Академический Документы

Профессиональный Документы

Культура Документы

An Integrated Approach Toward The Spatial Modeling of Perceived Customer Value

Загружено:

Dante EdwardsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

An Integrated Approach Toward The Spatial Modeling of Perceived Customer Value

Загружено:

Dante EdwardsАвторское право:

Доступные форматы

INDRAJIT SINHA and WAYNE S.

DeSARBC

The authors present a new measurement methodology of perceived

value, based on latent structure multidimensional scaling, that derives

simultaneously the underlying dimensions of the perceived value of various brands and market segment heterogeneity in terms of how such

value evaluations are made. This latent structure, ordered probit, multidimensional scaling (MDS) based methodology improves on existing industry techniques of illustrating perceived customer value because it enables

researchers to infer the underlying dimensions of perceived value from

the data without specifying these a priori, as is common in existing methods. The authors compare the proposed model against more traditional

MDS approaches in an empirical illustration involving the perceived value

of compact cars. Finally, the authors discuss managerial implications of

this technique and provide directions for further research.

An Integrated Approach Toward the Spatial

Modeling of Perceived Customer Value

Although perceived value often has been defined as a

trade-off of quality and price, several marketing researchers

have noted that perceived value is a more obscure and complex construct, in whieh notions sueh as perceived price.

quality, benefits, and sacrifice all are embedded (Bolton and

Drew 1991; Holbrook 1994) and whose dimensionality requires more systematic investigation. In addition. Zeithaml

(1988) reports considerable heterogeneity aniong consumers

in the integration of the underlying dimensions ot perceived

value. She defines perceived value as a trade-off of "higherorder abstractions." sucb as perceived benefits and sacrifice,

which are formed from both intrinsic and extrinsic produet

attributes, including texture, quality, price, performance,

service, and brand name.

In this article, we propose a perceived value mapping

methodology (called VALUEMAP) that seeks to capture the

segnienl-level heterogeneity in the identification and

weighting of underlying higher-level ditnensions of perceived value, which is to be interred empirically from the

data collected from consumers. Subsequently, we ascertain

the nature of these latent dimensions in relation to objective

attributes. Also, we identify how brands are perceived by

consumer segments in terms of value in a given category.

Finally, these derived segments can be characterized from

individual descriptor variables.

In subsequent sections, we discuss the theoretical background of perceived value and tie it to our model formulation. We calibrate the model using empirical data from a

survey of respondents in the automobile category and compare the results from the proposed model against tnore traditional multidimensional scaling (MDS) models. In closing, we hicblieht both the contributions and limitations of

Customer value management (CVM) recently has become a major focus in contemporary marketing, as value

marketing has become a watchword annmg marketing practitioners (cf. BusinessWeek 1991; Gale 1994; Treacy and

Wiersema 1995). Perceived value has been called the "new

marketing mania" and "the way to sell in the 9()s" (BusinessWeek 1991). In the marketplace, value often is defined

as "quality at the right price" iProi^ressive Grocer 1984)

and is seen as more important to consumers than quality, because value is quality that the consumers can afford. Industry gurus such as Gale (1994) and Treacy and Wiersema

(199.')) have called tor better management of the perceived

customer value of a firm's consumers as the uppermost priority of its executives. To that extent, customer value analysis has been accorded particular importance, and a host of

value mapping approaches have been advanced in the industry (see, e.g., Brayman 1996; Gale 1994). It has been reported that the AT&T board now is supplied regularly with

three metrics; customer value, overall quality, and price

competitiveness (Gale 1994). Ongoing research at AT&T

has provided evidence of a significant relaiionship between

improved customer value ratings by consumers and overall

market share gains (Kordupteski and Vogel 1989).

*IriJrajii Sinlia is Assislanl Prct'cssiir of Marveling. Schuol ol' F^u^illo^^

und Management. Tenipk- Universily (e-iii;iil: j^iiihaC(?*shin,temple,edu).

Wayne .S. DeSarho is Mary Jean Smeal und I-Yank F. Snieal Disliiiyiiished

Chaired Prolfssor oi Markcling. Smeal C\illeyc of Business Administration, Pennsylv;iniii Sliile University (e-mail: desarbows'ji'aul.coin). The

uulhurs thank Rabikar Cliallerjee. Mariin R, Ynuiig, AnanI Kshirsagar,

Vijay Mahajan. Russ Winer, and four anonymous JMK reviewers lor eommeni.s on a previous version ol this article.

Journal of Marketing KcM'aich

Vol. XXXV (May 1998), 236-249

236

Spatial Modeling of Perceived Customer Value

237

thi.s article and provide an agenda for additional research in

perceived value.

THEORETICAL BACKGROUND

Research in marketing thus tar has lagged in the systematic investigation. expUeation, and measurement oflhe perceived value construct. Note thai the notion ol" value is

central to economic exchange and endemic to marketing, in

which ideally both the buyer and seller infer a value greater

than each gives up; that is. both parties are economically the

gainer because each receives something more useful to him

or her than what he or she has relinquished (Smart 1891).

Although considerable analytical focus has been directed

toward modeling con.sumers' purchase decisions using

scanner data or their preference structure through conjoint

analysis, only a few articles have studied perceived value as

a focal construct (e.g.. Bolton and Drew 1991; Dodds. Monroe, and Grewal 1991: Zeithaml 1988). As Holbrook (1994.

p. 22) notes, "despite this obvious importance of customer

value to the study of marketing in general and buyer behavior in particular, consumer researchers have thus far devoted

surprisingly little attention to central questions concerning

the nature of value."

Customer value analysis in industry usually has taken the

form t)f a simple mapping of the perceived value of customers, as is seen in Figure I (taken from Gale 1994). In

such approaches (see Brayman 1996; Cale 1994). several

important quality and price attributes arc generated first

from customer-based focus groups and/or managerial intuition. Well-informed customers then are asked to assign relative importance weights (e.g., out of 100) to these qualityand price-based attributes, as well as to rate the firm and its

competitors on the same attributes. These ratings (after appropriate sealing, such as dividing by a particular firm's ratings) are multiplied by the importance weights to obtain the

relative quality and price scores for the individual subjects.

Tbese scores are tt)taled across all persons and are the valtie

coordinates of the lirm and its competitors in a two-dimensional map. A fair-value line, typieally defined in the 45degree diagonal ofthe map, identifies brands that provide an

average level of value, whereas the better-value brands are

those that provide higher relative quality at a lower priee.

and tbe worse-value brands are the ones that provide lower

Figure 1

relative quality at a higher price. Hence. Brand D in Figure

I provides the highest relative quality ai the lowest relative

price and is the best value, whereas Brand B, whieh offers

the lowest relative quality at the highest price, is the worst.

Although they possess the merit of simplicity, such approaches fail to account for the heterogeneous weighting of

dimensions by consumers with respect to value. Furthermore, the dimensions are imposed a priori and not inferred

from actual customer perceptions of value. The position of

the fair-value line also appears somewhat arbitrary. In contrast, we formulate the VALUEMAP model on the basis of

the conceptual underpinnings of perceived value gleaned

from existent literature, as described subsequently.

Multiditnensional Nature of Perceived Value

Perceived value is clearly a multidimensional construct

derived from perceptions of price, quality, quantity, benefits, and sacrifice, and whose dimensionality must be investigated and established for a given product category. Treaey

and Wiersema (1995, p. 165) note that the key questions that

customer value analysis must address are '"What are the

dimensions of value that customers care about?" and "How

do competing brands fare on these dimensions?"

Instead of making the prima facie assumption that perceived value is solely a trade-off between relative quality

and relative price (cf. Brayman 1996; Gale 1994). our proposed model is based on an MDS framework that allows

perceived value to be dependent on an unknown (to be determined) number of dimensions (T). Furthemiore, consistent with Zeithami's (1988) exploratory results, these dimensions, in turn, can be cbaracteri/ed from obiective product attributes either by property fitting the inferred brand locations with the attribute matrix or by assuming brand locations to be explicit linear combinations of a vector of objective product attributes, tbat is, linearly constrained as

Z|^T|^iZ|j^, where Z - [(z;t:)| is a known matrix of k attributes

for j brands. Therefore, we are able to ascertain the nature of

the inferred dimensions of perceived value post hoc from

the impact coelficients (Ti^,). These linear constraints imposed on the stimulus/brand dimensions are the same as

those presented in CANDELINC (Carroll. Green, and Carmone 1976; Carroll. Pruzansky, and Kruskal 1980), threeway multivariate conjoint analysis (DeSarbo et al. 1982),

and GENFOLD (DeSarbo and Rao 1984, 1986) (for a similar approach to constrained principal components analysis,

see also Takaiie and Shibayama 1991).

