Академический Документы

Профессиональный Документы

Культура Документы

Cause No. 2009 Ci 19492

Загружено:

Houston ChronicleИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cause No. 2009 Ci 19492

Загружено:

Houston ChronicleАвторское право:

Доступные форматы

CAUSE NO.

2009-CI-19492

THE CITY OF SAN ANTONIO, TEXAS, § IN THE DISTRICT COURT

ACTING BY AND THROUGH THE §

CITY PUBLIC SERVICE BOARD OF §

SAN ANTONIO, A TEXAS MUNICIPAL §

UTILITY, §

§

Plaintiff, §

§ OF BEXAR COUNTY, TEXAS

V. §

§

TOSHIBA CORPORATION; §

NRG ENERGY, INC.; NUCLEAR §

INNOVATION NORTH AMERICA, LLC; §

NINA TEXAS 3 LLC; and NINA TEXAS 4 LLC, §

§

Defendants. § 37 TH JUDICIAL DISTRICT

FIRST AMENDED ORIGINAL PETITION FOR DAMAGES,

DECLARATORY JUDGMENT, AND EXPEDITED INJUNCTIVE RELIEF

The City of San Antonio, Texas acting by and through the City Public Service Board of

San Antonio, a Texas municipal utility ("CPS Energy") requests the Court to award actual

damages in excess of $2 Billion and exemplary damages in excess of $30 Billion from Toshiba

Corporation, NRG Energy, Inc. and Nuclear Innovation North America arising from their

fraudulent, defamatory, and illegal conduct and that of their affiliates, parents, partners and co-

conspirators. CPS Energy also asks the Court to declare the rights, status, and other legal

relations among CPS Energy, NINA Texas 3 LLC, and NINA Texas 4 LLC as tenants in

common with an undivided interest in the South Texas Nuclear Project Units 3 and 4. In

addition, CPS Energy requests the Court for a temporary restraining order and other expedited

injunctive relief to preserve and protect from imminent irreparable injury the rights and interests

of CPS Energy.

AMENDED PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 1

Discovery Level

1. Plaintiff intends for discovery to proceed under Level 3 pursuant to Rule 190.4 of

the Texas Rules of Civil Procedure.

Jurisdiction and Venue

2. This Court has jurisdiction over the subject matter of this action and the parties

because the amount in controversy exceeds this court's minimum jurisdictional requirements.

3. Venue is proper in Bexar County, Texas, under Tex. Civ. Prac. & Rem. Code §

15.002 because a substantial part of the events or omissions giving rise to CPS Energy's claims

occurred here and because CPS Energy is located in Bexar County, Texas.

Parties

4. CPS Energy has its principal office in Bexar County, Texas.

5. Defendant NINA Texas 3 LLC ("NINA 3") is a Delaware limited liability

company registered to do business in Texas, with its principal place of business in Texas, doing

business in Texas, has been properly served and has answered.

6. Defendant NINA Texas 4 LLC ("NINA 4") IS a Delaware limited liability

company registered to do business in Texas, with its principal place of business in Texas, doing

business in Texas, has been properly served and has answered.

7. Defendant Toshiba Corporation ("Toshiba") is a Japanese corporation conducting

substantial business in the State of Texas and may be served through the Texas Secretary of State

pursuant to §17.044 of the Texas Civil Practice and Remedies Code because Toshiba does not

maintain a regular place of business in the State of Texas and this action arose from Toshiba's

business activities in the State of Texas.

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY nJDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INnJNCTIVE RELIEF Page 2

8. Defendant NRG Energy, Inc. ("NRG") is a Delaware corporation conducting

substantial business in the State of Texas and may be served through the Texas Secretary of State

pursuant to § 17.044 of the Texas Civil Practice and Remedies Code because NRG does not

maintain a regular place of business in the State of Texas and this action arose from NRG's

business activities in the State of Texas.

9. Defendant Nuclear Innovation North America, LLC ("NINA") is a Delaware

limited liability company conducting substantial business in the State of Texas and may be

served through the Texas Secretary of State pursuant to §17.044 of the Texas Civil Practice and

Remedies Code because NINA does not maintain a regular place of business in the State of

Texas and this action arose from NINA's business activities in the State of Texas.

Statement Of The Case

10. This case involves the construction of two nuclear reactors, known as Units 3 and

4, at the South Texas Project in Bay City, Texas (the "Project"). Defendants Toshiba, NRG, and

NINA have engaged in a course of action designed to deprive CPS Energy of its valuable rights

in the Project and to enhance their interest in and benefit from the Project at the expense of CPS

Energy. These Defendants made misrepresentations and also failed to disclose Project critical

information to induce CPS Energy to participate in the Project. They also conspired to and did

disparage CPS Energy and conspired to and did interfere with CPS Energy's business and

contractual relationships. This unlawful conduct includes a well-orchestrated public campaign to

harm the ability of CPS Energy to enjoy the benefits of its substantial investment in the Project.

11. Defendants Toshiba, NRG, and NINA have undertaken a campaign of media

misinformation, public threats and disclosure of confidential Project information, all designed to

harm CPS Energy. Defendants Toshiba, NRG, and NINA knew and intended that their actions

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 3

would endanger CPS Energy's ability to continue in the Project and would undermine support

from the ratepayers and the San Antonio City Council necessary for CPS Energy to continue in

the Project. The conduct of these Defendants is outrageous and entitles CPS Energy to recover

actual and punitive damages in excess of $30 Billion or a higher amount as may be determined

by the Jury.

12. The request for declaratory relief involves CPS Energy's undivided ownership

interest in the Project. CPS Energy, NINA 3 and NINA 4 entered into certain agreements to

define their participation in and ownership of the Project as tenants in common. Those

agreements also reflected their intention to enter into a future final agreement to set the terms of

their relationship with respect to ownership of the Project.

13. Since 2007, CPS Energy has invested approximately $300 million in the Project.

This work has resulted in considerable enhanced value in and to the Project site. Preliminary

assessments of the enhanced value of the Project are in excess of $2 Billion. But, the executed

participation agreements are either silent or ambiguous with respect to ownership rights in the

Project if one co-tenant exercises its contractual right to withdraw from the Project.

14. CPS Energy has not withdrawn from the Project and cannot make a decision

whether to proceed or withdraw until it receives the revised cost estimate on December 31, 2009.

Although CPS Energy continues to honor its obligations as an owner in the Project, it faces

extreme uncertainty and potential harm due to the lack of definition in the agreements as to a

withdrawing owner's rights in the Project, especially in light of its considerable investment in the

Project to date.

15. The Texas Declaratory Judgments Act, Texas Civil Practice & Remedies Code

§37.001 et seq, allows CPS Energy to bring this action to obtain relief and certainty with respect

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 4

to its rights and the rights of its co-tenants with an undivided interest in the Project. A real and

substantial controversy exists because the participation agreements are silent or ambiguous with

respect to the rights of these co-tenants in the event an owner opts to unilaterally withdraw.

