Академический Документы

Профессиональный Документы

Культура Документы

Econ 601 f14 Workshop 2 Answer Key PDF

Загружено:

юрий локтионовИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Econ 601 f14 Workshop 2 Answer Key PDF

Загружено:

юрий локтионовАвторское право:

Доступные форматы

Economics 601

Workshop #2 Answer Key

Dustin Chambers

Fall 2014

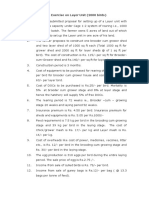

Instructions: Please show all of your work. Turn-in one assignment per group,

and make sure to list the names of each student in your group. Tip: This

assignment can be solved very quickly using Microsoft Excel.

1.

Suppose that the potential growth threshold for the U.S. is 2.5% per

year. If the Obama Administration wants to reduce the unemployment

rate by a full percentage point (i.e. 1%-point) over the next year, what

is the required rate of economic growth in the United States?

According to Okuns Law:

0.4% !"# !"#$%#&'( =

0.4% !"# 2.5% = 1%

!"# = 5%

2.

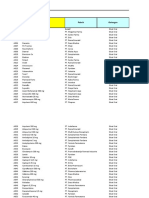

Suppose that you work for the Federal Reserve Bank and are asked to

determine the Federal Funds rate target using the Taylor Rule:

Nominal Fed Funds Rate Target = + 2.0 + 0.5 ( 2.0 ) 0.5(GDP Gap)

Use the following data to 1) calculate the Federal Funds target rate

based on the Taylor Rule, and 2) plot the Taylor Rule rate the actual

Federal Funds rate together and comment on any

similarities/differences.

Year

2000

2000

2000

2000

2001

2001

2001

2001

2002

2002

2002

2002

2003

2003

2003

2003

2004

2004

2004

2004

2005

2005

2005

2005

2006

2006

2006

2006

2007

2007

2007

2007

Quarter

1

2

3

4

1

2

3

4

1

2

3

4

1

2

3

4

1

2

3

4

1

2

3

4

1

2

3

4

1

2

3

4

inflation GDP GAP Taylor Rule fed funds rate

3.24

-2.93

7.33

5.68

3.33

-3.13

7.56

6.27

3.51

-3.00

7.77

6.52

3.43

-3.20

7.75

6.47

3.40

-2.53

7.37

5.59

3.38

-2.20

7.17

4.33

2.70

-1.33

5.72

3.50

1.86

0.00

3.79

2.13

1.25

0.40

2.68

1.73

1.30

0.67

2.62

1.75

1.59

0.47

3.15

1.74

2.20

0.73

3.94

1.44

2.87

0.73

4.94

1.25

2.13

1.27

3.56

1.25

2.20

1.27

3.67

1.02

1.90

0.67

3.52

1.00

1.79

0.40

3.49

1.00

2.87

0.20

5.21

1.01

2.73

-0.13

5.16

1.43

3.32

-0.13

6.05

1.95

3.04

-0.47

5.80

2.47

2.95

-0.87

5.86

2.94

3.83

-1.00

7.25

3.46

3.74

-1.13

7.18

3.98

3.65

-1.60

7.28

4.46

4.01

-1.67

7.85

4.91

3.34

-1.73

6.88

5.25

1.94

-2.13

4.98

5.25

2.42

-2.00

5.63

5.26

2.65

-1.93

5.94

5.25

2.36

-1.60

5.34

5.07

3.97

-1.33

7.62

4.50

Federal Funds Rate (%)

Taylor Rule

6

5

4

3

2

1

Actual Fed Funds Rate

0

2000 2001 2002 2003 2004 2005 2006 2007

3.

The original Federal Reserve Act (1913) has been amended on

numerous occasions as the role of the Federal Reserve has evolved.

Until 2010, the Fed had a two-pronged mandate, with each mandate

created by one of the following bills:

The Employment Act (1946)

Full Employment and Balanced Growth Act (1978)

a.) What was the Feds two-part mandate prior to 2010? Match each

mandate with the bill that created it above. Why did Congress make

these changes (i.e. provide some historical background/insights to

rationalize their policy decisions).

