Академический Документы

Профессиональный Документы

Культура Документы

2015 16PreliminaryBudget

Загружено:

Al LeachОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2015 16PreliminaryBudget

Загружено:

Al LeachАвторское право:

Доступные форматы

LEA Name:

Pottsgrove SD

Class: 3

AUN Number:

County:

123466303

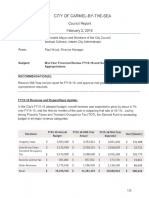

PDE-2028 - PRELIMINARY GENERAL FUND BUDGET

Fiscal Year 07/01/2015 - 06/30/2016

General Fund Budget Approval

Date of Adoption of the General Fund Budget:

President of the Board - Original Signature Required

Date

Secretary of the Board - Original Signature Required

Date

Chief School Administrator - Original Signature Required

Date

Ronald Linke

(610) 327-2277

Contact Person

Telephone

rlinke@pgsd.org

E-mail Address

Return to:

1/13/2015 3:20:45 PM

Pennsylvania Department of Education

Bureau of Budget and Fiscal Management

Division of Subsidy Data and Administration

333 Market Street

Harrisburg, PA 17126-0333

1024

Extension

Montgomery

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:20:51 PM v1.0

ITEM

ESTIMATED REVENUES AND OTHER FINANCING SOURCES: BUDGET SUMMARY

Page A-1

AMOUNTS

Estimated Beginning Unreserved Fund Balance Available for

Appropriation and Reserves Scheduled For Liquidation During

The Fiscal Year

Estimated Beginning Fund Balance - Committed

6,640,000

2

3

Estimated Beginning Fund Balance - Assigned

Estimated Beginning Fund Balance - Unassigned

4,557,181

Total Estimated Beginning Unreserved Fund Balance Available

for Appropriation and Reserves Scheduled For Liquidation

During The Fiscal Year

11,197,181

Estimated Revenues And Other Financing Sources

6000

Revenue from Local Sources

46,607,004

7000

Revenue from State Sources

16,278,964

8000

Revenue from Federal Sources

9000

Other Financing Sources

937,608

Total Estimated Revenues And Other Financing Sources

63,823,576

Total Estimated Fund Balance, Revenues, and Other Financing

Sources Available for Appropriation

75,020,757

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:20:55 PM v1.0

FUNCTION

DESCRIPTION

REVENUE FROM LOCAL SOURCES

6111

Current Real Estate Taxes

ESTIMATED REVENUES AND OTHER FINANCING SOURCES: DETAIL

Page B-1

Amounts

40,438,990

6112

Interim Real Estate Taxes

6113

Public Utility Realty Tax

6114

Payments in Lieu of Current Taxes - State / Local Reimbursement

6115

Payments in Lieu of Current Taxes - Federal Reimbursement

6120

Per Capita Taxes, Section 679

6130

Taxpayer Relief Taxes - Proportional Assessments

6140

Current Act 511 Taxes - Flat Rate Assessments

6150

Current Act 511 Taxes - Proportional Assessments

6160

Non-Real Estate Taxes - First Class Districts Only

6400

Delinquencies on Taxes Levied / Assessed by LEA

6500

Earnings on Investments

6700

Revenues from District Activities

6800

Revenue from Intermediary Sources / Pass-Through Funds

6910

Rentals

37,500

6920

Contributions/Donations/Grants From Private Sources

55,000

6940

Tuition from Patrons

6960

Services Provided Other Local Governmental Units / LEAs

6970

Services Provided Other Funds

6980

Revenue From Community Service Activities

6990

Refunds and Other Miscellaneous Revenue

REVENUE FROM LOCAL SOURCES

100,000

52,000

0

0

54,000

0

80,000

3,600,000

0

1,225,000

100,000

40,000

624,514

10,000

120,000

0

0

70,000

46,607,004

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:20:56 PM v1.0

FUNCTION

DESCRIPTION

REVENUE FROM STATE SOURCES

7110

Basic Education Funding (Gross)

ESTIMATED REVENUES AND OTHER FINANCING SOURCES: DETAIL

Page B-2

Amounts

7,683,694

7160

Tuition for Orphans and Children Placed in Private Homes

7170

School Improvement Grants

7180

Staff and Program Development

7220

Vocational Education

7240

Driver Education - Student

7250

Migratory Children

7260

Workforce Investment Act

7271

Special Education Funding for School Aged Pupils

7272

Early Intervention

7280

Adult Literacy

7292

Pre-K Counts

7299

Other Program Subsidies Not Listed in 7200 Series

7310

Transportation (Regular and Additional)

950,000

7320

Rental and Sinking Fund Payments / Building Reimbursement Subsidy

859,265

7330

Health Services (Medical, Dental, Nurse, Act 25)

