Академический Документы

Профессиональный Документы

Культура Документы

Tugas 1 Kapita Selekta Statistika II

Загружено:

Aci LusianaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tugas 1 Kapita Selekta Statistika II

Загружено:

Aci LusianaАвторское право:

Доступные форматы

NAMA : Wici Irawan

No.BP : 1110432047

SUBJEK : Tugas KSS 2

1) The average price/earnings ratio for a company for the years 1996-2000 is given below.

Year 1996 1997 1998 1999 2000 2001

p/e Ratio 16.3 16.5 17.1 19.6 13.1 ?

Predict the 2001 earnings per share using

a. a three-year moving average forecast.

b. an exponential smoothing forecast with o = .2

Answer :

By using the Microsoft Excel, we obtained :

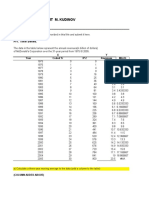

Tahun p/e ratio M(3) Ex

Smooth

1996 16.3 16.3

1997 16.5 16.3

1998 17.1 16.34

1999 19.6 16.63333 16.492

2000 13.1 17.73333 17.1136

2001 16.6 16.31088

a) With using the formula ; = + + ( )

So, we obtain that the average price/earning ratio for a company for the year 2001 using

average forecasting is 16.6

b) With using the formula ; = + (1 )

We obtain the average price/earning ratio for a company for the year 2001 using

exponential smoothing is 16.31088

2) Below you are given the size of the civilian labor force employed in agriculture (in

thousands) for the years 1995-2000. Using linear trend projection, forecast the size of the

civilian labor force employed in agriculture for 2001.

Year 1995 1996 1997 1998 1999 2000 2001

Number

Employed in

Agriculture

3440 3443 3399 3378 3281 3305 ?

Answer :

Determine slope (b

1

) and intercept (b

0

) by formula :

And ;

By using the Microsoft excel we obtained :

Year Number employed in

agriculture

1995 3440

1996 3443

1997 3399

1998 3378

1999 3281

2000 3305

1995 3440 6862800 3980025 -33.7714 70832.76

1996 3443 6872228 3984016

1997 3399 6787803 3988009

1998 3378 6749244 3992004

1999 3281 6558719 3996001

2000 3305 6610000 4000000

Total : 11985 Total :20246 Total : 40440794 Total : 23940055

-

-

=

n

t

t

n

Y t

tY

b

t

t

2

2

1

) (

|

|

.

|

\

|

-

|

|

.

|

\

|

=

n

t

b

n

Y

b

t

1 0

So, = 70832.76 + 33.7714

Size of the civilian labor force employed in agriculture for 2001 is

= 70832.76 + 33.771(2001)

= 70832.76 67575.77

= 3256.9

, = 3256.9

So, size of the civilian labor force employed in agriculture for 2001 is 3256.9.

3) Tentukanlah hubungan linier anatara X dan Y, kemudian lakukan uji asumsi klasik

terhadap model tersebut.

Answer :

Uji asumsi klasik berikut menggunakan tiga buah Uji data yaitu :

1. Uji Durbin-Watson

2. Uji Heteroskedastisitas

3. Uji Normalitas

Dengan menggunakan SPSS kita akan menguji data di atas dengan uji Durbin-

Watson:

GET DATA /TYPE=XLSX

/FILE='D:\my KSS project\Book3.xlsx'

/SHEET=name 'Sheet1'

/CELLRANGE=full

/READNAMES=on

/ASSUMEDSTRWIDTH=32767.

EXECUTE.

DATASET NAME DataSet1 WINDOW=FRONT.

REGRESSION

/MISSING LISTWISE

/STATISTICS COEFF OUTS R ANOVA

/CRITERIA=PIN(.05) POUT(.10)

/NOORIGIN

/DEPENDENT LotsizeX

/METHOD=ENTER ManhoursY

/RESIDUALS DURBIN.

Regression

Lot size (X) Man-hours (Y)

30 73

20 50

60 128

80 170

40 87

50 108

60 135

30 69

70 148

60 132

[DataSet1]

Variables Entered/Removed

a

Model Variables

Entered

Variables

Removed

Method

1 Man hours (Y)

b

. Enter

a. Dependent Variable: Lot size (X)

b. All requested variables entered.