Prior to 2010, the Feds two mandates were to maintain full

employment (created by The Employment Act (1946)) and price

stability (Full Employment and Balanced Growth Act (1978)).

Congress mandated the first change (full-employment) as the U.S. was

exiting the Great Depression and unemployment was the paramount

concern of policy makers. The added mandate of maintaining price

stability was a reaction to the record-breaking two-digit inflation that the

U.S. experienced during the 1970s (i.e. The Great Inflation).

b.) The DoddFrank Wall Street Reform and Consumer Protection Act

(2010) added one additional mandate to the Federal Reserve. What is

that mandate? What are some advantages and disadvantages of this

policy change?

The Dodd-Frank bill added the mandate of maintaining financial

stability. The advantage, if the bill can succeed in promoting its goals,

is to prevent major financial crises like that of 2008 and increase the

publics faith in the financial system. Critics of the bill cite numerous

problems, including 1) the greater politicizing of Fed actions, which

threatens Fed independence, 2) a lack of policy tools with which to

prevent crises, and 3) the failure of the bill to end the very government

policies which helped foster the housing bubble (mortgage guarantees

vis--vis Fannie Mae and Freddie Mac).

Вам также может понравиться

- Sample Exam QuestionsДокумент8 страницSample Exam QuestionsEmmanuel MbonaОценок пока нет

- 2021 en Tutorial 7Документ5 страниц2021 en Tutorial 7Hari-haran KUMARОценок пока нет

- ECO 372 EDU Teaching Effectively Eco372edudotcomДокумент25 страницECO 372 EDU Teaching Effectively Eco372edudotcomaadam456Оценок пока нет

- Cea Whitepaper 20050809Документ12 страницCea Whitepaper 20050809losangelesОценок пока нет

- F P M P I U.S. E .: Iscal Olicy and Onetary Olicy Mpact On The ConomyДокумент15 страницF P M P I U.S. E .: Iscal Olicy and Onetary Olicy Mpact On The ConomyHeather Lindquist VenableОценок пока нет

- Homework 3: Economics 105 - Chapters 6 & 4Документ1 страницаHomework 3: Economics 105 - Chapters 6 & 4Hummels1000Оценок пока нет

- 5) Exam Is Due Back Before Midnight (EST) On Nov 5: WWW - Federalreserve.govДокумент3 страницы5) Exam Is Due Back Before Midnight (EST) On Nov 5: WWW - Federalreserve.govTrevor TwardzikОценок пока нет

- ECO201 Pricniples of Macroeconomics Final ExaminationДокумент5 страницECO201 Pricniples of Macroeconomics Final ExaminationGinoh K.Оценок пока нет

- The Impact of Tax Cut and Job Acts On The Practice of Fundraising in The United States.Документ17 страницThe Impact of Tax Cut and Job Acts On The Practice of Fundraising in The United States.uzo ufombaОценок пока нет

- Macroecon TestДокумент15 страницMacroecon Testcarolinesteinocher_5100% (1)

- AG Quarter 2 and 4 Week 1 Economic Policy AssignmentДокумент7 страницAG Quarter 2 and 4 Week 1 Economic Policy AssignmentamiОценок пока нет

- Epp - Exam2 - Spring2023 - MOD 2Документ10 страницEpp - Exam2 - Spring2023 - MOD 2MasaОценок пока нет

- EportfolioassignmentДокумент9 страницEportfolioassignmentapi-311464761Оценок пока нет

- Obama's Economic Policies Since Becoming President: Obama and The EconomyДокумент7 страницObama's Economic Policies Since Becoming President: Obama and The EconomyasfawmОценок пока нет

- Abel Bernanke IM C01Документ10 страницAbel Bernanke IM C01James Jiang100% (2)

- Week 12 - Tutorial QuestionsДокумент5 страницWeek 12 - Tutorial QuestionsNguyen Trung Kien ( Swinburne HN)Оценок пока нет

