Академический Документы

Профессиональный Документы

Культура Документы

Ibovespa Performance, 2009

Загружено:

John Paul GroomИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ibovespa Performance, 2009

Загружено:

John Paul GroomАвторское право:

Доступные форматы

The Brazilian Stock Market Performance, 2009

A calendar year is to some extent an arbitrary period of time in reviewing economic

trends. For instance, the Brazilian stock market grew by 82.7% in 2009 using the

Ibovespa as our guide. If we had chosen a 15 month period, growth would have been

closer to 40%. However, a year end is an accepted point of time in which we can review

comparative performance and arrive at some conclusions.

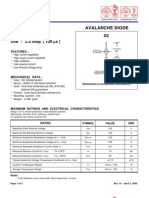

Figure 1.

Stock Market Performances, 2009

200%

180%

160%

140%

120%

100%

80%

60%

31

31

28

31

30

31

30

31

31

30

31

30

31

/1

/1

/2

/3

/4

/5

/6

/7

/8

/9

/1

/1

/1

/2

0/

1/

2/

/2

/2

/2

/2

/2

/2

/2

/2

2/

DJI 00 FTSE CAC 40 ^HSI IBOV S&P500

20

20

20

20

00

00

00

00

00

00

00

00

08

09

09

09

9

Source: Yahoo Finance

As seen previously in this blog, the Brazilian stock market fell earlier (starting in June

2008) and farther than any other of those under discussion here, and thus the

recuperation from these lower numbers contributes to some extent to the exaggerated

2009 performance of 82.7% growth. (The starting number used was the closing index of

Bovespa for 12/30/2008.) To make the performances comparative we have taken the

last index for each market for 2008, and called it 100%.

Figure 1 shows that the two emerging market indices, i.e. Ibovespa and the Hang Seng

(52%, 2009 growth) vastly out performing the indices of the USA (The DJI and S&P)

the UK (FTSE) and France (CAC 40). Indeed, the range of growth of the more

established markets was 19% for the DJI, to 23% for the S&P. The two other indices

grew by 22%.

By any standard the Brazilian performance was outstanding, and ultimately

demonstrated a confidence on the part of investors in Brazil that has come to show itself

in less quantitative areas such as diplomacy and politics.

However, we believe this confidence continues to be shown in the Brazilian stock

market even though the Brazilian government has taken steps to discourage foreign

sources of liquidity via taxation. (In October the government imposed a tax of 2.0% on

foreign investment capital entering the country for the purposes of stock market or fixed

income investments. In November the government extended this fiscal deterrent to

purchases of Brazilian shares on stock markets outside Brazil, although limiting the tax

to 1.5% of the purchase value.)

Figure 2.

Stock Markets Performances, October 20th - December 31st,

108,0% 2009

106,0%

104,0%

102,0%

100,0%

98,0%

96,0%

94,0%

92,0%

90,0%

20

27

10

17

24

15

22

29

3/

1/

8/

11

12

12

/1

/1

/1

/1

/1

/1

/1

/1

0/

1/

1/

2/

2/

0/

1/

2/

/0

/0

/0

09

09

09

09

09

09

09

09

9

9

DJI FTSE CAC HSI IBOV S&P

Source: Yahoo Finance

Figure 2 shows the performance of these same stock markets since the inception of the

Brazilian tax on foreign investment, on October 21st, which = 100% for all markets. As

of year-end we see that Ibovespa had increased in value by 5% during this period, more

than any of the other stock markets. The DJI grew by 4.2%, the FTSE by 3.2%, the S&P

by 2.2% and the CAC 40 by 1.7%. The Hang Seng actually declined in value over this

period by 2.3%.

Thus, we can see that the rate of growth of value of the Brazilian stock market has

declined somewhat since the inception of the tax, but the performance continues strong.

Month-end numbers from Bovespa concerning stock market investors will be available

tomorrow and we will post our analysis then.

Вам также может понравиться

- The Stock Market FallsДокумент2 страницыThe Stock Market FallsJohn Paul GroomОценок пока нет

- Early MayДокумент1 страницаEarly MayJohn Paul GroomОценок пока нет

- The Stock Market in MayДокумент2 страницыThe Stock Market in MayJohn Paul GroomОценок пока нет

- The Stock Market in AprilДокумент3 страницыThe Stock Market in AprilJohn Paul GroomОценок пока нет

- The Brazilian Balance of PaymentsДокумент2 страницыThe Brazilian Balance of PaymentsJohn Paul GroomОценок пока нет

- The Stock Market in AprilДокумент3 страницыThe Stock Market in AprilJohn Paul GroomОценок пока нет

- Pac 2Документ2 страницыPac 2John Paul GroomОценок пока нет

- Stock Market Parts Feb 10Документ2 страницыStock Market Parts Feb 10John Paul GroomОценок пока нет

- The Stock Market in MarchДокумент2 страницыThe Stock Market in MarchJohn Paul GroomОценок пока нет

