Академический Документы

Профессиональный Документы

Культура Документы

Accounting Valuation Model: Lectures 14 Valuation of Corporations

Загружено:

sarakhan0622Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Accounting Valuation Model: Lectures 14 Valuation of Corporations

Загружено:

sarakhan0622Авторское право:

Доступные форматы

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr.

Sohail Zafar

Lectures 14

Valuation of Corporations

Please note once you have done financial planning by preparing next 5 years projected income

statements and balance sheets then you are able to do valuation of the shares of that corporation.

Valuation means estimating fair value of shares of a corporation by a security analyst, and this estimated

value of share is also called intrinsic value. According to the Efficient Markets Hypothesis, in the efficient

markets the market price of a share is equal to its intrinsic value.

Different analysts may arrive at

different fair value estimates for the same corporation depending upon their assumptions about the

future performance of that particular corporation.

Security analysts disagree mostly about expected

growth rate of corporations and this disagreement results in variations in their respective fair value

estimates for a particular corporations share.

Commonly 6 models are used to value the common shares of a corporation, namely, dividend discount

model ( DDM);, its more elaborate form called equity cash flows model ; Free Cash Flows (FCF) Model;

Accounting valuation model; PE ratio; and PB ratio.

Accounting Valuation Model

Valuation refers to estimating a fair value for the equity of a Co, and is stated as rupees per share. The

first thing to understand about value of a companys share is the fact that the only valuable things in a

corporation are its assets which are found on the left hand side (LHS) of its balance sheet. Accountants

prepare balance sheet using historical cost principle whereby an asset is reported on balance sheet at the

cost at which it was bought in the past, and that may be a decade ago. Due to inflation, some of these old

assets have much higher market value (MV) today but accountants continue to report these assets at

their book value (BV). For depreciable assets book value (BV) reported on the balance sheet is cost of

acquisition of asset minus accumulated depreciation since it was acquired. Therefore there is likely to be a

significant difference between market value ( MV ) of some assets and BV of the same assets as reported

on the balance sheet.

Equity of corporation is represented by its shares. Since shares are pieces of papers, as such, shares have

no innate or inherent value.

Equity instruments (preferred and ordinary shares) and debt instruments

(such as bonds, notes, commercial papers, accounts payables) issued by a corporation derive their value

from the value of the assets of a corporation.

In this sense securities issued by corporations are

derivatives whose value is derived from the value of the underlying assets of that corporation.

Since

assets of a corporation are financed both by equity capital (i.e. owners funds) and debt capital (i.e.

52

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

creditors funds, loans) therefore equity holders and debt holders of a company have claim on the assets

of that co.

Therefore ultimate driver of value of corporate shares (and also of corporate bonds and other papers

issued by a corporation) is value of corporate assets. Since we already have argued that BV in balance

sheet is a past oriented number calculated by using historical cost principle of accounting, therefore the

resulting BV of equity (OE = TA TL) is a past oriented number. But use of this BV of OE is made by the

accountants to estimate share price, and it is called accounting valuation model.

The derivation of the accounting valuation model is straight forward as given below:

Statement of changes in OE can be written as an accounting equality.

Please note Ending OE = EOE; and Beginning OE = BOE

EOE = BOE + NI - cash dividends - shares repurchased + shares issued.

Let us symbolize D = (cash dividends shares repurchased + shares issued). In the literature it is called

clean surplus representing what is left out of NI after paying dividends as well as net effect of equity

financing operations through shares issuance are repurchase during that year. Symbolizing it with D is a

convention only.

Therefore we can write statement of changes in OE as:

EOE = BOE + NI D

EOE BOE NI = -D

-(EOE - BOE - NI ) = D

-EOE + BOE + NI = D, rearranging the terms gives :

BOE + NI EOE = D

Now take another perspective, suppose shareholders require risk adjusted rate of return Kc from their

investment in the shares of this company. Think for a moment about money you deposit in the beginning

of a year in bank account and earn a rate of return on it at the end of the year; and then calculate your

end of the year bank balance as:

End of the year bank balance = Beginning bank balance + (beginning balance * rate of return)

for example if you deposited 100 Rs and bank gave 10% interest at the end of the year:

End of the year bank balance =100 + (100 * 10%)

End of the year bank balance = 100 + 10

End of the year bank balance = 110

Similarly if shareholders required rate of return is Kc, then by the same logic EOE should be:

EOE = BOE + (BOE * Kc)

But we saw above that

D = BOE + NI EOE

53

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

Inserting the above expression of EOE in the expression for D

D = BOE + NI {BOE +( BOE * Kc)}

D = BOE + NI BOE (BOE*Kc)

as BOE cancels out, we are left with

D = NI (BOE* Kc)

Please note carefully that (BOE * Kc) is expected profit for the year as it was shown in case of the example

given about bank deposit; while NI is actual profit for the year. As D = NI (BOE*Kc), that means D is the

difference between actual profit and expected profit, so it is surprise profits. You would agree if this

surprise: NI (BOE * Kc) is positive number then it is a pleasant surprise, and shareholders would be

happy and therefore demand for such a share would go up in the market resulting in its price moving

northward.

This surprise profit is called in literature as Abnormal Net Income (ANI), or residual net income. So we

found that:

ANI = NI BOE *Kc

For example if BOE = 100, and Kc = 10%, then expected profits for shareholders are

BOE * Kc

100 * 10%

10

Suppose in that year actual NI reported in the income statement is 15, then you can find abnormal net

income as:

ANI = NI BOE*Kc

= 15 - 10

=5

Accounting valuation model discounts expected ANIs of all future years at Kc, and adding PVs of ANIs to

BOE gives value of equity of a company. If ANI expected in each future year is zero till infinity, then

according to accounting valuation model the value of equity should be equal to BOE (beginning OE) or

beginning Book Value (BV) of equity at the beginning of the year which can be taken from previous years

end of the year balance sheet. Therefore source of value creation in this accounting valuation model is

the expectation of positive abnormal net income in future years. This line of reasoning also implies that if

in future years ANIs are expected to be negative, then current share price would be lower than the

beginning BV per share Now we can write the model verbally as

Value of equity at time zero , that is today = BOE1 + Sum of PVs of ANIs of all future years till infinity.

