Академический Документы

Профессиональный Документы

Культура Документы

China and India

Загружено:

Sanjeev Sadanand PatkarАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

China and India

Загружено:

Sanjeev Sadanand PatkarАвторское право:

Доступные форматы

China and India

Shifting Trends, Outsized Potential

Executive Summary

Despite the impact of the recession on the global economy, China and India

continue to develop as emerging market superpowers, avoiding many of the

negatives that have plagued other countries during the same time period.

Peter Soo

Managing Director, Head of Asia

ex-Japan Equities, Hong Kong

Elizabeth Soon, CFA

Managing Director, Portfolio

Manager, Asia ex-Japan Equities,

Hong Kong

Kheng-Lai Tan

Managing Director, Portfolio

Manager, Asia ex-Japan Equities,

Singapore

Natasha Smirnova

Senior Analyst, Emerging Markets

Fixed Income, London

Andressa Tezine

Vice President, Senior Research

Analyst, Emerging Markets Fixed

Income, London

These two BRIC nations sometimes referred in the same breath as Chindia

have managed to achieve consistent, uncorrelated growth based on dramatically

different governments, cultures and economic strengths.

This paper examines how both nations differ by outlook and opportunity set, and

their changing prospects for future cooperation and conflict as each pursues

its individual and joint path to economic progress. Based on this continuing

convergence, the European Central Bank (ECB) refers to China and India as

TheTwin Titans for the New Millennium.1

In examining their current trajectories, as well as each countrys tantalizing

future potential, investors may enjoy more benefits through a combination of

China and India opportunities, providing an optimum balance of risk, reward

and diversification. China and India appear to be an especially attractive play in

2010-2011, given the halting but sustained recovery that continues to play out

in the US, Europe and Japan.

Huzaifa Husain

Head of Equities-India, Portfolio

Manager, Mumbai

Ruchir N. Parekh

Portfolio Manager, Fixed Income,

Mumbai

Siddhartha Singh

Head of Product DevelopmentIndia/Product Specialist, Mumbai

1 European Central Bank, Occasional Paper: Twin Titans for the New Millenium 2008

The China India story is one that unites three of the

most prevalent themes in emerging markets:

Strong export activity

Extensive investment in development,

including roads, ports, utilities, other

infrastructure projects and factories.

Clearly, Chinas current economy is fueled by exports

and domestic investment, while the Indian economy is

driven by consumption and domestic investment. But,

the story behind these two success stories begins with

the sheer enormity of numbers.

As the two most populous countries in the world, China

currently ranks #1, boasting more than 1.33 billion

citizens,2 while India is closing in quickly, ranking in

the #2 spot with 1.15 billion people,3 although it is

expected to surpass China by 2030.4 Jointly, China

and India account for more than 37% of the worlds

total population.5 By contrast, the United States runs a

distant third with 309 million people, representing only

4.54% of the worlds total population.6

A recent UN population study indicates that these

trends will continue at least for the time being. Chinas

population and workforce will continue to swell over the

2 Chinese Official Population Clock, 5 April 2010

3 indiaonlinepages.com, 5 April 2010

4,5 Population Division of the United Nations Department of Economic and

Social Affairs, 1 July 2009

6 U.S. Official Population Clock, 5 April 2010

7 Population Division of the United Nations Department of Economic and

Social Affairs, 1 July 2009

8,9 Bloomberg, 12 April 2010

10 AsiaNews.it, 2008

11 Sulekha.com, April 2010

200

Dec-09

Dec-08

Dec-07

Dec-06

Dec-05

Dec-04

100

Dec-03

300

Dec-02

India

400

Dec-99

China and Indias continued emergence can be directly

attributed to these top three growth drivers:

Market Growth

Strong commitment to investing for development,

expansion and improvement.

Local demand fueled by a

burgeoning middle class

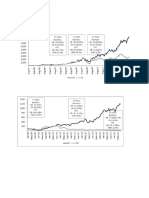

MSCI India

MSCI China

500

Consumption by a huge, growing middle class

China

600

Dec-01

Favorable demographics in the form of

population size

China-India Equity Market Growth

31 Dec 1999 to 31 Dec 2009

fIGURE 1

Dec-00

Similar Attributes for Success

Source: Bloomberg MSCI Index-India and MSCI Index-China, 12 April 2010.

Re-based to 100 at year-end 1999. Past performance is not indicative of

future results.

next decade, even with the strictly enforced One Child

rule, and potentially level off to zero population growth

within 30 years. During the next two decades, Chinas

working population those aged 15 to 64 will reach

approximately 1 billion people.7

Chinas population is also steadily becoming more

affluent:8 Already, the worlds third largest, Chinas

economy expanded by almost 12% in the first quarter

of 2010 (11% in the fourth quarter of 2009) after a 4

trillion yuan stimulus program, including US $1.3trillion

in new bank lending at record-low interest rates that was

originally enacted in 2008. Although Indias market has

grown a remarkable 216.65% in the past 10 years, China

has delivered a strong 94.16% growth during the same

period (FIgure 1).9

All of these factors are expected to lead to greater

production of goods and services, additional disposable

income, increased domestic demand for food and

resources, as well as enhanced export activity. On the

downside, it is estimated that Beijing will soon have to

find jobs for 33 million people, as certain industries,

such as textiles, steel, toys and construction materials

(specifically cement), have been hard hit by plummeting

global export activity and increased adherence to global

quality standards.10

In both nations, the middle class is also expanding

at ameteoric pace, fueling a wave of domestic

consumption that has still not begun to ebb. Adding

tothe positive outlook for continuing momentum, about

half of both the Chinese and Indian populations are

under age 45 presumably with many good buying

years ahead of them.11

fIGURE 2

By 2020 China GDP Is forecast to be

over US $12tn and India at US $3.4tn

(US$tn)

14

70

India

China

60

Chindia as a % of US (RHS)

10

50

40

30

20

10

1990

1995

2000

2005

2010

2015

2020

% of US GDP

US GDP

12

Source: IMF, World Bank, UN, National Statistics Offices, CLSA AsiaPacific Markets, June 2010.

In China, for example, promotion of private consumption

remains a high priority, and a long list of government

initiatives includes health care reforms and increased

spending on education, pension programs and

affordable housing. In India, thousands of young people

return to their homeland every year after studying or

working abroad, and that trend continues to grow.