CUSTOMER VALUE MAP (GALE 1994)

Sources of Heterogeneity

Market Feneived Qtntltiy finlin fKelatne Qmduyi

VViirsi' Cufiliimer

V iiluv

ii

A

Bi'tlvr<'usluiii.'r

Valuv

.Super

Various sources of heterogeneity can be identified regarding the perception of value that arises from differences

among consumers, product classes, and consumptive situations (Holbrook 1994; Zeithaml 1988). Empirical evidence

ha.s demonstrated that intersegment differences inOuence

the weighting ofthe perceived value dimensions. For example, Zeithaml (1988) reports that one segment judged value

from only quality, another from only priee. a third from both

quality and price, and, finally, a fourth from all "get" and

"give" eomponents. Segment characteristics (i.e.. background variables) such as age and income al.so have been

shown to affect the perception of value (Boiton and Drew

1991). Customer value analysis is also dependent on the

product class insofar that tbe salient value dimensions for a

238

JOURNAL OF MARKETING RESEARCH, MAY 1998

product elass, such as orange juice, clearly will differ from

another, such as automobiles. Makiguchi (1964) also discusses how perceptions of value are not immutable, but

change with the changing circumstances (situations) ofthe

person.

In our proposed model, we accommodate individuallevel heterogeneity through a latent structure Ibrmulation.

Latent structure MDS models bave been implemented

widely to incorporate consumer heterogeneity in marketing

models (see DeSarbo, Manrai, and Manrai 1994; De Soete

and Winsberg 1993). Here, the advantage is that we are able

to estimate simultaneously the brand and segment locations

and segment sizes and composition and then are able to

characterize the segments from background variables post

hoc by using the segment membership probabilities. The

traditional altemative approach to such latent structure

MDS modeling has been to perform MDS first and then

cluster consumer points/vectors. However, such a naive

two-step procedure has been criticized heavily in recent

psychometric and classification literature (cf. DeSarbo,

Manrai, and Manrai 1994). Gnaiiadesikan and Kettenring

(1972), Chang (1983). and Dillon, Mulani, and Frederick

(1989) demonstrate that if researchers retain components

with the larger eigenvalues, they often might fail to retain

valuable information about distances or clusterings contained in components with smaller eigenvalues. In addition,

such two-step procedures (spatial analysis, then cluster subject coordinates) involve selecting a specific spatial model,

rotational scheme, method ot nt)rmalizing subject coordinates, preprocessing for clustering, type of cluster analysis,

and/or a metric (in some cases), which most often will produce different results.

different brands are perceived by different consumer segments in tenTis of value, that is, if the brand locations are

found to be positioned above, in, or below the thresholds.

Role of Referetice Thresholds

Perceived value is typically a relative judgmentwhen

people evaluate a certain brand as a good buy, it is in comparison with other similar brands. Therefore, Tversky and

Kahneman (1991) advance a value framework in which the

perceived values of dilferent altematives are evaluated relative to a multiattribute reference point. Bolton and Drew

(1991) also find disconfirmation to be a major predictor of

perceived value of telecommunication servicesdisconfirmation (operationali/.cd as improvemetit) inherently implies

a comparison of the focal service with an intemal reference

level. Industry consultants such as Treaey and Wiersema

(1995, p. 21) report that for a firm to stay ahead, it must

exceed threshold standards of dimensions of value because

'[a|s value standards rise, so do consumer expectatitjiis."

Sherif and Hovland (1961) also discuss how subjects use

thre.sholds that circumscribe a zone or latitude of indifference for judging stimuli. Simon (1959, p. 264) notes there

are thresholds or aspiration levels for economic agents that

"define a natural zero point in the scale of utility."

Therefore, in the proposed model we assume that perceived value is judged by consumers relative to a reference

zone that represents his or her baseline expectations and is

bounded by upper and lower thresholds. A person's value

perception will be better than, worse than, or same as his or

her expectations only if the perceived value exceeds, falls

short of, or is bounded by these thresholds, respectively. Because these reference thresholds are to be estimated simultaneously for each segment, it is possible to determine how

METHODOLOGY

The VALUBMAP mode! is implemented as a latent .structure, bilinear, MDS vector model with reference thresholds

that use consumers* empirical categorizations of perceived

value (relative to expectations) as input data. Therefore,

subjects are asked in the empirical study only if the perceived value of a given brand is better than expected, same

as expected, or worse than expected^just as a shopper

browsing at a slore can determine quickly which are the

"good deals,"" the "so-so value" brands, and the "rip-offs."

Varian (1987) notes that few people have been known to

rate the value of individual brands in a numerically reliable

fashion. (Economists circumvent this issue by assuming

ordinal utility.) Measurement researchers find that if a stimulus is not highly discriminable, a scale with several categories does not improve accuracy and can be confusing (cf.

Komorita and Graham 1965). There is also some empirical

evidence showing tbat a scale with fewer response categories is considered easier to rate by subjects (see Diefenbach, Weinstein. and O'Reilly 1993). Although the

trichotomous category scale used here makes minimal

demands on the subjects" reporting a judgment as complex

as perceived value, the predicted perceived value of brands

from the model in the brand-segment space is still interpretable on a metric scale.

Let us define the notations as i = I, ..., I consumers; j = 1,

..,, J brands; k = I, ..., K attributes; s - I, ..., S segments or

latent classes; t - 1,..., T dimensions; and r = 1, ..., R replications (e.g., time, consumptive situations, experimental

treatments).

Furthermore, we define

5||p = an empirical categorization given by consumer i of

brand j in replication r if value is less tban expected, same as expected, or more than expected (coded

arbitrarily as - I , 0, I, respectively);

a^, = vector coordinate for segment s on t'*" dimension;

bj, = brand j location on t"' dimension;

U^ = upper threshold for segment s; and

L^ = lower threshold for segment s.

In the usual latent-class assumption, we assume there are

S (unknown) segments or latent classes, and each consumer

belongs to only one of these. Let the probability of consumer i belonging to a segment s ( - I

S) be given by A.^,

where 0 < X., < 1 and l.X = '

Now, let us denote the perceived value of a brand j for

consumer i (conditional on being in segment s) in replication r to be denoted by "^i\f\^~ and we represent perceived value in a scalar products or vector formulation (cf. Tucker

I960)as

{1}

a b

I

^'

Jl

ijr s

where the error term is distributed as i.i.d. N(0. a

Because the variance tenn is unidentifiable, without any

loss of generality it can be assumed to be I.

239

spatial Modeling of Perceived Customer Value

Then, consumer i in a given segment s will indicate that

brand j offers a higher-tlian-expected level of value in replication r if and only if the perceived value of thai brand exceeds the upper threshold for that segment. Therefore,

Pi 8 , = 1 = P V , > U

(2)

Ijrs

ijt\.

J -Va b

a b.

>U -

=P

^^

M Jt

because we have a.ssumed a, to be 1. Note that <l> i.s the c.d.f.

of the standard normal distribution.

By the same argument, the consumer will judge that

brand to have an expecled level of value if the perceived

value of that brand fall.s within the segment-specific upper

and lower thresholds. Hence,

[?) P 5

=0

- P L < V

< U^

= PI

< e . I <

Finally, the consumer will perceive Ihe brand to have a

lower than expecled level of value if the perceived value is

less than the lower threshold for the segment:

(4)

P5

=-1 \=P\ V

<L U

L - > ;i h

The conditional likelihood of the i"" consumer can be specified as

(5)

I-

where:

a.ir - 1, if 5ijr = - I , 0 otherwise;

p = 1, i f 6,.r - 0, 0 otherwise; and

Y ,. - 1, if'S,.f- 1 , 0 otberwise.

Tbe unconditional likelihood is then L; = S^X^L^j^, where

the X^s are the mixing proportions thai satisfy tbe usual

probability constraints. The complete likelihood function

across all consumers can be written as

(6) ^ =

, hence In L = /

In

As was discus.sed previously, an option exists to have bj,s

linearly constrained as = Iikt^jk- f''" K < J. where Z = [(Zj^))

is a prespecified matrix of attribute values for the different

brands. We can perform a likelihood ratio test to determine

if the previous constraint is meaningful (as contra.sted to the

more general unconstrained solution) for fixed S and T.

