Академический Документы

Профессиональный Документы

Культура Документы

CH 03

Загружено:

Khoirunnisa DwiastutiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CH 03

Загружено:

Khoirunnisa DwiastutiАвторское право:

Доступные форматы

Chapter 03 - Analyzing Financing Activities

Chapter 3

Analyzing Financing Activities

REVIEW

Business activities are financed through either liabilities or equity. Liabilities are

obligations requiring payment of money, rendering of future services, or dispensing of

specific assets. They are claims against a company's present and future assets and

resources. Such claims are usually senior to holders of equity securities. Liabilities

include current obligations, long-term debt, capital leases, and deferred credits. This

chapter also considers securities straddling the line separating liabilities from equity.

Equity refers to claims of owners to the net assets of a company. While claims of owners

are junior to creditors, they are residual claims to all assets once claims of creditors are

satisfied. Equity investors are exposed to the maximum risk associated with a business,

but are entitled to all residual rewards associated with it. Our analysis must recognize the

claims of both creditors and equity investors, and their relationship, when analyzing

financing activities. This chapter describes business financing and how this is reported

to external users. We describe two major sources of financingcredit and equityand

the accounting underlying reports of these activities. We also consider off-balance-sheet

financing, including Special Purpose Entities (SPEs), the relevance of book values, and

liabilities "at the edge" of equity. Techniques of analysis exploiting our accounting

knowledge are described.

3-1

Chapter 03 - Analyzing Financing Activities

OUTLINE

Liabilities

Current Liabilities

Noncurrent Liabilities

Analyzing Liabilities

Leases

Lease Accounting and Reporting Lessee

Analyzing Leases

Postretirement benefits

Pension Accounting

Other Postretirement Benefits (OPEBs)

Analyzing Postretirement Benefits

Contingencies and Commitments

Contingencies

Commitments

Off-Balance-Sheet Financing

Through-put and Take-or-pay agreements

Product financing arrangements

Special Purpose Entities (SPEs)

Shareholders Equity

Capital Stock

Retained Earnings

Computation of Book Value Per Share

Liabilities at the Edge of Equity

Redeemable Preferred Stock

Minority Interest

Appendix 3A: Lease Accounting Lessor

Appendix 3B: Accounting Specifics for Postretirement Benefits

3-2

Chapter 03 - Analyzing Financing Activities

ANALYSIS OBJECTIVES

Identify and assess the principal characteristics of liabilities and equity.

Analyze and interpret lease disclosures and explain their implications and the

adjustments to financial statements.

Analyze postretirement disclosures and assess their consequences for firm

valuation and risk.

Analyze contingent liability disclosures and describe risks.

Identify off-balance-sheet financing and its consequences to risk analysis.

Analyze and interpret liabilities at the edge of equity.

Explain capital stock and analyze and interpret its distinguishing features.

Describe retained earnings and their distribution through dividends.

3-3

Chapter 03 - Analyzing Financing Activities

QUESTIONS

1. The two major source of liabilities, for both current and noncurrent liabilities, are

operating and financing activities. Current liabilities of an operating naturesuch as

accounts payable and operating expense accrualsrepresent claims on resources

from operating activities. Current liabilities such as notes payable, bonds, and the

current maturities of long-term debt reflect claims on resources from financing

activities.

2. The major disclosure requirements (in SEC FRR, Section 203) for financing-related

current liabilities such as short-term debt are:

a. Footnote disclosure of compensating balance arrangements including those not

reduced to writing

b. Balance sheet segregation of (1) legally restricted compensating balances and (2)

unrestricted compensating balances relating to long-term borrowing

arrangements if the compensating balance can be computed at a fixed amount at

the balance sheet date.

c. Disclosure of short-term bank and commercial paper borrowings:

i. Commercial paper borrowings separately stated in the balance sheet.

ii. Average interest rate and terms separately stated for short-term bank and

commercial paper borrowings at the balance sheet date.

iii. Average interest rate, average outstanding borrowings, and maximum monthend outstanding borrowings for short-term bank debt and commercial paper

combined for the period.

d. Disclosure of amounts and terms of unused lines of credit for short-term

borrowing arrangements (with amounts supporting commercial paper separately

stated) and of unused commitments for long-term financing arrangements.

Note that the above disclosures are required for filings with the SEC but not

necessarily for disclosures in published annual reports. It should also be noted that

SFAS 6 states that certain short-term obligations should not necessarily be classified

as current liabilities if the company intends to refinance them on a long-term basis

and can demonstrate its ability to do so.

3. The conditions required by SFAS 6 that demonstrate the ability of the company to

refinance it short-term debt on a long-term basis are:

a. The company has actually issued a long-term obligation or equity securities to

replace the short-term obligation after the date of the company's balance sheet

but before its release.

b. The company has entered into an agreement with a bank or other source of

capital that permits the company to refinance the short-term obligation when it

becomes due.

Note that financing agreements that are cancelable for violation of a provision that

can be evaluated differently by the parties to the agreement (such as a material

adverse change or failure to maintain satisfactory operations) do not meet the

second condition. Also, an operative violation of the agreement should not have

occurred.

3-4

Chapter 03 - Analyzing Financing Activities

4. Since the interest rate that will prevail in the bond market at the time of issuance of

bonds can never be predetermined, bonds usually are sold in excess of par

(premium) or below par (discount). This premium or discount represents, in effect, an

adjustment of the coupon rate to the effective interest rate. The premium received is

amortized over the life of the issue, thus reducing the coupon rate of interest to the

effective interest rate incurred. Conversely, the discount also is amortized, thus

increasing the effective interest rate paid by the borrower.

5. The accounting for convertibility and warrants impacts income and equity as follows:

a. The convertible feature is attractive to investors. As a result, the debt will be

issued at a slightly lower interest rate and the resulting interest expense is less

(and conversely, equity is increased). Also, diluted earnings per share is reduced

by the assumed conversion. At conversion, a gain or loss on conversion may

result when equity instruments are issued.

b. Similarly, warrants attached to bonds allow the bonds to pay a lower interest rate.

As a result, interest expense is reduced (and conversely, equity is increased).

Also, diluted earnings per share is affected because the warrants are assumed

converted.

6. It is important to the analysis of convertible debt and stock warrants to evaluate the

potential dilution of current and potential shareholders if the holders of these options

choose to convert them to stock. This potential dilution would represent a real wealth

transfer for existing shareholders. Currently, this potential dilution is given little

formal recognition in financial statements.

7. SFAS 47 requires note disclosure of commitments under unconditional purchase

obligations that provide financing to suppliers. It also requires disclosure of future

payments on long-term borrowings and redeemable stock. Required disclosures

include:

For purchase obligations not recognized on purchaser's balance sheet:

a. Description and term of obligation.

b. Total fixed and determinable obligation. If determinable, also show these amounts

for each of the next five years.

c. Description of any variable obligation.

d. Amounts purchased under obligation for each period covered by an income

statement.

For purchase obligations recognized on purchaser's balance sheet, payments for

each of the next five years.

For long-term borrowings and redeemable stock:

a. Maturities and sinking fund requirements for each of the next five years.

b. Redemption requirements for each of the next five years.

