Академический Документы

Профессиональный Документы

Культура Документы

Technology in Banking and Foresight For BTA - 2012

Загружено:

shankaranandh1Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Technology in Banking and Foresight For BTA - 2012

Загружено:

shankaranandh1Авторское право:

Доступные форматы

Foreword

Banks and financial services are the biggest adopters and spenders on technology which has helped

them totally transform their business models. Banks have leveraged information technology (IT) in

multiple areas apart from core banking. There is also a marked difference in the approach to IT

which is no longer thought as replacement for human capital but as a critical enabler for business.

With the emergence and convergence of mobile technology with information technology, the

developments in the banking space has become much more exciting and dynamic, especially in

increasing the reach and last mile connectivity for banks. Most banking transactions today can be

executed through a mobile handset and the need to visit a bank branch has been drastically

reduced.

IT will continue to play an increasingly important role in banks of tomorrow. Information

management and data security will become critical. Some banks are already investing in social media

tools and strategies such as linking to customers' Facebook profiles and building online communities.

This will give banks access to customers' social profiles. This could be combined with customers'

transactions and behavior data will allow banks to personalize service and product offers. Security of

banks IT systems will become vital to prevent hacking attacks and information theft. Instances of

website cloning and identity theft are also on the rise and banks will have to be constantly a step

ahead on security issues. The roles and responsibilities of chief information officer (CIO) and chief

information security officer will become vital in the near future.

Significant initiatives are being taken by banks in areas like analytics for customer relationship

management, business intelligence, enterprise data warehouse, security and real-time systems to

manage business risks, consolidation. Banks are getting into virtualization and are quite curious

about cloud computing. Automated data flow is another area where there is considerable progress.

Banks have initiated the process of adopting IT Governance framework. Independent directors are

showing keen interest in facilitating IT governance process by putting in place appropriate strategies

and organizational structures.

We expect significant developments in these areas in the immediate future. This report captures the

developments in banking technology and their impact in various functional areas.

B. Sambamurthy

Director

Institute for Development & Research

in Banking Technology

Ashvin Parekh

Partner and National Leader

Global Financial Services

Ernst & Young Pvt. Ltd

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

Contents

Executive Summary................................................................................................................................. 3

1.

IDRBT Awards for Excellence in Banking Technology 2011 ............................................................ 4

2.

Introduction .................................................................................................................................... 4

3.

Use of Technology for Financial Inclusion (FI) ................................................................................ 6

4.

Mobile Banking and Electronic Payments....................................................................................... 9

5.

Customer Relationship Management (CRM) & Business Intelligence (BI) initiatives ...................12

6.

IT Implementation and Management...........................................................................................14

7.

IT for Operational Effectiveness....................................................................................................16

8.

Managing IT Risk ...........................................................................................................................17

9.

Conclusion.....................................................................................................................................18

Institute for Development & Research

in Banking Technology

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

Executive Summary

Most banks have evolved rapidly in technology adoption with infrastructure, governance, policies,

procedures and security in place. Public sector banks have progressed tremendously to narrow the

gap with new private sector banks, while old private sector banks and smaller banks still have some

way to go. A majority of banks having completed the implementation of core banking systems (CBS)

are exploring advanced solutions to business problems. Initiatives like enterprise data warehouse

and business intelligence solutions are being implemented for real-time data analysis and complete

view of customer relationships. Significant initiatives are being taken by banks on the financial

inclusion front. The total number of no-frill accounts increased from 50.8 million in FY11 to 69.3

million in FY12, importantly the number of no-frill accounts with overdraft showed a huge increase

from 99,000 in FY11 to 684,000 in FY12. Total outstanding balance in no-frill accounts increased

from INR 41 billion to INR 57 billion (approximately 40%). KCC/GCC cards increased from 9.6 million

in FY11 to 11.4 million in FY12. The number of BCs enrolled and SHGs linked also showed a huge

growth from 21,000 to 39,000 and 1.2 million to 1.6 million respectively. Inclusion efforts have

gained sufficient momentum with stabilization of technology and business models. Smaller banks

are also making increased efforts towards inclusion. With a sizable IT infrastructure deployed the

scale-up in the next few years is going to be rapid and we may see significant progress.

With the countrys mobile penetration at roughly 85%, mobile banking has been a thrust area for

banks with most banks already implementing a comprehensive service suite. However, the mobile

channel is mostly being used for information provision rather than banking transactions. The

number and amount of fund transfers will grow in the coming years as services (mobile to mobile

transfers and interbank mobile payment service IMPS) gains acceptance. Electronic payments have

been steadily growing with increase in NEFT/RTGS volumes but the usage of internet banking needs

to grow (only 2 out 25 banks declared average daily fund transfer of more than INR 10 billion). Debit

cards have become more popular with average daily value of transactions being almost 187 times

more for debit than credit cards.