Then, t^t is the impact coefficient in dimension I for

attribute k. Other ways of interpreting the dimensions

include correlating the matrix of brand location estimates

with the attrihuie matrix or through general property fitting

methods.

In the proposed VALUEMAP model, the posterior probabilities of membership are determined simultaneously, given the parameter estimates within any iterate, as

(7)

where Pj,, represents the posterior probability of the i''' consumer of belonging to segment s. A^ is the estimated segment weight, and L||^ is the estimated likelihood function for

the individual subject at any given iterate.

Given the A - ||(6|j|)|} and Z matrices, the objective is to

obtain maximum-likelihood estimates of a,b,(or T),U,L,X, to

maximize the log-likelihood in Equation 6. As such, the proposed methodology can be viewed roughly as a multidimensional and latent class extension of Thurstone's Law of

Categorical Judgment (Thurstone 1927, 1959; Torgerson

1958) that involves replication over persons (Class II) and

successive intervals (Condition D). This latent structure

MDS lormulaiion extends the methodological developments of Carroll (1972, 1980), DeSarbo and Cho (1989),

Bockenholt and Gaul (1989). and DeSarbo, Howard, and Jedidi (1991). Carroll (1972, 1980) developed MDPREI-a

metric MDS vector model hased on singular value decomposition for the analysis of metric preference or dominance

data. Here, eacb consumer is represented by a vector pointing in the direction of increasing preference, and brands are

represented by points in this T-dimensional joint space. As

such, our proposed methodology is not restricted solely to

the analysis of perceived value, but also can be used to represent preference or cboice judgments obtained from a trinary ordered scale. DeSarbo and Cho (1989) present a stochastic MDS threshold vector model for pick any/N binary

choice data that enables reparameterization of Ihe stimulus

space, but the vectors also are estimated at the individual

level. Bockenholt and Gaul (1989) present vector and unfolding MDS models for a latent structure analysis of binary pick any/N data, as well as a general framework for ordered category data (without opcrationali/ing il in tcmis of

a demonstrated st>ftware program). DeSarbo, Howard, and

Jedidi (1991) generalize this latent structure approach

(MULTICLUS) to continuous data (De Soete and Winsberg

(19931 generalized the DeSarbo, Howard, and Jedidi |I991|

approach two years later to accommodate linear restrictions). The present lalent structure MDS approach operates

on trinary ordinal scale data (not binary choice or continuous dala), estimales segment level vectors, and allows for a

reparameterization of the stimulus/brand space, with reference value thresholds. We chose to represent perceived value by a vector model (versus an ideal point model) because

the monotonicity assumption ("the more the belter") makes

explicit sense (cf. Dodds, Monroe, and Grewal 1991) iii this

240

JOURNAL OF MARKETING RESEARCH, MAY 1998

application (higher values of latent dimensions or ullributes

should increase perceived value). In addition, iniernal unfolding procedures are noted lor dilTiculties wiih degenerate

solutions. (Technical details regarding the maxnnuni likelihood estimation (algorithm) of the proposed model ean be

obtained from either author; interested readers can contact

the senior author retzardiiitz the S-Plus computer program for

VALUEMAP.)

Because neither S (number of segments) nor T (number

of dimensions) are known beforehand, the algorithm must

be run with different values of S and T. However, only solutions for S > T are identified (see DeSarbo, Manrai, and

Manrai 1994). Different information eriteria such as the

(modified) Akaike information Criterion (AIC), Bayesian

InfonTiation Criterion (BIC). and Consistent Akaike Information Criterion (CAIC) are considered as heuri.-^tics to

choose the mosl parsimonious values of S and T.

Finally, a note about model identifiability: There are two

aspects to the issue of identifiability of the VALUF.MAP

model here. Firsi, because it is a mixture model of univariate normals, we note that a finite mixture of univariate normal distributions has been identified (Teicher 1963). Second, there are Iransformational indeterminaeies in a bilinear

MDS model of [his nature. Consequently, we must subtraet

T- from the number of free parameters in the mode! because

of these indeterminacies (a general nonsingular linear transformation). Finally, to ensure that the segment vectors can

be embedded uniquely in the multidimensional space, the

condition we must satisfy is for S to be greater than or equal

to T (see DeSarbo. Manrai, and Manrai 1994).

AN EMPIRICAL ILLUSTRATION

The Dala

In an empirical illusiration of the VALUFMAP model,

we selected the small-car eategory and collected data

through a survey of a student sample. Ninety-five students

(mostly seniors) in an undergraduate marketing class In a

major midwestem university were used as subjects for the

survey and were asked to rate 12 small cars. Of the 95 subjects, 79 (i',39r} reported owning their own vehicle, and the

median number of years driven was six. The subjects were

provided information on the following attributes of these

cars, taken from Consumer Reports (1995): (1) manufacturer type (i.e., one of the following categories: General

Motors, Ford, Chrysler, Toyota. Honda, and Other Japanese

Manufacturer), (2) reliability. (3) mileage, (4) satety features, (5) cost factor, (5) depreciation, (7) performance, and

(8) average price. We prt)vided Ihis information beeause of

the young age of the student sample and because few had

ever purchased tbeir own car in this eategory. Therefore, we

attempted to equalize familiarity of the brands across the

sample. VALUBMAP still could be performed on unaided

perceptions without displaying such attribute infonnation a

priori. Information on price, reliability, depreciation,

mileage, and cost factor was readily available from Consumer Reports, and the performance and safety ratings were

obtained indirectly from the descriptions of performance

and handling and the available safety features of tbe individual ears. The average price was obtained from the mean

(after rounding) of the range of sticker prices for various

lines of each car. Reliability is a judgment by Consumer

Reports based on frequeney-of-repair data for pasi models

of the vehicle. Cost factor represents the percentage ol the

.sticker price that is dealer's co.st and thus denotes the bargaining power the consumer has over the dealers. The

attribute matrix (denoted by Z) for the empirical study is

shown in Table 1.

The subjects were provided with these attribute profiles

and were asked to evaluate the perceived value of each car.

No prior definitions or interpretations of the perceived value concept were provided to the subjects. The value categorizations given by the subjects constituted the A matrix of

consumer evaluations for R - I replication. Subjects also

were asked about the perceived importance of these attributes; their preference lor American versus import ears; the

perceived importance of price and quality; as well as current

vehicle ownership, purchase intentions, sex. age. and college major. These data were used as the matrix of the consumers' background descriptor variables (D).

Trudilional MDS Approaches

Here, we sought to investigate first the performance of

two existing MDS vector model formulations for the analysis of this collected data set. We initially perlbrmed an

MDPRFF analysis (Carroll 1972. 1980) of the - I . 0. 1

coded scores for the 95 student subjeets. The resulting scree

plot indicated one strong dimension (variance accounted for

[VAF| := 56.7%) and a possible weak second one (VAF 11.8%). We treated the data as originally coded, as pei the

suggestion of one reviewer. However, different preprocessing schemes in such metric analyses (e.g., row/column normalizations) can produce difierent results. At the request of

a different reviewer, we repeated this MDPREF analysis

using row normalized data with zero mean and unit sum-of

squares. The resulting solution yielded similar results to

those presented here with one strong dimension (VAF =

60.1%) and a possible weak second one (VAF = 10.6^/(). A

common scree plot test of cumulative VAF would point to a

one-dimensional solution in each case, given the dramatic

drop-off of explained variance afier the first dimension and

the subsequent leveling off of VAF by dimension for additional dimensions. However, we will report two dimensions

for the sake of subsequent comparison. The eanonical correlations (used bere as an approximate configuration matching

procedure) between the two MDPRFF subject vector spaces

were .943 and .882. .999 and .985 between the two

MDPRFF brand spaces, and .993 and .891 between the two

MDPRFF joint spaces. The interpretations from these two

MDPRFF analyses arc quite similar. Figure 2 depicts the

initial two-dimensional joint space MDPREF map, which

accounts for 68.5% of the variance in these value judgments. As is shown, the vertical dimension appears to distingui.sh the subject vectors as they are oriented toward the

left-hand side of the map. Here, the Impreza, Neon. Sentra.