7340

State Property Tax Reduction Allocation

7350

Sewage Treatment Operations / Environmental Subsidies

7360

Safe Schools

7400

Vocational Training of the Unemployed

7501

PA Accountability Grants

7505

Ready to Learn Block Grant

7509

Supplemental Equipment Grants

7598

Revenue for the Support of Public Schools

7599

Other State Revenue Not Listed in the 7500 Series

140,000

7810

7820

State Share of Social Security and Medicare Taxes

State Share of Retirement Contributions

1,020,000

3,460,000

7900

Revenue for Technology

REVENUE FROM STATE SOURCES

75,000

0

1,700,000

65,000

0

326,005

0

0

0

16,278,964

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:20:56 PM v1.0

FUNCTION

DESCRIPTION

REVENUE FROM FEDERAL SOURCES

8110

Payments for Federally Impacted Areas - P.L. 81-874

ESTIMATED REVENUES AND OTHER FINANCING SOURCES: DETAIL

Page B-3

Amounts

0

8190

Other Unrestricted Grants-in-Aid Direct from Federal Government

8200

Unrestricted Grants-in-Aid from Federal Gov't Through Commonwealth

8310

Payments for Federally Impacted Areas - P.L. 81-815

8320

Energy Conservation Grants - TA and ECM

8390

Other Restricted Grants-in-Aid Directly from Federal Government

8511

Grants for IDEA and NCLB Programs not Specified in 8510 series

8512

IDEA, Part B

8513

IDEA, Section 619

8514

NCLB, Title I - Improving the Acad. Achvmnt. of the Disadvantaged

386,815

8515

NCLB, Title II - Prep., Train. & Recruit. High Qual. Teachers & Principals

200,793

8516

NCLB, Title III - Language Instr. for LEP and Immgrant Students

8517

NCLB, Title IV - 21st Century Schools

8518

NCLB, Title V Promoting Informed Parental Choice And Innovative Programs

8519

NCLB, Title VI - Flexibility and Accountability

8521

Vocational Education - Operating Expenditures

8540

Nutrition Education and Training

8560

Federal Block Grants

8580

Child Care and Development Block Grants

8610

Homeless Assistance Act

8620

Adult Basic Education

8640

Headstart

8660

Workforce Investment Act

8690

Other Restricted Federal Grants-in-Aid Through the Commonwealth

8731

ARRA - Build America Bonds

8732

8733

ARRA-Qualified School Construction Bonds (QSCB)

ARRA-Qualified Zone Academy Bonds (QZAB)

0

0

8810

School-Based Access Medicaid Reimbursement Program (SBAP) (ACCESS)

8820

8830

Medical Assistance Reimbursement For Administrative Claiming (Quarterly)

Medical Assistance Reimbursements (ACCESS) - Early Intervention

REVENUE FROM FEDERAL SOURCES

350,000

0

0

937,608

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:20:56 PM v1.0

FUNCTION

DESCRIPTION

OTHER FINANCING SOURCES

9100

Sale of Bonds

ESTIMATED REVENUES AND OTHER FINANCING SOURCES: DETAIL

Page B-4

Amounts

0

9200

Proceeds From Extended Term Financing

9320

Special Revenue Fund Transfers

9330

Capital Projects Fund Transfers

9340

Debt Service Fund Transfers

9350

Enterprise Fund Transfers

9360

Internal Service Fund Transfers

9370

Trust and Agency Fund Transfers

9380

Activity Fund Transfers

9390

Permanent Fund Transfers

9400

Sale or Compensation for Loss of Fixed Assets

9500

Capital Contributions

9710

Transfers from Component Units

9720

Transfers from Primary Governments

9800

Intrafund Transfers In

9900

Other Financing Sources Not Listed in the 9000 Series

OTHER FINANCING SOURCES

TOTAL ESTIMATED REVENUES AND OTHER SOURCES

0

63,823,576

Real Estate Tax Rate (RETR) Report for 2015-2016

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:01 PM v1.0

Act 1 Index (current): 2.4%

Calculation Method:

Multi-County Rebalancing Based on Methodology of Section 672.1 of School Code

Page C-1

Revenue

Number of Decimals For Tax Rate Calculation:

Approx. Tax Revenue from RE Taxes:

Amount of Tax Relief for Homestead Exclusions

$40,439,023

$0

Total Approx. Tax Revenue:

Approx. Tax Levy for Tax Rate Calculation:

$40,439,023

$42,300,233

Montgomery

I.

2014-15 Data

a. Assessed Value

$1,078,300,000

b. Real Estate Mills

37.5095

2015-16 Data

c. 2013 STEB Market Value

d. Assessed Value

II.

2015-16 Calculations

g. Percent of Total Market Value

h. Rebalanced 2014-15 Tax Levy

(f Total * g)

i. Base Mills Subject to Index

(h / a * 1000) if no reassessment

(h / (d-e) * 1000) if reassessment

Calculation of Tax Rates and Levies Generated

j. Weighted Avg. Collection Percentage

k. Tax Levy Needed

$1,078,300,000

$1,483,298,229

$1,483,298,229

$1,078,300,000

$1,078,300,000

$0

$0

e. Assessed Value of New Constr/ Renov

2014-15 Calculations

f. 2014-15 Tax Levy

(a * b)

Total

$40,446,494

$40,446,494

100.00000%

100.00000%

$40,446,494

$40,446,494

37.5095

95.60000%

95.60000%

$42,300,233

$42,300,233

(Approx. Tax Levy * g)

III.

l. 2015-16 Real Estate Tax Rate

39.2286

(k / d * 1000)

m. Tax Levy Generated by Mills

$42,300,199

$42,300,199

(l / 1000 * d)

n. Tax Levy minus Tax Relief for Homestead Exclusions

(m - Amount of Tax Relief for Homestead Exclusions)

o. Net Tax Revenue Generated By Mills

(n * Est. Pct. Collection)

$42,300,199

$40,438,990

Real Estate Tax Rate (RETR) Report for 2015-2016

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:02 PM v1.0

Act 1 Index (current): 2.4%

Calculation Method:

Revenue

Number of Decimals For Tax Rate Calculation:

Approx. Tax Revenue from RE Taxes:

Amount of Tax Relief for Homestead Exclusions

Multi-County Rebalancing Based on Methodology of Section 672.1 of School Code

Page C-2

$40,439,023

+

Total Approx. Tax Revenue:

Approx. Tax Levy for Tax Rate Calculation:

$0

$40,439,023

$42,300,233

Montgomery

Index Maximums

p. Maximum Mills Based On Index

(i * (1 + Index))

q. Mills In Excess of Index

Total

38.4097

0.8189

0.8189

$41,417,180

$41,417,180

if (l > p), (l - p)

r. Maximum Tax Levy Based On Index

IV.

