Академический Документы

Профессиональный Документы

Культура Документы

095 Philippine Savings Bank V Chowking

Загружено:

Arnold Rosario ManzanoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

095 Philippine Savings Bank V Chowking

Загружено:

Arnold Rosario ManzanoАвторское право:

Доступные форматы

Commercial Law Review | Divina | 2nd Sem AY 2014-2015

Philippine Savings Bank v.

Chowking

3 July 2008

Reyes, R.T., J.

Manzano

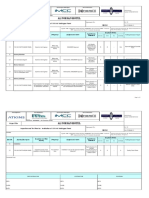

12

1989

074631

P159,634.

13

08

1989

017096

P 60,036.7

4

10

August

19892

August

Theaccounting

total

amount ofof

the

subject

checks

SUMMARY: Joe Kuan Food Corp issued 5 check in favor Chowking. The

manager

Chowking,

Rino

Manzano,

encashed

reached

P556,981.86.

the checks with PSB through Bustos Branchs Head Erlinda Santos. Santos encashed the checks even without the signature of the

2. On the respective due dates of each check, Chowking's

authorized officers of Chowking. It contained only Manzanos indorsement.

Chowking

filed manager,

a complaint

for sum

of money

against, PSB,

acting

accounting

Rino

Manzano,

endorsed

its president, and Santos. PSB, et al. claim that Chowkings own negligence

is

the

proximate

cause

of

the

loss.

SC

ruled

that

are

and encashed said checks with the Bustos branch banks

of

required the highest degree of diligence. This, PSB, et al. failed to observe.

PSBank.

3. All the five checks were honored by PSB Bustos Branch

Head Erlinda Santos, even with only the endorsement of

Manzano importance

approving them.

The signatures

of the

other

DOCTRINE: Banking business is impressed with public interest. Of paramount

is the trust

and confidence

of the

public in

authorized

officers

of

Chowking

were

absent

in

the

five

general in the banking industry. Consequently, the diligence required of banks is more than that of a Roman

(5) checks, contrary to usual banking practice. Manzano

father of a family. The highest degree of diligence is expected.

absconded with and misappropriated the check

In its declaration of policy, the General Banking Law of 2000 requiresproceeds.

of banks the highest standards of integrity and performance.

When

Chowking

found outcare."

Manzano's scheme, it

Needless to say, a bank is "under obligation to treat the accounts 4.

of its

depositors

with meticulous

demandedconcern.

reimbursement from PSBank. When PSBank

relationship between the bank and the depositors must always be of paramount

refused to pay, Chowking filed a complaint for a sum of

money with damages before the RTC. Likewise

FACTS:

impleaded were PSBank's president, Antonio S. Abacan,

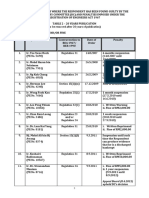

1. Between March 15, 1989 and August 10, 1989, Joe Kuan

and Bustos branch head, Santos.

Food Corporation issued in favor of Chowking five (5)

PSB: It exercised due diligence in the supervision of all

PSBank checks with the following numbers, dates and

its employees. It even dismissed defendant Santos after

denominations:

she was found guilty of negligence in the performance of

Check

Amount

Date

her duties.

No.

Santos: She merely followed the bank's practice of

honoring respondent's checks even if accompanied only

017069

P 44,120.0

15

March

by Manzano's endorsement. She is not negligent of her

0

1989

duties.

Abacan: As president and officer of petitioner bank, he

053528

P135,052.

09 May 1989

played no role in the transactions complained of. Thus,

87

Chowking has no cause of action against him.

All of them: The proximate cause of Chowking's loss

074602

P160,138.

08

August

was its own negligence.

Commercial Law Review | Divina | 2nd Sem AY 2014-2015

5. After MR, RTC reversered itself and ruled in favor of

Philippine Savings Bank.

6. CA reversed RTC and ruled in favor of Chowking.

ISSUE:

1. WON Chowkings negligence is the proximate

cause of its loss? No!

Banking business is impressed with public

interest. Of paramount importance is the trust

and confidence of the public in general in the

banking industry. Consequently, the diligence

required of banks is more than that of a

Roman pater familias or a good father of a

family. The highest degree of diligence is

expected.