And formally as:

1

Value of equity = BOE1 + ANI1/ (1 + Kc) + ANI2/ (1 + Kc) + ..+ ANI n/(1 + Kc)

54

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

Please note that BOE 1 is OE at the beginning of this year which is same as OE at the end of the previous

year, and it is found on the previous years balance sheet. But ANI 1 is found at the end of year one from

income statement prepared at the end of the year one, and so on for each subsequent year. The

following analysis shows how ANI can be written in various ways. We know that:

ROE = NI / BOE

and therefore

ROE * BOE = NI

Inserting this expression of NI in

ANI = NI BOE *Kc

We get

ANI = (ROE *BOE) - (BOE * Kc)

Taking BOE common

ANI = BOE (ROE Kc),

and valuation model which was previously written as:

1

Value of equity = BOE1 + ANI1/ (1 + Kc) + ANI2/ (1 + Kc) + ..+ ANI n/(1 + Kc)

now can be written as

1

Value of equity = BOE1 + BOE1 (ROE1 Kc) / (1 + Kc) + BOE2 (ROE2 Kc)/ (1 + Kc) + ..+ BOE n (ROEn Kc)/(1 + Kc)

Whereas subscript 1 to n refer to years, and BOE 1 refers to OE at the beginning of year one and it is same

as Ending OE from balance sheet of year just ended because OE at the end of year just ended is also OE at

the beginning of next year. This model is written for n years while n approaches infinity.

Please note we have estimated value of total equity with this model. To find value per share we

can divide value of equity by number of shares outstanding to get estimate of fair value or justified value

or intrinsic value per share.

We can also divide both sides by number of shares outstanding, but BOE / number of shares is called Beg

BV per share or simply Beg BV. So we get estimate of value per share as:

1

P0 = Beg BV1 + Beg BV1(ROE1 Kc) / (1 + Kc) + Beg BV2(ROE2 Kc) / (1 + Kc) +..+ Beg BVn (ROEn Kc) / (1 + Kc)

equation (1)

Please also note that

ANI = NI BOE *Kc

Dividing both sides by number of shares we get

55

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

ANI per share = EPS Beg BV*Kc

And first dividing the valuation model repeated below by number of shares and then inserting this

expression of ANI we get

1

Value of equity = BOE1 + ANI1/ (1 + Kc) + ANI2/ (1 + Kc) + ..+ ANI n/(1 + Kc)

P0

= Beg BV1 + (EPS1 Beg BV1* Kc)/ (1 + Kc) + (EPS2 Beg BV2* Kc)/ (1 + Kc) + . + (EPSn Beg BVn* Kc)/ (1 + Kc)

So this model can be written in term of EPS.

But the expression with ROE repeated below is used more frequently:

(

(

)

)

(

(

)

)

(

(

)

)

Please also do not make the mistake of attempting to forecast Kc for future years, you are estimating PVs

of future years ANI, so Kc of today is the relevant discount rate to discount expected abnormal net

income (ANI) of all future years.

The popularity of this expression is based upon the fact that it allows clear comparison of the accounting

rate of return actually earned by the shareholders in a year (ROE) and the risk adjusted rate of return

required by the shareholders (Kc). You already know that to estimate risk adjusted required rate of return

for shareholders, the relevant risk is beta of that share; and CAPM is the model used to estimate such risk

adjusted required rate of return by shareholders. Kc = Rf + (Rm - Rf) beta

This expression of share valuation using accounting data also clearly shows that to create value for the

owners (shareholders of a Co) , the management of a company should strive to earn ROE greater than Kc.

As long as a company reports ROE Kc as a positive number, the ANI of that year is positive , and the

market value of the share would be higher than the beginning book value per share. Value would be

created for the shareholders in the stock market in the form of increase in share price if expected ANIs of

future years are positive; or in other words if in future years ROEs are expected to be greater than todays

Kc.

On the other hand if ROEs in future years are expected to be lower than todays Kc, then value would be

destroyed and share price would be less than BV per share. One can mention example of the shares of

Modarba companies in Pakistan as mostly these shares are trading below their book value implying that

market believes their future ANIs are going to be negative. Also if in future years ROEs are expected to be

56

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

same as todays Kc then ROE Kc = 0; and ANIs would be zero, and PV of ANIs would be zero; therefore

fair value estimate for such a share would be equal to its beg BV per share. For example if todays beg BV

is 200 Rs per share, and in all future years ROE is expected to be same as todays Kc which is 20%

, then you would estimate fair value of share as :

1

P0 = Beg BV1 + {Beg BV1(ROE1 Kc) / (1 + Kc) } + { Beg BV2(ROE2 Kc)/(1 + Kc) } +

n

..+ { Beg BVn (ROEn Kc) / (1 + Kc) }

1

P0 = 200 + {200(20% - 20%)} / (1 + 0.2) + {Beg BV2 (20% - 20%)}/ (1 + Kc) + .

P0 = 200 + 0

+0

P0 = 200

And it is same as its book value per share today.

Though the model is written for n years, in real life as an analyst it is not possible for you to forecast ANI

for all future years; therefore practically you forecast ANI or ROE for the next 4 or 5 years. Doing such

forecasting requires preparing next 4 or 5 years projected income statements and balance sheets: a skill

which you have learned in previous lectures. Beyond 4 , 5 years either a zero ANI is assumed in all future

years; or a constant ANI is assumed for all future years; or a growing ANI is assumed for all future years.

Assuming zero ANI after year 5, you have the following pricing formula:

1

P0 = Beg BV1 + {Beg BV1(ROE1 Kc) / (1 + Kc) } + { Beg BV2(ROE2 Kc)/(1 + Kc) } + ..+

5

{ Beg BV5 (ROE5 Kc) / (1 + Kc) }

Assuming a constant ANI after year 5, you have the following pricing formula:

(

)

}

)

(

)

(

{

)

)

}

)

}

}

Please note the term

(

} is called terminal value of ANIs beyond year 5.

It is in fact present value of a perpetuity at the end of year 5, whereas perpetuity is ANI of year 5 that is

expected to remain constant each year after year 5 till infinity. Like ANI of year 5 this PV of perpetuity at

the end of year 5 is a future value when looked at from the vantage point of time zero, that is now;

therefore it has to be discounted for 5 years to get PV at time zero , that is why the denominator is:

5

(1 + Kc) within large bracket.

