Академический Документы

Профессиональный Документы

Культура Документы

Historical Perspective of Financial Reporting Regulations in Malaysia

Загружено:

ugloreАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Historical Perspective of Financial Reporting Regulations in Malaysia

Загружено:

ugloreАвторское право:

Доступные форматы

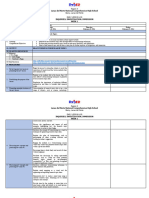

HISTORICAL PERSPECTIVE OF FINANCIAL REPORTING

REGULATIONS IN MALAYSIA

1940, 1946, 1956 Companies Ordinances (and amendments) - FIRST DOCUMENTED

FINANCIAL REPORTING REGULATIONS before Malaysia (then Malaya) achieved her

independence on 31 August 1957.

*continued to play an important role in regulating financial reporting after the independence

of Malaysia.

1965 Establishment of the Companies Act repealed Companies Ordianances.

Reporting requirements, rules and regulations on accounting were formally

established.

Contains a schedule (Ninth Schedule) specifies the disclosure requirements in

financial statements of Malaysian companies.

Remained relatively unchanged over the years until

1985 the Companies Act was amended (to incorporate a revised Ninth Schedule).

Ninth Schedule:

1. Remains in force till to date

2. Contains more comprehensive disclosure requirements and

3. Specifically requires that a statement of source and application of funds be an integral

part of financial statements.

Companies Act 1965 financial statements must contain:

1. Profit and loss account

2. Balance sheet

3. Statement of source and application of funds

4. Notes to account

*main concern accounts should be true and fair.

Prior to 1/9/1998 Companies Act did not make reference to the accounting standards issued

by the professional accountancy bodies. Thus, in practice and in the absence of an accepted

accounting framework for financial accounting in Malaysia, companies then tended to use the

Act as the absolute disclosure requirements rather than as min requirements.

*the extent of voluntary disclosure practices among Malaysian companies was very low, even

among listed ones.

It is not suprising that in the past, there were many preparers in Malaysia who believed that

disclosures should be strictly in accordance with those required by the Act ( and approved

accounting standard) and nothing more.

This trend however has changed in recent years when the Malaysian approved accounting

standards were amended to converge with those of the International Financial Reporting

Standards issued by the International Financial Reporting Standards Board (IASB).

*focus provide info that is useful to users in making economic decisions.

1958 Malaysian Institute of Certified Public Accountants (MICPA) was established as a

company limited by guarantee.

MICPA:

1. PRIVATE SECTOR ACCOUNTANCY BODY.

2. Regulates the practices of its members who carry the title of a certified public

accountant (CPA).

3. Issued the first accounting guidance in 1968.

4. Dealt with specimen company accounts.

ITEMS:

Being drawn up so as to comply with the requirements of the 9th

Schedule of the Companies Act 1965.

Were largely influenced by the practices then in UK and Australia

most of its members were either trained in the UK or Australia

@ had professional qualifications from accountancy bodies.

1978 MICPA began adopting IASs (IASs 1 to 4) after being admitted as a member of the

then International Accounting Standard Committee (IASC).

1984 First Malaysian Accounting Standard (MAS 1) on Earnings per share was issued.

*process of the adoption of IASs & development of MASs continued until 1997.

1997 Malaysian Accounting Standards Board (MASB) was established to take over the

role of standard setting in Malaysia.

1967 Malaysian Institute of Accountants (MIA) was established under the Accountants Act

1967.

Operates largely as a private sector accountancy body.

Its regulations cover the practices of the whole accounting profession in Malaysia.

Remained inactive and concentrated mainly on the registration of accountants in

Malaysia after its establishment.

1987 Its operations were elevated to that of a national accountancy body. Also began to

issue accounting standards.

