Академический Документы

Профессиональный Документы

Культура Документы

Introduction to Management Accounting Concepts

Загружено:

saneesh81Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Introduction to Management Accounting Concepts

Загружено:

saneesh81Авторское право:

Доступные форматы

Management Accounting

Unit 1

Unit 1

Introduction to Management Accounting

Structure:

1.1 Introduction

Objectives

1.2 Meaning and Definition of Management Accounting

1.3 Features and Objectives of Management Accounting

Features

Objectives of management accounting

1.4 Nature and Scope of Management Accounting

1.5 Importance and Need for Management Accounting

Importance

Need for management accounting

1.6 Functions of Management Accounting

1.7 Differences between Financial Accounting, Cost Accounting and

Management Accounting and Similarities

1.8 Summary

1.9 Glossary

1.10 Terminal Questions

1.11 Answers

1.1 Introduction

The inadequacies or limitations of financial accounting and cost accounting

have paved the way for the evolution of management accounting.

Management accounting is the presentation of data needed by the

management, at the required time, in the most suitable format.

In this unit, you will be introduced to management accounting, which can be

defined as the art or technique of analysis, interpretation and presentation of

facts, results and information revealed by financial accounting, cost

accounting and other books and records maintained by the business for the

benefit of people who are in charge of managing the business efficiently.

Let us first understand management accounting by explaining the features

and scope or various areas covered. You will also learn why it is important

for an organisation to have a clear focus on its various uses.

Sikkim Manipal University

Page No.: 1

Management Accounting

Unit 1

We will also learn the functions of management accounting, and how it

helps the management to effectively discharge its managerial functions.

Finally, we will differentiate between financial accounting, cost accounting

and management accounting to know the importance from the point of view

of management and its nature of functioning.

Objectives:

After studying this unit, you should be able to:

describe the meaning and features of management accounting

explain the scope of management accounting

recall the importance and functions of management accounting

distinguish between financial accounting, cost accounting

management accounting

and

1.2 Meaning and Definition of Management Accounting

In the previous section, we were introduced to management and financial

accounting. In this section, we will study about the meaning and definition of

management accounting.

Management accounting is the accounting that provides necessary

information to the management for discharging functions such as planning,

organising, directing and controlling in an efficient manner. It is concerned

with the interpretation of accounting information to guide the management

for future planning, decision making, controlling, etc. It mainly deals with

providing information and reports relating to the conduct of the various

aspects of a business.

Management accounting is a blend of financial accounting, cost accounting

and financial management to serve as a good guide to management in

planning, coordinating, executing, controlling and motivating. It is a branch

of accounting that deals with providing information to managers to enable

them to decide about the best utilisation of resources made available to the

management.

Management accounting is a science in which accounting information is

collected and analysed. This information is then provided to management

for creation of policies and decision making. It is not just concerned with the

post-mortem analysis of the historical or past results. On the other hand, it

Sikkim Manipal University

Page No.: 2

Management Accounting

Unit 1

mainly deals with forecasts or future estimates. It helps management plan

for the future in the light of past experiences.

Management accounting is the art or technique of analysis, interpretation

and presentation of facts, results and information revealed by financial

accounting, cost accounting and other books and records maintained by the

business for the benefit of people who are in charge of managing the

business more efficiently.

Management accounting or managerial accounting is concerned with the

provisions and use of accounting information to managers within

organisations, to provide them with the basis to make informed business

decisions that will allow them to be better equipped in their management

and control functions.

In contrast to financial accountancy information, management accounting

information is:

Primarily forward-looking, instead of historical.

Model-based with a degree of abstraction to support decision-making

generically, instead of case-based.

Designed and intended for use by managers within the organisation,

instead of being intended for use by shareholders, creditors and public

regulators.

Usually confidential and used by management, instead of publicly

reported.

Computed by reference for managers, often using management

information systems, instead of by reference to general financial

accounting standards.

According to the Chartered Institute of Management Accountants (CIMA),

management accounting is "the process of identification, measurement,

accumulation, analysis, preparation, interpretation and communication of

information used by management to plan, evaluate and control within an

entity and to assure appropriate use of and accountability for its resources.

Management accounting also comprises the preparation of financial reports

for non-management groups such as shareholders, creditors, regulatory

agencies and tax authorities" (CIMA Official Terminology).

Sikkim Manipal University

Page No.: 3

Management Accounting

Unit 1

The Institute of Management Accountants (IMA) recently updated its

definition as follows: "Management accounting is a profession that involves

partnering in management decision making, devising planning and

performance management systems, and providing expertise in financial

reporting and control to assist management in the formulation and

implementation of an organisations strategy".

The American Institute of Certified Public Accountants (AICPA) states that

management accounting as practice extends to the following three areas:

Strategic Management Advancing the role of the management

accountant as a strategic partner in the organisation.

Performance Management Developing the practice of business

decision-making and managing the performance of the organisation.

Risk Management Contributing to frameworks and practices for

identifying, measuring, managing and reporting risks to the achievement

of the objectives of the organisation.

The Institute of Certified Management Accountants (ICMA) states that, "A

management accountant applies his/her professional knowledge and skill in

the preparation and presentation of financial and other decision-oriented

information in such a way as to assist management in the formulation of

policies and in the planning and control of the operation of the undertaking".

Management accountants, therefore, are seen as the "value-creators"

amongst the accountants. They are much more interested in forward-looking

and taking decisions that will affect the future of the organisation, rather than

in the historical recording and compliance (score keeping) aspects of the

profession. Management accounting knowledge and experience can

therefore be obtained from varied fields and functions within an

organisation, such as information management, treasury, efficiency auditing,

marketing, valuation, pricing, logistics, etc.

In the next section, we will study about the features and objectives of

management accounting.

Self Assessment Questions

1. ______________ is concerned with the interpretation of accounting

information to guide the management for future planning, decision

making, control, etc.

