Академический Документы

Профессиональный Документы

Культура Документы

Full Dissertation

Загружено:

Sandip NaradАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Full Dissertation

Загружено:

Sandip NaradАвторское право:

Доступные форматы

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

CHAPTER 1

INTRODUCTION

1.1) INTRODUCTION: A Co-operative bank, as its name indicates is an institution consisting of a

number of individuals who join together to pool their surplus savings for the purpose

of eliminating the profits of the bankers or money lenders with a view to distributing

the same amongst the depositors and borrowers.

The Co-operative Banks Act, of 2007 (the Act) defines a co-operative bank as

a co-operative registered as a co-operative bank in terms of the Act whose members

1. Are of similar occupation or profession or who are employed by a common

employer or who are employed within the same business district; or

2. Have common membership in an association or organization, including a

business, religious, social, co-operative, labor or educational group; or

3. Have common membership in an association or organization, including a

business, religious, social, co-operative, labor or educational group; or

4. Reside within the same defined community or geographical area.

Co-operating Banking: Co-operative bank, in a nutshell, provides financial assistance to the people

with small means to protect them from the debt trap of the money lenders. It is a part

of vast and powerful structure of co-operative institutions which are engaged in tasks

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

of production, processing, marketing, distribution, servicing and banking in India. A

co-operative bank is a financial entity which belongs to its members, who are at the

same time the owners and the customers of their bank. Co-operative banks are often

created by persons belonging to the same local or professional community or sharing

a common interest. These banks generally provide their members with a wide range of

banking and financial services (loans, deposits, banking accounts). Co-operative

banks differ from stockholder banks by their organization, their goals, their Values

and their governance.

The Co-operative Banking System in India is characterized by a relatively

comprehensive network to the grass root level. This sector mainly focuses on the local

population and micro- banking among middle and low income strata of the society.

These banks operate mainly for the benefit of rural areas, particularly the agricultural

sector.

1.2) ORIGIN OF CO-OPERATIVE BANKING: The beginning co-operative banking in India dates back to about 1904, when

official efforts were made to create a new type of institution based on principles of cooperative organization & management, which were considered to be suitable for

solving the problems peculiar to Indian conditions. The philosophy of equality, equity

and self help gave way to the thoughts of self responsibility and self administration

which resulted in giving birth of co-operative. The origin on co-operative movement

was one such event-arising out of a situation of crisis, exploitation and sufferings.

Co-operative banks in India came into existence with the enactment of the

Agricultural Credit Co-operative Societies Act in 1903. Co-operative bank form an

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

integral part of banking system in India. Under the act of 1904, a number of cooperative credit societies were started. Owing to the increasing demand of cooperative credit, anew act was passed in 1912, which was provided for establishment

of co-operative central banks by a union of primary credit societies and individuals.

Co-operative Banks in India are registered under the Co-operative Societies

Act. The cooperative bank is also regulated by the RBI. They are governed by the

Banking Regulations Act 1949 and Banking Laws (Cooperative Societies) Act, 1965.

1.3) IMPORTANCE OF CO-OPERATIVE BANKING: Co-operative bank forms an integral part of banking system in India. This

bank operates mainly for the benefit of rural area, particularly the agricultural sector.

Co-operative bank mobilize deposits and supply agricultural and rural credit with the

wider outreach. They are the main source for the institutional credit to farmers. They

are chiefly responsible for breaking the monopoly of moneylenders in providing

credit to agriculturists.

Co-operative bank has also been an important instrument for various

development schemes, particularly subsidy-based programs for the poor. Co-operative

banks operate for non-agricultural sector also but their role is small. Though much

smaller as compared to scheduled commercial banks, co-operative banks constitute an

important segment of the Indian banking system. They have extensive branch network

and reach out to people in remote areas. They have traditionally played an important

role in creating banking habits among the lower and middle income groups and in

strengthening the rural credit delivery system.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Types of Co-operative Banks

Multistate Consultant Private Limited: Multistate Consultant Private Limited provides A-Z services regarding Multistate

Cooperative Society, Mutual Benefit (Nidhi) Company, Producer Company, Section

25 Company, NBFC etc starting from its registration, Advisory services regarding

daily activities, finalization of accounts, Submission of annual return and so on.

Multistate Co-operative Society: A multi-state cooperative society may be registered if its main object is not confined

to one State and serving the interests of members in more than one State, to facilitate

the voluntary formation and democratic functioning of Co-Operatives as people's

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

institutions based on self-help and mutual aid and to enable them to promote their

economic and social betterment and to provide functional autonomy and for matters

connected therewith or incidental thereto.

A multi-state Co-operative Society is basically a society that is registered or

deemed to be registered under the Multi-State Cooperative Societies Act, 2002 and

includes a National Cooperative Society or a Federal Cooperative. Ministry of

Agriculture is will issue the registration certificate.

Multi State Co-operative Societies are of several types:

Multistate Credit Co-operative Society

Multistate Housing Co-operative Society

Multistate Farming Co-operative Society

Multistate Dairy Firm Multi State Co-operative Society

Multistate Solar Credit Co-operative Society

Multistate Multi State Multi Purpose Co-operative Society

Multistate Transport Co-operative Society and many more

Producer Company: The Companies (Amendment) Act 2002 vides notification no. S.O. 135 (E) inserted

part IX A of the Companies Act, 1956 (hereinafter referred to as the Act ) and

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

introduced the concept of Producer Company. In the year 2002 an expert committee

led by noted economist Y.K Alagh framed legislation for incorporation of a producer

company, and conversion of inter- state cooperative society into a producer company

and its reconversion into cooperative society. It aims at upliftment of rural producers

for following reasons:

Rural producers have been at a potential disadvantage given their limited

assets, resources, educational and access to advanced technology.

In Indian context the farmers disposes of his produce in unprocessed form

there is no plough back of surpluses from value addition to the farm.

Agribusiness enterprises are therefore increasingly looking for direct tie up

with the farmers to source the agricultural produce required by them.

Therefore companies (Amendment) act 2002 part IX-A is a step in this direction.

The companies shall be termed as limited and the liability of the members will be

limited to the amount, if any, unpaid on the shares. On registration, the producer

company shall become as if it is a private limited company with the significant

difference that a minimum of two persons cannot get them registered, the provision

relating to a minimum paid-up capital of Rs. 1 lakh will not apply and the maximum

number

of

members

can

also

exceed

50.

Members' equity cannot be publicly traded but be only transferred. As such, "producer

companies would not be vulnerable to takeover by other companies or by MNCs.''

Formation of Producer Company: -

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Any ten or more individuals, each of them being a producer, that is, any

person engaged in any activity connected with primary produce, any two or more

producer institutions, that is, producer companies or any other institution having

only producers or producer companies as its members or a combination of ten or

more individuals and producer institutions, can get a producer company

incorporated under the Act.

Every producer company is to have at least five and not more than 15

directors.

A full time chief executive, by whatever name called, is to be appointed by the

board.

Following enclosures and documents are required to be submitted with along the

application:

A copy of the special resolution passed with2/3 majority of the member.

