Академический Документы

Профессиональный Документы

Культура Документы

MAIN IDEAS IN CHAPTER 1, TOPIC 1, © Kermit Keeling: Solution - PAGE 1

Загружено:

юрий локтионовИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

MAIN IDEAS IN CHAPTER 1, TOPIC 1, © Kermit Keeling: Solution - PAGE 1

Загружено:

юрий локтионовАвторское право:

Доступные форматы

Chapter 1: Entity Types and Their Formation

COURSE MAP

Business

Entity

Types &

Formn

\

Federal Tax

System and

its

Implications

Business

Entity

Characterist

ics

\

/

Taxation of

Investment

Earnings &

Expenses

\

Tax Cost Recovery

(Depr)

\ /

Taxation of

Operating

Asset Dispositions

Accrual Tax

Accounting

What we need

to learn about

Taxn of

Corp.

Operations

Taxn of

Corp.

Distribution

s

State

and

\

/

Taxn of

PassThru

Entity

\

/

Operatio

ns

Key BookTax

Differences

Accounting

for

Income

Taxes

Business

Entities

Foundational Tax Knowledge

come

Taxa-

Taxn of

PassThru

Entity

State

Cash

Distribution

s

Local

and

Sales

Taxa-

Certain Business

Dedns

What we need to know

about

business income and

deductions

Local

In-

tion

Taxn of Investment

Sales

\

tion

What we need to

know

about corporation

taxation,

operations

and distributions

What we need

to

know about

passthrough

entity

operations

and

distributions

State

taxatio

n

we

need

to

learn

Advanced Tax Knowledge

OVERVIEW OF CHAPTER 1

HOW DOES THIS CHAPTER (BUSINESS ENTITY TYPES)

FIT IN THE FLOW OF A BUSINESS ENTITY TAX RETURN?

We must know the business entity typecorporation or

partnership

in order to determine what tax return it must file with the

IRS.

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 1

Chapter 1: Entity Types and Their Formation

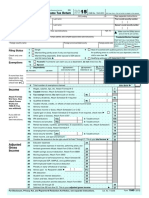

THERE ARE ONLY THREE DIFFERENT TAX RETURNS

THAT BUSINESS ENTITIES CAN FILE WITH THE IRS.

LETS LOOK AT THEM.

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 2

Chapter 1: Entity Types and Their Formation

Form

U.S. Corporation Income Tax Return

1120

A Check if

1 Consolidated return

2 Personal holding co.

3 Personal service crop.

4 Schedule M-3 required

E Check if: (1)

I

N

C

O

M

E

D

E

D

U

C

T

I

O

N

S

T

A

X

E

S

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

2013

For calendar year 2013 or the year begin______, and end______

Name of corporation

B Employer Id number

Number, street, and room or suite

C Date incorporated

City or town, state, and ZIP code

D Total assets (see instr)

Initial return (2)

Final Return (3)

Name Change (4)

a. Gross receipts or sales

1a

b. Returns and allowances

1b

Cost of goods sold (attach Form 1125-A)

Gross Profit. Subtract line 2 from line 1c

Dividends (Gross amount)

Interest......

Gross rents....

Gross Royalties.

Capital gain net income (attach Schedule D (Form 1120))..

Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797)..

Other income (attach statement)..

Total Income (loss). Add lines 3 through 10.

Compensation of officers (see instructionsattach Form 1125-E)

Salaries and Wages (less employment credits)

Repairs and maintenance.

Bad debts.....

Rent.....

Taxes and licenses...

Interest.....

Charitable contribution (see instructions)

Depreciation not claimed on Form 1125-A or elsewhere on rtrn (attach Form 4562)

Depletion... .....

Advertising...

Pension, profit-sharing, etc. plans....

Employee benefits programs....

Domestic production activities deduction (attach Form 8903)

Other deductions (attach statement).

Total deductions. Add lines 12 through 26

Taxable income before NOL and special deductions. Subtract line 27 from line 11

a. Net operating loss deduction (see instructions). 29a

b. Special deductions (Schedule C line 20) .. 29b

Taxable income. Subtract line 29c from line 28 (see instructions)..

Total tax (Schedule J, Part I, Line 11)..

Total payments and refundable credits (Schedule J, Part II, Line 21).

Estimate tax penalty (see instructions).

Amount owed. If line 32 is smaller than the total of lines 31 and 33.

Overpayment. If line 32 is larger than the total of lines 31 and 33...

Enter amt from ln 35 you want: Crd to 2014 estd tax

Refunded

Address change

1c

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29c

30

31

32

33

34

35

36

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 3

Chapter 1: Entity Types and Their Formation

Form

1120S

U.S. Income Tax Income for an S Corporation

2013

For calendar year 2013 or the year begin_____, and end_____

A S election effective date

Name of corporation

D Employer Id number

B. Business activity code

number (see instructions)

Number, street, and room or suite

E Date incorporated

City or town, state, and ZIP code

F Total assets (see instr)

C.

