Академический Документы

Профессиональный Документы

Культура Документы

2012 LI ss04 2 PDF

Загружено:

NguyenИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2012 LI ss04 2 PDF

Загружено:

NguyenАвторское право:

Доступные форматы

STUDY SESSION 4

ECONOMICS:

Microeconomic Analysis

his study session focuses on the microeconomic principles used to describe the

marketplace behavior of consumers and firms. The first reading explains the

concepts and tools of demand and supply analysisthe study of how buyers and

sellers interact to determine transaction prices and quantities. The second reading

covers the theory of the consumer, which addresses the demand for goods and

services by individuals who make decisions that maximize the satisfaction received

from present and future consumption. The third reading deals with the theory of

the firm, focusing on the supply of goods and services by profit-maximizing firms.

That reading provides the basis for understanding the cost side of firms profit

equation. The fourth and final reading completes the picture by addressing revenue

and explains the types of markets in which firms sell output. Overall, the study

session provides the economic tools for understanding how product and resource

markets function and the competitive characteristics of different industries.

READING ASSIGNMENTS

Reading 13

Demand and Supply Analysis: Introduction

by Richard V. Eastin and Gary L. Arbogast, CFA

Reading 14

Demand and Supply Analysis: Consumer Demand

by Richard V. Eastin and Gary L. Arbogast, CFA

Reading 15

Demand and Supply Analysis: The Firm

by Gary L. Arbogast, CFA and Richard V. Eastin

Reading 16

The Firm and Market Structures

by Richard G. Fritz and Michele Gambera, CFA

LEARNING OUTCOMES

Reading 13: Demand and Supply Analysis: Introduction

The candidate should be able to:

a. distinguish among types of markets;

b. explain the principles of demand and supply;

2012 Level I CFA Program Curriculum CFA Institute.

Study Session 4

c. describe causes of shifts in and movements along demand and supply curves;

d. describe the process of aggregating demand and supply curves, including the

concept of equilibrium and mechanisms by which markets achieve equilibrium;

e. distinguish between stable and unstable equilibria and identify instances of such

equilibria;

f. calculate and interpret individual and aggregate inverse demand and supply

functions and individual and aggregate demand and supply curves;

g. calculate and interpret the amount of excess demand or excess supply associated

with a non-equilibrium price;

h. describe the types of auctions and calculate the winning price(s) of an auction;

i. analyze the causes of a demand or supply imbalance that affects a good or

service;

j. describe the impact of government regulation and intervention on demand and

supply;

k. forecast the effect of the introduction and removal of a market interference (e.g.,

a price floor or ceiling) on price and quantity;

l. calculate and interpret consumer surplus, producer surplus, and total surplus;

m. calculate and interpret price, income, and cross-price elasticities of demand,

including factors that affect each measure.

Reading 14: Demand and Supply Analysis: Consumer Demand

The candidate should be able to:

a. describe consumer choice theory and utility theory;

b. describe the use of indifference curves, opportunity sets, and budget constraints

in decision making;

c. calculate and interpret a budget constraint;

d. determine a consumers equilibrium bundle of goods based on utility analysis;

e. compare substitution and income effects;

f. distinguish between normal goods and inferior goods, and explain Giffen goods

and Veblen goods in this context.

Reading 15: Demand and Supply Analysis: The Firm

The candidate should be able to:

a. calculate, interpret, and compare accounting profit, economic profit, normal

profit, and economic rent;

b. calculate and interpret total, average, and marginal revenue;

c. describe the firms factors of production;

d. calculate and interpret total, average, marginal, fixed, and variable costs;

e. describe breakeven and shutdown points of production;

f. explain how economies of scale and diseconomies of scale affect costs;

g. describe approaches to determining the profit-maximizing level of output;

h. distinguish between short-run and long-run profit maximization;

i. distinguish among decreasing-cost, constant-cost, and increasing-cost industries

and describe the long-run supply of each;

2012 Level I CFA Program Curriculum CFA Institute.

Study Session 4

j. calculate and interpret total, marginal, and average product of labor;

k. describe the phenomenon of diminishing marginal returns and calculate and

interpret the profit-maximizing utilization level of an input;

l. describe the optimal combination of resources that minimizes cost.

