Академический Документы

Профессиональный Документы

Культура Документы

Comparing Volatility Between Dhaka and Chittagong Stock Exchanges

Загружено:

NiladriAcholИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Comparing Volatility Between Dhaka and Chittagong Stock Exchanges

Загружено:

NiladriAcholАвторское право:

Доступные форматы

International Journal of Economics, Finance and Management Sciences

2014; 2(1): 43-52

Published online January 30, 2014 (http://www.sciencepublishinggroup.com/j/ijefm)

doi: 10.11648/j.ijefm.20140201.16

Stock market volatility: comparison between Dhaka stock

exchange and Chittagong stock exchange

Md. Ariful Islam1, Md. Rayhan Islam2, Mahmudul Hasan Siddiqui3

1

ASIC Bank Limited, Khulna, Bangladesh

Business Administration Discipline, Khulna University, Khulna-9208, Bangladesh

3

Unilever Bangladesh Limited, Gulshan-1, Dhaka-1212, Bangladesh

2

Email address:

arifrussell@yahoo.com (Md. A. Islam), rayhan_07@yahoo.com (Md. R. Islam), mhs.sadi@gmail.com (M. H. Siddiqui)

To cite this article:

Md. Ariful Islam, Md. Rayhan Islam, Mahmudul Hasan Siddiqui. Stock Market Volatility: Comparison Between Dhaka Stock Exchange

and Chittagong Stock Exchange. International Journal of Economics, Finance and Management Sciences. Vol. 2, No. 1, 2014, pp. 43-52.

doi: 10.11648/j.ijefm.20140201.16

Abstract: This paper is a comparison the volatility of price between Dhaka stock exchange (DSE) and Chittagong Stock

Exchange (CSE). I did this study on volatility as a part of academic course of Research Methodology and Dissertation. The

main objective of this study is to determine whether the markets are same volatile or not. Volatility is the most basic

statistical measure. It can be used to measure the market risk of a single instrument or entire portfolio of investment.

Investors, regulators, brokers, dealers and the media have all express concern over the level of stock market volatility. After

market crash of 1996, individuals as well as corporate investors along with the regulators have become conscious about the

volatility and felt importance of information regarding market to take good investment decision. This paper also discussed

about the preliminary concept of volatility. For analysis of data I have consider only year 2004. Standard deviation,

coefficient of Variation, F-test and monthly return is calculated. All the result shows the same picture. CSE is more volatile

than DSE. The CSE30 and DSE20 also show the same result. Interesting finding is that general price is less volatile than

CSE30 and DSE20. It implies that the top 20 and 30 securities influence the whole market. If the price of these securities

increases, the price index increases. Ups and downs of the price of these securities in CSE is higher than that of DSE.

Although investors are suffering from lack of information about the quality of securities, they take investment decision

considering the general price index of two markets. Some time it may mislead the investor the differences of indexes of two

markets. As the base of these two indices is different they can consider the percentage change in indexes and standard

deviation of the indexes. Though the calculation is based on only the index one individual investor can calculate the return

from individual security and then can take the portfolio investment decision. In this study individual securities are not

considered as it would take massive calculating and data collection operation. Despite of these limitations it can easily be

told that Chittagong Stock Exchange is more volatile than Dhaka Stock Exchange.

Keywords: Stock Market, DSE, CSE, Volatility, Market Risk, Variation

1. Introduction

1.1. Study Area

In case of study on any discipline, the co-ordination of

both theory and practice gets due importance in the modern

world. To bridge the gap between theory and practice the

students of Masters in Bank Management (MBM) of

Bangladesh Institution of bank Management (BIBM) have

to study on some economic or finance and banking related

issues for partial fulfilment of Research Methodology and

Dissertation course. After getting consent of guide teacher I

have chosen the Stock market as my study area. Stock

market is a vast issue; therefore I have selected a specific

area Volatility of Stock market that is approved by my

guide teacher.

As I did this study on Volatility of Stock market for

academic purpose within the limited time, this is conducted

mainly basis on the Price Indices of Dhaka Stock Exchange

(DSE) and Chittagong Stock Exchange (CSE) and these

indices are collected from the Daily Financial Express.

1.2. Study Objectives

DSE and CSE are the two stock exchange of Bangladesh.

44

Md. Ariful Islam et al.: Stock Market Volatility: Comparison Between Dhaka Stock Exchange and Chittagong Stock Exchange

For the development of capital market of Bangladesh DSE

was established in 1954. Up to December/2004 there is 237

listed companies, 11 mutual funds and 8 debentures in DSE.

CSE was established in 1995 after successful operation of

DSE and to meet the increased demand of expanded capital

market. . There is 198 listed companies 11 mutual funds

and 2 debentures in CSE. In our country investors are not

so award about the factors what should be considered to

take an investment decision either in primary market or in

secondary market. Consequences of this unawareness in

1999 the capital market was depressed and investors lose

their investment. To ensure the investors interest and

operating in trading a lot of measures was taken by Security

Exchange Commission (SEC) like Central Depository

System (CDS), screen based operating system, etc. But

over the all measures investor has to know the risk and

return associated with their investment. For that purpose

knowing about volatility of price is very important.

The main objective of the study is to know about the

security market of Bangladesh, volatility and to compare

the volatility of two security markets. Identification of the

problems regarding the volatility and suggestions to the

investors in this regard there are also the prime objectives

of this study. There are some specific objectives those are

set to attain the major objectives:

1. To provide an overview of security markets of

Bangladesh

2. To provide an overview of volatility of stock

exchange

3. To acquaint with the technique of calculation of

volatility

To develop knowledge about the volatility of stock

exchange.

1.3. Operational Definition of Important Terms

Market Capitalization: Market Capitalization is the

sum of the market value of all stocks included in the index.

The market value of each stock is equal to,

Where, Pi = the last transaction price for the stock in

period i.

Ni = the number of shares issued and outstanding at the

end of the period i

Turn Over: The value or volume of outstanding shares

traded in a particular stock exchange during a period of

time.

Amount Traded: Amount traded means market value of

securities traded on the floors of a security exchange.

Stock Market Index: A stock market index is a number

that indicates the relative level of prices or value of

securities in a market on a particular day compared with a

base-day figure, which is usually 100 or 1000. There are

many different ways of constructing an index. One of the

most common methods is,

Index of a particular day = (Portfolio value of a particular

day/ Base Day's portfolio value)*Base Day's index.

1.4. Methodology

Both statistical and graphical approach is used in this

study. As it is a comparison between two stock markets and

a wide range of data has been considered, hypothesis is

tested by F-test, and line graph is used.

1.4.1. Procedure Used

To compare the volatility of the DSE and the CSE in this

study, standard deviation of general price index, DSE20

and CSE30 has considered. The standard deviation is

calculated by adding squired value of all differences of

daily price index from its geometric mean divided by the n1. Then the value is squired rooted.

1.4.2. Population and Sample of the Study

In this study the general index of DSE and CSE has

considered as population. DSE-20 and CSE-30 indices are

also considered. The daily price index throughout the year

2004 is the sample which selected judgemental basis for

convenience and to restrict the study within limited

boundaries.

1.4.3. Source of Data

Secondary data is used in this study and has collected

from the Daily Financial Express.

1.4.4. Quality and Representativeness of Data

The data is more reliable than any other published

secondary source but due to unavailability of a few days

newspaper there is a lack of an ignorable percentage of data.

