Академический Документы

Профессиональный Документы

Культура Документы

Final Report Airtel

Загружено:

Vipin MuraleedharanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Final Report Airtel

Загружено:

Vipin MuraleedharanАвторское право:

Доступные форматы

STRATEGIC LEADERSHIP

A Project Report

On

Submitted to

Prof. J Ramachandran

On

Jan 14th, 2015

Submitted By:

DEEPTI TANDON 1311084

RAKESH RANGDAL -- 1311112

VINOTHKUMAR P -- 1311136

VIPIN M 1311137

STRATEGIC LEADERSHIP PROJECT

Table of Contents

INTRODUCTION .................................................................................................................................. 3

ABOUT BHARTI AIRTEL .................................................................................................................... 3

AIRTEL HISTORY ................................................................................................................................ 4

INFLECTION POINTS IN TELECOM INDUSTRY ............................................................................ 5

COMPETITIVE POSITIONING & GENERIC STRATEGY ............................................................... 7

GROWTH STRATEGY BCG MATRIX ............................................................................................ 7

STRATEGIC DECISIONS BY AIRTEL ............................................................................................... 8

PRESENT CHALLENGES AND THE WAY AHEAD ...................................................................... 13

Challenge #1: Market Saturation ...................................................................................................... 13

Key Recommendation.................................................................................................................... 13

Alternatives considered ..................................................................................................................... 13

Plan for implementation ................................................................................................................ 14

Challenge #2: Declining ARPU ........................................................................................................ 14

Key Recommendation........................................................................................................................ 15

Alternatives considered ..................................................................................................................... 15

Plan for implementation ................................................................................................................ 15

Challenge #3: Uncertainty in the African operations ........................................................................ 16

Key Recommendation.................................................................................................................... 16

Plan for Implementation ................................................................................................................... 17

Challenge #4: Feeble response to Airtel Money ............................................................................... 17

Key Recommendation.................................................................................................................... 18

Challenge #5: Net Neutrality Issue ................................................................................................... 18

Key Recommendation.................................................................................................................... 19

CONCLUSION ..................................................................................................................................... 19

REFERENCES ..................................................................................................................................... 20

STRATEGIC LEADERSHIP PROJECT

INTRODUCTION

India's telecommunication industry is the second largest in the world based on the total number

of telephone users. It has one of the lowest call tariffs in the world due to mega telephone

Network companies and hyper-competition among them. The total annual revenue of this

industry is USD 33,350 millioni. Major verticals of the Indian telecommunication industry are

telephony, internet and television broadcasting. The major players in this industry are Bharti

Airtel, Vodafone, Reliance, Idea, and Tata DoCoMo- to name a few. We have done our analysis

on Bharti Airtel, which is a market leader in the India's telecommunication industry. Scope of

our analysis is restricted to Voice & Text Services, Mobile Internet, and Value Added Services.

Market Share of Telecom Players as On 28th Feb, 14

Src: http://www.telecomlead.com/telecom-statistics/indian-telecom-market-share-report-february-2014-trai-85888-50423

ABOUT BHARTI AIRTEL

Bharti Airtel is an Indian Telecommunication Multinational company head quartered in New

Delhi. It has today evolved into a huge scale operating in nearly 20 countries. Bharti Airtel has

been credited with revolutionizing Indian telecom industry. Today Airtel has grown into the

Third Largest Telecom Company in the world. The following details give information about

the performance of Airtel in the near past

Highest market share in Indian Telecom Industry (~23%)

Largest customer base in India having nearly 275 million customers.

Highest Profit margin compared to other players in Indian Market with approximately

10% margin.

Better return on capital with a 12.07% ROC compared to the industry average of 9.72%

STRATEGIC LEADERSHIP PROJECT

AIRTEL HISTORY1

1976

Bharti Enterprises founded by Sunil Bharti Mittal

Bharti makes it entry into the telecom sector with Bharti Telecom.

1985-88 Bharti Telecoms Ludhiana factory commences operations for manufacturing push button phones

1989

Bharti ties-up with Takacom Corporation, Japan to become the first company in India to

manufacture telephone answering machines

Bharti ties-up with Lucky Gold Star, South Korea to become the first company in India to manufacture cordless

telephones.

Bharti Telecoms products reach international markets. Company signs OEM contract with Sprint, USA for

1990-95 manufacture and export of telephone sets.

Bharti Telecoms Gurgaon factory becomes the first manufacturer of push button phones to be awarded ISO

9002Bharti launches Delhis first GSM mobile services under the Airtel brand.

Telecom Italia acquires 20% equity interest in Bharti Tele-Ventures

British Telecom acquires equity interest in Bharti Cellular.

1996-99 Airtel becomes the first mobile service provider in the country to cross the 100,000 customers mark

Bharti becomes the first Indian company to offer telecom services in international markets

Bharti acquires majority stake in SkyCell, establishes presence in the Chennai circle

Bharti and Singtel, Asias leading telco, form strategic partnership. Singtel invests $ 400 million in

Bharti.

2000-02 Bharti wins mobile service provider licences in 8 circles and fixed-line service provider licences in

4 circles. Bhartis mobile service provider licence in Punjab is restored.

Bharti launches mobile services in Gujarat, Haryana, Kerala, Madhya Pradesh circle, Maharashtra,

Mumbai, Punjab, Tamil Nadu, Uttar Pradesh (West).

Bharti acquires Spice Cell and enters the Kolkata circle

Bharti goes public, completes Indias first 100% book building issue and gets listed on the National

stock Exchange, Bombay Stock Exchange and the Delhi Stock Exchange on February 18, 2002.

2003-05 Airtel becomes Indias largest GPRS network.

Bharti becomes Indias first mobile service provider to complete a national footprint in all 23

telecom circles.

Bharti becomes the first Indian telecom operator to launch 3G services, starts 3G operations in

Seychelles

2006-07 Bharti becomes the fastest private telecom company in the world to cross the 50 million mark.

Enters the league of top 5 mobile companies in the world.

Bharti launches Mobile Money Transfer pilot project in India in partnership with GSMA.

Bharti received licence to offer Direct to Home (DTH) Satellite TV services in India.

