Академический Документы

Профессиональный Документы

Культура Документы

Frequently Asked Questions

Загружено:

mevrick_guy0 оценок0% нашли этот документ полезным (0 голосов)

91 просмотров7 страницatm

Оригинальное название

MOBICASHFAQ

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документatm

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

91 просмотров7 страницFrequently Asked Questions

Загружено:

mevrick_guyatm

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 7

Frequently Asked Questions

1) What is State Bank MobiCash?

State Bank MobiCash is a prepaid virtual mobile wallet on mobile phones. The

product is offered by State Bank. It helps you to do banking transactions like Deposit

and Withdrawal of money, Fund transfers, bill payment, prepaid mobile top-up,

DTH top-up, etc.

2) How Mobile Wallet is different from mobile banking?

Mobile Banking is a channel which is linked to the customer Banks account,

whereas Mobile Wallet is a prepaid payment instrument. Any person without a Bank

account may also apply for a Mobile Wallet.

3) How do I get client/application download into my mobile?

Send a SMS MOBICASH to 9870888888 / 9967878888. You will receive a return

SMS containing a link. Access the link using your GPRS connection. You will be

able to download the Mobile Wallet application. The application may also be

downloaded from the M/s. Oxigen website www.myoxigen.com and also through

other devices using Bluetooth or data cable. You may also visit nearest Customer

Service Point (CSP) of M/s. Oxigen and he would help in downloading the

application. In case the application cannot be downloaded for any reason, the

Services of State Bank MobiCash Mobile Wallet may be used through SMS.

4) What is CSP?

CSP is Customer Service Point appointed by the Business Correspondence or third

party agents. They are the primarily mom and pop stores owners, small retail store

owners or sellers of telecom vouchers available near your locality.

5) After I have installed the application, how do I activate it in order to access my

Mobile Wallet account?

Fill the Wallet Account Opening Form (AOF) for MobiCash at CSP.

You need to visit the nearest linked branch with original KYC documents as

mentioned in AOF for your KYC approval.

As the KYC is done by the branch official, you will receive a default MPIN and

Wallet I/D. Your mobile number is your Mobile Wallet number.

Your Wallet gets activated

Change your MPIN before using any of the Mobile Wallet Services.

6) What is MPIN?

MPIN is a six (6) digits Mobile Wallet Personal Identification Number or password.

MPIN will be required to carry out every transaction. Default MPIN needs to be

changed before using the service or carrying out any transaction.

7) What if I forget my MPIN?

You need to call Customer Care Number of SBI customer care 080 2659 9990 or

1800 425 3800 (Toll free). Customer Care Executive will ask for your personal

details for confirming your identity and will forward your request for new MPIN. You

1

Frequently Asked Questions

will be receiving a default MPIN through a message. Please change your MPIN

before proceeding to do any transaction.

8) What will happen if I enter wrong MPIN? What if I enter wrong MPIN

repetitively?

If you enter the wrong MPIN, your transaction will fail. If you enter MPIN wrongly for

3 consecutive times, wallet will be blocked for a day (24 Hours). After 2 consecutive

blockages, your wallet will be suspended. You need to generate a new MPIN.

9) Can I change my M-PIN?

Yes, the MPIN can be changed any time. However, to use the application for the

first time, it is mandatory for you to change the default MPIN and set your own

MPIN.

10) Is it necessary for the MPIN to be numeric?

The MPIN has to be numeric only.

11) How much time will it take to generate a new MIPN?

Once you lodge a request, you will be provided a reference number, which would be

l acted upon within 24 hours to 72 hours. Please quote your reference number for

future communications.

12) How many users can use this application on a particular mobile phone?

Only one user may register and access his Mobile Wallet on a particular mobile

phone.

13) Can any of my SBI accounts be attached to this wallet?

Since it is a prepaid payment instrument, no account can be attached to this wallet.

14) What are the documents required for obtaining a State Bank MobiCash?

Original documents for proof of identity and address as mentioned in AOF should be

submitted for activation of Wallet. These will be verified by the designated bank

official at the linked branch.

15) What are State Bank MobiCash Mobile Wallet opening charges?

The Wallet opening charges are Rs. 60 which is payable at CSP and the initial cashin while opening the wallet is Rs. 200. Hence the total amount payable at the time of

opening the wallet is Rs 260.

16) Is the account opening charges of Rs. 60 refundable?

