Академический Документы

Профессиональный Документы

Культура Документы

Homework3 Sol

Загружено:

vikbitАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Homework3 Sol

Загружено:

vikbitАвторское право:

Доступные форматы

HOMEWORK3SOLUTION

Chapter8

1.

AssumethatyourcompanyexportstoJapanandearnsyenrevenues,thusforecastsoftheYen/$

rate are important. Suppose two forecasters issue their predictions for the Yen/$ exchange rate.

ThecurrentspotrateisYen90/$.ForecasterApredictsarateof98nextmonthandforecasterB

predictsarateof88.Theforwardrateisat89,reflectingtheinterestratedifferentialbetweenthe

twocurrencies.Onemonthlater,thespotratereaches92Yen/$.

a.

WhichoftheforecastersA,Bortheforwardratemadethemostaccurateforecast?

b.

Whichoneisthemostuseful?

SOLUTIONS:

a.

Threeforecasters(SA,SB,andSForward)forecast98,88and89Yen/$respectively.Thefuture

spotrateSt+1=92Yen/$.Theforwardratewasthemostaccuratewithanerrorof3/92or

3.26%.

b.

ForecasterAhadthemostusefulforecastsincehecorrectlypredictedthattheyenwould

fallagainstthedollar.ForecasterBwouldhaveadvisednottohedgeandthefirmwould

haveincurredaforeignexchangelossonitsJapanesesales.Eventhoughtheforecastisfar

off,ForecasterAgavethecorrectadviceleadingtoacorrectahedgingdecisionbythefirm.

ForwardsaleofYenat89wouldhavesavedthefirmsomeforeignexchangelosses

2.

You are the treasurer of a large multinational company. Suppose that you receive every month

exchangerateforecastsfortheYen/$exchangeratefromfivedifferentforecastinginstitutions:A,

B,C,D,andE.Fromyourpastexperience,thebestforecasterhasbeenfirmC,followedbyA,D,B,

andE.

ThehistoricRMSE(standarddeviationofforecastingerrors)forthefiveforecastersandthecurrent

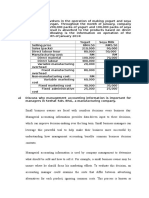

predictionsareshowninthefollowingtable:

Forecaster

RMSE

YenForecast

80

15

82

85

10

81

20

88

a.

Calculatethecompositeforecastthatresultsfromevenlyweightingthesefiveforecasts.

b.

Calculateacompositeforecastasdescribedinthechapterthatassignsgreaterweightto

forecastswithgreateraccuracy.

c.

Discusstheadvantagesanddisadvantagesofusingtheforecastin(b)versus(a).

SOLUTIONS:

a.

Theevenlyweightedforecastis0.2x80+0.2x82+0.2x85+0.2x81+0.2x88=83.2

b.

Thissystemassignsweightsinverselyproportionaltoeachforecaster'sstandarddeviation.

TheseweightsarewA=25.53%,wB=11.91%,wC=35.74%,wD=17.87%,andwE=8.94%.

Thecompositeforecast:25.53%x80+11.91%x82+35.74%x85+17.87%x81+8.94%x88=

Yen82.92/$

c.

Composite forecast (b) should be a superior forecast with a smaller RMSE and less bias

since it places greater weights on forecasters that have been more accurate. The

superiority of composite forecast (b), however, depends upon the individual forecasters

retaining their relative accuracy ratings. If the rankings of RMSE were to change, then a

simpleevenlyweightedcompositeforecast,asin(a),couldbesuperior.

3.

Supposeyouareevaluatingtwoforecastersbasedonthefollowinginformation.

ForecasterAmade30"correct"forecastsofatotalof50forecastsduringthelastyear.ForecasterB

made114"correct"forecastsofatotalof200forecastsduringthelastyear,.

a.

WhatistheprobabilitythatforecasterA'strackrecordofcorrectforecastswassimplydue

tochance?(Note:youmayusethenormalapproximationtothebinomialdistribution.)

b.

WhatistheprobabilitythatB'strackrecordofcorrectforecastswassimplyduetochance?

(Note:youmayusethenormalapproximationtothebinomialdistribution.)

c.

