Академический Документы

Профессиональный Документы

Культура Документы

Birla Institute of Technology & Science, Pilani Distance Learning Programmes Division Second Semester 2006-2007 Comprehensive Examination (EC-2 Regular)

Загружено:

rajpd28Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Birla Institute of Technology & Science, Pilani Distance Learning Programmes Division Second Semester 2006-2007 Comprehensive Examination (EC-2 Regular)

Загружено:

rajpd28Авторское право:

Доступные форматы

Birla Institute of Technology & Science, Pilani

Distance Learning Programmes Division

Second Semester 2006-2007

Comprehensive Examination (EC-2 Regular)

Course No.

Course Title

Nature of Exam

Weightage

Duration

Date of Exam

Note:

1.

2.

3.

4.

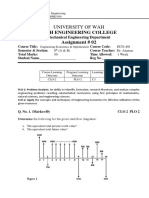

Q.1

: ET ZC414

: PROJECT APPRAISAL

: Open Book

: 60%

: 3 Hours

: 01/04/2007 (FN)

No. of Pages

=2

No. of Questions = 9

Please follow all the Instructions to Candidates given on the cover page of the answer book.

All parts of a question should be answered consecutively. Each answer should start from a fresh page.

Mobile phones and computers of any kind should not be brought inside the examination hall.

Use of any unfair means will result in severe disciplinary action.

Three assets, designated as P, Q, and R have expected returns of 0.12, 0.18 and 0.24

respectively. The variances and co-variances are as follows:

P

Q

R

P

0.02

0.01

-0.03

Q

0.01

0.06

0.00

R

-0.03

0.00

0.08

Find out the expected return and standard deviation of a portfolio consisting of 40% of

funds in A, 30% of funds in B, and 30% of funds in C.

[5]

Q.2

Discuss basic principles and of biases in the cash flow estimation.

Q.3

VHL is considering an investment proposal involving an outlay of Rs. 4500000. The

expected cash flows (ECF) and certainty equivalent coefficients (CEC) are:

Year:

ECF:

CEC:

1

1000000

0.9

2

1500000

0.85

3

2000000

0.82

[5]

4

2500000

0.78

The risk-free interest rate is 5%. Calculate the NPV.

[5]

Q.4

Point out the difference between BCR and NPV criteria in the feasibility report. Between

the two, which one is better and in what situations?

[5]

Q.5

The following information is available on quantity demand and income level

Quantity demanded:

Q1 = 50

Q2 = 55

Income:

Y1 = 1000

Y2 = 1020

Find out income elasticity of demand

[5]

Describe the steps in Decision Tree Analysis.

[5]

Q.6

PAGE 1 OF 2

PTO

ET ZC414 (EC-2 REGULAR)

SECOND SEMESTER 2006-2007

PAGE 2

Q.7

The return two projects X and Y under two different states of nature, which correspond to

different states of economy, are as follows:

Economic Growth

Return

X

Y

Strong (0.3)

.233

.100

Moderate (0.5)

.200

.150

Weak (0.2)

.150

.225

Find out variance, covariance, correlation and Beta of two returns.

[10]

Q.8

The expected cash flows of a project, which involves an investment outlay of Rs.

1000000, are as follows:

Year:

1

2

3

4

5

Cash Flows:

200000

300000

400000

300000

200000

The risk adjusted discount rate for this project is 18%. Is this project worthwhile? If

discount rate varies from 18% to 20% and 15%, who does again affect the feasibility of

the project?

[10]

Q.9

HPL Engineering is currently at its largest debt-equity ratio of 4: 5. It is evaluating a

proposal to expand capacity, which is expected to cost Rs. 4.5 million and generate afterrax cash flows of Rs. 1 million per year for the next 10 years. The tax rate for the

company is 25%. Two financing options are being looked at:

Issue of equity stock. The required return on the companys new equity is 18%. The

issuance cost will be 10%.

Issue of debentures a yield of 12%. The issuance cost will be 2%

What is NPV of the expansion projects and what will be the effect of weighted average

flotation costs.

