Академический Документы

Профессиональный Документы

Культура Документы

Tax Rem Flowchart

Загружено:

DennisSaycoАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tax Rem Flowchart

Загружено:

DennisSaycoАвторское право:

Доступные форматы

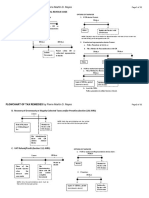

TAXPAYERS REMEDIES FROM ASSESSMENT OF LOCAL TAXES OTHER THAN REAL PROPERTY TAXES

START

Local Treasurer* (LT)

assess local taxes within

5 years from date they

become due or 10 years

from discovery of fraud

LT decides

w/in 60

days?

Taxpayer files written protest is

protest made within 60 days

from receipt of assessment

Local Treasurer issues

notice of assessment

Local Treasurer

decides on protest

within 60 days from

filing of protest

Is protest made w/in

YES

prescribed period?

NO

LT grants

protest?

Taxpayer appeals to court of

competent jurisdiction (regular

courts) within 30 days from

receipt of notice or from lapse

of 60 days

NO

YES

Local Treasurer issues notice

cancelling partially/wholly

the assessment

END

Appeal to CTA Division; but if

the decision is from an RTC

exercising appellate

jurisdiction, appeal should be

made directly to CTA en banc

under Rule 43 of the ROC

NO

Assessment

becomes final

If Division decides against the taxpayer,

he must file a Motion for Reconsideration

w/in 15 days with the same division

If Motion for Reconsideration

is denied, file Petition for

review with CTA en banc

Appeal to Supreme

Court (SC)

END

PROCEDURE FOR DISTRAINT AND LEVY FOR PURPOSES OF SATISFYING LOCAL TAXES

START

Tax constitutes a lien superior to

all liens and may only be

extinguished upon payment of the

tax and the related charges. (Sec.

173)

Officer posts notice in office of the

chief executive of the LGU** where

the property is distrained and in at

least 2 other public places specifying

the time and place of sale, and

distrained goods. The time of sale shall

not be less than 20 days after the

notice. (Sec. 175)

Before the sale, the goods or effects

distrained shall be restored to the

owner provided all charges are paid

Excess of proceeds over charges

shall be returned to the owner

of the property sold.

Time for

payment of Local

taxes expires

Local Treasurer (LT), upon written notice,

seizes sufficient personal property to

satisfy the tax, and other charges (Sec. 175)

LT issues a certificate which

serves as warrant for the

distraint of personal property.

(Sec. 175)

Officer executing the distraint

accounts for the goods

distrained. (Sec. 175)

Property distrained

Disposed within 120 days

from distraint?

NO

It shall be considered as sold to the LGU

for the amount of the assessment made

by the Committee on Appraisa***l and to

the extent of the same amount, the tax

delinquencies shall be cancelled.

YES

Officer sells the goods at public

auction to the highest bidder for

cash. Within 5 days, the local

treasurer shall report sale to the

local chief executive concerned

If the proceeds of the sale are

insufficient, other property

may be distrained until the

full amount due, including all

expenses, is collected

Real property may be levied on before,

simultaneously, or after the distraint of

personal property (Sec. 176)**** until said

tax, fee, or charge has been fully paid.

Take note:

*LT Local Treasurer;

**LGU Local Government Unit;

*** It is composed of Local Treasurer as Chairman, Commission on Audit representative and LGU assessor as members;

****Procedure for levying real properties to satisfy local taxes is the same as levy procedure for satisfying real property taxes (Sec. 258-266) except the

following:

a. Publication is once a week for 3 weeks for local taxes (Sec. 178) and once a week for 2 weeks for real property taxes (Sec. 260);

b. For local taxes, LGU may purchase levied property if there is no bidder or of the highest bid is insufficient to cover the taxes and other charges (Sec.

181) while for real property taxes, the LGU may purchase levied property if there is no bidder.