Вам также может понравиться

- Far410 Chapter 1 Fin Regulatory FrameworkДокумент19 страницFar410 Chapter 1 Fin Regulatory Frameworkafdhal50% (4)

- Financial Reporting FrameworkДокумент47 страницFinancial Reporting FrameworkAndi Nabila Anabell100% (1)

- PSA Assignment (Completed)Документ25 страницPSA Assignment (Completed)pavishalekhaОценок пока нет

- Accounting internship report on Lawrence Wong & CoДокумент14 страницAccounting internship report on Lawrence Wong & Corajes2301Оценок пока нет

- Organizing MGT 162Документ5 страницOrganizing MGT 162LUQMAAN MUHAMMAD SUKERIОценок пока нет

- BBAW2103 Financial AccountingДокумент14 страницBBAW2103 Financial AccountingAttenuator James100% (1)

- Megan MediaДокумент8 страницMegan Mediarose0% (1)

- Standard Unqualified Audit ReportДокумент3 страницыStandard Unqualified Audit ReportjeremymjrОценок пока нет

- Fin430 - Dec2019Документ6 страницFin430 - Dec2019nurinsabyhahОценок пока нет

- PBL Tax - Final-EditДокумент23 страницыPBL Tax - Final-EditRE100% (1)

- MFRS 108 & 110 Class ExerciseДокумент2 страницыMFRS 108 & 110 Class ExerciseRubiatul AdawiyahОценок пока нет

- Delima ReportДокумент16 страницDelima ReportEstrada Alf100% (7)

- Importance of Accountability and Fairness in Islamic AccountingДокумент4 страницыImportance of Accountability and Fairness in Islamic Accountingbobby perdanaОценок пока нет

- Tuto4 BKAL DoneДокумент12 страницTuto4 BKAL DoneThe Four Incredible Hulks80% (5)

- MFRS 108 Tutorial Questions and AnswerДокумент16 страницMFRS 108 Tutorial Questions and AnswerRAUDAH100% (2)

- Topic 1 Introduction To Public SectorДокумент29 страницTopic 1 Introduction To Public SectorHKS67% (3)

- Chapter Three: Classifying Public UndertakingsДокумент11 страницChapter Three: Classifying Public Undertakingsizatul294Оценок пока нет

- Micro Accounting SystemДокумент1 страницаMicro Accounting SystemkhanОценок пока нет

- Tutorial 3 Answer SegmentalДокумент6 страницTutorial 3 Answer Segmental--bolabolaОценок пока нет

- Flat Cargo Berhad - Report To Managing PartnerДокумент3 страницыFlat Cargo Berhad - Report To Managing PartneramalinaghaniОценок пока нет

- For The Full Essay Please WHATSAPP 010-2504287Документ11 страницFor The Full Essay Please WHATSAPP 010-2504287Simon RajОценок пока нет

- Maybank: Organisational Transformation Through Human ResourcesДокумент20 страницMaybank: Organisational Transformation Through Human ResourcesHridaya RamanarayananОценок пока нет

- INDIVIDUAL ASSINGMENT FIN420 (Syu)Документ9 страницINDIVIDUAL ASSINGMENT FIN420 (Syu)nurainna syuhadaОценок пока нет

- Group 5: Case Study 26Документ10 страницGroup 5: Case Study 26auni fildzahОценок пока нет

- Modul P&P - FAR320 Nov 2014-Yusnaliza Vs NorlianaДокумент21 страницаModul P&P - FAR320 Nov 2014-Yusnaliza Vs NorlianaAiman Abdul BaserОценок пока нет

- Flat Cargo BerhadДокумент6 страницFlat Cargo BerhadJahirul Islam AsifОценок пока нет

- Accounting Theory & PracticesДокумент6 страницAccounting Theory & PracticesNur AbidinОценок пока нет

- Macro EnvironmentДокумент5 страницMacro EnvironmentSobanah ChandranОценок пока нет

- PAD370Документ3 страницыPAD370Amylia IsmailОценок пока нет

- Chapter 3 - Agriculture AllowancesДокумент3 страницыChapter 3 - Agriculture AllowancesNURKHAIRUNNISA100% (2)

- Assignment POM (AEON)Документ4 страницыAssignment POM (AEON)maizatul athirahОценок пока нет

- Tutorial 3 AnswerДокумент2 страницыTutorial 3 AnswerAiden YingОценок пока нет

- Tutorial 5 PDFДокумент11 страницTutorial 5 PDFtan keng qi100% (1)

- Ais Chapter 2 CaseДокумент3 страницыAis Chapter 2 CasesaffzxОценок пока нет

- Acc407 Quiz 1 Introduction To Accounting (Question)Документ7 страницAcc407 Quiz 1 Introduction To Accounting (Question)Tuan AinnurОценок пока нет

