Академический Документы

Профессиональный Документы

Культура Документы

BIR Ruling 456-2011

Загружено:

Mikz Polzz0 оценок0% нашли этот документ полезным (0 голосов)

777 просмотров5 страницBIR Ruling on the credit card payments by TTC.

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBIR Ruling on the credit card payments by TTC.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

777 просмотров5 страницBIR Ruling 456-2011

Загружено:

Mikz PolzzBIR Ruling on the credit card payments by TTC.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

Copyright 2014 CD Technologies Asia, Inc. and Accesslaw, Inc.

Philippine Taxation Encyclopedia First Release 2014 1

November 16, 2011

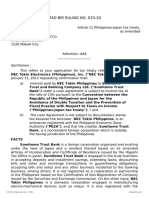

BIR RULING NO. 456-11

RR 2-98 as amended by RR 17-03;

RMC 72-04;

BIR Ruling No. 151-90; BIR Ruling

No. 023-09

Law Offices of Siguion Reyna Montecillo & Ongsiako

4th & 6th Floors, Citibank Center,

8741 Pasco De Roxas, Makati City

Attention: Attys. Jose Lis C. Leagogo

& Ma. Corazon U. Del Castillo

Gentlemen :

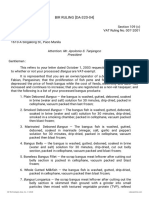

This refers to your letter dated February 18, 2010 requesting, on behalf of your

client, SWEDISH MATCH PHILIPPINES, INC. (SMPI), confirmation of your

opinion on the following: (1) that SMPI is not required to withhold 1% or 2% EWT

upon presentation of the credit card to the supplier; and (2) that SMPI is required to

withhold 2% EWT on the interest payment and/or service fee and other charges

imposed by the credit card company.

It is represented that SMPI, with Taxpayer Identification No. 000-363-177-000,

is a domestic corporation registered with the Securities and Exchange Commission

(SEC) under SEC Registration No. 187000; that its primary purpose for which it was

organized is to manufacture, produce, purchase, import or otherwise acquire, and sell,

export or otherwise dispose of, lighters and the machinery, equipment and component

parts for manufacturing lighters; that its principal office is located at 104 Technology

Avenue, Laguna Technopark Special Economic Zone, Bian, Laguna; that it is a

wholly-owned subsidiary of Swedish Match A.B., a company organized and existing

under the laws of Sweden; that on 14 March 2007, SMPI was classified by the Bureau

of Internal Revenue (BIR) as one of the Top Ten Thousand (10,000) Private

Corporations (TTC) for tax purposes; that SMPI has numerous suppliers of goods and

Copyright 2014 CD Technologies Asia, Inc. and Accesslaw, Inc. Philippine Taxation Encyclopedia First Release 2014 2

services that it pays by credit cards, such as utility providers; that upon purchase, the

suppliers issue their own official receipts and card transaction slips to SMPI; that

instead of collecting the payment from SMPI, the suppliers collect from the card

issuer; and that the card issuer then collects from SMPI for the payments it made to

the suppliers.

In reply, please be informed that Revenue Memorandum Circular (RMC) No.

72-2004

1

provides that: SCaTAc

"Q20. If the payment for the purchase of goods or services to their regular

suppliers by the TTC/GO/LT is through credit card or through company

issued credit card to officers/employees for purposes of reimbursements,

will the TTC/GO/LT be required to withhold the tax when it presents the

credit card to the supplier?

A20. The TTC/GO/LT is not required to withhold the tax upon presentation of

the credit card to the supplier. The TTC/GO/LT, however, is required to

withhold the 2% expanded withholding tax corresponding to the interest

payment and/or service fee and other charges imposed by the credit card

company. The credit card company, on the other hand, shall withhold

1% of 50% of the gross amount paid to any business entity pursuant to

Section 2.57.2(L) of RR 2-98, as amended." (Emphasis supplied)

On the other hand, Sec. 2.57.2 (M) of Revenue Regulations (RR) No. 2-98, as

amended by RR No. 14-2008, provides:

"(M) Income payments made by the top twenty thousand (20,000)

private corporations to their local/resident supplier of goods and local/resident

supplier of services other than those covered by other rates of withholding tax.

Income payments made by any of the top twenty thousand (20,000) private

corporations, as determined by the Commissioner, to their local/resident

supplier of goods and local/resident supplier of services, including non-resident

alien engaged in trade or business in the Philippines.

