Академический Документы

Профессиональный Документы

Культура Документы

News Flash - Indirect Tax - 041114

Загружено:

Udyog Software India Ltd.0 оценок0% нашли этот документ полезным (0 голосов)

21 просмотров3 страницыCustoms: Tariff values revised

Service Tax: Land value component of membership deductible from gross value of club service: CESTAT

Service Tax: Payable on commitment charges in relation to loan: CESTAT

Service Tax / Cenvat Credit: Interest payable on Rule 5 refund: CESTAT

Оригинальное название

News Flash - Indirect Tax_041114

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCustoms: Tariff values revised

Service Tax: Land value component of membership deductible from gross value of club service: CESTAT

Service Tax: Payable on commitment charges in relation to loan: CESTAT

Service Tax / Cenvat Credit: Interest payable on Rule 5 refund: CESTAT

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

21 просмотров3 страницыNews Flash - Indirect Tax - 041114

Загружено:

Udyog Software India Ltd.Customs: Tariff values revised

Service Tax: Land value component of membership deductible from gross value of club service: CESTAT

Service Tax: Payable on commitment charges in relation to loan: CESTAT

Service Tax / Cenvat Credit: Interest payable on Rule 5 refund: CESTAT

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

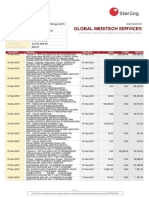

News Flash Indirect Tax

Udyog Software (India) Ltd.

04/11/2014

This document contains a brief summary of the latest updates related to Indirect Taxes

Customs: Tariff values revised

The CBEC has issued notification 100/2014-Customs (NT) dated 31 October 2014 to fix tariff values for

specified commodities for purpose of valuation of the goods under section 14 of the Customs Act 2014. The

tariff value of gold for which the benefit of entries number 321 and 323 of notification 12/2012-Customs is

availed has been reduced to USD 391 per 10 grams (from USD 401); and the tariff value of silver for which the

benefit of serial numbers 322 and 324 of the said notification is availed has been reduced to USD 551 per

kilogram (from USD 575). There is reduction in the tariff value of palm oils and oleins, crude soyabean oil,

and brass scrap also. Only the value of areca nuts remains the same.

The notification 100/2014-Customs (NT) dated 31 October 2014 can be accessed at

http://cbec.gov.in/customs/cs-act/notifications/notfns-2014/cs-nt2014/csnt100-2014.htm.

Service Tax: Land value component of membership deductible from gross value of club service: CESTAT

Country Club, Hyderabad, offered a category of membership called membership with land and charged a

membership fee that was said to include the cost of land that was transferred to another concern for the

purpose of registration in the names of the members. In appeal by the Country Club against a demand of

service tax on these amounts, the CESTAT, Bangalore, relied upon its own earlier order to hold that the cost

of land must be deducted from the gross amount to arrive at the taxable value for service tax. The matter was

remanded to verify the amounts involved. This order of CESTAT Bangalore, in service tax appeal number

ST/1247/2010, can be accessed by entering the said information in

http://judis.nic.in/dist_judis/Cestat_Delhi/Retrieve/CaseNo_Qry.asp.

Service Tax: Payable on commitment charges in relation to loan: CESTAT

Punjab National Bank was charging commitment charges on the amount of loan sanctioned but not drawn by

the customer. A single-member bench of the CESTAT followed the earlier decision in the case of HUDCO and

observed that this is integrally connected to the service of lending and is taxable as such. This order of Delhi

bench of CESTAT in service tax appeal number 50421/2014 can be retrieved from

http://judis.nic.in/dist_judis/Cestat_Delhi/Retrieve/CaseNo_Qry.asp.

However, it may be noted that the HUDCO order has been distinguished on facts in granting stay in a case of

Andhra Pradesh State Financial Corporation recently by Bangalore bench of the CESTAT (2 members) based on

the factual scenario narrated in paragraph 10 of the said HUDCO order.

Service Tax / Cenvat Credit: Interest payable on Rule 5 refund: CESTAT

The department sanctioned refund under rule 5 of the Cenvat Credit Rules, but declined to pay interest, on

the ground that there was no provision for it in law. The CESTAT, in appeal, observed that the CBEC has

instructed its officers that refund of Cenvat credit under rule 5 of the Cenvat Credit Rules 2004 must be made

within 30 days of application by the assessee or at most within 45 days; and that this in fact placed such

refunds on a higher platform than refunds under section 11B. Interest on rule 5 refunds sanctioned and paid

belatedly would be payable as for section 11B refunds. This order of CESTAT, Ahmedabad bench, in the case

of appeal number ST/166/2011 of Reliance Industries can be retrieved in case number search from

http://judis.nic.in/dist_judis/Cestat_Delhi/Retrieve/CaseNo_Qry.asp.

Central Excise: Capital goods credit available if intention to use later in dutiable production is shown

Rule 6(4) of the Cenvat Credit Rules 2004 bars credit of duties paid on capital goods that are used exclusively

in the manufacture of exempted products. The determination of use has to be done at the time of receipt and

installation of the machinery, as per Spenta International case and the ruling of the Supreme Court in the case

of Surya Roshni. For this reason it is the settled position that if, at the time of receipt and installation of the

capital goods, they are used only for exempted products, and later the use is changed, the later use is

irrelevant, and the credit of excise duty paid on the capital goods is not available under the Cenvat Credit

Rules. However, in excise appeal number E/432/2007 of Brindavan Beverages Private Limited, the CESTAT,

Delhi bench, brought a new nuance into this discussion, and held that if the manufacturers intention was to

use the machinery for dutiable goods in the future, the credit will be available, even if the use is for

exempted goods only in the initial period of use. The CESTAT remanded the matter to examine evidence and

determine the intention of the manufacturer. This order can be retrieved from case number search at

http://judis.nic.in/dist_judis/Cestat_Delhi/Retrieve/CaseNo_Qry.asp.