Customer relationship management (CRM) and business intelligence (BI) initiatives of the banks still

have some way to go. With the exception of a handful of banks, others are still in the process of

integrating data warehouses to get a full view of all customer relationships. BI and analytics teams

are being setup and strengthened but real-time availability and full view of customer relationships is

still a couple of years away. Cross-selling and lead generation activities are offline and based on

inputs from customer facing personnel.

The IT implementation capabilities of banks has improved tremendously with most banks having

aligned their corporate structure for a better and improved interactions of the business and IT teams

for implementation. Banks also need to now measure and track metrics like return on investment

(ROI) and total cost of operations (TCO) as the balance of IT expenses tilts more towards operational

expenses than capital expenses. The scale of IT infrastructure set-up also requires attention and

proper policies and procedures for managing infrastructure as well as IT risks which have become

fairly standardized across banks.

Institute for Development & Research

in Banking Technology

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

1. IDRBT Awards for Excellence in Banking Technology 2011

The process for the eighth edition of the excellence in banking technology awards was initiated in

March 2012 with a jury meeting to discuss and finalize the award categories. The jury for the year

was chaired by Mr. KV Kamath, Chairman ICICI Bank and comprised the following:

Dr. R. B. Barman, Former Executive Director, RBI (Jury Member)

Dr. K. Ramakrishnan, CEO, IBA (Jury Member)

Prof. G. Sivakumar, IIT Mumbai (Jury Member)

Prof. U. B. Desai, Indian Institute of Technology, Hyderabad (Jury Member)

The awards categories for the year were as follows:

1.

2.

3.

4.

5.

6.

Use of Technology for Financial Inclusion

Mobile Banking & Electronic Payment Systems

CRM & Business Intelligence Initiatives

IT Implementation and Management

IT for Operational Effectiveness

Managing IT Risk

The jury also decided that IT innovation be one of the parameter for judging the nominations, but

given the past experience where the nominations were not very strong, the jury felt that in each of

the categories banks may be asked to reply on any innovative initiative and if found substantial they

may be requested for further details. However once the evaluation was completed the jury decided

that the category may be dropped. The jury also noted that multiple initiatives have been taken by

banks on innovation but the results are not yet visible and strong response in the category is

expected from the banks in next years awards.

Evaluation Process

Strong and heartening response was received from the banks in all awards categories, indicating an

overall increase in level of confidence and maturity in use of technology in banking. A total of 30

banks, with 138 nominations, participated in the awards process, comprising 21 large and 9 small

banks. Banks were segregated into large and small category based on deposit size of INR 50,000

crores.

2. Introduction

Financial services especially banks have been early adopters of technology and have leveraged it in

multiple areas like service delivery (alternate channels), operational effectiveness (workflow and

data management), cost reduction, productivity enhancement and governance. Information and

communication technology (ICT) has helped banks increase their scope and scale to overcome

geographic and time boundaries. Indian banks today have global operations and round the clock

service delivery. The Banking sector has and continues to implement new information technology

systems to assist and complement growth. Banks have been significantly upgrading their technology

Institute for Development & Research

in Banking Technology

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

infrastructure to bring down costs of resources, facilitate cross selling and enhance customer service

and operational efficiency.

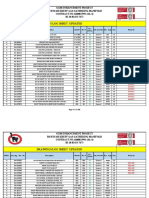

A look at the IT expenses1 (both capital and operational) of banks shows that the average spends has

increased from Rs. 269 crores in 2009-10 to Rs. 283 crores in 2010-11 and Rs. 308 crores in 2011-12.

Figure 1

Average IT spend (Rs.cr)

422

391

373

308

283

269

54

41

35

2009-10

2010-11

All Banks

2011-12

Large Banks

Small Banks

The IT expenses grew by approximately 9% in FY12 as compared to 5% in FY11. Smaller banks are

increasingly embarking on transformation and undertaking technology adoption to retain, grow and

service their clientele. Their IT expenses grew by 16% in FY11 and 32% in FY12.

Figure 2

Figure 3

Y-o-Y Growth in IT spend

Y-o-Y Growth in IT spend

All Banks

40%

30%

20%

9%

10%

0%

8%

All Banks

20%

15%

10%

5%

5%

0%

5%

Small Banks

16%

Large Banks

2010-11

Small Banks

32%

Large Banks

2011-12

IT strategy and vision

IT is recognized as a key Strategic function, as appropriate use of IT can improve the efficiency and

competitiveness of businesses. The increasing criticality of ICT in banking operations have led the

banks to define long term IT vision and strategy aligned with business goals and objectives. The IT

1

Based on a sample of 26 banks (18 large and 8 small) categorized as large and small based on deposit base

above and below Rs.50,000 crores.