1.4.5. Statistical Tools Used for Analysis

To test whether there is variation between these two

stock markets F test has been used. Coefficient of Variation

(CV), Standard Deviation (SD) and graphical presentation

is used to compare two stock exchanges.

1.5. Limitations

In this study, a whole-hearted effort was applied to

collect, organize, analyze, and interpret the related data and

finally to attain the optimum outcome of the research. In

spite of these efforts, there exist some limitations that acted

as a barrier to conduct the research. These limitations are:

2 The time allocated for the study was limited. It is

tough to work with the history of the security market

and its reforms only within three months in the midst

of two other courses.

2 All data are secondary and thus problems were faced

in collection of data.

1.6. Importance of the Study

In its role as the capital market DES and CSE tries to

satisfy the need of entrepreneurs and the investors by

accumulating capital and ensuring safe and sustaining

return. Volatility of stock return has been mainly studied in

developed economies. There is relatively a few empirical

research has been conducted on stock return volatility in

International Journal of Economics, Finance and Management Sciences 2014; 2(1): 43-52

the Bangladeshi market context. So it is important to

investigate the pattern of volatility in the Bangladeshi stock

market specially during the 1998-2004. This study simply

giving a touch toward a large study analysing the data of

year 2004.

2. Literature Review

Akhter and Quddus (1996) reveal that initial subscriber

obtain the same return whenever they dispose of their

shares in Initial Public Offerings (IPOs) in a short period of

about five or six months. They used mean adjusted

performance index to analyze price behaviour of

unseasoned new issues from the point of view of initial

subscribers who are interested only in short-run. They

found that the standardized mean excess return were

virtually the same in first 30 trading days and concluding

30 trading days of the first 100 trading days since debut.

Imam and Amin (2004) found that the volatility of the

stock return of Bangladesh Capital Market follows a

generalized autoregressive conditional heteroskedastic

(GARCH) process. It has been observed that the volatility

predicted this period has more influence in forecasting

volatility for the next period. For the DSE return series

volatility clustering is said to be persistence implying that

in Dhaka Stock Market todays return has a large effect on

the conditional forecast variance many periods in the future.

The GARCH model for the two sub-periods of pre-crash

and post-crash shows different result. The reason for such

structural shifts in GRACH process may be due to high

volatility in return series in the later period and to the

change in the behaviour of investor after the stock market

crash in 1996. Passive role-played by the institutional

investors, lack of confidence by the long-term individual

investors and the dominance of speculators, among many,

are the notable reasons for the change in investors

behaviour. Tests for non-stationarity indicated that the

conditional volatility of DSE index in post-crash period in

mean reverting. This finding suggests that

current

information has no effect on long run forecasts, rather,

volatility shocks (random error) than the volatility

estimated at earlier period influence more in estimating

future volatility.

Kaur (2004) found that like many major developed and

emerging stock markets volatility of Indian stock markets

behave same. Volatility clustering, i, e., shocks to the

volatility process persists and the response to news arrival

is asymmetrical, meaning that the impact of good and bad

news is not same. Sayed (2002) works on the recent

selective external and monetary measures that influence the

investors and may create the market-oriented environment

to invest money in the stock market of Bangladesh. He said

that the portfolio is mainly limited to land, commodities,

real assets, banks and National Savings Directorate (NSD)

certificates due to need of financial innovations. Therefore,

actions of the monetary sector largely influence the flow of

funds. In Bangladesh, flow of cash is not generally based

45

on past profit and thus the credit markets have greater

impact on the retained earnings of the firms.

Kearney and Daly (1998) examines the extent to which

the conditional volatility of stock market returns in a small,

internationally integrated stock market are related to the

conditional volatility of finance and business cycle

volatility. It employs a low frequency monthly dataset for

Australia including stock market returns, interest rates,

inflation, the money supply, industrial production and the

current account deficit. Among these variables, the strong

effect is found to be from the conditional volatility of the

money supply to the conditional volatility of the stock

market. By contrast, no evidence is found of volatility

spillover from the foreign exchange market to the stock

market in Australia.

Masulis and Huang (1999) examine the relation between

stock price volatility and trading activity on the London

Stock Exchange. They found that the number of small

trades and their average size significantly impact price

volatility. Again splitting the small trade category into

relatively smaller and larger trades, they found that only for

larger trades, close to the maximum guaranteed depth of

existing quotes, are there significance positive impacts on

stock price volatility from both the trade frequency and

average trade size..

3. An Overview of Bangladesh security

Markets

3.1. Financial System of Bangladesh: Basic Concept

The financial system is a set of institutional arrangement

through financial surpluses in the economy are mobilized

from surplus units and transferred to deficit spenders.

Creating and supporting efficient financial systems should

be a high priority in development. Much of the wealth of

developing countries remains invested in traditional savings

vehicles such as gold, land, or cash under the mattress.

But formal savings systems provide a more productive and

often safer conduit for funds than these other alternatives.

The formal financial system when efficient, well regulated,

and competitive or at least contestable can offer lower

intermediation costs than informal channels. The main

constituents of any financial system are: financial

institutions, financial instruments and financial markets.

Financial Institutions: The modern name of financial

institution is financial intermediary, it mediates or stands

between ultimate borrowers and ultimate lenders. Financial

institutions are generally classified under two main heads: a)

Banks and b) Non-Bank Financial Intermediaries. Financial

intermediaries include banks (central bank, commercial

banks, investment banks etc.), Securities and Exchange

Commission (SEC), specialised financial institutions,

development financial institutions and institutional

investors (i.e. Investment Corporation of Bangladesh).

Financial Instruments: Financial Instrument is the

financial claim of the holder against the issuer. Financial

46

Md. Ariful Islam et al.: Stock Market Volatility: Comparison Between Dhaka Stock Exchange and Chittagong Stock Exchange

Instruments are of two types: Primary or Direct and

Secondary or Indirect Financial Instruments.

Primary or direct financial instruments are financial

claims against real sector units.

Secondary or indirect financial instruments are financial

claims against financial institutions or intermediaries.

Financial Markets: Financial market is the market where

financial instruments are purchased and sold. The market

can be classified into a number of ways, but from the

duration point of view, it is classified into two: money

market and capital market.

(1) Money market is a market where financial securities

maturing in less than one year that is short-term fund are

transacted. Typical money market instruments are

certificates of deposits, treasury bills, post office savings

etc.

(2) The Capital market is a market for long-term funds. It

facilitates an efficient transfer of resources from savers to

investors and becomes conduits for channelling investment

funds from investors to borrowers. The capital market is

required to meet at least two basic requirements: (a) it

should support industrialisation through savings

mobilisation, investment fund allocation and maturity

transformation and (b) it must be safe and efficient in

discharging the aforesaid function. It has two segments,

namely, securities segments and non-securities segments.

Securities Segments - The securities segment is

concerned with the process a firm distributes its securities

to the public in the primary market and the securities are

then traded in the secondary markets. Financial

intermediaries, such as merchant banks, Asset Management

Company, underwriters, broker-members etc. are involved

in the process. Securities segments of capital market have

two important roles to play: (a) information production and

(b) monitoring. Security segment of the markets can be

divided into two:

(1) Primary or New Issue Market: The market in which

newly issued securities are sold by their issuers, who

received the proceeds. Securities are issued in the

primary market by one or more of the following

methods:

(a) Public Issue: An offer to the public by an issuer

through a prospectus for subscription. This is the most

common method of primary market placement in

Bangladesh.