Thus, this action involves a genuine conflict of tangible interest and is not merely theoretical.

16. Pursuant to the Texas Declaratory Judgments Act, CPS Energy respectfully asks

the Court to declare the rights, obligations, and legal relations of the parties under applicable law

and the agreements in the event of a unilateral withdrawal. Nothing in this request is intended or

should be construed as a withdrawal by CPS Energy from the Project, and CPS Energy

specifically reserves its right to exercise the full range of rights given under the controlling

agreements, including the unilateral right to withdraw, when and ifit chooses to do so.

A. The 1997 Participation Agreement

17. In November 1997, CPS Energy entered into an agreement that, among other

things, gave the owners of Units 1 and 2 of the South Texas Project the option to participate in

building additional generating units at the site. This agreement, named the Amended and

Restated South Texas Project Participation Agreement, is an agreement between CPS Energy,

the City of Austin, and NRG South Texas LP, the predecessor entity to NINA 3 and NINA 4

("Participation Agreement").

18. The Participation Agreement provides that each owner had an undivided

percentage ownership interest as tenants in common in Units 1 and 2, the 11,000 acre plant site,

the transmission corridor, the railroad strip, the pumping facility, the cooling reservoir discharge

station, and the switchyard, among other items.

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 5

19. The Participation Agreement further provides that any owner may propose the

construction of additional generating units by written notice to all other owners. Each owner

may then elect to participate in the construction of additional generating units on the site.

B. The 2007 Supplemental Participation Agreement

20. In or around June 2006, CPS Energy and Defendants agreed to participate in the

design and construction of Units 3 and 4.

21. In October 2007, ten years after entering into the Participation Agreement, CPS

Energy entered into the South Texas Project Supplemental Agreement ("Supplemental

Agreement"). The Supplemental Agreement was between CPS Energy and NRG South Texas

LP, the predecessor entity to Defendants NINA 3 and NINA 4.

22. The Supplemental Agreement did not restate or replace the 1997 Participation

Agreement. Rather, the Supplemental Agreement provides that all of the provisions of the

Participation Agreement remain in effect, except those provisions of the Participation Agreement

that are "affected" by the Supplemental Agreement. The Supplemental Agreement governs as to

those "affected" provisions. (Supp. Agreement, ~ 12.1). However, the Supplemental Agreement

does not identify specifically which provisions of the Participation Agreement survIve the

Supplemental Agreement or which prOVISIons of the Supplemental Agreement replace the

Participation Agreement.

23. Paragraph 5.1 of the Supplemental Agreement provides that CPS Energy and

Defendants will own an undivided interest in Units 3 and 4 as tenants in common. CPS Energy

and NINA 3 each own an undivided 50 percent interest in Unit 3 as tenants in common. CPS

Energy and NINA 4 each own an undivided 50 percent interest in Unit 4 as tenants in common.

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 6

24. Unlike the 1997 Participation Agreement, the Supplemental Agreement gives the

parties the right to cease participating in the development of the Project by unilaterally

withdrawing. The parties further agreed that the withdrawing party "shall cease having any

further obligations for the Project," except to the extent of obligations already incurred by the

31 51 day after the date of withdrawal. (Supp. Agreement, ~ 5.3).

25. While the Supplemental Agreement permits an owner to unilaterally withdraw

from the Project and expressly relieves the withdrawing party of any further obligations for the

Project, the Supplemental Agreement does not determine how the withdrawing party's undivided

ownership interest in the Project is treated, or how the withdrawing party recovers its investment

in the Project, or what rights the remaining tenants in common have regarding the withdrawing

owner's share of the Project.

26. In the Supplemental Agreement, the parties agreed to execute a final agreement

("which the Parties anticipate will occur on or after February 1, 2008") with respect to ownership

of the Proj ect, including, presumably, disposition of the withdrawing party's ownership interest.

(Supp. Agreement, ~ 5.1.3.)

27. The parties were unable to agree on the terms of an owner's agreement and never

executed the final owner's agreement contemplated by the Supplemental Agreement.

C. The Value of CPS Energy's Participation in the Project

28. Since agreeing to participate in building Units 3 and 4, CPS Energy has spent

approximately $300 million on preliminary design and engineering for the Project and

improvements to the Project site. Preliminary assessments of the value of the participation and

related rights in the Project site are in excess of$2 Billion.

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 7

D. Defendants' Illegal Conduct To Defraud CPS Energy And To Drive CPS Energy

From the Project

29. CPS Energy's decision to continue to invest in two new nuclear power plants was

based on representations by Toshiba, NRG, and NINA about their particular expertise and

experience in nuclear development. Specifically, these Defendants represented that they had

financial and licensing expertise in developing large nuclear generation projects across the

United States. These Defendants represented that they would employ the disciplined approach of

NRG and Toshiba in the Project and touted that their approach "aligns the interests of both

developer and prime contractor to optimize the schedule, performance and costs of its projects."

NRG and NINA also represented that they would collaborate with Toshiba to develop accurate

Project costs and that such collaboration and Toshiba's proven design would bring a higher

probability of success and certainty to the Project. Toshiba, NRG, and NINA further represented

that their expertise was key to this nuclear development because, they acknowledged, "the costs

and commercial terms associated with the construction of new nuclear units have emerged ... as

perhaps the biggest remaining obstacles to the nuclear renaissance in the United States." Thus,

Defendants knew or should have known that accurate Project costs were critical to the success of

the Project.

30. Toshiba, NRG, and NINA prepared Project cost estimates and were responsible

for bringing the Project in on-time and on-budget as they had represented they would and could

do. CPS Energy relied upon these representations in entering into the Project, continuing to

invest, and in performing its contract obligations.

31. In June 2009, Defendants provided a cost estimate of $9.9 Billion (excluding

financing costs) to build the two new reactors. Although this was a non-binding estimate, the

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 8

validity of that number was confirmed by independent reports from consultants Sargent and

Lundy and the Brattle Group that concluded the Project cost estimate was reasonable.

Defendants knew that CPS Energy relied upon and used the estimate of $9.9 Billion as the basis

for comparing alternative resource plans, for arranging financing, and for obtaining the necessary

approvals from the San Antonio City Council and the ratepayers to proceed.

32. On October 13,2009, CPS Energy decided to reduce its interest in the Project to a

total of 20 to 25 percent. CPS Energy then entered into discussions with various Texas

cooperatives and municipalities for the purchase of CPS Energy's equity interest in the Project to

reduce its ownership level. CPS Energy planned to sell a portion of the energy it produced as a

50 percent owner to other users outside of San Antonio, thereby creating an income stream for

CPS Energy and the City of San Antonio. The City of San Antonio collects 14 percent of the

revenue from CPS Energy. Or, alternatively, CPS Energy planned to sell a portion of its 50

percent interest and reap a substantial return on its investment by selling an equity share in the

Project.