Institute for Development & Research

in Banking Technology

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

vision provides direction to IT initiatives, and aligns IT objectives with the banks mission and vision.

IT strategies of bank have been designed to provide necessary support to improve Business, i.e. align

IT with Business requirement and reduce costs. The following aspects inter alia form critical

components of IT vision and strategy for effective and efficient use of technology.

Use IT to provide and enable scale to cater to business growth

Enable branches/users to provide quality services to customers

Optimize transaction handling capability of the Bank

High availability and performance of systems

Decision support systems based on single version of truth

Security and protection of customer data privacy

IT Governance policy and procedures

Strategies to reduce carbon foot prints

Banks have also put in strong mechanisms to align IT and business objectives. IT strategy committee,

IT steering committee and project level committee have been put in place with representation from

business owners to facilitate and ensure that IT initiatives are driven by business goals.

3. Use of Technology for Financial Inclusion (FI)2

Technology has been a major driver of FI initiatives in India and globally. The initial hurdles of reach,

cost and illiteracy among the target customers were all solved by the use of technology. The use of

handheld devices for customer acquisition and transaction processing, use of fingerprint for

authentication and IT infrastructure for driving down costs are slowly making FI initiatives viable. The

regulatory policy relaxation on branchless banking and business correspondents to enroll customers

and self help groups for credit as well as savings linkage has created adequate momentum. In

addition the governments support in terms of electronic transfer of benefits is also adding to

viability of the initiatives.

Business Growth

FI has been the policy thrust area in the past few years and banks have made remarkable efforts

towards increasing inclusion. The efforts have begun to stabilize and sufficient traction is being

generated in the FI initiatives with stabilization business models, technology infrastructure and

processes. On an overall basis no-frill accounts opened by banks grew by 36% over the last year. The

small banks show a large increase in percentage due to the base effect. Overall half of the banks are

adding upto a quarter of their customer base every year indicated by the median growth of 28%.

Data is based on the nomination submitted by 18 large and 4 small banks for the category

Institute for Development & Research

in Banking Technology

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

Figure 4

Figure 5

No-frill accounts (million)

Growth of No-frill accounts

111%

3.85

3.15

2.34

1.97

36%

28%

36%

49%

27%

0.01 0.01

All Banks

Large Banks

Small Banks

Average Median

All Banks

Large Banks

Average

Small Banks

The outstanding balances in no-frill accounts show a sizable growth with an average of Rs. 2,590

million and median of Rs.895 million. The large banks expectedly are driving the FI agenda and the

smaller banks have also started to make their presence felt.

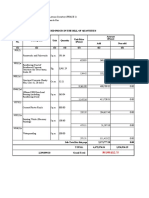

Figure 6

Figure 7

Balance o/s in No-frill accounts (Rs.mn)

3,164

2,590

2,014

895

Growth in balance o/s in No-frill

accounts

272%

79%

11

All Banks

Large Banks

Small Banks

Average Median

35%

All Banks

43% 35%

Large Banks

Average

100%

Small Banks

The average active (accounts with at least 4 transactions in the last financial year) have also shown

some improvement. However it is an area of concern as only 7 out of 22 banks have active accounts

ratio of more than 10%, the remaining 15 banks hover around 1-1.5%.

Figure 8

Figure 9

Active no-frill accounts (000s)

Active no-frill accounts percentage

All Banks

300

226

200

All Banks

20%

15%

10%

100

-

Small Banks

0%

285

Large Banks

Average

Small Banks

20%

15%

Large Banks

Average

Business and operations model

Banks have experimented with various business models namely brick and mortar branches, ICT

based models, mobile vans and ultra small branches. A mix of all three models is today deployed by

Institute for Development & Research

in Banking Technology

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

banks and the primary mode of distribution and reaching the target customers is through business

correspondents (BCs) and self help group (SHG) linkage.

The enrollment of BCs and linkage of SHGs has improved drastically with banks having an average of

1,788 BCs and 74,000 SHGs linked. Growth over the previous year for BCs has been approximately

86% driven by large banks. A total of 39,346 BCs and 1.62 million SHGs have been linked by the 22

nominating banks of which 18,160 BCs and 349,389 SHGs have been added for the year.