(p / 1000) * d)

s. Millage Rate within Index?

No

(If l > p Then No)

t. Tax Levy In Excess of Index

if (m > r), (m - r)

$883,019

$883,019

u. Tax Revenue In Excess of Index

$844,166

$844,166

(t * Est. Pct. Collection)

Information Related to Property Tax Relief

Assessed Value Exclusion per Homestead

Number of Homestead/Farmstead Properties

V.

Median Assessed Value of Homestead Properties

$0

0

0

$0

Real Estate Tax Rate (RETR) Report for 2015-2016

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:03 PM v1.0

Act 1 Index (current): 2.4%

Calculation Method:

Revenue

Number of Decimals For Tax Rate Calculation:

Approx. Tax Revenue from RE Taxes:

Amount of Tax Relief for Homestead Exclusions

Multi-County Rebalancing Based on Methodology of Section 672.1 of School Code

Page C-3

$40,439,023

+

Total Approx. Tax Revenue:

Approx. Tax Levy for Tax Rate Calculation:

$0

$40,439,023

$42,300,233

Total

Montgomery

State Property Tax Reduction Allocation used for: Homestead Exclusions

Prior Year State Property Tax Reduction Allocation used for: Homestead Exclusions

Amount of Tax Relief from State/Local Sources

$0

$0

Lowering RE Tax Rate

$0

$0

$0

$0

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:05 PM v1.0

LOCAL EDUCATION AGENCY TAX DATA (TAXD)

REAL ESTATE, PER CAPITA (SEC. 679), EIT/PIT (ACT 1), LOCAL ENABLING (ACT 511)

Page D-1

CODE

6111

Current Real Estate Taxes

County Name

Montgomery

Taxable Assessed Value

1,078,300,000

Totals:

Real Estate Mills

39.2286

Amount of Tax Relief for

Homestead Exclusions

Tax Levy Generated by Mills

Tax Levy Minus Homestead

Exclusions

42,300,199

95.60000%

0.00000%

0.00000%

0.00000%

1,078,300,000

42,300,199

42,300,199

95.60000%

Rate

6120

Per Capita Taxes, Section 679

6140

Current Act 511 Taxes - Flat Rate Assessments

6141

Per Capita Taxes, Act 511

Net Tax Revenue

Generated By Mills

Percent Collected

40,438,990

Estimated Revenue

5.00

54,000

Rate

Add'l Rate (if appl.)

Tax Levy

$5.00

$0.00

54,000

Estimated Revenue

54,000

6142

Occupation Taxes - Flat Rate

$0.00

$0.00

6143

Local Services / Occupational Privilege Taxes

$5.00

$0.00

26,000

26,000

6144

6145

Trailer Taxes

Business Privilege Taxes - Flat Rate

$0.00

$0.00

$0.00

$0.00

0

0

0

0

6146

Mechanical Device Taxes - Flat Rate

$0.00

$0.00

6149

Other Flat Rate Assessments

Total Current Act 511 Taxes - Flat Rate Assessments

$0.00

$0.00

0

80,000

80,000

6150

Current Act 511 Taxes - Proportional Assessments

6151

Earned Income Taxes, Act 511

Tax Levy

Rate

Add'l Rate (if appl.)

0.50%

0.00%

2,820,000

Estimated Revenue

2,820,000

6152

Occupation Taxes - Proportional Rate

6153

Real Estate Transfer Taxes

0.50%

0.00%

315,000

315,000

6154

Amusement Taxes

0.00%

0.00%

6155

Business Privilege Taxes - Proportional Rate

6156

Mechanical Device Taxes - Percentage

0.00%

0.00%

6157

Mercantile Taxes

1.5

465,000

465,000

6159

Other Proportional Assessments

Total Current Act 511 Taxes - Proportional Assessments

3,600,000

3,600,000

Total Act 511, Current Taxes

3,680,000

Act 511 Tax Limit

--->

1,483,298,229

Market Value

12

Mills

17,799,579

(511 Limit)

Comparison of Tax Rate Changes to Index (CTRI)

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:13 PM v1.0

2014-2015 vs. 2015-2016

Page E-1

Tax Rate Charged in:

Tax

Function

6111

Description

2015-2016

Less than

or equal to

Index

Additional Tax Rate

Charged in:

Index

Current Real Estate Taxes

Montgomery County

6120

2014-2015

(Rebalanced)

Percent

Change in

Rate

Per Capita Taxes, Section 679

37.5095

39.2286

$5.00

$5.00

$5.00

4.58%

No

2.4%

0.00%

Yes

2.4%

$5.00

0.00%

Yes

2.4%

$5.00

$5.00

0.00%

Yes

2.4%

0.500%

0.500%

0.00%

Yes

2.4%

0.500%

0.500%

0.00%

Yes

2.4%

1.500

1.5000

0.00%

Yes

2.4%

Act 1 EIT/PIT

6131

Earned Income Taxes, Act 1

6132

Personal Income Taxes, Act 1

Act 511 Flat Rate Taxes

6141

Per Capita Taxes, Act 511

6142

Occupation Taxes - Flat Rate

6143

Local Services / Occupational Privilege Tax

6144

Trailer Taxes

6145

Business Privilege Taxes - Flat Rate

6146

Mechanical Device Taxes - Flat Rate

6149

Other Flat Rate Assessments

Act 511 Proportional Rate Taxes

6151

Earned Income Taxes, Act 511

6152

Occupation Taxes - Proportional Rate

6153

Real Estate Transfer Taxes

6154

Amusement Taxes

6155

Business Privilege Taxes - Proportional Rate

6156

Mechanical Device Taxes - Percentage

6157

Mercantile Taxes

6159

Other Proportional Assessments

2014-2015

(Rebalanced)

