Академический Документы

Профессиональный Документы

Культура Документы

Images Ebook Sample - Assessment.questions Ceilli Ceilli - English Ceilli - Set2

Загружено:

phyliciayapИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Images Ebook Sample - Assessment.questions Ceilli Ceilli - English Ceilli - Set2

Загружено:

phyliciayapАвторское право:

Доступные форматы

CEILLI- Set 2 2010

CEILI - SET 2

Anticipated Questions with Answers

1

The term Investment-linked in Malaysia shall be similar to the term "__________________" in

the United Kingdom and to the term "_______________________" in the United States.

A

B

C

D

2

Unit-Linked and Unit Trust

Unit-Linked and Variable Life

Unit Trust and Variable Investment

Investment Trust and Variable-Linked

Risk can be classified into two particular categories in relation to investment. They include

_________________.

I.

II.

III.

IV.

A

B

C

D

3

I & II

I & III

II & IV

III & IV

Diversification in investment involves __________________________.

A

B

C

D

4

the risk of not losing some or all of a persons initial investment

the risk of rate of return on the investment not matching up to the individuals

expectation

the risk of rate of return on the investment matching up to the individuals

expectation

the risk of losing some or all of a persons initial investment

reducing the risks of investment by putting the fund under management into several

categories of investment

reducing the risks of investment by putting all ones eggs in one basket

putting all the funds under management into one category of investment

spreading the risks of investment by not putting the fund into several categories of

investment

People generally invest their money to provide:

I.

II.

III.

IV.

A

B

C

D

an improvement in their financial position

a less comfortable standard of living

income in retirement

funds for paying necessary expenses and taxes when the person dies

I, II & III

I, III & IV

I, II & IV

II, III & IV

AIA Premier Academy

Page 1

CEILLI- Set 2 2010

5

Three elements affect the accessibility of the funds. They include __________________.

I.

II.

III.

IV.

A

B

C

D

6

I, II & III

I, II & IV

I, III & IV

II, III & IV

What is/are the characteristic(s) of warrants?

I.

II.

III.

IV.

A

B

C

D

7

warrants give the holder the option to subscribe for ordinary shares at a

predetermined conversion ratio

warrants give the holder the option to subscribe for ordinary shares at a

predetermined exercise price

warrants are usually detached from the loan stock and traded separately in

securities market

warrants are issued on their own

I

I, II & III

I, III & IV

I, II, III & IV

The following characteristics of shares at a predetermined conversion ratio warrants are true,

EXCEPT

A

B

C

D

8

the age and attitude of the investor towards risk

the initial cost in setting up or buying into the investment

the time horizon of needs of the fund

the cost or penalty of realising the investment before its maturity period

warrants gives the holder the option to subscribe for ordinary shares at a

predetermined conversion ratio

warrants gives the holder the option to subscribe for ordinary shares at a

predetermined exercise price

the life span of a warrant can be varied at the discretion of the holder

the option attached to the warrants can be exercise by subscribing for ordinary shares

in cash, by exchanging the loan stock or by a combination of both

The disadvantage of warrants or TSR is _____________________.

A

B

C

D

investor have to put in a large initial outlay to establish an exposure to the shares

on expiry, warrants which are not exercised lose their value completely

like ordinary shares, there is no chance for price recovery

by selling the warrants given to an investor in the first instance; the investor cannot

benefit from the capital gain

AIA Premier Academy

Page 2

CEILLI- Set 2 2010

9

Rank the following investment vehicle in terms of their level of risks, from the least risky to the

most risky.

I.

II.

III.

IV.

A

B

C

D

10

I, III, IV & II

I, IV, III & II

I, II, III & IV

I, IV, II & III

Which of the following is NOT a type of fixed income securities?

A

B

C

D

11

cash and deposit

derivatives

a well diversified investment portfolio of a company

stock option

money market instruments

government bonds

preference shares

none of the above

Which of the following statements about corporate bonds are FALSE?

I.

II.

III.

A

B

C

D

12

I, II

I, III

II, III

I, II & III

What are the advantages of investing in preference shares?

I.

II.

III.

A

B

C

D

13

medium or long term debt obligation of a company secured by specific assets

the higher the security pledge and the credit worthiness of the company

the higher the rate of return will be unsecured bonds carry lower rates of

interest than secured bonds

it gives shareholder the right to a fixed dividend

has priority over company assets during dissolution

they enjoy benefit of capital appreciation

I, II

I, III

II, III

I, II & III

Which one of the following investment vehicles are for capital appreciation purpose?

A

B

C

D

corporate bonds and preference shares

preference shares and ordinary shares

corporate bonds and ordinary shares

ordinary shares and option

AIA Premier Academy

Page 3

CEILLI- Set 2 2010

14

What are the disadvantages in investing in ordinary shares?

I.

II.

III.

A

B

C

D

15

B

C

D

it is a place of temporary refuge when the investor foresee

that the market outlook is uncertain

it offers protection to the principal and guaranteed steady

stream of income

it enables the investor an opportunity for capital appreciation

it allows the investor a chance for capital preservation

Spot markets, a type of cash markets are ___________________.

A

B

C

D

18

futures, investment trusts and options

fixed income stocks, treasury bills and time deposits

debenture stocks, loan stocks and convertible stocks

preference stocks, unit trusts and derivatives

Investing in bonds offers the following advantages EXCEPT

17

I, II

I, III

II, III

I, II & III

The three basic types of corporate stocks include ___________________.

A

B

C

D

16

dividends are paid not more than the fixed rate

investor are exposed to market and specific risks

shares can become worthless if company becomes insolvent

markets which quote prices referred to the current market price of an item available for

immediate delivery

markets for deferred delivery of commodities

markets that are traceable only from the late 20 century

known to establish forward contracts featuring the contract price and future delivery

dates

Which of the following fixed income securities yield the highest return?

A

B

C

D

government bonds

corporate bonds

convertible bonds

unsecured non-convertible bonds

AIA Premier Academy

Page 4

CEILLI- Set 2 2010

19

Which of the following statements about fixed income securities are FALSE?

I.

II.

III.

A

B

C

D

20

cash

bond

futures

ordinary shares

An investment trust is _______________.

A

B

C

D

23

people invest money to enhance a comfortable standard of living

people invest money in fixed deposits to produce high and guaranteed returns

people invest money to provide funds for higher education for their children

investment in commodities no regular income

Which of the following investment options has all the advantages of capital appreciation,

liquidity and inflation hedge?