Check if Sch M-3 attached

G.

Is the corporation electing to be an S corporation beginning with this year?

Check if (1)

Final rtrn (2)

Name change (3)

Yes

Address change (4)

No

If yes attach Form 2553 if not already filed .

Amended rtrn (5)

S election termination or revocation

I Enter the number of shareholders who were shareholders during any part of the tax year

Caution. Include only trade or business income and expenses on lines 1a through 22 below. See instructions for more information.

1

I

N

C

O

M

E

D

E

D

U

C

T

I

O

N

S

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

Sign

a. Gross receipts or sales... 1a

b. Returns and allowances 1b

c. Balance. Subtract line 1b from line 1a

Cost of goods sold (attach Form 1125-A)...

Gross Profit. Subtract line 2 from line 1c..

Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797).

Other income (attach statement).

Total Income (loss). Add lines 3 through 5...

Compensation of officers (see instructionsattach Form 1125-E)

Salaries and Wages (less employment credits)

Repairs and maintenance.

Bad debts.....

Rent.....

Taxes and licenses...

Interest.....

Depreciation not claimed on Form 1125-A or elsewhere on return (attach Form 4562)

Depletion (Do not deduct oil and gas depletion).

Advertising......

Retirements plans, etc.....

Employee benefits programs...

Other deductions (attach statement)....

Total deductions. Add lines 12 through 26...

Ordinary business income (loss). Subtract line 20 from line 6..

1c

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and

statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration

of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here

Signature of officer

Date

Title of officer

Form 1120S

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 4

Chapter 1: Entity Types and Their Formation

Form

U.S. Return of Partnership Income

1065

2013

For calendar year 2013 or the year begin_______, and end_______

A Principle business activity

Name of Partnership

D Employer Id number

B Principle product or srvc

Number, street, and room or suite

E Date business started

C Business code number

City or town, state, and ZIP code

F Total assets (see instr)

Initial return (2)

Check applicable boxes (1)

(6)

H Accounting method: (1)

Final Return (3)

Name Change (4)

Address Change (5)

Amended Return

Technical termination also check (1) or (2)

Cash (2)

Accrual (3)

Other (specify)

I Number of Schedules K-1. Attach one for each person who was a partner during the year.

J Check if Schedules C and M-3 are attached

Caution. Include only trade or business income and expenses on lines 1a through 22 below. See instructions for more information.

I

N

C

O

M

E

D

E

D

U

C

T

I

O

N

S

1a

1b

1c

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16a

16b

17

18

19

20

21

22

Sign

Gross receipts or sales 1a

Returns and allowances.. 1b

Balance. Subtract line 1b from line 1a..

Cost of goods sold (attach Form 1125-A)..

Gross Profit. Subtract line 2 from line 1c..

Ordinary income (loss) from other partnerships, estates and trusts. (attach statement).

Net farm profit (loss) [attach Schedule F (Form 1040)].

Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797)

Other income (attach statement).

Total Income (loss). Add lines 3 through 7.

Salaries and wages (other than to partners)....

Guaranteed payments to partners...

Repairs and maintenance....

Bad debts....

Rent....

Taxes and licenses......

Interest....

Depreciation (if required, attach Form 4562).

16a

Less Depreciation reported on Form 1125-A and elsewhere on return

16b

Depletion (Do not deduct oil and gas depletion).

Retirements plans, etc.....

Employee benefits programs......

Other deductions (attach statement)...

Total Deductions. Add the amounts in the far right column for lines 9 through 20

Ordinary business income (loss). Subtract lines 21 from line 8.

1c

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16c

17

18

19

20

21

22

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and

statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration

of preparer (other than general partner) is based on all information of which preparer has any knowledge.

Here

Signature of general partner or limited liability company member

Date

Form 1065

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 5

Chapter 1: Entity Types and Their Formation

CHAPTER 1, CONTENTS: ENTITY TYPES AND FORMATION

\ /

\ /

\ /

\ /

Topic 11: Types

of

Business

Entities

Topic 1-2:

Corporation

Formation and Rules

Encouraging

Investments in

Corporations

Topic 1-3:

Partnership

Formation and

Rules Encouraging

Investments in

Partnerships

Topic 1-4:

Requireme

nts to

Become an

S

corporation

OVERVIEW OF TOPIC 1-1

A.

B.

THE OBJECTIVES OF THIS TOPIC ARE TWOFOLD:

Describe the state law classifications of business

entities

Describe the tax law classifications of business

entities

WHY IS OBJECTIVE A IMPORTANT?

Every business entity we will study in this course

must first be organized under state law.

WHY IS OBJECTIVE B IMPORTANT?

Every business entity recognized by state law must file

one of the three tax return we have just reviewed.