A statement showing names, addresses and occupation of the Directors and the

Chief Executive.

A list of the members.

A statement indicating that the Inter-State Cooperative Society is any one or

more of the objects specified in section 581B.

A declaration by two or more Directors certifying that the particulars given as

per para (1) to (4) above are correct.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Guidance on Software Development procedure,

Regular updating regarding multistate societys laws/ circulars / notifications

to our clients.

Peoples cooperative bank, Hingoli is also one of the parts of Multistate Consultant

Private Limited and this study of project mainly focuses on the leading functions of

the banks with special reference to Peoples cooperative bank, Hingoli.

The report states different kinds of loans and the survey that shows the average

number of loan proposal approved and disapproved by the bank.

The study gives an insight into procedures followed by the bank as per the norms of

Reserve Bank of India and Co-operative Society Act 1960.

1.4) HOUSING FINANCE:

Housing finance is a broad topic, the concept of which can vary across

continents, regions and countries, particularly in terms of the areas it covers. For

example, what is understood by the term housing finance in a developed country

may be very different to what is understood by the term in a developing country.

The International Union for Housing Finance, as a multinational networking

organization, has no official position on what the best definition of housing finance is.

However, the selection of quotes below is offered as a snapshot of what housing

finance as a topic covers

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Housing finance brings together complex and multi-sector issues that are

driven by constantly changing local features, such as a countrys legal environment or

culture, economic makeup, regulatory environment, or political system

In addition, the concept of housing finance and housing finance systems has

been evolving over time. Looking at definitions from the mid-1980s, we see that

housing finance was defined primarily in terms of residential mortgage finance:

The purpose of a housing finance system is to provide the funds which homebuyers need to purchase their homes. This is a simple objective, and the number of

ways in which it can be achieved is limited. Notwithstanding this basic simplicity, in a

number of countries, largely as a result of government action, very complicated

housing finance systems have been developed. However, the essential feature of any

system, that is, the ability to channel the funds of investors to those purchasing their

homes, must remain.

However, in more recent years, a number of other much wider definitions have

appeared:

Put simply, housing finance is what allows for the production and

consumption of housing. It refers to the money we use to build and maintain the

nations housing stock. But it also refers to the money we need to pay for it, in the

form of rents, mortgage loans and repayments.

Or

There is recognition of other relevant forms of housing finance [apart from

residential mortgage finance] such as developer finance, rental finance, or

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

microfinance applied to housing. Developer finance is often in the form of

unregulated advance payments by buyers, and developers sometimes provide longterm finance to buyers through installments sales when mortgages markets are not

accessible. Microfinance for housing is typically used for home improvement or

progressive housing purposes. Loans are typically granted without pledging

properties. Although the overall impact of microfinance in housing remains limited,

this activity can represent an important source of funding for those in the informal

sector.

1.5) HOUSING LENDING MODEL:

Over the ages, shelter has remained as one of the most basic and important

needs of human beings. Peoples housing needs have increased manifold in recent

times as the population grows, the middle class expands and younger generations

choose to move into nuclear family units, or move near the increasingly popular

regional work hubs. However, with high costs of construction materials, high capital

costs and increasing complexity of the legal and technical paperwork needed,

accessibility and affordability of house ownership continues to remain a challenge.

Housing finance acts as a bridge to provide financing and open up the housing

market to aspiring house owners. In recent times, specialist housing finance

companies (HFCs) targeting the low-income/financially-excluded household segment

have emerged as a key player to meet the demands of the newly bankable population

who do not have credit history in conventional terms, and are often not served by

banks and mainstream HFCs. The lending model and operational processes of these

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

specialist HFCs- which we will refer to as Affordable Housing Finance Companies

(AHFCs) are the subject of this post.

Housing Finance Sector Review: The Environment for AHFCs and HFCs

There are several players in the housing finance space, such as Scheduled

Commercial Banks (SCBs), Housing Finance Companies (HFCs), Affordable

Housing Finance Companies (AHFCs), Financial Institutions (FIs), Regional Rural

Banks (RRBs), Scheduled Cooperative Banks, Agriculture and Rural Development

Banks, State Level Apex Cooperative Housing Society and development

organizations like MFIs or SHGs. However the most significant contribution comes

from SCBs and HFCs (including AHFCs).

As of 28 November 2013, there are 18 HFCs which have been granted

Certificate of Registration2 (CoR) with permission to accept public deposits including

6 HFCs that are required to obtain prior written permission from National Housing

Bank (NHB) before accepting any public deposits. 39 HFCs were granted CoR

without permission to accept public deposits. 5 applications for grant of CoR are still

under process.

HFCs typically offer three products housing loan, home improvement loan

and Loan against Property. As of March 31, 2012, the percentage of housing loan to

total loans offered by HFCs was about 74%3. The general product bifurcation of

disbursement for housing in FY 2011-12 by HFCs is given below which clearly

depicts the high demand for loans below 25 lakhs.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

To enable continuous and uninterrupted disbursements of loans to eligible

borrowers, AHFCs must have continuous, diverse, and reliable sources of funding.

Currently, these sources are limited to raising equity from private sources, bank funds,

private placement of debt, and for a handful of AHFCs (such as Gruh Finance, Saral

Home Finance), public deposits with or without prior written permission. For the

larger universe of AHFCs, however, the lack of access to capital markets and public

deposits compels AHFCs to rely heavily on bank funding, in the form of both longand short-term loans. This mixed composition of liabilities, when combined with the

largely long-term nature of assets the housing loan portfolio to the tune of 86.7%

of assets having a tenure above 7 years 4, requires AHFCs to manage the risk of assetliability duration mismatches including risk of refinancing short-term debt at higher

interest rates. Hence, Asset Liability Management (ALM) becomes a key challenge to

HFCs that are highly leveraged and rely predominantly on bank funding.

The regulatory authority and apex financial institution for HFCs, the NHB

provides refinance assistance to eligible HFCs against their existing housing loans.

Such a refinance scheme would be very beneficial for AHFCs and would help them in

managing their ALM mismatches. NHB carried out refinancing to the tune of Rs

17,500 crore5 in the year ended June 2013 and expects to disburse Rs 20,000 crore

under the refinance window. Funding of HFCs as on Mar 31, 2012 is shown in the

below table:

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

In Part 2 of this post we write about the key features of the lending model,

divergence in processes adopted by some AHFCs and the road ahead.

1.6) PURPOSE OF HOUSING FINANCE:

Home Buying

For home buyers, the primary purpose of a loan is to facilitate the purchase of

a house or to finance the construction of one. A home is the biggest investment most

people will ever make, and few private individuals could afford one without a

mortgage. Mortgage loans give borrowers with good credit histories access to lower

interest rates and make it affordable to own a home within the two or three decades

that the loan takes to pay off.

Home Improvement

Home loans can also fund home improvements, which are very important for

homeowners. Home improvement loans are usually a wise investment because they

add value to a home, some or all of which will be realized when it comes time to sell.

Home improvement loans can also save borrowers money by allowing them to pay for

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

necessary repairs as needed, rather than waiting to save up money and finding that the

damage is worse and the repairs more expensive that they would have been earlier.

