsidiaries is engaged in other businesses, including financing

vehicles. The Company operates in two segments: Automotive and Financial Services.

Automotive includes Ford North America, Ford South America, Ford Europe, and Ford Asia

Pacific Africa region. Financial services include Ford Motor Credit Company and Other

Financial Service. The Company manufactures or distributes automobiles across six continents.

Its automotive brands include Ford and Lincoln. Other Financial Services includes a range of

businesses, including holding companies and real estate. Effective September 26, 2013, Ford

Motor Company acquired Livio, a developer of software.

4

Ford introduced methods for large-scale manufacturing of cars and large-scale

management of an industrial workforce using elaborately engineered manufacturing sequences

typified by moving assembly lines; by 1914 these methods were known around the world as

Fordism. Ford's former UK subsidiaries Jaguar and Land Rover, acquired in 1989 and 2000

respectively, were sold to Tata Motors in March 2008. Ford owned the Swedish automaker

Volvo from 1999 to 2010. In 2011, Ford discontinued the Mercury brand, under which it had

marketed entry-level luxury cars in the United States, Canada, Mexico, and the Middle East

since 1938.

Ford is the second-largest U.S.-based automaker and the fifth-largest in the world based on

2010 vehicle sales. At the end of 2010, Ford was the fifth largest automaker in Europe. Ford is

the eighth-ranked overall American-based company in the 2010 Fortune 500 list, based on global

revenues in 2009 of $118.3 billion. In 2008, Ford produced 5.532 million automobiles and

employed about 213,000 employees at around 90 plants and facilities worldwide.

History;

Ford Motor Company is one of the greatest automobile manufacturers of all time. They

started under Henry Ford in Detroit, Michigan. Ford had a skill for craftsmanship when he built

an experimental car in 1896. It was a twin cylinder engine with potential of 20 mph. In 1899 he

left his job in order to organize the Detroit Automobile Company. Ford's first production was in

1903, the Model A, with an under the floor engine selling for $850. In the first season it sold

1,708 cars.

Thereafter, Ford became increasing interested in speed. He built an experimental racing

machine called the 999, which reached 91.4 mph in 1904. He also produced the Model C the

5

same year only later introducing the Model B for $2000. These models were improved in 1905

with the Model K that sold for $2500. In 1906 Ford introduced the Model N for $500 destroying

Oldsmobile's business, while only leading to the introduction of the famous Model T in 1909. In

1930, Ford introduced the Model A, the first car with safety glass in the windshield. Ford

launched the first low priced V8 engine powered car in 1932.

After World War II production slowed down until the entrance of the 1949 line. At this

time power units were new along with the automatic transmission in 1950. Great automobiles

were manufactured in the coming years. The sporty Ford Thunderbird was introduced with 5.1

litres and capabilities of 113 mph. In 1958 it became a convertible with five seats and a

strengthened structure. Major restyling occurred in the late 1950's with such automobiles as the

Falcon, a compact car, with the help of General Motors and Chrysler.

Ford offered the Lifeguard safety package from 1956, which included such innovations

as a standard deep-dish steering wheel, optional front, and, for the first time in a car, rear

seatbelts, and an optional padded dash. Ford introduced child-proof door locks into its products

in 1957, and in the same year offered the first retractable hardtop on a mass-produced six-seater

car. In 1965 Ford introduced the seat belt reminder light.

During the 1960's competition increased and Ford had to become innovative in order to

remain one of the top manufacturers. They put their minds together to create the Ford Mustang in

1964, a compact semi GT with four seats, at a price of $2480. The automobile had a 4.7 litre V8

engine with speeds exceeding 110 mph. The car was a great success and remained so until the

present day selling over 500,000 in the first year and a half on the market.

6

During the coming years Ford realized its potential. They have created some great cars

including the Thunderbird, Model T, Fairlaine, Galaxie, Falcon, and Mustang. They have also

increased their production well into the 1980's and further with the offerings of four wheel drive

pickup trucks and all terrain vehicles such as the Bronco, Jeep, F series, and Ranger. They

became increasingly aware of needs for change such as colors, convertibles, hardtops, and

number of doors. With increased production, innovative styles, low prices, and customer

satisfaction Ford Motor Company has become a worldwide leader in the manufacturing of

automobiles.

Fords Statement of Mission, Values and Guiding Principles

Ford Motor Company is a worldwide leader in automotive and automotive-related products

and services as well as in newer industries such as aerospace, communications and financial

services. Our mission is to improve continually our products and services to meet our customers

needs, allowing us to prosper as a business and to provide a reasonable return for our

stockholders, the owners of our business.

One Ford Mission and Vision

ONE Ford expands on the companys four-point business plan for achieving success globally. It

encourages focus, teamwork and a single global approach, aligning employee efforts toward a

common definition of success and optimizing their collective strengths worldwide. The elements

of ONE Ford are:

7

One Team

People working together as a lean, global enterprise for automotive leadership, as measured by:

Customer, Employee, Dealer, Investor, Supplier, Union/Council, and

Community Satisfaction

One Plan

Aggressively restructure to operate profitably at the current demand and

changing model mix

Accelerate development of new products our customers want and value

Finance our plan and improve our balance sheet

Work together effectively as one team

One Goal

An exciting viable Ford delivering profitable growth for all.

Values

How do the company accomplish the mission is as important as the mission itself.

Fundamental to success for the company are these basic values:

People: Our people are the source of our strength. They provide our corporate

intelligence and determine our reputation and vitality. Involvement and teamwork are our

core human values.

Products: Our products are the end result of our efforts, and they should be the best in

serving our customers worldwide. As our products are viewed, so are we viewed.

8

Profits: Profits are the ultimate measure of how efficiently we provide customers with

the best products for their needs. Profits are required to survive and grow.

Guiding Principles

Quality comes first: To achieve customer satisfaction the quality of our products and

services must be our number one priority.

Customers are the focus of everything we do. Our work must be done with our

customers in mind, providing better products and services than our competition.

Continuous improvement is essential to our success. We must strive for excellence in

everything we do: in our products, in their safety and value, and in our services, our

human relations, our competitiveness and our profitability

Employee involvement is our way of life. We are a team. We must treat each other with

trust and respect.

Dealers and suppliers are our partners. The Company must maintain mutually beneficial

relationships with dealers, suppliers and our other business associates.

Integrity is never compromised. The conduct of our Company worldwide must be

pursued in a manner that is socially responsible and commands respect for its integrity

and for its positive contributions to society. Our doors are open to men and women alike

without discrimination and without regard to ethnic origin or personal beliefs.

Ref: http://retailindustry.about.com (mission statement)

9

Developed Objectives and Guidance

Ford Motor (NYSE: F) outlined its 2020 vision, which includes plans to substantially increase its

global vehicle sales and automotive operating margin, and achieve more balanced geographic

profitability.

By 2020, Ford projects annual global sales to increase 45 to 55 percent to approximately 9.4

million. Its automotive operating margin is projected to improve to about 8 percent during the

same period, with a long-term target of 8 percent to 9 percent.

Our long-term plan underscores the commitment we have to our One Ford plan, while

accelerating our pace of progress, delivering product excellence and driving innovation in all

areas of our business, said Mark Fields, Fords president and CEO. We remain completely

focused on offering customers the freshest lineup of world-class vehicles to meet their needs.