(b) Private Placement: An offer to specific known persons

selected by the sponsors for procuring subscription.

(c) Right Issue: An offer in which existing shareholders

are offered new securities in proportion to their

existing holdings.

(d) Offer for Sale: An invitation to the general public to

purchase the stock of a company through an

intermediary.

(2) Secondary Market: Market that permits trading in

outstanding issues; that is, stocks or bonds already

sold to the public are traded between current and

potential owners. The proceeds from a sale in the

secondary market do not go to the issuing unit, but

rather to the current owner of the security. Again

secondary market has four parts:

(a) Organized Stock Exchange: Securities are traded

according to organized rules and regulations.

(b) Over-the-counter (OTC) Market: OTC market

includes trading in all stocks not listed on one of the

exchanges. The OTC market is not a formal

organization with membership requirements or a

specific list of stocks deemed eligible for trading. In

theory, any security can be traded on the OTC market

as long as a registered is willing to make a market in

the security (willing to buy and sell shares of the

stocks). Generally companies which are unable and

unwilling to enlist, float their shares in the OTC

market.

(c) Third Market: The term third market describes overthe-counter trading of shares listed on an exchange.

(d) Fourth Market: The term fourth market describes

direct trading of securities between two parties with

no broker intermediary. In all most all cases, both

parties involved are institutions.

Non-securities Segments - are those markets in which

loan / equity loan are provided by the banks and financial

institutions, such as Nationalized Commercial Banks

(NCBs), Development Financial Institutions (DFIs), Private

Commercial Banks (PCBs), Investment Corporation of

Bangladesh (ICB). Broadly non-security segments are

divided into two parts: (a) Banking Financial Institutions

and (b) Non-Banking Financial Institutions. We need to

recognize that conditions in the bank-based system are

unpalatable in the sense of huge non-performing loans,

high degree of classified and default loans, capital

inadequacy of banks and the like.

3.2. Operational Procedures in Primary and Secondary

Markets

Securities market operation means primary and

secondary market operations. Affairs of the primary market

can be handled easily. The entire process of allotment is

executed under the instruction of the regulatory authority.

SEC has been successful in obtaining maximum disclosure

through prospectus, which is approved by them. Primary

market is also a one-way traffic. It is the secondary market

where lie all actions, thrill and tensions. In fact secondary

market is a complex one. It may have the problem of inside

trading, market rigging and manipulation and what not?

Hence the regulating authoritys main thrust is upon the

rules and regulations of the bourses, obviously with a view

to protecting the interest of the investors. Most of these are

prepared by the bourses themselves as Self-Regulatory

Organization (SRO). The floor where the secondary market

operations conducted is known as stock exchange, in

French it is Bourse and Bolsa in Latin America.

The stock exchange has been operating for the last three

centuries and the number is increasing day by day. During

this long period there has been a sea change in the

International Journal of Economics, Finance and Management Sciences 2014; 2(1): 43-52

operational procedure of the stock exchanges. In earlier

days how did it operate? Let us read the following

comments on London Stock Exchange by an anonymous

commentator in 1695, The howling of the wolf, the

grunting of the dog, the braying of the ass, the nocturnal

wooing of the cat, all these in unison could not be more

hideous than the noise which these being make in the Stock

Exchange

But now electronic media and state of the art technology

on securities market have brought tremendous changes. In

most developed countries the investors no more rush to the

stock exchanges. Even brokers do not bother to go there

rather transactions are carried through computer terminal

and deals are auto matched. Some countries have even

adopted scrip less trading. Central Share Depositories

maintain record through book entries of distinctive

numbers and shares have been dematerialized. Here in DSE

(Dhaka Stock Exchange) and CSE (Chittagong Stock

Exchange) trading system is fully automated screen based.

Both the Stock Exchanges of Bangladesh provide Clearing

Services for members through their Clearing Houses. The

Clearing House acts as a common agent between members

by delivering and receiving their securities/cheques.

Custodian services in Bangladesh are provided by the

Standard Chartered Bank. The following services are

available to foreign investors: 1) Settlement, 2)

Safekeeping, 3) Registration, 4) Corporate Actions, 5)

Proxy Voting, 6) Client Reporting, 7) Cash Management, 8)

Market information. Under Securities and Exchange

Commission Act, 1993 all players of the securities markets,

like brokers, managers to issues, underwriters, investment

advisors are to obtain licenses from SEC.

3.3. Trading Period

3.3.1. Pre-Opening Session

Order entry, deletion/modification of limit orders is only

permitted; execution of orders shall not be done during this

session. The previous days closing price and index will be

available to the dealers/brokers during this session.

3.3.2. Opening Session

During this session Matching of orders shall be done at

opening price. The opening price of a security shall be the

price at which maximum number of securities is matched.

In the event of being no trade for certain securities, then the

last closing price for the security shall be made the opening

price for the day. No order entry shall be permitted during

this session.

3.3.3. Continuous Trading Session

Orders shall be executed during this session and if an

order can not be executed in whole or in part, then it will be

stored as an unfilled order. Unfilled orders from the preopening session shall be carried forward with time stamp to

this session.

3.3.4. Closing Session

No order is received in this session. Pending orders

47

executable at closing price and orders match at closing

price shall be executed in this session.

3.3.5. Close Price Trading Session

Only match at closing price order and all executable

pending orders shall be executed in this Session at closing

price. If any match at closing price order is not executed

in whole or in part, it will be removed from the system

automatically and all other pending orders except the

expired ones shall be carried forward to the following

Trading Day.

3.3.6. Post-Closing Session

The trading members will make enquiries, verify, and

down load the daily transaction details in this session.

3.4. International Framework

A comparison of the microstructure, architecture, and

regulatory environment of the security market of

Bangladesh with emerging and developed markets implies

that the determinants of growth of capital markets in Asia

may be structural as well as economic. A well-designed

regulatory structure is necessary to reach an optimal

balance between agency costs of capital formation and

monitoring costs imposed by regulation. In the absence of

regulation, wealth transfers between shareholders, debt

holders, and management may occur that raise the cost of

capital to corporations and lower investment in productive

assets. Excessive and inappropriate regulations are

associated with high monitoring costs to corporations

because they limit the ability of the market to attract new

capital. What may be less widely acknowledged is that not

only the regulatory structure but the market microstructure

and organization also have the ability to promote or hinder

economic development by acting through the cost of capital.

Proper design of the trading mechanism and clearing

function promotes liquidity, low transaction costs, low

frictional losses, and fewer mispricing episodes. Thus, we

can say that the liberalization and reform of capital markets

in Bangladesh may fail to deliver the desired results

without structural and regulatory changes to the market.

There are mainly three organizations involved in security

market: (1) Securities and Exchange Commission (SEC), (2)

Dhaka Stock Exchange (DSE) and (3) Chittagong Stock

Exchange (CSE).

