Академический Документы

Профессиональный Документы

Культура Документы

Andex Wall CANENG

Загружено:

hyporОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Andex Wall CANENG

Загружено:

hyporАвторское право:

Доступные форматы

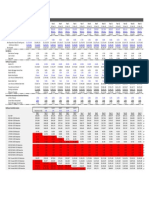

Andex Chart

1-888-4-CHARTS

100%

75%

50

51

52

55

56

11.2%

1.0%

54

53

18.2%

12.7%

57

58

59

www.andexcharts.com

60

61

62

63

9.1%

2.0%

64

10.0%

65

6.8%

66

67

3.4%

4.5%

68

69

70

71

73

72

6.8%

75

74

10.4%

9.4%

76

77

78

79

80

81

7.3%

7.6%

82

83

17.5%

84

85

16.0%

12.2%

86

87

13.7%

11.9%

88

89

90

91

92

93

94

95

20.8% 10.6% 12.8%

96

11.6%

97

98

99

00

01

02

6.4%

03

04

4.0%

5.6%

05

3.2%

06

07

7.8%

3.1%

08

09

10

11

50%

50%

25%

25%

0%

(25%)

0%

Calendar Year Returns (incl the Moderate Portfolio)

(25%)

ST. LAURENT

DIEFENBAKER

TRUMAN

EISENHOWER

PEARSON

JOHNSON

KENNEDY

TRUDEAU

$100,000

Highest

Return

FORD

Lowest

Return

60-Month Rolling Periods

Negative

Periods

Highest

Return

Lowest

Return

Negative

Periods

Highest

Return

Lowest

Return

TSE 300 11,389

29.7%

19.5%

29.6%

2.0%

1.3%

1.0%

21.1%

15% Bonds

5% Cash

0.0%

10% Canadian Stocks

10% U.S. Large Stocks

20% Canadian Stocks

20% U.S. Large Stocks

20% World ex-U.S. Stocks

DJIA 2,000

DJIA 3,000

DJIA 5,000

17.3%

27.8%

0.4%

0.0%

2.3%

18.6%

20%

11.0%

capital gains exemption

introduced

$55,242

Confed Life fails

10.8%

$40,578

Nortel high

$124.5034.2% of TSE 300

10.3%

IBM PC

introduced

$3,405 U.S.

30% foreign content rule eliminated

9.8%

Canadas population

34,349,200

Nortel low $0.67

population

(over 65) 13.9%

$11,640

10%

10%

11.6%

48.6%

10.6%

22.0%

1.6%

0.0%

3.3%

16.0%

0.0%

Ontarios top marginal

tax rate 50.3%

DJIA closes above 1,000

8.0%

Hypothetical Moderate Portfolio

down 29% from 2000 high

Russian debt default

Mexican peso crisis

Income Trust tax introduced

$8,473

7.5%

60%

5 year GIC

National Energy 17.5%

Program

Canadian Stocks

U.S. Large Stocks

World ex-U.S. Stocks

U.S. Small Stocks

Bonds

first World Trade Center bombing

Cash

Canada/U.S. auto pact signed

life expectancy

$2,984

Enron

M-66.5 yrs

F-71.0 yrs

Canada/U.S. free trade approved

Chrysler files for

bankruptcy

Bre-X

1st class

stamp 4

Charlottetown referendum defeated

5 year mortgage

21.5%

Canadas first TV broadcast

1st class

stamp

59 +GST

average family

income $82,325

M-17.2 yrs

F-20.6 yrs

$982

3.8%

PCs fall from 169 to 2 seats

Dow Jones Industrial

Average (DJIA) closes

above 500

population

(over 65) 7.8%

life expectancy

of a 65 yr old

2nd Quebec referendum

50.4% vote NO

Meech Lake constitution failure

Canadas population

13,712,000

GST starts

Parti Qubcois wins

provincial election

average family

income $12,716

Percentage Returns (June 30, 2011)

1 Yr

3 Yr

5 Yr

10 Yr

20 Yr

30 Yr

Since

Jan 1, 50

Risk

Worst

5 Yrs

U.S. Small Stock Total Return Index in CAD

World Markets ex-U.S. Total Return Index in CAD

U.S. Large Stock Total Return Index in CAD

S&P/TSX Composite Total Return Index

24.4

18.6

18.4

20.9

7.0

2.9

1.4

0.2

0.1

0.4

0.0

5.7

3.2

1.9

1.8

8.0

11.5

5.8

7.8

9.4

10.6

8.9

10.2

8.9

13.6

10.9

11.0

10.3

24.8

19.6

17.6

17.1

14.1

5.9

7.5

1.9

Aggressive Portfolio (20% Fixed Income, 80% Equity)