DiscusswhetheryouwouldprefertousetheforecastspreparedbyAorB.

SOLUTIONS:

a.

b.

c.

A's track record is p = r/n = 30/50 = 60%. This is greater than 50%. But with only 50

observations, the standard error of the estimate is fairly large, 0.0707 = (0.5*(1

0.5)/50)0.5=(p*(1p)/n)0.5.Sothetvalueagainstthenullhypothesisthatp=0.5[t=(0.60

0.50)/0.0707]is1.414,whichdoesnot fallintotherejectregion at=0.025level(t

2.009)andwefailtorejectthenullhypothesis(Astrackrecordofcorrectforecastswas

simplyduetochance).

B's track record is p = r/n = 114/200 = 57%. This is also greater than 50%. With 200

observations,thestandarderroroftheestimateissmaller,0.0354=(0.5*(10.5)/200)0.5

= (p*(1p)/n)0.5. So the tvalue against the null hypothesis that p=0.5 [t=(0.57

0.50)/0.0354] is 1.977, which does fall into the rejection region at =0.025 level (t

1.960)andwerejectthenullhypothesis(Bstrackrecordofcorrectforecastswassimply

duetochance)andacceptthealternative.

ThereisatradeoffbetweenAandB.Aappearstohaveabetterrecord,butitisbased

on a shorter history so we have less confidence in it. B's track record is slightly less

impressive,butstillshowssignificantexpertisewithatrackrecordbetterthan50%.

4.

AsamultinationalfirmwithsalesinJapan,yourequireforecastsoftheYen/$exchangerate.You

havebeenusingaprofessionalforecastingfirm,CrystalBallAssociates,andnowwanttomeasure

the performance of their predictions. Following is a table showing the Crystal Ball forecasts, the

actualendofperiodratesandtheoneperiodaheadforwardrates.

Period

10

11

12

CrystalBall

Forecast

100

106

102

108

115

109

103

95

93

90

91

85

Actualspotrate

(endofperiod)

101

110

108

105

110

110

98

90

91

85

88

84

1period

forwardrate

98

105

100

102

108

112

105

98

90

89

90

86

(endofperiod)

a.

CalculatetheperformanceoftheCrystalBallforecastsandtheforwardrateusingtheMSE

andRMSEmethodtomeasuretheiraccuracy.

b.

Calculate the performance of the Crystal Ball forecasts and the forward rate using the

percentagecorrectmethodtomeasuretheirusefulness.

c.

Has Crystal Ball Associates demonstrated unusual forecasting expertise according to the

percentagecorrectmethod?

d.

Compareyourresultsusingthetwomethods.Whatdoyouconclude?

SOLUTIONS:

a.

For the forward rate, MSE = 0.0022; RMSE = 0.0468 or 4.68% error in the onemonth

forecast.FortheCrystalBallforecast,MSE=0.0015;RMSE=0.0392or3.92%errorinthe

onemonthforecast.

b.

CrystalBallAssociatesforecastswere"correct"orontherightsideoftheforwardrate10

timesoutof12months,or83.3%.Thepercentagecorrectmethodcannotbeusedforthe

forwardrate.

c.

Crystal Ball Associates track record, 83.3%, is highly unusual, signifying expertise and

makingtheforecastveryuseful.Theprobabilityofgetting10,11or12correctforecastsout

of12(assumingthattheforecasterhasnoexpertise)is(66+11+1)/4096=1.9%,sothisisa

very rare and statistically significant event. The forecaster appears to have significant

expertise.[NOTE:66=12!/(10!2!);11=12!/(11!1!);1=12!/(12!0!);and4096=212which

representsthenumberofpatternsfortossingafaircointwelvetimes.]

d.

CrystalBallAssociatesarenotmuchmoreaccuratethantheforwardrate,buttheycould

beveryusefulifthefirmhashedgingdecisionstomakeonaonemonthhorizon.

Chapter9

3.

GeneralMotorsfinancesitself,amongotherchannels,byusingoneyear,floatingratenoteswhose

ratesarerecalculatedeverythreemonthsatLIBOR+1/8.Anew$250,000,000issueisplannedfor

midSeptember2001withaoneyearmaturity.

a.

