Академический Документы

Профессиональный Документы

Культура Документы

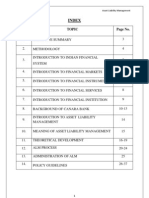

Performance of Non-Banking Financial Companies in India - An Evaluation

Загружено:

Himanshu ParmarОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Performance of Non-Banking Financial Companies in India - An Evaluation

Загружено:

Himanshu ParmarАвторское право:

Доступные форматы

- Journal of Arts Science & Commerce

ISSN 2229-4686

123

PERFORMANCE OF NON-BANKING FINANCIAL COMPANIES

IN INDIA - AN EVALUATION

Suresh Vadde

Associate Professor

Commerce & Business Management,

P.G Centre, Lal Bahadur College,

S.P Road, Warangal- 506009 (A.P) India.

ABSTRACT

Non-banking financial and investment companies operate as an important adjunct

to the banking sector in financial intermediation. They provide support to the capital

market through investment holding, share trading and merchant banking activities, to the

credit market through short and medium-term loans and also help in acquiring long-term

assets through lease and hire purchase activities. This article analyses the performance of

non-government financial and investment companies (other than banking, insurance and

chit-fund companies) during the year 2008-09. The study is based on the audited annual

accounts of 1,215 companies, which closed their accounts during the period April 2008 to

March 2009. The segment of financial and investment companies in the private corporate

sector is highly skewed. The presence of a large sized company, viz., Housing

Development Finance Corporation (HDFC) Limited in the study would exert

considerable influence on the overall performance of the companies in this group in terms

of various quantitative measures. In view of such marked skewness in the size structure,

the analysis presented in the article excludes results of HDFC. Further, it is observed that

the results of three other companies are in large variance with the remaining companies

and accordingly these companies are also kept outside the scope of the study. Thus, the

present analysis is confined to 1,211 companies. However, the data on all the select 1,215

companies including HDFC and other three outlier companies are separately presented.

The study also presents comparable data for the preceding two years 2006-07 and 200708 for the same set of companies, based on the analysis of their accounts for the

respective years.

Keywords: Non-banking, share trading, merchant banking, capital market, lease and hire

purchase, Housing Development Finance Corporation.

Introduction:

International Refereed Research Journal

www.researchersworld.com Vol. II, Issue 1,January 2011

- Journal of Arts Science & Commerce

ISSN 2229-4686

124

The activities of non-banking financial companies (NBFCs) in India have undergone qualitative

changes over the years through functional specialization. The role of NBFCs as effective financial

intermediaries has been well recognized as they have inherent ability to take quicker decisions,

assume greater risks, and customize their services and charges more according to the needs of the

clients. While these features, as compared to the banks, have contributed to the proliferation of

NBFCs, their flexible structures allow them to unbundle services provided by banks and market the

components on a competitive basis. The distinction between banks and non-banks has been gradually

getting blurred since both the segments of the financial system engage themselves in many similar

types of activities. At present, NBFCs in India have become prominent in a wide range of activities

like hire-purchase finance, equipment lease finance, loans, investments, etc. By employing innovative

marketing strategies and devising tailor-made products, NBFCs have also been able to build up a

clientele base among the depositors, mop up public savings and command large resources as reflected

in the growth of their deposits from public, shareholders, directors and other companies, and

borrowings by issue of non-convertible debentures, etc. Consequently, the share of non-bank deposits

in household sector savings in financial assets, increased from 3.1 per cent in 1980-81 to 10.6 per

cent in 1995- 96. In 1998, the definition of public deposits was for the first time contemplated as

distinct from regulated deposits and as such, the figures thereafter are not comparable with those

before.

Non-banking Financial Institutions carry out financing activities but their resources are not directly

obtained from the savers as debt. Instead, these Institutions mobilize the public savings for rendering

other financial services including investment. All such Institutions are financial intermediaries and

when they lend, they are known as Non-Banking Financial Intermediaries (NBFIs) or Investment

Institutions. Apart from these NBFIs, another part of Indian financial system consists of a large

number of privately owned, decentralized, and relatively small-sized financial intermediaries. Most

work in different, miniscule niches and make the market more broad-based and competitive. While

some of them restrict themselves to fund-based business, many others provide financial services of

various types. The entities of the former type are termed as "non-bank financial companies

(NBFCs)". The latter types are called "non-bank financial services companies (NBFCs)". Post 1996,

Reserve Bank of India has set in place additional regulatory and supervisory measure that demand

more financial discipline and transparency of decision making on the part of NBFCs. NBFCs

regulations are being reviewed by the RBI from time to time keeping in view the emerging situations.

Further, one can expect that some areas of co-operation between the Banks and NBFCs may emerge

in the coming era of E-commerce and Internet banking. The RBI regulates NBFCs engaged in

Equipment leasing, hire purchase finance, loan and investment, residuary non-banking Companies

(RNBCs) and the deposit taking Activity of miscellaneous non-banking Companies (chit funds). With

the amendment Of the RBI Act in 1997, it is obligatory for NBFCs to apply for a certificate of

registration (COR). As at the end of June, 2004, the RBI Received 38,050 applications for

registration. Out of these, the RBI approved 13,671 Applications, including 584 applications of

Companies authorized to accept public Deposits. The supervisory role of the RBI Encompasses onsite inspection, off-site Monitoring, market intelligence and exception Reports of statutory auditors.