Their target is to meet customer demand: Fords 2020 vision is driven by the companys

confidence in its global product plans. Those plans focus on delivering a full family of vehicles

that meet and exceed customer expectations in Fords four brand pillars quality, green, safe

and smart across the world.

The luxury brand Lincoln sales seen tripling as brand expands to China. The reinvention of

Lincoln as a world-class luxury brand continues in North America and China and will lead to

long-term sales growth and an increase in operating margin. By 2020, Lincoln targets a tripling

of vehicle sales to approximately 300,000 because of the brands debut in China and increased

10

market coverage. Lincoln anticipates a long-term operating margin in line with leading luxury

brands.

Our Lincoln sales and profit margin targets are supported by our aggressive product investment

strategy and growth plans in China, said Kumar Galhotra, president of Lincoln. Our

opportunity is to attract luxury customers who are looking for new and personalized customer

experiences.

Ref:-

http://www.streetinsider.com/Corporate+News/Ford+Motor+(F)+Updates+on+Growth+Objectives,+Guidance+at+I

nvestor+Day/9868432.html

11

SWOT Matrix

Ford: Strengths, Weaknesses, Opportunities, Threats

Strengths:

Stability and Predictability:- Ford was founded in 1903 and has been producing cars for over 100

years. Ford will be still be a very strong and popular in the next few decades.

12

Brand Recognition and Loyalty:- The iconic Ford logo is known by nearly every person in the

world, and many potential car buyers will choose Ford because of their long track record of

producing quality cars.

Strong position in US market:- Ford is the second largest automaker in US, the second largest

vehicle market in the world. Ford has great reputation in its home market and strong commercial

vehicle sales that are the most profitable Fords vehicles.

Global Presence:- Ford sells vehicles in 180 countries around the world, and also Ford had set up

several plants in China, which is now the largest vehicle market in the world. According to data

Ford announced in a month, in 2013, Ford sold out 935813 cars in China, which increased by

49% from 626616 in 2012 . The huge success in China and Asian-Pacific region gave Ford a

strong finical support.

Weaknesses:

Poor environmental record:- Ford has been criticized for poor efforts to decrease environment

pollution. Not only the huge volume of vehicles like Mustang but also Fords manufacturing

plants is rated as a huge air polluter. The US Environmental Protection Agency also linked Ford

to 42 toxic waste sites.

High cost structure:- Although One Ford initiative led to substantial cost reduction and sold

most pre-owned brands in recent years, Ford still has a high cost structure, compared to other

automobiles manufacturers. Fords costs are driven by its generous employee compensation and

pension plans. But Ford may benefit from this kind of policy in a long term.

13

Loss money in Europe:- In 2012, Ford lost $1.75 billion in Europeand expects a $1.8 billion

annual loss in Europe 2013although the official data hasnt came out. Because of the rise of

German cars, Ford will be still struggle in Europe in the next few years.

Opportunities:

Positive attitude towards green vehicles:- Cars that are fuel inefficient and emit large quantities

of CO2 heavily pollute air and negatively affect the environment. The new Eco-boost series

engines are providing a better brand image for Ford. The new vehicles with new engine inside

are emitting much less CO2 and are more fuel-efficient. At the same time, Ford is developing a

variety of electric and hybrid cars, which is good news for the future.

Strategic partnerships:- Ford has great experience in creating strategic alliances and partnerships

with other automotive companies. Now Ford is developing a new 9/10 speed gearbox with GM,

new engines with Mazda, new hybrid cars with Toyota. Thats the great chance Ford could do

something with those.

Threats:

Intense Competition:- The automobile industry is one of the most competitive industries in the

world, and this fierce battling to provide the best product for the lowest price can lead to margin

contraction. In recent years German brands are leading the industry in the technology field. And

also they are having more profits than Ford and other US or Japanese brands.

Debt:- The company still has $13.1 billion left on their balance sheets from loans taken out

during the great recession in 2008. This could be the most terrible finical problem Ford has ever

met in the history.

14

CPM

EFE Matrix

15

Ratios

IFE Matrix

16

BCG Matrix

IE Matrix

17

SPACE Matrix

Grand Strategy Matrix

18

QSPM

Financial Position

Ford Motor Company [NYSE: F] reported a 2014 first quarter pre-tax profit of $1.4 billion, its

19th consecutive profitable quarter. The company also affirmed its full-year pre-tax profit

guidance of $7 billion to $8 billion as it launches 23 new global vehicles, the most in a single

year in its history.

The companys pre-tax profit of $1.4 billion was $765 million lower than a year ago. After-tax

earnings per share were 25 cents, excluding special items, 16 cents below a year ago. Net income

for the quarter was $989 million, or 24 cents per share, a decline of $622 million, or 16 cents,

from a year ago. Net income included pre-tax special item charges of $122 million for

separation-related actions, primarily to support the European transformation plan.

19

The companys results were adversely affected by several significant factors that were not

representative of its underlying business run rate. In North America, these included warranty

reserve increases for field service actions for prior models, including safety recalls and other

product campaigns, and weather-related costs. For South America, these included balance sheet

currency exchange effects.

In total, these factors reduced first quarter pre-tax profit by about $900 million, or the equivalent

of 17 cents per share. They also account for a year-over-year decline in company pre-tax profit

of $700 million. While similar factors could occur in the future, it is unusual for items like these

to occur in this magnitude in the same quarter.

Fords Automotive operating-related cash flow was $1.2 billion in the first quarter. The company

ended the first quarter with Automotive gross cash of $25.2 billion, exceeding debt by

$9.5 billion, and a strong liquidity position of $36.6 billion, an increase of $400 million from

year-end 2013.

Although not yet included in the companys total liquidity, Ford is in the process of amending

and extending its revolving credit facility. The facility is expected to grow to about $12 billion

from $10.7 billion after its anticipated completion at the end of this month. This will improve

further the companys strong liquidity position as it expands globally. Consistent with its capital

and funding strategy, Ford plans to allocate $2 billion of the facility to Ford Credit to support its

liquidity.

20

Ford Motor Company [NYSE: F] reported a 2014 second quarter pre-tax profit of $2.6 billion,

its 20th consecutive profitable quarter and its best since second quarter 2011. The company also

affirmed its full-year pre-tax profit guidance of $7 billion to $8 billion as it continues to

implement its One Ford plan to deliver profitable growth for all.

The companys pre-tax profit of $2.6 billion, excluding special items, was $44 million higher

than a year ago. After-tax earnings per share were 40 cents, excluding special items, 5 cents

below a year ago. Net income for the quarter was $1.3 billion, or 32 cents per share, an increase

of $78 million, or 2 cents, from a year ago.

Net income included pre-tax special item charges of $481 million. These include the impairment

of Fords equity investment in the Ford Sollers joint venture in Russia, reflecting the present

outlook for the business, including a weaker ruble, lower industry volume and industry

segmentation changes that negatively impact sales of Focus. Also included in special item

charges are separation-related actions, primarily in Europe to support Fords transformation plan.

Second quarter wholesale volume and company revenue declined 1 percent year-over-year. The

company achieved higher market share in Asia Pacific, driven by record share in China.