The youthfulness of both nations also represents a key

source of low-cost labor for business growth, industry

expansion and infrastructure projects. Industries that

benefit from being able to draw on a large, stable mass

of younger workers include construction, consumer

goods manufacturing, agriculture, textiles, apparel

and energy. Service industries, including call-center

operations, accounting and basic medical analytics,

could also benefit.11

Partially as a result of these favorable demographics,

China enjoyed strong 8.45% GDP increases in 2009,

while India lagged only somewhat with steady 6.7% GDP

growth. Over the next few years, these growth rates

are predicted to pick up and reach 10% in China and

7-8% in India.12 These figures are even more impressive

when compared to other emerging economies that have

shrunk in response to recessionary forces, including

Brazil and Eastern Europe, as well as struggling

developed nations. (Figure 2)

China has also been able to attract favorable attention

through the recent 2008 Beijing Olympic Games more

than 4.7 billion viewers watched the Games worldwide

according to Nielsen, making it the largest global TV

audience in history and India is increasingly being

recognized for its innovation in both the pharmaceutical

and automotive industries. In 2009, for example, Tata

introduced the US $2,400 Tata Nano car, designed

to make automobile ownership accessible to millions

of Indians who previously could only afford a more

dangerous motorcycle for their daily travel needs.

Unlike India, however, China has recently become

viewed as souring on foreign investment, making

headlines with actions that ranged from publicly

criticizing the quality of foreign-made goods to

pressuring Google to leave the market by limiting its

business activities.13

Closely Linked for Centuries

The argument for considering Chinas and Indias

prospects in tandem is firmly rooted in both countries

history. Goods and ideas have always flowed easily

between the two nations: Buddhism was originally

introduced to China via India as early as the second

century B.C., and India played a significant role in

Chinas Silk Road, which was important not only for

trade, but also for cultural and technological exchanges

between the two countries merchants, soldiers and

pilgrims for nearly 3,000 years. In July 2006, this

legendary trade route was reopened with considerable

fanfare, pointing to a new era of trade cooperation,

albeit symbolically.

Today the two nations share more than 2,100 miles of

border, although about half still qualifies as disputed

territory. These blurred boundary lines have sometimes

led to heated conflicts, including a war between China

and India in 1962 over a contentious portion near the

Himalayas.

Ongoing diplomatic tensions have also bubbled to the

surface occasionally, such as those stemming from

India granting asylum to the Dalai Lama in 1959 and

China continuing to provide assistance to Pakistani

nuclear-weapons-related projects starting in 1977

and continuing to the present day.14 More recently, in

1993 and 1996, both countries signed the Sino-Indian

11 Sulekha.com, April 2010

12 Trading Economics, 5 April 2010

13 New York Times, Business Day, 26 March, 2010

14 National Security Archive, 2010

fIGURE 3

Indias Trade Deficit With China

(US$billion)

0

Looking at the composition of Indias exports specifically

to China, more than half the demand is for ores and

minerals (particularly iron ore). While exports are lowvalue-added, demand is likely to be boosted as Chinas

purchasing power increases, and the recovery continues.

-5

-10

-15

-20

Indias trade

deficit with

China has

widened 30

times in the last

decade

19

95

19

96

19

97

19

98

19

99

20

00

20

01

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

-25

Fiscal Year

Source: India Macroscope: Imminent RMB Revaluation: Revisiting ChinaIndia Trade Flows, Citigroup Global Markets, Rohini Malkani and Anushka

Shah, 22 April 2010

Bilateral Peace and Tranquility Accords, focused on

ending conflict along the Line of Actual Control (LoAC),

although neither country has agreed to the exact

location of this key line of demarcation.

Nevertheless, proximate nations naturally tend to

forge trading relationships, if only because of logistical

convenience and the generally lower associated costs

of transporting goods and exchanging services. As of

2010, India has emerged as Chinas seventh largest

export market, principally in the form of iron ore, steel,

plastics and cotton. Over the past five years, India/

China trade has increased by more than 50%. In FY09,

bilateral trade between the two countries reached more

than US $40 billion, and China officially became Indias

largest trading partner, replacing the US, as well as

Chinas 10th-largest export market.15

15 India Macroscope: Imminent RMB Revaluation: Revisiting China-India Trade

Flows, Citigroup Global Markets, Rohini Malkani and Anushka Shah, 22 April

2010

16 India Macroscope: Imminent RMB Revaluation: Revisiting China-India Trade

Flows, Citigroup Global Markets, Rohini Malkani and Anushka Shah, 22 April

2010

17 US Department of Commerce, 5 April 2010 and Reserve Bank of India, 23

April 2010

Today India imports 10% of everything China exports,

and her technology and engineering services-based

export economy is often dependent on what China

manufactures or copies in its thousands of factories

nationwide, adding to her US $84.7 billion deficit.

India imports electronic and engineering goods from

China, as well as key items that include capital goods,

and intermediates, such as chemicals and minerals.

Given that these categories represent key components

of investment growth, demand for such imports may be

on an uptick. However, this could limit gains seen on

the export front, resulting in the deficit remaining high.16

(Figure 3)

The future of both countries seems inextricably linked

going forward, as both have achieved a relatively

high degree of internal stability and global economic

success, despite the daunting odds that often define the

emerging world.

A Study in Divergent Paths

Because China is the worlds largest Communist state,

and India is the worlds largest democracy, the striking

contrasts are also readily apparent.

As Figure 4 indicates, these countries contrast in nearly

every way, down to what seems to be their national

DNA. China is a highly centralized nation with one ruling

party, the Chinese Communist Party, which has been

in power since its civil war victory in 1949. China also

speaks one principal language (Mandarin), while India

is a collection of 28 often-contentious states and seven

union territories, 16 official languages and four major

religions (Hinduism, Buddhism, Jainism, Sikhism) plus

a national centralized parliament with two houses and

more than 70 different ministries.

Moreover, their sources of economic success are also

vastly different. China has built on its solid productmanufacturing legacy to become a largely export-driven

economy, while India focuses primarily on its domestic

market, outsourcing only high-end technology and

business services. One hundred of the worlds Fortune

500 organizations maintain R&D facilities in India, and

more than 250 of the Fortune 500 have IT and backoffice operations.17

While China would seem to be a quantum leap ahead

of India, the European Central Bank concluded the

following in comparing the two economies:

First, considering trade in goods, the overall

degree of Chinas trade intensity is higher than

fundamentals would suggest, whereas the

converse is true for India. Second, Chinese

goods exports seem to compete increasingly

with those of mature economies, while Indian

exports remain more low-tech. Third, exports

of services tend to complement its exports

of goods, while Indias exports are growing

only in deregulated sectors, such as IT-related

services. Last, Chinas and Indias role in the

global financial system is still relatively limited

and often complementary to their roles in

globaltrade.