Corolla, and Metro are depicted as the automobiles of highest perceived value by the majority of these subjects,

whereas the Summit and Mirage are the lowest-valued automobiles. In property fitting the attribute factors displayed in

Table I, we see that import status, reliability, performance.

mileage, and safety lead to improved value perceptions,

whereas price and cost factor diminish them, as we

expected. To uncover market segments, we might consider

cluster analyzing these subjects' vectors. However, as we

diseussed previously, there is substantial controversy in

241

spatial Modeling of Perceived Customer Value

Table 1

ATTRIBUTE PROFILES FOR THE EMPIRICAL APPLICATION

Mileu\;e

Ntimhi'r

Maittifacturer

Ri'liahilitv

(tnilf\ jH'r

i<alli>n)

Safety

Cosl

Factor

A iTt-a\-i'

Dcprcciatidti

Pi'rftirmance

Price

87%

Betier than

average

Average

% 12.(X)0

Saltirn

GM

Average

2.1

A verage

Subaru Iniprc/a

OJM'

Better than

average

29

Beller ihan

average

91%

Average

Betier than

average

14,(KH>

Chevy Cavalier

GM

Average

26

Average

94%

Average

Beller Ihan

average

13.000

Eagle Sumiiiii

Chrysler

Worse than

average

34

Worse ihati

average

92%

Worse than

average

Worse Ihan

average

12.000

Dodge Neon

Chrysler

Average

31

Better than

average

93%

Average

Better than

average

11.000

Ford Escort

Ford

Average

33

Average

92%

Worse than

average

Worse than

average

!I.(HH)

Geo Metro

GM

Average

33

Average

93%

Average

Average

9.000

Honda Civic

Honda

Belter than

average

29

Average

90%

Woi>c than

average

Better than

average

I5.(K)O

MazJa Protege

OJM

Average

33

Average

90%

Worse than

average

Better than

average

15.(KM)

Mitsuhi.shi Mirage

OJM

Worse than

average

30

Worse than

average

90%

Average

Worse than

average

12.000

Toyoia Corolla

Toyoia

Betier than

average

30

Average

88%

Average

Beller than

average

16.(MK)

Nissan Sentra

OJM

Belter than

average

30

Average

88%

Average

Better than

average

13,(KM)

10

1 1

12

+OJM = Olher Japanese Maniilaciuter. (e.g.. NLssan. Suharu, Mazda).

Source: Cimsutiter

Rcpi/rts (1995).

cluster analyzing such MDS results. To illustrate these difficulties, we pcrtbnncd cluster analyses of the untiormalizcd

MDPREF vectors, includitig LI K-meatis cluster analysis atid

Ward hierarchical cluster analysis. The Ward dendrogram

pointed to two or three clusters, whereas the scree plot of the

within sum-ol'-squares by numbers of clusters in K-means

denoted three clusters. We focus on two clusters, given the

analyses to follow. A 2 x 2 cotitingeney table was constructed after optimally permuting cluster labels. Twentytwo subjects were classified differently between these two

schemes, and the resulting chi-square = 36.46.'S was significant beyond p = .001. which indicates that the two segmentation schemes appear utirelatcd lo each other, even though

they were computed on the basis of the same dataa typical problem encountered with naive, two-stage approaches.

To attempt to uncover market segments (cf. Zeithaml

1988), we applied the MULTICLUS latent structure vector

MDS model to this - I , 0. I vaiue data. As with MDPREF,

preprocessing will alfeet the results, so we sitiiply analyzed

the raw data in T, S = I

4. According to all intbmiation

heuristics, the T - S - 1 solution is the most parsinu)nit)us

solution, though it is rather uninteresting to exhibit.

Nonetheless, we still can convey the unidimensionality and

one segtnetit vector by examitiing the T = S = 2 solution in

Figure 3. This figure aptly describes a one-dimensional subplane on which the 12 automobiles order themselves. In addition, there is little angular separation between the two segments" vectors, which indicates virtually no heterogeneity

between these value perceptions. All that cati be gleaned

from this analysis is that we can recover the marginals in

value perceptions for the 12 brands and order them from

high (Impreza, Sentra) to low (Sutnmit, Mirage). Clearly,

the mixture distribution assutiiptions of the MULTICLUS

procedure are violated with the use of such trinary data. It is

interesting to note the rather dramatic differences in the

MDPREF and MULTICLUS solutions even though we used

the derived MDPREF stimulus space as a rational start to

MULTICLUS. (This satne MULTICLUS analysis also was

run from ten different random starting positions, with the

same solution obtained as was presented |up to fourth place

decimal in log-likelihood functioni every time). Cars such

as Saturn and Cavalier, wbich are perceived as "average values" in tbe MDPRHF solution iti Figure 2. appear among the

best values in MULTICLUS in Figlire 3.

In summary, bt)th traditional procedures appear inadequate for data of this type, given the goals of the analysis.

MDPREF assumes metric data and estimates vectors at the

itidividual consumer level. Difficulties can arise in attemptitig to cluster analyze MDPREF results for market segmentation purposes. MULTICLUS uncovers tnarkct scgmetits

but assumes metric, normally (a mixture) distributed data.

Both produce dramatically different solutions. In addition,

neither procedure accommodates the estimation of reference

thresholds or cutoffs. As such, there is no accurate mechanism for making - I . 0. or +1 predictions from the scalar

products of brand points and consutner vectors, as these

metric predictions necessarily fall outside the range of this

ordered trinary scale. As we show subsequently, neither pro-

242

JOURNAL OF MARKETING RESEARCH, MAY 1998

Figure 2

MDPREF SOLUTION IN TWO DIMENSIONS

Price

Ruliabilily

Safety

/////'

/ill ' !

cedure allows for the cxplicii brand reparamcterization that

is needed for assessing prediclive validation.

VALVEMAP Results

Because the number of segments (S) and dimensions (T)

have to be prespecified, we perlormed the estimation tor different S and T combinations and selected the hest solution

on the basis of the inforiiKHion criteria, such as the BIC and

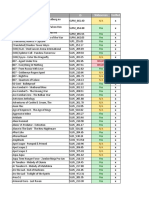

the CAIC. Table 2 reports the respective values of tlie loglikelihood and the infonnation statistics. Note that, as was

expected, though the log-likelihood monotctnically

decreases with increased parameterization, both the BIC

(1723.42) and CAIC (1752.42) indicate that the S ^ 2, T = 2

solution minimi/.es these information criteria. Only the

modified AIC statistics seem to point to the S = 3, T - 3

solution as the best one. However, for the ease of three segments and three dimensit)ns, this model yielded estimates of

mixture probabilities (i.e., A.^s) of .58, .01. and .41. In other

words, the S = 3, T = 3 solution nearly collapses to a twosegment solution. We note further that the BIC and CAIC

are considered more reliable criteria than the modified AIC

because tbey penalize over-parameterization more than the

modified AIC and are therefore more conservative (see Bozdogan 1987; Rustetal. 1995).

Cosl

The VALUEMAP two-segment, two-dimensit>nal unc(Mistrained solution is displayed In Figure 4. The estimated segment weights (X^s) are .64 and .36. Two distinct segments in

the data are indicated by the clear separation of the segment

vectors in the two-dimensional space, as well as by an entropy-based measure (bounded between 0 and 1) that examines the centroid separation of the conditional parametric

distributions (.see DeSarbo et al. 1992). The entropy value in

this case was .86 (a value close to I indicates that the centroids are well separated for the ntimber of segments specified). The (rotated) location for the first segment is 1.01 and

.43 in two dimensions. Therefore, Segment I weights the

horizontal dimension (Di[nension I) much more than the

vertical one. In contrast. Segment 2 weights the vertical dimension (Dimension 2) more than the horizontal, as its (rotated) location is .43 and -.75. We note in Figure 4 that, for

Segment I. the Subaru Impreza, Nissan Sentra, and Dodge

Neon are considered good values, whereas the Mazda Protege, Honda Civie, Toyota Corolla, Saturn. Geo Metro,

Chevrolet Cavalier, and Ford Hscort are projected near reference values. The Civic and Protege are poor values for

Segment 2, whereas the Impreza. Sentra, Neon, and Metro

are good values. Note that for both segments Mitsubishi Mirage and Fagle Summit are perceived as poor values.

243

spatial Modeling of Perceived Customer Value

for the eost factor correlation being highly negative. Given

the location ofthe two segments and the previous interpretations of the two dimensions, it appears that Segment I

weights the quality dimension more than the sacrifice one,

whereas the reverse is true for Segment 2.

The nature of the dimensions, as uncovered from the prior

analysis, also can he validated by an examination of Figure 4.