Home Equity

Second mortgages, which include home equity loans and home equity lines of

credit, and cash-out refinance loans give homeowners access to money for home

improvements, medical bills, college tuition or other expenses, based on the equity

built up by paying off the original mortgage. All of these loan types use home equity-the amount the borrower has already paid against the initial mortgage--to give the

homeowner access to cash. A home equity line of credit is a loan that the borrower

can dip into as needed, making charges periodically. A home equity loan and a cashout refinance loan both give the homeowner an up-front lump sum payment. While a

home equity loan exists as a second mortgage alongside the first mortgage, a cash-out

refinance replaces the original mortgage and may also give the borrower access to a

new, lower interest rate.

Lenders

For lenders that provide home loans, including mortgage banks and most large

commercial banks, home loans serve as a means of earning a profit. Lenders charge

interest based on a borrower's degree of risk. In addition, some lenders require certain

borrowers who represent a higher risk to purchase mortgage insurance, which protects

the lender in case the borrower is unable to pay back the loan. Lenders use home loan

interest to pay stock dividends, to pay interest to depositors and to fund other

corporate activities.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

The Economy

Home loans have an important purpose in the global economy. Besides

helping to pay for the employment of bank staff, home builders and real estate agents,

home loans also fuel mortgage-backed securities. These are investments that earn

money based on homeowners paying interest to lenders. Investment banks and other

firms use mortgage-backed securities to distribute investments across the economy.

1.7) FOUNDER OF THE BANK:

Sahakarratna Shri Omprakashji Deora Life Profile

Name:-- Omprakash Devkinandanji Deora

Sunil New Mondha, Hingoli

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Dist. Hingoli431513

Phone (House) (02456) 220825,220225

Mobile 9422875781

Date Of Birth: -- 08 March 1943

Education: -- Graduate (Sahitya Sudhakar)

Award: --

1) Sahkarratna

2) Dharmalankar

3) Agraratna

4) Yagnik

Business & Other:-1) Agriculture & Social Activities, Industrialist Participate In Agriculture, Social &

Religious Program

2) Last 30 Years Working In Co Operative Banking Sector

Founder Chairman:-1) Apex Co Op Bank Of Urban Banks Of Maharashtra & Goa Ltd, Mumbai

2) Peoples Co Op Bank Ltd Hingoli (One of the Multistate Bank in Marathwada

region)

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

3) Marathwada Urban Co Op Bank Association Ltd. Aurangabad

4) Parbhani/ Hingoli Dist. Urban Co Op Banks Association Ltd. Parbhani

5) Shri Shankarrao Chavan P V C Pipe Utpadak Sahakari Santha Maryadit. Hingoli

Ex Chairman:-1) Maharashtra State Cooperative Banks Association Ltd Mumbai

2) Maharashtra State Urban Co Op Bank Federation Ltd Mumbai

3) Bhu Vikas Bank Maryadit Dist . Parbhani

Chairman:-1) Peoples Co Op Bank Ltd Hingoli (One Of The Multi State Bank In Marathwada

Region)

2) Marathwada Nagari Sahkari Banks Co Op Bank Association Ltd Aurangabad

3) Parbhani/Hingoli Dist Nagari Sahkari Banks Association Ltd

4) Gandhi Sewa Trust Hingoli, Sewabhawi Santha

Vice Chairman:-Ex Vice Chairman National Federation of Urban Co Op Bank Credit Society Ltd,

New Delhi

Director:-1) Maharashtra State Urban Co Op Bank Federation Ltd Mumbai

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

2) National Federation of Co Op Bank & Credit Society Ltd New Delhi

Ex Member:-1) All India Sanskrit Committee, Varanasi (Uttarpradesh)

2) Hindi Sahitya Adviser Committee (Home Ministry) New Delhi

3) R B I Mumbai Adviser Committee

4) Ward Member Hingoli (1965-1995)

5) Shantata Committee Hingoli

6) Sales Tax Advisor Committee, Maharashtra

7) D P D C Parbhani & Hingoli District Member

8) National Film & Fine Art Cooperative Society New Delhi

9) Bhuvikas Bank Member

Foreign Tour For Studies:-Tour for Cooperative Revolution Studies Russia, Japan, Italy, Rome, West

Germany & Zekoslovakiya

Political Achievement:-1) Year1978 to 1995 Marathwada Regional Congress Sarchitnis

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

2) Chairman, Maharashtra State Congress Committee (Cooperative Revolution,

Mumbai)

3) Chairman, Maharashtra State Congress Committee (Economic Department,

Mumbai)

Social Activity:1) Inauguration Statues At Hingoli Of Lord Shri Maharaja Agrasenji & Late Smt

Indira Gandhi ( Ex Prime Minister)

2) Construction Temple for Society

3) Construction Religious School At Haridwar, Mathura, Allahabad, Trambakeshwar

& Varanasi

4) Make at Hingoli City Cement Road, Green Belt, Toilet, Cold Water Tank For Use

Hingoli Citizen

5) 500 Acre Land Provide For Development Industries Zone From Maharashtra State

Industrial Sector At Hingoli

6) Loans Available By Bhuvikas Bank For Formers

7) At Adgaon Tq Hingoli Atleast 350 Formers Get Together & 3500 Acre Land

Getting

Social & Education Activity:-At Hingoli Established Gandhi Seva Trust

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

1) Established Shri Shankarrao Chavan Urdu Primary & High School

2) Matoshri Gangadevi Deoda Niwasi Andh Vidyalaya

3) Adult Literacy Programs

4) Established Shri Jai Bajrangbali Vyayam School

5) Provide Land To Nagar Parishad Hingoli Employee For Construction Building So

That Area Called Deora Nagar

Future Plan:-1) For Bank Employees Residence Society Develop At Hingoli

2) Co Op Multi City Hospital

1.8) PRODUCTS:

Current Account

Proprietorship

Partnership

Limited Company

Society Current

Savings Account

Personal Savings

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

HUF

Society Savings

Fixed Deposits

Fixed Deposits

Senior Citizen

Society Fixed

Re-Investment Deposits

Re-Investment Deposits

Senior Citizen Re-Investment Deposits

Recurring Deposits

Loan Account

Cash Credit Loan

Secured Cash Credit Loan

Term Loan

Housing Loan

Salary Loan

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Vehicle Loan

Warehouse Loan

1.9) BANKING CHANNELS:

Any Branch Banking

Internet Banking

ATM Banking

Mobile Branch Banking

SMS Banking

Tele Banking

Mobile Banking

IFSC Codes

1.10) BRANCHES:

Head office- People's Co-op.Bank Ltd.,Hingoli (Multi State Bank)

Head Office, Main Road, Hingoli

Tq.Dist.Hingoli-4311513

Ph:(02456) 220748,220749,220518

Fax: 220481

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Email: hng_pcbhnl@rediffmail.com

Branches

Maharashtra

Andhra Pradesh

Hingoli branch (Main branch)

