Академический Документы

Профессиональный Документы

Культура Документы

(Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 52

Загружено:

JasmeetИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

(Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 52

Загружено:

JasmeetАвторское право:

Доступные форматы

36

Accounting for Derivatives

Under the structure depicted, the borrower effectively achieves funding at Euribor plus

50 bps. Note that all the GBP cash flows have to be fully synchronised to eliminate the GBP

exposure. Chapter 6 includes several examples of CCSs and their pricing mechanics.

2.3.2 IAS 39 Accounting Implications

Cross-currency swaps are the most basic instruments to hedge foreign currency denominated

liabilities. In general, CCSs do not imply a major challenge from IAS 39 viewpoint. As

mentioned for interest rate swaps, there are two particular points that are worth noting: firstly,

the need to define hedge relationships involving CCS in such a way that eligibility for hedge

accounting is maximised, and secondly, the need to exclude the interest accrual amounts when

calculating CCS fair value changes.

In a hedge accounting context, a CCS is often linked to a specific foreign currency denominated liability. The market value of a CCS and its related liability are typically determined

using different yield curves. Normally, the market values a liability using a yield curve that

incorporates the issuers credit spread, while CCSs are valued excluding the issuers credit

spread from the yield curve. As a result the interest rate sensitivities of a liability and its related CCS can be significantly different, endangering the eligibility for hedge accounting of a

well-constructed hedge. When the liability and the CCS rate sensitivities are notably different,

it is suggested that one defines the hedge relationship as the hedge of interest rate and FX risk

only (i.e., excluding other risks, such as credit risk).

Often valuation dates fall within interest periods. The inclusion or exclusion of accrued

interest in the valuation of a CCS can make a huge difference. The solution to this problem

is to exclude interest accrual amounts when calculating a CCS fair value. The exclusion is

especially important to make consistent fair value comparisons of liabilities and CCS with

different interest periods. The exclusion is also needed to avoid double counting the interest

income or expense related to a CCS, as the income or expense associated with a cash flow is

apportioned into the periods to which it relates. Chapter 6 includes detailed computations of

the interest accruals of CCSs.

In addition to hedging foreign currency denominated liabilities, CCSs are used to hedge the

FX exposure of net investments in foreign operations. For this type of hedge, IAS 39 sets a

special type of hedge accounting, called net investment hedge. When designated as hedging

instruments of net investment hedges, some aspects of the accounting treatment of CCSs are

still unclear. This is particularly the case of CCSs in which the entity pays a fixed interest rate

in the leg denominated in the groups functional currency leg. This accounting uncertainty is

covered in more detail in Chapter 4.

2.4 STANDARD (VANILLA) OPTIONS

2.4.1 Product Description

In general there are two types of options: standard options and exotic options. The standard,

options, also called vanilla options or just options, are the most basic option instruments.

Unlike the terms of most exotic options, the terms of a standard option (e.g., nominal, strike,

expiry date, etc) are known at its inception. There are two types of standard options:

Call options. A call gives the buyer the right, but not the obligation, to buy a specific amount

of an underlying at a predetermined price on or before a specific future date.

Вам также может понравиться

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОт EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОценок пока нет

- III.B.6 Credit Risk Capital CalculationДокумент28 страницIII.B.6 Credit Risk Capital CalculationvladimirpopovicОценок пока нет

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSОт EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSОценок пока нет

- Cae05-Chapter 5 Bonds and Other ConceptsДокумент9 страницCae05-Chapter 5 Bonds and Other ConceptsSteffany RoqueОценок пока нет

- (Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 49Документ1 страница(Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 49JasmeetОценок пока нет

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceОт EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceОценок пока нет

- The Optimization of Everything: OTC Derivatives, Counterparty Credit Risk and FundingДокумент8 страницThe Optimization of Everything: OTC Derivatives, Counterparty Credit Risk and FundingsinghhavefunОценок пока нет

- Fitch C Do RatingДокумент29 страницFitch C Do RatingMakarand LonkarОценок пока нет

- A simple approach to bond trading: The introductory guide to bond investments and their portfolio managementОт EverandA simple approach to bond trading: The introductory guide to bond investments and their portfolio managementРейтинг: 5 из 5 звезд5/5 (1)

