Академический Документы

Профессиональный Документы

Культура Документы

Contributions/ Fees 1. EE's Contribution: Members Who Can Afford

Загружено:

blimjucoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Contributions/ Fees 1. EE's Contribution: Members Who Can Afford

Загружено:

blimjucoАвторское право:

Доступные форматы

5

Contributions/ Fees

Bianca Alana Hizon Limjuco

Mandatory for the member &

the ER to pay the monthly

contributions.

1. EE's Contribution Beginning

as of the last day of the calendar

month when an EE's compulsory

coverage takes effect & every

month thereafter during his

employment, the ER shall deduct

& withhold from such EE's

monthly salary, wage,

compensation or earnings, the

EE's contribution in an amount

corresponding to his salary,

wage, compensation or earnings

during the month.

2. ER's Contributions Beginning

as of the last day of the month

when an EE's compulsory

coverage takes effect & every

month thereafter during his

employment, his ER shall pay,

with respect to such covered EE,

the ER's contribution in

accordance with the schedule

indicated in Section Eighteen of

this Act. Notwithstanding any

contract to the contrary, an ER

shall not deduct, directly or

indirectly, from the compensation

of his EEs covered by the SSS or

otherwise recover from them the

ER's contributions with respect to

such EEs.

3. The contributions to the SSS of

the self-employed member shall

be determined in accordance with

Section Eighteen of this Act.

Agrarian Law & Social Legislation

All members who can afford to

pay shall contribute to the Fund,

in accordance with a reasonable,

equitable & progressive

contribution schedule to be

determined by the Corporation

on the basis of applicable

actuarial studies & in

accordance with the following

guidelines:

(a) Members in the formal

economy & their ERs shall

continue paying the same

monthly contributions as

Provided for by law until such

time that the Corporation shall

have determined a new

contribution schedule: Provided,

That their monthly contributions

shall not exceed (5%) of their

respective monthly salaries.

It shall be mandatory for all

government agencies to include

the payment of premium

contribution in their respective

annual appropriations: Provided,

further, That any increase in the

premium contribution of the

national government as ER shall

only become effective upon

inclusion of said amount in the

annual General Appropriations

Act.

(b) Contributions from members

in the informal economy shall be

based primarily on household

earnings & assets. Those from

the lowest income segment who

do not qualify for full subsidy

under the means test rule of the

DSWD shall be entirely

subsidized by the LGUs or

through cost sharing

mechanisms between/among

LGUs &/or legislative sponsors

&/or other sponsors &/or the

member, including the national

member, to be paid to him, his

estate or beneficiaries upon

termination of membership, or

from which peripheral benefits

for the member may be drawn.

Coverage of the Fund &/or

the payment of monthly

contribution to the same may

be rules & resolutions of the

Board of Trustees be waived

or suspended by reasons of

nature of employment,

condition of business, ability to

make contributions & other

reasonable considerations.

Atty. Berne Guerrero

Benefits

&

Rules on Entitlement

SIMILARITIES

DIFFERENCE

Bianca Alana Hizon Limjuco

1. Monthly pensions;

2. Retirement benefits;

3. Permanent disability benefits;

4. Death benefits;

5. Funeral benefits;

6. Loan grant

1. Temporary disability

benefits;

2. Separation benefits;

3. Unemployment/

involuntary separation benefits;

4. Survivorship benefits; &

5. Life insurance benefits.

1. Retirement Benefits

(1) has rendered at least 15 yrs

of service;

(2) at least 60 yrs of age at the

time of retirement; &

(3) not receiving a monthly

pension benefit from

permanent total disability.

2. Unemployment benefits paid to a permanent EE who is

involuntarily separated from the

service due to the abolition of

his office or position usually

resulting from reorganization:

Provided, That he has been

paying integrated contributions

government: Provided, That the

identification of beneficiaries who

shall receive subsidy from LGUs

shall be based on a list to be

Provided by the DSWD through

the same means test rule or any

other appropriate statistical

method that may be adopted for

said purpose.

(c) Contributions made in behalf

of indigent members shall not

exceed the minimum

contributions for employed

members.

(d) The required number of

monthly premium contributions

to qualify as a lifetime member

may be increased by the

Corporation to sustain the

financial viability of the Program:

Provided, That the increase shall

be based on actuarial estimate &

study.