Вам также может понравиться

- Tax Remedies ReviewerДокумент9 страницTax Remedies ReviewerheirarchyОценок пока нет

- Tax Remedies SummaryДокумент6 страницTax Remedies Summarypja_14100% (1)

- Taxpayer Tax Assessment Process BIR IssuesДокумент3 страницыTaxpayer Tax Assessment Process BIR IssuesPetrovich Tamag50% (4)

- Flowchart of Tax Remedies I. Remedies UnДокумент12 страницFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Flowchart Remedies of A TaxpayerДокумент2 страницыFlowchart Remedies of A TaxpayerRab Thomas BartolomeОценок пока нет

- RA 1125 as amended: Jurisdiction and Procedures of the Court of Tax AppealsДокумент66 страницRA 1125 as amended: Jurisdiction and Procedures of the Court of Tax AppealsAgui S. T. PadОценок пока нет

- Tax RemediesДокумент51 страницаTax RemediesBevz23100% (6)

- Taxation Bar Questions (Multiple Choice Questions and Answers)Документ81 страницаTaxation Bar Questions (Multiple Choice Questions and Answers)Anonymous Mickey Mouse100% (1)

- Tax Flowchart Remedies (Tokie)Документ9 страницTax Flowchart Remedies (Tokie)Tokie TokiОценок пока нет

- MamalateoДокумент12 страницMamalateoKim Orven M. SolonОценок пока нет

- Tax Remedies in Flowchart 102019Документ2 страницыTax Remedies in Flowchart 102019Cecilbern ayen BernabeОценок пока нет

- Advance Tax Review - AlabangДокумент10 страницAdvance Tax Review - Alabangwrecker40Оценок пока нет

- Flowchart of Tax Remedies I. Remedies Un PDFДокумент12 страницFlowchart of Tax Remedies I. Remedies Un PDFJunivenReyUmadhayОценок пока нет

- Rev Regs No. 12-99 (As Amended) - 08012014Документ27 страницRev Regs No. 12-99 (As Amended) - 08012014Jacob DalisayОценок пока нет

- Remedies Under Local Government CodeДокумент15 страницRemedies Under Local Government Codecmv mendoza100% (3)

- Tax Remedies Flowchart (Revised)Документ6 страницTax Remedies Flowchart (Revised)GersonGamas0% (1)

- 2019 Ust Pre Week Taxation LawДокумент36 страниц2019 Ust Pre Week Taxation Lawdublin80% (20)

- 2018 Mercantile Law Suggested Answer (Incomplete)Документ10 страниц2018 Mercantile Law Suggested Answer (Incomplete)Victoria Denise Monte80% (5)

- TRAIN Part 4 - Documentary Stamp TaxДокумент21 страницаTRAIN Part 4 - Documentary Stamp TaxGianna CantoriaОценок пока нет

- Taxation - 8 Tax Remedies Under NIRCДокумент34 страницыTaxation - 8 Tax Remedies Under NIRCcmv mendoza100% (3)

- FRIA Flow Chart FinalДокумент44 страницыFRIA Flow Chart Finalamun din78% (9)

- SRCodeДокумент42 страницыSRCodeMcdx FriesОценок пока нет

- TAX REMEDIES AND FILING REQUIREMENTSДокумент11 страницTAX REMEDIES AND FILING REQUIREMENTSNingning Carios100% (1)

- Table of Remedies by LumberaДокумент10 страницTable of Remedies by LumberaJodea Pearl AbalosОценок пока нет

- YTLC Tax Remedy FlowchartДокумент3 страницыYTLC Tax Remedy Flowchartalfx216100% (1)

- Tax 2 SyllabusДокумент9 страницTax 2 SyllabusAlvin RufinoОценок пока нет

- Tax+Remedies Nirc 2011 AteneoДокумент103 страницыTax+Remedies Nirc 2011 AteneoGracia Jimenez-CastilloОценок пока нет

- Tax Finals ReviewerДокумент51 страницаTax Finals ReviewerCelestino Law100% (2)

- TAX REMEDIES by Sababan Reviewer 2008 EdДокумент11 страницTAX REMEDIES by Sababan Reviewer 2008 Edolaydyosa95% (20)

- Chapter 10 - Concepts of Vat 7thДокумент11 страницChapter 10 - Concepts of Vat 7thEl Yang100% (3)

- Notes On Tax Remedies of The Government and TaxpayersДокумент74 страницыNotes On Tax Remedies of The Government and TaxpayersMakoy Bixenman100% (1)

- Bar Exam 2016 Suggested Answers in Remedial Law by The UP Law ComplexДокумент26 страницBar Exam 2016 Suggested Answers in Remedial Law by The UP Law ComplexSamuel Luptak100% (1)

- Sample PANДокумент5 страницSample PANArmie Lyn Simeon100% (1)

- Tax Remedies Under The NircДокумент119 страницTax Remedies Under The NircAnonymous a4JYe5d150% (2)

