Академический Документы

Профессиональный Документы

Культура Документы

Nepal Bank Limited

Загружено:

MoonmoonShresthaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Nepal Bank Limited

Загружено:

MoonmoonShresthaАвторское право:

Доступные форматы

CHAPTER 1

HISTORICAL BACKGROUND

The history of modern bankin system in Ne!a" is #ery short$ "ess than ha"f

%ent&ry$ in the absen%e of modern bankin system in Ne!a" a"" the monetary

transa%tions 'ere %arried o&t by a fe' money "enders the need of the masses

'ere meet by in dieneo&s money "ender ( as a matter of )a%t$ a #ery "are

!ortion of the !rod&%ti#e a%ti#ities of the %o&ntry sti"" remains %om!"ete"y

o&tside the !re#ie' of the orani*ed bankin system+

If 'e try to see the history of bankin transa%tions in de!th e#iden%e of money

"endin f&n%tion is a"so fo&nd in !ra%ti%es before ,th %ent&ry$ in -./ A+D+0

G&nakama de#$ the r&"er of Kathmand& re%onstr&%ted Kathmand& to'n by

%o""e%tin f&nd 1takin "oans2 from the !eo!"e+ At the end of ,th %ent&ry$

Shankhadhar$ a martinet of Ne!a"$ !aid a"" the o&tstandin "oans of the Ne!a"i

!eo!"e and started a Ne' 3ra Ne!a" sambat+ Tho&h 'e no !roof to s&!!ort the

fa%t that these transa%tions 'ere %arried on a%%ordin to the bankin system or

not$ b&t there is no do&bt that takin and rantin "oans 1monetary transa%tions2

'ere in !ra%ti%es in o&r an%ient so%iety+

To'ards the end of 45th %ent&ry$ 6ayasthi 7a""a$ r&"er of bankin %"assified the

!eo!"e into 85 different %asts on the basis of their o%%&!ation+ The "ist in%"&ded

a %ast %a""ed 9Tanka Dhari: meanin money "enders 'ere the o'ners of the

monetary transa%tions+ Th&s$ in the medi#a"ae a ro&! of !eo!"e 1Tanka Dhari

ro&!2 had not a&thority to dea" 'ith money and they a"so had b&siness

re"ationshi! 'ith India ( Tibet+ The main f&n%tions of these Tanka Dhari 'ere

to a%%e!t !ersona" se%&rity and ad#an%e$ for b&siness transa%tions$ to rant "oan

for fami"y affair$ to he"! forein trade et%+ B&t d&e to "a%k of %ontro" to their

mono!o"y b&siness$ there arose many defe%ts "ike e;!"oitation$ aain as their

b&siness ro' &!$ they bean to %hane e;orbitant rates of interest and their

e;tra d&es in "oans ad#an%ed+

4

D&e to s&%h in%on#enien%e bro&ht by money "enders in Kathmand& #a""ey in

14,--<4,,=2 d&rin the !eriod of !rime minister Ranodhi! sinh$ a finan%ia"

instit&tion$ 9Te>arath Adda: 'as estab"ished as a first orani*ed bankin

orani*ation on 4??/ B+S+ Te>arath 'as a state finan%ia" instit&tion 'hi%h

s&!!"y %redit at =@ rate of interest aainst se%&rity of o"d$ si"#er ( ornaments+

The main ob>e%ti#es of this instit&tion 'as to free the !eo!"e from money

"enders e;!"oitation+ This instit&tion a"so !ro#ided "oans to the o#ernment

em!"oyee$ as 'e"" as enera" !&b"i%+ At the time of !rime minister Chandra

Shamser 14?A4<4?.?2$ %redit fa%i"ities of Te>arath 'ere e;tended to other !arts

of the %o&ntry by o!enin its bran%hes$ in order to %ontro" the hih rate of

interest$ those made the money "enders !o'er"ess to fi"e s&it aainst their

debtors e#en in %ase of defa&"t$ "ater$ Te>arath 'as re!"a%ed by a %ommer%ia"

bank kno'n as Ne!a" Bank Limited+ D&rin the time of !rime minister 6&ddha

Shamser in 4?/,+

Ne!a" is a de#e"o!in %o&ntry$ in a %o&ntry "ike Ne!a" the need of the masses

%o&"dnBt be f&"fi""ed on"y by s&%h instit&tions+ In the history of Ne!a"$ to so"#e

this !rob"em$ for the first time in 4?/,$ Ne!a" Bank Limited 'as estab"ished as

one of the he"!in too"s to o#er %ome that obsta%"e as semi<o#ernment

orani*ation+ It has done !ioneerin f&n%tion in s!readin the bankin habits

amon the !eo!"e+ B&t there 'as "a%k of %entra" bank in the %o&ntry+ To f&"fi""

this need$ Ne!a" Rastra Bank$ the %entra" bank %ame into e;isten%e in 4?=8+

Aain to f&"fi"" the ro'in %redit reC&irements of the %o&ntry$ Rastria

Bani>aya Bank$ the other %ommer%ia" bank 'as set &! in 6&"y ./$4?88+ After

the estab"ishment of this bank$ most of the bran%hes of Ne!a" a Bank are bein

rad&a""y handed o#er to this bank+ To f&"fi"" the ro'in %redit reC&irements

and a"so to %o""e%t more de!osits for the de#e"o!ment !ro>e%ts$ Ne!a" Arab

Bank Limited the first >oint #ent&re bank in Ne!a"$ started its o!eration sin%e

6&"y 4?,5+ No' there are 45 %ommer%ia" bank+

1.2 SIGNIFICANCE OF THE STUDY

.