3.5. Securities and Exchange Commission (SEC)

In order to protect the interest of investors in securities,

and to develop a viable securities market the Securities and

Exchange Commission (SEC) was established on 8th June

of 1993 under the Securities and Exchange Commission

Act. Consistent with overall policies, SEC is supposed to

act as a central regulatory agency performing wide range of

functions covering the entire capital market including the

proper issue of capital, the establishment of fair trading

practices and the close supervision of issuers, markets and

intermediaries

Md. Ariful Islam et al.: Stock Market Volatility: Comparison Between Dhaka Stock Exchange and Chittagong Stock Exchange

2004

(Marc h)

2003

2002

2001

2000

1999

1998

1997

1196

1995

2500

2000

1500

1000

500

0

Weighted average price index

Graph-1

3.7. Chittagong Stock Exchange (CSE)

The Chittagong Stock Exchange (CSE) was registered as

a public limited company and incorporated on 1st April

1995.In the backdrop of a strong need to institute a

dynamic automated and transparent stock exchange in the

country, 70 reputed business personalities established this

bourse in the commercial capital Chittagong. Only 30

securities were listed on the first day trade when market

capitalization stood at $0.2 billion. The trading operations

of the exchange are fully automated from 1998. CSE is a

self-regulated non-profit organization. A 24 member Board

of Directors manages its business out of which 12 are

elected from the members, and 12 are nominated from the

non-members by SEC. The number of members is 129. The

foreigners can also become members of CSE. It has

provision for 500 members; all members shall be body

corporate. The executive power of CSE is vested with the

Chief Executive Officer (CEO). The CEO is appointed by

the Board with the consent of SEC. The authorized and

paid up capitals of CSE are Tk.150.00 million and Tk.38.40

million respectively.

Weighted average price index

(M

ar

ch

)

03

20

04

20

02

20

01

20

00

20

99

19

98

19

19

97

2000

1500

1000

500

0

96

In the early part of 1952, about five years after the

independence of erstwhile Pakistan in 1947, the East

Pakistan Stock Exchange Association Ltd., an independent

Stock Exchange, was incorporated on April 28, 1954. It

changed name to the East Pakistan Stock Exchange Ltd. on

June 23, 1962 and finally to its present name of the Dhaka

Stock Exchange Ltd. on May 14, 1964. However, formal

trading began in 1956 with 196 securities listed on the DSE

with a total paid up capital of about Taka 4 billion. After

1971, the trading activities of the Stock Exchange remained

suppressed until 1976 due to the liberation war and the

economic policy pursued by the then government. The

trading activities resumed in 1976 with only 9 companies

listed, having a paid up capital of Taka 137.52 million on

the stock exchange. The total numbers of securities listed

with the DSE stood at 267 in March 2004 against 260

securities in June 2003. As of March 2004 the issued

capital and debenture of listed securities amounted to Tk.

4723.30 crore as compared with the Tk. 3608.10 crore in

June 2003 registering an increase of 30.91 percent. As of

March 2004 the market capitalization of all securities stood

at Tk. 10042.90 crore which was Tk. 7299.80 crore in June

2003 showing an increase of 37.58 percent the weighted

average share price index in June 2003 was 823.14 against

973.88 March 2004 in June 2003.

The Dhaka Stock Exchange (DSE) is registered as a

Public Limited Company and its activities are regulated by

its Articles of Association and its own rules, regulations,

and by-laws along with the Securities and Exchange

Weighted average price index

95

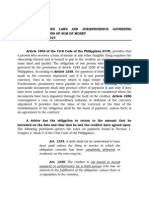

3.6. Dhaka Stock Exchange

Ordinance, 1969; the Companies Act, 1994; and the

Securities and Exchange Commission Act, 1993 (DSE,

1999). As per the DSE Article 105B, its management is

separated from the Council. The executive power of the

DSE is vested with the Chief Executive Officer (CEO). The

CEO is appointed by the Board with the approval of the

SEC. Following graph shows the year wise price index of

DSE.

11

Monitoring and supervision by the commission

The Commission monitored compliance of laws by

public listed companies, stock exchanges and stockbrokers/dealers. Among others [13], the Commission

monitored whetherannual general meetings (AGMs) were held on time

by public listed companies;

declared dividends were paid on time by public listed

companies;

refunds made and allotment letters issued against IPO

on time by public listed companies;

share certificates were issued on time by public listed

companies;

funds raised by IPO or right share were utilized by

public listed companies as per financial and physical

plans approved by the Commission;

half-yearly accounts were issued by public listed

companies on time;

financial statements complied with the disclosure

requirements prescribed by law;

there were unusual fluctuations in the stock prices

without known reasons;

right shares were issued by public listed companies

complying with the prescribed requirements; and

interest on, and principal of, debentures were paid by

public listed companies as per terms of debenture.

19

48

Weighted average price index

Graph-2

International Journal of Economics, Finance and Management Sciences 2014; 2(1): 43-52

The total number of securities listed with the Chittagong

Stock Exchange in March 2004 stood at 200 against 195

securities in June 2003. As of March 2004 market

capitalization of all securities stood at Tk. crore against Tk.

6020.86 crore in June 2003 register an increase of 7.15

percent. The weighted average share price index in March

2004 was 1630.93 against 1642.78 in June 2003.

4. Concept of Volatility

Volatility is the most basic statistical measure. It can be

used to measure the market risk of a single instrument or an

entire portfolio of instruments. While volatility can be

expressed in different ways, statistically, volatility of a

random variable is its standard deviation. In day-to-day

practice, volatility is calculated for all sorts of random

financial variables such as stock return, interest rate, the

market value of portfolio, etc. stock return volatility

measures the random variability of the stock returns.

Simply put stock return volatility in the variation of the

stock return in time. More specifically, it is the standard

deviation of the daily stock return around the mean value

and the stock market volatility in the return volatility of the

aggregate market portfolio.

4.1. Components of Stock Market Volatility

Researchers have sought to analyze the relative

importance of economy-wide factors, industry-specific

factors, and firm-specific factors on a stock's volatility. This

approach borrows from modern asset pricing theory and its

emphasis on so-called factor models, or models that assume

a firm's stock return is governed by factors such as the

overall market return, the return on a portfolio of firms

sampled from the same industry, or even changes in

economic factors such as inflation, changes in oil prices, or

growth in industrial production. If returns have a factor

structure, then the return volatility will depend on the

volatilities of those factors. Campbell, et al. (2001) assume

the factors are the overall market return, an industry return

(e.g., financial, industrial, etc.), and an idiosyncratic noise

term that captures firm-specific information. They

document the important empirical fact that while volatility

moves considerably over time, there is not a distinct trend

upwards or downwards. More interestingly, however, since

1962, there has been a steady decline in stock market

volatility attributed to the overall market factor; that is, the

common volatility shared across returns on different stocks

has diminished over that period. The variation ascribed to

firm-specific sources, by contrast, has risen. The

implication for investors, then, is that they need to hold

more stocks in their portfolios in order to achieve

diversification.

4.2. Stock Market Volatility and Dividends

Stock market performance is usually measured by the

percentage change in the stock price or index value, that is,

49

the returns, over a set period of time. One commonly used

measure of volatility is the standard deviation of returns,

which measures the dispersion of returns from an average.

If the stock market is efficient, then the volatility of stock

returns should be related to the volatility of the variables

that affect asset prices. One candidate variable is dividends.

But research conducted in the early 1980s suggests that

variation in dividends alone cannot fully account for the

variation in prices (see Le Roy and Porter 1981 and Shiller

1981). Prices are much more variable than are the changes

in future dividends that should be capitalized into prices.

Asset prices apparently tend to make long-lived swings

away from their fundamental values. This fact turned out to

be equivalent to the finding that, at long horizons, stock

returns displayed predictability. Thus, the literature on

excess volatility broached the possibility that the stock

market may not be efficient.

