Академический Документы

Профессиональный Документы

Культура Документы

2015 Budget Powerpoint

Загружено:

thrnewsdeskАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2015 Budget Powerpoint

Загружено:

thrnewsdeskАвторское право:

Доступные форматы

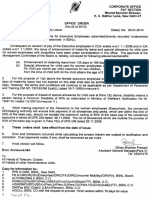

REPORT TO THE LEGISLATURE

ON THE REVIEW OF

THE 2015 PROPOSED BUDGET

October 29, 2014

H. Chris Kopf

Partner

ckopf@odpkf.com

Nicholas DeSantis

Partner

ndesantis@odpkf.com

Alan Kassay

Partner

akassay@odpkf.com

Agenda / Contents

Budget Overview

New Initiatives

Discussion Items

Revenues

Expenditures

Summary of Findings

Conclusion

Questions?

2

Budget Overview

The 2015 Proposed Budget is $334.5 million, a decrease of $1.7 million

(0.5% decrease) as compared to the adopted budget for 2014

The budget as proposed contains a property tax levy of $77,943,104, a

decrease of $800,000 (1.0% decrease) as compared to the adopted 2014

budget

The appropriation of fund balance:

2014 adopted budget of $16.71 million

2015 proposed budget $19.47 million

$2.76 million increase

3

New Initiatives

Infrastructure Investment Program - $3,500,000

Tax Stabilization Reserve Fund - $1,500,000

Help America Vote Act (3 year takeover) - $194,329

Job Creation and Retention Programs - $500,000

Apprenticeship Agreements Proposed new local law for bridge contracts

in excess of $500,000

4

REVENUES

Discussion Items

5

Sales Tax

Budget Assumptions

2014 payments through 10/14/14 growth at 1.7%

2014 Adopted Budget = $89.0 million

Our projection of revenue = $88.3 million

$700,000 (net of municipal sharing) less than the adopted budget

2015 Proposed Budget = $92.35 million

Our projection of revenue = $92.0 million

1.75% growth on our 2014 projection

$350,000 (net of municipal sharing) less than the proposed budget

Our projection indicates an unfavorable variance of $350,000 when compared to the

2015 proposed budget.

6

2014 Adopted Budget = $4.6 million

Our projection of revenue = $4.7 million

$100,000 more than the adopted budget

2015 Proposed Budget = $4.7 million

Interest & Penalties on Real Property Taxes

Our projection is similar to the amount contained in the 2015 Proposed Budget.

Therefore, there is no variance.

7

Hotel/Motel Tax

Budget Assumptions:

Minimal growth based on past trends

2014 Adopted Budget = $1.2 million

Our projection of revenue = $1.15 million

$50,000 less than the adopted budget

2015 Proposed Budget = $1.2 million

Our projection = $1.2 million

8

Our projection is similar to the amount contained in the 2015 Proposed Budget.

Therefore, there is no variance.

2014 Adopted Budget = $150,000

Our projection = $100,000

$50,000 less than the adopted budget

2015 Proposed Budget = $100,000

Off Track Betting Tax (OTB)

9

Our projection is similar to the amount contained in the 2015 Proposed Budget.

Therefore, there is no variance.

2014 Adopted Budget = $625,000

Our projection = $1,525,000

$900,000 more than the adopted budget

2015 Proposed Budget = $675,000

Our projection = $775,000

Gain on Sale of Tax Acquired Property

10

Our projection indicates a favorable variance of $100,000 when compared to the 2015

Proposed Budget.

Deferred Taxes/Tax Overlay

2014 Adopted Budget = ($750,000)

Our projection = ($500,000)

$250,000 favorable variance

2015 Proposed Budget = ($1,000,000)

11

Our projection is similar to the amount contained in the 2015 Proposed Budget.

Therefore, there is no variance.

