Академический Документы

Профессиональный Документы

Культура Документы

Indian Insurance Industry

Загружено:

shoaibАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Indian Insurance Industry

Загружено:

shoaibАвторское право:

Доступные форматы

A PROJECT REPORT ON

INDIAN INSURANCE INDUSTRY

SUBMITTED BY

BHAVSAR MANTHAN RAJENDRA

THIRD YEAR (BANKING AND INSURANCE (SEMESTER VI)

2011-2012

MODEL COLLEGE

DOMBIVLI

UNIVERSITY OF MUMBAI

APRIL 2012

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

A PROJECT REPORT ON

INDIAN INSURANCE INDUSTRY

SUBMITTED TO

THE UNIVERSITY OF MUMBAI

IN PARTIAL FULFILLMENT

FOR THE AWARD OF THE DEGREE OF

BACHELOR OF COMMERCE (BANKING AND INSURANCE)

(VI SEMESTER)

BY

BHAVSAR MANTHAN RAJENDRA

MODEL COLLEGE

DOMBIVLI

APRIL 2012

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

TABLE OF CONTENTS

SR.NO.

DESCRIPTION

PAGE NO.

1.

DECLARATION

2.

ACKNOWLEDGEMENT

3.

CHAPTER 1: INTRODUCTION

6-12

4.

CHAPTER 2:THEORETICAL VIEW

13-33

5.

CHAPTER 3:COMPARATIVE STUDY

34-45

6.

CHAPTER 4: CONCLUSION

46-47

7.

BIBLOGRAPHY

48

8.

ANNEXURE

49-51

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

DECLARATION

I, BHAVSAR MANTHAN RAJENDRA, STUDENT OF BANKING AND

INSURANCE VI SEMESTER OF MODEL COLLEGE DOMBIVLI (E),

HERE BY DECLARE THAT, I HAVE COMPLETED THIS PROJECT

ON Indian Insurance Industry FOR THE ACADEMIC YEAR 20112012

THE INFORMATION SUMBITTED IS TRUE AND

ORIGINAL TO THE BEST OF MY KNOWLEDGE.

BHAVSAR MANTHAN RAJENDRA

THIRD YEAR (BANKING AND INSURANCE)

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

ACKNOWLEDGEMENT

I WOULD LIKE TO EXTEND MY SINCERE GRATITUDE TO ALL

THOSE PEOPLE WHO HAVE HELPED ME IN THE SUCCESSFUL

COMPLETION OF MY PROJECT ENTITLED Indian insurance

industry

FIRST AND FOREMOST I WOULD LIKE TO THANK MY PROJECT

GUIDE MRS.GAURI PATHAK FOR BEING KIND ENOUGH IN

SPARING HER TIME AND ENERGY FROM HER BUSY SCHEDULE

AND HELPING ME IN COLLECTING THE NECESSARY DATES.

I WOULD ALSO LIKE TO EXPRESS MY SINCERE THANKS TO

OUR PRINCIPLE, DR. M.R.NAIR FOR HIS CONSTANT MORAL

SUPPORT AND VISION

THIS PROJECT COULD NOT HAVE BEEN POSSIBLE WITHOUT

HELP

OF

ENTIRE

LIBRARY

DEPARTMENT

OF

OUR

COLLEGE.THEY MAKE AS MUCH DATA, BOOKS, MAGAZINES,

ETC. AVAILABLE AS THEY CAN TO FACILITATE THE EASY

COLLECTION OF INFORMATION.

BHAVSAR MANTHAN RAJENDRA

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

CHAPTER 1

AN INTRODUCTION

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Introduction

In 2003, the Indian insurance market ranked 19th globally and was

the fifth largest in Asia. Although it accounts for only 2.5% of

premiums in Asia, it has the potential to become one of the biggest

insurance markets in the region. A combination of factors underpins

further strong growth in the market, including sound economic

fundamentals, rising household wealth and a further improvement in

the regulatory framework.

The insurance industry in India has come a long way since the time

when businesses were tightly regulated and concentrated in the

hands of a few public sector insurers. Following the passage of the

Insurance Regulatory and Development Authority Act in 1999, India

abandoned public sector exclusivity in the insurance industry in favor

of market-driven competition. This shift has brought about major

changes to the industry. The inauguration of a new era of insurance

development has seen the entry of international insurers, the

proliferation of innovative products and distribution channels, and the

raising of supervisory standards.

By mid-2004, the number of insurers in India had been augmented by

the entry of new private sector players to a total of 28, up from five

before liberalization. A range of new products had been launched to

cater to different segments of the market, while traditional agents

were supplemented by other channels including the Internet and bank

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

branches. These developments were instrumental in propelling

business growth, in real terms, of 19% in life premiums and 11.1% in

non-life premiums between 1999 and 2003.

There are good reasons to expect that the growth momentum can be

sustained. In particular, there is huge untapped potential in various

segments of the market. While the nation is heavily exposed to

natural catastrophes, insurance to mitigate the negative financial

consequences of these adverse events is underdeveloped. The same

is true for both pension and health insurance, where insurers can play

a critical role in bridging demand and supply gaps. Major changes in

both national economic policies and insurance regulations will

highlight the prospects of these segments going forward.