In its declaration of policy, the General Banking

Law of 2000 requires of banks the highest

standards of integrity and performance. Needless

to say, a bank is "under obligation to treat the

accounts of its depositors with meticulous

care." The fiduciary nature of the relationship

between the bank and the depositors must always

be of paramount concern.

PSB, through Santos, was clearly negligent when it

honored respondent's checks with the lone endorsement

of Manzano. In the similar case of Philippine Bank of

Commerce v. Court of Appeals, an employee of

Rommel's Marketing Corporation (RMC) was able to

illegally deposit in a different account the checks of the

corporation. This Court found that it was the bank teller's

failure to exercise extraordinary diligence to validate the

deposit slips that caused the crime to be perpetrated.

The proximate cause of the loss is not Chowking's

alleged negligence in allowing Manzano to take hold and

encash its checks. It is PSB's own negligence in the

supervision of its employees when it overlooked the

irregular practice of encashing checks even without the

requisite endorsements.

DISPOSITIVE: CA affirmed. PSBs negligence is the

proximate cause of the loss to Chowking.

Вам также может понравиться

- HR Project Background Screening & AnalysisДокумент86 страницHR Project Background Screening & AnalysisDamu_Prashanth_5848Оценок пока нет

- Elements of LibelДокумент9 страницElements of LibelArnold Rosario ManzanoОценок пока нет

- Principles of Taxation-ReviewerДокумент36 страницPrinciples of Taxation-ReviewerNikki Coleen SantinОценок пока нет

- Request For Number Coding ExemptionДокумент1 страницаRequest For Number Coding ExemptionArnold Rosario ManzanoОценок пока нет

- An Ideal Law Professor - Dean Pineda PDFДокумент14 страницAn Ideal Law Professor - Dean Pineda PDFSakuraCardCaptorОценок пока нет

- Associated Bank (Now Westmont Bank) vs. Vicente Henry Tan G.R. No. 156940 December 14, 2004 Panganiban, J. FactsДокумент1 страницаAssociated Bank (Now Westmont Bank) vs. Vicente Henry Tan G.R. No. 156940 December 14, 2004 Panganiban, J. FactsChester BryanОценок пока нет

- Montuerto v. Ty DigestДокумент2 страницыMontuerto v. Ty DigestArnold Rosario ManzanoОценок пока нет

- Civ Pro ReviewerДокумент88 страницCiv Pro ReviewerHazel Alcaraz Robles100% (1)

- Fortuitous Event Case - OBLICONДокумент43 страницыFortuitous Event Case - OBLICONGe LatoОценок пока нет

- Cacayorin v. Armed Forces and Police Mutual Benefit AssociationДокумент13 страницCacayorin v. Armed Forces and Police Mutual Benefit AssociationRainОценок пока нет

- PNB Vs CAДокумент2 страницыPNB Vs CAArnold Rosario ManzanoОценок пока нет

- Mendoza v. Arrieta G.R. No. L-32599, June 29, 1979 Melencio-Herrera, J. FactsДокумент6 страницMendoza v. Arrieta G.R. No. L-32599, June 29, 1979 Melencio-Herrera, J. FactsAnonymous abx5ZiifyОценок пока нет

- 018 - Quisumbing v. CA and PALДокумент3 страницы018 - Quisumbing v. CA and PALArnold Rosario ManzanoОценок пока нет

- Itp Installation of 11kv HV Switchgear Rev.00Документ2 страницыItp Installation of 11kv HV Switchgear Rev.00syed fazluddin100% (1)

- Eastern Assurance Vs Secretary of LaborДокумент2 страницыEastern Assurance Vs Secretary of LaborGui EshОценок пока нет

- Rule 9 Defenses and DefaultДокумент8 страницRule 9 Defenses and DefaultChaОценок пока нет

- Arwood Industries, Inc. vs. D.M. Consunji, Inc.Документ3 страницыArwood Industries, Inc. vs. D.M. Consunji, Inc.phiaОценок пока нет

- Standard Joist Load TablesДокумент122 страницыStandard Joist Load TablesNicolas Fuentes Von KieslingОценок пока нет