County Clerk Fees

(Recording Division)

12

2014 Adopted Budget = $1.8 million

Our projection = $1.5 million

$300,000 less than the adopted budget

2015 Proposed Budget = $1.4 million

Our projection = $1.5 million

Our projection indicates a favorable variance of $100,000 when compared to the 2015

Proposed Budget.

County Clerk Fees

(Motor Vehicle Division)

13

2014 Adopted Budget = $830,000

Our projection = $830,000

2015 Proposed Budget = $780,000

Our projection = $830,000

Our projection indicates a favorable variance of $50,000 when compared to the 2015

Proposed Budget.

Public Safety Communication

(Emergency 911)

14

Received a $1.7 million grant for an enhanced interoperability

communication system

2015 Proposed Budget includes additional grants of $1.7 million

continuing the interoperability communication system project

Appropriation from Reserves

15

2014 Adopted Budget = $404,000

Emergency Telephone (E-911) = $79,000

Stop DWI = $180,000

URGENT Forfeitures = $145,000

2015 Proposed Budget = $140,000

URGENT Forfeitures = $140,000

Automobile Use Tax

16

2014 Adopted Budget = $1.2 million

Our projection = $1.2 million

2015 Proposed Budget = $1.2 million

Our projection is similar to the amount contained in the 2015 Proposed Budget.

Therefore, there is no variance.

2014 Adopted Budget = $1.2 million

Our projection = $1.4 million

$200,000 more than the adopted budget

2015 Proposed Budget = $800,000

Our projection = $200,000

Jail

(Inmate Board-Ins)

17

Our projection indicates an unfavorable variance of $600,000 when compared to the

2015 Proposed Budget.

2015 proposed budget

Includes $300,000 of estimated revenue from the sale of 300 Flatbush Ave.,

Kingston, NY

Department of Public Works

(Sale of Real Property)

18

EXPENDITURES

Discussion Items (Continued)

19

2014 Adopted Budget = $74 million

Our projection = $70 million

$4 million less than the adopted budget

2015 Proposed Budget = $76.4 million

The administration has indicated to us that thy do not include a vacancy factor

in the budget as a matter of policy

20

Our projection indicates that budgetary savings may be available. The County has

never budgeted salary savings in order to remain conservative and to have budget

flexibility if unforeseen emergencies occur.

Personnel Costs

(Excluding Overtime)

1,940

1,854

1,785

1,740

1,628

1,316

1,320

-

500

1,000

1,500

2,000

2,500

2009 2010 2011 2012 2013 2014 2015

Number of Positions

Number of

Positions

Budgeted Positions

21

Vacant Positions

22

Department

Number of

Positions Salary

Buildings 2 $71,800

Bus Operations 1 38,398

Central Data Processing 2 91,897

Clerk 1 29,323

Commissioner of Finance 3 97,517

Environmental Control 1 55,047

Jail 2 82,182

Maintenance of Roads & Bridges 13 435,653

Vacant Positions (Continued)

23

Department

Number of

Positions Salary

Mental Health Administration 1 52,526

Mental Health Programs 1 55,047

Personnel 1 29,323

Planning 1 65,334

Public Health 2 104,978

Safety Inspection 1 33,598

Social Services Administration 8 313,234

WIC Program 2 77,646

Totals 42 $1,633,503

Overtime

Budget Assumptions

Vacancies remain stable through 2015

2014 Adopted Budget = $2.4 million

Our projection = $3.1 million

$700,000 more than the adopted budget

2015 Proposed Budget = $2.7 million

Our projection = $3.1 million

24

Our projection indicates an unfavorable variance of $400,000 when compared to the

2015 Proposed Budget. However, this amount could be absorbed by vacancy savings

in regular salary lines.

Labor Contracts

Expired Contracts

-Police Benevolent Association 12/31/09

-Superior Officers Unit 12/31/09

Settled Contracts

-Sheriffs Association 12/31/15

-Staff Association 12/31/16

-Civil Service Employees Association 12/31/16

25

2014 Adopted Budget = $700,000

Our projection = $700,000

2015 Proposed Budget = $700,000

Our projection = $700,000

Jail

(Food Costs)

26

Our projection is similar to the amount contained in the 2015 Proposed Budget.