Insurance or assurance, device for indemnifying or guaranteeing an

individual against loss. Reimbursement is made from a fund to which

many individuals exposed to the same risk have contributed certain

specified amounts, called premiums. Payment for an individual loss,

divided among many, does not fall heavily upon the actual loser. The

essence of the contract of insurance, called a policy, is mutuality. The

major operations of an insurance company are underwriting, the

determination of which risks the insurer can take on; and rate making,

the decisions regarding necessary prices for such risks. The

underwriter is responsible for guarding against adverse selection,

wherein there is excessive coverage of high risk candidates in

proportion to the coverage of low risk candidates.

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

In preventing adverse selection, the underwriter must consider

physical, psychological, and moral hazards in relation to applicants.

Physical hazards include those dangers which surround the individual

or property, jeopardizing the well-being of the insured. The amount of

the premium is determined by the operation of the law of averages as

calculated by actuaries. By investing premium payments in a wide

range of revenue-producing projects, insurance companies have

become major suppliers of capital, and they rank among the nation's

largest institutional investors.

GENERAL DEFINITION:

The general definitions are given by the social scientists & they

consider insurance as a device to protection against risks, or a

provision against inevitable contingencies or a co-operative device of

spreading risks. Some of such definitions are given below:

In the words of John Magee, Insurance is a plan by which

large number of people associate themselves & transfer to the

shoulder of all, risks that attach to individuals.

In the words of Sir William, The collective bearing of risks is

insurance.

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

In the words of Boone & Kurtz, Insurance is a substitution for a

small known loss (the insurance premium) for a large unknown loss,

which may or may not occur.

In the words of Thomas, Insurance is a provision, which a

prudent man makes against for the loss or inevitable contingencies,

loss or misfortune.

In the words of Allen Z. Mayer, Insurance is a device for the

transfer to an insurer of certain risks of economic loss that would

otherwise come by the insured.

In the words of Ghosh & Agarwal, Insurance is a co-operative

form of distributing a certain risk over a group of persons who are

exposed to it.

10

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

ABOUT THE REPORT

TITLE OF THE STUDY

The present study is titled as INDIAN INSURANCE INDUSTRY

OBJECTIVES OF THE STUDY

To Study the awareness of the insurance policies.

To know what are the priorities of people of city for making

investment in Insurance.

To know what are the perception of the consumer about

investments in insurance sector.

To know the standing of the Indian insurance sector in global.

SCOPE OF THE STUDY

It provides a complete knowledge of insurance sector in India.

It provides a view in Indian insurance market.

11

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

DATA AND METHODOLOGY:The data has been collected in two ways:

PRIMARY DATA

As far as primary data is concerned, a detailed study is done and a

survey has been taken up; the carefully analysis of the data is done

to arrive at conclusion. Hence, for this study, primary data has been

collected directly from the respondents through an questionnaire.

SECONDARY DATA

The secondary source of information has been collected from

internet, books.

CHAPTER LAYOUT

CHAPTER 1 Introduction of the title Indian insurance industry

CHAPTER 2 Theoretical view of Indian insurance industry.

CHAPTER 3 Survey.

CHAPTER 4 Summarizes the results of the study.

12

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

CHAPTER 2

THEORETICAL VIEW

13

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

HISTORY OF INSURANCE IN INDIA

In India, insurance has a deep-rooted history. It finds mention in the

writings of Manu (Manusmrithi), Yagnavalkya (Dharmasastra) and

Kautilya (Arthasastra). The writings talk in terms of pooling of

resources that could be re-distributed in times of calamities such as

fire, floods, epidemics and famine. This was probably a pre-cursor to

modern day insurance. Ancient Indian history has preserved the

earliest traces of insurance in the form of marine trade loans and

carriers contracts. Insurance in India has evolved over time heavily

drawing from other countries, England in particular.

1818 saw the advent of life insurance business in India with the

establishment of the Oriental Life Insurance Company in Calcutta.

This Company however failed in 1834. In 1829, the Madras Equitable

had begun transacting life insurance business in the Madras

Presidency. 1870 saw the enactment of the British Insurance Act and

in the last three decades of the nineteenth century, the Bombay

Mutual (1871), Oriental (1874) and Empire of India (1897) were

started in the Bombay Residency. This era, however, was dominated

by foreign insurance offices which did good business in India, namely

Albert Life Assurance, Royal Insurance, Liverpool and London Globe

Insurance and the Indian offices were up for hard competition from

the foreign companies.

14

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

In 1914, the Government of India started publishing returns of

Insurance Companies in India. The Indian Life Assurance Companies

Act, 1912 was the first statutory measure to regulate life business. In

1928, the Indian Insurance Companies Act was enacted to enable the

Government to collect statistical information about both life and nonlife business transacted in India by Indian and foreign insurers

including provident insurance societies. In 1938, with a view to

protecting the interest of the Insurance public, the earlier legislation

was consolidated and amended by the Insurance Act, 1938 with

comprehensive provisions for effective control over the activities of

insurers.

The Insurance Amendment Act of 1950 abolished Principal

Agencies. However, there were a large number of insurance

companies and the level of competition was high. There were also

allegations of unfair trade practices. The Government of India,

therefore, decided to nationalize insurance business.