In the excess volatility literature, it was seen that the

dividends that are capitalized in the stock price arrive in the

future and need to be "discounted" back to the present

using a discount rate (Krainer 2002). In the early research

it was assumed that this discount rate was constant.

However, discount rates depend on investors' preferences

for risk, which could very well change over time. Therefore,

stock market volatility may not be excessive if discount

rates are variable enough. Thus, the real contribution of the

excess volatility literature was to call attention to the fact

that corporate dividends are simply too smooth a series to

account for the high volatility in prices. Subsequent

research necessarily focused away from the payout policy

of firms and toward the characteristics of investors and of

actual stock market trading.

4.3. Indexes

In analyzing volatility of security markets of Bangladesh,

this report is based on the analysis of indexes of two

security markets of Bangladesh. Rather considering

individual stock, the portfolio (all treaded stocks,

Debentures and mutual funds) is considered. Each market

calculates two indexes. DSE use General Price Index and

DSE20. CSE use General Price Index and CSE30. DSE20

represents the top 20 stocks of DSE and CSE30 represents

top 30. Both the bourses of the country introduced SEC

prescribed index under weighted average method and

excluded Z Group shares from the calculation list since

November 2001. Both the indices have replaced the

conventional age-old all share price indices which had been

as the benchmark barometer of the bourses. DSE named the

new index as Weighted Average Share Price Index and the

base index has been calculated at 817.62 points while the

CSE calls the new index Trade Volume Weighted Index,

which stood at 1836.72 points on the close of first day

trading. SEC termed the new move as an attempt to arrest

any bid to bring down or push share prices up by trading a

small number of shares.

These security-market indexes have five major specific

uses. These are,

Md. Ariful Islam et al.: Stock Market Volatility: Comparison Between Dhaka Stock Exchange and Chittagong Stock Exchange

5.1. F-test

The null Hypothesis is there is no variation between the

mean return of DSE and CSE. Variation of DSE is equal to

the variance of CSE. Volatility of both markets is same. So

the alternative hypothesis is Volatility of both markets is

different the computed value of test statistic is 3.5544

which is greater than the critical value 1.00 at 10% level of

significance. The null hypothesis is rejected and alternative

hypothesis accepted. There is variation between the mean

Month

SD from

General

price

index of

DSE

SD from

General

price index

of CSE

SD from

General

price

index of

DSE-20

SD General

price index

of CSE-30

January

6.52

15.896

8.9347

16.1235

February

24.0362

24.3875

12.9435

22.2344

March

9.4551

14.1435

14.9142

22.3505

April

34.5483

67.8144

36.4729

60.5687

May

20.3639

43.4381

67.5262

40.5833

June

42.5552

74.5427

42.7699

104.6256

July

14.9139

28.4582

18.645

35.0565

August

55.2672

114.9357

67.0889

154.8239

September

55.9362

108.1055

44.5722

101.1496

October

57.3651

75.3925

30.2654

70.917

November

71.7838

126.3259

84.4356

129.6821

December

27.5188

76.8292

27.3749

27.3749

Dhaka Stock Exchange

80

70

60

50

40

30

20

10

0

Chittagong Stock Exchange

150

100

50

0

n

F e ua ry

b ru

a

M a ry

rc h

Ap

ri

Ma l

y

Ju

ne

Ju

A u ly

S e gu

pte s t

m

O c ber

No tobe

v r

D e em b

c e er

mb

er

5. Analysis and Findings

The following table shows the standard deviation from

average index of each month of 2004 for DSE, CSE,

DSE20 and CSE30.

Standard Deviation

Stock market volatility tends to be persistent; that is,

periods of high volatility as well as low volatility tend to

last for months. In particular, periods of high volatility tend

to occur when stock prices are falling and during recessions.

Stock market volatility also is positively related to volatility

in economic variables, such as inflation, industrial

production, and debt levels in the corporate sector (see

Schwert 1989).

The persistence in volatility is not surprising: stock

market volatility should depend on the overall health of the

economy, and real economic variables themselves tend to

display persistence. The persistence of stock market return

volatility has two interesting implications. First, volatility is

a proxy for investment risk. Persistence in volatility implies

that the risk and return trade-off changes in a predictable

way over the business cycle. Second, the persistence in

volatility can be used to predict future economic variables.

For example, Campbell, et al. (2001) show that stock

market volatility helps to predict GDP growth.

5.2. Volatility and Comparison between DSE and CSE

Ja

n

Fe uar

br y

ua

M ry

ar

ch

Ap

ril

M

ay

Ju

ne

Ju

A ly

Se ug

pt us t

em

O be

c r

No tob

ve er

De m b

c e er

m

be

r

4.4. Persistence of Stock Market Volatility

return of DSE and CSE.

S ta n d a r d D e v i a ti o n

To examine total returns for an aggregate market or

some components of a market over a specified time

period and use the rates of return computed as a

benchmark to judge the performance of individual

portfolios.

To develop an index portfolio. Index portfolio led to

the creation of index funds to track the performance of

the specified market series (index) over time.

To examine the factors that influence aggregate

security price movement by securitises analysts,

portfolio managers and others use security-market

indexes.

To project future stock price movements, technicians

would plot and analyze price and volume changes for

a stock market series.

An individual risky asset is its systematic risk, which

is the relationship between the rates of return for a

risky asset and the rates of return for a market

portfolio of risky asset. Therefore it is necessary when

computing the systematic risk of an individual risky

asset (security) to relate its return to the returns for an

aggregate market index that is used as a proxy for the

market portfolio of risky assets.

Ja

50

International Journal of Economics, Finance and Management Sciences 2014; 2(1): 43-52

Volatility of DSE20 and CSE30

S tandard D e v iation

CSE30

200

100

50

Ja

n

F e uar

br y

ua

Ma ry

rc

h

Ap

ril

Ma

y

Ju

ne

J

A uly

S e ug

pt us t

em

O be

No c tob r

v e

D e em b r

c e er

m

be

r

Standard De v iation

100

80

60

40

20

0

Ja

n

F e u ar

br y

ua

Ma ry

rc

h

Ap

ril

Ma

y

Ju

ne

Ju

A ly

S e ug

pt us t

em

O be

c r

No tob

v e er

De mb

c e er

m

be

r

CV-DSE

0.6834

2.5434

0.9778

3.2835

1.7643

3.3482

1.1760

3.9111

3.5329

3.3645

3.9387

1.4204

CV-CSE

0.9937

1.5278

0.8783

3.8432

2.1904

3.3316

1.2725

4.6958

3.8195

2.5049

3.9092

2.1919

Volatility DES and CSE

5

4.5

4

3.5

3

2.5

2

1.5

1

0.5

0

CV-DSE

CV-CSE

F e ar y

br

ua

r

Ma y

rc

h

Ap

r il

Ma

y

Ju

ne

Ju

A ly

S e u gu

pt s t

em

O ber

c

No tobe

ve r

De mb

c e er

m

be

r

C .V.

CV-CSE-30

6. Conclusion

Standard deviation of the price index of DSE and CSE

shows the ups and down between months and continuous

trend to grow. The more the standard deviation more the

price volatility. As the base of the indexes are not same so

to compare between DSE and CSE we should consider the

Coefficient of Variations (CVs) of these two markets.