A

B

C

D

22

I & II

I & III

II & III

I, II & III

Which of the following statements about investment objectives is FALSE?

A

B

C

D

21

the interest rate is directly proportional to the price of the bonds

the coupon rate is directly proportional to the price of the bonds

the longer the maturity period, the more volatile the price of the bonds will be

one whereby investor buy units in the trust itself and not shares in the company

an organisation registered under the Societies Act which usually invests in a wide

range of equities and other investment

a closed-end fund and does not have to dispose off its assets if large number of

investors sell their shares

established by a trust deed which enables a trustee to hold the pool of money and

assets in trust on behalf of the investor

Which one of the following statements about diversification in portfolio management is FALSE?

A

B

C

D

diversification can completely eliminate the risk of investing in stocks in a portfolio

diversification helps to spread the portfolio risk by investing in different categories of

investment in a portfolio

diversification can involve purchasing different types of stocks and investing in stocks

of different countries

a diversified portfolio provides greater security to an investor having to sacrifice the

return for the portfolio

AIA Premier Academy

Page 5

CEILLI- Set 2 2010

24

Investing in properties can __________________.

A

B

C

D

25

Which of the following statement is TRUE?

A

B

C

D

26

B

C

D

provides for payment of the sum assured when the life assured survives a specific

period

is one that if the life assured survives the specified period, the policy ceases and no

return of premiums is given

is the most complex and expensive of all the life insurance

provides for surrender or cash values on early termination of the insurance

Whole life and endowment policies are known as ______________________, because they

may be for a guaranteed return only.

A

B

C

D

29

ensuring that the fund manager adhere to the provision of the trusts deeds

acting generally to protect the unit-holders

holding the pool of money and assets in trust on behalf of the investors

managing the portfolio of investments and administering the buying and selling of

shares in the unit trust itself

Term insurance _______________.

28

amount invested in cash depends on the size of cash flow requirement

investment in cash decrease when interest rates rise

investment in cash increase when there is a bull run in the stock market

it has high yield potential

The duties of the trustee of unit trust do not include ________________.

A

B

C

D

27

provide good capital appreciation cut a poor flow of income

be high risks investment especially if good repayment methods are obtained

result in easy disposal of the properties during economic recession

result in free capital gain through proper mortgaging of the properties

profit or participating policies

options

non-profits or non-participating policies

spot transaction

The first new generation investment-linked life insurance product was ______________.

A

B

C

D

an individual retirement annuity for the self-employed by London & Manchester

Assurance Company limited in 1957

variable life insurance in the US in 1976

the Hambro Whole Life Plan introduced in 1977

in 1973 by NTUC Income Singapore

AIA Premier Academy

Page 6

CEILLI- Set 2 2010

30

The introduction of the _____________________ is one of the factors which contributed to the

expansion of the investment-linked insurance business in Singapore.

A

B

C

D

31

the formation of the Investment Scheme by the Central Provident fund in 1997

the requirement of the Securities Exchange Act 1934 that all insurance agents and

agency office employees dealing in variable life insurance must pass an examination in

securities business

the introduction of the Enhanced Investment Scheme by the Central Provident fund in

1993

the regulation of investment companies management and operation including that of

insurance companies underwriting variable life

Under the Securities Exchange Act 1934 of US ________________________.

I.

II.

III.

IV.

A

B

C

D

32

I, II & III

I, II & IV

I, III & IV

II, III & IV

Apart from the investment management charges, what other kind of charges do single premium

investment-linked policy charge?

I.

II.

III.

A

B

C

D

33

insurance agents and agency office employees dealing in variable life

insurance must register with the National Association of Securities Dealers

insurance companies or the sales company dealing in variable life insurance

must register as a broker-dealer

insurance agents and agency office employees dealing in variable life

insurance must pass an examination in securities business

a prospectus disclosing the identity and nature of the insurers business,

among others, must be provided by the insurers to potential client

policy fees

administrative and mortality charges

assurance charges

I & II

I & III

II & III

I, II & III

The investment returns under an investment-linked life insurance policy _________________.

I.

II.

III.

IV.

A

B

C

D

are not guaranteed

are assured

are linked to the performance of the investment fund managed by the life

office

fluctuate according to the rise and fall of market prices

I, II & III

I, II & IV

I, III & IV

II, III & IV

AIA Premier Academy

Page 7

CEILLI- Set 2 2010

34

The initial units form of charge under the investment-linked life insurance policies _________.

I.

II.

III.

IV.

A

B

C

D

35

I, II & III

I, II & IV

I, III & IV

II, III & IV

Policy fee payable by an investment-linked life insurance policyowner is to cover _________.

A

B

C

D

36

will have higher annual management charges such as 6% per annum

throughout the term of the policy contract

means that their cash value of the initial units is much lower than their

is much less commonly used these date than in the past

bear lighter discontinuance charges

the mortality costs of the investment-linked life insurance policy

the administrative expenses of setting up the investment-linked life insurance policy

the handling charges by professional investment managers

the price for each unit bought under the investment-linked life insurance policy

Under a regular premium investment-linked whole life insurance plan ______________.

I.

II.

III.

IV.

A

B

C

D

premium top-ups and holidays, subject to the life offices administrative rules

are usually allowed

life protection is the main objective of the plan with investment as a nominal

purpose

withdrawals and surrenders, usually after the payment of a few years premium

are allowed

a one-off premium contribution is made to the policy which uses the premium

to purchase units in an investment-linked fund and to provide certain level life

cover

I, II & III

I, II & IV

I, III & IV

II, III & IV

AIA Premier Academy

Page 8

CEILLI- Set 2 2010

37

The characteristics of an investment-linked life insurance policy include ____________.

I.

its cash value and protection benefits are determined by the investment

performance of the underlying assets

its protection costs are generally met by implicit charges

its commissions and office expenses are met by a variety of explicit charges

with normally 6 months notice given by the life offices prior to any change

its cash value is normally the value of units allocated to the policyowner,

calculated at the bid price

II.

III.

IV.

A

B

C

D

38

I, II & III

I, II & IV

I, III & IV

II, III & IV

Which of the following statements about the characteristics of investment-linked policies are

TRUE?

I.

investment-linked policies generally have a larger exposure to equity

investment than with profits and other conventional policies

the protection costs are generally met by implicit charges, which vary with age

and level of cover

commission and office expenses are met by a variety of explicit charges, some

of which are variable

II.

III.

A

B

C

D

39

I & II

I & III

II & III

I, II & III

Which of the following is/are the main characteristic(s) of investment-linked life policies?

