Академический Документы

Профессиональный Документы

Культура Документы

Budgeting

Загружено:

Rith TryАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Budgeting

Загружено:

Rith TryАвторское право:

Доступные форматы

Question 2

The following information relates to the polishing section of the furniture assembly

department of Cooper Highlife Ltd, for the budget year, Year 9:

(1)

Planned output of polished units:

Product XR9

1,000 units

Product XT69

1,600 units

Product XM3

530 units

(2)

This output is expected to be evenly spread over the 50-week production

(3)

(4)

year.

Standard polishing times in hours per unit:

Product XR9

2.5

Product XR6

3.2

Product XR3

6.0

10% of the attendance time of direct operatives will be preparation and

cleaning time. This is not allowed for in the standard polishing times give in

(5)

(3).

Two indirect workers will also be employed, each attending for a 44-hour

week. Four of these hours will be overtime, payable at time and a half. Direct

(6)

operatives work a basic 40-hour week and do not work any overtime.

Budget rates of pay per attendance hour are:

(7)

Direct operatives

RM8.40

Indirect operatives

RM6.10

Two weeks holiday pay at basic rates (excluding overtime) should be

(8)

provided for both direct and indirect operatives.

The polishing section supervisor receives a salary of RM20,000 per annum.

REQUIRED:

(i) Prepare a budget for all labour costs of the polishing section for Year 9,

analyzed under appropriate headings. Your answer should show

clearly the number of direct operatives to be employed.

(12 marks)

(ii) From the following information which relates to Week 1 of Year 9,

calculate:

(a)

The Production Volume ratio (or Activity ratio)

(b)

The Efficiency ratio

Units polished:

Product XR9

17 units

Product XT6

40 units

Product XM3

4 units

Direct operative hours:

Attended

Preparation/Cleaning

240 hours

30 hours

Productive hours

210 hours

(8marks)

(Total 20marks)

Suggested Answer 2

(i)

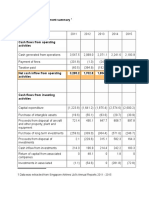

LABOUR BUDGET FOR YEAR 9- POLISHING SECTION

Normal Attendance

Overtime

Holiday

Pay

Pay

Pay

RM

RM

Total

RM

RM

Direct labor cost

Direct operatives (12,000 x RM8.40) 100,800

100,800

Indirect labor cost

(6 workers x 40

Direct operatives

x 2 wks x 8.40)

(2 workers x 40 x

Indirect operatives 50 wks x RM6.10)

4,032

4,032

(2 x 4 x 50 x

24,400 RM6.10 X 1.5)

3,660 (2 X 40 X 2 X 6.10)

976

29,036

Supervisors salary

20,000

Total labor cost budget

153,868

No. of Direct Operatives=

Budget Standard Hours( Attendance)

Attendance Hours per Operative

12,000

2, 000

=6

(ii)(a) Production Volume Ratio

(or Activity Ratio)

Standard Hours of Actual Production (W 2)

x100%

Budget Standard Hours(W 3)

194.5

x100%

216

=90.05%

(b) Efficiency Ratio

Standard Hours of Actual Production

x100%

Actual Hours Worked

194.5

x100%

210

=92.62%

WORKINGS:

(1) Polishing Section

XR9

Standard hours per unit

2.5

Budgeted output (units)

1,000

Budgeted standard hours 2,500

Preparation& Cleaning time

(10% of attendance time)

Budgeted attendance time per year

Per direct operative

No. of weeks per year

Less: No. of weeks holiday

Product

XT6

XM3

3.2

1,600

5,120

6

530

3,180

Total

10,800

1,200

90

10

12,000

100

52

2

50

No. of weeks productive

x Attendance hours per week

x 40

Total attendance hours per year

2,000

(2) Standard (Polishing) Hours of Actual Production

Product

XR9

XT6

XM3

Actual Productions

(Unit)

17

40

4

Standard Polishing Hours

Per Unit

2.5

3.2

6.0

Standard Hours

of Actual Production

42.50

128.00

24.00

194.50

(3)

Budgeted Standard Hours

Product

XR9

XT6

XM3

Budgeted Production/work Standard Polishing Hours

(Unit)

Per Unit

(1,000/50 wks) 20.00

2.5

(1,600/50 wks) 32.00

3.2

( 530/50 wks) 10.60

6.0

Budgeted Standard

Hours

50.00

102.40

63.60

216.00

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Quit Your JobДокумент30 страницQuit Your JobNoah Navarro100% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Contract Law CasesДокумент6 страницContract Law CasesRith Try100% (2)

- FORM16Документ11 страницFORM16ganeshPVRMОценок пока нет

- 4 Theory of Behavioral FinanceДокумент27 страниц4 Theory of Behavioral FinanceImran AliОценок пока нет