Bharti Airtel launches its services in Sri Lanka (2G/3G network).

2008-10 Bharti crosses 60 million telecom customers landmark.

Bharti Airtel launches iPTV service; Digital TV interactive.

Bharti Airtel crosses the 100 million telecom customers mark. (2009)

Airtel launches 3G launch services in Bangalore

Bharti Airtel becomes the fourth largest mobile operator in the world

2011-14 Bharti Airtel crosses 200 million customer (mobile, fixed line & DTH) milestone in India

Airtel launches Indias first 4G service in Kolkata

1 http://www.bharti.com/wps/wcm/connect/BhartiPortal/Bharti/home/about_us/Milestones

STRATEGIC LEADERSHIP PROJECT

INFLECTION POINTS IN TELECOM INDUSTRY

1. Introduction of revenue sharing model

Governments decision to allow private sector participation in the Indian telecom sector that

started the mobile telephone revolution started in India. In 1994, the Department of

Telecommunications (DoT) with the support of Government of India (GoI), issued licenses to

private operators to start mobile services in the four major cities of Delhi, Mumbai, Chennai,

and Calcutta (now Kolkata).2 Nineteen more circles obtained mobile licenses in August 1995.

Kolkata became the first Indian city to get a mobile network when mobile services were started

there on July 31, 1995, by Mobile Net, a joint venture between the Modi group of India and

the Australian telecom operator Telstra. During the first days of cell phones being introduced,

they were out of the reach of most Indians as airtime charges were extremely high. But all this

changed when the government introduced the revenue sharing method in the National Telecom

Policy announced in 1999. Companies like BAL lobbied heavily for the introduction of a

revenue sharing policy. On October 19, 2002, BSNL became the third operator to start mobile

services in the country by starting its cellular services in the country. The market became more

competitive with the entry of more players into the sector.

2. Lowering of license fee and entry of CDMA players (esp. Reliance)

The number of subscribers started to swell with tariffs falling due to the intense competition

among the players and the reduction in the license fees paid to the government. The fixed

service operators were allowed to provide mobile services over a limited area using CDMA

technology in 1999. A bitter legal conflict arose between the fixed service operators and the

cellular operators when Reliance Infocomm3 Ltd. (now a part of Reliance Communications

Ltd.), a fixed service operator, started to provide virtually complete mobile services using

CDMA-WLL (Wireless in local loop), without a cellular license, allegedly by misusing the

loopholes in the telecom policy of 1993. Eventually the Government of India stepped in and

cleared up the mess by introducing the Universal service telecom license in 2004. The Uniform

telecom license did away with the practice of issuing separate licenses for fixed, cellular, ISP,

long distance etc. and introducing a single license whereby the service providers could provide

any service using the technology of their choice. This further fuelled the growth in the sector

with almost all the fixed service operators (including Tata) starting to provide cellular services.

The number of service providers increased to six in almost all the circles. This also fuelled a

convergence in the telecom services being offered as the service providers started providing all

the services. 4

http://cis-india.org/telecom/resources/licensing-framework-for-telecom

http://www.rcom.co.in/rcom/StoreLocator/press_release_detail.jsp?id=72

4

Bharti Airtel Limited and the Indian Telecom Sector, case study from www.icmrindia.org

3

STRATEGIC LEADERSHIP PROJECT

3. Consolidation of telecom sector

With intense competition in this sector, small players like RPG cellular and Fascel sold out to

bigger players and exited from the sector as they could not infuse the capital needed. This

resulted in consolidation of the telecom sector, with only a few big players remaining in the

market. During the same period, some foreign players like AT&T exited the Indian telecom

market citing reasons such as lack of clarity in the policy regarding foreign investment in the

sector and the falling average revenues/user (ARPU). Major players like BPL and Escotel who

had a strong presence in south India also entered into mergers with prominent players.5

4. Spectrum auctions

In 2010, 3G and 4G telecom spectrum were auctioned in a highly competitive bidding. The

government earned a total of 1062 billion from the auction. Department of Telecom auctioned

off 2g spectrum in both CDMA & GSM bandwidths in 2012. About 271 Mhz of spectrum was

put on sale. Government earned RS. 94 billion far less than its estimated target of RS. 280

billion. In 2014, the Dot auctioned 2G telecom spectrum in the frequency range of 900 MHz

and 1800 MHz Vodafone and Airtel had to renew their licenses in the 2014 bidding. For 3G

auctions, the highest amount paid by any player was Airtel (RS.122.95 billion). It obtained 3g

licenses for 13 circles in India: Mumbai, AP, Delhi, Tamil Nadu, UP, Karnataka, WB, HP,

Rajasthan, Assam, Northeast and J&K. Airtel also operates 3G services in Maharashtra & Goa

and Kolkata circles through an agreement with Vodafone and in Gujarat through an agreement

with Idea. This gives Airtel a 3G presence in 15 out of 22 circles in India. Airtel 3G services

are available in 200 cities through its network and in 500 cities through intra-circle roaming

arrangements with other operators. Airtel boasted about 54 lakhs of 3G customers, out of which

4 million are 3G data consumers as of Sept, 2012.

For 4G spectrum auctions, Airtel paid RS. 33.1436 billion (US$520 million) for spectrum in 4

circles: Maharashtra and Goa, Karnataka, Punjab and Kolkata. On 10 April 2012, Airtel

launched 4G services through dongles and modems using TD-LTE technology in Kolkata,

becoming the first company in India to offer 4G services. The launch in Kolkata was succeeded

by launches in Bangalore, Pune & Chandigarh, Mohali and Panchkula. Airtel received 4G

licences & spectrum in the telecom circles of Delhi, Haryana, Kerala and Mumbai after

acquiring Wireless Business Services Private Limited, a JV founded by Qualcomm, which was

victorious in winning BWA spectrum in all the aforementioned circles during the 4g auction.6

The spectrum auctions appear a real inflection point in the Indian telecom industry. The

industry, already deemed high on competition, struggled to straddle between low operating

margins and high capital expenditure. Airtel, who has a pan-India presence couldnt afford to

sit back and let others win the bid and had to pump out money from every possible pockets.