Reading 16: The Firm and Market Structures

The candidate should be able to:

a. describe the characteristics of different market structures: perfect competition,

monopolistic competition, oligopoly, and pure monopoly;

b. explain the relationships between price, marginal revenue, marginal cost,

economic profit, and the elasticity of demand under each market structure;

c. describe the firms supply function under each market structure;

d. describe and determine the profit-maximizing price and output for firms under

each market structure;

e. explain the effects of demand changes, entry and exit of firms, and other factors

on long-run equilibrium under each market structure;

f. describe the use and limitations of concentration measures in identifying market

structure;

g. identify the type of market structure within which a firm is operating.

2012 Level I CFA Program Curriculum CFA Institute.

Вам также может понравиться

- Study Session 5: EconomicsДокумент3 страницыStudy Session 5: EconomicsAadilIftikharОценок пока нет

- Economics for Investment Decision Makers Workbook: Micro, Macro, and International EconomicsОт EverandEconomics for Investment Decision Makers Workbook: Micro, Macro, and International EconomicsОценок пока нет

- Demand and Supply Analysis: Introduction: ReadingДокумент8 страницDemand and Supply Analysis: Introduction: ReadingSatishОценок пока нет

- CT7 Business EconomicsДокумент7 страницCT7 Business EconomicsVignesh Srinivasan100% (1)

- course planДокумент3 страницыcourse planunstopable 7 rodiesОценок пока нет

- Narver and Slater 1990Документ17 страницNarver and Slater 1990Catalin PinteaОценок пока нет

- CH 06Документ12 страницCH 06leisurelarry999Оценок пока нет

- Learning ObjectivesДокумент2 страницыLearning Objectivesmtaylor654Оценок пока нет

- Economics 1st Edition Acemoglu Solutions Manual DownloadДокумент22 страницыEconomics 1st Edition Acemoglu Solutions Manual DownloadJohn Mader100% (22)

- Agricultural MarketingДокумент133 страницыAgricultural MarketingRadhey Shyam KumawatОценок пока нет

- Agricultural Marketings, Trade and PricesДокумент133 страницыAgricultural Marketings, Trade and PricesNirmal Kamboj100% (4)

- Reduced As SpecificationДокумент9 страницReduced As Specificationwilsonn1996Оценок пока нет

- Economic Principles and Their Application To BusinessДокумент9 страницEconomic Principles and Their Application To BusinessRaheelAhmed09Оценок пока нет

- CT7Документ8 страницCT7Vishy BhatiaОценок пока нет

- Managerial Economics Past PapersДокумент47 страницManagerial Economics Past Papersfizzymizzy4Оценок пока нет

- Class Notes 4Документ2 страницыClass Notes 4Phillemon MuridzoОценок пока нет

- Chapter 4Документ2 страницыChapter 4kw8bgyvm8kОценок пока нет

- CSEC Economics SyllabusДокумент6 страницCSEC Economics Syllabussmartkid167100% (2)

- Some Important Long QuestionsДокумент3 страницыSome Important Long QuestionsRiya SinghalОценок пока нет

- Dwnload Full Economics and Contemporary Issues 8th Edition Moomaw Solutions Manual PDFДокумент35 страницDwnload Full Economics and Contemporary Issues 8th Edition Moomaw Solutions Manual PDFbyronrogersd1nw8100% (10)

- Market StudyДокумент14 страницMarket StudySheldon RajОценок пока нет

- Galutera Man EconДокумент6 страницGalutera Man Econbeavivo1Оценок пока нет

- ExchangeДокумент486 страницExchangealc1b1ad3sОценок пока нет

- AP Microeconomics SyllabusДокумент4 страницыAP Microeconomics SyllabusMr. PopoОценок пока нет

- M.B.A. (First Semester) Examination, 2014-15 Managerial Economics Model Answer Section - AДокумент28 страницM.B.A. (First Semester) Examination, 2014-15 Managerial Economics Model Answer Section - AIjaz M.KОценок пока нет

- Annexure-172. B.com. Programme Ge CoursesДокумент4 страницыAnnexure-172. B.com. Programme Ge CoursesANANT AGGARWALОценок пока нет