Account opening charges of Rs. 60 is non-refundable once the wallet is activated.

17) How much amount will be refunded to me in case of non activation of Mobile

Wallet?

In case of non activation of Mobile Wallet, the entire amount will be refunded.

2

Frequently Asked Questions

18) How will CSP identify the customer during refund process in case AOF is

rejected?

For refund, CSPs will ask the customer for the receipt provided to him at the time of

submitting the AOF along with the OTP sent to the customer during notification of

AOF rejection.

19) When can I use the initial wallet balance of Rs. 200?

Once activated, the initial wallet balance of Rs. 200 can be used for transactional

purpose.

20) What is the minimum balance to be maintained?

No minimum balance has been prescribed at present.

21) What are the Service Charges for State Bank MobiCash?

The schedule of charges for various services is available under Annexure IV.

22) Do I need to pay the service charges even if I try to avail any service but the

transaction fails / dont proceed?

No. You will be charged only for successful transactions.

23) Do I need to pay the service charges separately to CSPs if I am availing any

service assisted by CSP?

In case of Cash out, you will get the net amount after deducting the service charges

from Cash out amount. However, for other services, the charges will be deducted

from the Wallet balance.

24) After activation of my services, how can I top-up my Mobile Wallet?

It can be topped up at CSPs locations. You need to go to the nearest CSP for Topup and submit cash. You can also top up your State Bank MobiCash through Banks

account using mobile banking. We are in the process of enabling top up through

Banks account using channels e.g., internet banking and Self Service Kiosk (SSK).

25) Is this service available 24x7 under State Bank MobiCash?

Services delivered at CSP will be available as per their outlet timings. However,

other services on Wallet are available round the clock.

26) How do I locate the CSPs in my area providing Mobile Wallet?

State Bank MobiCash is being offered at CSP locations of Ms/. Oxigen which may

be identified by State Bank MobiCash logo. Customer may also find the locations

from Oxigen web site http://www.myoxigen.com or may also call SBI customer

care 080 2659 9990 or 1800 425 3800 (Toll free).

27) Will State Bank MobiCash Mobile Wallet application run on all types of mobile

phones?

3

Frequently Asked Questions

The State Bank MobiCash Mobile Wallet application runs on all JAVA enabled as

well as Android application based Mobile Handsets. Your mobile connection should

be enabled for GPRS. Applications for other mobile handsets are being developed.

Meanwhile, the customers who do not have java/ GPRS enabled handsets may use

the services under State Bank MobiCash using SMS.

28) I am not able to download State Bank MobiCash application. How do i get the

service?

You may use the service over SMS however the business rules (i.e. the transaction

limit etc.) may vary. For details regarding Business rules, please see Annexure- III

29) How do I use SMS based transaction?

A list of key words for SMS based transactions is enclosed in Annexure I.

30) What is State Bank Mobile Wallet Number?

The Mobile Wallet Number is the Mobile Number on which the service has been

registered.

31) What is State Bank Mobile Wallet I/D?

It is a twelve digits numeric number advised while activating the wallet. It may be

used for future references.

32) Can I open a different wallet with same KYC documents?

No. As per RBI guidelines on issuance of Mobile Wallet, one applicant can obtain

one mobile wallet only.

33) Is there any time limit within which I need to visit the bank for AOF

submission?

You can visit the linked Branch and submit AOF and KYC document during business

hours

34) What happens if I dont report to the Nodal Branch along with the AOF and

KYC documents?

, your Mobile Wallet account would be activated, only after you submit the original

documents for KYC verification.

35) How much memory space is required to install the mobile banking

application?

Approximately, 550 KB of free memory space is required to install this application.

36) How do I setup/activate GPRS on my mobile?

Please contact your Mobile Service Provider for providing the GPRs facility on your

Mobile phone.

37) Can I use the Wallet for on-line transactions?

Presently, the Mobile Wallet is not enabled for e-Commerce.

4

Frequently Asked Questions

38) Should Contact Centre log in a complaint if it is a 3rd party call (other than the

wallet owner)

No. The call should be from Mobile Wallet holder only.

39) How does change of address is recorded?

As per the present process, there is no provision of recording the change of address.

This is similar to other prepaid instrument/ mobile connection.

40) Why should I Cash in?

