Академический Документы

Профессиональный Документы

Культура Документы

Unit Trust DHP

Загружено:

Slice Le0 оценок0% нашли этот документ полезным (0 голосов)

40 просмотров4 страницыunit trust

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документunit trust

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

40 просмотров4 страницыUnit Trust DHP

Загружено:

Slice Leunit trust

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

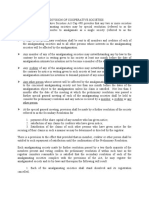

Unit trust

- Investors money is pooled with

Investment trust

- Investors investing in an

ETF

- Investors money is pooled

other investors. Unit trust is a kind

investment trust trade its shares

with money from other

of collective investment scheme.

on the stock exchange through a

investors and invested

broker.

according to ETFs stated

investment objective.

- Investment trust is a limited

- The pool of money is used to

finance a wide range of

investments such as shares,

bonds, property, commodity,

company which operates to

An ETFs objective is to produce

a return that follows closely a

generate income for its

specific index such as a stock or

shareholders through investing in

commodity index. ETFs may

the shares of other companies.

have complex structures. They

derivatives.

may be structured as cashbased ETFs or as synthetic

ETFs, which refers to the use of

- Investors invest in unit trusts by

derivatives.

- Investors invest in investment

Investors invest in ETF by

buying units in the fund. All units

trust by buying shares of the

of the same fund rank equally.

investment trust. Therefore, they,

buying units of the fund.

Investors earn income by capital

at the same time, become the

Any investors (small

gain and some unit trusts pay

shareholders with voting rights.

individual investors or large

dividends.

institutions) can equally get

access to ETFs. There is

capital gain when the price of

the units rises above the price

- It is an open-ended fund..

- Closed-ended fund .

- There is a fund manager who

takes care of investors money.

- There is no fund manager.

Investors buy and sell shares in

- The value of a unit = net asset

value = Total value of the funds/

number of units

paid for them. Some ETFs also

pay dividends.

- It is open-ended fund

- EFTs are managed

investment trusts on the stock

passively by EFT

exchange rather than dealing

managers. There are

with a fund management

management costs and

company.

other charges, however,

- Share price of an investment

they are very low.

trust can be higher or lower than

its NAV (net asset value). This

- EFTs are quoted in real

feature is factored by market

time. They are traded

demand. To be more detailed, if

throughout the day in line

share price is lower than NAV,

with the underlying index.

the shares are traded at a

discount. If share price is higher

than NAV, the shares are traded

at a premium.

- If new monies are received, new

units will be created. When

investors want to withdraw their

money from the fund, units will be

exchanged for cash value. If new

monies exceed redemptions,

managers will have additional

cash for further investments. If

new monies are less than

redemptions, managers may have

to sell some of the underlying

assets to afford the redemptions.

- Investment trust is a limited

company, so it is allowed to have

capital loan and other borrowing

forms. Capital in investment

trusts are fixed, so that they can

benefit from continuity. In fact,

capital is raised in the primary

market through IPO. Then shares

are traded publicly on the stock

exchange in secondary market.

Those transactions in secondary

market do not affect the

investment trusts capital, but

they impact the share prices

through market demand and

supply instead.

Вам также может понравиться

- BKM CH 04 AnswersДокумент9 страницBKM CH 04 Answerseric3765Оценок пока нет

- Crusades-Worksheet 2014Документ2 страницыCrusades-Worksheet 2014api-263356428Оценок пока нет

- An Introduction To Exchange Traded FundsДокумент31 страницаAn Introduction To Exchange Traded FundsChristophe HenryОценок пока нет

- 5 Investment CompaniesНИИ 3Документ15 страниц5 Investment CompaniesНИИ 3AlinaVieruОценок пока нет

- Mutual FundsДокумент6 страницMutual FundsSwahum MukherjeeОценок пока нет

- Exchange-Traded Funds: Tax Advantages For ShareholdersДокумент5 страницExchange-Traded Funds: Tax Advantages For ShareholderscaashutoshsinghОценок пока нет

- Nism Exam For Mutual FundДокумент210 страницNism Exam For Mutual FundarmailgmОценок пока нет

- MF Module 1Документ75 страницMF Module 1Gouri K MakatiОценок пока нет

- NewGold BrochureДокумент6 страницNewGold Brochurebeyu777Оценок пока нет

- 050 Chapter 12Документ20 страниц050 Chapter 12Izwa BaizuraОценок пока нет

- Mutual Funds and Other Investment CompaniesДокумент47 страницMutual Funds and Other Investment Companiesshao9213Оценок пока нет