- ECONOMICS AND BUSINESS LANDSCAPE ANALYSIS - Chapter 1 & Chapter 3Документ4 страницыECONOMICS AND BUSINESS LANDSCAPE ANALYSIS - Chapter 1 & Chapter 3Daniel TjeongОценок пока нет

- Principles of Micro Economics Question Bank Ist SemДокумент3 страницыPrinciples of Micro Economics Question Bank Ist Semyjayasanka588Оценок пока нет

- Economics 2009-2010 8-14-2008Документ7 страницEconomics 2009-2010 8-14-2008Jill StassieОценок пока нет

- Introduction To Microeconomics I OEC 101Документ202 страницыIntroduction To Microeconomics I OEC 101tauqeerОценок пока нет

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Документ7 страницAllama Iqbal Open University, Islamabad (Department of Business Administration)haroonsaeed12Оценок пока нет

- Efm Vvim Notes - Aur & SGB - New - GousiaДокумент92 страницыEfm Vvim Notes - Aur & SGB - New - Gousiasyedasara630Оценок пока нет

- Dwnload Full Microeconomics and Behavior 9th Edition Frank Solutions Manual PDFДокумент35 страницDwnload Full Microeconomics and Behavior 9th Edition Frank Solutions Manual PDFreneestanleyf375h100% (9)

- Microeconomics and Behavior 9th Edition Frank Solutions ManualДокумент35 страницMicroeconomics and Behavior 9th Edition Frank Solutions Manualbejumbleaugitexy08y100% (22)

- E.pub Px1l8vgytk6pceo72vaa - VBK OEBPS CFA0016 S04 Print 1Документ1 страницаE.pub Px1l8vgytk6pceo72vaa - VBK OEBPS CFA0016 S04 Print 1adhia_saurabhОценок пока нет

- Perfect Competition-Term ReportДокумент40 страницPerfect Competition-Term ReportTalha HameedОценок пока нет

- Tutorial Questions EC101Документ3 страницыTutorial Questions EC101jh342703Оценок пока нет

- CBSE Class 12 Syllabus For Economics 2014-2015Документ4 страницыCBSE Class 12 Syllabus For Economics 2014-2015cbsesamplepaperОценок пока нет

- ECONOMIC ANALYSIS FOR BUSINESSДокумент8 страницECONOMIC ANALYSIS FOR BUSINESSSenthil Kumar GanesanОценок пока нет

- IGCSE Economics Notes With Syllabus StatmentsДокумент48 страницIGCSE Economics Notes With Syllabus StatmentsMeemzii79% (14)

- Microeconomics and Behavior 9th Edition Frank Solutions ManualДокумент25 страницMicroeconomics and Behavior 9th Edition Frank Solutions ManualDeborahWestwdzt96% (51)

- Understanding Supply and Demand ConceptsДокумент7 страницUnderstanding Supply and Demand ConceptsOliver Eudan Bolaños SilvaОценок пока нет

- Economics of Managerial Decisions 1st Edition Blair Solutions ManualДокумент35 страницEconomics of Managerial Decisions 1st Edition Blair Solutions ManualhesseesarahjeanneОценок пока нет

- Full Download Economics of Managerial Decisions 1st Edition Blair Solutions ManualДокумент35 страницFull Download Economics of Managerial Decisions 1st Edition Blair Solutions Manualramshunapituk100% (40)

- Article 2Документ17 страницArticle 2Feven WenduОценок пока нет

- Narver J C Slater S F (1990) The Effect of A Market Orientation On Business Profitability PDFДокумент17 страницNarver J C Slater S F (1990) The Effect of A Market Orientation On Business Profitability PDF邹璇Оценок пока нет

- Full Download Fundamentals of Economics 6th Edition Boyes Solutions ManualДокумент35 страницFull Download Fundamentals of Economics 6th Edition Boyes Solutions Manualinserve.absolve.q2oxs100% (30)

- Business Economics: Mid Term SyllabusДокумент37 страницBusiness Economics: Mid Term SyllabusZaigham AbbasОценок пока нет

- Principles of Microeconomics Unit 1: Introduction To EconomicsДокумент5 страницPrinciples of Microeconomics Unit 1: Introduction To EconomicsKeyah NkonghoОценок пока нет