- Understanding The True Cost of Issuing Convertible Debt and Other Equity Linked FinancingДокумент5 страницUnderstanding The True Cost of Issuing Convertible Debt and Other Equity Linked Financing_lucky_Оценок пока нет

- Accounting For Embedded DerivativesДокумент22 страницыAccounting For Embedded Derivativeslwilliams144Оценок пока нет

- Credit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsОт EverandCredit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsРейтинг: 1 из 5 звезд1/5 (1)

- Model Guide To Securitisation Techniques: Slaughter and MayДокумент42 страницыModel Guide To Securitisation Techniques: Slaughter and May111Оценок пока нет

- Allen Overy 3 49729Документ10 страницAllen Overy 3 49729Jose CarterОценок пока нет

- CDS PricingДокумент28 страницCDS Pricingexet2695Оценок пока нет

- The Treatment of Large Exposures in The Basel Capital Standards - Executive SummaryДокумент2 страницыThe Treatment of Large Exposures in The Basel Capital Standards - Executive SummaryrakhalbanglaОценок пока нет

- Derivatives Discounting Explained: Wujiang LouДокумент38 страницDerivatives Discounting Explained: Wujiang LouMypatОценок пока нет

- Weighted Average Cost of Capital: Article Summary of 100 WordsДокумент12 страницWeighted Average Cost of Capital: Article Summary of 100 WordspratiksinghiОценок пока нет

- Pros and Cons of Different CLO ModelsДокумент4 страницыPros and Cons of Different CLO ModelsJuan Carlos RussoОценок пока нет

- Chatham Financial Counterparty Risk and Collateral ProtectДокумент8 страницChatham Financial Counterparty Risk and Collateral ProtectjitenparekhОценок пока нет

- Hedge Accounting Under IFRS 9 GL IFRSДокумент48 страницHedge Accounting Under IFRS 9 GL IFRSEmezi Francis Obisike100% (1)

- RM-MTP M22Документ10 страницRM-MTP M22Mani ganesanОценок пока нет

- Capitulo 2Документ12 страницCapitulo 2Daniel Adrián Avilés VélezОценок пока нет

- Revision OCT2018 Exams BAN2602Документ9 страницRevision OCT2018 Exams BAN2602RoelienОценок пока нет

- Call Option AmortizationДокумент40 страницCall Option Amortizationtribhuwan kharkwalОценок пока нет

- Considerations in Corporate Bond Portfolio Management: Chapter SummaryДокумент17 страницConsiderations in Corporate Bond Portfolio Management: Chapter SummaryasdasdОценок пока нет

- CH 03Документ67 страницCH 03Khoirunnisa Dwiastuti100% (2)

- CH - 03financial Statement Analysis Solution Manual CH - 03Документ63 страницыCH - 03financial Statement Analysis Solution Manual CH - 03OktarinaОценок пока нет

- Financial Instruments (April 2009)Документ51 страницаFinancial Instruments (April 2009)Imran AuliyaОценок пока нет

- Actuarial Society of India: ExaminationsДокумент14 страницActuarial Society of India: ExaminationsYogeshAgrawalОценок пока нет

- Pricing CTRP RiskДокумент36 страницPricing CTRP RiskJin DongОценок пока нет

- SA CCRPaper0718Документ20 страницSA CCRPaper0718Animesh SrivastavaОценок пока нет

- Credit Spreads ExplainedДокумент18 страницCredit Spreads ExplainedJay KabОценок пока нет

- Lecture 7 - Structured Finance (CDO, CLO, MBS, Abl, Abs) : Investment BankingДокумент10 страницLecture 7 - Structured Finance (CDO, CLO, MBS, Abl, Abs) : Investment BankingJack JacintoОценок пока нет

- Advanced Notice of Proposed Rulemaking Relating To Protection of Cleared Swaps Customers Before and After Commodity Broker BankruptciesДокумент13 страницAdvanced Notice of Proposed Rulemaking Relating To Protection of Cleared Swaps Customers Before and After Commodity Broker BankruptciesMarketsWikiОценок пока нет