Therefore, there is no variance.

2014 Adopted Budget = $3.05 million

Our projection = $2.85 million

$200,000 less than the adopted budgeted

2015 Proposed Budget = $2.9 million

Our projection = $2.9 million

Jail

(Medical Services)

27

Our projection is similar to the amount contained in the 2015 Proposed Budget.

Therefore, there is no variance.

Employee Benefits

28

Medical Benefits $ 23.0

Retirement 14.5

Social Security 6.1

Workers' Compensation 3.1

Unemployment 0.2

Vacation & Sick Time Buybacks 0.8

Other Employee Benefits 0.4

$ 48.1

2015

Proposed

(millions)

Budget

Employee Benefits

(Retirement)

2014 Adopted Budget = $17.8 million

Our projection = $14.75 million

$3.05 million less than the adopted budget

2015 Proposed Budget = $14.55 million

Our projection = $15.1 million

$550,000 more than proposed budget

29

Our projection indicates an unfavorable variance of $550,000 when compared to the

2015 Proposed Budget.

Employee Benefits

(Medical Benefits [Health, Dental & Vision])

30

2014 Adopted Budget = $22.75 million

Our projection = $21.3 million

$1.45 million less than the adopted budget

2015 Proposed Budget = $23 million

Allows for an 8% increase in claims costs

Employee Benefits

(Social Security)

31

2014 Adopted Budget = $5.9 million

Our projection = $5.6 million

$300,000 less than the adopted budget

2015 Proposed Budget = $6.1 million

Our projection = $6 million

Our projection indicates a favorable variance of $100,000 when compared to the 2015

Proposed Budget.

Employee Benefits

(Unemployment)

32

2014 Adopted Budget = $700,000

Our projection = $250,000

$450,000 less than the adopted budget

2015 Proposed Budget = $200,000

Our projection = $200,000

Our projection is similar to the amount contained in the 2015 Proposed Budget.

Therefore, there is no variance.

Department of Social Services

(Programs included in the 2015 Proposed Budget)

33

DSS Administration $ 21,518 $ 31,251 $ 33,289

Purchase of Services - Day Care Program 3,486 3,025 3,375

MMIS - Medicaid 36,709 39,358 36,279

Family Assistance 13,368 14,500 14,000

Children's Services 24,727 27,029 26,142

Safety Net 9,105 9,500 11,000

Other Programs 1,426 2,075 2,285

Total Department of Social Services $ 110,339 $ 126,738 $ 126,370

County Taxation $ 57,223 $ 61,056 $ 64,153

(000's) (000's) (000's)

2013 2014 2015

Actuals Adopted Budget Proposed Budget

2014 Adopted Budget = $3 million

Our projection = $3.5 million

$500,000 more than the adopted budget

2015 Proposed Budget = $3.4 million

Our projection = $3.5 million

$100,000 more than the proposed budget

34

Department of Social Services

(Day Care)

Our projection indicates an unfavorable variance of $100,000 when compared to the

2015 Proposed Budget.

2014 Adopted Budget = $14.5 million

Our projection = $13.4 million

$1.1 million less than the adopted budget

2015 Proposed Budget = $14 million

Our projection = $14 million

35

Department of Social Services

(Family Assistance)

Our projection is similar to the amount contained in the 2015 Proposed Budget.

Therefore, there is no variance.

2014 Adopted Budget = $9.5 million

Our projection = $9.5 million

2015 Proposed Budget = $11 million

Our projection = $10.5 million

$500,000 less than the proposed budget

36

Department of Social Services

(Safety Net)

Our projection indicates a favorable variance of $500,000 when compared to the 2015

Proposed Budget.