I.

the policies can be used for investment, as source of regular savings and

protection

the cash values and protection benefits are determined by the investment

performance of the underlying assets

the net cash values of the policies are the gross cash values shown in the

policy that includes reversionary bonus up to the date of surrender, less all

indebtedness include interest

II.

III.

A

B

C

D

40

I

II

I & II

I, II & III

Surrender charges under the investment-linked life insurance policies _________________.

A

B

C

D

are deducted from the value of units at surrender

are deducted from the value of units at the commencement of the policies

are applicable to policies with not uniform allocation

represent initial expenses which have already been incurred and recovered

AIA Premier Academy

Page 9

CEILLI- Set 2 2010

41 The offer price under an investment-linked life insurance policy is _____________.

A

B

C

D

a fixed amount throughout the life of the policy

also known as the bid price

the price at which units under the policy are bought back by the life office

the price at which units under the policy are offered for sale by the life office

42 The fundamental differences between traditional with-profit life insurance policies and investmentlinked life insurance policies include ___________.

I.

II.

III.

IV.

A

B

C

D

investment-linked life insurance policies are less likely to offer more choice in

terms of the type of investment funds

the investment element of investment-linked life insurance policies is made

known to the policyowner at the outset and is invested in a separately identifiable

fund which is made up units of investment

investment-linked life insurance policies offer the potential for higher returns

traditional with profits life policies aim to produce a steady return by smoothing

out market fluctuation

I, II & III

I, II & IV

I, III & IV

II, III & IV

43 The protection costs under an investment-linked life insurance policy ______________.

I.

II.

III.

IV.

A

B

C

D

are met by a flat initial charge for regular premium plans

are generally covered by cancellation of units in the fund

are generally met by explicit charges stipulated openly in the policy terms

vary with age of policyowner and level of cover

I, II & III

I, II & IV

I, III & IV

II, III & IV

44 Investment-linked funds can be structured into two ways, namely accumulation units and

distribution units. In accumulation units, the investment income of the funds is _____________.

A

B

C

D

ploughed back into the fund, thus the unit prices will increase over the long term

ploughed back into the fund, thus the unit prices will decrease over the long term

used to purchase additional units to be distributed to the policyowners, thus the unit price

remains unchanged but the policyowners gets more units

used to purchase additional units to be distributed to the policyowners, thus the unit price

decreases and the policyowners get more units

AIA Premier Academy

Page 10

CEILLI- Set 2 2010

45 Which of the following statement(s) about switching is/are TRUE?

I.

II.

III.

IV.

A

B

C

D

switching facility allows a policyholder the liberty to move part or all of his money

from one fund to another

switching facility can be useful for retirement and education fees planning

if the company offers only one fund to its policyholders, it will normally include a

switching facility

it is advisable for policyholders to switch assets in the bond type funds (which are

more variable in returns)

I & II

II

III

III & IV

46 The switching facility under investment-linked life insurance policies is very useful ________.

A

B

C

D

for the purpose of assets planning by the trustee

for the purpose of profit planning by the life policies

for the purpose of financial planning by the policyowners

for the purpose of sales planning by the fund managers

47 Which one of the following funds comprises a higher proportion of equity and a lower proportion

of fixed income instruments?

A

B

C

D

Bond funds

Mixed funds

Property funds

Managed funds

48 Which of the following funds normally include a provision for the deferment of unit redemption by

the manager, for up to 12 month, except for death?

A

B

C

D

Property funds

Managed funds

Equity funds

Government bond funds

AIA Premier Academy

Page 11

CEILLI- Set 2 2010

49 Investment-linked funds can be invested in any financial instruments including cash funds, bond

funds, equity funds, property funds, specialised funds and diversified funds. Diversified funds

____________.

I.

II.

III.

IV.

A

B

C

D

include funds invested in a wide variety of assets such as equities, bonds,

properties, cash, etc.

include funds invested in fixed proportion of specialised assets, for example, 70%

of the funds are in equities and 30% in bonds

include funds that are restricted to investment in a particular country only such as

the ASEAN Fund, the Emerging Markets Fund and the International Bond Fund

invest in a wide variety of assets, their allocation of funds will depend on the fund

managers views of the future prospects of the financial markets involved

I, II & III

I, II & IV

I, III & IV

II, III & IV

50 Investment-linked funds can be invested in any financial instruments including cash funds, bond

funds, property funds, specialised funds and diversified funds.

Equity funds ________________________.

A

B

C

D

invest in stocks and shares and the magnitude of the change in unit prices will depend on

the quantity only of the equities held

invest in stocks and shares and are inherently of lower risk in nature and the prices of the

stocks and shares are stable

invest in stocks and shares and investor who buy such assets usually aim for capital

appreciation

invest in stocks and shares and during market recession, such assets are usually the last to

depreciate

51 In risk-return profile of cash funds, bond funds, balanced funds, managed funds and equity funds,

a risk-return graph will show that _______________.

I.

II.

III.

IV.

A

B

I, II & III

I, II & IV

C

D

I, III & IV

II, III & IV

higher return normally comes with lower risk

higher return normally comes with higher risk

at the top end of the graph are the equity funds

the relatively risk less cash funds sit at the bottom end of the graph

AIA Premier Academy

Page 12

CEILLI- Set 2 2010

52 Single premium investment-linked life insurance policy

A

B

has no death benefit

has cash value

C

D

must be issued with a minimum of RM3000

must be issued with a minimum of RM5000

53 Under investment-linked life insurance policies _________________.

I.

II.

III.

IV.

A

B

C

D

there is no guaranteed minimum sum assured for the purpose of declaring

bonuses

there is no guaranteed minimum sum assured as a level of life insurance

protection

each of the policyownerss will be used to purchase units, the number of which is

dependent on the offer price of each unit

purchases of units can only be made from the investment-linked fund itself, which

will then create new units and add the investment monies to the value of the fund

I, II & III

I, II & IV

I, III & IV

II, III & IV

54 Under an investment-linked life insurance policy, if a policyowner pays a regular payment to the

insurance company; this is normally for _________________.

A

B

C

D

Regular premium plans

Annual policy plans with renewals

Top-up policy plans

Single premium plans

55 Under the dual pricing method of single premium policies, ________________.

A

B

C

D

the policyowner buys the units at the life offices buying price and sells the units at the life

offices selling price

the policyowner buys the units at the offer price and sells the units at the bid price

there is only one price quoted whether the policyowner is buying or selling his units

the bid price is always higher than the offer price

56 Under the single pricing method of single premium policies, the number of units that can be

bought is equivalent to ___________.