5

6

http://archives.digitaltoday.in/businesstoday/20050925/cover3.html

http://en.wikipedia.org/wiki/Indian_Telecom_Spectrum_Auction

STRATEGIC LEADERSHIP PROJECT

COMPETITIVE POSITIONING & GENERIC STRATEGY

Airtels generic strategy can be stated as Cost Leadershipii. Supported by a solid customer

base, Airtel is able to provide services at prices below-par of competitors. The company gives

a broad focus on all segments, restricting itself from particular segments (e.g. Virgin mobiles)

and the various innovations and differentiations the company follows are short and are

immediately imitated by the competitors. The following figure gives a better picture of the

current strategy.

GROWTH STRATEGY BCG MATRIX

To understand the growth strategy for Airtel it is imperative to use the BCG matrix. Using the

data collected above and plotting the various businesses of Airtel, the BCG matrix is as follows:

STRATEGIC LEADERSHIP PROJECT

STRATEGIC DECISIONS BY AIRTEL

1. Entry into Telecom industry and redefinition of cellular services

The launch of cellular services in Delhi in 1995 marked the entry of Bharti in the Telecom

industry. The telecom arm of the business group was under the tutelage of Bharti tele ventures

(BTV). The cell phone services in Delhi was launched under the brand name Airtel by Bharti

cellular limited, a subsidiary of Bharti tele-ventures. Indias mobile telephony owes to Airtel

for setting many benchmarks in its history which in fact redefined the way cellular services

operated in the country till then. Airtel opened Airtel connect in Delhi in December 1995.

Airtel Connect indeed was a one stop shop for cell phones where users could buy phones, get

new subscriptions, make use of various value added services (VAS), and defray their phone

bills.7

2. Expansion and Acquisition

The expansion of BTV in other telecom circles was through securing licenses in those areas

and through acquisitions. A few of the prominent ones in this regard were Skycell in Chennai,

JT Mobile in Andhra and Bangalore and Spice cell in Calcutta. The business was further

expanded through fixed line services under the brand name Touchtel. BTV started expanding

by offering fixed line services in 2001 under the brand name Touchtel.8 It also launched the

long distance services in the same year under the brand name IndiaOne. BTV further

widened its portfolio by offering Internet Services under the brand name Mantra in late 2001.

With the introduction of the revenue sharing model between the Gol and operators under the

New Telecom Policy (NTP) of 1999, the cellular services grew quite rapidly. BTV initially

targeted the premium segment however soon it reduced the tariffs to make the services

affordable to the masses. It went in for an Initial Public Offer (IPO) in 2002 through a 100%

book building process which helped bring in the funds that proved vital in expanding the

companys business in India.9

3. Building a strong brand

Bharti Airtel, right from the inception, recognized the significance of creating a mighty brand

through various innovative promotional strategies. Some of the strategies adopted by BAL

were enrolling celebrities as its brand ambassadors to appeal to the masses. It initially used

cricket star Sachin Tendulkar and later Bollywood stars like Shahrukh Khan and Kareena

Kapoor as brand ambassadors for promoting its products and services. Shahrukh Khans

popularity proved to be very successful, especially for its former prepaid mobile services brand

Magic.10 The iconic musician A R Rahman composed special ringtones for Airtel which

became a huge hit among the masses further strengthening the brand. Campaigns such as

Express Yourself launched in the year 2003 proved very effective in making Airtel a big

brand in India. By the mid-2000s, the company had gone on to become one of the biggest

http://www.icmrindia.org/free%20resources/casestudies/Airtel.htm

http://www.airtel.in/about-bharti/media-centre/bharti-airtel-news/telemedia/bharti-launches-touchtel-in-delhi

9 http://www.airtel.in/about-bharti/media-centre/bharti-airtel-news/corporate/bharti-tele-ventures-public-offer-receivesexcellent-response

10 http://www.rediff.com/money/2002/jun/27airtel.htm

8

STRATEGIC LEADERSHIP PROJECT

advertisers in India, with total expenditure on marketing, distribution, and advertising of INR

12.55 billion (INR 4.02 billion on advertising alone) in 2006- 07

4. Innovative Business Model

Bharti Airtel Limited (BAL) was one of the first Telecom companies to adopt the idea of

becoming a lean organization. Towards this, it performed outsourcing of its network

deployment (to Ericsson and Nokia), IT services (to IBM), and customer contact centres (to

Nortel). It utilized different payment models from revenue per share to cost per call. This

helped BAL to cut down on its operational expenses and save on capital expenditures.

According to management consulting firm Oliver Wyman, BALs operating expenses as a

share of revenue had declined 8% annually since 2003. This enabled BAL to offer services to

its customers at a low cost and focus on its core business. We were seeing people laugh at us,

saying, how you can give away your lifeline to vendors? We were very clear that the technology

was not something we need to focus on. Technology is something we buy to sell to the customers.

Ericsson, Nokia, and IBM do technology for a living, so lets give it to them because they know best. It

has made the business model of Bharti very, very sustainable, said Mittal.11Along with that, BAL

countered challenges put forward by new entrants like BSNL in the mobile phone market quite

deftly. BSNL was the first company to introduce free incoming calls to its mobile phone users.

BSNL capitalised on its strong fixed line customer base, by providing free incoming calls to

its mobile phone users from its fixed line users. BAL however couldnt afford to imitate

BSNLs strategy as it had to pay interconnection charges. But BAL later lobbied heavily

through the COAI to get the GoI to reduce the interconnection charges and made the incoming

calls free across all operators & the services offered.

5. Network Expansion

Foreseeing the competition, Airtel planned to expand its network coverage all over the country

to gain a sustained competitive advantage ahead of other players. In February 2008, it

announced an annual investment plan of US $ 2 billion to expand its network over the next 3

years12. It also mooted to augment its base stations by another 30000 transceiver stations over

existing 40,000 base stations in the year 2007 thereby covering 70% of the country. Bharti

Airtel Limited (BAL) aimed to achieve a target of 97% coverage by 2010. 50-60% of this

expansion was targeted at rural parts of India. . In July 2007, BAL entered into a memorandum

of understanding (MOU) worth US $ 900 million with Nokia Siemens Networks (NSN) for an

end-to-end network expansion across all of BALs mobile, fixed, and intelligent network

platforms. As part of the deal, NSN was to expand BALs GSM network in 8 circles in 2 years.