Sikkim Manipal University

Page No.: 4

Management Accounting

Unit 1

2. Management accounting is mainly concerned with the ______ or

estimates of the future.

3. Management accounting is not just concerned with the post-mortem

analysis of the historical or past results. (True/False)

1.3 Features and Objectives of Management Accounting

In the previous section, we studied about the meaning and definition of

management accounting. In this section, we will study about the features

and objectives of management accounting.

1.3.1 Features

Management accounting is mainly related to financial information, wherein

management accountants use the data provided by financial accountants to

understand the business and make decisions with respect to future

budgeting and forecasting.

Management accounting is concerned with accounting information that is

useful to management in maximising profits or minimising losses. The main

characteristics of management accounting are:

Forecasting It is concerned with the future. It is not confined only to

the collection of historical data or facts, but also helps in planning for the

future because decisions are always taken for the future course of

action.

Supply information It provides information to the management and

not decisions. It can inform, but it cannot prescribe. The way in which

the data is used depends on the efficiency of the management.

Cause and effect analysis It attempts to examine the cause and

effect of different variables. For instance, if there is a loss, the reasons

for the loss are probed. Similarly, if there is a profit, the factors directly

influencing the profitability are studied. This may be the reason that

management accounting is called as a science.

No fixed norms i.e. flexibility It has no set of rules and formats like

double-entry system of book-keeping. The analysis of data depends on

the person using it.

Achievement of objectives The principle objective of management

accounting is to enable managers to manage better. To take more

Sikkim Manipal University

Page No.: 5

Management Accounting

Unit 1

intelligent decisions, management accounting provides necessary

information to the management.

Increase in efficiency The main objective of management accounting

is to increase the efficiency of the organisation by constant performance

appraisal. The performance appraisal will enable management to pinpoint efficient and inefficient spots. Corrective measures taken by the

management will improve the efficiency of the firm.

Quantitative and qualitative information Decision-making cannot

restrict itself to monetary and financial considerations. As such,

management accounting takes into account the non-monetary variables

as well. The management needs qualitative information (i.e., the

information that is not computable or measurable in monetary terms) as

well. Qualitative information relates to the performance of employees,

research work undertaken, efficiency of production, etc.

Accounting information The basis of management accounting is

financial and cost accounting information. It makes use of such

information in a manner befitting the managerial needs of planning,

control and decision making.

Tools techniques Various tools and techniques are used to make the

accounting information suitable for managerial needs. The tools and

techniques are budgetary control, standard costing, ratio analysis, cash

flow statement and comparative analysis, etc.

Responsibility accounting It is an important managerial tool to

control human performance. It sets the targets for each individual,

reviews their working and points out their effectiveness and

inefficiencies.

1.3.2 Objectives of management accounting

Financial accounting is typically used for documenting a company's financial

transactions and keeping a record of its financial growth. Financial

accounting is a fairly passive form of accounting. In contrast, management

accounting is involved in the strategic planning of companies. It is focused

on the future and how to make improvements that will result in better

performance and greater profits for the firm. For these reasons,

management accounting is of great importance to businesses in competitive

environments that requires the company to constantly improve their

Sikkim Manipal University

Page No.: 6

Management Accounting

Unit 1

processes and procedures. Management accounting has three main

objectives that allow managers to make improvements and plan for the

future: measuring performance, assessing risks and allocating resources.

Other objectives are to:

Help the management promote efficiency.

Finalise budgets covering all functions of a business.

Study the actual performance with a plan for identifying deviations and

their causes.

Analyse financial statements to enable management to formulate future

policies.

Help management at frequent intervals by providing operating

statements and short-term financial statements.

Arrange for systematic allocation of responsibilities for implementation of

plans and budgets.

Provide a suitable organisation for discharging responsibilities.

In the next section, we will study about the nature and scope of

management accounting.

Self Assessment Questions

4. ________ has no set of rules and formats like double-entry system of

book keeping.

5. The basis of management accounting is ________ and cost accounting

information.

6. Management accounting takes in to account only the non-monetary

variables. (True/False)

Activity 1:

State the rules for debiting and crediting applied in double-entry system.

Draft the format of any one book of accounts with explanation.

1.4 Nature and Scope of Management Accounting

In the previous section, we studied the features and objectives of

management accounting. In this section, we will study about the nature and

scope of management accounting.

Sikkim Manipal University

Page No.: 7

Management Accounting

Unit 1

Management accounting comprises management and accounting.

Management involves all personnel in-charge of running a business apart

from the top management. Management accounting involves providing

accounting-related details, based on which management may base its

decisions. It provides management with the tools for analysing its

administrative action and lays emphasis on possible cost, price and profit

alternatives. However, information related to accounting is not the only basis

for management to take business decisions. It should also take into

consideration other factors concerning actual execution. Management must

also apply its common sense, foresight, knowledge and experience of

running a business apart from using the information provided to it in order to

arrive at a final decision.

In management accounting, accounting does not only involve recording

business transactions such as book keeping, but it is indeed a macroeconomic approach. It is an inter-disciplinary subject, as it draws its raw

material from various other disciplines such as costing, statistics,

mathematics, financial accounting, etc. Management accounting also covers

economics, political science, psychology, sociology, management, law,

statistics, etc. While the study of political science helps us understand

authority relationship and responsibility identification, sociology helps us

understand the behaviour of a person in groups. A knowledge of psychology

helps us know the mental make-up of employers and employees. Hence,

the study of all these disciplines enables us to increase motivation and

control the actions of people responsible for cost related decisions. A

knowledge of management helps us know the processes involved in the art

of managing. The study of economics helps us attain optimal output while

forecasting sales and production, and analyse the actions of the

management in terms of profit, cost revenues, growth, etc. Statistics helps

to present information to the management in a form that can be easily

assimilated. Hence, we can state that management accounting is a subject

with wide and diverse implications.