- Axis IncoprationДокумент9 страницAxis IncoprationR •100% (1)

- Megan Media Company PresentationДокумент13 страницMegan Media Company PresentationNuruljannatulSyahiraОценок пока нет

- CHPT 19 Answer MFRS 118 Revenue-180214 - 050144Документ3 страницыCHPT 19 Answer MFRS 118 Revenue-180214 - 050144Navin El Nino50% (2)

- ACW366 - Tutorial Exercises 3 PDFДокумент2 страницыACW366 - Tutorial Exercises 3 PDFMERINA100% (1)

- Far410 Chapter 2 Conceptual Framework EditedДокумент60 страницFar410 Chapter 2 Conceptual Framework EditedWAN AMIRUL MUHAIMIN WAN ZUKAMALОценок пока нет

- Ads560 Group Assignment-Timor Leste CrisisДокумент18 страницAds560 Group Assignment-Timor Leste CrisisFatin AqilahОценок пока нет

- Compare The Characteristic of Islamic Accounting Versus ConventionalДокумент13 страницCompare The Characteristic of Islamic Accounting Versus ConventionalHafiz BajauОценок пока нет

- Maybank Nature of BusinessДокумент1 страницаMaybank Nature of Businesssyahir0% (1)

- PAD370 NotaДокумент12 страницPAD370 Notanurulfahizah67% (3)

- Avel Consultants SDN BHD & Anor V Mohamed Zain Yusof & Ors - (1985) 2 MLJ 209Документ5 страницAvel Consultants SDN BHD & Anor V Mohamed Zain Yusof & Ors - (1985) 2 MLJ 209Alvin SigarОценок пока нет

- Case Study Maf661Документ12 страницCase Study Maf661Nur Dina AbsbОценок пока нет

- MFRS 108 Changes in Accounting PoliciesДокумент21 страницаMFRS 108 Changes in Accounting Policiesnatasha thaiОценок пока нет

- Assignment Question BAC2634 2110Документ11 страницAssignment Question BAC2634 2110Syamala 29Оценок пока нет

- DEBT-EQUITY RATIO ANALYSISДокумент9 страницDEBT-EQUITY RATIO ANALYSISSHRI0588Оценок пока нет

- Toyota Situation AnalysisДокумент3 страницыToyota Situation AnalysisSayed Riyaz0% (1)

- Financial Analysis of United Plantation Berhad and Jaya Tiasa Holdings BerhadДокумент33 страницыFinancial Analysis of United Plantation Berhad and Jaya Tiasa Holdings Berhadwawan100% (1)

- Flat Cargo (C) 1Документ13 страницFlat Cargo (C) 1nadsirah100% (4)

- Assignment 2 Bkaf 3083Документ5 страницAssignment 2 Bkaf 3083Nur Adilah Dila100% (1)

- Satyam and Welli MultiДокумент7 страницSatyam and Welli Multilyj1017Оценок пока нет

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXДокумент4 страницыComputation Format For Individual Tax Liability For The Year of Assessment 20XXannastasia luyah100% (1)

- Malaysia Financial Reporting Framework and International Accouting StandardsДокумент30 страницMalaysia Financial Reporting Framework and International Accouting StandardsKim Tat TehОценок пока нет

- Introduction To Financial Accounting and Reporting in MalaysiaДокумент32 страницыIntroduction To Financial Accounting and Reporting in MalaysiaDINIE RUZAINI BINTI MOH ZAINUDINОценок пока нет

- Malaysia's Standard Setting BodiesДокумент16 страницMalaysia's Standard Setting BodiesRuqaiyah MarzukiОценок пока нет

- MASB and IASB standards in MalaysiaДокумент14 страницMASB and IASB standards in MalaysiaLuqman Nul HakimОценок пока нет

- Chapter 1 Notes Far210Документ23 страницыChapter 1 Notes Far210Muzzammil Azfar Merzuki100% (1)

- Ahmad Aburayyan Resume 3Документ1 страницаAhmad Aburayyan Resume 3api-484032691Оценок пока нет

- Global Perspectives & Research-2022-SyllabusДокумент44 страницыGlobal Perspectives & Research-2022-SyllabustawananyashaОценок пока нет