Data and Methodology:

For the present study data are collected from various issues of RBI Bulletin regarding Financial and

Investment companies. This article analyses the performance of non-government financial and

investment companies (other than banking, insurance and chit-fund companies) during the year 200809. The study is based on the audited annual accounts of 1,215 companies, which closed their

accounts during the period April 2008 to March 2009. The segment of financial and investment

companies in the private corporate sector is highly skewed. The presence of a large sized company,

International Refereed Research Journal

www.researchersworld.com Vol. II, Issue 1,January 2011

- Journal of Arts Science & Commerce

ISSN 2229-4686

125

viz., Housing Development Finance Corporation (HDFC) Limited in the study would exert

considerable influence on the overall performance of the companies in this group in terms of various

quantitative measures. In view of such marked skewness in the size structure, the analysis presented

in the article excludes results of HDFC. The study also presents comparable data for the preceding

two years 2006-07 and 2007-08 for the same set of companies, based on the analysis of their accounts

for the respective years.

I. Composition of the Select Companies:

The select 1,211 financial and investment companies were classified into five groups, viz., (1) Share

trading and investment holding, (2) Loan finance, (3) Asset finance, (4) Diversified and (5)

Miscellaneous. A company was placed in one of the first three principal activity groups if at least half

of its annual income during the study year 2008-09 was derived from that principal activity consistent

with the income-yielding assets. In case no single principal activity was predominant, the company

was classified under Diversified group. Companies not engaged in the above three activities,

however, conducting financial activities were classified as Miscellaneous3. The composition of the

select companies according to their total number, paid-up capital, main income and total net assets

across the above-mentioned activities are presented in Table 1.

The Share Trading and Investment Holding companies, which accounted for 41.9 per cent, in terms

of number, of the select 1,211 companies, had a share of 30.7 per cent of the total paid-up capital in

2008-09; but accounted for only 12.8 per cent of the total net assets and 14.0 per cent of the total

main income. Loan Finance companies (37.8 per cent in terms of number) accounted for 51.6 per

cent of total paid-up capital, contributed a major share in total main income and in total net assets at

70.6 per cent and 65.3 per cent, respectively, in 2008-09.

Activity

Share trading

Investment

holding

Loan finance

Table -1

Number of

Companies

507

-41.9

(Amount in ` crore)

Paid-up

Capital

7,567

-30.7

458

12,736

-37.8

-51.6

Asset finance

42

1,393

-3.5

-5.6

Diversified

49

410

-4

-1.7

Miscellaneous

155

2,568

-12.8

-10.4

All Activities

1,211

24,675

-100

-100

Note: Figures in parentheses represent percentages to total.

4,069

Total

Net Assets

41,171

-14

-12.8

20,544

-70.6

1,905

-6.5

672

-2.3

1,906

-6.6

29,097

-100

2,09,417

-65.3

13,806

-4.3

6,503

-2

50,038

-15.6

3,20,934

-100

Main Income

II. Operational Results:

International Refereed Research Journal

www.researchersworld.com Vol. II, Issue 1,January 2011

- Journal of Arts Science & Commerce

ISSN 2229-4686

126

Onset of global financial crisis in 2008- 09 initially led to liquidity problems in non- banking

financial companies as their traditional funding sources dried up. However, the liquidity-augmenting

measures taken by the Reserve Bank addressed the problem swiftly. Subsequently, demand for credit

also came down. On another front, reversal of capital flows in the second half of the financial year

put severe pressure on domestic capital market and the investors suffered huge losses. Operating

results of non-banking financial and investment companies were also affected.

The main income of the select 1,211 non-government non-banking financial and investment

companies increased only by 15.7 per cent in 2008-09 to ` 29,097 crore as against 40.6 per cent

growth observed in 2007-08 (Statements 1 and 3). Growth in interest income (which contributed 49.2

per cent to the total income) at 30.8 per cent during the year under review was lower compared with

61.8 per cent recorded in the previous year and net profit from share dealings (contribution to total

income is 10.6 per cent) declined by 19.0 per cent. However, the other income (contribution to total

income is 25.2 per cent) grew by 34.4 per cent during 2008-09. As a result, total income of the select

companies increased by 20.8 per cent in 2008-09 as compared with 46.9 per cent in the previous year.

Interest payments went up by 40.0 per cent in 2008-09 on top of 62.7 per cent growth

registered in 2007-08. However, employees remuneration witnessed a growth of only 14.0 per cent

in 2008-09 as against 68.4 per cent in 2007-08. Growth in depreciation provision of 15.2 per cent

during 2008-09 was also lower compared with 28.1 per cent growth in 2007-08. As a result, total

expenditure went up by 33.4 per cent in 2008-09 as compared with 62.6 per cent growth registered in

2007-08.