As a result, China continues to far outpace India in

terms of its sizable foreign exchange reserves (US $2.45

trillion, versus Indias approximately US $280 billion),

and in its essential infrastructure, such as roads, ports

and trains, needed to sell its goods globally.18

Although India is committed to achieving enduring

financial prosperity, it is still working to shed its

reputation for Third-World-style chaos. This includes a

lack of adequate major highways, electrical power, fresh

drinking water and other basic necessities, including

sufficient hospitals and health care for its burgeoning

population. The vast majority of the country still lives on

less than US $2.00 per day and suffers from widespread

poverty, illiteracy, disease and malnutrition, especially in

remote rural areas.

As the worlds largest democratic republic, India places

a high value on business ownership, and many smalland medium-sized enterprises (SMEs) are continuously

evolving into larger businesses. Yet, in this more

individually focused environment, key decisions are

often hampered by official bureaucracy and the legal

requirements involved in gaining consensus. This

can range from obtaining key permits from multiple

governmental ministries to compensating those

who might be adversely affected by key projects or

initiatives, such as those impacted by a new road,

housing development or dam project.

While it could also be argued that the socialist

underpinnings of Communism limit incentives for

individual business ownership and expansion in China, the

day-to-day decisions that can help a business succeed

also tend to be more streamlined due to this highly

efficient, centralized system. The downside, of course, is

fIGURE 4

The China/India Scorecard

China

Governmental efficiency

Free-market economy

Adequate infrastructure

Transparency of public information

Significant urban development

India

Property rights protections

Greater support for rapid entry by

multi-national companies

Greater support for local, private enterprises

More foreign investors

Influential, supportive expatriate community

Resistance to multi-lateral regulations

by other nations

Source: Deutsche Bank, Taimur Baig, Chief Economist, India. March, 2010

that this commitment to moving forward has also led to lax

quality standards and human rights violations in the quest

for economic progress and state unity.

One high-profile example is the Three Gorges Dam on

the Yangtze River, where as many as 2 million rural

inhabitants were relocated to less desirable locations to

create a hydroelectric reservoir, all without their consent

or sufficient compensation.

Other similar problems with Chinese dam and

infrastructure projects have resulted in allegations

of official cover-ups of inadequacies and failures in

resettlement programs; falsification of figures on

their progress; endemic corruption and misuse of

resettlement funds; systematic discrimination against

rural residents in the allocation of resettlement

resources; and a lack of proper efforts to inform, let

alone consult with the populations to be relocated.19

The resulting firestorm of criticism worldwide has only

begun to recently die down, but intensified scrutiny of

China by human rights activists continues. Clearly, China

and India are both defined by a mixture of opportunities

and much-needed improvements.

18 US Department of Commerce, 5 April 2010

19 Human Rights in China/International Rivers Network, 2009

The Quest for Natural Resources

Both countries are further united by their determined

search for raw materials and commodities to meet

future needs, including land, electrical power and water,

but here China is far ahead of India due to central

government foresight. Building on a series of Five Year

Plans that target economic development and using their

sizable capital, China has been steadily buying land in

Latin America and Africa, purchasing industries that could

generate imports or increase consumption over the long

term, and making deals with Russia, Kazakhstan and

Venezuela to secure its future oil supply.

According to a recent China at 2050 report:20

China has one-fifth of the worlds population, but only

about 7% of the globes arable land. Of that, only about

33% is believed to be productive, and the amount of

arable land is declining because of soil erosion and

the demands of a growing population. Farms also face

threats from industrial and agricultural pollution.

Chinas consumption of water already rivals that

of the United States and continues to rise. Its total

energy consumption is second only to the United

States, and China is the second largest emitter of

industrial carbon dioxide pollution.

Given those variables, some analysts believe China

will become much more dependent on food imports.

But that scenario might change, depending on

future technological advances and newly installed

government conservation and environmental

policies.

Even within its own borders, the Chinese government

has developed a number of policies with the aim of

developing its rural areas. These include westward

expansion, with a greater focus on developing inland

cities and communities, as well as offering subsidies

on household appliances and building materials only to

residents living well outside its cities.

Indias relationship to natural resources is considered

more sustainable overall than Chinas, partially because

of the agrarian base of the economy and its strong

internal focus. While air- and water-pollution controls

exist in India, there are still water shortages, soil erosion

and exhaustion, and deforestation occurring due to

increasing consumption needs.

20 CNN 2009

21 Economic Times, 4 April 2010

According to the World Bank, China has also achieved

some significant gains, including increased forest cover

and reduced air and water pollution caused by rampant

over-industrialization. A major stabilization program

enacted in 2008 is helping to expand sewage and waste

treatment facilities throughout the country.

India also appears to be doing more to stabilize agrarian

communities through the National Rural Employment

Guarantee Act Programme. This legislation ensures that

one family member is guaranteed 100 days of wage

employment per year to a rural household whose adult

members volunteer to do unskilled manual work, as well

as direct grants and subsidies for food, fuel and fertilizer.

In this way, the central government hopes to ensure more

long-range sustainability for areas beyond the major

metropolitan centers. Because the subsidies heavily

impact the national budget, the government is trying

to phase them out gradually over time, although this is

extremely unpopular with the electorate.

It remains to be seen how both China and India

will respond to pressure to adopt new, stricter

environmental guidelines, as proposed during the

2009 Copenhagen Climate Conference. The global

environmental summit ended without any legally

binding agreement by the two nations and without any

prospects for further action in 2010-2011.

Opportunities by Asset Class

and Industry

Chinese Equities

The current state of Chinese equities reflects the

central governments recent determination to learn

from the past and prosper based on new insights.

The global financial crisis has now led China to place

more emphasis on internal consumption as a driver

of economic growth, rather than relying as heavily on

exports, as they have in the past.

Nonetheless, Chinas economy remains more

hardware-dominated, with strong manufacturing,

real estate and infrastructure sectors predominating.

While there has been a significant increase in private

companies, the country is defined by its more than

300,000 State Owned Enterprises (SOEs), with the

150 largest employing more than 75 million people.21

Yet, according to a recent trend noted by McKinsey,

government favoritism towards state-owned

companies is fading as officials have attempted to

strengthen domestic businesses and the economy to

prepare them for unfettered global competition.22

The outlook for equities in China continues to be defined

by state-mandated policies, as the government tries

to maintain steady high growth, while avoiding the

bubbles that can form from the economy overheating.