57

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

Assuming ANI beyond year 5 is growing at a constant growth rate, g, then the accounting valuation

formula is:

)

(

)(

(

))

{

)

The term {

)

(

{

(

}

)(

))

}

}

} is called terminal value of ANIs beyond year 5.

In this case it is assumed that ANI of year 5 is a perpetuity that is expected to grow at a constant growth

rate in all subsequent future years till infinity; and the terminal value in year 5 is PV of a growing

perpetuity at the end of year 5. Since the PV of growing perpetuity is found at the end of year 5 in this

example therefore from the vantage point of time zero it is still a future value; therefore the denominator

5

(1 + Kc)

is a discount factor of 5 years, and it is discounting both the ANI of year 5 as well as the terminal

value at the end of year 5 within large brackets .

For example

In the latest balance sheet OE per share was Rs 200. In the next 5 years ROE is expected to be 22%, 23%,

25%, 22% and 21%. Shareholders require a risk adjusted Return of 20%. Beginning OE per share in the

year 2, 3, 4, and 5 is estimated as Rs 220, 230, 250, and 260. And thereafter ANI is expected to grow at

constant growth rate of 2% per year forever. Please estimate fair value of share using accounting

valuation model.

1

ANI of year 1 = 200(0.22 0.2) = 4 ; and PV of ANI = 4 / (1.2) = 3.33 Rs per share

2

ANI of year 2 = 220 (0.23 0.2) = 6.6; and PV of ANI = 6.6/(1.2) = 4.58 Rs per share

3

ANI of year 3 = 230 (0.25 -0.2) = 11.5 ; and PV of ANI = 11.5 /(1 . 2) = 6.65 Rs per share

ANI of year 4 = 250 (0.22 - 0.2) = 5 ; and PV of ANI = 5 /(1.2)

= 2.41 Rs per share

5

ANI of year 5 = 260 (0.21 0.2) = 2.6 ; and PV of ANI = 2.6 /(1.2) = 1.04 Rs per share

Terminal Value of ANI in year 5 = 260 (0.21 0.2)(1 + 0.02) / (0.2 - 0.02) = 2.65/ 0.18 = 14.4 Rs per share

5

PV of terminal value = 14.4/(1.2) = 5.78 Rs per share

Fair value of share = 200 + 3.33 + 4.58 + 6.65 + 2.41 + 1.04 + 5.78 = 223 Rs per share

Since ANIs of future years are positive therefore you have estimated a fair value of 223 Rs that is higher

than the beginning OE per share of 200 Rs.

58

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

Price To Earnings Ratio (PE) Or Earnings Multiple Model Of

Valuation

Another popular valuation model is price to earnings ratio (PE) to value the shares. It also called earnings

multiple because it states price of a share as multiple of EPS.

Since PE ratio =P0 /EPS, therefore PE ratio * EPS = Po.

For example if PE ratio is 12 times and EPS is 6 Rs then you would estimate the share price as:

12 * 6 = 72 Rs

This method of valuation of share assumes that PE ratio of a co is stable over time; and multiplying EPS by

PE ratio gives an estimate of share price. This model uses the logic that price of share depends on

earnings per share, and companies whose EPS is higher should have higher price. On the other hand if 2

companies have same EPS but PE is different than their estimated share value would be different.

For Example

Co

PE

EPS

Estimated share value

12

60

10

50

Please note PE ratio brings price in relation to one rupee of earning. For example

Co

EPS

PE

100

10

10/1

200

25

8/1

So the comparison between 2 companies share price is based on the one rupee of earnings, in this

example co X one rupee of earning is priced in the market at 10 rupees but same one rupee of earnings of

co Z is priced in the market at 8 rupees.

But implicit in this model is an ambiguity as to why 1 Rs of EPS of one co is priced more highly than the

same 1 Rs of EPS of another Co as implied by different PE ratios for the 2 companies? For example:

Co A

Co B

P0

100

500

EPS

100

PE ratio

20 /1

5/1

In both companies 1 Rs of EPS is priced differently in the market. For co A it is 20 Rs while in Co B it is only

5 Rs. Note in co A, both its share price and EPS are much lower than co B, but PE ratio of co A is 4 times

more than PE ratio of co B. That means stock market participants are putting much greater value on 1

rupee of earnings of co A than on 1 rupee of earnings of co B. Why it is so?

59

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

Usually the prospects for future growth is given as reason for this difference in earnings valuation, that is

difference in PE ratios; implying that market believes co A is likely to grow much faster in future than co

B, and that is why earnings of co A are considered more valuable today as these earnings are likely to

grow faster in future, and therefore owner of share of co A are likely to enjoy fast growth in earnings in

future years and therefore higher DPS in future years and also higher share price in future. Therefore, it

is argued that, it makes sense to pay more to get ownership right of such a company whose growth

prospects are brighter.

If you divide both sides of DDM with constant growth model, you get a more clear idea about PE ratio

and its relationship with growth rate as shown below: according to Gordons model

P0 = DPS1 / (Kc - g)

Dividing by EPS0 (1 + g)

P0 / EPS0 (1 + g) = {DPS0 (1 + g) / EPS0 (1 + g)} / (Kc - g)

PE ratio = d / (Kc g).

Note DPS / EPS = d, dividend payout ratio.

This expression of PE ratio clearly shows that PE ratio has 3 drivers:

1) dividend payout ratio (d) positively affects PE ratio;

2) required rate of return of shareholders (Kc) negatively affects PE ratio,

3) growth rate (g) positively affects PE ratio.

Interestingly relationship of PE ratio with growth rate is positive under this formulation. Thus companies

that are expected to grow fast are likely to have higher PE ratio implying that companies with slow growth

prospects are likely to have low PE ratio.

Valuing The Private Limited Companies Using PE Ratio :

This valuation model , Po = PE ratio * EPS, can be used for companies which do not pay cash dividends. It

is also usable to value companies whose shares are not listed and therefore their share price is not

observable, such as private limited companies. In such situations average PE ratio of comparable

companies is used as proxy for PE ratio of the private co of interest; and then that average PE ratio is

multiplied by EPS of the private co of interest to arrive at an estimate of fair value of the shares of this co.

