Академический Документы

Профессиональный Документы

Культура Документы

GB Recollected Qestions 2

Загружено:

mevrick_guyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

GB Recollected Qestions 2

Загружено:

mevrick_guyАвторское право:

Доступные форматы

GENERAL BANK MANAGEMENT (CAIIB)

TEST 02

CTDI

1) Correspondent banking relationship:

a) Account with each other is a must.

b) Can include forex services, trade references and LC

related business also

c) Need not comply to KYC / AML guidelines.

d) Does not allow use of branch network of the

correspondent bank.

2) Foreign Exchange markets are:

a) Regional markets

b) Domestic markets

c) Global markets

d) Localized exchange traded markets

3) Exchange Fluctuation Risk of ECGC:

a) Covers all exports payments upto six months period

b) Covers 100% exchange fluctuation of Indian exporters

c) Covers exchange fluctuation above 2% and upto 50% only

d) Covers exchange fluctuation above 2% & upto 35% only

4) Mr. Vipin wants to pay Rs 400,000 in cash to purchase

TC/Currency for private visit abroad? He wants to know

is the ceiling for payment in Rupees by cash, for

purchase of foreign exchange for any purpose.

a) Rs. 1 lac b) Rs. 5 lac c) USD 2000

d) Rs. 50,000

5) SWIFT is ______:

a) A mode of financing exporters swiftly

b) A mode of clearing house payment of cheques received

c) A telecommunication system globally used for

authenticated messaging

d) A mode of Telecommunication within the EURO ZONE

6) Forward contracts are the most common form of

Derivatives in India. They are:

a) Exchange traded contracts

b) Standardized contracts in fixed amounts and tenor

c) OTC derivatives with no standard for amounts and tenor

d) Not binding on the buyer

7) Mr.Amrit is your valued customer. He wants to know

the ceiling for availing foreign currency when travelling

abroad for business visits, irrespective of the number of

days. He does not have EEFC or RFC(D) or RFC

accounts.

a) USD 500 per day

b) USD 10,000 in all

c) USD 25,000

d) USD 100,000

8)____ is a NRI as per FEMA.

a) An Indian who proceeds abroad for definite stay with

relatives on a holiday

b) A resident Indian who is a citizen of Bangladesh and has

an Indian passport.

c) An Indian citizen working abroad on assignments with

foreign government, UNO or IMF

d) An Indian who is employed in India, but his son is working

abroad.

9) Mandatory features of a Letter of Credit:

a) Must have an applicant and a beneficiary

b) Should have an advising bank and a confirming bank

c) Should be confirmed to be operative

d) Must be confirmed by the reimbursing bank

10) Veena Jayaram has Rs 4.5 crores in her SB account.

She is proceeding to Switzerland for a holiday. What is

the ceiling for availing foreign currency for such a

private visit abroad?

a) Rs. 1 lac

b) USD 1 lac

c) USD 10,000

d) USD 1 million

11) _____ does not closely relate to Emotional

Intelligence.

a) Empathy

b) Self Awareness

CTDI, SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH

c) Self Regulation

d) Self Esteem

12) Quote Bill selling rate for import bill under LC, if

interbank market is 44.67/ 69 and a margin of 0.20% is to

be loaded in the rate (rounded to 0025 paise).

a) 44,7800

b) 44,6000

c) 44,7600

d) 44,6900

13) Eric Berne has propounded the concept of ______

which operates at inter-personal level.

a) Locus of Control

b) Transactional Analysis

c) Need Satisfaction

d) None of these

14) Quote TT buying forward rate for delivery full Oct.

2006, if spot USD / INR is 44.30/32 and premiums are,

Spot Sept. 0450/065, Spot Oct., 06/08 and Spot Nov. 07/10

(ignore margins):

a) 44.36 b) 44.3850

c) 44.39

d) 44.3450

15) Working hours of workers are regulated by:

a) Industrial Disputes Act 1947

b) Factories Act 1948

c) Workmen Compensation Act 1923 d) None of the above

16) Knowledge Management most closely refers to:

a) Creating knowledge workers in the organisation

b) Sharing the knowledge through quality circles

c) Capturing tacit working of people for future use

d) Providing information to management for decision making

17) _____ is not a part of Job Analysis.

a) Job Enrichment

b) Job Description

c) Job Specification

d) Job Evaluation

18) Mr.Dev is a type A personality. He _____:

a) Does several things at a time

b) Has control over time

c) Appears to take things easy

d) None of these

19) What will be TT selling rate for GBP / INR, if USD /

INR is 44.25/27 and GBP/ USD is 1.7828/ 38, and a

margin of 0.15% is to be charged?

a) 78.9700

b) 79.0900

c) 78.7700

d) 79.0000

20) A spot FX deal is done on Wednesday 25-1-2006.

