Академический Документы

Профессиональный Документы

Культура Документы

Iron Ore: Domestic Production and Use

Загружено:

sfsdffedsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Iron Ore: Domestic Production and Use

Загружено:

sfsdffedsАвторское право:

Доступные форматы

84

IRON ORE1

(Data in million metric tons gross weight unless otherwise noted)

Domestic Production and Use: In 2014, mines in Michigan and Minnesota shipped 93% of the usable iron ore

products in the United States, with an estimated value of $5.1 billion. Twelve iron ore mines (9 open pits and 3

reclamation operations), 9 concentration plants, 10 pelletizing plants, 2 direct-reduced iron (DRI) plants, and 1 iron

nugget plant operated during the year. Almost all ore was concentrated before shipment. Eight of the mines, operated

by three companies, accounted for the majority of production. The United States was estimated to have produced and

consumed 2% of the worlds iron ore output.

Salient StatisticsUnited States:

Production2

Shipments

Imports for consumption

Exports

Consumption:

3

Reported (ore and total agglomerate)

4

Apparent

5

Price, U.S. dollars per metric ton

Stocks, mine, dock, and consuming

plant, yearend, excluding byproduct ore

Employment, mine, concentrating and

pelletizing plant, number

6

Net import reliance as a percentage of

apparent consumption (iron in ore)

2010

49.9

50.6

6.4

10.0

2011

54.7

55.6

5.3

11.1

2012

54.0

52.9

5.2

11.2

2013

53.0

52.7

3.2

11.0

2014

57.5

54.2

5.5

13.0

42.3

47.9

98.79

46.3

49.1

99.45

46.9

48.1

98.16

48.8

47.1

104.90

49.5

47.8

101.00

3.47

3.26

3.11

2.29

4.50

4,780

5,270

5,420

5,644

5,750

Recycling: None (see Iron and Steel Scrap section).

Import Sources (201013): Canada, 71%; Brazil, 12%; Russia, 3.0%; Venezuela, 3.0%; and other, 11%.

Tariff: Item

Concentrates

Coarse ores

Fine ores

Pellets

Briquettes

Sinter

Roasted Iron Pyrites

Number

2601.11.0030

2601.11.0060

2601.11.0090

2601.12.0030

2601.12.0060

2601.12.0090

2601.20.0000

Normal Trade Relations

123114

Free.

Free.

Free.

Free.

Free.

Free.

Free.

Depletion Allowance: 15% (Domestic), 14% (Foreign).

Government Stockpile: None.

Events, Trends, and Issues: U.S. iron ore production was expected to increase in 2014 and 2015 from that of 2013

owing to new production that began in late 2013 and 2014. In December 2013, one company in Louisiana began

producing DRI pellets from imported iron ore concentrates. The facility was the largest of its kind in the world, with a

2.5 million-ton-per-year capacity, although equipment failure, upgrades, and repairs temporarily idled the plant

periodically during the year. In September, Reynolds Pellet Plant began operations in Indiana using iron ore

concentrates from Minnesota reclamation operations. The plant was designed to produce 3 million tons per year of

high-quality flux pellets to feed blast furnaces in Ohio and Kentucky. Mesabi Chief Plant Four, a 2-million-ton-per-year

iron ore reclamation plant, was set to begin operations in the first quarter of 2015.

In February, it was announced that the Empire Mine would remain open through January 2017 following an extension

of supply and joint-operating agreements. Production rates reached 2 million tons per year for the Comstock

Mountain Lion Mine in Utah, which produces concentrates for export. One companys project in Minnesota to

construct a 7-million-ton-per-year open-pit iron ore mine, concentrator, pelletizing plant, and DRI plant was expected

to begin in the second half of 2015 after receiving financing needed to complete the project. Construction began on a

2-million-ton-per-year DRI plant in Texas, expected to be operational by yearend 2015. Weather-related delays on the

Great Lakes reduced shipments from January through April; however, record-high shipments of iron ore were

recorded during the summer months.