33. Approximately two weeks later, Defendants NRG, NINA and Toshiba made

comments in the press about the dramatic increases in the cost of the Project. These new cost

estimates were significantly higher than had been previously represented to CPS Energy. On or

around October 26, 2009, news articles reported that the estimated cost of the Project could

increase by as much as $4 Billion, a 40 percent increase over Defendants' original cost estimate.

34. Defendants knew that for CPS Energy to proceed with the Project, it must have

support from the San Antonio City Council and the consent of the ratepayers and that inflated

and inaccurate cost estimates recklessly released to the public would seriously harm, if not

destroy, CPS Energy's ability to continue with the Project.

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY nJDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 9

35. Defendants knew that if CPS Energy lost public approval for the Project, then

CPS Energy would be unable to continue with the Project and would be placed in a weakened

negotiating position. Defendants knew that by manipulating the estimated Project costs and

letting that play out in the public arena, they would deprive CPS Energy of the benefit of its

bargain of affordable nuclear power, thereby threatening or depriving CPS Energy of the

healthy return on its investment when it sold equity in the Project or entered into long-term

power contracts for the sale of the excess electricity produced. Defendants also knew that the

political fallout resulting from a significantly more expensive price tag than anticipated by the

San Antonio City Counsel would cause a loss of public support and deprive CPS Energy of the

time it would need to search for a buyer and sell its equity share, which could take more than a

year.

36. In November 2009, right after the news hit that Defendants expected construction

costs to run $4 Billion over the cost estimates provided to CPS Energy earlier this year, officials

from NRG, NINA, and CPS Energy flew to Japan for meetings held by executive management

of Toshiba to evaluate Project costs and potential cost reductions. CPS Energy returned from its

meeting with Defendants in Japan with no guaranty or assurances regarding the cost of the

Project or the methodology Defendants would use to arrive at these ever-changing cost estimates.

37. Over the days and weeks that followed, Defendants took full advantage of this

situation by reporting to the press about the status of contract negotiations and by publicly

speculating about CPS Energy's willingness and ability to continue the Project. This was done

to enhance Defendants' own position to the detriment of CPS Energy. For example, Steve Winn,

the chief executive officer of Defendant NINA, told an NRG investor meeting on Thursday,

November 19, 2009, that a higher cost estimate to build the two new reactors may force its

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 10

partner, CPS Energy, to cut its ownership interest in the project below 20 percent. He speculated

that an updated cost estimate for two new reactors may exceed the target rate increases that CPS

Energy had promised its customers. "It's probable that the estimate may come outside of their

range," Mr. Winn was reported to say. Mr. Winn also said that he expected CPS Energy's final

equity stake to fall to between zero and 20 percent. Mr. Winn admitted that CPS Energy, as a

municipal utility, had to consider not only the long-term economics of its investment, but the

impact on its customers. Mr. Winn intended that his public speculation about the rising cost of

the project would produce "near-term rate shock," as Mr. Winn himself called it, for CPS

Energy's ratepayers.

38. Defendants' public speculation about CPS Energy's ability to perform the

contract and realize on its significant investment not only disclosed confidential information

about the Project but also invited confusion and public outcry by the citizens of San Antonio that

jeopardized CPS Energy's position on the Project. Mr. Winn's actions put Defendants in a

position to assume control over CPS Energy's ownership for their own benefit and enjoy the

investment that CPS Energy had made in the Project without just compensation.

39. Defendants jeopardized CPS Energy's position on the Project by releasing

preliminary cost estimates to the press and by manipulating the numbers for their benefit.

Defendants' actions caused CPS Energy to lose public support and the confidence of San

Antonio's City Council and endangered CPS Energy's ultimate ownership position.

40. Within a matter of a few weeks after the $4 Billion cost increase was reported in

the newspapers, NINA's chief operating officer was quoted in the press as saying that NINA was

working to reduce the cost of the two new units to less than $10 Billion, the very number that

CPS Energy had been relying on previously to move forward with the Project. In another press

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY nJDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INmNCTIVE RELIEF Page 11

release, Bloomberg reported that Toshiba was "confident" that costs of less than $10 Billion are

achievable. On November 19, NINA presented an updated cost estimate at its analyst's meeting

that targeted the final project cost estimates at between $9.2 Billion and $10 Billion.

41. On November 19, 2009, Bloomberg reported that NRG had disclosed III an

analyst's meeting that it had identified a new partner for the Project and had "a contingency plan

for every foreseeable CPS ownership outcome," including no ownership interest.

42. After Toshiba was selected as the contractor, CPS learned that Toshiba purchased

its 12 percent interest in NINA by paying $300 million to NRG. Half of that amount, or $150

million, now appears to be related, in part, to Toshiba's right to be general contractor on the

Project. Thus, Toshiba, NRG, and NINA were aligned in interest to and did manipulate Project

costs for their collective benefit. Defendants failed to disclose these facts to CPS Energy at the

time CPS Energy entered into its relationships with Defendants.

43. Moreover, upon information and belief, CPS Energy would show that the

Defendants have taken other unilateral actions with respect to the development of the Project that

are favorable to Toshiba (its partner in NINA) and detrimental to CPS Energy.

44. CPS Energy has learned that NRG and NINA representatives have threatened to

"hit CPS Energy with a two by four" through some sort of "countersuit." As recently as

December 16, 2009, Steve Winn has been quoted that "San Antonio's indecision could risk

federal loan guarantees needed to build two reactors." For example, in the same article, Mr.

Winn was also quoted that "if either party quits making payments for 90 days, they lose their

share in the Project."

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 12

45. Defendants' threats are part of their scheme to interfere with CPS Energy's ability

to continue with the Project. These statements are false and are part of Defendants' plan to harm

CPS Energy, its ratepayers and the citizens of San Antonio.

46. Mr. Winn's speculation about the ramifications of withdrawal from the Project are

particularly irresponsible and damaging in light of the fact that the parties have never come to

final terms on withdrawal rights, and those very issues are pending before this Court.

47. NRG made clear its course of dealing with CPS Energy in a Forbes.com article

dated December 14, 2009. The article states that David Crane, the chief executive officer of

NRG Energy, plans to develop a nuclear project "with a time honored strategy: use other

people's money." The article describes NRG's plan as "finding a series of suckers to take the

risk off his hands." NRG's reckless statements aside, CPS Energy cannot and will not allow it

and its ratepayers to become one of NRG's "suckers." CPS Energy is entitled to full and

adequate relief to protect its valuable investment and rights in the Project.

COUNT 1 - Suit For Declaratory Relief

48. CPS Energy incorporates paragraphs 1 through 47 by reference as if fully set forth

below.

49. Because both the 1997 Participation Agreement and the 2007 Supplemental

Agreement are silent or at least ambiguous as to disposition of the parties' undivided interests in

the Project after withdrawal, CPS Energy asks this Court to exercise its equitable powers under

the Texas Declaratory Judgments Act to determine the rights of these tenants in common in the

event of a voluntary withdrawal from the Project by any party. Due to the sizeable investment

that CPS Energy has in the Project to date and the value of its interest in the site improvements,

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 13

CPS Energy will suffer extreme harm unless it knows with certainty the risks, benefits, and

consequences of a unilateral withdrawal.