This strategic move by BAL was to increase its foothold in rural India and increase its network

capacity to face the increasing competition from other players. This was one of the greatest

expansions in the GSM domain of the country.

6. Targeting all the segments

With respect to Value Added Services, Airtel launched Mobile payment services, Money

transfer etc. Airtel also expanded its m-commerce services facilitating lot of online purchases.

11

http://globalens.com/DocFiles/PDF/cases/inspection/GL1428864I.pdf

http://www.icmrindia.org/casestudies/catalogue/Business%20Strategy/Bharti%20AirtelIndian%20Telecom%20Sector%20Case%20Studies1.htm

12

STRATEGIC LEADERSHIP PROJECT

In 2007, Airtel tied up with Nokia to offer entry level handsets to users. It was an effort to

bundle the handset with Airtel services at subsidized prices. This move was also aimed at

countering self-branded phones released by Vodafone and Tata at low costs, generally to appeal

to the rural masses. Through this tie-up Airtel and Nokia combined their advertising and

marketing initiatives to focus on the lower part of the pyramid. It was also an era where Airtel

did away with single strategy to target all customer segments. High-end customers were

segmented into a separate category called, funsters.13 Industry experts said that as the mobile

telecom domain attained maturity, a single strategy for all was no more the reliable technique.

Proper segmentation of the market was adjudged the key for better targeting. Airtel planned to

intensify its marketing campaigns on tech savvy VAS users who fell in the age group of 18-35

years. To improve its revenues and deal with the steadily falling ARPUs, Airtel decided to get

into tie-ups with leading manufacturers of high-end hand-held devices such as HTC and RIM.

Through these tie-ups, products of the likes of Blackberry & HTC Touch were launched which

provided handy features like touch screen interface, doc support, push email etc. These

products were aimed at high-end corporate users whose ARPUs were high. Airtel hoped to

increase its falling ARPUs through a slew of such high-end offers. Airtel also decreased its

overall tariffs to lure its low-end customers. On January 15, 2008, Airtel reduced its tariffs to

Re. 1 for its lifetime prepaid users -- a reduction of 50% when compared to the previous rate

of RS. 2 per minute. It even reduced the fixed charges for lifetime validity for prepaid

subscribers to RS. 495 from RS. 999.14 Airtel also introduced a number of post-paid plans like

the Airtel Supersaver-399 which provided users with free talk time equal to the value of

monthly rental paid by them. This brought the effective recurring monthly rental charges to

zero. Airtel planned at deleting the entry barriers & bringing down the recurring maintenance

charges for consumers in order to create a new customer base to fuel its growth. The slash in

the tariffs & decrease in the fixed & recurring charges were aimed at increasing the consumer

base by further stretching the market. Analysts opined that reduction in the entry as well as

monthly recurring charges were the hotspots to market expansion in rural India. Airtel also

started new advertising cum promotional campaigns to reposition its brand.

7. Appealing to the Rural Masses

Market penetration for mobile companies in rural India has always been a daunting task. Low

ARPUs were a key concern as the customers were low income people. More towers and that

too taller ones had to be installed to cater to the higher population density. Uninterrupted power

supply was also challenging to achieve. All these aspects raised the costs. Multiple language,

numerous dialects and various scripts made the provision of mobile services further difficult.

In what analysts saw as another innovative approach to rural markets, Airtel started to tie up

with shop owners in remote areas of India and bundled information on issues important to the

rural population (such as weather, crop yield, fertilizers, etc.) with the mobile phone. It also

began providing economical plans (with handset bundling) to rural people to betters its value

proposition. Our next 50 million will largely come from rural India as our plan is to reach

5,200 census towns and over five lakh (500,000) villages, covering 96 per cent of the Indian

population, said Mr. Manoj Kohli, the then MD of Airtel. In 2008, Airtel launched a joint

venture company, IFFCO Kisan Sanchar Limited (IKSL) with Indian Farmers Fertilizer

13

14

http://www.slideshare.net/karanjaidkakj/airtel-marketing-insights

http://www.seminarsonly.com/Engineering-Projects/Marketing/Lifetime-Plans-of-the-Cellular-Companies.php

10

STRATEGIC LEADERSHIP PROJECT

Cooperative Ltd (IFFCO) to provide VAS and voice services to farmers throughout India.15 In

addition to the low tariff of RS. 0.50 per minute between IFFCO members, it planned to offer

economical handsets bundled with attractive offers and connections. Voice message were

broadcasted on a daily basis on mandi prices, weather forecast, rural health programs, farming

techniques etc. The farmers would also have access to a dedicated helpline managed by experts

from various fields to address their queries. Airtel said that the initiative would help in the up

lift of the agrarian community and the rural economy.

8. New Advertising Strategy

As many players started competing in the telecom domain, branding played a crucial role and

Airtels efforts towards that were truly commendable. It also helped to convey the brand to

position itself in the minds of people. From early 2007, it began to roll out some new

promotional campaigns, one of the important ones being the Kuch Bandhan atoot hote hain

[Some bonds are unbreakable] campaign launched in March 2007. The campaign stressed the

wide coverage that the nationwide mobile network of AIRTEL provided. The advertisement

displayed a divided family coming together after long 22 years. The advertisement depicted a

young man, who comes to his parental village to meet his grandparents for the first time. His

father had left the village 22 years ago apparently due to arguments with his father & never

returned. The grandfather is disinterested to talk to the boy first but gives in after speaking to

his own son on the mobile phone with Airtels network. Not being purely emotional like its

earlier Express Yourself campaign, the new advertisement campaign highlighted the

capabilities of Airtels mobile telecom network. Airtel launched another major advertising

campaign in December 2007 called Barriers break when people talk. The theme was that

communication dissolved boundaries and barriers broke down when people started

communicating. The advertisement was shot in Morocco and the characters in it spoke a French

dialect. The ad was based upon the story of two boys separated by border fencing. When one

of the boys starts playing with a football it falls on the other side of the fence. Hearing the

sound, the boy on the other side of the fence comes out of his house. The first boy persuades

him to kick the ball over the border fence. Finally, the two boys crawl under the fence and start

playing football with each other. No celebrities were used in the film and the two protagonists

in the advertisement were picked up from the streets of Morocco. This new advertising

campaign from Airtel was considered one of the most creative advertising campaigns in the