As in accountancy, management accounting does not follow set principles

like the double-entry system. Instead, it is based on the principles of cost

benefit analysis, which states that no accounting system is good or bad as

long as it contributes to incremental benefits that are more that its

incremental costs. Applying the principles of management accounting to

Sikkim Manipal University

Page No.: 8

Management Accounting

Unit 1

financial matters would not always help us arrive at the solution; therefore, it

is considered to be an inexact science that uses other conventions rather

than standardised principles. The facts to be studied could be interpreted in

many ways and the inferences are based on the ability, judgement and

common sense of management accountants. Hence, the subject is neither

fully matured nor is an infant.

As management accounting relates more to managerial matters, its data is

selective in nature and focuses on potential rather than on lost opportunities.

The data is operative in nature and caters to a firms operational needs such

as events, monetary and non-monetary details. The characteristic of data,

mode of presentation and duration are ascertained by managerial needs.

Reports are generated frequently and are used for managerial control and

internal uses. A management accountant must always look at his

organisation from the management point of view.

Management accounting is sensitive to management needs; however, it

assists the management and does not replace it. It acts as a service phase

to the management that provides highly personalised services instead of

acting as a service to management from the management accountant. In

other words, management accounting serves as a management information

system, thereby helping the management to better manage its business.

The main concern of management accounting is to provide the necessary

information to the management for the efficient discharge of various

managerial functions. The scope of management accounting covers the

following:

Financial accounting Management accounting is mainly concerned

with the modification or rearrangement of the information provided by

financial accounting.

Cost accounting Planning and decision-making controls are the basic

managerial functions. In the discharge of these managerial functions,

cost accounting techniques or tools such as standard costing and

budgetary control play a valuable role.

Financial management It is primarily concerned with the procurement

of funds and their efficient and effective utilisation. Although financial

management has emerged as a separate subject itself, management

accounting includes financial management as well.

Sikkim Manipal University

Page No.: 9

Management Accounting

Unit 1

Budgeting and forecasting Budgeting means preparing budgets/

setting targets for a definite future period. Forecasting is a prediction of

what will happen under the given set of circumstances/conditions. The

comparison of actual performance with the budgeted figures will give an

idea about the performance of various departments.

Inventory or material control Inventory control includes control over

inventory or material from the time that it is acquired until its final

disposal. One of the tasks of management accounting is inventory

control. Inventory control includes control over stock of raw materials,

work in process and stock of finished goods by determining different

levels of stock minimum stock level, maximum stock level and

reordering stock level.

Statistical methods Management accounting provides data to the

management in the form of reports. For this, statistical methods or tools

such as graphs, charts, diagrams, pictorial presentation, index number,

etc. are used. For instance, comparative sales statements for a number

of years are made for knowing the difference in sales.

Taxation Taxation includes computation of income tax payable by the

business in accordance with the tax regulations, filing of returns and

payment of taxes. The management accountant has to plan taxes to

minimise the tax liabilities of the firm.

Financial statement analysis and interpretation of data

Management accounting provides various techniques for financial

analysis and interpretation like ratio analysis, comparative financial

statement, etc. Analysis and interpretation of financial statements are

important parts of management accounting. Financial statements may

be studied in comparison to statements of earlier periods or in

comparison with the statements of similar other firms. After analysis, the

interpretation is made and reports drawn from these analyses are

presented to the management in a simple format.

Methods and procedures This includes maintenance of proper data

processing and office management services, reporting on the best use

of mechanical and electronic devices. It provides statistical data to the

various departments of the organisation. It undertakes special cost

Sikkim Manipal University

Page No.: 10

Management Accounting

Unit 1

studies and estimations, reports on cost-volume-profits relationship,

under changing circumstances.

Reporting The interpreted information must be communicated to the

management within a reasonable time in the form of statement or

reports such as comparative financial statements, cash flow statements,

fund flow statements, stock reports, etc. These reports are helpful in

reviewing the working of the business.

In the next section, we will study the importance and need for management

accounting.

Self Assessment Questions

7. Financial management is primarily concerned with the procurement of

the fund and their efficient and effective utilisation. (True/False)

8. _________ is a prediction of what will happen under the given set of

circumstances.

9. _________ includes computation of income tax payable by the

business in accordance with the tax regulations, filing of returns and

payment of taxes.

1.5 Importance and Need for Management Accounting

In the previous section, we studied about the nature and scope of

management accounting. In this section, we will study the importance and

need for management accounting.

1.5.1 Importance

Management accounting is very helpful to management in every field of

activity. It assists the management in the performance of the various

managerial functions of planning, controlling, co-coordinating, organising,

motivating and communicating. Its importance may be summarised under

the following heads:

Increases efficiency Management accounting encourages efficiency

in business operations. The targets of different departments are fixed in

advance and achievement of target forms a yardstick for measuring their

efficiency.

Measures performance The system of budgetary control and

standard costing enable the measurement of performance. The

Sikkim Manipal University

Page No.: 11

Management Accounting

Unit 1

performance will be good if the actual cost does not exceed the standard

cost.

Effective management control The tools and techniques of

management accounting are helpful to management in planning,

controlling and coordination of the activities of the concern. The

techniques of budgetary control, standard costing and departmental

operating statements greatly help in controlling various functions.

It involves the evaluation of actual performance to see whether the

actual performance corresponds with the planned performance, and the

taking up of remedial measures, if there are deviations or variations

between the two.

Maximises profitability The use of management accounting may

control or even eliminate various types of wastage, production

defectives, etc. The various management techniques are used to control

cost of production. The reduction in cost of production increases the

sales volume, there by maximises profit to the concern.

Maximises return on capital employed Management accounting,

through the process of planning, control and coordination, helps

management get maximum returns on capital employed.

Services to customers The cost control devices employed in

management accounting enable the reduction of prices. All employees

in the concern are made cost conscious. Since, quality of goods is

determined in advance the quality of products becomes good and hence

customers are provided quality goods at reasonable prices.