An Ordinance was issued on 19th January, 1956 nationalising the

Life Insurance sector and Life Insurance Corporation came into

existence in the same year. The LIC absorbed 154 Indian, 16 nonIndian insurers as also 75 provident societies245 Indian and

foreign insurers in all. The LIC had monopoly till the late 90s when

the Insurance sector was reopened to the private sector.

15

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

The history of general insurance dates back to the Industrial

Revolution in the west and the consequent growth of sea-faring trade

and commerce in the 17th century. It came to India as a legacy of

British occupation. General Insurance in India has its roots in the

establishment of Triton Insurance Company Ltd., in the year 1850 in

Calcutta by the British. In 1907, the Indian Mercantile Insurance Ltd,

was set up. This was the first company to transact all classes of

general insurance business.

1957 saw the formation of the General Insurance Council, a wing of

the Insurance Association of India. The General Insurance Council

framed a code of conduct for ensuring fair conduct and sound

business practices.

In 1968, the Insurance Act was amended to regulate investments

and set minimum solvency margins. The Tariff Advisory Committee

was also set up then.

In 1972 with the passing of the General Insurance Business

(Nationalization) Act, general insurance business was nationalized

with effect from 1st January, 1973. 107 insurers were amalgamated

and grouped into four companies, namely National Insurance

Company Ltd., the New India Assurance Company Ltd., the Oriental

Insurance Company Ltd and the United India Insurance Company

Ltd. The General Insurance Corporation of India was incorporated as

a company in 1971 and it commence business on January 1sst 1973.

16

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

This millennium has seen insurance come a full circle in a journey

extending to nearly 200 years. The process of re-opening of the

sector had begun in the early 1990s and the last decade and more

has seen it been opened up substantially. In 1993, the Government

set up a committee under the chairmanship of RN Malhotra, former

Governor of RBI, to propose recommendations for reforms in the

insurance sector. The objective was to complement the reforms

initiated in the financial sector. The committee submitted its report in

1994 wherein, among other things, it recommended that the private

sector be permitted to enter the insurance industry. They stated that

foreign companies are allowed to enter by floating Indian companies,

preferably a joint venture with Indian partners.

Following the recommendations of the Malhotra Committee report,

in 1999, the Insurance Regulatory and Development Authority (IRDA)

was constituted as an autonomous body to regulate and develop the

insurance industry. The IRDA was incorporated as a statutory body in

April, 2000. The key objectives of the IRDA include promotion of

competition so as to enhance customer satisfaction through

increased consumer choice and lower premiums, while ensuring the

financial security of the insurance market.

The IRDA opened up the market in August 2000 with the invitation

for application for registrations. Foreign companies were allowed

ownership of up to 26%. The Authority has the power to frame

regulations under Section 114A of the Insurance Act, 1938 and has

17

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

from 2000 onwards framed various regulations ranging from

registration of companies for carrying on insurance business to

protection of policyholders interests.

In December, 2000, the subsidiaries of the General Insurance

Corporation of India were restructured as independent companies

and at the same time GIC was converted into a national re-insurer.

Parliament passed a bill de-linking the four subsidiaries from GIC in

July, 2002.

Today there are 24 general insurance companies including the

ECGC and Agriculture Insurance Corporation of India and 23 life

insurance companies operating in the country.

The insurance sector is a colossal one and is growing at a

speedy rate of 15-20%. Together with banking services, insurance

services add about 7% to the countrys GDP. A well-developed and

evolved insurance sector is a boon for economic development as it

provides long- term funds for infrastructure development at the same

time strengthening the risk taking ability of the country.

18

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Characteristics of Insurance:

Sharing of Risks

Insurance is a co-operative device to share the burden of risk, which

may fall on happening of some unforeseen events, such as the death

of head of the family, or on happening of marine perils or loss of by

fire.

Co-operative Device

Insurance is a co-operative form of distributing a certain risk over a

group of persons who are exposed to it (Ghosh & Agarwal). A large

number of persons share the losses arising from a particular risk.

Evaluation of Risk

For the purpose of ascertaining the insurance premium, the volume of

risk is evaluated, which forms the basis of insurance contract.

Payment of happening of specified event

On happening of specified event, the insurance company is bound to

make payment to the insured. Happening of the specified event is

certain in life insurance, but in the case of fire, marine or accidental

insurance, it is not necessary. In such cases, the insurer is not liable

for payment of indemnity.

19

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Amount of payment

The amount of payment in indemnity insurance depends on the

nature of losses occurred, subject to a maximum of the sum insured.

In life insurance, however, a fixed amount is paid on the happening of

some uncertain event or on the maturity of the policy.

Large number of insured persons

The success of insurance business depends on the large number of

persons insured against similar risk. This will enable the insurer to

spread the losses of risk among large number of persons, thus

keeping the premium rate at the minimum.

Insurance is not a gambling

Insurance is not a gambling. Gambling is illegal, which gives gain to

one party & loss to the other.

Insurance is a valid contract to

indemnity against losses. Moreover, insurable interest is present in

insurance contracts & it has the element of investment also.