Akhada Balapur Branch

Parbhani Branch

Sengaon Branch

JawalaBajar Branch

Jintur Branch

Deulgaon Raja Branch

Mantha Branch

Jalna Branch

Nanded Branch

Akola Branch

Aurangabad Branch

Pandharkawda Branch

Yawalmal Branch

Dharmabad Branch

Selu Branch

Bori Branch

Degloor Branch

Hadgaon Branch

Bhaisa Branch

Nagpur Branch

Wardha Branch

Chopada Branch

Pune Branch

Bhokar Branch

Adilabad Branch

CHAPTER 2

REVIEW OF LITERATURE

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

LITERATURE REVIEW:

1. Journal Name: Housing Finance in India: Development, Growth and Policy

implications

Volume number 1 (1)

Edition- 2 (2008)

Page number- 171

Author name- Dr. Ashwani Kumar Bhalla, Dr. Pushpinder Singh Gill, Dr. Parvinder

Arora

Abstract

Housing Finance is a high flying sector these days and is tipped to grow at a

phenomenal 36% P.a. Banks and financial institutions have brought sea changes in

their strategies and there is shift from sellers market to buyers market. Liberal tax

incentives by the govt. low and competitive interest rates for housing finance has

made this sector as red hot sector. Keeping in view the importance of housing finance

in solving the housing problem this paper analyse the performance of this sector while

identifying the its problems and challenges. A look has also been given to the future

prospects of this sector.

2. Journal Name: Markets and housing finance

Volume number 18

Edition- 3

Page number- 257-274

Author name- Veronica Cacdac Warnock, Francis E. Warnock

AbstractWe examine the extent to which markets enable the provision of housing

finance across a wide range of countries. Housing is a major purchase requiring longCollege of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

term financing, and the factors that are associated with well-functioning housing

finance systems are those that enable the provision of long-term finance. Across all

countries, controlling for country size, we find that countries with stronger legal rights

for borrowers and lenders (through collateral and bankruptcy laws), deeper credit

information systems, and a more stable macroeconomic environment have deeper

housing finance systems. These same factors also help explain the variation in

housing finance across emerging market economies. Across developed countries,

which tend to have low macroeconomic volatility and relatively extensive credit

information systems, variation in the strength of legal rights helps explain the extent

of housing finance. We also examine another potential factorthe existence of

sizeable government securities marketsthat might enable the development of

emerging markets housing finance systems, but we find no evidence supporting that

3. Journal Name: Housing microfinance in post-conflict Angola: overcoming

socioeconomic exclusion through land tenure and access to credit

Volume number 3

Edition- 1

Page number- 9-15

Author name- Cain, A

AbstractDevelopment Workshop, human settlements NGO has been working in Angola

since 1981 and is developing approaches to post-conflict shelter challenges. Two

linked programmes of the NGO are discussed in this paper: the KixiCasa housing

microfinance model, aiming to address the issue of economic exclusion through the

provision of microcredit and together with the Ministry of Urbanism and

Environment, the land management strategy, using upgradeable occupancy rights and

land pooling to facilitate the regularization and securing of tenure rights for the poor.

CHAPTER 3

RESEARCH METHODOLOGY

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Research in common parlance refers to search for knowledge. Research is an

academic activity and as such it is used in a technical sense. According to Clifford

Woody, research comprises defining and redefining problems, formulating hypothesis

or suggesting solutions, collecting, organizing and evaluating data, making deductions

and research conclusions to determine whether they fit the formulating hypothesis.

3.1) OBJECTIVES OF THE STUDY:

The study specifically aims at:

1. Studying the importance of housing, demand for housing and house finance in

India.

2. Evaluation of the role of financing of houses in Yavatmal.

3. To identify the popular schemes of Peoples cooperative bank, Hingoli.

4. To analyze the trends in housing finance.

5. To ascertain the problems of borrowers for availing housing loans.

6. To evaluate the impact of tax considerations on housing finance.

7. Measuring the service quality being provided by Peoples cooperative bank,

Hingoli.

3.2) RESEARCH DESIGN:

A Questionnaire is used to do the research

Exploratory Research design

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Focus Group

Primary data analysis

3.3) DATA COLLECTION:

Data means information required in the research. There are two types of data

sources, which have been helpful to carry out the research these, are as follows:

Primary data

Primary data are those, which are collected a fresh and for the first time. Primary

data was collected through questionnaires & Interview schedule.

Secondary data

Secondary data are those, which have already been collected by publication of

Governments, Periodicals of organization, newspaper, books, & internet etc.

Questionnaire

The questionnaire is one of the many ways through which data can be collected.

Questionnaire is widely used by researcher to collect information on related study.

Questionnaire is a method of getting data about respondent by asking them than by

observing and sampling their behavior. Questionnaire should be standardized, its

anonymity can be assured and questionnaire should be design to meet the simple and

native language to allow the use of large sample.

Sampling Universe

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

The first step in devolving any sample design is to clearly define the set of

objects, technically called the universe.

Sample universe includes investors of Peoples cooperative bank, Hingoli.

Sample Technique

Sampling technique used for selection of sample non-probability,

Convenience sampling technique.

A convenience sample is that where the sample is selected, in part or only a

limited attempt, to ensure that this sample is an accurate representation of some larger

group of population. The classic example of convenience sample is standing at

shopping mall and selecting shoppers as they walk by to fill out a survey. A

convenience sample chooses the individuals that are easiest to reach or sampling that

is done easy. Hence, convenience sampling was used for the research.

Sample Size

This refers to the number of item to be selected from the universe to constitute a

sample. The sample size is 50. These users are the families.

3.4) LIMITATION:

The limitation of this study is that sometimes the male or female respondents

may not give the proper and correct information regarding the Training and

Development.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

1) The study was limited to Peoples co-operative bank, Hingoli, only.

2) Due to limited time & money, it was not peruse to come whole entire, hence

the sample size was 50 respondents.

3) The study was limited to Yavatmal city.

CHAPTER 4

DATA ANALYSIS & INTERPRETATION

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

The data so collected is scrutinized, tabulated and analyzed by the help of

some statistical tools and techniques and finally used for the study purpose. Following

are the major conclusions are drawn by the researchers.

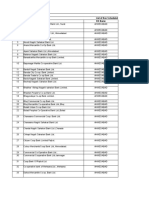

Table No. 4.1 RESPONDENTS HAVING OWN HOME

Opinion

Number of

Sr. No

Percentage

1

2

Yes

No

TOTAL

respondents

70

30

70

30

100

100

Sources: Primary Data

Graph no. 4.1 RESPONDENTS HAVING OWN HOME

Number of respondents

Yes

30%

No

70%

Interpretation

From above data it can be concluded that, 70% of the respondents are having

their own home and 30% are not having their own home they living in the rent

houses.