Which will be the date of delivery, considering that all

days of the month are working days, except Thursday

26-1-2006, which is a national holiday on account of

Republic Day?

a) 27-1-2006 b) 28-1-2006 c) 30-1-2006 d) 31-1-2006

21) Mr.Armani is a Lottery afficiando.He wants to buy

lottery ticket abroad for USD1000.What is the ceiling for

availing foreign currency for remittance towards

purchase of lottery tickets?

a) USD, 5000

b) USD 10,000

c) USD 25,000

d) Not permitted (None of these)

22) ERG theory has been propounded by:

a) Clayton Alderfer

b) Eric Berne

c) Frederick Herzberg

d) Abraham Maslow

23) Quote TT rate to a foreign correspondent maintaining

a Vostro Account with your Overseas Branch, for

funding the account, if Interbank rate for USD is 44.7250/

7350 and a margin of 0.05% is to be applied (rounded to

0005 paise):

a) 44.7250

b) 44.7375

c) 44.7575 d) 44.7025

24) Mrs.Narayanan wants to send a Deepavali gift to her

daughter in UK. What is the ceiling for availing foreign

currency for remittance toward gift or donations?

a) USD 500 per month

b) USD 5,000 per year

c) USD 5,000 per month d) USD 1,00,000 per year

25) Which one of the following statements is false?

a) Employees feedback is useful for the organisation

GENERAL BANK MANAGEMENT (CAIIB)

TEST 02

CTDI

b) There is no need to develop a questionnaire for the

organisation as they are available in the market which can be

used across organisations

c) The survey has to be planned well, if not it can be counter

productive

d) None of these

26) The compensation paid to the Managerial positions

is commonly referred as:

a) Wages b) Salary c) Remuneration

d) Fees

27) Message flow structure of our RTGS is:

a) V-shaped b) Y-Shaped c) L-Shaped

d) T-Shaped

28) Which one of the following statements is false?

a) New skills can easily be blended with the old ones

b) Job analysis is the basic framework for most of the HRD

Systems

c) Career Planning is a motivational exercises

d) Performance Appraisal, Training and Development are

critical elements in the entire HRD System

29) Johari Window is most useful for:

a) Understanding others b) Self-Awareness

c) Working in Teams

d) Improving inter-personal relations

30) Closed and Open Stored Value Card is also known

as:

a) Electronic Purse

b) Electronic Wallet

c) Both a and b

d) Magnetic Strip Card

31) In ISDN based communication, BRI connectivity

supports:

a) Two 64 kpb B- channels

b) One 128 kbp B channels

c) One 16 kbp D channels

d) Both a and c above

32) Which one of the following statements is true?

a) Performance appraisal system cannot be widely used for

employees development as it lacks objectivity.

b) There is no need to make the appraisal system open and

transparent, it may spoil relations at work place

c) Appraisal system generally suffers from halo effect

d) None of these

33) According to Hertzbergs Two factor Motivation

theory, ______is a Motivator.

a) Responsibility

b) Company policy and administration

c) Interpersonal relations

d) None of the above

34) Which one of the following statements is true?

a) Pedagogy and androgogy mean the same thing

b) Training plan is a summary of all training needs identified

c) It is better to do all the training in house

d) Evaluation of training is an important step but it may not be

possible

35) Which one of the following statements is true?

a) People component of an organisation has always received

due attention

b) Management theories and approach to people

management are very closely related

c) Scientific Management approach is the foundation of

todays concept of Human Resource Management

d) Personal Management and HRD are synonymous terms

36) The role of Project Manager is to plan, co-ordinate

and control the project terms efforts. The Project

Manager is expected to _____:

(i) Have flexibility and adaptability to changing situations

(ii) Manage Data Warehouse

CTDI, SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH

(iii) Have understanding Technical problems and design

details

a) (i) and (ii)

b) (i) and (iii) c) (ii) & (iii) d) (i), (ii) & (iii)

37) Organizations must transform themselves into ebusiness to expand markets, improve efficiency and

retain customers. The dimensions on which e-business

is carried out should be:

a) SCM b) CRM

c) E-Commerce

d) All of these

38) A Data Warehouse Architecture (DWA) is a way of

representing the overall structure of data. Which of the

following part/s may be included in the architecture of

DWA? (select the answer which in your option is true)?

i) Data Access Layer

ii) Data Directory (Metadata) Layer

iii) Data Staging Layer

a) (i) and (iii)

b) (i) ,(ii)and (iii) c) (ii) & (iii) d) (i) & (ii)

39) The SQL (Structure Query Language) is referred as

query Language for relational databases. Which of the

following part/s does the SQL have? ( Select the answer

which in your opinion is true)?

i) Data Definition Language (DDL)

ii) Data Manipulation Language (DML)

iii) Embedded DML

a) (i) & (ii)

b) (i) & (iii)

c) (i),(ii) & (iii) d) (ii) & (iii)

40) VSAT system enables to carryout:

a) Electronic funds transfer

b) EFT / POS

c) Asynchronous Transfer Mode (ATM) traffic

d) All of the above

41) The class of the IP Address and the subnet mask

determine:

a) As to which part belongs to the network address

b) As to which part belongs to the node address

c) Both a and b

d) None of these

42) In Prototype:

a) The user specifies the entire system

b) The user specifies part of the system

c) The user describes what the system is going to be used

for

d) All of the above

43) The major types of information systems are (Select

the answer which in your opinion in true).

