Академический Документы

Профессиональный Документы

Культура Документы

China Formulario Certificado Origen Ingles

Загружено:

Lissette Fernanda Moraga VergaraИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

China Formulario Certificado Origen Ingles

Загружено:

Lissette Fernanda Moraga VergaraАвторское право:

Доступные форматы

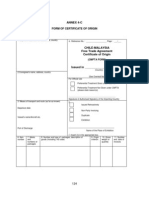

Certificate of Origin

1.

Certificate No.:

Exporters name, address, country:

CERTIFICATE OF ORIGIN

2.

Producers name and address, if known:

Form F for China-Chile FTA

Issued in

(see Instruction overleaf)

3.

Consignees name, address, country:

5.

For Official Use Only

Preferential Tariff Treatment Given Under _______

Preferential Treatment Not Given (Please state reasons)

4.

Means of transport and route (as far as known)

Departure Date

Signature of Authorized Signatory of the Importing Country

Vessel /Flight/Train/Vehicle No.

6.

Remarks

Port of loading

Port of discharge

7. Item

number

(Max. 20)

14.

8. Marks and 9. Number and kind of packages; description of goods

numbers

on packages

Declaration by the exporter

15.

10. HS code

(Six digit code)

11. Origin

criterion

12. Gross weight,

quantity (Quantity

Unit) or other

measures (liters, m3,

etc)

13. Number,

date of invoice

and invoiced

value

Certification

The undersigned hereby declares that the above details and statement are It is hereby certified, on the basis of control carried out, that the declaration of the exporter is correct.

correct, that all the goods were produced in

(Country)

and that they comply with the origin requirements specified in the FTA for the

goods exported to

Place and date *, signature and stamp of certifying authority

Certifying authority

Importing country)

Tel:

Fax:

Address:

Place and date, signature of authorized signatory

A Certificate of Origin under China-Chile Free Trade Agreement shall be valid for one year from the date of issue in the exporting country.

Overleaf Instruction

Box 1:

State the full legal name, address (including country) of the exporter.

Box 2:

State the full legal name, address (including country) of the producer. If more than one producers good is included in the certificate, list the

additional producers, including name, address (including country). If the exporter or the producer wishes the information to be confidential, it

is acceptable to state Available to the competent governmental authority upon request. If the producer and the exporter are the same, please

complete field with SAME. If the producer is unknown, it is acceptable to state "UNKNOWN".

Box 3:

State the full legal name, address (including country) of the consignee.

Box 4:

Complete the means of transport and route and specify the departure date, transport vehicle No., port of

Box 5:

The customs authorities of the importing country must indicate () in the relevant boxes whether or not preferential tariff treatment is

accorded.

Box 6:

Customers Order Number, Letter of Credit Number, and etc. may be included if required. If the invoice is issued by a non-Party operator, the

name, address of the producer in the originating Party shall be stated

Box 7:

State the item number, and item number should not exceed 20.

Box 8:

State the shipping marks and numbers on the packages.

Box 9:

Number and kind of package shall be specified. Provide a full description of each good. The description should be sufficiently detailed to

enable the products to be identified by the Customs Officers examining them and relate it to the invoice description and to the HS description

of the good. If goods are not packed, state in bulk. When the description of the goods is finished, add *** (three stars) or \ (finishing

slash).

Box 10:

For each good described in Box 9, identify the HS tariff classification to six digits.

Box 11:

If the goods qualify under the Rules of Origin, the exporter must indicate in Box 11 of this form the origin criteria on the basis of which he

claims that his goods qualify for preferential tariff treatment, in the manner shown in the following table:

The origin criteria on the basis of which the exporter claims that his goods qualify for

preferential tariff treatment

Goods wholly obtained

Insert in Box 11

General rule as 40% regional value content

RVC

Products specific rules

PSR

Box 12:

Gross weight in Kilos should be shown here. Other units of measurement e.g. volume or number of items which would indicate exact

quantities may be used when customary.

Box 13:

Invoice number, date of invoices and invoiced value should be shown here.

Box 14:

The field must be completed, signed and dated by the exporter. Insert the place, date of signature.

Box 15:

The field must be completed, signed, dated and stamped by the authorized person of the certifying authority. The telephone number, fax and

address of the certifying authority shall be given.

