Академический Документы

Профессиональный Документы

Культура Документы

QS02 - Class Exercises

Загружено:

lyk0texАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

QS02 - Class Exercises

Загружено:

lyk0texАвторское право:

Доступные форматы

Accounting 225 Quiz Section #2

Chapter 2-1 Class Exercises

1. Wollogong Group Ltd. of New South Wales, Australia, acquired its factory building about 10 years ago.

For several years the company has rented out a small annex attached to the rear of the building. The

company has received a rental income of $30,000 per year on this space. The renters lease will expire

soon, and rather than renewing the lease, the company has decided to use the space itself to manufacture

a new product.

Direct materials cost for the new product will be $80 per unit. To have a place to store finished units of

product, the company will rent a small warehouse nearby. The rental cost will be $500 per month. In

addition, the company must rent equipment for use in producing the new product; the rental cost will be

$4,000 per month. Workers will be hired to manufacture the new product, with direct labor cost

amounting to $60 per unit. The space in the annex will continue to be depreciated on a straight-line

basis, as in prior years. This depreciation is $8,000 per year.

Advertising costs for the new product will total $50,000 per year. A supervisor will be hired to oversee

production; her salary will be $1,500 per month. Electricity for operating machines will be $1.20 per

unit. Costs of shipping the new product to customers will be $9 per unit.

To provide funds to purchase materials, meet payrolls, and so forth, the company will have to liquidate

some temporary investments. These investments are presently yielding a return of about $3,000 per year.

Product Cost

Name of the Cost

Period

Cost

(selling

Variable Fixed Direct Direct Manufacturing

and

Opportunity Sunk

Cost

Cost Materials Labor

Overhead

admin)

Cost

Cost

Accounting 225 Quiz Section #2

Chapter 2-1 Class Exercises

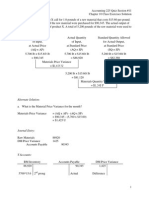

2. You are an intern at WiddiGnomerson Corporation. Management has asked for your help in preparing

some reports for June. Raw materials beginning inventory balance was $20,000. The company

purchased $69,000 of raw materials during the month; the ending raw materials inventory balance was

$32,000. Direct labor cost incurred in June was $24,000, which was 25% of conversion cost for the

month. Beginning work-in-process balance was $22,000; the ending balance was $19,000. Beginning

and ending finished goods balances were $53,000 and $51,000, respectively. The company incurred

$20,000 in selling expense and $35,000 administrative expense during the month.

Use the space below for T-Accounts:

a. What was the prime cost for June?

b. What was the Cost of Goods Manufactured for June?

c. What was the Cost of Goods Sold for June?

Accounting 225 Quiz Section #2

Chapter 2-1 Class Exercises

3. For each item in the table below, indicate whether the cost behavior appears to be fixed (F), variable

(V), or mixed (M).

Cost Item

Cost A

Cost B

Cost C

Total Cost to

Produce 5,000 units

$13,500

$22,500

$62,500

Total Cost to

Produce 3,000 units

$13,500

$15,500

$37,500

F, V, or M?

4. Lucerne Corporation purchased a machine 7 years ago for $339,000 when it launched Product X05K.

Unfortunately, this machine has now broken down and cannot be repaired. The machine can be replaced

by a new Model 360 machine costing $353,000 or by a new Model 280 machine costing $332,000.

Management has decided to buy the Model 280 machine. It has less capacity than the Model 360, but its

capacity is sufficient to continue making product X05K to meet anticipated demand. Management also

considered, but rejected, the alternative of dropping product X05K and not replacing the old machine. If

that had been done, the $332,000 invested in the new machine could instead have been invested in a

project that would have returned a total of $426,000. (1 point each response)

a. In consideration of the decision to buy the Model 280 rather than the Model 360 machine, the

differential cost was

and the sunk cost was

.

b. Identify the amount of any opportunity cost involved in the decision to invest in the Model 280 machine.

If there is none, enter zero in the space provided.

.

5. For each item in the table below, indicate whether the cost is direct (D) or indirect (I) with respect to the

cost object listed next to it.

Cost Item

Cost Object

Salary of the president of a home

A particular home being built

construction company.

Cost of lubrication oil used at the auto

The auto repair shop

repair shop of an automobile dealer

The total tip given to a waiter by a group A particular member of the group

of 10 people dining together

D or I?