Co-ordination Co-ordinating refers to inter-linking of the different

divisions of a business enterprise in such a way as to achieve the

objectives of the business as a whole. Perfect co-ordination among the

various divisions or departments of an enterprise, such as production,

purchase, finance, personnel, and sales departments can be achieved

through departmental budgets and reports, which form an integral part of

management accounting.

Organisation This refers to the identification of total work in the

undertaking, distribution of work, delegation of authority and

responsibility and provision of physical facilities for the smooth

functioning of the undertaking. Management accounting helps the

Sikkim Manipal University

Page No.: 12

Management Accounting

Unit 1

management considerably establish a sound system of internal control

and internal audit. This in turn helps identify inefficiencies, if any, and

makes them responsible for performing the job.

Motivation Motivating refers to encouraging for maintaining high

degree of morale in the organisation and creation of such conditions

such as to induce each person to give his best to realise the goals of the

enterprise. For the purpose of motivating personnel, the management

should be in a position to find out whom to reward and whom to

penalise. Management accounting helps the management to achieve

this objective through periodical departmental profit and loss account,

budgets and reports.

Communication One of the primary objectives of the management

accounting is to keep the management fully informed about the latest

position of the company. This facilitates the management to take

properly and timely decisions. It presents the different alternative plans

before the management in a comparative manner. The performance of

the various departments is also regularly communicated to the top

management.

1.5.2 Need for management accounting

The inadequacies or limitations of financial accounting and cost accounting

have paved the way for the emergence or evolution of management

accounting. Financial accounting has failed to communicate proper

information to the management. Cost accounting with its emphasis only on

costs and not on revenues has also not been very useful to the

management. Hence there has arisen the need for the development of

management accounting.

In the next section, we will study about the functions of management

accounting.

Self Assessment Questions

10. The system of budgetary control and ______ enable the measurement

of performance.

11. _________ refers to inter-linking of the different divisions of a business

enterprise in such a way as to achieve the objectives of the business as

a whole.

Sikkim Manipal University

Page No.: 13

Management Accounting

Unit 1

Activity 2:

What is return on capital? Compute the return on capital of your friends

organisation.

1.6 Functions of Management Accounting

In the previous section, we studied about the importance and need for

management accounting. In this section, we will study the functions of

management accounting.

The basic function of management accounting is to assist the management

to perform various managerial functions such as planning, organising,

directing and controlling effectively. The various specific functions are:

Provision of data Management accounting provides valuable data to

the management for the formulation of future policies and plans. The

accounts and documents maintained under the system of management

accounting are data about the past progress of the enterprise, which is

useful to the management for making future policies and plans.

Modification of data The available accounting data is not suitable for

managerial decision making. Management accounting modifies the

available accounting data by rearranging the same through the process

of classification and combination. For instance, the sales figures for

different months may be classified to show total sales made during the

period, product-wise, territory-wise and salesman-wise.

Analysis and interpretation of data Management accounting

analyses and interprets the financial or accounting data meaningfully

along with comments and suggestions for effective management

planning and decision making. For this purpose, the data is presented in

a comparative form with ratios for predicting the likely trends. Analytical

tools such as comparative financial statements and ratio analysis are

used and likely trends are projected.

Provision of qualitative information Mere financial data and its

analysis and interpretation are not sufficient for effective managerial

decision making and control. The management needs qualitative

information (i.e. information that is not computable or measurable in

monetary terms) as well. Qualitative information relates to the

Sikkim Manipal University

Page No.: 14

Management Accounting

Unit 1

performance of employees of undertaking, research work undertaken,

efficiency of production, etc.

Facilitating management control Management accounting facilitates

management control through the techniques of budgetary control and

standard costing.

Budgeting and forecasting Budgeting means preparing

budgets/setting targets for definite future period. Forecasting is a

prediction of what will happen under the given set of circumstances. The

comparison of actual performance with the budgeted figures will give an

idea about the performance of various departments.

Satisfaction of the informational needs of different management

levels Management accounting satisfies the informational needs of

different management levels by processing the accounting and other

data in such a way as to satisfy the needs of the different management

levels.

Co-ordination This refers to interlinking of different divisions of a

business in such a way as to achieve the objectives of the business as a

whole. Perfect co-ordination among the various divisions or departments

of an enterprise, such as production, purchase, finance, personnel and

sales departments can be achieved through departmental budgets and

reports, which form an integral part of management accounting.

Protection of assets A management accountant should assure fiscal

protection for the assets of the business through adequate internal

control and proper insurance coverage.

Economic appraisal A management accountant should continuously

appraise economic and special forces and government influences and

interpret their effect upon the business.

The functions of a management accountant are:

Collection of data

Analysis

Presentation of data

Planning: A management accountant plans the entire accounting

functions.

Sikkim Manipal University

Page No.: 15

Management Accounting

Unit 1

Controlling: Examines the performance against the set standard and

reports it to the management.

Reporting: He reports to the management and advises them on future

decisions.

Coordinating: preparation of master budget8.Decision making

In the next section, we will study about the differences between financial

accounting, cost accounting and management accounting.

Self Assessment Questions

12. _________ is the information which is not computable or measurable in

monetary terms.

13. A management accountant should assure fiscal protection for the

assets of the business through adequate internal control and proper

insurance coverage. (True/False)

Activity 3:

Assume you are the management accountant of one of the public limited

companies of your city. You are advised to get practical knowledge by

making comparative study and analysis of balance sheets of three years.

1.7 Differences between Financial Accounting, Cost Accounting

and Management Accounting and Similarities

In the previous section, we studied the functions of management

accounting. In this section, we will study about the differences between

financial accounting, cost accounting and management accounting and

similarities.

Despite the close relationship between financial accounting, cost accounting

and management accounting, there are certain differences. The main

differences are:

Age Financial accounting is several centuries old (4th century). The

development of cost accounting dates back to industrial revolution

(1850-1900). However, management accounting has developed only in

the last 60 years (1950 onwards).