Our One Ford plan continues to deliver, enabling us to reach our 20th consecutive quarter of

profitability, said Mark Fields, president and CEO. Moving forward, our commitment is to

build on this success by accelerating our pace of progress, while delivering product excellence

and driving innovation in all areas of our business.

21

Fords Automotive operating-related cash flow was $2.6 billion in the second quarter, its

17thconsecutive quarter of positive performance. The company ended the second quarter with

Automotive gross cash of $25.8 billion, exceeding debt by $10.4 billion. The company

completed its corporate credit facility amendment and maturity extension in the second quarter.

The facility is now $12.2 billion, of which $2 billion has been allocated to Ford Credit. The

company ended the quarter with Automotive liquidity of $36.7 billion.

In the second quarter, Ford declared a dividend of $0.125 per share on the companys

outstanding Class B and common stock and paid about $500 million in dividends. This is the

same level of dividend paid in the first quarter, and a 25 percent increase from the level of

quarterly dividends paid in 2013. Ford is currently implementing the previously announced share

repurchase program for up to 116 million shares, or almost $2 billion, to offset an up to 3 percent

dilutive effect of potential convertible debt conversions and stock-based compensation.

Fords second quarter operating effective tax rate was 44 percent, reflecting calendarization

effects, including the impact of regional profits. Ford continues to expect its full-year operating

effective tax rate to be about 35 percent, assuming retroactive extension of U.S. research credit

legislation in the fourth quarter. Fords third quarter rate is expected to be about equal to the

second quarter rate.

Ref:- http://corporate.ford.com

22

Income Statement showing income fluctuation (2009 to 2013)

Fiscal year is January-December. All values USD

millions.

2009 2010 2011 2012 2013

Sales/Revenue 118.37B 128.92B 136.27B 134.27B 146.92B

Cost of Goods Sold (COGS) incl. D&A 95B 99.36B 107.76B 109.61B 121.5B

COGS excluding D&A 86.98B 93.36B 102.37B 103.42B 114.99B

Depreciation & Amortization Expense 8.02B 6B 5.39B 6.19B 6.52B

Depreciation 8.02B 5.9B 5.38B 6.18B 6.5B

Amortization of Intangibles 0 97M 12M 10M 11M

Gross Income 23.37B 29.56B 28.51B 24.66B 25.42B

Gross Income Growth - 26.49% -3.55% -13.52% 3.08%

Ref:- http://www.marketwatch.com/investing/stock/f/financials

23

Total Company Analysis of Financial Condition

Net income attributable to Ford Motor Company was $7.2 billion or $1.76 per share of Common

and Class B Stock in 2013, an improvement of $1.5 billion or $0.34 per share from 2012.

Total Company results are shown below:

2013 2012 2011

(Mils.) (Mils.) (Mils.)

Income

Pre-tax results (excl. special items) $ 8,569 $ 7,966 $ 8,763

Special items (1,568) (246) (82)

Pre-tax results (incl. special items) 7,001 7,720 8,681

(Provision for)/Benefit from income taxes 147 (2,056) 11,541

Net income 7,148 5,664 20,222

Less: Income/(Loss) attributable to noncontrolling

interests (7) (1) 9

Net income attributable to Ford $ 7,155 $ 5,665 $ 20,213

Net income includes certain items (special items) that have grouped into Personnel and

Dealer-Related Items and Other Items to provide useful information to investors about the

nature of the special items. The first category includes items related to Fords efforts to match

production capacity and cost structure to market demand and changing model mix and therefore

helps investors track amounts related to those activities. The second category includes items that

do not generally consider to be indicative of Fords ongoing operating activities, and therefore

allows investors analyzing companies pre-tax results to identify certain infrequent significant

items that they may wish to exclude when considering the trend of ongoing operating results.

24

Ford allocate special items to a separate reconciling item, as opposed to allocating them

among the operating segments and Other Automotive, reflecting the fact that management

excludes these items from its review of operating segment results for purposes of measuring

segment profitability and allocating resources among the segments.

The following table details automotive sector pre-tax special items in each category:

2013 2012 2011

(Mils.) (Mils.) (Mils.)

Personnel and Dealer-Related Items

Separation-related actions (a) $ (856) $ (481) $ (176)

Mercury discontinuation/Other dealer actions (71) (151)

Total Personnel and Dealer-Related Items (856) (552) (327)

Other Items

U.S. pension lump-sum program (594) (250)

FCTA -- subsidiary liquidation (103) (4)

CFMA restructuring 625

Loss on sale of two component businesses (174)

AAI consolidation (b) 136

FordSollers gain 401

Belgium pension settlement (109)

Debt reduction actions (60)

Other (15) (27) 13

Total Other Items (712) 306 245

Total Special Items $ (1,568) $ (246) $ (82)

Not shown in the table above are tax benefits of $2.2 billion, $315 million, and $14.2 billion

for 2013, 2012, and 2011, respectively, that Ford consider to be special items. For 2013, these

included the impact of a favorable increase in deferred tax assets related to investments in

25

European operations and the release of valuation allowances held against U.S. state and local

deferred tax assets. For 2011, these primarily consisted of the release of almost all of the

valuation allowance against net deferred tax assets in the United States, Canada, and Spain.

Discussion of Automotive sector, Financial Services sector, and total Company results of

operations below is on a pre-tax basis and excludes special items unless otherwise specifically

noted. References to records by Automotive segments North America, South America,

Europe, and Asia Pacific Africaare since at least 2000 when Ford began reporting results for

these segments.

The chart below shows 2013 pre-tax results by sector:

Total Company 2013 pre-tax profit of $8.6 billion was among the best in Fords history.

Compared with 2012, total Company pre-tax profit increased by $603 million, explained

by higher Automotive sector results.

Ref:- www.annualreport.ford.com

26

FORD MOTOR COMPANY INCOME STATEMENT (2011,2012&2013)

Period Ending Dec 31, 2013 Dec 31, 2012 Dec 31, 2011

Total Revenue 146,917,000 133,559,000 135,605,000

Cost of Revenue 128,094,000 116,107,000 117,225,000

Gross Profit 18,823,000 17,452,000 18,380,000

Operating Expenses

Research Development - - -

Selling General and Administrative 13,176,000 11,494,000 10,884,000

Non Recurring 208,000 77,000 (36,000)

Others - - -

Total Operating Expenses - - -

Operating Income or Loss 5,439,000 5,881,000 7,532,000

Income from Continuing Operations

Total Other Income/Expenses Net 1,322,000 1,964,000 1,466,000

Earnings Before Interest And Taxes 7,830,000 8,433,000 9,498,000

Interest Expense 829,000 713,000 817,000

Income Before Tax 7,001,000 7,720,000 8,681,000

Income Tax Expense (147,000) 2,056,000 (11,541,000)

Minority Interest 7,000 1,000 (9,000)

Net Income From Continuing Ops 8,224,000 6,253,000 20,713,000

Non-recurring Events

Discontinued Operations - - -

Extraordinary Items - - -

Effect Of Accounting Changes - - -

Other Items - - -

Net Income 7,155,000 5,665,000 20,213,000

Preferred Stock And Other Adjustments - - -

Net Income Applicable To Common Shares 7,155,000 5,665,000 20,213,000

27

FORD MOTOR COMPANY BALANCE SHEET (2011,2012&2013)

