Академический Документы

Профессиональный Документы

Культура Документы

GAZETTETC13 3428august2013

Загружено:

Mohammed Sayed KammelОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

GAZETTETC13 3428august2013

Загружено:

Mohammed Sayed KammelАвторское право:

Доступные форматы

Gazette

Commonwealth

of Australia

No. TC 13/34, Wednesday, 28 August 2013

Published by the Commonwealth of Australia

TARIFF CONCESSIONS

CONTENTS

TCO Applications........................................................................2

TCOs Made................................................................................5

Local Manufacturer Initiated - TCO Revocation Requests..............6

Local Manufacturer Initiated - TCOs Revoked...............................7

TCOs Revoked - Unused for over 2 years.....................................8

Customs Review of TCO Applications Notification.......................10

Customs Review of TCO Revocations Results.............................10

Intention to Revoke TCOs.........................................................11

Section 273 Determinations Made.............................................12

Section 273 Determinations Revoked........................................17

By-Laws Made..........................................................................18

The Australian Customs and Border Protection Service (Customs

and Border Protection) publishes the Commonwealth of Australia

Tariff Concessions Gazette (the Tariff Concessions Gazette) free of

charge on the Customs

internet site at: http://www.customs.gov.au

Please select tariff, then tariff concessions gazette.

The gazettes are listed in date order and may be selected from the list of

Adobe

(PDF) file

General Inquiries: .............................................................(02) 6275 6404

Facsimile: ..........................................................................(02) 6275 6376

Cat. No.

ISSN 0813-8389

Commonwealth of Australia, 2013

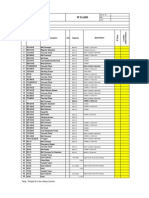

3 TCO Applications

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

TCO Application s

CUSTOMSACT1901NOTICEPURSUANTTOSECTION269K(1)APPLICATIONSMADEFORTARIFFCONCESSIONORDERS

ApplicationshavebeenlodgedforTariffConcessionOrdersforthegoodsdescribedinthefollowingTABLE.

AustralianmanufacturerswhowishtocontestthegrantingofaTariffConcessionOrderforthegoodsdescribed

areinvitedtolodgeasubmissioninwritinginanapprovedform.Submissionsmustbelodgedwithin50days

ofthedateofpublicationofthisNotice.

Theoperativedate(Op.)andTCreferencenumberfollowthedescriptionofgoods.

Toassistlocalmanufacturers,theuse(s)towhichthegoodscanbeputfollowthedescriptionofgoods.

ObjectionstothemakingofTCOsubmissionformsareavailableathyperlink

http://www.customs.gov.au/webdata/resources/files/TYPABLEB4442001.pdf.

Forguidanceontherequireddescriptionstyle,phone0262756404,fax0262756376oremail

tarcon@customs.gov.au.

THETABLE

Description of Goods including the

Customs Tariff Classification

3926.30.10

HOUSINGS, AUTOMOTIVE, being ANY of the following:

(a) accessory pockets;

(b) drink holders;

(c) audio component mounts;

(d) compact disc storage

Op. 01.08.13

Schedule 4 Item Number

General Duty Rate

50

- TC 1326030

Stated Use:

To suit aftermarket installations of electronics and accessories

5%

Applicant: TDJ AUSTRALIA PTY LTD

7307.99.00

END CAPS, PRESSURE VESSEL

Op. 01.08.13

50

- TC 1325951

Stated Use:

For the sealing of pressure vessels used in refrigeration, air

conditioning and industrial applications

5%

Applicant: HELDON PRODUCTS AUSTRALIA PTY LTD

8205.59.00

HANDTOOLS, being powder actuated fasteners with OR without

magazine

Op. 30.07.13

50

- TC 1325577

Stated Use:

For interior fastening finishing, mechanical and electrical

applications and in construction and manufacturing to join

and/or fasten materials to substrates like wood, steel and

concrete

5%

4 TCO Applications

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

Applicant: HILTI (AUST) PTY LTD

8427.10.00

GUIDED VEHICLE SYSTEM, programmable logic controlled, selfnavigating, traction powered

Op. 01.08.13

50

- TC 1325950

Stated Use:

To navigate freely via programmable logic control and

laser navigation to load, unload and transport various

equipment inside buildings and facilities

5%

Applicant: MLR AUSTRALIA PTY LTD

8428.33.00

CONVEYORS, CROSS BELT SORTER, having EITHER of the following:

(a) carriers;

(b) induction stations

Op. 29.07.13

50

- TC 1325499

Stated Use:

Conveyor modules which make up a sortation line

5%

Applicant: DEMATIC PTY LTD

8431.39.00

PARTS, CROSS BELT SORTER CONVEYOR, being track modules having

BOTH of the following:

(a) linear induction motors;

(b) power AND data rails

Op. 29.07.13

50

- TC 1325498

Stated Use:

To support and control the carriers of a cross belt sorter

conveyor

5%

Applicant: DEMATIC PTY LTD

8436.80.90

DAIRY MILKING AND TEAT CLEANING MACHINES, programmable logic

controlled, including ALL of the following:

(a) milk extracting AND disinfecting rubber liner teat holders;

(b) pumps;

(c) pipes;

(d) tank

Op. 01.08.13

50

- TC 1326029

Stated Use:

For dairy milking purposes

5%

Applicant: AUTOMATED DIPPING & FLUSHING PTY LTD

8481.30.00

VALVES, CHECK, flange mounted OR lugged wafer end connection,

having a pressure-temperature rating complying with Class 900 OR

50

5 TCO Applications

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

Class 1 500, American Society of Mechanical Engineers standard

B16.34-2004 (ASME B16.34-2004)

Op. 02.08.13

- TC 1326032

Stated Use:

To regulate the flow of petroleum and natural gas in offshore

oil and gas well pipes

5%

Applicant: ORIGIN ENERGY RESOURCES LTD

8481.80.90

VALVES, MONOFLANGE, DOUBLE BLOCK AND BLEED, complying with

American Petroleum Institute standard 6A(API 6A)

Op. 30.07.13

50

- TC 1325691

Stated Use:

To regulate the flow of petroleum and natural gas in pipes and

tanks for offshore oil and gas wells

5%

Applicant: ORIGIN ENERGY RESOURCES LTD

8481.80.90

VALVES, BALL, flanged end connection, split body, lever OR

gearbox operated, trunnion mounted ball, having BOTH of the

following:

(a) valve outside diameter NOT less than 12 mm and NOT greater

than 265 mm;

(b) compliance with American Society of Mechanical Engineers

B16.34-2004 (ASME B16.34-2004)

Op. 01.08.13

50

- TC 1326031

Stated Use:

To regulate the flow of petroleum and natural gas in pipes for

offshore oil and gas wells

5%

Applicant: ORIGIN ENERGY RESOURCES LTD

8901.90.10

BARGES, twin hull, inboard twin diesel powered, road

transportable, including ALL of the following:

(a) length NOT greater than 17.5 m;

(b) weight NOT exceeding 150 gross construction tons;

(c) moulded depth NOT less than 1.6 m;

(d) crane;

(e) winch

Op. 31.07.13

50

- TC 1325864

Stated Use:

A workboat (barge) to operate primarily as a fish farm support

vessel

5%

Applicant: HUON AQUACULTURE COMPANY PTY LTD

9508.90.00

LOCOMOTIVES, DIESEL, AMUSEMENT PARK TRAIN RIDE

Op. 05.08.13

50

6 TCO Applications

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

- TC 1326212

Stated Use:

To transport passenger carriages or carts on tracks in amusement

parks

Applicant: ARDENT LEISURE LTD

5%

7 TCOs Made

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

TCOs Made

CUSTOMSACT1901NOTICEPURSUANTTOSECTION269R(1)TARIFFCONCESSIONORDERSMADE

TariffConcessionOrdershavebeenmadeforthegoodsdescribedinthefollowingTABLE.

Theoperativedate(Op.)andTCreferenceNo.followthedescriptionofgoods.Localmanufacturersof

substitutablegoodsmayrequesttherevocationofTCOsatanytime.

THETABLE

Description of Goods including the

Customs Tariff Classification

3923.90.00

4016.99.00

4803.00.90

4818.30.00

7214.20.00

7228.30.90

7308.90.00

7318.15.00

8302.50.00

8309.90.00

HOLDERS, LIPSTICK, plastic

Op. 07.06.13

Schedule 4 Item Number

Last Date of Effect

50

Dec. date 26.08.13

- TC 1319209

ANNULAR PACKING SUBASSEMBLIES, BLOWOUT PREVENTER, OIL AND/OR

GAS PRODUCTION, consisting of nitrile rubber packer AND donut on

a steel frame

Op. 03.06.13

Dec. date 26.08.13

- TC 1318098

TABLE NAPKIN STOCK, wood cellulose, single ply OR multi-ply, in

rolls having a width NOT less than 400 mm and NOT greater than

475 mm

Op. 30.05.13

Dec. date 26.08.13

- TC 1317649

TABLE NAPKIN STOCK, wood cellulose, single ply OR multi-ply, in

rolls having a width NOT less than 230 mm and NOT greater than

310 mm

Op. 30.05.13

Dec. date 26.08.13

- TC 1317650

REINFORCING BARS, CRYOGENIC, LIQUID NATURAL GAS STORAGE TANK,

having ALL of the following:

(a) un-notched bar uniform elongation at maximum force

("Agt") NOT less than 3% at cryogenic temperature

minus 168 degrees Celsius;

(b) un-notched bar yield strength NOT less 575 MPa;

(c) transverse rib surface geometry

Op. 05.06.13

Dec. date 26.08.13

- TC 1318643

REINFORCING BARS, CRYOGENIC, LIQUID NATURAL GAS STORAGE TANK,

having ALL of the following:

(a) un-notched bar uniform elongation at maximum force

("Agt") NOT less than 3% at cryogenic temperature minus

168 degrees Celsius;

(b) un-notched bar yield strength NOT less 575 MPa;

(c) transverse rib surface geometry

Op. 05.06.13

Dec. date 26.08.13

- TC 1318642

TEMPLATES, ANCHOR BOLT, TECHNICAL AMMONIUM NITRATE (TAN)

PLANT

Op. 30.05.13

Dec. date 26.08.13

- TC 1317818

KITS, PURLIN ASSEMBLY, mild steel OR high tensile steel, zinc

plated and galvanised, with OR without washers, being EITHER of

the following:

(a) hex bolts and nuts;

(b) hex flanged bolts and flanged nuts

Op. 28.05.13

Dec. date 26.08.13

- TC 1317230

BRACKETS, TOILET PAN AND CISTERN WALL FIXTURE, zinc coated steel

Op. 28.05.13

Dec. date 26.08.13

- TC 1317286

50

CLOSURES, tinplate, having ALL of the following:

(a) outside body diameter NOT greater than 51 mm;

(b) vacuum button;

(c) retortable to 121 degrees C for 60 minutes

Op. 31.05.13

Dec. date 26.08.13

- TC 1317848

50

50

50

50

50

50

50

50

8 TCOs Made

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

Schedule 4 Item Number

Last Date of Effect

General Duty Rate

Description of Goods including the

Customs Tariff Classification

8418.69.00

8418.69.00

8422.19.00

8479.89.90

8481.80.90

8705.90.00

COMPRESSION REFRIGERATORS, with OR without cup warmer AND/OR

water tank, having a storage capacity NOT greater than 15 L

Op. 30.05.13

Dec. date 26.08.13

- TC 1317634

BLAST CHILLERS AND/OR FREEZERS, having a maximum capacity of NOT

less than 40 trays

Op. 03.06.13

Dec. date 26.08.13

- TC 1318396

DISHWASHERS, flight type, programmable logic controlled, having

a capacity of NOT less than 4 000 plates per hour

Op. 06.06.13

Dec. date 26.08.13

- TC 1318809

HYDRAULIC HAMMER STATIONS, CARBON ANODE CLEANING, single hammer

OR twin hammer, programmable logic controlled, including ALL of

the following:

(a) steel mounting frames AND bases;

(b) hammer mount steel rails;

(c) greasers with reservoirs AND valves;

(d) hydraulic power modules with air-to-oil coolers

Op. 29.05.13

Dec. date 26.08.13

- TC 1317554

KITS, TOILET CISTERN, with OR without stopcock, including ALL of

the following:

(a) bracket;

(b) flexible hose;

(c) plug set, consisting of ALL of the following:

(i) stepped flange;

(ii) nut;

(iii) plastic stop plug,

(d) inlet valve bayonet

Op. 28.05.13

Dec. date 26.08.13

- TC 1317401

SWEEPERS, VEHICLE, ROAD RAIL, having ALL of the following:

(a) length NOT greater than 6 900 mm with front boom;

(b) width NOT greater than 1 910 mm;

(c) height NOT greater than 2 800 mm;

(d) water tank capacity NOT less than 810 litres and NOT

greater than 1 810 litres;

(e) hopper capacity NOT greater than 4 m3;

(f) minimum curve radius 25 m;

(g) 2 sweeping levels

Op. 27.05.13

Dec. date 26.08.13

- TC 1317161

50

50

50

50

50

50

Local Manufacturer Initiated - TCO Revocation Reque sts

NOTIFICATIONOFANAUSTRALIANINDUSTRYREVOCATIONREQUESTSECTION269SC(1A)CUSTOMSACT

AnapplicationhasbeenlodgedforrevocationoftheTariffConcessionOrdersetoutinthefollowingTABLE.