Po of a private limited Co = Average PE ratio of comparable companies * EPS of this private Ltd co.

Please note if data is not per share then PE ratio = MV of equity / NI

60

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

PE Ratio and its bifurcation into Tangible PE and Franchise PE; and the use of PE ratio in identifying

undervalued shares

PE ratio (price of share / EPS) is also called earning multiplier, and it is commonly used to identify

whether a share is undervalued or over valued at its prevailing current market price. As a rule

undervalued shares are bought and overvalued shares are not bought or sold if investor already owns

these shares. Generally it is believed that relatively high PE ratio for a stock indicates high growth

prospects for that company, and low PE stocks have relatively low growth prospects. But on the other

hand high PE ratio may indicate overvalued stock and low PE ratio may indicate undervalued stock. Then

the question arises if high PE ratio means expected high growth of share price and also over valuation at

the current price then how come overvalued share is expected to grow in price because common sense

tells us that overvalued shares are expected to experience a fall in their price not an increase. Therefore

this possible conflicting signal sent by PE ratio must be kept in mind.

More clarity is needed while using PE ratio. Using current P0 and last years EPS to calculate PE ratio gives

Actual Trailing PE because it relates latest price to last years earnings ( PE = P0 /EPS0). But you know that

current price is based on future expectation about earning , dividends and growth in share price; and not

on past earning performance. Therefore calculating such PE ratio is not very useful though most of the

text book while discussing PE ratio show calculation using latest EPS, that is EPS0. Relating current price

of share with the expected earnings makes sense because buying share at todays price gives investor

right on future earnings, therefore such PE ratio is called Actual Leading PE ratio

Actual Leading PE ratio = P0 / EPS1

This conflicting signals sent by high PE ratio about overvaluation at current price and expected high

growth is resolved by having clarity that actual PE ratio is based upon actual (last years) EPS and is called

actual trailing PE, or based on estimated next year earnings (EPS1) and current market price of the share

and called actual leading PE. On the other hand intrinsic leading PE ratio is calculated from fair value

estimates of share price using Gordon model called DDM with constant growth. The two PE ratios ( actual

leading PE and intrinsic leading PE) can be different.

The decision rule is :

If actual leading PE is greater than intrinsic leading PE, the share is overvalued at its current market

price. If actual leading PE ratio is greater than the intrinsic leading PE ratio, then actual price of share is

more than the intrinsic value of that share; and therefore the share is over valued at its current market

61

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

price. Since undervalued assets are the ones you like to buy (if you do not have a twisted personality

tainted by the false concept of status) and overvalued shares are not to be bought and not to be included

in your portfolio as an individual investor. Corporate finance mangers also look for undervalued shares to

identify and select target companies to do mergers with or to takeover such companies as part of their

growth strategy.

Example of Actual PE ratio

For Example Last years EPS of a Co was Rs 5 (EPS0), and currently its share price (P0 ) in the market is 100

Rs, and it is expected to have a growth rate {ROE (1 - d)} of 5%. Based on CAPM its Kc (risk adjusted

required ROR for shareholders) is 13%. It has paid last year 25% of its profits as cash dividends and that

policy is likely to continue next year. So dividend payout ratio (d) is 25%.

You can calculate 2 actual PE ratios called Trailing PE ratio and Leading PE ratio.

Actual Trailing PE ratio is P0 / EPS0 = 100 / 5 = 20 times.

Actual Leading PE ratio is P0 / EPS1

Since EPS1= EPS0 (1 + g) therefore

Leading PE ratio = P0 / EPS0 (1 + g)

= 100 / 5 (1 + 0.05)

= 100 / 5.25

= 19.04

Intrinsic Leading PE Ratio (Also called Justified PE ratio)

Again given below is Gordon valuation formula for fair value or intrinsic value of share:

Po = DPS1 / (Kc g)

Dividing both sides of equation by expected earnings per share for next year, that is expected EPS,

symbolized here as EPS1, you get:

Po / EPS1 = {DPS1 / (Kc g)} / EPS1

Which can be written as :

Po / EPS1 = {(DPS1 / EPS1)/ (Kc g)} .

62

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

But DPS1 / EPS1 is dividend payout ratio of next year symbolized as d1, and since it is assumed that this

wont change from the last years d of 25% in future years therefore though strictly speaking this is d 1

for the next year but it is same as d0 for the previous year so

Po / EPS1 = d / (Kc g)

Intrinsic Leading PE ratio = d / (Kc g)

Using the data from the example above

Intrinsic Leading PE ratio =Po / EPS1 = 0.25 / (0.13 0.05)

Intrinsic Leading PE ratio= 3.125

Decision rule to decide mispricing of a share is:

Overvalued if actual leading PE ratio > Intrinsic Leading PE ratio.

Undervalued if actual leading PE < intrinsic leading PE

In this company actual leading PE ratio 19.04, as calculated above, and it is greater than intrinsic leading

PE of 3.125. So you decide that this share is overvalued in the market at its current price of 100 rupees.

So we found that intrinsic leading PE ratio = dividend payout ratio / difference between required rate of

return and constant growth rate ; and it is called Intrinsic Leading PE ratio because it is derived by using

Gordon formula for intrinsic (or fair) value of a share. We need to have greater understanding of the

intrinsic leading PE ratio.

Intrinsic PE = Tangible PE + Franchise PE

Intrinsic PE ratio is sum of two components:

1) Tangible PE ratio :

Tangible PE ratio refers to a situation where co does no reinvestment of its profits, rather all the NI is

given out as cash dividends, the resulting PE is based on perpetual use of existing assets, and resulting

earnings or profits from the productive use of such non growing assets. Please note that if all the NI is

given out as cash dividends then dividend payout rate (d) is 1, ; that means 100% of earning is given out as

dividends and no portion of NI is kept as retained earnings and reinvested in the business therefore there

is no growth in the co that is financed from internally generated equity funds in the form of addition to

63

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

RE. But such a co can still finance growth in its assets by raising external equity funds through issuance of

more shares and/or by raising more debt capital from bond market or banks. With no retention of NI,

constant growth rate is calculated as:

g = ROE (1 - d) = ROE ( 1 - 1) = ROE (0) = 0 . In this case intrinsic leading PE ratio is :

Intrinsic Leading PE ratio =Po / EPS1 = d / (Kc g)

=1 / (Kc 0)

=1 / Kc

Let us see how this result is attained.