Period Ending Dec 31, 2013 Dec 31, 2012 Dec 31, 2011

Assets

Current Assets

Cash And Cash Equivalents 14,468,000 15,659,000 17,148,000

Short Term Investments 22,100,000 20,284,000 18,618,000

Net Receivables 87,309,000 81,869,000 78,541,000

Inventory 7,708,000 7,362,000 5,901,000

Other Current Assets - - -

Total Current Assets 131,585,000 125,174,000 120,208,000

Long Term Investments 3,679,000 3,246,000 2,936,000

Property Plant and Equipment 47,600,000 40,245,000 35,209,000

Goodwill - - -

Intangible Assets - - 100,000

Accumulated Amortization - - -

Other Assets 5,847,000 5,556,000 4,770,000

Deferred Long Term Asset Charges 13,315,000 15,185,000 15,125,000

Total Assets 202,026,000 189,406,000 178,348,000

Liabilities

Current Liabilities

Accounts Payable 19,531,000 19,308,000 63,093,000

Short/Current Long Term Debt - - -

Other Current Liabilities - - -

Total Current Liabilities 19,531,000 19,308,000 63,093,000

Long Term Debt 114,688,000 105,058,000 99,488,000

Other Liabilities 40,462,000 48,259,000 -

Deferred Long Term Liability Charges 598,000 470,000 696,000

Minority Interest 33,000 42,000 43,000

Negative Goodwill - - -

Total Liabilities 175,312,000 173,137,000 163,320,000

28

Period Ending Dec 31,2013 Dec 31,2012 Dec 31,2011

Stockholders' Equity

Misc Stocks Options Warrants 331,000 322,000 -

Redeemable Preferred Stock - - -

Preferred Stock - - -

Common Stock 40,000 40,000 38,000

Retained Earnings 23,658,000 18,077,000 12,985,000

Treasury Stock (506,000) (292,000) (166,000)

Capital Surplus 21,422,000 20,976,000 20,905,000

Other Stockholder Equity (18,231,000) (22,854,000) (18,734,000)

Total Stockholder Equity 26,383,000 15,947,000 15,028,000

Net Tangible Assets 26,383,000 15,947,000 14,928,000

FORD MOTOR COMPANY CASH FLOW STATEMENT (2011,2012&2013)

Period Ending Dec 31, 2013 Dec 31, 2012 Dec 31, 2011

Net Income 7,155,000 5,665,000 20,213,000

Operating Activities, Cash Flows Provided By or Used In

Depreciation - - -

Adjustments To Net Income - - -

Changes In Accounts Receivables - - -

Changes In Liabilities - - -

Changes In Inventories - - -

Changes In Other Operating Activities - - -

Total Cash Flow From Operating Activities 10,444,000 9,045,000 9,784,000

Investing Activities, Cash Flows Provided By or Used In

Capital Expenditures (6,597,000) (5,488,000) (4,293,000)

Investments 32,498,000 29,447,000 35,762,000

Other Cash flows from Investing Activities (45,632,000) (38,249,000) (34,510,000)

Total Cash Flows From Investing Activities (19,731,000) (14,290,000) (3,041,000)

29

Period Ending Dec 31, 2013 Dec 31, 2012 Dec 31, 2011

Financing Activities, Cash Flows Provided By or Used In

Dividends Paid (1,574,000) (763,000) -

Sale Purchase of Stock (213,000) (125,000) -

Net Borrowings 9,663,000 4,434,000 (4,333,000)

Other Cash Flows from Financing Activities 257,000 159,000 92,000

Total Cash Flows From Financing Activities 8,133,000 3,705,000 (4,241,000)

Effect Of Exchange Rate Changes (37,000) 51,000 (159,000)

Change In Cash and Cash Equivalents (1,191,000) (1,489,000) 2,343,000

Ref:- finance.yahoo.com/q/is?s=F+Income+Statement&annual [Annual Date Ford Motor Co.(F)]

Financial Ratio Analysis of Ford Motor Company(2010 to 2013)

Period Ending: Trend 9/30/2013 9/30/2012 9/30/2011 9/30/2010

Liquidity Ratios

Current Ratio

307% 214% 611% 733%

Quick Ratio

265% 171% 583% 702%

Cash Ratio

159% 63% 417% 556%

Profitability Ratios

Gross Margin

21% 13% 22% 22%

Operating Margin

2% 11% 9% 8%

Pre-Tax Margin

0% 11% 9% 8%

Profit Margin

1% 33% 13% 9%

Pre-Tax ROE

0% 36% 11% 7%

After Tax ROE

2% 105% 16% 8%

Ref:- http://www.nasdaq.com/symbol/ford/financials?query=ratios

30

After comparing the financial ratio of Ford Motor we can analyze that the company enjoyed a

good performance in liquidity ratio. Furthermore when we come to Profitability ratio, only the

Gross Margin has increased from 13% to 21% in 2013 and rest all figures including Profit

Margin has decreased which shows that the firm is not having an ability to pay back short-time

liabilities. This shows that Ford Motors is not financial health during the period of 2013, but

these figures are not sufficient enough for us to conclude about the companys performance in

this current year. According to the sales in half quarter of 2014 and the innovation techniques

implemented by the company makes us hope that the company is running under a healthy

financial background.

Marketing and Distribution

The organization of Ford is using Differentiated Strategy in their businesses. This

strategy is to targets two or more segments by developing marketing mix for each segment. Ford

Motor Company designed to appeal to many different types of consumers and to satisfy many

different needs in the form of economy cars, sports cars, luxury cars, station wagons, vans,

trucks, and so on. Now the latest cars that the company produce is FORD FIESTA, this car are

focus on young people and ladies.

Segmentation variables

Segmentation variables used by FORD Motor Company are Geographic segmentation,

Demographic segmentation, Psychographic segmentation and Behavioral segmentation. Ford

automobile is mainly segmented to the United Kingdom automobile market industry but it also

segmented to others country like Malaysia, Indonesia and so on to various basis which are the

31

parts of above mentioned factors. The latest model FORD FIESTA is using Demographic

Variables which is age, gender and income. It is because this model is focus for young people,

ladies and average income consumer. In the other hand, FORD FIESTA also uses behaviorist

variables with the benefit for safety and fuel efficiency.

Market Segment Profiles

FORD Motor Company profile offers a comprehensive analysis for the organization; it is

business segments, and competitors. It used to analyze the business and marketing strategies

adopted by the company, and to gain a competitive edge in the market industry. This profile also

evaluates the strengths of the company and the opportunities present in the market. It is also

involves analysis of the company at three levels - segments, organizational structure and

ownership composition. Beside this, both business and geographic segments are analyzed along

with their recent financial performance. It further discusses the major subsidiaries of the

company and the recent merger & acquisitions. Most of the consumer for FORD Motor

Company may choose our product because the organization has the needs of the consumers.

Evaluate Relevant Market Segment

The FORD organization is selling FORD FEISTA for a reasonable price. It is because

this product has the necessary that are good for the consumers such as save fuel. This product is

increasing the sale potential for the company. It also determines the market industry that the Ford

Motor Company is segment to the right position for the product that the consumers are likely to

buy this automobile for their daily use.