- Open End Fund: Buy Securities From DC Receive Return (B) Sales Share To GP Pay Dividend To GP (A)Документ8 страницOpen End Fund: Buy Securities From DC Receive Return (B) Sales Share To GP Pay Dividend To GP (A)MD Abdur RahmanОценок пока нет

- Mutual Funds and Other Investment CompaniesДокумент5 страницMutual Funds and Other Investment Companiespiepkuiken-knipper0jОценок пока нет

- ETFДокумент21 страницаETFAkshita JainОценок пока нет

- Intro of MFДокумент2 страницыIntro of MFSantosh KrishnaОценок пока нет

- Exchange Traded Funds (Etfs) What Is An Etf?Документ3 страницыExchange Traded Funds (Etfs) What Is An Etf?RahulОценок пока нет

- Mutual Funds: Investing in Exchange-Traded FundsДокумент4 страницыMutual Funds: Investing in Exchange-Traded FundsGaurav GuptaОценок пока нет

- Exchange Traded FundsДокумент3 страницыExchange Traded FundsK MaheshОценок пока нет

- ETF Golden GlobeДокумент13 страницETF Golden Globepinki8Оценок пока нет

- Banking PresentationДокумент56 страницBanking PresentationRabia KhanОценок пока нет

- What Is A Mutual Fund?Документ13 страницWhat Is A Mutual Fund?uzmanickОценок пока нет

- Class 26Документ2 страницыClass 26Aasim Bin BakrОценок пока нет

- What Is A Mutual FundДокумент3 страницыWhat Is A Mutual FundNguyên HàОценок пока нет

- Chapter 6 Investment & Pension FundsДокумент31 страницаChapter 6 Investment & Pension FundsSantosh BhandariОценок пока нет

- Project On Capital Markets: Exchange Traded FundsДокумент14 страницProject On Capital Markets: Exchange Traded FundsSwati Agarwal100% (1)

- Guide To Mutual Fund InvestingДокумент8 страницGuide To Mutual Fund Investinger.nikhilpathak1Оценок пока нет

- Money That Is Gathered Is Used To Buy and Sell (Trade)Документ4 страницыMoney That Is Gathered Is Used To Buy and Sell (Trade)Jasmine OrijuelaОценок пока нет

- Investment CompanyДокумент16 страницInvestment CompanyMd Abu Taher ChowdhuryОценок пока нет

- Mutual Fund: Advantages and Disadvantages To InvestorsДокумент3 страницыMutual Fund: Advantages and Disadvantages To InvestorsafreenessaniОценок пока нет

- Glossary of Mutual Fund TermsДокумент8 страницGlossary of Mutual Fund TermsM JanОценок пока нет

- Assignment For FmsДокумент4 страницыAssignment For FmsSouvik PurkayasthaОценок пока нет

- Understanding Mutual Fund: InvestmentДокумент21 страницаUnderstanding Mutual Fund: InvestmentMegha LagareОценок пока нет

- Supply of Capital: Investment FundДокумент3 страницыSupply of Capital: Investment FundMahnoor AbbasiОценок пока нет

- Sbi Gold Etf: Etfs Charge You For Their ExpensesДокумент3 страницыSbi Gold Etf: Etfs Charge You For Their ExpensesNeha JethiОценок пока нет

- Risk Return Matrix: Mutual FundДокумент4 страницыRisk Return Matrix: Mutual FundSantosh KrishnaОценок пока нет

- Exchange Traded FundsДокумент17 страницExchange Traded Fundssiddharth18novОценок пока нет

- Exchange Traded Funds (Etfs) : Are Etfs Popular Worldwide?Документ15 страницExchange Traded Funds (Etfs) : Are Etfs Popular Worldwide?Pradeep PoojariОценок пока нет

- 3 3MutualFundsДокумент37 страниц3 3MutualFundsSwathi SriОценок пока нет

- CAPMДокумент2 страницыCAPMdantesdrechgioОценок пока нет

- Project ReportДокумент95 страницProject ReportsaivasuОценок пока нет

- Review 1 (5.1.12)Документ24 страницыReview 1 (5.1.12)sathy_sathyОценок пока нет

- Mutual Fund Valuation and Accounting Notes at MbaДокумент71 страницаMutual Fund Valuation and Accounting Notes at MbaBabasab Patil (Karrisatte)100% (1)