Prepared by Christopher A. Tuck [(703) 6484912, ctuck@usgs.gov]

85

IRON ORE

Following the completion of several infrastructure improvement and capacity projects by the three largest iron ore

miners in Western Australia, regional shipments increased to record levels. Additional projects in Australia were

aimed at increasing capacity in 2015 and could put as much as 100 million tons of additional product on the market

annually. Increased production in Australia and lower than expected consumption in China moved the market into

oversupply. Spot market prices per dry metric ton of fines at 62% iron content fell to nearly $80 in October from a high

of $154 in 2013. Global mine closures were attributed to sustained reductions in spot market prices.

In eastern Canada, the Wabush Scully Mine was closed and the Pointe-Noire Pellet Plant was idled indefinitely, which

could lead to increased domestic exports to Canada in 2014. Three mines in Australia were closed or idled in late

2014. An estimated 20% to 30% of iron mines in China were closed or idled in 2014. Production, by iron content, of

iron ore in China was estimated to decline by 16% to 310 million tons in 2014 and projected to decline to 275 million

tons in 2015. Chinas Ministry of Industry Information and Technology announced they would close an additional 19

million tons per year of iron ore capacity and 29 million tons per year of steelmaking capacity by yearend 2014.

World Mine Production and Reserves: Mine production for China is based on crude ore, rather than usable ore,

which is reported for the other countries.

United States

Australia

Brazil

Canada

China

India

Iran

Kazakhstan

Russia

South Africa

Sweden

Ukraine

Other countries

World total (rounded)

Mine production

e

2013

2014

53

58

609

660

317

320

43

41

1,450

1,500

150

150

50

45

26

26

105

105

72

78

26

26

82

82

127

131

3,110

3,220

Crude ore

6,900

53,000

31,000

6,300

23,000

8,100

2,500

2,500

25,000

1,000

3,500

8

6,500

18,000

190,000

Reserves

Iron content

2,100

23,000

16,000

2,300

7,200

5,200

1,400

900

14,000

650

2,200

8

2,300

9,500

87,000

World Resources: U.S. resources are estimated to be about 27 billion tons of iron contained within 110 billion tons of

iron ore. U.S. resources are mainly low-grade taconite-type ores from the Lake Superior district that require

beneficiation and agglomeration prior to commercial use. World resources are estimated to exceed 230 billion tons of

iron contained within greater than 800 billion tons of crude ore.

Substitutes: The only source of primary iron is iron ore, used directly as direct-shipping ore or converted to

briquettes, concentrates, DRI, iron nuggets, sinter, or pellets. At some blast furnace operations, ferrous scrap may

constitute as much as 7% of the blast furnace feedstock. Scrap, DRI, and iron nuggets are extensively used for

steelmaking in electric arc furnaces and in iron and steel foundries, but scrap availability can be limited. Technological

advancements have been made, which allow hematite to be recovered from tailings basins and pelletized.

Estimated. E Net exporter.

See also Iron and Steel and Iron and Steel Scrap.

2

Includes agglomerates, concentrates, DRI, direct-shipping ore, iron nuggets, pellets, and byproduct ore for consumption.

3

Includes weight of lime, flue dust, and other additives in sinter and pellets for blast furnaces.

4

Defined as production + imports exports + adjustments for industry stock changes.

5

Estimated from reported value of ore at mines.

6

Defined as imports exports + adjustments for Government and industry stock changes.

7

See Appendix C for resource/reserve definitions and information concerning data sources.

8

For Ukraine, reserves consist of the A+B categories of the former Soviet Unions reserves classification system.