Supplier of goods - 1%

Supplier of services - 2%

xxx xxx xxx"

The 1% and 2% tax rate on income payments will only apply in cases of

income payments made by top 20,000 corporations to supplier of goods or services

Copyright 2014 CD Technologies Asia, Inc. and Accesslaw, Inc. Philippine Taxation Encyclopedia First Release 2014 3

which are not subject to any specific withholding tax rates provided in the said

revenue regulations. (BIR Ruling No. 023-09 dated November 26, 2009)

In BIR Ruling No. 151-90 dated August 16, 2006, this Office illustrated the

nature of the business of credit cards, to wit:

"In reply, please be informed that based on the foregoing facts, the credit

card company generates revenues principally from discount granted by the

establishment and incidentally from fees paid by the cardholder; and that the

credit card company finances the cardholder for the latter's purchases on credit,

since said purchases are paid by the company prior to billing the cardholder.

Accordingly, these activities fall within the purview of finance companies, or

similar to it, as defined in Section 11 of P.D. No. 1739, which reads as follows:

aIcSED

(ee) The term "finance companies" refers to

corporations or partnerships other than a bank, or insurance

company, primarily organized for the purpose of extending

credit facilities to consumers and to industrial, commercial or

agricultural enterprises whether by granting direct loans or by

discounting or factoring commercial papers or accounts

receivables for profit, buying and selling contracts, leases,

chattel mortgages and other evidences of indebtedness arising

out of one or more of the steps in the distribution and sale of

commodities."

In case of purchases using a credit card, the merchant/service establishment

(M/SE) allows the customer (i.e., cardholder) to make the purchase on credit. The said

receivables of the M/SE from the customer or cardholder are then assigned by the

former to the credit card company at a discount for early payment or settlement of the

transaction. What is being sold to and purchased by the credit card companies are the

receivables from purchaser-cardholder. Hence, the payments made by the credit card

companies, which are termed "settlement of accounts", are those receivables

transferred or assigned to them by the merchant. Clearly, such payments are neither

payments for the purchase of goods or services. (BIR Ruling No. 023-09 dated

November 26, 2009)

Considering that it has been settled in several BIR Rulings that a credit card

business is engaged in financing activities with respect to its discounting of

receivables (BIR Ruling No. 023-09 citing BIR Ruling No. 151-06 and BIR Ruling No.

UN-170-95 dated April 19, 1995) and that the credit card company generates revenues

Copyright 2014 CD Technologies Asia, Inc. and Accesslaw, Inc. Philippine Taxation Encyclopedia First Release 2014 4

principally from the discount granted by the establishment and incidentally from fees

paid by the cardholder, therefore, the cardholder is then required to withhold the 2%

expanded withholding tax on the interest payment and/or service fee and other charges

imposed by the credit card company when it subsequently pays the credit card

company.

On the part of the credit card company, Section 2.57.2 (L) of RR 2-98 provides

that a withholding tax of 1% shall be withheld on the 1/2 of the gross amounts paid by

any credit card company in the Philippines to any business entity, whether natural or

juridical person, representing the sales of goods or services made by the aforesaid

business entity to card holders. (BIR Ruling No. 023-09)

In view of the specific provision in Section 2.57.2 (L) of RR 2-98, as amended,

payments made by credit card companies to M/SE for the purchase of receivables are

not subject to the 1% or 2% withholding tax under Section 2.57.2 (M) of RR 2-98 but

rather to the 1% of the 1/2 of the gross amount paid. ACETID

From the foregoing, this Office hereby confirms your opinion that for payment

transactions of SMPI for the purchase of goods or services from its regular suppliers

through credit card:

(1) SMPI is not required to withhold the 1% or 2% EWT as imposed

under Section 2.57.2 (M) of RR 2-98 and pursuant to RMC

72-2004 upon presentation by SMPI of its credit card to suppliers

of goods or services; and

(2) that SMPI is, however, required to withhold the 2% EWT on the

interest payment and/or service fee and other charges imposed by

the credit card company.

This ruling is being issued on the basis of the foregoing facts as represented.

However, if upon investigation, it will be ascertained that the facts are different, then

this ruling shall be considered null and void.

Very truly yours,

(SGD.) KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

Copyright 2014 CD Technologies Asia, Inc. and Accesslaw, Inc. Philippine Taxation Encyclopedia First Release 2014 5

Footnotes

1. November 16, 2004. Clarification of Issues on the Additional Transactions Subject to

Creditable Withholding Tax under Revenue Regulations (RR) No. 17-2003, as

amended by RR 30-2003 and RR 3-2004.