8. a.

Information about debt covenant restrictions are available in the details of the

bond indentures of a company. Moreover, key restrictions usually are identified

and discussed in the financial statement notes.

b. The margin of safety as it applies to debt contracts refers to the slack that the

company has before it would violate any of the debt covenant restrictions and be

in technical default. For example, if the debt covenant mandates a maximum debt

to assets ratio of 50% and the current debt to assets ratio is 40%, the company is

said to have a margin of safety of 10%. Technical default is costly to a company.

3-5

Chapter 03 - Analyzing Financing Activities

Thus, as the margin of safety decreases, the relative level of company risk

increases.

3-6

Chapter 03 - Analyzing Financing Activities

9. Analysis of the terms and conditions of recorded liabilities is an area deserving an

analyst's careful attention. Here, the analyst must examine critically the description of

debt, its terms, conditions, and encumbrances with a desire to satisfy him/her as to

the ability of the company to meet principal and interest payments. Important

analyses in the evaluation of liabilities are the examination of features such as:

Contractual terms of the debt agreement, including payment schedule

Restrictions on deployment of resources and freedom of action

Ability to engage in further financing

Requirements relating to maintenance of working capital, debt to equity ratio, etc.

Dilutive conversion features to which the debt is subject.

Prohibitions on disbursements such as dividends

Moreover, we review the audit report since we expect auditors to require satisfactory

recording and disclosure of all existing liabilities. Auditor tests include the scrutiny of

board of director meeting minutes, the reading of contracts and agreements, and

inquiry of those who may have knowledge of company obligations and liabilities.

The analysis of contingencies (and commitments) also is aided by financial statement

analysis. However, the analysis of contingencies and commitments is more

challenging because these liabilities typically do not involve the recording of assets

and/or costs. Here, the analyst must rely on information provided in notes to the

financial statements and in management commentary found in the text of the annual

report and elsewhere. Due to the uncertainties involved, the descriptions of

commitments, and especially contingent liabilities, in the notes are often vague and

indeterminate. This means that the burden of assessing the possible impact of

contingencies and the probabilities of their occurrence is passed to the analyst. Yet,

the analyst assumes that if a contingency (and/or commitment) is sufficiently serious,

the auditor can qualify the audit report.

The analyst, while utilizing all information available, must nevertheless bring his/her

own critical evaluation to bear on the assessment of all existing liabilities and

contingencies to which the company may be subject. This process must draw not

only on available disclosures and reports, but also on an understanding of industry

conditions and practices.

10. a. A lease is classified and accounted for as a capital lease if at the inception of the

lease it meets one of four criteria: (1) the lease transfers ownership of the

property to the lessee by the end of the lease term; (2) the lease contains an

option to purchase the property at a bargain price; (3) the lease term is equal to 75

percent or more of the estimated economic life of the property; or (4) the present

value of the rentals and other minimum lease payments, at the beginning of the

lease term, equals 90 percent of the fair value of the leased property less any

related investment tax credit retained by the lessor. If the lease does not meet any

of those criteria, it is to be classified and accounted for as an operating lease.

With regard to the last two of the above four criteria, if the beginning of the lease

term falls within the last 25 percent of the total estimated economic life of the

leased property, neither the 75 percent of economic life criterion nor the 90

percent recovery criterion is to be applied for purposes of classifying the lease

and as a consequence, such leases will be classified as operating leases.

3-7

Chapter 03 - Analyzing Financing Activities

b. Summary of accounting for leases by lessees:

1. The lessee records a capital lease as an asset and an obligation at an amount

equal to the present value of minimum lease payments during the lease term,

excluding executory costs (if determinable) such as insurance, maintenance,

and taxes to be paid by the lessor together with any profit thereon. However,

the amount so determined should not exceed the fair value of the leased

property at the inception of the lease. If executory costs are not determinable

from provisions of the lease, an estimate of the amount shall be made.

2. Amortization, in a manner consistent with the lessee's normal depreciation

policy, is called for over the term of the lease except where the lease transfers

title or contains a bargain purchase option; in the latter cases amortization

should follow the estimated economic life.

3. In accounting for an operating lease the lessee will charge rentals to expenses

as they become payable, except when rentals do not become payable on a

straight-line basis. In the latter case they should be expensed on such a basis

or on any other systematic or rational basis that reflects the time pattern of

benefits serviced from the leased property.

11. a. The major classifications of leases by lessors are:

1. Sales-type leases

2. Direct financing leases

3. Operating leases

The criteria for classifying each type are as follows: If a lease meets any one of

the four criteria for capitalization (see question 10a above) plus two additional

criteria (see below), it is to be classified and accounted for as either a sales-type

lease (if manufacturer or dealer profit is involved) or a direct financing lease. The

additional criteria are (1) collectibility of the minimum lease payments is

reasonable predictable, and (2) no important uncertainties surround the amount of

unreimbursable costs yet to be incurred by the lessor under the lease. A lease not

meeting these criteria is to be classified and accounted for as an operating lease.

b. The accounting procedures for leases by lessors are:

Sales-type leases

1. The minimum lease payments plus the unguaranteed residual value accruing

to the benefit of the lessor are recorded as the gross investment in the lease.

2. The difference between gross investment and the sum of the present value of

its two components is recorded as unearned income. The net investment

equals gross investment less unearned income. Unearned income is amortized

to income over the lease term so as to produce a constant periodic rate of

return on the net investment in the lease. Contingent rentals are credited to

income when they become receivable.

3. At the termination of the existing lease term of a lease being renewed, the net

investment in the lease is adjusted to the fair value of the leased property to

the lessor at that date, and the difference, if any, recognized as gain or loss.

The same procedure applies to direct financing leases (see below.)

4. The present value of the minimum lease payments discounted at the interest

rate implicit in the lease is recorded as the sales price. The cost, or carrying

amount, if different, of the leased property, and any initial direct costs (of

negotiating and consummating the lease), less the present value of the

unguaranteed residual value is charged against income in the same period.

3-8

Chapter 03 - Analyzing Financing Activities

5. The estimated residual value is periodically reviewed. If it is determined to be

excessive, the accounting for the transaction is revised using the changed

estimate. The resulting reduction in net investment is recognized as a loss in

the period in which the estimate is changed. No upward adjustment of the

estimated residual value is made. (A similar provision applies to direct

financing leases.)

Direct-financing leases

1. The minimum lease payments (net of executory costs) plus the unguaranteed

residual value plus the initial direct costs are recorded as the gross

investment.

2. The difference between the gross investment and the cost, or carrying

amount, if different, of the leased property, is recorded as unearned income.

Net investment equals gross investment less unearned income. The unearned

income is amortized to income over the lease term. The initial direct costs are

amortized in the same portion as the unearned income. Contingent rentals are

credited to income when they become receivable.

Operating leases

The lessor will include property accounted for as an operating lease in the

balance sheet and will depreciate it in accordance with his normal depreciation

policy. Rent should be taken into income over the lease term as it becomes

receivable except that if it departs from a straight-line basis income should be

recognized on such basis or on some other systematic or rational basis. Initial

costs are deferred and allocated over the lease term.