The infamously booming China property market may

well slow down now, as the government has recently

introduced somewhat draconian measures to cool

off the market and drive speculators away. Other

governmental reforms may be implemented slowly, as

senior leadership remains keenly aware of the political

and economic risks of each decision.

For now, the best opportunities for Chinese

equity investors seem to be in consumer goods,

semiconductors, heavy equipment manufacturing

and banking, as they remain largely unaffected by the

downturn in export activity. The automobile industry is

another with relatively attractive prospects, given the

still low penetration of car ownership. For example,

according to the International Road Federations World

Road Statistics 2009, there were only 22 passenger

cars per 1,000 people in China in 2007, compared to

451 for the US.

However, foreign direct investment (FDI) activity and

ownership is still heavily regulated. According to

foreign investment guidelines issued by the National

Development and Reform Commission (NDRC), no

foreign firm can be the majority owner of any entity in

industries such as life insurance, fund management,

printing and publishing, construction, movie theaters

and many other enterprises. This also extends to the

banking industry, and there is a 25% limit on overseas

ownership in Chinese banks.

For certain industries, such as the processing of green

tea using traditional Chinese techniques and ivory

carving, foreign investment is prohibited altogether.

Clearly, the Chinese seem prepared to favor a more

exclusionary long-term approach over short-term

economic gains.

There is some cause for optimism, however, and the

landscape may be liberalizing on an industry-by-industry

basis. In 2009, for example, the government announced

that foreign investments in domestic travel agencies

could now exceed 50%.23

Indian Equities

For all of its challenges, perhaps the biggest surprise in

India is the robust scope of the countrys technologically

advanced, high-speed stock market. As the oldest stock

market in Asia, dating back to 1875 (even older than

Japans), the robust Bombay Stock Exchange (BSE)

numbers 6,600 listed companies only the NYSE has

more and settlement times are now a brisk T + 2. In

fact, the BSE was the second stock exchange in the

world to obtain ISO 9001:2000 certification.

In 2009, the average volume of business conducted on

the BSE was approximately US $40 billion each month,

and the total market capitalization for the companies

traded in the area of US $1.1 trillion.24 Opportunities

abound in India for savvy investors who are ready and

willing to take the long-term view. In 2009 and thus

far in 2010, India has delivered some of the strongest

equity performance of any emerging market. While the

Shanghai composite returned 78% in 2009, 25 Indias

SENSEX returned 80%.26

Long-standing corporate governance laws are also

in place that facilitate transparency. For example,

information about all major companies is readily

available through a Directors Database, as well as the

Indian Corporate Electronic Reporting System (ICERS).

Additionally, Fortune 500 companies continue to

invest in India across a spectrum of sectors: food and

beverages (Coca-Cola, PepsiCo), consumer durables

(Samsung, Philips, LG, Canon, Electrolux), automotives

(General Motors, Ford, Toyota), computers and software

services (IBM, Sun, Honeywell), pharmaceuticals

(GlaxoSmithKline, Pfizer), consumer products (Unilever),

financial services (Citigroup, HSBC), insurance (Allianz,

Prudential), engineering (Siemens, ABB, Alstom,

Bombardier), logistics (FedEx), and petrochemicals and

chemicals (BP, Shell, BASF).

Confidence in Indias equity market has continued to

grow after the Congress Partys decisive win in the most

recent national elections. Immediately afterward, the

legislature began implementing much-needed, muchdelayed financial reforms.

Subsequently, the Congress Party has successfully

moved forward with two IPOs of government-owned

firms, further enhancing their reputation for raising

22 McKinsey Quarterly, July 2008

23 European Chamber of Commerce, 2010

24 CIA World Factbook, 2009

25 MSCI China, 2009

26 Money-zine.com, 2010

money through the equity market. Over the years, the

Indian government has undertaken several ambitious

divestments plans of this type, but success has proven

elusive. This time the outcome may be different, as India

is under constant pressure from the markets and rating

agencies to reduce its chronic budget deficits.

Positive economic data has also supported the partys

cause, delivering strong growth of 7.2% in the first

quarter of 2010.27 It yet remains to be seen how

unpredictable variables such as monsoons, political

uncertainty, further rural development and relations

with Pakistan and China will play out, but Indias equity

market appears to be on a sustained upward trajectory.

Chinese and Indian Fixed Income

CHINA

Chinese and Indian fixed income markets have already

come a long way, but many impediments remain.

In both, foreign investors must obtain licenses and

both place ceilings on foreign holdings and charge

withholding taxes. However, they are both working to

gradually minimize these obstacles to allow increasing

foreign ownership.

In the past, the Chinese bond market was designed to

fund government fiscal deficits, while the corporates

were encouraged to borrow from the banks or tap

equity markets for their financing needs. Over time,

domestic investors have begun searching for alternative

investments and other funding sources than banks and

the equity markets. More recently, the government has

begun gradually easing regulations, leading to faster

development of the overall bond market.

Although China is rich in its potential for bonds, the

market is primarily domestically focused, as foreign

investors can earn only relatively low yields in the

context of emerging markets: CNY-denominated bond

yields may go up to just 4% in the corporate space and

1.5-3.5% in government bonds.28 Abundant liquidity and

traditional reliance on bank lending for corporates are

27 Trading Economics, 5 April 2010

28 JPM Local Currency Guide, October 2008

29 India Macroscope: Imminent RMB Revaluation: Revisiting China-India Trade

Flows, Citigroup Global Markets, Rohini Malkani and Anushka Shah, 22 April

2010

30 Moodys, April 2010

31 Standard & Poors, April 2010

to blame, rather than lack of interest in capital markets.

The Chinese government bond market is the second

largest in Asia, after Japan.

The Chinese currency landscape has also proven

intriguing more from the perspective of politics

and diplomacy than a fundamentally driven valuation

exercise. Many experts argue that the yuan is

significantly undervalued, but some, including the

Chinese government and the sell side, believe it is

priced at fair value.

The currency question in China will remain a

controversial issue that periodically flares up and drives

speculation on potential China-US trade wars, as well

as even gloomier doomsday scenarios. Recently, there

seems to be greater understanding on the currency front

between the two nations, and the stage is now set for

currency reform in China sooner than later, should that

mean gradual appreciation, widening trade bands or a

new currency basket.