Figure 10

Figure 11

Growth in BCs

Business Correspondents

All Banks

3,000

1,788

2,000

1,000

2,175

48

Small Banks

Large Banks

Figure 12

All Banks

100%

86%

50%

0%

Small

Banks

86%

Large

Banks

65%

Figure 13

SHGs (000s)

All Banks

100

74

80

60

40

20

3

Small Banks

Growth in SHGs

All Banks

30%

28%

20%

10%

0%

89

Large Banks

Small Banks 11%

28%

Large Banks

Technology infrastructure deployed

Banks have deployed either the in-house or out-sourced model for FI technology implementations.

For in-house systems banks have put in place a separate CBS and FI server.

Core Banking System (CBS):

The accounts of financial inclusion are hosted in a separate CBS which offers all the functionalities

required for conducting basic banking transactions and does not clog the existing bank CBS with low

value high volume transactions.

Financial Inclusion Gateway (Switch):

The FIG purpose is to integrate all diverse front end technology platforms with Banks CBS and thus

promote BC interoperability and integrated middleware, referred to as the Financial Inclusion

Institute for Development & Research

in Banking Technology

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

Gateway. This switch would manage the diverse authentication modes (till date the authentication

responsibility mostly resided with the BCs) and interface seamlessly with the external environment

like NPCI/ UIDAI. It would act as a repository of Biometric Fingerprints and authentication, maintain

DCMS for Rupay Cards, offer user friendly interfaces for customer enrolment and kiosk applications

facilitate reconciliation and MIS etc.

In the outsourced model the necessary IT infrastructure is provided by the service provider which

interface/ establishment of connectivity with CBS of bank, supply of point of sale (POS) devices/

hand held terminals, webcams, biometric reader to the field BC for capturing of enrolment data,

photo and finger prints of the customers at villages.

Financial inclusion initiatives have started to generate momentum with increasing number of

customers being acquired and banks making increasing efforts to deliver basic banking services on a

large scale and low cost. The technology enabled service delivery model coupled with viability

measures through Aadhar and other electronic benefit transfer (EBT) mechanisms will lead to

sustained momentum of FI initiatives. Some banks have also begun to offer micro-insurance

products through BCs and SHGs leading to improved viability for the intermediaries as well as the

banks themselves.

4. Mobile Banking and Electronic Payments3

Mobile Banking Business Growth

Banking has been one of the early adopters of mobile technology and really come into its own with

the advent of smart phones. While during the early stages, led by the private banks, information

provision was the main driver, banks today provide a wide range of transaction services which can

be executed through the mobile phones. Majority of m-banking applications today are handset

agnostic and interoperable across telecom service providers and available via SMS, GPRS, WAP,

USSD and Plain text SMS Banking.

The use of mobile is more as an information channel rather than for any actual banking transaction,

however its utility in funds transfer can be vital especially for remittances under financial inclusion

and banks need to popularize the same to FI customer base.

Figure 14

Figure 15

Avg daily number of alerts pushed by banks

(000s)

All Banks

1,500

1,000

879

500

Small Banks

1,117

166

Large Banks

Average daily information alerts pulled by

users (000s)

All Banks

150.0

110.5

100.0

50.0

147.0

1.1

Small Banks

Large Banks

Data based on nomination submitted by 18 large and 7 small banks for the category

Institute for Development & Research

in Banking Technology

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

The total customer base enrolled for mobile banking stood at 81.7 million; however most of them

were registered only for alert services pushed by the banks. Only 23% of the total or 18.7 million of

them were registered for mobile funds transfers. Additionally only 9 large banks and 1 small bank

have mobile customer base of more than 1 million.

Figure 16

Figure 17

Mobile Banking user base (million)

Growth in Customer Base

4.33

All Banks

150%

3.28

100%

50%

1.52

0%

0.92

0.54 0.53

All Banks

Large Banks

Average

Small

Banks

106%

59%

57%

Large

Banks

Small Banks

Median

While the banks have managed to register a sizable customer base for mobile banking the usage of

the channel for banking transactions need to be popularized.

Figure 18

Mobile fund transfer user base (000s)

1,001

771

99

94

64

All Banks

Large Banks

Average

16

Small Banks

Median

The average daily value of mobile fund transfers stood at Rs. 16.85 million for the year 2011-12.

However the growth for the year has not been significant which could be due to customer behavior

and concerns on security.

Institute for Development & Research

in Banking Technology

10

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

Figure 19

Figure 20

Avg daily value of mobile fund transfers

(Rs.mn)

All Banks

20.00

16.85

15.00

10.00

5.00

12.95

18.37

Small

Large

Banks

Banks

Growth in value of mobile fund transfers

All Banks

50%

32%

0%

Small

Banks

1%

45%

Large

Banks

According to the recent World Bank report, Information and Communications for Development

2012: Maximizing Mobile (released July 17, 2012), the number of mobile subscriptions in use

worldwide, both pre-paid and post-paid, has grown from fewer than 1 billion in 2000 to over 6

billion now, of which nearly 5 billion in developing countries. The report estimates that soon the

number of mobile phone subscriptions will exceed the world population.