Table No. 4.2 AWARENESS ABOUT THE HOME LOAN PRODUCT OF

FOLLOWING BANK

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Bank

Number of respondents

Sr. No

Percentage

ICICI

20

20

HDFC

30

30

PNB

20

20

Other

30

30

100

100

TOTAL

Sources: Primary Data

Graph no. 4.2 AWARENESS ABOUT THE HOME LOAN PRODUCT OF

FOLLOWING BANK

Awareness about home loan

30%

20%

ICICI

HDFC

PNB

Other

20%

30%

Interpretation

From above data it can be concluded that, 30% of the respondent mostly aware

about the home loan scheme of HDFC, 20% respondents aware each of ICICI and

PNB and 30% respondents other banks.

In other State bank of India, central bank of India, bank of Maharashtra is involved.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Table No. 4.3 RESPONDENTS TAKEN HOME LOAN OR NOT

Option

Sr. No

1

2

Number of respondents

Yes

No

TOTAL

100

0

Percentage

100

0

100

100

Sources: Primary Data

Graph no. 4. 3 RESPONDENTS TAKEN HOME LOAN OR NOT

Home loan taken

Yes

No

100

Interpretation

From above data it can be concluded that, 100% respondents are taken the

home loan and 0% respondents have not taken the home loan.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Table No. 4.4 FACTOR INFLUENCING RESPODENTS TO TAKEN LOAN

Factor

Number of

Interest rate

respondents

16

16

Service provide by peoples coop.

43

43

Sr. No

Percentage

bank, hingoli

Payback period

20

20

Other

21

21

100

100

TOTAL

Sources: Primary Data

Graph no. 4. 4 FACTOR INFLUENCING RESPODENTS TO TAKEN LOAN

21

16

Interest rate

Service provide by

peoples coop. bank,

hingoli

20

Payback period

43

Other

Interpretation

From above data it can be concluded that, 43% respondents have said the

factor of taking home loan to service provided by Peoples cooperative Bank, Hingoli,

16% respondents said interest rates, 20% respondents give payback period reason and

21% respondents said other.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

In other State bank of India, central bank of India, bank of Maharashtra is involved.

Table No. 4.5 IN FUTURE, RESPONDENTS WOULD BE INTERESTED TO TAKE

HOME LOAN

Opinion

Number of

Sr. No

Percentage

1

2

Yes

N0

TOTAL

respondents

55

45

55

45

100

100

Sources: Primary Data

Table No. 4.5 IN FUTURE, RESPONDENTS WOULD BE INTERESTED TO TAKE

HOME LOAN

Number of respondents

Yes

N0

45%

55%

Interpretation

From above data it can be concluded that, 55% of the respondents are would

be take loan in future, and 45% respondents dont want to take home loan in future.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Table No. 4.6 WHEN HAVE TAKEN LOAN BY RESPONDENTS

Time

Number of

Sr. No

1

2

3

Percentage

Before 1 year

Before 2-3 years

Before more than 3 years

TOTAL

respondents

33

46

21

33

46

21

100

100

Sources: Primary Data

Graph no. 4.6 WHEN HAVE TAKEN LOAN BY RESPONDENTS

time of loan taken

Before 1 year

21

33

Before 2-3 years

Before more than 3

years

46

Interpretation

From above data it can be concluded that, the time is shown when respondents

taken home from the peoples cooperative bank, Hingoli

Before 1 year- 33%

Before 2-3 years- 46%

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Before more 3 years- 21%

Table No. 4.7 THE AMOUNT OF HOUSING LOAN TAKEN BY THE

RESPONDENTS

Amount

Number of

Sr. No

1

2

3

Percentage

5-10 Lacs

10-15 lac

More than 15 lacs

TOTAL

respondents

69

20

11

69

20

11

100

100

Sources: Primary Data

Graph no. 4.7 THE AMOUNT OF HOUSING LOAN TAKEN BY THE

RESPONDENTS

Amount of loan taken

11

5-10 Lacs

10-15 lac

20

More than 15 lacs

69

Interpretation

From above data it can be concluded that, 69% of the respondents are said 510 lacs loan taken from the bank of Peoples Cooperative, Hingoli, 20% said 10-15

lacs, and 11% respondents said more than 15 lacs.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Table No. 4.8 REASON OF TAKING LOAN FROM PEOPLES COOPERATIVE

BANK HINGOLI

Reason

Number of respondents

Sr. No

Percentage

Faster processing

39

39

Interest rates

31

31

Brand image of the bank

21

21

other

09

09

100

100

TOTAL

Sources: Primary Data

Graph no. 4.8 REASON OF TAKING LOAN FROM PEOPLES COOPERATIVE

BANK HINGOLI

Reason for taking loan

Faster processing

Interest rates

21

39

Brand image of the bank

other

31

Interpretation

From above data it can be concluded that, 39% of the respondents are said

reason for taking loan from peoples coop. bank, Hingoli is fast processing and 31%

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

are said to interest rates of the bank, 21% said brand image of the bank and 09% said

other reason.

Table No. 4.9 RATING OF THE INTEREST RATES CHARGE BY THE PEOPLES

COOPERATIVE BANK HINGOLI

Rating

Number of

Sr. No

1

2

3

4

Highly satisfactory

Satisfactory

Averagely satisfactory

dissatisfactory

TOTAL

Percentage

respondents

31

29

22

18

31

29

22

18

100

100

Sources: Primary Data

Graph no. 4.9 RATING OF THE INTEREST RATES CHARGE BY THE PEOPLES

COOPERATIVE BANK HINGOLI

rating of interest rates

Highly satisfactory

18

31

Satisfactory

Averagely satisfactory

dissatisfactory

22

29

Interpretation

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

From above data it can be concluded that, 31% of the respondents give rating

as highly satisfactory to interest rates of Peoples cooperative Bank, Hingoli, 29%

give satisfactory, 22% rate averagely satisfactory and 18% give dissatisfactory.

Table No. 4.10 RATING OF THE EMI OF PEOPLES COOPERATIVE BANK

HINGOLI

Sr. No

1

2

3

4

Rating

Number of respondents

Highly satisfactory

Satisfactory

Averagely satisfactory

dissatisfactory

TOTAL

28

22

15

35

Percentage

28

22

15

35

100

100

Sources: Primary Data

Graph no. 4.10 RATING OF THE EMI OF PEOPLES COOPERATIVE BANK

HINGOLI

rating of EMI

Highly satisfactory

Satisfactory

Averagely satisfactory

dissatisfactory

35%

15%

28%

22%

Interpretation

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

From above data it can be concluded that, 28% of the respondents give rating

as highly satisfactory to EMI of Peoples cooperative Bank, Hingoli, 22% give

satisfactory, 15% rate averagely satisfactory and 35% give dissatisfactory.

Table No. 4.11 RATING OF THE DOCUMENTATION PROCEDURES OF

PEOPLES COOPERATIVE BANK HINGOLI

Sr. No

1

2

3

4

Rating

Number of respondents

Highly satisfactory

Satisfactory

Averagely satisfactory

dissatisfactory

TOTAL

28

22

15

35

Percentage

28

22

15

35

100

100

Sources: Primary Data

Graph no. 4.11 RATING OF THE DOCUMENTATION PROCEDURES OF

PEOPLES COOPERATIVE BANK HINGOLI

rating about deocumentry

28

35

Highly satisfactory

Satisfactory

Averagely satisfactory

dissatisfactory

15

22

Interpretation

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

From above data it can be concluded that, 28% of the respondents give rating

as highly satisfactory to documentary procedures of Peoples cooperative Bank,

Hingoli, 22% give satisfactory, 15% rate averagely satisfactory and 35% give

dissatisfactory.