Cars such as the Subaru Impreza. Nissan Sentra, and Dodge

Neon received excellent ratings from Cotisutner Reports on

reliability, safety, and performance features. Consequently,

these cars are found to be high on Dimension I, which, it may

be recalled, is characterized by these attributes. In contrast.

both the Mit.subishi Mirage and tiagle Summit, which are

perceived as poor values by both segments, were given

To interpret the dimensions of the derived space, the

brand location matrix was correlated wiih the attribute matrix. Table 3 provides these correlations, which can be used

to infer the nature of the perceived value dimensions. It appears that Dimension 1 is dominated by the reliability, performance, and safety attributes of an automobile. Overall.

this dimension can be interpreted as the "benefit" aspect of

the car. The second dimension is dominated by the importorigin, cost factor, and price attributes of the car. This dimension can be labeled broadly as the "sacrifice" or the

"cost-based" dimension. Note that the cars high on this dimension are imports, generally are more expensive, and

have lower cost factors because there is less bargaining

leverage, as compared to American models. This accounts

Figure 3

MULTICLUS T = S - 2 SOLUTION

* Saturn

* Sentra

*lmpreza

Segment 2

*Cavalier

*Neon

*Metro

C orolla

Segment 1

^Civic

*Protege

*Escort

'Summit

*l\/lirage

Table 2

MODEL CALIBRATION RESULTS: KEY STATISTICS

Crilcrui

Free parameters (#)

t,og-likelihood

Modified Ate

BiC

CAIC

S^

t T= I

14

-84L77

17''5.54

1747.^9

1761 29

*lndiciilcs the minimum lor the corresponding row.

S^2T^t

18

-829.57

1713.14

1741.11

1759-11

.V

^2T=2

29

-795.68

I678.-K1

1723.42*

1752.42*

S = 3T^ 1

22

-819.25

1704.50

17.18 69

1760.69

S = _i T = 2

34

-788.43

1678.86

1731.69

1765.69

.V = 3 T ^ J

44

-768-29

1668.58*

1736.95

1780.95

244

JOURNAL OF MARKETING RESEARCH, MAY 1998

Figure 4

VALUEMAP OF 12 CARS

Ma; da Protege

Honda (I!!ivic

Segment 1

Upl

.2

Tpyola Corolla

Mitsubishi Mirage

L()2

. . . . . .

^y^

Chevy

Cavalier

Lol \

Eagle

Summit

Saturn

\,

/ ^ :., Ford

\ Escort \

Subaru

Impreza

Nissan

Sentra

Scgmctit 2

Geo

Metro

Dodge Neon

Dimension 1

Table 3

MODEL CALIBRATION RESULTS INTERPRETING THE

DIMENSIONS

Attribute

Amencan/impori

Reliahiliiy

COM factor

Pcrlormaiico

Price

Mileage

Safety"

Depreciation

Dimension t

Dtniensioti 2

-.1129

.466

-.072

.569

-.09

,093

.536

.077

-.653

.261

-.677

..^61

.825

.095

-288

.026

"Worse than Average" ratings hy Consumer Reports on performance, safety, and reliability atirihutes. Japanese cars,

such as the Ma/_da Protege, Honda Civic, and Toyota Corolla, are located high in Dimension 2, which is dominated by

the import origin, price, and cost factor. Low priced American cars, such as the Ford Escort, Geo Metro, and Dodge

Neon, are found to be low on this dimension. We note that, in

general, Japanese cars are more expensive than American

cars in this class and offer less bargaining leverage, which

explains why these cars are high on this dimension.

To compare these VALUEMAP results with those obtained from MDPREF and MULTICLUS more formally, we

used canonical correlation as an approximate configuration

matching procedure. In matehing the stimulus/brand space

between MDPRBF and VALUBMAP, we obtained canonical correlations of X\ = .998 and X2 - .957. which indicates

that hoth solutions can be rotated orthogonally tt) high congruence. Unfortunately, we have no easy way of comparing

the consumer versus segment vectors hecause of their different orders. We al.so compared the full MULTICLUS solution with that obtained frt)m VALUEMAP by stacking the

segment vectors (after similar normalizations with adjustment to the brand space) atop the brand coordinates. Here,

X^ = .995 and ^2 - -*^^ indicate one dimension in common

between these two solutions. (We also performed Ward and

K-means cluster analyses to the raw data in two clusters and

then pertbrmed a two dimensional MDPRFF analysis on

these averaged scores, as per the suggestion ot a reviewer.

The two sets of canonical correlations between these solutions and VALUEMAP were X, = ,745 and Xi ^ .351 for Kmeans, and k[ = .812 and ^2 = -313 for WARD. These results also indieate some, but not full, congruence with the

VALUEMAP solutions.) At the insistence of one reviewer,

we compared the K-means and Ward segmentation schemes

245

Spatial Modeling of Perceived Customer Value

Table 4

MODEL CALIBRATION RESULTS CHARACTERIZING SEGMENT V

CoetfuieiUs

Value

.Stttiiilarcl Error

Intercept

Sex

Maniifucturcr

Oeprcciaiion

Siilety

Perlormance

I'ricc scnsitiviiy

Qualiiy seasitivily

Preference tor Japanese curs

-.512

.733

-.046

-.104

.03

.224

-.379

.157

.017

.191

.053

.013

.014

.015

.018

.024

,03

.007

t-vithii

-2.689

13.752**

-.3.521**

-7.002**^

1.988**

12.72**

16.086**

5.147**

2-445**

liitetprcttttitin

Mostly leniiile

Brand in.sensitive

Depreciation unimporlanl

Salety conscious

Performance consciotis

Price insensitive

Quality conscious

Prefers Japanese cars

'The interpretation of .Segment 2 is just !he reverse of

**/'<,05.

with that produced by VALUEMAP. We performed two

chi-square tests with the resulting contingency tables

formed after optimal permutation of cluster labels. The Ktneans solution classified 14 of the 95 subjects differently

and produced a significant chi-square dip = .001. The Ward

solution cla.ssified .U suhjects differently, al.so producing a

significani chi-square at/7<.001. Thus, we obtain a different

segmentation scheme with VALUEMAP than can he obtained with traditional methods.

Next, we sought to characterize the two uncovered VALUEMAP segtiients in the data. To accomplish this, a logistic regression was performed with the estitnated segment

tnembership probabilities from the base VALUEMAP model (i.e.. with (P||/l - P||) as the dependent response) and the

individual descriptor variables (D) from the matrix as eovariates. Because there are two segments, only one regression is necessary. Table 4 offers the interpretations of Segment I relative to Segment 2 (note thai the meaning of Segment 2 is just the reverse ofthe first segtnent). The t-values

for all eovariates are significant (however, we tiote that the

t-statistics have only approxitnate meaning in this regression). Therefore, we find that Segment 1 is mostly female;

price and brand insensitive; safety, perfortnance. and quality conscious; and prefers Japanese cars. In contrast. Segment 2 is mostly male; highly price and depreciation conscious; less interested in the safety, performance, and quality aspects of the autotnobile; and prefers American cars.

The key result of this analysis is that for one segment,

cotnposed mostly of young tnale subjects from the empirical

study, the perceived value of automobiles seems to be driven getierally by the sacrifice (price and depreciation) aspecL In contrast, another segment, consisting tiiostly of fetnale subjects, defines perceived value in terms o\' the quality and performance. This finding relates closely to the empirical results reported hy Zeithaml (1988) from focus group

studiesamong tbe four segtnents described by the author,

one group saw perceived value as the quality attributes of

the brand, whereas another judged the value of a brand from

its priee. that is. whatever was low-priced was good value

for them. Although Zeithaml did not report the nature of

these two segments, the VALUEMAP tnethodology tnakes

it possible to detertnine quantitatively the ditnensionality

and heterogeneity of perceived value, as well as to characterize tbe nature of the eonsumer segments.

Subsequent to the prior analysis, we opted to constrain the

brand locations to a linear combination of the attribute ma-

trix. Seven salient attrihutes of automobiles were provided:

country of origin, reliabiliiy, cost factor, performance, price,

tnileage, atid safety. The depreciation attrihute is elitninated,

because prelitninary analysis revealed that addition of this

attribute to the attribute matrix does not improve the information criteria. The estimated mixture probabilities tor the

two segtnents in the constraitied tnodel solution were .62

and .38. The log-likelihood for the model ft)r S = T - 2 is

-821.36, and tbe infonnation statistics are as follows: modilled AIC = 1705.72; CAiC = 1759.35; and BIC = 1738.35.