Since DPS = EPS *d, and if d = 1, then DPS = EPS; therefore

Gordon valuation model becomes:

Po = DPS1 / (Kc g)

Po = EPS 1 / (Kc 0)

Po = EPS 1 / Kc

current price is based on perpetual earning. EPS is a perpetuity that is discounted at discount rate Kc;

and PV of this perpetuity is the current price of the share in the absence of growth. It further means that

Intrinsic leading PE ratio is derived by taking EPS1 on the LHS of equation :

Po / EPS1 = 1 / (Kc 0)

=1 / Kc

And such PE ratio is called tangible PE because it is expected to be the PE if assets of co are not growing

because no portion of earnings is retained and reinvested in the business, therefore expected stream of

EPS is constant in all future years due to a non growing asset base.

2) Franchise PE:

It has 2 components, namely Franchise Factor (FF) and Growth Factor (G). Franchise

factor is result of a company earning on projects financed from RE a higher ROE than Kc, while Kc is risk

adjusted ROR for share holders.

The growth factor is PV (present value) of constant growth rate attained from reinvesting of some NI into

business as addition to RE and not giving out all of NI as dividends.

Again as you know from corporate finance course that growth rate of a companys OE can translate into

growth rate of its Sales, TA, TL, NI, EPS, DPS, and ultimately growth rate of share price if 5 policies are kept

64

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

constant. These 5 policies are : net profit margin, total asset turnover, equity multiplier, dividend payout

rate, and number of shares outstanding ; and you have already learnt that such growth rate can be

quantified as:

g = ROE * (1 d).

Thus Gordon formula for fair value of share:

Po = DPS1 / (Kc g)

becomes

Po = DPS1 / [Kc ROE * (1- d)]

And by dividing both sides of equation with EPS1 , intrinsic leading PE ratio becomes:

Intrinsic leading PE ratio = Po / EPS1 = d / [Kc ROE (1 d)]

Now multiply RHS with Kc / Kc (E1 is used for EPS1 for ease)

(

)[

)[

]

))

]

))

It can be written as

Since (1 - d) is called retention ratio , let us show it with symbol b, and thus

d = (1 b), now inserting this value, you get

(

)[

)[

]

)

Kc multiplies with (1 b) in the numerator

(

(

Adding and subtracting ROE * b in numerator of right hand side will give:

65

]

)

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

)[

)[

and placing ROE* b closer to Kc gives:

]

Bringing divisor {Kc ROE* b}] under both the terms of RHS

(

And {(

) [{

(

}]

} is 1 so

)[

)

(

}]

Taking b as common in numerator of 2nd term on RHS

(

)[

{

(

)

}]

)

Multiplying and dividing the term in large bracket after 1 with ROE we get

(

)[

)

}]

)

Since b = (1- d) and ROE * (1 d) = g, so you can write ROE * b = g. Now inserting this g in place of

ROE*b you get

(

)[

(

(

)

}]

)

When 1 / Kc is brought inside the bracket, it multiplies with both 1 and with the term right of 1, and you

get

[

(

(

)

}]

)

And second 1/Kc can be written as Kc multiplying with the denominator so you get

66

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

)

(

}]

Further simplification gives

(

{

{

(

}]

Bringing denominator (Kc* ROE) under both terms of the numerator , that is under ROE as well as under

Kc gives

[

{

(

}]

ROE and Kc cancels out in middle bracket leaving

[

{

(

}]

is called Tangible PE ratio

{

} is called franchise factor; and it represents competitive advantage of a business over its

competitors. If it is positive it means co has competitive advantage in the product market and if it is

negative then it means co has a competitive disadvantage in the product market. Bigger franchise factor

means ability of a company to earn on shareholders invested funds a rate of return higher than the

shareholders expected (risk adjusted required) rate of return (Kc). The underlying logic is that a company

can earn ROE higher than Kc only if its management selects promising projects in which it invests retained

earnings and then manages these projects such as new product lines and new factories in a manner that it

ends up earning a ROE higher than Kc from these projects due to superior product offering, better quality,

cost control in production, better marketing, and better innovation according to consumers needs.

{(

} is called growth factor. So

Intrinsic Leading PE = Tangible PE

+ Franchise PE

Franchise PE ratio = Franchise factor * Growth factor

Comparison of Intrinsic Leading PE ratio with the Actual Leading PE ratio allows you to make a decision

about overvaluation or undervaluation of a share.

67

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

For Example

ROE 15%, dividend payout ratio (d) is 70%, NI expected for next year 100 million, market value of its

equity is 600 million Rs. Shareholders require a risk adjusted ROR from share of this Co , Kc, 20% which

was estimated using CAPM.

Please Find: growth rate g; Tangible PE, franchise factor, growth factor, franchise PE, and intrinsic

Leading PE, Actual Leading PE ratio, your verdict about over or under valuation of this share on its current

price.

Answers:

g = ROE ( 1 - d) = 15% (1 - 0.7) = 4.5%

Tangible PE ratio = 1 / Kc = 1 / 0.2 = 5

Franchise factor = 1/Kc 1/ROE = 1/0.2 1/.15 = 5 6.67 = -1.67

Growth factor = g / (kc g) = 0.045 / (0.2 0.045) = 0.045 / .155 = 0.29

Franchise PE ratio = franchise factor * growth factor

= -1.67 * 0.29

= -0.48

Intrinsic Leading PE ratio = Tangible PE ratio + Franchise PE ratio

=5

+ -0.48

= 4.52

As a double check of the accuracy of the bifurcation of Intrinsic Leading PE into Tangible PE and

Franchise PE you can apply directly intrinsic leading PE formula derived from Gordon model:

Intrinsic Leading PE

Po / EPS1 = d / (Kc g)

= 0.7 / (0.2 - 0.045)

= 0.7 / 0.155

= 4.52

68

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

So we get the same answer from both methods, but the former method of bifurcating into tangible PE

and franchise PE provides additional insight. For example in this case growth factor (0.29) is very small;

and franchise factor depicting the ability to earn ROE higher than Kc is negative ( - 1.67) implying poor

competitive advantage of this company in the product markets. Therefore overall contribution growth by

reinvesting profits in the business is negative as depicted by negative franchise PE.

