Академический Документы

Профессиональный Документы

Культура Документы

Ratio Analysis

Загружено:

viveknayeeАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ratio Analysis

Загружено:

viveknayeeАвторское право:

Доступные форматы

Ratio analysis

IMPORTANT OF RATIO ANALYSIS:Ratio Analysis is a widely used tool of Financial Analysis. It is defined as the

systematic Use of Ratio to interpret the financial statement so that the strength and weakness

of a firm as well as its historical performance and current financial condition can be

determined. The Ratio refers to the numerical or quantitative relationship between two

variables\items. Ratio analysis presents the financial statement into various functional areas

which highlight various aspects of the business like inequality, Profitability, assets turn over,

financial structure etc., all these ratios are important to both categories of the suppliers of

funds owners, and outsiders.

Ratio analysis presents the financial statement in to various functional areas which

highlight various aspects of the business like liquidity, profitability, assets turn-over, financial

structure etc. All the ratios are important of the both categories of the suppliers of funds,

owners and outsiders. They are more useful to the owners whose interest is reflected in

various valuation ratios those are in under.

Ratios are very important to know the financial position of the company. And the

classification of ratio is mainly five broad categories and those are as under.

(A) LIQUIDITY RATIOS

(B) PROFITABILITY RATIOS

(C) ASSETS TURNOVER RATIOS

(D) FINANCE STRUCTURE RATIOS

(E) VALUATION RATIOS

Ratio Analysis of wipro ltd

RATIOS

LIQUIDITY RATIOS

Current Ratio

Quick Ratio

PROFITABILITY RATIOS

Gross Profit ratio ( % )

operating profit ratio( % )

Net Profit ratio (%)

Rate of Return on Investment

Rate of Return on Equity

ASSETS TURN OVER RATIOS

Total assets Turnover ratio

Net Fixed Turnover ratio

Inventory Turnover ratio

Debtors turnover ratio

FINANCE SRUCTURE RATIOS

Equity ratio

Debt ratio

Debt-equity ratio

Interest coverage ratio

VALUEATION RATIOS

Earnings per share(EPS)

Dividend pay-out ratio(DPS)

Dividend yield

P/E ratio

Mar 2014

Mar 2013

Mar 2012

Mar 2011

Mar 2010

2.19

1.74

1.76

1.97

2.03

2.03

2.1

2.7

2.78

2.17

27.62

23.33

20.57

24.96

32.87

0.9

4.47

141.27

4.55

0.84

3.88

60.11

4.04

0.88

3.83

42.12

4.63

0.82

3.63

39.65

4.89

0.83

3.68

43.14

4.86

0.16

26.64

0.25

21.45

0.22

10.77

0.22

42.95

0.32

58

29.96

26.7

1.47

22.94

30.51

1.6

19.06

31.48

1.37

19.74

30.4

1.25

33.37

17.98

0.85

Ratio Analysis of TCS ltd

RATIOS

LIQUIDITY RATIOS

Current Ratio

Quick Ratio

PROFITABILITY RATIOS

Gross Profit ratio ( % )

operating profit ratio( % )

Net Profit ratio (%)

Rate of Return on Investment

Rate of Return on Equity

ASSETS TURN OVER RATIOS

Total assets Turnover ratio

Net Fixed Turnover ratio

Inventory Turnover ratio

Debtors turnover ratio

FINANCE SRUCTURE RATIOS

Equity ratio

Debt ratio

Debt-equity ratio

Interest coverage ratio

VALUEATION RATIOS

Earnings per share(EPS)

Dividend pay-out ratio(DPS)

Dividend yield

P/E ratio

Mar 2014

Mar 2013

Mar 2012

Mar 2011

Mar 2010

2.84

2.84

2.46

2.46

1.87

1.87

1.72

1.72

1.78

1.78

48.29

44.69

49.62

43.89

39.62

1.29

6.31

8675.53

5.04

1.26

5.88

9241.79

4.77

1.27

5.72

8013.56

5.48

1.21

5.37

4819.04

7.19

1.13

4.99

1942.22

6.52

0

1006.74

0.01

513.84

0

816.02

0

435.8

0

668.75

94.18

33.98

65.23

33.73

55.97

44.67

38.62

36.25

28.62

69.88

1.5

1.4

2.14

1.18

2.56

Ratio Analysis of Infosys ltd

RATIOS

LIQUIDITY RATIOS

Current Ratio

Quick Ratio

PROFITABILITY RATIOS

Gross Profit ratio ( % )

operating profit ratio( % )