- IFM Chapter 11 AnswersДокумент6 страницIFM Chapter 11 AnswersPatty CherotschiltschОценок пока нет

- CFINДокумент10 страницCFINAnuj AgarwalОценок пока нет

- Alm in BankДокумент34 страницыAlm in BankdeepakОценок пока нет

- Real-World and Risk-Neutral: Default ProbabilityДокумент6 страницReal-World and Risk-Neutral: Default ProbabilityGunpreet ChahalОценок пока нет

- Literature Review On Credit Default SwapДокумент5 страницLiterature Review On Credit Default Swapea3d6w9v100% (1)

- Cloud Across AtlanticДокумент6 страницCloud Across AtlanticArif AhmedОценок пока нет

- Analyzing Financing Activities: ReviewДокумент64 страницыAnalyzing Financing Activities: ReviewNisaОценок пока нет

- OTCДокумент20 страницOTCLameuneОценок пока нет

- Chapter 03 - Analyzing Financing ActivitiДокумент72 страницыChapter 03 - Analyzing Financing ActivitiMuhammad HamzaОценок пока нет

- Credit Default SwapДокумент12 страницCredit Default SwapHomero García AlonsoОценок пока нет

- Chapter 2 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Документ23 страницыChapter 2 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarОценок пока нет

- Bespoke Portfolio (CDO)Документ4 страницыBespoke Portfolio (CDO)brian3442Оценок пока нет

- Chapter 8 Role of Regulators & Other AgenciesДокумент6 страницChapter 8 Role of Regulators & Other AgenciesSuraj Sharma SharmaОценок пока нет

- FRTBДокумент3 страницыFRTBrevola28Оценок пока нет

- Collateralized Debt Obligation: Rahul Krishna M Roll No:159 PGDM-FinanceДокумент25 страницCollateralized Debt Obligation: Rahul Krishna M Roll No:159 PGDM-FinanceRahul KrishnaОценок пока нет

- Fair Value GIДокумент45 страницFair Value GIscamardela79Оценок пока нет

- Solution To Previous Year Questions Course Code: Course Name: AdvancedДокумент20 страницSolution To Previous Year Questions Course Code: Course Name: AdvancedSHAFI Al MEHEDIОценок пока нет

- Convertible ArbitrageДокумент10 страницConvertible ArbitrageGorakhnathОценок пока нет

- Chapter 8 Role of Regulators & Other AgenciesДокумент6 страницChapter 8 Role of Regulators & Other AgenciesMahesh BaburaОценок пока нет

- Capital Structure Decision ReportДокумент14 страницCapital Structure Decision ReportPratik GanatraОценок пока нет

- Securitization of Life InsuranceДокумент59 страницSecuritization of Life Insurancemiroslav.visic8307100% (1)

- BSRM PresentationДокумент4 страницыBSRM PresentationMostafa Noman DeepОценок пока нет

- Silber - 1984 - Marketmaker Behavior in An Auction Market, An Analysis of Scalpers in Futures MarketsДокумент18 страницSilber - 1984 - Marketmaker Behavior in An Auction Market, An Analysis of Scalpers in Futures MarketsjpkoningОценок пока нет

- ch07 Godfrey Teori AkuntansiДокумент34 страницыch07 Godfrey Teori Akuntansiuphevanbogs100% (2)

- CH 08Документ24 страницыCH 08Jenny Ann ManaladОценок пока нет

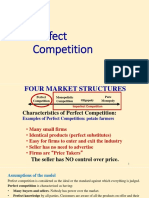

- Perfect Competition AДокумент67 страницPerfect Competition APeter MastersОценок пока нет

- Important Tables in SAP FICOДокумент5 страницImportant Tables in SAP FICOkeyspОценок пока нет

- Governmental and Nonprofit Accounting 10th Edition Smith Test BankДокумент13 страницGovernmental and Nonprofit Accounting 10th Edition Smith Test Bankjessica100% (20)

- ColaДокумент4 страницыColaAkhil ChauhanОценок пока нет

- MBA Finance Project On Retail Banking With Special Reference To YES BANKДокумент111 страницMBA Finance Project On Retail Banking With Special Reference To YES BANKChandramauli Mishra100% (1)