Moderate Portfolio (40% Fixed Income, 60% Equity)

Conservative Portfolio (80% Fixed Income, 20% Equity)

16.9

13.4

8.1

2.2

2.7

5.2

3.0

3.9

5.5

4.0

4.7

6.3

8.8

8.4

8.7

10.2

10.2

10.5

10.8

9.8

8.0

13.0

10.3

7.5

2.0

0.4

1.6

7.0

2.0

0.9

3.1

7.5

2.2

0.8

1.3

7.1

2.6

2.0

1.8

8.2

2.9

2.4

2.0

9.9

4.5

3.9

1.8

11.8

6.9

6.3

3.0

7.5

6.9

5.7

3.8

9.8

3.4

4.0

1.0

2.6

0.9

Chrysler bailout

Growth of $100

first Intel microchip

CBCs first colour TV broadcast

Canadas

first lottery

CPP/QPP approved

($100,000 prize)

OAS reduced from 70 to 65

with no acquisition costs or

taxes & all income reinvested

birth of

Parti Qubcois

Avro Arrow terminated

DEX Long Bond Index

5 Year Guaranteed Investment Certificates

90 Day Canada Treasury Bills

Consumer Price Index (Cost of Living)

$100

$145.31

Arab oil embargo

gold's fixed price of

$35 U.S. per oz abandoned

Oil (West Texas

Intermediate Crude)

$2.57 U.S. per barrel

$850

$482

$195

$4.11

$104

$12.60

$711

22.75%

$38.34

$297

$509

$500

$284

Government of Canada

Long Term Bond Yield

$14.23

10%

$31.70

$10.40

$40.65

$17.50

$37.22

$10.82

$1,213

$1,011

$77.05

$725

$713

$561

$50.51

$30.28

$253

$81.03

$1,553

$1,421

$113.39

$91.48

$64.78

BP oil spill

2.4%

2.6%

Compound Annual Rate of Inflation by Decade

10%

5%

7.6%

6.2%

2.1%

0%

2.1%

RRSP started with

RRSP

RRSP

RRSP

RRSP

RRSP

RRSP

a limit of $2,500

$4,000

$5,500

$7,500

$11,500

$12,500

$13,500 $14,500 $13,500

5%

RRSP

RRSP

RRSP

RRSP

RRSP

RRSP

$14,500

$15,500 $16,500 $18,000

RRSP

RRSP

$19,000 $20,000

RRSP

RRSP

RRSP

$21,000

$22,000 $22,450

2.4% Unemployment Rate

7.1%

3.4%

6.2%

5.3%

12.7%

$1.00

$0.90

minimum wage

$1.00/hr

$0.80

minimum wage

$2.90/hr

$0.70

6.7%

11.6%

6.7%

0%

$1.00

$0.90

$0.80

$1.0852 Nov 6

Up 75% since Jan 18 02 low

Gross Domestic Product

2%

7.4%

8.7%

Canadian Dollar in USD

dollar peaks at $1.06

10%

5%

Inflation (Cost of Living)

0%

15%

10%

Prime Rate

5%

0%

5.7%

Canada hosts

Winter Olympics

average family

income $38,059

govt of Canada

20 yr bond 17.75%

life expectancy

WorldCom

largest TSE 300 company

BCE Inc. 6.6%

Northland Bank & Canadian

Commercial Bank go bankrupt

Korean War

6.9%

GM files

for bankruptcy

M-78.3 yrs

F-83.0 yrs

Iraq invades Kuwait

Ontarios top marginal tax rate

drops from 82.4% to 59.5%

OAS starts for those over 70

$5,962

9/11 attacks

Berlin Wall torn down

capital gains tax introduced

0%

(2%)

$30,706

Japan earthquake

and tsunami

Ontarios top marginal

tax rate 46.4%

8.1%

15%

$56,959

capital gains exemption eliminated

capital gains exemption

frozen at $100,000

Conservative

20%

$60,150

Lehman Brothers

files for bankruptcy

O&Y bankruptcy

Canadas first

gold coin,

the Maple Leaf,

goes on sale

0.0%

20%

$10,000

S&P/TSX

drops 840.93 points in a

single day most in 8 years

NASDAQ down 78% from Mar 10 00 close

1st Quebec referendum

60% vote NO

24.2%

13.6%

10.9%

20%

50.8%

$248,768

Wall Street

Reform Act

DJIA 7,286 (down 38%)