- School of Business Market Study GuideДокумент8 страницSchool of Business Market Study GuideABDEL RAHMAN ALIОценок пока нет

- Assignment: Submitted To: Submitted byДокумент4 страницыAssignment: Submitted To: Submitted byFaizan ShowkatОценок пока нет

- Course Outline Me 2016-18 v1.0Документ8 страницCourse Outline Me 2016-18 v1.0viewpawanОценок пока нет

- Chapter 6 & 7 Homework PacketДокумент6 страницChapter 6 & 7 Homework PacketJohn JohnsonОценок пока нет

- PresentationДокумент138 страницPresentationMd Ghulam RabbanyОценок пока нет

- Chapter 3Документ4 страницыChapter 3fritzcastillo026Оценок пока нет

- Business EconomicsДокумент2 страницыBusiness EconomicsDavinder BhawaniОценок пока нет

- Full Download Economics and Contemporary Issues 8th Edition Moomaw Solutions ManualДокумент35 страницFull Download Economics and Contemporary Issues 8th Edition Moomaw Solutions Manualolivermornw7i100% (40)

- Demand Estimation and ForecastingДокумент116 страницDemand Estimation and ForecastingRabindra Rajbhandari100% (1)

- Microecomomics Syllabus 2022Документ5 страницMicroecomomics Syllabus 2022An NguyenОценок пока нет

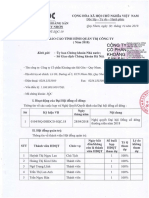

- Trai Phieu 17Документ12 страницTrai Phieu 17NguyenОценок пока нет

- Trai Phieu 15Документ6 страницTrai Phieu 15NguyenОценок пока нет

- Trai Phieu 18Документ6 страницTrai Phieu 18NguyenОценок пока нет

- Trai Phieu 14Документ6 страницTrai Phieu 14NguyenОценок пока нет

- Quarterly Report: Fixed - Income ResearchДокумент9 страницQuarterly Report: Fixed - Income ResearchNguyenОценок пока нет

- Trai Phieu 27 PDFДокумент6 страницTrai Phieu 27 PDFNguyenОценок пока нет

- Trai Phieu 22Документ6 страницTrai Phieu 22NguyenОценок пока нет

- Trai Phieu 21Документ6 страницTrai Phieu 21NguyenОценок пока нет

- Trai Phieu 29 PDFДокумент8 страницTrai Phieu 29 PDFNguyenОценок пока нет

- Monthly Report: Fixed-Income ResearchДокумент8 страницMonthly Report: Fixed-Income ResearchNguyenОценок пока нет

- Trai Phieu 26 PDFДокумент6 страницTrai Phieu 26 PDFNguyenОценок пока нет

- Trai Phieu 25Документ7 страницTrai Phieu 25NguyenОценок пока нет

- Weekly Report: Fixed-Income ResearchДокумент7 страницWeekly Report: Fixed-Income ResearchNguyenОценок пока нет

- Trai Phieu 6Документ6 страницTrai Phieu 6NguyenОценок пока нет

- Trai Phieu 5 PDFДокумент6 страницTrai Phieu 5 PDFNguyenОценок пока нет

- Trai Phieu 5 PDFДокумент6 страницTrai Phieu 5 PDFNguyenОценок пока нет

- Công Ty C PH N Khoáng S N Sài Gòn Quy NH NДокумент5 страницCông Ty C PH N Khoáng S N Sài Gòn Quy NH NNguyenОценок пока нет

- Trai Phieu 2Документ7 страницTrai Phieu 2NguyenОценок пока нет

- Monthly Report: Fixed - Income ResearchДокумент8 страницMonthly Report: Fixed - Income ResearchNguyenОценок пока нет

- Trai Phieu 9 PDFДокумент6 страницTrai Phieu 9 PDFNguyenОценок пока нет

- Trai Phieu 7Документ6 страницTrai Phieu 7NguyenОценок пока нет

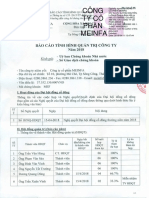

- SDE Baocaoquantri 2018Документ2 страницыSDE Baocaoquantri 2018NguyenОценок пока нет