12. Where land only is involved the lessee should account for it as a capital lease if either

of the enumerated criteria (1) or (2) is met. Land is not usually amortized.

In a case involving both land and building(s), if the capitalization criteria applicable to

land (see above) are met, the lease will retain the capital lease classification and the

lessor will account for it as a single unit. The lessee will have to capitalize the land

and buildings separately, the allocation between the two being in proportion to their

respective fair values at the inception of the lease.

If the capitalization criteria applicable to land are not met, and at the inception of the

lease the fair value of the land is less than 25 percent of total fair value of the leased

property both lessor and lessee shall consider the property as a single unit. The

estimated economic life of the building is to be attributed to the whole unit. In this

case if either of the enumerated criteria (3) or (4) is met the lessee should capitalize

the land and building as a single unit and amortize it.

If the conditions above prevail but the fair value of land is 25 percent or more of the

total fair value of the leased property, both the lessee and the lessor should consider

the land and the building separately for purposes of applying capitalization criteria (3)

and (4). If either of the criteria is met by the building element of the lease it should be

accounted for as a capital lease by the lessee and amortized. The land element of the

lease is to be accounted for as an operating lease. If the building element meets

neither capitalization criteria, both land and buildings should be accounted for as a

single operating lease.

Equipment which is part of a real estate lease should be considered separately and

the minimum lease payments applicable to it should be estimated by whatever means

are appropriate in the circumstances. Leases of certain facilities such as airport, bus

3-9

Chapter 03 - Analyzing Financing Activities

terminal, or port facilities from governmental units or authorities are to be classified

as operating leases.

3-10

Chapter 03 - Analyzing Financing Activities

13. In the books of the lessee, the primary consideration regarding leases is the

appropriate classification of operating leases. When leases are classified as

operating leases, the lease payment is recorded as rent expense. However, lease

assets and liabilities are kept off the balance sheet. Because of this, many companies

avail themselves of operating lease treatment even when the underlying economics

justify capitalizing the leases. If this is done, the asset and liabilities of a company are

underreported and its debt-to-equity ratios are biased downward. Often such leases

are a form of off balance sheet financing. Therefore, an analyst must carefully

examine the classification of operating leases and capitalize the leases when the

underlying economic justify.

14. For the lessor, when a lease is considered an operating lease, the leased asset

remains on its books. For the lessee, it will not report an asset or an obligation on its

balance sheet.

15. When a lease is considered a capital lease for both the lessor and the lessee, the

lessor will report lease payments receivable on its balance sheet. The lessee will

report the leased asset and a lease obligation totaling the present value of future

lease payments.

16. a. Rent expense

b. Interest expense and depreciation expense

17. a. Leasing revenue

b. Interest revenue (and possibly gain on sale in the initial year of the lease)

18.

Property, plant, and equipment can be financed by having an outside party

acquire the facilities while the company agrees to do enough business with the

facility to provide funds sufficient to service the debt. Examples of these kinds of

arrangements are through-put agreements, in which the company agrees to run a

specified amount of goods through a processing facility or "take or pay"

arrangements in which the company guarantees to pay for a specified quantity of

goods whether needed or not.

A variation of the above arrangements involves the creation of separate entities for

ownership and the financing of the facilities (such as joint ventures or limited

partnerships) which are not consolidated with the company's financial statements

and are, thus, excluded from its liabilities.

Companies have attempted to finance inventory without reporting on their balance

sheets the inventory or the related liability. These are generally product financing

arrangements in which an enterprise sells and agrees to repurchase inventory with

the repurchase price equal to the original sales price plus carrying and financing

costs or other similar transactions such as a guarantee of resale prices to third

parties.

19.

In a defined contribution plan, the employer promises to currently contribute a

fixed sum of money to the employees retirement fund, so it is the contribution

that is defined. In a defined benefit plan, the employer promises to pay a periodic

pension benefit to the employee after retirement (typically until death), so it is the

3-11

Chapter 03 - Analyzing Financing Activities

benefit that is defined. The risk (or reward) of the investment performance in the

former case is borne by the employee and in the latter by the employer.

3-12

Chapter 03 - Analyzing Financing Activities

20.

Accounting for defined contribution plans is simple: whenever a contribution is

made it is recorded as an expense. Defined benefit plans accounting is complex

and involves currently recording a liability based on future expected benefit

payments and an asset to the extent the plan is funded. Pension expense in this

case depends on the changes in pension obligation and the return on plan assets.

21.

(a) Pension obligation: This is the present value of expected benefit payments to

the employee based on current service.

(b) Pension asset: this is the fair market value of the plan assets on the date of the

balance sheet.

(c) Net economic position of the plan: This is the difference between the fair

market value of the pension assets and the pension obligation. When this

difference is positive the plan is referred to as overfunded and when negative the

plan is termed underfunded.

(d) Economic pension cost: Economically, pension cost is equal to the change

(increase) in pension obligation minus return on plan assets. This is called the

funded status. Typically, pension obligation changes because of additional

employee service (service cost) and present value effects (interest cost).

22.

The common non-recurring components are: (a) Actuarial Gain/Loss: This arises

because of changes in actuarial assumptions such as discount rates and

compensation growth rates. (b) Prior Service Cost: This arises because of

changes in pension formulas, usually because of renegotiation of pension

contracts. In addition, the return on plan assets can have a recurring or expected

component and an unexpected component that is not expected to persist into the

future.

SFAS 158 has a complex method by which the non-recurring amounts are first

deferred, i.e., excluded from current income, and then the opening net deferrals

are amortized over the remaining employee service. For this purpose, the excess

of actual plan asset return over expected return is netted against actuarial gains

or losses and then deferred/amortized using something called the corridor

method. Prior service cost is deferred and amortized separately on its own.

23.

The net periodic pension cost is a smoothed version of the economic pension

cost. For determining net periodic pension cost, all non-recurring or unusual

components of economic pension cost (e.g., actuarial gain/loss, prior service

cost, excess of actual plan return over expected return) are deferred and

amortized using a complex corridor method. The rationale for this smoothing

mechanism is that the economic pension cost is very volatile. Including this in

income would cause income to be very volatile and also hide the true operating

profitability of the firm.

3-13

Chapter 03 - Analyzing Financing Activities

24.

Under the current standard (SFAS 158), the balance sheet recognizes the funded

status of the plan. The income statement, however, does not recognize the net

economic cost, but a net periodic pension cost in which unusual or non-recurring

pension cost components are deferred and amortized. The cumulative net

deferrals are included in accumulated other comprehensive income. Under the

older standard, SFAS 87, the net periodic pension cost is recognized on the

income statement. The balance sheet however, merely recognized the accrued (or

prepaid) pension cost, which was simply the cumulative net periodic pension cost.

The accrued (or prepaid) pension cost was equal to the funded status minus

cumulative net deferrals.

25.

Under SFAS 158, the difference between the economic pension cost (which

articulates with the change in the funded status which is recorded in the balance

sheet) and the smoothed net periodic pension cost (which is essentially the net

deferral for the period) is included in other comprehensive income for the period,

which is transferred to accumulated other comprehensive income on the balance

sheet.

26.

