Академический Документы

Профессиональный Документы

Культура Документы

Alejandrino V de Leon

Загружено:

MartinCroffsonОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Alejandrino V de Leon

Загружено:

MartinCroffsonАвторское право:

Доступные форматы

Alejandrino v.

De Leon

Quo warranto to annul the election of all or any one of the respondents as directors of Pampanga Sugar

Development Co. or Pasudeco and to declare petitioner as director.

P and R are stockholders of Pasudeco. A meeting was held to elect a new board and 9 Rs were voted,

each with more than 19K votes, with R Jose de Leon getting 19,907 votes, while P got only 14K votes.

However, 6k shares held by P given to him by 18 SHs were not accepted by the chairman and the

secretary for registration and election, reasoning that the 18 SHs previously executed pledges in favor of

Pambul Inc., whereby they granted the pledgee the right to vote the shares.

P alleged that Pambul was an alter ego of Pasudeco and its principal SH de Leon, that Pambul was

organized pursuant to a resolution of Pasudeco SHs as a financing corporation, that the SHs of Pasudeco

automatically became SHs of Pambul, that Pambul offered Pasudeco SHs loans with lenient terms, and

that as a result of the irrevocable proxies in the pledge agreements, only 2 families with only 30% of

Pasudeco outstanding capital stock have monopolized the directorship.

P alleges that irrevocable proxies are contrary to good morals and public policy and thus void or

revocable.

SC:

1. P did not adduce evidence to prove that irrevocable proxies were contrary to good morals or public

policy. The right of an SH to vote is inherent in ownership, and if the owner can dispose of the property

itself, it is apparent that he can dispose the right to manage it.

2. No allegation that the proxies were procured thru error, deceit, fraud or intimidation. The

circumstances of the case are not sufficient in law to vitiate or invalidate the proxies. The desire and

design of a majority of stockholders of a private corporation to control management and operation is

legitimate per se. The monopoly of corporations is not actionable per se. Also, the organization of

Pambul was accomplished by a vote of the majority of Pasudeco SHs. Stockholders of Pambul are free to

vote their shares.

3. P alleged that terms of loans were way of bribing SHs to vote for management. But to vote at SHs

meeting is not a political franchise and involves no public interest. It can no more be called bribery than

the payment by the purchaser of the price of goods he bought.

4. If proxies were given in consideration of pledge, in good faith without fraudulent intent, it cannot be

deemed immoral just because it offers a temptation to abuse power and to oppress minority SHs.

5. No SH is compelled to borrow money from and pledge his shares to Pambul. The benefits are mutual.

So long as management acts honestly, no one can question their acts, which are purely intra vires.

Вам также может понравиться

- S 1. Scope. - These Guidelines Shall Apply To The Registration of NewДокумент3 страницыS 1. Scope. - These Guidelines Shall Apply To The Registration of NewCzarina Danielle EsequeОценок пока нет

- Someone Else - Oscar AntonДокумент2 страницыSomeone Else - Oscar AntonMartinCroffsonОценок пока нет

- SEC MC 17 AFS DeadlinesДокумент3 страницыSEC MC 17 AFS DeadlinesjvpvillanuevaОценок пока нет

- SECMCNo18 1 PDFДокумент4 страницыSECMCNo18 1 PDFzelayneОценок пока нет

- 2020MCNo12 1 PDFДокумент2 страницы2020MCNo12 1 PDFMartinCroffsonОценок пока нет

- 2017MCno04 LatestДокумент1 страница2017MCno04 LatestFloisОценок пока нет

- SEC Guidelines Notice of Regular MeetingsДокумент1 страницаSEC Guidelines Notice of Regular MeetingsRia CostalesОценок пока нет

- 2020MCNo13 1 PDFДокумент2 страницы2020MCNo13 1 PDFMartinCroffsonОценок пока нет

- MC No. 11 Dated March 26, 2020Документ2 страницыMC No. 11 Dated March 26, 2020Roan Noreen DazoОценок пока нет