(i) Transaction Processing System (TPS) (ii) Management

Information System (MIS) (iii) Decision Support System

(DSS).

a) (i) & (ii)

b) (i) & (iii) c) (i), (ii) & (iii)

d) (ii) & (iii)

44) Corporate Office of a Bank wants to send and receive

messages through network. To ascertain integrity,

authenticity and non-repudiation of the messages the

bank should use:

a) Digital Signature

b) Symmetric Cyphers

c) Rivest Cyphers

d) All of the above

45) Marketing consists of certain inter related concepts

which focus on:

a) Customers, advertising and promotion

b) Customers and a set of management techniques

c) Pricing and product development

d) Packaging and product development

46) A Bank wants to maintain a single RDBMS, but wants

to restrict access to all the data in the database by users.

This can be done by Database Administrator by:

a) Scheme Definition

b) Granting of authorization for data access

c) Storage structure and access method

d) Integrity constraints specification

47) Marketing management is a process involving:

GENERAL BANK MANAGEMENT (CAIIB)

TEST 02

CTDI

a) Analysis, planning, implementation and control

b) Goods, services and ideas

c) Stimulation of demand for the companys product and

satisfaction to the customer

d) Satisfaction to the customers involved and the personnel

dealing with customer market

48) In Centralized Banking Solution ( CBS), the Banks

are facing problem of reliable connectivity. To overcome

this problem banks should:

a) Keep server at every branch

b) Restrict to limited services through CBS

c) Have standby connectivity

d) All the above

49) Marketing concept rests on 4 main pillars which are:

a) Large market target sales, profitability and product

innovation

b) Target market, customer needs, integrated marketing and

profitability

c) Target customer group, customer needs, selling orientation

and social marketing

d) Value, cost, satisfaction of customers and profitability

50) Several branches of a Nationalized Bank are being

provided SFMS server, which requires Digital Certificate.

The branches are operating on 8 to 8 basis. To overcome

the problem of giving digital certificates to every

concerned official, the bank should get digital certificate:

a) In the name of branch and concerned officials should use

b) In the name of Branch Manager and concerned officials

should use

c) For the server and concerned officials should use.

d) None of these

51) A Bank has got demographic data and want to

classify the data into different population segment

depending upon their buying habits. Which data mining

tool can be used by the bank?

a) Clustering

b) Forecasting

c) Classification

d) Both a and c

52) A Bank wants to use back up technique to provide

for ongoing operation of a LAN when the file server fails.

The bank should use:

a) Disk arrays

b) H Backup c) Disk Duplexing

d) Disk mirroring

53) The three alternatives in collecting data for marketing

research to:

a) Sampling, questionnaire and door to door survey

b) Books and publications, interviewing of customers &

experiment

c) Economic surveys, industry reports and library reference

d) Observation, experiment and survey

54) What are the factors that influence a customers

Choice of Bank?

a) Safety, return and quality of services

b) Location, range of products and return

c) Quality of service, personalized service and location

d) Return, location, quality of service and range of service

55) What is the term given to a bank that serves a small

market segment not being served by the larger banks?

a) Market leader

b) Market follower

c) Market nicher

d) Market challenger

56) Servucation Process means:

a) Survival against competition

b) Qualilty of service to the customers

c) Offering range of service to meet the needs of various

customers

CTDI, SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH

d) Simultaneous occurrence of production and consumption

57)____ is a name, sign or symbol intended to identify

the goods / services of one seller and differentiate them

from those of the competitors .

a) Attribute b) Brand

c) Product

d) Ambassador

58) A customer judges quality not only on the basis of

technical quality of the product services package but

also by its functional quality. This is known as:

a) Triangle of service theory of Karl Albrecht

b) Services marketing model of Gronross

c) Interactive Marketing model of Leonard and Berry

d) Services quality model of Gronross

59) Service quality can be judged based on ____ (Select

the option which is most appropriate)

a) Courtesy, problem solving ability and office environment

b) Speed and range of service

c) Appearance of staff, speed and accuracy of processing of

transaction and courtesy

d) Reliability assurance and empathy

60) Which of the following is not a base for segmenting

consumer market?

a) Demographic segmentation

b) Psychographic segmentation

c) Behavioural segmentation

d) Physiological segmentation

61) Which of the following terms is not associated with

customer relationship marketing?

a) Pure competition

b) Pure monopoly

c) Oligopoly

d) Monopolistic competition

62) Which of the following terms is not associated with

customer relationship marketing?

a) Suspects

b) Prospects

c) Disqualified prospectus d) Productive Prospectus

63) Secondary data are data that:

a) Already exist elsewhere, having been collected elsewhere

b) Available with a company

c) Available from govt. publications

d) Collected from market place

64-67) Read the following case carefully Q. 64 to 67 are

based on this case. Examine the various alternatives

provided and select the answer / alternative which you

consider to be the most appropriate.

An exporter M/s XYZ Ltd. dealing in exports of Woolen

garments for last 3 years, with estimated sales of Rs. 5

crores during the year approaches the bank and

requests for sanction of export credit facilities. The bank

sanctions export credit limits as under:

PCL / FBP / FBN Rs. 100 lacs

Sub-limit: PCL (Rs. 50 lacs) Margin 20% on FOB value.