1

U.S. Geological Survey, Mineral Commodity Summaries, January 2015

Вам также может понравиться

- MSPLДокумент16 страницMSPLYashaswini SОценок пока нет

- Fact - Raw Materials - 2019 PDFДокумент3 страницыFact - Raw Materials - 2019 PDFHardik AdhyaruОценок пока нет

- Fact - Raw Materials - 2019 PDFДокумент3 страницыFact - Raw Materials - 2019 PDFRamiz ShaikhОценок пока нет

- Fact Sheet Steel and Raw MaterialsДокумент2 страницыFact Sheet Steel and Raw MaterialsSravanОценок пока нет

- Commodity Research Report: Copper Fundamental AnalysisДокумент18 страницCommodity Research Report: Copper Fundamental AnalysisarathyachusОценок пока нет

- ISRI Fact Iron Steel 041213Документ1 страницаISRI Fact Iron Steel 041213Rohit RanjanОценок пока нет

- 2121bm010027-M.MARY KAVYA-IA-EXTERNALДокумент34 страницы2121bm010027-M.MARY KAVYA-IA-EXTERNALKavya MadanuОценок пока нет

- Commodity Profile - Copper: Properties & UsesДокумент11 страницCommodity Profile - Copper: Properties & UsesAnup Kumar O KОценок пока нет

- Fact - Raw Materials - 2016 PDFДокумент2 страницыFact - Raw Materials - 2016 PDF1debaОценок пока нет

- India - Mineral Yearbook 2005Документ15 страницIndia - Mineral Yearbook 2005jfgarciadelrealОценок пока нет

- Projects in Manganese WorldДокумент31 страницаProjects in Manganese WorldleniucvasileОценок пока нет

- The Status of The Iron Ore Industry in IndiaДокумент2 страницыThe Status of The Iron Ore Industry in IndiaSoumit JenaОценок пока нет

- 2005 Minerals Yearbook: IndiaДокумент15 страниц2005 Minerals Yearbook: Indiaminingnova1Оценок пока нет

- The Coming Copper CrunchДокумент19 страницThe Coming Copper Crunchsamriddha pyakurelОценок пока нет

- The World's Biggest Zinc ProducersДокумент8 страницThe World's Biggest Zinc Producersrubencito1Оценок пока нет

- Susmita Dasgupta Economic Research Unit, Joint Plant CommitteeДокумент24 страницыSusmita Dasgupta Economic Research Unit, Joint Plant CommitteezillionpplОценок пока нет

- Iron and Steel IndustryДокумент17 страницIron and Steel IndustryEMJAY100% (1)

- Carbon Products - A Major ConcernДокумент3 страницыCarbon Products - A Major ConcernjaydiiphajraОценок пока нет

- A K Pandey SAIL FinalДокумент33 страницыA K Pandey SAIL FinalSaket NivasanОценок пока нет

- Report On Iron Ore: Aurobinda Prasad - Head of Research Sundeep Jain - Fundamental Analyst MetalsДокумент10 страницReport On Iron Ore: Aurobinda Prasad - Head of Research Sundeep Jain - Fundamental Analyst MetalsVijay PasupathyОценок пока нет

- Bauxite and AluminaДокумент2 страницыBauxite and Aluminahobbiton04Оценок пока нет

- Iron Ore PosterДокумент2 страницыIron Ore PosterJawad HamzeОценок пока нет

- 0909 PDFДокумент3 страницы0909 PDFCris CristyОценок пока нет

- IRON ORE AssignmentДокумент3 страницыIRON ORE AssignmentFaheem WassanОценок пока нет

- Investment Options FinalДокумент94 страницыInvestment Options Finalswapnil_jadhav_8Оценок пока нет

- 2008 Minerals Yearbook: Antimony (Advance Release)Документ9 страниц2008 Minerals Yearbook: Antimony (Advance Release)Mikhail FedchikОценок пока нет

- Iron Ore Pellet Is at IonДокумент19 страницIron Ore Pellet Is at Ionvivekojha14645100% (1)

- The Iron Ore, Coal and Gas Sectors: Virginia Christie, Brad Mitchell, David Orsmond and Marileze Van ZylДокумент8 страницThe Iron Ore, Coal and Gas Sectors: Virginia Christie, Brad Mitchell, David Orsmond and Marileze Van ZylBatush MongoliaОценок пока нет