Net Profit ratio (%)

Rate of Return on Investment

Rate of Return on Equity

ASSETS TURN OVER RATIOS

Total assets Turnover ratio

Net Fixed Turnover ratio

Inventory Turnover ratio

Debtors turnover ratio

FINANCE SRUCTURE RATIOS

Equity ratio

Debt ratio

Debt-equity ratio

Interest coverage ratio

VALUEATION RATIOS

Earnings per share(EPS)

Dividend pay-out ratio(DPS)

Dividend yield

P/E ratio

Mar 2014

Mar 2013

Mar 2012

Mar 2011

Mar 2010

3.83

3.83

4.82

4.82

4.72

4.72

5.05

5.05

5.38

5.38

26.09

27.7

31.22

27.69

28.89

0.94

4.8

0.94

4.83

0.97

4.43

0.93

3.82

0.9

3.43

NA

NA

NA

NA

NA

6.47

6.25

6.5

6.81

6.37

0

2334.67

0

4120

0

5838

0

8822

0

3737

178.22

35.35

1.92

158.82

26.45

1.45

147.56

31.85

1.64

112.25

53.45

1.85

100.26

24.93

0.96

Ratio Analysis of HCL Tech. ltd

RATIOS

LIQUIDITY RATIOS

Current Ratio

Quick Ratio

PROFITABILITY RATIOS

Gross Profit ratio ( % )

operating profit ratio( % )

Net Profit ratio (%)

Rate of Return on Investment

Rate of Return on Equity

ASSETS TURN OVER RATIOS

Total assets Turnover ratio

Net Fixed Turnover ratio

Inventory Turnover ratio

Debtors turnover ratio

FINANCE SRUCTURE RATIOS

Equity ratio

Debt ratio

Debt-equity ratio

Interest coverage ratio

VALUEATION RATIOS

Earnings per share(EPS)

Dividend pay-out ratio(DPS)

Dividend yield

P/E ratio

Mar 2014

Mar 2013

Mar 2012

Mar 2011

Mar 2010

1.6

1.59

1.33

1.31

1.69

1.68

2.19

2.18

1.64

1.61

44.81

33.06

23.26

26.39

31.83

0.85

3.28

137.69

5.32

0.83

2.79

79.19

4.88

0.73

2.63

99.18

3.63

0.64

2.39

102.55

2.84

0.75

2.63

53.73

3.79

0.06

59.22

0.17

25.27

0.18

13.72

0.3

12.37

0.16

43.42

51.82

23.16

1.55

28.13

42.66

2.52

17.4

43.11

1.52

15.57

25.7

1.1

14.88

47.04

3.77

Ratio Analysis of Tech Mahindra ltd

RATIOS

LIQUIDITY RATIOS

Current Ratio

Quick Ratio

PROFITABILITY RATIOS

Gross Profit ratio ( % )

operating profit ratio( % )

Net Profit ratio (%)

Rate of Return on Investment

Rate of Return on Equity

ASSETS TURN OVER RATIOS

Total assets Turnover ratio

Net Fixed Turnover ratio

Inventory Turnover ratio

Debtors turnover ratio

FINANCE SRUCTURE RATIOS

Equity ratio

Debt ratio

Debt-equity ratio

Interest coverage ratio

VALUEATION RATIOS

Earnings per share(EPS)

Dividend pay-out ratio(DPS)