TheLodgementRequestDateshowninthetablebelowistheintendedrevocationdatefortheTariffConcession

Orderwhichwilltakeeffectshouldtheapplicationforrevocationbesuccessful.

Importationsnotcoveredbyintransitprovisionsmaybesubjecttopostactionasanydecisiontorevokean

orderisbackdatedtothedateofrequestforrevocation.

THETABLE

Description of Goods including the

Customs Tariff Classification

7308.90.00

RACKING, PALLET, having a height greater than 28 metres

Op. 11.08.05

Dec. date 04.11.05

- TC 0510587

Schedule 4 Item Number

Lodgement Request Date

50

15.08.13

9 Local Manufacturer Initiated - TCOs Revoked

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

Local Manufacturer Initiated - TCO s Revo ked

CUSTOMSACT1901NOTICEPURSUANTTOSECTION269SE(1)AUSTRALIANINDUSTRYINITIATEDTARIFFCONCESSION

ORDERSREVOKED

TheTariffConcessionOrderforthegoodsdescribedinthefollowingTABLEhasbeenrevoked.

THETABLE

Description of Goods including the

Customs Tariff Classification

7210.49.00

COILS, non-alloy steel, hot rolled, zinc coated, complying with

American Society for Testing and Materials Standard ASTM A 653/A

653M - 05a, having ALL of the following:

(a) coil thickness NOT less than 1.48 mm and NOT greater than

6.0 mm;

(b) coil width NOT less than 784 mm and NOT greater than

1 263 mm;

(c) minimum yield strength NOT less than 360 Mpa;

(d) minimum tensile strength NOT less than 460 Mpa;

(e) coil inside diameter NOT less than 711 mm and NOT greater

than 813 mm;

(f) zinc coating mass NOT less than 0.080 kg/m2 per side;

(g) each coil weighing NOT less than 14 metric tonnes;

(h) chemical composition by weight of ALL of the following:

(i) carbon content NOT greater than 0.20%;

(ii) manganese content NOT less than 0.50% and

NOT greater than 1.00%;

(iii) phosphorus content NOT greater than 0.03%;

(iv) sulphur content NOT greater than 0.03%;

(v) chromium content less than 0.30%;

(vi) molybdenum content less than 0.08%;

(vii) aluminium content NOT greater than 0.10%;

(viii) copper content NOT greater than 0.25%;

(ix) nickel content NOT greater than 0.25%;

(x) titanium content NOT greater than 0.04%;

(xi) vanadium content less than 0.1%;

(xii) silicon content NOT greater than 0.45%,

Op. 13.11.12

Dec. date 30.05.13

- TC 1317796

Substitutable goods produced in Australia in the ordinary

course of business by BlueScope Steel Ltd, Port Kembla, NSW

Schedule 4 Item Number

Last Date of Effect

50

26.06.13

10 TCOs Revoked - Unused for over 2 years

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

TCOs Revoked - Unu sed for over 2 years

CUSTOMSACT1901

NOTICEPURSUANTTOSECTION269SE(2)TARIFFCONCESSIONORDERREVOCATIONATTHEINITIATIVEOFCUSTOMS

TheTariffConcessionOrderslistedinTHETABLEbelowhavenotbeenusedforatleast2yearsandhavebeen

revokedunderSection269SD(1A).Intransitprovisionsapply.

TheintentiontorevoketheseorderswasnotifiedinGazetteTC13/29dated24July2013.

Contact:Phone0262756404,fax0262756376oremailtarcon@customs.gov.au.

THETABLE

Description of Goods including the

Customs Tariff Classification

8428.39.00

8454.30.00

8464.90.00

8474.10.00

8474.20.00

CONVEYORS, DRUM, CONTINUOUS PAINT LINE

Op. 03.03.06

Dec. date 09.11.09

- TC 0937988

Revoked: 2 years non-use. In transit provisions apply.

ZINC SLAB INGOT CASTING MACHINE LINES, comprising ALL of the

following:

(a) casting machines;

(b) mould coolers;

(c) skimmers;

(d) conveyors;

(f) stackers;

(g) ingot compressors;

(h) ingot weighers;

(i) strappers;

(j) hydraulic units;

(k) working decks

Op. 17.07.08

Dec. date 10.10.08

- TC 0819443

Revoked: 2 years non-use. In transit provisions apply.

LINES, HANDLING CUTTING AND BREAKOUT, GLASS SHEET, computer

numeric controlled, comprising ALL of the following:

(a) cutting tables;

(b) breakout tables;

(c) belt conveyors;

(d) aerial loaders

Op. 01.01.07

Dec. date 27.02.07

- TC 0702027

Revoked: 2 years non-use. In transit provisions apply.

LINES, GOLD RECOVERY, HEAP LEACH EXTRACTION, comprising

ALL of the following:

(a) grinding roll crushers;

(b) agglomeration drums;

(c) conveyors;

(d) pipes

Op. 23.11.06

Dec. date 02.03.07

- TC 0618762

Revoked: 2 years non-use. In transit provisions apply.

MILLS, BALL, comprising ALL of the following:

(a) conveyors;

(b) feeders;

(c) chutes;

(d) filters;

(e) cooling fans;

(f) heaters;

(g) launders;

(h) motors;

(i) pumps;

(j) tanks;

Schedule 4 Item Number

Last Date of Effect

50

20.08.13

50

20.08.13

50

20.08.13

50

20.08.13

50

20.08.13

11 TCOs Revoked - Unused for over 2 years

(k) valves

Op. 08.02.06

8474.20.00

8474.20.00

8481.80.90

8481.80.90

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

Dec. date 18.04.06

- TC 0603535

Revoked: 2 years non-use. In transit provisions apply.

MILLS, SAG, comprising ALL of the following:

(a) coolers;

(b) fans;

(c) conveyors;

(d) converter;

(e) feeder;

(f) pulleys;

(g) chutes;

(h) heaters;

(i) filters;

(j) pumps;

(k) gauges;

(l) switches;

(m) tanks

Op. 08.02.06

Dec. date 18.04.06

- TC 0603537

Revoked: 2 years non-use. In transit provisions apply.

MILLS, CEMENT, having ALL of the following:

(a) feeders;

(b) conveyors;

(c) ball mills;

(d) motors;

(e) chutes;

(f) vents;

(g) dust collectors;

(h) cyclones;

(i) air slides;

(j) coolers;

(k) valves;

(l) dryers;

(m) power supplies;

(n) controllers;

(o) pumps

Op. 25.05.06

Dec. date 11.08.06

- TC 0609084

Revoked: 2 years non-use. In transit provisions apply.