2015-2016

Percent

Change in

Rate

Less than

or equal to

Index

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:27 PM v1.0

ESTIMATED EXPENDITURES AND OTHER FINANCING USES: BUDGET SUMMARY

Page F-1

ITEM

AMOUNTS

1000

Instruction

24,979,100

10,190,883

2,022,030

200,657

0

0

0

0

37,392,670

2000

1100

Regular Programs - Elementary/Secondary

1200

Special Programs - Elementary/Secondary

1300

Vocational Education

1400

Other Instructional Programs - Elementary/Secondary

1500

Nonpublic School Programs

1600

Adult Education Programs

1700

Higher Education Programs

1800

Pre-Kindergarten

Total 1000 Instruction

Support Services

2,024,649

2,459,433

3,604,428

715,213

829,071

5,275,011

2,790,800

2,732,186

34,000

20,464,791

3000

2100

Support Services - Pupil Personnel

2200

Support Services - Instructional Staff

2300

Support Services - Administration

2400

Support Services - Pupil Health

2500

Support Services - Business

2600

Operation & Maintenance of Plant Services

2700

Student Transportation Services

2800

Support Services - Central

2900

Other Support Services

Total 2000 Support Services

Operation of Non-instructional Services

4000

3100

Food Services

3200

Student Activities

3300

Community Services

3400

Scholarships and Awards

Total 3000 Operation of Non-instructional Services

Facilities Acquisition, Construction and Improvement Services

4000

Facilities Acquisition, Construction and Improvement Services

Total 4000 Facilities Acquisition, Construction and Improvement

5000

0

1,074,938

17,000

0

1,091,938

0

0

Total Estimated Expenditures

Other Expenditures and Financing Uses

5100

Debt Service

5200

Interfund Transfers - Out

5300

Transfers Involving Component Units

5500

Special and Extraordinary Items

5900

Budgetary Reserve

Total Other Financing Uses

Total Estimated Expenditures and Other Financing Uses

Appropriation of Prior Year Fund Balance

Total Appropriations

Ending Committed, Assigned and Unassigned Fund Balance

58,949,399

5,624,210

0

0

0

625,000

6,249,210

65,198,609

0

65,198,609

9,822,148

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:31 PM v1.0

Function-Object

1000

ESTIMATED EXPENDITURES AND OTHER FINANCING USES: DETAIL

Page G-1

Description

Amounts

INSTRUCTION

1100 Regular Programs - Elementary/Secondary

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Regular Programs - Elementary/Secondary

1200

Special Programs - Elementary/Secondary

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Special Programs - Elementary/Secondary

1300

4,078,508

2,758,334

1,381,626

17,990

1,830,985

109,640

11,575

2,225

10,190,883

Vocational Education

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Vocational Education

1400

14,453,617

8,245,453

117,840

12,477

1,407,470

669,114

64,849

8,280

24,979,100

0

0

0

0

2,022,030

0

0

0

2,022,030

Other Instructional Programs - Elementary/Secondary

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Other Instructional Programs - Elementary/Secondary

110,000

36,907

30,000

0

23,750

0

0

0

200,657

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:31 PM v1.0

Function-Object

1500

Description

0

0

0

0

0

0

0

0

0

Higher Education Programs

500

Other Purchased Services

600

Supplies

Total Higher Education Programs

1800

0

0

0

0

0

0

0

0

0

Adult Education Programs

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Adult Education Programs

1700

Amounts

Nonpublic School Programs

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Nonpublic School Programs

1600

ESTIMATED EXPENDITURES AND OTHER FINANCING USES: DETAIL

Page G-2

0

0

0

Pre-Kindergarten

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Pre-Kindergarten

Total Instruction

0

0

0

0

0

0

0

0

0

37,392,670

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:31 PM v1.0

Function-Object

2000

ESTIMATED EXPENDITURES AND OTHER FINANCING USES: DETAIL

Page G-3

Description

Amounts

SUPPORT SERVICES

2100 Support Services - Pupil Personnel

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Support Services - Pupil Personnel

2200

Support Services - Instructional Staff

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Support Services - Instructional Staff

2300

1,235,165

754,525

337,323

830

35,500

93,970

0

2,120

2,459,433

Support Services - Administration

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Support Services - Administration

2400

1,175,582

679,967

105,550

0

2,000

60,690

0

860

2,024,649

2,019,983

1,092,085

309,950

4,310

85,000

50,100

7,000

36,000

3,604,428

Support Services - Pupil Health

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Support Services - Pupil Health

424,272

239,796

11,825

0

0

19,045

20,275

0

715,213

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:31 PM v1.0

Function-Object

2500

Description

1,957,458

1,240,553

172,000

383,000

232,300

1,275,200

11,000

3,500

5,275,011

Student Transportation Services

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Student Transportation Services

2800

379,394

238,766

7,940

106,900

8,500

85,371

0

2,200

829,071

Operation & Maintenance of Plant Services

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Operation & Maintenance of Plant Services