FBP (Rs. 50 lacs) Margin 10% on invoice value

FBN could be allowed upto Rs. 100 lacs at 5% margin on

invoice value.

Bank charges interest on PCL at 8% up to 180 days,Post

shipment 8% on sight documents & 8.5% for DA documents

up to 90 days and 9.50% thereafter and OD interest at 12%.

The company receives an export order for USD 125,000 from

M/s Monte-carlo Japan Division for export of Ladies

sweaters. The prices are on C&I basis. On 9-12-2005 when

the USD / INR rate was 44.50, he approaches the bank for

releasing PCL, which is released as per terms of sanction.

On 9-1-2006, the exporter submits to the bank, export

documents, drawn on sight basis for USD 124,000 drawn on

C&I basis, and requests the bank to purchase the documents

GENERAL BANK MANAGEMENT (CAIIB)

TEST 02

CTDI

and afford credit to companys current account. The bank

purchases the documents and credits / debits the current

account, after adjustment of PCL and interest dues under this

order. The prevailing exchange rate of the day, were as

under:

TT Buying 44.30, TT selling 44.50 Bill Buying 44.25 and Bill

Selling 44.55

The documents are realized on 7-2-2006, value 6-2-2006

after deduction of foreign bank charges of USD 200. The

bank adjusts the outstanding post shipment advance against

the bill.

64) What will be the amount of interest recovered, if any,

on account of adjustment of PCL, at the time of purchase

of export bill?

a) Nil

b) Rs. 7,607

c) Rs. 27,059

d) Rs. 8,659

65) What is the amount of post shipment advance

allowed by the Bank under FBP, for the bill submitted by

the exporter?

a) Rs. 49,38,300

b) Rs. 49,78,125

c) Rs. 50,00,000

d) Rs. 54,87,000

66) What is the amount that the bank allows as PCL to

the exporter against the given export order, considering

the profit margin of 10% and estimated insurance cost of

15%?

a) Rs. 55,62,500

b) Rs. 3782500

c) Rs. 40,60,625

d) Rs. 44,50,000

67) What will be the applicable rate at which the Bank

would have purchased the export documents submitted

by M/s XYZ Ltd.

a) Rs. 43.30

b) Rs. 44.30 c) Rs. 44.55 d) Rs. 44.25

68-72: Read the following case carefully. Q. No. 6872

are based on this case. Examine the various alternative

provided for answers, keeping in view the facts of the

case and select the answer / alternative which you

consider closely reflects the relationship between the

two officials.

Mr. Mohan Chandra, Assistant General Manager incharge of Credit at Zonal Office of a bank was an

autocratic boss and wanted to have full control over all

the decisions and activities. Four officers viz. Mr.

Swaminathan, Mr. Ghosh, Mr. Mehta and Mr. Patil were

working under him and directly reporting to him. Mr.

Swaminathan quite,systematic and efficient quoting all

the rules and regulations correctly and giving the

rationale while proposing a decision. Mr. Chandra

generally used to clear his cases without much of

queries. Mr. Ghosh,new to credit department,did not

have much exposure in the credit area. He used to seek

guidance and suggestions from his colleagues and

boss. Thus,he was prone to frequent firings from the

boss for not being able to justify his proposed

decision.This used to depress him.Mr. Mehta was a

strong man. He used his commonsense for his

decisions and was not much bothered about the

procedures and guidelines.An argumentative man he

used to take a stand on his proposed action. He felt that

the knowledge of Mr. Mohan Chandra is only superficial.

He used to challenge him for differing from his proposed

decision. Mr. Patil was another character. He was very

casual in his approach and was marking the time till

retirement. He used to be always in past glory and

condemning any thing and every one including the

CTDI, SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH

decisions taken by his boss. He used to hide his

inefficiency by pointing out others mistakes.

68) Between Mr. Mohan Chandra and Mr. Mehta from the

point of view of Mr. Mehta:

a) I am ok, you are ok

b) I am ok, you are not ok

c) I am not ok, you are ok d) I am not ok, you are not ok

69) Between Mr. Mohan Chandra and Mr. Patil from the

point of view of Mr. Patil.

a) I am ok, you are ok

b) I am ok, you are not ok

c) I am not ok, you are ok d) I am not ok, you are not ok

70) Between Mr. Mohan Chandra and Mr. Swaminathan

from the point of view of Mr.Swaminathan:

a) I am ok, you are ok

b) I am ok, you are not ok

c) I am not ok, you are ok d) I am not ok, you are not ok

71) Between Mr. Mohan Chandra and Mr. Ghosh from the

point of view of Mr. Ghosh:

a) I am ok, you are ok

b) I am ok, you are not ok

c) I am not ok, you are ok d) I am not ok, you are not ok

72) Between Mr. Mohan Chandra and Mr. Swaminathan

from the point of view of Mr. Mohan Chandra:

a) I am ok, you are ok

b) I am ok, you are not ok

c) I am not ok, you are ok d) I am not ok, you are not ok

73-74: Read the following case carefully. Q. No. 73 and

74 are based on this case. Examine the various

alternatives provided for answers to the questions given

below, keeping in view the facts of the case and select

the answer / alternative which you consider to be the

most appropriate.