Tbe likelihood ratit) test results in a chi-square statistic of

6.42 with 8 degrees of freedom and a />-value of .60

(nonsignificant). Because the constrained model is nested in

the unconstraitied model, these results indicate that the latter model is superior to the fomier for the present study (as

determined hy a likelihood ratio test, as well as comparison

ofthe infonnation heuristics). It is possible that the attrihute

matrix might he enriched with the addition of more charaeteristics that are not under the purview of this application.

The VALUEMAP joint space for the constrained solution is

shown in Figure 5.

Validation

To establish the validity of the results obtained by the

Maxitnum Likelibood Estitnation procedure on tbe empirical data, we performed a small-scale predictive validation

study. Data corresponding to two hrands chosen at random

were removed from analysis as a holdout sample. The holdout brands for this study happened to be Saturn and Subaru

Impreza. The constrained model was then calibrated and all

the parameters for the new model were reestimated. The

locations ofthe two holdout brands then were forecast using

the reparameteri/.ation: B - Zi. The predicted locations of

both brands correspond well to those estitnated from the full

data seL A canonical correlation analysis between the segment and hratid location matrix, estimated from the validation subsatnpie (appended with the predicted locations of

the two holdout brands), and the originally estimated segment and brand location matrix produced canonical correlations of .98 and .97.

Next, to complete the validatioti procedure, we sought to

predict the data that have been held out of the original A tnatrix. A comparison ofthe actual versus predicted data yielded the result that 76% (144 of 190) of the original eategorizations had heen elassified correctly by the estimation procedure (we would expect 33/<%, by chance). Of 190 mis-

246

JOURNAL OF MARKETING RESEARCH, MAY 1998

Figure 5

VALUEMAP OF ^2 CARS (REPARAMETERIZED MODEL)

Honda Civic

Upl

^._

Mazda Protege

Toyota Corolla

X.

// c Segment. ,1

-.,..

Subaru

,

Inipreza

*

Nissan

/

Sentra

/

/

Cbevy

Dodge Neon

/

Satttrti

Cavalier

Lo2

. /

/

\,^^

X^

Mitsubishi Mirage

/

Lol

^^^-^

Geo

Metro

\ .

/Pord

SutTimii rbsciMl

Segment 2

Dimension 1

S=2T=2

classified entries. 44 (23^^) were off by one position (i.e.. 0

instead of 1. 0 instead of -1). and only two etitries were off

by two positions (I instead o f - 1 and vice versa). Figure 6

depicts the predicted locations for the two cars held out of

the analysis. Note how close they are to their actual positions in Figure 5. Consequently, the results of this validation

study using the etnpirical data enable us to establish further

the utility of the VALUEMAP methodology atid the estimated results describe!.! previously.

DISCUSSION

The VALUEMAP tnethodology allows for the sitnultaneous estimation of brand location paratneters in terms of

value perceptions and the segmentatioti of consumers in a

joint-dimensiotial space. The results help detertnine the

dimensions of perceived value for a given category for a

giveti pool of suhjects. The location ofthe brands also indicates how different brands fare on the identified diiiiensions

oi" value. For example. Figure 4 reveals that the Subaru

Itnpreza does well on the reliability, safety, and performance dimension, whereas tbe Dodge Neon fares well on

both dimensions, Tbe importance weights assigned by the

segments to the ditnensit)ns also are indicated by their estimated locations. The compositions of the dimensions were

ohtained from correlating the hrand location tnatrix with the

attribute matrix (or itispection of T). The brands locatetl

between the segment-specific thresholds are the "reference

brands" for the corresponding segmentsthey have both

theoretically appealing and managerially practicable implications (cf. Mardie. Johnson, and Fader 1993; Tversky atid

Kahnetnan 1991), Utitil tiow. the concept of reference

hrands has beeti ad\anced, but VALUBMAP provides ;t

concrete technique for identifying them. We also ba\e seen

how the proposed methodology accounts for the latettt

dimensionality and heterogeneity better atid that its results

are tnore meaningful than tbose obtained from competing

approaches such as MDPREF and MULTICLUS, whose

underlying assutiiptions ate violated given such ordered categorical judgments.

There are several ob\ioits limitations ofthe article. First,

though the methodoUigy has been able to indicate if brattds

are perceived as good, reference, or poor values, it doe.s not

tell us about how value perceptions are fomied. Instead, the

focus here is on explicating the nature of perceived value. In

the etnpirical illustration, attrihute information was provided to the subjects a priori to equalize fatniliarity of the

brands across subjects because of their youth and lack of

prior experience in buying in this product class. Here, VAL-

247

spatial Modeling of Perceived Customer Value

Figure 6

VALUEMAP VALIDATION

Honda Civic

Upl

Mazda Protege

\ ^

Lo2

Mitsubishi Mirage

Segment 1

ToyotUyCorolla

Nissan

/

^Chevy Sentra Dodge Neon

/

Cavalier

r- i

/

Subaru

/

Saturn

Impreza

/

(predicted

(predicted

/

location)

location)

Lol

Geo Metro

/

'/..,

E^g'^ F o r /

Summit rhscdtt

Segment 2

Dimension 1

S = 2 T = 2 (Reparameterized)

LIEMAP provides insight as to how these suhjects integrate

this infonnation in deriving their value judgments. This

study could he performed with real consumers without such

prelitninary infonnation. which might bias value perceptiotis. Second, we bave incorpotated itidividual differences

as the only source of heterogeneityit is also important to

consider both product-class and situational beterogeneity.

Third, we used an obiective attribute tnatrix frotn Consutner

Reports to characterize the dimensions, hut it is reasonahle

to assume that a subjective perceptual attribute matrix might

capture reality better. Finally, though we purposely restricted consumer judgtnents to trinary ordered categorizations.

there i.s evidetice in the literature (e.g.. Cox !9S()) to suggest

that use of response scales with five to nine categories might

represent such perceptual evaluations more accurately. We

discuss this issue further iti the following section.

FUTURE RESEARCH AREAS

There are several ways in whieb this researeh on perceived value migbt be extended. Oti the substantive side, the

focus should be on investigating the process of how the

notion of value is fortned in the minds of consumers. Here,

the role of prior expectations as well as eontextual inlluences should be salient. Also, how value is perceived from

bundles tnight be an interesting research topic, because people generally regard bundles as better values Ibr the tnoney.

Finally, the recent surge in the popularity of store-lahel

brands over manufacturer labels might he of substantive

interest to the tnarketing researcher because this has potential implicatit)ns in the areas of eustomer value and brand

equity.

In our study, we itnpose sparse requiretnents about the input data-subjects were asked merely to categorize the given hrand as a better-than, same-as, or less-than-expected

value. The idea was that the response task should not be too

demanding, such as requiring them to provide quantitative

ratitigs on something as complex as v;tlue. One direction lor

furtber research would he to generalize this VALUEMAP

tnethodology to tnultivalued ordered category scales, as are

found in more getieralized studies involving successive category scaling. Also, the measurctncnt properties of the perceived value concept must be investigated more thoroughly.

To do this formally, hoth internal-consistency reliability and

tesi-retest reliability might need to he exatnined. as well as

the discriminant validity of perceived value established

from other related constructs such as utility, hrand equity,

customer satisfaction, and purchase intentioti. The multitrait, niultimethod approach and structural equation model-

248

JOURNAL OF MARKETING RESEARCH, MAY 1998

ing provide ways of empirically establishing the measurement properties of theoretical constructs such as perceived

value.

On the tnethodological side, the VALUEMAP model can

be extended in sevetal directions. A feature of this model is

that it enables the segtnent tnembership probabilities of the

subjects (i.e,, the ^^s) to be reparameterized a priori, if desired, as an explicit logit function ofthe concomitant demographic variables, such us Gupta and Chintaguttta (1994)

etiiploy in their article, in this special instance, all the parameters can he estitnated simultaneously: however, the estimation procedure might become somewhat onerous, hi addition, such repataineterization otily affects the sizes o( these

derived segments. Still another methodological area for further research of the VALUEMAP approach involves an ideal point/unfolding tnodel specification. Here, we have assumed frotn the available empirical evidence (sec Dodds,

Monroe, and Grewal 1991) that perceived value is monotonic with respect to its underlying dimensions (e.g.. perceived

quality and price). However, in practice, some of these ditnensions migbt not be tnonotonic with the fundatnental

eompotient attributes of the stitnuli/brands. In such etnptrical applications, a "tnixed model" might be assutned in

which some dimensions are vector-like and otbers ideal

point-like.