- Accounting Textbook Solutions - 14Документ18 страницAccounting Textbook Solutions - 14acc-expertОценок пока нет

- Balance Budget Sim Lesson PlanДокумент5 страницBalance Budget Sim Lesson Planapi-245012288Оценок пока нет

- Ungarded Problem Set 4: Difference in DifferencesДокумент14 страницUngarded Problem Set 4: Difference in DifferencesBao An Phan ThaiОценок пока нет

- E - Portfolio Assignment Mike KaelinДокумент9 страницE - Portfolio Assignment Mike Kaelinapi-269409142Оценок пока нет

- Final Econ e PortfolioДокумент7 страницFinal Econ e Portfolioapi-317164511Оценок пока нет

- Weekly Economic Commentary 5/6/2013Документ6 страницWeekly Economic Commentary 5/6/2013monarchadvisorygroupОценок пока нет

- Int Econ Final ExamДокумент9 страницInt Econ Final ExamWilson LiОценок пока нет

- APGov Econ CH 18Документ26 страницAPGov Econ CH 18ManasОценок пока нет

- Senate Hearing, 112TH Congress - Federal Reserve's First Monetary Policy Report For 2011Документ134 страницыSenate Hearing, 112TH Congress - Federal Reserve's First Monetary Policy Report For 2011Scribd Government DocsОценок пока нет

- Lab 2Документ9 страницLab 2Ahmad AlОценок пока нет

- M01 Abel4987 7e Im C01Документ10 страницM01 Abel4987 7e Im C01Mk KongОценок пока нет

- E - Portfolio Assignment-1 Econ 2020 Valeria FinisedДокумент7 страницE - Portfolio Assignment-1 Econ 2020 Valeria Finisedapi-317277761Оценок пока нет

- Federal Deficits and DebtДокумент10 страницFederal Deficits and DebtSiddhantОценок пока нет

- MarketingДокумент4 страницыMarketingjyotiprakash giriОценок пока нет

- 2 2 Evaluating Economic PerformanceДокумент11 страниц2 2 Evaluating Economic Performanceapi-234789837Оценок пока нет

- Lê Phương Linh - HW 2.3.2022Документ8 страницLê Phương Linh - HW 2.3.2022Linh LêОценок пока нет

- Partial Credit, End of Chapter 4.11Документ7 страницPartial Credit, End of Chapter 4.11FahadОценок пока нет

- E - Portfolio Assignment 2Документ8 страницE - Portfolio Assignment 2api-248058538Оценок пока нет

- Full Solution Manual For Solution Manual For Macroeconomics 10Th Edition Abel PDF Docx Full Chapter ChapterДокумент36 страницFull Solution Manual For Solution Manual For Macroeconomics 10Th Edition Abel PDF Docx Full Chapter Chaptershrunkenyojan6amf2100% (13)

- Rebuild America - Mike Ball An Tine 2012 Ver 1.1Документ5 страницRebuild America - Mike Ball An Tine 2012 Ver 1.1Michael D. BallantineОценок пока нет

- Answers AllChapsДокумент163 страницыAnswers AllChapsAnonymous L7XrxpeI1zОценок пока нет

- Introduction To Finance Markets Investments and Financial Management 15Th Edition Melicher Solutions Manual Full Chapter PDFДокумент36 страницIntroduction To Finance Markets Investments and Financial Management 15Th Edition Melicher Solutions Manual Full Chapter PDFmargaret.clark112100% (12)

- Introduction To Finance Markets Investments and Financial Management 15th Edition Melicher Solutions Manual 1Документ13 страницIntroduction To Finance Markets Investments and Financial Management 15th Edition Melicher Solutions Manual 1samanthahortoncbdsetjaxr100% (25)

- Accounting Textbook Solutions - 62Документ18 страницAccounting Textbook Solutions - 62acc-expertОценок пока нет

- Assignment 1Документ2 страницыAssignment 1KRYSTELLE BOLIVARОценок пока нет

- Problem Set #2: Due Monday, Sept. 19 by 10:00pm Via Canvas Answers Must Be TypedДокумент3 страницыProblem Set #2: Due Monday, Sept. 19 by 10:00pm Via Canvas Answers Must Be TypedDarrek F CrisslerОценок пока нет