- Investment 1Документ26 страницInvestment 1anupan92Оценок пока нет

- What Are Mutual FundsДокумент8 страницWhat Are Mutual Fundsrushi4youОценок пока нет

- Chapter 5: Investment CompaniesДокумент16 страницChapter 5: Investment CompaniesJahangir AlamОценок пока нет

- Investment FundsДокумент16 страницInvestment Fundseunicecisnero9395Оценок пока нет

- Dividend/Constant Growth Rate of Interest (Calculate Required Return) Tutorial 6 Stock Mutual Fund StructureДокумент4 страницыDividend/Constant Growth Rate of Interest (Calculate Required Return) Tutorial 6 Stock Mutual Fund StructurehansinivrОценок пока нет

- Exchange-Traded Funds (Etfs) : Ken HawkinsДокумент21 страницаExchange-Traded Funds (Etfs) : Ken HawkinsaksiitianОценок пока нет

- d8c5cM&S IVДокумент8 страницd8c5cM&S IVashish_gupta_143Оценок пока нет

- Disadvantages Advantages and Disadvantages of Debt Financing. AdvantagesДокумент30 страницDisadvantages Advantages and Disadvantages of Debt Financing. AdvantagesazeemОценок пока нет

- BKM CH 04 Answers 561987b22037eДокумент9 страницBKM CH 04 Answers 561987b22037eLiaquat Ali KhanОценок пока нет

- Executive SummaryДокумент7 страницExecutive SummaryAshi GargОценок пока нет

- MFS, Etfs, HfsДокумент25 страницMFS, Etfs, HfsAriful Haidar MunnaОценок пока нет

- PM - Reading 42 PDFДокумент1 страницаPM - Reading 42 PDFVũ Lan PhươngОценок пока нет

- Financial Markets and Instruments 8Документ33 страницыFinancial Markets and Instruments 8Zhichang ZhangОценок пока нет

- Types of MarketsДокумент8 страницTypes of MarketsManas JainОценок пока нет

- Financial Analytics PPT EtfДокумент11 страницFinancial Analytics PPT EtfKeerthana Gowda .13Оценок пока нет

- Amfi Exam Nism V AДокумент218 страницAmfi Exam Nism V AUmang Jain67% (6)

- A Beginner's Guide to Exchange-Traded Funds (ETFs): Financial Advice Detective, #1От EverandA Beginner's Guide to Exchange-Traded Funds (ETFs): Financial Advice Detective, #1Оценок пока нет

- Australian Managed Funds for Beginners: A Basic Guide for BeginnersОт EverandAustralian Managed Funds for Beginners: A Basic Guide for BeginnersОценок пока нет

- Property DHPДокумент2 страницыProperty DHPSlice LeОценок пока нет

- Eg For Section VДокумент3 страницыEg For Section VSlice LeОценок пока нет

- Brief Examples of Writing (From Fundamental Analysis Module Guide Example of A ThirdДокумент3 страницыBrief Examples of Writing (From Fundamental Analysis Module Guide Example of A ThirdSlice LeОценок пока нет

- JD Accounts 2010Документ126 страницJD Accounts 2010Slice LeОценок пока нет

- Duong Ha PhuongДокумент1 страницаDuong Ha PhuongSlice LeОценок пока нет

- Tra MyДокумент1 страницаTra MySlice LeОценок пока нет

- Ar 2012Документ158 страницAr 2012Slice LeОценок пока нет

- Ar 2013Документ80 страницAr 2013Slice LeОценок пока нет

- How To Bathe A CatДокумент3 страницыHow To Bathe A CatSlice LeОценок пока нет

- Ar 2013Документ80 страницAr 2013Slice LeОценок пока нет

- Factors Affecting Quality of English Language Teaching and Learning in Secondary Schools in NigeriaДокумент20 страницFactors Affecting Quality of English Language Teaching and Learning in Secondary Schools in NigeriaSlice LeОценок пока нет

- Based On The Objective of Team BuildingДокумент3 страницыBased On The Objective of Team BuildingSlice LeОценок пока нет

- Ham Mo Than Tuong - Mai HienДокумент2 страницыHam Mo Than Tuong - Mai HienSlice LeОценок пока нет

- Quick NSR FormatДокумент2 страницыQuick NSR FormatRossking GarciaОценок пока нет