In !resent sit&ation$ there are 45 %ommer%ia" banks ( their bran%hes !ro#idin

bankin fa%i"ities in the %o&ntry$ besides these the reiona" Gramin Bikash

Bank in a"" de#e"o!ments reions of o&r %o&ntry has been started+ They are

f&n%tionin at the r&ra" area as 'here %ommer%ia" banks 'ere not ab"e to

%o""e%t de!osit and to disb&rse the "oans$ be%a&se %ommer%ia" banks are fa%in

many diffi%&"ties in mobi"i*in the de!osit in r&ra" ( &rban areas+

The sinifi%an%e of the st&dy that I "ike to state here is ho' NBL Ba"a>& bran%h

is s&%%essf&" to a%%&m&"ate the de!osit ( to &ti"i*e these de!osits to the

!rod&%ti#e se%tors and it 'i"" he"! abo&t the different ty!es of !rob"ems arisen

in these se%tors+

Here is keen %om!etition bet'een %ommer%ia" banks be%a&se they !ro#ide the

same bankin ser#i%es$ so the main fo%&s of the st&dy is 'hether the NBL BB

ab"e to disb&rse f&nd+

/

1.3 OBJECTIVES OF THE STUDY

The main o!e"#i$e% o& #hi% %#'() a*e+ ,

< To kno' abo&t the "endin !ro%ed&re of NBL

< To find o&t the reC&ired do%&ments

< To find o&t re!ayment !ro%ess$ as 'e"" as "oan a!!ro#a" !ro%ess

< To e;amine ho' far the de!osits of NBL Ba"a>& bran%h is effi%ient"y

&ti"i*e+

1.- .I/ITATIONS OF THE STUDY

As the tit"e s!e%ified this st&dy is main"y %on%ern 'ith the NBL BB so there are

some "imitations<

1.-.1, There are many ty!es of transa%tion is o!erated b&t st&dy fo%&s on"y on

"oan !ro%ed&re+

1.-.2, The "endin !ro%ed&re is same for a"" the bran%hes of NBL b&t st&dy

fo%&s BB on"y+

1.-.3, Be%a&se of time "imit of 4= days diffi%&"t to et detai" information on

re"ated s&b>e%t+

1.-.-, Diffi%&"t to et informationa" book as need to st&dy+

1.-.0, Diffi%&"t to meet dire%t"y 'ith re"ated !eo!"e 1borro'er ( staff2

1.0 /ETHODO.OGY OF STUDY

This st&dy has been in%"&ded most"y !rimary data$ then after some !art of the

se%ondary data$ the information of the st&dy has been %o""e%ted by different

re"ated !&b"i%ations as se%ondary so&r%e of data ( !rimary so&r%e of

information is by askin ( dis%&ssin 'ith %on%erned offi%ers+

5

CHAPTER II

2.1 INTRODUCTION TO NEPA. BAN2 .I/ITED

Ne!a" Bank Limited$ the first %ommer%ia" bank of the %o&ntry 'as estab"ished

in 4?/, &nder the Ne!a" bank a%t 4?/-+ It is a semi<o#ernment ha#in =4@

share of the o#ernment ( 5?@ of the enera" !&b"i%+ At the time of

estab"ishment$ its a&thori*ed %a!ita" 'as Rs+ 4 %rore$ no' this bank is 'orkin

&nder %ommer%ia" bank a%t 4?-=+

After estab"ishin this bank$ it remo#ed a"" the in%on#enien%e d&e to non<

e;isten%e of a bankin %on%ern in Ne!a"+ As the e%onomi% a%ti#ities of a

%o&ntry are reat"y inf"&en%ed by the de#e"o!ment of a so&nd bankin system$

the NBL is %ontrib&tin to %reate bankin habit amon the !eo!"e$ to e;tend

bankin fa%i"ities thro&ho&t the %o&ntry ( so on the bank has a"so ob>e%ti#e to

a%%&m&"ate s%attered %a!ita" reso&r%es and mobi"i*ed them for the !romotion of

the desired se%tors of the %o&ntry "ike ari%&"t&re$ ind&stry$ trade ( %ommer%e

'hi%h a"" s&!!osed to be 5 'hee"s of de#e"o!ment+

At !resent Ne!a" Bank Limited has been !ro#idin ser#i%e 'ith 48A bran%hes

in%"&din 8- distri%ts of the %o&ntry+ It has !ro#idin ser#i%e to the #i""ae area

a"so+ The Ba"a>& bran%h of the NBL is sit&ated on Ba"a>&$ Kathmand&

m&ni%i!a"ity 'ard no+48 It 'as estab"ished on .A.. B+S+ This bank has been

!ro#idin different ty!es of ser#i%es to the !eo!"e of the Ba"a>& area+ A"tho&h

the BB isnDt on"y one bank of the 'ho"e 1Ba"a>&2 area+ It is fo&nd 8=8? n&mber

of a%%o&nts are o!eratin amon them 4A= n&mber of a%%o&nts are o!eratin in

the name of fa%tory$ and others a%%o&nts are o!eratin in the name of Ind&stry

( !ersona"+ The BB is 'orkin &nder the instr&%tion ( r&"e of the head offi%e

of NBL+

=

3.1 FUNCTIONS OF NB.3 BB

The ma!o* &'n"#ion% o& BB a*e &o'n( a% e4o5,

16 A""e7#in8 (e7o%i#

<C&rrent de!osit

<Sa#in de!osit

< )i;ed de!osit

26 A($an"in8 4oan

< Cash %redit

< Dire%t "oan

36 A8en") %e*$i"e

< Co""e%tion of %heC&e

< Eayment of amo&nt

< Remittan%e of money

< Re%ei!t of !ayment

-6 /i%"e44aneo'% %e*$i"e%

< )inan%ia" ad#isory ser#i%es

< Co""e%tion of information

< Credit %reation

< Re!ort sendin 1to head offi%e2

3.1 INTRODUCTION OF .OAN PROCEDURE

The main f&n%tion of the bank is "oan rantin to !&b"i% aainst essentia"

se%&rities$ it is a"so the main in#estment area to in%rease !rofit so bank a%%e!ts

de!osit from one side ( !ro#ides the f&nd as a "oan$ as m&%h &ses of more

de!osit for "oan %an ab"e to et more !rofit in enera"$ the de!osit !ro%ed&re (

%redit !o"i%y is determined by a%%ordin to r&"es and re&"ations of Ne!a"