Вам также может понравиться

- Formulario Certificado de OrigenДокумент2 страницыFormulario Certificado de OrigenCarolina AparicioОценок пока нет

- Formato de Guia Comerci ExteriorДокумент2 страницыFormato de Guia Comerci ExteriorGuga Jara VelizОценок пока нет

- Bill of Lading: Bar Code SpaceДокумент3 страницыBill of Lading: Bar Code Spacealexandra reyesОценок пока нет

- Hapag-Lloyd Aktiengesellschaft, Hamburg: Multimodal Transport or Port To Port ShipmentДокумент3 страницыHapag-Lloyd Aktiengesellschaft, Hamburg: Multimodal Transport or Port To Port ShipmentVanessa Angulo100% (1)

- BLДокумент4 страницыBLIgnacio Solo de ZaldívarОценок пока нет

- Bill of Lading Andina ChileДокумент1 страницаBill of Lading Andina ChileH'a Ram0% (1)

- Formato Modelo de Conocimiento de Embarque - Bill of Lading Clase Mayo 10Документ1 страницаFormato Modelo de Conocimiento de Embarque - Bill of Lading Clase Mayo 10Andres Fernando Millan PereaОценок пока нет

- Shippers Letter of InstructionДокумент1 страницаShippers Letter of InstructionhmarcalОценок пока нет

- Booking Edgar Pozo 1 ContenedorДокумент1 страницаBooking Edgar Pozo 1 ContenedorSebastian Aguilar EscalanteОценок пока нет

- Original Bill of Lading: CarrierДокумент5 страницOriginal Bill of Lading: Carrierjose0% (1)

- S H I P P e R I N Formation - Not Part of This B/L ContractДокумент4 страницыS H I P P e R I N Formation - Not Part of This B/L ContractRenato Mendoza BerecheОценок пока нет

- Bill of LadingДокумент1 страницаBill of LadingLuis BirminghanОценок пока нет

- Akkon KonşimentoДокумент1 страницаAkkon Konşimentoعلي ابراهيمОценок пока нет

- 1BLB000293 BLДокумент1 страница1BLB000293 BLritaОценок пока нет

- (Doe-001) BL OriginalДокумент2 страницы(Doe-001) BL OriginalVictor Manuel Sanchez Reyes100% (1)

- Practica de Llenado de BLДокумент2 страницыPractica de Llenado de BLCesar RamírezОценок пока нет

- Hapag-Lloyd Aktiengesellschaft, Hamburg: Multimodal Transport or Port To Port ShipmentДокумент2 страницыHapag-Lloyd Aktiengesellschaft, Hamburg: Multimodal Transport or Port To Port ShipmentMapi Suyo Reyes100% (1)

- BL Master: Coffe World CorporationДокумент4 страницыBL Master: Coffe World Corporationwendy ramonОценок пока нет

- Hapag-Lloyd Aktiengesellschaft, Hamburg: Multimodal Transport or Port To Port ShipmentДокумент2 страницыHapag-Lloyd Aktiengesellschaft, Hamburg: Multimodal Transport or Port To Port ShipmentJhonatan aragon nuñezОценок пока нет

- Bill of Lading: Bar Code SpaceДокумент1 страницаBill of Lading: Bar Code SpacedownloadnovaОценок пока нет

- Modelo de Contrato AlibabaДокумент8 страницModelo de Contrato AlibabaEduardo Franklin Vasquez HuamanОценок пока нет

- BL Don AguacateДокумент1 страницаBL Don AguacateedcastanedapОценок пока нет

- 6225761420Документ3 страницы6225761420Sol SolОценок пока нет

- Zzsmedc8bkey PDFДокумент2 страницыZzsmedc8bkey PDFAlejandro L GonzalezОценок пока нет

- Esun 158178 MTДокумент1 страницаEsun 158178 MTJhona NainggolanОценок пока нет

- Modelo de Conocimiento de Embarque Bill of Lading Abril 2012Документ1 страницаModelo de Conocimiento de Embarque Bill of Lading Abril 2012Anunnaki Ocampo0% (1)

- Formato de BookingДокумент1 страницаFormato de BookingFinitus InfinitusОценок пока нет

- Modelo de Conocimiento de Embarque Bill of Lading Abril 2012Документ1 страницаModelo de Conocimiento de Embarque Bill of Lading Abril 2012Viviana GuzmanОценок пока нет

- Hapag-Lloyd Aktiengesellschaft, HamburgДокумент4 страницыHapag-Lloyd Aktiengesellschaft, HamburgJeremyClaeysОценок пока нет