Other post employment benefits (OPEBs) are retirement benefits other than

pensions, such as post retirement health care benefits. OPEBs differ from pension

on two dimensions: (1) most of them are non-monetary and therefore create

difficulties in estimation and (2) because of tax laws, companies rarely fund these

benefits.

27.

The pension note consists of five main parts: (1) an explanation of the reported

position in the balance sheet, (2) details of net periodic benefit costs, (3)

information regarding actuarial and other assumptions, (4) information regarding

asset allocation and funding policies, and (5) expected future contributions and

benefit payments.

28.

Since the funded status of the plan is reported on the balance sheet under SFAS

158, there is no adjustment to the balance sheet that is required. However, some

analysts note that netting pension assets and obligations tends to mask the

underlying pension risk exposure and thus recommend showing pension assets

and liabilities separately without netting them out.

Adjustments to the income statement depend on the purpose of the analysis. The

net periodic benefit cost that is reported under SFAS 158 is appropriate if the

objective of the analysis is identifying the permanent or core component of

income. However, to estimate a periods economic income it is advisable to use

the economic pension cost which includes all non-recurring items.

29.

The major actuarial assumptions underlying pension accounting are: (a) discount

rate (b) compensation growth rate and (c) expected rate of return on pension

assets. Less important assumptions include life expectancy and employee

turnover. In addition OPEBs also make assumptions about healthcare cost trends.

Managers can affect both the post-retirement benefit economic position (or

economic cost) and the reported cost. For example, choosing a higher discount

rate can reduce the pension obligation and thus improve economic position

(funded status). Also, increasing the expected rate of return on plan assets can

reduce the reported pension cost (net periodic pension cost).

3-14

Chapter 03 - Analyzing Financing Activities

30.

31.

Pension risk exposure is the risk that a company is exposed to from its pension

plans. This risk arises because of a mismatch of the risk profiles of pension

assets and liabilities, primarily because companies invest pension assets whose

returns are not correlated with those of long-term bonds which form the basis for

the discount rate assumption affecting the measurement of the pension

obligation.

The pensions crisis in the early 2000s in the U.S. was precipitated by an unusual

combination of declining equity values (which lowered the value of pension

assets) and declining long-term interest rates, which increased the pension

obligations. The net effect was a steep reduction in pension funded status which

even resulted in some companies filing for bankruptcy.

The three factors that an analyst needs to consider when evaluating pension

exposure are: (1) the plans funded status relative to the companys assets (2) the

pension intensity, i.e., the size of the pension obligation and assets (without

netting) relative to total assets and (3) the extent to which the assets and

obligation is mismatched, which can be determined by the proportion of pension

assets invested in non-debt securities or assets.

32.

Current cash flows for pensions (or OPEBs) measure the extent of company

contributions into the plan during the year. For pensions, this is obviously not a

good indicator of future cash contributions since contributions are affected by

complex factors which eventually affect the funded status of the plan. For OPEBs,

current contributions are a somewhat better indicator of future contributions

since contributions in a period typically equal benefits paid (since most OPEB

plans are unfunded), and benefits are more predictable over time.

33.

Accumulated benefit obligation (ABO): This is the present value of estimated

future pension benefit payments assuming current compensation. Projected

benefit obligations (PBO): This is the present value of estimated future pension

benefit payments assuming future compensation on the date of retirement. ABO is

closer to the legal obligation.

34.

The corridor method is used for determining the amount of amortization for net

gain or loss. Net gain or loss for the period is determined by netting the actuarial

gain/loss for the period with the difference between actual and expected return on

plan assets. Then the net gain or loss for the period is added to the cumulative net

gain or loss at the start of the period. Next a corridor for cumulative net

gain/loss is determined as the greater of 10% of PBO or 10% of plan assets

(whichever is greater). Only the amount of cumulative net gain/loss beyond this

corridor (in either direction) is amortized.

35.

Like the pension obligation, the OPEB obligation is the present value of expected

future benefits attributable to employee service to-date. The present value of the

expected future benefits is termed EPBO and that portion which is attributable to

service to-date is termed the APBO. The APBO is the obligation that is used to

estimate the funded status or the economic position of the plan reported on the

balance sheet.

3-15

Chapter 03 - Analyzing Financing Activities

36.

While the estimation process for OPEB costs is similar to that of estimating

pension costs it is more difficult and more subjective. First, data about costs are

more difficult to obtain. Pension benefits involve either fixed dollar amounts or a

defined dollar amount, based on pay levels. Health benefits, by contrast, are

estimates not easily computed by actuarial formula. Many factors enter in to such

estimates, including deductibles, ages, marital status, number of dependents, etc.

Second, more assumptions than those governing pension calculations are

needed. For example, in addition to retirement dates, life expectancy, turnover,

and discount rates, there is a need for estimates of the medical costs trend rate,

Medicare reimbursements, etc.

34. a. A loss contingency is any existing condition, situation, or set of circumstances

involving uncertainty as to possible loss that will be resolved when one or more

future events occur or fail to occur. Examples of loss contingencies are: litigation,

threat of expropriation, uncollectibility of receivables, claims arising from product

warranties or product defects, self-insured risks, and possible catastrophe losses

of property and casualty insurance companies.

b. The two conditions that must be met before a provision for a loss contingency can

be charged to income are: (1) it must be probable that an asset had been impaired

or a liability incurred at a date of a companys financial statements. Implicit in that

condition is that it must be probable that a future event or events will occur

confirming the fact of the loss. (2) the amount of loss must be reasonably

estimable. The effect of applying these criteria is that a loss will be accrued only

when it is reasonably estimable and relates to the current or a prior period.

35.

When a company decides to take a big bath, the company will recognize as many

discretionary expenses and losses as possible in the current year. Such a strategy

usually accompanies a period of unusually poor operating resultsthe managerial

belief is that the market will not further downgrade the stock from the one-time

charge and that the market will be less scrutinizing of such a charge. A major result

of a big bath is the inflated increase in future periods net income figures. Also, when

a company takes a big bath, it often causes reserves and/or liabilities to be

overstated. For example, the company might record an overstated restructuring

charge or contingent liability. When a company employs a big bath strategy,

analysts should assess whether certain reserves and liabilities are actually overstated

and adjust their models accordingly. (The income statement loss is probably

overstated as well).

36. Commitments are potential claims against a companys resources due to future

performance under a contract. Examples of commitments include contracts to

purchase products or services at specified prices, purchase contracts for fixed

assets calling for payments during construction, and signed purchase orders.

37. Commitments are not recorded liabilities because commitments are not completed

transactions. Commitments become liabilities when the transaction is completed.

For example, consider a commitment by a manufacturer to purchase 100,000 units of

materials per year for 5 years. Each time a purchase is made at the agreed upon

price, part of the purchase commitment expires and a purchase is recorded. The

remaining part continues as an obligation by the manufacturer to purchase materials.

3-16

Chapter 03 - Analyzing Financing Activities

38.

39. Off-balance-sheet financing refers to the nonrecording of certain financing

obligations. Examples of off-balance-sheet financing include operating leases when

they are in-substance capital leases, joint ventures and limited partnerships, and

many recourse obligations on sold receivables.