Вам также может понравиться

- Ss-4 EIN Certificate - PDF - OneDriveДокумент1 страницаSs-4 EIN Certificate - PDF - OneDriveResplandor de Gloria Blue Island ILОценок пока нет

- Oracle Applications: Accounts PayableДокумент13 страницOracle Applications: Accounts PayableVenkat Subramanian RОценок пока нет

- BIR Ruling 023-09Документ5 страницBIR Ruling 023-09Juno Geronimo100% (1)

- Invoice - Zoya Ali Traders LLC 2023-02-02Документ2 страницыInvoice - Zoya Ali Traders LLC 2023-02-02Bahar AliОценок пока нет

- Directors CertificateДокумент2 страницыDirectors CertificateCesar DionidoОценок пока нет

- BIR - Ruling - DA - C-148 - 406-09 - Collection On Behalf of NRFC Not Subject To WHTДокумент6 страницBIR - Ruling - DA - C-148 - 406-09 - Collection On Behalf of NRFC Not Subject To WHTjohn allen MarillaОценок пока нет

- BIR Form No. 0608 PDFДокумент2 страницыBIR Form No. 0608 PDFPaolo MartinОценок пока нет

- FINAL FOI Request Form - Annex BДокумент1 страницаFINAL FOI Request Form - Annex BAnnie Bag-ao100% (1)

- Share For Share Under Section 40 CДокумент13 страницShare For Share Under Section 40 CCkey ArОценок пока нет

- BIR Ruling No. 242-18 (Gift Certs.)Документ7 страницBIR Ruling No. 242-18 (Gift Certs.)LizОценок пока нет

- Mandatory Disclosure Form (MDF)Документ2 страницыMandatory Disclosure Form (MDF)jonilyn florentino100% (1)

- Estate Tax: Bantolo, Javier, MusniДокумент31 страницаEstate Tax: Bantolo, Javier, MusniPatricia RodriguezОценок пока нет

- PFF053 MembersContributionRemittanceForm V02-FillableДокумент2 страницыPFF053 MembersContributionRemittanceForm V02-FillableCYvelle TorefielОценок пока нет

- Process For Application To Use LooseleafДокумент1 страницаProcess For Application To Use LooseleafFrancis MartinОценок пока нет

- 1999 BIR RulingsДокумент74 страницы1999 BIR Rulingschris cardinoОценок пока нет

- R1 (Answers) 20200915174338prl3 - v1 - 0 - Exercise - Year - End - Qu - Bec - 2017 - 0120Документ8 страницR1 (Answers) 20200915174338prl3 - v1 - 0 - Exercise - Year - End - Qu - Bec - 2017 - 0120Arslan HafeezОценок пока нет

- Psa 200 PDFДокумент7 страницPsa 200 PDFDanzen Bueno ImusОценок пока нет

- RMC 24-02 Format SLS-SLPДокумент60 страницRMC 24-02 Format SLS-SLPMikz Polzz67% (3)

- Bir Ruling 2021 - DST On Loan Exemption by PezaДокумент5 страницBir Ruling 2021 - DST On Loan Exemption by Pezajohn allen MarillaОценок пока нет

- Sworn Statement For Application of Permit To Use Loose Leaf Books of AccountsДокумент1 страницаSworn Statement For Application of Permit To Use Loose Leaf Books of AccountsTesston BullionОценок пока нет

- RR 2-98 Section 2.57 (B) - CWTДокумент3 страницыRR 2-98 Section 2.57 (B) - CWTZenaida LatorreОценок пока нет

- How To Enroll EfpsДокумент18 страницHow To Enroll EfpsAdyОценок пока нет

- RR 12-98Документ3 страницыRR 12-98matinikki100% (1)

- BIR Ruling 456-2011 PDFДокумент5 страницBIR Ruling 456-2011 PDFLianne Carmeli B. FronterasОценок пока нет

- RR 9-89Документ6 страницRR 9-89papepipupoОценок пока нет

- BIR Ruling 555-12Документ4 страницыBIR Ruling 555-12Rebecca ChanОценок пока нет

- Accountstatementfrom01-10-2023To22-01-2024: AccountdetailsДокумент38 страницAccountstatementfrom01-10-2023To22-01-2024: Accountdetailsr6540073Оценок пока нет

- Revenue Regulations on Minimum Corporate Income TaxДокумент5 страницRevenue Regulations on Minimum Corporate Income TaxKayzer SabaОценок пока нет

- Pbcom V CirДокумент9 страницPbcom V CirAbby ParwaniОценок пока нет

- Fort Bonifacio vs. CIRДокумент3 страницыFort Bonifacio vs. CIRDNAAОценок пока нет