Cash in amount will be used for carrying out day to day transactions like fund

transfer, bill pay, mobile/DTH top-up etc. That stored value can also be used for

Cash Withdrawal at CSPs.

41) Am I eligible to earn interest on the Mobile Wallet balance?

The Mobile Wallet is a prepaid account. Therefore, the balance does not earn any

interest.

42) What is OTP?

OTP is One Time Password (Six digits numerical) which is generated for carrying

out the CSP assisted transactions e.g. Cash-out. OTP is valid only for 1 hour after

that it expires and you may require a new OTP for carrying the transaction.

43) What if the OTP is not received by me?

You may send the repeat request for OTP and you would receive the original OTP

along with the original time stamp.

44) If I want to continue with the transaction after the expiry of OTP, what should I

do?

You need to generate a new OTP for carrying out the transaction.

45) I have requested for the OTP but have not used it. However, my balance

enquiry/mini statement shows debit for the transaction amount.

The OTP is expected to be generated before carrying out the transaction as such

the wallet is debited as soon as the request for OTP is received by the system.

46) I have generated OTP and fund has been debited from my account. However, I

have not done any transaction at CSP using OTP. What should I do now?

If you have not done any transaction, after the expiry of OTP, the transaction will be

reversed and the debited amount will be credited back.

47) What if I need to carry out two different transactions requiring OTP?

For different transactions of different amounts, you will receive two different OTPs.

However, if you need to carry out two different transactions for the same amount,

you have to generate second OTP, only after using the first OTP.

5

Frequently Asked Questions

48) How can I cash out / withdraw the balance from my Mobile Wallet?

For cashing out/ withdrawing cash, you need to go to a CSP. You need to generate

the OTP for Cash Out and advise your mobile number, amount and OTP to CSP for

cash out. CSP will deliver the cash for a successful transaction. The applicable

charges would be deducted.

49) Is it mandatory to use Mobile Money Identifier (MMID) for using fund transfer

facility in a Mobile Wallet to transfer fund to any Bank account?

Yes, it is mandatory. The remittance is possible only with a valid MMID and the

Mobile number

50) I dont have the information about MMID of the beneficiary bank account. What

should I do?

You need to obtain the MMID of the beneficiary bank account. If the beneficiary does

not have MMID, he needs to apply to his / her bank to obtain MMID first.

51) Can I view the transactions relating to my account?

Mini statement allows you to view a summary of your last 5 transactions.

52) What are the facilities available under Bill Pay?

Currently, payment of Mobile bill is available. However, in future, other bills like

electricity bill, Telephone bill, etc. will be introduced.

53) Will I be charged for paying bills through SBI MobiCash?

You may have to pay the required service charges for bill payment. Please refer to

Annexure IV dealing with service charge

54) If I opt for payment of a bill over mobile, later on, can I pay in person?

Yes, you can pay your bills using the traditional channels even if you opt for paying it

using Mobile Wallet.

55) Do I have to pay the entire bill amount?

You can make a part or full payment, depending upon biller concerned..

56) If there is a problem with my mobile wallet, where should I go or whom shall I

contact?

You may call on a Customer Care Number of SBI customer care 080 2659 9990 or

1800 425 3800 (Toll free) or write to us on feedback.mobicash@sbi.co.in.

57) What should I do if my request is not addressed within the timeline?

For any complain registered with Customer care, you will be provided a complaint

reference number. If the issue is not addressed within the prescribed time limit, you

can write to us on feedback.mobicash @sbi.co.in.

58) What if I lose my mobile phone?

You should block your SIM immediately by calling the telecom service provider.

6

Frequently Asked Questions

59) What do I do when I change my handset or mobile number? Do I need to

register again?

a. If you want to change your handset, download the wallet application in your new

mobile phone and start using the wallet using the existing MPIN.

b. If your want to change your Mobile Number, you need to register again and fresh

wallet will be issued. The balance in your existing wallet can be transferred to the

new wallet. If you desire you can close the wallet. Please ensure that you have

withdrawn/ transferred the balance before closing.

60) What happens if I dont use the service, for a period of time, will the wallet be

deactivated?

If the wallet is not used for 6 months, the account will be treated as

suspended/dormant.

If the account remains dormant for one year, the wallet is closed and the balance

in the wallet is forfeited.

However, the suspended/dormant wallet account may be re-activated through

our call centre within the specified time limit.

61) How to close the Mobile Wallet account?