39. Under SFAS 105, companies are required to disclose the following information about

financial instruments with off-balance-sheet risk of accounting loss:

a. The face, contract, or notional principal amount.

b. The nature and terms of the instruments and a discussion of their credit and

market risk, cash requirements, and related accounting policies.

c. The accounting loss the company would incur if any party to the financial

instruments failed completely to perform according to the terms of the contract,

and the collateral or other security, if any, for the amount due proved to be of no

value to the company.

d. The company's policy for requiring collateral or other security on financial

instruments it accepts, and a description of collateral on instruments presently

held.

Information about significant concentrations of credit risk from an individual

counter-party or groups of counterparties for all financial instruments is also

required.

These disclosures help financial analysis by revealing existing economic events that

can reduce the relevance and reliability of the balance sheet as reported by

management. With the information in these disclosures, the analyst can revise

his/her personal models to factor in the impact of off-balance-sheet items or

otherwise adjust the analyses for these items.

40. SFAS 140 replaced SFAS 125 and defines new rules for the sale of accounts

receivable to special purpose entities (SPEs). In order to treat the transfer as a sale

(rather than a borrowing), the SPE must be a Qualifying SPE. Otherwise, the SPE

must be consolidated unless third-party investors make equity investments that are,

Substantive (more than 3% of assets)

Controlling (e.g., more than 50% ownership)

Bear the first dollar risk of loss

Take the legal form of equity

If any of the above conditions is not met, the transfer of the receivable is considered

as a loan with the receivables pledged as security for such loan.

41. Analysts should identify off-balance-sheet financing arrangements and either factor

these arrangements into their models or otherwise adjust the analyses for the

additional risk created by off-balance-sheet financing arrangements.

42. Some equity securities have mandatory redemption provisions that make them more

akin to debt than they are to equitya typical example is preferred stock. Whatever

their name, these securities impose upon the issuing companies various obligations

to dispense funds at specified dates. Such provisions are inconsistent with the true

nature of an equity security. The analyst must be alert to the existence of such

equity securities and examine for substance over form when making financial

statement adjustments.

3-17

Chapter 03 - Analyzing Financing Activities

43.

43. In order to facilitate their understanding and analysis, reserves and provisions can be

redivided into a number of major categories.

The first category is most correctly described as comprising provisions for

obligations that have a high probability of occurrence, but which are in dispute or are

uncertain in amount. As is the case with many financial statement descriptions,

neither the title nor the location in the financial statement can be relied upon as a

rule-of-thumb guide to the nature of an account. The best key to analysis is a

thorough understanding of the business and the financial transactions that give rise

to the account. The following are representative items in this group: provisions for

product guarantees, service guarantees, and warranties that are established in

recognition of future costs that are certain to arise although presently impossible to

measure. Another type of obligation that must be provided for is the liability for

unredeemed coupons such as trading stamps. To the company issuing these

coupons, there is no doubt about the liability to redeem them for merchandise or

cash. The only uncertainty concerns the number of coupons that will be presented

for redemption. Consequently, a provision is established for these types of items by a

charge to income at the time products covered by guarantees (or

related to these coupons) are soldthe amount is established on the basis of

experience or on the basis of any other reliable factor.

The second category comprises reserves for expenses and losses, which by

experience or estimates are very likely to occur in the future and that should properly

be provided for by current charges to operations. One group within this category is

comprised of reserves for operating costs such as maintenance, repairs, painting, or

overhauls. Thus, for example, since overhauls can be expected to be required at

regularly recurring intervals, they are provided for ratably by charges to operations to

avoid charging the entire cost to the year in which the actual overhaul takes place.

A third category comprises provisions for future losses stemming from decisions or

actions already taken. Included in this group are reserves for relocations,

replacement, modernization, and discontinued operations.

A fourth category includes reserves for contingencies. For example, reserves for

self-insurance are designed to provide the accumulation against which specific types

of losses, not covered by insurance, can be charged. Although the term

self-insurance contradicts the very concept of insurance, which is based on the

spreading of risks among many business units, it nevertheless is a practice that has a

good number of adherents. Other contingencies provided against by means of

reserves are those arising from foreign operations and exchange losses due to

official or de facto devaluations.

A fifth group of future costs that must be provided for is that of employee

compensation. These costs, in turn, give rise to provisions for vacation pay, deferred

compensation, incentive compensation, supplemental unemployment benefits, bonus

plans, welfare plans, and severance pay. The related category of estimated liabilities

includes provisions for claims arising out of pending or existing litigation.

3-18

Chapter 03 - Analyzing Financing Activities

Of importance to the analyst is the adequacy of the reserves and provisions that are

often established on the basis of prior experience or on the basis of other estimates.

Concern with adequacy of amount is a prime factor in the analysis of all reserves and

provisions, whatever their purpose. Reserves and provisions appearing above the

equity section are almost invariably created by means of charges to income. They are

designed to assign charges to the income statement based on when they are

incurred rather than when they are paid in cash.

44. Reserves for future losses represent a category of accounts that require particular

scrutiny. While conservatism in accounting calls for recognition of losses as they can

be determined or clearly foreseen, companies tend, particularly in loss years, to

over-provide for losses not yet incurred. Such losses not yet incurred often involve

disposal of assets, relocations, and plant closings. Overprovision shifts expected

future losses to the present period, which likely already shows adverse results.

One problem with such reserves is that once established there is no further

accounting for the expenses and losses that are charged against them. Only in

certain financial statements required to be filed with the SEC (such as Form 10-K) are

details of changes in reserves required. Recent requirements have, however,

tightened the disclosure rules in this area.

3-19

Chapter 03 - Analyzing Financing Activities

The reason why over-provisions of reserves occur is that the income statement

effects are often accorded more importance than the residual balance sheet effects.

While a provision for future expenses and losses establishes a reserve account that

is analytically in the "never-never land" between liabilities and equity accounts, it

serves the important purpose of creating a cushion that can absorb future expenses

and losses. This shields the all-important income statement from them and their

related volatility. The analyst should endeavor to ascertain that provisions for future

losses reflect losses that can reasonably be expected to have already occurred rather

than be used as a means of artificially benefiting future income by adding excessive

provisions to present adverse results.

45. An ever increasing variety of items and descriptions are included in the "deferred

credits" group of accounts. In many cases these items are akin to liabilities; in others,

they either represent deferred income yet to be earned or serve as income-smoothing

devices. A lack of agreement among accountants as to the exact nature of these

items or the proper manner of their presentation compounds the confusion

confronting the analyst. Thus, regardless of category or presentation, the key to their

analysis lies in an understanding of the circumstances and the financial transactions

that brought them about.

At one end of the spectrum we find those items that have characteristics of liabilities.

Here we can find items such as advances or billings on uncompleted contracts,

unearned royalties and deposits, and customer service prepayments. The

outstanding characteristics of these items is their liability aspects even though, as in

the case of advances of royalties, they may, after certain conditions are fulfilled, find

their way into the company's income stream. Advances on uncompleted contracts

represent primarily methods of financing the work in progress while deposits of rent

received represent, as do customer service prepayments, security for performance of

an agreement. At the other end of the spectrum are deferred credits that exhibit many

qualities similar to equity. The key to effective analysis is the ability to identify those

items most like liabilities from those most like equity.