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutДокумент4 страницыBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiОценок пока нет

- RR No. 13-98Документ16 страницRR No. 13-98Ana DocallosОценок пока нет

- 2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Документ2 страницы2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Yya Ladignon100% (2)

- RMC No 5-2014 - Clarifying The Provisions of RR 1-2014Документ18 страницRMC No 5-2014 - Clarifying The Provisions of RR 1-2014sj_adenipОценок пока нет

- 1601EДокумент7 страниц1601EEnrique Membrere SupsupОценок пока нет

- Tax Bulletin by SGV As of Oct 2014Документ18 страницTax Bulletin by SGV As of Oct 2014adobopinikpikanОценок пока нет

- Bir Ruling (Da 146 04)Документ4 страницыBir Ruling (Da 146 04)cool_peachОценок пока нет

- Bir Itad Ruling No. Da-065-07Документ23 страницыBir Itad Ruling No. Da-065-07Emil A. MolinaОценок пока нет

- Practice Test - Financial ManagementДокумент6 страницPractice Test - Financial Managementelongoria278100% (1)

- Expanded Withholding Taxes On Government Income PaymentsДокумент172 страницыExpanded Withholding Taxes On Government Income PaymentsBien Bowie A. CortezОценок пока нет

- Guidelines and Instruction For BIR Form No 1702 RTДокумент2 страницыGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- ATC HandbookДокумент15 страницATC HandbookPrintet08Оценок пока нет

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFДокумент29 страниц209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaОценок пока нет

- Tax Update RR 18-2012Документ32 страницыTax Update RR 18-2012johamarz6245Оценок пока нет

- WITHHOLDING TAX GUIDEДокумент5 страницWITHHOLDING TAX GUIDEKobe BullmastiffОценок пока нет

- BIR Ruling on Informer's RewardДокумент4 страницыBIR Ruling on Informer's RewardAnonymous fnlSh4KHIgОценок пока нет

- Rmo 22 01Документ20 страницRmo 22 01Maria Leonora Bornales100% (1)

- Passive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCДокумент10 страницPassive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCBARBEKS 202021Оценок пока нет

- REVISED PASAY CITY REVENUE CODE (As of July 17, 2023)Документ148 страницREVISED PASAY CITY REVENUE CODE (As of July 17, 2023)Alyssa Marie MartinezОценок пока нет

- 62983rmo 5-2012Документ14 страниц62983rmo 5-2012Mark Dennis JovenОценок пока нет

- Local Business TaxДокумент2 страницыLocal Business TaxvenickeeОценок пока нет

- Cta 2D CV 09224 M 2019feb12 AssДокумент17 страницCta 2D CV 09224 M 2019feb12 AssMelan YapОценок пока нет

- Rmo 9-2000Документ2 страницыRmo 9-2000Martin EspinosaОценок пока нет

- Bir Ruling No. 108-93Документ2 страницыBir Ruling No. 108-93saintkarriОценок пока нет

- General Audit Procedures and Documentation-BirДокумент3 страницыGeneral Audit Procedures and Documentation-BirAnalyn BanzuelaОценок пока нет

- Deed of Sole HeirДокумент1 страницаDeed of Sole HeirLuisa LopezОценок пока нет

- The Regional Director Bureau of Internal RevenueДокумент1 страницаThe Regional Director Bureau of Internal RevenueRomrick TorregosaОценок пока нет

- Requirements For An IncorporatorДокумент2 страницыRequirements For An IncorporatorMikMik UyОценок пока нет

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasДокумент4 страницыWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasОценок пока нет

- Annex C-1 - Summary of System DescriptionДокумент4 страницыAnnex C-1 - Summary of System DescriptionChristian Albert HerreraОценок пока нет

- CTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceДокумент74 страницыCTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceJerwin DaveОценок пока нет

- Operations Order SBM NO. 2014-013Документ3 страницыOperations Order SBM NO. 2014-013Thelma Evangelista100% (1)

- HGC 2015 - Notes To Financial StatementsДокумент34 страницыHGC 2015 - Notes To Financial StatementsDeborah DelfinОценок пока нет

- ITAD BIR Ruling No. 311-14Документ9 страницITAD BIR Ruling No. 311-14cool_peachОценок пока нет

- Income Tax On IndividualsДокумент29 страницIncome Tax On IndividualsJamielene TanОценок пока нет

- Withholding On Credit Card TransactionsДокумент2 страницыWithholding On Credit Card TransactionsAly San PedroОценок пока нет