[10]

*********

Page 2 of 2

Вам также может понравиться

- Birla Institute of Technology & Science, Pilani Distance Learning Programmes Division First Semester 2007-2008 Comprehensive Examination (EC-2 Regular)Документ3 страницыBirla Institute of Technology & Science, Pilani Distance Learning Programmes Division First Semester 2007-2008 Comprehensive Examination (EC-2 Regular)rajpd28Оценок пока нет

- UW Mechanical Engineering Assignment on Engineering EconomicsДокумент2 страницыUW Mechanical Engineering Assignment on Engineering EconomicsMuhammad Nouman khanОценок пока нет

- BITS Pilani Project Appraisal Comprehensive ExamДокумент2 страницыBITS Pilani Project Appraisal Comprehensive Examrajpd28Оценок пока нет

- BITS Pilani Distance Learning Project Appraisal ExamДокумент3 страницыBITS Pilani Distance Learning Project Appraisal Examrajpd28Оценок пока нет

- Course No.: ET ZC414 Course Title: Project Appraisal Nature of Exam: Closed Book Weightage: 40% Duration: 2 Hours Date of Exam: 07/02/2010 (FN) No. of Pages 2 No. of Questions 10Документ2 страницыCourse No.: ET ZC414 Course Title: Project Appraisal Nature of Exam: Closed Book Weightage: 40% Duration: 2 Hours Date of Exam: 07/02/2010 (FN) No. of Pages 2 No. of Questions 10rajpd28Оценок пока нет

- R32 Capital Budgeting - AnswersДокумент30 страницR32 Capital Budgeting - AnswersVipul 663Оценок пока нет

- Cee 1Документ14 страницCee 1Abdullah RamzanОценок пока нет

- BUS2201-S12 Outline 2022-23 T2Документ6 страницBUS2201-S12 Outline 2022-23 T2JOANNA LAMОценок пока нет

- Group 4 IpfДокумент21 страницаGroup 4 IpfSkn KumarОценок пока нет

- Quantitative MethodsДокумент18 страницQuantitative MethodsNikhil SawantОценок пока нет

- BBK BUMN052S6 2015 Financial ManagementДокумент10 страницBBK BUMN052S6 2015 Financial ManagementVan Der Heijden CОценок пока нет

- FRM Test 07 ANSДокумент42 страницыFRM Test 07 ANSKamal BhatiaОценок пока нет

- Spring2017 - GENG360 Engineering Economics Web - Section-L02Документ5 страницSpring2017 - GENG360 Engineering Economics Web - Section-L02Mohamed AymanОценок пока нет

- Cee 1Документ14 страницCee 1Abdullah RamzanОценок пока нет

- ENGR 301 Final Exam CPM Network AnalysisДокумент13 страницENGR 301 Final Exam CPM Network AnalysisSang MangОценок пока нет

- Course No.: ET ZC414 Course Title: Project Appraisal Nature of Exam: Closed Book Weightage: 40% Duration: 2 Hours Date of Exam: 05/08/2007 (FN) No. of Pages 1 No. of Questions 8Документ1 страницаCourse No.: ET ZC414 Course Title: Project Appraisal Nature of Exam: Closed Book Weightage: 40% Duration: 2 Hours Date of Exam: 05/08/2007 (FN) No. of Pages 1 No. of Questions 8rajpd28Оценок пока нет

- 2014 Mock Exam - AM - AnswersДокумент25 страниц2014 Mock Exam - AM - Answers12jdОценок пока нет

- Syllabus Diploma Civil Lateral 2012-13Документ64 страницыSyllabus Diploma Civil Lateral 2012-13iamaashuОценок пока нет

- Case 26 Star River - Group Thạch Trung Hiển ChươngДокумент13 страницCase 26 Star River - Group Thạch Trung Hiển ChươngTrương ThạchОценок пока нет

- FNCE10002 Principles of Finance Semester 2, 2019 Sample Final ExamДокумент3 страницыFNCE10002 Principles of Finance Semester 2, 2019 Sample Final ExamC A.Оценок пока нет

- 2018 Portfolio Risk and Return: Part I: Test Code: R41 PRR1 Q-BankДокумент7 страниц2018 Portfolio Risk and Return: Part I: Test Code: R41 PRR1 Q-BankAhmed RiajОценок пока нет

- Module 6 Irr and Payback PeriodДокумент4 страницыModule 6 Irr and Payback PeriodSulaim Al KautsarОценок пока нет