Rastra Bank+ Different term ( %riteria ha#e to be f&"fi""ed to i#e "oan from

8

bank$ 'hi%h is kno'n as !ro%ed&re 'itho&t 'hi%h the "endin !ro%ess 'o&"d

be %om!"i%ated+

Loan !ro#idin is one of most im!ortant f&n%tions of bank$ it s&%h kind of

fa%i"ity 'hi%h %an be &sed by that !eo!"e 'ho are interested to &se their ski"" on

in%ome eneratin area+ Loan a"so he"!s to so"#e #ario&s !rob"ems$ the main

im!ortant of "oan %an mention as be"o'<

16 I# he47% #o 7*o$i(e 5o*9 #o 'nem74o)ee 5ho (on:# ha$e &'n(.

26 He47% #o (e$e4o7 in('%#*) ; a8*i"'4#'*e %e"#o*.

36 He47% #o in"*ea%e #he na#iona4 in"ome o& #he "o'n#*) a% 5e44 a% e"onomi"

%#a#'% o& %o"ie#).

-6 He47% #o in"*ea%e e<7o*# ; (e"*ea%e im7o*#.

The 4en(in8 7*o"e('*e (i&&e* &o* (i&&e*en# #)7e% o& 4oan '# %ome #e*m% ;

"*i#e*ia ha$e #o e &'4&i44e( &o* e$e*) #)7e o& 4oan3 #he%e a*e men#ione(

e4o5,

< Any Ne!a"i %iti*en 'hose ae sho&"d be abo#e 4= years+

< A!!"i%ation for "oan reC&estin ( a !hoto%o!y of %iti*enshi!+

< Area ( ho&se ma! 'ith !ermanent address+

< Bo&ndary of 'ards$ res!onsib"e !erson if ha!!en of anythin in f&t&re+

< Sho&"d not ha#e any re%ord of non<!ayment of "oan+

-.1 TYPES OF .OAN

Lendin !ro%ed&re is different on the basis of nat&re of "oan$ f&nd based "oan (

non<f&nd based "oan %an be kno'n %o""atera" ( !ersona" ad#an%es+ In the

%o""atera" "endin$ the borro'er has to !ro#ide some se%&rity or %o""atera" 'hi"e

the bank e;tend as %redit on the basis of his %redibi"ity in the "atter %ase+ Here$

the Ba"a>& bran%h of NBL !ro#idin main"y f&nd based "oan mentioned as

be"o'<

-

1. So"ia4 %e"#o* 4oan

< Go"d ( si"#er "oan 1on term basis2

< Staff "oan

< Disaster s&ffer "oan 1earthC&ake2

2. B'%ine%% 4oan=in('%#*ia4

< Hy!othe%ation "oan

< Hire !&r%hase "oan

< 7is%e""aneo&s$ im!orts$ ind&stry

3. P*io*i#) %e"#o*

< De!ri#ed se%tor

< Ari%&"t&re "oan

< Sma"" ind&stry

< Ser#i%e "oan

-.1 GO.D ; SI.VER .OAN

This ty!e of "oan is !ro#ided to the enera" !&b"i% takin o"d ( si"#er as a

se%&rity+ The main !&r!ose of this ty!e of "oan is to so"#e ho&seho"d !rob"em+

It is a kind of easy method to et "oan$ bank donBt %are abo&t the &se of f&nd+

A%%ordin to the C&a"ity of o"d ( si"#er$ the market #a"&e of 'hi%h is not at

any time "ess than the amo&nt of s&%h "oan or ad#an%es+

-.1.1 Re>'i*emen#%

< Feiht$ C&a"ity ( #a"&ation of !ri%e of o"d ( si"#er to be ke!t as %o""atera"+

-.1.2 P*o"e('*e

< The a%t&a" #a"&e of o"d ( si"#er 'i"" be #a"&ed be"o' than market !ri%e+

-.1.3 Pe*io(

< Eeriod 'i"" be one year from the time of "oan a!!ro#a"+

-.1.- If borro'er is &nab"e to !ay "oan 'ithin s!e%ified !eriod or time %an

rene' !re#io&s areement after the !ayment of interest+

,

-.2 HYPOTHECATION .OAN

The mortae of %&rrent !ro!erty is %a""ed hy!othe%ation$ if a "oan is !ro#ided

on the basis of !"ede of %&rrent assets$ then the borro'er i#es the o'nershi!