DJIA 11,723

Asian currency crisis

TSE 300

closes above 1,000

9.7%

S&P/TSX

7,567 (down 50%)

U.S.

subprime

crisis

60% Bonds

20% Cash

30% Bonds

10% Cash

Moderate

30%

S&P/TSX

15,073

S&P/TSX

5,695 (down 50%)

TSE 300 5,000

TSE 300 2,000

10%

OBAMA

Conservative

25%

20%

CLINTON

Negative

Periods

25%

57.7%

HARPER

MARTIN

BUSH

TSE 300 3,000

25% Canadian Stocks

25% U.S. Large Stocks

20% World ex-U.S. Stocks

10% U.S. Small Stocks

10.7%

CHRETIEN

KC

BUSH

REAGAN

120-Month Rolling Periods

5%

10%

CARTER

Moderate

Aggressive

Aggressive

15%

MULRONEY

JT

Hypothetical Portfolios

12-Month Rolling Periods

Compound

Annual Return

TRUDEAU

CLARK

NIXON

Rolling Period Portfolio Performance

$1,000

100%

75%

Compound Annual Returns by Decade

minimum wage

$6.85/hr

minimum wage

$10.25/hr

$0.6202 Jan 18

$0.70

2%

0%

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

Hypothetical value of $100 invested at the beginning of 1950. Assumes reinvestment of income and no transaction costs or taxes. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. Past performance is no guarantee of future results. Government bonds and Treasury bills are guaranteed by the full faith and credit of the Canadian government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than the other asset classes. Furthermore, small stocks are more volatile

than large stocks and are subject to significant price fluctuations, business risks, and are thinly traded. International investments involve special risks such as fluctuations in currency, foreign taxation, economic and political risks, liquidity risks, and differences in accounting and financial standards. Canadian recessions are defined as two or more consecutive quarters of negative GDP growth, while U.S. recession data is from the National Bureau of Economic Research (NBER). Gold prices are from London Bullion Market Association and represent the London P.M. daily closing prices per troy ounce.

Gold and oil prices quoted in U.S. dollars. Hypothetical portfolios were created for illustrative purposes only. They are neither a recommendation, nor actual portfolios. All income was reinvested and the portfolios were rebalanced every 12 months. Returns are compound annual returns, and risk is calculated as the standard deviation of calendar-year returns. The worst 5-year calculations are out of 679 rolling 60-month periods. Source: U.S. Small Stocksrepresented by the fifth capitalization quintile of stocks on the NYSE for 19501981 and the performance of the Dimensional Fund Advisors, Inc.

U.S. Micro Cap Portfolio thereafter; World Markets ex-U.S.Global Financial Data for 19501969 and Morgan Stanley Capital International (MSCI) World ex U.S. Index thereafter; U.S. Large Stocksrepresented by the Standard and Poors 90 index from 1950 through February 1957 and the S&P 500 index thereafter, which is an unmanaged group of securities and considered to be representative of the U.S. stock market in general; S&P/TSX CompositeCanadian Financial Markets Research Center for 19501955 and Standard and Poors/TSX Composite Index total return series thereafter, which

replaced the TSE300 Total Return Index on May 1, 2002; DEX Long Bond IndexPC-Bond, a business unit of TSX, Inc.; 5 Year Guaranteed Investment CertificatesBank of Canada; 90 Day Canada Treasury BillsBank of Canada; Consumer Price IndexStatistics Canada; Gross Domestic ProductBank of Canada for 19501992 and Statistics Canada thereafter (the second-quarter 2011 GDP value is an average analysts estimate); Canadian Dollar in U.S. DollarsBank of Canada; Prime RateBank of Canada; Government of Canada Long Term Bond YieldBank of Canada. A contraction is

defined by a time period when the stock market value declined from its peak by 20% or more. Expansion measures the recovery of the index from the bottom of a contraction to its previous peak and the subsequent performance of the index until it reaches the next peak level before another 20% decline. 2011 Morningstar. All Rights Reserved.