- Andamo Vs IACДокумент6 страницAndamo Vs IACArmen MagbitangОценок пока нет

- Batal DigestДокумент4 страницыBatal DigestMilcah MagpantayОценок пока нет

- 005-Pioneer Insurance v. CAДокумент3 страницы005-Pioneer Insurance v. CAArnold Rosario ManzanoОценок пока нет

- De Leon V. Ong G.R. No. 170405 February 2, 2010Документ1 страницаDe Leon V. Ong G.R. No. 170405 February 2, 2010Paula TorobaОценок пока нет

- 6 Raquel Santos vs. Court of AppealsДокумент33 страницы6 Raquel Santos vs. Court of Appealscool_peachОценок пока нет

- Ganaan Vs IacДокумент2 страницыGanaan Vs IacSalahoden Guinar MoteОценок пока нет

- 031 in Re Petition To Sign in The Roll of AttorneysДокумент5 страниц031 in Re Petition To Sign in The Roll of AttorneysAlvin John Dela LunaОценок пока нет

- LTE CS Fallback (CSFB) Call Flow Procedure - 3GLTEInfoДокумент10 страницLTE CS Fallback (CSFB) Call Flow Procedure - 3GLTEInfoClive MangwiroОценок пока нет

- Lambino V ComelecДокумент4 страницыLambino V Comelec上原クリスОценок пока нет

- Land Ownership UpheldДокумент2 страницыLand Ownership UpheldDanielle DacuanОценок пока нет

- Garcia v. Social Security CommissionДокумент3 страницыGarcia v. Social Security CommissionJD JasminОценок пока нет

- Pichel Vs AlonzoДокумент7 страницPichel Vs Alonzobrida athenaОценок пока нет

- CONSTI Underlined CasesДокумент162 страницыCONSTI Underlined CasesTrishОценок пока нет

- Sanitary Steam Laundry Responsible for Fatal CrashДокумент4 страницыSanitary Steam Laundry Responsible for Fatal CrashLulu VedОценок пока нет

- Proximate Cause of Negligence Sustained Is That of The Bank's Failure To Observe Extra-Ordinary DiligenceДокумент3 страницыProximate Cause of Negligence Sustained Is That of The Bank's Failure To Observe Extra-Ordinary DiligenceSherlyn LopezОценок пока нет

- Gutierrez Vs Gutierrez GДокумент3 страницыGutierrez Vs Gutierrez GAiza EsposaОценок пока нет

- 91 Paculdo Vs RegaladoДокумент2 страницы91 Paculdo Vs RegaladoMichael John Duavit Congress OfficeОценок пока нет

- MACALINTAL VS. COMELEC RULING ON OVERSEAS VOTINGДокумент2 страницыMACALINTAL VS. COMELEC RULING ON OVERSEAS VOTINGGale Charm SeñerezОценок пока нет

- William Golangco Construction Corporation, Petitioner, vs. Philippine Commercial International Bank, Respondent DecisionДокумент18 страницWilliam Golangco Construction Corporation, Petitioner, vs. Philippine Commercial International Bank, Respondent DecisionRyan MostarОценок пока нет

- Estela M. Perlas-BernabeДокумент5 страницEstela M. Perlas-BernabecmdelrioОценок пока нет

- Magno Vs PeopleДокумент5 страницMagno Vs PeopleDswdCoaОценок пока нет

- RAMOS V PHILIPPIPINE NATIONAL BANKДокумент2 страницыRAMOS V PHILIPPIPINE NATIONAL BANKmaraОценок пока нет

- Inchiong Vs CAДокумент1 страницаInchiong Vs CAsarah abutazilОценок пока нет

- National Liga NG Mga Barangay v. Paredes DigestДокумент6 страницNational Liga NG Mga Barangay v. Paredes DigestArnold Rosario ManzanoОценок пока нет

- People v. HolgadoДокумент2 страницыPeople v. HolgadoLyleThereseОценок пока нет

- Djumantan v. DomingoДокумент7 страницDjumantan v. DomingomisterdodiОценок пока нет

- 1 Estate of Rodriguez vs. Republic 2022Документ2 страницы1 Estate of Rodriguez vs. Republic 2022krizzledelapenaОценок пока нет

