Академический Документы

Профессиональный Документы

Культура Документы

Advance Tax Calculator

Загружено:

uttamsaxenaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Advance Tax Calculator

Загружено:

uttamsaxenaАвторское право:

Доступные форматы

Advance Tax Calculator

1 of 4

http://www.incometaxindia.gov.in/Pages/tools/advance-tax-calculator.aspx

Download

Skip to main content

ABOUT US

ASK

1800 180 1961/ 1961

Help

Department Use

I AM

I NEED

PAN

A+

RETURNS

A-

CHALLANS

Income Tax Department > Advance Tax Calculator

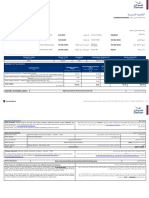

ADVANCE TAX CALCULATOR FOR

FINANCIAL YEAR 2014-15

Click here to view relevant Act & Rule.

TAX LAWS & RULE

S

Tax Payer

INTERNATIONAL T

AXATION

Individual

Male / Female / Senior Citizen

DEPARTMENTAL I

NFORMATION

Male

Residential Status

Resident

Income from Salary

20,00,000

Income From House Property

Show Details

Hide Details

Capital Gains

40,000

Short Term Capital GainS (Other than covered under

section 111A)

From

From

From

From

Total

2/25/2015 4:53 PM

Advance Tax Calculator

2 of 4

http://www.incometaxindia.gov.in/Pages/tools/advance-tax-calculator.aspx

01/04/2014 16/09/2014 16/12/2014 16/03/2015

to

to

to

to

15/09/2014 15/12/2014 15/03/2015 31/03/2015

4,000

4,000

4,000

4,000 16,000

Short Term Capital GainS (Covered under section 111A)

From

From

From

From

01/04/2014 16/09/2014 16/12/2014 16/03/2015

Total

to

to

to

to

15/09/2014 15/12/2014 15/03/2015 31/03/2015

1,000

1,000

1,000

1,000 4000

Long Term Capital Gains (Charged to tax @ 20%)

From

From

From

From

01/04/2014 16/09/2014 16/12/2014 16/03/2015

Total

to

to

to

to

15/09/2014 15/12/2014 15/03/2015 31/03/2015

3,000

3,000

3,000

3,000 12,000

Long Term Capital Gains (Charged to tax @ 10%)

From

From

From

From

01/04/2014 16/09/2014 16/12/2014 16/03/2015

Total

to

to

to

to

15/09/2014 15/12/2014 15/03/2015 31/03/2015

2,000

2,000

2,000

Income From Other Sources

2,000 8000

Show Details

60,000

Profits and Gains of Business or Profession

(enter profit only)

Agricultural Income

Deductions

Show Details

2,60,000

Net Taxable Income

Income Liable to Tax at Normal Rate

2/25/2015 4:53 PM

Advance Tax Calculator

3 of 4

http://www.incometaxindia.gov.in/Pages/tools/advance-tax-calculator.aspx

18,16,000

3,69,800

--- Short

Long Term

Term

Capital

Capital Gains

Gains (Charged

(Covered

to

u/stax

111A)

@

20%)

10%)

20%

12,000

2,400

Winnings from Lottery, Crossword Puzzles,

etc)

Income Tax

3,73,600

Surcharge

0

Education Cess

7,472

Secondary and higher education cess

3,736

Total Tax Liability

3,84,808

Relief other than relief u/s 87A

TDS/TCS/MAT (AMT) Credit Utilized

Assessed Tax

3,84,808

Calculate

Reset

2/25/2015 4:53 PM

Advance Tax Calculator

4 of 4

http://www.incometaxindia.gov.in/Pages/tools/advance-tax-calculator.aspx

Advance tax payable upto September 15, 2014

(Cumulative)

1,13,450.00

Advance tax payable upto December 15, 2014

(Cumulative)

2,28,227.00

Advance tax payable upto March 15, 2015

(Cumulative)

3,82,594.00

Advance tax payable upto March 31, 2015

(Cumulative)

3,84,808.00

Advance Tax Installments

Description

Installment

First installment payable for the period April 1,

2014 to September 15, 2014

1,13,450.00

Second installment payable for the period

September 16, 2014 to December 15, 2014

1,14,777.00

Third installment payable for the period

December 16, 2014 to March 15, 2015

1,54,367.00

Last installment payable for the period March 16,

2015 to March 31, 2015

2,214.00

Advisory: Information relates to the law prevailing in the year of publication/ as

indicated . Viewers are advised to ascertain the correct position/prevailing law

before relying upon any document.

Disclaimer:The above calculator is only to enable public to have a quick and an

easy access to basic tax calculation and does not purport to give correct tax

calculation in all circumstances. It is advised that for filing of returns the exact

calculation may be made as per the provisions contained in the relevant Acts,

Rules etc.

Download

Report Phishing

RTI

Ombudsman

Website Policies

Useful Links

Subscribe

Feedback

Terms &

Conditions

Sitemap

Shortcut Keys

Accessibility

Statement

Disclaimer

Contact Us

Webmaster # 7008,

Aayakar Bhawan,

Vaishali,Ghaziabad.

U.P.