Accordingly, operating profits and post- tax profits of the select companies declined by 6.7

per cent and 7.9 per cent, respectively, during the period under review (Table 2). Operating profit

margin, measured as a ratio of operating profits to main income, of the select companies decreased to

35.0 per cent in 2008-09 from 43.4 per cent in 2007-08 (Table 3). The return on shareholders equity

(ratio of profits after tax to net worth) of the select companies was lower at 7.8 per cent in 2008-09

compared with 9.5 per cent registered in 2007-08. However, the select companies rewarded their

shareholders with marginally higher dividends in 2008-09. The dividend rate increased marginally to

6.8 per cent in 2008-09 from 6.6 per cent in 2007-08. Retention ratio (retained profits to profits after

tax) of select companies decreased moderately to 80.3 per cent in 2008-09 from 82.8 per cent in

2007-08 (Statement 2). Bad debts including provisions accounted for a higher share of 5.3 per cent of

total income in 2008-09 as against 4.4 per cent in the previous year, indicating deterioration in assets

quality of the select companies.

While the companies across all the groups recorded lower profits, those engaged in miscellaneous

financial activities, could post positive growth in their operating profits and post-tax profits in 200809. Companies in Share Trading and Investment Holding activity and Diversified group were

most adversely affected in terms of growth in net profits. The companies engaged in miscellaneous

financial activities registered the highest operating profit margin followed by the companies dealing

in Share Trading and Investment Holding activity. The dividend rate was the highest for the

companies engaged in miscellaneous financial activities.

III. Sources and Uses of Funds Sources of Funds:

Faced with a recessionary prospect world-wide, business of non-banking financial and

investment companies expanded at a slower pace. The select companies raised funds amounting to `

44,947 crore during 2008-09 as against ` 86,348 crore raised during the previous year (Statement 5).

Funds raised through external sources declined to ` 30,251 crore from ` 74,250 crore in the previous

year.

Table-2: growth Rate of Select Items, 2007-08 and 2008-09

International Refereed Research Journal

www.researchersworld.com Vol. II, Issue 1,January 2011

- Journal of Arts Science & Commerce

Activity

Item

All Activities

ISSN 2229-4686

127

Share Trading

Asset

& Investment

Loan Finance

Diversified Miscellaneous

Finance

Holding

2008- 2007- 2008- 2007- 2008- 2007- 2008- 2007- 20082007-08

09

08

09

08

09

08

09

08

09

200708

200809

Main

Income

40.6

15.7

-10.9

-3

63.6

28.3

41.2

27.3

27.5

-12.7

54.8

-28.6

Total

Income

46.9

20.8

-6.5

-6.3

61.5

28.4

48.9

23.4

31.9

6.8

71.2

21.1

Total

Expenditure

62.6

33.4

49.1

-4.2

67.8

43.9

43

31.2

32.2

17.9

65.9

25.3

Operating

Profits

24.9

-6.7

-25.9

-5.8

55.8

-9.3

84.8

-44.3

17.6

-33.3

95.8

5.4

Profits

After Tax

18.4

-7.9

-20.5

-14.8

39.4

-8.6

63

-4.3

42.1

-48.9

88.9

8.2

Table 3: Select Profitability Ratios, 2007-08 and 2008-2009

Activity

Item

Operating

Profit Margin

Effective Tax

Rate*

Return on

equity

Dividend

Rate

. Return on

Assets

All Activities

Share

Trading&

Investment

Holding

Loan Finance

Asset

Finance

Diversified

Miscellaneous

2007- 2008- 2007- 2008- 2007- 2008- 2007- 2008- 2007- 2008- 200708

09

08

09

08

09

08

09

08

09

08

200809

43.4

35

68.7

66.8

32.2

22.8

23.7

10.4

21.3

16.3

87.7

129.7

26.3

28.1

15.9

19.7

28.2

29.1

30.5

33.9

26.9

38.2

11.4

11.1

9.5

7.8

7.1

8.3

6.7

10

7.6

6.4

3.1

18.8

16.4

6.6

6.8

4.3

7.2

5.6

6.2

3.3

3.2

3.4

12

11.9

2.4

6.5

5.2

2.2

1.7

1.7

1.6

2.2

1.1

3.7

3.3

Calculated based on the companies which made profits during that year.

Accordingly, the share of external sources in total sources declined to 67.3 per cent during

2008-09 as against 86.0 per cent in the previous year (Table 4). The share of funds mobilised from

capital market through issue of fresh capital (including premium on shares) in the total sources of

funds decreased to 12.7 per cent during 2008-09 from 22.9 per cent during 2007-08. Similarly, share

International Refereed Research Journal

www.researchersworld.com Vol. II, Issue 1,January 2011

- Journal of Arts Science & Commerce

ISSN 2229-4686

128

of borrowings declined to 52.0 per cent during 2008-09 from 56.8 per cent during 2007-08. The share

of Debentures in total borrowings remained close to 28 per cent, whereas, the share of Bank

borrowings in total borrowings decreased to 55.6 per cent during 2008-09 from 59.1 per cent in

2007-08.