- Iron, Copper and Gold PresentationДокумент46 страницIron, Copper and Gold PresentationmanisharoraОценок пока нет

- MIning IndustryДокумент37 страницMIning Industrypkjain009Оценок пока нет

- Company InformationДокумент36 страницCompany InformationAnaruzzaman SheikhОценок пока нет

- Corppub IronOreДокумент12 страницCorppub IronOremelbourne00Оценок пока нет

- Timin Mcs 06Документ2 страницыTimin Mcs 06böhmitОценок пока нет

- Bi2001 - 05a Ferrous Report 2019Документ44 страницыBi2001 - 05a Ferrous Report 2019kumarkg1Оценок пока нет

- A Report On Merger and Acquisition OF Tata-CorusДокумент70 страницA Report On Merger and Acquisition OF Tata-CorusKshitiz PandyaОценок пока нет

- Steel Industries Problem by Amitab - MudgalДокумент22 страницыSteel Industries Problem by Amitab - MudgalRavinder Singh PadamОценок пока нет

- Myb1-2006-Nickel by Peter H. KuckДокумент27 страницMyb1-2006-Nickel by Peter H. KuckAhmad AshariОценок пока нет

- Coal Deficit Widens On Rising DemandДокумент4 страницыCoal Deficit Widens On Rising DemandSumanth KumarОценок пока нет

- Sail ProjectДокумент69 страницSail ProjectBhoomika SrivastavaОценок пока нет

- Chapter1: Industry Profile: 1.1) ZINCДокумент46 страницChapter1: Industry Profile: 1.1) ZINCsyed bismillahОценок пока нет

- Business Talk: - Namita NaikДокумент5 страницBusiness Talk: - Namita NaikakmullickОценок пока нет

- Iron Ore Pellet PlantДокумент15 страницIron Ore Pellet PlantvuonghnОценок пока нет

- CorpPub EnergyДокумент12 страницCorpPub EnergyCamilaОценок пока нет

- Environmental IssuesДокумент8 страницEnvironmental IssueskaumaaramОценок пока нет

- Production and ConsumptionДокумент3 страницыProduction and ConsumptionPulak SarkarОценок пока нет

- Iron Ore: Demand EstimationДокумент12 страницIron Ore: Demand Estimationmaverick1911Оценок пока нет

- Copper CompaniesДокумент2 страницыCopper Companiesvkk123456Оценок пока нет

- The Copper Report 2006Документ18 страницThe Copper Report 2006turtlelordОценок пока нет

- 12 - Chapter 3 PDFДокумент20 страниц12 - Chapter 3 PDFkathirОценок пока нет

- Antimony James F CarlinДокумент8 страницAntimony James F CarlinShivaОценок пока нет

- Iron OreДокумент27 страницIron OreVijay Chander Reddy Keesara0% (1)

- C C C CC CCC: An Organization Study at Rayen Steels (P) LTDДокумент38 страницC C C CC CCC: An Organization Study at Rayen Steels (P) LTDAvishek MukhopadhyayОценок пока нет

- Extractive Metallurgy 2: Metallurgical Reaction ProcessesОт EverandExtractive Metallurgy 2: Metallurgical Reaction ProcessesРейтинг: 5 из 5 звезд5/5 (1)

- Solutions Manual to accompany Engineering Materials ScienceОт EverandSolutions Manual to accompany Engineering Materials ScienceРейтинг: 4 из 5 звезд4/5 (1)

- Sheet Metalwork on the Farm - Containing Information on Materials, Soldering, Tools and Methods of Sheet MetalworkОт EverandSheet Metalwork on the Farm - Containing Information on Materials, Soldering, Tools and Methods of Sheet MetalworkОценок пока нет

- BVR - Quarries & MinesДокумент19 страницBVR - Quarries & MinessfsdffedsОценок пока нет