Table No. 4.12 RATING OF THE SANCTIONING PROCEDURES OF PEOPLES

COOPERATIVE BANK HINGOLI

Sr. No

1

2

3

4

Rating

Number of respondents

Highly satisfactory

Satisfactory

Averagely satisfactory

dissatisfactory

TOTAL

20

18

16

35

Percentage

20

18

16

35

100

100

Sources: Primary Data

Graph no. 4.12 RATING OF THE SANCTIONING PROCEDURES OF PEOPLES

COOPERATIVE BANK HINGOLI

rating of sanctioning procedures

20

35

Highly satisfactory

Satisfactory

Averagely satisfactory

dissatisfactory

18

16

Interpretation

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

From above data it can be concluded that, 20% of the respondents give rating

as highly satisfactory to sanctioning procedures of Peoples cooperative Bank,

Hingoli, 18% give satisfactory, 16% rate averagely satisfactory and 35% give

dissatisfactory.

Table No. 4.13 SATISFACTION FROM HOUSING FINANCE OF PEOPLES

COOPERATIVE BANK, HINGOLI

Sr. No

1

2

Opinion

Number of respondents

Yes

N0

TOTAL

55

45

Percentage

55

45

100

100

Sources: Primary Data

Table No. 4.13 SATISFACTION FROM HOUSING FINANCE OF PEOPLES

COOPERATIVE BANK, HINGOLI

satisfaction

Yes

45%

N0

55%

Interpretation

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

From above data it can be concluded that, 55% of the respondents are satisfied

with home loan of Peoples cooperative Bank, Hingoli and 45% not satisfied with

taking home loan of the bank.

Table No. 4.14 DURATION PREFERENCES OF LOAN OF PEOPLES

COOPERATIVE BANK HINGOLI

Duration

Sr. No

1

2

3

4

Number of respondents

Below 5 years

5-10 years

10-15 years

15-20 years

TOTAL

39

31

21

09

Percentage

39

31

21

09

100

100

Sources: Primary Data

Graph no. 4.14 DURATION PREFERENCES OF LOAN OF PEOPLES

COOPERATIVE BANK HINGOLI

Reason for taking loan

9

21

Below 5 years

39

5-10 years

10-15 years

15-20 years

31

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

Interpretation

From above data it can be concluded that, 39% of the respondents prefer

below 5 years duration of EMI loan from peoples coop. bank, Hingoli and 31% are

prefer 5-10 years, 21% prefer 10-15 years and 09% prefer 15-20 years.

CHAPTER 5

FINDINGS & CONSLUSIONS

1. In this research process, 70% respondents are their own home.

2. In this research process, researcher found that, mostly respondents have aware

about HDFC home loan.

3. 70% respondents having taken home loans from bank.

4. From that research process, 43% respondents said the factor influencing to taking

home loan that service provided by the Peoples cooperative Bank, Hingoli.

5. In this research process, in future 55% respondents would be home loan taken

from the any bank.

6. In between the respondents who taken the home loan from a bank, they mostly

said that, they took loan before 2-3 years ago.

7. In the research process, 69% respondents taken the loan amount of 5-10 lacs most.

8. In this research process, mostly respondents said the reason to take the loan from

Peoples cooperative bank, Hingoli is to faster processing.

9. In the rating par, respondents rate the interest rate of the bank is highly

satisfactory.

10. In another part of EMI rating, mostly respondents rate the EMI as highly

satisfactory.

11. In this research process, respondents rate the documentation procedures as highly

satisfactory.

12. In this research process, respondents rate the sanctioning procedures as

satisfactory.

13. Mostly respondents are satisfied with taking home loan from the bank of Peoples

cooperative bank, Hingoli.

14. Duration that prefer by the respondents mostly is below 5 years.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

CHAPTER 6

SUGGESTIONS

1. Bank should try to concentrate on the satisfaction level of the loan taker.

2. Bank should decrease the problem in case of the documentary, sanctioning, and

EMI.

3. Bank should try to sale more loans by reducing the interest rates.

4. They should try to provide loan schemes to the customers.

5. Bank should try to open more branches at tahsil level and other district level

where it havent branch.

6. Bank should try to create advertisement about loan schemes of the bank.

7. Bank should try to aware the customer about the all procedures and documentary

before the loan taken.

8. Bank should try to give more emphasize on the loan scheme.

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

CHAPTER 7

HYPOTHESIS TESTING

1.

Customers are satisfied by the housing finance facilities provided by the

peoples co-operative bank.

Satisfaction from housing finance of peoples cooperative bank, hingoli

Sr. No

1

2

Opinion

Number of respondents

Yes

N0

TOTAL

78

22

Percentage

78

22

100

100

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

satisfaction

22%

Yes

N0

78%

From above data it , 78% of the respondents are satisfied with home

loan of Peoples cooperative Bank, Hingoli and 28% not satisfied with taking

home loan of the bank. Alternate hypothesis is proved.

2.

The process of loan and documentation are easy and bank approved more

number of proposals.

Process of loan and documentation are easy of Peoples co-operative

bank, Hingoli

Sr. No

1

2

Opinion

Number of respondents

Yes

N0

TOTAL

55

45

Percentage

55

45

100

100

College of Management & Computer science, Yavatmal

A Study of Housing Finance with reference to Peoples Co-operative Bank Hingoli

Branch Yavatmal

satisfaction

Yes

N0

45%

55%

From above data it , 55% of the respondents are said yes to lengthy

documentation with home loan of Peoples cooperative Bank, Hingoli and

45% said no. Alternate hypothesis is proved.

College of Management & Computer science, Yavatmal

Вам также может понравиться

- Banking India: Accepting Deposits for the Purpose of LendingОт EverandBanking India: Accepting Deposits for the Purpose of LendingОценок пока нет

- Cooperative Banking ProjectДокумент53 страницыCooperative Banking ProjectselvamОценок пока нет

- Introduction PDCBДокумент8 страницIntroduction PDCBletter2lalОценок пока нет

- Cooperative Bank Whole InfoДокумент9 страницCooperative Bank Whole Infoyatin patilОценок пока нет

- Guidance Note on State-Owned Enterprise Reform in Sovereign Projects and ProgramsОт EverandGuidance Note on State-Owned Enterprise Reform in Sovereign Projects and ProgramsОценок пока нет

- Introduction To Co-Operative Banking: DefinationДокумент9 страницIntroduction To Co-Operative Banking: DefinationHelloprojectОценок пока нет

- Guidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsОт EverandGuidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsОценок пока нет

- Co Operative Banking ProjectДокумент55 страницCo Operative Banking ProjectlizamandevОценок пока нет

- Co-Operative Bank: Sr. No. Topic NameДокумент66 страницCo-Operative Bank: Sr. No. Topic NameAmey DalviОценок пока нет