2700

Amounts

Support Services - Business

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Support Services - Business

2600

ESTIMATED EXPENDITURES AND OTHER FINANCING USES: DETAIL

Page G-4

0

0

1,490,000

47,100

579,200

423,000

250,000

1,500

2,790,800

Support Services - Central

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Support Services - Central

598,912

778,723

36,999

966,772

14,000

283,555

52,500

725

2,732,186

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:31 PM v1.0

Function-Object

2900

ESTIMATED EXPENDITURES AND OTHER FINANCING USES: DETAIL

Page G-5

Description

Amounts

Other Support Services

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Other Support Services

0

0

0

0

34,000

0

0

0

34,000

Total Support Services

3000

20,464,791

OPERATION OF NON-INSTRUCTIONAL SERVICES

3100 Food Services

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Food Services

3200

0

0

0

0

0

0

0

0

0

Student Activities

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Student Activities

604,105

249,133

65,000

25,600

23,600

75,700

7,100

24,700

1,074,938

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:31 PM v1.0

Function-Object

3300

Description

Amounts

Community Services

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Community Services

3400

ESTIMATED EXPENDITURES AND OTHER FINANCING USES: DETAIL

Page G-6

0

0

17,000

0

0

0

0

0

17,000

Scholarships and Awards

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

800

Other Objects

Total Scholarships and Awards

0

0

0

0

0

0

0

0

0

Total Operation of Non-instructional Services

4000

FACILITIES ACQUISITION, CONSTRUCTION AND IMPROVEMENT

4000 Facilities Acquisition, Construction and Improvement Services

100

Personnel Services-Salaries

200

Personnel Services-Employee Benefits

300

Purchased Professional & Technical Services

400

Purchased Property Services

500

Other Purchased Services

600

Supplies

700

Property

Total Facilities Acquisition, Construction and Improvement Services

5000

1,091,938

0

0

0

0

0

0

0

0

OTHER EXPENDITURES AND FINANCING USES

5100 Debt Service

800

Other Objects

900

Other Uses of Funds

Total Debt Service

5200

1,349,210

4,275,000

5,624,210

Interfund Transfers - Out

900

Other Uses of Funds

Total Interfund Transfers - Out

0

0

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:31 PM v1.0

Function-Object

5300

Description

0

0

Special and Extraordinary Items

800

Other Objects

900

Other Uses of Funds

Total Special and Extraordinary Items

5900

Amounts

Transfers Involving Component Units

900

Other Uses of Funds

Total Transfers Involving Component Units

5500

ESTIMATED EXPENDITURES AND OTHER FINANCING USES: DETAIL

Page G-7

0

0

0

Budgetary Reserve

800

Other Objects

Total Budgetary Reserve

Total Other Expenditures and Financing Uses

TOTAL EXPENDITURES

625,000

625,000

6,249,210

65,198,609

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:33 PM v1.0

SCHEDULE OF CASH AND INVESTMENTS (CAIN)

Page H-1

06/30/2015 Estimate

06/30/2016 Projection

CASH AND SHORT-TERM INVESTMENTS

General Fund

13,000,000

12,500,000

Athletic/School-Sponsored Extra Curricular Activities

Other Comptroller-Approved Special Revenue Fund

Special Revenue Fund

Capital Projects Fund

Capital Reserve Fund - 690

Capital Reserve Fund - 1431

5,000,000

4,000,000

Capital Projects Fund Other

Debt Service Fund

Enterprise Fund (Food Service, Child Care)

Internal Service Fund

75,000

70,000

1,500,000

2,000,000

Fiduciary Trust Fund (Investment, Pension)

65,000

60,000

Agency Fund

85,000

80,000

19,725,000

18,710,000

Athletic/School-Sponsored Extra Curricular Activities

Other Comptroller-Approved Special Revenue Fund

Capital Reserve Fund - 690

Capital Reserve Fund - 1431

Capital Projects Fund Other

0

0

0

0

Debt Service Fund

Enterprise Fund (Food Service, Child Care)

Internal Service Fund

0

0

0

0

Fiduciary Trust Fund (Investment, Pension)

Agency Fund

Total Long-Term Investments

19,725,000

18,710,000

Total Cash and Short-Term Investments

LONG-TERM INVESTMENTS

General Fund

Special Revenue Fund

Capital Projects Fund

TOTAL CASH AND INVESTMENTS

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:36 PM v1.0

SCHEDULE OF INDEBTEDNESS (DEBT)

Page I-1

06/30/2015 Estimate

06/30/2016 Projection

LONG-TERM INDEBTEDNESS

Extended Term Financing Agreements Payable

Other Long-Term Liabilities

0

40,000,000

Bonds Payable

Lease-Purchase Obligations

45,000,000

0

375,000

365,000

45,375,000

40,365,000

General Fund

Other Funds

TOTAL SHORT-TERM PAYABLES

45,375,000

40,365,000

Accumulated Compensated Absences

Authority Lease Obligations

TOTAL LONG-TERM INDEBTEDNESS

SHORT-TERM PAYABLES

TOTAL INDEBTEDNESS

2015-2016 Preliminary General Fund Budget (PDE-2028)

AUN:

123466303 Pottsgrove SD

Printed 1/13/2015 3:21:38 PM v1.0

Account

0830

Description

Estimated Ending Committed Fund Balance

Fund Balance Summary (FBS)

Page J-1

Amounts

5,890,000

Explanation: Funds set aside for future PSERS rate increases and OPEB

0840

Estimated Ending Assigned Fund Balance

0850

Estimated Ending Unassigned Fund Balance

3,932,148

Explanation: Funds to help start the succeeding fiscal year

Total Ending Fund Balance - Committed, Assigned, and

Unassigned

5900

Budgetary Reserve

9,822,148

625,000

Explanation: Funds for unanticipated expenditures

Total Estimated Ending Committed, Assigned, and

Unassigned Fund Balance and Budgetary Reserve

Estimated Ending Nonspendable and Restricted Fund Balances Not

Scheduled for Liquidation

10,447,148

Вам также может понравиться

- 2013-14 Proposed FInal BudgetДокумент23 страницы2013-14 Proposed FInal BudgetPress And JournalОценок пока нет