- Geologic and Groundwater Considerations: Agricultural Waste Management Field HandbookДокумент43 страницыGeologic and Groundwater Considerations: Agricultural Waste Management Field HandbooksfsdffedsОценок пока нет

- SARMa Manual Resource EfficiencyДокумент56 страницSARMa Manual Resource EfficiencysfsdffedsОценок пока нет

- BSC Mining120501 v12d 1MBДокумент48 страницBSC Mining120501 v12d 1MBsfsdffedsОценок пока нет

- 17 LucasДокумент12 страниц17 LucassfsdffedsОценок пока нет

- Tech Con 2 Lime Mortar enДокумент7 страницTech Con 2 Lime Mortar ensfsdffedsОценок пока нет

- Cement Processing PDFДокумент11 страницCement Processing PDFDipannita GhoshОценок пока нет

- UKMY2013Документ95 страницUKMY2013sfsdffedsОценок пока нет

- SARMa Center Action PlanДокумент15 страницSARMa Center Action PlansfsdffedsОценок пока нет

- SARMa Report Revarsarea QuarryДокумент15 страницSARMa Report Revarsarea QuarrysfsdffedsОценок пока нет

- SARMa Report Iacobdeal QuarryДокумент14 страницSARMa Report Iacobdeal QuarrysfsdffedsОценок пока нет

- SARMa Recom Best Practises Auth 01Документ3 страницыSARMa Recom Best Practises Auth 01sfsdffedsОценок пока нет

- SARMa Center Feasibility StudyДокумент29 страницSARMa Center Feasibility StudysfsdffedsОценок пока нет

- Quarry Study Brief (Part Version Covering SEA)Документ27 страницQuarry Study Brief (Part Version Covering SEA)sfsdffedsОценок пока нет

- GeneratorДокумент1 страницаGeneratorelectricalconsultantОценок пока нет

- Sample Financial ProjectionsДокумент21 страницаSample Financial ProjectionssfsdffedsОценок пока нет

- Mcs 2014 FeoreДокумент2 страницыMcs 2014 FeoresfsdffedsОценок пока нет

- Managing A Quarry in Nigeria - A Case StudyДокумент20 страницManaging A Quarry in Nigeria - A Case Studysfsdffeds100% (3)

- Prac Docs Labour Based MethodsДокумент369 страницPrac Docs Labour Based MethodssfsdffedsОценок пока нет

- Pidspn 0105Документ4 страницыPidspn 0105sfsdffedsОценок пока нет

- Journal141 Article07 PDFДокумент5 страницJournal141 Article07 PDFsfsdffedsОценок пока нет

- Gold Demand Usd q3 14Документ1 страницаGold Demand Usd q3 14sfsdffedsОценок пока нет

- EnergyДокумент5 страницEnergysfsdffedsОценок пока нет

- Article 11Документ5 страницArticle 11Al HelloОценок пока нет

- ConcretingДокумент7 страницConcretingsfsdffedsОценок пока нет

- Study On Durability of Natural Fibre Concrete Composites Using Mechanical Strength and Microstructural PropertiesДокумент11 страницStudy On Durability of Natural Fibre Concrete Composites Using Mechanical Strength and Microstructural PropertiessfsdffedsОценок пока нет

- Booklet Compaction FinishingДокумент24 страницыBooklet Compaction FinishingmasteriragaОценок пока нет

- The Indian Ocean Coast of SomaliaДокумент19 страницThe Indian Ocean Coast of Somaliasfsdffeds100% (2)

- 605-File Utama Naskah-1304-1-10-20181011Документ7 страниц605-File Utama Naskah-1304-1-10-20181011abang adekОценок пока нет

- Materi Presentasi Insinyur TerryДокумент19 страницMateri Presentasi Insinyur TerryRizqi SBSОценок пока нет

- TonnageДокумент1 страницаTonnageLalitRatheeОценок пока нет

- Regression Analysis For Tankers and Bulk CarriersДокумент36 страницRegression Analysis For Tankers and Bulk CarriersBayu Arya SОценок пока нет