%ertifi%ate to bank b&t borro'er %an &se same !ro!erty as before$ if the "oan is

not !aid by borro'er$ bank 'i"" re%o#er the "oan by se""in those !ro!erty

a%%ordin to !re#io&s areement$ it is a"so kno'n as b&sinessG%ommer%ia" "oan

this ty!e of "oan is !ro#ided main"y to !romote b&siness a%ti#ities+

-.2.1,Re>'i*e( "on(i#ion%

< Sho&"d be %&rrent a%%o&nt in the name of firm or !erson+

< Sho&"d not be taken "oan fa%i"ity or the se%&rity sho&"d not be

en%&mbered or <hy!othe%ated to any bankGfinan%ia" instit&tions+

< Sho&"d not be any re%ord of d&e amo&nt a%%ordin to !re#io&s re%ord

1to bank2+

-.2.2 Re>'i*e (o"'men#%

Com!any reistration %ertifi%ate ( rene'a" %ertifi%ate 'o&"d be needed+

Sto%k re!ort d&"y sined by the borro'er is to be obtained at "east on%e in

fortniht b&t 'hi"e re"easin f&nds &! to date !ortion of sto%k sho&"d be

obtained+

The areement 'i"" be on one<year basis b&t the borro'er %an et "oan

aain from bank after the !ayment of !re#io&s "oan+

-.2.3 P*o"e('*e

The #a"&e of !ro!erty 'o&"d be re<#a"&ed on the basis of market !ri%e and

the determined #a"&e 'o&"d be ded&%ted /A@ to 5A@+

Hy!othe%ated sto%k m&st be ins!e%ted by the bank+

If the sto%k of !ro!erty<in%reased borro'er %an et more "oans on the basis

of in%reased #a"&e ( if de%reased$ sho&"d ref&nd to bank eC&a" to de%rease

#a"&e of sto%k+

?

-.3 HIRE PURCHASE .OAN

Hire !&r%hase is an areement for the bai"ment of oods &nder 'hi%h the bai"ee

may b&y the oods or &nder 'hi%h the !ro!erty of the oods 'i"" or may !ass

to the bai"ee+ In other 'ords hire !&r%hase transa%tion is a kind of bai"ment

'here the hirer !ays money in %onsideration of the &se of oods+ The

o'nershi! %ontin&es to remains 'ith the !ersonGinstit&tion 'ho i#es the

%ommodities on hire+ This ty!e of "oan is main"y !ro#ided as a !&r!ose of

b&yin #e%hi"e+ The %ondition 'i"" be different for firmG!ersonG%om!any as

be"o'<

-.3.1 7a7e* %'"h a% "4ea*an"e "e*#i&i"a#e In"ome #a<3 *e8i%#*a#ion *ene5a4

7a*#ne*%hi7 a8*eemen#3 (e"i%ion o& oa*( meme* 5o'4( e *e>'i*e( 5ho

a774ie% &o* hi*e 7'*"ha%e 4oan.

-.3.2 The in$oi"e ; %"heme o& #*an%7o*#a#ion ?o* ('*a4e 8oo(%6

-.3.3 Con(i#ion%=7*o"e('*e% &o* in(i$i('a4

The iss&ed "oan in the name of one !erson sho&"d not &se by another+

The !&r%hased #e%hi"e &nder hire !&r%hase "oan sho&"d be 'ritten$

Hfinan%ed by Ne!a" Bank LimitedH+

The tit"e of o'nershi! of #e%hi"e 'i"" be transferred on"y 'hen "oan is %"ear+

If #e%hi"e<o!eratin area is different than mentioned ha#e to inform to bank+

4A

-.3.- Re>'i*e "on(i#ion% &o* In('%#*)