For closing your Mobile Wallet, you need to visit nearest CSP and ask for a closure

form. The form may also be downloaded from www.statebankofindia.com or

www.sbi.co.in. After filling the form, submit it to the CSP. You are advised to

withdraw entire balance before closing your wallet.

62) May I go to any CSP to close my Mobile Wallet?

Yes. You may visit any CSP for closing your wallet.

63) What will happen to my balance if I close the State Bank Mobile Wallet?

You are advised to with draw or transfer the entire balance before you close your

Mobile Wallet.

64) Is there a fee for obtaining refunds/ full Cash out on the balance on the State

Bank MobiCash?

The normal Cash Out charges would apply.

Вам также может понравиться

- Generate Multiple Demand Drafts from Deposit AccountДокумент40 страницGenerate Multiple Demand Drafts from Deposit Accountmevrick_guyОценок пока нет

- Flexcube Atm Interface: ISO 8583 (1993) MESSAGE FORMATДокумент25 страницFlexcube Atm Interface: ISO 8583 (1993) MESSAGE FORMATAjay Kaushik50% (2)

- Payment MethodДокумент19 страницPayment MethodOliviaDuchess100% (1)

- 01 02-CifДокумент25 страниц01 02-Cifmevrick_guyОценок пока нет

- 01.13 ClearingДокумент38 страниц01.13 Clearingmevrick_guy0% (1)

- 01.12 Posting RestrictionsДокумент14 страниц01.12 Posting Restrictionsmevrick_guyОценок пока нет

- IBPS Interview PrepДокумент33 страницыIBPS Interview Prepmevrick_guyОценок пока нет

- MTN MobileMoney GuideДокумент20 страницMTN MobileMoney GuideOluwaphemmy SobakinОценок пока нет

- Transaction Processing: Cash, Cheques, TransfersДокумент23 страницыTransaction Processing: Cash, Cheques, Transfersmevrick_guyОценок пока нет

- 01.19 Safe CustodyДокумент9 страниц01.19 Safe Custodymevrick_guyОценок пока нет

- Unit 2 - BilpДокумент14 страницUnit 2 - BilpYashika GuptaОценок пока нет

- Currency Chest Operations GuideДокумент10 страницCurrency Chest Operations Guidemevrick_guyОценок пока нет

- 01.20 Government BusinessДокумент48 страниц01.20 Government Businessmevrick_guyОценок пока нет

- 01.03-Deposit Accounts OpeningДокумент38 страниц01.03-Deposit Accounts Openingmevrick_guy0% (1)

- First Bank September 1st To January 23Документ16 страницFirst Bank September 1st To January 23Samuel OshinnugaОценок пока нет

- Disrupting The $8T Payment Card Business:: The Outlook On Buy Now, Pay Later'Документ34 страницыDisrupting The $8T Payment Card Business:: The Outlook On Buy Now, Pay Later'Tawanda Ngowe0% (1)

- Deposit Accounts - Joint Accounts and NomineesДокумент30 страницDeposit Accounts - Joint Accounts and Nomineesmevrick_guyОценок пока нет

- Savings AccountДокумент27 страницSavings AccountkjlgururajОценок пока нет

- 01.14 Maker Checker FunctionalitiesДокумент19 страниц01.14 Maker Checker Functionalitiesmevrick_guyОценок пока нет

- Ofs ResponsesДокумент30 страницOfs Responsesnana yaw0% (1)

- Mobile Money Account Guide 1Документ84 страницыMobile Money Account Guide 1Martins Othniel100% (1)

- FAQ On Mobile Banking ServicesДокумент8 страницFAQ On Mobile Banking Servicessimar raiОценок пока нет

- Mobicash PptfranchiseeДокумент20 страницMobicash Pptfranchiseeapi-374418427Оценок пока нет

- Mobile Banking FaqДокумент4 страницыMobile Banking FaqSenthil KumarОценок пока нет

- FAQs on IBG transfers for individualsДокумент2 страницыFAQs on IBG transfers for individualsHafiz AbdulОценок пока нет

- Customer Faqs in MindДокумент5 страницCustomer Faqs in MindAnkit JaiswalОценок пока нет

- BM Remit FAQs enДокумент7 страницBM Remit FAQs enopera miniОценок пока нет

- Customer'S Faqs For Interbank Mobile Payment Service (Imps) : October, 2010Документ6 страницCustomer'S Faqs For Interbank Mobile Payment Service (Imps) : October, 2010Ram MurthyОценок пока нет