There is no doubt that mobile banking will become increasing critical for banking not just as an

information device but as a channel banking transactions. However the process simplicity, security

and interoperability will be crucial in driving the increase in usage.

Electronic Payments Business Growth

Electronic payment has been a critical component of technology adoption by banks. Initiatives from

the regulator such as electronic clearing service (ECS), national electronic funds transfer (NEFT), realtime gross settlement (RTGS) have accelerated the pace of technology adoption by banks and

enabled interconnectivity between banks. This has truly manifested in anywhere anytime banking.

However a look at the data shows that a large proportion of banking funds transfers are paper

based.

Figure 21

Figure 22

Average daily value of paper based fund

transfers (Rs.bn)

Small Banks

All Banks

750

468

500

250

15

645

Large Banks

Average daily value of electronic fund

transfers (Rs.bn)

All Banks

100

73

80

60

40

20

4

99

Small Banks

Large Banks

Trends in retail payments show that the use of debit cards has increase considerably alongwith

internet banking, credit cards still have not gained much acceptance possible due to a dislike for

credit among the general populace or the high charge structure of credit cards.

Institute for Development & Research

in Banking Technology

11

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

Figure 23

Average daily payments (Rs. mn)

6,574

7,000

6,000

5,000

5,311

4,742

3,831

4,000

3,000

2,000

1,000

31

25.4

Debit cards

33.0

5.9

Credit cards

All Banks

Large Banks

24

Internet banking

Small Banks

Changing customer preferences, mobile and internet penetration, rising cards, growth in disposable

income and spend, as well as new technology initiatives have bolstered the payments landscape in

India.

5. Customer Relationship Management (CRM) & Business Intelligence

(BI) initiatives

CRM in banks is increasingly gaining importance. The increasing competitiveness in the market is

necessitating improvement in customer service as the differentiator. Banks are increasingly investing

in enterprise data warehouse and CRM systems to get a full view of customer relationships and cross

sell to maximize share of wallet.

Customer Relationship Management is a comprehensive approach which provides seamless

integration of every area of business that touches the customer-namely marketing, sales, customer

services and field support through the integration of people, process and technology. A typical CRM

solution has modules like Business Prospect Management to enable complete view of a customer,

Leads Management for effectively capturing, tracking and managing business opportunities received

through any of the customer touch points and maximizing conversions, Campaign Management to

track campaigns undertaken by various departments of the Bank, Product Management to facilitate

a standardized view of requirements and performance of banking products, Business Intelligence

Reporting to understand customer behavior and to offer them relevant offers & products and

Complaints Management System for speedy grievance handling.

As CRM is integrated with various legacy systems viz. CBS, ASCROM, DEMAT, Debit Card Application,

GBM and LAPS therefore wherever the information is available same is updated. Thus CRM is

continuously getting converted into the customer data hub. This helps Bank to have 360 view of the

customer enabling banks in providing better service as well as cross-selling the products.

An analysis of the channels shows that branch is still the dominant channel for receiving customer

requests, closely followed by ATMs which means that a significant proportion of routine deposit,

Institute for Development & Research

in Banking Technology

12

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

withdrawals and cheque book requests have taken some burden of the branches. However

phone/internet banking still has a long way to go. A probable reason for phone banking's lower

popularity could be the troublesome menu and waiting time.

Figure 24

Channel wise requests received for the year (mn)

3,000

2,458

2,500

2,000

1,500

1,484

1,000

500

Branch

281

27

0.18 9.36

447

45

0.16 14.91

All Banks

Large Banks

Internet banking/ email ATMs Mobile

22 1 33 0.21 1.04

Small Banks

Call center/ Phone

Business Intelligence

With the exception of a few banks, most others are still in the process of putting business analytics

in place in terms of people and IT tools. BI capabilities in terms of data mining and knowledge

management capabilities are still low. Customer life cycle management approach is still to be

adopted and most banks rely on branches or other product teams to pass on information of a

customers additional requirements.

The largest bank in the country has undertaken commendable initiatives in BI like a data warehouse

with seamless integration to different source systems, corporate one view (which provides the

exposure to Corporates, turnover with the Bank and the income generated through services

provided to them. It includes commercial, institutional, small business and small industries

corporate, campaign management tool (to track campaign category, and customers reached etc),

periodic analysis of customer churn/ attrition, acquisition and retention.

As the proliferation of business processes on systems continues unabated, banks are in the distinct

situation of having access to a lot of data online. Staying competitive increasingly means utilizing this

data in a way that it transforms into Information that can be converted into a business advantage.