Model Summary

b

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

Durbin-Watson

1 .998

a

.996 .995 1.366 2.064

a. Predictors: (Constant), Man hours (Y)

b. Dependent Variable: Lot size (X)

ANOVA

a

Model Sum of Squares df Mean Square F Sig.

1

Regression 3385.066 1 3385.066 1813.333 .000

b

Residual 14.934 8 1.867

Total 3400.000 9

a. Dependent Variable: Lot size (X)

b. Predictors: (Constant), Man hours (Y)

Coefficients

a

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1

(Constant) -4.758 1.357 -3.508 .008

Man hours (Y) .498 .012 .998 42.583 .000

a. Dependent Variable: Lot size (X)

Residuals Statistics

a

Minimum Maximum Mean Std. Deviation N

Predicted Value 20.13 79.87 50.00 19.394 10

Residual -2.445 1.449 .000 1.288 10

Std. Predicted Value -1.540 1.540 .000 1.000 10

Std. Residual -1.790 1.061 .000 .943 10

a. Dependent Variable: Lot size (X)

Interpretasi :

Nilai DW adalah 2.064, selanjutnya nilai ini akan dibandingkan dengan nilai table signifikansi

5%dalam jumlah sampel = 10 dan jumlah variabel independen 1 = 1 (table Durbin

Watson) maka di peroleh nilai = 1.319 . Nilai 4 = 4 1.319 = 2.680.

Jika nilai > dan kurang dari (4 ) maka di simpulkan bahwa tidak terdapat

autokorelasi. Jadi, karena < < 4 1.319 < 2.064 < 2.680 , disimpulkan tidak

terjadi autokorelasi pada data sampel.

Dengan Uji Heteroskedastisitas menggunakan SPSS di peroleh :

Lot Size (X) Man Hours(Y) Res_1

30 73 3.00000

20 50 .00000

60 128 -2.00000

80 170 .00000

40 87 -3.00000

50 108 -2.00000

60 135 5.00000

30 69 -1.00000

70 148 -2.00000

60 132 2.00000

Dimana outputnya adalah :

COMPUTE RES2=ABS_RES(RES_1).

EXECUTE.

REGRESSION

/MISSING LISTWISE

/STATISTICS COEFF OUTS R ANOVA

/CRITERIA=PIN(.05) POUT(.10)

/NOORIGIN

/DEPENDENT RES2

/METHOD=ENTER LotsizeX

/SAVE RESID.

Regression

[DataSet1]

Variables Entered/Removed

a

Model Variables

Entered

Variables

Removed

Method

1 Lot size (X)

b

. Enter

a. Dependent Variable: RES2

b. All requested variables entered.

Model Summary

b

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

1 .077

a

.006 -.118 1.57648

a. Predictors: (Constant), Lot size (X)

b. Dependent Variable: RES2

ANOVA

a

Model Sum of Squares df Mean Square F Sig.

1

Regression .118 1 .118 .047 .833

b

Residual 19.882 8 2.485

Total 20.000 9

a. Dependent Variable: RES2

b. Predictors: (Constant), Lot size (X)

Coefficients

a

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1

(Constant) 1.706 1.441 1.184 .270

Lot size (X) .006 .027 .077 .218 .833

a. Dependent Variable: RES2

Interpretasi :

Karena nilai signifikansi = 0.833 lebih besar dari 0.05 (0.833 > 0.05) maka di simpulkan

bahwa tidak terjadi heteroskedastisitas.

Dengan Uji Normalitas menggunakan SPSS di peroleh :

Lot Size (X) Man Hours (Y) Res_1

30 73 3.00000

20 50 .00000

60 128 -2.00000

80 170 .00000

40 87 -3.00000

50 108 -2.00000

60 135 5.00000

30 69 -1.00000

70 148 -2.00000

60 132 2.00000

Di peroleh output :

GET DATA /TYPE=XLSX

/FILE='D:\my KSS project\Book3.xlsx'

/SHEET=name 'Sheet1'

/CELLRANGE=full

/READNAMES=on

/ASSUMEDSTRWIDTH=32767.

EXECUTE.

DATASET NAME DataSet1 WINDOW=FRONT.

REGRESSION

/MISSING LISTWISE

/STATISTICS COEFF OUTS R ANOVA

/CRITERIA=PIN(.05) POUT(.10)

/NOORIGIN

/DEPENDENT ManhoursY

/METHOD=ENTER LotsizeX

/SAVE RESID.