Insurance is not charity

Charity pays without consideration but in the case of insurance,

premium is paid by the insured to the insurer in consideration of

future payment.

Protection against risks

Insurance provides protection against risks involved in life, materials

& property. It is a device to avoid or reduce risks.

20

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Spreading of risk

Insurance is a plan, which spread the risks & losses of few people

among a large number of people. John Magee writes, Insurance is a

plan by which large number of people associates themselves &

transfer to the shoulders of all, risks attached to individuals.

Transfer of risk

Insurance is a plan in which the insured transfers his risk on the

insurer.

This may be the reason that Mayerson observes, that

insurance is a device to transfer some economic losses to the

insurer, and otherwise such losses would have been borne by the

insured themselves.

Ascertaining of losses

By taking a life insurance policy, one can ascertain his future losses

in terms of money. This is done by the insurer to determining the rate

of premium, which is calculated on the basis of maximum risks.

A contract

Insurance is a legal contract between the insurer & insured under

which the insurer promises to compensate the insured financially

within the scope of insurance policy, & the insured promises to pay a

fixed rate of premium to the insurer.

21

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Based upon certain principle

Insurance is a contract based upon certain fundamental principles of

insurance, which includes utmost good faith, insurable interest,

contribution, indemnity, cause proximal, subrogation, etc., which are

the basis for successful operation of insurance plan.

Utmost Good Faith

Insurance is a contract based on good faith between the parties.

Therefore, both the parties are bound to disclose the important facts

affecting to the contract before each other. Utmost good faith is one

of the important principles of insurance.

To conclude, insurance is a device for the transfer of risks from the

insured to the insurers, who agree to it for a consideration (known as

premium), & promises that the specified extent of loss suffered by the

insured shall be compensated. It is a legal contract of a technical

nature.

22

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Insurance Sector Reforms

In 1993, Malhotra Committee- headed by former Finance Secretary

and RBI Governor R.N. Malhotra- was formed to evaluate the Indian

insurance industry and recommend its future direction. The Malhotra

committee was set up with the objective of complementing the

reforms initiated in the financial sector. The reforms were aimed at

creating a more efficient and competitive financial system suitable for

the requirements of the economy keeping in mind the structural

changes currently underway and recognizing that insurance is an

important part of the overall financial system where it was necessary

to address the need for similar reforms. In 1994, the committee

submitted the report and some of the key recommendations included:

i)

Structure Government stake in the insurance Companies to be

brought down to 50%. Government should take over the holdings of

GIC and its subsidiaries so that these subsidiaries can act as

independent corporations. All the insurance companies should be

given greater freedom to operate.

ii)

Competition Private Companies with a minimum paid up capital

of Rs.1bn should be allowed to enter the sector. No Company should

deal in both Life and General Insurance through a single entity.

Foreign companies may be allowed to enter the industry in

collaboration with the domestic companies. Postal Life Insurance

should be allowed to operate in the rural market. Only one State

23

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Level Life Insurance Company should be allowed to operate in each

state.

iii)

Regulatory Body The Insurance Act should be changed. An

Insurance Regulatory body should be set up. Controller of Insurancea part of the Finance Ministry- should be made independent

iv)

Investments Mandatory Investments of LIC Life Fund in

government securities to be reduced from 75% to 50%. GIC and its

subsidiaries are not to hold more than 5% in any company (there

current holdings to be brought down to this level over a period of

time)

v)

Customer Service LIC should pay interest on delays in

payments

beyond

30

days.

Insurance

companies

must

be

encouraged to set up unit linked pension plans. Computerization of

operations and updating of technology to be carried out in the

insurance industry.

The committee emphasized that in order to improve the customer

services and increase the coverage of insurance policies, industry

should be opened up to competition. But at the same time, the

committee felt the need to exercise caution as any failure on the part

of new players could ruin the public confidence in the industry.

Hence, it was decided to allow competition in a limited way by

stipulating the minimum capital requirement of Rs.100 crores.

The committee felt the need to provide greater autonomy to

insurance companies in order to improve their performance and

24

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

enable them to act as independent companies with economic

motives. For this purpose, it had proposed setting up an independent

regulatory body- The Insurance Regulatory and Development

Authority.

Reforms in the Insurance sector were initiated with the passage of

the IRDA Bill in Parliament in December 1999. The IRDA since its

incorporation as a statutory body in April 2000 has fastidiously stuck

to its schedule of framing regulations and registering the private

sector insurance companies. Since being set up as an independent

statutory body the IRDA has put in a framework of globally

compatible regulations. The other decision taken simultaneously to

provide the supporting systems to the insurance sector and in

particular the life insurance companies was the launch of the IRDA

online service for issue and renewal of licenses to agents. The

approval of institutions for imparting training to agents has also

ensured that the insurance companies would have a trained

workforce of insurance agents in place to sell their products.

25

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

MALHOTRA COMMITTEE :

In 1993, the first step towards insurance sector reforms was initiated

with the formation of Malhotra Committee, headed by former Finance

Secretary and RBI Governor R.N. Malhotra. The committee was

formed to evaluate the Indian insurance industry and recommend its

future direction with the objective of complementing the reforms

initiated in the financial sector.