50. Accordingly, CPS Energy requests that this Court construe the contracts to

determine the parties' rights upon unilateral withdrawal or, alternatively, declare the legal

relations among the parties as tenants in common.

51. CPS Energy also respectfully requests that this Court award its reasonable and

necessary attorney fees under Tex. Civ. Prac. & Rem. Code § 37.009.

COUNT 2 - Tortious Interference with Contracts and

Prospective Business Relationships

52. The allegations set forth in paragraphs 1 through 51 are incorporated by reference

as if set forth fully below.

53. As described above, CPS Energy had (a) an agreement with its ratepayers to

deliver power at an affordable price, (b) prospective business relationships with other

municipalities and cooperatives to sell the power produced by the Project, and (c) a contract with

NINA 3 and NINA 4 to build the Project.

54. Defendants, in concert and conspiracy with one another, have interfered with CPS

Energy's prospective and actual contracts and business relationships and Defendants'

interference was intentional and malicious.

55. As a proximate result of this wrongful conduct, CPS Energy has sustained

damages in excess of $2 billion.

56. Defendants' actions were willful and wanton, and CPS Energy is also entitled to

punitive damages.

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 14

COUNT 3 - Fraud

57. The allegations set forth in paragraphs 1 through 56 are incorporated by reference

as if set forth fully below.

58. The information that Defendants NRG, NINA, and Toshiba disseminated publicly

was malicious, false and misleading. NRG, NINA, and Toshiba also failed to disclose

information to CPS Energy that was critical to the Project and that it had a duty to disclose.

Moreover, the cost estimates they provided to CPS Energy in June 2009 were false and

misleading and designed to sabotage the Project for CPS Energy. Finally, Defendants NRG,

NINA, and Toshiba failed to disclose that Toshiba had paid NRG to purchase an ownership

interest after it had been awarded the construction contract.

59. These Defendants knew and intended that CPS Energy would rely on these

misrepresentations and omissions and that CPS Energy would be - and was - harmed by such

misrepresentations.

60. As a consequence of Defendants misleading, false, and malicious representations,

CPS Energy has sustained damages in excess of $2 billion. Defendants' actions were willful and

wanton, which entitles CPS Energy to an award of punitive damages.

COUNT 4 - Negligent Misrepresentation

61. The allegations set forth in paragraphs 1 through 60 are incorporated by reference

as if set forth fully below.

62. The information disseminated by NRG, NINA, and Toshiba publicly and to CPS

Energy contained inaccurate, false, and misleading information. Specifically, the cost estimates

provided to CPS Energy in June 2009 were false and misleading, as were reports about CPS

Energy's ability or inability to continue with the Project. In addition, NRG, NINA, and Toshiba

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 15

had a duty to infonn CPS Energy that Toshiba, who had been awarded the construction contract,

was also going to be participating in the project by paying NRG to participate in the Project as a

12% owner.

63. Defendants failed to exercise reasonable care or competence when making these

misrepresentations.

64. CPS Energy has sustained damages as a result of Defendants' negligent

misrepresentations in excess of $2 billion.

COUNT 5 - Business Disparagement

65. The allegations set forth in paragraphs 1 through 64 are incorporated by reference

as if set forth fully below.

66. The statements Defendants have made in the press and elsewhere about CPS

Energy's interest in and ability to complete the Project were false and hannful to CPS Energy's

economic interests and to the character of its business.

67. Defendants knew or should have known that their statements were false and

would have a detrimental impact on CPS Energy, or Defendants made these false statements

with reckless disregard for whether they were true and without verifying the accuracy of their

statements.

68. Defendants made these statements with the intent to interfere with CPS Energy's

ability to participate in the Project and with CPS Energy's other economic interests. These

statements were made without any privilege to do so.

69. As a proximate result of Defendants' misconduct, CPS Energy has suffered

damages in excess of $2 billion.

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 16

70. Because Defendants' actions were willful and malicious, CPS Energy is also

entitled to punitive damages.

COUNT 6 - Fraudulent Inducement

71. The allegations set forth in paragraphs 1 through 70 are incorporated by reference

as if set forth fully below.

72. Defendants fraudulently induced CPS Energy to enter into the subject contracts

for participation in and construction of the Project by overstating and misrepresenting their

capabilities regarding this type of Project and providing an initial cost estimate that they knew to

be inaccurately low. In addition, NRG and NINA permitted Toshiba to join the project as a 12

percent owner.

73. Defendants understood the critical importance of an accurate cost estimate to CPS

Energy's sustained participation in the Project and intended for CPS Energy to rely on its initial

ill-conceived cost estimate. Moreover, Defendants concealed the fact that Toshiba had

purchased an ownership interest in the Project. CPS Energy reasonably relied on the fact that

NRG and NINA had awarded the construction contract to Toshiba based upon its track record

and experience for constructing such facilities on time and on-budget.

74. Defendants made these misrepresentations and omissions in order to induce CPS

Energy to enter the contracts to build the Project and to secure, in NRG's own words, the

"suckers" Defendants needed to finance the initial stages of the Project.

75. As a result, CPS Energy was fraudulently induced to enter the Supplemental

Agreement as has sustained significant damages, in excess of $2 billion.

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 17

76. Because Defendants' actions were willful and wanton, CPS Energy is also entitled

to punitive damages.

COUNT 7 - Conspiracy

77. The allegations set forth in paragraphs 1 through 76 are incorporated by reference

as if set forth fully below.

78. Defendants conspired to defraud CPS Energy by, among other things, acting in

concert to mislead CPS Energy by failing to disclose Project critical information. Defendants

also acted in concert to disparage CPS Energy and to interfere with its prospective and other

business relationships by engaging in a coordinated public effort to disseminate false information

about CPS Energy for the purpose of ousting CPS Energy or making it impossible for CPS

Energy to continue with the Project.

79. Defendants executed their plan by commISSIOn and omission to induce CPS

Energy to enter into the Project to initially finance it, and then to eliminate CPS Energy from the

Project and take over CPS Energy's valuable investment.

80. Defendants have made misrepresentations to and about CPS Energy or failed to

communicate critical truthful information in furtherance of Defendants' illegal scheme.

81. As a result of Defendants' illegal conduct, CPS Energy has suffered damages in

excess of $2 billion.

82. As a result of Defendants' wanton and willful conduct, CPS Energy is also

entitled to punitive damages.

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 18

COUNT 8 - Request For Expedited Relief

83. The allegations set forth in paragraphs I through 82 are incorporated by reference

as if set forth fully below.

84. Due to the urgency surrounding the issues brought to the Court and the

uncertainty faced by the parties, CPS Energy respectfully urges the Court to expedite CPS

Energy's request for relief, including discovery and final adjudication.

COUNT 9 - Request for Temporary Restraining Order and

Other Injunctive Relief

85. CPS Energy incorporates paragraphs I through 84 by reference as if fully set forth

below.