In theory, an appreciation in the RMB would lead to

exports from China becoming less competitive, and boost

its purchasing power of imports. Countries that have a

similar export structure to China such as India would

benefit most from an RMB revaluation, given that their

products would be priced more competitively.29

One particularly attractive opportunity for foreign fixed

income investors in China is in China-USD-denominated

corporate bonds. This market is relatively small,

despite Chinas vast size, but it is developing, as many

corporates are looking to diversify their funding sources

beyond bank borrowing, which are normally short-term

and uncommitted.

Chinese high yield Eurobonds are currently dominated

by approximately 10 Chinese property developers, and

their ratings span BB to B-, with yields that range from

8% to 15%.30 Industry sectors of other issuers vary from

domestic consumption plays to natural resources, and

these are currently yielding 4% to 14%,31 depending on

the fundamentals.

INDIA

In contrast, Indias currency continues to float against

the US dollar and offers much broader fixed income

potential. Its bond market has been well-developed

since the mid-1990s, and foreign institutional investors

are permitted, albeit constrained by quotas.

The Indian debt market consists of three main

segments:

1. Sovereign - Government securities, comprising

central and state government securities, and

Treasury bills.

2. Public Sector - Public Sector Undertaking (PSU)

bonds are generally treated as surrogates of

sovereign paper, sometimes due to explicit guarantee

and often due to the comfort of government

ownership of the PSUs.

3. Corporate Sector - Corporate securities comprising

debentures/corporate bonds and commercial paper

This market also has a well-developed term and call

and notice money market. These are non-collateralized

transactions, where players lend and borrow money

among themselves. In addition to ready-forward

transactions, the collateralized borrowing and lending

obligation (CBLO) platform is a unique feature that

offers a secured, guaranteed platform for borrowing and

lending monies in the institutional market.

Pre dominantly a wholesale market, the Indian

debt market is dominated by institutional investor

participation. Major investors in the debt markets are

comprised of banks, financial institutions, mutual funds,

provident funds, insurance companies and corporates.

The smaller number of large players has resulted in the

debt markets being fairly concentrated and evolving into

a wholesale negotiated dealings market.

Corporate debt issues are generally privately placed,

while the government issues are auctioned to the

participants. Secondary-market dealings for government

securities and Treasury bills are done via Negotiated

Dealing Settlement, while corporate bonds are largely

traded over-the-counter (OTC), and negotiated through

brokers.

Major market participants in Indias debt market include:

Indias Central Government

Public-sector Financial Institutions

Reserve Bank of India

Banks

Primary Dealers

Mutual Funds

Indias State Governments

Foreign Institutional Investors

Public Sector Units

Provident Funds

Corporate Treasuries

Charitable Institutions, Trusts and Societies

It is important to note that the average Indian citizen

does not carry significant debt, is risk-averse and

typically has a high savings rate of 32% of disposable

income.32 Most of this money flows into traditional

savings vehicles, such as bank deposits, retirement

funds and insurance, where it is then recirculated into

the economy in the form of loans, further supporting

fixed income activity.

At present, however, the principal drawbacks to Indias

fixed income market are the fairly limited universe of

financial instruments and limited overall access to the

market. The government regulates foreign-investor

participation in Indias fixed income local markets by

imposing strict quotas currently US $5 billion for

investments into India government bonds and US $15

billion into local corporates. Credit default swaps are

non-existent, as are longer-maturity bonds (those with

maturities greater than 10 years).

Corporates that do not make it into the marketplace

typically depend on bank funding, but there is no

secondary market for lower-grade commercial paper.

Secondary markets activity on the corporate side is

primarily for bank certificates of deposit at the short end

of the curve, and bonds of public-sector enterprises.

Activity in non-public-sector companies and commercial

paper is extremely thin.

India also suffers from lacking a single financial

services regulator that can help create a more cohesive

marketplace. For example, mutual funds are overseen

by the Securities and Exchange Board of India (SEBI),

the banks are regulated by the Reserve Bank of India,

and the national pension fund is governed by yet

another regulatory body, the Pension Fund Regulatory

and Development Authority (PFRDA). This lack of a single

overarching structure and more bureaucracy contributes

to fewer market participants.

Today a 10-year Indian government bond offers

very attractive returns 400 basis points over a US

government bond33 especially given that incremental

risks are not increasing. Despite the Asian economic

crisis of 1997-1998, the Indian government has never

defaulted on any of its obligations.34 Bonds issued

by public-sector enterprises (those in which the

Government of India owns a majority stake) tend to

grade at around 80-100 basis points over comparable

32 Confederation of Indian Industry, 2008

33 Seeking Alpha, December 2009

34 Goldman Sachs, Fair Value of BRIC Currencies, BRICs Monthly, 16 March 2010

government bonds. These issuers enjoy the highest

credit-quality ratings from domestic rating agencies due

to their ownership; i.e., their default risk is perceived to

be the same as that of the Government of India.

In Indias USD-denominated corporate bond market, the

opportunities are quite limited. The market itself is very

small with literally only a few issues; primarily banks that

are priced quite expensively and return yields ranging from

4% to 7%. Because the countrys bond market is deep

and liquid, Indian corporations have traditionally relied

on raising funds at home to avoid currency risk. Most US

dollar bonds were issued in 2006-2007, as the issuers

clients wanted access to dollar funding at the time.

As for its stature among rating agencies, Standard &

Poors rates India as investment grade, while Moodys

considers it one notch below investment grade due to

its high fiscal deficit and ongoing infrastructure issues.

As a way of closing the budget gap, the government is

trying to develop a unified tax rate for all types of assets

and services so that there is more uniformity, fairness

and potential revenue generation inherent in the tax

code, but that proposal has recently been postponed

until 2011.35

Weighing Political and Economic Risks

As with all emerging markets, China and India also

carry inherent economic, social and political risks for

investors. Despite having joined the modern age in

many respects, both countries determination to keep

foreigners at arms length and the potential for currency

and market fluctuations, together with their relentless

appetite for raw materials to accommodate population

expansion, may well lead to higher inflation, as well as

boom and bust cycles.

At present, the chief risk in China is a potential property

bubble, but inflation, excessive monetary tightening and

the administrative measures needed to regulate the

economy also represent concerns. If the government

is too harsh in containing property price increases,

for example, it may have a negative impact on raw

materials, employment and housing-related industries.

Excessive monetary tightening could also squeeze

growth in corporate earnings, and a further rally in

commodity prices would increase Chinas imports.