IV. Liabilities and Assets Structure :

Liabilities Structure:

The total liabilit ies of t he select companies increased by 15.8 per cent to `

3,18,167 crore in 2008-09 (Statement 4). Though Borrowings (outstanding) grew at a lower rate by

13.8 per cent in 2008-09, it continued to be the major component, constituting 60.5 per cent of

total liabilities (Chart 1). The share of bank borrowings in total borrowings marginally increased to

44.7 per cent in 2008-09 from 43.2 per cent in the previous year. The debt-equity ratio marginally

increased to 106.2 per cent in 2008-09 from 105.6 per cent in 2007-08. Total outside liabilities

grew at a higher rate (17.0 per cent) compared with net worth (13.1 per cent). As a result, the ratio

of total outside liabilities to net worth increased to 226.9 per cent in 2008-09 from 219.4 per cent in

2007-08. The composition of total liabilities of select companies across activity groups is given in

Table 4.

Assets Structure:

T he asset s p at t er n o f t he select companies showed marginal variation in 2008-09

from that of previous year (Table 6). While the share of Loans and Advances extended by the

select companies in total assets decreased to 60.9 per cent in 2008-09 from 61.7 per cent in 2007-08,

the share of Investments in total assets increased to 22.9 per cent in 2008-09 from 22.0 per cent in

2007-08. Invest ment s and loans and advances extended by these companies grew at a lower

rate by 20.6 per cent and 14.3 per cent, respectively, in 2008-09 compared with 42.6 per cent and 45.2

per cent, respectively, in 2007-08. The ratio of borrowings to total assets decreased to 60.5 per cent in

2008-09 from 61.5 per cent in 2007-08.

Table 4: Liabilities Structure of Select Financial and Investment Companies, 2007-08 and

2008-09

Share

Trading

All Activities

Loan Finance

&Investment

Holding

20072008- 2007- 2008- 2007- 200808

09

08

09

08

09

Capital and

Liabilities

A. Share

Capital

B. Reserves

and Surplus

Asset

Finance

Diversified

Miscellaneous

2007- 2008- 2007- 2008- 200708

09

08

09

08

200809

8.2

7.8

19.3

18.4

6.5

6.1

7.3

10.1

6.7

6.4

5.6

5.1

23.1

22.8

52.5

54.6

19.6

19

9.9

10.4

28.1

28.2

14.1

15

C.Borrowings 61.5

60.5

22.4

19.6

68.7

66

68.4

70.6

44.7

43.3

67.8

69.9

i. Debentures

17.8

3.8

3.5

22

20

29.1

40.5

10.3

5.9

14

15.6

18.3

International Refereed Research Journal

www.researchersworld.com Vol. II, Issue 1,January 2011

- Journal of Arts Science & Commerce

ii.Bank

borrowings

D. Liabilities

Sundry

Creditors

E. Other

Liabilities

Total

129

ISSN 2229-4686

26.6

27

5.8

6.3

28.1

28.1

28.2

16.2

24

25.7

39.2

42.4

5.7

5.3

4.7

6.3

3.7

3.7

13.4

18.5

20.6

11

8.3

1.9

1.6

2.2

1.2

4.8

3.5

2.6

2.4

4.4

3.4

1.5

3.6

1.1

1.2

1.6

5.2

0.9

1.4

1.5

1.6

100

100

100

100

100

100

100

100

100

100

100

100

Borrowings (outstanding) continued to be t he ma jor co mp o nent in t he t o t al

liabilities for all the groups of companies, except for the companies engaged in Share Trading

and Investment Holding activity, for which reserves and surplus was the major

component. Major contributor in total borro wings was debent ures in case of co mpanies

engaged in Asset Financeactivity, whereas, for other companies bank borrowings was the

major contributor.

The asset s st ruct ure of t he select co mpanies was in line wit h t he major activity

undertaken by them. Investments accounted for a major share of 58.0 per cent in total assets

for co mpanies in Share Trading and Investment Holding activity, whereas, loans and

advances extended fo r med a ma jo r shar e fo r co mp an ies eng aged in Lo an Finance

and Asset Finance activity at 70.4 per cent and 80.2 per cent, respectively, in 2008-09.