Following graphs shows the relationship of general price

index of DSE CSE and DSE20-CSE-30.

nu

CV-DES-20

The tables and graphs show that CV of CSE is more than

DSE. It implies that the stock price at CSE is more volatile

than DSE. Even the stock price of leading companies (top

20 and 30 companies of DSE and CSE) also varies from

DSE to CSE and the volatility is much high than CSE30 of

DSE20.

DSE20

Ja

7

6

5

4

3

2

1

0

Ja

n

F e u ary

br

ua

Ma ry

rc

h

Ap

r il

Ma

y

Ju

ne

Ju

A ly

S e ugu

p te s t

m

O c b er

No tob e

ve r

De m b

c e er

m

be

r

C .V.

150

Month

January

February

March

April

May

June

July

August

September

October

November

December

51

Economists have long been interested in the patterns of

stock market volatility. Their research on excess volatility

relative to dividends found that volatility tends to ebb and

flow; subsequent research found that periods of high

volatility are persistent and occur during periods of stock

market declines, and that the stock market volatility

associated with systematic factors has been declining over

time. These academic findings may offer little consolation

to today's investor for whom volatility means portfolio

losses, but the research has yielded important insights into

how stock market information can help forecast economic

variables, and how investors can construct portfolios that

can minimize volatility. Credit market has a great impact on

retained earnings of the firm and so stock price. Even little

change in interest rate has an impact on stock market as the

information is not so available and asymmetric. Credit

market is affected from various problem like Moral Hazard

between the lenders and borrowers, Costly monitoring,

Default loans, and lower amount of foreign reserves.

Although investors are suffering from lack of

information about the quality of securities, they take

investment decision considering the general price index of

two markets. Some time it may mislead the investor the

differences of indexes of two markets. As the base of these

two indexes are different they can consider the percentage

change in indexes and standard deviation of the indexes.

Though the calculation is based on only the index one

individual investor can calculate the return from individual

security and then can take the portfolio investment decision.

In this study individual securities are not considered as it

would take massive calculating and data collection

operation. Despite of these limitations it can easily be told

that Chittagong Stock Exchange is more volatile than

Dhaka Stick Exchange.

52

Md. Ariful Islam et al.: Stock Market Volatility: Comparison Between Dhaka Stock Exchange and Chittagong Stock Exchange

7. Suggestions

To reduce the volatility and to help the investors taking

good investment decisions the following points may be

considered:

1. Trading of the stock of those companies should be

suspended who do not call AGM and distribute

dividend.

2. Before going IPO it should be carefully checked by

the SEC whether they have capacity to offer according

to law.

3. Accounts of listed company should audited by

renowned audit firm and to ensure whether the

information are sufficiently disclose.

4. Manipulation by large company and stock exchange

members must be resists by controlling authority.

Most important one is awareness. To make investors

aware and knowledgeable SEC and Govt. should take

awareness programme which is also an objective of SEC.

References

[1]

[2]

Sayed, Imam Abu.(2002), Investment in the stock market

of Bangladesh: Recent selective external and monetary

sector measures. Bangladesh Arthaniti Samoyiki-2004.

December-2004.

Imam, Mahmood Osman and Abu Saleh Mohammed

Muntasir Amin .(2004). Volatility in the stock return:

Evidence from Dhaka Stock Exchange. Journal of the

institute of Bankers, Bangladesh. Vol. 51, No. 1, June.

[3]

Kaur, Harvinder .(2004). Time Varying Volatility in the

Indian Stock Market. Vikalpa. Vol. 29, No. 4, OctoberDecember.

[4]

Kearney, Colm and Kevin Daly. (1998). The case of stock

market volatility in Australia. Applied Financial

Economics. Vol. 8. pp. 597-605.

[5]

Huang, Roger D. and Ronald W. Masulis. (1999). Informed

Trading Activity and stock price Volatility: Evidence from

London Stock Exchange. Working paper. Vanderbilt

University.

[6]

Schwert, G. William. (1990). Stock Market Volatility.

Financial Analysts Journal. May-June 1990.

[7]

Quddus, Abdul and Selim Akhter .(1996). Price behavior of

new issues listed with DSE: An analysis from the point of

vie of initial subscriber. Asian Economic Review.

[8]

Agundu, P.U.C. (1999). Merchant-Commercial Banks

Conversion: A comparative Business Fertility Analysis.

Asian Economic Review.

[9]

Eilly, Frank K. and Edgar A. Norton. (1995). Investment. 4th

edition. New York: Harcourt Brace College Publishers.

[10] Ministry of Finance, GOB. (2003). Bangladesh Economic

Review-2003.

[11] Ministry of Finance, GOB. (2004). Bangladesh Economic

Review-2004

[12] Mishkin, Fredric S. (2001). The Economics of Money,

Banking and Financial Markets. 6th edition. Bston: AddisonWesley.

Вам также может понравиться

- Analysis of Volatility and Forecasting General Index of Dhaka Stock ExchangeДокумент14 страницAnalysis of Volatility and Forecasting General Index of Dhaka Stock ExchangeDr-Kiran JameelОценок пока нет

- BG 223071519 Md. Asadujjaman SaheenДокумент22 страницыBG 223071519 Md. Asadujjaman SaheenMd. Asadujjaman SaheenОценок пока нет

- IJCRT2207620Документ6 страницIJCRT2207620Natasha GuptaОценок пока нет

- A Dea Comparison of Systematic and Lump Sum Investment in Mutual FundsДокумент10 страницA Dea Comparison of Systematic and Lump Sum Investment in Mutual FundspramodppppОценок пока нет

- Conceptual School Work On Stock IndicesДокумент73 страницыConceptual School Work On Stock IndicesFawaz MushtaqОценок пока нет

- (1-12) Stock Prices and Micro Economic VariablesДокумент12 страниц(1-12) Stock Prices and Micro Economic VariablesiisteОценок пока нет

- Reason Behind Crashing Capital Market in Bangladesh in 2010Документ6 страницReason Behind Crashing Capital Market in Bangladesh in 2010hasib santobuОценок пока нет

- Factors Affecting Stock Index and Share PricesДокумент73 страницыFactors Affecting Stock Index and Share PricesPraveen KambleОценок пока нет

- Comparative Analysis of Mutual Funds at HDFC BankДокумент12 страницComparative Analysis of Mutual Funds at HDFC BankkhayyumОценок пока нет

- SSRN Id4031224Документ23 страницыSSRN Id4031224Rituparna DasОценок пока нет

- Studt of Mutual Fund in India Final ProjectДокумент38 страницStudt of Mutual Fund in India Final ProjectjitendraouatОценок пока нет

- A Comparative Analysis of Mutual Funds With Respect To IL CoДокумент175 страницA Comparative Analysis of Mutual Funds With Respect To IL CoUpasana BhattacharyaОценок пока нет

- 10.3934 Nar.2021014Документ21 страница10.3934 Nar.2021014Özgür Hasan AytarОценок пока нет

- Financial Derivatives Study: Futures & OptionsДокумент93 страницыFinancial Derivatives Study: Futures & OptionsVinod Ambolkar100% (2)

- Paes ReligareДокумент8 страницPaes ReligareMubeenОценок пока нет

- A Study On Financial Derivatives (Futures & Options)Документ70 страницA Study On Financial Derivatives (Futures & Options)Satinder ShindaОценок пока нет

- Macroeconomic Forces and Stock Prices in BangladeshДокумент55 страницMacroeconomic Forces and Stock Prices in BangladeshSayed Farrukh AhmedОценок пока нет