An outline of the content and organization of Topic 01-1 is as

follows:

Part A: Business Forms from a State Law Perspective

I.

List the entities Recognized by State Law.

II.

Define and/or describe the Entities Recognized by State Law

Part B: Business Forms from A Tax Perspective

I.

Describe the tax law process for entity classification.

II.

Default Rules and Positive Elections to be a Corporation

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 6

Chapter 1: Entity Types and Their Formation

III. Discuss Taxable Entities versus Pass-Through Entities

IV.

Discuss the second level election available to all corporations

V.

Course Assumptions and Various Summaries

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 7

Chapter 1: Entity Types and Their Formation

PART A: VARIOUS BUSINESS FORMS FROM A LEGAL

PERSPECTIVE

(Text pages 15-2)

LO

1

Describe the state law classifications of business entities.

OVERVIEW OF ENTITIES RECOGNIZED BY STATE LAW

Entities recognized

by

state law that do

not have

any filing

requirements

\ /

Sole

Propriet

orship

(SP)

\ /

Genera

l

Partner

ship

(GP)

Entities that must file with a state agency to be

recognized

\ /

\ /

Entities that file Articles

of

Organization

Entities that file

Articles

of Incorporation

\ /

\ /

\ /

Limited

Limited

Liability

Limited Part-

Corporation

Liabilit

y

Compa

ny

nership

(LLLP)

\ /

There are two types of Limited Liability Companies recognized by state

law

\ /

Single member Limited Liability

Company (SMLLC)

I.

\ /

Multiple member Limited

Liability Company (LLC)

DESCRIBE THE STATE LAW PROCESS FOR

RECOGNITION OT BUSINESS ENTITIES.

A. FIRST THERE ARE SOME ENTITIES THAT ARE

RECOGNIZED BY STATE BASED ON STATE COMMON

LAW. They are

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 8

Chapter 1: Entity Types and Their Formation

1. Sole Proprietorship (SP). This is a business

formed by an individual with an objective to carry

on a trade or business for profit.

2. General Partnership (GP). This is a business

formed by two or more partners with an objective to

carry on a trade or business for profit.

The partners should document their business

arrangement with written agreement called a

partnership agreement.

B. SECOND THERE ARE OTHER ENTITIES THAT ARE

RECOGNIZED BY STATE BASED ON STATE LAW

ENABLING ACTS. There are two overall categories as

follows:

1. Entities required to file Articles of Organization.

2. Entities required to file Articles of

Incorporation.

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 9

Chapter 1: Entity Types and Their Formation

C. ENTITIES FILING ARTICLES OF ORGANIZATION.

Most states recognize may different types of these

entities. For the purposes of this course we are only

concerned with the following two types:

1. Limited Liability Company (LLC). This entity will

be defined below.

2. Limited Liability Limited Partnership (LLLP).

This entity will be defined below.

D. ENTITIES FILING ARTICLES OF INCORPORATION.

This entity is recognized as a corporation.

II.

DEFINE/DESCRIBE ENTITIES RECOGNIZED BY STATE

LAW

A. SOLE PROPRIETORSHIP (SP)

1. Definition. This is an entity formed by an individual

with an objective to carry on a trade or business for

profit.

Individuals are not required to formally organize

their business with a state.

B. GENERAL PARTNERSHIPS (GP)

1. Definition. This is an entity formed by two or more

partners with an objective to carry on a trade or

business for profit.

The partners should document their business

arrangement with written agreement called a

partnership agreement..

The partners are not required to formally

organize their business with a state.

C. LIMITED LIABILITY COMPANIES

1. Organization Requirements. These are entities

created by filing LLC Articles of Organization

with a state in which the owner(s) are organizing a

business.

Owner(s) are called member(s).

2. Types of LLCs. Most state allow LLCs to have only

one memberthis distinction is important for tax

purposes as explained below

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 10

Chapter 1: Entity Types and Their Formation

a Single member limited liability companies

. (SMLLC). This entity cannot be considered a

partnership (If the sole member is an individual,

the SMLLC is taxed as a proprietorship.)

b Limited liability companies (LLC). This entity

. is assumed to have two or more members. (The

LLC is taxed as a partnership.)

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 11

Chapter 1: Entity Types and Their Formation

D. LIMITED LIABILITY LIMITED PARTNERSHIP (LLLP)

1. Definition. This entity consists of a general

member who manages the business and limited

members who are investors, all of whom are not

responsible for the liabilities of the entity; and are

not permitted to have any management functions.

Having two classes of members is an

attractive feature for joint ventures where the

person with a plan and talent to carry it out

needs venture capital from investors.

2. Organization Requirements. To operate in this

form the owners (typically the general member) files

a LLLP Articles of Organiza-tion with the state in

which the business is being organized.

Owner(s) are called member(s).