2014 Adopted Budget = $27 million

Our projection = $25.9 million

$1.1 million less than adopted budget

2015 Proposed Budget = $26.1 million

Our projection = $26.05 million

$50,000 less than the proposed budget

37

Department of Social Services

(Childcare Division)

Our projection indicates a favorable variance of $50,000 when compared to the 2015

Proposed Budget.

38

2014 Adopted Budget = $10.1 million

Our projection = $10.05 million

$50,000 less than the adopted budget

2015 Proposed Budget = $9 million

Our projection = $9 million

Our projection is similar to the amount contained in the 2015 Proposed Budget.

Therefore, there is no variance.

Debt Service

(Serial Bonds Principal and Interest)

39

2014 Adopted Budget = $1.25 million

Our projection = $1.6 million

$350,000 more than the adopted budget

2015 Proposed Budget = $1.5 million

Our projection = $1.6 million

Department of Public Works

(Buildings and Grounds Electricity and Gas)

Our projection indicates an unfavorable variance of $100,000 when compared to the

2015 Proposed Budget.

40

2014 Adopted Budget = $450,000

Our projection = $450,000

2015 Proposed Budget = $495,000

Our projection = $495,000

Department of Public Works

(Buildings and Grounds Heating Fuel)

Our projection is similar to the amount contained in the 2015 Proposed Budget.

Therefore, there is no variance.

41

Department of Public Works

(Buildings and Grounds Repairs and Maintenance)

Quarry Substation Building Improvements $ 125,000

Court House Elevator Upgrades 46,000

County Office Building Elevator Upgrades 50,000

Fallen Heroes Memorial 85,000

Family Court Moves Re-Configuration 325,000

Maintain 94 Mary's Avenue (STRIVE) 92,500

$ 723,500

Increases

in 2015

Budget

Proposed

42

2014 Adopted Budget = $700,000

Our projection = $850,000

$150,000 more than the adopted budget

2015 Proposed Budget = $700,000

Our projection = $800,000

Department of Public Works

(Highways and Bridges Salt and Chloride)

Our projection indicates an unfavorable variance of $100,000 when compared to the

2015 Proposed Budget.

Community College Tuition Expense

Dutchess -

$562,389

35%

Orange -

$362,191

23%

Columbia Greene

- $272,597

17%

Fashion Institute

of Technology -

$177,111

11%

Sullivan -

$112,869

7%

Herkimer -

$29,823

2%

Other - $75,351

5%

Community College Chargebacks

Amount Paid: 9/1/13 - 8/31/14

43

Community College Tuition Expense

Dutchess - 256

FTEs

53%

Orange - 88 FTEs

18%

Columbia

Greene - 53 FTEs

11%

Fashion Institute

of Technology -

15 FTEs

3%

Sullivan - 25

FTEs

5%

Herkimer - 14

FTEs

3%

Other - 31 FTEs

7%

Community College Chargebacks

FTE Students: 9/1/13 - 8/31/14

44

45

2014 Adopted Budget = $3.85 million

Our projection = $3.5 million

$350,000 less than the adopted budget

2015 Proposed Budget = $4.2 million

Our projection = $3.6 million

$600,000 less than the proposed budget

Community College Tuition

Our projection indicates a favorable variance of $600,000 when compared to the 2015

Proposed Budget.

Contingency

2015 Proposed Budget

Components

$825,000 for general contingency

46

47

2015 Proposed Budget

$1.1 million for the purchase of buses through the use of Federal

and State Aid

Bus Operations

(Ulster County Area Transit UCAT)

48

No funds transferred from the UTASC for 2015 due to

ongoing Trapping event

Tobacco Securitization

Summary of Findings - Revenues

49

Revenues

Unfavorable

Increase in

County Share

Favorable

Decrease in

County Share

Favorable

Variance

Unfavorable

Variance

Sales and Use Tax $ 350,000 $ - $ - $ 700,000

Interest and Penalties on Property Taxes - - 100,000 -

Hotel/Motel Occupancy Tax - - - 50,000

Off Track Betting Tax - - - 50,000

Gain on Sale of Tax Acquired Property - 100,000 900,000 -

Deferred Taxes/Tax Overlay A - - 250,000 -

County Clerk Fees:

Recording division - 100,000 - 300,000

Motor vehicle division - 50,000 - -

Jail - Inmate Board-Ins 600,000 - 200,000 -

Total Revenues $ 950,000 $ 250,000 $ 1,450,000 $ 1,100,000

2015 2014

50

Summary of Findings - Expenditures

Expenditures

Personnel Costs:

Salaries $ - $ - $ 2,800,000 $ -

Overtime - - - 700,000

Jail

Medical services - - 200,000 -

Employee Benefits:

Retirement Costs 550,000 - 3,050,000 -

Health Benefits - - 1,450,000 -

Social Security - 100,000 300,000 -

Unemployment - - 450,000 -

Department of Social Services, Net:

Administration - - 1,200,000 -

Day Care 100,000 - - 500,000

Family Assistance - - 400,000 -

Safety Net - 300,000 - -

Child Care Division - 50,000 250,000 -

Debt Service - - 50,000 -

Department of Public Works:

Electricity and Gas 100,000 - - 350,000

Salt and Chloride 100,000 - - 150,000

Community College Tuition - 600,000 350,000 -

Contingency - - 1,300,000 -

Total Expenditures 850,000 1,050,000 11,800,000 1,700,000

Total Revenues and Expenditures 1,800,000 1,300,000 13,250,000 2,800,000

Net Impact to County Taxation $ - $ (500,000) $ 10,450,000 $ -

QUESTIONS?

OConnor Davies, LLP

www.odpkf.com

500 Mamaroneck Avenue

Harrison, NY 10528

914.381.8900

Dorothy B. Kraft Building

15 Essex Road

Paramus, NJ 07652

201.712.9800

555 Hudson Valley Ave Ste 106

New Windsor, NY 12553

845.220.2400

29 Broadway

New York, NY 10006

212.867-8000

665 Fifth Avenue

New York, NY 10022

212.286.2600

One Stamford Landing

62 Southfield Avenue, Suite 101

Stamford, CT 06902

203.323.2400

100 Great Meadow Road

Wethersfield, CT 06109

860.257.1870

Nicholas DeSantis, CPA

ndesantis@odpkf.com

Alan Kassay, CPA

akassay@odpkf.com

H. Chris Kopf, CPA

ckopf@odpkf.com

52

Вам также может понравиться

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Opinion From State Supreme Court, Appellate DivisionДокумент7 страницOpinion From State Supreme Court, Appellate DivisionthrnewsdeskОценок пока нет

- CDBG Memo Response - 4-12-15Документ4 страницыCDBG Memo Response - 4-12-15thrnewsdeskОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Smilowitz v. PrusinskiДокумент17 страницSmilowitz v. PrusinskithrnewsdeskОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Independent Business White Paper FINALДокумент4 страницыIndependent Business White Paper FINALNick ReismanОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Federal Class Action Voting ComplaintДокумент66 страницFederal Class Action Voting ComplaintthrnewsdeskОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Response Letter To Cross 7-17Документ2 страницыResponse Letter To Cross 7-17thrnewsdeskОценок пока нет

- Greg Gilligan's Experience As A Poll WatcherДокумент3 страницыGreg Gilligan's Experience As A Poll WatcherthrnewsdeskОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Wjcny Letter To Dss 11.11.14Документ2 страницыWjcny Letter To Dss 11.11.14thrnewsdeskОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Conservation Efforts and Mitigation of Potential Impacts: 110-00 Rockaway BLVD, Jamaica, NY 11420Документ7 страницConservation Efforts and Mitigation of Potential Impacts: 110-00 Rockaway BLVD, Jamaica, NY 11420thrnewsdeskОценок пока нет