GATE VALVES, DOUBLE BLOCK AND BLEED, motor operated, having ALL

of the following:

(a) nominal bore diameter NOT less than 250 mm and NOT greater

than 450 mm;

(b) pressure rating at 1 000 degrees F NOT less than 19 bar

and at 100 degrees F NOT greater than 150 bar, in

accordance with American Society of Mechanical Engineers

class 900 (ASME class 900);

(c) complying with American Petroleum Institute Standard

6D (API 6D) and American Society of Mechanical Engineers

Standard B16.34 (ASME B16.34)

Op. 15.04.09

Dec. date 03.07.09

- TC 0912405

Revoked: 2 years non-use. In transit provisions apply.

ORIFICE PLATES, ADJUSTABLE, COAL PULVERISER OUTLET PIPES, STEAM

GENERATION BOILER

Op. 11.05.09

Dec. date 31.07.09

- TC 0915970

Revoked: 2 years non-use.

In transit provisions apply.

50

20.08.13

50

20.08.13

50

20.08.13

50

20.08.13

12 Customs Review of TCO Applications Notification and

Customs Review of TCO Revocations Results

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

Custom s Review of TCO Applications Notification

CUSTOMSACT1901NOTIFICATIONOFREQUESTFORREVIEWOFAPPLICATIONDECISIONS

ArequesthasbeenreceivedforreviewbyCustomsofthedecisionmadeontheapplicationfortheTariff

ConcessionOrderforgoodsdescribedinthefollowingTABLE.

THETABLE

Description of Goods including the

Customs Tariff Classification

9405.10.00

Schedule 4 Item Number

Initial

Date of Lodgement of Request Decision

LIGHTS, WALL MOUNTED, light emitting diode, non-ceramic

with OR without ceramic bulb holder, with OR without

EITHER of the

following:

(a) shades;

(b) globes

Op. 18.03.13

50

21.08.13

REFUSE

- TC 1309603

Custom s Review of TCO Revocations Results

CUSTOMSACT1901269SH(10)RESULTOFCUSTOMSREVIEWOFAREVOCATIONDECISION

TheCustomsinternalreviewresultmadeontheTariffConcessionOrderrevocationforgoodsdescribedinthe

followingTABLEhasbeenfinalised:

THETABLE

Description of Goods including the

Customs Tariff Classification

TCO REVOKED

4016.91.00 MATTING, rubber, having raised stipples and/or nipples

and/or

checker plate and/or ribbing on one surface

Op. 14.11.06

- TC 0618516

ACBPS Decision : Revocation of TCO affirmed

Schedule 4 Item Number

Last Date of Effect

50

06.05.13

Review

Decision

REVOKED

13 Intention to Revoke TCOs

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

Intention to Revo ke TCOs

INTENTION TO REVOKE TARIFF CONCESSION ORDERS

It is intended to revoke Tariff Concession Orders for the goods described in the following TABLE.

I, Andrew Mumberson, a delegate of the Chief Executive Officer (CEO), declare my intention, subject to

s.269SD(1AB), to make orders revoking the TCOs in the table below with effect from 27 August 2013.

On 27 August 2013, I formed the belief in respect of the TCOs, that if the TCOs were not in force on that day,

and an application for the TCOs were made on that day, the CEO would not have made the TCOs. That is because

the TCOs were made in contravention of s.269SD(1AA) in that there is a local manufacturer of the goods the

subject of the TCOs.

Interested parties are invited to provide, by close of business Wednesday 25 September 2013, written reasons

why these TCOs should not be revoked. Interested parties may consider applying for new Tariff Concession

Orders on the application forms, B443 (updated March 2010) for the goods described below.

Contact: email tarcon@customs.gov.au, fax 02 6275 6376 or telephone 02 6275 6041

THETABLE

Description of Goods including the

Customs Tariff Classification

Schedule 4 Item Number

Last Date of Effect

6005.32.00

NETTING, KNOTLESS, of polyamide multifilament yarn 210 denier, ply

rating NOT exceeding 400 ply

Op. 23.05.02

- TC 0204480

5

0

6005.32.00

NETTING, KNOTLESS, comprising polyester multifilament yarn, NOT less

than 200 and NOT greater than 250 denier, ply rating NOT greater than

440

Op. 18.01.05

- TC 0500978

5

0

6005.33.00

FABRIC, polyethylene, raschell knit, having ALL of the following:

a

ultra violet stabilizers;

b

colour pigments;

c

width NOT less than 0.9m and NOT greater than 4 m

Op. 11.05.06

- TC 0608185

5

0

6005.32.00

FABRIC, SHADE NETTING, high density polyethylene, raschel warp

knitted, having ALL of the following:

a

extruded strip and 16 gauge monofilament fibres;

b

stentered;

c

ultra violet blockout NOT less than 85%

Op. 06.06.06

- TC 0609978

5

0

6005.33.00

FABRIC, POLETHYLENE, raschel knit, having ALL of the following:

a

ultra violet stabilisers;

b

colour pigments;

c

width NOT less than 0.9 m and NOT greater than 30 m

Op. 09.09.08

-TC 0830251

5

0

14 Section 273 Determinations Made

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

Section 273 Determinations Made

NOTICEOFDETERMINATIONSMADEUNDERPARTXVIOFTHECUSTOMSACT1901

Undersubsection273B(2)oftheCustomsAct1901,noticeisherebygivenofthemakingofdeterminations

applyingtogoodsofakindspecifiedinthetablebelow.

Inthetable:

(i)thefirstcolumnspecifiesthekindofgoodstowhichthedeterminationapplies,anyconditionsspecified

inthedetermination,thecommencementandcessationdatesofthedeterminationandtheDetermination

referencenumber;

(ii)thesecondcolumnspecifiestheiteminSchedule4totheCustomsTariffAct1995thatappliestothe

specifiedgoods.

GoodsancillarytoanEPBSproject,includingofficeequipment,buildings,office/personnelaccommodationand

goodsusedinactivitiessuchaslandpreparation,roadconstructionandmaintenance,transportation(other

thanpipes,pipelines,conveyors,powertransmissionlines,flexibleflowlines,etcintegraltotheproject

andusedtoconveygasliquids,minerals,electricityorothermaterialsorgoods)andtheprovisionof

telecommunicationsandothergeneralservicesareexcluded.Materials,consumablesandconstructionand

servicingequipment,includingallfuels,oilslubricants,adhesives,filters,protectivegarments,tools,

ladders(otherthanarticlesauxiliarytoanddesignedtobepermanentlyattachedtoeligiblegoodsunder

EPBS,suchaspylons,supportingstructures,staircases,ladders,railings,etc)paint,varnishandthelike

areineligibleunderEPBS,asaresparepartsusedforongoingmaintenancebeyondthecommissioningofthe

project.

EPBSDeterminationsalsoapplytoallgoodslistedintheDeterminationwhentheyareimportedinmultiple

shipments,whichmaybefromdifferentlocationsatdifferenttimes.