- 3.03 TemplateДокумент3 страницы3.03 TemplateDestiny LittleОценок пока нет

- ECO 372 Final ExamECO 372 Week 5 Final Exam Answers Free - UOP StudentsДокумент11 страницECO 372 Final ExamECO 372 Week 5 Final Exam Answers Free - UOP StudentsUOP Students100% (1)

- What Is The Difference Between Fiscal and Monetary PolicyДокумент4 страницыWhat Is The Difference Between Fiscal and Monetary Policykhuram786835Оценок пока нет

- Solution Manual For Solution Manual For Macroeconomics 10th Edition AbelДокумент37 страницSolution Manual For Solution Manual For Macroeconomics 10th Edition Abelfurculapesterer.kxun100% (15)

- Solution Manual For Solution Manual For Macroeconomics 10th Edition AbelДокумент17 страницSolution Manual For Solution Manual For Macroeconomics 10th Edition AbelRoy Stookey100% (38)

- Memorandum: Text of The NBER's Statement On The Recession and FAQ'sДокумент9 страницMemorandum: Text of The NBER's Statement On The Recession and FAQ'sdmilesaiОценок пока нет

- Introduction To Macroeconomics 1. An Overview of MacroeconomicsДокумент19 страницIntroduction To Macroeconomics 1. An Overview of Macroeconomicslerma parconОценок пока нет

- Economics With Taxation and Land Reform Introduction To MacroeconomicsДокумент2 страницыEconomics With Taxation and Land Reform Introduction To MacroeconomicsrobertОценок пока нет

- Chipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentОт EverandChipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentРейтинг: 1 из 5 звезд1/5 (1)

- E - Portfolio AssignmentДокумент3 страницыE - Portfolio Assignmentapi-252922808Оценок пока нет

- The US Stock Market Wants To Go Up Part II 03-31-20111 - by Economist Mike AstrachanДокумент11 страницThe US Stock Market Wants To Go Up Part II 03-31-20111 - by Economist Mike AstrachanShlomiОценок пока нет

- E - Portfolio Assignment MacroДокумент8 страницE - Portfolio Assignment Macroapi-316969642Оценок пока нет

- Summativeunit 722615Документ7 страницSummativeunit 722615api-280442205Оценок пока нет

- Macro Termpaper Possible Discussion TopicsДокумент6 страницMacro Termpaper Possible Discussion TopicsRaja Tejas YerramalliОценок пока нет

- MloneychoicesДокумент3 страницыMloneychoicesapi-318753557Оценок пока нет

- Applied Economics-Worksheet-Week 1Документ1 страницаApplied Economics-Worksheet-Week 1Christine Joy CalupigОценок пока нет

- Inflation Targeting ThesisДокумент6 страницInflation Targeting Thesisdwsdzrcq100% (1)

- EmailДокумент1 страницаEmailюрий локтионовОценок пока нет

- Interconnected-WorldДокумент1 страницаInterconnected-Worldюрий локтионовОценок пока нет

- Russell-AthleticДокумент28 страницRussell-Athleticюрий локтионовОценок пока нет

- HSBC in ChinaДокумент3 страницыHSBC in Chinaюрий локтионов100% (1)

- Bolender-MemoДокумент2 страницыBolender-Memoюрий локтионовОценок пока нет

- 4 9 NotesДокумент1 страница4 9 Notesюрий локтионовОценок пока нет

- RIASEC Personality TestДокумент2 страницыRIASEC Personality TestSarah Jane NomoОценок пока нет

- The Development of Attachment in Separated and Divorced FamiliesДокумент33 страницыThe Development of Attachment in Separated and Divorced FamiliesInigo BorromeoОценок пока нет

- Bartos P. J., Glassfibre Reinforced Concrete - Principles, Production, Properties and Applications, 2017Документ209 страницBartos P. J., Glassfibre Reinforced Concrete - Principles, Production, Properties and Applications, 2017Esmerald100% (3)