- Tổng Công Ty Cổ Phần Y Tế DanamecoДокумент14 страницTổng Công Ty Cổ Phần Y Tế DanamecoNguyenОценок пока нет

- Trai Phieu 9 PDFДокумент6 страницTrai Phieu 9 PDFNguyenОценок пока нет

- Macroeconomic Research April 2019: by A Member of VIETCOMBANKДокумент14 страницMacroeconomic Research April 2019: by A Member of VIETCOMBANKNguyenОценок пока нет

- MEF Baocaoquantri 2018Документ3 страницыMEF Baocaoquantri 2018NguyenОценок пока нет

- Macroeconomics Research: Quarterly ReportДокумент11 страницMacroeconomics Research: Quarterly ReportNguyenОценок пока нет

- KTS Baocaotaichinh Q3 2019Документ31 страницаKTS Baocaotaichinh Q3 2019NguyenОценок пока нет

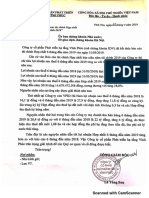

- IDV Giaitrinh KQKD 6T 2019 Soatxet HopnhatДокумент1 страницаIDV Giaitrinh KQKD 6T 2019 Soatxet HopnhatNguyenОценок пока нет

- SLS Baocaotaichinh Q3 2019 PDFДокумент25 страницSLS Baocaotaichinh Q3 2019 PDFNguyenОценок пока нет

- Xiameter Strategy AnalysisДокумент2 страницыXiameter Strategy AnalysisRahul KrishnetОценок пока нет

- Project Manager ManualДокумент330 страницProject Manager ManualJavier Contreras100% (3)

- Trading and Profit Loss AccountДокумент8 страницTrading and Profit Loss AccountOrange Noida100% (1)

- A Study On Financial Analysis of Tata Motors: AbstractДокумент5 страницA Study On Financial Analysis of Tata Motors: AbstracthimanshuОценок пока нет

- Assignment II (FA of Acledabank FinalДокумент25 страницAssignment II (FA of Acledabank FinalKim Synalyn100% (2)

- American Economic Association Journal Article Discusses Business Cycles and Economic Stability in 1990sДокумент23 страницыAmerican Economic Association Journal Article Discusses Business Cycles and Economic Stability in 1990slcr89Оценок пока нет

- Tea Industry Analysis of Jayshree Tea IndustriesДокумент30 страницTea Industry Analysis of Jayshree Tea IndustriesSathish JuliusОценок пока нет

- Jurnal Balanced ScorecardДокумент13 страницJurnal Balanced ScorecardIekar 'Fhai'100% (1)

- Examiner's Report: MA2 Managing Costs & Finance December 2012Документ4 страницыExaminer's Report: MA2 Managing Costs & Finance December 2012Ahmad Hafid Hanifah100% (1)

- Final Report of Saqib Manzoor MalhiДокумент86 страницFinal Report of Saqib Manzoor MalhiHafiz Saqib JavedОценок пока нет

- Fair and Lovely marketing strategiesДокумент38 страницFair and Lovely marketing strategiesShreeya Shrestha100% (2)

- Managing Idle Capacity to Improve EfficiencyДокумент15 страницManaging Idle Capacity to Improve EfficiencyDeborshee GogoiОценок пока нет

- Chap 012Документ14 страницChap 012HassaanAhmadОценок пока нет

- GCSE Bitesize Mark Scheme ExplainedДокумент15 страницGCSE Bitesize Mark Scheme ExplainedAshley MorganОценок пока нет

- Food and Beverage ExcercisesДокумент9 страницFood and Beverage Excercisesaerisk07Оценок пока нет

- CFOs View of ProcurementДокумент20 страницCFOs View of ProcurementTarig TahaОценок пока нет

- ECG80 Energy Use in The Animal Feed SectorДокумент8 страницECG80 Energy Use in The Animal Feed SectorIppiОценок пока нет

- Producing Pine Oil in EthiopiaДокумент17 страницProducing Pine Oil in Ethiopiabig johnОценок пока нет

- Bus 110-Introduction To MarketingДокумент45 страницBus 110-Introduction To MarketingEligius NyikaОценок пока нет