- MDB Digital Savings Account FAQsДокумент4 страницыMDB Digital Savings Account FAQsKamrul islam ShohagОценок пока нет

- NIC ASIA Mobile Banking FAQДокумент4 страницыNIC ASIA Mobile Banking FAQrezina pokhrelОценок пока нет

- Interbank Mobile Payment ServiceДокумент24 страницыInterbank Mobile Payment ServiceThilaga Senthilmurugan100% (1)

- FAQ Mobile BankingДокумент5 страницFAQ Mobile BankingAshif RejaОценок пока нет

- Imps Faqs Final 1Документ3 страницыImps Faqs Final 1murli-krishna-9540Оценок пока нет

- Digital Banking UpdatesДокумент46 страницDigital Banking Updatesvivek_anandОценок пока нет

- NetBanking FAQДокумент3 страницыNetBanking FAQTanzeem AhmedОценок пока нет

- E-banking services and features offered by banksДокумент11 страницE-banking services and features offered by banksvivek kumarОценок пока нет

- MBanking FAQs-EnglishДокумент21 страницаMBanking FAQs-EnglishMugenyiОценок пока нет

- Mobile Banking Guidelines To CustomerДокумент3 страницыMobile Banking Guidelines To CustomerVaibhav BulkundeОценок пока нет

- State Bank FreedoM FAQsДокумент20 страницState Bank FreedoM FAQssree8884Оценок пока нет

- Community Services-11832Документ12 страницCommunity Services-118322BA19EC113 VijayОценок пока нет

- State Bank Freedom Mobile Banking App SMS USSD ServicesДокумент5 страницState Bank Freedom Mobile Banking App SMS USSD ServicesDev YadavОценок пока нет

- Immediate Payment Service FAQsДокумент3 страницыImmediate Payment Service FAQsVirendra kambliОценок пока нет

- MCB Mobile FAQsДокумент5 страницMCB Mobile FAQsQasim Abbas BhattiОценок пока нет

- Iob4704how To Avail Door Step BankingДокумент5 страницIob4704how To Avail Door Step BankingAbhishek LenkaОценок пока нет

- SBI MobiCash user manual covers fund transfer, cash withdrawal, rechargesДокумент6 страницSBI MobiCash user manual covers fund transfer, cash withdrawal, rechargesBijendra SinghОценок пока нет

- QR PH P2P FAQsДокумент5 страницQR PH P2P FAQsArman D. VillarascoОценок пока нет

- What Is Mobile Banking?Документ5 страницWhat Is Mobile Banking?Md. Arfat Uddin MamunОценок пока нет

- Interbank Mobile Payment ServiceДокумент2 страницыInterbank Mobile Payment ServicePrincePSОценок пока нет

- LPB Team AssignmentДокумент26 страницLPB Team AssignmentMukul PОценок пока нет

- Mobile Banking Brochure EnglishДокумент7 страницMobile Banking Brochure EnglishFoez LeonОценок пока нет

- FAQ iOS V 8 QatarДокумент10 страницFAQ iOS V 8 QatarFalmin RehanОценок пока нет

- Unified Payments InterfaceДокумент29 страницUnified Payments InterfaceBhaskar KothariОценок пока нет

- IMPS FAQsBankers PDFДокумент5 страницIMPS FAQsBankers PDFAccounting & TaxationОценок пока нет

- Real-Time Payment System IMPS - Future & ChallengesДокумент27 страницReal-Time Payment System IMPS - Future & ChallengesRahul AminОценок пока нет

- The Accounts of The Customers of Five Associate Banks Should Be Treated As Other Bank AccountДокумент6 страницThe Accounts of The Customers of Five Associate Banks Should Be Treated As Other Bank AccountEr Mosin ShaikhОценок пока нет

- SBI Traning ReportДокумент66 страницSBI Traning ReportAmardeep SinghОценок пока нет

- To View The Live Member Banks For Imps Click. HereДокумент4 страницыTo View The Live Member Banks For Imps Click. Heremanoj AgarwalОценок пока нет

- PM Street Vendor'S Atmanirbhar NidhiДокумент4 страницыPM Street Vendor'S Atmanirbhar NidhicloudОценок пока нет