Actual Leading PE ratio = P0 / EPS1

since per share data is not given you can use total amounts of expected NI of next year instead of EPS and

total MV of equity instead of MV per share , that is P 0.

Actual Leading PE ratio

= MV of equity / NI1

= 600 / 100

= 6

Decision : Since

actual leading PE > Intrinsic leading PE

6

> 4.52

Therefore actual price is greater than theoretical price, and the share of this co is overvalued at its

current price in the market and you should not invest in it; rather wait for fall in its price because

overvalued assets are expected to experience decline in their market price: once that happens then it

would be ok to buy it. Another possibility is to attempt to make profit by short selling this share in the

hope of price fall in future.

Please note that ROE was less than Kc, so franchise factor (an evidence of competitive advantage of this

co over its competitors) is negative. Though this co has positive growth prospects as shown by positive

growth factor of 0.29, but due to its inability to earn ROE > Kc on reinvested earnings, the growth is going

to be value destroying instead of value creating; and therefore ultimately its intrinsic PE would be less

than its tangible PE which is result of no growth in business and is based on doing no retention and

reinvesting of profits. In simple word this company would have been better off by giving all its NI as cash

dividends instead of retaining some of NI and reinvesting it in projects which earn ROE lesser than Kc thus

resulting in negative franchise factor; though growth has occurred as growth factor is positive yet the

combined effect of franchise factor and growth factor is negative franchise PE; and when that negative

franchise PE is added to tangible PE the resulting intrinsic PE is lower than the tangible PE. In simple words

this company has growth opportunities, but its management decided to invest in such projects which

69

Lahore School of Economics. MBA II. Advance Corporate Finance. Winter 2014. Dr. Sohail Zafar

were not very profitable enough to give ROE exceeding the Kc, and therefore its growth has not been

creating value, rather it is value destroying growth.

Companies with profitable investment opportunities in new projects have positive franchise factor and

therefore their franchise PE is positive resulting in their intrinsic PE being higher than their tangible PE.

And such companies should not give all their NI in dividends, rather some NI should be retained and

reinvested in profitable projects whose ROE is greater than Kc.

The lesson is important: It is not growth per se that creates value for the shareholders, but profitable

growth where new projects earn ROE greater than Kc, only then value would be created and intrinsic PE

would be higher than tangible PE, that is PE based on no growth; otherwise growth can turn into a

value destroying phenomenon instead of being a value creating phenomenon, as was the case in this

example.

70

Вам также может понравиться

- LBO Modeling Test Example - Street of WallsДокумент18 страницLBO Modeling Test Example - Street of WallsVineetОценок пока нет

- Financial Terms and RatiosДокумент76 страницFinancial Terms and Ratiosbanshidharbehera100% (1)

- Kellogg Valuation HelpДокумент56 страницKellogg Valuation HelpJames WrightОценок пока нет

- Applied Corporate Finance. What is a Company worth?От EverandApplied Corporate Finance. What is a Company worth?Рейтинг: 3 из 5 звезд3/5 (2)

- Financial Statements, Cash Flow, and Taxes - Solutions - Solutions - Solutions - SolutionsДокумент73 страницыFinancial Statements, Cash Flow, and Taxes - Solutions - Solutions - Solutions - SolutionspepeОценок пока нет

- Assessment CentreДокумент7 страницAssessment Centresarakhan0622Оценок пока нет

- Walter Mart Financial StatementДокумент55 страницWalter Mart Financial StatementRIANNE MARIE REYNANTE RAMOSОценок пока нет

- Assign 3 Answer Partnership Dissolution Millan 2021Документ6 страницAssign 3 Answer Partnership Dissolution Millan 2021mhikeedelantarОценок пока нет

- ROI, EVA and MVA IntroductionДокумент4 страницыROI, EVA and MVA IntroductionkeyurОценок пока нет

- Nmims: Cost and Management AccountingДокумент276 страницNmims: Cost and Management AccountingAbinaya Kumar60% (5)

- Return On Investment: Assignment-2Документ7 страницReturn On Investment: Assignment-2Vineet AgrawalОценок пока нет

- Accounting For Single Entry and Incomplete RecordsДокумент18 страницAccounting For Single Entry and Incomplete RecordsCA Deepak Ehn77% (13)

- Corporate Finance SummaryДокумент44 страницыCorporate Finance SummaryZoë BackbierОценок пока нет

- Total Quality ManagementДокумент21 страницаTotal Quality ManagementHilmi Amir100% (1)

- Packages and MitsДокумент15 страницPackages and Mitssarakhan0622Оценок пока нет

- Slides of Chapter 4Документ27 страницSlides of Chapter 4Uzzaam HaiderОценок пока нет

- Session 10,11,12 Financial Analysis - Performance EvaluationДокумент12 страницSession 10,11,12 Financial Analysis - Performance EvaluationPooja MehraОценок пока нет

- Materi 1 Manajemen Keuangan II - ValuationДокумент13 страницMateri 1 Manajemen Keuangan II - Valuationvinn albatraozОценок пока нет

- Capital Structure (WordДокумент32 страницыCapital Structure (Wordrashi00100% (1)

- READING 8 Free Cashflow (Equity Valuation)Документ25 страницREADING 8 Free Cashflow (Equity Valuation)DandyОценок пока нет

- 2 Lecture 4 and 5 Contant GДокумент21 страница2 Lecture 4 and 5 Contant GNaveed SheikhОценок пока нет

- Written Assignment Unit 1Документ9 страницWritten Assignment Unit 1sir jОценок пока нет

- RoeДокумент3 страницыRoeShakir AbdullahОценок пока нет

- Technical Accounting Interview QuestionsДокумент14 страницTechnical Accounting Interview QuestionsRudra PatidarОценок пока нет

- Forecasting Financial Statements NotesДокумент20 страницForecasting Financial Statements NotesUzzaam HaiderОценок пока нет