E. CORPORATIONS

1. Definition. Corporations are entities which are

allowed to be created by state law whose business

activities are accounted for separate and apart from

the owner(s).

2. Organization Requirements. To be recognized as

a corporation for state law purposes the owner(s)

must file Articles of Incorporation with the state

in which the business is being organized.

PART B: VARIOUS BUSINESS FORMS FROM A TAX

PERSPECTIVE

(Text pages 15-5 to 15-7)

LO

2

Describe the tax law classifications of business entities.

OVERVIEW OF THE TAX LAW PROCESS

First:

Every entity recognized by state law is recognized for

federal tax purposes

Secon

d:

Every recognized entity is required to be classified for tax

purposes.

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 12

Chapter 1: Entity Types and Their Formation

Third:

Election available to non-corporate entities

Fourth

:

Election available to ALL corporations

I.

DESCRIBE THE TAX LAW PROCESS FOR ENTITY

CLASSIFICATION.

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 13

Chapter 1: Entity Types and Their Formation

OVERVIEW OF ENTITY TAX CLASSIFICATION

EVERY LEGAL ENTITY IS CLASSIFIED AS ONE OF THE FOLLOWING

(FOR TAX PURPOSES)

\ /

Disregarded Entity

\ /

Sole

Proprietor

-ship

\ /

Single

Member

Limited

Liability

Company

\ /

Gener

al

Partn

ership

\ /

Partnership

\ /

Corporation

\ /

Limited

\ /

Corps which

have

not yet made

any tax

elections

Liabilit

y

Compa

ny

\ /

Limited

Liability

Limited

Partnershi

p

A. OVERVIEW.

1. First every entity recognized by state law is

recognized for federal tax purposes.

2. Second because of filing requirements tax law

required every entity is required to be classified.

3. Third every non-corporate entity can elect to be

treated as a corporation for tax purposes.

3. Fourth all corporation can elect to taxed as a passthrough entity (as defined in Paragraph III below)

B. FEDERAL TAX LAW CLASSIFICATION. For Federal

income tax purposes there are three overall types of

entities

1. Disregarded entities.

2. Partnerships.

3. Corporations.

C. DISREGARDED ENTITIES. This is a business which

has only one owner and which is considered to be the

same entity as the ownertax law recognizes two types

1. Sole Proprietorship (SP). This is a business

operated by an individual with an objective to carry

on a trade or business for profit.

This entity files a Schedule C.

2. Single Member LLC (SMLLC). This is limited

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 14

Chapter 1: Entity Types and Their Formation

liability company owned by a one member.

If the owner is an individual, the entity is

considered a sole proprietorshipindividuals can

file multiple Schedule Cs

If the owner is, a corporation for example, the

income or loss from the SMLLC is reported on the

corporate tax return, probably, Form 1120, line 10

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 15

Chapter 1: Entity Types and Their Formation

D. PARTNERSHIPS. Tax law defines partnerships are as an

association of two or more partners with an objective

to carry on a business for profit and a plan for joint

division of profits. These entities file a Form 1065.

1. General Partnership (GP). Entities formed by

written partnership agreement among the partners

2. Limited Liability Limited Partnership (LLC).

Entity formed by filing LLC Articles of Organization

with a state.

3. Limited Liability Limited Partnership (LLLP).

.

Entity formed by filing LLLP Articles of Organization

with a state.

C.

II.

CORPORATIONS. Can have as few as one owner.

For now these are entities that have filed Articles of

Incorporation, who have not yet made any tax

elections

LIST THE DEFAULT RULES AND POSITIVE

ELECTIONS PROVIDED BY THE CHECK-THE-BOX

REGULATIONS

OVERVIEW OF THE FIRST LEVEL OF TAX ELECTIONS

EVERY NON-CORPORATE ENTITY CAN ELECT TO BE A

CORPORATION

\ /

Disregarded Entity

\ /

Sole Proprietorsh

ip

\ /

Single Member

Limited Liability

Company

\ /

Partnership

\ /

General

Partners

hip

\ /

Limited

Liability

Company

\ /

Limited

Liability

Limited

Partnership

\ /

\ /

\ /

\ /

\ /

All Can Elect to be Treated as a Corporation for Tax Purposes

A. BACKGROUND. The IRS has issued its so-called checkthe-box regulations, which enables businesses to choose

the tax status of the entity in which it operates without

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 16

Chapter 1: Entity Types and Their Formation

regard to its corporate or non-corporate

characteristics..

B. ENTITIES WHICH CANNOT MAKE AN ELECTION.

Entities that have filed articles of incorporation with

a state to be a corporation (i.e., Fixed Status

Corporations).

All other entities subject to default rules and can

make a positive election to be taxed as a corporation.

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 17

Chapter 1: Entity Types and Their Formation

C. THE DEFAULT RULES AND POSITIVE ELECTION FOR

SINGLE MEMBER ENTITIES.