Table -5: Assets Structure of the Select Companies

Assets

All

Share

International Refereed Research Journal

Loan Finance

Asset

Diversified

Miscellaneous

www.researchersworld.com Vol. II, Issue 1,January 2011

- Journal of Arts Science & Commerce

Activities

Trading

&Investment

Holding

130

ISSN 2229-4686

Finance

200

708

2008- 2007- 2008- 2007- 2008- 2007- 2008- 2007- 2008- 200709

08

09

08

09

08

09

08

09

08

200809

A. Cash and

Bank Balances

8.3

8.8

4.3

7.8

8.8

6.3

7.5

10.1

6.2

3.3

10

20.4

Deposits with

Banks

8.1

8.7

4.2

7.8

8.7

6.2

9.7

5.9

3.2

9.8

20.1

B. Investments

22

22.9

60.8

58

17.5

21.2

4.6

4.6

11.5

9.6

11.6

7.8

C. Receivables

65.2 64.5

20.9

20.5

71

70.4

82.9

80.2

77.8

81.3

75.1

68.7

61.7 60.9

17.2

16.2

69.4

68.8

81.6

74.1

75.6

73.1

62.1

58.8

2.4

2.6

3.4

0.4

0.3

0.3

0.5

1.1

1.1

11.5

8.4

2.4

2.4

11.7

11.5

1.1

1.1

0.3

0.4

2.4

3.7

0.2

0.4

1.6

2.3

9.7

11.4

0.3

0.3

0.2

3.4

0.1

0.3

1.4

1.2

1.5

0.8

0.8

4.2

3.8

2.1

2.8

2.3

0.7

100

0.2

100

0.8

100

1.3

100

0.9

100

0.2

100

0.6

100

0.9

100

0

100

0.2

100

0.3

100

0.6

100

(i) Loans and

Advances

(ii) Sundry

debtors

D. Inventories

Industrial

Securities

E. Net Fixed

Assets

F. Other Assets

Total

V. Conclusion:

It was observed from the consolidated results of the select 1,211 non-Government financial

and investment companies that growth in income, both main as well as other income, decelerated

during the year 2008-09. Though, growth in total expenditure also decelerated, it was higher than the

income growth. The growth in expenditure was mainly driven by the growth in interest payments. As

a result, operating profits of the select companies declined along with diminishing profitability during

2008-09. Business of select non-banking financial and investment companies expanded at a slower

pace during 2008-09. The share of external sources in total sources declined during 2008-09 when

compared with the previous year. However, they continued to be the major sources of finance. A

substantial portion of funds raised during the year was in the form of borrowings. Other significant

portion of funds was in the form of raising fresh capital from the capital market. Major portion of the

funds raised during the year was deployed as loans and advances in the credit market. However, its

share in total uses of funds decreased. The share of Investments in total uses of funds increased

during 2008-09 on account of investments in the mutual funds and shares and debentures of other

Indian companies.

References:

Nabhis Law relating to Non Banking Financial Companies, A Nabhi Publication, 1994, pp.

1, 3, 5.

International Refereed Research Journal

www.researchersworld.com Vol. II, Issue 1,January 2011

- Journal of Arts Science & Commerce

ISSN 2229-4686

131

Reserve Bank of India Bulletin, August 2009, p. 591

Machiraju H.R.: Indian Financial System, Vikas Publishing House Pvt. Limited, 1998, p. 7.1

CMIE, Monthly Review of Indian Economy, Dec. 1997, pp. 129-131.

Reserve Bank of India Bulletin, July 1998, p. 581

CMIE, Monthly Review of Indian Economy, May 1999, pp. 119.

CMIE, Monthly Review of Indian Economy, June 1999, pp. 110.

Seema Saggar, Financial Performance of Leasing Companies, During the Quinquennium Ending

1989-90 Reserve Bank of India: Occasional Papers, Vol. 16, No. 3 September 95, pp. 223236.

Harihar T.S. Non-Banking Finance Companies, The Imminent Squeeze, Chartered Financial

Analyst, February 1998, p. 40-47.

Reserve Bank of India Bulletin, August 1997, pp. 592-593.

Reserve Bank of India Bulletin Various issues, February 1991, May 1992, December 1992

etc.

Economic Times, Ahmedabad Edition, 26/3/99, p. 10

Bhole, L.M., Financial Institutions and Markets, Tata MC Graw Hill Publishing CO. Ltd., 1992.

Report of the Working Group on Financial Companies, Reserve Bank of India, Bombay,

September, 1992.

International Refereed Research Journal

www.researchersworld.com Vol. II, Issue 1,January 2011

Вам также может понравиться

- EIB Working Papers 2019/10 - Structural and cyclical determinants of access to finance: Evidence from EgyptОт EverandEIB Working Papers 2019/10 - Structural and cyclical determinants of access to finance: Evidence from EgyptОценок пока нет

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveОт EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveОценок пока нет

- Performance Analysis Mba ProjectДокумент64 страницыPerformance Analysis Mba ProjectShanmukhaSharmaОценок пока нет

- Investment Strategies in NBFCS: An Over ViewДокумент9 страницInvestment Strategies in NBFCS: An Over ViewIAEME PublicationОценок пока нет

- The Post Offering Performance of Ipos From The Banking IndustryДокумент20 страницThe Post Offering Performance of Ipos From The Banking IndustrypradeepchoudharyОценок пока нет

- Financial Liberalisation, Corporate Governance and The Efficiency of Firms in Indian ManufacturingДокумент24 страницыFinancial Liberalisation, Corporate Governance and The Efficiency of Firms in Indian ManufacturingMuhammad Sualeh KhattakОценок пока нет