- Alderman Brad Will's Letter About Kingston Local Development CorporationДокумент38 страницAlderman Brad Will's Letter About Kingston Local Development CorporationthrnewsdeskОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- Ulster County AuditДокумент5 страницUlster County AuditthrnewsdeskОценок пока нет

- Casino Deals ChartДокумент1 страницаCasino Deals ChartthrnewsdeskОценок пока нет

- U.S. Department of Veterans Affairs VA Access Audit and Wait-Time Fact Sheet VISN 1 June 9, 2014Документ4 страницыU.S. Department of Veterans Affairs VA Access Audit and Wait-Time Fact Sheet VISN 1 June 9, 2014Kristin Palpini HaleОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- VA AuditДокумент54 страницыVA Auditkballuck1Оценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Complaint Against Golden Hill Care Center NurseДокумент3 страницыComplaint Against Golden Hill Care Center NursethrnewsdeskОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Orange County 2013 Medicaid EnrollmentДокумент5 страницOrange County 2013 Medicaid EnrollmentthrnewsdeskОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Valley View Request For ProposalsДокумент24 страницыValley View Request For ProposalsthrnewsdeskОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Global New Windsor Rail Project Air Permit Mod App FINALДокумент358 страницGlobal New Windsor Rail Project Air Permit Mod App FINALthrnewsdeskОценок пока нет

- Memorandum Rebutting Alderman Will's Allegations About The Kingston Local Development CorporationДокумент3 страницыMemorandum Rebutting Alderman Will's Allegations About The Kingston Local Development CorporationthrnewsdeskОценок пока нет

- Letter To Monroe Town Board - Establishment ClauseДокумент8 страницLetter To Monroe Town Board - Establishment ClauseJohn N. AllegroОценок пока нет

- Alderman Brad Will's Letter About Kingston Local Development CorporationДокумент38 страницAlderman Brad Will's Letter About Kingston Local Development CorporationthrnewsdeskОценок пока нет

- Memorandum Rebutting Alderman Will's Allegations About The Kingston Local Development CorporationДокумент3 страницыMemorandum Rebutting Alderman Will's Allegations About The Kingston Local Development CorporationthrnewsdeskОценок пока нет

- Kiryas Joel Aqueduct Connection Project Business PlanДокумент7 страницKiryas Joel Aqueduct Connection Project Business PlanthrnewsdeskОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Grand Jury Report On Leigh BentonДокумент72 страницыGrand Jury Report On Leigh BentonthrnewsdeskОценок пока нет

- Final Operation Deep Dive ReportДокумент31 страницаFinal Operation Deep Dive Reportkballuck1Оценок пока нет

- NYU Policy Breakfast, April 10, 2014Документ9 страницNYU Policy Breakfast, April 10, 2014thrnewsdeskОценок пока нет

- Global New Windsor Rail Project Air Permit Mod App FINALДокумент358 страницGlobal New Windsor Rail Project Air Permit Mod App FINALthrnewsdeskОценок пока нет

- STAR Registration Percentages by County, As of Dec. 29, 2013Документ1 страницаSTAR Registration Percentages by County, As of Dec. 29, 2013thrnewsdeskОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- STAR Registration Percentages by Town, As of Dec. 29, 2013Документ24 страницыSTAR Registration Percentages by Town, As of Dec. 29, 2013thrnewsdeskОценок пока нет

- Volunteer Handbook Kerry LGBT Festival of PrideДокумент44 страницыVolunteer Handbook Kerry LGBT Festival of PrideKerryFestivalofPrideОценок пока нет

- JL HR Rasuna Said Kav.20 Tower 12A-E, Jakarta Selatan 12950Документ2 страницыJL HR Rasuna Said Kav.20 Tower 12A-E, Jakarta Selatan 12950Hani ZeinОценок пока нет

- Research About CooperativesДокумент12 страницResearch About CooperativesJimbo ManalastasОценок пока нет