A

B

C

D

the premium paid divided by the unit price

the premium paid less policy charges divided by the unit price

the premium paid divided by the bid price

the premium paid less policy charges divided by the bid price

AIA Premier Academy

Page 13

CEILLI- Set 2 2010

57 Under the dual pricing method of her single premium investment-linked life insurance policy,

Agnes had allocated an amount of RM4,000 premium to buying units. The number of units that

Agnes holds is 4,000. After 10 years, the offer price is now RM1.97. The bid-offer spread is 5%.

The mortality charge is 1% and the policy fee is RM100. The ending value of investment, the

return on gross premium and the annual yield under Agness policy are ____________.

A

B

C

D

RM7,311.14, RM1.828 and 0.062 or 6.2% respectively

RM7,701.20, RM1.925 and 0.118 or 11.8%

RM7,486, RM1.871 and 0.087 or 8.7% respectively

RM7,311.14, RM1.924 and 0.118 or 11.8% respectively

58 Investment-linked life insurance policyowners may make withdrawals in term of _____________.

A

B

C

D

number of units through cancellation of units

fixed monetary amount only through reduction of the life cover sum assured

number of units or fixed monetary amount through reduction of the life cover sum assured

number of units or fixed monetary amount through cancellation of units

59 The number of units under a single pricing method single premium investment-linked life

insurance policy is 3,800 with a sum assured of RM5,000. The offer price when the policyowner

first pays his premium is RM1.00. The units price at the time of the policyowners death is

RM1.22. Under the unit value plus sum assured type of death benefits, this will result in a death

benefit of ___________.

A

B

C

D

RM9,636

RM8,800

RM5,000

RM4,636

60 The following statements about investment-linked policies are true EXCEPT

A

B

C

D

some investment-linked policies grant loans to policyholders and it is limited to a percentage

of cash value

the structure of charges and the investment content of investment-linked policy are specified

in an investment-linked policy

policyholders may request for a partial surrender of the policy and the withdrawal amount

will be met by cashing the units at the offer price

all or part of the premiums of an investment-linked policy will be applied to purchase units in

the fund

61 Which of the following statements about single premium investment-linked policies are TRUE?

I.

II.

III.

A

B

C

D

there is no fixed term in a single premium investment-linked policy and

therefore, they are technically whole life assurance

top-ups or single premium injections are allowed

policyholders have the flexibility of varying the level cover

I & II

I & III

II & III

I, II & III

AIA Premier Academy

Page 14

CEILLI- Set 2 2010

62 What are the risks involved in investing in investment-linked products?

I.

II.

III.

A

B

C

D

the risk of insolvency of the life insurance company due to the depletion of the

life funds

the risk of fluctuations of the unit price of the policy that may rise or fall,

depending on the current market situation

the risk of the cash and maturity values of the policy being adversely affected if

the bid price of the units falls

I & II

I & III

II & III

I, II & III

63 Which one of the following BEST describes the policy benefits of investment-linked policies?

A

B

C

D

the policy benefits are guaranteed

the policy benefits are payable only on death or disability

the policy benefits will depend on the long-term of the life office

the policy benefits are directly linked to the investment performance of the underlying

assets

64 Which one of the following statements about the benefits in investment-linked fund is FALSE?

A

B

C

D

the fund provides a highly diversified portfolio, thus, lowering the risk of investment

the fund relieves the investor from the hassle of administering his/her investment

the fund ensures definite high yield for an investor since it is managed by professionals

who are well-versed in the management of risks of investment portfolios

the fund enables small investor to participate in a pool of diversified portfolio in which

he/she, with low investment capital is unlikely to have acceded to

65 What are the benefits available when investing in investment-linked funds?

I.

II.

III.

A

B

C

D

the investment-linked funds offer policyholders an access to a pooled or

diversified portfolio

the investment-linked policyholder can vary his premium payments, take

premium holidays, add single premium top-ups and change the level of sum

assured easily

the investment-linked policyholder can have access to a pool of qualified and

trained professional fund managers

I & II

I & III

II & III

I, II & III

AIA Premier Academy

Page 15

CEILLI- Set 2 2010

66 The benefits of investing in investment-linked funds include _______________.

I.

II.

III.

IV.

A

B

C

D

policyowners have access to a pooled or diversified portfolio of investment

policyowners can easily change the level of the premium payments as the

product design of investment-linked life insurance policies have clear structures

which cater separately for investment and insurance protection

policyowners can gain access to investment-linked funds managed by

professional investment managers with unproven tracked records

policyowners can buy an investment-linked life insurance policy with an initial

investment of as low as RM4,000

I, II & III

I, II & IV

I, III & IV

II, III & IV

67 Which one of the following statements about the flexibility features of investment-linked policies

is FALSE?

A

B

C

D

policyholders have the flexibility of switching from one fund to another provided it satisfies

the companies switching criteria

policyholders may request for a partial surrender of the policy and the withdrawal amount

will be met by cashing the units at bid price

policyholders can take loans against their investment-linked policies up to the entire cash

value of their policies

policyholders have the flexibility of increasing or decreasing their premiums for regular

premium investment-linked policies

68 The flexibility benefit of investing in investment-linked funds include ______________.

I.

II.

III.

IV.

A

B

C

D

policyowners can easily change the level of sum assured and switch their

investment between funds

policyowners can easily take premium holidays and add single premium top-ups

investment-linked life insurance products have a simple product design with a

clear structure with caters separately for investment and insurance protection

policyowners can easily change the level of their premium payment

I, II & III

I, II & IV

I, III & IV

I, II, III & IV

AIA Premier Academy

Page 16

CEILLI- Set 2 2010

69 Policyowners of investment-linked life insurance policies are relieved of the day-to-day

administration of their investment. All that are required of them include ____________.

I.

II.

III.

IV.

A

B

C

D

their engaging independent professional fund managers personally to manage

the complicated transactions

their constructing their own diversified portfolio and passing them on to the life

offices

keeping track of their investment through the unit statements provided regularly

by their life offices

keeping track of the unit price published in financial pages of major newspapers

I & II

I, II & III

I, II & IV

I, II, III & IV

70 The following statement about risks of investing in investment-linked funds is TRUE.

A

B

C

D

policyowners who are risk averse should not purchase life insurance policies with high

protection and guaranteed cash and maturity values

policyowners who invest in unitised funds with high equity investment face greater risk but

can expect to achieve higher return than the traditional life insurance product over the long

term

investment in unitised funds which are fully invested in units of equity funds are not

suitable for policyowners who can tolerate the risks of short term fluctuation in their cash

value

policyowners who are risk averse should buy investment-linked life insurance policies with

high equity investment

71 The administrative fee, insurance charge, fund management fee and the like under an

investment-linked life insurance policy are ______________.