Subject matter Financial accounting is concerned with the recording,

classifying and summarising of business transactions with a view to

Sikkim Manipal University

Page No.: 16

Management Accounting

Unit 1

determine profit or loss of a business for a certain period and to

ascertain the assets and liabilities of the business at the end of a

particular period. On the other hand, management accounting is

concerned with the presentation of information to the management for

the efficient discharge of managerial functions. Cost accounting is

primarily concerned with the ascertainment of cost and profitability and

control of cost.

Events considered Financial accounting considers only the monetary

events (i.e. only those events that can be expressed in terms of money).

However, management accounting is interested in monetary events and

in non-monetary events such as performance of employees, quality of

products, etc. In cost accounting, mostly monetary events are

considered.

Coverage Financial accounting deals with overall performance of the

business. On the other hand, cost and management accounting deals

with the details of the various divisions, departments, products or other

sub-divisions of the enterprise.

Users of data Financial accounting is designed to provide information

through the profit and loss account and the balance sheet, to outsiders,

such as the shareholders, debenture holders, bankers, creditors,

investors, and the government. However, management accounting is

designed principally to provide information to the management. Cost

accounting provides information to both external and internal parties.

Figures taken into account Financial accounting is concerned only

with historical or past data. It confines itself to the analysis of what has

happened in the past. However, management accounting is concerned

with the past data as well as the estimates for the future i.e. future plans.

Though cost accounting takes into account estimates for the future, it

mostly uses past data.

Periodicity of reporting The period of reporting is much longer in

financial accounting as compared to cost and management accounting.

Generally financial statements (i.e. the profit and loss account and the

balance sheet) are prepared at the end of every accounting year.

However, cost and management accounting furnishes information

Sikkim Manipal University

Page No.: 17

Management Accounting

Unit 1

quickly and at short intervals as per the requirements of the

management.

Accounting principles Generally, financial accounting is governed by

certain accepted principles, while cost and management accounting are

not governed by any accepted accounting principles. It is generally

moulded according to the needs of the particular organisation.

Legal compulsion Financial accounting has more or less become

compulsory for all forms of business organisations. It is compulsory for

joint stock companies because of statutory provisions. It is necessary

even for other forms of business organisations for tax purposes. On the

other hand, cost and management accounting is purely optional, though

it is desirable because of its immense utility.

Compulsory auditing Auditing of accounts kept and statement

prepared under financial accounting is compulsory for joint stock

companies. However, auditing of statements prepared under cost and

management accounting is not compulsory for any organisation.

Compulsory publication The publication of statements prepared

under financial accounting is compulsory for all joint stock companies,

whereas the publication of statements prepared under cost and

management accounting is not compulsory for any joint stock company.

Self Assessment Questions

14. Which of the following is NOT related to financial accounting?

a) Recording of transactions

b) Classifying transactions

c) Summarising transactions

d) Reporting to management

15. The publication of statements prepared under financial accounting is

not compulsory for all joint stock companies. (True/False)

1.8 Summary

Let us recapitulate the important concepts discussed in this unit:

Management accounting is the art or technique of analysis and

interpretation and presentation of facts, results and information revealed

by financial accounting, cost accounting and other books and records

Sikkim Manipal University

Page No.: 18

Management Accounting

Unit 1

kept by the business for the benefit of people who are in charge of

managing the business more efficiently.

The features of management accounting are function of forecasting,

cause and effect analysis, flexibility, provision of quantitative and

qualitative information, application of tools and techniques, responsibility

accounting and so on.

The aspects or areas covered under the scope of management

accounting are financial accounting, cost accounting, financial

management, budgeting and forecasting, inventory or material control,

statistical tools and so on.

Management accounting is very important or helpful to management in

every field of activity. It assists the management in the performance of

the various managerial functions of planning, controlling, cocoordinating, organising, motivating and communicating.

Despite the close relationship between financial accounting, cost

accounting and management accounting, there are certain differences.

The main differences between financial accounting, cost accounting and

management accounting are related to subject matter, events

considered, coverage, users of data, figures taken into account, legal

compulsion and so on.

1.9 Glossary

Budgetary control A budgetary control system is a method of monitoring

and controlling income and expenditure, and for managing the demands for

cash and minimising borrowings.

Cash flow statement Financial statements reflect the inflow of revenue

vs. the outflow of expenses resulting from operating, investing and financing

activities during a specific time period.

Double-entry system Double-entry book keeping system is the dual

aspect of entering the transactions on both the sides i.e. on the debit and

credit side of an account.

Internal audit Internal auditing is an independent, objective assurance

and consulting activity designed to add value and improve an organisation's

operations.

Sikkim Manipal University

Page No.: 19

Management Accounting

Unit 1

Joint stock company A joint stock company is a type of business

partnership in which the capital is formed by the individual contributions of a

group of shareholders. Certificates of ownership or stocks are issued by the

company in return for each contribution, and the shareholders are free to

transfer their ownership interest at any time by selling their stockholding to

others.

Performance appraisal A performance appraisal, employee appraisal,

performance review or (career) development is a method by which the job

performance of an employee is evaluated (generally in terms of quality,

quantity, cost, and time) typically by the corresponding manager or

supervisor.

Ratio analysis A tool used by individuals to conduct a quantitative

analysis of information in a company's financial statements.

Reordering stock level The reorder level of stock is the point at which

stock on a particular item has diminished to a point where it needs to be

replenished.

Standard costing A management tool used to estimate the overall cost of

production, assuming normal operations.

1.10 Terminal Questions

1.

2.

3.

4.

5.

Define management accounting. Discuss the various features.

Explain the scope of management accounting.

Describe the importance of management accounting.

What are the functions of management accounting? Explain.

Distinguish between financial accounting, cost accounting

management accounting.

and

1.11 Answers

Self

1.

2.

3.

4.

5.