Regression

[DataSet1]

Variables Entered/Removed

a

Model Variables Entered Variables

Removed

Method

1 Lot size (X)

b

. Enter

a. Dependent Variable: Man hours (Y)

b. All requested variables entered.

Model Summary

b

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

1 .998

a

.996 .995 2.739

a. Predictors: (Constant), Lot size (X)

b. Dependent Variable: Man hours (Y)

ANOVA

a

Model Sum of Squares df Mean Square F Sig.

1

Regression 13600.000 1 13600.000 1813.333 .000

b

Residual 60.000 8 7.500

Total 13660.000 9

a. Dependent Variable: Man hours (Y)

b. Predictors: (Constant), Lot size (X)

Coefficients

a

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1

(Constant) 10.000 2.503 3.995 .004

Lot size (X) 2.000 .047 .998 42.583 .000

a. Dependent Variable: Man hours (Y)

Residuals Statistics

a

Minimum Maximum Mean Std. Deviation N

Predicted Value 50.00 170.00 110.00 38.873 10

Residual -3.000 5.000 .000 2.582 10

Std. Predicted Value -1.543 1.543 .000 1.000 10

Std. Residual -1.095 1.826 .000 .943 10

a. Dependent Variable: Man hours (Y)

NPAR TESTS

/K-S(NORMAL)=RES_1

/MISSING ANALYSIS.

NPar Tests

[DataSet1]

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 10

Normal Parameters

a,b

Mean 0E-7

Std. Deviation 2.58198890

Most Extreme Differences

Absolute .200

Positive .200

Negative -.123

Kolmogorov-Smirnov Z .632

Asymp. Sig. (2-tailed) .819

a. Test distribution is Normal.

b. Calculated from data.

Interpretasi :

Dari hasil di atas kita peroleh nilai signifikansi = 0.819 lebih besar dari 0.05 (0.819 > 0.05)

sehingga dapat di simpulkan bahwa data yang telah kita uji berdistribusi normal.

4) Tentukanlah CMA (Centered Moving Average) dan SF (Seasonal Factor) serta ASF dari

data berikut :

Year Quarter Time

Index

Y

1 1 1 10

2 2 18

3 3 20

4 4 12

2 1 5 12

2 6 20

3 7 24

4 8 13

4 1 9 14

2 10 22

3 11 28

4 12 16

untuk menentukan CMA (Centered Moving Average) digunakan rumus berikut :

( ) = , sehingga diperoleh hasil seperti pada table :

Year Quarter Time

Index

Y

CMA

1 1 1 10

2 2 18

3 3 20 14.4

4 4 12 16.4

2 1 5 12 17.6

2 6 20 16.2

3 7 24 16.6

4 8 13 18.6

4 1 9 14 20.2

2 10 22 18.6

3 11 28

4 12 16

Untuk menentukan SF digunakan rumus sebagai berikut :

=

Year Quarter

Time

Index CMA SF

1 1 1

2 2

3 3 14.4 1.388889

4 4 16.4 0.731707

2 1 5 17.6 0.681818

2 6 16.2 1.234568

3 7 16.6 1.445783

4 8 18.6 0.698925

3 1 9 20.2 0.693069

2 10 18.6 1.182796

3 11

4 12

Untuk menentukan ASF digunakan rumus sebagai berikut :

=

Year Quarter

Time

Index Y CMA SF ASF

1 1 1 10

2 2 18

3 3 20 14.4 1.388889 0.960648

4 4 12 16.4 0.731707 1.046904

2 1 5 12 17.6 0.681818 0.983766

2 6 20 16.2 1.234568 1.043771

3 7 24 16.6 1.445783

4 8 13 18.6 0.698925

3 1 9 14 20.2 0.693069

2 10 22 18.6 1.182796

3 11 28

4 12 16

Plot data antara Y, CMA, SF dan ASF :

0

5

10

15

20

25

30

1 2 3 4 5 6 7 8 9 10 11 12

Y

CMA

SF

ASF

5) Menentukan ( ), ,

Tahun

p/e

ratio M(3)