- 2577003870Документ2 страницы2577003870Nguyễn Sơn CaОценок пока нет

- SALE CHICKEN - BK - JMSL-FCL 'Документ9 страницSALE CHICKEN - BK - JMSL-FCL 'Bhagoo HatheyОценок пока нет

- Sitc Container Lines Co., LTD.: B/L No. SITGTXSG315754Документ1 страницаSitc Container Lines Co., LTD.: B/L No. SITGTXSG315754Group CCLОценок пока нет

- Arrival Notice - Giay Bao Hang VeДокумент2 страницыArrival Notice - Giay Bao Hang VePeace TranОценок пока нет

- Documnto de Transporte Bill of Lading ConocimДокумент1 страницаDocumnto de Transporte Bill of Lading ConocimJhonCasquinSilvaОценок пока нет

- BL Cambiado Jowess-Ricardo MeloДокумент1 страницаBL Cambiado Jowess-Ricardo MeloNiquilinsebasОценок пока нет

- Evergreen Marine Corporation: Bill of LadingДокумент2 страницыEvergreen Marine Corporation: Bill of LadingDilan Rodriguez Mendoza100% (1)

- Bill of Lading PDFДокумент1 страницаBill of Lading PDFRohan GandhiОценок пока нет

- SalesOrd 53865 From Sizto Tech Corporation 4392 PDFДокумент1 страницаSalesOrd 53865 From Sizto Tech Corporation 4392 PDFwzuniniОценок пока нет

- Höegh Autoliners AS: Bill of LadingДокумент4 страницыHöegh Autoliners AS: Bill of Ladingk100% (1)

- Bill of LadingДокумент2 страницыBill of LadingJohan BenavidesОценок пока нет

- BillOfLadingДокумент1 страницаBillOfLadingDarrenОценок пока нет

- Booking ConfirmationДокумент4 страницыBooking ConfirmationCAROLINA CORTESОценок пока нет

- Modelo de Conocimiento de Embarque Bill of Lading Abril 2012Документ1 страницаModelo de Conocimiento de Embarque Bill of Lading Abril 2012ELYОценок пока нет

- Format SIsДокумент2 страницыFormat SIsSalim MalickОценок пока нет

- ISF 10+2 Fact SheetДокумент2 страницыISF 10+2 Fact Sheetpraveen10986Оценок пока нет

- DraftДокумент1 страницаDraftAlex Samuel SilvaОценок пока нет

- Origen ChinaДокумент3 страницыOrigen ChinaRodrigoMoralesMuñozОценок пока нет

- Annex 4-C: Form of Certificate of OriginДокумент3 страницыAnnex 4-C: Form of Certificate of OriginWei YeeОценок пока нет

- Certificado de Origen Peru ChinaДокумент2 страницыCertificado de Origen Peru ChinaChristianGutierrezSulcaОценок пока нет

- Original: Certificate of Origin Form For China-Peru FTAДокумент2 страницыOriginal: Certificate of Origin Form For China-Peru FTAMuñoz Sanchez EsthefanyОценок пока нет

- Certificate of Origining Feb WR PDFДокумент3 страницыCertificate of Origining Feb WR PDFLucero GonzalesОценок пока нет

- Chile Cert Origen ChinaДокумент2 страницыChile Cert Origen ChinamiОценок пока нет

- Certificate of Origin Form F For China-Chile FTAДокумент2 страницыCertificate of Origin Form F For China-Chile FTAinspectormetОценок пока нет

- Co Thailand - ModificadoДокумент2 страницыCo Thailand - ModificadoSebastian Aguilar EscalanteОценок пока нет

- United States - Chile Free Trade Agreement Tratado de Libre Comercio Chile - Estados Unidos Certificate of OriginДокумент3 страницыUnited States - Chile Free Trade Agreement Tratado de Libre Comercio Chile - Estados Unidos Certificate of OriginSoledad AceitunoОценок пока нет

- Shippers Letter Instruction Template 2012Документ1 страницаShippers Letter Instruction Template 2012daljitkaurОценок пока нет

- Cusdec InformationДокумент11 страницCusdec InformationlikehemanthaОценок пока нет