- Marketing Management: IntroductionДокумент51 страницаMarketing Management: IntroductionRavi HoneyОценок пока нет

- FMДокумент77 страницFMYawar Khan KhiljiОценок пока нет

- Sales Budget and ControlДокумент8 страницSales Budget and ControlDeenanath SahuОценок пока нет

- Infosys Valuation Template - BlankДокумент8 страницInfosys Valuation Template - BlankRohan DeodharОценок пока нет

- 5 Ways For Lead Time ReductionДокумент5 страниц5 Ways For Lead Time ReductionYamini ShamiОценок пока нет

- The Measurement and Structure of The National Economy: Numerical ProblemsДокумент0 страницThe Measurement and Structure of The National Economy: Numerical ProblemsNaga Manasa K0% (1)

- Costing in HotelДокумент35 страницCosting in HotelsamismithОценок пока нет

- Asia Ghee Mill ReportДокумент27 страницAsia Ghee Mill ReportHafiz AbdulwahabОценок пока нет

- Guide to Accounting for Construction ContractsДокумент5 страницGuide to Accounting for Construction ContractsmasahinОценок пока нет

- Practice Questions PDFДокумент24 страницыPractice Questions PDFsanjayifmОценок пока нет

- Chapter15 NewДокумент33 страницыChapter15 NewKiem DuongОценок пока нет

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyОт EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyРейтинг: 4 из 5 звезд4/5 (51)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesОт EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Look Again: The Power of Noticing What Was Always ThereОт EverandLook Again: The Power of Noticing What Was Always ThereРейтинг: 5 из 5 звезд5/5 (3)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyОт EverandChip War: The Quest to Dominate the World's Most Critical TechnologyРейтинг: 4.5 из 5 звезд4.5/5 (227)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsОт EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsРейтинг: 4.5 из 5 звезд4.5/5 (94)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaОт EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaОценок пока нет

- Second Class: How the Elites Betrayed America's Working Men and WomenОт EverandSecond Class: How the Elites Betrayed America's Working Men and WomenОценок пока нет

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingОт EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingРейтинг: 4.5 из 5 звезд4.5/5 (97)

- A Place of My Own: The Architecture of DaydreamsОт EverandA Place of My Own: The Architecture of DaydreamsРейтинг: 4 из 5 звезд4/5 (241)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomОт EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomОценок пока нет

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentОт EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentРейтинг: 4.5 из 5 звезд4.5/5 (92)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationОт EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationРейтинг: 4.5 из 5 звезд4.5/5 (46)

- The Lords of Easy Money: How the Federal Reserve Broke the American EconomyОт EverandThe Lords of Easy Money: How the Federal Reserve Broke the American EconomyРейтинг: 4.5 из 5 звезд4.5/5 (69)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailОт EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailРейтинг: 4.5 из 5 звезд4.5/5 (237)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetОт EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetОценок пока нет

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- How an Economy Grows and Why It Crashes: Collector's EditionОт EverandHow an Economy Grows and Why It Crashes: Collector's EditionРейтинг: 4.5 из 5 звезд4.5/5 (102)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- The Hidden Habits of Genius: Beyond Talent, IQ, and Grit—Unlocking the Secrets of GreatnessОт EverandThe Hidden Habits of Genius: Beyond Talent, IQ, and Grit—Unlocking the Secrets of GreatnessРейтинг: 3.5 из 5 звезд3.5/5 (12)

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsОт EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsРейтинг: 5 из 5 звезд5/5 (2)

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldОт EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldРейтинг: 4 из 5 звезд4/5 (16)

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineОт EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineРейтинг: 4.5 из 5 звезд4.5/5 (36)

- The Finance Curse: How Global Finance Is Making Us All PoorerОт EverandThe Finance Curse: How Global Finance Is Making Us All PoorerРейтинг: 4.5 из 5 звезд4.5/5 (18)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyОт EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyРейтинг: 4.5 из 5 звезд4.5/5 (263)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistОт EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistРейтинг: 4.5 из 5 звезд4.5/5 (37)

- Oceans of Grain: How American Wheat Remade the WorldОт EverandOceans of Grain: How American Wheat Remade the WorldРейтинг: 4.5 из 5 звезд4.5/5 (3)