- Ch. 1. Introduction To Co-Operative Banking: DefinationДокумент54 страницыCh. 1. Introduction To Co-Operative Banking: DefinationBinoy MehtaОценок пока нет

- Co Operative Bank 48Документ35 страницCo Operative Bank 48Akanksha SawantОценок пока нет

- Agencies of Cash Flow: How to Raise and Invest Long-Term Money for Foundations and EndowmentsОт EverandAgencies of Cash Flow: How to Raise and Invest Long-Term Money for Foundations and EndowmentsОценок пока нет

- Comparative Study of Saraswat Co-Operative Bank and Abhudaya Co-Operative BankДокумент74 страницыComparative Study of Saraswat Co-Operative Bank and Abhudaya Co-Operative BankAakash SonarОценок пока нет

- Full Info of Coperative BanksДокумент15 страницFull Info of Coperative BanksAkash ShirsatОценок пока нет

- 25 Co-Operative Banks in IndiaДокумент20 страниц25 Co-Operative Banks in IndiaAman SinghОценок пока нет

- Comparative Study Between Two Co-Opertive BankДокумент47 страницComparative Study Between Two Co-Opertive BankParag More71% (7)

- Banking Law SaloniДокумент14 страницBanking Law SaloniNikunj Adrian PokhrelОценок пока нет

- INTRODUCTION TO CO OperativeДокумент30 страницINTRODUCTION TO CO OperativeAkash MauryaОценок пока нет

- Co Operative Banking ProjectДокумент55 страницCo Operative Banking Projectamit9_prince91% (11)

- Co Operative Banking Final ProjectДокумент65 страницCo Operative Banking Final ProjectYogi525Оценок пока нет

- Citizen Urban Co-Op. BankДокумент55 страницCitizen Urban Co-Op. BankSpUnky Rohit100% (1)

- Raj BankДокумент56 страницRaj BankSunny BhattОценок пока нет

- 1.industry Overview of Co-Operative Bank: 1.1 Defination: Co-Opertive BankingДокумент6 страниц1.industry Overview of Co-Operative Bank: 1.1 Defination: Co-Opertive BankingGokul KrishnanОценок пока нет

- Introduction of Banking System and Co-Operative BankingДокумент50 страницIntroduction of Banking System and Co-Operative Bankingjkpatel221Оценок пока нет

- Projct 2Документ46 страницProjct 2Varinder BhukalОценок пока нет

- Introduction To Co OpsДокумент5 страницIntroduction To Co Opssapanamadas4540Оценок пока нет

- Avinash ProjectДокумент58 страницAvinash ProjectSonali Pawar100% (1)

- Co-Operative Banking Chapter-1 Introduction To Co-Operative BankingДокумент10 страницCo-Operative Banking Chapter-1 Introduction To Co-Operative BankinggupthaОценок пока нет

- Pallavi Co-Operative Bank FinalДокумент70 страницPallavi Co-Operative Bank FinalS101117400076Оценок пока нет

- 11 Chapter 4Документ7 страниц11 Chapter 419UEI014 , PRITAM DebОценок пока нет

- Project Report On Citizens Urban Co-Op. Bnak: Submitted To: - Submitted ByДокумент55 страницProject Report On Citizens Urban Co-Op. Bnak: Submitted To: - Submitted ByAnkitОценок пока нет

- Snehit Bank LTD Final PDFДокумент69 страницSnehit Bank LTD Final PDFRuishabh RunwalОценок пока нет

- Rural Banking and Micro Finance: Unit: IVДокумент17 страницRural Banking and Micro Finance: Unit: IVkimberly0jonesОценок пока нет

- Comparative Study of Sarswat Co POOJAДокумент9 страницComparative Study of Sarswat Co POOJARavi harhareОценок пока нет

- Pooja Project BB (AutoRecovered)Документ51 страницаPooja Project BB (AutoRecovered)Ravi harhareОценок пока нет

- Pooja Project BBДокумент22 страницыPooja Project BBRavi harhareОценок пока нет

- Chapter - IДокумент32 страницыChapter - ISiva KumarОценок пока нет

- Cooperative Banks: Role and Status in IndiaДокумент26 страницCooperative Banks: Role and Status in IndiaRanjit Kumar MahtoОценок пока нет

- E Banking ServicesДокумент90 страницE Banking ServicesManjunath Leo100% (2)

- Priyankur SynopsisДокумент26 страницPriyankur SynopsisMukesh SharmaОценок пока нет

- Rad HaДокумент80 страницRad HaHarisha HmОценок пока нет

- Cooperative Banks: School of Law, Narsee Monjee Institute of Management Studies, BangaloreДокумент13 страницCooperative Banks: School of Law, Narsee Monjee Institute of Management Studies, BangaloreHIMANSHU GOYALОценок пока нет

- Cooperative Banking-1111Документ63 страницыCooperative Banking-1111ch.nagarjunaОценок пока нет

- Ms. Reeti Bora Mondal Aarzoo, Anubhav, Ashwani, Bhawna, Keshav, TariniДокумент16 страницMs. Reeti Bora Mondal Aarzoo, Anubhav, Ashwani, Bhawna, Keshav, TariniAditi MondalОценок пока нет

- Cooperative Bank Internship ProjectДокумент64 страницыCooperative Bank Internship ProjectPrashanth Gowda82% (57)

- Sutex Co-Op Bank ProjectДокумент49 страницSutex Co-Op Bank ProjectHinal Prajapati100% (4)

- Unit 5Документ17 страницUnit 5aОценок пока нет

- Banking System in India1Документ7 страницBanking System in India1Srikanth Prasanna BhaskarОценок пока нет

- Dokumen - Tips Cooperative Bank Internship ProjectДокумент66 страницDokumen - Tips Cooperative Bank Internship ProjectShubhamverrma8517Оценок пока нет

- Cooperative Bank Internship ProjectДокумент64 страницыCooperative Bank Internship ProjectJagadish KumarОценок пока нет

- 07 - Chapter 2Документ40 страниц07 - Chapter 2Aakash DebnathОценок пока нет

- Industry ProfileДокумент15 страницIndustry ProfileP.Anandha Geethan80% (5)

- Pooja 121998 Mcom ProjectДокумент92 страницыPooja 121998 Mcom ProjectFranklin RjamesОценок пока нет

- Co-Operative Banking ProjecT2Документ38 страницCo-Operative Banking ProjecT2manindersingh9490% (1)

- Diversified Products of HaldiramДокумент44 страницыDiversified Products of HaldiramSandip NaradОценок пока нет

- Full DissertationДокумент50 страницFull DissertationSandip NaradОценок пока нет

- Dissertation On Retail Marketing of Pragati Bakery Ltd. AmrvattiДокумент43 страницыDissertation On Retail Marketing of Pragati Bakery Ltd. AmrvattiSandip NaradОценок пока нет

- Final DISSERTATION SALES PROMOTION OF SONY LENOVO LAPTOPSДокумент13 страницFinal DISSERTATION SALES PROMOTION OF SONY LENOVO LAPTOPSSandip NaradОценок пока нет