- Bangladesh Stock Market Returns, Volatility and EfficiencyДокумент25 страницBangladesh Stock Market Returns, Volatility and EfficiencyHalimur RahamanОценок пока нет

- A Study On Comparative Analysis Between Indian Stock Market World Stock ExchangeДокумент45 страницA Study On Comparative Analysis Between Indian Stock Market World Stock ExchangeBalakrishna ChakaliОценок пока нет

- Project On Commodity ExchangeДокумент83 страницыProject On Commodity ExchangeJanani BharathiОценок пока нет

- Introduction and Design of The StudyДокумент47 страницIntroduction and Design of The Studysandy santhoshОценок пока нет

- G. Manasa YadavДокумент8 страницG. Manasa YadavmubeenuddinОценок пока нет

- A Comparative Study On Evaluation of Selected Mutual Funds InindiaДокумент24 страницыA Comparative Study On Evaluation of Selected Mutual Funds InindiaChiranjeevi Revalpalli R100% (1)

- A Study On Portfolio Evaluation and Investment Decision With Reference To Sharekhan Limited, ChennaiДокумент5 страницA Study On Portfolio Evaluation and Investment Decision With Reference To Sharekhan Limited, ChennaiGetyeОценок пока нет

- A Study On Mutual Funds in IndiaДокумент40 страницA Study On Mutual Funds in IndiaYaseer ArafathОценок пока нет

- Technical analysis of PSUДокумент42 страницыTechnical analysis of PSUVignesh HollaОценок пока нет

- 22668_LINH_TRUONG_NGOC_NHAT_11_Truong_Ngoc_Nhat_Linh_Final_Exam_21_518136285Документ13 страниц22668_LINH_TRUONG_NGOC_NHAT_11_Truong_Ngoc_Nhat_Linh_Final_Exam_21_518136285hocbaidinao123Оценок пока нет

- Fibonaccitradingperformanceof Dogucand ErdoganДокумент24 страницыFibonaccitradingperformanceof Dogucand ErdoganAbdulrahman SaadiОценок пока нет

- Forecasting Volatility of Stock Indices With ARCH ModelДокумент18 страницForecasting Volatility of Stock Indices With ARCH Modelravi_nyseОценок пока нет

- Public and Private Sector Mutual Fund in India: Original ArticleДокумент5 страницPublic and Private Sector Mutual Fund in India: Original ArticleGaurav SarkarОценок пока нет

- Performance Analysis of Small Investors in The Capital Market of Bangladesh (A Case Study of Chittagong Stock Exchange (CSE) )Документ15 страницPerformance Analysis of Small Investors in The Capital Market of Bangladesh (A Case Study of Chittagong Stock Exchange (CSE) )N. MehrajОценок пока нет

- 1 PBДокумент10 страниц1 PBCtg TalkОценок пока нет

- Astudyon" ": Analysis of Equities and Mutual FundsДокумент77 страницAstudyon" ": Analysis of Equities and Mutual FundsSameer P HarpanhalliОценок пока нет

- Thesis For Mbs 2nd YearДокумент7 страницThesis For Mbs 2nd Yearerinrossportland100% (2)

- Investment Factors Mutual Funds Study OrissaДокумент22 страницыInvestment Factors Mutual Funds Study OrissaPrakash KumarОценок пока нет

- RechrpprДокумент10 страницRechrpprNiam MahmudОценок пока нет

- Comparing Equity and Mutual Fund ReturnsДокумент63 страницыComparing Equity and Mutual Fund ReturnsDev Choudhary75% (4)

- Index PageДокумент42 страницыIndex PageBalakrishna ChakaliОценок пока нет

- Lecturer of Business Management Project Report Submitted in Partial Fulfillment For The Award of Degree ofДокумент93 страницыLecturer of Business Management Project Report Submitted in Partial Fulfillment For The Award of Degree ofsohailsamОценок пока нет

- Stock Market: A Comparative Study Between S&P 500 and DSE General IndexДокумент7 страницStock Market: A Comparative Study Between S&P 500 and DSE General IndexNiladriAcholОценок пока нет

- The Technical Analysis For Gaining Profitability On Large Cap StocksДокумент7 страницThe Technical Analysis For Gaining Profitability On Large Cap StocksBhaskar PatilОценок пока нет

- Dividend Announcement of The Commercial Banks in DSE: Scenario and Effect On Stock PriceДокумент14 страницDividend Announcement of The Commercial Banks in DSE: Scenario and Effect On Stock PriceMayaz AhmedОценок пока нет

- Market Timing With Moving Averages: SSRN Electronic Journal November 2012Документ40 страницMarket Timing With Moving Averages: SSRN Electronic Journal November 20124nagОценок пока нет

- Main PartДокумент53 страницыMain PartAbdullah Mamun Al SaudОценок пока нет

- Jin2019 PDFДокумент17 страницJin2019 PDFNurdiAfribiОценок пока нет

- Technical Analysis of Public Sector Unit Project ReportДокумент42 страницыTechnical Analysis of Public Sector Unit Project Reportdhiraj singhОценок пока нет

- Fractal Formation and Trend Trading Strategy in Futures MarketДокумент5 страницFractal Formation and Trend Trading Strategy in Futures MarketPinky BhagwatОценок пока нет

- Chapter - I: Chapter - Iv Chapter - VДокумент71 страницаChapter - I: Chapter - Iv Chapter - Vbalki123Оценок пока нет

- The Role of Fundamental Information For Trading STДокумент8 страницThe Role of Fundamental Information For Trading STHaichuОценок пока нет

- Investment Management 543..Документ36 страницInvestment Management 543..yajuvendrarathoreОценок пока нет

- Declaration: II Sem (I Batch)Документ51 страницаDeclaration: II Sem (I Batch)Honey AliОценок пока нет

- 11 - Chapter 03 Review of LiteratureДокумент66 страниц11 - Chapter 03 Review of LiteratureAman GuptaОценок пока нет

- AStudyonAnalysisofStockPricesofSelectedIndustries-research GateДокумент51 страницаAStudyonAnalysisofStockPricesofSelectedIndustries-research GateAvicena Ilham GhifarieОценок пока нет

- The Determinants of Stock Prices in PakistanДокумент17 страницThe Determinants of Stock Prices in PakistaneditoraessОценок пока нет

- Ap19 PDFДокумент9 страницAp19 PDFAnuradhaОценок пока нет

- Study of Sector Wise Allocation of Selected Schemes of ELSS Mutual FundsДокумент9 страницStudy of Sector Wise Allocation of Selected Schemes of ELSS Mutual FundsAnuradhaОценок пока нет

- Stock Market and Foreign Exchange Market: An Empirical GuidanceОт EverandStock Market and Foreign Exchange Market: An Empirical GuidanceОценок пока нет

- Supply Chain Performance Achieving Strategic Fit and Scope: Bent Steenholt Kragelund Benk@itu - DKДокумент27 страницSupply Chain Performance Achieving Strategic Fit and Scope: Bent Steenholt Kragelund Benk@itu - DKisanОценок пока нет

- 3018 Apparel TextilesДокумент10 страниц3018 Apparel TextilesNiladriAcholОценок пока нет

- Real State BDДокумент59 страницReal State BDNiladriAcholОценок пока нет

- Grameen BankДокумент7 страницGrameen BankNiladriAcholОценок пока нет

- Math 4Документ134 страницыMath 4NiladriAcholОценок пока нет

- Literature ReviewДокумент48 страницLiterature ReviewWan Muhamad MustaQimОценок пока нет