86. In the alternative, CPS Energy requests injunctive relief to prevent Defendants

from taking action to destroy or otherwise damage the value of CPS Energy's interests in the

Project. Additionally, CPS Energy fears that Defendants may destroy, remove or secret

documents and other information related to the issues and causes of action in an attempt to

conceal crucial evidence of their illegal conduct. If Defendants succeed in these efforts, CPS

Energy will suffer immediate and irreparable harm in that (a) this heavily negotiated and

valuable Project may be lost; (b) the credibility and goodwill of CPS Energy will be lost; and (c)

documentation relating to the claims asserted herein will be destroyed.

87. As set forth above, CPS Energy has shown a probable right of recovery and

likelihood of success on the merits on its claims against Defendants and that CPS Energy will

suffer imminent, irreparable harm without Court intervention, for which there is no adequate

remedy at law.

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 19

88. It is because CPS Energy finds itself in this perilous position that it seeks

extraordinary relief from the Court to immediately restrain Defendants from engaging in the

illegal conduct described above. In order to preserve the status quo and to prevent imminent and

irreparable harm to CPS Energy's vested rights, CPS respectfully urges the Court to grant an

immediate Temporary Restraining Order and Injunctive Relief pursuant to Tex. R. Civ. P. 680

and Tex. Civ. Prac. & Rem. Code § 65.001 et seq.

89. CPS Energy asks the Court to order Defendants and their agents, servants,

employees, independent contractors, attorneys, representatives, affiliates, parents, owners and

those persons or entities in active concert or participation with them (collectively, the

"Restrained Parties") as follows:

a. Enjoin the Restrained Parties from making any public pronouncements about the

rights and responsibilities of the parties under their agreements before the Court

has an opportunity to decide those issues in this lawsuit;

b. Enjoin the Restrained Parties from declaring any purported "default" under the

Project until such time as the Court can declare the legal rights of the parties with

respect to the Project;

c. Enjoin the Restrained Parties from interfering with or thwarting the Project by

refusing to act in good faith in negotiating a definitive agreement regarding the

Defendants interests in the Project;

d. Enjoin the Restrained Parties from manipulating the media to "report"

misinformation, threats or confidential Project information;

e. Enjoin the Restrained Parties from further engaging in manipulative business

strategies designed to interfere with CPS Energy's business relations, disparage

CPS Energy's economic interests, and damage CPS Energy's ability to negotiate a

reasonable business solution on behalf of its ratepayers;

f. Enjoin the Restrained Parties from altering the status quo by misleading the

Department of Energy ("DOE") about the rights of CPS Energy in the Project and

from taking any action that would jeopardize funding currently available from the

DOE;

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 20

g. Enjoin the Restrained Parties from taking any action or making any statements

that are adverse to CPS Energy's interests as a co-tenant with an undivided

interest in the Project;

h. Enjoin the Restrained Parties from depleting funds available for the Project;

1. Enjoin the Restrained Parties from negotiating, entering into, canceling, altering,

or modifying any oral or written contracts, understandings, or arrangements,

which conduct would operate to modify, compromise, jeopardize, undermine,

nullify, terminate, hinder, or obstruct the Project or funding for the Project;

J. Enjoin the Restrained Parties from destroying, removing, or secreting documents,

records and other information related to the claims and allegations set forth in this

lawsuit.

90. The requested temporary restraining order and request for injunctive relief will

allow the maintenance of the last, actual, peaceable, and uncontested status quo.

91. CPS Energy is exempt from posting a bond pursuant to § 6.002 of the Texas Civil

Practice and Remedies Code.

Jury Demand

92. CPS Energy demands a trial by jury.

Conditions Precedent

93. All conditions precedent to CPS Energy's claim for relief have been performed or

have occurred.

Prayer

For all the reasons set forth above, CPS Energy respectfully requests the Court to declare

the rights and legal relations of the parties in the event of a unilateral withdrawal, award CPS

Energy its actual damages in an amount in excess of $2 Billion, as well as exemplary damages

pursuant to Texas Civil Practice and Remedies Code § 41.003 in an amount in excess of $30

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 21

Billion, enter a Temporary Restraining Order in the form attached hereto, and award CPS Energy

its reasonable and necessary attorneys fees in connection with seeking declaratory relief, and for

all additional relief as is just.

Respectfully submitted,

SONNENSCHEIN NATH & ROSENTHAL, LLP

By: __- - ' - - - - - - - - - - - - . - - -

C. Michael Moore

State Bar No. 14323600

~ .r:~.

Matthew D. Orwig

State Bar No. 15325300

Karen C. Corallo

State Bar No. 04811490

Gene R. Besen

State Bar No. 2404549

2000 McKinney Ave., Suite 1900

Dallas, TX 75201

(214) 259-0900 - telephone

(214) 259-0910 - facsimile

and

DAVIS, CEDILLO & MENDOZA, INC.

Ricardo G. Cedillo

State Bar No. 4043600

Les 1. Strieber III

State Bar No. 19398000

McCombs Plaza, Suite 500

755 E. Mulberry Avenue

San Antonio, Texas 78212

(210) 822-6666 - telephone

(210) 822-1151 - facsimile

ATTORNEYS FOR PLAINTIFF,

THE CITY OF SAN ANTONIO, TEXAS,

ACTING BY AND THROUGH THE CITY

PUBLIC SERVICE BOARD OF SAN

ANTONIO, A TEXAS MUNICIPAL UTILITY

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT.

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 22

CERTIFICATE OF SERVICE

This is to certify that a true and correct copy of the foregoing was sent to the following

opposing counsel on December 23,2009 via email and certified mail, return receipt requested.:

Lamont A. Jefferson

Haynes and Boone, LLP

112 East Pecan Street

Suite 1200

San Antonio, Texas 78205

lamont.jefferson@haynesboone.com

Les

~ /1A-

--+l-'"F--''----i.L-.

trieber III

----

FIRST AMENDED ORIGINAL PETITION FOR DECLARATORY JUDGMENT,

EXPEDITED RELIEF, OR, ALTERNATIVELY FOR INJUNCTIVE RELIEF Page 23

Вам также может понравиться

- Cps Energy Files LawsuitДокумент80 страницCps Energy Files LawsuitDavid IbanezОценок пока нет

- Plaintiffs Original Petition Suit For Declaratory ReliefДокумент29 страницPlaintiffs Original Petition Suit For Declaratory ReliefKBTXОценок пока нет

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionОт EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionОценок пока нет

- BidPrime Amended Complaint Against SmartProcure GovSpendДокумент48 страницBidPrime Amended Complaint Against SmartProcure GovSpendGT M100% (1)

- Harris County Family vs. ITC LawsuitДокумент15 страницHarris County Family vs. ITC LawsuitKHOUОценок пока нет

- Chapman v. Voestalpine LawsuitДокумент16 страницChapman v. Voestalpine LawsuitcallertimesОценок пока нет