Вам также может понравиться

- 305 Final Exam Cram Question PackageДокумент14 страниц305 Final Exam Cram Question PackageGloriana FokОценок пока нет

- Case Study On Standard Costing and CVP AnalysisДокумент3 страницыCase Study On Standard Costing and CVP AnalysisEmmanuel VillafuerteОценок пока нет

- Homework AssignmentДокумент11 страницHomework AssignmentHenny DeWillisОценок пока нет

- Ca 1Документ2 страницыCa 1Alex LagmanОценок пока нет

- Brewer Chapter 1 Alt ProbДокумент8 страницBrewer Chapter 1 Alt Probenny546Оценок пока нет

- Docx 1Документ10 страницDocx 1Anna Marie AlferezОценок пока нет

- Exam 21082011Документ8 страницExam 21082011Rabah ElmasriОценок пока нет

- MA2 (100 QS)Документ30 страницMA2 (100 QS)Alina NaeemОценок пока нет

- SESSION 6 - Chapter 14Документ8 страницSESSION 6 - Chapter 14Malefa TsoeneОценок пока нет

- Assignment 1Документ5 страницAssignment 1kamrulkawserОценок пока нет

- Bài Tập Tự LuậnДокумент5 страницBài Tập Tự Luậnhn0743644Оценок пока нет

- Exam2505 2012Документ8 страницExam2505 2012Gemeda GirmaОценок пока нет

- Section C Part 2 MCQДокумент344 страницыSection C Part 2 MCQSaiswetha BethiОценок пока нет

- QS07 - Class Exercises SolutionДокумент8 страницQS07 - Class Exercises Solutionlyk0texОценок пока нет

- Jimma University Construction Economics (CEGN 6108)Документ7 страницJimma University Construction Economics (CEGN 6108)TesfuОценок пока нет

- Department of Accounting and Information SystemДокумент8 страницDepartment of Accounting and Information SystemLabib SafeenОценок пока нет

- Acct1003 Midsemester Exam08-09 SOLUTIONSДокумент7 страницAcct1003 Midsemester Exam08-09 SOLUTIONSKimberly KangalooОценок пока нет

- Weeks 1-7 Examples Answers and Key Concepts Discussion ProblemsДокумент57 страницWeeks 1-7 Examples Answers and Key Concepts Discussion ProblemsAshish BhallaОценок пока нет

- Session 1 ProblemsДокумент5 страницSession 1 ProblemsdonjazonОценок пока нет

- Managerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Test Bank Full Chapter PDFДокумент67 страницManagerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Test Bank Full Chapter PDFKimberlyLinesrb100% (12)

- Cga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursДокумент18 страницCga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursasОценок пока нет

- Sample MidTerm MC With AnswersДокумент5 страницSample MidTerm MC With Answersharristamhk100% (1)

- Accounting 2304 - Final Exam Practice: Tables ChairsДокумент12 страницAccounting 2304 - Final Exam Practice: Tables ChairsBella BallОценок пока нет

- Exercise 1 - Cost Concepts-1Документ7 страницExercise 1 - Cost Concepts-1Vincent PanisalesОценок пока нет

- Quiz 5 SolutionДокумент5 страницQuiz 5 SolutionMichel BanvoОценок пока нет

- Final Exam - Fall 2007Документ9 страницFinal Exam - Fall 2007jhouvanОценок пока нет

- Answers Homework # 16 Cost MGMT 5Документ7 страницAnswers Homework # 16 Cost MGMT 5Raman AОценок пока нет

- Practice Question 2,3,5,6Документ10 страницPractice Question 2,3,5,6student.devyankgosainОценок пока нет

- Mid Assignment - ACT 202Документ4 страницыMid Assignment - ACT 202ramisa tasrimОценок пока нет

- Tutorial Problems - Capital BudgetingДокумент6 страницTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- Chapter 7 ReviewДокумент8 страницChapter 7 ReviewRenzo RamosОценок пока нет

- NameДокумент13 страницNameNitinОценок пока нет

- Practice Worksheet Chapter2Документ6 страницPractice Worksheet Chapter2student.devyankgosainОценок пока нет

- Final Exam, s1, 2018-FINAL PDFДокумент14 страницFinal Exam, s1, 2018-FINAL PDFShivneel NaiduОценок пока нет

- 8508 QuestionsДокумент3 страницы8508 QuestionsHassan MalikОценок пока нет

- Man Account Hw1Документ5 страницMan Account Hw1Quỳnh Anh Tô TrầnОценок пока нет

- Cost AccountingДокумент7 страницCost AccountingCarl AngeloОценок пока нет

- EXERCISECHAPTER2Документ8 страницEXERCISECHAPTER2Bạch ThanhОценок пока нет

- Management Advisory Services - MidtermДокумент7 страницManagement Advisory Services - MidtermROB101512Оценок пока нет

- ACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDДокумент17 страницACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDEjaz KhanОценок пока нет

- Ma2 Specimen j14Документ16 страницMa2 Specimen j14talha100% (3)

- ADMS2510 Fall 2009 Final Exam-Part One-With SolutionsДокумент8 страницADMS2510 Fall 2009 Final Exam-Part One-With SolutionsDavid ChenОценок пока нет