00

01

02

03

Recessions

CANADA

U.S.A. as per NBER

04

05

06

07

08

09

10

11

(2%)

Вам также может понравиться

- Whitehall: Monitoring The Markets Vol. 5 Iss. 21 (June 17, 2015)Документ2 страницыWhitehall: Monitoring The Markets Vol. 5 Iss. 21 (June 17, 2015)Whitehall & CompanyОценок пока нет

- Characteristics of The Stocks and Bonds In: 7twelveДокумент3 страницыCharacteristics of The Stocks and Bonds In: 7twelveadamcohen81Оценок пока нет

- TD Ameritrade Commission-Free EtfsДокумент6 страницTD Ameritrade Commission-Free EtfsVaro LiouОценок пока нет

- Putnam Alternating Market LeadershipДокумент2 страницыPutnam Alternating Market LeadershipPutnam InvestmentsОценок пока нет

- Wet Seal - VLДокумент1 страницаWet Seal - VLJohn Aldridge ChewОценок пока нет

- Investors Income Plus PortfolioДокумент1 страницаInvestors Income Plus PortfolioMasakik86Оценок пока нет

- TD Ameritrade Commission-Free EtfsДокумент6 страницTD Ameritrade Commission-Free EtfsSteve SantucciОценок пока нет

- 1909 Ausbil Unitholder Report PDFДокумент32 страницы1909 Ausbil Unitholder Report PDFTonyОценок пока нет

- Sleeping Beauties Bonds - Walt Disney CompanyДокумент15 страницSleeping Beauties Bonds - Walt Disney CompanyThùyDương Nguyễn100% (2)

- Whitehall: Monitoring The Markets Vol. 5 Iss. 22 (June 24, 2015)Документ2 страницыWhitehall: Monitoring The Markets Vol. 5 Iss. 22 (June 24, 2015)Whitehall & CompanyОценок пока нет

- Weekly Market Recap, May 13-Main Street FinancialДокумент2 страницыWeekly Market Recap, May 13-Main Street Financialasmith2499Оценок пока нет

- Tutorial Week 10Документ21 страницаTutorial Week 10Ann JoyОценок пока нет

- Lessons From Capital Market History: Return & RiskДокумент46 страницLessons From Capital Market History: Return & RiskBlue DemonОценок пока нет

- 3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDДокумент1 страница3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDasdzxcv1234Оценок пока нет

- Current 1 2 3 4 5 6 7 8 9 10: Year Revenues Change in Revenue Sales/Capital Ratio Reinvestment Capital InvestedДокумент5 страницCurrent 1 2 3 4 5 6 7 8 9 10: Year Revenues Change in Revenue Sales/Capital Ratio Reinvestment Capital InvestedFırat ŞıkОценок пока нет

- Weekly Market Recap-Week of May 6th-MSFДокумент2 страницыWeekly Market Recap-Week of May 6th-MSFasmith2499Оценок пока нет

- Weekly Trends Nov 21Документ5 страницWeekly Trends Nov 21dpbasicОценок пока нет

- RAM WeeklyFX April 2012Документ3 страницыRAM WeeklyFX April 2012Sarkıs UsaklıgılОценок пока нет

- Financial Ratio Calculator: (Complete The Yellow Cells Only, The Spreadsheet Does The Rest)Документ8 страницFinancial Ratio Calculator: (Complete The Yellow Cells Only, The Spreadsheet Does The Rest)4Lions1Оценок пока нет

- Evercore Partners 8.6.13 PDFДокумент6 страницEvercore Partners 8.6.13 PDFChad Thayer VОценок пока нет

- Chapter 7. CH 7-20 Build A Model: Dividend $1.60 1.92 2.304 2.44224Документ6 страницChapter 7. CH 7-20 Build A Model: Dividend $1.60 1.92 2.304 2.44224wincippОценок пока нет

- XLS092-XLS-EnG Tire City - RaghuДокумент49 страницXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeОценок пока нет

- Refinance Analysis v1.01Документ1 страницаRefinance Analysis v1.01AlexОценок пока нет

- Weekly Mutual Fund and Debt Report: Retail ResearchДокумент14 страницWeekly Mutual Fund and Debt Report: Retail ResearchGauriGanОценок пока нет

- ValueResearchFundcard HDFCTaxsaverFund 2014jul23Документ4 страницыValueResearchFundcard HDFCTaxsaverFund 2014jul23thakkarpsОценок пока нет

- 2.41 Whitehall: Monitoring The Markets Vol. 2 Iss. 41 (October 9, 2012)Документ2 страницы2.41 Whitehall: Monitoring The Markets Vol. 2 Iss. 41 (October 9, 2012)Whitehall & CompanyОценок пока нет