Mr. Satpal Singh joined a bank as a specialized officer as

economist. He got first promotion quite early alongwith his

batch mates and his performance as well as motivation level

was quite high. Being youngest in his batch he was expecting

to reach to the level of DGM to head the Research

Department of the bank. He used to have difference of

opinion with his boss Mr. Maheshwari, both on official and

other issues. Mr. Maheshwari was not happy with the

behaviour of Mr. Singh and used to criticize him publicly. Mr.

Singh was trying to ignore his comments and was

concentrating on his job performance. Since both Mr.

Maheshwari and Mr. Singh belonged to the specialized

department there was no chance for getting rid of each other.

When the time for next promotion came, Mr. Singh was

hopeful to get the promotion because of his performance. To

his surprise, he was not selected. He came to know

informally that his Performance Appraisal Report (PAR) was

not upto the mark. He was thoroughly disappointed but

continued to perform. He got an opportunity in another bank

and decided to join at the same level losing all the benefits of

his seniority.

73) The above de-motivational situation has been best

explained by:

a) Maslows Need Hierarchy theory

b) Herzbergs Two Factors Theory

c) Vrooms Expetancy Model

d) Adams Equity Theory

74) The above issue pre-dominantly related to:

a) Inter-personal relations

b) Performance Appraisal System

c) Job Rotation Policy

d) Promotion Policy

75-76: Read the following case carefully. Q. No. 75 and

76 are based on this case. Examine the various

alternatives provided for answers to the questions given

below, keeping in view the facts of the case and select

GENERAL BANK MANAGEMENT (CAIIB)

TEST 02

CTDI

the answer / alternative which you consider to be the

most appropriate.

Mr. Ramesh Kumar a post graduate in Mathematics has

joined as a PO in a public sector bank. Though good at

Computers, and getting offers for computer related jobs from

small firms ,he did not take up because of lack of job security

and stability. Initially he was posted in the Computer Cell at

the Zonal Office of the bank for a period of 3 years and his

work was highly appreciated. He was given advanced

training in computer programming and networking. He used

enjoying his job thoroughly. Due to banks rotation policy Mr.

Kumar was posted in the general administration to deal with

the staff discipline. He was not given a computer. He has

started losing his interest in the job and was missing from his

seat and was generally found in the Computer Cell learning

some advanced computer skills.

75) The above issue mainly relates to:

a) Job security and stability

b) Lack of recognition and appreciation

c) Placement Policy

d) Lack of interest in new job

76) Pre-dominant need of Mr. Kumar is:

a) Social Need

b) Safety Need

c) Self-Actualization Need

d) Recognition Need

Read the following case carefully. Q.77-80 are based on

this case. Examine the various alternatives for the

answers to the questions given below and select the

answer, which you consider to be the most appropriate.

a) The clock struck 10. Three men entered the branch. They

turned out to be IS Auditors. Without exchanging normal

pleasantries, one of them demanded a copy of Total Branch

Automation (TBA) operational guidelines for Database

Administrator (DBA). DBA started wondering what guidelines

or manual they were demanding? He rushed to Branch

Managers cabin, but Branch Manager was also not aware of

such manual. Branch Manger told DBA to enquire from Indira

Madam, the oldest and senior most officer of the Branch.

Indira Madam was also not aware of the rare manual. The

Branch Manager took initiative and asked IS auditors about

the details of the manual. With the help of IS Auditor the

manual was located in a cupboard of Branch Managers

cabin. A little later one IS Auditor asked DBA for software

details. Branch Manager and DBA were fully prepared for this

query. They had already informed computer software expert

a day in advance about the audit, DBA requested the auditor

to wait for 10 minutes, because, software expert was

expected to come in 10 minutes. IS Auditor was also

informed that here nobody is expert on the software package

and so all queries are resolved by vendors man IS Auditor

was surprised to note that the outsider is working as System

Administrator of the branch, without being aware of branch,

without being aware of branch working procedures.

The branch was not able to produce invoices to the server,

PCs and printers etc. no one knew anything. The whole

branch was struggling to produce the required details and

documents to the IS Auditor. The IS Auditor also demanded

to show him the details of insurance Policies and Annual

Maintenance Contracts (AMC) of hardware. It appeared that

AMC/Insurance was not renewed (as per Indira Madam)

A little later, the software expert appeared. The software

expert started replying the query of IS Auditors and DBA

came back to his seat. After some time IS Auditor asked DBA

what the software expert was doing alone in the server room

CTDI, SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH

without him. DBA replied that he must have been rectifying

some problem whenever we get stuck up, we call him and he

is co-operative and we trust him.

77) In computerized branches:

a) Vendors man should be allowed to work as System

Administrator

b) The branch officials cant be system expert

c) Outsiders should not be allowed to work in server room in

isolation

d) Software vendor / engineer should work with DBA

password.

78) Whenever IS Audit conducted at branch level:

a) IS Auditor should carry required manual with them

b) Branch people should be informed in advance about the

requirements of IS Auditors

c) Branch should provide all the required documents

d) None of these

79) In the present case:

a) The Head Office has not made mandatory to follow

guidelines

b) Branch people were not properly trained for working in

computerized environment

c) There was total negligence on the part of branch officials

d) The auditors are unnecessarily demanding several

documents.