- 16 Bureau of Internal Revenue v. First E-Bank Tower Condominium CorpДокумент18 страниц16 Bureau of Internal Revenue v. First E-Bank Tower Condominium CorpChristian Edward CoronadoОценок пока нет

- 11) BIR vs. First E-Bank Tower Condominium CorpFirst EBank E-Bank Tower Condominium Corp. Vs BIRДокумент28 страниц11) BIR vs. First E-Bank Tower Condominium CorpFirst EBank E-Bank Tower Condominium Corp. Vs BIRRaimer Gel CaspilloОценок пока нет

- Documentation TechniquesДокумент2 страницыDocumentation TechniquesMikz PolzzОценок пока нет

- RR 11-2006Документ14 страницRR 11-2006Peggy SalazarОценок пока нет

- 55026RR 14-2010 Accreditation PDFДокумент5 страниц55026RR 14-2010 Accreditation PDFlmin34Оценок пока нет

- C. Limitations On The Power of TaxationДокумент2 страницыC. Limitations On The Power of TaxationMikz PolzzОценок пока нет

- Capital BudgetingДокумент3 страницыCapital BudgetingMikz PolzzОценок пока нет

- C. Limitations On The Power of TaxationДокумент2 страницыC. Limitations On The Power of TaxationMikz PolzzОценок пока нет

- 1BNC2400C0321C856180081088909A: Online Enrollment Confimation ReceiptДокумент1 страница1BNC2400C0321C856180081088909A: Online Enrollment Confimation ReceiptNeil BrazaОценок пока нет

- Payslip - 2019 09 30Документ1 страницаPayslip - 2019 09 30Khatija PinjrawalaОценок пока нет

- Free MOUSECOIN MIC3 Faucet and Daily Staking RewardsДокумент4 страницыFree MOUSECOIN MIC3 Faucet and Daily Staking RewardsCrypto MinersОценок пока нет

- KTM Duke 250 Abs 2017 GST 0Документ1 страницаKTM Duke 250 Abs 2017 GST 0zaim nur hakimОценок пока нет

- BSNLДокумент1 страницаBSNLRamki KvlОценок пока нет

- New Loyalty ProgramДокумент25 страницNew Loyalty ProgramjgaeqОценок пока нет

- Taxation in EthiopiaДокумент50 страницTaxation in Ethiopiastrength, courage, and wisdom92% (12)

- Impact of GST Implementation On Automobile IndustryДокумент22 страницыImpact of GST Implementation On Automobile IndustryvasanthisbОценок пока нет

- Qi0243 - Amnpn5168p - 2022-23 - Fy 2022 - 2023Документ9 страницQi0243 - Amnpn5168p - 2022-23 - Fy 2022 - 2023Dharma kurraОценок пока нет

- STATEMENT Format SviДокумент4 страницыSTATEMENT Format SviSUMIT SAHAОценок пока нет

- Hetzner 2022-03-01 R0015282079Документ4 страницыHetzner 2022-03-01 R0015282079antonОценок пока нет

- CH 10. Money Its Functions and PropertiesДокумент12 страницCH 10. Money Its Functions and PropertiesMr RamОценок пока нет

- Income Tax and Value Added TaxДокумент388 страницIncome Tax and Value Added Taxgerald kayОценок пока нет

- TaxДокумент3 страницыTaxArven FrancoОценок пока нет

- Types of Bank AccountsДокумент3 страницыTypes of Bank AccountsAkshay BhasinОценок пока нет

- Jeremyybardolazacabillo: Page1of4 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Документ4 страницыJeremyybardolazacabillo: Page1of4 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Jeremy CabilloОценок пока нет

- Nova Pulse Ivf Clinic PVT LTDДокумент2 страницыNova Pulse Ivf Clinic PVT LTDHarinathОценок пока нет

- Mody School Fee StructureДокумент2 страницыMody School Fee StructureHarsh ChauhanОценок пока нет

- Kra Pin PDF EditДокумент1 страницаKra Pin PDF EditFrancis KorirОценок пока нет

- UPVC Windows Quotation ProjectДокумент3 страницыUPVC Windows Quotation ProjectsathishОценок пока нет

- Fastweld: QuotationДокумент1 страницаFastweld: QuotationManikandan MОценок пока нет

- Ewaybill - Master Steel - 01112019Документ1 страницаEwaybill - Master Steel - 01112019AshishОценок пока нет

- Newsletter 336Документ8 страницNewsletter 336Henry CitizenОценок пока нет

- Mepco Online BilllДокумент1 страницаMepco Online BilllMuhammad Asim Hafeez ThindОценок пока нет