A

B

C

D

usually guaranteed

not subject to review

subject to change by the life office after written notice is given

always up-front charges

72 Why is a term assurance policy not suitable for investment purpose?

A

B

C

D

it is a short term policy

there is no investment element in a term policy

term policies are meant solely for protection needs

the cash value in a term is not enough to cover the investment returns from other

investment vehicles

AIA Premier Academy

Page 17

CEILLI- Set 2 2010

73 Which of the following statements describe the differences between investment-linked products

and with-profits products?

I.

II.

III.

A

B

C

D

investment-linked products allow policyholders to vary the premium payments

unlike with-profits products

investment-linked products can take the form of whole life or endowment

policies with-profits products

investment-linked products allows policyholders to pay future single premiums

from time to time to add more units to his accounts unlike with-profits products

I

I & III

II & III

I, II & III

74 The criteria for comparing traditional life insurance products with investment-linked life insurance

products include _____________.

I.

II.

III.

IV.

A

B

C

D

the life offices management expertise

the products investment returns and risks

the policies premium computation

death benefit provided under the policies

I, II & III

I, II & IV

I, III & IV

II, III & IV

75 Which one of the following statements is FALSE?

A

B

C

D

life office will carry out a valuation of its funds yearly and any surplus may be allocated to

with-profits policyholder as reversionary bonus

investment-linked life insurance policies offer investors policies with values indirectly

linked to the investment performance of the life office

the investment element of investment-linked policies varies according to underlying assets

of the portfolio

both Whole Life and Endowment policies can be used as an investment media with

benefits than become payable at a future date

AIA Premier Academy

Page 18

CEILLI- Set 2 2010

76 Which one of the following statements about the difference between investment-linked policies

and endowment policies are FALSE?

I.

II.

III.

A

B

C

D

the policy values of investment-linked and endowment policies directly reflect

the performance of the fund of the life office

the premiums and benefits of the endowment policies are described at inception

of the policy whereas investment-linked policies are flexible as they are account

driven

the benefits and risk of investment-linked and endowment policies directly

accrued to the policyholders

I & II

I & III

II & III

I, II & III

77 Which one of the following statements describe the differences between investment-linked

products and with products?

I.

II.

III.

A

B

C

D

Investment-linked products allow policyholders to pay top-up premiums from

time to time to buy more units to his account unlike with-profits products

Investment-linked product allow policyholders to take a premium holiday unlike

with-profits products

Investment-linked products can take the form of whole life or endowment

policies unlike with-profits products

I

I & II

I & III

I, II & III

78 With traditional with-profit life insurance products, the allocations to policyowners in the form of

bonuses __________.

I.

II.

III.

IV.

A

B

C

D

are not directly linked to the life offices investment performance

have already been smoothened by the life offices

do not have the peaks and troughs of investment return as in good investment

years of life offices, contributions have been made to reserve and vice versa

are not fixed at the inception of the policy, but are greatly dependent on the

investment performance of the life offices

I, II & III

I, II & IV

I, III & IV

II, III & IV

AIA Premier Academy

Page 19

CEILLI- Set 2 2010

79 Reversionary bonus under traditional with-profit life insurance policies ___________.

is paid at the time of death under the life policies or on maturity of the policies

can either be simple (based purely on the original sum assured) or compound (based on

the sum insured less previous bonuses)

once allocated can, however, be removed or reduced when the life office cannot afford to

sustain it

is usually expressed as a percentage of the sum assured and will vary in accordance with

the performance of the underlying assets of the unitised fund

A

B

C

D

80 The death benefit under regular premium investment-linked life insurance policies is either

______________.

I.

II.

III.

IV.

A

B

C

D

81

I & II

II & III

III & IV

I & IV

The following statement about surrender value under traditional with-profit life insurance

products is TRUE.

A

B

C

D

82

the sum assured chosen by the life assured or the value of the units in the fund

at the bid price, whichever is higher

the sum assured chosen by the life assured plus the value of units in the fund at

the bid price

the minimum sum assured or the value of the units in the fund at the bid price,

whichever is higher

the minimum sum assured plus the value of the units in the fund at the bid price

the amount of surrender value is usually higher that the amount under without-profit

policies and it varies with the age of the assured, being lower at older age

in the case of with-profit policies, the net cash surrender value includes the surrender

value of the reversionary bonus up to the date of surrender

other than term insurance of more than 20 years, limited payment is made when such

insurance policies are surrender

when a with-profit insurance policy is surrendered, the surrender value is calculated by

multiplying the bid price with number of units

The following statement about surrender value under investment-linked life insurance is

TRUE.

A

B

C

D

the amount of surrender value is always higher than the amount under with-profit

policies

for dual pricing policies, the surrender value is the offer price multiplied by the number

of units

for single pricing policies, the surrender value is the market price multiplied by the

number of units

the amount of surrender value varies with the age of the policyowner, being higher at

older ages

AIA Premier Academy

Page 20

CEILLI- Set 2 2010

83

The following statement about option to top-up under investment-linked life insurance products

is FALSE.

A

B

C

D

84

policyowners are normally allowed to top-up their policies at any time, subject to a

minimum amount

to top-up a policy, the policyowner pays further single premium at the time to top-up

policyowners may buy additional units of the investment-linked fund and these units will

be allocated to new investment-linked life insurance policies

further premiums at time of top-up will be used in full, after deducting charges for topups, to purchase additional units of the investment-linked fund

Which of the following statement are TRUE?

I.

II.

III.

A

B

C

D

85

capital gain is not taxable

capital losses is not tax deductible

dividend income is not subjected to withholding tax according to the prevailing

corporate tax rate

if personal tax rate is less than corporate tax rate, shareholder is entitle to rebate on the

portion of the dividend paid as tax

The principal legal document regulating income tax in Malaysia is the ___________.