Key Recommendations of Malhotra Committee:

Structure

Government stake in the insurance Companies to be brought down

to 50%.

Government should take over the holdings of GIC and its

subsidiaries so that these subsidiaries can act as independent

corporations.

All the insurance companies should be given greater freedom to

operate.

26

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Competition

Private Companies with a minimum paid up capital of Rs.1billion

should be allowed to enter the industry.

No Company should deal in both Life and General Insurance

through a single Entity.

Foreign companies may be allowed to enter the industry in

collaboration with the domestic companies.

Postal Life Insurance should be allowed to operate in the rural

market.

Only one State Level Life Insurance Company should be allowed to

operate in each state.

Regulatory Body

The Insurance Act should be changed.

An Insurance Regulatory body should be set up.

Controller of Insurance should be made independent.

27

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Investments

Mandatory Investments of LIC Life Fund in government securities to

be reduced from 75% to 50%.

GIC and its subsidiaries are not to hold more than 5% in any

company.

Customer Service

LIC should pay interest on delays in payments beyond 30 days

Insurance companies must be encouraged to set up unit linked

pension plans.

Computerisation of operations and updating of technology to be

carried out in the insurance industry.

Malhotra Committee also proposed setting up an independent

regulatory body - The Insurance Regulatory and Development

Authority (IRDA) to provide greater autonomy to insurance

companies in order to improve their performance and enable them to

act as independent companies with economic motives.

28

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Life Insurance Companies at a Glance:

a)

LIFE INSURANCE CORPORATION OF INDIA:

On January 19, 1956 the President of the Indian Union issued an

ordinance, providing for the taking over, in public interest, of the

management of life insurance pending nationalization of such

business, & the then Finance Minister explained the objectives of

nationalization of life insurance business.

In June 1956, the parliament passed a bill for nationalization of life

insurance business in India and for setting up a corporation as the

sole agency for carrying on this business in India. The corporation,

set up under this Act, is known as Life Insurance Corporation of

India, which started functioning on September 1, 1956.

For the purpose of servicing of policies issued before September 1,

1956, some integrated head offices & integrated branch office units

were created.

These offices have nothing to do with the policies

issued by the corporation.

Corporation also took over foreign life

business of the Indian insurers.

29

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Objectives of LIC:

Maximize mobilization of peoples savings by making insurance

linked savings adequately attractive. Conduct business with utmost

economy & with the full realization that the moneys belong to the

policyholders.

To publicize & extent the insurance business specifically in rural

& remote areas.

To provide suitable financial security at reasonable cost.

To make the investments more dynamic by popularizing the

savings plans attached with insurance.

To invest the insurance fund keeping with maximum benefit &

interest of insureds.

To run the insurance business at minimum administrative costs.

To function as trusts of the insureds.

To fulfill the needs of the society in a changing social and

economic environment.

To make the employees collectively responsible for providing

efficient services to the insureds.

To develop work satisfaction among agents & employees.

30

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

b)

HDFC STANDARD LIFE INSURANCE COMPANY:

HDFC Standard Life Insurance Co. Ltd. is a joint venture between

HDFC, Indias largest housing finance institution and Standard Life

Assurance Company, Europes largest mutual life company. HDFC

manages Rs. 21,450 Crores in assets and Standard Life manages

over US $100 billion in assets. Both the promoters are well known for

their ethical dealings, their financial strength and their commitment to

be a long-term player in the life insurance industry.

c)

MAX NEW YORK LIFE INSURANCE COMPANY:

Max New York Life Insurance Company is a joint venture between

New York Life International Inc. and Max India Limited. New York

Life, a Fortune 100 Company, is one of the worlds experts in life

insurance with over 156 years of experience in the business and over

US$ 165 billion (Rs. 775,000 Crores) in assets under management.

Max India Limited is a multi-business corporate, focused on the

knowledge,

people,

and

service-oriented

business

insurance, healthcare and information technology.

31

of

life

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

d)

OM KOTAK MAHINDRA LIFE INSURANCE:

Om Kotak Mahindra Life Insurance, a company under Kotak

Mahindra Group is a 74:26 life insu rance joint venture

between Kotak Mahindra Finance Limited with Old Mutual,

U.K.

The philosophy of Om Kotak Mahindra is helping their

customers take financial decisions at every stage in life.

Their aim is to consistently offer a wide range of innovative

life insurance products, to help their customers remain

financially independent, which is why they believe that

freedom to take life on "Jeene Ki Aazadi"

The alliance of Om Kotak Mahindra with Old Mutual has

given it unmatched expertise in life insurance a rea.

With

156 years of experience in life insurance business, Old

Mutual is today an International Financial Service Group

based in London.

e)

BIRLA SUN LIFE INSURANCE COMPANY:

It is a joint venture of Aditya Birla Group and Sun Life

Financial Services with the objective that Insurance is not

about something going wrong. It's often about things going

right. One of the wonders of human nature is that we never

believe anything can actually go wrong. Surely, life has its

share of ifs. At Birla Sun Life however, we believe it has its

32

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

equally pleasant share of buts as well. We at Birla Sun Life

stand

committed

to

helping

you

realize

those

happy

moments, which make a life. Be it living the same lifestyle

in your post retirement days or providing a secure future for

your loved ones, in case something happens to you.

f)

TATA AIG LIFE INSURANCE COMPANY:

Tata AIG is a joint venture that is backed by the Tata Group

Indias most respected industrial conglomerate, with

revenues of more than US $8.4 billion, and American

International Group, Inc. (AIG) the leading US-based

international insurance and financial services organization,

with a presence in over 130 countries and jurisdictions

throughout the world. Tata AIG offers a gamut of innovative

products in the Life Insurance sector.

g)

SBI LIFE INSURANCE COMPANY:

SBI Life Insurance Company Ltd. is a joint venture between

State Bank of India and Cardiff of France.