Assessment Questions

Management accounting

Forecasts

True

Management accounting

Financial

Sikkim Manipal University

Page No.: 20

Management Accounting

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

Unit 1

False

True

Forecasting

Taxation

Standard costing

Co-ordinating

Qualitative information

True

d) Reporting to management

False

Terminal Questions

1. Management accounting is the accounting that provides necessary

information to the management for discharging functions such as

planning, organising, directing and controlling in an efficient manner.

The features of management accounting are function of forecasting,

cause and effect analysis, flexibility, provision of quantitative and

qualitative information, application of tools and techniques, responsibility

accounting and so on. For more details, refer sections 1.2 and 1.3.

2. Management accounting in its scope includes financial accounting, cost

accounting, financial management, budgeting and forecasting, inventory

or material control, statistical tools and so on. For more details, refer

section 1.4.

3. Management accounting is important due to its contribution for

increasing efficiency, bringing effective management control, maximising

profitability and return on capital employed, bringing coordination and so

on. For more details, refer section 1.5.

4. Management accounting performs the functions of provision of data,

modification of data, analysis and interpretation of data and so on. It

assists the management in the performance of the various managerial

functions of planning, controlling, co-coordinating, organising, motivating

and communicating. For more details, refer section 1.6.

5. The main differences between financial accounting, cost accounting and

management accounting are related to subject matter, events

considered, coverage, users of data, figures taken into account, legal

compulsion and so on. For more details, refer section 1.7.

Sikkim Manipal University

Page No.: 21

Management Accounting

Unit 1

References:

Lal Jawahar (2010). Accounting for Management. Himalaya Publishing

House

Pillai R. S. N and Bagavathi (2009). Management Accounting. Chand S

& Co.

Maheshwari S. N. (2009). Management Accounting & Financial Control.

Chand S & Sons

Dr. Periasamy P. (2010). Financial, Cost and Management Accounting.

Himalaya Publishing House

Sikkim Manipal University

Page No.: 22

Вам также может понравиться

- Unit 1Документ72 страницыUnit 1Sumit SoniОценок пока нет

- Unit 1 - Management AccountingДокумент16 страницUnit 1 - Management Accountingdilipkumar.1267Оценок пока нет

- MANAGEMENT ACCOUNTINg Unit-1Документ49 страницMANAGEMENT ACCOUNTINg Unit-1Vishwas AgarwalОценок пока нет

- Management Accounting Definition and FunctionsДокумент16 страницManagement Accounting Definition and FunctionsRahul kumar100% (1)

- Meaning and Definition of Management AccountingДокумент93 страницыMeaning and Definition of Management AccountingJean Fajardo BadilloОценок пока нет

- Bcom 203Документ134 страницыBcom 203Dharmesh GoyalОценок пока нет

- Management Accounting - An OverviewДокумент14 страницManagement Accounting - An OverviewMadhurGuptaОценок пока нет

- Management AccountingДокумент13 страницManagement AccountingEricka BautistaОценок пока нет

- Management AccountingДокумент132 страницыManagement Accountingaanchal singhОценок пока нет

- Management Accounting - SBA1501: Unit - IДокумент9 страницManagement Accounting - SBA1501: Unit - ISubhasri RajaОценок пока нет

- Lesson 1: Introduction To Management Accounting: Learning ObjectivesДокумент5 страницLesson 1: Introduction To Management Accounting: Learning ObjectivesShivani GuptaОценок пока нет

- Management_Accounting-February 2024Документ51 страницаManagement_Accounting-February 2024Somesh AgrawalОценок пока нет

- management accounting notesДокумент80 страницmanagement accounting notesnuk.2021018028Оценок пока нет

- Acct 232 Management and Cost Accounting IiДокумент14 страницAcct 232 Management and Cost Accounting IipfungwaОценок пока нет

- Projects Ma 1Документ16 страницProjects Ma 1nikkiОценок пока нет

- Fa 1Документ18 страницFa 1Rahul KotagiriОценок пока нет

- 2 Zapya StatiscДокумент10 страниц2 Zapya StatiscLOND SONОценок пока нет

- Chapter I: Management and The Nature of Management AccountingДокумент11 страницChapter I: Management and The Nature of Management AccountingMark ManuntagОценок пока нет

- Managerial Accounting Lecture 1stДокумент8 страницManagerial Accounting Lecture 1stkhizarniazОценок пока нет

- Management Accounting NotesДокумент72 страницыManagement Accounting NotesALLU SRISAIОценок пока нет

- Management AccountingДокумент135 страницManagement Accountingdibakardas10017100% (1)

- Management AccountingДокумент18 страницManagement AccountingmayankОценок пока нет

- Hrithik kamble hkДокумент36 страницHrithik kamble hkHRITHIK KambleОценок пока нет

- Copy Cost Accting-1Документ205 страницCopy Cost Accting-1Kassawmar DesalegnОценок пока нет

- Nature and Objectives of Management AccountingДокумент13 страницNature and Objectives of Management AccountingpfungwaОценок пока нет

- Introduction to Management AccountingДокумент12 страницIntroduction to Management Accountingmannat sethiОценок пока нет

- Cost & Mgt. Acct - I, Lecture Note - Chapter 1 & 2Документ35 страницCost & Mgt. Acct - I, Lecture Note - Chapter 1 & 2Yonas BamlakuОценок пока нет

- Introduction To Managerial AccountingДокумент10 страницIntroduction To Managerial AccountingMark Ronnier VedañaОценок пока нет

- Meaning and Definitions of Management AccountingДокумент9 страницMeaning and Definitions of Management AccountingHafizullah Ansari100% (1)

- Intro to Managerial AcctДокумент9 страницIntro to Managerial AcctMark Ronnier VedañaОценок пока нет

- Module 4 Management AccountingДокумент14 страницModule 4 Management AccountingRajimol KPОценок пока нет

- Characteristics/Nature of Management AccountingДокумент7 страницCharacteristics/Nature of Management Accountingritu paudelОценок пока нет