- Dissertation On Retail Marketing of Pragati Bakery Ltd. AmrvattiДокумент43 страницыDissertation On Retail Marketing of Pragati Bakery Ltd. AmrvattiSandip NaradОценок пока нет

- A Dissertation On Satisfaction LevelДокумент44 страницыA Dissertation On Satisfaction LevelSandip Narad0% (1)

- MBA Dissertation On Consumer BehaviorДокумент45 страницMBA Dissertation On Consumer BehaviorSandip Narad100% (1)

- Dave Final PropsalДокумент21 страницаDave Final PropsalDeavoОценок пока нет

- Directorate of Planning & Statistics: Administration of The Union Territory of LakshadweepДокумент248 страницDirectorate of Planning & Statistics: Administration of The Union Territory of LakshadweepAjims SaidukudyОценок пока нет

- 18 MANAGE Discussion Paper 18 MANAGE 2020Документ43 страницы18 MANAGE Discussion Paper 18 MANAGE 20201stabhishekОценок пока нет

- Tax Law Assignment 2015 November 29Документ5 страницTax Law Assignment 2015 November 29Samuel NgangaОценок пока нет

- Fedore Cooperative Effective Conflict Resolution and Decision MakingДокумент12 страницFedore Cooperative Effective Conflict Resolution and Decision MakingShujat AliОценок пока нет

- Abhishekgouda Danappagoudar 20SKCMD007Документ80 страницAbhishekgouda Danappagoudar 20SKCMD007Siddanna ChoudhariОценок пока нет

- Description About The KomulДокумент36 страницDescription About The KomulShashi ReddyОценок пока нет

- A Critical Analysis of The Land Reforms Programme in India: Jyoti BerwalДокумент5 страницA Critical Analysis of The Land Reforms Programme in India: Jyoti Berwalgaurav singhОценок пока нет

- VitttaДокумент16 страницVitttaMonika SainiОценок пока нет

- Name: Nudrat Zaheen ID: 173011078 GED-467: Seminar On Grassroots Economic DevelopmentДокумент6 страницName: Nudrat Zaheen ID: 173011078 GED-467: Seminar On Grassroots Economic DevelopmentNudrat Zaheen ChowdhuryОценок пока нет

- CASE: SSS vs. Atlantic GulfДокумент8 страницCASE: SSS vs. Atlantic GulfNelia Mae S. VillenaОценок пока нет

- Agrarian Reform Law and Soc LegДокумент100 страницAgrarian Reform Law and Soc Leghello_hoarderОценок пока нет

- Co OpsДокумент66 страницCo OpsnehaasОценок пока нет

- FM ELECT-3 Module EDITEDДокумент11 страницFM ELECT-3 Module EDITEDRoel P. Dolaypan Jr.Оценок пока нет

- Introduction To Project ReportДокумент79 страницIntroduction To Project Reportvageeshhonnali4618Оценок пока нет

- GFRAS NELK M11-Agricultural Entrepreneurship-ManualДокумент273 страницыGFRAS NELK M11-Agricultural Entrepreneurship-ManualNikk G100% (1)

- Paress J. KiweluДокумент66 страницParess J. KiweluYonas Adugna YonasОценок пока нет

- Learning Unit 3: Establishing A BusinessДокумент9 страницLearning Unit 3: Establishing A BusinessVhukhudo SikhwivhiluОценок пока нет

- Sample Legal Documents For CooperativesДокумент50 страницSample Legal Documents For CooperativesBuatienoОценок пока нет

- Government of India Allocation of Business Rules 1961Документ173 страницыGovernment of India Allocation of Business Rules 1961Latest Laws TeamОценок пока нет

- FoKSBI National Action Plan - Draft 6Документ30 страницFoKSBI National Action Plan - Draft 6fellandoОценок пока нет

- Activity Sheet - Preparing A Business Plan (2nd)Документ9 страницActivity Sheet - Preparing A Business Plan (2nd)lionellОценок пока нет

- Imp SipДокумент59 страницImp Sipvenkatesh telangОценок пока нет

- Short Answer QuestionsДокумент3 страницыShort Answer QuestionsHarman Singh KalsiОценок пока нет

- Report On Trend and Progress of Banking in India 2020-21-1640701782Документ248 страницReport On Trend and Progress of Banking in India 2020-21-1640701782Uttkarsh BhatnagarОценок пока нет

- Social Enterprise TypologyДокумент133 страницыSocial Enterprise TypologyJorge MiguelОценок пока нет

- Chapter 2 FormsofaBusinessOrganizationДокумент19 страницChapter 2 FormsofaBusinessOrganizationAnuj Kumar SinghОценок пока нет

- TriVita Sales & Marketing PlanДокумент10 страницTriVita Sales & Marketing PlanShelly DuncanОценок пока нет

- List of Non-Scheduled Urban Co-Operative Banks Sr. No. Bank Name RO NameДокумент102 страницыList of Non-Scheduled Urban Co-Operative Banks Sr. No. Bank Name RO NameSusanОценок пока нет

- INTRODUCTORY STUDY From Natalia LAZAR, Lya BENJAMIN Joint Tipar 10 Octombrie FINALДокумент29 страницINTRODUCTORY STUDY From Natalia LAZAR, Lya BENJAMIN Joint Tipar 10 Octombrie FINALAdrian Cioflâncă100% (1)

- How To Budget And Manage Your Money In 7 Simple StepsОт EverandHow To Budget And Manage Your Money In 7 Simple StepsРейтинг: 5 из 5 звезд5/5 (4)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantОт EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantРейтинг: 4 из 5 звезд4/5 (104)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonОт EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonРейтинг: 5 из 5 звезд5/5 (9)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationОт EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationРейтинг: 4.5 из 5 звезд4.5/5 (18)

- The Best Team Wins: The New Science of High PerformanceОт EverandThe Best Team Wins: The New Science of High PerformanceРейтинг: 4.5 из 5 звезд4.5/5 (31)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyОт EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyРейтинг: 5 из 5 звезд5/5 (1)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОт EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОценок пока нет

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.От EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Рейтинг: 5 из 5 звезд5/5 (89)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessОт EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessРейтинг: 4.5 из 5 звезд4.5/5 (4)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)От EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Рейтинг: 3.5 из 5 звезд3.5/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОт EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОценок пока нет

- Rich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouОт EverandRich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouРейтинг: 4 из 5 звезд4/5 (2)

- How to Save Money: 100 Ways to Live a Frugal LifeОт EverandHow to Save Money: 100 Ways to Live a Frugal LifeРейтинг: 5 из 5 звезд5/5 (1)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestОт EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestРейтинг: 5 из 5 звезд5/5 (1)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherОт EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherРейтинг: 5 из 5 звезд5/5 (14)

- The Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomОт EverandThe Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayОт EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayРейтинг: 3.5 из 5 звезд3.5/5 (2)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitОт EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitОценок пока нет

- Buy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeОт EverandBuy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeОценок пока нет

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsОт EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsРейтинг: 4 из 5 звезд4/5 (4)