- Nestle HRДокумент33 страницыNestle HRNiladriAcholОценок пока нет

- Comparing HRM Practices of Foreign and Local Garment Firms in BangladeshДокумент25 страницComparing HRM Practices of Foreign and Local Garment Firms in BangladeshNiladriAcholОценок пока нет

- Singer HRДокумент15 страницSinger HRNiladriAchol100% (1)

- Design Wallpaper in Adobe PhotoshopДокумент19 страницDesign Wallpaper in Adobe PhotoshopNiladriAcholОценок пока нет

- HRM JournalДокумент6 страницHRM JournalNiladriAcholОценок пока нет

- Hun Hsin Textile Co. (BP) LTD.: - ' - :rjgs°::'"Документ1 страницаHun Hsin Textile Co. (BP) LTD.: - ' - :rjgs°::'"NiladriAcholОценок пока нет

- Human Resources Policy NestleДокумент17 страницHuman Resources Policy NestleAbdur RabОценок пока нет

- Bcs Advertise 0601115408Документ24 страницыBcs Advertise 0601115408Rashed IslamОценок пока нет

- Corporate Social DisclosureДокумент29 страницCorporate Social DisclosureNiladriAcholОценок пока нет

- The Effect of HRM Practices and R&D Investment On Worker ProductivityДокумент35 страницThe Effect of HRM Practices and R&D Investment On Worker ProductivityZaki AbbasОценок пока нет

- Stock Market: A Comparative Study Between S&P 500 and DSE General IndexДокумент7 страницStock Market: A Comparative Study Between S&P 500 and DSE General IndexNiladriAcholОценок пока нет

- BEXIMCO Project Study PDFДокумент147 страницBEXIMCO Project Study PDFMahtab Uddin100% (2)

- Relationship between Ownership Structure and Dividend PolicyДокумент21 страницаRelationship between Ownership Structure and Dividend PolicyNiladriAcholОценок пока нет

- A Comparative Analysis of Theperformance o FAfrican Capital Market Volume 2 2010Документ81 страницаA Comparative Analysis of Theperformance o FAfrican Capital Market Volume 2 2010NiladriAcholОценок пока нет

- PrefaceДокумент115 страницPrefaceThulasi RamanОценок пока нет

- Proposal LetterДокумент1 страницаProposal LetterNiladriAcholОценок пока нет

- Admission and Disclosure Standards PDFДокумент57 страницAdmission and Disclosure Standards PDFNiladriAcholОценок пока нет

- Stock Market Crash in 2010: An Empirical Study On Retail Investor's Perception in BangladeshДокумент15 страницStock Market Crash in 2010: An Empirical Study On Retail Investor's Perception in BangladeshNiladriAcholОценок пока нет

- Admission and Disclosure Standards PDFДокумент57 страницAdmission and Disclosure Standards PDFNiladriAcholОценок пока нет

- February 2014 Etf and Et P Monthly ReportДокумент15 страницFebruary 2014 Etf and Et P Monthly ReportNiladriAcholОценок пока нет

- SSRN Id269648Документ23 страницыSSRN Id269648atifghoghaОценок пока нет

- SSRN Id269648Документ23 страницыSSRN Id269648atifghoghaОценок пока нет

- Steel Authority of India Limited Working Capital Management: About SailДокумент4 страницыSteel Authority of India Limited Working Capital Management: About SailHarsh ChadhaОценок пока нет

- Legal Memo - Collection of Sum of MoneyДокумент9 страницLegal Memo - Collection of Sum of MoneyArnold Cavalida Bucoy100% (3)

- Singsong vs. SawmillДокумент2 страницыSingsong vs. SawmillLilibeth Dee GabuteroОценок пока нет

- Lal Project...Документ80 страницLal Project...Mamta KhowalОценок пока нет

- Darshan Gandhi - Sem 6 - Roll No-052 - Sec-C - CORPORATE LAWДокумент19 страницDarshan Gandhi - Sem 6 - Roll No-052 - Sec-C - CORPORATE LAWSounak VermaОценок пока нет

- Wealth DynamicsДокумент32 страницыWealth Dynamicsmauve08Оценок пока нет

- Getin Noble Bank S.AДокумент2 страницыGetin Noble Bank S.AParag ShettyОценок пока нет

- Grant Application GuideДокумент2 страницыGrant Application GuideMunish Dogra100% (1)

- CH 23 Hull Fundamentals 8 The DДокумент31 страницаCH 23 Hull Fundamentals 8 The DjlosamОценок пока нет

- MGT401 Final Term 7 Solved Past PapersДокумент71 страницаMGT401 Final Term 7 Solved Past Paperssweety67% (3)

- CorpoДокумент81 страницаCorpoShan BantogОценок пока нет

- ACC501-Short Notes Lec 23-45Документ39 страницACC501-Short Notes Lec 23-45dani73% (11)

- SALES Digest CasesДокумент53 страницыSALES Digest CasesjennyОценок пока нет

- Merchant Bank in IndiaДокумент14 страницMerchant Bank in IndiaRk BainsОценок пока нет

- Module 2Документ7 страницModule 2RyuddaenОценок пока нет

- ACCOUNTING COMPETENCY EXAM SAMPLEДокумент12 страницACCOUNTING COMPETENCY EXAM SAMPLEAmber AJОценок пока нет

- Financing Infrastructure in the Philippines: Assessing Fiscal Resources and OpportunitiesДокумент64 страницыFinancing Infrastructure in the Philippines: Assessing Fiscal Resources and OpportunitiesCarmelita EsclandaОценок пока нет

- Mcleod Vs NLRCДокумент2 страницыMcleod Vs NLRCAnonymous DCagBqFZsОценок пока нет

- Financial Mathematics Chapter 2 SummaryДокумент209 страницFinancial Mathematics Chapter 2 Summarywan lingОценок пока нет

- PIBT Information Memorandum PDFДокумент23 страницыPIBT Information Memorandum PDFSajid BalochОценок пока нет

- Public Procurement Act 2011Документ98 страницPublic Procurement Act 2011Nyeko FrancisОценок пока нет

- Toyota Shaw IncДокумент2 страницыToyota Shaw IncBrains SagaОценок пока нет

- Ratio Analysis of Jamuna BankДокумент27 страницRatio Analysis of Jamuna BankUpendra SolankiОценок пока нет

- Pmay UДокумент37 страницPmay UNikita AntonyОценок пока нет

- Relay 760 Fortress IssuedДокумент2 страницыRelay 760 Fortress Issuedcodeblack100% (3)

- Analysis of Cash Flow Statement Havard Case StudyДокумент22 страницыAnalysis of Cash Flow Statement Havard Case StudyPrashant JainОценок пока нет

- J.P. Morgan - Taking EM Asia's Pulse PDFДокумент7 страницJ.P. Morgan - Taking EM Asia's Pulse PDFkumarrajdeepbsrОценок пока нет

- Monopoly PSP - GDDДокумент21 страницаMonopoly PSP - GDDapi-256929116Оценок пока нет

- Factor of Currency Develuation PakistanДокумент8 страницFactor of Currency Develuation PakistanjavedalyОценок пока нет

- Briault (1995) PDFДокумент13 страницBriault (1995) PDFMiguel SzejnblumОценок пока нет