Towards this purpose many banks have put in place Information Management systems ranging from

process specific data marts to Enterprise wide Data Warehouses. Significant investments have also

been made in procuring and deploying state of the art reporting and analytics tools that help the

banks make more sense of the data its systems are capturing. However most banks are at the start

of the curve and need to increase efforts towards effective leverage of business intelligence.

Institute for Development & Research

in Banking Technology

13

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

6. IT Implementation and Management

With the ever increasing use of technology in all areas of banking it is becoming critical for banks to

have effective IT implementation and management plans in place. Effective IT implementation

requires alignment of IT plan with the business objectives and organization mechanism to closely

align business and IT teams. Misalignment of any sort would lead to unnecessary costs, delays and

opportunity loss. The critical components of an effective implementation plan are outlined in the

figure below.

Figure 25 Components of IT implementation

Banks have formed various teams under the chief information officer (CIO) and chief technology

officer (CTO) like infrastructure technology group, systems management group, technology solutions

group, governance compliance and finance group to effectively align business objectives with IT

objectives in addition to chief information security officer to cover all aspects of technology

implementation.

Most of the banks have put in place adequate IT and network infrastructure for operational needs.

The data center infrastructure is mostly tier 3 and designed and maintained according to Uptime

standards institute and ISO 27001 certified. In view of the criticality of IT infrastructure banks have

put in place appropriate disaster recovery (DR) and redundancy plans.

Given the critical dependence on IT, banks have implemented a robust IT Governance mechanism

considering best practices under different IT frameworks and standards like CoBIT [Control

Objectives for Information and Related Technology], ITIL, ISO20000, ISO27001 and other regulatory

requirements. To ensure good synergy between Business & IT Strategy, banks have set-up following

mechanisms:

Institute for Development & Research

in Banking Technology

14

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

IT Strategy Committee to provide overall direction to IT function and to look into strategy

alignment, policy formulation, reviewing IT investment, value delivery, risk management, compliance

aspects. IT Steering Committee at group head & business head level, to take forward the directions

set by strategy committee and drives, implements & reviews the execution. Project Steering

Committees for all significantly large strategic initiatives to review and monitor project progress. IT

Disaster Recovery Committee for application team, DR teams, and other related parties about

disaster and records of all DR events. Project progress is monitored throughout the project lifecycle

and post project Go Live, there is a Post Implementation Review (PIR), which is conducted for all

significantly large projects. Control Self-Assessment (CSA), which is conducted by IT Governance

team to ensure that laid-down policies & processes are adhered and a report is presented to IT

senior management.

Management of IT assets is another critical component of the IT strategy and banks have put in place

various policies and processes to effectively manage the IT infrastructure. Bank are adopting best

practices and frameworks like COBIT, ISO20000 & ISO27001 standards for building a robust IT

Governance infrastructure and accordingly various IT Policies and procedures have been launched.

Below are some of the specific processes, which are focused on management of information

applications, infrastructure & people.

IT Capacity Management Process

IT Technology Infrastructure Management Process

IT New Solution Identification Process

IT Change Management Process

IT Release Management Process

IT Asset Lifecycle Management Process

IT Outsourcing Process

IT Supplier Management Process

IT Configuration Management Process

Banks have put in place a proper IT Policy & IS Security Policy and set standards to efficiently manage

the Information Security and risks. The Information Systems Security Standards Committee (ISSSC) is

used for approving the standards and procedures to safeguard and improve the information security

within the Bank. Periodic IS audit also creates and reinforces security awareness.

Energy management and green technology is also increasing forming a critical part of IT

management, banks are increasingly looking at energy saving measures and reducing the power

consumption of data centers. Green initiatives like solar powered ATMs and even branches have

been adopted by some banks.

Institute for Development & Research

in Banking Technology

15

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

7. IT for Operational Effectiveness

Banks have implemented data quality solution which sources its data from the Data Warehouse

which in turn extracts data from various operation systems like core banking, loan management

system, credit card system etc. The solution standardizes (identification of gender, rationalization of

dates, standardization of telephone numbers, area codes, mapping of cities and association of pin

codes based on city) and enriches the data of each record set. It works on the basic logic of

extracting data from data warehouse, identifying the duplicate customers which are then grouped

with cluster id, system id and household id. This processed data is then pushed into data warehouse.

This has benefited in de-duplication on the entire customer base spanning across various business

segments. This enabled the bank to have customers complete relationship, profitability with the

bank even if relationship was not been declared by the customer.