Proprietorship

Single member

LLC

Default Rule

Disregarded

entity

Disregarded

entity

Positive Election

Elect corporate status

Elect corporate status

D. THE DEFAULT RULES AND POSITIVE ELECTION FOR

MULTIPLE MEMBER ENTITIES.

General

partnership

Multiple member

LLC

LLLP

III.

Default Rule

Considered a

partnership

Considered a

partnership

Considered a

partnership

Positive Election

Elect corporate status

Elect corporate status

Elect corporate status

BECOMING A CORPORATION FOR FEDERAL TAX LAW.

1. For tax purposes, an entity can become a

corporation by two different means.

a. Fixed status. These are entities that have filed

articles of incorporation with a state

b. Elective status. These entities that have NOT

filed articles of incorporation with a state; but

have elected to be considered a corporation

for tax purposes

2. The primary entity which might choose to be a

corporation is the Limited Liability Company

(LLC).

a. Proprietorships, general partnerships, and

limited liability limited partnerships rarely elect

corporate status

b. Further discussion. See Topic 1-4

DEFINE TAXABLE VERSUS PASS-THROUGH ENTITIES

A. FOR TAX PURPOSES EVERY ENTITY IS EITHER A

TAXABLE ENTITY OR A PASS-THROUGH ENTY.

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 18

Chapter 1: Entity Types and Their Formation

1. Taxable entities. Separate tax paying entities (1)

calculate their taxable income; (2) determine their

tax liability; and (3) pay taxes to federal

government.

2. Pass-through entities. Pass-through entities (1)

determine their items of income and deduction (2)

pass these items through to their owner(s); and (3)

the owners are responsible for paying taxes on the

net earnings reported to them.

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 19

Chapter 1: Entity Types and Their Formation

IV.

DISCUSS THE SECOND LEVEL ELECTION AVAILABLE

TO ALL CORPORATIONS.

OVERVIEW OF THE SECOND LEVEL OF TAX ELECTIONS

EVERY CORPORATION CAN

\ /

Make an S election

\ /

Do nothing (do not make an S

election)

\ /

If an S election is made, the

corporation becomes a passthrough entity

\ /

If an S election is NOT made, the

corporation is a taxable

corporation

A. TAXABLE CORPORTION.

Corporations which have NOT made an S election.

Also known as a C Corporation.

B. PASS-THROUGH CORPORATION.

S Corporations. Corporations which have made an

S election.

C. COMMENT ABOUT OTHER PASS-THROUGH ENTITIES.

These are entities which have NOT made a (Level One)

election to be taxed as a corporations. They are:

1. Limited Liability Company

2. Limited Liability Limited Partnership.

3. General Partnership.

4. Sole Proprietorship

V.

DISCUSS THE COURSE ASSUPTIONS AND VARIOUS

SUMMARIES

A. COURSE ASSUMPTIONS.

1. For the purposes of this course, we will assume that

ALL non-corporate entities DO NOT elect to be

considered a corporation for tax purposes.

2. For the purposes of this course, we will assume that

Limited Liability Companies (LLCs) have at least two

members.

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 20

Chapter 1: Entity Types and Their Formation

B. SUMMARY OF ENTITY TAX CLASSIFICTIONS AND

FILING REQUIREMENTS. See next page.

C. SUMMARY OF ENTITIES TO BE SDUDIED. See next

page.

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 21

Chapter 1: Entity Types and Their Formation

SUMMARY OF ENTITY TAX CLASSIFICATIONS

AND FILING REQUIREMENTS

Did the entity file Articles of Incorporation to become a legal

corporation?

No

\ /

Does the entity elect

to be

treated as a

corporation

for tax purposes?

Yes

/

File Form

8852

No

\ /

Does the entity have

more than one owner?

Yes

No

\ /

C

corporatio

n

for tax

purposes

File From

1120

No

\ /

Partnershi

p

for tax

purposes

File From

1065

\ /

Is the

owner

an

individual?

Yes

Yes

\ /

Does the entity

qualify

for, and elect, S

corp.?

File Form 2553

No

\ /

Sole proprietorship for tax

purposes

File Form 1040, Schedule C

Yes

\ /

S

corporation

for tax

purposes

File From

1120S

Disregarded entity

/ Treated the same as the

owner

(not a separate entity

from

the owner). Income or

loss

is reported on the

owners tax return

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 22

Chapter 1: Entity Types and Their Formation

SUMMARY OF TAX ENTITIES TO BE STUDIED

Entities that file Articles of

Organization with a State

Entities that file Articles

of Incorporation with a

State

\ /

Limited

Liability

Company

\ /

Limited Liability

\ /

S Corpora-

\ /

Taxable

Limited

Partnership

Files Form 1065

tion Files

Corporation

Form

1120S

Files Form

1120

\ /

\ /

Taxable

Entity

Files Form

1065

\ /

\ /

Pass-Through Entities

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 23

Chapter 1: Entity Types and Their Formation

TOPIC 1-1: CONCEPT QUESTIONS

1.1 Which of the following entity(ies) is(are) not required to

formally organize its (their) business with a state?