Describe how GM could hedge its interest payments for the year. [For convenience,

assumethatCMEmaturitydatescoincidewiththefirm'srolloverdates.]

b.

UsingTable9.3,whatistheyearlyratethatGMcansecureifithedges?

c.

CalculateGM'stotalcostsforthe$250,000,000issueassumingthatithedges.

SOLUTIONS:

a.

GM could sell 250 Eurodollar interest rate futures for every maturity where its interest

paymentsaresetinitiallyorreset;thatis,SeptemberandDecember2001andMarchand

June2002.

b.

Forthenextyear,GMcanlockinLIBORratesof7.13%(Sept2001at92.87);7.17%(Dec

2001at92.83);7.11%(Mar02at92.89);and7.11%(June02at92.89).TheannualLIBOR

rateis:7.13%/4+7.17%/4+7.11%/4+7.11%/4=7.13%/4=1.7825%;or(1+7.13%/4)x(1

+7.17%/4)x(1+7.11%/4)x(1+7.11%/4)1=2.33%.

c.

GMwillpay$250,000,000*(0.017825+0.00125)=$4,768,750.

4.

TheABCfirmisconsideringborrowing$50,000,000foroneyeareitheratafixedrateof6.50%in

the US domestic market or at a floating rate indexed to threemonth LIBOR+1/4 in the

Eurocurrencymarket.Currently,3monthLIBORis5.25%andexpectedtoremainconstantforthe

year.

a.

HowmuchwouldABCsaveifitusestheEuromarketsandtheseexpectationsaremet?[For

convenience,assumethatCMEmaturitydatescoincidewiththefirm'srolloverdates.]

b.

WhataretherisksinusingaEuromarketloan?

c.

Calculate the eventual saving for ABC in the case where LIBOR increases by .50% every

threemonths.

SOLUTIONS:

a.

Savingsare1%oftheoutstandingamountforoneyear,or$500,000.

b.

TherisksareinterestrateriskbecausetheEuromarketloanisonfloatingrateterms,and

rolloverriskifthebankhastheoptiontorefusetoreneworrollovertheloan.IfABChasa

commitment for the year, then it has no rollover risk as long as the bank remains in

operation.

c.

Fixedratecosts:6.5%of$50,000,000=$3,250,000

Floatingratecosts:(1+5.5%/4)*(1+6.0%/4)*(1+6.5%/4)*(1+7.0%/4)=1.0625,ora

costof6.25%.On$50,000,000principaltheinterestbillwillbe$3,125,000;stillbetterthan

a6.5%fixedrate.

5.

Suppose that threemonth Eurodollars are quoted in the interbank markets at 6.0% 6.125% by

Londonbanks,and6.25%6.375%bySingaporebanks.

a.

Explainhowyoucouldattempttomakearbitrageprofitsintheabovecase.

b.

Howlargeistheprofitfromarbitraging$1,000,000inthiscase?

c.

Whatrisksand/orcostsdoyoufaceinattemptingthearbitrage?

SOLUTIONS:

a.

A trader would attempt to borrow dollars from a bank in London at 6.125% and then

depositthematabankinSingaporefor6.25%.

b.

The potential profit is 0.00125 * $1,000,000 / 4 = $312.50. Remember, these are per

annuminterestratesforathreemonthperiod.

c.

The trader carries the political risk of deposits in Singapore. If funds were blocked in

Singapore, he might not be able to pay back his London loan. Time differences between

LondonandSingaporemayalsoincreasethedifficultyofthistransaction.

Chapter10

1.

Suppose IBM is issuing $100 million in 7year Eurobonds priced at U.S. Treasury minus 25 basis

points.Thereisgreatdemandfortheissueandyouarewillingtobid102for10%oftheissue.

a.

Ifyouactuallygetyourbidexecuted,howmuchwillyoupayforthebond?

b.

Ayearlater,theIBMEurobondsaretradedontheLuxembourgExchangeat105.Whatis

thevalueofyourinvestment?Whatisyourcapitalgain(loss)?

c.