Ero>e%t or b&siness s%heme is reC&ired 'ith a!!"i%ation+

In%ome ( e;!enses statement ( %ash f"o' statement of three years is

reC&ired+

3stimated finan%ia" statement as 'e"" as ba"an%e sheet of three years+

Loan fa%i"ity from another bank sho&"d not taken+

The b"&e book of #e%hi"e sho&"d be in the name of the bank &nti" the "oan

d&e+

-.3.0 Con(i#ion% &o* %an"#ion o& amo'n#

The "oan amo&nt 'i"" be 8A@ of the s&bmitted in#oi%e0 remainin 5A@

ha#e to in#est by borro'er 1for indi#id&a"2 himse"f+

-A@ amo&nt of s&bmitted in#oi%e 'i"" be !ro#ided by the bank then the rest

f&nd sho&"d be in#ested by %om!any itse"f+

Eeriod < the ma;im&m term of "oan 'i"" be for !eriod of / years interest (

!rin%i!a" sho&"d be !aid 'ithin inter#a" of three month ass&min on the

basis of // insta""ments+

The a!!ro#ed "oan sho&"d be dra'n on the basis of 'orkin s%hed&"e+

-.- PRIORITY SECTOR .OAN

Commer%ia" banks ha#e been s&b>e%ted to "end to sma"" enter!rises in

ari%&"t&re %ottae ind&stries and ser#i%es &nder Ne!a" Rastra Bank instr&%tion

sin%e 4?-5 at !referentia" rates of interest+ Sin%e 4?,4$ !riority se%tor "endin

has been named intensi#e bankin !roram 1IBE2+ IBE 'as %on%ei#ed as a

means of in#o"#in %ommer%ia" banks in e%onomi% ( so%ia" de#e"o!ment of

r&ra" !eo!"e thro&h s&!er#ised bank %redit+ 7inim&m "endin ratio for !riority

se%tor no' stands at 4.@ o&t of 'hi%h A+.=@ to /@ has been fi;ed for the

'eaker se%tions+ This se%tor different ty!e of interest rate !o"i%y is &sed

a%%ordin to #ario&s ty!e of !ro>e%t main"y based on ari%&"t&re$ ind&stry$

ser#i%e b&siness+

44

-.0 DOCU/ENTS

O'nershi! %ertifi%ate of !ro!erty$ ser#i%eGind&stryGb&siness reistration+

Certifi%ate is reC&ired 'ith a!!"i%ation+

Eermission 1a&thori*ation2 "etter of "o%a" administration de!artment is a"so

reC&ired+

Ero!erty statement ( &arantee "etter if anyone+

Erofessiona" kno'"ede ( e;!erien%e of the a!!"i%ant+

+

-.0.1 P*o"e('*e

The reistered a!!"i%ation 'i"" be ins!e%ted by the bank 'ithin .4 days$ as

'e"" as %hara%ter of a!!"i%ant and his !ro!erty+

The a!!"i%ant %an et on"y &! to "imit of bank for different ty!e of !ro>e%t+

The "imit for different se%tor is determined as be"o'<

16 A8*i"'4#'*e , 21 4a9h

26 Se*$i"e '%ine%% , 11 4a9h

36 Sma44 in('%#*) , 21 4a9h

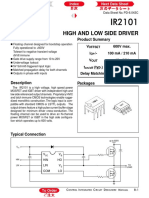

P*io*i#) %e"#o* 4en(in8 o& Ba4a!' B*an"h3

1O&tstandin .A=-$ /4st Ashadh2

Area N&mber Erin%i!a" 1Rs+DAAAB2 Interest

Ari%&"t&re , ,8=- ?4/

Sma"" Ind&stry , /.,= ,/?

Ser#i%e / 5=/, =--

Tota" 4? 485,A ./.?

1So&r%e < NBL$ BB2

Tab"e No<4

4.

D&rin )+I+ .A=8G.A=-$ ari%&"t&re se%tor &nder !riority se%tor "endin is more

than other se%tor+ The "ife of the !eo!"e main"y based on ari%&"t&re of Ba"a>&

area+ S o the "oan f&nd in this se%tor is fo&nd hiher than other+ The "o'est

f&nd is &sed for ind&stry the reason may be that the sma"" ind&stry are se"f

de!ended ( not so many n&mber in Ba"a>& area+ The ser#i%e se%tor has a"so

&sed more f&nd$ main"y the f&nd is &sed for sma"" hote"$ retai" sho! et%

0.1 .OAN APPRAISA. PROCESS

This is the e#a"&ation !ro%ess of in#estment$ bank sho&"d %he%k re%ei#ed

do%&ment ( st&dy dee!"y abo&t "oan disb&rse for the !&r!ose of "oan st&dy (

a!!raise a %ommittee has been estab"ished in the e#ery bran%hes of NBL+

Bran%h manaer as a !resident$ a%%o&ntant ( in<%hare of "oan se%tion as

members are in#o"#ed for this %ommittee+ This %ommittee takes minim&m of

4= days to a!!raise the !ro!osa"$ if somethin fo&nd do&btf&" after %ombine

st&dy$ the %ommittee 'i"" send the re"ated do%&ments to the head offi%e 'ith

detai" information$ if they fo&nd the !ro!osa" aressi#e or risky to bank they

ha#e riht to re>e%t it+ The %ommittee sho&"d inform to a!!"i%ant abo&t the

4/

0

2000

4000

6000

8000

10000

NUM. PRI. INT

PRIORITY SECTOR LENDING OF

BALAJU BRANCH, 2057.

AG

SI

SER

a!!ro#a" or re>e%tion of the !ro!osa"$ they a"so ha#e riht to ask re"ated matter

'ith a!!"i%ant$ some times bank may 'ant &aranteed+

NBL a!!raises "oan after detai" st&dy of the !ro!osa"$ the !ro!osa" is

a!!rises on the basis of =B%sB$ theory of K&"b ( Rodri&e*+ These =B%sB'hi%h

are ana"y*ed before rantin the "oan+ These are %hara%ter$ %a!a%ity$ %o""atera"$

%ondition ( %a!ita"+

The %hara%ter of the borro'er sho&"d be ood$ there sho&"d not be bad

re%ord of the a!!"i%ant in the so%iety i+e+ !ersona"ity$ orani*ation$ !re#io&s d&e

amo&nt+ Therefore the !erson name sho&"d not in the b"a%k "ist$ this kind of

information %an be fo&nd by #ario&s method+

The ne;t one is the %a!a%ity of a!!"i%ant0 the re!ayment of "oan dire%t"y

de!ends &!on the %a!a%ity+ It %an be st&died dee!"y on the basis of %ash f"o' of

f&t&re !ro!osa" is !rofitab"e or not+

The %o""atera" oods sho&"d be #a"&ab"e if borro'er &nab"e to !ay the

"oan+ They sho&"d re%o#er by that the #a"&e of !ro!erty sho&"d be more than

!ro#ided f&nd+ Ja"&ation sho&"d be done on the basis of "o'er market rate (

another fa%tor is oods sho&"d be borro'erBs o'nershi!+

The %a!ita" %ondition of the borro'er sho&"d adeC&a%y$ it %an be kno'n

by the e%onomi% %ondition of borro'er$ if borro'er has adeC&ate %a!ita" there

is "ess do&bt of not !ayin "oan+ The ne;t one is the %ondition of the %o""atera"

oods$ the de%reasin ( in%reasin trend of oods in f&t&re+ Those oods

sho&"d not taken as %o""atera" 'hi%h #a"&e 'i"" be &! ( do'n 'ithin a short

!eriod$ in enera" if the market #a"&e is in red&%in trend those oods 'i"" be

re>e%ted+

@.1 INTEREST RATE

Interest is that kind of in%ome of bank 'hi%h is !aid by the borro'er as an

o!!ort&nity %ost$ the rate is determined &nder the instr&%tion of %enter bank

1NRB2+ A"" of %ommer%ia" banks ha#e to riht to determine the rate of interest

themse"#es+ The %entra" bank of NBL determines the rate of interest for its

bran%hes ( it is main"y fi;ed a%%ordin to the market %ondition ( r&"e of the

45

rate %an be %haned at any time+ It 'o&"d be different for different ty!es of "oan