SBI is the

largest bank in India and Cardiff is a leading insurance

company in France operating in 29 countries.

Cardiff is a

wholly owned

the largest

subsidiary of

European Bank.

33

BNP Paribas,

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

CHAPTER 3

SURVEY, DATA ANALYSIS

34

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Q.1.Do you have a Life Insurance Policy?

Criteria

No. Of

Respondents

Yes

50

No

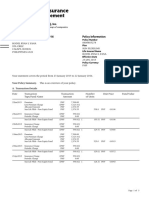

Q.2.Which Companys Insurance Policies do you have?

Company

No. of Respondents

LIC

50

Birla Sunlife

SBI

ICICI Pru. Life

10

Kotak Mahindra

Post Office

15

HDFC

35

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

No. of Respondents

No. of

Respondents

60

50

40

30

20

10

0

LIC

SBI

Kotak

HDFC

As from the above chart it is very clear the all of the respondents

have an insurance of the LIC while some of them have an insurance

of the other companies like post Office, ICICI Prudential Life

insurance Co., HDFC Co. Etc.

The reason behind this is that the LIC competitor since more than

four decades and the Indian Govt. allowed the Introduction of private

player in Insurance in the year 2000.

36

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Q.3What is amount of insurance premium you pay annually?

Criteria

No. of Respondents

Below Rs. 10,000

11

10,000 to 20,000

18

20,000 to 30,000

30,000 to 40,000

Above 40,000

10

The analysis of the above available data is merely to find out the

percentage of income that one is willing to invest in insurance.

37

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Q.4What priorities would you consider most important, while

purchasing a policy?

Criteria/Rank

Total

Death Benefit

29

10

50

Childrens

13

21

44

20

43

Tax Planning

18

48

Financial

11

25

46

Future

Retirement

Planning

Planning

From the table and chart it can be say that most of the people rank

death benefit first for the decision to make investment in Insurance.

Their second priority is tax planning because the premium, which is

paid by the people towards Insurance, is deductible up to certain limit

from the income and also the maturity amount is also tax free. The

third and fourth priorities are childrens future and retirement

planning.

38

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Q.5 Do you have any knowledge of the stock market?

Criteria

No. of Respondents

Yes

32

No

18

Q.6If Yes do you have any knowledge about unit linked

insurance plans?

Criteria

No. of Respondents

Yes

25

No

The question number 5 and 6 are designed to know the awareness of

people who have knowledge of share market or deals in shares also

have the knowledge of the new modern insurance product i.e. Unit

Linked Insurance Plan. From the available data it can be say that

those who deal in shares are also aware of the ULIP.

39

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Q.7 If given a choice, where would you like to invest your

money?

(Please Rank Your Choice)

Choice/Rank

Total

Mutual Fund

25

12

50

Insurance

12

14

45

Gold

13

13

48

Equities

17

34

Post Office

22

12

12

50

Debenture

10

14

33

Bank Deposit

12

19

42

Other

10

20

This question is mainly designed to know the investment priorities of

the people of DOMBIVLI town.

40

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Q.8 According to you what are the factors that would affect

your decision while purchasing an insurance policy?

Criteria/Rank

50

Premium

12

15

15

50

Return

21

17

50

Safety

20

14

15

50

Liquidity

18

21

50

Market

16

21

40

Condition

The question No. 8 is designed to know which the factors are

affecting the most to the prospect while making decision to invest in

insurance. As far as investment in insurance is concerned most of the

people want that it should be safe and at the same time giving the

compatible returns because insurance is not only for death benefit it

is also a saving tool for future. So the mix response of respondents is

welcomed. Available data is such that there is a bit ambiguity.

41

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Q. 9 Are you or any of your family members are planning to buy

an insurance policy in near future?

Criteria

No. of Respondents

Yes

13

No

37

This question is taken to collect the information of those respondents

who are going to plan to purchase insurance within near future that is

used by the company for making personal contact for sale.

Q. 10 Are your needs satisfied with your current investment in

insurance?

Criteria

No. of Respondents

Yes

10

No

30

42

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Q. 11 If No, then give reasons?

Criteria

No. of Respondents

High Premium

Low Return

Poor Services

Others

The question No.10 and 11 are designed to know the percentage of

people who are not satisfied with the current investment in insurance

and also to know the reasons behind it. So, that the company can

focus on those areas where the competitors fail. Because now a days

the competition is very stiff in the insurance industry. All companies

are trying to attract more customers by anyhow. So it will be useful for

designing the promotional schemes of the company.

From the above table and chart it can be seen that the respondents

who are dissatisfied give the main reason behind it are poor services.