- 351 UN 1824 Sodium Hydroxide SolutionДокумент8 страниц351 UN 1824 Sodium Hydroxide SolutionCharls DeimoyОценок пока нет

- Plastic As Soil StabilizerДокумент28 страницPlastic As Soil StabilizerKhald Adel KhaldОценок пока нет

- R. Nishanth K. VigneswaranДокумент20 страницR. Nishanth K. VigneswaranAbishaTeslinОценок пока нет

- AluminumPresentationIEEE (CompatibilityMode)Документ31 страницаAluminumPresentationIEEE (CompatibilityMode)A. HassanОценок пока нет

- Why Men Want Sex and Women Need Love by Barbara and Allen Pease - ExcerptДокумент27 страницWhy Men Want Sex and Women Need Love by Barbara and Allen Pease - ExcerptCrown Publishing Group62% (34)

- Pure Vegeterian: Kousika (CaterersДокумент2 страницыPure Vegeterian: Kousika (CaterersShylender NagaОценок пока нет

- Food Safety PosterДокумент1 страницаFood Safety PosterMP CariappaОценок пока нет

- Ural Evelopment: 9 9 Rural DevelopmentДокумент17 страницUral Evelopment: 9 9 Rural DevelopmentDivyanshu BaraiyaОценок пока нет

- Ams - 4640-C63000 Aluminium Nickel MNДокумент3 страницыAms - 4640-C63000 Aluminium Nickel MNOrnella MancinelliОценок пока нет

- 365 Days (Blanka Lipińska)Документ218 страниц365 Days (Blanka Lipińska)rjalkiewiczОценок пока нет

- Gratuity SlidesДокумент11 страницGratuity SlidesK V GondiОценок пока нет

- Self Reflection 1Документ5 страницSelf Reflection 1api-270873994Оценок пока нет

- Case Exercise On Layer Unit (2000 Birds)Документ2 страницыCase Exercise On Layer Unit (2000 Birds)Priya KalraОценок пока нет

- The Preparation of Culture MediaДокумент7 страницThe Preparation of Culture MediaNakyanzi AngellaОценок пока нет

- Presentasi Evaluasi Manajemen Risiko - YLYДокумент16 страницPresentasi Evaluasi Manajemen Risiko - YLYOPERASIONALОценок пока нет

- Educational Facility Planning: Bsarch V-2 Arch. Rey GabitanДокумент20 страницEducational Facility Planning: Bsarch V-2 Arch. Rey Gabitanidealistic03Оценок пока нет

- 1 PolarographyДокумент20 страниц1 PolarographyRiya Das100% (1)

- EE2401 Power System Operation and ControlДокумент93 страницыEE2401 Power System Operation and ControlPrasanth GovindarajОценок пока нет

- Periodontology Question BankДокумент44 страницыPeriodontology Question BankVanshika Jain100% (6)

- Ethics, Privacy, and Security: Lesson 14Документ16 страницEthics, Privacy, and Security: Lesson 14Jennifer Ledesma-Pido100% (1)

- Data Obat VMedisДокумент53 страницыData Obat VMedismica faradillaОценок пока нет

- On How To Design A Low Voltage SwitchboardДокумент11 страницOn How To Design A Low Voltage SwitchboardsabeerОценок пока нет

- MSDS of Poly Aluminum ChlorideДокумент5 страницMSDS of Poly Aluminum ChlorideGautamОценок пока нет

- Report Text: General ClassificationДокумент7 страницReport Text: General Classificationrisky armala syahraniОценок пока нет

- 2008 03 20 BДокумент8 страниц2008 03 20 BSouthern Maryland OnlineОценок пока нет

- Poverty and Children's Personal RelationshipsДокумент87 страницPoverty and Children's Personal RelationshipsJoe OgleОценок пока нет

- HOPE 3-Module 8-Week 5-6Документ9 страницHOPE 3-Module 8-Week 5-6Freya SalorОценок пока нет