1. Sickness benefits;

2. Maternity leave benefits; &

3. Dependents pension.

1. Retirement Benefits. (a)

member who has paid at least

120 monthly contributions prior to

the semester of retirement & who

(1) has reached the age of 60 yrs

& is already separated from

employment or has ceased to be

selfemployed or (2) has reached

the age of 65 yrs, shall be entitled

for as long as he lives to the

monthly pension: Provided, That

he shall have the option to

receive his first 18 monthly

pensions in lump sum discounted

at a preferential rate of interest to

be determined by the SSS.

Agrarian Law & Social Legislation

A member whose premium

contributions for at least (3)

months have been paid within

(6) months prior to the first day

of availment, including those of

the dependents, shall be entitled

to the benefits of the Program:

Provided, That such member

can show that contributions have

been made with sufficient

regularity: Provided, further,

That the member is not currently

subject to legal penalties as

Provided for in Section 44 of this

Act.

The following need not pay the

Provident (savings) benefits

claim:

Pag-IBIG Fund guarantees the

refund of member's total

accumulated savings (TAV),

which consists of the

member's accumulated

contributions, the ER

counterpart contributions, if

any, & the dividend earnings

credited to the member's

account upon occurrence of

any of the following grounds

for withdrawal:

1. Membership maturity. The

member must have remitted at

Atty. Berne Guerrero

Вам также может понравиться

- Social Legislation DummyДокумент91 страницаSocial Legislation DummyMylesGernaleОценок пока нет

- Comparative Matrix of Social Legislation in The PhilippinesДокумент14 страницComparative Matrix of Social Legislation in The PhilippinesHowie Malik100% (2)

- GSIS ReportДокумент177 страницGSIS ReportAbigail PasionОценок пока нет

- Agra - SSS Law - 102017Документ34 страницыAgra - SSS Law - 102017Andrea DeloviarОценок пока нет

- Part 2Документ2 страницыPart 2blimjucoОценок пока нет

- Social Welfare LegislationДокумент12 страницSocial Welfare LegislationMarianita CenizaОценок пока нет

- Iv. Computation of The Amount of ContributionДокумент11 страницIv. Computation of The Amount of ContributionYoan Baclig BuenoОценок пока нет

- Social Welfare Legislation LectureДокумент16 страницSocial Welfare Legislation LectureAllyza RamirezОценок пока нет

- COOP LAWS AND SOCIAL LEGISLATIONДокумент24 страницыCOOP LAWS AND SOCIAL LEGISLATIONyannie11Оценок пока нет

- Gsis LawДокумент26 страницGsis LawMaia DelimaОценок пока нет

- Who Are Covered Under The Social Security System?Документ6 страницWho Are Covered Under The Social Security System?Mervic Al Tuble-NialaОценок пока нет

- GSISДокумент56 страницGSISGilbert Gabrillo JoyosaОценок пока нет

- RFBT.10 - Lecture Notes (SSS Law)Документ10 страницRFBT.10 - Lecture Notes (SSS Law)Monica Garcia100% (1)

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент23 страницыBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJayMichaelAquinoMarquezОценок пока нет

- GSIS: Government Service Insurance SystemДокумент56 страницGSIS: Government Service Insurance SystemJonna Maye Loras Canindo100% (6)

- Irr Gsis LawДокумент46 страницIrr Gsis LawMa Geobelyn LopezОценок пока нет

- SssДокумент15 страницSssarianna0624Оценок пока нет

- SssДокумент18 страницSssKevinRubioОценок пока нет

- Gsis - Ra 8291Документ33 страницыGsis - Ra 8291RoySantosMoralesОценок пока нет

- GSISДокумент61 страницаGSISJelly BeanОценок пока нет

- Agra Final PaperДокумент21 страницаAgra Final PaperMacy Jesienne OuanoОценок пока нет

- Ecc Basics 1Документ26 страницEcc Basics 1Anton FortichОценок пока нет

- The Proceeds of Life Insurance Policies They Do The Heirs or Beneficiaries Upon Death of The Insured Shall Be Exempt From Income TaxДокумент18 страницThe Proceeds of Life Insurance Policies They Do The Heirs or Beneficiaries Upon Death of The Insured Shall Be Exempt From Income TaxXhien YeeОценок пока нет

