Академический Документы

Профессиональный Документы

Культура Документы

ICICI Prudential Monthly Income Plan

Загружено:

Robert AyalaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ICICI Prudential Monthly Income Plan

Загружено:

Robert AyalaАвторское право:

Доступные форматы

ICICI Prudential Monthly Income Plan

Investing has always meant seeking a stable, regular return. Although there are those who

would sway towards leveraging the benefits of equity investing, several investors are focused

on conservative growth and regular income.

However, inflation tends to impact conservative returns, so a limited exposure to equity has

the potential to add a spark to your returns, while treading along cautiously.

ICICI Prudential Monthly Income Plan (MIP), (Monthly Income is not assured and is subject to

availability of distributable surplus), an open-ended fund, is designed to be a low risk income-

generating product for an investor who likes to earn the short term debt market return

enhanced by a small equity component that does not significantly add to the risk of the

portfolio.

Investment Philosophy

This conservatively managed fund invests predominantly in debt securities with the view of generating regular

income. To this basic portfolio, it adds on a very limited equity exposure to a maximum of 15%, such that the risk-

adjusted returns have potential to be enhanced. The intent is to provide the benefit of equity returns, without

adding on significant risk. The fund aims to manage interest rate risks and credit risks by investing in high quality

debt instruments & also has the ability to be dynamically managed to alter asset allocation, depending on the

equity / debt market scenario.

Investor Profile

This fund is ideal for -

Investors focused on earning income and seeking limited growth without too much risk.

Investors willing to take on limited equity exposure.

Investors concerned about the interest rate risks in pure debt funds.

Key Benefits

A core portfolio invested in debt provides stability to the investment.

Limited exposure to equity has the potential to spike up the returns generated from the basic debt portfolio

& provides an opportunity to earn better risk-adjusted returns

The fund has the track record of uninterrupted monthly dividends since inception.

Key Features

Type

Open-ended Fund

Plans

Regular & Direct

Options

Growth and Dividend

Default Option

Growth

Application Amount

Rs.5000 (plus in multiples of Rs.1)

Min. Additional Investment

Rs.1000 (plus in multiples of Re.1)

Entry Load

Nil.

Exit Load

(a) If the amount, sought to be redeemed or switched out, is invested for a period of upto 1 year from the date of

allotment 1%; (b) If the amount, sought to be redeemed or switched out, is invested for a period more than 1year

from the date of allotment - Nil.

Redemption Cheques Issued

Generally Within 3 business day for Specified RBI locations and additional 3 Business Days for Non-RBI

locations.

Minimum Redemption Amt.

Rs.500 (plus in multiples of Re.1)

Systematic Investment Plan

Dividend & AEP Option - Monthly and Cumulative (without AEP) Option - Monthly: Min Rs.1000 + 5 post - dtd

cheques for a minimum of Rs.1000 each Quarterly: Minimum Rs. 5000 + 4 post - dated cheques of Rs. 5000

each. Exit Load: (w.e.f. 01-10-09): (a) If the amount, sought to be redeemed or switched out, is invested for a

period of upto 1 year from the date of allotment 1%; (b) If the amount, sought to be redeemed or switched out,

is invested for a period more than 1year from the date of allotment - Nil.

Systematic Withdrawal Plan

Minimum of Rs.500 and multiples of Re1/-

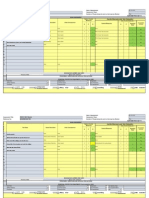

Schemes Latest NAV (Rs.)