WhereanumberofEPBSDeterminationsareissuedforaparticulareligiblegood,allassociatedDeterminations

mustnotexceedthequantityofgoodsapprovedbytheDelegateintheEPBSProjectEligibleGoodsList.

THETABLE

Importer

ProjectProponent

ProjectName

DescriptionofGoods

DatesofEffect

Exclusions

Goods, imported by Australia Pacific LNG Pty Ltd (ABN 68001646331),

71

for use in the Australia Pacific LNG Pty Ltd (ABN 68001646331),

Australia Pacific LNG Project (Upstream), as follows:

(a) seven (7) only Gas processing facilities consisting of ALL

of the following:

(i) air coolers;

(ii) centrifugal compression train;

(iii) high pressure compressor and after-cooler;

(iv) low pressure compressor and after-cooler;

(v) filter coalescers;

(vi) gas metering units;

(vii) flare system;

(viii) pipes, valves and fittings;

(ix) instrumentation;

(x) pumps and motors;

(xi) sales meter;

(xii) scrubbers;

(xiii) switchrooms;

(xiv) transformers;

(xv) inlet separators; and

(xvi) oil flooded compressors.

(b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

(c) but specifically excluding:

items peripheral to the process of function performed by the gas

processing facility, including fittings, conveyors, or pipelines

connecting functional units to each other or to other parts of

the project.

20.12.2012 to 28.02.2013

- AD 01003757

Schedule4

ItemNumber

15 Section 273 Determinations Made

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

Goods, imported by Australia Pacific LNG Pty Ltd (ABN 68001646331),

for use in the Australia Pacific LNG Pty Ltd (ABN 68001646331),

Australia Pacific LNG Project (Upstream), as follows:

44

(a) seven (7) only Gas processing facilities consisting of ALL of the

following:

(i) air coolers;

(ii) centrifugal compression train;

(iii) high pressure compressor and after-cooler;

(iv) low pressure compressor and after-cooler;

(v) filter coalescers;

(vi) gas metering units;

(vii) flare system;

(viii) pipes, valves and fittings;

(ix) instrumentation;

(x) pumps and motors;

(xi) sales meter;

(xii) scrubbers;

(xiii) switchrooms;

(xiv) transformers;

(xv) inlet separators; and

(xvi) oil flooded compressors.

(b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

(c) but specifically excluding:

items peripheral to the process of function performed by the gas

processing facility, including fittings, conveyors, or pipelines

connecting functional units to each other or to other parts of the

project.

1.3.2013 to 19.12.2014

- AD01003756

Goods, imported by Australia Pacific LNG Pty Ltd (ABN 68001646331),

for use in the Australia Pacific LNG Pty Ltd (ABN 68001646331),

Australia Pacific LNG Project (Upstream), as follows:

(a) two (2) only Water Treatment Facilities consisting of ALL of the

following:

(i) air compressors;

(ii) analyser units;

(iii) boilers;

(iv) boiler feedwater systems;

(v) chemical dosing & transfer package;

(vi) control systems;

(vii) cooling towers;

(viii) disk filtration package;

(ix) electrical systems;

(x) fuel gas conditioning systems;

(xi) ion exchange/silica removal package;

(xii) ion exchange/ silica removal pressure vessels;

(xiii) ion exchange resin/ silica removal activated alumina;

(xiv) HDPE pond liners;

(xv) membrane filtration package;

(xvi) multi effect distillation package;

(xvii) pipes, valves and fittings;

(xviii) process instrumentation & actuation;

(xix) pumps and motors;

(xx) reverse osmosis membrane package;

(xxi) steam transformers;

(xxii) structural steel; and

(b) components of the goods specified in (a) above, including commissioning

(c) but specifically excluding:

(i) items peripheral to the function performed by the water treatment

facility, including fittings, pipes, or pipelines connecting

functional units to each other or to other parts of the project;

and

(ii) structural steel external to the water treatment facility.

20.03.2013 to 19.03.2015

- AD01003758

Goods, imported by SANDVIK MINING AND CONSTRUCTION AUSTRALIA PTY LTD(ABN 62003771382),

for use in the PILBARA IRON PTY LTD (ABN75107216535), Pilbara Iron Capital Development,

as follows:

44

16 Section 273 Determinations Made

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

(a) one (1) only Stacker and/or Reclaimer, ore handling, consisting of ALL the

following:

(i) drives;

(ii) bogies;

(iii) equalisers;

(iv) luff hydraulic cylinders;

(v) pulleys;

(vi) conveyor belts; and

(b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

17.12.2010 to 15.12.2012

- AD01003721

Goods, imported by SANDVIK MINING AND CONSTRUCTION AUSTRALIA PTY LTD(ABN 62003771382),

for use in the PILBARA IRON PTY LTD (ABN75107216535), Pilbara Iron Capital Development,

as follows:

(a) four (4) only Stackers and/or Reclaimers, ore handling, consisting of

ALL the following:

(i) drives;

(ii) bogies;

(iii) equalisers;

(iv) luff hydraulic cylinders;

(v) pulleys;

(vi) conveyor belts; and

b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

1.03.2011 to 27.02.2013

- AD01003722

Goods, imported by JOEST AUSTRALIA PTY LTD (ABN 28095504135), for use in the PILBARA IRON

PTY LTD (ABN 75107216535), Pilbara Iron

Capital Development, as follows:

(a) components of an Ore Crushing Processing Line consisting of all of the

following:

six (6) vibratory screens; but

(b) excluding the following goods:

(i) jaw and/or gyratory crushers;

(ii) conveyors;

(iii) bins and/or chutes;

(iv) tramp metal magnets and/or detectors

(c) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

1.12.2010 to 29.11.2012

- AD01003723

Goods, imported by HAMERSLEY IRON PTY LTD (ABN 49004558276), for use in the PILBARA IRON

PTY LTD (ABN 75107216535), Pilbara Iron

Capital Development, as follows:

(a) four (4) only Haul trucks, rear dump, off highway, rigid frame,

4x2 drive, capacity exceeding 31 t, but NOT including underground

mining trucks; and

(b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

13.10.2010 to 11.10.2012

- AD01003724

Goods, imported by FALK AUSTRALIA PTY LTD (ABN 65084207652), for use in the

(ABN 75107216535), Pilbara Iron

Capital Development, as follows:

(a) sixteen (16) only Conveyor Drives; and

(b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

1.01.2011 to 30.12.2012

-AD01003725

PILBARA IRON PTY LTD

17 Section 273 Determinations Made

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

Goods, imported by BRIDGESTONE ENGINEERED PRODUCTS OF ASIA SDN. BHD. (ABN 43088157135),

for use in the PILBARA IRON PTY LTD

(ABN 75107216535), Pilbara Iron Capital Development, as follows:

(a) one (1) Conveyor System consisting of all the following:

(i) nine thousand three hundred and ninety five (9395) meters only

synthetic belt cord, fabric reinforced;

(ii) pulleys and/or feeders; and

(b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

1.10.2011 to 28.02.2013

- AD01003738

Goods, imported by BRIDGESTONE ENGINEERED PRODUCTS OF ASIA SDN. BHD. (ABN

43088157135), for use in the PILBARA IRON PTY LTD

(ABN75107216535), Pilbara Iron Capital Development, as follows:

(a) one (1) Conveyor System consisting of all the following:

(i) nine thousand three hundred and ninety five (9395) meters only

synthetic belt cord, fabric reinforced;

(ii) pulleys and/or feeders; and

(b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

1.03.2013 to 29.09.2013

- AD01003739

Goods, imported by HAMERSLEY IRON PTY LTD (ABN 49004558276), for use in the PILBARA IRON

PTY LTD (ABN 75107216535), Pilbara

Iron Capital Development, as follows:

(a) one (1) only Ore Crushing Processing Line consisting of all of the

following:

(i) one (1) gyratory crusher; but

(b) excluding the following goods:

(i) feeders and/or screens;

(ii) conveyors;

(iii) bins and/or chutes

(iv) tramp metal magnets and/or detectors; and

(c) inclusive of components of the goods specified in (a) above, including

commissioning spare parts integral to the project.

1.01.2012 to 28.02.2013

- AD01003740

Goods, imported by HAMERSLEY IRON PTY LTD (ABN 49004558276), for use in the PILBARA IRON

PTY LTD (ABN 75107216535), Pilbara Iron

Capital Development, as follows:

(a) one (1) only Ore Crushing Processing Line consisting of all of the

following:

(i) one (1) gyratory crusher; but

(b) excluding the following goods:

(i) feeders and/or screens;

(ii) conveyors;

(iii) bins and/or chutes

(iv) tramp metal magnets and/or detectors; and

(c) inclusive of components of the goods specified in (a) above,

including commissioning spare parts integral to the project.

1.03.2013 to 30.12.2013

- AD01003741

Goods, imported by FALK AUSTRALIA PTY LTD (ABN 65084207652), for use in the PILBARA IRON

PTY LTD (ABN 75107216535), Pilbara Iron

Capital Development, as follows:

(a) fifteen (15) only Conveyor Drives; and

(b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

1.01.2012 to 28.02.2013

- AD01003742

Goods, imported by FALK AUSTRALIA PTY LTD (ABN 65084207652), for use in the

PILBARA IRON PTY LTD (ABN 75107216535), Pilbara Iron

Capital Development, as follows:

a) fifteen (15) only Conveyor Drives; and

b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

18 Section 273 Determinations Made

1.03.2013 to 30.12.2013

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

- AD01003743

Goods, imported by SANDVIK MINING AND CONSTRUCTION AUSTRALIA PTY LTD(ABN

62003771382), for use in the PILBARA IRON

PTY LTD (ABN75107216535), Pilbara Iron Capital Development, as follows:

(a) one (1) only Stacker and/or Reclaimer, Ore Handling, consisting of ALL

the following:

(i) drives;

(ii) bogies;

(iii) equalisers;

(iv) luff hydraulic cylinders;

(v) pulleys;

(vi) conveyor belts; and

(b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

1.06.2011 to 28.02.2013

- AD01003745

Goods, imported by SANDVIK MINING AND CONSTRUCTION AUSTRALIA PTY LTD(ABN

62003771382), for use in the PILBARA

IRON PTY LTD (ABN75107216535), Pilbara Iron Capital Development, as

follows:

(a) one (1) only Stacker and/or Reclaimer, Ore Handling, consisting of ALL

the following:

(i) drives;

(ii) bogies;

(iii) equalisers;

(iv) luff hydraulic cylinders;

(v) pulleys;

(vi) conveyor belts; and

(b) components of the goods specified in (a) above, including commissioning

spare parts integral to the project.

1.03.2013 to 30.05.2013

- AD01003746

High impact, environmental stress crack resistant polystyrene

pellets for specific use in the manufacture of refrigerator and/or

freezer internal cabinet linings, freezer bins and breaker collars

.

02.07.13 to 01.07.15

- AD 01003761

19 Section 273 Determinations Revoked

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

Section 273 Determinations Revo ked

NOTICEOFREVOCATIONOFDETERMINATIONSMADEUNDERPARTXVIOFTHECUSTOMSACT1901

Undersubsection273B(2)oftheCustomsAct1901,noticeisherebygivenoftherevocationofdeterminations

madeundersection273oftheCustomsAct1901,whichappliedtogoodsofakindspecifiedinthetablebelow.

Inthetable:

(i)thefirstcolumnspecifiesthekindofgoodstowhichthedeterminationapplied,anyconditionsspecified

inthedetermination,theoriginalcommencementdateofthedeterminationandtheDeterminationreference

number;

(ii)thesecondcolumnspecifiestheiteminSchedule4totheCustomsTariffAct1995thatappliedtothe

specifiedgoods.

(iii)thethirdcolumnspecifiesthedateofrevocation,beingthedateonwhichthedeterminationceasesto

haveeffect.

THETABLE

Description of Goods

CommencementDate

Change in importer's details, new AD 01003758

Op. 20.03.13

Change in importer's details, new AD 01003756.

Op. 01.03.13

Schedule 4

Item Number

Revocation

Date

44

22.08.13

44

22.08.13

- AD 01003705

- AD 01003714

20 By-Laws Made

Commonwealth of Australia Gazette

No TC 13/34, Wednesday, 28 Aug 2013

By-Laws Made

Customs Act 1901

PART I of Schedule 4 to the Customs Tariff Act 1995

By-law No. 1325719

I, Alison Neil, under section 271 of the Customs Act 1901, make the by-law set out in

the Schedule below for the purposes of item 48 in PART I of Schedule 4 to the Customs

Tariff.

In the by-law set out in the Schedule below, "security" means security required from

the importer to the satisfaction of the Collector under section 42 of the Customs Act

1901.

THE SCHEDULE

This by-law may be cited as Customs By-law No. 1325719.

2.

This by-law shall take effect on 29 August 2013.

3. For the purposes of item 48 of Schedule 4 to the

Customs Tariff Act 1995, paper and paperboard classified under

headings 4810 or 4811 of Schedule 3 of the Customs Tariff Act

1995 for use in the manufacture of flip-top cigarette packaging

are prescribed, Under Security.

4. For the purposes of this by-law, the "Customs Tariff

Act 1995" means the Customs Tariff Act 1995, as amended or

proposed to be altered.

Dated this nineteenth day of August 2013.

