Академический Документы

Профессиональный Документы

Культура Документы

Wage Board Order

Загружено:

devraferst0 оценок0% нашли этот документ полезным (0 голосов)

11K просмотров3 страницыWage Board Order

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документWage Board Order

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

11K просмотров3 страницыWage Board Order

Загружено:

devraferstWage Board Order

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

Order of Acting Commissioner of Labor Mario J. Musolino on the

Report and Recommendations of the 2014 Hospitality Wage Board

February 24, 2015

The 2014 Wage Board has fulfilled its charge. After more than 4 months of study and

deliberations informed by a large amount of public input from persons whose livelihoods

come from the restaurant and hotel industries, the Wage Board has made several

recommendations regarding tipping practices in the hospitality industry.

The Board's recommendations would simplify criteria for tipped workers and increase

worker wages — especially in New York City, which has a significantly higher cost of

living.

Section 656 of the Labor Law authorizes the Commissioner to accept, reject or modify

the Recommendations of the Board or to remand matters for further consideration.

My decisions are as follows with respect to each of the recommendations made in the

“Report and Recommendation of the Minimum Wage Board to the Commissioner of

Labor Pursuant to Labor Law Section 655 (Article 19, the Minimum Wage Act)":

A. The board recommends uniform tip amounts and criteria for all tipped workers

in the hospitality industry, so that the same rates apply to food service workers,

service employees and service employees in resort hotels.

| accept the recommendation to consolidate tip amounts and criteria so that the same

rates apply to food service workers, service employees and service employees in resort

hotels, as further provided for by the board’s second recommendation. In doing so, we

ratify the goal set by the 2009 Wage Board and Commissioner to combine all tipped

workers into one class.

B. The board recommends an increase in the tipped cash wage amounts from

their current rates of $4.90, $5.00 and $5.65, which have not increased since 2011,

to $7.50 per hour, effective December 31, 2015.

| accept the recommendation to increase the cash wage for all tipped workers in the

hospitality industry to $7.50 per hour beginning December 31, 2015. After receiving

testimony divided between those in favor of eliminating the tip credit and those opposed

to any change, | believe this recommendation strikes the proper balance. It increases

wages for those who have been without a raise for far too long and completes the goal

that was postponed in 2009 of establishing a single rate for all tipped workers.

C. The board recommends that, if the legislature enacts a separate minimum

wage rate for New York City, then the cash wage for such workers be increased

by one dollar, effective on the date that such separate minimum wage rate for

New York City takes effect.

| accept the recommendation for a one-dollar increase for tipped workers in New York

City if and when the legislature enacts a separate minimum wage rate for New York

City. | believe this recommendation complements the Governor's initiative to provide a

minimum wage in New York City that would be one dollar higher than in the rest of the

state. The net effect would maintain the same tip allowance throughout the state, which

would be consistent with Recommendation A.

D. The board recommends a review of whether the system of cash wages and tip

credits should be eliminated.

| accept the recommendation for a review of whether to eliminate the system of cash

wages and tip credits. The board received testimony and signatures from numerous

individuals who called for the current system to be eliminated

E, The board recommends that, effective December 31, 2015, the tip allowance be

increased by $1.00 per hour when the weekly average of cash wages and tips

equals or exceeds the applicable hourly minimum wage rate by 150% in New York

City or 120% in the rest of the state.

| reject the recommendation to give some employers a larger tip allowance. This final

recommendation appears to be inconsistent with recommendations A and C, which

provides for a single tip allowance for all tipped workers throughout the state, by

establishing three-tiers of tip allowances, with two different thresholds applied in

different parts of the state. As the members who voted for this recommendations

acknowledged, the recommendation is complicated and its impact is unclear.

Moreover, | reject the underlying assumptions that tip allowances function as a penalty

for employers who violate the law, that relief from such “penalty” should only be

extended to certain law abiding employers, and that the relief provided would be used to

increase compensation to employees in the back of the house.

| would like to thank the members of the 2014 Wage Board for all their hard work, their

deep commitment to advancing the well being of workers and businesses in the

hospitality industry and their vision of change. | would also like to thank the numerous

workers, businesses owners and operators, unions, organizations and other industry

representatives who took the time to submit testimony to the Wage Board.