- Epza Vs Dulay GR No. L-59603 Gutierrez (J)Документ37 страницEpza Vs Dulay GR No. L-59603 Gutierrez (J)alkrysxОценок пока нет

- Petition For Leave To Resume Practice of Law, Benjamin M. DacanayДокумент4 страницыPetition For Leave To Resume Practice of Law, Benjamin M. DacanayMiguelОценок пока нет

- Case Digests SummaryДокумент13 страницCase Digests SummaryHERNANDO REYESОценок пока нет

- Caasi V CAДокумент2 страницыCaasi V CA123014stephenОценок пока нет

- People Vs BandianДокумент7 страницPeople Vs Bandianautumn moonОценок пока нет

- EVANGELISTA VS SISTOZAdigestДокумент2 страницыEVANGELISTA VS SISTOZAdigestEileenShiellaDialimas100% (1)

- PEOPLE VS JUGUETA CASE DIGESTДокумент2 страницыPEOPLE VS JUGUETA CASE DIGESTMa. Goretti Jica Gula100% (1)

- 03 - A - PUBCORP Part III Cases PDFДокумент20 страниц03 - A - PUBCORP Part III Cases PDFTricia GrafiloОценок пока нет

- Export Processing Zone Authority Vs DulayДокумент1 страницаExport Processing Zone Authority Vs DulayJM Manicap-OtomanОценок пока нет

- Barredo v. Garcia, 73 Phil 607 (1942)Документ18 страницBarredo v. Garcia, 73 Phil 607 (1942)Clive HendelsonОценок пока нет

- Republic v. Luzon Stevedoring Co., 21 SCRA 279 (1967)Документ2 страницыRepublic v. Luzon Stevedoring Co., 21 SCRA 279 (1967)Fides DamascoОценок пока нет

- Dokumen - Tips - Inchausti V Yulo 565736d21f1e3Документ3 страницыDokumen - Tips - Inchausti V Yulo 565736d21f1e3Tzuyu TchaikovskyОценок пока нет

- Integrated Reaty Corp. Vs PNBДокумент8 страницIntegrated Reaty Corp. Vs PNBaudreyracelaОценок пока нет

- TORTS Cases Batch 2 FinalsДокумент9 страницTORTS Cases Batch 2 FinalsRainnie McBeeОценок пока нет

- In Re Plagiarism Case Against Justice Del CastilloДокумент112 страницIn Re Plagiarism Case Against Justice Del CastilloRaffyLaguesmaОценок пока нет

- US vs. Lim, 36 Phil. 682Документ10 страницUS vs. Lim, 36 Phil. 682racel joyce gemotoОценок пока нет

- Human Relations (Arts. 19-36, NCC) PDFДокумент511 страницHuman Relations (Arts. 19-36, NCC) PDFYan AringОценок пока нет

- Mercado v. CAДокумент1 страницаMercado v. CAHana Chrisna C. RugaОценок пока нет

- Asturias Sugar Central v. Pure Cane MolassesДокумент2 страницыAsturias Sugar Central v. Pure Cane MolassesJennifer OceñaОценок пока нет

- Germann & Co. vs. Donaldson, Sim & Co., 1 Phil., 63, November 11, 1901Документ3 страницыGermann & Co. vs. Donaldson, Sim & Co., 1 Phil., 63, November 11, 1901Campbell HezekiahОценок пока нет

- BERNARDINO JIMENEZ v. CITY OF MANILAДокумент2 страницыBERNARDINO JIMENEZ v. CITY OF MANILAGellomar AlkuinoОценок пока нет

- PHILIPPINE COMMERCIAL INTERNATIONAL BANK (Formerly INSULAR BANK OF ASIA AND AMERICA), Petitioner, vs. COURT OF APPEALS and FORD PHILIPPINES, INC. and CITIBANK, N.A., Respondents.Документ7 страницPHILIPPINE COMMERCIAL INTERNATIONAL BANK (Formerly INSULAR BANK OF ASIA AND AMERICA), Petitioner, vs. COURT OF APPEALS and FORD PHILIPPINES, INC. and CITIBANK, N.A., Respondents.Karen PascalОценок пока нет