- A Project Report On Ratio Analysis at Il&Fs Invest Smart Mba Project FinanceДокумент88 страницA Project Report On Ratio Analysis at Il&Fs Invest Smart Mba Project Financesatish pawarОценок пока нет

- Financial Efficiency of Commercial Banks: A Comparative Study of Public and Private Banks in India in The Post-Global Recession EraДокумент14 страницFinancial Efficiency of Commercial Banks: A Comparative Study of Public and Private Banks in India in The Post-Global Recession Eraಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್Оценок пока нет

- Ratio Analysis at Il&Fs Invest Smart Mba Project FinanceДокумент86 страницRatio Analysis at Il&Fs Invest Smart Mba Project FinanceBabasab Patil (Karrisatte)Оценок пока нет

- Project in E-I-C Analysis at Il&f Invest Smart Stock LTD Mba FinanceДокумент87 страницProject in E-I-C Analysis at Il&f Invest Smart Stock LTD Mba FinanceBabasab Patil (Karrisatte)Оценок пока нет

- NBFCs Sip 2020Документ52 страницыNBFCs Sip 2020Prashant AgarkarОценок пока нет

- Finacial Performance of NBFC I IdiaДокумент12 страницFinacial Performance of NBFC I IdiaKutub UdaipurwalaОценок пока нет

- Financial Analysis of Information and Technology Industry of India (A Case Study of Wipro LTD and Infosys LTD)Документ13 страницFinancial Analysis of Information and Technology Industry of India (A Case Study of Wipro LTD and Infosys LTD)A vyasОценок пока нет

- Literature Review On Financial Analysis of BanksДокумент6 страницLiterature Review On Financial Analysis of Banksea30d6xs100% (1)

- Shashank RN Project 2Документ76 страницShashank RN Project 2Nithya RajОценок пока нет

- Full Paper For IndividualДокумент19 страницFull Paper For IndividualGetaneh YenealemОценок пока нет

- 5indian Bond Market WP Nipfp 2012Документ22 страницы5indian Bond Market WP Nipfp 2012Rajat KaushikОценок пока нет

- Mini Paper AkuntansiДокумент13 страницMini Paper AkuntansiFathiya RachmasariОценок пока нет

- 43 Shweta SinghДокумент5 страниц43 Shweta Singhrohit sharmaОценок пока нет

- Corporate Financing With Special Reference To Bank of India, Thane (Main) BranchДокумент73 страницыCorporate Financing With Special Reference To Bank of India, Thane (Main) BranchMohit SharmaОценок пока нет

- Historical Background of Finance:-: DefinitionsДокумент28 страницHistorical Background of Finance:-: DefinitionsApoorva A NОценок пока нет

- Group - 3 - Assignment (Term Paper)Документ13 страницGroup - 3 - Assignment (Term Paper)Biniyam YitbarekОценок пока нет

- Financial Performance of Non Banking Finance Companies in India Amita S. KantawalaДокумент7 страницFinancial Performance of Non Banking Finance Companies in India Amita S. KantawalajayasundariОценок пока нет

- A Study On The Financial and Operational Efficiency of Sakthi Finance LimitedДокумент88 страницA Study On The Financial and Operational Efficiency of Sakthi Finance LimitedmaheswariОценок пока нет

- A Study On Financial Performance Analysis of The Sundaram Finance LTDДокумент56 страницA Study On Financial Performance Analysis of The Sundaram Finance LTDSindhuja Venkatapathy88% (8)

- Visit Report Financial Institution Other Than BankДокумент49 страницVisit Report Financial Institution Other Than BankAMIT K SINGH69% (29)

- Camel Analysis of NBFCS in TamilnaduДокумент7 страницCamel Analysis of NBFCS in TamilnaduIAEME PublicationОценок пока нет

- Mba Afm Yashika DamodarДокумент9 страницMba Afm Yashika DamodarYashika DamodarОценок пока нет

- JETIR1906667Документ9 страницJETIR1906667Pooja MОценок пока нет

- Private Equity Research PapersДокумент5 страницPrivate Equity Research Papersc9rvz6mm100% (1)

- Financial Statement Analysis-Indian BankДокумент74 страницыFinancial Statement Analysis-Indian Bankharpreet kaurОценок пока нет

- Interim Financial Reporting & Compliance With SEBIs Guidelines The Case of India's Financial Industry - GIBS Bangalore - Top B-School in BangaloreДокумент10 страницInterim Financial Reporting & Compliance With SEBIs Guidelines The Case of India's Financial Industry - GIBS Bangalore - Top B-School in BangalorePradeep KhadariaОценок пока нет

- Determinants of Profitability of Non Bank Financial Institutions' in A Developing Country: Evidence From BangladeshДокумент12 страницDeterminants of Profitability of Non Bank Financial Institutions' in A Developing Country: Evidence From BangladeshNahid Md. AlamОценок пока нет

- Financial Institution Other Than Bank ReportДокумент10 страницFinancial Institution Other Than Bank ReportVinod Kale72% (18)