32

Target Markets

FORD Motor Company designed as the new model FORD FIESTA is target to young

people and ladies. The young people that the organization focuses on 18-25years old which are

teenagers and ladies with average income can affordable to purchase the cars. And this kind of

model is suitable for those unmarried people because this car only have 5 seats that are not for a

big size family. Therefore, this automobile size is average so it is suitable for those consumers

that like middle size car.

Industry Factors and Competitors

FORD view environmental forces as uncontrollable and maintain passive and reactive to

the environment. In the automobile market, FORD is facing many competitors like TOYOTA,

HONDA and NISSAN. Competitors are affecting the FORD Company by reducing the sales

rate. In this situation, FORD is producing a new model car which is FORD FIESTA this season

of car is focus to attract young people and ladies. Not only that but FORD Motor Company also

focused on creating a strong business plan that produce great products that contribute to this new

generation. As part of organization plan, the company may continue to press forward to globalize

automobiles platforms that can be adapted to meet specific regional needs. Flexible

manufacturing capabilities allow us to bring products to market with greater speed and efficiency

than ever before. The marketers define the FORD companies as an oligopoly competition in the

market structure because in the market there are many substitutes available but only one

company offerings for another.

33

Product, Promotion, Pricing and Distribution Strategies

Product Strategies

The Ford classified the brand names of midsize cars, elegant and generous by research

techniques. Ford uses blue oval that Ford branding which determines price and value. The Ford

oval is proud and historic symbol for Ford Motor Company and one of the most recognized

trademarks in the world.

Promotion strategies

Ford has use difference promotional strategies to maintain their marketing edge over the

competitors. Ford is the one of the top 20th of the highest media spend companies list. During

the recession, the Ford starting to cut cost to reduce their promotional budget and cancelled all

the promotion advertising. Ford organized a lot of campaigns and tied up with the long lasting

sponsorships and regular to conducted sport events. The advertisements and logos with attractive

strap line, amazing designs and advertisement are giving edge over competitors activities. Ford

promotional strategy has classifications, 2 type of promotion such as above the line promotion

and below the line promotion.

Pricing Strategies

Ford has implemented their own pricing strategies which are more demand or market

based pricing oriented. Ford has use new strategies call Blue Tag is expanding from its large

car to the small car range. The price reductions are between 6%-15% on the Ford Fiesta. The

Ford Motor Company is setting two types of price which is price skimming and penetration

pricing in the market industry.

34

Distribution Strategies

For the marketing channel selection, Ford Motor Company uses the channel of producers,

dealers and consumers. Vehicles that are manufactured at Ford factories are distributed to dealers

through road or train transportation. Consumers can buy the cars directly at the dealers show

room.

Recommendations: -

Since Ford is the only one auto motor industry in the US who tried to sustain its

leadership and its market position with effective strategies to match the market requirements

and needs. It should give concern to update its products with latest technology gadgets and

equipped its products with the latest ones.

After conducting the in depth analysis of the companys success factors, revamped

process and other operational strategies as well as the study of case study. I came to the

following recommendations for the Ford Motors that can help the company to leverage its

market position and sustain profitability:

Recommendations: Objectives and Policies

Establish a positive reputation of long duty, safety, honesty, and customer service in the eyes

of all publics about Ford.

Invest more in research and development.

35

Manufacture genuine parts with an affordable price.

Provide first year free car insurance to attract the buyers.

Ford dealers must provide emergency 24hrs recovery services.

Recommendations: Strategy

To make the face of Ford shine brighter and to replace the companys current damaged

reputation with a new, positive image proper campaign is recommendable.

Well maintained financial planning which improve companys balance sheet and short-term

liabilities.

Accelerate the speed of developing new products which customers want and value.

Recommendations: Personal Experience

As a successful seller of automobiles, Ford must focus on giving dealership of the brand to

authorized party. A dull dealer will make customers dissatisfaction; hence the brand will lose

its goodwill. Therefore, appealing to the customers and potential customers is the most

important factor in reaching the short-term goal of selling more cars.

Research: Not only from the case analysis, but also from my personal experience after using

ford vehicles I recommend Ford motors should conduct a market research and survey with

different nations to understand the customer preferences. Vehicles must be produced

according to this preference and specifications. The company should keep an eye on the

market trends and needs because one wrong step can lead it to the deepest pit which the

36

company is scared of. Instead of changing the models each year, they should bring out the

quality and performance in the existing projects by improving the production operations of

the company. The company should focus more on the designs of its products and come up

with more diverse and efficient models.

Innovation: In Middle East market and other market, Japanese car makers are already

providing small cars and catering to the needs of the people in the segment. Fords main

competitors in this market are Toyota, Honda and others. Who are offering products that are

priced low, carrying nice features and their performance is not under rated in anyway.

According to my analysis its a fact that Ford must expand sales in Middle East. Ford must

consider the interest of Middle East customers; of course they prefer four wheel suv for the

dry desert. Ford can make more sales on vehicles like F-150 Raptor and other heavy duty

four wheel drives.

Green Vehicles: Due to the increasing emphasis by the government of US and other countries

on the production of eco-friendly cars and other vehicles, it has become extremely very

important for every car maker to introduce the cars which are more fuel efficient than those

V8 Hemi engines producing by Ford. The Japanese car makers like Honda and Toyota has

introduced more fuel efficient cars like Civic and Corolla, which even come with hybrid

engines to save petrol. Even though Ford has also taken initiative of producing environmental

friendly cars like Ford Fiesta SFE, it only scored a rank of seven in the ACEE list. Producing

greener vehicle not only increases sale,but also helps us to save from the increasing fuel cost.

37

Marketing: Today it is an era of marketing. Only those who market them-self well are likely

to succeed in this competitive market. Ford has won the marketer awards several times, I

suggest that the company should continue with the current marketing strategies and the other

promotional channels it is already into. They should also engage into aggressive marketing

and promotional activities to attract the customers about the newly introduced products.

Savvy marketing and re-defined focus can be a good sign for this iconic company. The

company should link up with the TV sponsorship and engage in the public relations activities

to attract the general public about how concerned the company is towards the social issues.

Ford has a lot of scope for producing buses to take advantage of the growing needs of public

transports, utility vehicles as well as other vehicles that may find their use in some other

industries. For example, manufacturing buses and trucks for India and African nations, oil

tankers for oil producing countries, etc.

Case as well as SWOT Analysis Recommendations:

The Company in order to gain public favor in Asia and China and to gain profits in recession

hit Europe may try to reduce its cost structure for these countries as a short term plan.

The company may risk its sales in the US to cover the subsidy given in third world

countries, but given the large size of potential customers in the target countries, possibility of

profits in long term cant be ruled out.

38

The company may resort to multiple raw material suppliers and may even try to set up its

own unit for production of raw materials. This will reduce dependence and make company

more competent with rapidly shifting raw material prices.

The production of cheaper motor vehicles in masses for mass sales rather than the making of

luxury vehicle is a good option because this will offer a large market and there is safety in the

numbers because of the large market share presented.

There should be some more less degree of centralization than present standards with some

more autonomy to regional heads to match different demands.

