Академический Документы

Профессиональный Документы

Культура Документы

Earn Out Excel Working

Загружено:

premoshinАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Прочесть этот документ на других языках

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Earn Out Excel Working

Загружено:

premoshinАвторское право:

Доступные форматы

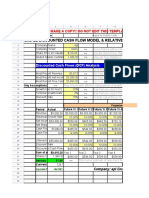

Buyer Valuation

Base Year Sales

Earnout Period, in Years

$ 10,000

5

Sales

Year 1

$

Growth Rate

min

most likely

max

0%

5%

10%

min

most likely

max

0%

5%

10%

Operating Income

Earnout Target

Annual Earnout Value

Year 3

Year 4

$ 11,025

$ 11,576

$ 12,155

5%

Profit Margin

10,500

Year 2

525

5%

5%

$

$

250

275

Present Value of the Earnout,

Discounted at

12%

286

Dollars at Closing

2,000

Valuation of Proposed Total Payment

2,286

551

5%

5%

$

$

500

51

579

750

-

5%

5%

$

$

Year 5

608

5%

5%

$

$

1,000

-

12,763

638

5%

$

$

1,250

-

Note: This exhibit shows the results of one

draw of the simulation. Each time the

model is opened, it recalculates, producing

different numbers from those appearing in

Exhibit 3 of Chapter 22. Please allow for

this in comparing the results of this table

with Exhibit 3.

Distribution for Enterprise Valuation of

Proposed Earnout

0.1

0.08

0.06

0.04

0.02

0

$2

,0

00

$2

,1

32

$2

,2

63

$2

,3

95

$2

,5

26

$2

,6

58

$2

,7

90

$2

,9

21

$3

,0

53

$3

,1

85

PROBABILITY

0.12

Minimum $

Mean

$

Maximum $

2,000

2,414

3,316

Note: The minimum, mean, and maximum

are based on a simulation of 100 draws.

Repeating this simulation, especially with

more draws will likely produce slightly

different estimates. With a very large

number of draws, the estimates should be

reasonably consistent from simulation to

Seller Valuation

Base Year Sales

Earnout Period, in Years

$ 10,000

5

Sales

Year 1

$

Growth Rate

min

most likely

max

10%

15%

20%

min

most likely

max

5%

10%

15%

Operating Income

Earnout Target

Annual Earnout Value

Year 3

Year 4

$ 13,225

$ 15,209

$ 17,490

15%

Profit Margin

11,500

Year 2

1,150

15%

10%

$

$

250

900

Present Value of the Earnout,

Discounted at

12%

2,916

Dollars at Closing

2,000

Valuation of Proposed Total Payment

4,916

1,323

15%

10%

$

$

500

823

1,521

750

771

15%

10%

$

$

Year 5

1,749

15%

10%

$

$

1,000

749

20,114

2,011

10%

$

$

1,250

761

Note: This exhibit shows the results of one

draw of the simulation. Each time the model

is opened, it recalculates, producing

different numbers from those appearing in

Exhibit 4 of Chapter 22. Please allow for

this in comparing the results of this table

with Exhibit 4.

0.16

0.14

0.12

0.1

0.08

0.06

0.04

0.02

0

$2

,8

92

$3

,3

63

$3

,8

35

$4

,3

06

$4

,7

77

$5

,2

49

$5

,7

20

$6

,1

92

$6

,6

63

$7

,1

35

PROBABILITY

Distribution for Enterprise Valuation of

Proposed Earnout

Minimum

Mean

Maximum

$

$

$

2,892

5,484

7,606

Note: The minimum, mean, and maximum

are based on a simulation of 100 draws.

Repeating this simulation, especially with

more draws will likely produce slightly

different estimates. With a very large

number of draws, the estimates should be

reasonably consistent from simulation to

Вам также может понравиться

- The Unveiling of The Teachings of The Rosicrucian Order An ExposéДокумент187 страницThe Unveiling of The Teachings of The Rosicrucian Order An ExposéClymer77798% (56)

- Financial Tools For Product ManagersДокумент33 страницыFinancial Tools For Product ManagersSohaeb1100% (1)

- Carter's LBO CaseДокумент3 страницыCarter's LBO CaseNoah57% (7)

- Cafe Financial ModelДокумент68 страницCafe Financial ModelShankey Bafna100% (1)