- BOL TrainingДокумент36 страницBOL TrainingeptrollerОценок пока нет

- Form AДокумент2 страницыForm AgeorgevoommenОценок пока нет

- Certificado TPPДокумент2 страницыCertificado TPPRobert TurnerОценок пока нет

- Mechanizing Philippine Agriculture For Food SufficiencyДокумент21 страницаMechanizing Philippine Agriculture For Food SufficiencyViverly Joy De GuzmanОценок пока нет

- InvoiceДокумент1 страницаInvoicesunil sharmaОценок пока нет

- Quijano ST., San Juan, San Ildefonso, BulacanДокумент2 страницыQuijano ST., San Juan, San Ildefonso, BulacanJoice Dela CruzОценок пока нет

- Presentation NGOДокумент6 страницPresentation NGODulani PinkyОценок пока нет

- Lecture 6Документ19 страницLecture 6salmanshahidkhan100% (2)

- Cfa - Technical Analysis ExplainedДокумент32 страницыCfa - Technical Analysis Explainedshare757592% (13)

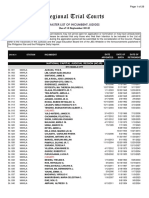

- Regional Trial Courts: Master List of Incumbent JudgesДокумент26 страницRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaОценок пока нет

- Calander of Events 18 3 2020-21Документ67 страницCalander of Events 18 3 2020-21Ekta Tractor Agency KhetasaraiОценок пока нет

- Voltas Case StudyДокумент27 страницVoltas Case Studyvasistakiran100% (3)

- Year 2016Документ15 страницYear 2016fahadullahОценок пока нет

- The Global Interstate System Pt. 3Документ4 страницыThe Global Interstate System Pt. 3Mia AstilloОценок пока нет

- Kennedy 11 Day Pre GeneralДокумент16 страницKennedy 11 Day Pre GeneralRiverheadLOCALОценок пока нет

- ENG Merchant 4275Документ7 страницENG Merchant 4275thirdОценок пока нет

- Aptdc Tirupati Tour PDFДокумент1 страницаAptdc Tirupati Tour PDFAfrid Afrid ShaikОценок пока нет

- The System of Government Budgeting Bangladesh: Motahar HussainДокумент9 страницThe System of Government Budgeting Bangladesh: Motahar HussainManjare Hassin RaadОценок пока нет

- Design Analysis of The Lotus Seven S4 (Type 60) PDFДокумент18 страницDesign Analysis of The Lotus Seven S4 (Type 60) PDFChristian Villa100% (4)

- JK Fenner (India) LimitedДокумент55 страницJK Fenner (India) LimitedvenothОценок пока нет

- Measure of Eco WelfareДокумент7 страницMeasure of Eco WelfareRUDRESH SINGHОценок пока нет

- A Study On Performance Analysis of Equities Write To Banking SectorДокумент65 страницA Study On Performance Analysis of Equities Write To Banking SectorRajesh BathulaОценок пока нет

- A Study On Green Supply Chain Management Practices Among Large Global CorporationsДокумент13 страницA Study On Green Supply Chain Management Practices Among Large Global Corporationstarda76Оценок пока нет

- Use CaseДокумент4 страницыUse CasemeriiОценок пока нет

- Coconut Oil Refiners Association, Inc. vs. TorresДокумент38 страницCoconut Oil Refiners Association, Inc. vs. TorresPia SottoОценок пока нет

- Posting Journal - 1-5 - 1-5Документ5 страницPosting Journal - 1-5 - 1-5Shagi FastОценок пока нет

- Procedure For Making Location DecisionsДокумент7 страницProcedure For Making Location DecisionsFitz JaminitОценок пока нет

- Quasha, Asperilla, Ancheta, Peña, Valmonte & Marcos For Respondent British AirwaysДокумент12 страницQuasha, Asperilla, Ancheta, Peña, Valmonte & Marcos For Respondent British Airwaysbabyclaire17Оценок пока нет

- Accra Resilience Strategy DocumentДокумент63 страницыAccra Resilience Strategy DocumentKweku Zurek100% (1)

- Billing Summary Customer Details: Total Amount Due (PKR) : 2,831Документ1 страницаBilling Summary Customer Details: Total Amount Due (PKR) : 2,831Shazil ShahОценок пока нет

- TCW Act #4 EdoraДокумент5 страницTCW Act #4 EdoraMon RamОценок пока нет

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersДокумент148 страницHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerОценок пока нет

- Production Planning & Control: The Management of OperationsДокумент8 страницProduction Planning & Control: The Management of OperationsMarco Antonio CuetoОценок пока нет