- Turriff& District Community Council Incorporating Turriff Town Pride GroupДокумент7 страницTurriff& District Community Council Incorporating Turriff Town Pride GroupMy TurriffОценок пока нет

- ENTU NI 28 JuneДокумент4 страницыENTU NI 28 JuneZm KholhringОценок пока нет

- CHALLANДокумент1 страницаCHALLANDaniyal ArifОценок пока нет

- K. A. Abbas v. Union of India - A Case StudyДокумент4 страницыK. A. Abbas v. Union of India - A Case StudyAditya pal100% (2)

- Moovo Press ReleaseДокумент1 страницаMoovo Press ReleaseAditya PrakashОценок пока нет

- Amalgamation of SocietiesДокумент4 страницыAmalgamation of SocietiesKen ChepkwonyОценок пока нет

- Double Shot Arcade Basketball System: Assembly InstructionsДокумент28 страницDouble Shot Arcade Basketball System: Assembly Instructionsمحمد ٦Оценок пока нет

- Soon Singh Bikar v. Perkim Kedah & AnorДокумент18 страницSoon Singh Bikar v. Perkim Kedah & AnorIeyza AzmiОценок пока нет

- Plaintiff-Appellee Vs Vs Defendants-Appellants Claro M. Recto Solicitor General Pompeyo Diaz Solicitor Meliton G. SolimanДокумент9 страницPlaintiff-Appellee Vs Vs Defendants-Appellants Claro M. Recto Solicitor General Pompeyo Diaz Solicitor Meliton G. Solimanvienuell ayingОценок пока нет

- Introduction To The Study of RizalДокумент2 страницыIntroduction To The Study of RizalCherry Mae Luchavez FloresОценок пока нет

- Exception Report Document CodesДокумент33 страницыException Report Document CodesForeclosure Fraud100% (1)

- Combinepdf PDFДокумент487 страницCombinepdf PDFpiyushОценок пока нет

- Pre-Commencement Meeting and Start-Up ArrangementsДокумент1 страницаPre-Commencement Meeting and Start-Up ArrangementsGie SiegeОценок пока нет

- Labour Cost Accounting (For Students)Документ19 страницLabour Cost Accounting (For Students)Srishabh DeoОценок пока нет

- Procedure Manual - IMS: Locomotive Workshop, Northern Railway, LucknowДокумент3 страницыProcedure Manual - IMS: Locomotive Workshop, Northern Railway, LucknowMarjorie Dulay Dumol67% (3)

- The Forrester Wave PDFДокумент15 страницThe Forrester Wave PDFManish KumarОценок пока нет

- Annual Report 17-18Документ96 страницAnnual Report 17-18Sajib Chandra RoyОценок пока нет

- Pranali Rane Appointment Letter - PranaliДокумент7 страницPranali Rane Appointment Letter - PranaliinboxvijuОценок пока нет

- Facts:: Matienzo vs. Abellera (162 SCRA 7)Документ1 страницаFacts:: Matienzo vs. Abellera (162 SCRA 7)Kenneth Ray AgustinОценок пока нет

- Social Justice Society v. Atienza, JR CASE DIGESTДокумент1 страницаSocial Justice Society v. Atienza, JR CASE DIGESTJuris Poet100% (1)

- VMA FCC ComplaintsДокумент161 страницаVMA FCC ComplaintsDeadspinОценок пока нет

- LabRel MT Long QuizДокумент4 страницыLabRel MT Long QuizDerek EgallaОценок пока нет

- LR Approved Manufacturers of Steel Castings 100104 PDFДокумент41 страницаLR Approved Manufacturers of Steel Castings 100104 PDFmaxwell onyekachukwuОценок пока нет

- Online Auction: 377 Brookview Drive, Riverdale, Georgia 30274Документ2 страницыOnline Auction: 377 Brookview Drive, Riverdale, Georgia 30274AnandОценок пока нет

- JAbraManual bt2020Документ15 страницJAbraManual bt2020HuwОценок пока нет

- Statement by Bob Rae On The Death of Don SmithДокумент1 страницаStatement by Bob Rae On The Death of Don Smithbob_rae_a4Оценок пока нет

- Cruz v. IAC DigestДокумент1 страницаCruz v. IAC DigestFrancis GuinooОценок пока нет

- Protect Kids Using Parental Control For Internet AccessДокумент2 страницыProtect Kids Using Parental Control For Internet AccessVishal SunilОценок пока нет