- 3 Statement & DCF ModelДокумент17 страниц3 Statement & DCF ModelarjunОценок пока нет

- DCF ValuationДокумент3 страницыDCF ValuationDurga ShankarОценок пока нет

- Lecture 6 & 7Документ17 страницLecture 6 & 7Yumna AzharОценок пока нет

- 3 Statement & DCF ModelДокумент17 страниц3 Statement & DCF ModelArjun KhoslaОценок пока нет

- Conversion Often Rises and Falls With The Stock Price) - Although The Possibility of All of The Dilutive Securities Being CalledДокумент5 страницConversion Often Rises and Falls With The Stock Price) - Although The Possibility of All of The Dilutive Securities Being CalledLoudie Ann MarcosОценок пока нет

- Slides - Session 5Документ49 страницSlides - Session 5Murte BolaОценок пока нет

- Measuring and Controlling Assets EmployedДокумент39 страницMeasuring and Controlling Assets Employedsumitchawla12Оценок пока нет

- Financial Leverage Grp1 Assgnmt 3Документ23 страницыFinancial Leverage Grp1 Assgnmt 3QUADRI YUSUFОценок пока нет

- Economic Value Added (Eva)Документ6 страницEconomic Value Added (Eva)Ashwin KumarОценок пока нет

- Unit 2 RatioДокумент51 страницаUnit 2 Ratiov9510491Оценок пока нет

- Clean Surplus AccountingДокумент3 страницыClean Surplus Accountingmcturra20000% (1)

- BBA-4 Cost Acc - Unit 1Документ5 страницBBA-4 Cost Acc - Unit 1TilluОценок пока нет

- Forecasting - Module 4 AllДокумент22 страницыForecasting - Module 4 AllSandeepPusarapu50% (2)

- FM FormulasДокумент13 страницFM Formulassudhir.kochhar3530Оценок пока нет

- An Empirical Analysis of Linkage BetweenДокумент15 страницAn Empirical Analysis of Linkage BetweenSumant AlagawadiОценок пока нет

- Iapm - Ratios & Dupont ExplanationДокумент2 страницыIapm - Ratios & Dupont ExplanationParvathi M LОценок пока нет

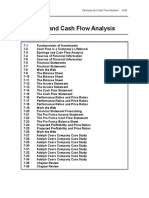

- Earnings and Cash Flow Analysis: SlidesДокумент6 страницEarnings and Cash Flow Analysis: Slidestahera aqeelОценок пока нет

- By M. Saqib Shahzad 361-570-88: ROA Net Profit After Taxes / AssetsДокумент9 страницBy M. Saqib Shahzad 361-570-88: ROA Net Profit After Taxes / AssetsSaqib ShahzadОценок пока нет

- Financial Terms and RatiosДокумент20 страницFinancial Terms and RatiosRethiesh ArОценок пока нет

- Financial Terms and RatiosДокумент13 страницFinancial Terms and RatiosAnonymous nTxB1EPvОценок пока нет

- Accounting For Price Level Changes 1Документ8 страницAccounting For Price Level Changes 1lil telОценок пока нет

- Final Exam - Financial Analysis - Marc BergeotДокумент7 страницFinal Exam - Financial Analysis - Marc BergeotMarc BergeotОценок пока нет

- If You Dont Understand Accounting, There Is No Way You Can Understand FinanceДокумент3 страницыIf You Dont Understand Accounting, There Is No Way You Can Understand FinanceAni Dwi Rahmanti RОценок пока нет

- AEO - LBO Scenario #1a, Case 1 OverviewДокумент4 страницыAEO - LBO Scenario #1a, Case 1 Overviewmilken466Оценок пока нет

- 10 CAPEX KPIsДокумент4 страницы10 CAPEX KPIsbarsancameliaОценок пока нет

- Capital Structure, Cost of Capital and ValueДокумент33 страницыCapital Structure, Cost of Capital and Valuemanish9890Оценок пока нет

- David Corporate AssignmentДокумент13 страницDavid Corporate Assignmentsamuel debebeОценок пока нет

- Market-Based Valuation: Price and Enterprise Value MultiplesДокумент62 страницыMarket-Based Valuation: Price and Enterprise Value Multiplessino akoОценок пока нет

- Guide Lines Project 19Документ26 страницGuide Lines Project 19Muhammad Danish AamirОценок пока нет

- Corporate Profitability 2022Документ22 страницыCorporate Profitability 2022Valerie RogatskinaОценок пока нет

- Rough Work AreaДокумент7 страницRough Work AreaAnkur SharmaОценок пока нет

- FAH - Business ValuationДокумент22 страницыFAH - Business ValuationFaisal A. HussainОценок пока нет

- Financial Statements & AnalysisДокумент14 страницFinancial Statements & AnalysisMuntasir SizanОценок пока нет

- Indian Oil ProjectДокумент7 страницIndian Oil ProjectManisha SharmaОценок пока нет

- Capital BudgetingДокумент24 страницыCapital BudgetingFunshoОценок пока нет

- Construction of Cash Flows RevisitedДокумент29 страницConstruction of Cash Flows RevisitedShito RyuОценок пока нет

- Eps Ias 33Документ5 страницEps Ias 33Yasir Iftikhar AbbasiОценок пока нет

- Ratio Analysis Is A Form of FinancialДокумент18 страницRatio Analysis Is A Form of FinancialAmrutha AyinavoluОценок пока нет

- Notes - An Introduction To Financ, Accouting, Modeling, and ValuationДокумент8 страницNotes - An Introduction To Financ, Accouting, Modeling, and ValuationperОценок пока нет

- AD202205145Документ9 страницAD202205145Path GargОценок пока нет

- Chapter ThirteenДокумент31 страницаChapter Thirteensarakhan0622Оценок пока нет

- SapphireДокумент22 страницыSapphiresarakhan0622Оценок пока нет

- Final Term Date SheetДокумент4 страницыFinal Term Date Sheetsarakhan0622Оценок пока нет

- Dr. Kaiser Waheed Pharmaceutical Paradigm ShiftДокумент26 страницDr. Kaiser Waheed Pharmaceutical Paradigm Shiftsarakhan0622Оценок пока нет