- Bus146 Mock Exam Fall 2020Документ32 страницыBus146 Mock Exam Fall 2020shahverdyanarevik1Оценок пока нет

- Ca CH4Документ12 страницCa CH4Charlotte ChanОценок пока нет

- Flexible BudgetДокумент2 страницыFlexible BudgetLhorene Hope DueñasОценок пока нет

- W7 CMA SampleEssayQuestionsДокумент11 страницW7 CMA SampleEssayQuestionsLouieОценок пока нет

- Additional FINAL ReviewДокумент41 страницаAdditional FINAL ReviewMandeep SinghОценок пока нет

- Exam161 10Документ7 страницExam161 10Rabah ElmasriОценок пока нет

- F2 MockДокумент23 страницыF2 MockH Hafiz Muhammad AbdullahОценок пока нет

- Exam 1 - VI SolutionsДокумент9 страницExam 1 - VI SolutionsZyraОценок пока нет

- Tutorial 4 - Capital Investment DecisionsДокумент4 страницыTutorial 4 - Capital Investment DecisionsIbrahim HussainОценок пока нет

- Tutorial 4 Capital Investment Decisions 1Документ4 страницыTutorial 4 Capital Investment Decisions 1phillip HaulОценок пока нет

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Документ2 страницы3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- Wa0025Документ5 страницWa0025Anggari SaputraОценок пока нет

- Assigment 6 - Managerial Finance Capital BudgetingДокумент5 страницAssigment 6 - Managerial Finance Capital BudgetingNasir ShaheenОценок пока нет

- PGP 2019 CM Exam Question Paper SharedДокумент19 страницPGP 2019 CM Exam Question Paper SharedAMARJEET KUMARОценок пока нет

- QS17 - Class Exercises SolutionДокумент4 страницыQS17 - Class Exercises Solutionlyk0texОценок пока нет

- QS16 - Class Exercises SolutionДокумент5 страницQS16 - Class Exercises Solutionlyk0texОценок пока нет

- QS14 - Class ExercisesДокумент4 страницыQS14 - Class Exerciseslyk0texОценок пока нет

- QS15 - Class ExercisesДокумент4 страницыQS15 - Class Exerciseslyk0texОценок пока нет

- QS15 - Class Exercises SolutionДокумент5 страницQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS16 - Class ExercisesДокумент5 страницQS16 - Class Exerciseslyk0texОценок пока нет

- QS17 - Class ExercisesДокумент4 страницыQS17 - Class Exerciseslyk0texОценок пока нет

- QS14 - Class Exercises SolutionДокумент4 страницыQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS12 - Midterm 2 Review SolutionДокумент7 страницQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS11 - Class ExercisesДокумент5 страницQS11 - Class Exerciseslyk0texОценок пока нет

- QS13 - Class Exercises SolutionДокумент2 страницыQS13 - Class Exercises Solutionlyk0texОценок пока нет

- QS12 - Midterm 2 ReviewДокумент5 страницQS12 - Midterm 2 Reviewlyk0texОценок пока нет

- QS13 - Class ExercisesДокумент2 страницыQS13 - Class Exerciseslyk0texОценок пока нет

- QS12 - Class Exercises SolutionДокумент2 страницыQS12 - Class Exercises Solutionlyk0tex100% (1)

- QS09 - Class Exercises SolutionДокумент4 страницыQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS12 - Class ExercisesДокумент2 страницыQS12 - Class Exerciseslyk0texОценок пока нет

- QS11 - Class Exercises SolutionДокумент8 страницQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS09 - Class ExercisesДокумент4 страницыQS09 - Class Exerciseslyk0texОценок пока нет

- QS07 - Class Exercises SolutionДокумент8 страницQS07 - Class Exercises Solutionlyk0texОценок пока нет

- QS10 - Class ExercisesДокумент1 страницаQS10 - Class Exerciseslyk0texОценок пока нет

- QS10 - Class Exercises SolutionДокумент2 страницыQS10 - Class Exercises Solutionlyk0texОценок пока нет

- QS08 - Class Exercises SolutionДокумент5 страницQS08 - Class Exercises Solutionlyk0texОценок пока нет

- QS08 - Class ExercisesДокумент4 страницыQS08 - Class Exerciseslyk0texОценок пока нет

- QS07 - Class ExercisesДокумент8 страницQS07 - Class Exerciseslyk0texОценок пока нет

- QS05 - Class ExercisesДокумент2 страницыQS05 - Class Exerciseslyk0texОценок пока нет

- QS04 - Class ExercisesДокумент3 страницыQS04 - Class Exerciseslyk0texОценок пока нет

- QS06 - Class Exercises SolutionДокумент2 страницыQS06 - Class Exercises Solutionlyk0texОценок пока нет