Ex

Smooth e(T) |ei|

sigma

|ei|/N

1996 16.3 16.3 0 0 0

1997 16.5 16.3 0.2 0.2 0.04

1998 17.1 16.34 0.76 0.76 0.152

1999 19.6 16.63333 16.492 3.108 3.108 0.6216

2000 13.1 17.73333 17.1136 -4.0136 4.0136 0.80272

16.6 16.31088 -16.3109

MAE ei kuadrat ei kuadrat/N sigma ei kuadrat/N

1.61632 0 0 5.277249792

0.04 0.008

0.5776 0.11552

9.659664 1.9319328

16.108985 3.221796992

Вам также может понравиться

- STA302 Mid 2009FДокумент10 страницSTA302 Mid 2009FexamkillerОценок пока нет

- STA302 Mid 2010FДокумент9 страницSTA302 Mid 2010FexamkillerОценок пока нет

- ExamsДокумент74 страницыExamsSuraj SinghОценок пока нет

- Linear Regression Analysis of Olympic Long Jump DataДокумент8 страницLinear Regression Analysis of Olympic Long Jump DataAndrés García Arce0% (1)

- Numerical Method For Engineers-Chapter 19Документ25 страницNumerical Method For Engineers-Chapter 19MrbudakbaekОценок пока нет

- Solution Assig# 1w 08Документ6 страницSolution Assig# 1w 08mehdiОценок пока нет

- Isye4031 Regression and Forecasting Practice Problems 2 Fall 2014Документ5 страницIsye4031 Regression and Forecasting Practice Problems 2 Fall 2014cthunder_1Оценок пока нет

- Assignment #3 Solution - Spring 2014Документ5 страницAssignment #3 Solution - Spring 2014Deepak KumarОценок пока нет

- Numerical Method For Engineers-Chapter 17Документ30 страницNumerical Method For Engineers-Chapter 17Mrbudakbaek90% (10)

- Least SquareДокумент43 страницыLeast SquareShane ChuОценок пока нет

- Neville.: TAREA #2. Métodos Numéricos. Por: Ingrid Jiménez López. C.C. 1.152.700.197Документ11 страницNeville.: TAREA #2. Métodos Numéricos. Por: Ingrid Jiménez López. C.C. 1.152.700.197Susana OriaОценок пока нет

- Basic Econometrics HealthДокумент183 страницыBasic Econometrics HealthAmin HaleebОценок пока нет

- Time Series Analysis and ForecastingДокумент5 страницTime Series Analysis and ForecastingMusa KhanОценок пока нет

- 19bit0404 VL2020210101940 Ast02Документ11 страниц19bit0404 VL2020210101940 Ast02Saji JosephОценок пока нет

- ExtrapolationДокумент48 страницExtrapolationkelexyzОценок пока нет

- Moises Henriques - 1001008456 AssignmentДокумент14 страницMoises Henriques - 1001008456 AssignmentMoises HenriquesОценок пока нет

- Regression Analysis of Physics and Mathematics ScoresДокумент12 страницRegression Analysis of Physics and Mathematics Scoressawalsaleh100% (1)

- 06 03 Linear RegressionДокумент13 страниц06 03 Linear RegressionJohn Bofarull GuixОценок пока нет

- Exercise Prod Design PracticingДокумент9 страницExercise Prod Design PracticingLaura AlósОценок пока нет

- Analytical MethodsДокумент26 страницAnalytical MethodsRanga FernandoОценок пока нет

- ENGR 351 Numerical Methods College of Engineering Southern Illinois University Carbondale Exams Fall 2007 Instructor: Professor L.R. ChevalierДокумент13 страницENGR 351 Numerical Methods College of Engineering Southern Illinois University Carbondale Exams Fall 2007 Instructor: Professor L.R. ChevalierAli O DalkiОценок пока нет

- HW6 CEE275 UC BerkeleyДокумент10 страницHW6 CEE275 UC BerkeleyKurtWalterSonccoОценок пока нет

- Lampiran Jadi IniДокумент9 страницLampiran Jadi Inimonica zulqaОценок пока нет

- Econometric FinalДокумент5 страницEconometric Finaltech damnОценок пока нет

- Hierarchy of Decimal NumbersДокумент26 страницHierarchy of Decimal NumberskunkumabalaОценок пока нет

- Hand Calculation 2 - Simple Homogeneous Wet SlopeДокумент10 страницHand Calculation 2 - Simple Homogeneous Wet SlopeWashington BobadillaОценок пока нет