CONCLUSION

This Order is hereby filed with the Secretary of the Department of Labor, to be effective

thirty (30) days after publication of a notice of such filing in at least ten (10) newspapers

of general circulation in the state.

Dated: February 24, 2015

Albany, New York

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Cornell ComplaintДокумент41 страницаCornell Complaintjspector100% (1)

- Joseph Ruggiero Employment AgreementДокумент6 страницJoseph Ruggiero Employment AgreementjspectorОценок пока нет

- State Health CoverageДокумент26 страницState Health CoveragejspectorОценок пока нет

- Pennies For Charity 2018Документ12 страницPennies For Charity 2018ZacharyEJWilliamsОценок пока нет

- IG LetterДокумент3 страницыIG Letterjspector100% (1)

- Federal Budget Fiscal Year 2017 Web VersionДокумент36 страницFederal Budget Fiscal Year 2017 Web VersionjspectorОценок пока нет

- Teacher Shortage Report 05232017 PDFДокумент16 страницTeacher Shortage Report 05232017 PDFjspectorОценок пока нет

- NYSCrimeReport2016 PrelimДокумент14 страницNYSCrimeReport2016 PrelimjspectorОценок пока нет

- Film Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFДокумент8 страницFilm Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFjspectorОценок пока нет

- Abo 2017 Annual ReportДокумент65 страницAbo 2017 Annual ReportrkarlinОценок пока нет

- Inflation AllowablegrowthfactorsДокумент1 страницаInflation AllowablegrowthfactorsjspectorОценок пока нет

- Darweesh Cities AmicusДокумент32 страницыDarweesh Cities AmicusjspectorОценок пока нет

- 2017 08 18 Constitution OrderДокумент27 страниц2017 08 18 Constitution OrderjspectorОценок пока нет

- SNY0517 Crosstabs 052417Документ4 страницыSNY0517 Crosstabs 052417Nick ReismanОценок пока нет

- Oag Sed Letter Ice 2-27-17Документ3 страницыOag Sed Letter Ice 2-27-17BethanyОценок пока нет

- Class of 2022Документ1 страницаClass of 2022jspectorОценок пока нет

- Opiods 2017-04-20-By Numbers Brief No8Документ17 страницOpiods 2017-04-20-By Numbers Brief No8rkarlinОценок пока нет

- 2017 School Bfast Report Online Version 3-7-17 0Документ29 страниц2017 School Bfast Report Online Version 3-7-17 0jspectorОценок пока нет

- Youth Cigarette and E-Cigs UseДокумент1 страницаYouth Cigarette and E-Cigs UsejspectorОценок пока нет

- Hiffa Settlement Agreement ExecutedДокумент5 страницHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- Schneiderman Voter Fraud Letter 022217Документ2 страницыSchneiderman Voter Fraud Letter 022217Matthew HamiltonОценок пока нет

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Документ4 страницыActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorОценок пока нет

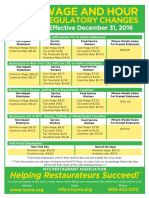

- Wage and Hour Regulatory Changes 2016Документ2 страницыWage and Hour Regulatory Changes 2016jspectorОценок пока нет

- Siena Poll March 27, 2017Документ7 страницSiena Poll March 27, 2017jspectorОценок пока нет

- 16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsДокумент55 страниц16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsjspectorОценок пока нет

- Review of Executive Budget 2017Документ102 страницыReview of Executive Budget 2017Nick ReismanОценок пока нет

- p12 Budget Testimony 2-14-17Документ31 страницаp12 Budget Testimony 2-14-17jspectorОценок пока нет

- Pub Auth Num 2017Документ54 страницыPub Auth Num 2017jspectorОценок пока нет

- 2016 Local Sales Tax CollectionsДокумент4 страницы2016 Local Sales Tax CollectionsjspectorОценок пока нет

- Voting Report CardДокумент1 страницаVoting Report CardjspectorОценок пока нет