A.

Proprietorship.

B.

Corporations.

C.

Limited liability companies.

D. Partnerships.

E.

Proprietorships and partnerships.

Answer to Question E

1.1

Corporations and LLCs are required to file articles with a

state.

1.2 Which of the following is not a disregarded entity?

A.

Proprietorship.

B.

Single member limited liability company.

C.

Partnerships

D. They all are disregarded entities.

Answer to Question C.

1.2

1.3 Which of the following is the positive election for check-thebox regulations?

A.

Elect proprietorship status

B.

Elect partnership status

C.

Elect corporation status

Answer to Question C.

1.3

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 24

Chapter 1: Entity Types and Their Formation

TOPIC 1-1:

TYPES OF BUSINESS ENTITIES

LEARNING EXPECTATIONS

Now that Topic 1-1 is complete you should be able to

A. Describe the state law classifications of business

entities

1. List the entities recognized by state law.

2. Define and/or describe the entities recognized by state

law.

3. Describe the two subtypes of corporations.

B. Describe

entities

the

tax

law

classifications

of

business

1. Describe the tax law process for entity classification.

2. List the default rules and positive elections provided by

the check-the-box regulations.

3. Discuss taxable versus pass-through entities.

4. Discuss the second level election available to all

corporations.

5. Summarize the various business forms from a tax

perspective.

We have completed the contents of Topic 1-1 and are ready to

move on to Topic 1-2.

MAIN IDEAS IN CHAPTER 1, TOPIC 1, Kermit Keeling: Solution PAGE 25

Вам также может понравиться

- Profit or Loss From Business: Schedule C (Form 1040) 09Документ2 страницыProfit or Loss From Business: Schedule C (Form 1040) 09Dunk7Оценок пока нет

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Документ2 страницыFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyОценок пока нет

- 2015 Tax Return Documents (US Auto Motors LLC) Revised PDFДокумент20 страниц2015 Tax Return Documents (US Auto Motors LLC) Revised PDFzlОценок пока нет

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnДокумент6 страницCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnStephanie YatesОценок пока нет

- Business Tax Basics - IndexДокумент64 страницыBusiness Tax Basics - IndexLuvli PhươngОценок пока нет

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnДокумент6 страницCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620Оценок пока нет

- TaxReturn PDFДокумент7 страницTaxReturn PDFChristine WillisОценок пока нет

- 1040x2 PDFДокумент2 страницы1040x2 PDFolddiggerОценок пока нет

- Pennsylvania Income Tax Return: Official Use OnlyДокумент2 страницыPennsylvania Income Tax Return: Official Use OnlyVioleta BusuiocОценок пока нет

- BNI 1120 ReturnДокумент5 страницBNI 1120 ReturndishaakariaОценок пока нет

- 2015 Two BrothersДокумент43 страницы2015 Two BrothersAnonymous Wu0bxv6p7Оценок пока нет

- Jeff Bell 2012 Tax ReturnДокумент71 страницаJeff Bell 2012 Tax ReturnRaylene_Оценок пока нет

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeДокумент5 страницU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyОценок пока нет

- Pet Kingdom IncДокумент20 страницPet Kingdom Incjessica67% (3)

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionДокумент4 страницыShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionFrancis Wolfgang UrbanОценок пока нет

- Return For Provisional Tax PaymentДокумент2 страницыReturn For Provisional Tax PaymentByron KanengoniОценок пока нет

- Chapter 4 For FilingДокумент9 страницChapter 4 For Filinglagurr100% (1)

- Tax Return ScribdДокумент5 страницTax Return ScribdYvonne TanОценок пока нет

- U.S. Information Return Trust Accumulation of Charitable AmountsДокумент4 страницыU.S. Information Return Trust Accumulation of Charitable AmountspdizypdizyОценок пока нет

- F 1040 SaДокумент2 страницыF 1040 Saljens09Оценок пока нет

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesДокумент2 страницыAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranОценок пока нет

- PDC 2006Документ10 страницPDC 2006NC Policy WatchОценок пока нет

- Tax Return ProjectДокумент62 страницыTax Return ProjectGiovaniPerez100% (1)

- BriteSol Inc IRS 1120 Corporation Tax Return 2012Документ5 страницBriteSol Inc IRS 1120 Corporation Tax Return 2012how3935Оценок пока нет

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionДокумент4 страницыShort Form Return of Organization Exempt From Income Tax: Open To Public Inspectiongeoffb1Оценок пока нет