- A Brown vs. CIRДокумент11 страницA Brown vs. CIRKwini RojanoОценок пока нет

- MCQ On TaxationДокумент24 страницыMCQ On TaxationZed AbantasОценок пока нет

- Orca Share Media1548911466614Документ548 страницOrca Share Media1548911466614Ixhanie Cawal-oОценок пока нет

- 2015 Bar Exam Suggested Answers in Civil Law by The UP Law ComplexДокумент9 страниц2015 Bar Exam Suggested Answers in Civil Law by The UP Law ComplexLeonardo Egcatan100% (3)

- Multiple Choice Tax ReviewДокумент1 страницаMultiple Choice Tax ReviewQuasi-Delict89% (18)

- For GericahДокумент22 страницыFor GericahTauniño Jillandro Gamallo NeriОценок пока нет

- Tax CPAR Final Pre Board2Документ5 страницTax CPAR Final Pre Board2No Longer Existing67% (3)

- Tax Administration Powers and RemediesДокумент16 страницTax Administration Powers and Remediescristiepearl100% (5)

- Bar Question SRCДокумент9 страницBar Question SRChypholaphamusОценок пока нет

- IPLДокумент4 страницыIPLJao Santos100% (1)

- 2018 Taxation Bar Questions and AnswersДокумент14 страниц2018 Taxation Bar Questions and AnswersAlexLesle Roble100% (7)

- Notice of DiscrepancyДокумент4 страницыNotice of DiscrepancyMartin PagtanacОценок пока нет

- Taxation Reviewer PicpaДокумент29 страницTaxation Reviewer PicpaMike Antolino50% (2)

- UP-Law 2016 Tax Bar ExamДокумент23 страницыUP-Law 2016 Tax Bar Examrobertoii_suarez67% (3)

- Tax Remedies under NIRCДокумент32 страницыTax Remedies under NIRCCire GeeОценок пока нет

- Fria Flow Chart 9 Voluntary Liquidation Involuntary LiquidationДокумент4 страницыFria Flow Chart 9 Voluntary Liquidation Involuntary LiquidationPaul Dean MarkОценок пока нет

- TAX - LEAD BATCH 3 - Preweek 1 PDFДокумент28 страницTAX - LEAD BATCH 3 - Preweek 1 PDFMay Litt0% (1)

- Taxpayer Revised FlowchartДокумент6 страницTaxpayer Revised FlowchartRab Thomas BartolomeОценок пока нет

- Local Taxation RemediesДокумент16 страницLocal Taxation RemediesJordan TumayanОценок пока нет

- 2012 08 NIRC Remedies TablesДокумент8 страниц2012 08 NIRC Remedies TablesJaime Dadbod NolascoОценок пока нет

- Taxation Law II: Atty. Loverhette Jeffrey P. VillaordonДокумент18 страницTaxation Law II: Atty. Loverhette Jeffrey P. VillaordonGrace Secorin - SevillaОценок пока нет

- Tax RemediesДокумент19 страницTax Remediesstannis69420Оценок пока нет

- Tax On Transfer of Real PropertiesДокумент8 страницTax On Transfer of Real PropertiesKristine Astorga-NgОценок пока нет

- Revenue Assessment ProcedureДокумент6 страницRevenue Assessment ProcedureJezreel CastañagaОценок пока нет

- Tax Assessment and Collection ProceduresДокумент1 страницаTax Assessment and Collection ProceduresBetson CajayonОценок пока нет

- Tax Rates Effective January 1, 1998 Up To PresentДокумент8 страницTax Rates Effective January 1, 1998 Up To PresentJasmin AlapagОценок пока нет

- Affidavit of Change Classification - SCRIBDДокумент2 страницыAffidavit of Change Classification - SCRIBDDennisSayco100% (2)

- Motion To Reduce Bond With Entry of Appearance - SAMPLE SCRIBD 1Документ2 страницыMotion To Reduce Bond With Entry of Appearance - SAMPLE SCRIBD 1DennisSaycoОценок пока нет

- Motion to Pay Fine in InstallmentsДокумент2 страницыMotion to Pay Fine in InstallmentsDennisSayco100% (1)

- Fishing Corporation terminates employee for social media abuseДокумент2 страницыFishing Corporation terminates employee for social media abuseDennisSaycoОценок пока нет

- Affidavit of Low Income - SCRIBDДокумент1 страницаAffidavit of Low Income - SCRIBDDennisSaycoОценок пока нет

- Affidavit of Desistance - WATERFALLSДокумент1 страницаAffidavit of Desistance - WATERFALLSDennisSaycoОценок пока нет