- Financial Statement Black BookДокумент35 страницFinancial Statement Black BookomkarОценок пока нет

- Financial Analysis of Information and Technology Industry of India 2017Документ17 страницFinancial Analysis of Information and Technology Industry of India 2017Priyanka KumariОценок пока нет

- Analysis of Icici Bank A Report On Business Strategy: Submitted To: Prof. Vikas ChandraДокумент22 страницыAnalysis of Icici Bank A Report On Business Strategy: Submitted To: Prof. Vikas ChandraIshu GoelОценок пока нет

- An Appraisal OF Investment Banking IN IndiaДокумент22 страницыAn Appraisal OF Investment Banking IN Indiaganesh189Оценок пока нет

- Sini Final ProДокумент59 страницSini Final ProGokul KrishnanОценок пока нет

- Research Paper Ma PiyushДокумент15 страницResearch Paper Ma Piyushpiyushpurva2005Оценок пока нет

- Chapter - 1 Introduction: 1.1 Background of The StudyДокумент78 страницChapter - 1 Introduction: 1.1 Background of The StudyPRIYA RANAОценок пока нет

- Thesis On Mutual FundДокумент185 страницThesis On Mutual Fundsidhantha83% (6)

- Thesis Topic On Banking SectorДокумент4 страницыThesis Topic On Banking Sectorstaceycruzwashington100% (1)

- Chapter: 1 IntroductionДокумент6 страницChapter: 1 IntroductionDipen BhattaraiОценок пока нет

- New Financial Performance of Icici BankДокумент10 страницNew Financial Performance of Icici BankcityОценок пока нет

- Vision 2020 For India The Financial Sector: Planning CommissionДокумент22 страницыVision 2020 For India The Financial Sector: Planning Commissionarpitasharma_301Оценок пока нет

- 24Документ8 страниц24GAYATHRIОценок пока нет

- IJRPR18248Документ5 страницIJRPR18248mudrankiagrawalОценок пока нет

- Institution Other: Visit Report Financial Than BankДокумент4 страницыInstitution Other: Visit Report Financial Than BankMaheshwar morghadeОценок пока нет

- Ganeshan VanamamalaiДокумент57 страницGaneshan Vanamamalaisweetlingeethu_kannanОценок пока нет

- 1106-Article Text-3172-4-10-20210519Документ24 страницы1106-Article Text-3172-4-10-20210519hoaintt0122Оценок пока нет

- Priyam IFS CIA 3.1Документ14 страницPriyam IFS CIA 3.1ADITYA JAIN 1620203Оценок пока нет

- Nayan ProjectДокумент5 страницNayan ProjectNayan MaldeОценок пока нет

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)От EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Оценок пока нет

- EIB Working Papers 2018/08 - Debt overhang and investment efficiencyОт EverandEIB Working Papers 2018/08 - Debt overhang and investment efficiencyОценок пока нет

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingОт EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingОценок пока нет

- Takaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaОт EverandTakaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaОценок пока нет

- Marketing of Consumer Financial Products: Insights From Service MarketingОт EverandMarketing of Consumer Financial Products: Insights From Service MarketingОценок пока нет

- Writing ProposalsДокумент25 страницWriting ProposalsSihamou AltawbaОценок пока нет

- Southern Technologies Rbi NBFC Npa ProvisionsДокумент60 страницSouthern Technologies Rbi NBFC Npa ProvisionsHimanshu ParmarОценок пока нет

- Criminal Charged PoliticДокумент12 страницCriminal Charged PoliticHimanshu ParmarОценок пока нет

- NBFCs A PrimerДокумент11 страницNBFCs A PrimerJayant AryaОценок пока нет

- Negotiable Instruments 1229854285942730 1Документ60 страницNegotiable Instruments 1229854285942730 1Rohan RustagiОценок пока нет

- Negotiable InstrumentsДокумент56 страницNegotiable InstrumentsHimanshu ParmarОценок пока нет

- Manusmriti: A Critique of The Criminal Justice Tenets in The Ancient Indian Hindu CodeДокумент13 страницManusmriti: A Critique of The Criminal Justice Tenets in The Ancient Indian Hindu CodeHimanshu ParmarОценок пока нет

- RP27 Kujur NaxalДокумент24 страницыRP27 Kujur NaxalHimanshu ParmarОценок пока нет

- BailДокумент3 страницыBailHimanshu ParmarОценок пока нет

- Common Law Civil Law TraditionsДокумент11 страницCommon Law Civil Law Traditionsmohsinemahraj100% (3)

- Industrial PropertyДокумент2 страницыIndustrial PropertyHimanshu ParmarОценок пока нет

- LinuxДокумент5 страницLinuxHimanshu ParmarОценок пока нет

- General Knowledge Quiz Questions With AnswersДокумент5 страницGeneral Knowledge Quiz Questions With AnswersHimanshu ParmarОценок пока нет

- Judicial Creativity Law 04Документ16 страницJudicial Creativity Law 04Himanshu Parmar100% (1)