- Inclusion and Exclusion of GIДокумент14 страницInclusion and Exclusion of GIRoxanne Dela Cruz100% (1)

- Republic Act No. 8291Документ14 страницRepublic Act No. 8291MerabSalio-anОценок пока нет

- The GSIS and RA 8291Документ6 страницThe GSIS and RA 8291Efeiluj CuencaОценок пока нет

- SSS Law Strengthens Social Security ProtectionДокумент3 страницыSSS Law Strengthens Social Security ProtectionRosalia L. Completano LptОценок пока нет

- Social Security System: Presented By: Aguba, Rica Dimayuga, Grazelle MДокумент33 страницыSocial Security System: Presented By: Aguba, Rica Dimayuga, Grazelle MRica AgubaОценок пока нет

- Social Security System: Presented By: Aguba, Rica Dimayuga, Grazelle MДокумент33 страницыSocial Security System: Presented By: Aguba, Rica Dimayuga, Grazelle MRica AgubaОценок пока нет

- Salary, Benefits and Leave for MDT EmployeesДокумент10 страницSalary, Benefits and Leave for MDT EmployeesMiguel Valdivia RosasОценок пока нет

- Source: HTTPS://WWW - Sss.gov - Ph/sss/printversion - Jsp?id 73&file Ben5000.html What Is The Retirement Benefit?Документ2 страницыSource: HTTPS://WWW - Sss.gov - Ph/sss/printversion - Jsp?id 73&file Ben5000.html What Is The Retirement Benefit?palmpoeyОценок пока нет

- R.A. No. 1161 (The Social Security Act of 1997)Документ7 страницR.A. No. 1161 (The Social Security Act of 1997)nicole coОценок пока нет

- Module No 7 - Exclusions From Gross IncomeДокумент5 страницModule No 7 - Exclusions From Gross IncomeKatherine June CaoileОценок пока нет

- GSISДокумент56 страницGSISsantasantita100% (1)

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент21 страницаBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledRhenfacel ManlegroОценок пока нет

- The Government Insurance Act: ServiceДокумент53 страницыThe Government Insurance Act: ServiceAngelica Mojica LaroyaОценок пока нет

- GsisДокумент28 страницGsisKristiana Montenegro GelingОценок пока нет

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент22 страницыBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledTeresa CardinozaОценок пока нет

- Sss and Gsis LawДокумент61 страницаSss and Gsis LawNikki BorcenaОценок пока нет

- GSIS Benefits GuideДокумент11 страницGSIS Benefits GuideLaurie Carr LandichoОценок пока нет

- Soc LegДокумент144 страницыSoc LegHaru RodriguezОценок пока нет

- Tax Deductions under Sections 80C to 80UДокумент41 страницаTax Deductions under Sections 80C to 80UanupchicheОценок пока нет

- GSIS retirement and social benefits guideДокумент40 страницGSIS retirement and social benefits guideSweetHiezel SaplanОценок пока нет

- Gross Income Inclusion and ExclusionДокумент26 страницGross Income Inclusion and ExclusionIvanna BasteОценок пока нет

- Gross Income (Exclusions and Inclusions From Gross Income) - REVISED 2022Документ34 страницыGross Income (Exclusions and Inclusions From Gross Income) - REVISED 2022rav dano100% (1)

- SOCIAL SECURITY SYSTEM: A GUIDEДокумент35 страницSOCIAL SECURITY SYSTEM: A GUIDENJ GeertsОценок пока нет

- Pre Finals For AgraДокумент7 страницPre Finals For Agraaquanesse21Оценок пока нет

- Gsis LawДокумент17 страницGsis LawJohn Ree Esquivel DoctorОценок пока нет

- What Is The Retirement BenefitДокумент3 страницыWhat Is The Retirement BenefitKnight-Zussette VillarОценок пока нет

- Eco HWДокумент4 страницыEco HWNorlan Santiago BartolomeОценок пока нет

- The Employees' State Insurance (ESI) ACT, 1948Документ17 страницThe Employees' State Insurance (ESI) ACT, 1948goldberg13Оценок пока нет

- Gsis LawДокумент24 страницыGsis LawEdsoul Melecio EstorbaОценок пока нет

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент17 страницBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledRen MagallonОценок пока нет

- Employees' State Insurance Act benefits overviewДокумент17 страницEmployees' State Insurance Act benefits overviewNisar Ahmad SiddiquiОценок пока нет