(signed)

Alison Neil

Delegate of the Chief Executive Officer

Вам также может понравиться

- Blowby SpecДокумент10 страницBlowby Specbambang eengОценок пока нет

- Amclyde M60 Crane SpecificationДокумент22 страницыAmclyde M60 Crane SpecificationWong Yew WeiОценок пока нет

- LBT 1090TДокумент9 страницLBT 1090Tnavalzero910Оценок пока нет

- Cement Mixer Model Mx-80 Owner'S/Operator'S - Parts ManualДокумент12 страницCement Mixer Model Mx-80 Owner'S/Operator'S - Parts Manualrelh62Оценок пока нет

- Comparative Sheet of Wagon TiplerДокумент3 страницыComparative Sheet of Wagon TiplerKenny RuizОценок пока нет

- Flowserve Lined Flush BottomДокумент32 страницыFlowserve Lined Flush BottomDevdatt WaghuleОценок пока нет

- Vertical shaft Francis turbines for Kotlibhel HEPДокумент38 страницVertical shaft Francis turbines for Kotlibhel HEPpavankumar001Оценок пока нет

- Atlas Copco TH60DH Water Well Drill SpecificationsДокумент12 страницAtlas Copco TH60DH Water Well Drill Specificationsanemoss100% (1)

- 32 Samss 009Документ14 страниц32 Samss 009naruto256Оценок пока нет

- Brochure TATA TrailerДокумент20 страницBrochure TATA TrailerRam RKОценок пока нет

- FCC Reactor Design Improves Hydrocarbon SeparationДокумент25 страницFCC Reactor Design Improves Hydrocarbon SeparationPraveen KumarОценок пока нет

- Tapflo CT BrochureДокумент8 страницTapflo CT BrochureСања БанковићОценок пока нет

- Catalyst Loading ProcedureДокумент3 страницыCatalyst Loading ProcedureNaresh SamalaОценок пока нет

- 03 2359 03 P 3 004 Rev 3 Span Analysis ReportДокумент872 страницы03 2359 03 P 3 004 Rev 3 Span Analysis Reporticemage1991100% (1)

- Manejadoras WestinghouseДокумент4 страницыManejadoras WestinghouseANA CATAGNIAОценок пока нет

- 4530 Spec SheetДокумент2 страницы4530 Spec SheetLye YpОценок пока нет

- 22 1739 04 - 02012010XXДокумент16 страниц22 1739 04 - 02012010XXMartinez MarОценок пока нет

- 10 SEER air conditioner specsДокумент4 страницы10 SEER air conditioner specsOscar Sanchez Velasquez0% (1)

- 245 Class SEACOR StormДокумент3 страницы245 Class SEACOR Stormlsd15251525Оценок пока нет

- Moeller Sasy 60iДокумент50 страницMoeller Sasy 60iOscar TorresОценок пока нет

- TT Platform Rig Evaluation Matrix - FINALДокумент9 страницTT Platform Rig Evaluation Matrix - FINALrdos14100% (1)

- Book 1Документ3 страницыBook 1charansalkutiОценок пока нет

- Main Group 3 Equipment For CargoДокумент13 страницMain Group 3 Equipment For CargoVladi GasperОценок пока нет

- Siemens 3KL 3KM Fuseswitch 2009 PDFДокумент19 страницSiemens 3KL 3KM Fuseswitch 2009 PDFragupathiОценок пока нет

- Installation and service manual for Potterton Suprima wall mounted gas boilerДокумент64 страницыInstallation and service manual for Potterton Suprima wall mounted gas boilerMartin Lee SmithОценок пока нет

- NAFRA Guaranteed Technical Perticulars Spherical ValveДокумент8 страницNAFRA Guaranteed Technical Perticulars Spherical Valvepavankumar001Оценок пока нет

- RoboticAutomatic Tool Changer PDFДокумент36 страницRoboticAutomatic Tool Changer PDFTesfahun GirmaОценок пока нет

- Coal Handling Equipment ListДокумент2 страницыCoal Handling Equipment ListLionel ZakhyОценок пока нет

- Yaesu G-450A Operating ManualДокумент15 страницYaesu G-450A Operating Manualdj03djj100% (1)

- Catalogohce090 150Документ18 страницCatalogohce090 150Xol DiaMa GarciaОценок пока нет

- Pump Polaris SeriesДокумент47 страницPump Polaris SeriesDANIZACHОценок пока нет

- Full DWT Product CatalogДокумент11 страницFull DWT Product CatalogAmir JoonОценок пока нет

- Volume - 4Документ72 страницыVolume - 4Arunkumar AdikesavanОценок пока нет

- Tyler Union CatalogДокумент65 страницTyler Union Catalognjsmith5Оценок пока нет

- Ine - Chiller Carrier - 30rb090Документ13 страницIne - Chiller Carrier - 30rb090yves2329Оценок пока нет

- Using The 1U-8860 Large Engine Blowby Pickup Group (0781, 0785)Документ10 страницUsing The 1U-8860 Large Engine Blowby Pickup Group (0781, 0785)mkОценок пока нет

- 13.8kV Bus Duct Sizing For Arar Dated 23.03.2005Документ9 страниц13.8kV Bus Duct Sizing For Arar Dated 23.03.2005srigirisetty208Оценок пока нет

- 2.1 GeneralДокумент248 страниц2.1 GeneralHugo Alfredo Calderon TapiaОценок пока нет

- Inverter Microprocessor-Controlled: Certified Kubota Mfg. CorpДокумент4 страницыInverter Microprocessor-Controlled: Certified Kubota Mfg. CorpTotok SurotoОценок пока нет

- Brochure sr30 PDFДокумент8 страницBrochure sr30 PDFNishant Sinha100% (1)

- VRV Outdoor Unit Daikin - BrochureДокумент2 страницыVRV Outdoor Unit Daikin - Brochurekunal_singhaiОценок пока нет

- Fuller Rtlo 16913aДокумент40 страницFuller Rtlo 16913acecy1712100% (1)

- T3802-Z-DS-001 - Rev. 3 - Technical DocumentДокумент5 страницT3802-Z-DS-001 - Rev. 3 - Technical DocumentpetricamafteiОценок пока нет

- Carrier38CKC 50HzДокумент20 страницCarrier38CKC 50HzAaron LeveyОценок пока нет

- Carrrier Manual 38ckc-c5pdДокумент20 страницCarrrier Manual 38ckc-c5pdAaron LeveyОценок пока нет

- t7000 6cng50 ManualДокумент49 страницt7000 6cng50 ManualAlsheikh875Оценок пока нет

- Injector Bypass Fuel Flow - Test: Previous ScreenДокумент10 страницInjector Bypass Fuel Flow - Test: Previous ScreenMiguel Gutierrez100% (1)