A

B

C

D

87

I & II

I & III

II & III

I, II & III

The following statements about taxation are true, EXCEPT

A

B

C

86

the policy values of investment-linked policies is determined by the offer price

at the time of valuation

the policy value of endowment policies is the cash value plus any reversionary

bonus less any outstanding automatic premium loans and any interest due at

time of surrender

the life office needs to maintain a separate fund for investment-linked policies

distinct from the life fund as in the case for conventional policies

Income Tax Act, 1967

Insurance Act, 1996

Contracts Act, 1950

Companies Act, 1965

An insurer must provide each investment-linked policyholder with

A

B

C

D

an advice of daily investment of funds

a policy statement and the fund performance report

the company annual financial reports

the funds manager entertainment expenses

AIA Premier Academy

Page 21

CEILLI- Set 2 2010

88

In order to encourage national thrift and promote individual financial independence particularly

in old age, tax relief is allowed in respect of premiums paid on life insurance and deferred

annuities which is on the ________________.

I.

II.

III.

IV.

A

B

C

D

89

B

C

D

there is no free-look provision in an investment-linked policy as there is no life

insurance

the agent can decide when he wants to deliver the policy

the agent can decide within 15 days of the issuance of the policy to demand a full

refund of all his units at offer price

a policyholder has only 15 days from the date he receives the policy document to

examine and decide the suitability of the policy and demand a full refund

Effective from the year of assessment 1997, the sum of tax relief allowable ____________.

A

B

C

D

91

I, II & III

I, II & IV

I, III & IV

II, III & IV

Under the free-look provision

90

in respect of payment of life insurance premiums for a life insurance policy is subject to

the limit of 7% of the capital sum assured of the policy

in respect of separate assessments for married couples, the limit of 7% in respect of

payment of life insurance premiums is the same in total

is RM2,500 plus RM2,000 for education and medical insurance

in respect of payment of life insurance premiums for a life insurance policy is no longer

subject to the limit of 7% of the capital sum assured of the policy

Which one of the following statements about investment-linked policies are TRUE?

I.

II.

III.

A

B

C

D

92

Individuals life

The life of the spouse of the individual

The joint lives of the individual and his/her spouse

The lives of the individual and his/her immediate family members

the cash value is not guaranteed

the volatility of the returns depends on the investment strategy of the fund

the investment-linked policyholders has direct control over the investment

decisions of the unitised fund

I & II

I & III

II & III

I, II & III

Which one of the following statement is FALSE?

A

B

C

D

The principles of investment-linked policies vary but all operate on the same features

Investment-linked policies can be classified single premium assurance plans or regular

premium assurance plans or investment-linked annuities

Investment-linked policies can be used for investment, regular savings and protection

The cash value and protection benefits are determined by the investment performance

of the underlying assets

AIA Premier Academy

Page 22

CEILLI- Set 2 2010

93

Which one of the following statements about investment-policies are TRUE?

I.

II.

III.

A

B

C

D

94

I & II

I & III

II & III

I, II & III

BNMs circular JPI:1/1997 on Specification of Assets for the purpose of a Licensed Insurers

Margin of Solvency _________________

I.

II.

III.

IV.

A

B

C

D

95

offer price is used to determined the number of units to be credited to the

account

the margin between the bid and offer price is used to cover the marketing cost

of the policy

the policy value is calculated based on the bid price of units allocated into the

policy

is not applicable to the investment-linked funds, in view of the nature of the

business that investment-linked funds could be invested 100% in equities

specifies the extent of a class of assets or description of assets that may be

taken into account for the purpose of a licensed insurers margin of solvency

is applicable to the investment-linked funds as all laws to investment-linked

life insurance policies

specifies the class or description of assets of a licensed insurer that may be

taken into account for the purpose of a licensed insurers margin of solvency

I, II & III

I, II & IV

I, III & IV

II, III & IV

Which one of the following statements are true for investment-linked policies?

I.

II.

III.

A

B

C

D

the owner of an investment-linked policy must be at least 18 years old

there is no requirement of insurable interest for investment-linked policies

there is no restriction on the age of the life assured

I & II

I & III

II & III

I, II & III

AIA Premier Academy

Page 23

CEILLI- Set 2 2010

96

What are required of an insurance agent conducting investment-linked life insurance

business?

I.

II.

III.

IV.

A

B

C

D

97

Sales-oriented basis

Hard sales basis

Market oriented basis

Varied product basis

Why is it so important that the customer must understand the recommendation in full?

A

B

C

D

99

I & III

I & IV

II & III

III & IV

Owing to changes in the market environment, many insurance companies now sell their

products on a ___________.

A

B

C

D

98

relevant knowledge and understanding of the technical aspects of investmentlinked life coverage

ability to give financial advice according to clients needs

general idea only of investment-linked life coverage

good marketing strategy with promising talk

because the insurer may give the wrong recommendations

because the insurer does not guarantee any return

because the impact on changed in investment condition of investment-linked life policy

falls wholly on the customer

because the policyholder expects higher return

The objective of satisfying customers needs profitably can be achieved by an agent through

_________.

I.

II.

III.

IV.

A

B

C

D

the giving of freebies to the customers

extensive investment training by the company

the use of sales plan, where sales goals, strategies and objectives are

coordinated with market analysis, segmentation and targeting

the giving of monetary assistance and discount to the customers

I, II & IV

II, III & IV

I & III

II & III

AIA Premier Academy

Page 24

CEILLI- Set 2 2010

100

Why is the personal delivery of policy regarded as an important aspect of providing after-sale

service?

I.

II.

III.

IV.

A

B

C

D

101

I, II & III

II, III & IV

I, III & IV

All

In Part II of the General Sales Principles of LIAMs Code of Conduct, intermediaries are

forbidden to ________________.

I.

II.

III.

IV.

A

B

C

D

102

sell high premium policy with good income for herself

make inaccurate or unfair criticism of any insurers

deal with or source other specialist advice when in doubt except from his

supervisor

attempt to persuade a prospect to cancel any existing policies unless these

are clearly unsuited to his needs

I & II

II & III

II & IV

III & IV

Which one of the following statements about rebating are TRUE?

I.

II.

III.

A

B

C

D

103

it alleviates the customers cognitive dissonance by the agents reassurance

on the right purchase

the agent can take the opportunity to obtain more names of referred leads and

other prospects

it re-emphasize the agents commitment to provide the policyholder with

quality service

policyholder is encouraged to call the agent whenever the need arises

rebating is prohibited under the Professional Agent Code of Conduct

rebating deals with offering the prospect a special inducement to purchase a

policy

rebating will enhance the sales performance and uphold the prestige of an

agent

I & II

I & III

II & III

I, II & III

Which one of the following statements is FALSE?

A

B

C

D

twisting is a specific form of misrepresentation

misrepresentation is a specific form of twisting

switching is a facility allowing policyholders to switch to other offered by company

rebating is to offer a prospect a special inducement to purchase a policy

AIA Premier Academy

Page 25

CEILLI- Set 2 2010

104

Which one of the following statements about twisting is FALSE?