- DELL LBO Model Part 2 Completed (Excel)Документ9 страницDELL LBO Model Part 2 Completed (Excel)Mohd IzwanОценок пока нет

- DCF Valuation ModelДокумент25 страницDCF Valuation Modelgwheinen100% (2)

- SPAC LBO Structuring Model - 1Документ7 страницSPAC LBO Structuring Model - 1www.gazhoo.com100% (1)

- 30 Questions & Answers: That Every Saas Revenue Leader Needs To KnowДокумент10 страниц30 Questions & Answers: That Every Saas Revenue Leader Needs To KnowJohn Golob100% (1)

- DCF ModelДокумент29 страницDCF ModelPATMON100% (7)

- Startup Financial ModelДокумент102 страницыStartup Financial ModelkanabaramitОценок пока нет

- Hansson Private LabelДокумент4 страницыHansson Private Labelsd717Оценок пока нет

- 107 09 IPO Valuation ModelДокумент8 страниц107 09 IPO Valuation ModelAnirban Bera100% (1)

- Dead Island PC ManualДокумент20 страницDead Island PC ManualNapalmLove100% (1)

- Cap Table TemplateДокумент5 страницCap Table TemplatetransitxyzОценок пока нет

- Cap Table and Returns TemplateДокумент5 страницCap Table and Returns TemplatedeepaknadigОценок пока нет

- Enterprise Value Vs Equity ValueДокумент14 страницEnterprise Value Vs Equity Valuecrazybobby007100% (1)

- 2022 Jurists Pre-Week Notes On Law On Public OfficersДокумент7 страниц2022 Jurists Pre-Week Notes On Law On Public OfficersDan Alden ContrerasОценок пока нет

- Hansson Private Label FinalДокумент13 страницHansson Private Label Finalrohan pankar67% (3)

- LBO (Leveraged Buyout) Model For Private Equity FirmsДокумент2 страницыLBO (Leveraged Buyout) Model For Private Equity FirmsDishant KhanejaОценок пока нет

- Case Hansson Private LabelДокумент15 страницCase Hansson Private Labelpaul57% (7)

- Excel Drill Exercise 1 MDLДокумент16 страницExcel Drill Exercise 1 MDLEugine AmadoОценок пока нет

- Financial ModelДокумент83 страницыFinancial Modelapi-376449680% (5)

- Hansson Private Label - FinalДокумент34 страницыHansson Private Label - Finalincognito12312333% (3)

- MW Petroleum Corporation (A)Документ6 страницMW Petroleum Corporation (A)AnandОценок пока нет

- Assignment 8 - W8 Hand in (Final Project)Документ3 страницыAssignment 8 - W8 Hand in (Final Project)Rodrigo Montechiari33% (6)

- Hannson Private Label VFДокумент9 страницHannson Private Label VFAugusto Peña ChavezОценок пока нет

- Simple Discounted Cash Flow Model & Relative ValuationДокумент14 страницSimple Discounted Cash Flow Model & Relative ValuationlearnОценок пока нет

- Hansson Private Label: Operating ResultsДокумент28 страницHansson Private Label: Operating ResultsShubham SharmaОценок пока нет

- Bessemer's Top 10 Laws For Being SaaS-yДокумент11 страницBessemer's Top 10 Laws For Being SaaS-yjon.byrum9105100% (4)

- Outreach NetworksДокумент3 страницыOutreach NetworksPaco Colín50% (2)

- Capital BudgetingДокумент74 страницыCapital BudgetingAaryan RastogiОценок пока нет

- HPL CaseДокумент2 страницыHPL Caseprsnt100% (1)

- Earn-Out TemplateДокумент9 страницEarn-Out Templatevaibhav sinhaОценок пока нет

- Earnout: Acquisitions by Robert F. Bruner. See Chapter 22 For Further Discussion of Earnout ValuationДокумент3 страницыEarnout: Acquisitions by Robert F. Bruner. See Chapter 22 For Further Discussion of Earnout ValuationLuisMendiolaОценок пока нет

- AsthmaДокумент48 страницAsthmapremoshin50% (2)

- Flash Memory IncДокумент3 страницыFlash Memory IncAhsan IqbalОценок пока нет

- Principles of Finance Work BookДокумент53 страницыPrinciples of Finance Work BookNicole MartinezОценок пока нет

- US vs. Alvarez-MachainДокумент1 страницаUS vs. Alvarez-MachainAra KimОценок пока нет