All Rights Reserved USIL an Adaequare Company

Page 1

Content provided by:

Radha Arun

Consultants to Udyog Software (India) Ltd.

radha.arjuni@gmail.com

Please connect with us at:

Web: www.udyogsoftware.com

Call: +91 (0) 40 6603 6561

Email: teammarketing@udyogsoftware.com

All Rights Reserved USIL an Adaequare Company

Page 2

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- FTF 2022-03-23 1648079099327Документ14 страницFTF 2022-03-23 1648079099327Charles Goodwin100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Airway Bill SAMPLEДокумент1 страницаAirway Bill SAMPLEMildred C. WaltersОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Nizhoni STYLZ $1,096.37 30 $1,043.27: Checking StatementДокумент3 страницыNizhoni STYLZ $1,096.37 30 $1,043.27: Checking StatementTina BrownОценок пока нет

- Verified by Visa & MasterCard SecureCode: Fraudulent Chargeback Liability ShiftДокумент16 страницVerified by Visa & MasterCard SecureCode: Fraudulent Chargeback Liability Shiftmskaler100% (1)

- IT-02 Residential StatusДокумент26 страницIT-02 Residential StatusAkshat GoyalОценок пока нет

- Journal EntriesДокумент61 страницаJournal EntriesTavnish Singh100% (1)

- Income TaxДокумент7 страницIncome TaxDhang Cerilo AparenteОценок пока нет

- Budget Highlights 2014-15Документ4 страницыBudget Highlights 2014-15Udyog Software India Ltd.Оценок пока нет

- Udyog Tax News FlashДокумент6 страницUdyog Tax News FlashUdyog Software India Ltd.Оценок пока нет

- Udyog Tax News FlashДокумент5 страницUdyog Tax News FlashUdyog Software India Ltd.Оценок пока нет

- Udyog Tax News FlashДокумент5 страницUdyog Tax News FlashUdyog Software India Ltd.Оценок пока нет

- MS.3506 Short-Term Budgeting ANSWERSДокумент39 страницMS.3506 Short-Term Budgeting ANSWERS2023000664Оценок пока нет

- 1801 SilvozaДокумент1 страница1801 SilvozaKate Hazzle JandaОценок пока нет

- Format For Send To KCGДокумент6 страницFormat For Send To KCGMayank GandhiОценок пока нет

- Jurisprudence-Pacta Sunt ServandaДокумент3 страницыJurisprudence-Pacta Sunt ServandaMavisJamesОценок пока нет

- MEDITECH - MEDITECH Statement 20191128 PDFДокумент49 страницMEDITECH - MEDITECH Statement 20191128 PDFLion Micheal OtitolaiyeОценок пока нет

- Final Sad S-131104 Cutting FatДокумент2 страницыFinal Sad S-131104 Cutting FatCAMILLE ANNE PROCESOОценок пока нет

- Taxation For Decision Makers 2016 1st Edition Escoffier Test BankДокумент25 страницTaxation For Decision Makers 2016 1st Edition Escoffier Test Bankmonicamartinezaekngtcimj100% (12)

- Under Composite Scheme of VAT Assessment Annexure-I Project/ Contract Details (EPC Contracts)Документ2 страницыUnder Composite Scheme of VAT Assessment Annexure-I Project/ Contract Details (EPC Contracts)ghaghra bridgeОценок пока нет

- Product Overview IMPSДокумент3 страницыProduct Overview IMPSKuriya HardikОценок пока нет

- CS Professional Programme Tax NotesДокумент47 страницCS Professional Programme Tax NotesridhiworkingОценок пока нет

- BSNL Odisha BillДокумент3 страницыBSNL Odisha BillASANTA SWAINОценок пока нет

- Lakshadweep Island-Tour Packages - APAДокумент2 страницыLakshadweep Island-Tour Packages - APAmanishk21Оценок пока нет

- 24 Emv 00001Документ1 страница24 Emv 00001Chandra SekaranОценок пока нет

- 2024 02 12 13 46 39jan 24 - 641607Документ5 страниц2024 02 12 13 46 39jan 24 - 641607VKОценок пока нет

- Direct Tax NotesДокумент41 страницаDirect Tax NotesRenandОценок пока нет

- Comprehensive Income Statement ExampleДокумент1 страницаComprehensive Income Statement ExampleAdil AliОценок пока нет

- Assignment 2Документ3 страницыAssignment 2Umme Habiba100% (1)

- Schedule of Charges MTB Cards Effective October 2022 Website UpdatedДокумент5 страницSchedule of Charges MTB Cards Effective October 2022 Website UpdatedShohag MahmudОценок пока нет

- Value Added Tax-Day2Документ22 страницыValue Added Tax-Day2Brian Reyes GangcaОценок пока нет

- Amount Chargeable (In Words)Документ1 страницаAmount Chargeable (In Words)Varun GopalОценок пока нет

- This Study Resource WasДокумент2 страницыThis Study Resource WasMay RamosОценок пока нет

- E-Payment System in Saudi Arabia PDFДокумент16 страницE-Payment System in Saudi Arabia PDFRohan MehtaОценок пока нет

- Public Finance & Taxation - Chapter 4, PT IVДокумент24 страницыPublic Finance & Taxation - Chapter 4, PT IVbekelesolomon828Оценок пока нет