Indian telecom sector. Marketing experts said that the main aim of this new advertisement

campaign was to bring iconic status to its Airtel brand. As Airtel was expanding into foreign

telecom markets, the ad campaign also aimed at projecting Airtel as a global brand. The

campaign aimed to achieve this by making the advertisement in a foreign land. The need to

project Airtel as a global brand was felt more urgently as it had to face competition from global

brands such as Vodafone, they said. After the mobile revolution, Airtel realised a huge potential

in the youth of the nation and network externalities brought by it. Ads like Har ek friend

zaroori hota hain, Jo Tera hain wo mera hai etc. entirely capitalised on this concept.16 The

15

http://www.airtel.in/about-bharti/media-centre/bharti-airtelnews/corporate/pg_iffco+and+bharti+airtel+join+hands+to+usher+in+the+second+green+revolution+to+benefit+millions+

of+rural+consumers

16

http://www.slideshare.net/manigarg211/airtel-advertisement-analysis

11

STRATEGIC LEADERSHIP PROJECT

new Ad of Airtel focuses on One-Touch internet to rope-in elderly customers as well to the

data revolution.

9. Early adoption of new technology

The 3G and 4G services were another area on which Airtel decided to focus so as to retain its

dominant position in the Indian mobile telecom services market. It started the next generation

3G mobile services as and when GoI declared its policy and allotted the spectrum. Analysts

say that this move helped Airtel to increase its revenues in spite of its falling ARPU and that

3G also proved a new growth engine in saturated circles like the big metros. The same trend

continues with 4G as Airtel has launched the countrys first 4G services in Bangalore and

Kolkata. Airtel has launched multiple initiatives to leverage on its mobile data capabilities

Tie-ups with major phone manufacturers17 Airtel, following the western model of

carrier backed purchases, tied up with Apple during its launch of iPhone 3, 4 and 5 in

India. Also with the high end Samsung Galaxy models, they followed the same tactics.

Launch of mobile radio

Special packages for Facebook, WhatsApp etc.

Pact with Opera for Opera mini browsers for Airtel users

Launch of education portal

Applications like smart drive and wynk music18 to promote data expenditures by

consumers

Launch of 4g dongles and devices

Airtel being the market leader and having the highest network presence and customer base,

couldnt shy away from the spectrum auctions that decided the future of Indian telecom

industry. Bidding for a great number of circles & spending a whopping figure in the auctions

were indeed a bold move. The sustainability of such a huge capital expenditure is yet to be

tested and proved in the highly competitive, saturated and low margin Indian context. The

innovative thinking, ultra-modern services and high diversification are definitely raising rays

of hope.

10. Entry into emerging markets

By 2008, Airtel not only established its dominance in the Indian market but also had a

prominent presence in Seychelles through its subsidiary Telecom Seychelles Ltd., and Europe

(Channel Islands) through its subsidiaries Jersey Airtel Limited & Guernsey Airtel Limited.19

It has been rendering cellular services in Seychelles from 1998. In 2006, it became the first

Indian telecom operator to launch 3G services in Seychelles. In May 2007, JAL & GAL entered

into a partnership with Vodafone to launch mobile services in Channel Islands under the AirtelVodafone brand. In the subsequent month, telecom services were launched in Jersey. The

Guernsey services started in March 2008. By middle of 2007, Airtel also made an entry into

17

http://www.airtel.in/about-bharti/media-centre/bharti-airtel-news/mobile/bharti-airtel-to-bring-iphone3gs-to-india-on-march-26

18

http://lighthouseinsights.in/airtel-launches-cross-operator-music-streaming-app-wynk-but-why-will-otheroperators-follow.html/

19

http://www.icmrindia.org/casestudies/catalogue/Business%20Strategy/Bharti%20AirtelIndian%20Telecom%20Sector%20Case%20Studies1.htm

12

STRATEGIC LEADERSHIP PROJECT

neighbouring Sri Lanka, which had around 45 lakhs of mobile users by the end of 2006. The

company entered into an agreement with Sri Lankas main foreign investment promotion body

to invest US$150 million in the country. In what was viewed as Airtels attempt to make its

first major foray into international markets, Airtel and Africa-based MTN Group (MTN),

which had a presence in 24 African and Middle East countries, initiated talks on Airtel possible

takeover of the African telecom major in February 2008. In May 2008, the companies

announced that they were considering a deal valued at US$40 billion, the biggest in the

emerging market. Analysts said that the deal would propel the merged entity to the sixth

position among the top telecom companies in terms of subscriber base, which would touch 130

million with MTN bringing in 68 million subscribers. Madhudusan Gupta, telecoms analyst at

Gartner, said, This would give the combined entity a footprint in one of the least penetrated

mobile markets. With the market in Africa experiencing high growth (and projected to grow

at 11% through 2010, according to Gartner), and there being a huge disparity in income like in

India, analysts expected that Airtel could repeat the success achieved in India in Africa.

Airtel, in connection to its global entry, underwent a Rebranding exercise. The A in the name

has been turned to lower case with a curvy design. AR Rahman has once again associated

with the brand to release a new jingle. The exercise, altogether, was aimed at bringing

dynamism, energy and appeal. Again, the deep red colour portrayed in the new symbol was

targeted to the African markets where the same stands for hope. The rebranding exercise, in its

entirety, was an ambitious journey by airtel to increase its international appeal and way for the

world to recall their brand. Analysts are also of the opinion that this exercise was aimed at

countering the global aura brought into the Indian market by Vodafone.

PRESENT CHALLENGES AND THE WAY AHEAD

Challenge #1: Market Saturation

One of the biggest problems faced by Bharti Airtel is market saturation in urban region. The

urban tele-density has reached 146%. The company should tap into the relatively under

penetrated markets so that it sustain its growth.