- A Ybx: Scatter Diagram Correlation CoefficientДокумент7 страницA Ybx: Scatter Diagram Correlation CoefficientNaheed Nazneen TuLiОценок пока нет

- Tugasan/Assignment 5 (20 Markah/marks) : Serial NoДокумент4 страницыTugasan/Assignment 5 (20 Markah/marks) : Serial NoNurul FadzillahОценок пока нет

- The Following Statistical Parameters Have Been Obtained by SPSS SoftwareДокумент4 страницыThe Following Statistical Parameters Have Been Obtained by SPSS SoftwareMohammad Bin FahadОценок пока нет

- Mat530 MM A1 2012 - EditedДокумент11 страницMat530 MM A1 2012 - Editedquiah89Оценок пока нет

- Forecasting Supply Chain Requirements: Forecast Error Squared ErrorДокумент20 страницForecasting Supply Chain Requirements: Forecast Error Squared ErrorFiorela RiveraОценок пока нет

- Problemas Bono para Tercer Examen de Estadística - Verano 2012Документ8 страницProblemas Bono para Tercer Examen de Estadística - Verano 2012David Meza CarbajalОценок пока нет

- MC0074 Sem3 Smu 2011Документ17 страницMC0074 Sem3 Smu 2011Nitin SivachОценок пока нет

- Regression and CorrelationДокумент2 страницыRegression and CorrelationKhurram ShahzadaОценок пока нет

- CBNST QUESTION BANK (2012-2013 Session) CSE-2nd YearДокумент3 страницыCBNST QUESTION BANK (2012-2013 Session) CSE-2nd YearRahul SinghОценок пока нет

- 1 Slide © 2006 Thomson/South-WesternДокумент50 страниц1 Slide © 2006 Thomson/South-WesternSheen ZuzaОценок пока нет

- DispersionДокумент9 страницDispersionNishu MishraОценок пока нет

- Lab-5-1-Regression and Multiple RegressionДокумент8 страницLab-5-1-Regression and Multiple RegressionRakib KhanОценок пока нет

- MA2264 NUMERICAL METHODS INTERPOLATION AND APPROXIMATIONДокумент2 страницыMA2264 NUMERICAL METHODS INTERPOLATION AND APPROXIMATIONAnonymous zHmefGH30YОценок пока нет

- NUS Lab Report on Microsystems Design ApplicationsДокумент13 страницNUS Lab Report on Microsystems Design ApplicationsTâm Nguyễn Duy100% (1)

- Example EconometricsДокумент6 страницExample Econometricsyoutube2301Оценок пока нет

- Digital Assignmen T-3: Mat 2001 Statistics For EngineersДокумент14 страницDigital Assignmen T-3: Mat 2001 Statistics For EngineersHarsha VardhanОценок пока нет

- Practical Files 2018Документ75 страницPractical Files 2018Yash PaulОценок пока нет

- GRAFIK DATA PADA DATA ASLI (BELUM DI STASIONERIN) COCOAДокумент13 страницGRAFIK DATA PADA DATA ASLI (BELUM DI STASIONERIN) COCOARahsafitОценок пока нет

- Wa0004Документ13 страницWa0004Ha M ZaОценок пока нет

- EGM6341 Sol HW 05Документ14 страницEGM6341 Sol HW 05Redmond R. ShamshiriОценок пока нет

- Phy Lab XC1 G02Документ29 страницPhy Lab XC1 G02vicencio39Оценок пока нет

- Assignment No 2 - Calculation Fo VARДокумент7 страницAssignment No 2 - Calculation Fo VARMuhammad ImranОценок пока нет

- School of Advanced SciencesДокумент9 страницSchool of Advanced SciencesAswin MMОценок пока нет

- A Review of Basic Statistical Concepts: Answers To Odd Numbered Problems 1Документ32 страницыA Review of Basic Statistical Concepts: Answers To Odd Numbered Problems 1Abbas RazaОценок пока нет

- Introduction To Econometrics: Bivariate Regression ModelsДокумент21 страницаIntroduction To Econometrics: Bivariate Regression ModelsrimzhaОценок пока нет

- PEME200001 Mathematical Techniques 2Документ10 страницPEME200001 Mathematical Techniques 2Andrew AndersonОценок пока нет