35 Seeking Alpha, December 2009

10

Additionally, there are many unknowns related to full and

accurate financial reporting in Chinas economy. It is well

known that local government entities engage in heavy

borrowing that does not appear in any official statistics.

Instead, these expenditures are being funded through

the use of off-balance-sheet special purpose vehicles.

In India, inflation is the key risk, as it has reached

almost 10% year-over-year in March 2010 and may

well increase. The central bank only became serious

about tackling this issue recently through a series of

emergency rate hikes. Investments are also a high

priority on the governments agenda and prominent

on investor radar screens, so any further delays and

setbacks would clearly have a negative ripple effect.

Although steady, sustained measures have been

taken to integrate Indias economy into a globalized

environment, her future growth will also depend on

successfully establishing a world-class infrastructure,

and still more needs to be done to reduce the fiscal

deficit. For India to sustain strong GDP growth,

investment in infrastructure needs to be enhanced

significantly. Without more roads, the number of

cars cannot increase; without more power, industrial

production cannot grow; without more ports, trade will

be unable to expand. It is therefore imperative for this

sector to keep delivering above GDP growth rates in

order for India to flourish.

Envisioning the Future

Due to the difference in the immediate focus of the

two economies, including both countries in a portfolio

would allow an investor to maximize a broader spectrum

of opportunities, while at the same time diversifying

underlying political and socioeconomic risks.

It is obviously essential to be able to wield the local

knowledge, cultural insight and in-depth experience to

identify and capture the right opportunities at the right

time in order to avoid the pitfalls before they make an

impact.

The picture of Chinas and Indias immediate future is

still coming into sharper focus, but the well-learned

lessons of the past indicate there is still much more to

be gained in the months and years ahead.

biographies

Peter Soo, Managing Director, Head of Asia ex-Japan Equities

PineBridge Investments, Hong Kong

Mr. Soo joined the firm in 1989 and is responsible for Asia ex-Japan equities. Mr. Soo also oversees

regional portfolio management and strategic asset allocation. His investment industry experience started

in 1985 when he was a Portfolio Manager for New Zealand Equities. Mr. Soo graduated from Auckland

Technical Institute specializing in Accounting and Finance. He is a Chartered Accountant and a member of

the Chartered Institute of Corporate Secretaries and Administrators.

Elizabeth Soon, CFA, Managing Director, Portfolio Manager, Asia ex-Japan Equities

PineBridge Investments, Hong Kong

Ms. Soon joined the firm in 2008, having extensive experience in managing investment teams and

running Asia equity portfolios. She was Director and Head of the Pacific Basin for Standard Life

Investments (Asia) Ltd., where she was responsible for the management of the Groups Asian funds and

amember of the Global Stock and Sector Insights Committee (UK). Ms. Soon also spent 10 years at

Schroder Investment Management (HK), where she was Director and Head of Asia ex-Japan,

responsible for asset allocation and stock selection in Asia, and managing retail unit trusts and large

institutional portfolios. She is also a CFA charter holder and a board director of the Hong Kong Society

of Financial Analysts.

Kheng-Lai Tan, Managing Director, Portfolio Manager, Asia ex-Japan Equities

PineBridge Investments, Singapore

Mr. Tan joined the firm in 1999 and is responsible for managing Asia ex-Japan equity client portfolios. He

is also responsible for managing the balance sheet and product portfolios related to Indonesian equities

for AIGs insurance operations (AIA Financial). Prior to joining our firm, Mr. Tan worked as a Portfolio

Manager with AGF of Canada and John Govett from the United Kingdom. He was also involved in the

establishment and running of Pheim Asset Management, a boutique investment firm in Singapore. Mr. Tan

began his career in investments as an Analyst with DG-GZB (Asia) in 1988. He received a Bachelor of

Business Administration from the National University of Singapore. He also obtained his Certified

Financial Planner designation.

Natasha Smirnova, Senior Analyst, Emerging Markets Fixed Income

PineBridge Investments, London

Ms. Smirnova is a research analyst working in the Emerging Markets Fixed Income Team. She joined the

firm in 2004 as a Management Associate in the Emerging Markets Fixed Income Team. Prior to this, Ms.

Smirnova was a Junior Macro economist with the Emerging Markets Research team at Credit Suisse

First Boston, covering Russia and Ukraine. Before that, she worked for the Moscow-based AIG

Investment Bank. Ms. Smirnova received a first class honors degree in BA Foreign Languages from the

Moscow State Linguistic University, a first class honors postgraduate degree in Financial Management

from Finance Academy at the Government of the Russian Federation in Moscow and an MSc in Money,

Banking and Finance (Merit) from the Middlesex University in London. Ms. Smirnova passed Level I of

the CFA program.

Andressa Tezine, Vice President, Senior Research Analyst, Emerging Markets Fixed Income

PineBridge Investments, London

Ms. Tezine joined the firm in 2005 as a Senior Analyst for Latin America. She is responsible for the

coverage of Latin American sovereign credits and market analysis. In 2008 she became Head of

Research for the Emerging Markets team. Prior to joining PineBridge Investments, she was a Senior

Analyst at ABN Amro Bank Brazil and also Dresdner Bank Lateinamerika. Ms Tezine began her investment

career in 1993 at Unibanco. She received a degree in Economics from the University of Sao Paulo and an

MSc in Economics from the Universitat Pompeu Fabra, Barcelona.

Huzaifa Husain, Head of Equities-India, Portfolio Manager, Mumbai*

Mr. Husain joined the firm in 2004 and is now the Head of Equities in India. He has more than 12 years

of experience in fund management in India. At the firm, Mr. Husain has been a key member of the

team advising AIG India Equity Fund (a Dublin domiciled India offshore fund). He is also responsible for

managing the India domestic funds. Prior to joining the firm, Mr. Husain was an Equity Analyst at Principal

Mutual Fund and SBI Mutual Fund. Mr. Husain received a Post Graduate Diploma in Management (PGDM)

from Indian Institute of Management (IIM) Bangalore and a B.Tech from the Institute of Technology

(Banaras Hindu University).