The governance process for people includes clear definition of roles, proper assignment of roles and

responsibilities through a specific office order, segregation of duties, ensuring that conflicting roles

are not included in the scope of work, rotation of duties, ensuring second line for continuity of

operations. Process governance includes proper documentation of the process flow, activities

involved, persons involved in the activity, the details of the servers and the jobs performed along

with the commands, The activity charts and check lists and monitoring mechanism to ensure that all

the regular daily /weekly/monthly and adhoc activities are completed. There is also error handling

procedures. The status of activities is also monitored through key performance indicators (KPIs) and

status notes. Exceptions and error reporting and escalations are part of the governance process.

Data management is ensured by the development and execution of architectures, policies, practices

and procedures in order to manage the information lifecycle needs of the bank in an effective

manner. Standard policies practices and procedures are put in place. Automated solutions are being

used for data extraction and population. The solution focuses on improving data quality, promoting

the efficient sharing of information, providing trusted business-critical data, and managing

information throughout its lifecycle. Workflow automation is being used in various internally

developed applications like reimbursement of staff expenses, leave management systems, payment

processing systems etc. which work with human resource management system (HRMS) and financial

applications.

Payment processing covers all the processes right from inputting documents like invoices from

branch/remote locations with a maker checker functionality to directing the workflow automatically

in a predefined route as is required by the bank. It provides facility to track the present status of the

work item not only in the centralization software but also in related softwares like core banking

software, ERP while seamlessly integrating the various systems. The applications also facilitate

routing performing of tasks across various modules. In terms of system architecture, the systems

implemented are scalable and enable addition of new systems and modules in the future. The

systems are built upon commonly used, industry standard platforms.

Operations is an area where IT can add a lot of value and seamless integration of all operational

systems is a desired ideal state but due to various legacy systems in use, it has become a difficult

state to attain. The use of IT in operational effectiveness also requires a huge amount of business

process re-engineering to simplify processes and appropriately use technology for the processes.

Institute for Development & Research

in Banking Technology

16

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

Despite the intensive use of IT, people will remain a critical aspect of service delivery and continuous

training both job skills and soft skill will be important in achieving operational effectiveness.

8. Managing IT Risk

Most banks have IT security policy in place which is reviewed every year in accordance with the

regulatory guidelines. The policy covers information security management (ISA) architecture, data

classification, access control, change management, backup, password policy, email policy, internet

usage policy, incident handling, business continuity and disaster recovery plan, security awareness &

training, disposal of IT assets, etc. All these information are to have better controls on IT security and

ultimately managing and minimizing IT risk.

Figure 26 Managing IT Risk

On IT hardware, policies covers pre-dispatch inspection, the precautions to be undertaken while

installing the IT equipments like adherence to the specifications and recommendations of the

vendor, proper environmental controls, only necessary services, etc. It also incorporates the practice

of acceptance tests to ascertain whether system is working correctly, maintenance and support in

the form of annual maintenance contract (AMC), insurance, disposal of IT hardware, documenting

hardware inventory, logical security of hardware, backup of its data, etc. IT software policies cover

information security needs to be incorporated at all stages of software development so that

software risks as well as costs are minimized. Software policies also cover maintenance, upgrade or

patching of the software, controlling program source library, emergency amendment, etc. so that IT

software risks are minimized.

Institute for Development & Research

in Banking Technology

17

Technology in Banking: Towards Optimization and Effective Utilization of IT Resources

The logical access control is based on user ID. The user type and capability level associated with each

user ID is based on the role the user would perform. Most IT policies cover all the aspects of

information handling and processing and the requirements of latest security standards and the best

industry practices.

IT risks in terms of security and threats need to be monitored on a continuous basis and automated

and real-time alerts systems need to be implemented in addition the incident response plans need

to be initiated as soon as possible on indication of any threat.

9. Conclusion

Information technology (IT) has become critical for many organizations. In todays business

environment, IT is a fundamental and growing component of day-to-day business operations and

represents a significant area of investment for many banks. In recent years, the role of IT has been

changing and rather than being seen merely as a utility, the function is increasingly expected to

come up with innovative business improvements. With competition increasingly being shaped by a

number of macroeconomic factors, IT leaders have to understand the dynamics of this new normal

and work closely with the business to address the challenges.

Business and IT leaders must balance their vision for how IT can add value to the enterprise, while

addressing concerns such as levels of IT service and support, program delivery and other

fundamental operational needs. Many banks have made progress to counter significant challenges

to:

Align IT strategy, investment and efforts with the business strategy

Provide IT enablement for key business process and major transformations

Increase the overall return on IT investments

Reduce the cost and effort required for IT to maintain required levels of support

Establish effective IT sourcing strategies

Improve the management of security, risk and compliance issues related to IT

Manage and measure IT performance

However all the initiatives have to result in operational agility and not just remain on paper. The

speed with which a bank can respond and adapt to market changes has a direct influence on how

effectively it can compete.