- 8 Important Books For Overman and Mining Sirdar ExamsДокумент4 страницы8 Important Books For Overman and Mining Sirdar ExamsMd shahbaz64% (14)

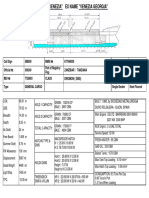

- Venezia ParticularsДокумент1 страницаVenezia ParticularsAhmed HossamОценок пока нет

- Tabel Perhitungan SRДокумент1 страницаTabel Perhitungan SRKris CandraОценок пока нет

- INA Problems 2Документ6 страницINA Problems 2siddarth amaravathiОценок пока нет

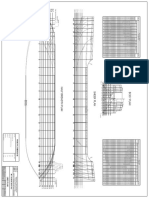

- Lines Plan AssignmentДокумент1 страницаLines Plan Assignmentyosef thio widyawanОценок пока нет

- 7 Longwall Sublevel Caving Block CavingДокумент110 страниц7 Longwall Sublevel Caving Block CavingGustiTeguhОценок пока нет

- IMU SEM I - T103 - ShipConДокумент61 страницаIMU SEM I - T103 - ShipConSubhash shahu0% (1)

- Mines in IndiaДокумент2 страницыMines in Indiadharan511Оценок пока нет

- CURRICULUM VITAE Boniface Nkumba New2Документ2 страницыCURRICULUM VITAE Boniface Nkumba New2Rufaro MufambiОценок пока нет

- International Convention On Tonnage Measurement of SHIPS, 1969Документ19 страницInternational Convention On Tonnage Measurement of SHIPS, 1969rigel100% (2)

- (Paper Format) : NotesДокумент44 страницы(Paper Format) : NotesJoyal JoseОценок пока нет

- Sispen Terbuka Week 6Документ25 страницSispen Terbuka Week 6Muhammad RinaldiОценок пока нет

- Grade 12 NSC Geography P2 (English) Preparatory Examination Possible AnswersДокумент19 страницGrade 12 NSC Geography P2 (English) Preparatory Examination Possible Answersnthakotebza629Оценок пока нет

- Tonnage Two Primary Types of Tonnage - Volume - WeightДокумент17 страницTonnage Two Primary Types of Tonnage - Volume - WeightPromotions KSA100% (1)

- Seam 2 Trim, Stability and StressДокумент141 страницаSeam 2 Trim, Stability and Stressbrian estri96% (27)

- Tanker Offset TableДокумент2 страницыTanker Offset TableSyafiq SyaridwanОценок пока нет

- Groupe 3Документ25 страницGroupe 3Ralph Carlo EvidenteОценок пока нет

- Load Line: Ship DesignДокумент89 страницLoad Line: Ship DesignMuhammed Talha ÖzdenoğluОценок пока нет

- M.V ROSEBANK - SHIPS PARTICULAR-NewДокумент1 страницаM.V ROSEBANK - SHIPS PARTICULAR-NewIrfan ZidniОценок пока нет

- Class 2 Stability: Load LinesДокумент15 страницClass 2 Stability: Load LinesAdrian BianesОценок пока нет

- Dry DockingДокумент35 страницDry DockingMaulana AdiОценок пока нет

- Draft Survey Pac AquilaДокумент60 страницDraft Survey Pac AquilaAldo TrinovachaesaОценок пока нет

- MPA Class 1/2 Stability QuestionsДокумент10 страницMPA Class 1/2 Stability QuestionsRahul RaiОценок пока нет

- Mid Ship Section Calculations Principle Particulars: ResultДокумент9 страницMid Ship Section Calculations Principle Particulars: ResultHasib Ul Haque AmitОценок пока нет

- Load Line DNV PDFДокумент31 страницаLoad Line DNV PDFJoaoОценок пока нет

- Data Kapal LNG Dan LPGДокумент68 страницData Kapal LNG Dan LPGDaniel WeeksОценок пока нет