- 2020MCNo10-SEC Memorandum Circular No. 10, Series of 2020, Dated 20 March 2020Документ3 страницы2020MCNo10-SEC Memorandum Circular No. 10, Series of 2020, Dated 20 March 2020SGOD HRDОценок пока нет

- MC No. 7 Dated March 16, 2020Документ3 страницыMC No. 7 Dated March 16, 2020Roan Noreen DazoОценок пока нет

- SECMCNo18 1 PDFДокумент4 страницыSECMCNo18 1 PDFzelayneОценок пока нет

- Sec Memorandum Circular No. - : Provided, Further, That It Shall Be A Defense To Any Action Under ThisДокумент2 страницыSec Memorandum Circular No. - : Provided, Further, That It Shall Be A Defense To Any Action Under Thiscathy cenonОценок пока нет

- 2020MCNo09 1 PDFДокумент3 страницы2020MCNo09 1 PDFMartinCroffsonОценок пока нет

- Sec Memorandum Circular No. - : Provided, Further, That It Shall Be A Defense To Any Action Under ThisДокумент2 страницыSec Memorandum Circular No. - : Provided, Further, That It Shall Be A Defense To Any Action Under Thiscathy cenonОценок пока нет

- 2020 MCNo 06Документ9 страниц2020 MCNo 06Karren de ChavezОценок пока нет

- SEC FS Deadline ExtensionsДокумент3 страницыSEC FS Deadline ExtensionsBrunxAlabastroОценок пока нет

- Securities and Exchange Commission: PhilippinesДокумент3 страницыSecurities and Exchange Commission: PhilippinesMartinCroffsonОценок пока нет

- 2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFДокумент73 страницы2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFCris Anonuevo100% (1)

- 2019MCNo07 1 PDFДокумент19 страниц2019MCNo07 1 PDFMartinCroffsonОценок пока нет

- 2020MCNo12 1 PDFДокумент2 страницы2020MCNo12 1 PDFMartinCroffsonОценок пока нет

- Pursuant To SEC Notice Dated 18 March 2020Документ2 страницыPursuant To SEC Notice Dated 18 March 2020MartinCroffsonОценок пока нет

- SEC Guidelines Notice of Regular MeetingsДокумент1 страницаSEC Guidelines Notice of Regular MeetingsRia CostalesОценок пока нет

- GISДокумент25 страницGISnatalieОценок пока нет

- SEC MC 17 AFS DeadlinesДокумент3 страницыSEC MC 17 AFS DeadlinesjvpvillanuevaОценок пока нет

- MC No. 11 Dated March 26, 2020Документ2 страницыMC No. 11 Dated March 26, 2020Roan Noreen DazoОценок пока нет

- S 1. Scope. - These Guidelines Shall Apply To The Registration of NewДокумент3 страницыS 1. Scope. - These Guidelines Shall Apply To The Registration of NewCzarina Danielle EsequeОценок пока нет

- MC No. 7 Dated March 16, 2020Документ3 страницыMC No. 7 Dated March 16, 2020Roan Noreen DazoОценок пока нет

- 2020 MCNo 06Документ9 страниц2020 MCNo 06Karren de ChavezОценок пока нет

- 2020MCNo09 1 PDFДокумент3 страницы2020MCNo09 1 PDFMartinCroffsonОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Power TIB Draft FinalДокумент106 страницPower TIB Draft Finalanon-358293Оценок пока нет

- 247 795 2 PBДокумент13 страниц247 795 2 PBF LОценок пока нет

- Anti Corruption PrincipleДокумент1 страницаAnti Corruption PrincipleAbdellah EssonniОценок пока нет

- Social Responsibility Towards The ContractorsДокумент17 страницSocial Responsibility Towards The ContractorsMariella Angob67% (3)

- Iso 37001 Anti Bribery MssДокумент8 страницIso 37001 Anti Bribery MssDisha Shah0% (1)

- The Effects of Corruption On Political Development in SomaliaДокумент8 страницThe Effects of Corruption On Political Development in SomaliaAbidinaser WasugeОценок пока нет