Promote 24hrs service centre for vehicles and customer service to answer questions regarding

complaints, recalls and changes within the company.

Institute a policy that features free car accident services for breakdowns or miner issues

related to the vehicle. This will attract customers and may result in gaining more customers.

Conclusion:

Ford Motor Company is considered as one of the largest automobile makers throughout the

world. We have a wrong believe that Ford products are expensive and only available for higher

income people. Ford changed this believe with the introducing of economical vehicles like Ford

Focus, Ikon, Fiesta and so on. This automaker transformed the world by making fuel efficient,

heavy duty and performance vehicles. Ford F-150 Raptor is one of a kind off-road vehicle with a

39

6.2liter performance engine which was a large success for the company. The success story

continues by winning several awards, "Accessory-Friendly Pick-up" Design Award from SEMA

is one among them. Ford has gain global recognition by staying focus to its product and by

delivering to the customer a full range of vehicles with outstanding fuel economy. Technology

has not remained standstill with this automobile maker. They continue to develop new affordable

automobiles with new advance technology that has captivated the suppliers, dealers,

shareholders, employees and the communities.

References:

Geyer, G. (2011). Ford Motor Company: The greatest corporate turnaround in U.S. history.

S.l.: Gerhard Geyer.

Hoffman, B. G. (2012). American icon: Alan Mulally and the fight to save Ford Motor

Company. New York: Crown Business.

Bibliography:

http://retailindustry.about.com

http://www.streetinsider.com/Corporate+News/Ford+Motor+(F)+Updates+on+Growth+Objectiv

es,+Guidance+at+Investor+Day/9868432.html

http://corporate.ford.com

40

http://www.marketwatch.com/investing/stock/f/financials

http:// www.annualreport.ford.com

www.finance.yahoo.com/q/is?s=F+Income+Statement&annual

http://www.nasdaq.com/symbol/ford/financials?query=ratios

Вам также может понравиться

- Ford 1969 Car Shop Manual Volume One Chassis PDFДокумент413 страницFord 1969 Car Shop Manual Volume One Chassis PDFjgarfield420100% (3)

- Texas Temporary TagДокумент1 страницаTexas Temporary TagYesenia Ruiz100% (1)

- Continental Airlines Case Study ResponseДокумент11 страницContinental Airlines Case Study ResponseNordia BarrettОценок пока нет

- Chapter 13 WordДокумент12 страницChapter 13 WordAmanda ClaroОценок пока нет

- Manufacturing - Design, Production, Automation and IntegrationДокумент586 страницManufacturing - Design, Production, Automation and Integrationboo100% (2)

- Casestudy - Fiat and GMДокумент3 страницыCasestudy - Fiat and GMruchisingh1104Оценок пока нет

- Company Analysis EMPERADORДокумент11 страницCompany Analysis EMPERADORDindee GutierrezОценок пока нет

- Short Quiz (3 Items X 5 Points) : Quiz On Global Marketing Date: JAN.22.2021 ScoreДокумент1 страницаShort Quiz (3 Items X 5 Points) : Quiz On Global Marketing Date: JAN.22.2021 ScoreJean Rose Orlina100% (1)

- Assignment Name: Part 1. Computation Choose The Letter of The Best Answer. Highlight Your Answer. 2 Points EachДокумент5 страницAssignment Name: Part 1. Computation Choose The Letter of The Best Answer. Highlight Your Answer. 2 Points EachCacjungoyОценок пока нет

- Problem StatementДокумент5 страницProblem StatementHazel TeОценок пока нет

- Five Competitive Forces in China's Automobile IndustryДокумент8 страницFive Competitive Forces in China's Automobile IndustrykatnavОценок пока нет

- Ford Marketing StrategyДокумент13 страницFord Marketing StrategyAnurag AnuОценок пока нет

- WWW - Incar.tw-1989 Ford F250 Diesel Repair Manual PDFДокумент5 страницWWW - Incar.tw-1989 Ford F250 Diesel Repair Manual PDFkenneth0% (3)

- 5.4L Engine Circuit 2 of 6Документ1 страница5.4L Engine Circuit 2 of 6Bronwynne OctoberОценок пока нет

- 2007 Ford Mustang Shelby GTДокумент3 страницы2007 Ford Mustang Shelby GTKen LooОценок пока нет

- Ogilvy Creative Briefchevy - Brief PDFДокумент4 страницыOgilvy Creative Briefchevy - Brief PDFRahul TatooskarОценок пока нет

- Business Aspects Objectives MeasuresДокумент1 страницаBusiness Aspects Objectives MeasuresMauiОценок пока нет

- Spotifire Ayala-Land Final-PaperДокумент74 страницыSpotifire Ayala-Land Final-PaperTrace AsinasОценок пока нет

- Corporate StrategyДокумент10 страницCorporate StrategyMadhav RajbanshiОценок пока нет

- Managerial Economics Assignment 3 PDFДокумент2 страницыManagerial Economics Assignment 3 PDFSakinaОценок пока нет

- Pricing Strategy ReviewerДокумент2 страницыPricing Strategy ReviewerMarissa PatricioОценок пока нет

- Gov Chapter 3Документ31 страницаGov Chapter 3Isaiah ValenciaОценок пока нет

- MNGT 4121 GarcesДокумент3 страницыMNGT 4121 GarcesReyjie GarcesОценок пока нет

- Strategic Analysis On Ford MotorДокумент20 страницStrategic Analysis On Ford Motormahithegr8Оценок пока нет

- An Introduction To Risk and Return-History of Financial Market ReturnsДокумент10 страницAn Introduction To Risk and Return-History of Financial Market ReturnsanisaОценок пока нет

- BuyGasCo Legal Team AssessmentДокумент3 страницыBuyGasCo Legal Team AssessmentLeslie RondinaОценок пока нет

- Reflection-Paper Chapter 2 Intenational Financial ManagementДокумент8 страницReflection-Paper Chapter 2 Intenational Financial ManagementJouhara G. San JuanОценок пока нет

- Operations ManagementДокумент4 страницыOperations ManagementFarel Abdia HarfyОценок пока нет

- Strategic Management Assessment Task 8: Market ResearchДокумент4 страницыStrategic Management Assessment Task 8: Market ResearchJes Reel100% (1)

- QUESTIONSДокумент19 страницQUESTIONSrahidarzooОценок пока нет

- New Era University: International Business PlanДокумент50 страницNew Era University: International Business PlanNesly Ascaño CordevillaОценок пока нет

- 05 Quiz 1Документ3 страницы05 Quiz 1Goose ChanОценок пока нет

- Public Sector/Enterprises (Napocor) in Enviromental Management SystemДокумент9 страницPublic Sector/Enterprises (Napocor) in Enviromental Management SystemShiela PОценок пока нет

- CADBURY Case StudyДокумент1 страницаCADBURY Case StudySomdeep SenОценок пока нет

- Midterm Quiz 2Документ11 страницMidterm Quiz 2SGwannaBОценок пока нет

- San Miguel Corp. Case Study 1Документ7 страницSan Miguel Corp. Case Study 1Casiano SeguiОценок пока нет

- Strategic Management - Chapter 7 - Business Strategy & ModelsДокумент83 страницыStrategic Management - Chapter 7 - Business Strategy & ModelsMurselОценок пока нет