Youdecidetosellthebondattheabovepricetopursueotheropportunities.Whatamount

ofwithholdingtaxesareyourequiredtopay?

SOLUTIONS:

a.

Priceis102%ofparor1,020perbond;102%*10%*100million=$10.20millionforyour

shareoftheissue.

b.

Priceis105%*10%*100=$10.50million.Gainis$300,000.

c.

NowithholdingtaxesapplyintheEurobondmarket.

2.

SupposeCreditSuisseFirstBoston(CSFB)isthesoleleadmanagerina$100millionboughtdealfor

theWorldBank.CSFBdecidestopricethesevenyearissueatpartoyield8%.

a.

WhatwillbeCSFBspositioniftheFeddecidestoincreaseshortterminterestratesby50

basispointsduringtheofferingperiod?

b.

InsteadoftheFedmovedescribedinaabove,supposethatinternationaltradetalksbreak

down leading to a depreciation of the dollar on currency markets. What will be CSFBs

positioninthiscase?

c.

CalculatethegainorlossforCSFBifthesevenyearEurobondraterisesto8.25%onthe

offeringday.(Note:Eurobondspayinterestonlyonceeachyear.)

d.

SupposeCSFBcollects2%infeesforleadmanagingtheissue.Again,calculatetheoverall

gainorlossforCSFBifthesevenyearEurobondraterisesto8.25%ontheofferingday.

e.

(Optional)HowcouldCSFBhedgetherisksdescribedin(a)and(b)?

SOLUTIONS:

a.

b.

Sameasin(a).Toattractinvestorsthatshyawayfromdollarassets,CSFBwillhavetolower

theEurobondpricetoalevelattractivetolenders.

The yield required bythe marketonlongterm bondsmay changein response to the 50

basispointincreaseinshorttermrates.Iflongterminterestratesrise,thenbypledgingto

sell the Eurobonds at par, CSFB will lose the difference between par and the new lower

priceofthebond.Longterminterestratesmayfall,however,ifthemarketsensesthatthe

increaseinshorttermrateswillreducelongerruninflationarypressures.Inthiscase,CSFB

enjoysacapitalgain.

c.

TheEurobondpricefallsto$987.09per$1,000.00facevalue.

7

$987.09 =

T =1

80

1.0825

1000

7

1.0825

Theunderwriterloses1.291%onthe$100,000,000issueor$1,291,000.

d.

IfCSFBcollects2.0%infees,ittransfersonly$980perbond,or$98,000,000ontheentire

issuetotheWorldBank.CSFB'snetprofitisthen$2,000,000$1,291,000=$709,000.

e.

CSFBcanhedgetheincreaseininterestratesbysellinginterestratefutures.

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Business-Marketing Budget TemplateДокумент6 страницBusiness-Marketing Budget Templateruchit2809Оценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Strategic Risk TakingДокумент18 страницStrategic Risk TakingvikbitОценок пока нет

- Fund Accounting ConceptДокумент11 страницFund Accounting ConceptJasiz Philipe Ombugu0% (1)

- Wey AP 8e Ch01Документ47 страницWey AP 8e Ch01Bintang RahmadiОценок пока нет

- RespMemo - NUJS HSFДокумент36 страницRespMemo - NUJS HSFNarayan GuptaОценок пока нет

- Republic v. COCOFED (G.R. No. 147062-64) CASE DIGESTДокумент3 страницыRepublic v. COCOFED (G.R. No. 147062-64) CASE DIGESTEricha Joy GonadanОценок пока нет

- RevenueДокумент2 страницыRevenuevikbitОценок пока нет

- Fixed Income - Project 1Документ7 страницFixed Income - Project 1vikbitОценок пока нет

- HW1Документ4 страницыHW1vikbitОценок пока нет

- International Bond Pricing Homework: OutputДокумент7 страницInternational Bond Pricing Homework: OutputvikbitОценок пока нет

- HW2Документ10 страницHW2vikbitОценок пока нет

- HW1Документ4 страницыHW1vikbitОценок пока нет

- International Finance Policy and Practice LevischДокумент7 страницInternational Finance Policy and Practice LevischvikbitОценок пока нет