- Styles & TrendsДокумент14 страницStyles & Trendssarakhan0622Оценок пока нет

- Beech NutДокумент10 страницBeech Nutsarakhan0622Оценок пока нет

- Final Term Date SheetДокумент4 страницыFinal Term Date Sheetsarakhan0622Оценок пока нет

- Problems BataДокумент6 страницProblems Batasarakhan062250% (2)

- Pharma SwotДокумент4 страницыPharma SwotzeeshannaqviОценок пока нет

- Brand Adver MNGT 2015course OutlineДокумент4 страницыBrand Adver MNGT 2015course Outlinesarakhan0622Оценок пока нет

- Chapter ThreeДокумент123 страницыChapter Threesarakhan0622Оценок пока нет

- Chap 6integratedmarketingcommunicationstobuildbrandequity 130519080754 Phpapp01Документ22 страницыChap 6integratedmarketingcommunicationstobuildbrandequity 130519080754 Phpapp01sarakhan0622Оценок пока нет

- S.N Name Dob (Dd/Mm/Yy) Cnic Degree Completed MajorsДокумент4 страницыS.N Name Dob (Dd/Mm/Yy) Cnic Degree Completed Majorssarakhan0622Оценок пока нет

- Strategic Brand ManagementДокумент23 страницыStrategic Brand ManagementAsad AliОценок пока нет

- Adnan Durrani Living Dell TimeДокумент8 страницAdnan Durrani Living Dell TimeAdnan Karim DurraniОценок пока нет

- Strategicanalysisofpia 100610043040 Phpapp02Документ44 страницыStrategicanalysisofpia 100610043040 Phpapp02Sajid AliОценок пока нет

- The Power of DreamsДокумент21 страницаThe Power of DreamsAman7190Оценок пока нет

- The Changing Role of Managerial Accounting in A Dynamic Business EnvironmentДокумент69 страницThe Changing Role of Managerial Accounting in A Dynamic Business Environmentsarakhan0622Оценок пока нет

- Cost Accounting: A Managerial EmphasisДокумент13 страницCost Accounting: A Managerial Emphasissarakhan0622Оценок пока нет

- KellerДокумент23 страницыKellersaaigeeОценок пока нет

- Customer-Based Brand EquityДокумент30 страницCustomer-Based Brand Equitysarakhan0622Оценок пока нет

- Cost Accounting: A Managerial EmphasisДокумент13 страницCost Accounting: A Managerial Emphasissarakhan0622Оценок пока нет

- BatesДокумент11 страницBatessarakhan0622Оценок пока нет

- Excel HanoverbatesДокумент5 страницExcel Hanoverbatessarakhan0622Оценок пока нет

- Samsung Sponsors Punjab OlympicsДокумент1 страницаSamsung Sponsors Punjab Olympicssarakhan0622Оценок пока нет

- Chap 004Документ37 страницChap 004sarakhan0622Оценок пока нет

- GroupДокумент5 страницGroupsarakhan0622Оценок пока нет

- Jieya Kylah D. Casiple BSMA 4-BДокумент4 страницыJieya Kylah D. Casiple BSMA 4-BJieya Kylah CasipleОценок пока нет

- Depreciation Notes PDFДокумент16 страницDepreciation Notes PDFPriYansh PaTelОценок пока нет

- Cases PMF 11thed GitmannДокумент61 страницаCases PMF 11thed GitmannJohn Carlos WeeОценок пока нет

- Crash That Shook The NationДокумент7 страницCrash That Shook The NationAnjana JaggerОценок пока нет

- Itc Clsa Oct2020Документ100 страницItc Clsa Oct2020ksatishbabuОценок пока нет

- IDLC Finance Limited Internship ReportДокумент36 страницIDLC Finance Limited Internship ReportZordanОценок пока нет

- Viva Questions 2Документ7 страницViva Questions 2Proshanto Chandra DasОценок пока нет

- Introduction To Companies Act 1956Документ35 страницIntroduction To Companies Act 1956Gouri ShankarОценок пока нет

- 202 824 1 PBДокумент12 страниц202 824 1 PBZihr EllerycОценок пока нет

- CK Foods Significant Accounting PoliciesДокумент9 страницCK Foods Significant Accounting PoliciesA YoungОценок пока нет

- Bài Tập Buổi 4 (Updated)Документ4 страницыBài Tập Buổi 4 (Updated)Minh NguyenОценок пока нет

- Financial Management, Scope, Objectives and Types of FinancesДокумент13 страницFinancial Management, Scope, Objectives and Types of Financesvenkataswamynath channa69% (13)

- Sources of FinanceДокумент39 страницSources of Financemohammedakbar88Оценок пока нет

- Auditing NotesДокумент121 страницаAuditing Noteslipsa PriyadarshiniОценок пока нет

- Bornok Merchandising Store Completed The Following Merchandising Transaction June, 2018. Bornok Used Periodic Inventory SystemДокумент8 страницBornok Merchandising Store Completed The Following Merchandising Transaction June, 2018. Bornok Used Periodic Inventory SystemDindin Oromedlav LoricaОценок пока нет

- Question About Accounting Week1 - INGLES UNPHUДокумент5 страницQuestion About Accounting Week1 - INGLES UNPHURobertico LirianoОценок пока нет

- R. Im 18Документ36 страницR. Im 18abhishekrawat9137Оценок пока нет

- Islami Com Insurance-P-353Документ383 страницыIslami Com Insurance-P-353Rumana SharifОценок пока нет

- BBLD0919Документ93 страницыBBLD0919Syifa Musvita Ul BadriahОценок пока нет

- Poodle GroupДокумент2 страницыPoodle GroupFarОценок пока нет

- Corporation Definition The Most Common Form ofДокумент20 страницCorporation Definition The Most Common Form ofmtayyab_786100% (2)

- Par CorДокумент15 страницPar CorKim Nayve57% (7)

- AbcДокумент3 страницыAbcPia Sotto100% (1)

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFДокумент7 страницCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavОценок пока нет

- Atq - 1Документ7 страницAtq - 1Philip CastroОценок пока нет

- Financial Accounts ConceptДокумент191 страницаFinancial Accounts ConceptsridhartksОценок пока нет