- SSS and GSIS Benefits ComparisonДокумент4 страницыSSS and GSIS Benefits ComparisonAppleSamsonОценок пока нет

- SSS Law Outline: Sickness, Maternity, Disability and Retirement BenefitsДокумент14 страницSSS Law Outline: Sickness, Maternity, Disability and Retirement BenefitsJohn Baja GapolОценок пока нет

- Module No 7 - Exclusions From Gross IncomeДокумент6 страницModule No 7 - Exclusions From Gross IncomeLysss Epssss100% (1)

- Section 80C To 80U 1Документ41 страницаSection 80C To 80U 1karanmasharОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Demande de Conversion de Certificat de Vaccination en Cle85188dДокумент2 страницыDemande de Conversion de Certificat de Vaccination en Cle85188dblimjucoОценок пока нет

- Gabrito V CAДокумент6 страницGabrito V CAblimjucoОценок пока нет

- Charter PartyДокумент4 страницыCharter Partyjcfish07Оценок пока нет

- Chapter 5 CharterpartiesДокумент24 страницыChapter 5 Charterpartiesblimjuco100% (3)

- Mariano V ReyesДокумент13 страницMariano V ReyesblimjucoОценок пока нет

- Reviewer in Local Government (Law On Public Corporation) : Fall in L (Aw) Ve.Документ41 страницаReviewer in Local Government (Law On Public Corporation) : Fall in L (Aw) Ve.blimjucoОценок пока нет

- Chapter 5 CharterpartiesДокумент24 страницыChapter 5 Charterpartiesblimjuco100% (3)

- Colinares Vs PeopleДокумент2 страницыColinares Vs PeopleblimjucoОценок пока нет

- Holiday Gift TagДокумент1 страницаHoliday Gift TagblimjucoОценок пока нет

- Tax 1 Syllabus-AДокумент15 страницTax 1 Syllabus-AblimjucoОценок пока нет

- Tax I Syllabus-B PDFДокумент9 страницTax I Syllabus-B PDFblimjucoОценок пока нет

- Tax 1 Syllabus-A PDFДокумент15 страницTax 1 Syllabus-A PDFblimjucoОценок пока нет

- Tax 1 Syllabus-A PDFДокумент15 страницTax 1 Syllabus-A PDFblimjucoОценок пока нет

- Tax I Syllabus-B PDFДокумент9 страницTax I Syllabus-B PDFblimjucoОценок пока нет

- Part 5Документ2 страницыPart 5blimjucoОценок пока нет

- Tax 1 Syllabus-A PDFДокумент15 страницTax 1 Syllabus-A PDFblimjucoОценок пока нет

- Tax I Syllabus-B PDFДокумент9 страницTax I Syllabus-B PDFblimjucoОценок пока нет

- LEGRES - FlattenedДокумент2 страницыLEGRES - FlattenedblimjucoОценок пока нет

- Tax I Syllabus-B PDFДокумент9 страницTax I Syllabus-B PDFblimjucoОценок пока нет

- Rule 113 - Warrantless arrests and seizure of evidenceДокумент36 страницRule 113 - Warrantless arrests and seizure of evidenceblimjucoОценок пока нет

- Tax 1 Syllabus-A PDFДокумент15 страницTax 1 Syllabus-A PDFblimjucoОценок пока нет

- CrimPro SyllabusДокумент8 страницCrimPro SyllabusblimjucoОценок пока нет

- SC rules on unjust vexation and kidnapping casesДокумент2 страницыSC rules on unjust vexation and kidnapping casesblimjucoОценок пока нет

- OBLIGATIONS TITLEДокумент105 страницOBLIGATIONS TITLEEmerson L. Macapagal84% (19)

- Part 4Документ2 страницыPart 4blimjucoОценок пока нет

- LEGRESДокумент128 страницLEGRESblimjucoОценок пока нет

- Gsis SSS Philhealth Pag-Ibig (HDMF) : ER EE XPTДокумент2 страницыGsis SSS Philhealth Pag-Ibig (HDMF) : ER EE XPTblimjucoОценок пока нет

- Tamil Nadu Govt Employee Pension Interest RateДокумент2 страницыTamil Nadu Govt Employee Pension Interest RateMani BaluОценок пока нет