- Weekly Plan 16th Sept'13-22nd Sept'13Документ5 страницWeekly Plan 16th Sept'13-22nd Sept'13vikbitОценок пока нет

- AES FAQ IndividualДокумент2 страницыAES FAQ IndividualvikbitОценок пока нет

- 6214 Homework 3 2015 AESДокумент3 страницы6214 Homework 3 2015 AESvikbit0% (1)

- Production and Cost SpreadsheetДокумент103 страницыProduction and Cost SpreadsheetvikbitОценок пока нет

- BPT GroupДокумент4 страницыBPT GroupvikbitОценок пока нет

- Coal Mine ElegibiltyДокумент4 страницыCoal Mine ElegibiltyvikbitОценок пока нет

- Income Statement Exercise PDFДокумент1 страницаIncome Statement Exercise PDFAngelica NecorОценок пока нет

- Finacc 3 Question Set BДокумент9 страницFinacc 3 Question Set BEza Joy ClaveriasОценок пока нет

- Financial DerivativesДокумент12 страницFinancial DerivativesNony BahgatОценок пока нет

- The Following Is The List of Banks in PakistanДокумент3 страницыThe Following Is The List of Banks in PakistanSidra AdilОценок пока нет

- PALДокумент35 страницPALJohn Paul MillezaОценок пока нет

- Accounting For Income Taxes: About This Chapter!Документ9 страницAccounting For Income Taxes: About This Chapter!sabithpaulОценок пока нет

- The Goals and Functions of Financial ManagementДокумент55 страницThe Goals and Functions of Financial ManagementwerlamodeОценок пока нет

- Presentation On Liabilities Under Securities Law 28.11.2011Документ51 страницаPresentation On Liabilities Under Securities Law 28.11.2011Vidya AdsuleОценок пока нет

- Cat 2009 Quant Test 53Документ3 страницыCat 2009 Quant Test 53comploreОценок пока нет

- JP Morgan DR Whitepaper - Unsponsored ADR ProgramsДокумент3 страницыJP Morgan DR Whitepaper - Unsponsored ADR ProgramsIRWebReport.com Investor Relations Research and Intelligence100% (1)

- My Internship Report at EFUДокумент212 страницMy Internship Report at EFUAyesha Yasin85% (13)

- Changing Work Culture in Indian Banking SectorДокумент16 страницChanging Work Culture in Indian Banking SectorrupinderkangОценок пока нет

- Jotun Group 2016 - tcm169 127024Документ39 страницJotun Group 2016 - tcm169 127024Sathishkumar SrinivasanОценок пока нет

- China Pakistan Economic Corridor (CPEC) and Small Medium Enterprises (SMEs) of PakistanДокумент12 страницChina Pakistan Economic Corridor (CPEC) and Small Medium Enterprises (SMEs) of PakistanTayyaub khalidОценок пока нет

- BBAP2103 Management AccountingДокумент4 страницыBBAP2103 Management AccountingTeam JobbersОценок пока нет

- Taxation - UP 2008Документ163 страницыTaxation - UP 2008Martoni SaliendraОценок пока нет

- Solvency II - Introductory GuideДокумент12 страницSolvency II - Introductory Guiderushdi36Оценок пока нет

- MMX Annual Report 2018 Version 821Документ78 страницMMX Annual Report 2018 Version 821clouso100Оценок пока нет

- IDBI Federal Life InsuranceДокумент15 страницIDBI Federal Life InsuranceAiswarya Johny RCBSОценок пока нет

- Undergraduate Economics Reading List 2016-17Документ8 страницUndergraduate Economics Reading List 2016-17rahulОценок пока нет

- Myles Bassell 505SGS1Документ2 страницыMyles Bassell 505SGS1Prakhar CmОценок пока нет

- Profit and Loss Account of Friends Flower and ShopДокумент11 страницProfit and Loss Account of Friends Flower and ShopHitesh BalОценок пока нет

- HW Astrological MagazineДокумент6 страницHW Astrological MagazinegaelmesabosОценок пока нет

- Marketing Metrics - Assignment 2 (16pgm40)Документ2 страницыMarketing Metrics - Assignment 2 (16pgm40)nambi2rajanОценок пока нет