- UT Dallas Syllabus For Stat1342.001.09s Taught by Yuly Koshevnik (Yxk055000)Документ5 страницUT Dallas Syllabus For Stat1342.001.09s Taught by Yuly Koshevnik (Yxk055000)UT Dallas Provost's Technology GroupОценок пока нет

- Unit 9. Choosing A Career (1) : OpportunityДокумент7 страницUnit 9. Choosing A Career (1) : OpportunityNguyễn ThảoОценок пока нет

- Identity MirrorsДокумент3 страницыIdentity MirrorsCarlo Vilela Alipio100% (1)

- SyllabusДокумент1 страницаSyllabusapi-265062685Оценок пока нет

- Krishna Sen - Gender and Power in Affluent Asia (New Rich in Asia) (1998)Документ338 страницKrishna Sen - Gender and Power in Affluent Asia (New Rich in Asia) (1998)jindan100% (1)

- Sample Lesson Plan For Catch Up FridayДокумент2 страницыSample Lesson Plan For Catch Up Fridayailynsebastian254Оценок пока нет

- Imam-e-Zamana Scholarship Application Form 2018Документ3 страницыImam-e-Zamana Scholarship Application Form 2018Shakeel AhmedОценок пока нет

- Milos Jenicek,: Reasoning, Decision Making, and Communication in Health SciencesДокумент359 страницMilos Jenicek,: Reasoning, Decision Making, and Communication in Health SciencesGabo CarreñoОценок пока нет

- 1MS Sequence 02 All LessonsДокумент14 страниц1MS Sequence 02 All LessonsBiba DjefОценок пока нет

- (Letter) Dir Biyo Re DOST Scholars FY 2020Документ3 страницы(Letter) Dir Biyo Re DOST Scholars FY 2020Lhermie Pugal ButacОценок пока нет

- Iare TKM Lecture NotesДокумент106 страницIare TKM Lecture Notestazebachew birkuОценок пока нет

- Computer System Servicing (Grade 11) : I. ObjectivesДокумент2 страницыComputer System Servicing (Grade 11) : I. ObjectivesRalfh Pescadero De GuzmanОценок пока нет

- Higher SuperstitionДокумент47 страницHigher SuperstitionsujupsОценок пока нет

- Final Exam Questions on Teacher and School CurriculumДокумент3 страницыFinal Exam Questions on Teacher and School CurriculumJan CjОценок пока нет

- Kedir SaidДокумент5 страницKedir Saidmubarek oumerОценок пока нет

- Describe The Three Methods of Heat Transfer. Distinguish How Heat Is TransferredДокумент7 страницDescribe The Three Methods of Heat Transfer. Distinguish How Heat Is TransferredWellaCelestinoОценок пока нет

- Project Stakeholder Management GuideДокумент2 страницыProject Stakeholder Management Guideashunir2001Оценок пока нет

- Activity 2: Vocabulary in A Cover LetterДокумент2 страницыActivity 2: Vocabulary in A Cover LetterAlbeline DjajaОценок пока нет

- Appendix V-Sample Preliminary Pages For Thesis or DissertationДокумент11 страницAppendix V-Sample Preliminary Pages For Thesis or DissertationJalefaye Talledo AbapoОценок пока нет

- British Mathematical Olympiad 30Документ1 страницаBritish Mathematical Olympiad 30SempiternalОценок пока нет

- Government of Rajasthan: Vendor Master Detail ReportДокумент3 страницыGovernment of Rajasthan: Vendor Master Detail Reportmanishclass01 01Оценок пока нет

- 3is QUARTER 3 WEEK1Документ5 страниц3is QUARTER 3 WEEK1Monique BusranОценок пока нет

- Wright, Marketplace Metacognition IntelligenceДокумент6 страницWright, Marketplace Metacognition Intelligencelionel_frОценок пока нет

- Resume - Kaylee CannonДокумент1 страницаResume - Kaylee Cannonapi-602662735Оценок пока нет

- 2023 Pascal ResultsДокумент31 страница2023 Pascal Resultsxmetal123devОценок пока нет

- Selecting The New Vice President - 1Документ2 страницыSelecting The New Vice President - 1KristelleОценок пока нет

- PHYA11H3 Syllabus 2023Документ7 страницPHYA11H3 Syllabus 2023박정원Оценок пока нет

- CH 0175Документ8 страницCH 0175NoGamesForMeОценок пока нет