- Babst vs. Court of Appeals, 350 SCRA 341, G.R. NO. 99398, G.R. NO. 104625 JANUARY 26, 2001Документ2 страницыBabst vs. Court of Appeals, 350 SCRA 341, G.R. NO. 99398, G.R. NO. 104625 JANUARY 26, 2001mark gil alpasОценок пока нет

- PP Vs ManabaДокумент1 страницаPP Vs ManabaDanny DayanОценок пока нет

- BUNGE CORPORATION v. ELENA CAMENFORTEДокумент1 страницаBUNGE CORPORATION v. ELENA CAMENFORTEAlfaria Ayan CharpangОценок пока нет

- Group 10 Assigned Villagonzalo Case 94 Andamo vs Larida JrДокумент1 страницаGroup 10 Assigned Villagonzalo Case 94 Andamo vs Larida JrMaddison YuОценок пока нет

- Judge Pascual Accused of Extortion in Angat Municipal Trial CourtДокумент3 страницыJudge Pascual Accused of Extortion in Angat Municipal Trial CourtJoshua Janine LugtuОценок пока нет

- Ledesma vs. Ca: G.R 54598 - April 15, 1988Документ2 страницыLedesma vs. Ca: G.R 54598 - April 15, 1988Trina RiveraОценок пока нет

- Philippine Savings Bank V Chowking Food Corp. GR No. 177526, July 4, 2008Документ1 страницаPhilippine Savings Bank V Chowking Food Corp. GR No. 177526, July 4, 2008Charise GonzalesОценок пока нет

- Delayed Registration RequirementsДокумент4 страницыDelayed Registration RequirementsArnold Rosario ManzanoОценок пока нет

- Affidavit of Service (Philman v. Manaligod)Документ1 страницаAffidavit of Service (Philman v. Manaligod)Arnold Rosario ManzanoОценок пока нет

- Formal Offer of EvidenceДокумент1 страницаFormal Offer of EvidenceArnold Rosario ManzanoОценок пока нет

- 19690228-Grl27360-Papa Vs MagoДокумент9 страниц19690228-Grl27360-Papa Vs MagonikkaremullaОценок пока нет

- RR 02-01Документ4 страницыRR 02-01saintkarriОценок пока нет

- Engtek v. CIR PDFДокумент16 страницEngtek v. CIR PDFArnold Rosario ManzanoОценок пока нет

- (Crim2) (Papa v. Mago) (Manzano)Документ3 страницы(Crim2) (Papa v. Mago) (Manzano)Arnold Rosario ManzanoОценок пока нет

- Affidavit of Loss (Template)Документ1 страницаAffidavit of Loss (Template)Arnold Rosario ManzanoОценок пока нет

- CDBS Elementary Graduation Speech 2016 (Arnold's MacBook Air's Conflicted Copy 2016-03-28)Документ5 страницCDBS Elementary Graduation Speech 2016 (Arnold's MacBook Air's Conflicted Copy 2016-03-28)Arnold Rosario ManzanoОценок пока нет

- 018 - SSS v. MoonwalkДокумент4 страницы018 - SSS v. MoonwalkArnold Rosario ManzanoОценок пока нет

- 002 - People's Car v. CommandoДокумент4 страницы002 - People's Car v. CommandoArnold Rosario ManzanoОценок пока нет

- 030-Simex International Inc. v. CAДокумент3 страницы030-Simex International Inc. v. CAArnold Rosario ManzanoОценок пока нет

- OLA1 - Team 9 - Hearing Calendar - As of September 3, 2014Документ2 страницыOLA1 - Team 9 - Hearing Calendar - As of September 3, 2014Arnold Rosario ManzanoОценок пока нет

- (Crim2) (Papa v. Mago) (Manzano)Документ3 страницы(Crim2) (Papa v. Mago) (Manzano)Arnold Rosario ManzanoОценок пока нет

- Philippines v. Lol-lo & Saraw - Piracy JurisdictionДокумент1 страницаPhilippines v. Lol-lo & Saraw - Piracy JurisdictionArnold Rosario ManzanoОценок пока нет

- Pimentel v. Ex SecДокумент2 страницыPimentel v. Ex SecArnold Rosario ManzanoОценок пока нет