- QS06 - Class ExercisesДокумент3 страницыQS06 - Class Exerciseslyk0texОценок пока нет

- QS05 - Class Exercises SolutionДокумент3 страницыQS05 - Class Exercises Solutionlyk0texОценок пока нет

- QS04 - Class Exercises SolutionДокумент3 страницыQS04 - Class Exercises Solutionlyk0texОценок пока нет

- Lean Production SystemДокумент8 страницLean Production SystemRoni Komarul HayatОценок пока нет

- Tank+Calibration OP 0113 WebsiteДокумент2 страницыTank+Calibration OP 0113 WebsiteMohamed FouadОценок пока нет

- Niraj-LSB CatalogueДокумент8 страницNiraj-LSB CataloguenirajОценок пока нет

- Pledge, REM, Antichresis DigestsДокумент43 страницыPledge, REM, Antichresis DigestsAnonymous fnlSh4KHIgОценок пока нет

- English 8 - Q3 - Las 1 RTP PDFДокумент4 страницыEnglish 8 - Q3 - Las 1 RTP PDFKim Elyssa SalamatОценок пока нет

- Mathematics in The Modern World AmortizationДокумент5 страницMathematics in The Modern World AmortizationLeiLezia Dela Cruz100% (1)

- Yoox AssessmentДокумент11 страницYoox AssessmentGeorge KolliasОценок пока нет

- Air Travel Demand ElasticitiesДокумент69 страницAir Travel Demand ElasticitiesKatiaОценок пока нет

- Canada Post Amended Statement of Claim Against Geolytica and Geocoder - CaДокумент12 страницCanada Post Amended Statement of Claim Against Geolytica and Geocoder - CaWilliam Wolfe-WylieОценок пока нет

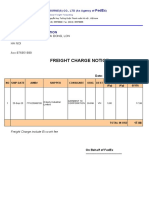

- Freight Charge Notice: To: Garment 10 CorporationДокумент4 страницыFreight Charge Notice: To: Garment 10 CorporationThuy HoangОценок пока нет

- Stefan CraciunДокумент9 страницStefan CraciunRizzy PopОценок пока нет

- I INVENTED THE MODERN AGE: The Rise of Henry Ford by Richard SnowДокумент18 страницI INVENTED THE MODERN AGE: The Rise of Henry Ford by Richard SnowSimon and SchusterОценок пока нет

- What Marketing Strategies Used by Patanjali?: 5 AnswersДокумент4 страницыWhat Marketing Strategies Used by Patanjali?: 5 Answerskarthikk09101990Оценок пока нет

- Project Analysis Report Optus StadiumДокумент14 страницProject Analysis Report Optus StadiumRida ZainebОценок пока нет

- Section 114-118Документ8 страницSection 114-118ReiZen UelmanОценок пока нет

- CH 07Документ41 страницаCH 07Mrk KhanОценок пока нет

- Payback PeriodДокумент32 страницыPayback Periodarif SazaliОценок пока нет

- Cross TAB in Crystal ReportsДокумент15 страницCross TAB in Crystal ReportsMarcelo Damasceno ValeОценок пока нет

- Top 10 Agile Techniques v14Документ24 страницыTop 10 Agile Techniques v14fsato1100% (1)

- Pharmaceutical Specialty Account Manager in Springfield MA Resume Richard PielaДокумент2 страницыPharmaceutical Specialty Account Manager in Springfield MA Resume Richard PielaRichardPielaОценок пока нет

- Customer SQ - Satisfaction - LoyaltyДокумент15 страницCustomer SQ - Satisfaction - LoyaltyjessiephamОценок пока нет

- Uber Final PPT - Targeting and Positioning MissingДокумент14 страницUber Final PPT - Targeting and Positioning MissingAquarius Anum0% (1)

- FMEA Training v1.1Документ78 страницFMEA Training v1.1Charles Walton100% (1)

- Integrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesДокумент18 страницIntegrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDarren Joy CoronaОценок пока нет

- A Flock of Red Flags PDFДокумент10 страницA Flock of Red Flags PDFSillyBee1205Оценок пока нет

- Online Shopping PDFДокумент4 страницыOnline Shopping PDFkeerthanasubramaniОценок пока нет

- The Implications of Globalisation For Consumer AttitudesДокумент2 страницыThe Implications of Globalisation For Consumer AttitudesIvan Luis100% (1)

- PT Rea Kaltim Plantations PDFДокумент4 страницыPT Rea Kaltim Plantations PDFAnggah KhanОценок пока нет

- Staffing - Responsibilities, Tools and Methods of SelectionДокумент30 страницStaffing - Responsibilities, Tools and Methods of SelectionAmreen KhanОценок пока нет