- MBA-03-2015 - Su Wei Hnin Aung, Aye Phyu Phyu, Htet Aung Shine, Myat Myo Swe, Kyi Lai Han, Myat Wut Yee - (Strategic Marketing Management)Документ32 страницыMBA-03-2015 - Su Wei Hnin Aung, Aye Phyu Phyu, Htet Aung Shine, Myat Myo Swe, Kyi Lai Han, Myat Wut Yee - (Strategic Marketing Management)suwaihninnaung.sbsОценок пока нет

- Criteo and Double Click Ad Exchange Case Study 6-1-2011Документ2 страницыCriteo and Double Click Ad Exchange Case Study 6-1-2011Sujith KumarОценок пока нет

- Accounting AnalysisДокумент15 страницAccounting AnalysisMonoarul IslamОценок пока нет

- C2 CSRДокумент26 страницC2 CSRKhả UyênОценок пока нет

- Chcolate Project - Five BrandsДокумент46 страницChcolate Project - Five BrandsNitinAgnihotriОценок пока нет

- 1 Digital EntreprenuershipДокумент32 страницы1 Digital EntreprenuershipJit MukherheeОценок пока нет

- Nidhi Mittal ReportДокумент123 страницыNidhi Mittal Reportarjun_gupta0037Оценок пока нет

- Digital Marketing Assignment YasirДокумент11 страницDigital Marketing Assignment YasirSyed YasirОценок пока нет

- Between Monopoly and Perfect CompetitionДокумент23 страницыBetween Monopoly and Perfect CompetitionAmlan SenguptaОценок пока нет

- Reckitt Benckiser Case Study Ed 5aДокумент1 страницаReckitt Benckiser Case Study Ed 5aDivya JainОценок пока нет

- Test Bank-Auditing Theory Chapter 9Документ6 страницTest Bank-Auditing Theory Chapter 9Michael CarlayОценок пока нет

- Entity Level Controls Drafts and FormatsДокумент36 страницEntity Level Controls Drafts and FormatsGaurav RamrakhyaОценок пока нет

- 101 Marketing Ideas JUST Creative PDFДокумент27 страниц101 Marketing Ideas JUST Creative PDFWellis Raik CarvalhoОценок пока нет

- Account StatementДокумент4 страницыAccount StatementgrtrОценок пока нет

- I CPAДокумент2 страницыI CPAHydeeОценок пока нет

- Executive SummaryДокумент33 страницыExecutive SummaryRajiv Ranjan SharmaОценок пока нет

- CBLM Bookkeeping Nciii PDF FreeДокумент52 страницыCBLM Bookkeeping Nciii PDF FreeJhonalyn Jaranilla-mahino TamposОценок пока нет

- You Exec - Action Plan Part 2 FreeДокумент12 страницYou Exec - Action Plan Part 2 FreeanmОценок пока нет

- MODULE Session 13 - The Role of AccountantsДокумент24 страницыMODULE Session 13 - The Role of AccountantsOlivioОценок пока нет

- The Determination of Exchange RatesДокумент20 страницThe Determination of Exchange RatesSauryadeep DwivediОценок пока нет

- Cambridge International Examinations Cambridge International Advanced LevelДокумент8 страницCambridge International Examinations Cambridge International Advanced LevelIlesh DinyaОценок пока нет

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (15)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОт EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОценок пока нет

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeОт EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeРейтинг: 4 из 5 звезд4/5 (21)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookОт EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookРейтинг: 5 из 5 звезд5/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetОт EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageОт EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageРейтинг: 4.5 из 5 звезд4.5/5 (109)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCОт EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCРейтинг: 5 из 5 звезд5/5 (1)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsОт EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsРейтинг: 4 из 5 звезд4/5 (7)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyОт EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyОценок пока нет

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookОт EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookОценок пока нет

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityОт EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityОценок пока нет

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsОт EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsРейтинг: 4.5 из 5 звезд4.5/5 (2)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItОт EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItРейтинг: 4.5 из 5 звезд4.5/5 (14)