- Currency Street: The Greenback Up Amidst Disappointing June DataДокумент5 страницCurrency Street: The Greenback Up Amidst Disappointing June Dataविवेक कुमार मुकेशОценок пока нет

- Debt Policy at UST Inc.Документ47 страницDebt Policy at UST Inc.karthikk1990100% (2)

- Annuities K. RaghunandanДокумент18 страницAnnuities K. RaghunandanShubhankar ShuklaОценок пока нет

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingДокумент4 страницыGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlОценок пока нет

- Amortization Schedule: Monthly PaymentДокумент1 страницаAmortization Schedule: Monthly PaymentraqibappОценок пока нет

- Session 3 AДокумент10 страницSession 3 AAashishОценок пока нет

- Bukit Sembawang EstatesДокумент7 страницBukit Sembawang EstatesNicholas AngОценок пока нет

- Solution To Case 2: Bigger Isn't Always Better!Документ9 страницSolution To Case 2: Bigger Isn't Always Better!Muhammad Iqbal Huseini0% (1)

- JPM Guide To The Markets - Q1 2014Документ71 страницаJPM Guide To The Markets - Q1 2014adamsro9Оценок пока нет

- Dividend Weekly 38 - 2013Документ33 страницыDividend Weekly 38 - 2013Tom RobertsОценок пока нет

- VCM - 3time Value of MoneyДокумент50 страницVCM - 3time Value of MoneyChaella Mae UsiОценок пока нет

- Bullish Review First Look Jan 12 2012Документ9 страницBullish Review First Look Jan 12 2012shaunnd1Оценок пока нет

- Fundcard L&TCashДокумент4 страницыFundcard L&TCashYogi173Оценок пока нет

- Financial Management: PortfolioДокумент22 страницыFinancial Management: Portfolioapi-100770959Оценок пока нет

- New Malls Contribute: Capitamalls AsiaДокумент7 страницNew Malls Contribute: Capitamalls AsiaNicholas AngОценок пока нет

- Testbankanswers Chap009Документ33 страницыTestbankanswers Chap009d-fbuser-179310519Оценок пока нет

- 26 Colgate Palmolive LimitedДокумент15 страниц26 Colgate Palmolive LimitedAkhil GoyalОценок пока нет

- Optimism Regarding Possible New Measures: Morning ReportДокумент3 страницыOptimism Regarding Possible New Measures: Morning Reportnaudaslietas_lvОценок пока нет

- Systematic Investment Plan: DSP Blackrock Mutual FundДокумент28 страницSystematic Investment Plan: DSP Blackrock Mutual FundmynksharmaОценок пока нет

- Craig James, Chief Economist, Savanth Sebastian, Economist,: Commsec CommsecДокумент33 страницыCraig James, Chief Economist, Savanth Sebastian, Economist,: Commsec CommsecAaron Christie-DavidОценок пока нет

- 2016 05 Dual Momentum InvestingДокумент100 страниц2016 05 Dual Momentum InvestingBala karthickОценок пока нет

- BAM Balyasny 200809Документ6 страницBAM Balyasny 200809jackefellerОценок пока нет

- Quick Reference Guide For Financial Planning Aug 2012Документ7 страницQuick Reference Guide For Financial Planning Aug 2012imygoalsОценок пока нет

- Ishares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummaryДокумент3 страницыIshares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummarywanwizОценок пока нет

- Kajaria Ceramics: Upgrade in Price TargetДокумент4 страницыKajaria Ceramics: Upgrade in Price TargetSudipta BoseОценок пока нет

- Quick Reference Guide For Financial Planning July 2012Документ7 страницQuick Reference Guide For Financial Planning July 2012imygoalsОценок пока нет

- 2011 01 07 - 062649 - Mcqjamuv 2Документ2 страницы2011 01 07 - 062649 - Mcqjamuv 2dnm110Оценок пока нет

- Dividends Still Don't Lie: The Truth About Investing in Blue Chip Stocks and Winning in the Stock MarketОт EverandDividends Still Don't Lie: The Truth About Investing in Blue Chip Stocks and Winning in the Stock MarketОценок пока нет

- f9 2006 Dec PPQДокумент17 страницf9 2006 Dec PPQMuhammad Kamran KhanОценок пока нет

- Asteri Capital (Glencore)Документ4 страницыAsteri Capital (Glencore)Brett Reginald ScottОценок пока нет