- Ipcr - Recio 1st Sem 2022Документ2 страницыIpcr - Recio 1st Sem 2022Angelic RecioОценок пока нет

- CIR Vs PLDT DigestДокумент3 страницыCIR Vs PLDT DigestKath Leen100% (3)

- Final Global Entrep Summer Sy2019 PDFДокумент32 страницыFinal Global Entrep Summer Sy2019 PDFThoughts and More ThoughtsОценок пока нет

- Business Statistics FormulaДокумент4 страницыBusiness Statistics FormulaRith TryОценок пока нет

- f6 SGP SG 2016Документ12 страницf6 SGP SG 2016Rith TryОценок пока нет

- Cashflow Statements - ACCA GlobalДокумент3 страницыCashflow Statements - ACCA GlobalRith TryОценок пока нет

- 5 Year Cash FlowДокумент5 страниц5 Year Cash FlowRith TryОценок пока нет

- Decision Making LCCIДокумент9 страницDecision Making LCCIRith TryОценок пока нет

- We Like Project23Документ68 страницWe Like Project23Manish ChuriОценок пока нет

- Initiating Coverage On JP Associates LTDДокумент23 страницыInitiating Coverage On JP Associates LTDVarun YadavОценок пока нет

- Cherryl Febryan Christyanto - 202030225Документ6 страницCherryl Febryan Christyanto - 202030225Cherryl Febryan ChristyantoОценок пока нет

- Manchester United PLC 20f 20141027Документ706 страницManchester United PLC 20f 20141027Hassan ShahidОценок пока нет

- Chapter 4 & 5Документ136 страницChapter 4 & 5Bangtan RuniОценок пока нет

- A Comparative Analysis of Investors Buying Behavior of Urban Rural For Financial Assets Specifically Focused On Mutual FundДокумент10 страницA Comparative Analysis of Investors Buying Behavior of Urban Rural For Financial Assets Specifically Focused On Mutual FundSrishti GoyalОценок пока нет

- Circular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButДокумент18 страницCircular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButAnshОценок пока нет

- Disbursement Voucher FidelityДокумент1 страницаDisbursement Voucher FidelityGigi Quinsay VisperasОценок пока нет

- 12 Economic Lyp 2016 Delhi Set2 PDFДокумент20 страниц12 Economic Lyp 2016 Delhi Set2 PDFAshish GangwalОценок пока нет

- 1st Amendment To Valvino Operating AgreementДокумент6 страниц1st Amendment To Valvino Operating AgreementJeff BoydОценок пока нет

- Chapter 2 PPT - UpdatedДокумент58 страницChapter 2 PPT - UpdatedmmОценок пока нет

- Features of SBI Simply Save CardДокумент2 страницыFeatures of SBI Simply Save CardPradyumna CbОценок пока нет

- MYPF Pref Database 15may'13Документ319 страницMYPF Pref Database 15may'13Fiachra O'DriscollОценок пока нет

- Strategic Management Chap008Документ60 страницStrategic Management Chap008rizz_inkays100% (2)

- What Is CapitalismДокумент15 страницWhat Is Capitalismkingfund7823Оценок пока нет

- Calamos Market Neutral Income Fund: CmnixДокумент2 страницыCalamos Market Neutral Income Fund: CmnixAl BruceОценок пока нет

- Name: Saebyuck Co. LTD Address: 131-4, Jikdong-Ro, Gwagju-Si, Gyeonggi-Do, Republik of Korea Phone: 031-766-6987Документ5 страницName: Saebyuck Co. LTD Address: 131-4, Jikdong-Ro, Gwagju-Si, Gyeonggi-Do, Republik of Korea Phone: 031-766-6987Deni RahmatОценок пока нет

- 62 US Soft Drink MarketДокумент20 страниц62 US Soft Drink MarketViktoria BerezhetskayaОценок пока нет

- Psa 500Документ19 страницPsa 500Anthony FinОценок пока нет

- Final Project ForexДокумент145 страницFinal Project ForexdamupatelОценок пока нет

- Primary Objective (RA 11211) : Salient AmendmentsДокумент25 страницPrimary Objective (RA 11211) : Salient AmendmentsSam OneОценок пока нет

- Campos Rueda & Co V Pacific Commercial (44 Phil 916) : Eluao vs. CasteelДокумент7 страницCampos Rueda & Co V Pacific Commercial (44 Phil 916) : Eluao vs. CasteelR-lheneFidelОценок пока нет

- 032465913X 164223Документ72 страницы032465913X 164223March AthenaОценок пока нет

- Cadbury CodeДокумент15 страницCadbury CodetoahaОценок пока нет