Another potential extension might be to devise a spatial

conjoint tnodel that will allow the measuretnent ofthe partworths of the attributes of perceived value and the identification of tbe bypt)tbetiL-;tl "best value"" hrand. Such a fratiiework is thus conducive to determining the way to position a

certain brand optimally in terms of perceived value. In addition, extension of VALUEMAP to an unfolding model

seems appropriate, though there does seetn to be more operational difficulties with that type ol model, giveti the prevalence of degenerate solutions. All in all, much work remains

to be done toward explicating the perceived value ct)nstruct.

As articulated by Woodruff (1997), given the pervasive

global importance of value marketing and growitig international cotnpetition in trade and eommerce. this area should

continue to be a fertile area for research for quite sotne time.

nar Press. 105-55.

(!98()). ""Models and Methods for Multidimensional

Analysis of Preferential Choice (or other Dominance) Data." in

Similarity and Choice. E. D. Lantermann and J. Feger. eds.

Bern. Switzerland: Hans Huber. 234-89.

. P. E. Green, atid F. J. Carmone (1976). "CANDELINC

(CANonicai Dcconipositioti With LINear Constraints): A New

Method For Multitlimensional Analysis With Constrained Solutions (Abstract)." Proceedini-s ofthe 2tst International Congress of Psycholo^-y. Paris, (July).

-, S. Pru/.ansky. atiU J.B. Kruskal (1980). "CANDELINC: A

General Approach To Multidimensional Analysis Of Many-way

Arrays Witli Linear Constraints On Parameters,"" Psvchomeiri/;/j,45. 3-24.

Chang. W. C. (I9S3I. ""On tjsing Prtticlpal Components Before

Separaliiig a Mixluie ot" Two Mullivariate Normal Di.sirbuXions." Applied Statistics. 32 (June), 267-75.

Consumer Reports (1995). '"95 Cars." (April). 230-57.

Cox. E. P. (1980), "The Optimal Number of Response Alternatives

for a Scale: A Review." Journal t\f Marketing Research. I 7 (November). 410-19.

DeSarbo. W. S.. J.D. Carroll. D.R. Lehmann. atid J. O'Sbaugbnessy (1982). "Three-Way Multivariate Cotijolnl Analysi.s."

Marketing Science. I. 323-50.

and Jaewun Cho (1989), "A Stochastic Multidimensional

Scaling Vector Threshold Model for the Spatial Representation

of 'Pick Any/N" Data." Psychotnetrika, 54 (March), 103-30.

and Donna L. HolTinan (1987). "Constructinu MDS Joint

Spaces from Bin;try Choice Data: A New Muhidiniensional Unfolding Threshold Model for Marketing Research," Journal of

Marketing Resvurch. 24 (February), 40-54.

. Daniel Howard, and Kamel Jedidi (1991). "MULTICLUS: A New Method for Simultaneously Peiforming Mullidimensional Sealing and Cluster Analysis," Psychometrika. 56

(March), 121-36

-. Ajay Manrai. and Lalita A. Manrai (1994), "'Latent Class

Multidimensional SealingA Review of RecenI Developments

the Marketing and Psychometric Literaiure." in Advatued Methods of Marketing Research. R, P, Bagoz-zi, ed. Oxford: Blackwell.

and V.R. Rao (1984), "GENFOLD2: A Set of Models and

Algorithms for the GENeral UnFOLDing Analysis of Preference/Dominance DMI[." Jcnirixtl of Classiftcation. I. 147-86.

and

(I9S6). "A Constrained Unfolding Model For

Product Positioning Analysis," Marketing Science. 5 (Winter).

1-19,

, Michel Wedel, Marco Vriens, and Venkairam Ramaswamy (1992). "Latent Class Metric Conjoint Analysis."'

REFERENCES

Akaike, H. (I974J. 'A New Look ;it Slatistical Mode! IdcntiMcation." IEEE Transactions on Automatic Control. 6. 716-2.V

BockenhoU, I. antJ W. Gaul (1989), "GetieralJzcd Lateiil Class

Analysis: An New Methodology for Market Structure Atialysis," in Concepttuil and Nutnerical An(il\.\i.s oj Data. O. Opit/,.

ed. Berlin: Sprinyer Verlag, 367-76,

Bolton, Ruth N. atid James H. Drew (1991), "A Multi.stage Model

of Customers" Assessments of Service Quality and Value.'"

Journal of Consumer Hesearch. 17 (March). 375-84.

Bozdogan, hi. (1987). ""Model Selection and Akaike's Inloimation

Criterion (AIC): The General Theoty and Its Analytical Kxicnsions," Psvchometrika. 52 (September), 345-70.

Brayman, Joann M, Davis (1996), "Building a Bcllei Business

Tool^Custotner Value Analysis," paper presented at the AMA

Conference on Cusioiner Satisfaction. (January).

Busine.vsWeek (1991). -Value-Marketing." (November I I).

132^0.

CarToll, J. Douglas (1972). ""Individual Differences anJ MuUiJimensional Scaling." in Multidimensional Scaling: Theotr and

Applications in the Behavioral Sciences, R. N. Shepard, A. K.

Romney, and S. B. Nerlove, eds. New York and London: Semi-

Marketing Utters.

3 (3). 273-88.

De Soete. G. and Su/aiine Winsherg (1993), "Latent Cla.ss Vector

Models for Preference Ratings," Joitrnal of Ciassificatioii. 10,

195-218.

Diefenbach, Michael A.. Neil D, Weinstein. and Jo.seph O'Reilly

(1993), "Scales for Assessing Perception of Health Hazard Susccplihility," Health Education Research, 8 (June), 187-92.

Dillon. W. R., N. Mulani. and D.G. Frederick (1989), "On the Use

of Component Scores in ihe Presence of Group Structure." Journal of Consumer Reseinih. 16 (June). 106-12.

Dodds. William B.. Kent B. Monroe, and Dhruv Grewal (1991).

""Effects ot" Price. Brand, and Store Information on Buyers'

Product Evaluations." Joutnal of Marketing Re.search. 28 (August), 307-91.

Gale. Bradley T. (1994). Managing Customer Value. New York:

The Free Press.

Gnanadesikan. R. and J. R. Keltenring (1972). "Robust Residuals

and Outlier Defection with Multiresponse Dala." Biometrics. 28

(March). 81-124.

Gupta. Sachin and Pradeep K. Chintagunta (1994), "On U.sing De-

249

spatial Modeling of Perceived Customer Value

mographic Variables lo Determine Segment Membership in

Logit Mixture Models." Jounial of Marketing Research. 31

(February). 128-36.

Hardie. Bruce G. S.. Eric Johnson, atid Peter S. Fader (1993),

"Modeling Loss Aversion and Reference Dependence Eftect.s on

Brand Choice,"' Marketing Science. 12 (Fall), 378-94,

Hartigan. J. A. (1975). Clustering Algorithms. New York: John

Wiley & Sons.

Holbrook. Morris B. (1994). "The Nature of Customer Value: An

Axiology of Services in the Consumption Experience." in Service Quality: New Direetions in Theory and Practice. Roland T.

Rust and Richard L. Oliver, eds. Thousand Oaks, CA: Sage Publications. 21-71.

Komorita. S. S. and W. K. Graham (1965). "Number of Scale

Points and ihe Reliahility of Scales.'" Education atui Psychological Measurement. 25. 987-95.

Kordupleski. Raymond E. and We.st C. Vogel ( I 9 8 9 | . The Right

Choice-What Does It Mean'.' AT&T White Paper. Whippany.

NJ: AT&T,

Makigucbi, Tsunesaburo (1964). Philosophy of Value. Tokyo:

Scikyo Press.

Progressive Grocer (1984). "The Meaning. Measuring, and Markeling of Value." executive report.

Rust. Rolatid T., D. Simester, R. Brodie. and V. Nilikanl (1995),

"Model Seleclion Criteria: An Invesligation of Relative Accuracy, Posteri()r Prohabiliiies. and Combinations of Criteria." Management Science. 41 (February), 322-33.

Sberif. M. and C. Hovland (1961). Social Judgment. New Haven.

CT: Yale University Press.