There are many others reasons like more time taken by the company

for claim settlement, non-dispatchment of cheques and other

important vouchers, etc. So the company can improve upon these

and increase its market share by offering quality service to the

customers.

43

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

SWOT ANALYSIS

Strengths

1.

Flexible Products

2.

Partners having experience in different markets of the world.

3.

Synergy with existing operations

4.

Expertise in the field of insurance

5.

Professional management

6.

Create a brand name

Weakness

1.

Low capital base

2.

Yet to build strong distribution network

3.

Cannot tap rural market

44

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Opportunities

1.

Untapped market

2.

Banks ready to tie up for as a readymade distribution network

for a small fee.

Threats

1.

Large distribution network of LIC

2.

Decades of experience and brand name of LIC

3.

5% service tax on investments.

45

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

CHAPTER 4

CONCLUSION

46

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

India is among the most promising emerging insurance markets in the

world. Its current premium volume of USD 18 billion has the potential

to increase to USD 90 billion within the next decade. In particular, life

insurance, which currently makes up 80% of premiums, is widely

tipped to lead the growth. The major drivers include sound economic

fundamentals, a rising middle-income class, an improving regulatory

framework and rising risk awareness.

The groundwork for realizing potential was arguably laid in 2000

when India undertook to open the domestic insurance market to

private-sector and foreign companies. Since then, 13 private life

Insurers and eight general insurers have joined the Indian market.

Significantly, foreign players participated in most of these new

companies despite the restriction of 26% on foreign ownership.

Incumbent state-owned insurance companies have so far managed

to hold their own and retain dominant market positions. Yet, their

market share is likely to decline in the near to medium term.

Important steps have thus been already taken, but there are still

major hurdles to overcome if the market is to realize its full potential.

To begin with, India needs to further liberalize investment regulations

on insurers to strike a proper balance between insurance solvency

and investment flexibility. Furthermore, both the life and non-life

insurance sectors would benefit from less invasive regulations. In

addition, price structures need to reflect product risk. Obsolete

regulations on insurance prices will have to be replaced by riskdifferentiated pricing structures.

47

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

BIBLOGRAPHY

WEBLIOGRAPHY

http://www.irda.gov.in/ADMINCMS/cms/NormalData_Layout.aspx?pa

ge=PageNo4&mid=2

http://en.wikipedia.org/wiki/Insurance#History_of_insurance

http://en.wikipedia.org/wiki/Insurance_in_India

BOOKS

Insurance Industry vol.3- edited by U. JAWAHARLAL

48

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

ANNEXURE

49

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

Do you have a Life Insurance Policy?

Yes

No

Which Companys Insurance Policies do you have?

(Tick where applicable)

LIC

SBI Life Insurance

HFC Standard Life

New York MaxLife

Birla Sunlife

Alliance Bajaj

Cholamandalam

ICICI Pru. Life Insurance

TATA AIG Insurance

MetLife Insurance

ING Vysya

OM Kotak Mahindra

AVIVA Life

AMP Sanmar

What is amount of insurance premium you pay annually?

What priorities would you consider most important, while purchasing

a policy? (Please Rank Your Choice)

Death Benefit

Childrens Education

Retirements Benefit

Tax Planning

Financial Planning

you have any knowledge of the stock market?

Yes

No

If Yes do you have any knowledge about unit linked insurance

plans?

Yes

No

50

A PROJECT REPORT ON INDIAN INSURANCE INDUSTRY

If given a choice, where would you like to invest your money?

(Please Rank Your Choice)

Mutual Funds

Post Office Schemes

Insurance Policies

Debentures

Gold

Banks (FDs etc.)

Equities

If other (specify)___________

According to you what are the factors that would affect you decision

while

purchasing an insurance policy?

(Please Rank Your Choice)

Premium

Return

Safety

Liquidity

Market Condition

Are you or any of your family members are planning to buy an

insurance policy in near future?

Yes

No

Are your needs satisfied with your current investment in insurance?

Yes

No

If No, then give reasons?

High Premium

Low Return

51

Poor Services

Other Reasons__________

Вам также может понравиться

- K.G.Joshi College of Arts & N.G.Bedekar College of Commerce Certificate of Project WorkДокумент2 страницыK.G.Joshi College of Arts & N.G.Bedekar College of Commerce Certificate of Project Workdarthvader005Оценок пока нет

- SSC CGL 2013 Preliminary Exam Question PaperДокумент16 страницSSC CGL 2013 Preliminary Exam Question PaperSai Bhargav VeerabathiniОценок пока нет

- IM 4th SemДокумент20 страницIM 4th Semdarthvader005Оценок пока нет

- RM 4th SemДокумент26 страницRM 4th Semdarthvader005Оценок пока нет

- Edited MicrofinanceДокумент59 страницEdited Microfinancedarthvader005Оценок пока нет

- Euro Currency MarketДокумент42 страницыEuro Currency Marketdarthvader005Оценок пока нет

- Student - Declaration: Bilin.E.B, East West College of ManagementДокумент4 страницыStudent - Declaration: Bilin.E.B, East West College of Managementdarthvader005Оценок пока нет