- ETC1010 Paper 1Документ9 страницETC1010 Paper 1wjia26Оценок пока нет

- BITS Pilani Quality Control ExamДокумент1 страницаBITS Pilani Quality Control Examrajpd28Оценок пока нет

- ex2014FMII MidДокумент2 страницыex2014FMII MidA SunОценок пока нет

- Modern Control Technology Components & Systems (2nd Ed.)Документ2 страницыModern Control Technology Components & Systems (2nd Ed.)musarraf172Оценок пока нет

- SEEM2440 Engineering EconomicsДокумент27 страницSEEM2440 Engineering Economicse1782319Оценок пока нет

- Assignment 2 1Документ3 страницыAssignment 2 1Muhammad Nouman KhanОценок пока нет

- Problems On Capital BudgetingДокумент2 страницыProblems On Capital BudgetingDeepakОценок пока нет

- Bachelor of Mechatronics EngineeringДокумент7 страницBachelor of Mechatronics EngineeringNyak PereraОценок пока нет

- BITS Pilani Instrumentation Exam QuestionsДокумент2 страницыBITS Pilani Instrumentation Exam QuestionsAabid ShahpureОценок пока нет

- Etzc 341Документ2 страницыEtzc 341rajpd28Оценок пока нет

- Comp Exam20 QP 02052k12Документ2 страницыComp Exam20 QP 02052k12Sajid AliОценок пока нет

- NPTEL Assign 4 Jan23 Behavioral and Personal FinanceДокумент6 страницNPTEL Assign 4 Jan23 Behavioral and Personal FinanceNitin Mehta - 18-BEC-030Оценок пока нет

- 9707 s11 Ms 22Документ6 страниц9707 s11 Ms 22kaviraj1006Оценок пока нет

- CT 1201404Документ22 страницыCT 1201404Lee Shin LeongОценок пока нет

- Birla Institute of Technology & Science, Pilani Distance Learning Programmes Division Second Semester 2007-2008 Mid-Semester Test (EC-1 Regular)Документ1 страницаBirla Institute of Technology & Science, Pilani Distance Learning Programmes Division Second Semester 2007-2008 Mid-Semester Test (EC-1 Regular)MukeshSharmaОценок пока нет

- MM Zg523 Ec-3r Second Sem 2015-2016Документ2 страницыMM Zg523 Ec-3r Second Sem 2015-2016Lakshmananan NagarajanОценок пока нет

- Project Planning & Evaluation - May10Документ2 страницыProject Planning & Evaluation - May10puruaggarwalОценок пока нет

- Deliverable I - Interview, IPS and Asset Allocation 2Документ3 страницыDeliverable I - Interview, IPS and Asset Allocation 2p869qmskm7Оценок пока нет

- 1 - Finance Spring - 2022 - JGLSДокумент7 страниц1 - Finance Spring - 2022 - JGLSIshika PatnaikОценок пока нет

- Fee 2010Документ22 страницыFee 2010gohviccОценок пока нет

- 395 37 Solutions Case Studies 4 Time Value Money Case Solutions Chapter 4 FMДокумент13 страниц395 37 Solutions Case Studies 4 Time Value Money Case Solutions Chapter 4 FMblazeweaver67% (3)

- Syllabusbtechec1 PDFДокумент107 страницSyllabusbtechec1 PDFAmol AmollОценок пока нет

- The Number in Parentheses Represents The Allocated Weight of The Question. This Exam Makes 60% of Total ScoreДокумент4 страницыThe Number in Parentheses Represents The Allocated Weight of The Question. This Exam Makes 60% of Total ScoreMalcolmОценок пока нет

- MBA I-SEMESTER ASSIGNMENT CIRCULAR & QUESTIONSДокумент2 страницыMBA I-SEMESTER ASSIGNMENT CIRCULAR & QUESTIONSSRIram sriramОценок пока нет

- Exam - Final - May 5th 2021 - Student VersionДокумент7 страницExam - Final - May 5th 2021 - Student Versionveronika mrÄ‘a podÄŤedenšekОценок пока нет

- First Sem BsДокумент2 страницыFirst Sem BsSrikanth DОценок пока нет

- FINM1416 2022S2 FinalExam+solsДокумент6 страницFINM1416 2022S2 FinalExam+solsMa HiОценок пока нет