Key Recommendation

The tele-density in rural India is assumed around 33%. The rural India is comparatively

kept virgin by the telecom revolution witnessed in the last few years. A huge 'digital divide',

which is reflected by the enormous difference of more than 100% between the urban and

rural tele-density, reiterates this factiii. Bharti Airtel should target the rural market and

generate more revenues.

Alternatives considered

The other alternative considered was to gain market share in urban location instead of entering

rural market. As market has reached saturation, the only way to gain market share is by taking

it from competitor. For this to be possible, Bharti Airtel has to cut down its prices. But price

war will be very harmful for this industry and company as it is already facing hypercompetition.

13

STRATEGIC LEADERSHIP PROJECT

Plan for implementation

Bharti Airtel should target the rural India and deploy scalable network. It should also carry

out cost-effective sales and marketing, and establish distribution channel to provide service

promotion and customer support.

Infrastructure: Deployment of telecom infrastructure in rural areas could be one of the major

expensesiv; hence infrastructure sharing among player would reduce the cost. Initial set-up

costs for new service providers and existing service providers planning to enter new service

areas are very high. Infrastructure sharing will reduce their operating costs. Infrastructure

sharing will reduce the time required to roll out the service.

Affordability in Rural Area: To create affordability in rural India, Bharti Airtel should

collaborate with mobile device manufacturers and dealer and also microfinance institution.

Bharti should provide subsidized tariffs and subscriber identity module cards to rural users,

device manufacturers and dealers should provide subsidized handsets, and micro financing

institution should provide small loans.

Increase ARPU: Rural Telephony faces the problem of very low ARPU. Bharti Airtel should

provide Value added services by collaborating with federation relevant to rural market like

IFFCO Kisan Sanchar which has deep penetration in rural area(80% of rural India), and use its

appeal among the rural agricultural community to create a Brand value.

Sales and Marketing: Marketing content in local language will be most effective in rural

area. Bharti Airtel should set up Service Centres in villages to address customer queries which

will even act as sales and distribution outlets. Therefore, integrating sales & marketing with

distribution channels will bring down cost.

Challenge #2: Declining ARPU

With advent of new mobile applications which enables user to communicate, share files

through data which costs much lesser than voice call, the revenues generated out of voice calls

have been dwindling. Also revenue from messaging service (SMS) has also diminished

considerably. This has created an impact on Airtels revenue last quarter and their ARPU fell

from Rs.200 to Rs.192. The main component Airtels ARPU voice calls came down from Rs.

166 to Rs.160v.

14

STRATEGIC LEADERSHIP PROJECT

Revenue from SMS and VAS as a percentage of total revenue has reduced from 8.2% to 6.7%v,

though the loss was compensated by the increase in data usage with increase of revenue from

7.4% of total revenue to 9.2%. Airtel has an ARPU of Rs.70 for Data which is half as that of

voice. This trend has created a negative impact on Airtels financial performance; however

there are scopes for development in the Data domain

Key Recommendation

Airtel should focus on data as it has huge potential for growth in the future. With increase

in smart phone usage, mobile applications and free services, data usage is going to skyrocket

in the next 5 years. With Airtels dominating presence in India and existence in Africa they

have huge opportunity for capturing this space in the future.

Fig. Mobile data traffic growth 20112012 and CAGR 20122018, by regionvi 2013

Alternatives considered

It is to focus on voice and SMS services. But as gradually the industry is going to evolve with

data as the key entity, the strategy of concentrating on voice & text would fail in long term.

Plan for implementation

Mobile data usage is exploding and the traffic is doubling every year for the past few years.

Under this situation it would be ideal for Airtel to have partnership with leaders in Data Traffic

like Qualcomm, Siemens, Huawei, etc. to gain competitive advantage and possess the best

technology before the competitors.

15

STRATEGIC LEADERSHIP PROJECT

Along with the above mentioned recommendation, in order to improve data usage they can

provide,

Customized Data plans for only for specific apps

Customizable mobile plans (Pipeline)

Flexibility, Millions of Combinations

Premium pricing for premium segments E.g. LTE Data plans

Challenge #3: Uncertainty in the African operations

Airtel is yet to make a turnaround in all the markets except India. In the July-September quarter

2014, Bharti Airtel reported a net profit of INR 1,383 crore, a 170 per cent rise from the

corresponding quarter of 2013-14.20 It could have reported a much stronger result if it did not

have to suffer the mounting pressure from Africa, Bangladesh & Sri Lanka. India has generated

a net profit (before exceptional items) of INR 2,449 crore; however, it generated a loss of INR

753 crore in Africa and INR 153 crore in Bangladesh and Lanka. The figure for these countries

previous year was a loss in Africa at INR 288 crore and one of INR 133 crore in Bangladesh

and Lanka. In July-September, capital expenditure in Africa rose to INR 1,602 crore, a 166 per

cent jump from INR 964 crore, while operating cash flow was barely INR 28 crore, as

compared with INR 936 crore in July-September 2013. However, capex in Bangladesh and

Lanka together almost halved to INR 66 crore from INR 132 crore and operating cash flow

almost doubled. Analysts have remained sceptical about Bharti Airtels operations abroad. At

this stage, it would be very difficult to correct operations in Bangladesh. Sri Lanka never paid

back. And, pressure in Africa has been increasing. Bharti has been looking for a buyer for its

Sri Lanka operations for quite a long time but is yet to find a suitor. The way Bangladesh is

going, it might have a similar fate, said a top analyst with a global management consulting

firm, with experience of working for a rival Telco.

Key Recommendation

Airtel has to leverage on its key capabilities which include outsourcing important operations

in Africa and change from volume based service to value based service.