be%a&se of e%onomi% %ondition+ Ne' rate ha#e to !ay by the borro'er in %ase

of %hane d&rin the "oan !eriod+ The interest rates taken by NBL$ BB are as

fo""o's 1effe%ti#e from 4st Ashadh .A=-2<

T)7e% o& .oan In#e*e%# Ra#e

1. H)7o#he"a#ion

i2 B&siness 4/+=A@

ii2 Ind&stry 4.+=A@

2. O$e*(*a&#

i2 B&siness 45+=A@

ii2 Ind&stry 45@

3. Hi*e P'*"ha%e 45@

i2 H+E+ for bank staff ?@

-. Go4( ; Si4$e* 45+-=@

0. P*io*i#) Se"#o* 45@

i2 for ser#i%e 45@

ii2 for de!ri#ed <

1so&r%e < NBL$ BB2Tab"e no 4+4

NBL !ro#ides hy!othe%ation ( o#erdraft "oan for b&siness as 'e"" as

ind&stria" se%tor$ the rate of interest for both is fo&nd different+ If the !eriod of

"oan is more the rate of interest a"so 'o&"d be more i+e+ if H+E+ "oan is taken on

ind&stria" se%tor for 4. month the rate 'o&"d be 4/+=A@ ( 4.+=A@ for

b&siness+ By the abo#e tab"e it is kno'n the interest rate taken for b&siness is

reater than the ind&stria" se%tor$ for both hy!othe%ation ( o#erdraft+ It is

be%a&se of ind&stria" se%tor is i#en more !riority than b&siness ( ha#e to

moti#ate to in#est on this se%tor+ The interest rate taken on o#erdraft is hiher

than the rate of hire !&r%hase be%a&se o#erdraft is a kind of fa%i"ity i#en to its

%&stomer by bank+

Interest rate for hire !&r%hase "oan is a"so hih$ be%a&se the earnin

%a!a%ity of hire 1 #e%hi"e$ d&rab"e oods2 is more than other 'ithin a short

!eriod+

4=

The interest taken for o"d ( si"#er "oan is 45+-=@$ it is hiher than

other$ the reason may be that the "oan !&r!ose is not for in%ome eneratin$ the

main !&r!ose of this ty!e of "oan is to so"#e ho&seho"d !rob"ems+ The interest

on !riority se%tor is "ess than other se%tor+ Ne!a" is &nderde#e"o!ed %o&ntry to

e"iminate different ty!es of mismat%hes ( to moti#ate this se%tor0 the rate of

interest is "o'est+ Eriority se%tor in%"&des ari%&"t&re$ ind&stry$ ser#i%e (

!riority for ser#i%e 1i2 in%"&des the "oan for b&yin !&r!ose of motor%ar or

tra%tor$ so the interest rate is hih+

A.1 REPAY/ENT OF .OAN

Re!ayment of "oan means %o""e%tion of in#ested amo&nt by the bank

from the borro'er 'ithin mentioned !eriod+ it may in%"&des any %ommission if

ne%essary+ Borro'er ha#e to !ay the "oan 'ithin s!e%ified !eriod$ in order to

et 4@ dis%o&nt on interest+ In %ase of borro'er in%on#enien%e to !ay

ERINCIEAL ( "oan 'ithin s!e%ified time$ he %an rene' it after !ayin interest

if his finan%ia" %ondition fo&nd !roressi#e+ Borro'er sho&"d !ay interest on

e#ery C&arter of the year i+e+ /4st of Ashadh$ Ash'in$ Eo&sh ( Chaitra+ If

interest ( !rin%i!a" is not !aid time"y bank 'o&"d %hared interest of interest at

same rate+

If borro'er defa&"t to !ay interest ( !rin%i!a" for "on !eriod$ the bank

has riht to a&%tion ( se"" the se%&rities taken as %o""atera"+ B&t before se""in

bank has to i#e reminder "etter or noti%e to the borro'er abo&t the re!ayment

of "oan+ )irst bank sends a "etter i#in information abo&t the interest (

!rin%i!a" to !ay 'ithin mat&rity !eriod$ before one month of e;!ire date+ If the

borro'er sti"" ref&se to !ay$ bank i#es /= days information to C+D+O+ offi%e

GJDC offi%e and any !&b"i% !"a%e$ than after bank has riht to se"" the !ro!erty

taken as %o""atera"+

48

.oan in$e%#men# o& BB ) #a4e,

A""o*(in8 #o *e"o*( o& F.Y 210@=0A ?R%.B111B6

A*ea N'me* P*in"i7a4 In#e*e%#

4+ Go"d ( Si"#er ?/, 4/-/5 ,8,

.+ Staff Loan =- 8/A4 /-?