A

B

C

D

105

it refers to an agent offering a prospect a special inducement to purchase a policy

twisting is a special form of misrepresentation

it refers to an agent inducing a policyholder to discontinue policy with another company

without disclosing the disadvantage of doing so

it includes misleading or incomplete comparison of policies

Misrepresentation resulting in inducing policyowner to cancel or have his policy made paid-up

in order to purchase a new policy to earn more income for the agent is known as

A

B

C

D

switching

replacing

twisting

changing

AIA Premier Academy

Page 26

Вам также может понравиться

- Ceili Sample Questions Set 2Документ26 страницCeili Sample Questions Set 2jsdawson67% (3)

- Ceilli1 SQ en Eah PDFДокумент24 страницыCeilli1 SQ en Eah PDFLeevya GeethanjaliОценок пока нет

- Ceili Sample Questions Set 1Документ14 страницCeili Sample Questions Set 1jsdawson29% (7)

- Variable Life Licensing Mock Exam Set D 2Документ13 страницVariable Life Licensing Mock Exam Set D 2Neil ArmstrongОценок пока нет

- VUL Mock Exam 1 - June 6, 2011 Version 1Документ11 страницVUL Mock Exam 1 - June 6, 2011 Version 1Anonymous iOYkz0w73% (45)

- IC Exam Reviewer VUL No AnswerДокумент12 страницIC Exam Reviewer VUL No AnswerRoxanne Reyes-LorillaОценок пока нет

- Vul Mock Exam 2Документ15 страницVul Mock Exam 2Mark Glenn Baluarte100% (3)

- 2 Ceilli Set A (Eng)Документ24 страницы2 Ceilli Set A (Eng)chiewteck0% (1)

- VL Mock Exam Set 1Документ12 страницVL Mock Exam Set 1Arvin AltamiaОценок пока нет

- SunLEARN Variable Life InsuranceДокумент10 страницSunLEARN Variable Life InsuranceLady Glorien cayonОценок пока нет

- IC Exam ReviewerДокумент14 страницIC Exam Reviewerfrancis75% (8)

- VULДокумент15 страницVULlancekim21Оценок пока нет

- VUL MOck 2Документ10 страницVUL MOck 2Franz JosephОценок пока нет

- VARIABLE MOCK EXAM Questionnaire and Answer Key 08172021.doc 1Документ11 страницVARIABLE MOCK EXAM Questionnaire and Answer Key 08172021.doc 1TANTAN TV100% (1)

- Variable ReviewerДокумент14 страницVariable ReviewerMaria Teresa ArceОценок пока нет

- VARIABLE LIFE REVIEWER - Intermediary ExamДокумент25 страницVARIABLE LIFE REVIEWER - Intermediary ExamJohn Michael FernandezОценок пока нет

- Variable Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerДокумент14 страницVariable Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerKenneth QuiranteОценок пока нет

- Axa Philippines Mock Exam-Investment Link Products (Vul)Документ7 страницAxa Philippines Mock Exam-Investment Link Products (Vul)SHAMIR LUSTRE100% (1)

- Variable Life Licensing Mock ExamДокумент8 страницVariable Life Licensing Mock ExamLance LimОценок пока нет

- VARIABLE LIFE REVIEWER 140 Items With Answer Key TrainersДокумент25 страницVARIABLE LIFE REVIEWER 140 Items With Answer Key Trainersjima jam selomandinОценок пока нет

- Insurance Commision Variable Insurance ContractsДокумент11 страницInsurance Commision Variable Insurance ContractsPetRe Biong PamaОценок пока нет

- Variable Reviewer12346Документ17 страницVariable Reviewer12346jeffОценок пока нет

- Vul/Ulp Mock Exams Vul Mock Exam (Документ23 страницыVul/Ulp Mock Exams Vul Mock Exam (Sheryl Grace BaranganОценок пока нет

- VUL Mock Exam Reviewer-Set 1 (For ACE With Answers)Документ12 страницVUL Mock Exam Reviewer-Set 1 (For ACE With Answers)Lady Glorien cayonОценок пока нет

- Variable - Online Mock ExamДокумент11 страницVariable - Online Mock ExamMitziRawrrОценок пока нет

- ACE Variable IC Online Mock Exam - 08182021Документ11 страницACE Variable IC Online Mock Exam - 08182021Ana FelicianoОценок пока нет

- Pru Life Uk: Variable Life Licensing Mock Exam (Set D)Документ14 страницPru Life Uk: Variable Life Licensing Mock Exam (Set D)Judy Ann LeguaОценок пока нет

- VUL Mock Exam 2 WITH EXPLANATIONS Answer KeyДокумент16 страницVUL Mock Exam 2 WITH EXPLANATIONS Answer KeyFranz JosephОценок пока нет

- Vul QuestionnaireДокумент14 страницVul QuestionnaireKyla Bianca Cuenco TadeoОценок пока нет

- VUL Reviewer Sample QuestionsДокумент3 страницыVUL Reviewer Sample QuestionsBieОценок пока нет

- CEILLI Sample Questions - Set 1 (ENG)Документ13 страницCEILLI Sample Questions - Set 1 (ENG)Premkumar NadarajanОценок пока нет

- IC Exam Reviewer For VULДокумент9 страницIC Exam Reviewer For VULjohninopatin94% (17)

- Variable Mock Exam UpdatedДокумент14 страницVariable Mock Exam UpdatedOliver papaОценок пока нет

- Variable Exam ReviewerДокумент11 страницVariable Exam ReviewerBryan MorteraОценок пока нет

- Mock ExamsДокумент7 страницMock ExamsJim AkinoОценок пока нет

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)От EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- STD Insurance Commission VUL REVIEWER Answer Key 1.2Документ12 страницSTD Insurance Commission VUL REVIEWER Answer Key 1.2Shenna PalajeОценок пока нет

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)От EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Оценок пока нет

- VUL ReviewerДокумент11 страницVUL ReviewerJohn Joshua JJ Jimenez100% (1)

- VUL Mock Exam 2 (October 2018)Документ11 страницVUL Mock Exam 2 (October 2018)Alona Villamor Chanco100% (1)

- VUL Insurance Concepts Accreditation MaterialДокумент13 страницVUL Insurance Concepts Accreditation MaterialLady Glorien cayonОценок пока нет

- VUL Mock Exam 1 (October 2018)Документ12 страницVUL Mock Exam 1 (October 2018)Alona Villamor ChancoОценок пока нет