- Stress Analysis Report AB118Документ9 страницStress Analysis Report AB118Pinak Projects100% (2)

- PACKAGE 67 (III) /2014-15: Odisha Power Transmission Corporation LimitedДокумент6 страницPACKAGE 67 (III) /2014-15: Odisha Power Transmission Corporation LimitedVelu SamyОценок пока нет

- K TRON Loss in Weight Single Screw Feeder K ML S500 10DДокумент2 страницыK TRON Loss in Weight Single Screw Feeder K ML S500 10Ddeus_7Оценок пока нет

- CS3001 EManual (Pilot) SPANISH Pt1Документ50 страницCS3001 EManual (Pilot) SPANISH Pt1eddyfredy100% (2)

- Pressure Vessel Training ModuleДокумент40 страницPressure Vessel Training ModuleIdil Fitri100% (1)

- Rocket Boomer E3-C18 EspecificacionesДокумент4 страницыRocket Boomer E3-C18 EspecificacionesDiego CarrilloОценок пока нет

- NBIC Part 2 PDFДокумент12 страницNBIC Part 2 PDFjhonjimenez87Оценок пока нет

- PAT130A1 - Pratt Whitney PW6000 Archived 02 2011Документ6 страницPAT130A1 - Pratt Whitney PW6000 Archived 02 2011JOSEPH TinderОценок пока нет

- Harmonic AnalysisДокумент17 страницHarmonic Analysiscuongpham30160% (5)

- Hydraulics and Pneumatics: A Technician's and Engineer's GuideОт EverandHydraulics and Pneumatics: A Technician's and Engineer's GuideРейтинг: 4 из 5 звезд4/5 (8)

- School Listening Test AnswersДокумент3 страницыSchool Listening Test AnswersMohammed Sayed KammelОценок пока нет

- المراجعة النهائية الصف الرابع انجليزى 2016Документ9 страницالمراجعة النهائية الصف الرابع انجليزى 2016Mohammed Sayed KammelОценок пока нет

- Memoirs02egypgoog PDFДокумент195 страницMemoirs02egypgoog PDFMohammed Sayed KammelОценок пока нет

- Chikr Halima: Teaching History and Geography and Civic Education at A Middle SchoolДокумент2 страницыChikr Halima: Teaching History and Geography and Civic Education at A Middle SchoolMohammed Sayed KammelОценок пока нет

- EducationДокумент3 страницыEducationMohammed Sayed KammelОценок пока нет

- Chikr Halima: Teaching History and Geography and Civic Education at A Middle SchoolДокумент2 страницыChikr Halima: Teaching History and Geography and Civic Education at A Middle SchoolMohammed Sayed KammelОценок пока нет

- AL Qaradawi PrizeДокумент3 страницыAL Qaradawi PrizeMohammed Sayed KammelОценок пока нет

- Omar Abd ElДокумент2 страницыOmar Abd ElMohammed Sayed KammelОценок пока нет

- Presentation 1Документ1 страницаPresentation 1Mohammed Sayed KammelОценок пока нет

- Introduction To Powder Metallurgy A ReviДокумент7 страницIntroduction To Powder Metallurgy A ReviFerry SetiawanОценок пока нет

- l05 092Документ7 страницl05 092rammirisОценок пока нет

- Korloy CatalogeДокумент1 150 страницKorloy CatalogePRO TECHОценок пока нет

- Lecture3 CH315 Winter2013 ClassДокумент30 страницLecture3 CH315 Winter2013 ClassRaj PatelОценок пока нет

- Mohanty ThesisДокумент231 страницаMohanty ThesisbaloochybОценок пока нет

- Charpy Impact TestДокумент3 страницыCharpy Impact TestKajal KhanОценок пока нет

- MMCДокумент39 страницMMCgopal rao sirОценок пока нет

- Lecture 17 Shaft Loading PDFДокумент26 страницLecture 17 Shaft Loading PDFAndrew Tan100% (1)

- Konnerup (2012) Design of Steel-Concrete Composite Structures For A High-Rise BuildingДокумент185 страницKonnerup (2012) Design of Steel-Concrete Composite Structures For A High-Rise Buildingint8Оценок пока нет

- Single Row Deep Groove Ball Bearings - SKFДокумент1 страницаSingle Row Deep Groove Ball Bearings - SKFLuis EstradaОценок пока нет

- SmagДокумент28 страницSmagcsvasukiОценок пока нет

- Catalog eДокумент32 страницыCatalog ebignose93gmail.comОценок пока нет

- Proposal AACДокумент23 страницыProposal AACHery Dimitriy100% (1)

- Drill Pipe ManДокумент46 страницDrill Pipe ManMohamed SaeedОценок пока нет

- Lube 1090Документ2 страницыLube 1090ΠΑΝΑΓΙΩΤΗΣΠΑΝΑΓΟΣОценок пока нет

- Hexion Starting Formulation 8014Документ4 страницыHexion Starting Formulation 8014uzzy2Оценок пока нет

- FatigueДокумент6 страницFatigueEnriqueGDОценок пока нет

- AccumulatorsДокумент9 страницAccumulatorsBaldo CastilloОценок пока нет

- Interview Q and Ans FOR THARMAL POWER PLANTДокумент15 страницInterview Q and Ans FOR THARMAL POWER PLANTRajkumar Prasad100% (2)

- Prevention, Fishing and Casing Repair - Jim Short - Part 2Документ249 страницPrevention, Fishing and Casing Repair - Jim Short - Part 2MitsúMilagrosToroSayasОценок пока нет

- Module Heat - Answer SchemeДокумент27 страницModule Heat - Answer SchemeCart KartikaОценок пока нет

- Compression MouldingДокумент41 страницаCompression MouldingSuranjana Mandal100% (1)

- Traditional Machining Processes Research AdvancesДокумент242 страницыTraditional Machining Processes Research AdvancesGema Rodriguez DelgadoОценок пока нет

- IWS Sample QandA ExaminationsДокумент23 страницыIWS Sample QandA ExaminationsRohit Malhotra71% (7)

- JORC DrainsДокумент36 страницJORC DrainsMod KaewdaengОценок пока нет

- JOB SAFETY ANALYSIS FOR WELDINGДокумент2 страницыJOB SAFETY ANALYSIS FOR WELDINGSravan Dasari100% (3)

- Manual SaniviteДокумент26 страницManual Sanivitejottings100% (1)

- DC Hydraulic Power Unit PDF DrawingsДокумент1 страницаDC Hydraulic Power Unit PDF DrawingsngazawooОценок пока нет

- CAE DS – Designing Cast FeaturesДокумент15 страницCAE DS – Designing Cast Featurespatiltushar79Оценок пока нет

- Architectural Woodwork Specification GuideДокумент8 страницArchitectural Woodwork Specification GuideRonnell RepilОценок пока нет