- Order #122725511Документ6 страницOrder #122725511Henry BetОценок пока нет

- 2013 Proposed Program Budget: Village of Grafton, WisconsinДокумент42 страницы2013 Proposed Program Budget: Village of Grafton, Wisconsinsschuster4182Оценок пока нет

- New - Haven - FY 2015-16 Mayors Budget1Документ419 страницNew - Haven - FY 2015-16 Mayors Budget1Helen BennettОценок пока нет

- 2013 14 d156 Budget State Form 091013Документ29 страниц2013 14 d156 Budget State Form 091013api-233183949Оценок пока нет

- 2012-13 Budget Presentation As of 1-4-12Документ38 страниц2012-13 Budget Presentation As of 1-4-12Hemanta BaishyaОценок пока нет

- Lakeport City Council - Budget PresentationДокумент37 страницLakeport City Council - Budget PresentationLakeCoNewsОценок пока нет

- Saskatoon City Budget 2015Документ3 страницыSaskatoon City Budget 2015David A. GilesОценок пока нет

- Draft: 2015 Minnesota House of Representatives - HF 848, Omnibus Tax Bill General Fund Tax RevenuesДокумент14 страницDraft: 2015 Minnesota House of Representatives - HF 848, Omnibus Tax Bill General Fund Tax Revenuescrichert30Оценок пока нет

- October 8, 2012 Forum: Impact of Props 30 & Passing/Not Passing On SPUSD and Extension of Existing Parcel TaxДокумент18 страницOctober 8, 2012 Forum: Impact of Props 30 & Passing/Not Passing On SPUSD and Extension of Existing Parcel Taxk12newsnetworkОценок пока нет

- HB-SB76 Presentation To Senate Finance 10-15-2013Документ29 страницHB-SB76 Presentation To Senate Finance 10-15-2013shadowchbОценок пока нет

- Seminole County Public Schools Budget Work SessionДокумент9 страницSeminole County Public Schools Budget Work SessionWekivaPTAОценок пока нет

- WPS FY15 Preliminary Budget EstimatesДокумент32 страницыWPS FY15 Preliminary Budget EstimatesMegan BardОценок пока нет

- Lakewood Final ReportДокумент24 страницыLakewood Final ReportAsbury Park PressОценок пока нет

- LM2 2011 MeaДокумент127 страницLM2 2011 MeaRob LawrenceОценок пока нет

- IT Calculator, Mohandas 2013Документ36 страницIT Calculator, Mohandas 2013DEEPTHISAIОценок пока нет

- Highlights of The North Carolina Public School Budget 2013Документ41 страницаHighlights of The North Carolina Public School Budget 2013Nathaniel MaconОценок пока нет

- MSD 2011/12 Preliminary BudgetДокумент123 страницыMSD 2011/12 Preliminary BudgetDebra KolrudОценок пока нет

- Shenendehowa School District Budget PresentationДокумент21 страницаShenendehowa School District Budget PresentationDavid LombardoОценок пока нет

- W-2 Preview ADPДокумент4 страницыW-2 Preview ADPRyan AllenОценок пока нет

- ABC Annexure 'B': Journals & Librarary FacilitiesДокумент67 страницABC Annexure 'B': Journals & Librarary FacilitieslicgroupsОценок пока нет

- Miag-Ao Iloilo ES2014Документ5 страницMiag-Ao Iloilo ES2014Roi Baltazar BaylenОценок пока нет

- Laws Relating To Finance and Support Services of TESDA, CHED, Dep-EdДокумент51 страницаLaws Relating To Finance and Support Services of TESDA, CHED, Dep-EdEron Roi Centina-gacutan100% (1)

- 2013-2014 BudgetДокумент16 страниц2013-2014 Budgetharryb1978Оценок пока нет

- Fy 2015 Mayors BudgetДокумент398 страницFy 2015 Mayors BudgetMark BrackenburyОценок пока нет

- CBSE SCH VI MaterialДокумент10 страницCBSE SCH VI MaterialTanuj JhunjhunwalaОценок пока нет

- Budget Ordinance 2013-2014Документ6 страницBudget Ordinance 2013-2014Jesse Franklin SrОценок пока нет

- 16 07 July Bot DraftДокумент8 страниц16 07 July Bot Draftapi-254207269Оценок пока нет

- City of Carmel-By-The-Sea: Council Report February 2, 2016Документ6 страницCity of Carmel-By-The-Sea: Council Report February 2, 2016L. A. PatersonОценок пока нет

- Fargo 2013 Financial ReportДокумент16 страницFargo 2013 Financial ReportRob PortОценок пока нет

- MOUSUMI Income Tax Calculation 2015-16.Документ4 страницыMOUSUMI Income Tax Calculation 2015-16.anirbanpwd76Оценок пока нет

- Elcc3 1financial Analysis-2Документ9 страницElcc3 1financial Analysis-2api-232175107Оценок пока нет

- Best BudgetДокумент31 страницаBest BudgetSyed Muhammad Ali SadiqОценок пока нет

- Wealth Managemen T Project: Submitted by Talluri PrasanthДокумент7 страницWealth Managemen T Project: Submitted by Talluri PrasanthPrasanth TalluriОценок пока нет

- North Syracuse Central School District: Proposed BudgetДокумент30 страницNorth Syracuse Central School District: Proposed BudgetTime Warner Cable NewsОценок пока нет

- Apac BFP 2015-16Документ202 страницыApac BFP 2015-16derr barrОценок пока нет

- ENCSD, NCSD Closing in HOUSE BILL 200 RATIFIED BILL Section 7.25. (A)Документ343 страницыENCSD, NCSD Closing in HOUSE BILL 200 RATIFIED BILL Section 7.25. (A)Brance-Rhonda LongОценок пока нет