5+ Hy!othe%ation 84 /8.?, 5-/,

=+ Hire E&r%hase / ./4, 4A/

8+ Ind&stria" /4 ./88= =-84

-+ Im!orts . 4..8 ?=

,+ 7is%e""aneo&s /? .-5A- =/A/

1So&r%e < NBL$ BB2 Tab"e no<4+/

A""o*(in8 #o 4oan %#'() o& 2 )ea*% o& BB3 5e &o'n( 4oan &4o5 ; 7a)men#

a% e4o5,

F=Y N'me* P*in"i7a4 In#e*e%# N'me* P*in"i7a4 In#e*e%#

100=0@ 20C1 22013@ 21ADC- 22-- 2110A2 100C21

10@=0A 2@A@ 311@C1 A3D0@ 333@ 2--03@ 2DC@C

Series 4< ERINCIEAL of Loan in#estment ( Series .< ERINCIEAL of Loan

re!ayment

Series 4< ERINCIEAL of Loan in#estment ( Series .< ERINCIEAL of Loan

re!ayment

C.1 CONC.USION ; RECO//ENDATIN

C.1 Con"4'%ion

The bank of Ba"a>& area is !ro#idin reat ser#i%e to the "o%a" !eo!"e$

this bank !ro#idin different ser#i%es to those !eo!"e 'ho are most"y

&ned&%ated+ The bank 'as o!erated 'ith on"y se#en staffs at initia" !eriod$ and

transa%tions 'ere a"so "imit+ No' the bank has tota""y in%reased its transa%tions

as 'e"" as n&mber of staffs+

The Ba"a>& bran%h of NBL has been o!eratin itBs ser#i%e sin%e .A5A

B+S+ in this area 'hi"e other finan%ia" orani*ations are rare"y fo&nd here+ It is

!ro#idin different ser#i%e 'ith different de!artment i+e+ finan%ia" de!artment$

%ash de!t+$ de!osit de!t+$ a%%o&ntin de!t 1re%ord2+ This bran%h has !"ayin a

4-

0

100000

200000

300000

400000

055/56 056/57

LOAN INVESTMENT RS.'000'

NUM.

PRI.

INT

0

50000

100000

150000

200000

250000

055/56 056/57

LOAN REPAYMENT RS.'000'

NUM.

PRI.

INT

#ita" ro"e main"y to disb&rse on in%ome eneratin 'ork as 'e"" as finan%ia"

s&estion+

In the !eriod of st&dy of BB$ 'e fo&nd that the !o"ite beha#e of the staff

'ith %&stomer a"so %o<o!erati#e 'ork to'ard the &ned&%ated %&stomers$ the

!"easin 'orkin en#ironment fo&nd fami"iar ( friend"y to ea%h other bet'een

staff ( %&stomer+ + A"tho&h this bran%h is in b&sy area+ it is s&%%essf&""y

!ro#idin fami"iar ser#i%es to the %&stomer+ The 'orkin system of the bank is

fo&nd %om!&teri*e+

Ee &o'n( %ome 7*o4em on 4oan 7*o"e('*e o& BB,

< La%k of de#e"o!ment of 'oman ski"" in Ba"a>& area+

< La%k of bankin habit d&e to #i""ae area as 'e"" as ed&%ation+

< La%k of s!a%e+

4,

C.2 Re"ommen(a#ion%

)o""o'in re%ommendations %an be s&ested for the im!ro#ement of "endin

a%ti#ities of NBL$ BB<

Bank sho&"d !ro#ide more attention to'ards the !riority se%tor to &ti"i*e

their id"e reso&r%e to %ontrib&te e%onomi% de#e"o!ment of the nation+

Bank sho&"d i#e more attention to im!ro#e its manaement and "endin

!o"i%y$ 'hi%h 'i"" he"! to in%rease more transa%tions+

The interest rate sho&"d be a!!ro!riate to in#est more+

Lendin Ero%ed&re sho&"d better to determine different for r&ra" area+

4?

BIB.IOGRAPHY

16 Ne7a4 Ban9 2o San"hi7#a I#ihan% ,Go4(en J'4ie 21--

26 Ne7a4 Ban9 Pa#*i9a ,Bai%a9h /a%an#a3 210A

36 Ne7a4 ma Ban9in8 B)aa%a)a ,Yo8en(*a Timi4%ina3 2103

?Theo*)3 .a5 ; P*a"#i"e%6

-6 2a#hman(' Po%# ; Ri%in8 Ne7a4 ,2a*#i9 31

#h

210@

06 O#he* mon#h4) 7a7e* o& NB. ,NB.3 Hea( O&&i"e

.A

AC2NOE.EDG/ENT

Thi% %#'() ha% een "om74e#e( a% 7a*#ia4 &'4&i44men# &o*

"om7'4%o*) *e>'i*emen# o& #he Ba"he4o*% De8*ee P*o8*am o& &a"'4#) o&

mana8emen#.

I e<#*eme4) ha77)3 ha$in8 o77o*#'ni#) o& 7*a"#i"a4 9no54e(8e

ao'# an9in8 on eha4& o& e4e"#i$e a*ea FBan9in8 ; In%'*an"eG.

I am $e*) 8*a#e&'4 5i#h m) *e%7e"#e( #ea"he*3 /*.D*.Sh)am 2.

Sh*e%#ha ; &o*ma4 "am7'% "hie& S'a*na 4a4 Ba!*a"ha*)a 5ho ha$e 9in(4)

7*o$i(e( #hei* $a4'a4e %'88e%#ion% an( "ommen#% in o'* o*ien#a4 "4a%%

'n(e* 7*o7e* 8'i(an"e.

.i9e5i%e3 I 5i%h #o e<#en( m) %in"e*e 8*a#i#'(e #o /*%. An!'

Sha*ma ; m) 'n"4e Om 9a* P*a(han %#a&&% o& NB.3 BB 5ho 9in(4)

7*o$i(e me #he *e4a#e( in&o*ma#ionB% ) 8i$in8 hi% $a4'a4e #ime.

.i9e5i%e3I 5o'4( 4i9e #o #han9% #o m) a44 o& &*ien(% 5ho 9in(4)

he47 #o 7*e7a*e m) #hi% *e7o*#.