- Nexus Techs. v. Unlimited Power - ComplaintДокумент16 страницNexus Techs. v. Unlimited Power - ComplaintSarah BursteinОценок пока нет

- Lawsuit Filed Against Curtis Coats - Aug. 2016Документ6 страницLawsuit Filed Against Curtis Coats - Aug. 2016Anonymous Pb39klJОценок пока нет

- ITC PetitionДокумент8 страницITC PetitionAnonymous pPSymSvyОценок пока нет

- Forest City Brief in Response To Al Ratner LawsuitДокумент17 страницForest City Brief in Response To Al Ratner LawsuitNorman OderОценок пока нет

- Bachrach Motor v. Ledesma, G.R. No. L-42462, Aug. 31, 1937Документ9 страницBachrach Motor v. Ledesma, G.R. No. L-42462, Aug. 31, 1937Ron Jacob AlmaizОценок пока нет

- Tire Injury: Christie Et Al v. Hankook Tire America Et Al Second Amended ComplaintДокумент17 страницTire Injury: Christie Et Al v. Hankook Tire America Et Al Second Amended ComplaintWigingtonRumleyDunnBlairLLPОценок пока нет

- Texaco Puerto Rico, Inc. v. Jose Medina, Etc., 834 F.2d 242, 1st Cir. (1987)Документ9 страницTexaco Puerto Rico, Inc. v. Jose Medina, Etc., 834 F.2d 242, 1st Cir. (1987)Scribd Government DocsОценок пока нет

- Heirs of Tunged v. Sta. Lucia Realty andДокумент8 страницHeirs of Tunged v. Sta. Lucia Realty andChristian Edward CoronadoОценок пока нет

- Power of Corporations - in GeneralДокумент2 страницыPower of Corporations - in GeneralMIKHAEL MEDRANOОценок пока нет

- Bancamerica v. Mosher Steel, 100 F.3d 792, 10th Cir. (1996)Документ33 страницыBancamerica v. Mosher Steel, 100 F.3d 792, 10th Cir. (1996)Scribd Government DocsОценок пока нет

- La Quinta LawsuitДокумент35 страницLa Quinta LawsuitMaritza NunezОценок пока нет

- Brief Regarding Residency As FiledДокумент26 страницBrief Regarding Residency As FiledK FineОценок пока нет

- Chaudhari - Original Petition FinalДокумент9 страницChaudhari - Original Petition FinalAnonymous Pb39klJ100% (1)

- United States Court of Appeals: For The First CircuitДокумент27 страницUnited States Court of Appeals: For The First CircuitScribd Government DocsОценок пока нет

- Cabutihan vs. LandcenterДокумент7 страницCabutihan vs. LandcenterDael GerongОценок пока нет

- Amended Petition 1Документ15 страницAmended Petition 1api-468462896Оценок пока нет

- Filinvest Credit Corporation Vs IAC and Nestor Sunga JRДокумент8 страницFilinvest Credit Corporation Vs IAC and Nestor Sunga JRAnonymous ubixYAОценок пока нет

- Kinder Morgan LawsuitДокумент22 страницыKinder Morgan LawsuitJohn MoritzОценок пока нет

- Ed 26. Napocor V Heirs of Macabangkit SangkayДокумент3 страницыEd 26. Napocor V Heirs of Macabangkit SangkayEileen Eika Dela Cruz-LeeОценок пока нет

- Stambler v. Neiman Marcus Et. Al.Документ5 страницStambler v. Neiman Marcus Et. Al.PriorSmartОценок пока нет

- Heirs of Spouses Tumang v. National PowerДокумент5 страницHeirs of Spouses Tumang v. National PowerMitch TuazonОценок пока нет

- Coon Ot Tax Appeals: Second DivisionДокумент17 страницCoon Ot Tax Appeals: Second DivisionLeamieRetalesОценок пока нет

- Plaintiff's Original Complaint Alleging Whistleblower RetaliationДокумент15 страницPlaintiff's Original Complaint Alleging Whistleblower RetaliationColin WalshОценок пока нет

- G.R. No. 146594Документ7 страницG.R. No. 146594Pierre CaspianОценок пока нет

- Epcon Homestead, LLC v. Town of Chapel Hill, No. 21-1713 (4th Cir. Mar. 20, 2023)Документ15 страницEpcon Homestead, LLC v. Town of Chapel Hill, No. 21-1713 (4th Cir. Mar. 20, 2023)RHTОценок пока нет

- 2023.07.14 FINAL 1st Amnd Petition, Dec Action & Summary Removal of LienДокумент29 страниц2023.07.14 FINAL 1st Amnd Petition, Dec Action & Summary Removal of LienApril ToweryОценок пока нет

- Rhode Island Committee On Energy v. General Services Administration, 561 F.2d 397, 1st Cir. (1977)Документ11 страницRhode Island Committee On Energy v. General Services Administration, 561 F.2d 397, 1st Cir. (1977)Scribd Government DocsОценок пока нет

- United States Court of Appeals Third CircuitДокумент7 страницUnited States Court of Appeals Third CircuitScribd Government DocsОценок пока нет

- JD Batch 2017 Administrative Law Case DigestsДокумент80 страницJD Batch 2017 Administrative Law Case Digestsmi4keeОценок пока нет

- United States Court of Appeals, Ninth CircuitДокумент6 страницUnited States Court of Appeals, Ninth CircuitScribd Government DocsОценок пока нет

- Folio v. City of Clarksburg, 4th Cir. (1998)Документ11 страницFolio v. City of Clarksburg, 4th Cir. (1998)Scribd Government DocsОценок пока нет

- G.R. No. 231737Документ6 страницG.R. No. 231737Nichole LusticaОценок пока нет

- Philconstrust Resources vs. Santiago, G.R. No. 174670, July 26, 2017Документ20 страницPhilconstrust Resources vs. Santiago, G.R. No. 174670, July 26, 2017Harold Q. GardonОценок пока нет

- Tito Oliveras and Henry Compta v. Sergio Miranda Lopo, 800 F.2d 3, 1st Cir. (1986)Документ8 страницTito Oliveras and Henry Compta v. Sergio Miranda Lopo, 800 F.2d 3, 1st Cir. (1986)Scribd Government DocsОценок пока нет

- Solar Vs KaplanДокумент23 страницыSolar Vs Kaplantriguy_2010Оценок пока нет

- Mega Vape Full LawsuitДокумент47 страницMega Vape Full LawsuitMaritza NunezОценок пока нет

- Napocor vs. TiangcoДокумент10 страницNapocor vs. TiangcoKate DomingoОценок пока нет

- G.R. No. 170945, September 26, 2006 National Power Corporation vs. Maria Mendoza San PedroДокумент39 страницG.R. No. 170945, September 26, 2006 National Power Corporation vs. Maria Mendoza San Pedromonica may ramosОценок пока нет