Simon. Herbert A. (1959). "Theories of Decision-Making in Fxonotnics and Behavioral Science." American Econotnic Review.

49, 253-83.

Smart. William (1891 ). Ati Introduction to the Theory of Value.

London: MacMillan and Co.

Takane, Y. and T. Shihayaina. (1991). "Principal Component

Analysis with External Information on Both Subjects and Variables,"" Psychometriku. 56 (March), 97-120.

Teicher. H. (1963). "Identifiahility of Finite Mixtures," Annals of

Mathematical .Statistics. 34. 1265-69,

Thurstone. L.L. (1927). 'A Law of Comparative Judgment." Psychological Review. 273-86.

(19,59). The Measurenwnt of Values. Chicago: The University of Chicago Press.

Torgerson. Warren S. (1958). Theory And Methods

Of .Scaling.

New York: John Wiley & Sons.

Treaey. Micbael and Fred Wiersema (1995), The Discipline of

Market Leaders. Reading. MA: Addison-Wesley.

Tucker, L. R. (I960), "lntia-lndividual and Inter-Individual Multidimensionality," in Psychological Scaling: Theoiy and Applications. H. Gulliksen & S. Messick, eds. New York: John Wiley &

Sons, 155-67.

Tversky. Amos and Daniel Kabneman (1991). ""Loss Aversion and

Riskless Cboice: A Reference Dependent Model." Qiiartetly

Journal of Economics. 106 (November). 1039-61.

Varian. Hal (1987). Intermediate Microeconotnics. New York: W.

W. Norton & Cotnpany.

Woodruti. Robed B. (I997t. ""Custotiier Value: The Next Source

for Competitive Advantage." Journal ofthe Academy of Marketmg

Science.

25 {2). 1 3 9 - 5 3 .

Zeitbanil. Valarie A. (1988). ""Consumer Perceptions of Price.

Quality, and Value: A Means-End Model and Syntbesis of Evidence." Journal of Marketing. 52 (July). 2-22.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- H&M Case Study AssignmentДокумент7 страницH&M Case Study AssignmentwqvyakОценок пока нет

- Fire Alarm SymbolsДокумент6 страницFire Alarm Symbolscarlos vasquezОценок пока нет

- Transformative SERVICE Research An Agenda For The FutureДокумент8 страницTransformative SERVICE Research An Agenda For The FutureDante EdwardsОценок пока нет

- X Blocker Et Al. 2011 Applying A TCR Lens To Understanding and Alleviation Porverty PDFДокумент9 страницX Blocker Et Al. 2011 Applying A TCR Lens To Understanding and Alleviation Porverty PDFDante EdwardsОценок пока нет

- BLOCKER - Et Al - 2013 - Understanding Poverty and Promoting Poverty Alleviation Through Transformative Consumer Research PDFДокумент8 страницBLOCKER - Et Al - 2013 - Understanding Poverty and Promoting Poverty Alleviation Through Transformative Consumer Research PDFaugustofhОценок пока нет

- Using The Base-Of-The-Pyramid Perspective To Catalyze PDFДокумент6 страницUsing The Base-Of-The-Pyramid Perspective To Catalyze PDFDante EdwardsОценок пока нет

- The Practice of Transformative Consumer Research PDFДокумент7 страницThe Practice of Transformative Consumer Research PDFDante EdwardsОценок пока нет

- The Costs and Benefits of Consuming PDFДокумент7 страницThe Costs and Benefits of Consuming PDFDante EdwardsОценок пока нет

- Journal of Macromarketing-2014-Viswanathan-8-27 PDFДокумент21 страницаJournal of Macromarketing-2014-Viswanathan-8-27 PDFDante EdwardsОценок пока нет

- Aula 2 The Four Service Marketing Myths PDFДокумент12 страницAula 2 The Four Service Marketing Myths PDFDante EdwardsОценок пока нет

- Journal of Macromarketing-2014-Saatcioglu-122-32 PDFДокумент12 страницJournal of Macromarketing-2014-Saatcioglu-122-32 PDFDante EdwardsОценок пока нет

- Mick Origins Qualities and Envisionments of TCR-libre PDFДокумент54 страницыMick Origins Qualities and Envisionments of TCR-libre PDFDante EdwardsОценок пока нет

- Incorporating Transformative Consumer Research Into The Consumer Behavior Course Experience PDFДокумент9 страницIncorporating Transformative Consumer Research Into The Consumer Behavior Course Experience PDFDante EdwardsОценок пока нет

- Transformative Consumer ResearchДокумент4 страницыTransformative Consumer ResearchDante EdwardsОценок пока нет

- Small Scale Farming and Agricultural Products Marketing For Sustainable Poverty Alleviation in NigeriaДокумент8 страницSmall Scale Farming and Agricultural Products Marketing For Sustainable Poverty Alleviation in NigeriaDante EdwardsОценок пока нет

- The Uses of Marketing TheoryДокумент20 страницThe Uses of Marketing TheoryDante EdwardsОценок пока нет

- Consumer SymbolismДокумент14 страницConsumer SymbolismDante EdwardsОценок пока нет

- Culture Fashion BlogДокумент24 страницыCulture Fashion BlogDante EdwardsОценок пока нет

- Aula 12 Understanding Retail Experiences PDFДокумент29 страницAula 12 Understanding Retail Experiences PDFDante EdwardsОценок пока нет

- Consumer Fantasies HollbrookДокумент9 страницConsumer Fantasies HollbrookDante EdwardsОценок пока нет

- Youth CultureДокумент18 страницYouth CultureDante EdwardsОценок пока нет

- National CulturesДокумент29 страницNational CulturesDante EdwardsОценок пока нет

- Positivism and InterpretativismДокумент15 страницPositivism and InterpretativismDante EdwardsОценок пока нет

- Gender MasculinityДокумент20 страницGender MasculinityDante EdwardsОценок пока нет

- Social ClassДокумент14 страницSocial ClassDante EdwardsОценок пока нет

- Culture StarbucksДокумент13 страницCulture StarbucksDante EdwardsОценок пока нет

- SelfconceptДокумент15 страницSelfconceptDante EdwardsОценок пока нет

- Group e TribaliztionДокумент13 страницGroup e TribaliztionDante EdwardsОценок пока нет

- Aula 4 Historical MethodДокумент17 страницAula 4 Historical MethodDante EdwardsОценок пока нет

- Nature of AttitudesДокумент33 страницыNature of AttitudesDante EdwardsОценок пока нет

- Journal of Consumer Research, Inc.: The University of Chicago PressДокумент17 страницJournal of Consumer Research, Inc.: The University of Chicago PressDante EdwardsОценок пока нет

- Journal of Consumer Research, IncДокумент9 страницJournal of Consumer Research, IncDante EdwardsОценок пока нет

- TCS3400 DS000411 4-00Документ34 страницыTCS3400 DS000411 4-00Miguel_Angel92Оценок пока нет

- PC Engineering Undergr 2014Документ94 страницыPC Engineering Undergr 2014Austin JamesОценок пока нет

- Prof Ed 9-A - Module 6 - Tumacder, DHMLДокумент6 страницProf Ed 9-A - Module 6 - Tumacder, DHMLDanica Hannah Mae TumacderОценок пока нет

- 12 ĀnurũpyenaДокумент7 страниц12 ĀnurũpyenashuklahouseОценок пока нет

- HVS Hotel Cost Estimating Guide 2021Документ124 страницыHVS Hotel Cost Estimating Guide 2021pascal rosasОценок пока нет

- 20160323110112-Sae 1215Документ1 страница20160323110112-Sae 1215awesome_600Оценок пока нет

- 141-203 Solar 660 60 - 40 - 30 - 225 Amp Fleet Battery ChargerДокумент10 страниц141-203 Solar 660 60 - 40 - 30 - 225 Amp Fleet Battery Chargerjose alberto alvarezОценок пока нет

- Which Will Weigh The Least Without AnswerДокумент7 страницWhich Will Weigh The Least Without AnswerumeshОценок пока нет

- List of Tyre Pyrolysis Oil Companies in IndiaДокумент2 страницыList of Tyre Pyrolysis Oil Companies in IndiaHaneesh ReddyОценок пока нет

- Ground Architecture (Mourad Medhat)Документ146 страницGround Architecture (Mourad Medhat)Aída SousaОценок пока нет

- Term Test Pointers For Review - 1st TermДокумент2 страницыTerm Test Pointers For Review - 1st Termjessica holgadoОценок пока нет