- Variable IC Exam ReviewerДокумент101 страницаVariable IC Exam ReviewerMarian Grace De La TorreОценок пока нет

- CEILI - Set 1Документ18 страницCEILI - Set 1Divyaa Krishnan40% (5)

- IC VAR LIFE - Reviewer With Answer KeyДокумент15 страницIC VAR LIFE - Reviewer With Answer KeyDalton Jay LuzaОценок пока нет

- CEILLI Sample Questions - Set 3 (ENG)Документ11 страницCEILLI Sample Questions - Set 3 (ENG)Raja Mohan83% (6)

- VulДокумент18 страницVulAnna Kristine M. Nepomuceno100% (1)

- CEILLI PDF Revision Questions v1.0 (2023)Документ15 страницCEILLI PDF Revision Questions v1.0 (2023)Qistina IzharОценок пока нет

- Variable IC Mock Exam Version 2 10022023Документ16 страницVariable IC Mock Exam Version 2 10022023Jayr Purisima100% (1)

- STD InsCom VUL Reviewer 2019 0121Документ12 страницSTD InsCom VUL Reviewer 2019 0121Bestfriend Ng Lahat100% (1)

- CEILI Set 1Документ18 страницCEILI Set 1Sarah May Miole InocandoОценок пока нет

- Review Philam ExamДокумент10 страницReview Philam Examroyce542Оценок пока нет

- Variable Examination Review Session (Verse) Mock ExamДокумент12 страницVariable Examination Review Session (Verse) Mock ExamArvinALОценок пока нет

- VUL Mock Exam Reviewer Set 2 For ACE With Answers 2Документ11 страницVUL Mock Exam Reviewer Set 2 For ACE With Answers 2Theo AgustinoОценок пока нет

- Insurance Commission Licensure Examination Reviewer Variable Universal Life (Vul)Документ16 страницInsurance Commission Licensure Examination Reviewer Variable Universal Life (Vul)Dave Panulaya100% (3)

- Std-Ic Vul Simulated Exam (Questionnaire) - FinalДокумент10 страницStd-Ic Vul Simulated Exam (Questionnaire) - FinalRey Bautista69% (13)

- Investing Made Easy: Finding the Right Opportunities for YouОт EverandInvesting Made Easy: Finding the Right Opportunities for YouОценок пока нет

- 201743-2016-InG Bank N.V. v. Commissioner of InternalДокумент11 страниц201743-2016-InG Bank N.V. v. Commissioner of Internalaspiringlawyer1234Оценок пока нет

- Lorenzo v. Posadas JRДокумент4 страницыLorenzo v. Posadas JRGRОценок пока нет

- Informe de Riesgo JorsunДокумент14 страницInforme de Riesgo JorsunJosé Andrés Carrasco SáezОценок пока нет

- General Ledger TablesДокумент3 страницыGeneral Ledger TablesSiji SurendranОценок пока нет

- ManojДокумент1 страницаManojAjit pratap singh BhadauriyaОценок пока нет

- Acc7 Ho 3 Ri EvaДокумент3 страницыAcc7 Ho 3 Ri EvaShao BajamundeОценок пока нет

- Pay Slip: Navsarjan ConsultancyДокумент1 страницаPay Slip: Navsarjan ConsultancyRavi SarvaiyaОценок пока нет

- SafariДокумент1 страницаSafarijayОценок пока нет

- Benefits To The Tax Payer. For Example Taxes On Income, Wealth, Imports, Exports EtcДокумент3 страницыBenefits To The Tax Payer. For Example Taxes On Income, Wealth, Imports, Exports EtcSaurabhОценок пока нет

- County Administrator 2017 Budget MemoДокумент20 страницCounty Administrator 2017 Budget MemoFauquier NowОценок пока нет

- Acc324 MidsДокумент8 страницAcc324 MidsAccounting GuyОценок пока нет

- Business Customer Information FormДокумент3 страницыBusiness Customer Information Formpretty mangayОценок пока нет

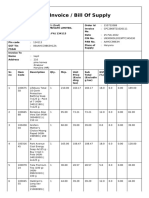

- Tax Invoice / Bill of SupplyДокумент2 страницыTax Invoice / Bill of SupplyKapil SinglaОценок пока нет

- Aryan Sports Industries: Mr. RaynazДокумент1 страницаAryan Sports Industries: Mr. RaynazNaОценок пока нет

- OO1120Документ16 страницOO1120Anonymous 9eadjPSJNgОценок пока нет

- Sample Investment ReportДокумент27 страницSample Investment ReportMs.WhatnotОценок пока нет

- 2014 Yara Fertilizer Industry HandbookДокумент46 страниц2014 Yara Fertilizer Industry HandbookMarcusWerteck100% (1)

- Bache vs. RuizДокумент18 страницBache vs. RuizCJ CasedaОценок пока нет

- CUSTOMS LAW MANUAL - NotesДокумент10 страницCUSTOMS LAW MANUAL - NotesChetanya KapoorОценок пока нет

- Republic of The Philippines Court of Tax Appeals Quezon CityДокумент16 страницRepublic of The Philippines Court of Tax Appeals Quezon CityEvan TriolОценок пока нет

- Practical Accounting of Cash Flow From Operating ActivitiesДокумент13 страницPractical Accounting of Cash Flow From Operating ActivitiesDJ Nicart63% (8)

- Introduction of A Speaker SINGCULANДокумент2 страницыIntroduction of A Speaker SINGCULANRonna Mae DungogОценок пока нет

- GE 104 Lecture 1 Person Authorized To Conduct Land Survey - PPSXДокумент58 страницGE 104 Lecture 1 Person Authorized To Conduct Land Survey - PPSXBroddett Bello AbatayoОценок пока нет

- Steve BuchheitДокумент4 страницыSteve BuchheitCulverhouse InteractiveОценок пока нет

- BeaconДокумент20 страницBeaconCatawba SecurityОценок пока нет

- Tobacco UK - TSNichollДокумент21 страницаTobacco UK - TSNicholltsnichollОценок пока нет

- 1Документ13 страниц1gamalbedОценок пока нет

- Tax Movie Research Paper - AAДокумент6 страницTax Movie Research Paper - AAAndrea Galeazzi RosilloОценок пока нет

- Case Digest in ConstiДокумент11 страницCase Digest in ConstiAllana Erica CortesОценок пока нет

- Kiplinger's Personal Finance - January 2018 PDFДокумент74 страницыKiplinger's Personal Finance - January 2018 PDFjkavinОценок пока нет