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsОт EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Tactical Portfolios: Strategies and Tactics for Investing in Hedge Funds and Liquid AlternativesОт EverandTactical Portfolios: Strategies and Tactics for Investing in Hedge Funds and Liquid AlternativesОценок пока нет

- Inside the Currency Market: Mechanics, Valuation and StrategiesОт EverandInside the Currency Market: Mechanics, Valuation and StrategiesОценок пока нет

- Direct Tax Article Taxation of Agricultural LandДокумент7 страницDirect Tax Article Taxation of Agricultural LandmanishdgОценок пока нет

- Met Smart GoldДокумент10 страницMet Smart GoldyatinthoratscrbОценок пока нет

- Individual Finance PDFДокумент575 страницIndividual Finance PDFshivam vajpai100% (1)

- 3946 Mohamed Alameri ResumeДокумент2 страницы3946 Mohamed Alameri Resumeapi-413425549Оценок пока нет

- Gerald Appel - Opportunity Investing. Time Cycles, Market Breadth, and Bottom-Finding StrategiesДокумент26 страницGerald Appel - Opportunity Investing. Time Cycles, Market Breadth, and Bottom-Finding StrategiesJohn SmithОценок пока нет

- Managing Commodity Price Risk: A Supply Chain PerspectiveДокумент9 страницManaging Commodity Price Risk: A Supply Chain PerspectiveBusiness Expert Press50% (2)

- Chapter 6 - Accounting For SalesДокумент4 страницыChapter 6 - Accounting For SalesArmanОценок пока нет

- AFM P4 Class APVДокумент8 страницAFM P4 Class APVSabeenIbrahimОценок пока нет

- Zerodha ComДокумент25 страницZerodha ComBalakrishna BoyapatiОценок пока нет

- Bayawan City Investment Code 2011Документ12 страницBayawan City Investment Code 2011edwardtorredaОценок пока нет

- TurtleДокумент12 страницTurtleanon-373190Оценок пока нет

- Deepak InsДокумент3 страницыDeepak InsNaveen Kumar E ( Brand Champion )Оценок пока нет

- Price of MoneyДокумент32 страницыPrice of MoneyneffjasoОценок пока нет

- Macro Economics NotesДокумент31 страницаMacro Economics NotesSonali_2503Оценок пока нет

- Ch-12 Recommending Model Portfolios and Financial PlansДокумент8 страницCh-12 Recommending Model Portfolios and Financial PlansrishabhОценок пока нет

- Section 50C and 56 (2) (Vii) of The Income Tax ActДокумент14 страницSection 50C and 56 (2) (Vii) of The Income Tax Acthari01011954Оценок пока нет

- Solved Perry Chandler A Broker With Caveat Emptor LTD Offers FreeДокумент1 страницаSolved Perry Chandler A Broker With Caveat Emptor LTD Offers FreeM Bilal SaleemОценок пока нет

- Life Insurance Trust AgreementДокумент2 страницыLife Insurance Trust AgreementThea BaltazarОценок пока нет

- 3232 Void Corrected: Copy A W-2GДокумент8 страниц3232 Void Corrected: Copy A W-2GSrujan KumarОценок пока нет

- Insight Title Company, LLC - Company ProfileДокумент2 страницыInsight Title Company, LLC - Company ProfilebmarcuzzoОценок пока нет

- FA3 CabreraДокумент139 страницFA3 CabreraLaurenz Simon ManaliliОценок пока нет

- Unpacking Sourcing Business ModelsДокумент37 страницUnpacking Sourcing Business ModelsAlan Veeck100% (3)

- Campus Deli Case 4Документ15 страницCampus Deli Case 4Ash RamirezОценок пока нет

- The Financial Sector and The Role of Banks in Economic DevelopmentДокумент6 страницThe Financial Sector and The Role of Banks in Economic Developmentpravas ranjan beheraОценок пока нет

- Banking & InsuranceДокумент19 страницBanking & Insuranceshanu000Оценок пока нет

- Direct Taxation Memorial FinalДокумент16 страницDirect Taxation Memorial FinalAmitKumarОценок пока нет

- Question Paper International Finance and TradeДокумент12 страницQuestion Paper International Finance and TradeRaghavendra Rajendra Basvan33% (3)

- Introducing LetsVenture-CA FinalДокумент13 страницIntroducing LetsVenture-CA FinalsreewealthОценок пока нет

- PakistanДокумент4 страницыPakistanAsif AliОценок пока нет