Ph. : 0120 2770483, 2770438

(Fax)

webmanager@incometax.gov.in

Copyright Income Tax Department, Ministry of Finance| All rights reserved worldwide. Developed & Maintained by Taxmann

Publications Pvt. Ltd

2/25/2015 4:53 PM

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Hearing Transcript - April 8 2010Документ252 страницыHearing Transcript - April 8 2010kady_omalley5260Оценок пока нет

- In The United States District Court For The District of ColoradoДокумент16 страницIn The United States District Court For The District of ColoradoMichael_Lee_RobertsОценок пока нет

- ISM Code UpdatesДокумент9 страницISM Code UpdatesPaulici PaulОценок пока нет

- Corruption and Indonesian CultureДокумент6 страницCorruption and Indonesian CultureRopi KomalaОценок пока нет

- THE Story OF THE Rizal LAW (RA 1425) : FilibusterismoДокумент5 страницTHE Story OF THE Rizal LAW (RA 1425) : FilibusterismoKristine PangahinОценок пока нет

- Tunnels and Sky Bridges Network Task Force Final Report and Recommendations FINALДокумент6 страницTunnels and Sky Bridges Network Task Force Final Report and Recommendations FINALRobert WilonskyОценок пока нет

- CivproДокумент60 страницCivprodeuce scriОценок пока нет

- Allowable DeductionsДокумент5 страницAllowable DeductionsAimeeОценок пока нет

- Safety Data Sheet: Magnafloc LT25Документ9 страницSafety Data Sheet: Magnafloc LT25alang_businessОценок пока нет

- Day 1 Newsela Article Systematic OppressionДокумент6 страницDay 1 Newsela Article Systematic Oppressionapi-315186689Оценок пока нет

- Think Equity Think QGLP 2018 - Applicaton FormДокумент18 страницThink Equity Think QGLP 2018 - Applicaton FormSHIVAM CHUGHОценок пока нет

- Export Import Procedures and Documentation in India PDFДокумент2 страницыExport Import Procedures and Documentation in India PDFTerraОценок пока нет

- Civrev1 CasesДокумент264 страницыCivrev1 Casessamjuan1234Оценок пока нет

- Martha Washington Based On A 1757 Portrait By: John WollastonДокумент1 страницаMartha Washington Based On A 1757 Portrait By: John WollastonroyjaydeyОценок пока нет

- Manifestations of ViolenceДокумент2 страницыManifestations of ViolenceProjectSakinahDCОценок пока нет

- Fundamentals of Corporate Finance 7th Edition Ross Solutions ManualДокумент10 страницFundamentals of Corporate Finance 7th Edition Ross Solutions Manualomicronelegiac8k6st100% (18)

- CIS-Client Information Sheet - TEMPLATEДокумент15 страницCIS-Client Information Sheet - TEMPLATEPolat Muhasebe100% (1)

- PNP Aviation Security Unit 6 Kalibo Airport Police StationДокумент3 страницыPNP Aviation Security Unit 6 Kalibo Airport Police StationAngelica Amor Moscoso FerrarisОценок пока нет

- Liberia Ok Physical Examination ReportcertДокумент2 страницыLiberia Ok Physical Examination ReportcertRicardo AquinoОценок пока нет

- Mockbar 2018 Criminal-Law GarciaДокумент9 страницMockbar 2018 Criminal-Law GarciasmileycroixОценок пока нет

- Your Document Checklist - Immigration, Refugees and Citizenship CanadaДокумент2 страницыYour Document Checklist - Immigration, Refugees and Citizenship Canadacreadorcito100% (1)

- NSTP - National Security NSS2018Документ8 страницNSTP - National Security NSS2018vener magpayoОценок пока нет

- Property Law Exam NotesДокумент30 страницProperty Law Exam NotesRitesh AroraОценок пока нет

- In Re John H. Gledhill and Gloria K. Gledhill, Debtors, State Bank of Southern Utah v. John H. Gledhill and Gloria K. Gledhill, 76 F.3d 1070, 10th Cir. (1996)Документ26 страницIn Re John H. Gledhill and Gloria K. Gledhill, Debtors, State Bank of Southern Utah v. John H. Gledhill and Gloria K. Gledhill, 76 F.3d 1070, 10th Cir. (1996)Scribd Government DocsОценок пока нет

- Answer Key PSC FinalДокумент1 страницаAnswer Key PSC FinalPriyasajan J PillaiОценок пока нет

- Matungao, Lanao Del NorteДокумент2 страницыMatungao, Lanao Del NorteSunStar Philippine NewsОценок пока нет

- Peraturan Skim Pemeriksaan Khas BIДокумент56 страницPeraturan Skim Pemeriksaan Khas BIahmad exsanОценок пока нет

- UMIDIGI Power 3 - Android 10 - Android Development and HackingДокумент7 страницUMIDIGI Power 3 - Android 10 - Android Development and HackingAahsan Iqbal احسن اقبالОценок пока нет

- HEAVYLIFT MANILA V CAДокумент2 страницыHEAVYLIFT MANILA V CAbelly08100% (1)

- Invoice Form 9606099Документ4 страницыInvoice Form 9606099Xx-DΞΛDSH0T-xXОценок пока нет