46. The accounting for the equity section as well as its presentation, classification, and

note disclosure have certain basic objectives. The most important of these are:

a. To classify and distinguish among the major sources of owner capital contributed

to the entity.

b. To set forth the priorities of the various classes of stockholders and the manner in

which they rank in partial or final liquidation.

c. To set forth the legal restrictions to which the distribution of capital funds are

subject to for whatever reason.

d. To disclose the contractual, legal, managerial, and financial restrictions that the

distribution of current and retained earnings is subject to.

The accounting principles that apply to the equity section do not have a marked

effect on income determination and, as a consequence, do not hold many pitfalls for

the analyst. From the analyst's point of view, the most significant information here

relates to the composition of the capital accounts and to the restrictions that they are

subject to.

3-20

Chapter 03 - Analyzing Financing Activities

The composition of equity capital is important because of provisions affecting the

residual rights of common equity. Such provisions include dividend participation

rights, and the great variety of options and conditions that are characteristic of the

complex securities frequently issued under merger agreements, most of which tend

to dilute common equity. Analysis of restrictions imposed on the distribution of

retained earnings by loan or other agreements will usually shed light on a company's

freedom of action in such areas as dividend distributions and the required levels of

working capital. Such restrictions also shed light on the company's bargaining

strength and standing in credit markets. Moreover, a careful analysis of restrictive

covenants will enable the analyst to assess how far a company is from being in

default of these provisions.

47. Preferred stock often carries features that make it preferred in liquidation and

preferred as to dividends. Also, it is often entitled to par value in liquidation and can

be entitled to a premium. On the other hand, the rights of preferred stock to dividends

are generally fixedalthough they can be cumulative, which means that preferred

shareholders are entitled to arrearages of dividends before common stockholders

receive any dividends. These features of preferred stock as well as the fixed nature of

the dividend give preferred stock some of the earmarks of debt with the important

difference that preferred stockholders are not generally entitled to demand

redemption of their shares. However, there are preferred stock issues that have set

redemption dates and require sinking funds to be established for that purposethese

issuances are essentially debt.

Characteristics of preferred stock that make them more akin to common stock are

dividend participation rights, voting rights, and rights of conversion into common

stock.

48. Accounting standards state (APB 10): Companies at times issue preferred (or other

senior) stock which has a preference in involuntary liquidation considerably in

excess of the par or stated value of the shares. The relationship between this

preference in liquidation and the par or stated value of the shares may be of major

significance to the users of the financial statements of those companies and the

Board believes it highly desirable that it be prominently disclosed. Accordingly, the

Board recommends that, in these cases, the liquidation preference of the stock be

disclosed in the equity section of the balance sheet in the aggregate, either

parenthetically or in short rather than on a per share basis or by disclosure in notes."

Such disclosure is particularly important since the discrepancy between the par and

liquidation value of preferred stock can be very significant.

49. This question is answered in a SEC release titled Pro Rata Distribution to

Shareholders:

Several instances have come to the attention of the Commission in which registrants

have made pro rata stock distributions that were misleading. These situations arise

particularly when a registrant makes distributions at a time when its retained earnings

or its current earnings are substantially less than the fair value of the shares

distributed. Under present generally accepted accounting rules, if the ratio of

distribution is less than 25 percent of shares of the same class outstanding, the fair

value of the shares issued must be transferred from retained earnings to other capital

accounts. Failure to make this transfer in connection with a distribution or making a

distribution in the absence of retained or current earnings is evidence of a misleading

3-21

Chapter 03 - Analyzing Financing Activities

practice. Distributions of over 25 percent (which do not normally call for transfers of

fair value) may also lend themselves to such an interpretation if they appear to be

part of a program of recurring distribution designed to mislead shareholders.

3-22

Chapter 03 - Analyzing Financing Activities

It has long been recognized that no income accrues to the shareholder as a result of

such stock distributions or dividends, nor is there any change in either the corporate

assets or the shareholders' interest therein. However, it is also recognized that many

recipients of such stock distributions, which are called or otherwise characterized as

dividends, consider them to be distributions of corporate earnings equivalent to the

fair value of the additional shares received. In recognition of these circumstances, the

American Institute of Certified Public Accountants has specified in Accounting

Research Bulletin No. 43, Chapter 7, paragraph 10, that "... the corporation should in

the public interest account for the transaction by transferring from earned surplus to

the category of permanent capitalization (represented by the capital stock and capital

surplus accounts) an amount equal to the fair value of the additional shares issued.

Unless this is done, the amount of earnings which the shareholder may believe to

have been distributed will be left, except to the extent otherwise dictated by legal

requirements, in earned surplus subject to possible further similar stock issuances or

cash distributions. Both the New York and American Stock Exchanges require

adherence to this policy by their listed companies.

50. Accounting standards require that, except for corrections of errors in financial

statements of a prior period and adjustments that result from realization of income

tax benefits of preacquisition operating loss carry forwards of purchased

subsidiaries, all items of profit and loss recognized during a period (including

accruals of estimated losses from loss contingencies) be included in the

determination of net income for that period. The standard permits limited

restatements in interim periods of a company's current fiscal year.

51. a. Minority interests are the claims of shareholders of a majority owned subsidiary

whose total net assets are included in a consolidated balance sheet.

b. Consolidated financial statements often show minority interests as liabilities:

however, they are fundamentally different in nature from legally enforceable

obligations. Minority shareholders do not have any legally enforceable rights for

payments of any kind from the parent company. Therefore, the financial analyst

can justifiably classify minority interest as equity funds in most cases.

3-23

Chapter 03 - Analyzing Financing Activities

EXERCISES

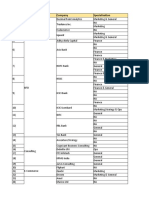

Exercise 3-1 (20 minutes)

a.

Long-term debt [46]

A

B

159.7

0.3

G

H

24.3

250.3

805.8

beg

0.1

99.8

100.0

199.6

C

D

E

F

1.9

772.6

I

end

A = Retirement of 13.99% Zero Coupon Notes.

B = Repayment of 9.125% Note.

C = Additional borrowing on 7.5% Note.

D = Borrowing on 9% Note

E = Borrowing on Medium-Term Notes.

F = Borrowing on 8.875% Debentures

G = Repayment of Other Notes

H = Reclassification of Note

I = Increase in capital lease obligation

b. Campbell Soups debt footnote indicates maturities of (in $millions) $227.7 in

Year 12, $118.9 in Year 13, $17.8 in Year 14, $15.9 in Year 15, and $108.3 in Year

16. The remaining long-term debt matures in excess of 5 years. Given

Campbells operating cash flow of $805.2 million, solvency does not appear to

be a problem. Further, Campbell reports net income of $401.5, well in excess

of its interest expense of $116.2 in Year 11, an interest coverage ratio of 6.7

[$667.4 + $116.2]/ $116.2). The company should also be able to meet its

interest obligations.