- This Is My First Word DocumentДокумент1 страницаThis Is My First Word DocumentHimanshu ParmarОценок пока нет

- Ipc Amendment 2013Документ20 страницIpc Amendment 2013Sushil ShuklaОценок пока нет

- Joint Family System Its Present and FutureДокумент4 страницыJoint Family System Its Present and FutureHimanshu ParmarОценок пока нет

- Managerial Accounting Multiple Choice AnswersДокумент21 страницаManagerial Accounting Multiple Choice Answersmobinil1Оценок пока нет

- 1.0 Ratio AnalysisДокумент6 страниц1.0 Ratio Analysissam1702Оценок пока нет

- Avoid Bases That Make Too Deep A DropДокумент2 страницыAvoid Bases That Make Too Deep A DropAndraReiОценок пока нет

- Oblicon Cases Joint and Solidary Until Obligations With A Penal ClauseДокумент82 страницыOblicon Cases Joint and Solidary Until Obligations With A Penal ClausezenbonetteОценок пока нет

- The Institute of Bankers Pakistan: Sample PaperДокумент5 страницThe Institute of Bankers Pakistan: Sample PaperkoolyarОценок пока нет

- Hedging, Critical Discourse Analysis and The Original Brexit AffairДокумент8 страницHedging, Critical Discourse Analysis and The Original Brexit AffairNordsci ConferenceОценок пока нет

- AIG HistoryДокумент9 страницAIG Historysandeepkumar.jha5715Оценок пока нет

- 05 Narra Nickel Mining and Development Corp. vs. Redmont Consolidated Mines Corp. (2015) RESOLUTIONДокумент4 страницы05 Narra Nickel Mining and Development Corp. vs. Redmont Consolidated Mines Corp. (2015) RESOLUTIONRalph Deric EspirituОценок пока нет

- 726 Various Hedge Fund LettersДокумент13 страниц726 Various Hedge Fund Lettersapi-3733080100% (3)

- BaselДокумент3 страницыBaselFarhan Ashraf SaadОценок пока нет

- Implementation of EVA at Godrej - Case StudyДокумент4 страницыImplementation of EVA at Godrej - Case StudyJitendra RamtekeОценок пока нет

- Equity Lenders Acceptance, IncДокумент15 страницEquity Lenders Acceptance, Incsirach2006Оценок пока нет

- IDX Monthly Statistics Oktober 2009Документ57 страницIDX Monthly Statistics Oktober 2009fahriyaniОценок пока нет

- Pertemuan 14 - Investasi Saham (20% - 50%) PDFДокумент17 страницPertemuan 14 - Investasi Saham (20% - 50%) PDFayu utamiОценок пока нет

- Itulip - Fire Economy in Crisis Part IДокумент16 страницItulip - Fire Economy in Crisis Part Idonnal47Оценок пока нет

- PBU0054 Chapter 14 Financing SourcesДокумент36 страницPBU0054 Chapter 14 Financing SourcesMUHAMMAD AQIL BIN KHAIRUL AZHARОценок пока нет

- CA Devendra Jain Sec 56 9-6-2018Документ46 страницCA Devendra Jain Sec 56 9-6-2018ShabarishОценок пока нет

- Revocation of Guarantee: Chanakya National Law UniversityДокумент20 страницRevocation of Guarantee: Chanakya National Law UniversitySHUBHAM RAJОценок пока нет

- 2017 Delegate ListДокумент50 страниц2017 Delegate ListITZMERZSОценок пока нет

- Actex IFM Manual Fall 2019 SampleДокумент35 страницActex IFM Manual Fall 2019 SampleBrian NgОценок пока нет

- Project Homeless Connect 2012 990Документ14 страницProject Homeless Connect 2012 990auweia1Оценок пока нет

- NomuraДокумент37 страницNomuradavidmcookОценок пока нет

- Factoring, Forfaiting & Bills DiscountingДокумент3 страницыFactoring, Forfaiting & Bills DiscountingkrishnadaskotaОценок пока нет

- Ministry of Corporate Affairs - MCA ServicesДокумент2 страницыMinistry of Corporate Affairs - MCA ServicesMeiyappan MОценок пока нет

- Accounting Corporation ExerciseДокумент5 страницAccounting Corporation ExerciseJennifer AdvientoОценок пока нет

- FinLiab QuizДокумент8 страницFinLiab QuizAeris StrongОценок пока нет

- Dps Security Analysis and Portfolio ManagementДокумент96 страницDps Security Analysis and Portfolio ManagementDipali ManjuchaОценок пока нет

- 17-1553 2018 US Custom GF Catalog LowRes ShaftOptions IronsДокумент11 страниц17-1553 2018 US Custom GF Catalog LowRes ShaftOptions IronsGanny RachmadiОценок пока нет

- Delpher Traders vs. IacДокумент3 страницыDelpher Traders vs. IacKent A. AlonzoОценок пока нет

- Ansbacher Cayman Report Appendix Volume 7Документ699 страницAnsbacher Cayman Report Appendix Volume 7thestorydotieОценок пока нет