- Affidavit of Low Income - SCRIBDДокумент1 страницаAffidavit of Low Income - SCRIBDDennisSaycoОценок пока нет

- Affidavit of Desistance - WATERFALLSДокумент1 страницаAffidavit of Desistance - WATERFALLSDennisSaycoОценок пока нет

- Affidavit of Surviving SpouseДокумент1 страницаAffidavit of Surviving SpouseDennisSayco100% (2)

- Motion For Extension - SCRIBDДокумент3 страницыMotion For Extension - SCRIBDDennisSayco0% (1)

- Affidavit of Low Income - SCRIBDДокумент1 страницаAffidavit of Low Income - SCRIBDDennisSaycoОценок пока нет

- Affidavit of Desistance - WATERFALLSДокумент1 страницаAffidavit of Desistance - WATERFALLSDennisSaycoОценок пока нет

- Partnership Quiz - Monday - July 31Документ2 страницыPartnership Quiz - Monday - July 31DennisSaycoОценок пока нет

- Demand Letter - Sample Investment ScamДокумент1 страницаDemand Letter - Sample Investment ScamDennisSayco100% (5)

- Complaint Affidavit Falsified Land DocumentsДокумент2 страницыComplaint Affidavit Falsified Land DocumentsDennisSayco50% (4)

- Republic of the Philippines court petition for bailДокумент3 страницыRepublic of the Philippines court petition for bailDennisSaycoОценок пока нет

- Comment Opposition - SCRIBDДокумент3 страницыComment Opposition - SCRIBDDennisSaycoОценок пока нет

- Motion To Revive The Case and Admit Position PaperДокумент2 страницыMotion To Revive The Case and Admit Position PaperDennisSayco100% (3)

- Affidavit of Accident - SCRIBDДокумент1 страницаAffidavit of Accident - SCRIBDDennisSaycoОценок пока нет

- Supplemental complaint affidavit Mang Tomas CityДокумент3 страницыSupplemental complaint affidavit Mang Tomas CityDennisSayco67% (3)

- Partnership Quiz - Monday - July 31Документ2 страницыPartnership Quiz - Monday - July 31DennisSaycoОценок пока нет

- Guidelines for Submitting and Processing Soft Copies in the Supreme CourtДокумент4 страницыGuidelines for Submitting and Processing Soft Copies in the Supreme CourtDennisSaycoОценок пока нет

- Direct Cross GuideДокумент4 страницыDirect Cross GuideDennisSaycoОценок пока нет

- Criminal Law II Case Digests on Treason, PiracyДокумент108 страницCriminal Law II Case Digests on Treason, PiracyBoy Kakak Toki80% (5)

- ASIA Application ForeignInvAct401Документ3 страницыASIA Application ForeignInvAct401DennisSaycoОценок пока нет

- Compilation of CasesДокумент18 страницCompilation of CasesAlman-Najar NamlaОценок пока нет

- Deed of RestrictionsДокумент5 страницDeed of RestrictionsDennisSaycoОценок пока нет

- RULE 86 Cases 6 To 9Документ8 страницRULE 86 Cases 6 To 9DennisSaycoОценок пока нет

- Citizens Manual On Registration of Corporation and PartnershipДокумент3 страницыCitizens Manual On Registration of Corporation and PartnershipAnonymous b2aRrNWfОценок пока нет

- DO 40-03 - As Amended by A-GДокумент25 страницDO 40-03 - As Amended by A-GJohn TelanОценок пока нет

- Govt of HK Vs OlaliaДокумент5 страницGovt of HK Vs OlaliaShalena Salazar-SangalangОценок пока нет

- United States Court of Appeals, Second Circuit.: No. 424, Docket 75 - 7468Документ4 страницыUnited States Court of Appeals, Second Circuit.: No. 424, Docket 75 - 7468Scribd Government DocsОценок пока нет

- Adolfo Vs Adolfo, GR No. 201427Документ20 страницAdolfo Vs Adolfo, GR No. 201427Paolo TarimanОценок пока нет

- Bihar Judiciary (BPSC Civil Judge Exam) Syllabus Bihar Judiciary (BPSC Civil Judge Exam) SyllabusДокумент3 страницыBihar Judiciary (BPSC Civil Judge Exam) Syllabus Bihar Judiciary (BPSC Civil Judge Exam) SyllabusKapil KaroliyaОценок пока нет

- Prudente v. Dayrit G.R. No. 82870Документ6 страницPrudente v. Dayrit G.R. No. 82870XuagramellebasiОценок пока нет