- Birla Institute of Technology & Science, Pilani Distance Learning Programmes Division Second Semester 2006-2007 Mid-Semester Test (EC-1 Regular)Документ1 страницаBirla Institute of Technology & Science, Pilani Distance Learning Programmes Division Second Semester 2006-2007 Mid-Semester Test (EC-1 Regular)rajpd28Оценок пока нет

- Project CriteriaДокумент2 страницыProject CriteriaLe DungОценок пока нет

- PAF-KIET Aviation Finance Assignment 1Документ2 страницыPAF-KIET Aviation Finance Assignment 1Rumaisa HamidОценок пока нет

- Assignment Question For Financial Services CourseДокумент3 страницыAssignment Question For Financial Services CourseJahid HasanОценок пока нет

- BSC (Hons) Actuarial Science: School of Innovative Technologies and EngineeringДокумент14 страницBSC (Hons) Actuarial Science: School of Innovative Technologies and EngineeringMaharshiMishraОценок пока нет

- Annuities What Is The Module All About?Документ12 страницAnnuities What Is The Module All About?AdonisОценок пока нет

- 2010 Sem 2 Final - LatestДокумент8 страниц2010 Sem 2 Final - LatestArthur NitsopoulosОценок пока нет

- Reading 1 Rates and Returns - AnswersДокумент23 страницыReading 1 Rates and Returns - Answersmenexe9137Оценок пока нет

- (Ii) Time (Iii) : ECON-502 (3-0) Class: M.Sc. C (SELFSUPPORT) Teacher Name: Shahid IqbalДокумент1 страница(Ii) Time (Iii) : ECON-502 (3-0) Class: M.Sc. C (SELFSUPPORT) Teacher Name: Shahid IqbalosamaОценок пока нет

- Beyond Crisis: The Financial Performance of India's Power SectorОт EverandBeyond Crisis: The Financial Performance of India's Power SectorОценок пока нет

- Bitszc423t - Course Handout FileДокумент15 страницBitszc423t - Course Handout Filerajpd28Оценок пока нет

- CДокумент4 страницыCrajpd28Оценок пока нет

- QДокумент49 страницQrajpd28Оценок пока нет

- Is 12556Документ6 страницIs 12556rajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент9 страницDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Quality Control Assurance and Reliability (ETZC 432) : BITS PilaniДокумент42 страницыQuality Control Assurance and Reliability (ETZC 432) : BITS Pilanirajpd28Оценок пока нет

- Is 13673 4 1998 PDFДокумент17 страницIs 13673 4 1998 PDFrajpd28Оценок пока нет

- Is 13122 1 1993Документ22 страницыIs 13122 1 1993rajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент16 страницDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент13 страницDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Is 13122 2 1991Документ10 страницIs 13122 2 1991rajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент13 страницDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент20 страницDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Is 10398Документ16 страницIs 10398rajpd28Оценок пока нет

- Is 12554 1 1988Документ10 страницIs 12554 1 1988rajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент24 страницыDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент32 страницыDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент20 страницDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент26 страницDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент20 страницDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент22 страницыDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Is 10398Документ16 страницIs 10398rajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент22 страницыDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Is 9334 1986Документ20 страницIs 9334 1986rajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент26 страницDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент24 страницыDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Is 9334 1986Документ20 страницIs 9334 1986rajpd28Оценок пока нет

- Disclosure To Promote The Right To InformationДокумент15 страницDisclosure To Promote The Right To Informationrajpd28Оценок пока нет

- Is 9334 1986Документ20 страницIs 9334 1986rajpd28Оценок пока нет

- Is 8824Документ9 страницIs 8824rajpd28Оценок пока нет

- FOUNDATION REPAIR AND REGROUT FOR BODYMAKER AT CARNDAUD METALBOX SINGAPOREДокумент15 страницFOUNDATION REPAIR AND REGROUT FOR BODYMAKER AT CARNDAUD METALBOX SINGAPORETrúc NguyễnОценок пока нет