San!i$ 2 C

.4

Con#en#%

Cha7#e* I

1.1 Hi%#o*i"a4 Ba"98*o'n(

1.2 Si8ni&i"an"e o& #he S#'()

1.3 O!e"#i$e% o& #he S#'()

1.- .imi#a#ion% o& #he S#'()

1.0 /e#ho(o4o8) o& S#'()

Cha7#e* II

2.1 In#*o('"#ion #o Ne7a4 Ban9 .#(.

3.1 F'n"#ion% o& NB.3 BB

3.1 In#*o('"#ion o& .oan P*o"e('*e

-.1 T)7e% o& .oan

-.1 Go4( ; Si4$e* .oan

-.2 H)7o#he"a#ion .oan

-.3 Hi*e 7'*"ha%e .oan

-.- P*io*i#) %e"#o*

-.0 Do"'men#%

0.1 .oan a77*ai%a4 P*o"e%%

@.1 In#e*e%# Ra#e

A.1 Re7a)men# o& .oan

C.1 Con"4'%ion ; Re"ommen(a#ion

..

ABBREVIATION

NB. , Ne7a4 Ban9 .imi#e(

BB , Ba4a!' B*an"h

HP , Hi*e 7'*"ha%e

F.Y. , Fi%"a4 )ea*

./

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Aortic Stenosis, Mitral Regurgitation, Pulmonary Stenosis, and Tricuspid Regurgitation: Causes, Symptoms, Signs, and TreatmentДокумент7 страницAortic Stenosis, Mitral Regurgitation, Pulmonary Stenosis, and Tricuspid Regurgitation: Causes, Symptoms, Signs, and TreatmentChuu Suen TayОценок пока нет

- The Temple of ChaosДокумент43 страницыThe Temple of ChaosGauthier GohorryОценок пока нет

- Xii Neet Chemistry Mcqs PDFДокумент30 страницXii Neet Chemistry Mcqs PDFMarcus Rashford100% (3)

- Theoretical and Actual CombustionДокумент14 страницTheoretical and Actual CombustionErma Sulistyo R100% (1)

- RPG-7 Rocket LauncherДокумент3 страницыRPG-7 Rocket Launchersaledin1100% (3)

- NDE Procedure - Radiographic TestingДокумент43 страницыNDE Procedure - Radiographic TestingJeganeswaranОценок пока нет

- A Study On Customer Satisfaction Towards Honda Bikes in CoimbatoreДокумент43 страницыA Study On Customer Satisfaction Towards Honda Bikes in Coimbatorenkputhoor62% (13)

- Clean Milk ProductionДокумент19 страницClean Milk ProductionMohammad Ashraf Paul100% (3)

- LTE EPC Technical OverviewДокумент320 страницLTE EPC Technical OverviewCristian GuleiОценок пока нет

- 47-Article Text-338-1-10-20220107Документ8 страниц47-Article Text-338-1-10-20220107Ime HartatiОценок пока нет

- Datasheet PDFДокумент6 страницDatasheet PDFAhmed ElShoraОценок пока нет

- Project Binder 2Документ23 страницыProject Binder 2Singh DhirendraОценок пока нет

- Helmitin R 14030Документ3 страницыHelmitin R 14030katie.snapeОценок пока нет

- SOR 8th Ed 2013Документ467 страницSOR 8th Ed 2013Durgesh Govil100% (3)

- VT6050 VT6010 QuickGuide ENДокумент19 страницVT6050 VT6010 QuickGuide ENPriyank KumarОценок пока нет

- 11bg USB AdapterДокумент30 страниц11bg USB AdapterruddyhackerОценок пока нет

- Metal Framing SystemДокумент56 страницMetal Framing SystemNal MénОценок пока нет

- JY Series Single-Phase Capacitor Induction MotorsДокумент1 страницаJY Series Single-Phase Capacitor Induction MotorsAditya PrasetyoОценок пока нет

- An Online ECG QRS Detection TechniqueДокумент6 страницAn Online ECG QRS Detection TechniqueIDESОценок пока нет

- Gas Natural Aplicacion Industria y OtrosДокумент319 страницGas Natural Aplicacion Industria y OtrosLuis Eduardo LuceroОценок пока нет

- JUPITER 9000K H1PreliminaryДокумент1 страницаJUPITER 9000K H1PreliminaryMarian FlorescuОценок пока нет

- A Fossil Hunting Guide To The Tertiary Formations of Qatar, Middle-EastДокумент82 страницыA Fossil Hunting Guide To The Tertiary Formations of Qatar, Middle-EastJacques LeBlanc100% (18)

- Idioms & Phrases Till CGL T1 2016Документ25 страницIdioms & Phrases Till CGL T1 2016mannar.mani.2000100% (1)

- Virchow TriadДокумент6 страницVirchow Triadarif 2006Оценок пока нет

- Quaternary Protoberberine Alkaloids (Must Read)Документ26 страницQuaternary Protoberberine Alkaloids (Must Read)Akshay AgnihotriОценок пока нет

- A Compilation of Thread Size InformationДокумент9 страницA Compilation of Thread Size Informationdim059100% (2)

- Clausius TheoremДокумент3 страницыClausius TheoremNitish KumarОценок пока нет

- Concept Page - Using Vagrant On Your Personal Computer - Holberton Intranet PDFДокумент7 страницConcept Page - Using Vagrant On Your Personal Computer - Holberton Intranet PDFJeffery James DoeОценок пока нет

- Lec9-Rock Cutting ToolsДокумент35 страницLec9-Rock Cutting ToolsAmraha NoorОценок пока нет

- Essentials For Professionals: Road Surveys Using SmartphonesДокумент25 страницEssentials For Professionals: Road Surveys Using SmartphonesDoly ManurungОценок пока нет