- IT-11GHA: Return of Income Under The Income Tax ORDINANCE, 1984 (XXXVI OF 1984)Документ7 страницIT-11GHA: Return of Income Under The Income Tax ORDINANCE, 1984 (XXXVI OF 1984)Amanat AhmedОценок пока нет

- f1120s AccessibleДокумент5 страницf1120s AccessiblebhanuprakashbadriОценок пока нет

- 990 Return of Organization Exempt From Income Tax: Use IRS East Carolina Development CO, INC 56-2044953Документ10 страниц990 Return of Organization Exempt From Income Tax: Use IRS East Carolina Development CO, INC 56-2044953NC Policy WatchОценок пока нет

- Return of Private Foundation: Line 16)Документ13 страницReturn of Private Foundation: Line 16)diego76diegoОценок пока нет

- Exempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )Документ2 страницыExempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )lp101goldОценок пока нет

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionДокумент4 страницыShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionpittscherylОценок пока нет

- Short Form Return of Organization Exempt From Income TaxДокумент9 страницShort Form Return of Organization Exempt From Income TaxHalosОценок пока нет

- Itx203 02 e - Return of Income Entity Colored OrangeДокумент9 страницItx203 02 e - Return of Income Entity Colored OrangeGregory MabinaОценок пока нет

- New York Corporation Tax ReturnДокумент4 страницыNew York Corporation Tax Returnbshahn1189Оценок пока нет

- LCGS 2011 941Документ2 страницыLCGS 2011 941Timothy Rampage RushОценок пока нет

- Example Tax ReturnДокумент6 страницExample Tax Returnapi-252304176Оценок пока нет

- Bruce Byrd 2013 Tax Return - T13 - For - Records PDFДокумент69 страницBruce Byrd 2013 Tax Return - T13 - For - Records PDFjessica50% (2)

- Short Form .EZ Return of Organization Exempt From Income Tax 2012Документ9 страницShort Form .EZ Return of Organization Exempt From Income Tax 2012FIXMYLOANОценок пока нет

- By The Numbers, Inc.Документ51 страницаBy The Numbers, Inc.mailfrmajithОценок пока нет

- Itemized Deductions: Medical and Dental ExpensesДокумент1 страницаItemized Deductions: Medical and Dental Expensesapi-173610472Оценок пока нет

- 2011 Pa-40Документ2 страницы2011 Pa-40Hesam AhmadiОценок пока нет

- 2014 Federal 1040 (Esther)Документ2 страницы2014 Federal 1040 (Esther)Abdirahman Abdullahi Omar43% (7)

- TDS Manual 2007 BДокумент51 страницаTDS Manual 2007 BVijaysreeram TalluruОценок пока нет

- Ivan Incisor CH 2 Tax Return - For - FilingДокумент4 страницыIvan Incisor CH 2 Tax Return - For - FilingShakilaMissz-KyutieJenkins100% (1)

- F 1040 SeДокумент2 страницыF 1040 SepdizypdizyОценок пока нет

- U.S. Individual Income Tax ReturnДокумент2 страницыU.S. Individual Income Tax Returnapi-310622354Оценок пока нет

- Form 4A: General Consumption Tax ReturnДокумент2 страницыForm 4A: General Consumption Tax ReturnSi KiОценок пока нет

- Please Review The Updated Information Below.: For Begins After This CoversheetДокумент6 страницPlease Review The Updated Information Below.: For Begins After This CoversheetAshutosh Singh ParmarОценок пока нет

- Ivan Incisor CH 3 2014 Tax Return - For - FilingДокумент6 страницIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsОценок пока нет

- Form 990-EZ: Short Form Return of Organization Exempt From Income TaxДокумент8 страницForm 990-EZ: Short Form Return of Organization Exempt From Income TaxJakara MovementОценок пока нет

- Short Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921Документ3 страницыShort Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921lesliebrodieОценок пока нет

- Vice-President Biden's 2010 Tax ReturnДокумент28 страницVice-President Biden's 2010 Tax ReturnBarack ObamaОценок пока нет

- DHHSCДокумент2 страницыDHHSClrowland974Оценок пока нет

- Supplemental Income and Loss: Schedule E (Form 1040) 13Документ2 страницыSupplemental Income and Loss: Schedule E (Form 1040) 13api-253299751Оценок пока нет

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawОт EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawРейтинг: 3.5 из 5 звезд3.5/5 (4)

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОт EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryОт EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- EmailДокумент1 страницаEmailюрий локтионовОценок пока нет

- Russell-AthleticДокумент28 страницRussell-Athleticюрий локтионовОценок пока нет

- Interconnected-WorldДокумент1 страницаInterconnected-Worldюрий локтионовОценок пока нет

- HSBC in ChinaДокумент3 страницыHSBC in Chinaюрий локтионов100% (1)