- Uefi Firmware Enabling Guide For The Intel Atom Processor E3900 Series 820238Документ42 страницыUefi Firmware Enabling Guide For The Intel Atom Processor E3900 Series 820238賴翊翊Оценок пока нет

- AVR R448: SpecificationДокумент2 страницыAVR R448: SpecificationAish MohammedОценок пока нет

- Foundations On Friction Creep Piles in Soft ClaysДокумент11 страницFoundations On Friction Creep Piles in Soft ClaysGhaith M. SalihОценок пока нет

- CE 308 Plain and Reinforced Concrete - Ii Determination of Size, Spacing and Cover in Reinforced Concrete Slab by Cover MeterДокумент9 страницCE 308 Plain and Reinforced Concrete - Ii Determination of Size, Spacing and Cover in Reinforced Concrete Slab by Cover MeterumairОценок пока нет

- Black HoleДокумент2 страницыBlack HoleLouis Fetilo Fabunan0% (1)

- Massive Transfusion ProtocolДокумент2 страницыMassive Transfusion ProtocolmukriОценок пока нет

- Angle Facts Powerpoint ExcellentДокумент10 страницAngle Facts Powerpoint ExcellentNina100% (1)

- Parts of The NailДокумент22 страницыParts of The NailMariel Balmes Hernandez100% (1)

- Matematika BookДокумент335 страницMatematika BookDidit Gencar Laksana100% (1)

- MSC Syllabus PDFДокумент34 страницыMSC Syllabus PDFMayadarОценок пока нет

- Petroleum GeomechanicsДокумент35 страницPetroleum GeomechanicsAnonymous y6UMzakPW100% (1)

- NX Advanced Simulation坐标系Документ12 страницNX Advanced Simulation坐标系jingyong123Оценок пока нет

- Flex-Shaft Attachment Instructions Model 225: WarningДокумент1 страницаFlex-Shaft Attachment Instructions Model 225: WarningFernando Lopez Lago100% (1)

- Lesson Planning Product-Based Performance TaskДокумент8 страницLesson Planning Product-Based Performance TaskMaricarElizagaFontanilla-LeeОценок пока нет

- Experiment03 PCM-DecodingДокумент10 страницExperiment03 PCM-DecodingMary Rose P Delos SantosОценок пока нет

- BUS STAT Chapter-3 Freq DistributionДокумент5 страницBUS STAT Chapter-3 Freq DistributionolmezestОценок пока нет

- Triad Over Root Chords Companion PDF 2.1Документ18 страницTriad Over Root Chords Companion PDF 2.1Vlado PetkovskiОценок пока нет

- Assignment 3Документ2 страницыAssignment 3Spring RollsОценок пока нет

- CN Lab ManualДокумент49 страницCN Lab ManualKN DEEPSHI100% (1)

- Association of Genetic Variant Linked To Hemochromatosis With Brain Magnetic Resonance Imaging Measures of Iron and Movement DisordersДокумент10 страницAssociation of Genetic Variant Linked To Hemochromatosis With Brain Magnetic Resonance Imaging Measures of Iron and Movement DisordersavinОценок пока нет

- The Structure of MatterДокумент3 страницыThe Structure of MatterFull StudyОценок пока нет

- Manage expenses and group contributions with Expense ManagerДокумент29 страницManage expenses and group contributions with Expense ManagerPt Kamal SharmaОценок пока нет

- P18 Probability in The CourtroomДокумент14 страницP18 Probability in The CourtroomYehiaОценок пока нет

- Js4n2nat 4Документ2 страницыJs4n2nat 4tingОценок пока нет

- EECIM01 Course MaterialДокумент90 страницEECIM01 Course Materialsmahesh_1980Оценок пока нет

- MOBICON Mobile Controller For GSM/GPRS Telemetry: 6ai 16-28di /12doДокумент2 страницыMOBICON Mobile Controller For GSM/GPRS Telemetry: 6ai 16-28di /12doĐặng Trung AnhОценок пока нет

- Java Practice Test 1Документ6 страницJava Practice Test 1Harsha VardhanaОценок пока нет

- Lectures Chpter#4 MOSFET of Sedra Semith (Micro Electronic Circuits)Документ170 страницLectures Chpter#4 MOSFET of Sedra Semith (Micro Electronic Circuits)Ahmar NiaziОценок пока нет