- Manage Acctg Provides Info for Decision MakingДокумент24 страницыManage Acctg Provides Info for Decision MakingguptaorchidОценок пока нет

- Manage Acct Ch 1Документ24 страницыManage Acct Ch 1Zaid ZatariОценок пока нет

- The Nature and Purpose of Accounting ExplainedДокумент16 страницThe Nature and Purpose of Accounting ExplainedSubashiиy PяabakaяaиОценок пока нет

- Management Accounting IntroductionДокумент45 страницManagement Accounting IntroductionK DevikaОценок пока нет

- Abdel Razza Khoirie-185020307141016-Assignment 1Документ5 страницAbdel Razza Khoirie-185020307141016-Assignment 1Abdel RazzaОценок пока нет

- MANAGEMENT ACCOUNTINGДокумент35 страницMANAGEMENT ACCOUNTINGshimmuuОценок пока нет

- Organization of Management AccountingДокумент3 страницыOrganization of Management AccountingRidwanullah ramadaniОценок пока нет

- Management Accounting Notes at Mba BKДокумент134 страницыManagement Accounting Notes at Mba BKBabasab Patil (Karrisatte)Оценок пока нет

- Management Accounting (Bba32) Unit - IДокумент42 страницыManagement Accounting (Bba32) Unit - IT S Kumar KumarОценок пока нет

- Management Accounting and The Modern Business EnvironmentДокумент6 страницManagement Accounting and The Modern Business EnvironmentdevajeetbaruahОценок пока нет

- Chapter 1 IntroductionДокумент40 страницChapter 1 IntroductionSoka PokaОценок пока нет

- Management Accounting Mba BKДокумент138 страницManagement Accounting Mba BKBabasab Patil (Karrisatte)100% (1)

- Management Accounting: DefinitionДокумент5 страницManagement Accounting: DefinitionSangram PandaОценок пока нет

- Introduction To Managerial AccountingДокумент6 страницIntroduction To Managerial AccountingMark Ronnier VedañaОценок пока нет

- Management AccountingДокумент5 страницManagement Accountingτυσηαρ ηαβιβОценок пока нет

- CH. 1 Introduction To Management AccountingДокумент15 страницCH. 1 Introduction To Management Accountingdivyakumbhar18Оценок пока нет

- Management AccountingДокумент36 страницManagement AccountingSreepada KameswariОценок пока нет

- Project Mahindra Finance PVT LTDДокумент63 страницыProject Mahindra Finance PVT LTDSpandana Shetty75% (4)

- Strategic Cost Management GuideДокумент27 страницStrategic Cost Management GuideGabrielle Anne MagsanocОценок пока нет

- Intro to Management Accounting FunctionsДокумент12 страницIntro to Management Accounting FunctionskipovoОценок пока нет

- Management AccountingДокумент24 страницыManagement AccountingRajat ChauhanОценок пока нет

- New Microsoft Office Word Document-1Документ73 страницыNew Microsoft Office Word Document-1Toshar JindalОценок пока нет

- Management AccountingДокумент358 страницManagement AccountingAsifHossain100% (8)

- Saya Sedang Berbagi '7. Belkaoui - Behavioral Management Accounting - 2002' Dengan Anda-Halaman-14-54Документ41 страницаSaya Sedang Berbagi '7. Belkaoui - Behavioral Management Accounting - 2002' Dengan Anda-Halaman-14-54ghina adhha hauraОценок пока нет

- Notes - Management AccountingДокумент54 страницыNotes - Management Accountingbenjoel1209Оценок пока нет

- Accounting NotesДокумент11 страницAccounting Noteszabi ullah MohammadiОценок пока нет

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersОт EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersОценок пока нет

- Cable Part CodeДокумент2 страницыCable Part Codesaneesh81Оценок пока нет

- 600 625 Kva DV 12 Powered GensetsДокумент12 страниц600 625 Kva DV 12 Powered Gensetssaneesh81Оценок пока нет

- AMFi Range Training - 01Документ33 страницыAMFi Range Training - 01saneesh81Оценок пока нет

- Battery AH Cable SizeДокумент1 страницаBattery AH Cable Sizesaneesh81Оценок пока нет

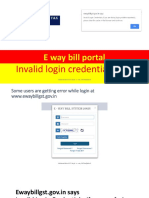

- Fix invalid login error ewaybillgst portalДокумент13 страницFix invalid login error ewaybillgst portalMagdum EngineeringОценок пока нет

- Low Budget Duplex House Design With Modern Exterior - : 19 Lakh For ConstructionДокумент3 страницыLow Budget Duplex House Design With Modern Exterior - : 19 Lakh For Constructionsaneesh81Оценок пока нет

- Kuv100 e Brochure Aug 2019Документ4 страницыKuv100 e Brochure Aug 2019DiditlkgxulrsОценок пока нет

- Cable Size For DG SetДокумент1 страницаCable Size For DG Setsaneesh81Оценок пока нет

- Funnel Presentation For Field TeamДокумент12 страницFunnel Presentation For Field Teamsaneesh81Оценок пока нет

- Untitled PDFДокумент35 страницUntitled PDFSafeer EdaloliОценок пока нет

- Master ECU wiring diagram componentsДокумент1 страницаMaster ECU wiring diagram componentssaneesh81Оценок пока нет

- USD Money Transfer Details Through Top US BanksДокумент2 страницыUSD Money Transfer Details Through Top US Bankssaneesh810% (1)

- ECEL Snap Ring ActivityДокумент5 страницECEL Snap Ring Activitysaneesh81Оценок пока нет

- Funnel Presentation For Field TeamДокумент12 страницFunnel Presentation For Field Teamsaneesh81Оценок пока нет

- Small Double Oor House Plan With 3 Bedroom and Stunning ExteriorДокумент3 страницыSmall Double Oor House Plan With 3 Bedroom and Stunning Exteriorsaneesh81Оценок пока нет