- Limbona Vs COMELECДокумент10 страницLimbona Vs COMELECPMVОценок пока нет

- Sy Chim and Felicidad Chan Sy vs Sy Siy Ho & Sons, Inc. dispute over corporate assets and fundsДокумент24 страницыSy Chim and Felicidad Chan Sy vs Sy Siy Ho & Sons, Inc. dispute over corporate assets and fundsClarence ProtacioОценок пока нет

- Nestle Vs PuregoldДокумент32 страницыNestle Vs PuregoldClarence FernandoОценок пока нет

- Witness Protection Scheme 2018Документ16 страницWitness Protection Scheme 2018Aafreen KhanОценок пока нет

- Declaratory Relief - DigestsДокумент7 страницDeclaratory Relief - DigestsTheHoneybhieОценок пока нет

- Mabo V Queensland (No 2) ("Mabo Case") (1992) HCA 23 (1992) 175 CLR 1 (3 June 1992)Документ137 страницMabo V Queensland (No 2) ("Mabo Case") (1992) HCA 23 (1992) 175 CLR 1 (3 June 1992)MikeJacksonОценок пока нет

- Fallis Lawsuit Amended 040715 PDFДокумент32 страницыFallis Lawsuit Amended 040715 PDFMichael_Lee_RobertsОценок пока нет

- Land Dispute and Marriage Nullity CaseДокумент2 страницыLand Dispute and Marriage Nullity CaseKaye Mendoza100% (2)

- Phil. American General Insurance Vs CAДокумент6 страницPhil. American General Insurance Vs CAPrecious RubaОценок пока нет

- Philippine Press Institute Vs COMELECДокумент1 страницаPhilippine Press Institute Vs COMELECKarizza Zoette Ann AlcardeОценок пока нет

- Training AgreementДокумент2 страницыTraining AgreementHoward UntalanОценок пока нет

- Razon JR vs. TagitisДокумент6 страницRazon JR vs. Tagitisgianfranco0613100% (1)

- Frontier Communications Temporary Restraining OrderДокумент6 страницFrontier Communications Temporary Restraining OrderAnna MooreОценок пока нет

- III. Sem Anti Defection LawДокумент32 страницыIII. Sem Anti Defection LawIramPeerzadaОценок пока нет

- Smt. Chand Dhawan Vs Jawaharlal Dhawan On 11 June, 1993Документ10 страницSmt. Chand Dhawan Vs Jawaharlal Dhawan On 11 June, 1993daljitsodhiОценок пока нет

- Guardianship appointment upheldДокумент2 страницыGuardianship appointment upheldReyrey DalisayОценок пока нет

- Daza V Singson, 180 SCRA 496 (1989)Документ18 страницDaza V Singson, 180 SCRA 496 (1989)pixiewinx20100% (2)

- 2003 2 MLJ 65Документ26 страниц2003 2 MLJ 65Nur Zakiah Mohd ArifinОценок пока нет

- EFFECT OF DEATH ON CIVIL LIABILITYДокумент2 страницыEFFECT OF DEATH ON CIVIL LIABILITYAlexis Ailex Villamor Jr.Оценок пока нет

- Answer To A Complaint (Civil Case)Документ4 страницыAnswer To A Complaint (Civil Case)Donali Gem Manalang PableoОценок пока нет

- Delevan Wesley Thomas v. Commonwealth of Virginia, 357 F.2d 87, 4th Cir. (1966)Документ5 страницDelevan Wesley Thomas v. Commonwealth of Virginia, 357 F.2d 87, 4th Cir. (1966)Scribd Government DocsОценок пока нет

- Napoles Vs de Lima 2016Документ16 страницNapoles Vs de Lima 2016Anthony Isidro Bayawa IVОценок пока нет

- Alternative Complaint Objecting To Secured Debt Til Bankruptcy-2006 - Appendix - GДокумент116 страницAlternative Complaint Objecting To Secured Debt Til Bankruptcy-2006 - Appendix - GCharlton ButlerОценок пока нет

- 303 Creative LLC Et Al V Elenis Et AlДокумент10 страниц303 Creative LLC Et Al V Elenis Et AlDavid HartОценок пока нет

- United States v. Cleophus Vernon, 933 F.2d 1002, 4th Cir. (1991)Документ2 страницыUnited States v. Cleophus Vernon, 933 F.2d 1002, 4th Cir. (1991)Scribd Government DocsОценок пока нет