- Engineering Economy 7th Edition - Solution Manual (Arrastrado)Документ22 страницыEngineering Economy 7th Edition - Solution Manual (Arrastrado)Martin Gonzalez100% (1)

- MA321 FINAL EXAM - TIME SERIES, REGRESSION, ANOVA ANALYSISДокумент33 страницыMA321 FINAL EXAM - TIME SERIES, REGRESSION, ANOVA ANALYSISEliott SanchezОценок пока нет

- Dar Solved AnsДокумент20 страницDar Solved AnsDevОценок пока нет

- Random Number GenerationДокумент33 страницыRandom Number GenerationSudamBeheraОценок пока нет

- Solution HW3Документ16 страницSolution HW3mrezzaОценок пока нет

- Diffuse Algorithms for Neural and Neuro-Fuzzy Networks: With Applications in Control Engineering and Signal ProcessingОт EverandDiffuse Algorithms for Neural and Neuro-Fuzzy Networks: With Applications in Control Engineering and Signal ProcessingОценок пока нет

- Disorders of Acid-Base Balance SEMINARIO PDFДокумент28 страницDisorders of Acid-Base Balance SEMINARIO PDFAnonymous uVinWXfo4Оценок пока нет

- PC On Elder Patients 2014Документ33 страницыPC On Elder Patients 2014Aci LusianaОценок пока нет

- Diagnosing Sore Throats in Different PatientsДокумент20 страницDiagnosing Sore Throats in Different PatientsAci LusianaОценок пока нет

- ACD Guidelines PDFДокумент11 страницACD Guidelines PDFAci LusianaОценок пока нет

- DMSO 49767 Effect of Calcium Channel Blockers On Incidence of Diabetes 072513Документ5 страницDMSO 49767 Effect of Calcium Channel Blockers On Incidence of Diabetes 072513Aci LusianaОценок пока нет

- Calcium Channel BlockersДокумент34 страницыCalcium Channel BlockersAci LusianaОценок пока нет

- Faktor Risiko DMДокумент6 страницFaktor Risiko DMKara Citra KalandraОценок пока нет

- The Role of Dispensers in The Rational Use of DrugsДокумент19 страницThe Role of Dispensers in The Rational Use of DrugsAci LusianaОценок пока нет

- Solid State PharmaceuticalДокумент56 страницSolid State PharmaceuticalAci LusianaОценок пока нет

- Toksisitas Ekstrak AirДокумент6 страницToksisitas Ekstrak AirAci LusianaОценок пока нет

- Antikonvulsan OkeДокумент77 страницAntikonvulsan OkeAci LusianaОценок пока нет

- Capsules (Kapsul)Документ8 страницCapsules (Kapsul)Aci LusianaОценок пока нет

- Feasibility StudyДокумент29 страницFeasibility StudyAci Lusiana100% (1)

- Asthma Bronchial Treatment TheophyllinДокумент27 страницAsthma Bronchial Treatment TheophyllinAci LusianaОценок пока нет

- Alda Risma CaseДокумент14 страницAlda Risma CaseAci LusianaОценок пока нет

- Alda Risma CaseДокумент14 страницAlda Risma CaseAci LusianaОценок пока нет

- Nilai Normal LaboratoriumДокумент3 страницыNilai Normal LaboratoriumAci Lusiana100% (1)

- KEMAMPUANDASARДокумент7 страницKEMAMPUANDASARAci LusianaОценок пока нет

- Concepts in Clinical Pharmacokinetics - 4th Ed. 2005Документ298 страницConcepts in Clinical Pharmacokinetics - 4th Ed. 2005mohanjaga793100% (3)

- Alda Risma CaseДокумент14 страницAlda Risma CaseAci LusianaОценок пока нет

- BHN Pak Adek STLH HPLCДокумент175 страницBHN Pak Adek STLH HPLCAci Lusiana100% (2)

- Correlation and RegressionДокумент8 страницCorrelation and RegressionWendel MatiasОценок пока нет

- Risk and Return Analysis of Tamor Krishi Udhemi Sahakari Sanstha Limited A Project Work Proposal OnДокумент13 страницRisk and Return Analysis of Tamor Krishi Udhemi Sahakari Sanstha Limited A Project Work Proposal OnPranesh KatuwalОценок пока нет