- Holy Spirit Homeowners Association, Inc. v. DefensorДокумент10 страницHoly Spirit Homeowners Association, Inc. v. DefensorPaolo Enrino PascualОценок пока нет

- Consti2Digest - Kabiling Vs NHA, 156 SCRA 623, GR L-57424 (18 Dec 1987)Документ2 страницыConsti2Digest - Kabiling Vs NHA, 156 SCRA 623, GR L-57424 (18 Dec 1987)Lu CasОценок пока нет

- United States Court of Appeals, Fourth CircuitДокумент16 страницUnited States Court of Appeals, Fourth CircuitScribd Government DocsОценок пока нет

- Section 5 Kilosbayan Garcia CREBA and SouthernДокумент5 страницSection 5 Kilosbayan Garcia CREBA and SouthernvinaОценок пока нет

- United States Court of Appeals, Fifth CircuitДокумент10 страницUnited States Court of Appeals, Fifth CircuitScribd Government DocsОценок пока нет

- Powerline Innovations v. IC Intracom Holdings Et. Al.Документ5 страницPowerline Innovations v. IC Intracom Holdings Et. Al.PriorSmartОценок пока нет

- Judicial Department #9 & #10Документ4 страницыJudicial Department #9 & #10Fatima FatemehОценок пока нет

- Cabutihan Vs Landcenter Construction & Devt (GR No. 146594. June 10, 2002)Документ7 страницCabutihan Vs Landcenter Construction & Devt (GR No. 146594. June 10, 2002)jtlendingcorpОценок пока нет

- 229 Main Street v. Massachusetts EPA, 262 F.3d 1, 1st Cir. (2001)Документ15 страниц229 Main Street v. Massachusetts EPA, 262 F.3d 1, 1st Cir. (2001)Scribd Government DocsОценок пока нет

- Fraudulent Lien Petition (Taylor Bret) Refile (FM)Документ15 страницFraudulent Lien Petition (Taylor Bret) Refile (FM)April ToweryОценок пока нет

- Tyger Construction Company Incorporated, a South Carolina Corporation, Individually, and for the Use and Benefit of Tyger-Pensacola Joint Venture v. Pensacola Construction Co., a Delaware Corporation, 925 F.2d 1457, 4th Cir. (1991)Документ6 страницTyger Construction Company Incorporated, a South Carolina Corporation, Individually, and for the Use and Benefit of Tyger-Pensacola Joint Venture v. Pensacola Construction Co., a Delaware Corporation, 925 F.2d 1457, 4th Cir. (1991)Scribd Government DocsОценок пока нет

- GR No 231737 - Heirs of Tunged v. Sta Lucia Realty Development Corp PDFДокумент7 страницGR No 231737 - Heirs of Tunged v. Sta Lucia Realty Development Corp PDFKristela AdraincemОценок пока нет

- 6 Sta. Ana v. CarpoДокумент25 страниц6 Sta. Ana v. CarpoMlaОценок пока нет

- Civ Rev 1 - Case DigestДокумент11 страницCiv Rev 1 - Case DigestPam NolascoОценок пока нет

- 2024 2025 Proficiency Screening Teachers 20 Feb 2024Документ31 страница2024 2025 Proficiency Screening Teachers 20 Feb 2024Houston ChronicleОценок пока нет

- NCAA Women's BracketДокумент1 страницаNCAA Women's BracketHouston Chronicle100% (1)

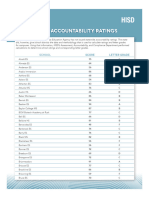

- HISD 2023 School Accountability RatingsДокумент10 страницHISD 2023 School Accountability RatingsHouston ChronicleОценок пока нет

- Printable 2024 March Madness NCAA Men's Basketball Tournament BracketДокумент1 страницаPrintable 2024 March Madness NCAA Men's Basketball Tournament BracketHouston Chronicle100% (1)

- Rachel Hooper InvoicesДокумент35 страницRachel Hooper InvoicesHouston ChronicleОценок пока нет

- R4 Tee TimesДокумент2 страницыR4 Tee TimesHouston ChronicleОценок пока нет

- Final Limited IEQ & Lead in Drinking Water Report-Various HISD Education FacilitiesДокумент18 страницFinal Limited IEQ & Lead in Drinking Water Report-Various HISD Education FacilitiesHouston ChronicleОценок пока нет

- Houston Astros 2024 Spring Training RosterДокумент1 страницаHouston Astros 2024 Spring Training RosterHouston Chronicle100% (1)

- Media Release For Free and Reduced-Price MealsДокумент2 страницыMedia Release For Free and Reduced-Price MealsHouston ChronicleОценок пока нет

- 2023 Preseason All-Big 12 Football TeamДокумент1 страница2023 Preseason All-Big 12 Football TeamHouston ChronicleОценок пока нет

- NFL Statement On Denzel PerrymanДокумент1 страницаNFL Statement On Denzel PerrymanHouston ChronicleОценок пока нет

- Astroworld Tragedy Final Report (Redacted)Документ1 266 страницAstroworld Tragedy Final Report (Redacted)Houston ChronicleОценок пока нет

- Ed Anderson TranscriptДокумент53 страницыEd Anderson TranscriptHouston ChronicleОценок пока нет

- Hecht Dissent On Crane vs. McLaneДокумент16 страницHecht Dissent On Crane vs. McLaneHouston ChronicleОценок пока нет

- Davis EmailДокумент3 страницыDavis EmailHouston ChronicleОценок пока нет

- Blacklock Dissent On Crane vs. McLaneДокумент4 страницыBlacklock Dissent On Crane vs. McLaneHouston ChronicleОценок пока нет

- 2023 NCAA Tournament BracketДокумент1 страница2023 NCAA Tournament BracketHouston Chronicle100% (1)

- Houston Astros 2023 Spring Training ScheduleДокумент1 страницаHouston Astros 2023 Spring Training ScheduleHouston ChronicleОценок пока нет

- Steven Hotze's 2022 DepositionДокумент23 страницыSteven Hotze's 2022 DepositionHouston ChronicleОценок пока нет

- HISD Board of Managers ApplicantsДокумент4 страницыHISD Board of Managers ApplicantsHouston Chronicle100% (1)

- TDECU Stadium Pricing MapДокумент1 страницаTDECU Stadium Pricing MapHouston ChronicleОценок пока нет

- Houston Astros Preliminary 2023 Spring Training RosterДокумент1 страницаHouston Astros Preliminary 2023 Spring Training RosterHouston ChronicleОценок пока нет

- FB23 TDECU Stadium Pricing MapДокумент1 страницаFB23 TDECU Stadium Pricing MapHouston ChronicleОценок пока нет

- Mark Stephens' 2020 Report On Voter Fraud InvestigationДокумент84 страницыMark Stephens' 2020 Report On Voter Fraud InvestigationHouston ChronicleОценок пока нет

- Minton Letter To TexasДокумент2 страницыMinton Letter To TexasHouston ChronicleОценок пока нет

- New Watson PetitionДокумент11 страницNew Watson PetitionHouston ChronicleОценок пока нет