- A Primer - Part 1Документ4 страницыA Primer - Part 1John Paul GroomОценок пока нет

- Its Well To Remember That Risk EvaluationДокумент2 страницыIts Well To Remember That Risk EvaluationJohn Paul GroomОценок пока нет

- Compaign 2010Документ2 страницыCompaign 2010John Paul GroomОценок пока нет

- Stock Market DevelopmentsДокумент2 страницыStock Market DevelopmentsJohn Paul GroomОценок пока нет

- SM - New YearДокумент2 страницыSM - New YearJohn Paul GroomОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Leijiverse Integrated Timeline - Harlock Galaxy Express Star Blazers YamatoДокумент149 страницLeijiverse Integrated Timeline - Harlock Galaxy Express Star Blazers Yamatokcykim4100% (3)

- Autoplant TutorialДокумент404 страницыAutoplant TutorialManish Tukaram Deshpande100% (1)

- Catalogo Bluefriction 2018 - v2Документ17 страницCatalogo Bluefriction 2018 - v2ChacalDcОценок пока нет

- Leps202 PDFДокумент20 страницLeps202 PDFSoma NaikОценок пока нет

- Cello GRADE 1Документ11 страницCello GRADE 1Paul CortyОценок пока нет

- Pmls2 Quiz QuestionsДокумент12 страницPmls2 Quiz QuestionsrytorvasОценок пока нет

- Changes in Ownership Interest: Multiple ChoiceДокумент19 страницChanges in Ownership Interest: Multiple ChoicepompomОценок пока нет

- Chapter 2Документ63 страницыChapter 2Mohammad ja'farОценок пока нет

- OSI Model and Its LayersДокумент9 страницOSI Model and Its LayersBakhtiyarОценок пока нет

- Learning-Activity-sheets - Gbio1 q2 HomeworkДокумент23 страницыLearning-Activity-sheets - Gbio1 q2 HomeworkChad Laurence Vinson CandelonОценок пока нет

- PC 2 Route For Mach Rev 1-9Документ18 страницPC 2 Route For Mach Rev 1-9Kenn FerroОценок пока нет

- SHMS BrochureДокумент36 страницSHMS BrochureRazvan AlexandruОценок пока нет

- Calcium Silicate Bricks or Sand Lime BricksДокумент4 страницыCalcium Silicate Bricks or Sand Lime Bricksmanhal alnoaimyОценок пока нет

- Emilio Elizalde Et Al - Casimir Effect in de Sitter and Anti-De Sitter BraneworldsДокумент36 страницEmilio Elizalde Et Al - Casimir Effect in de Sitter and Anti-De Sitter BraneworldsTurmav12345Оценок пока нет

- CS310 Dec 2021 - KCCДокумент18 страницCS310 Dec 2021 - KCCLAWRENCE ADU K. DANSOОценок пока нет

- FIGURE 1. Standard Input Protection NetworkДокумент3 страницыFIGURE 1. Standard Input Protection NetworkNilesh NarkhedeОценок пока нет

- Auditorium Booking Form PDFДокумент4 страницыAuditorium Booking Form PDFFawaz AzamОценок пока нет

- FRS MethodologyДокумент2 страницыFRS MethodologyHenry FlorendoОценок пока нет

- Final Report (2018-2019) Dubai GolfДокумент31 страницаFinal Report (2018-2019) Dubai GolfAlen ThakuriОценок пока нет

- Chapter End Stop SignsДокумент4 страницыChapter End Stop Signsapi-307327939Оценок пока нет

- DiCeglie052521Invite (30959)Документ2 страницыDiCeglie052521Invite (30959)Jacob OglesОценок пока нет

- MT-HN-RCTI-13 - Sealing CracksДокумент20 страницMT-HN-RCTI-13 - Sealing CracksManuela Angulo TrianaОценок пока нет

- Full Download Introduction To Management Science 12th Edition Taylor Test Bank PDF Full ChapterДокумент36 страницFull Download Introduction To Management Science 12th Edition Taylor Test Bank PDF Full Chapterhomelingcomposedvqve100% (16)

- Dangerous Prohibited Goods Packaging Post GuideДокумент66 страницDangerous Prohibited Goods Packaging Post Guidetonyd3Оценок пока нет

- Co2 KiddeДокумент50 страницCo2 KiddeNattapong Natt100% (2)

- TAI PI 500 2018 FormattedДокумент54 страницыTAI PI 500 2018 FormattedShinoharaОценок пока нет

- LSMW qp01Документ2 страницыLSMW qp01Tushar ShitoleОценок пока нет

- Technical Data: Rotax Kart Type R1, Model 2002Документ2 страницыTechnical Data: Rotax Kart Type R1, Model 2002Gallego VilaОценок пока нет

- R 2 KyДокумент3 страницыR 2 KyJorge AzurduyОценок пока нет

- CAF 8 AUD Autumn 2022Документ3 страницыCAF 8 AUD Autumn 2022Huma BashirОценок пока нет