- KMSCL e-Tender for Supply and Installation of Diesel Generator 40KVAДокумент76 страницKMSCL e-Tender for Supply and Installation of Diesel Generator 40KVAsaneesh81Оценок пока нет

- MTU 4R0120 DS125: Diesel Generator SetДокумент4 страницыMTU 4R0120 DS125: Diesel Generator Setsaneesh81Оценок пока нет

- Kseb Payment SlipДокумент1 страницаKseb Payment Slipsaneesh81Оценок пока нет

- 3 - 5 Kva Portable Kirloskar LeafletДокумент2 страницы3 - 5 Kva Portable Kirloskar Leafletsaneesh81Оценок пока нет

- Amf ControllerДокумент14 страницAmf Controllersaneesh81Оценок пока нет

- SEAMLESS LUXURY WITH FENESTA'S SYSTEM ALUMINIUM WINDOWS AND DOORSДокумент21 страницаSEAMLESS LUXURY WITH FENESTA'S SYSTEM ALUMINIUM WINDOWS AND DOORSsaneesh81Оценок пока нет

- SX-HS Series New1Документ19 страницSX-HS Series New1saneesh81Оценок пока нет

- Kg545 II UserДокумент86 страницKg545 II Usersaneesh81100% (1)

- JCB Catalogue AДокумент9 страницJCB Catalogue Asaneesh81100% (2)

- Marks Total MarksДокумент3 страницыMarks Total Markssaneesh81Оценок пока нет

- Volvo - Eicher AdvДокумент3 страницыVolvo - Eicher Advsaneesh81Оценок пока нет

- Bba404 SLM Unit 01Документ21 страницаBba404 SLM Unit 01saneesh81Оценок пока нет

- Diesel Generator SetДокумент1 страницаDiesel Generator Setsaneesh81100% (1)

- BB0015 Quality Management MQPДокумент13 страницBB0015 Quality Management MQPsaneesh81Оценок пока нет

- Oil Money 2015 BrochureДокумент6 страницOil Money 2015 BrochureTwirXОценок пока нет

- Solution WileyPlus COMM 305 / ACCO 240Документ62 страницыSolution WileyPlus COMM 305 / ACCO 240Léo Audibert100% (2)

- Fin1 Eq2 BsatДокумент1 страницаFin1 Eq2 BsatYu BabylanОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- India's Cost of Capital: A Survey: January 2014Документ16 страницIndia's Cost of Capital: A Survey: January 2014Jeanette JenaОценок пока нет

- Mother DairyДокумент16 страницMother DairyMano VikasОценок пока нет

- Professionalpractice 160908192356Документ25 страницProfessionalpractice 160908192356Ar Princy MarthaОценок пока нет

- The Roi CalculationДокумент3 страницыThe Roi CalculationSasaОценок пока нет

- Acctng Reviewer 2Документ21 страницаAcctng Reviewer 2alliahnah33% (3)

- What is Fedwire? Understanding the Federal Reserve Wire NetworkДокумент17 страницWhat is Fedwire? Understanding the Federal Reserve Wire NetworkVijai RaghavanОценок пока нет

- MT Morris: Downtown Revitalization in Rural New York StateДокумент29 страницMT Morris: Downtown Revitalization in Rural New York StateprobrockportОценок пока нет

- C4 GoldenДокумент4 страницыC4 GoldenJonuelin Infante100% (1)

- SanDisk Corporation Equity Valuation AnalysisДокумент6 страницSanDisk Corporation Equity Valuation AnalysisBrant HammerОценок пока нет

- Cost of Capital Components Debt Preferred Common Equity WaccДокумент55 страницCost of Capital Components Debt Preferred Common Equity Waccfaisal_stylishОценок пока нет

- Bond Amortization ScheduleДокумент10 страницBond Amortization ScheduleVidya IntaniОценок пока нет

- The Stochastic Oscillator - A Harmonious System of TradingДокумент9 страницThe Stochastic Oscillator - A Harmonious System of TradingMirabo AndreeaОценок пока нет

- Behavioural Finance: Theory and SurveyДокумент6 страницBehavioural Finance: Theory and SurveymbapritiОценок пока нет

- The Zone Issue 27Документ16 страницThe Zone Issue 27Jeff Clay GarciaОценок пока нет

- Assignment On JournalДокумент4 страницыAssignment On JournalNIKHIL GUPTAОценок пока нет

- JM Financial Mutual FundДокумент2 страницыJM Financial Mutual FundJohn WilliamsОценок пока нет

- Capital Budgeting: Session 3Документ50 страницCapital Budgeting: Session 3Isaack MgeniОценок пока нет

- Adjudication Order in Respect of Mr. Bikramjit Ahluwalia and Others in The Matter of Ahlcon Parenterals India) LTDДокумент9 страницAdjudication Order in Respect of Mr. Bikramjit Ahluwalia and Others in The Matter of Ahlcon Parenterals India) LTDShyam SunderОценок пока нет

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet JuneДокумент2 страницыAAIB Fixed Income Fund (Gozoor) : Fact Sheet Juneapi-237717884Оценок пока нет

- 03FM SM Ch3 1LPДокумент6 страниц03FM SM Ch3 1LPjoebloggs18880% (1)

- Converged Systems Sales PlaybookДокумент12 страницConverged Systems Sales PlaybookPeter Stone100% (3)

- HUL Financial AnalysisДокумент11 страницHUL Financial AnalysisAbhishek Khanna0% (1)

- SSS VacancyДокумент61 страницаSSS VacancyCess AyomaОценок пока нет

- Regional CSHP report for NCR projects in September 2017Документ53 страницыRegional CSHP report for NCR projects in September 2017JohnmoiОценок пока нет

- Maid FormДокумент2 страницыMaid FormhutuguoОценок пока нет

- Distressed Debt Investing - Trade Claims PrimerДокумент7 страницDistressed Debt Investing - Trade Claims Primer10Z2Оценок пока нет