- 144-Escario, Et Al. v. NLRC G.R. No. 160302 September 27, 2010Документ2 страницы144-Escario, Et Al. v. NLRC G.R. No. 160302 September 27, 2010Noel IV T. BorromeoОценок пока нет

- Enhancement of Maternity Leave and Special AllowanceДокумент5 страницEnhancement of Maternity Leave and Special Allowancenaveen kumarОценок пока нет

- Jobo - Plush and PlayДокумент6 страницJobo - Plush and PlayJohn Matthew JoboОценок пока нет

- A Study of Performance Appraisal in Public SectoreДокумент25 страницA Study of Performance Appraisal in Public SectoreNeelampariОценок пока нет

- Department of Labor: WH-381Документ2 страницыDepartment of Labor: WH-381USA_DepartmentOfLaborОценок пока нет

- Internal Scanning: Organizational AnalysisДокумент16 страницInternal Scanning: Organizational AnalysisÜ John Anderson100% (1)

- Joanna Mae P. Bersabal Operation Management (TQM)Документ8 страницJoanna Mae P. Bersabal Operation Management (TQM)Chard PintОценок пока нет

- merSETA Grants Policy - 2023 24.pdf - V1Документ14 страницmerSETA Grants Policy - 2023 24.pdf - V1Devon Antony HeuerОценок пока нет

- Reply To Sona by President RamaphosaДокумент18 страницReply To Sona by President RamaphosaCityPressОценок пока нет

- KRA PresentationДокумент26 страницKRA PresentationAmreesh MisraОценок пока нет

- Leadership Expert QuestionnaireДокумент4 страницыLeadership Expert QuestionnaireHalah Jawhar100% (1)

- Evaluating a Teaching Portfolio RubricДокумент3 страницыEvaluating a Teaching Portfolio RubricJa PalОценок пока нет

- Fire Safety in RMG Sector BangladeshДокумент188 страницFire Safety in RMG Sector BangladeshSayem Ahammed100% (4)

- Astra SR 2010Документ106 страницAstra SR 2010Fred's SiagianОценок пока нет

- Recruiting Manual for Hiring ManagersДокумент38 страницRecruiting Manual for Hiring ManagersRick JersonОценок пока нет

- Project Safety Management SystemДокумент16 страницProject Safety Management SystemrosevelvetОценок пока нет

- Proposed SP ordinance guidelines for COVID-19 workplace safetyДокумент7 страницProposed SP ordinance guidelines for COVID-19 workplace safetyJudeRamosОценок пока нет

- IIA - Bro A4 Soft Controls Engels 02 PDFДокумент41 страницаIIA - Bro A4 Soft Controls Engels 02 PDFBudi HidayatОценок пока нет

- Insurance Need AnalysisДокумент8 страницInsurance Need AnalysisRajesh Chowdary ChintamaneniОценок пока нет

- Tax AssignmentДокумент5 страницTax AssignmentdevОценок пока нет

- Guidelines On Cash AdvanceДокумент2 страницыGuidelines On Cash AdvanceAlyssa Molina100% (5)

- An Internship Report On: Supervised byДокумент8 страницAn Internship Report On: Supervised byarshed_69Оценок пока нет

- Neuroleadership in The Human ResourceДокумент3 страницыNeuroleadership in The Human ResourceCliff KaaraОценок пока нет

- Sales Force MotivatorsДокумент15 страницSales Force MotivatorsAshirbadОценок пока нет

- Ethics NotesДокумент31 страницаEthics NotesEngr Noman DilОценок пока нет

- Hrmo Prime-Hrm: Self-Assessment ToolДокумент24 страницыHrmo Prime-Hrm: Self-Assessment ToolJoy SingsonОценок пока нет

- Employment and Industrial Relations LAW L213 Distance StudentsДокумент74 страницыEmployment and Industrial Relations LAW L213 Distance StudentsNicodemus bupe mwimba100% (1)