20

http://www.business-standard.com/article/companies/bangladesh-goes-africa-way-for-bharti-airtel114110400936_1.html

16

STRATEGIC LEADERSHIP PROJECT

Plan for Implementation

Airtel should shift its focus from low price high volume strategy to high value model

Airtels low tariff strategy for voice has improved the minutes talk time revenue in India and

other Asian markets but this strategy has not resulted in the talk time improvement in Africavii

and on the other hand non-voice revenues that has grown 65% in the last two years but it

contributes to only 13% in the overall revenues in Africa. So, Data services like Airtel money

and VAS which fall under the category of non-voice revenue would hold the promise to

improve revenues owing to its exponential growth. viii

Airtel should pursue the infrastructure sharing model like it did in India

Airtel had to spend 50% more capital expenditure in the African operations than originally

estimated in the last financial yearix. Airtel underestimated the complexities in the operations

like lack of proper electric power in the network tower areas and overestimated the Zains

investments in the infrastructure. So Airtel has to aggressively pursue the infrastructure sharing

model that it pioneered in India, in Africa as well.

Airtel should outsource the key operations

Airtel is quiet successful in outsourcing its major operations previously to IBM, Nokia

Siemens, Ericson etc. in fact it has remarkable reputation in managing the outsourcing partnersx

well to improve quality of operations and services. So it has to implement the outsourcing in

its African business as well.

Challenge #4: Feeble response to Airtel Money

Airtel money, Indias first mobile wallet service is adjudged as one of the notable innovations

in the m-commerce domain. The new service, aimed at increasing loyalty, retention and

customer base was launched in 2012 across 700 cities. Airtel money is advertised as a swift,

simple and safe service that permits users to load cash on their phones to pay utility bills and

shop at 10,000 plus merchandises across the country. It also offers convenient transfers

between two mobile wallets. Many brands have endorsed Airtel money so far such as The

brands include utility provider such as Reliance Energy, Tata Power Company, Maharashtra

State Electricity Board, BSNL,LIC, Aviva, ICICI, SBI, PVR, DT Cinemas, Fun Cinemas,

Fame, INOX, mutual funds, retailers like Megamart, Walmart etc. Airtel money is also touted

as an alternative to debit and credit card transactions over online platforms like Flipkart,

amazon, yatra etc.21 Though Airtel money invoked lot of initial response, the response

paralysed after losing the initial momentum. For taking the scheme ahead, Airtel has to analyse

the pros and cons involved with it

21

http://www.mydigitalfc.com/personal-finance/airtel-money-enrolls-50000-subscribers-within-first-10-days-319

17

STRATEGIC LEADERSHIP PROJECT

Pros

Airtel has a huge customer base and is widely renowned as a trusted brand. The initial

momentum that it achieved is also testimony to the same.

Telecom infrastructure to facilitate payments (USSD,SMS or 3G) is already in place for

Airtel

Airtel also enjoys a huge network of dealers and distributors.

Cons

Debit/ Credit card is preferred over Airtel money.

Payment of utility bills, recharges etc. are not compelling enough to attract users

Transaction limits imposed by RBI is much lesser compared to debit/credit card

transactions.

No merchants/Few merchants- Its a catch 22 situation. Merchants dont adopt this

mechanisms as not many users are there and users dont adopt it as many merchants are not

there.

M-Pesa, a similar initiative in Nigeria by Safaricom has been a huge hit and airtel money has

also been able to emulate its success in Nigeria and certain other African economies whereas

in India the growth has been withheld by the aforementioned drawbacks.

Key Recommendation

Make Airtel money more attractive through loyalty points and discounts on e-commerce

platforms.

Incentivize merchants and bring in more players to the network

They should exercise pressure on RBI to increase the transaction limits to be at par

with card transactions.

Challenge #5: Net Neutrality Issue

Adoption of messaging services like WhatsApp and WeChat has totally replaced SMS services

which was a great revenue generator for service providers. Now, with VoIP services like Skype

and Viber gaining traction and also the message services like WhatsApp mooting the

integration of voice calls with the existing services, telecom operators like Airtel has grown

vigilant over the future. With decrease in revenues becoming a routine affair, Airtel was forced

to rethink their existing strategy. The increasing usage of messaging apps like WhatsApp has

resulted in easy communication to any corner of the world with minimum cost. The status of

telecom operators has drooped to that of a pipe for retrieving such web based services. The

acceleration in adoption was so rapid that Airtel had to announce change in pricing for VoIP

services on 27th Dec 2014. This led to outburst in social media, with @neutrality_in handle

being retweeted more than million times accompanied with numerous status updates on

Facebook against Airtels announcement. This was considered as the violation of net neutrality

(i.e. all data should be treated equally by Internet Service Providers). After consultation with

TRAI regarding this issue Airtel retracted their decision to charge for VoIP services within two

days after the announcement.

18

STRATEGIC LEADERSHIP PROJECT

Key Recommendation

Price of data packages to be incremented over a course of time. Addiction to the data

enabled services are increasing and the same can be capitalized for enforcing the price hike.

As the issue is pestering all the service providers and none can sustain the loss of revenue in

the low margin telecom industry, a possible collusion among the fellow players can be

contemplated.

The existing players are already blaming the new age apps like WhatsApp and Viber to

be free-riders as they escape the high capital investment in spectrum auctions and also

save their business from any form of taxation. Consequently, they are able to provide

free/cheap services that attract customers in large numbers. Airtel shall collude with the

fellow players and pitch before TRAI regarding this uneven ground of competition and

enforce tax and associated payments from all these VoIP and messaging apps.

CONCLUSION

The telecom industry faced various inflection points which were introduction of revenue sharing

model, lowering of license fee and entry of CDMA players (esp. Reliance), consolidation of

telecom sector and Spectrum auctions. Bharti Airtel has tackled these inflection points

successfully to a great extent by various strategic decisions like expansion and acquisition,

building a strong brand, innovative business model, network Expansion, appealing to the rural

Masses, new advertising strategy, early adoption of new technology and entry into emerging

markets. The current challenges which Bharti Airtel faces are market saturation, declining

ARPU, uncertainty in the African operations, feeble response to airtel Money and net neutrality

Issue. Our key recommendations to face these challenges are rural India penetration; focus on

its data services, outsourcing operations in Africa. Just as in past, with the right mix strategic

leadership and decision making, Bharti Airtel shall emerge as winner by facing its current

challenges.