80) The AMC and Insurance were not renewed for two

years. This shows:

a) Negligence on the part of Branch Officials

b) Negligence on the part of IS Auditor

c) Negligence on the part of Branch Manager

d) All of the above

Read the following case carefully. Q. No. 81-85 are based

on this case. Examine the various alternatives provided

for answers to the following questions and select he

answer / alternatives which you consider to be the most

appropriate.

Progressive Bank decided to introduce a few new retail

segment products for both deposits and loans with catchy

names like Griha Laxmi Deposit, Shishu Bhavishya Deposit,

Sunehra Nivas Grilha Rin and Chal Mere Sathi Vehicle Loan.

Catchy hoardings, leaflets and posters were prepared,

displayed and liberally distributed in the market places.

However, the growth of business in the new products was

very poor.

The Top Management of the Bank appointed a consultancy

firm to find out the reasons for such poor performance. The

consultancy firm visited some branches and found that when

people, being attracted by such ad campaign, approached

the counters of different branches, their experience was

unhappy. At some branches employees were not conversant

with the schemes and at some others, the requisite stationery

were not available. The consultancy firm then informed the

Top Management of the Bank that merely developing some

new products and giving wide publicity will have little impact

on business growth. To get the best results, out of any new

scheme, the Bank Management should take steps to sell the

schemes to the operating staff, offer them adequate training

about the operational details and ensure adequate supply of

the requisite stationery before launching any new product

and also certain incentives for bringing business under the

new schemes.

81) Which department has failed in their duties for which

the products have failed?

GENERAL BANK MANAGEMENT (CAIIB)

TEST 02

CTDI

a) Publicity Department

b) Banking Operations Deptt.

c) HRM Department

d) Marketing Department

82) What kind of staff profile is necessary for success of

any new product?

a) Positive attitude, willing to learn and a sense of belonging

to the organization

b) Knowledgeable, career aspirant and locally influential staff

c) Public relation quality, impressive appearance & well

dressed

d) Marketing orientation, good communication skills,

awareness about the marketing policies of the organization

and positive attitude

83) What is required to be ensured for successful

implementation of any product in any bank?

a) A professionally managed marketing department

b) A strong and effective HRM Department

c) An effective performance review system

d) A good employee relationship in the organization

84) Which of the following factors is not relevant to the

success of any new product?

a) Achievement Motive of staff

b) Performance linked career devl. plan of the organization

c) Payment policy for business growth

d) Selling of the new products to the staff at concessional

rates

85) What are the prerequisites for success of any new

product(s)?

a) Involvement of the Top Management

b) Effective publicity of the products

c) Customer Education

d) Marketing of the products to the internal customers.

Read the following case carefully. Q. No. 86-87 are based

on this case. Select the answer / alternative which you

consider to be the most appropriate.

A bank company had organized a seminar of its marketing

executives to deliberate and arrive at consensus on the

definition of services. After very intensive discussions, the

team could not agree to one agreed definition. They were

divided into two groups. One group defined services as

follows: A service is any act or performance that one party

can offer to another that is essentially intangible and does not

result in the ownership of anything; its production may or may

not be tied to a physical product.

The other group proposed the following definition: A service

is an activity or series of activities of more or less intangible

nature that normally, not necessarily, take place in

interactions between the customer and service employees

and / or physical resources or goods and / or systems of the

service provider, which are provided as solution to customers

problems.

86) Which are the common characteristics of services

highlighted in both the definition?

a) Intangible, an activity, two parties are involved

customers and service providers

b) Core value produced in buyer/ seller interaction, no

transfer of ownership and cannot be kept in stock.

c) Customers participation in production, production and

consumption are simultaneous processes.

d) A series of activities, provided as solution to customers

problem and physical resources / goods

87) None of the definition is original, definitions of the

first and second groups has been given respectively by:

CTDI, SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH

a) Kotler and Bloom

b) Kotler and Gronross

c) Kotler and Bloom & Gronross d) Kotler and Keeth Crosier

88-90: Read the following situation carefully and answer

Q. No. 88 to Q. 90 by selecting the alternative which you

consider to be the most appropriate out of the

alternatives given:

Marketing

Marketing

Pricing Implication

Area

Objective

Product

Improved quality Higher cost -> price rise

acceptance

or lower profit

Advertising

Stronger support

Increased

advertising

and

Budget -> Price increase

Promotion

or lower profit

Consumers Greater

Increased

advtg.

/

/ Users

acceptance

Publicity effort i.e. higher

distribution cost -> higher

price / lesser profit

88) Who has propounded this approach?

a) J.J. Ward

b) T.K. Sinha Committee

c) Sukhamoy Chakraborty Committee d) S.J. Bedekar

89) Which marketing area should have priority to a

banker?

a) Product and distribution

b) Advertising, promotion and consumers / users

c) Distribution and consumers / users

d) Product and consumers / users

90) Which marketing objectives are aimed at greater

visibility?

a) Improved quality and greater customer acceptance

b) Improved quality and stronger support

c) Additional selling points and greater customer acceptance

d) Stronger support and additional selling points.