- Pharmaceutical Marketing: Marketing Strategy Alternative Strategic ThrustsДокумент29 страницPharmaceutical Marketing: Marketing Strategy Alternative Strategic Thrustspremoshin100% (4)

- Hanson CaseДокумент14 страницHanson CaseSanah Bijlani40% (5)

- Week 2 Law of ContractДокумент11 страницWeek 2 Law of ContractBISMARK ANKUОценок пока нет

- Spa Draft Brazil Ic45Документ10 страницSpa Draft Brazil Ic45Chandan JstОценок пока нет

- Excel Spreadsheet For Mergers and Acquisitions ValuationДокумент6 страницExcel Spreadsheet For Mergers and Acquisitions Valuationisomiddinov100% (2)

- Earn Out ValuationДокумент6 страницEarn Out Valuationpmk1978Оценок пока нет

- HBR Hannson Final Case AnalysisДокумент5 страницHBR Hannson Final Case AnalysisTexasSWO75% (4)

- CasoДокумент20 страницCasoasmaОценок пока нет

- Break Even Point ExampleДокумент10 страницBreak Even Point Examplerakesh varmaОценок пока нет

- 1 - TVM Student TemplatesДокумент16 страниц1 - TVM Student Templatesaazad3201Оценок пока нет

- Braasduasn Ma3 Sasdfsadfm 10Документ63 страницыBraasduasn Ma3 Sasdfsadfm 10Kia PottsОценок пока нет

- Cash - $3,220,400 Cost Cap: NPV: $127,568 See p175 of Using Excel For Business AnalysisДокумент9 страницCash - $3,220,400 Cost Cap: NPV: $127,568 See p175 of Using Excel For Business AnalysisUmair KamranОценок пока нет

- Chapter 5 - Cost-Volume-Profit Relationships: Click On LinksДокумент34 страницыChapter 5 - Cost-Volume-Profit Relationships: Click On LinksRena AfrianiОценок пока нет

- MKT 300 F2020 Customer Lifetime Value Calculator Update1Документ14 страницMKT 300 F2020 Customer Lifetime Value Calculator Update1Mit DaveОценок пока нет

- Capital Budgeting Part One May 2003Документ22 страницыCapital Budgeting Part One May 2003Sudiman SanexОценок пока нет

- Financial ModellingДокумент55 страницFinancial ModellingHimanshu DubeyОценок пока нет

- W10 Case Study Capital BudgetingДокумент2 страницыW10 Case Study Capital BudgetingJuanОценок пока нет

- Chapter 26Документ26 страницChapter 26sumesh1980Оценок пока нет

- 0 CFP Investment Cards (7!22!2007)Документ467 страниц0 CFP Investment Cards (7!22!2007)Arcely HernandoОценок пока нет

- Exercise 1Документ7 страницExercise 1yingxuennn1204Оценок пока нет

- Residual Income Valuation:: Valuing Common EquityДокумент39 страницResidual Income Valuation:: Valuing Common EquityAvinash DasОценок пока нет

- Principles of Managerial Finance: Time Value of MoneyДокумент45 страницPrinciples of Managerial Finance: Time Value of MoneyJoshОценок пока нет

- Residual Income Valuation:: Valuing Common EquityДокумент39 страницResidual Income Valuation:: Valuing Common EquitySehar Salman AdilОценок пока нет

- Lecture 2 - Basic of ExcelДокумент50 страницLecture 2 - Basic of Excelअभिजीत आखाडेОценок пока нет

- The Most Common Variable CostsДокумент6 страницThe Most Common Variable CostsShamarat RahmanОценок пока нет

- CH 006Документ26 страницCH 006melodie03100% (1)

- Chap 009Документ68 страницChap 009Mnar Abu-ShliebaОценок пока нет

- Accounting RatiosДокумент6 страницAccounting RatiosLulo NnenaОценок пока нет

- Time Value of Money - GitmanДокумент7 страницTime Value of Money - GitmanJasmine FalibleОценок пока нет

- Ac102 ch6 PDFДокумент16 страницAc102 ch6 PDFGopi KrishnaОценок пока нет

- Pharmaceutical Print PromoДокумент4 страницыPharmaceutical Print PromopremoshinОценок пока нет