- OLA1 - Team 9 - Hearing Calendar - As of August 14, 2014Документ1 страницаOLA1 - Team 9 - Hearing Calendar - As of August 14, 2014Arnold Rosario ManzanoОценок пока нет

- (OLA) (Case List 2014-08-14) (Team 9)Документ12 страниц(OLA) (Case List 2014-08-14) (Team 9)Arnold Rosario ManzanoОценок пока нет

- LIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYДокумент1 страницаLIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYDarrenОценок пока нет

- Motion For Reconsideration Memorandum of Appeal Alvin AlcontinДокумент3 страницыMotion For Reconsideration Memorandum of Appeal Alvin AlcontinFrancis DinopolОценок пока нет

- Guidelines For The Writing of An M.Phil/Ph.D. ThesisДокумент2 страницыGuidelines For The Writing of An M.Phil/Ph.D. ThesisMuneer MemonОценок пока нет

- Soc Sci PT 3Документ6 страницSoc Sci PT 3Nickleson LabayОценок пока нет

- معجم مصطلحات وادوات النحو والاعرابДокумент100 страницمعجم مصطلحات وادوات النحو والاعرابC1rt0uche123 CartoucheОценок пока нет

- Consent of Occupant FormДокумент2 страницыConsent of Occupant FormMuhammad Aulia RahmanОценок пока нет

- Ingles Semana 5Документ5 страницIngles Semana 5marlon choquehuancaОценок пока нет

- Test 3 - Part 5Документ4 страницыTest 3 - Part 5hiếu võ100% (1)

- Discharger: Operating InstructionsДокумент18 страницDischarger: Operating InstructionsWaleed MouhammedОценок пока нет

- U0001 720148211316536201482113165384Документ6 страницU0001 720148211316536201482113165384Parveen Dagar0% (1)

- Cronicle of Spain PDFДокумент232 страницыCronicle of Spain PDFAlbiHellsingОценок пока нет

- Court Rules Criminal Charges Not Covered by Stay OrderДокумент6 страницCourt Rules Criminal Charges Not Covered by Stay OrderSharon BakerОценок пока нет

- Ass. 15 - Gender and Development - Questionnaire - FTC 1.4 StudentsДокумент5 страницAss. 15 - Gender and Development - Questionnaire - FTC 1.4 StudentsKriza mae alvarezОценок пока нет

- Leon County Sheriff'S Office Daily Booking Report 4-Jan-2022 Page 1 of 3Документ3 страницыLeon County Sheriff'S Office Daily Booking Report 4-Jan-2022 Page 1 of 3WCTV Digital TeamОценок пока нет

- GAISANO INC. v. INSURANCE CO. OF NORTH AMERICAДокумент2 страницыGAISANO INC. v. INSURANCE CO. OF NORTH AMERICADum DumОценок пока нет

- Bill of Supply For Electricity: Tariff Category:Domestic (Residential)Документ2 страницыBill of Supply For Electricity: Tariff Category:Domestic (Residential)Praveen OjhaОценок пока нет

- A L Ammen Transportation Company Inc Et Al Vs Jose Borja116 Phil 242Документ3 страницыA L Ammen Transportation Company Inc Et Al Vs Jose Borja116 Phil 242Isabella SiggaoatОценок пока нет

- Ibr 1950Документ5 страницIbr 1950sebinОценок пока нет

- REC Infra Bond Application FormДокумент2 страницыREC Infra Bond Application FormPrajna CapitalОценок пока нет

- 5.17.18 FIRST STEP ActДокумент28 страниц5.17.18 FIRST STEP ActSenator Cory BookerОценок пока нет

- Catalogo Generale Cuscinetti A Sfere e A Rulli: CorporationДокумент412 страницCatalogo Generale Cuscinetti A Sfere e A Rulli: CorporationAlessandro ManzoniОценок пока нет

- Declaration - 13th Melaka International Youth DialogueДокумент6 страницDeclaration - 13th Melaka International Youth DialogueBojan GrebenarОценок пока нет

- Dyslexia and The BrainДокумент5 страницDyslexia and The BrainDebbie KlippОценок пока нет