91) Which Committee had recommended use of technical

apparatus and systems in banks?

a) Ranga Rajan b) Vaz c) Kohli

d) Dr. Reddy

92) What was the objective of use of computers in

banks?

a) To better customer service

b) To better productivity

c) To better housekeeping

d) All the above

93) How are the computers helpful in achieving the

objectives by banks?

a) They have a high operating speed for handling lot of work

in short time

b) They are reliable in accuracy for bringing efficiency in

performance

c) They are cost effective and improve profitability

d) All the above

94) What type of computer system is used for ledgers

positing?

a) Stand alone b) Multi user

c) WAN

d) None

95) How data processing is handled in Advanced Ledger

Posting Machines?

a) At a centralised place

b) In the computer being used

c) At multi point situations

d) At the networking place

96) Where is data processing handled in Multi-user

computer net working system?

a) At a centralised place

b) In the computer being used

c) At multi point situations

d) At the networking place

97) How the different staff members work on multi user

computers system?

GENERAL BANK MANAGEMENT (CAIIB)

TEST 02

CTDI

a) They are provided an independent stand -alone computer

system

b) They transfer or share their data with other staff members

at regular intervals

c) They work on separate terminals connected with the main

computer

d) Any of the above

98) Which of the followings are in-built security features

in computers used in branches?

a) Transaction tracking

b) Pass world and locking

c) Data recovery and back ups

d) Disk duplex and mirror

e) All the above

99) What are the features of computers being used in

branches?

a) Data processing is fast

b) Software used is simple to operate

c) Staff members can easily handle without acquiring

specialization in computers

d) All the above

100) Which system is mainly used in branch level

computers?

a) Windows

b) Linux

c) Unix

d) None

CTDI, SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH

CTDI

GENERAL BANK MANAGEMENT (CAIIB)

TEST 02

GENERAL BANK MANAGEMENT

RECOLLECTED (TEST - 02)

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

CTDI WISHES YOU ALL THE BEST

CTDI, SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH

Вам также может понравиться

- Yuva Savings Bank AccountДокумент1 страницаYuva Savings Bank Accountmevrick_guyОценок пока нет

- Banking Glossary 2011Документ27 страницBanking Glossary 2011Praneeth Kumar NaganОценок пока нет

- NIOS Culture NotesДокумент71 страницаNIOS Culture Notesmevrick_guy0% (1)

- 9th Issue E-Gyan May, 2014 PDFДокумент17 страниц9th Issue E-Gyan May, 2014 PDFmevrick_guyОценок пока нет

- 47-Corporate Salary Package - CSPДокумент3 страницы47-Corporate Salary Package - CSPmevrick_guyОценок пока нет

- A StudyДокумент12 страницA Studymevrick_guyОценок пока нет

- 8 To 8 Functionality: Section Section DescriptionДокумент7 страниц8 To 8 Functionality: Section Section Descriptionmevrick_guyОценок пока нет

- 01.10 RemittancesДокумент40 страниц01.10 Remittancesmevrick_guyОценок пока нет

- 1st Issue E-Gyan, July-2013Документ13 страниц1st Issue E-Gyan, July-2013mevrick_guyОценок пока нет

- 01 21-RBIremittanceДокумент11 страниц01 21-RBIremittancemevrick_guyОценок пока нет

- IBPS Interview Prep - Graduation Related Questions BE, BCom, BAДокумент33 страницыIBPS Interview Prep - Graduation Related Questions BE, BCom, BAmevrick_guyОценок пока нет

- 2nd Issue E-Gyan, October-2013Документ28 страниц2nd Issue E-Gyan, October-2013mevrick_guyОценок пока нет

- 01.15 Bod EodДокумент25 страниц01.15 Bod Eodmevrick_guy100% (1)

- 01.20 Government BusinessДокумент48 страниц01.20 Government Businessmevrick_guyОценок пока нет

- 01.17 Currency ChestДокумент10 страниц01.17 Currency Chestmevrick_guyОценок пока нет

- 01.19 Safe CustodyДокумент9 страниц01.19 Safe Custodymevrick_guyОценок пока нет

- 01.13 ClearingДокумент38 страниц01.13 Clearingmevrick_guy0% (1)

- 01.15 Bod EodДокумент25 страниц01.15 Bod Eodmevrick_guy100% (1)

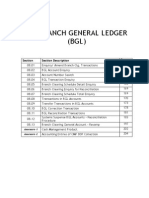

- 01 08-BGLДокумент40 страниц01 08-BGLmevrick_guy100% (2)

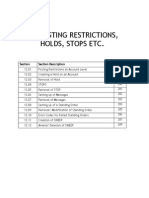

- 01.12 Posting RestrictionsДокумент14 страниц01.12 Posting Restrictionsmevrick_guyОценок пока нет

- 01.14 Maker Checker FunctionalitiesДокумент19 страниц01.14 Maker Checker Functionalitiesmevrick_guyОценок пока нет

- 01.09-User System ManagementДокумент12 страниц01.09-User System Managementmevrick_guyОценок пока нет