- Chapter 3. L3.2. Kinds of Trends in BankingДокумент4 страницыChapter 3. L3.2. Kinds of Trends in BankingvibhuОценок пока нет

- Modes and processes of electric money transfers through NEFT, RTGS, IMPS and UPIДокумент18 страницModes and processes of electric money transfers through NEFT, RTGS, IMPS and UPIkanikaОценок пока нет

- Product Disclosure Sheet: Page 1 of 4 (PDS027/REV201115)Документ4 страницыProduct Disclosure Sheet: Page 1 of 4 (PDS027/REV201115)Lipsin LeeОценок пока нет

- FAQs UPI Payments SystemДокумент5 страницFAQs UPI Payments SystemumeshrrОценок пока нет

- Project On IMPS (Immediate Payment Service)Документ46 страницProject On IMPS (Immediate Payment Service)Nayeem100% (1)

- UnionPayQRPayFAQ 20210607Документ2 страницыUnionPayQRPayFAQ 20210607el toramanОценок пока нет

- Welcome To You All in Our PresentationДокумент16 страницWelcome To You All in Our PresentationChowdhury Mahin AhmedОценок пока нет

- Citizens Charter Cbi19Документ20 страницCitizens Charter Cbi19Movies BlogОценок пока нет

- Moot Proposition (Inductions 2023)Документ6 страницMoot Proposition (Inductions 2023)Dev SharmaОценок пока нет

- Mobile Banking ManualДокумент70 страницMobile Banking ManualRelie ArambuloОценок пока нет

- Mobile Banking FAQ Updated PDFДокумент11 страницMobile Banking FAQ Updated PDFP N rajuОценок пока нет

- CA Project On Internet BankingДокумент18 страницCA Project On Internet BankingTejal KirpekarОценок пока нет

- RBI E-Mandate Guidelines FAQsДокумент3 страницыRBI E-Mandate Guidelines FAQsDjxjfdu fjedjОценок пока нет

- High-Yield Savings Account DetailsДокумент5 страницHigh-Yield Savings Account DetailsClaudette LopezОценок пока нет

- State Bank MobiCash Terms & ConditionsДокумент7 страницState Bank MobiCash Terms & ConditionsgovindsrОценок пока нет

- M2N12500728Документ1 страницаM2N12500728nareshreddy_nare2987Оценок пока нет

- Review of Some Online Banks and Visa/Master Cards IssuersОт EverandReview of Some Online Banks and Visa/Master Cards IssuersОценок пока нет

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaОт EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaОценок пока нет

- Banking Glossary 2011Документ27 страницBanking Glossary 2011Praneeth Kumar NaganОценок пока нет

- 2nd Issue E-Gyan, October-2013Документ28 страниц2nd Issue E-Gyan, October-2013mevrick_guyОценок пока нет

- 01 21-RBIremittanceДокумент11 страниц01 21-RBIremittancemevrick_guyОценок пока нет

- A StudyДокумент12 страницA Studymevrick_guyОценок пока нет

- BOD EOD ProcessesДокумент25 страницBOD EOD Processesmevrick_guy100% (1)

- Top 10 Economic Challenges for Modi GovtДокумент17 страницTop 10 Economic Challenges for Modi Govtmevrick_guyОценок пока нет

- NIOS Culture NotesДокумент71 страницаNIOS Culture Notesmevrick_guy0% (1)

- Yuva Savings Bank AccountДокумент1 страницаYuva Savings Bank Accountmevrick_guyОценок пока нет

- 47-Corporate Salary Package - CSPДокумент3 страницы47-Corporate Salary Package - CSPmevrick_guyОценок пока нет

- State Bank Learning Centre e-gyan Vol 1 Key HighlightsДокумент13 страницState Bank Learning Centre e-gyan Vol 1 Key Highlightsmevrick_guyОценок пока нет

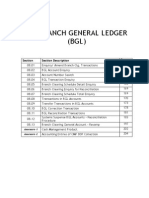

- 8 To 8 Functionality: Section Section DescriptionДокумент7 страниц8 To 8 Functionality: Section Section Descriptionmevrick_guyОценок пока нет

- BOD EOD ProcessesДокумент25 страницBOD EOD Processesmevrick_guy100% (1)

- 01.09-User System ManagementДокумент12 страниц01.09-User System Managementmevrick_guyОценок пока нет