- Tricks of The Rich - How To Make, Grow and Save MoneyДокумент221 страницаTricks of The Rich - How To Make, Grow and Save MoneyMariano100% (1)

- Taxation Important Q's CAtestseriesДокумент358 страницTaxation Important Q's CAtestseriessarvan kumarОценок пока нет

- Zimbabwe 2009 Budget Highlights: Taxation ProposalsДокумент46 страницZimbabwe 2009 Budget Highlights: Taxation ProposalsCarlos Paul NidzaОценок пока нет

- Information Guide To SRRVДокумент15 страницInformation Guide To SRRVA Febb M. VillarОценок пока нет

- Accounting For Governmental Nonprofit Entities 18th Edition Solution ManualДокумент28 страницAccounting For Governmental Nonprofit Entities 18th Edition Solution ManualDavidKingprza100% (37)

- Full Expense GuideДокумент124 страницыFull Expense GuideshahirfanОценок пока нет

- Saifullah Draft LettersДокумент6 страницSaifullah Draft Lettersddoid0101ccg92Оценок пока нет

- Oracle FAQsДокумент15 страницOracle FAQsjhakanchanjsrОценок пока нет

- Organizational Change An Action Oriented Toolkit Third Edition Ebook PDF VersionДокумент62 страницыOrganizational Change An Action Oriented Toolkit Third Edition Ebook PDF Versionehtel.hillyer547100% (43)

- Satish Kumar JiДокумент7 страницSatish Kumar JiANIL GIRDHARОценок пока нет

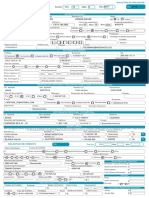

- Pension Papers ProformaДокумент12 страницPension Papers Proformasajidnazir56Оценок пока нет

- PAYE-GEN-01-G02 - Guide For Employers in Respect of Fringe Benefits - External GuideДокумент25 страницPAYE-GEN-01-G02 - Guide For Employers in Respect of Fringe Benefits - External Guidelixocan100% (1)

- FAR Final Preboard SolutionsДокумент6 страницFAR Final Preboard SolutionsVillanueva, Mariella De VeraОценок пока нет

- Ehsaas List of InitiativesДокумент15 страницEhsaas List of InitiativesAnas ShamimОценок пока нет

- Project On e Filing (Income Tax Return Online)Документ60 страницProject On e Filing (Income Tax Return Online)Prashant Jadhav87% (53)

- 2012 Payee Disclosure Report - Saskatchewan GovernmentДокумент252 страницы2012 Payee Disclosure Report - Saskatchewan GovernmentAnishinabe100% (1)

- Public Sector AccountingДокумент10 страницPublic Sector AccountingbillОценок пока нет

- Taxation Lecture - 2: Income TaxДокумент26 страницTaxation Lecture - 2: Income TaxAl SukranОценок пока нет

- Compensation: Incentive Plans: Profit SharingДокумент5 страницCompensation: Incentive Plans: Profit SharingFlorie Ann AguilarОценок пока нет

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceДокумент2 страницыNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavОценок пока нет

- DTC Agreement Between Netherlands and TurkeyДокумент29 страницDTC Agreement Between Netherlands and TurkeyOECD: Organisation for Economic Co-operation and DevelopmentОценок пока нет

- EFFORTS BY-Ravleen Kaur Roll No-01391101818Документ8 страницEFFORTS BY-Ravleen Kaur Roll No-01391101818Harleen KaurОценок пока нет

- Basic Excel Functions - ProblemsДокумент31 страницаBasic Excel Functions - ProblemsSushma Jeswani TalrejaОценок пока нет

- Credito Edwin GuzmanДокумент2 страницыCredito Edwin GuzmanCarol Milena Arias MontoyaОценок пока нет

- Pakistan PublicationДокумент61 страницаPakistan PublicationAnonymous xH14ycAumYОценок пока нет

- Compustat User AllДокумент735 страницCompustat User AllAnamaria CociorvaОценок пока нет

- BUSINESSPLANДокумент3 страницыBUSINESSPLANAlonso Ramírez OrtegaОценок пока нет

- Wilo BenefitsДокумент25 страницWilo BenefitsscottjsterlingОценок пока нет

- Printable Social Security Disability ApplicationДокумент7 страницPrintable Social Security Disability ApplicationDom Hilliard50% (2)