Dividend yield

P/E ratio

Mar 2014

Mar 2013

Mar 2012

Mar 2011

Mar 2010

1.67

1.67

0.91

0.91

1.16

1.16

1.2

1.2

2.38

2.38

43.11

17.43

13.6

22.32

31.29

1.51

5.59

0.89

4.03

0.85

3.96

1.05

4.46

3321.33

4.85

6.15

4.59

4.75

0.84

4.21

4965.5

5.07

0.04

38.3

0.34

8.5

0.33

6.64

0.36

8.24

0.74

6.46

115.01

17.39

1.11

50.94

9.82

0.47

36.13

11.07

0.56

55.29

7.23

0.59

60.74

5.76

0.41

NA

NA

NA

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- NokiaДокумент53 страницыNokiaYahya NiaziОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Lakshmi MittalДокумент18 страницLakshmi MittalviveknayeeОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Indian Insurance TrendДокумент6 страницIndian Insurance TrendSaket SwarnkarОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Adr & GDRДокумент13 страницAdr & GDRviveknayeeОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Basic InformationДокумент8 страницBasic InformationviveknayeeОценок пока нет

- Localk Traveling BusinessДокумент1 страницаLocalk Traveling BusinessviveknayeeОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

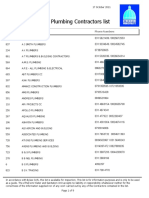

- Registered Plumbing Contractors List: Phone Numbers Number Company Name Phone NumbersДокумент9 страницRegistered Plumbing Contractors List: Phone Numbers Number Company Name Phone NumbersviveknayeeОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Chanda KochharДокумент39 страницChanda KochharviveknayeeОценок пока нет

- Banking RiskДокумент2 страницыBanking Riskmsy1991Оценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- India ProductionДокумент38 страницIndia ProductionviveknayeeОценок пока нет

- 8th Year PlanДокумент13 страниц8th Year PlanviveknayeeОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Azeem and Haq, 2012Документ18 страницAzeem and Haq, 2012viveknayeeОценок пока нет

- MRP PPT Mining Exam No. 23, 39,44Документ41 страницаMRP PPT Mining Exam No. 23, 39,44viveknayeeОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Five Year PlanДокумент7 страницFive Year PlanviveknayeeОценок пока нет

- SM ProjectДокумент20 страницSM Projectmsy1991Оценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- LicenseДокумент5 страницLicenseviveknayeeОценок пока нет

- Bamboo Prefab HousesДокумент70 страницBamboo Prefab HousesshreerishimunniОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- ProdctДокумент17 страницProdctshreerishimunniОценок пока нет

- ClearasilДокумент4 страницыClearasilviveknayeeОценок пока нет

- SemesterДокумент20 страницSemesterviveknayeeОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Adr GDRДокумент4 страницыAdr GDRviveknayeeОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- PricesДокумент6 страницPricesviveknayeeОценок пока нет

- Five Year PlanДокумент7 страницFive Year PlanviveknayeeОценок пока нет

- Ceramic IndustryДокумент90 страницCeramic IndustryJadavNikulkumarJОценок пока нет

- Power Sector in India ProjectДокумент23 страницыPower Sector in India ProjectRajesh ParidaОценок пока нет

- Ceramic IndustryДокумент90 страницCeramic IndustryJadavNikulkumarJОценок пока нет

- Technology Generation in The Indian Tyre Industry Has Witnessed A Fair Amount of Expertise and Versatility To AbsorbДокумент12 страницTechnology Generation in The Indian Tyre Industry Has Witnessed A Fair Amount of Expertise and Versatility To AbsorbshreerishimunniОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Power Sector in India ProjectДокумент23 страницыPower Sector in India ProjectRajesh ParidaОценок пока нет

- "E-I-C Analysis of Capital Goods Sector": Executive SummaryДокумент123 страницы"E-I-C Analysis of Capital Goods Sector": Executive SummarySaumil ShahОценок пока нет

- Chapter 7Документ7 страницChapter 7Fozia Zaka CheemaОценок пока нет

- Jawaban P5-6 Intermediate AccountingДокумент3 страницыJawaban P5-6 Intermediate AccountingMutia WardaniОценок пока нет