Campbell reports total liabilities of $2,355.6 million ($1278+$772.6+$305)

against stockholders equity of $1,793.4 million, a 1.3 times multiple. The

amount of debt does not appear to be excessive. Nor does the company

appear to be underutilizing its equity.

Given present debt levels that are not excessive and adequate cash flow, the

company should be able to finance additional investments with debt if desired

by management.

3-24

Chapter 03 - Analyzing Financing Activities

Exercise 3-2 (20 minutes)

a. The economic effects of a long-term capital lease on the lessee are similar to

that of an equipment purchase using installment debt. Such a lease transfers

substantially all of the benefits and risks incident to the ownership of property

to the lessee, and obligates the lessee in a manner similar to that created

when funds are borrowed. To enhance comparability between a firm that

purchases an asset on a long-term basis and a firm that leases an asset under

substantially equivalent terms, the lease should be capitalized.

b. A lessee should account for a capital lease at its inception as an asset and an

obligation at an amount equal to the present value at the beginning of the

lease term of minimum lease payments during the lease term, excluding any

portion of the payments representing executory costs, together with any profit

thereon. However, if the present value exceeds the fair value of the leased

property at the inception of the lease, the amount recorded for the asset and

obligation should be the fair value.

c. A lessee should allocate each minimum lease payment between a reduction of

the obligation and interest expense so as to produce a constant periodic rate

of interest on the remaining balance of the obligation.

d. Von should classify the first lease as a capital lease because the lease term is

more than 75 percent of the estimated economic life of the machine. Von

should classify the second lease as a capital lease because the lease contains

a bargain purchase option.

Exercise 3-3 (15 minutes)

a. A lessee would account for a capital lease as an asset and an obligation at the

inception of the lease. Rental payments during the year would be allocated

between a reduction in the obligation and interest expense. The asset would

be amortized in a manner consistent with the lessee's normal depreciation

policy for owned assets, except that in some circumstances the period of

amortization would be the lease term.

b. No asset or obligation would be recorded at the inception of the lease.

Normally, rental on an operating lease would be charged to expense over the

lease term as it becomes payable. If rental payments are not made on a

straight-line basis, rental expense nevertheless would be recognized on a

straight-line basis unless another systematic or rational basis is more

representative of the time pattern in which use benefit is derived from the

leased property, in which case that basis would be used.

3-25

Chapter 03 - Analyzing Financing Activities

Exercise 3-4 (18 minutes)

a. The gross investment in the lease is the same for both a sales-type lease and

a direct-financing lease. The gross investment in the lease is the minimum

lease payments (net of amounts, if any, included therein for executory costs

such as maintenance, taxes, and insurance to be paid by the lessor, together

with any profit thereon) plus the unguaranteed residual value accruing to the

benefit of the lessor.

b. For both a sales-type lease and a direct-financing lease, the unearned interest

income would be amortized to income over the lease term by use of the

interest method to produce a constant periodic rate of return on the net

investment in the lease. However, other methods of income recognition may

be used if the results obtained are not materially different from the interest

method.

c. In a sales-type lease, the excess of the sales price over the carrying amount of

the leased equipment is considered manufacturer's or dealer's profit and

would be included in income in the period when the lease transaction is

recorded.

In a direct-financing lease, there is no manufacturer's or dealer's profit. The

income on the lease transaction is composed solely of interest.

Exercise 3-5 (25 minutes)

A number of major companies have a meager debt ratio. Still, even when a

company shows little if any debt on its balance sheet, it can have considerable

long-term liabilities. This situation can reflect one or more of several factors such

as the following:

Lease commitments, while detailed in notes, are not recorded in the balance

sheets of many companies. This could be a critical problem for companies that

have expanded by leasing rather than buying property. These lease

commitments, while reflecting different attributes of pure debt, are just as surely

long-term obligations.

Many companies have very large unfunded postretirement liabilities. These often

are not recorded on the balance sheet, but are disclosed in the notes. At one

time, a case could have been made that such obligations were not a problem, for

as long as the business operated, payments would be made, and if it went

bankrupt, the liability would end. Now, under most laws, the company has a real

long-term obligation to employees.

Several companies guarantee the debt of another company. The most typical is a

nonconsolidated lease subsidiary. Although disclosed in the notes, this debt,

which is real and can be large, is not recorded on the parent's balance sheet.

3-26

Chapter 03 - Analyzing Financing Activities

Exercise 3-5continued

Off-balance-sheet debtsuch as industrial revenue bonds or pollution control

financing where a municipality sells tax-free bonds guaranteed for paymentare

cases where a supposedly debt-free balance sheet could look much worse if

these obligations were recorded.

Finally, the practice of deferred taxessuch as taking some expenses for tax, but

not book purposes, or through differences in timing for recognition of salesis

one that, while recorded on the balance sheet, is normally not recognized as a

long-term obligation. However, if the rate of investment slows dramatically for

some reason or if the sales trend is reversed, the sudden coming due of these tax

liabilities could be a major problem.

(CFA Adapted)

Exercise 3-6 (20 minutes)

a. An estimated loss from a loss contingency is accrued with a charge to income

if both of the following conditions are met:

Information available prior to issuance of the financial statements indicates

that it is probable that an asset had been impaired or a liability had been

incurred at the date of the financial statements. It is implicit in this

condition that it must be probable that one or more future events will occur

confirming the fact of the loss.

The amount of loss can be reasonably estimated.

b. In this case, disclosure should be made for an estimated loss from a loss

contingency that need not be accrued by a charge to income when there is at

least a reasonable possibility that a loss may have been incurred. The

disclosure should indicate the nature of the contingency and should estimate

the possible loss or range of loss or state that such an estimate cannot be

made.

Disclosure of a loss contingency involving an unasserted claim is required

when it is probable that the claim will be asserted and there is a reasonable

possibility that the outcome will be unfavorable.

Exercise 3-7 (15 minutes)

a. One reason that managers might want to resist recording a liability related to

an ongoing lawsuit is that the recorded liability can cause deterioration in the

financial position of the company. A second reason is that the opposing

attorneys may use the disclosure inappropriately as an admission of liability.

3-27

Chapter 03 - Analyzing Financing Activities

Exercise 3-7continued

b. If a manager believes that it is inevitable that a liability will be recorded, the

manager may want to time the recognition of the liability opportunistically.

For example, if the company has a relatively bad period, the liability can be

recorded in conjunction with a big bath. If the company has a very good

period, the manager might find that the liability can be recorded in that period

without causing an unexpectedly bad earnings report.

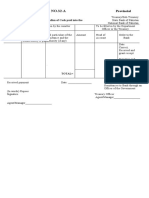

Exercise 3-8 (40 minutes)

[Note: Unless otherwise indicated, much of the information to answer this exercise can be found

in item [68] of Campbells financial statements.]

a. The causes of the $101.6 million increase are identified in the table below (see

Campbells Consol. Statement of Owners Equity and Changes in Number of

Shares):

Millions

10

Net Income............................................................

Cash Dividends.....................................................

Treasury Stock Purchase.....................................

Treasury Stock Issued

Capital Surplus................................................

Treasury Stock................................................

Translation Adjustment........................................

Sale of foreign operations...................................