- Chapter 4 SolvedДокумент4 страницыChapter 4 SolvedAsad BabbarОценок пока нет

- 03 Task Performance 1Документ1 страница03 Task Performance 1Palileo KidsОценок пока нет

- A Feasibility Study On Establishing An Auto Repair Shop With Mobile ApplicationДокумент12 страницA Feasibility Study On Establishing An Auto Repair Shop With Mobile ApplicationandreagassiОценок пока нет

- Capital StructureДокумент29 страницCapital StructureNawazish KhanОценок пока нет

- Case StudyДокумент10 страницCase StudyBishnu Dhamala33% (3)

- Case Study Ford Motor CompanyДокумент6 страницCase Study Ford Motor CompanyFatynОценок пока нет

- Buygasco Corporation: The Use of Alternative Costing MethodsДокумент5 страницBuygasco Corporation: The Use of Alternative Costing MethodsElla DavisОценок пока нет

- Procter Gamble AnalysisДокумент37 страницProcter Gamble Analysisapi-115328034100% (2)

- The Cost of Capital: Assets DebtДокумент22 страницыThe Cost of Capital: Assets Debtaku kamuОценок пока нет

- SBMДокумент10 страницSBMALi ShAhОценок пока нет

- Reflection PaperДокумент3 страницыReflection Paper061200150% (2)

- BCG Matrix and GE 9 Cell PlaningДокумент5 страницBCG Matrix and GE 9 Cell PlaningAmit Vasantbhai50% (2)

- Accn24b-Ppt - Strategic Audit of A Corporation - Group9Документ63 страницыAccn24b-Ppt - Strategic Audit of A Corporation - Group9Herald Vincent RamosОценок пока нет

- Solution by StuDocuДокумент13 страницSolution by StuDocuZia Ullah KhanОценок пока нет

- Baltzan6e Chapter03 TB AnswerKeyДокумент166 страницBaltzan6e Chapter03 TB AnswerKeyShaker ShubairОценок пока нет

- Statement of Cash FlowsДокумент2 страницыStatement of Cash FlowsMae MarinoОценок пока нет

- 02 Quiz 1 Managerial AcctgДокумент3 страницы02 Quiz 1 Managerial AcctgRalph Louise PoncianoОценок пока нет

- Instructional Module: IM No. INTL 1-1STSEM-2020-2021Документ3 страницыInstructional Module: IM No. INTL 1-1STSEM-2020-2021Frany IlardeОценок пока нет

- Term 2, Academic Year 2020-2021: Management Accounting Group Business Case AnalysisДокумент3 страницыTerm 2, Academic Year 2020-2021: Management Accounting Group Business Case AnalysisNevan NovaОценок пока нет

- Module 2. Cost-Volume-Profit AnalysisДокумент10 страницModule 2. Cost-Volume-Profit AnalysisAnnalyn ArnaldoОценок пока нет

- Airtel FinanceДокумент24 страницыAirtel FinancePrajjwol Bikram KhadkaОценок пока нет

- Coefficient of Variation : Standard Deviation Expected EPSДокумент2 страницыCoefficient of Variation : Standard Deviation Expected EPSJPОценок пока нет

- 04 TP FinancialДокумент4 страницы04 TP Financialbless erika lendroОценок пока нет

- Assignment 7 FinanceДокумент3 страницыAssignment 7 FinanceAhmedОценок пока нет

- Situation Analysis Instructions: Read and Analyze The Situation Below. Answer The Following Items On The Space ProvidedДокумент1 страницаSituation Analysis Instructions: Read and Analyze The Situation Below. Answer The Following Items On The Space ProvidedArgie Mae SalvadorОценок пока нет

- International Financial Management PPT Chap 1Документ25 страницInternational Financial Management PPT Chap 1serge folegweОценок пока нет

- Questionaire - About Role of Financial Statement On Investment Decision MakingДокумент4 страницыQuestionaire - About Role of Financial Statement On Investment Decision MakingIsmael yareОценок пока нет

- The Ford Motors StrategiesДокумент25 страницThe Ford Motors StrategiessabaОценок пока нет

- FordДокумент2 страницыFordShakeel ShemnaОценок пока нет

- Naseem FinalДокумент13 страницNaseem FinalimsluckyОценок пока нет

- TCS Annual Report 2013-2014Документ192 страницыTCS Annual Report 2013-2014Shoaib KhanОценок пока нет

- Strategicmanagementreport 131021101243 Phpapp01Документ30 страницStrategicmanagementreport 131021101243 Phpapp01Baloi-Mitrica DanielОценок пока нет

- The Role of Culture in International ManagementДокумент36 страницThe Role of Culture in International Managementrajanityagi23Оценок пока нет

- W1Документ100 страницW1rajanityagi23100% (1)

- W1Документ100 страницW1rajanityagi23100% (1)

- TCS Annual Report 2013-2014Документ192 страницыTCS Annual Report 2013-2014Shoaib KhanОценок пока нет

- Syllabus ESS 3290 WB Dubai F9022014 11152014Документ7 страницSyllabus ESS 3290 WB Dubai F9022014 11152014rajanityagi23Оценок пока нет

- Cross Cultural MGMTДокумент36 страницCross Cultural MGMTGuru GurbaxОценок пока нет

- Cross Cultural MGMTДокумент36 страницCross Cultural MGMTGuru GurbaxОценок пока нет

- Syllabus ESS 3290 WB Dubai F9022014 11152014Документ7 страницSyllabus ESS 3290 WB Dubai F9022014 11152014rajanityagi23Оценок пока нет

- Rajani CVДокумент3 страницыRajani CVrajanityagi23Оценок пока нет

- mgt4950 (1) .Docx2012 EdДокумент4 страницыmgt4950 (1) .Docx2012 Edrajanityagi23Оценок пока нет

- PresentationДокумент118 страницPresentationrajanityagi23Оценок пока нет

- Policy and Procedure ManualДокумент18 страницPolicy and Procedure Manualrajanityagi23Оценок пока нет

- MSFT Fy14q4 10KДокумент118 страницMSFT Fy14q4 10Krajanityagi23Оценок пока нет

- SaimaAkram - Apple Inc PDFДокумент79 страницSaimaAkram - Apple Inc PDFrajanityagi23Оценок пока нет

- SaimaAkram - Apple Inc PDFДокумент79 страницSaimaAkram - Apple Inc PDFrajanityagi23Оценок пока нет