Indian banking though a late adopter of technology has made rapid strides especially in the adoption

of newer technologies like internet and mobile banking and IT still offers space for improving

efficiency and effectiveness of banking as well as increasing the coverage.

IDRBT Team

Ernst & Young Team

Mr. M.V. Sivakumaran, Faculty

Mr. G. Raghuraj, General Manager

Dr. G.R. Gangadharan, Faculty

Ms. Hema Jagtiani, Senior Manager,

Performance Improvement, Financial Service

Mr. Kamal Tirkey, Assistant Manager,

Markets, Financial Services

Institute for Development & Research

in Banking Technology

18

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- UPS Case QuestionsДокумент3 страницыUPS Case QuestionsTalha Saeed100% (1)

- The Evolution of Cyber Espionage - Jessica BourquinДокумент0 страницThe Evolution of Cyber Espionage - Jessica BourquinVivek KhareОценок пока нет

- CV Alberto EduardoДокумент5 страницCV Alberto EduardoAlberto EduardoОценок пока нет

- FactoryTalk® Batch Software SuiteДокумент8 страницFactoryTalk® Batch Software SuiteVÕ QUỐC HIỆUОценок пока нет

- GGM Enhancement Project Drawings Log Sheet UpdatedДокумент198 страницGGM Enhancement Project Drawings Log Sheet UpdatedJohn BuntalesОценок пока нет

- Guide To ISO50001 PDFДокумент43 страницыGuide To ISO50001 PDFJohn Rajesh67% (3)

- Internship - BajajДокумент27 страницInternship - BajajRoyal ProjectsОценок пока нет

- Mark11 Spare Parts Section - REV3Документ72 страницыMark11 Spare Parts Section - REV3Orlando MelipillanОценок пока нет

- Raju - Reliability EngineerДокумент2 страницыRaju - Reliability EngineerMadhuseptember2022Оценок пока нет

- The Envelopes of The Arts Centre in SingaporeДокумент12 страницThe Envelopes of The Arts Centre in SingaporeAndriОценок пока нет

- Gyrolok CatalogДокумент58 страницGyrolok CatalogmartinvandoornОценок пока нет

- The Six Big Losses in Manufacturing - EvoconДокумент23 страницыThe Six Big Losses in Manufacturing - Evoconarvin john cabralОценок пока нет

- 15 Best Websites For Downloading Open Source SoftwareДокумент10 страниц15 Best Websites For Downloading Open Source SoftwarePerfectKey21Оценок пока нет

- IBIS Hotel Key Design and Construction CriteriaДокумент2 страницыIBIS Hotel Key Design and Construction Criteriachien100% (1)

- Epm Tips Issues 40 Up 167122Документ190 страницEpm Tips Issues 40 Up 167122RyanRamroopОценок пока нет

- Lawaan Cemetery Part 2Документ17 страницLawaan Cemetery Part 2Mark Joseph ArellanoОценок пока нет

- D9 MG GensetДокумент4 страницыD9 MG GensetAji HandokoОценок пока нет

- Metering For Linemen: Current TransformersДокумент3 страницыMetering For Linemen: Current TransformersEBEОценок пока нет

- MGT1211 - Development of Product and Services For Global MarketДокумент9 страницMGT1211 - Development of Product and Services For Global MarketShagufta Karim DinaniОценок пока нет

- Torneado del peón: Procesos de manufactura en el laboratorioДокумент14 страницTorneado del peón: Procesos de manufactura en el laboratorioDanny Urtecho Ponte100% (1)

- Ramcharan Resume LatestДокумент4 страницыRamcharan Resume LatestSri Surya LankapalliОценок пока нет

- Star DeltaДокумент15 страницStar DeltaAbdul HaleemОценок пока нет

- Airworks TeaserДокумент8 страницAirworks TeaserNavin GuptaОценок пока нет

- Training On Industrial Engineering Basics For RMGДокумент2 страницыTraining On Industrial Engineering Basics For RMGSalil BiswasОценок пока нет

- KrisEnergy LTD - Appendix D - Volume2Документ194 страницыKrisEnergy LTD - Appendix D - Volume2Invest StockОценок пока нет

- OSS ReferenceДокумент336 страницOSS ReferenceMonish R Nath50% (2)

- Handout 21553 Cs21553 Vermeulen Au2016Документ130 страницHandout 21553 Cs21553 Vermeulen Au2016KelvinatorОценок пока нет

- Honda Sales ProjectДокумент72 страницыHonda Sales Projectsurendar100% (2)

- Operation Management AssigementДокумент11 страницOperation Management AssigementYogendra RathoreОценок пока нет