Increase in Stockholders' Equity........................

a

1,793.4

- 1,691.8

101.6

[54]

11

$401.5

(142.2) (89)

(175.6)

$ 4.4 (28)

(126.9) (87)

(41.1) (87)

45.4 (91)

12.4 (91)

(29.9) (92)

(10.0) (93)

11.1 (87)

4.6 (87)

61.4 (87)

101.6a

(86.5)b

1,691.8 [54]

1,778.3 [87]

(86.5)

b. The average price for treasury share purchases is computed as:

[($175.6 million1 / 3.395 million treasury shares purchased)] = $51.72

1

Treasury stock purchases from Statement of Cash Flows and Statement of Shareholders

Equity

c. Book Value per Share of Common Stock is computed as:

[$1,793.4 [54] / 127.0* ] = $14.12

*135.6 [49] - 8.6 [52] note: There is no preferred stock outstanding

(Note: This value equals the company's computed amount [185] of $14.12.)

3-28

Chapter 03 - Analyzing Financing Activities

Exercise 3-8continued

d. The book value per share of common stock is $14.12. However, shares were

purchased during the year at an average of about $52 per share (an indicator of

market value during the year). In fact, according to note 24 to the financial

statements the stock traded in the $70 - $80 range in the fourth quarter of Year 11.

There are several reasons why the market value of the stock is much higher than

the book value of the stock. First, the market value impounds the investors

beliefs about the future earning power of the company. Investors apparently have

high expectations regarding future profitability. Second, the book value is

recorded using accounting conventions such as historical cost and conservatism.

Each of these conventions is designed to optimize the reliability of the information

but can cause differences between the market and book values of a companys

stock.

Exercise 3-9 (30 minutes)

a. The principal transactions and events that reduce the amount of retained

earnings include the following:

1. Operating losses (including extraordinary losses and other debit

adjustments).

2. Stock dividends.

3. Dividends distributing corporate assets such as cash or in-kind.

4. Recapitalizations such as quasi-reorganizations.

b. The principal reason for making the distinction between contributed capital

and retained earnings (earned capital) in the stockholders' equity section is to

enable stockholders and creditors to identify dividend distributions as actual

distributions of earnings or as returns of capital. This identification also is

necessary to comply with most state statutes that provide that there should

be no impairment of the corporation's legal or stated capital by the return of

such capital to owners in the form of dividends. This concept of legal capital

provides some measure of protection to creditors and imposes a liability upon

the stockholders in the event of such impairment.

Knowledge of the distinction between contributed capital and earned capital

provides a guide to the amount of dividends that can be distributed by the

corporation. Assets represented by the earned capital, if in liquid form, may

properly be distributed as dividends; but invested assets represented by

contributed capital should ordinarily remain for continued operation of the

corporation. If assets represented by contributed capital are distributed to

shareholders, the distribution should be identified as a return of capital and,

hence, is in the nature of a liquidating dividend. Knowledge of the amount of

capital that has been earned over a period of years after adjustment for

dividends also is of value to stockholders in judging dividend policy and

obtaining an indication of past profits to the extent not distributed as

dividends.

3-29

Chapter 03 - Analyzing Financing Activities

Exercise 3-9continued

c. The acquisition and reissuance of its own stock by a firm results only in the

contraction or expansion of the amount of capital invested in it by

stockholders. In other words, an acquisition of treasury shares by a

corporation is viewed as a partial liquidation and the subsequent reissuance

of these shares is viewed as an unrelated capital-raising activity. To

characterize as gain or loss the changes in equity resulting from a

corporation's acquisition and subsequent reissuance of its own shares at

different prices is a misuse of accounting terminology. When a corporation

acquires its own shares, it is not "buying" anything nor has it incurred a

"cost." The price paid represents the amount by which the corporation has

reduced its net assets or "partially liquidated." Similarly, when the corporation

reissues these shares it has not "sold" anything. It has increased its total

capitalization by the amount received.

It is the practice of referring to the acquisition and reissuance of treasury

shares as a buying and selling activity that gives the superficial impression

that, in this process, the firm is acquiring and disposing of assets and that, if

different amounts per share are involved, a gain or loss results. Note, when a

corporation "buys" treasury shares it is not acquiring assets; nor is it

disposing of any assets when these shares are subsequently "sold."

Exercise 3-10 (25 minutes)

a. There are four basic rights inherent in ownership of common stock. The first

right is that common shareholders may participate in the actual management

of the corporation through participation and voting at the corporate

stockholders meeting. Second, a common shareholder has the right to share

in the profits of the corporation through dividends declared by the board of

directors (elected by the common shareholders) of the corporation. Third, a

common shareholder has a pro rata right to the residual assets of the

corporation if it liquidates. Fourth, common shareholders have the right to

maintain their interest (percent of ownership) in the corporation if the

corporation issues additional common shares, by being given the opportunity

to purchase a proportionate number of shares of the new offering. This fourth

right is most commonly referred to as a "preemptive right."

b. Preferred stock is a form of capital stock that is afforded special privileges

not normally afforded common shareholders in return for giving up one or

more rights normally conveyed to common shareholders. The most common

right given up by preferred shareholders is the right to participate in

management (voting rights). In return, the corporation grants one or more

preferences to the preferred shareholders. The most common preferences

granted to preferred shareholders are these:

3-30

Chapter 03 - Analyzing Financing Activities

Exercise 3-10continued

1. Dividends are paid to common shareholders only after dividends have

been paid to preferred shareholders.

2. Claims of preferred shareholders are senior to common shareholders for

residual assets (after creditors have been paid) in the case of corporation

liquidation.

3. Although the board of directors is under no obligation to declare dividends

in any particular year, preferred shareholders are granted a cumulative

provision stating that any dividends not paid in a particular year must be

paid in subsequent years before common shareholders are paid any

dividend.

4. Preferred shareholders are granted a participation clause that allows them

to receive additional dividends beyond their normal dividend if common

shareholders receive dividends of greater percentage than preferred

shareholders. This participation is on a one-to-one basis (fully

participating); common shareholders are allowed to exceed the rate paid to

preferred shareholders by a defined amount before preferred shareholders

begin to participate: or, the participation clause can carry a maximum rate

of participation to which preferred shareholders are entitled.

5. Preferred shareholders have the right to convert their preferred shares to

common shares at a set future price no matter what the current market

price of the common stock is.

6. Preferred shareholders also can agree to have their stock callable by the

corporation at a higher price than when the stock was originally issued.

This item is generally coupled with another preference item to make the

issue appear attractive to the market.

c. 1. Treasury stock is stock previously issued by the corporation but

subsequently repurchased by the corporation. It is not retired stock, but

stock available for issuance at a subsequent date by the corporation.

2. A stock right is a privilege extended by the corporation to acquire

additional shares (or fractional shares) of its capital stock.

3. A stock warrant is physical evidence of stock rights. The warrant specifies

the number of rights conveyed, the number of shares to which the

rightholder is entitled, the price at which the rightholder can purchase

additional shares, and the life of the rights (time period over which the

rights can be exercised).

3-31

Chapter 03 - Analyzing Financing Activities

Exercise 3-11 (12 minutes)