- Fed Fund Report 2001Документ6 страницFed Fund Report 2001Kartika Ramadhani BahriОценок пока нет

- IT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsДокумент106 страницIT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsnarayanan630% (1)

- Bob Jones University Financial InfoДокумент8 страницBob Jones University Financial InfoblogwoapologyОценок пока нет

- Income Tax Calculation Statement: (Financial Year 2013-2014, and The Assessment Year 2014 - 2015)Документ17 страницIncome Tax Calculation Statement: (Financial Year 2013-2014, and The Assessment Year 2014 - 2015)saravanand1983Оценок пока нет

- 2010 - 2025 Scott County Iowa's Strategic PlanДокумент20 страниц2010 - 2025 Scott County Iowa's Strategic PlanIowans For Accountability - Scott CountyОценок пока нет

- SHS Implementation Updates For R7Документ141 страницаSHS Implementation Updates For R7tumasitoeОценок пока нет

- Pay SlipДокумент50 страницPay SlipSushil Shrestha100% (1)

- City of Troy Financial PresentationДокумент62 страницыCity of Troy Financial PresentationThe Saratogian and Troy RecordОценок пока нет

- New Haven Proposed Budget 2012 13Документ373 страницыNew Haven Proposed Budget 2012 13Helen BennettОценок пока нет

- 2010 LM-2 (AFSCME Council 5)Документ28 страниц2010 LM-2 (AFSCME Council 5)Jonathan BlakeОценок пока нет

- Schedule C Fy2013 EducationДокумент4 страницыSchedule C Fy2013 EducationGothamSchools.orgОценок пока нет

- School Aid BudgetДокумент8 страницSchool Aid BudgetWXYZ-TV Channel 7 DetroitОценок пока нет

- Pay SlipДокумент1 страницаPay SlipKyle Cruz0% (1)

- Fy 2014 Mayors Budget WebsiteДокумент437 страницFy 2014 Mayors Budget WebsiteHelen BennettОценок пока нет

- D.C. Commission On The Arts and Humanities: WWW - Dcarts.dc - Gov Telephone: 202-724-5613Документ10 страницD.C. Commission On The Arts and Humanities: WWW - Dcarts.dc - Gov Telephone: 202-724-5613Benjamin FreedОценок пока нет

- NCL Full Budget Report 14-15 (15-16)Документ17 страницNCL Full Budget Report 14-15 (15-16)api-257598923Оценок пока нет

- Nflpa 2015 - 2016 LM-2Документ522 страницыNflpa 2015 - 2016 LM-2Robert LeeОценок пока нет

- FY 2017 Budget AmendmentsДокумент2 страницыFY 2017 Budget AmendmentsIvan HerreraОценок пока нет

- General Fund Expenditures by Object and StaffingДокумент15 страницGeneral Fund Expenditures by Object and StaffingStatesman JournalОценок пока нет

- University Compensation DisclosureДокумент77 страницUniversity Compensation DisclosureFrances WillickОценок пока нет

- 2012/13: $73.7b (33.8% of GDP) : $7.3b $3.8b $23.2b $6.5bДокумент2 страницы2012/13: $73.7b (33.8% of GDP) : $7.3b $3.8b $23.2b $6.5briz2010Оценок пока нет

- NFLPA 2013 Dept of Labor LM-2Документ549 страницNFLPA 2013 Dept of Labor LM-2Robert LeeОценок пока нет

- Booster Club Membership FormДокумент1 страницаBooster Club Membership FormAl LeachОценок пока нет

- TH TH TH TH TH TH THДокумент4 страницыTH TH TH TH TH TH THAl LeachОценок пока нет

- TH TH TH TH TH TH THДокумент4 страницыTH TH TH TH TH TH THAl LeachОценок пока нет

- PA School Performance Profile Scores 2012-13Документ11 страницPA School Performance Profile Scores 2012-13Al LeachОценок пока нет

- PA School Performance Profile 12-13Документ22 страницыPA School Performance Profile 12-13Al LeachОценок пока нет

- PA School Performance Profile Scores 2012-13Документ11 страницPA School Performance Profile Scores 2012-13Al LeachОценок пока нет

- PA School Performance Profile Scores 2012-13Документ22 страницыPA School Performance Profile Scores 2012-13Al LeachОценок пока нет

- Board Notes 5-27-14Документ3 страницыBoard Notes 5-27-14Al LeachОценок пока нет

- Colleges That Required or Recommended The SAT Subject TestsДокумент14 страницColleges That Required or Recommended The SAT Subject TestsAl LeachОценок пока нет

- PA School Performance Profile Scores 2012-13Документ22 страницыPA School Performance Profile Scores 2012-13Al LeachОценок пока нет

- Standards Based GradingДокумент7 страницStandards Based GradingAl LeachОценок пока нет

- Upper Perkiomen Board NotesДокумент5 страницUpper Perkiomen Board NotesAl LeachОценок пока нет

- Action Agenda 6.17.14Документ16 страницAction Agenda 6.17.14Al LeachОценок пока нет

- PA School Performance Profile 12-13Документ22 страницыPA School Performance Profile 12-13Al LeachОценок пока нет

- Po#Sgrove School District Digital Learning Environment (Dile)Документ12 страницPo#Sgrove School District Digital Learning Environment (Dile)Al LeachОценок пока нет

- ASVAB Extra Sample Test 1Документ84 страницыASVAB Extra Sample Test 1Al LeachОценок пока нет

- ASvab Test Study GuideДокумент42 страницыASvab Test Study GuidedarnellreyesОценок пока нет