- Thyroid FormulaДокумент1 страницаThyroid FormulapremoshinОценок пока нет

- Monte LevoДокумент44 страницыMonte LevopremoshinОценок пока нет

- Bilayered TABДокумент9 страницBilayered TABpremoshinОценок пока нет

- Session 1 Financial Accounting Infor Manju JaiswallДокумент41 страницаSession 1 Financial Accounting Infor Manju JaiswallpremoshinОценок пока нет

- BrinДокумент30 страницBrinpremoshinОценок пока нет

- EO 55 A Curfew Addendum DSДокумент2 страницыEO 55 A Curfew Addendum DSJi KimОценок пока нет

- 17th Jan Course Outline 2019 Batch Corporate Law II - January-June 2022Документ19 страниц17th Jan Course Outline 2019 Batch Corporate Law II - January-June 2022SHIVAM BHATTACHARYAОценок пока нет

- III - 5th Sem - AmalgamationДокумент34 страницыIII - 5th Sem - AmalgamationAysha RiyaОценок пока нет

- HCA Owned Doctors Hospital Attorney Brian Hansen EmailsДокумент14 страницHCA Owned Doctors Hospital Attorney Brian Hansen EmailsourinstantmatterОценок пока нет

- 46 - Estate of Martin Luther King, Jr. v. CBSДокумент2 страницы46 - Estate of Martin Luther King, Jr. v. CBSJay EmОценок пока нет

- DTC Agreement Between Zambia and SeychellesДокумент31 страницаDTC Agreement Between Zambia and SeychellesOECD: Organisation for Economic Co-operation and DevelopmentОценок пока нет

- Taxation 1 CasesДокумент249 страницTaxation 1 CasesRomero MelandriaОценок пока нет

- Nelson Laneway House Design CompetitonДокумент17 страницNelson Laneway House Design CompetitonBillMetcalfe67% (3)

- Receipt and Utilization of Foreign Contribution by Voluntary AssociationsДокумент43 страницыReceipt and Utilization of Foreign Contribution by Voluntary Associationsbipin012Оценок пока нет

- Code Description Remark 4 3 3 2 3 2 3Документ1 страницаCode Description Remark 4 3 3 2 3 2 3Aljo FernandezОценок пока нет

- Contractual CapacityДокумент14 страницContractual CapacitysteОценок пока нет

- Forum TestДокумент48 страницForum TestDamodharan RameshОценок пока нет

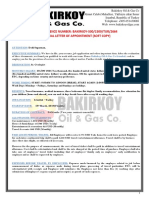

- Bakirkoy SoftДокумент3 страницыBakirkoy Softdslam saja50% (2)

- Evidence Rough DraftДокумент4 страницыEvidence Rough DraftShashwat mishraОценок пока нет

- Marina™ SID - SRB OASДокумент1 страницаMarina™ SID - SRB OASMichael AsuncionОценок пока нет

- BLT1 - Dec 6 - QuizДокумент1 страницаBLT1 - Dec 6 - QuizRoselle AnneОценок пока нет

- Guevarra vs. Eala A.C. No. 7136 August 1, 2007Документ1 страницаGuevarra vs. Eala A.C. No. 7136 August 1, 2007Renante NagaОценок пока нет

- Programme: Dr. Babasaheb Ambedkar Marathwada University, AurangabadДокумент2 страницыProgramme: Dr. Babasaheb Ambedkar Marathwada University, AurangabadNilesh RautОценок пока нет

- Core Characteristics of A CrimeДокумент27 страницCore Characteristics of A CrimepriscalauraОценок пока нет

- Essential Elements of A CrimeДокумент11 страницEssential Elements of A CrimeYash RaiОценок пока нет

- Change of Sex Is Not A Mere Clerical or Typographical Error But Is A Substantial Change. There Is Still No Law That Governs Change of SexДокумент2 страницыChange of Sex Is Not A Mere Clerical or Typographical Error But Is A Substantial Change. There Is Still No Law That Governs Change of SexJoesil Dianne SempronОценок пока нет

- What Is ADR? What Are The Types of ADR ?: Mediation Arbitration Neutral EvaluationДокумент9 страницWhat Is ADR? What Are The Types of ADR ?: Mediation Arbitration Neutral EvaluationNusrat ShoshiОценок пока нет

- Lof 2000Документ12 страницLof 2000seaguyinОценок пока нет

- AFFIDAVITДокумент2 страницыAFFIDAVITatty.elmanotarypublicОценок пока нет