19

STRATEGIC LEADERSHIP PROJECT

REFERENCES

ii

http://www.ukessays.com/essays/business/the-strategic-management-process-in-airtel-businessessay.php#ixzz2l7xHSrC7

iii

http://www.dnb.co.in/IndianTelecomIndustry/issues.asp

http://www.cisco.com/en/US/solutions/collateral/ns341/ns525/ns537/ns705/ns1186/Cisco_BhartiAirtel_CS.

html

vhttp://www.business-standard.com/article/companies/bharti-airtel-s-numbers-highlight-threat-for-thesector-113103100410_1.html

vi

Source: Analysis Mason, 2013.

vii

http://ovum.com/2012/03/09/airtels-african-safari-turns-into-a-hard-expedition/

viii

http://www.nyasatimes.com/2013/12/03/airtel-money-registers-500000-customers-transacts-12-millionmonthly/

ix

http://www.telecomlead.com/telecom-services/airtel-telecom-infrastructure-capex-touches-438-million-inq4-2012/

x

http://www.researchomatic.com/Strategic-Outsourcing-At-Bharti-Airtel-105185.html

iv

20

Вам также может понравиться

- Business in Emerging EconomiesДокумент3 страницыBusiness in Emerging EconomiesVipin MuraleedharanОценок пока нет

- Finncontainers SolutionДокумент4 страницыFinncontainers SolutionVipin MuraleedharanОценок пока нет

- EurekaДокумент1 страницаEurekaVipin MuraleedharanОценок пока нет

- Project Idea: Day-Care and Crèche Services - Objective: A Competent Business Through A Compassionate ActionДокумент2 страницыProject Idea: Day-Care and Crèche Services - Objective: A Competent Business Through A Compassionate ActionVipin MuraleedharanОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Perkins 20 Kva (404D-22G)Документ2 страницыPerkins 20 Kva (404D-22G)RavaelОценок пока нет

- Shubham Tonk - ResumeДокумент2 страницыShubham Tonk - ResumerajivОценок пока нет

- An RambTel Monopole Presentation 280111Документ29 страницAn RambTel Monopole Presentation 280111Timmy SurarsoОценок пока нет

- Missouri Courts Appellate PracticeДокумент27 страницMissouri Courts Appellate PracticeGeneОценок пока нет

- Sustainable Urban Mobility Final ReportДокумент141 страницаSustainable Urban Mobility Final ReportMaria ClapaОценок пока нет

- SME-Additional Matter As Per Latest Syllabus Implementation WorkshopДокумент14 страницSME-Additional Matter As Per Latest Syllabus Implementation WorkshopAvijeet BanerjeeОценок пока нет

- Peoria County Jail Booking Sheet For Oct. 7, 2016Документ6 страницPeoria County Jail Booking Sheet For Oct. 7, 2016Journal Star police documents50% (2)

- Form Three Physics Handbook-1Документ94 страницыForm Three Physics Handbook-1Kisaka G100% (1)

- 1400 Service Manual2Документ40 страниц1400 Service Manual2Gabriel Catanescu100% (1)

- CV Ovais MushtaqДокумент4 страницыCV Ovais MushtaqiftiniaziОценок пока нет

- Oracle Exadata Database Machine X4-2: Features and FactsДокумент17 страницOracle Exadata Database Machine X4-2: Features and FactsGanesh JОценок пока нет

- Applied-Entrepreneurship PPTДокумент65 страницApplied-Entrepreneurship PPTJanice EscañoОценок пока нет

- Intermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Документ11 страницIntermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Jericho PedragosaОценок пока нет

- How To Create A Powerful Brand Identity (A Step-by-Step Guide) PDFДокумент35 страницHow To Create A Powerful Brand Identity (A Step-by-Step Guide) PDFCaroline NobreОценок пока нет

- Recommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityДокумент49 страницRecommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityJohn DavisonОценок пока нет

- Basics: Define The Task of Having Braking System in A VehicleДокумент27 страницBasics: Define The Task of Having Braking System in A VehiclearupОценок пока нет

- Cam Action: Series: Inch StandardДокумент6 страницCam Action: Series: Inch StandardVishwa NОценок пока нет

- Exp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.Документ7 страницExp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.AbhishEk SinghОценок пока нет

- Brand Positioning of PepsiCoДокумент9 страницBrand Positioning of PepsiCoAbhishek DhawanОценок пока нет

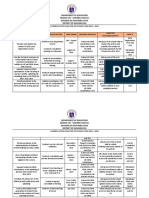

- Action Plan Lis 2021-2022Документ3 страницыAction Plan Lis 2021-2022Vervie BingalogОценок пока нет

- Configuring Master Data Governance For Customer - SAP DocumentationДокумент17 страницConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoОценок пока нет

- Interoperability Standards For Voip Atm Components: Volume 4: RecordingДокумент75 страницInteroperability Standards For Voip Atm Components: Volume 4: RecordingjuananpspОценок пока нет

- A Review Paper On Improvement of Impeller Design A Centrifugal Pump Using FEM and CFDДокумент3 страницыA Review Paper On Improvement of Impeller Design A Centrifugal Pump Using FEM and CFDIJIRSTОценок пока нет

- Ts Us Global Products Accesories Supplies New Docs Accessories Supplies Catalog916cma - PDFДокумент308 страницTs Us Global Products Accesories Supplies New Docs Accessories Supplies Catalog916cma - PDFSRMPR CRMОценок пока нет

- Subqueries-and-JOINs-ExercisesДокумент7 страницSubqueries-and-JOINs-ExerciseserlanОценок пока нет

- Forecasting of Nonlinear Time Series Using Artificial Neural NetworkДокумент9 страницForecasting of Nonlinear Time Series Using Artificial Neural NetworkranaОценок пока нет

- 21st Bomber Command Tactical Mission Report 178, OcrДокумент49 страниц21st Bomber Command Tactical Mission Report 178, OcrJapanAirRaidsОценок пока нет

- ESG NotesДокумент16 страницESG Notesdhairya.h22Оценок пока нет

- Fidp ResearchДокумент3 страницыFidp ResearchIn SanityОценок пока нет

- CH 1 India Economy On The Eve of Independence QueДокумент4 страницыCH 1 India Economy On The Eve of Independence QueDhruv SinghalОценок пока нет