- West PointДокумент6 страницWest PointAl LeachОценок пока нет

- Colleges in PAДокумент14 страницColleges in PAAl LeachОценок пока нет

- University of North Carolina - Greensboro ChatДокумент6 страницUniversity of North Carolina - Greensboro ChatAl LeachОценок пока нет

- University of ArizonaДокумент6 страницUniversity of ArizonaAl LeachОценок пока нет

- Grove CityДокумент4 страницыGrove CityAl LeachОценок пока нет

- UCLA Chat SessionДокумент8 страницUCLA Chat SessionAl LeachОценок пока нет

- BucknellДокумент16 страницBucknellAl LeachОценок пока нет

- Mike Neiffer Public CommentДокумент1 страницаMike Neiffer Public CommentAl LeachОценок пока нет

- Community Connection 4 29Документ1 страницаCommunity Connection 4 29Al LeachОценок пока нет

- Texas TechДокумент8 страницTexas TechAl LeachОценок пока нет

- Boston UniversityДокумент7 страницBoston UniversityAl LeachОценок пока нет

- Grading Survey ResultsДокумент15 страницGrading Survey ResultsAl LeachОценок пока нет

- Clinical Hyperbaric Facility Accreditation Manual 2005 Edition (Revision 1)Документ83 страницыClinical Hyperbaric Facility Accreditation Manual 2005 Edition (Revision 1)Paulo Costa SilvaОценок пока нет

- Florida Medicaid Handbook enДокумент24 страницыFlorida Medicaid Handbook enSam CollazoОценок пока нет

- Verify Gov SGДокумент3 страницыVerify Gov SGWei Xi TeeОценок пока нет

- New Zealand - Student Visa and Permit GuideДокумент16 страницNew Zealand - Student Visa and Permit GuideMtj M FrueldaОценок пока нет

- Propping Up The War On Terror - Lies About The WTC by NIST and Underwriters Laboratories by Kevin RyanДокумент7 страницPropping Up The War On Terror - Lies About The WTC by NIST and Underwriters Laboratories by Kevin RyanTyrone DrummondОценок пока нет

- Ante MercyДокумент1 страницаAnte MercyQuintin ShoneОценок пока нет

- McCain 2008 Oppo File On RomneyДокумент200 страницMcCain 2008 Oppo File On Romneytonygoprano2850Оценок пока нет

- AIESEC in BhubaneswarДокумент12 страницAIESEC in BhubaneswarAnonymous tkDPgnОценок пока нет

- Gurgaon Kidney Scam Case JudgementДокумент199 страницGurgaon Kidney Scam Case JudgementSampath Bulusu50% (2)

- Alki-Foa 342 PDFДокумент9 страницAlki-Foa 342 PDFErick Francis Suárez VelásquezОценок пока нет

- Medibank Private Information SheetДокумент8 страницMedibank Private Information SheetJBОценок пока нет

- Uhip Claim Form July 2006-1-40Документ1 страницаUhip Claim Form July 2006-1-40CollinОценок пока нет

- WC 240aДокумент2 страницыWC 240ajeffdandelОценок пока нет

- Fema Certificate 700a 1Документ1 страницаFema Certificate 700a 1api-339075613Оценок пока нет

- Flowable Wound Matrix Outpatient Reimbursement Summary 2019Документ4 страницыFlowable Wound Matrix Outpatient Reimbursement Summary 2019Bob RiouxОценок пока нет

- Document Required For Enhancement of Enlistment-IndigenousДокумент1 страницаDocument Required For Enhancement of Enlistment-Indigenousbiswasdipankar05Оценок пока нет

- The Eritrean Diaspora Savior or Gravedigger of The Regime. 2013. Nicole Hirt (Papers)Документ34 страницыThe Eritrean Diaspora Savior or Gravedigger of The Regime. 2013. Nicole Hirt (Papers)Tam ThanhОценок пока нет

- CSP - IOM Process MapДокумент2 страницыCSP - IOM Process MapMudalib HersiОценок пока нет

- Letter For DILG SecretaryДокумент4 страницыLetter For DILG SecretaryLouie Pangilinan LanajaОценок пока нет

- Private Healthcare Inquiry Executive SummaryДокумент9 страницPrivate Healthcare Inquiry Executive SummaryBusinessTechОценок пока нет

- DR Sajida RazaДокумент1 страницаDR Sajida Razazahid buttОценок пока нет

- Nzse International FormДокумент13 страницNzse International FormRajvir SinghОценок пока нет

- Functionality of Barangay Development CouncilДокумент2 страницыFunctionality of Barangay Development Councilxilver0092% (25)

- Sindhudurg Multiple Murder Case Sessions Court Judgement-Death SentenceДокумент174 страницыSindhudurg Multiple Murder Case Sessions Court Judgement-Death SentenceSampath Bulusu100% (1)

- Infectious Disease Act, 2020 (1964)Документ3 страницыInfectious Disease Act, 2020 (1964)Bijay ThapaОценок пока нет

- CertificateverifiedfromAWWandSupervisor (ForRural) OrANMandLHV (ForUrban)Документ1 страницаCertificateverifiedfromAWWandSupervisor (ForRural) OrANMandLHV (ForUrban)Pawan SharmaОценок пока нет

- Ethics in Specific IssuesДокумент11 страницEthics in Specific IssuesadystiОценок пока нет

- 116H - Safety Bulletin. Permit To Work Compliance PDFДокумент1 страница116H - Safety Bulletin. Permit To Work Compliance PDFBala MuruganОценок пока нет

- Montgomery County, MD Employee Salaries and Overtime Earnings - 2009Документ155 страницMontgomery County, MD Employee Salaries and Overtime Earnings - 2009Washington Examiner100% (1)

- Adjustment Codes.....Документ2 страницыAdjustment Codes.....M RAFI US SAMADОценок пока нет