- Electronic Measurements and Measuring InstrumentsДокумент45 страницElectronic Measurements and Measuring InstrumentsNandan PatelОценок пока нет

- Ch 03 - Demand ForecastingДокумент81 страницаCh 03 - Demand ForecastingAasif MOCKADDAMОценок пока нет

- Pad Assignment No - 01Документ6 страницPad Assignment No - 01L SURYA PRAKASH REDDYОценок пока нет

- CIGRE A Novel Method For Pollution Detection of External InsulationДокумент10 страницCIGRE A Novel Method For Pollution Detection of External InsulationMalik Shoaib khalidОценок пока нет

- Chem Lab 12 Reduction Kinetics of Methylene BlueДокумент4 страницыChem Lab 12 Reduction Kinetics of Methylene BlueNathan OdegardОценок пока нет

- Skew Gaussian Process For Nonlinear RegressionДокумент26 страницSkew Gaussian Process For Nonlinear RegressionShafayat AbrarОценок пока нет

- Econometrics ModuleДокумент185 страницEconometrics ModuleTsinatОценок пока нет

- E882 Standard Guide For Accountability and Quality Control in The Chemical Analysis LaboratoryДокумент6 страницE882 Standard Guide For Accountability and Quality Control in The Chemical Analysis LaboratoryBryan Mesala Rhodas Garcia100% (1)

- Business StatisticsДокумент500 страницBusiness StatisticsEsthee33% (3)

- 1641 gcs2007 08 Nguyen Xuan Nam Assignment 1Документ27 страниц1641 gcs2007 08 Nguyen Xuan Nam Assignment 1Hao DangОценок пока нет

- A Multi-Input-single-output Smith Predictor For Feeders Control in SAG Grinding PlantsДокумент7 страницA Multi-Input-single-output Smith Predictor For Feeders Control in SAG Grinding PlantsElena ReinosoОценок пока нет

- Essentials of Business Analytics 2nd Edition Camm Test Bank 1Документ53 страницыEssentials of Business Analytics 2nd Edition Camm Test Bank 1mary100% (35)

- Sampling Distribution and StatisticsДокумент15 страницSampling Distribution and StatisticsNatnael AsfawОценок пока нет

- Tugas 3Документ20 страницTugas 3dellaayuОценок пока нет

- Uji Akar Unit - Pendekatan Augmented Dickey-Fuller (ADF)Документ16 страницUji Akar Unit - Pendekatan Augmented Dickey-Fuller (ADF)fikhi cahyaniОценок пока нет

- Seminar Presentaion On Sip and Base PaperДокумент35 страницSeminar Presentaion On Sip and Base PaperSwati Utreja AroraОценок пока нет

- Windcatcher Calculations PDFДокумент49 страницWindcatcher Calculations PDFTim KingОценок пока нет

- Sophomore ResearchДокумент37 страницSophomore Researchapi-501281962Оценок пока нет

- Comstock 1979 PDFДокумент99 страницComstock 1979 PDFGIZI KABMALANGОценок пока нет

- Paper III - Objective III - ALexis Kabayiza - PHD AGBMДокумент9 страницPaper III - Objective III - ALexis Kabayiza - PHD AGBMAlexis kabayizaОценок пока нет

- Influence of Age Financial Status and Gender On AcДокумент6 страницInfluence of Age Financial Status and Gender On AcNCaparri CagayanОценок пока нет

- Chapter 3Документ87 страницChapter 3goegiorgianaОценок пока нет

- Notes On Forbidden RegressionsДокумент5 страницNotes On Forbidden RegressionsZundaОценок пока нет

- 3 - Labour Unrest in RMG SectorДокумент18 страниц3 - Labour Unrest in RMG SectorDipta Whippersnapper KaushikОценок пока нет

- PENGARUH MEKANISME GOOD CORPORATE GOVERNANCE TERHADAP CARBON EMISSION DISCLOSUREДокумент15 страницPENGARUH MEKANISME GOOD CORPORATE GOVERNANCE TERHADAP CARBON EMISSION DISCLOSUREsri zanraОценок пока нет

- Establishing Spectrophotometer Performance Tests: Standard Guide ForДокумент9 страницEstablishing Spectrophotometer Performance Tests: Standard Guide ForEric GozzerОценок пока нет