Ruchir N. Parekh, Portfolio Manager, Fixed Income, Mumbai*

Mr. Parekh joined AIG Investments in 2007 as Assistant Vice President, Fixed Income. Mr. Parekh is

responsible for driving fixed income investment strategy and managing fixed income portfolios of the

domestic mutual fund schemes. He has over 11 years of experience in the Fixed Income markets in India

and the US. Prior to joining AIG Investments, he was working as a fixed income analyst at HDFC Asset

Management Company, where he was responsible for analyzing a variety of credits across several

industries and asset-backed securities. Prior to that, Mr. Parekh worked with Bear Stearns and Moodys

Investor Services in New York, covering investment grade and high yield credits. Mr. Parekh completed his

MBA from the University of Hartford and is a Graduate in Commerce from the University of Mumbai.

Siddhartha Singh, Head of Product Development-India/Product Specialist, Mumbai*

Mr. Singh joined AIG Investments in 2006 as Head of Product Development based in Mumbai. Prior to

joining AIG Investments, he was head of the Product Development and New Initiatives function at Indias

largest AMC - Reliance Capital Asset Management Company. Before that, Mr. Singh was with ABN AMRO

Bank responsible for branch banking operations and third-party product distribution. Mr. Singh has a

Masters degree in Management Science (MMS) from DAVV, Indore and a Bachelors degree in Physics from

Delhi University.

*The team members located in India are currently part of AIG India Asset Management Company and

are scheduled to transition to PineBridge Investments shortly.

PineBridge Investments is a group of international companies acquired by Pacific Century Group from American International Group, Inc. in March 2010. PineBridge companies

provide investment advice and market asset management products and services to clients around the world.

PineBridge Investments is a service mark proprietary to PineBridge Investments IP Holding Company Limited. Services and products are provided by one or more affiliates of

PineBridge Investments. Certain middle and back office functions incidental to the services and products provided by PineBridge Investments and its affiliates may be outsourced

to third parties.

Readership: This document is intended solely for the addressee(s). Its content may be legally privileged and/or confidential.

Opinions: Any opinions expressed in this document may be subject to change without notice. We are not soliciting or recommending any action based on this material.

Risk Warning: Past performance is not indicative of future results. Our investment management services relate to a variety of investments, each of which can fluctuate in value. The

value of portfolios we manage may fall as well as rise, and the investor may not get back the full amount originally invested. The investment risks vary between different types of

instruments. For example, for investments involving exposure to a currency other than that in which the portfolio is denominated, changes in the rate of exchange may cause the

value of investments, and consequently the value of the portfolio, to go up or down. In the case of a higher volatility portfolio the loss on realization or cancellation may be very high

(including total loss of investment), as the value of such an investment may fall suddenly and substantially.

In making an investment decision, prospective investors must rely on their own examination of the merits and risks involved.

Unless otherwise noted, all information contained herein is sourced from PineBridge Investments internal data.

The content included herein has been shared with various in-house departments within the member companies of PineBridge Investments, in the ordinary course of completion. All

PineBridge Investments member companies comply with the confidentiality requirements of their respective jurisdictions.

Parts of this presentation may be based on information received from sources we consider reliable. We do not represent that all of this information is accurate or complete, however,

and it may not be relied upon as such.

PineBridge Investments Europe Limited is authorised and regulated by the Financial Services Authority (FSA). In the UK this communication is a financial promotion solely intended

for professional clients as defined in the FSA Handbook and has been approved by PineBridge Investments Europe Limited.

Approved by PineBridge Investments Ireland Limited. This entity is authorised and regulated by the Financial Regulator in Ireland.

800.706.6661

www.pinebridge.com

WP 5/10

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The-Power-To-Visualize - Unknown PDFДокумент31 страницаThe-Power-To-Visualize - Unknown PDFathanasia123100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The RSI Scalping StrategyДокумент30 страницThe RSI Scalping StrategyDavid Gordon83% (23)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Motilal Oswal - Value Migration - 2015 PDFДокумент60 страницMotilal Oswal - Value Migration - 2015 PDFSanjeev Sadanand PatkarОценок пока нет

- Innesting BehaviourДокумент38 страницInnesting BehaviourSanjeev Sadanand PatkarОценок пока нет

- CACIB - Research FAST FX Fair Value ModelДокумент5 страницCACIB - Research FAST FX Fair Value ModelforexОценок пока нет

- Wealth MGMT LifecycleДокумент1 страницаWealth MGMT LifecycleSanjeev Sadanand PatkarОценок пока нет

- Sub: Intimation of Resignation of Deputy Managing Director of HDFC Bank LimitedДокумент1 страницаSub: Intimation of Resignation of Deputy Managing Director of HDFC Bank LimitedSanjeev Sadanand PatkarОценок пока нет

- MSIL Gujarat - Project.. From ArchivesДокумент28 страницMSIL Gujarat - Project.. From ArchivesSanjeev Sadanand PatkarОценок пока нет

- Background Paper - Infrastructure - 27jan PDFДокумент39 страницBackground Paper - Infrastructure - 27jan PDFSanjeev Sadanand PatkarОценок пока нет

- Paul VolckerДокумент3 страницыPaul VolckerSanjeev Sadanand PatkarОценок пока нет

- Write Up For Navneet Jan202014Документ3 страницыWrite Up For Navneet Jan202014Sanjeev Sadanand PatkarОценок пока нет

- 19 Types of Tax Deductions in IndiaДокумент3 страницы19 Types of Tax Deductions in IndiaSanjeev Sadanand PatkarОценок пока нет

- C2 Method of SeparationДокумент8 страницC2 Method of SeparationSanjeev Sadanand PatkarОценок пока нет

- Tale of Two BanksДокумент1 страницаTale of Two BanksSanjeev Sadanand PatkarОценок пока нет

- Indias Ascent Executive BriefingДокумент40 страницIndias Ascent Executive BriefingSantanu DasmahapatraОценок пока нет

- Principles in One Chart - Vishal Khandelwal PDFДокумент1 страницаPrinciples in One Chart - Vishal Khandelwal PDFSanjeev Sadanand PatkarОценок пока нет

- IIFL - 2017 Investors Conference - 25 Jan 17Документ11 страницIIFL - 2017 Investors Conference - 25 Jan 17Sanjeev Sadanand PatkarОценок пока нет

- EPC Annual ReportДокумент56 страницEPC Annual ReportSanjeev Sadanand PatkarОценок пока нет

- 19 Types of Tax Deductions in IndiaДокумент3 страницы19 Types of Tax Deductions in IndiaSanjeev Sadanand PatkarОценок пока нет

- Sanitaryware and Faucets Sector - Sep 2014Документ36 страницSanitaryware and Faucets Sector - Sep 2014Sanjeev Sadanand PatkarОценок пока нет