- Man AHL Analysis CTA Intelligence - On Trend-Following CTAs and Quant Multi-Strategy Funds ENG 20140901Документ1 страницаMan AHL Analysis CTA Intelligence - On Trend-Following CTAs and Quant Multi-Strategy Funds ENG 20140901kevinОценок пока нет

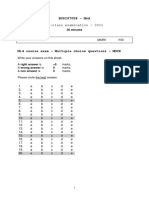

- QP 202301 Business U1Документ20 страницQP 202301 Business U1张查Оценок пока нет

- EXECUTIVE SUMMARY On Icici BankДокумент24 страницыEXECUTIVE SUMMARY On Icici BankSri Harsha100% (1)

- Model Paper Financial ManagementДокумент6 страницModel Paper Financial ManagementSandumin JayasingheОценок пока нет

- Banknifty Backtest DataДокумент2 страницыBanknifty Backtest DataSanjeev SinghОценок пока нет

- Introduction To Financial Statement AnalysisДокумент114 страницIntroduction To Financial Statement AnalysisHuy PanhaОценок пока нет

- Chapter 3 (10th Edition) 2013Документ37 страницChapter 3 (10th Edition) 2013Nguyen Dac ThichОценок пока нет

- BuyerWinback ChurnДокумент430 страницBuyerWinback ChurnKazi DarazОценок пока нет

- Srinivas Project Questionnaire 3Документ5 страницSrinivas Project Questionnaire 3Srinivas Kannan100% (1)

- Why Supply Chain by AmazonДокумент4 страницыWhy Supply Chain by Amazonasharmuhammadiqbal875Оценок пока нет

- Philip - Fisher - Checklist For Stock SelectionДокумент3 страницыPhilip - Fisher - Checklist For Stock SelectionKiran NikateОценок пока нет

- Busi97058 Icbs M&a MCQ Mock With AnswersДокумент4 страницыBusi97058 Icbs M&a MCQ Mock With AnswersrodrigoОценок пока нет

- FINE 6800 - Assignment 2 Fall 2023Документ4 страницыFINE 6800 - Assignment 2 Fall 2023Rishabh ValechaОценок пока нет

- Financial Ratio of C&B - WPS OfficeДокумент13 страницFinancial Ratio of C&B - WPS OfficeSiddharth AgarwalОценок пока нет

- Dividend DecisionДокумент20 страницDividend DecisionRiya_Biswas_8955Оценок пока нет

- Binomial Option Pricing ModelДокумент21 страницаBinomial Option Pricing ModelMahesh Balasubramaniam100% (1)

- Acquisition of Tetley by TataДокумент3 страницыAcquisition of Tetley by TataANUSHRI MAYEKARОценок пока нет

- List of Branches of Brokerage Firms 09.04.2019Документ87 страницList of Branches of Brokerage Firms 09.04.2019Muhammad AtharОценок пока нет

- Sun Microsystems A Good Strategic Fit For OracleДокумент5 страницSun Microsystems A Good Strategic Fit For OracleJosé F. PeñaОценок пока нет

- Tsla Vs FordДокумент5 страницTsla Vs Fordapi-314942529Оценок пока нет

- Final ADM 3350Документ13 страницFinal ADM 3350Dan Grimsey100% (1)

- Employee Stock OptionДокумент6 страницEmployee Stock OptionAvtar BrarОценок пока нет

- Procter Gamble AnalysisДокумент37 страницProcter Gamble Analysisapi-115328034100% (2)

- Chapter 11Документ60 страницChapter 11Mofdy MinaОценок пока нет

- Introduction To Currency Trading: Foreign Exchange Central Banks CurrenciesДокумент25 страницIntroduction To Currency Trading: Foreign Exchange Central Banks Currenciesarunchary007Оценок пока нет

- Chapter 12 - Marketing Mix ProductДокумент2 страницыChapter 12 - Marketing Mix ProductShayna ButtОценок пока нет

- Principles of Marketing S Units With One MarkДокумент76 страницPrinciples of Marketing S Units With One MarknandhiniОценок пока нет

- Slides SwapДокумент23 страницыSlides Swapqwsx098Оценок пока нет