- Wal-Mart de Mexico 1Документ4 страницыWal-Mart de Mexico 1braveusmanОценок пока нет

- Business Ethics in BangladeshДокумент14 страницBusiness Ethics in BangladeshAbrar Kamal Ami91% (22)

- Integrity and Ethics Module 12 Integrity Ethics and LawДокумент30 страницIntegrity and Ethics Module 12 Integrity Ethics and LawNur CaatoОценок пока нет

- The Media's Role in Curbing CorruptionДокумент34 страницыThe Media's Role in Curbing Corruptionjefribasiuni1517Оценок пока нет

- Chapter 4: Understanding The Global Context of BusinessДокумент23 страницыChapter 4: Understanding The Global Context of BusinessPradana MarlandoОценок пока нет

- Case Study:Kitchen Best: Ethics When Doing Cross-Boundary Business in Southern ChinaДокумент6 страницCase Study:Kitchen Best: Ethics When Doing Cross-Boundary Business in Southern ChinaSakibBinNavid33% (3)

- ETHICAL REVIEWS - Czarina M. Caballas BSCE 3DДокумент8 страницETHICAL REVIEWS - Czarina M. Caballas BSCE 3DCzarina CaballasОценок пока нет

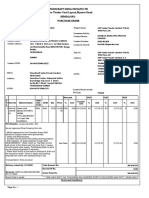

- Po 2798 Adp Green WallДокумент3 страницыPo 2798 Adp Green WallAbhimanyu SutharОценок пока нет

- Bauxite No 1 4 CompilationДокумент9 страницBauxite No 1 4 CompilationHidayah AbdullahОценок пока нет

- Gleeds: Anti-Bribery and CorruptionДокумент25 страницGleeds: Anti-Bribery and CorruptionTRIUMPH50000Оценок пока нет

- Case 2 3 Corruption - in - ChinaДокумент13 страницCase 2 3 Corruption - in - ChinaballckОценок пока нет

- Anti Bribery and Anti - Corruption Policy.Документ9 страницAnti Bribery and Anti - Corruption Policy.rajiv71Оценок пока нет

- Guide To Ethical Conduct 2012 FINAL ENGДокумент17 страницGuide To Ethical Conduct 2012 FINAL ENGMarco Tulio Holguín TapiaОценок пока нет

- Overview of Corruption and Anti Corruption in The Philippines PDFДокумент11 страницOverview of Corruption and Anti Corruption in The Philippines PDFERIC AREVALOОценок пока нет

- Chap05 Global Marketing 6eДокумент21 страницаChap05 Global Marketing 6eluckiestmermaid100% (2)

- Political Sci NewДокумент11 страницPolitical Sci NewMAGOMU DAN DAVIDОценок пока нет

- Sample Quotation Invitation Document (For Goods)Документ5 страницSample Quotation Invitation Document (For Goods)Nuzuliana EnuzОценок пока нет

- Reducing Corruption in Public Governance: Rhetoric To RealityДокумент18 страницReducing Corruption in Public Governance: Rhetoric To RealityK Rajasekharan100% (2)

- Sir Brits Mid Ex. QuestionДокумент5 страницSir Brits Mid Ex. QuestionCheche Gabato EspinosaОценок пока нет

- How Government Corruptions Can Affect The Program of DevelopmentДокумент5 страницHow Government Corruptions Can Affect The Program of DevelopmentJeremiah NayosanОценок пока нет

- Employee Code of ConductДокумент4 страницыEmployee Code of Conductmuna al harthyОценок пока нет

- IEEE Code of EthicsДокумент19 страницIEEE Code of EthicsAshwini MalcheОценок пока нет

- Charging Document Affidavit Micheal A Hanzman PDFДокумент3 страницыCharging Document Affidavit Micheal A Hanzman PDFAnonymous 2P5McgYtfОценок пока нет

- The Changing Face of Business Ethics in India-UpdatedДокумент133 страницыThe Changing Face of Business Ethics in India-Updatedgeetika mОценок пока нет