ICICI Prudential MIP - Direct Plan - Dividend Half Yearly 12.5097 (09 Apr 2013)

ICICI Prudential MIP - Direct Plan - Dividend Monthly 11.7387 (09 Apr 2013)

ICICI Prudential MIP - Direct Plan - Dividend Quarterly 12.6819 (09 Apr 2013)

ICICI Prudential MIP - Direct Plan Growth 30.0027 (09 Apr 2013)

ICICI Prudential MIP - Regular Plan - Dividend Half Yearly 12.5028 (09 Apr 2013)

ICICI Prudential MIP - Regular Plan - Dividend Monthly 11.6898 (09 Apr 2013)

ICICI Prudential MIP - Regular Plan - Dividend Quarterly 12.5327 (09 Apr 2013)

ICICI Prudential MIP - Regular Plan - Growth 29.9428 (09 Apr 2013)

Fund Manager

Equity: Rajat Chandak

Debt: Avnish Jain

ICICI Prudential Balanced Fund

Asset allocation is the key to investing success as it helps you reduce the volatility of returns.

By investing in equity for capital appreciation and debt for stable returns, you can reduce

instability of returns by increasing / decreasing exposure to various markets, based on in-

depth research and analysis.

ICICI Prudential Balanced Fund, an open-ended balanced fund, does just that. It takes care of

this asset allocation by constantly investigating market outlook and performance and

accordingly by increasing / decreasing equity exposure based on the market outlook and

using a core debt portfolio to do the rebalancing.

Investment Philosophy

This fund seeks to optimize the risk-adjusted return by distributing assets between both equity and debt markets.

In bullish markets equity allocation can go upto 80%. In bearish markets equity allocation can go down to 65%.

This dynamic allocation along with core debt portfolio reduces the volatility of return

Investor Profile

This Plan is ideal for -

Investors seeking exposure to both equity and debt markets through one fund

Investors considering reasonable returns with and lower risk through diversification.

Key Benefits

Provides the twin benefits of growth from equity markets and steady income from debt markets.

Lower volatility of returns and lower risk through diversification.

Key Features

Type

Open ended Balanced Fund

Plans

Regular & Direct

Options

Growth and Dividend

Default Option

Growth

Application Amount

Rs.5000 (plus in multiples of Rs.1)

Min. Additional Investment

Rs.1000 (plus in multiples of Re.1)

Entry Load

Nil.

Exit Load

(w.e.f. 24-05-12): (a) If the amount, sought to be redeemed/switched out within a period of 15 Months from the

date of allotment, an exit load of 1% of the applicable Net Asset Value shall be charged.

(b) If the amount, sought to be redeemed or switched out, is invested for a period of more than 15 Months from

the date of allotment - Nil.

Redemption Cheques Issued

Generally Within 3 business day for Specified RBI locations and additional 3 Business Days for Non-RBI

locations.

Minimum Redemption Amt.

Rs.500 (plus in multiples of Re.1)

Systematic Investment Plan

Monthly: Minimum Rs.1,000 + 5 post - dated cheques for a minimum of Rs.1,000 each Quarterly: Minimum Rs.

5000 + 3 post - dated cheques of Rs. 5000 each.

Systematic Withdrawal Plan

Minimum of Rs.500/- and Multiples thereof

Schemes Latest NAV (Rs.)

ICICI Prudential Balanced Fund - Direct Plan - Dividend 16.22 (09 Apr 2013)

ICICI Prudential Balanced Fund - Direct Plan - Growth 53.50 (09 Apr 2013)

ICICI Prudential Balanced Fund - Regular Plan - Dividend 16.19 (09 Apr 2013)

ICICI Prudential Balanced Fund - Regular Plan - Growth 53.38 (09 Apr 2013)

Fund Manager

Equity - Yogesh Bhatt - He has overall 20 years of experience in Fund Management.