- <!DOCTYPE HTML PUBLIC "-//W3C//DTD HTML 4.01 Transitional//EN" "http://www.w3.org/TR/html4/loose.dtd"> <HTML><HEAD><META HTTP-EQUIV="Content-Type" CONTENT="text/html; charset=iso-8859-1"> <TITLE>ERROR: The requested URL could not be retrieved</TITLE> <STYLE type="text/css"><!--BODY{background-color:#ffffff;font-family:verdana,sans-serif}PRE{font-family:sans-serif}--></STYLE> </HEAD><BODY> <H1>ERROR</H1> <H2>The requested URL could not be retrieved</H2> <HR noshade size="1px"> <P> While trying to process the request: <PRE> TEXT http://www.scribd.com/titlecleaner?title=International+Marketing.pdf HTTP/1.1 Host: www.scribd.com Proxy-Connection: keep-alive Accept: */* Origin: http://www.scribd.com X-CSRF-Token: 99b49d37cd6ea48c417003839ffcc5bb113e748b User-Agent: Mozilla/5.0 (Windows NT 6.1) AppleWebKit/537.22 (KHTML, like Gecko) Chrome/25.0.1364.29 Safari/537.22 X-Requested-With: XMLHttpRequest Referer: http://www.scribd.com/upload-document?archive_doc=18926113&metaДокумент250 страниц<!DOCTYPE HTML PUBLIC "-//W3C//DTD HTML 4.01 Transitional//EN" "http://www.w3.org/TR/html4/loose.dtd"> <HTML><HEAD><META HTTP-EQUIV="Content-Type" CONTENT="text/html; charset=iso-8859-1"> <TITLE>ERROR: The requested URL could not be retrieved</TITLE> <STYLE type="text/css"><!--BODY{background-color:#ffffff;font-family:verdana,sans-serif}PRE{font-family:sans-serif}--></STYLE> </HEAD><BODY> <H1>ERROR</H1> <H2>The requested URL could not be retrieved</H2> <HR noshade size="1px"> <P> While trying to process the request: <PRE> TEXT http://www.scribd.com/titlecleaner?title=International+Marketing.pdf HTTP/1.1 Host: www.scribd.com Proxy-Connection: keep-alive Accept: */* Origin: http://www.scribd.com X-CSRF-Token: 99b49d37cd6ea48c417003839ffcc5bb113e748b User-Agent: Mozilla/5.0 (Windows NT 6.1) AppleWebKit/537.22 (KHTML, like Gecko) Chrome/25.0.1364.29 Safari/537.22 X-Requested-With: XMLHttpRequest Referer: http://www.scribd.com/upload-document?archive_doc=18926113&metaNaren KirmaraОценок пока нет

- As A Way To Remember Stellar ClassificationДокумент5 страницAs A Way To Remember Stellar Classificationrajanityagi23Оценок пока нет

- Project Supply Chain Management: Perishable Products (Restaurant Chain)Документ34 страницыProject Supply Chain Management: Perishable Products (Restaurant Chain)rajanityagi23Оценок пока нет

- Mcdonald'S Value Chain Mcdonald'S Value Chain Analysis AnalysisДокумент33 страницыMcdonald'S Value Chain Mcdonald'S Value Chain Analysis Analysisrajanityagi23Оценок пока нет

- mgt4950 (1) .Docx2012 EdДокумент4 страницыmgt4950 (1) .Docx2012 Edrajanityagi23Оценок пока нет

- Mango VCA Final January 2011 PDFДокумент101 страницаMango VCA Final January 2011 PDFrajanityagi23Оценок пока нет

- MBA552 Lecture FourДокумент76 страницMBA552 Lecture Fourrajanityagi23Оценок пока нет

- Importance of Culture in Success of International Marketing PDFДокумент15 страницImportance of Culture in Success of International Marketing PDFrajanityagi23Оценок пока нет

- Internet MarketingДокумент28 страницInternet Marketingrajanityagi23Оценок пока нет

- HUM 119 Cross Cultural Communication - KoreguotaДокумент4 страницыHUM 119 Cross Cultural Communication - Koreguotarajanityagi23Оценок пока нет

- International Monetary Fund (Imf) & World Bank: Presented By: Yogesh Chinchole Harander Kumar Pawan Kumar KhushalyadavДокумент8 страницInternational Monetary Fund (Imf) & World Bank: Presented By: Yogesh Chinchole Harander Kumar Pawan Kumar Khushalyadavrajanityagi23Оценок пока нет

- International BusinessДокумент73 страницыInternational BusinessbagyabioОценок пока нет

- ImmmmmДокумент4 страницыImmmmmrajanityagi23Оценок пока нет

- Strategic Management Presentation On VW (FINAL)Документ32 страницыStrategic Management Presentation On VW (FINAL)manelisir43% (7)

- Ford Ka (A) INS984-PDF-ENGДокумент31 страницаFord Ka (A) INS984-PDF-ENGFabricio Eric ParraОценок пока нет

- Ford - KMДокумент40 страницFord - KMgbsshravanthy83% (6)

- World Survey Reports On International Human Resourse ManagementДокумент26 страницWorld Survey Reports On International Human Resourse ManagementgurgurgurgurОценок пока нет

- Case Study: Global Strategy of Ford: QuestionsДокумент1 страницаCase Study: Global Strategy of Ford: Questions17040643 Vũ Thị Phuơng AnhОценок пока нет

- ตารางชาฟДокумент9 страницตารางชาฟนัทไง จะใครหล่ะОценок пока нет

- The Electrical Worker December 2009Документ20 страницThe Electrical Worker December 2009Kathryn R. ThompsonОценок пока нет

- The Valley's Nickel Volume 2 Issue 2Документ20 страницThe Valley's Nickel Volume 2 Issue 2The Valley's NickelОценок пока нет

- Motorcraft Engine Antifreeze/Coolants - Usage Chart: DG (Prior To 7/11/11) DG (From 1/19/09)Документ3 страницыMotorcraft Engine Antifreeze/Coolants - Usage Chart: DG (Prior To 7/11/11) DG (From 1/19/09)Seth AdamsОценок пока нет

- 1966 Ford Vehicle Identification Numbers (Vin)Документ5 страниц1966 Ford Vehicle Identification Numbers (Vin)al.bigdaddy.thomasОценок пока нет

- Catalogo PUMA 2015Документ23 страницыCatalogo PUMA 2015bruno reginattoОценок пока нет

- Teikin Catalog Vol 16-Automobile FordДокумент6 страницTeikin Catalog Vol 16-Automobile FordROBINSON GUERREROОценок пока нет

- Ford Vs FerrariДокумент16 страницFord Vs FerrariRAFIAHAMMED100% (1)

- Toyota's Marketing StrategyДокумент14 страницToyota's Marketing StrategyLavin Gurnani0% (1)

- Seavitt Resume 2015 ReadДокумент2 страницыSeavitt Resume 2015 ReadHumaKhursheedОценок пока нет

- Tata JLRДокумент34 страницыTata JLRgouravjain86Оценок пока нет

- Issue21 Jul Eng Regional (R2)Документ9 страницIssue21 Jul Eng Regional (R2)Smarty PothithetОценок пока нет

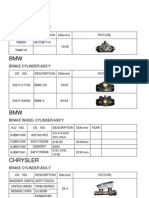

- Brake Cylinders & CalipersДокумент166 страницBrake Cylinders & CalipersArmo Morales86% (7)

- Car Logo MeaningДокумент3 страницыCar Logo MeaningPraveen KumarОценок пока нет

- Project Report On Jaguar.Документ28 страницProject Report On Jaguar.Santosh Kumar50% (2)

- AttendeeДокумент18 страницAttendeemanaswini routОценок пока нет

- Sample Assignment For The Course of International BusinessДокумент14 страницSample Assignment For The Course of International BusinessAnonymous RoAnGpAОценок пока нет

- 96-98 Steering ComponentsДокумент3 страницы96-98 Steering ComponentsDr Popo Ronn100% (2)