- Manage cash workflow and transactionsДокумент21 страницаManage cash workflow and transactionsmevrick_guyОценок пока нет

- 00.01 PrefaceДокумент1 страница00.01 Prefacemevrick_guyОценок пока нет

- 01 08-BGLДокумент40 страниц01 08-BGLmevrick_guy100% (2)

- 01.01 IntroductionДокумент16 страниц01.01 Introductionmevrick_guyОценок пока нет

- HABIB METROPOLITAN BANK (LTD)Документ51 страницаHABIB METROPOLITAN BANK (LTD)Aroosh Mehmood100% (10)

- Your Current Account TermsДокумент28 страницYour Current Account TermsaОценок пока нет

- Deaf TOURISM GR12 QP SEPT 2019 - English - 2Документ25 страницDeaf TOURISM GR12 QP SEPT 2019 - English - 2Lulamela Enkosi HabeОценок пока нет

- Orl 43 $150 GCДокумент2 страницыOrl 43 $150 GCCyberSoftОценок пока нет

- Chapter 5 - Using CreditДокумент48 страницChapter 5 - Using CreditALEXIA TANG DAI XIANОценок пока нет

- Pfin 6th Edition Billingsley Solutions ManualДокумент25 страницPfin 6th Edition Billingsley Solutions Manualsmiletadynamia7iu4100% (20)

- Sample Project ReportДокумент75 страницSample Project ReportAbhimanyu Chaudhary100% (1)

- pdfGenerateNewCustomer SAOAO1020618564Reciept SAOAO1020618564ResidentAccountOpenFormДокумент11 страницpdfGenerateNewCustomer SAOAO1020618564Reciept SAOAO1020618564ResidentAccountOpenFormpavan reddyОценок пока нет

- Challan FormДокумент1 страницаChallan FormYou YouОценок пока нет

- FASTAGДокумент5 страницFASTAGKavithaОценок пока нет

- Banker'S Indemnity Policy: Digital TrainingДокумент4 страницыBanker'S Indemnity Policy: Digital TrainingAjay Singh PhogatОценок пока нет

- PNC - Consumer Schedule of Service Charges and FeesДокумент4 страницыPNC - Consumer Schedule of Service Charges and FeesblarghhhhОценок пока нет

- MCB Annual Report-2011Документ284 страницыMCB Annual Report-2011yousaf120Оценок пока нет

- Cash Offers and Payment Options for Eligible BuyersДокумент3 страницыCash Offers and Payment Options for Eligible BuyersMero PaОценок пока нет

- Sbi Gopal Ganj SagarДокумент42 страницыSbi Gopal Ganj SagarRanjeet RajputОценок пока нет

- Datenformate Sepa Kunde Bank enДокумент511 страницDatenformate Sepa Kunde Bank enItsmevenki SmileОценок пока нет

- Schedule of Charges Combined Pos Pgmarch 14Документ2 страницыSchedule of Charges Combined Pos Pgmarch 14Tasbeeh EleОценок пока нет

- Revolut - Double Spends, Withheld Funds, Failed Top-Ups/paymentsДокумент17 страницRevolut - Double Spends, Withheld Funds, Failed Top-Ups/paymentsfoobarОценок пока нет

- Ent600 - A2 New Product Development (12.12.2021)Документ32 страницыEnt600 - A2 New Product Development (12.12.2021)Aliff haiqalОценок пока нет

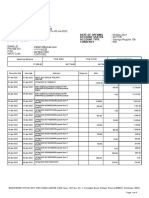

- Statement of Account: Date of Opening Account Status Account Type Currency Ms. Punam DeviДокумент4 страницыStatement of Account: Date of Opening Account Status Account Type Currency Ms. Punam DeviPunam PanditОценок пока нет

- Client Manual Consumer Banking - CitibankДокумент29 страницClient Manual Consumer Banking - CitibankNGUYEN HUU THUОценок пока нет

- Apostille/Certificate of Authentication RequestДокумент2 страницыApostille/Certificate of Authentication RequestAudwin CainesОценок пока нет

- EFT Payments and Receipts Ex. 21 - 30Документ14 страницEFT Payments and Receipts Ex. 21 - 30Derick du ToitОценок пока нет

- GCash QR Requirements by Business TypeДокумент4 страницыGCash QR Requirements by Business TypeAhn DohОценок пока нет