Debt - Avnish Jain - Overall 12 years experience in managing the fixed income investment.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Designing An Electrical Installation - Beginner GuideДокумент151 страницаDesigning An Electrical Installation - Beginner GuideFrankie Wildel100% (4)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- WWII Engineer Amphibian TroopsДокумент162 страницыWWII Engineer Amphibian TroopsCAP History Library67% (3)

- Net Test Sample PaperДокумент40 страницNet Test Sample PaperZenith Education67% (3)

- 11 EngineДокумент556 страниц11 Enginerumen80100% (3)

- Tally QuestionsДокумент73 страницыTally QuestionsVishal Shah100% (1)

- Task Based Risk Assesment FormДокумент2 страницыTask Based Risk Assesment FormKolluri SrinivasОценок пока нет

- Value Analysis and EngineeringДокумент25 страницValue Analysis and Engineeringeebeep100% (2)

- Martillo Komac KB1500 Parts ManualДокумент12 страницMartillo Komac KB1500 Parts ManualJOHN FRADER ARRUBLA LOPEZ100% (1)

- Loan Agreement with Chattel Mortgage SecuredДокумент6 страницLoan Agreement with Chattel Mortgage SecuredManny DerainОценок пока нет

- Kinetics of Acetone Hydrogenation For Synthesis of Isopropyl Alcohol Over Cu-Al Mixed Oxide CatalystsДокумент9 страницKinetics of Acetone Hydrogenation For Synthesis of Isopropyl Alcohol Over Cu-Al Mixed Oxide Catalysts李国俊Оценок пока нет

- Detailed Advt CWE Clerks VДокумент33 страницыDetailed Advt CWE Clerks VRahul SoniОценок пока нет

- Chatfield Pharmaceuticals Limited (International Online Interview)Документ2 страницыChatfield Pharmaceuticals Limited (International Online Interview)Robert AyalaОценок пока нет

- Manager Performance Review SummaryДокумент12 страницManager Performance Review SummaryRobert AyalaОценок пока нет

- Company Profile: Eagle Information Systems Pvt. LTDДокумент19 страницCompany Profile: Eagle Information Systems Pvt. LTDRobert AyalaОценок пока нет

- 001 Overview DashboardДокумент6 страниц001 Overview DashboardRobert AyalaОценок пока нет

- Kukukshetra University Kurukshetra: ( A' Grade, NAAC Accredited)Документ5 страницKukukshetra University Kurukshetra: ( A' Grade, NAAC Accredited)Robert AyalaОценок пока нет

- Har 2Документ12 страницHar 2Robert AyalaОценок пока нет

- Job Interview Questions For ProspectiveДокумент29 страницJob Interview Questions For ProspectiveRobert AyalaОценок пока нет

- MBA 016 Module IVДокумент6 страницMBA 016 Module IVRobert AyalaОценок пока нет

- Decision MakingДокумент53 страницыDecision MakingSalman M. AhmedОценок пока нет

- Must For Speeding DI PDFДокумент5 страницMust For Speeding DI PDFpraveenОценок пока нет

- MBA 016 Module IДокумент18 страницMBA 016 Module IRobert AyalaОценок пока нет

- Organizational ChangeДокумент20 страницOrganizational ChangeRobert AyalaОценок пока нет

- CFP BrochureДокумент8 страницCFP BrochureSumeet DarakОценок пока нет

- Presentation 2Документ9 страницPresentation 2Robert AyalaОценок пока нет

- APPLICATION FOR: Lecturer/Asstt. P./ Asso. P./Prof. DISCIPLINEДокумент3 страницыAPPLICATION FOR: Lecturer/Asstt. P./ Asso. P./Prof. DISCIPLINERobert AyalaОценок пока нет

- MBA 016 Module IIДокумент12 страницMBA 016 Module IIRobert AyalaОценок пока нет

- MBA 016 Module IIIДокумент12 страницMBA 016 Module IIIRobert AyalaОценок пока нет

- Risk and Return AnalysisДокумент1 страницаRisk and Return AnalysisRobert AyalaОценок пока нет

- GE MatrixДокумент17 страницGE MatrixAnjaliMore100% (1)

- Name: Vipen Kumar Bhasin Regional Manager H.Q. Ambala Division: Microvision-2Документ2 страницыName: Vipen Kumar Bhasin Regional Manager H.Q. Ambala Division: Microvision-2Robert AyalaОценок пока нет