- Davis Response To MintonДокумент2 страницыDavis Response To MintonHouston ChronicleОценок пока нет

- Liberty Center's 2020 Tax ReturnДокумент14 страницLiberty Center's 2020 Tax ReturnHouston ChronicleОценок пока нет

- Beard Notice of TerminationДокумент1 страницаBeard Notice of TerminationHouston ChronicleОценок пока нет

- Sally Yates Report To U.S. Soccer FederationДокумент319 страницSally Yates Report To U.S. Soccer FederationHouston ChronicleОценок пока нет

- 05 Saludo, Jr. vs. American Express International, Inc., 487 SCRA 462, G.R. No. 159507 April 19, 2006Документ25 страниц05 Saludo, Jr. vs. American Express International, Inc., 487 SCRA 462, G.R. No. 159507 April 19, 2006Galilee RomasantaОценок пока нет

- Digest 01 - Giron V COMELEC - GR 188179 - Jan 22 2013Документ2 страницыDigest 01 - Giron V COMELEC - GR 188179 - Jan 22 2013Kriska Herrero Tumamak100% (1)

- Sexton Opening Brief - 9th Circuit AppealДокумент77 страницSexton Opening Brief - 9th Circuit AppealCeleste FremonОценок пока нет

- January 16, 2017 G.R. No. 213224 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, Roque Dayaday Y DagoocДокумент1 страницаJanuary 16, 2017 G.R. No. 213224 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, Roque Dayaday Y DagoocbertОценок пока нет

- Test Drive AgreementДокумент5 страницTest Drive AgreementRedcorp_MarketingОценок пока нет

- Flores Cardozo Sandra FinalДокумент11 страницFlores Cardozo Sandra FinalSandraFlores0% (1)

- Republic of The Philippines: Supreme CourtДокумент7 страницRepublic of The Philippines: Supreme Courtjoa pazОценок пока нет

- SL BLR 28022020Документ13 страницSL BLR 28022020Swagath NОценок пока нет

- Suggested Answers To The Bar Exam Questions 2008 On Political LawДокумент7 страницSuggested Answers To The Bar Exam Questions 2008 On Political LawKye GarciaОценок пока нет

- People Vs Aure and FerolДокумент2 страницыPeople Vs Aure and FerolJuveren Jonald Bowat MendozaОценок пока нет

- Supreme Court of The State of New York County ofДокумент1 страницаSupreme Court of The State of New York County ofChacheiОценок пока нет

- Wortham v. Boren, 10th Cir. (2002)Документ3 страницыWortham v. Boren, 10th Cir. (2002)Scribd Government DocsОценок пока нет

- Appendix - "A" Form of Application For Recruitment of Constable (Tradesmen) in Cisf-2019 Roll No. - (To Be Allotted by The Recruitment Centre)Документ5 страницAppendix - "A" Form of Application For Recruitment of Constable (Tradesmen) in Cisf-2019 Roll No. - (To Be Allotted by The Recruitment Centre)Roshan MishraОценок пока нет

- Case DigestДокумент4 страницыCase DigestMichelle AlejandrinoОценок пока нет

- 1617 Warrant - Redacted Australian Federal Police Warrant To Search Premises Dated 18 May 2016Документ5 страниц1617 Warrant - Redacted Australian Federal Police Warrant To Search Premises Dated 18 May 2016clarencegirl100% (1)

- CIVPRO Wagan Notes Pre Trial To Modes of DiscoveryДокумент3 страницыCIVPRO Wagan Notes Pre Trial To Modes of DiscoveryShauna HerreraОценок пока нет

- I Want My Bonds LTR (Edited)Документ4 страницыI Want My Bonds LTR (Edited)rhouse_197% (31)

- Re Validation Form-Arms-license For IndividualsДокумент2 страницыRe Validation Form-Arms-license For IndividualsM.IMRAN50% (6)

- Legal Aspects of Business AssignmentДокумент13 страницLegal Aspects of Business AssignmentUtkarsh UpadhyayaОценок пока нет

- PHM Financial Incorporated v. Great American Mortgage LLP Et Al - Document No. 10Документ1 страницаPHM Financial Incorporated v. Great American Mortgage LLP Et Al - Document No. 10Justia.comОценок пока нет

- Castellvi Vs SellnerДокумент3 страницыCastellvi Vs SellnerAngelique Dirige BalisangОценок пока нет

- Kenya Law Internal Launch: Issue 22, July - September 2013Документ248 страницKenya Law Internal Launch: Issue 22, July - September 2013ohmslaw_Arigi100% (1)

- Third Division (G.R. No. 217044, January 16, 2019)Документ10 страницThird Division (G.R. No. 217044, January 16, 2019)Tam ChuaОценок пока нет

- Krivenko Vs ROD ManilaДокумент1 страницаKrivenko Vs ROD Manilahello_hoarderОценок пока нет

- DepEd RO V Conducts Investigation On The Complaint For An AllegedДокумент7 страницDepEd RO V Conducts Investigation On The Complaint For An AllegedIbiang DeleozОценок пока нет

- Ong vs. BognalbalДокумент2 страницыOng vs. BognalbalEcnerolAicnelavОценок пока нет

- Associated Bank Vs Court of AppealsДокумент21 страницаAssociated Bank Vs Court of Appealschristopher1julian1aОценок пока нет

- People vs. CastanedaДокумент1 страницаPeople vs. CastanedaAudreyОценок пока нет

- Data Privacy Act - Republic Act No. 10173 PDFДокумент12 страницData Privacy Act - Republic Act No. 10173 PDFJzevОценок пока нет

- Resolved That The Military Be Allowed To Use Propaganda in School - AFFIRMATIVEДокумент3 страницыResolved That The Military Be Allowed To Use Propaganda in School - AFFIRMATIVEMaria Reylan GarciaОценок пока нет

- The Captured: A True Story of Abduction by Indians on the Texas FrontierОт EverandThe Captured: A True Story of Abduction by Indians on the Texas FrontierРейтинг: 4.5 из 5 звезд4.5/5 (13)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsОт EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsОценок пока нет

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersОт EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersРейтинг: 5 из 5 звезд5/5 (1)

- How to Win Your Case In Traffic Court Without a LawyerОт EverandHow to Win Your Case In Traffic Court Without a LawyerРейтинг: 4 из 5 звезд4/5 (5)

- Apache Voices: Their Stories of Survival as Told to Eve BallОт EverandApache Voices: Their Stories of Survival as Told to Eve BallОценок пока нет

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityОт EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityОценок пока нет

- Learn the Essentials of Business Law in 15 DaysОт EverandLearn the Essentials of Business Law in 15 DaysРейтинг: 4 из 5 звезд4/5 (13)

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseОт EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseОценок пока нет

- How to Win Your Case in Small Claims Court Without a LawyerОт EverandHow to Win Your Case in Small Claims Court Without a LawyerРейтинг: 5 из 5 звезд5/5 (1)