- The LeavesДокумент3 страницыThe LeavesSanjeev Sadanand PatkarОценок пока нет

- Interest Rate CalcДокумент1 страницаInterest Rate CalcSanjeev Sadanand PatkarОценок пока нет

- 3D - The Crude ArithmeticДокумент13 страниц3D - The Crude ArithmeticSanjeev Sadanand PatkarОценок пока нет

- Animal TissuesДокумент3 страницыAnimal TissuesSanjeev Sadanand PatkarОценок пока нет

- History: Badminton Is A Racquet Sport Played UsingДокумент26 страницHistory: Badminton Is A Racquet Sport Played UsingSanjeev Sadanand PatkarОценок пока нет

- Satyam Daylight Robbery Theme Note 17-12-08Документ4 страницыSatyam Daylight Robbery Theme Note 17-12-08Sanjeev Sadanand PatkarОценок пока нет

- Question Bank - 2016Документ1 страницаQuestion Bank - 2016Sanjeev Sadanand PatkarОценок пока нет

- Choosing The Right Metrics To Maximize ProfitabilityДокумент17 страницChoosing The Right Metrics To Maximize ProfitabilitydipanshurustagiОценок пока нет

- Valuation BasicsДокумент9 страницValuation BasicsSanjeev Sadanand PatkarОценок пока нет

- MMS IV Final Project Marks StatementДокумент2 страницыMMS IV Final Project Marks StatementSanjeev Sadanand PatkarОценок пока нет

- Sanjeev: Three Rules of GoldrattДокумент3 страницыSanjeev: Three Rules of GoldrattSanjeev Sadanand PatkarОценок пока нет

- Financial Modelling, Simulation, and Optimisation: Mihir Dash Alliance Business School, Bangalore, IndiaДокумент10 страницFinancial Modelling, Simulation, and Optimisation: Mihir Dash Alliance Business School, Bangalore, IndiahaythoОценок пока нет

- LN10 Titman 479536 Valuation 03 LN10Документ48 страницLN10 Titman 479536 Valuation 03 LN10Sta Ker100% (1)

- Qtrade Investor Beginners Guide Investing OnlineДокумент15 страницQtrade Investor Beginners Guide Investing OnlinesevyОценок пока нет

- MBA Full Project List RM SolutionДокумент34 страницыMBA Full Project List RM SolutionKesanam SpОценок пока нет

- Chapter 2-Traditional Approach For Stock AnalysisДокумент20 страницChapter 2-Traditional Approach For Stock AnalysisPeterОценок пока нет

- HFJ 50 Women in Hedge Funds 2013Документ13 страницHFJ 50 Women in Hedge Funds 2013kwstisx2450Оценок пока нет

- Who Is An NRI?: NRI Can Invest in The Following ProductsДокумент7 страницWho Is An NRI?: NRI Can Invest in The Following ProductsnikmanojОценок пока нет

- Inclusive Business Ex-Ante Impact Assessment: A Tool For Reporting On ADB's Contribution To Poverty Reduction and Social InclusivenessДокумент34 страницыInclusive Business Ex-Ante Impact Assessment: A Tool For Reporting On ADB's Contribution To Poverty Reduction and Social InclusivenessADB Poverty ReductionОценок пока нет

- Nickel Pig Iron in China: CommoditiesДокумент8 страницNickel Pig Iron in China: CommoditiesDavid Budi SaputraОценок пока нет

- Money and BankingДокумент531 страницаMoney and BankingKofi Appiah-DanquahОценок пока нет

- R C o C A I: Akanshha Agrawal and Anupriya DhonchakДокумент18 страницR C o C A I: Akanshha Agrawal and Anupriya Dhonchakrishiraj singhОценок пока нет

- Prospectus: El Tucuche Fixed Income FundДокумент34 страницыProspectus: El Tucuche Fixed Income FundDillonОценок пока нет

- Internship Report BBAДокумент102 страницыInternship Report BBAfarukОценок пока нет

- Corporate Governance: Effectiveness of Zimbabwean Hard Law On Blockholders' ProtectionДокумент9 страницCorporate Governance: Effectiveness of Zimbabwean Hard Law On Blockholders' Protectionchris kingОценок пока нет

- Alfacurrate AAA PMS Jul16Документ39 страницAlfacurrate AAA PMS Jul16flytorahulОценок пока нет

- WINDOW DRESSING SДокумент2 страницыWINDOW DRESSING SShubhalaxmiОценок пока нет

- 07 Chapter 1Документ37 страниц07 Chapter 1bjoshna0% (1)

- Morningstar Indexes Market Beta Is A Commodity Dont OverpayДокумент8 страницMorningstar Indexes Market Beta Is A Commodity Dont OverpayAbhishek SinhaОценок пока нет

- Lovely Inu Finance WhitePaper - The Rise of Meme Token Revolution - Little Love Dream BigДокумент19 страницLovely Inu Finance WhitePaper - The Rise of Meme Token Revolution - Little Love Dream BigsCrypto AirdropОценок пока нет

- Welthee LiteДокумент22 страницыWelthee LiteMioara MihaiОценок пока нет

- SBI Mutual Funds: Financial ServicesДокумент9 страницSBI Mutual Funds: Financial ServicesShivam MutkuleОценок пока нет

- CS Executive Capital Market and Securities Laws Important Topics CSCARTINDIAДокумент10 страницCS Executive Capital Market and Securities Laws Important Topics CSCARTINDIAjesurajajosephОценок пока нет

- Literature Review of Mutual Fund and Fixed DepositДокумент2 страницыLiterature Review of Mutual Fund and Fixed DepositPar Th IV50% (2)

- Zimbabwe Investment and Development Agency Act Chapter 14.37Документ40 страницZimbabwe Investment and Development Agency Act Chapter 14.37Phineas Khosa NdhlauОценок пока нет

- IFSB-6 (December 2008) - enДокумент37 страницIFSB-6 (December 2008) - enZakkaОценок пока нет

- BUSINESS PLAN Mark ChavezДокумент8 страницBUSINESS PLAN Mark ChavezMark ChavezОценок пока нет

- NICEHoldingsInvestorsRelations 2020 3Q ENGДокумент31 страницаNICEHoldingsInvestorsRelations 2020 3Q ENGSimonasОценок пока нет

- He Watched Tech Stocks Scream Higher With Little InvolvementДокумент37 страницHe Watched Tech Stocks Scream Higher With Little InvolvementShankhadeep Mukherjee100% (1)