- Bolender-MemoДокумент2 страницыBolender-Memoюрий локтионовОценок пока нет

- 4 9 NotesДокумент1 страница4 9 Notesюрий локтионовОценок пока нет

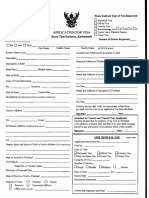

- Thailand VISA Application Form PDFДокумент2 страницыThailand VISA Application Form PDFnimesh gautam0% (1)

- People of The Philippines,: DecisionДокумент12 страницPeople of The Philippines,: DecisionGlendie LadagОценок пока нет

- Essay Question What Were The Main Factors That Enabled Mussolini To The Rise To PowerДокумент3 страницыEssay Question What Were The Main Factors That Enabled Mussolini To The Rise To Powerchl2367% (3)

- IcjДокумент18 страницIcjakshay kharteОценок пока нет

- Anaya Cruz Rec ReconsideracДокумент6 страницAnaya Cruz Rec ReconsideracElkins Guivar OrtizОценок пока нет

- Final Result of Udc Under Transport Department 2019Документ1 страницаFinal Result of Udc Under Transport Department 2019Hmingsanga HauhnarОценок пока нет

- BOC Personnel Orders Transferring 228 PersonnelДокумент5 страницBOC Personnel Orders Transferring 228 PersonnelPortCallsОценок пока нет

- Do Board Gender Quotas Affect Firm Value? Evidence From California Senate Bill No. 826Документ2 страницыDo Board Gender Quotas Affect Firm Value? Evidence From California Senate Bill No. 826Cato InstituteОценок пока нет

- Chapter 07Документ27 страницChapter 07Rollon NinaОценок пока нет

- Full Solution Manual For Optoelectronics Photonics Principles Practices 2 E 2Nd Edition Safa O Kasap PDF Docx Full Chapter ChapterДокумент32 страницыFull Solution Manual For Optoelectronics Photonics Principles Practices 2 E 2Nd Edition Safa O Kasap PDF Docx Full Chapter Chapterbranlinsuspectnm8l100% (13)

- ContractДокумент8 страницContractsamarth agrawalОценок пока нет

- Midterm Transcript 15-16Документ76 страницMidterm Transcript 15-16MikMik UyОценок пока нет

- Piczon V Piczon GR No L29139Документ3 страницыPiczon V Piczon GR No L29139Mary LeandaОценок пока нет

- Revised Rules of Evidence 2019Документ33 страницыRevised Rules of Evidence 2019Michael James Madrid Malingin100% (1)

- Rule 23 Depositions Pending ActionДокумент9 страницRule 23 Depositions Pending Actionfrank japosОценок пока нет

- Japanese Period (The 1943 Constitution)Документ3 страницыJapanese Period (The 1943 Constitution)Kiko CorpuzОценок пока нет

- Deed of Sale - Motor VehicleДокумент4 страницыDeed of Sale - Motor Vehiclekyle domingoОценок пока нет

- Civil PastorsДокумент24 страницыCivil PastorsJeremy SchneiderОценок пока нет

- Sample Offer - Offer LetterДокумент2 страницыSample Offer - Offer LetterharithcgОценок пока нет

- Ra 7691Документ23 страницыRa 7691Elenita OrdaОценок пока нет

- Composer's AgreementДокумент3 страницыComposer's AgreementErnesto RivasОценок пока нет

- NOP - 25.04.16 - RAM Contractual LetterДокумент2 страницыNOP - 25.04.16 - RAM Contractual LetterAvish BhinkahОценок пока нет

- Musicians' Union: Standard Live Engagement Contract L2Документ2 страницыMusicians' Union: Standard Live Engagement Contract L2Vishakh PillaiОценок пока нет

- CIR V Petron CorpДокумент15 страницCIR V Petron CorpChristiane Marie BajadaОценок пока нет

- Mayo, Et Al.) For Unlawful Detainer, Damages, Injunction, Etc., An Appealed Case From TheДокумент4 страницыMayo, Et Al.) For Unlawful Detainer, Damages, Injunction, Etc., An Appealed Case From TheRian Lee TiangcoОценок пока нет

- List of RTC MeTC Phones and EmialsДокумент15 страницList of RTC MeTC Phones and EmialsOnie Bagas100% (1)

- Legal ResearchДокумент27 страницLegal ResearchPaul ValerosОценок пока нет

- Louisiana Department of Public Safety and Corrections Office of State Police Louisiana Concealed Handgun Permit Application PacketДокумент8 страницLouisiana Department of Public Safety and Corrections Office of State Police Louisiana Concealed Handgun Permit Application Packetanon_322262811Оценок пока нет

- 9 Go V Colegio de San Juan de LetranДокумент9 страниц9 Go V Colegio de San Juan de LetranDebbie YrreverreОценок пока нет

- Memorial Behalf of D PDFДокумент27 страницMemorial Behalf of D PDFAnurag guptaОценок пока нет