- 01 02-CifДокумент25 страниц01 02-Cifmevrick_guyОценок пока нет

- 01.01 IntroductionДокумент16 страниц01.01 Introductionmevrick_guyОценок пока нет

- 01 06-CashДокумент21 страница01 06-Cashmevrick_guyОценок пока нет

- 01.05 Transaction ProcessingДокумент23 страницы01.05 Transaction Processingmevrick_guyОценок пока нет

- 01.03-Deposit Accounts OpeningДокумент38 страниц01.03-Deposit Accounts Openingmevrick_guy0% (1)

- 01.04-DepositAccounts Other FunctionalitiesДокумент30 страниц01.04-DepositAccounts Other Functionalitiesmevrick_guyОценок пока нет

- 00.01 PrefaceДокумент1 страница00.01 Prefacemevrick_guyОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Business Field EssayДокумент4 страницыBusiness Field Essayapi-242023925Оценок пока нет

- Strategic Management MCQ and Answers For MBA StudentsДокумент11 страницStrategic Management MCQ and Answers For MBA Studentsmarieieiem100% (3)

- A Case Study On RIL vs. RNRL DisputeДокумент6 страницA Case Study On RIL vs. RNRL DisputeAparajita SharmaОценок пока нет

- Accounting VoucherДокумент2 страницыAccounting VoucherRavanan v.sОценок пока нет

- Software Project Management Unit-4 - 6 PDFДокумент2 страницыSoftware Project Management Unit-4 - 6 PDFgambler yeagerОценок пока нет

- Graded Questions Solutions 2023Документ27 страницGraded Questions Solutions 20232603803Оценок пока нет

- The 60 Minute Startup PDFДокумент3 страницыThe 60 Minute Startup PDFtawatchai limОценок пока нет

- Lukoil A-Vertically Integrated Oil CompanyДокумент20 страницLukoil A-Vertically Integrated Oil CompanyhuccennОценок пока нет

- Income Taxation Quick NotesДокумент3 страницыIncome Taxation Quick NotesKathОценок пока нет

- QuizBee Final Questions PDFДокумент111 страницQuizBee Final Questions PDFJenny LariosaОценок пока нет

- Basic AccountingДокумент50 страницBasic Accounting_AislamОценок пока нет

- Basics of Supply Chain Management Business ConceptsДокумент7 страницBasics of Supply Chain Management Business ConceptsrsdeshmukhОценок пока нет

- WEEK 6 Seminar Q&AsДокумент26 страницWEEK 6 Seminar Q&AsMeenakshi SinhaОценок пока нет

- Hapter 10: © 2008 Prentice Hall Business Publishing Accounting Information Systems, 11/e Romney/SteinbartДокумент134 страницыHapter 10: © 2008 Prentice Hall Business Publishing Accounting Information Systems, 11/e Romney/SteinbartRoristua PandianganОценок пока нет

- KotakДокумент2 страницыKotakRandhir RanaОценок пока нет

- Y Combinator S Pocket Guide To Seed Fundraising 1692908038Документ1 страницаY Combinator S Pocket Guide To Seed Fundraising 1692908038DanОценок пока нет

- BSBMGT608 Student Assessment Tasks 2020Документ45 страницBSBMGT608 Student Assessment Tasks 2020Chirayu ManandharОценок пока нет

- C V Umair ShahidДокумент5 страницC V Umair ShahidHaris HafeezОценок пока нет

- Alternative Methods For Thetreatment of Non Recyclable WasteДокумент33 страницыAlternative Methods For Thetreatment of Non Recyclable WastesiyamsankerОценок пока нет

- Effect of Merger and Acqusition On The Financial Performance of Deposit Money Banks in Nigeria (A Study of Access Bank PLC)Документ50 страницEffect of Merger and Acqusition On The Financial Performance of Deposit Money Banks in Nigeria (A Study of Access Bank PLC)Feddy Micheal FeddyОценок пока нет

- B2C Cross-Border E-Commerce Export Logistics ModeДокумент7 страницB2C Cross-Border E-Commerce Export Logistics ModeVoiceover SpotОценок пока нет

- FOODIGOДокумент11 страницFOODIGONancy DhanukaОценок пока нет

- Acct Statement XX0012 25052023Документ5 страницAcct Statement XX0012 25052023JunoonОценок пока нет

- Sam en VattingДокумент37 страницSam en VattingthomasvandenboschОценок пока нет

- Consent Form CTOS V4Документ1 страницаConsent Form CTOS V4shahila shuhadahОценок пока нет

- BridgestoneДокумент1 страницаBridgestoneRam JainОценок пока нет

- 3 - Solution Guide - Short Term Budgeting AssignmentДокумент3 страницы3 - Solution Guide - Short Term Budgeting AssignmentEdward Glenn BaguiОценок пока нет

- Senior Project Engineering Manager in Chicago IL Resume Richard PrischingДокумент2 страницыSenior Project Engineering Manager in Chicago IL Resume Richard PrischingRichardPrischingОценок пока нет

- Management Accounting Summer 20091Документ18 страницManagement Accounting Summer 20091MahmozОценок пока нет

- How To Plan For Growth Peter BartaДокумент122 страницыHow To Plan For Growth Peter BartaOlga MolocencoОценок пока нет