- BDL&PLДокумент41 страницаBDL&PLRobert AyalaОценок пока нет

- Writing A Research PaperДокумент28 страницWriting A Research PaperRobert AyalaОценок пока нет

- AOA FinalДокумент33 страницыAOA FinalRobert AyalaОценок пока нет

- 8 QuestionnaireДокумент28 страниц8 QuestionnaireRobert AyalaОценок пока нет

- ICICI Prudential Monthly Income PlanДокумент3 страницыICICI Prudential Monthly Income PlanRobert AyalaОценок пока нет

- Portfolio Details AMC Name: Scheme Name: Scheme Features Investment DetailsДокумент4 страницыPortfolio Details AMC Name: Scheme Name: Scheme Features Investment DetailsRobert AyalaОценок пока нет

- Some Asset Management CompaniesДокумент1 страницаSome Asset Management CompaniesRobert AyalaОценок пока нет

- Essential earthquake preparedness stepsДокумент6 страницEssential earthquake preparedness stepsRalphNacisОценок пока нет

- Education, A Vital Principle For Digital Library Development in IranДокумент23 страницыEducation, A Vital Principle For Digital Library Development in Iranrasuli9Оценок пока нет

- Impact of COVIDДокумент29 страницImpact of COVIDMalkOo AnjumОценок пока нет

- BVM Type B Casing Tong ManualДокумент3 страницыBVM Type B Casing Tong ManualJuan Gabriel GomezОценок пока нет

- Norlys 2016Документ124 страницыNorlys 2016elektrospecОценок пока нет

- The Problem and Its SettingДокумент36 страницThe Problem and Its SettingRodel CamposoОценок пока нет

- Opening Up The Prescriptive Authority PipelineДокумент10 страницOpening Up The Prescriptive Authority PipelineJohn GavazziОценок пока нет

- EzraCohen TVMasterclass 2.0Документ10 страницEzraCohen TVMasterclass 2.0Pete PetittiОценок пока нет

- Washington State Employee - 4/2010Документ8 страницWashington State Employee - 4/2010WFSEc28Оценок пока нет

- Sonydsp v77 SM 479622 PDFДокумент41 страницаSonydsp v77 SM 479622 PDFmorvetrОценок пока нет

- E HANAAW 12 Sample QuestionДокумент16 страницE HANAAW 12 Sample QuestionsuryaОценок пока нет

- 9643 SoirДокумент38 страниц9643 SoirpolscreamОценок пока нет

- EasementДокумент10 страницEasementEik Ren OngОценок пока нет

- CLS1Документ3 страницыCLS1Shaina Kaye De GuzmanОценок пока нет

- Wizard's App Pitch Deck by SlidesgoДокумент52 страницыWizard's App Pitch Deck by SlidesgoandreaОценок пока нет

- Rheomix 141Документ5 страницRheomix 141Haresh BhavnaniОценок пока нет

- Dhilshahilan Rajaratnam: Work ExperienceДокумент5 страницDhilshahilan Rajaratnam: Work ExperienceShazard ShortyОценок пока нет

- Validate Internet Backbone Routing and SwitchingДокумент27 страницValidate Internet Backbone Routing and SwitchingThành Trung NguyễnОценок пока нет

- Management principles and quantitative techniquesДокумент7 страницManagement principles and quantitative techniquesLakshmi Devi LakshmiОценок пока нет

- Portfolio Management Banking SectorДокумент133 страницыPortfolio Management Banking SectorNitinAgnihotri100% (1)

- Risk Assessments-These Are The Risk Assessments Which Are Applicable To Works Onsite. Risk Definition and MatrixДокумент8 страницRisk Assessments-These Are The Risk Assessments Which Are Applicable To Works Onsite. Risk Definition and MatrixTimothy AziegbemiОценок пока нет

- Tds Uniqflow 372s enДокумент1 страницаTds Uniqflow 372s enm daneshpourОценок пока нет