- SMДокумент26 страницSMdarthvader005Оценок пока нет

- Brief OverviewДокумент5 страницBrief Overviewdarthvader005Оценок пока нет

- K. G. Joshi Collage of Arts & N.G. Bedekar College of CommerceДокумент18 страницK. G. Joshi Collage of Arts & N.G. Bedekar College of Commercedarthvader005Оценок пока нет

- HRM IndexДокумент1 страницаHRM Indexdarthvader005Оценок пока нет

- Project On AseanДокумент39 страницProject On Aseandarthvader005100% (1)

- Infosys LearningMate Recruitment Selection ProcessДокумент53 страницыInfosys LearningMate Recruitment Selection Processdarthvader005Оценок пока нет

- Management Practices and Organiztional Behavior: 1 Suman Tiwari (A-22)Документ22 страницыManagement Practices and Organiztional Behavior: 1 Suman Tiwari (A-22)darthvader005Оценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Mock Test - 1-1473080346944 PDFДокумент7 страницMock Test - 1-1473080346944 PDFSonali DulwaniОценок пока нет

- ZACKS Screening PDFДокумент53 страницыZACKS Screening PDFraviraviravi1100% (1)

- c3 Capital Allocation of Risky AssetsДокумент39 страницc3 Capital Allocation of Risky AssetsfelipeОценок пока нет

- 2021 FEDVIP Dental RatesДокумент3 страницы2021 FEDVIP Dental RatesFedSmith Inc.100% (3)

- Anniversary Statement 25 January 2016Документ3 страницыAnniversary Statement 25 January 2016Rodel Ryan YanaОценок пока нет

- A Study of An Derivative Market in IndiaДокумент22 страницыA Study of An Derivative Market in IndiaSuvankar MallickОценок пока нет

- C6T2 - Basel III - Risk Management PDFДокумент10 страницC6T2 - Basel III - Risk Management PDFTanmoy IimcОценок пока нет

- Financial Risk ManagementДокумент4 страницыFinancial Risk ManagementJeraldine Nicole RazonОценок пока нет

- The Relevance of Factors Affecting Real Estate Investment DecisionsДокумент16 страницThe Relevance of Factors Affecting Real Estate Investment DecisionsMariaОценок пока нет

- Insurance BusinessДокумент69 страницInsurance BusinessMittal Kirti MukeshОценок пока нет

- 999dice - BotДокумент30 страниц999dice - BotSMGОценок пока нет

- PPL Brokers Setup and Usage: April 2020Документ24 страницыPPL Brokers Setup and Usage: April 2020saxobobОценок пока нет

- M一级百题段风险管理Alex金程教育Документ56 страницM一级百题段风险管理Alex金程教育JIAWEIОценок пока нет

- List of Insurance Companies With Valid and Existing CA As of 30 June 2022Документ3 страницыList of Insurance Companies With Valid and Existing CA As of 30 June 2022LGU PASAY SAFETY SEAL CERTIFICATIONОценок пока нет

- Overview of Property and Casualty ReinsuranceДокумент29 страницOverview of Property and Casualty ReinsuranceAman AroraОценок пока нет

- CGC - 2.2.1 Study - 8FDLaelerДокумент7 страницCGC - 2.2.1 Study - 8FDLaelerCaleb Gonzalez CruzОценок пока нет

- KIM - Kotak Multi Asset Allocator Fund of Fund - DynamicДокумент17 страницKIM - Kotak Multi Asset Allocator Fund of Fund - DynamicTedtОценок пока нет

- Read This First - High ProbabilityДокумент5 страницRead This First - High ProbabilitySanthosh InigoeОценок пока нет

- User Manual PipGenius v1.25Документ10 страницUser Manual PipGenius v1.25maОценок пока нет

- Final RevisionДокумент25 страницFinal RevisionTrang CaoОценок пока нет

- Accounting For Proportional TreatiesДокумент35 страницAccounting For Proportional TreatiesGashawОценок пока нет

- CH12Документ39 страницCH12Z pristinОценок пока нет

- Zimbabwe 2011 Fourth Quarter - Short Term Insurance ReportДокумент33 страницыZimbabwe 2011 Fourth Quarter - Short Term Insurance ReportKristi DuranОценок пока нет

- FINANCIAL DERIVATIVES Unit - 1Документ18 страницFINANCIAL DERIVATIVES Unit - 1Neehasultana ShaikОценок пока нет

- BAUTISTA BAFIMARX ACT181, Activity 2Документ3 страницыBAUTISTA BAFIMARX ACT181, Activity 2Joshua BautistaОценок пока нет

- Credit Risk Modelling Literature ReviewДокумент5 страницCredit Risk Modelling Literature Reviewea3h1c1p100% (1)

- ABBREVIATIONSДокумент74 страницыABBREVIATIONSElizabeth SharmaОценок пока нет

- 1-Law On Insurance EngДокумент13 страниц1-Law On Insurance EngSao SaraОценок пока нет

- Introduction of InsuranceДокумент11 страницIntroduction of InsuranceNisarg ShahОценок пока нет

- Chapter 4 - Teori AkuntansiДокумент30 страницChapter 4 - Teori AkuntansiCut Riezka SakinahОценок пока нет