Академический Документы

Профессиональный Документы

Культура Документы

Revised PAT

Загружено:

Karl CabiliИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Revised PAT

Загружено:

Karl CabiliАвторское право:

Доступные форматы

Karl Cabili

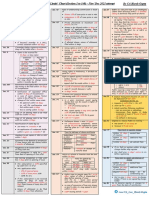

Partnership Cases

Article 1767

Luciano

E.

Salazar

vs.

Sanitary

Manufacturing Corporation, et al.

Wares

G.R. Nos. 75975-76

December 15, 1989

FACTS:

Saniwares was incorporated for the primary purpose of manufacturing

and marketing sanitary wares. One of the incorporators, Mr. Baldwin Young, went

abroad to look for foreign partners, for its expansion plans. Delaware entered into

an Agreement with Saniwares and some Filipino investors whereby ASI and the

Filipino investors agreed to participate in the ownership of an enterprise which

would engage primarily in the business of manufacturing in the Philippines and

selling here and abroad vitreous china and sanitary wares. The parties agreed

that the business operations in the Philippines shall be carried on by "Sanitary

Wares Manufacturing Corporation." An agreement was made, this containing

provisions designed to protect a minority group, including the grant of veto

powers over a number of corporate acts and the right to designate certain

officers. The relations of the members of the Corporation deteriorated over time,

and, during the election of its Board of Directors, the ASI group and the Filipino

Investors had a disagreement regarding the election of the six Philippine

Investors. This disagreement resulted in the filing of the two groups of different

sets of representatives of the Philippine Investors for the Sanitary Wares Mfg

Corp.

ISSUE:

Was the business established by the two a Joint Venture?

RULING:

Yes. In an action at law, where there is evidence tending to prove that the

parties joined their efforts in furtherance of an enterprise for their joint profit, the

question whether they intended by their agreement to create a joint adventure, or

to assume some other relation is a question of fact for the jury. The history of the

organization of Saniwares and the unusual arrangements which govern its policy

making body are all consistent with a joint venture and not with an ordinary

Page | 2

Partnership Cases

corporation. It has been noted that the important provisions of the Agreement and

evidences presented show that the parties have agreed to establish a joint

venture. Moreover, ASI in its communications referred to the enterprise as joint

venture. Furthermore, it is ruled by Jurisprudence that a Corporation may enter

into a joint venture Partnership with another so long as the nature of such

venture is in line with its business and authorized by its charter this which is

noticeable in the case at hand.

Thus, being a joint venture, they are to follow the Agreement set by them

wherein the ASI is only to elect three out of the nine directors while the rest shall

be designated by the Filipino Stockholders.

x x x

Commissioner of Internal Revenue vs. Suter, and

the Court of Tax Appeals

G.R. No. L-25532

February 28, 1969

FACTS:

A limited partnership, named "William J. Suter 'Morcoin' Co., Ltd.," was

formed on 30 September 1947 by respondent William J. Suter, as a General

Partner, and Julia Spirig and Gustav Carlson, as limited partners. It was

registered as a Limited Partnership with the Securities and Exchange

Commission (SEC). In 1948, however, Suter and Spirig got married and,

thereafter, on 18 December 1948, Carlson sold his share in the partnership to the

two. The Commissioner of Internal Revenue, in 1959 found in an assessment

that the income of the firm and the individual incomes of the partners-spouses

Suter and Spirig resulted in a deficiency of income tax.

ISSUE:

Was the Partnership dissolved after the marriage of the partners and the

subsequent sale to the spouses by the remaining partner of his participation in

the partnership?

RULING:

No. The Partnership was formed by Mr. Suter, Ms. Spirig, and Mr. Carlson

for the business of importing, marketing, distributing, and operating automatic

Page | 3

Partnership Cases

phonographs, radios, television sets, and gaming machines, their parts, and their

accessories. What they have all donated to the mutual fund was owned by each

other separately. The Partnership was also formed long before the marriage of

Suter and Spirig. Furthermore, though it is true that the Partners are now

spouses to each other, and that the third partner has sold his share in the

Partnership to the said spouses, the respondents-partners capital contribution

were separately owned and contributed before the occurrence of the wedding;

thus they separately own their respective contributions in the Partnership. They

are not prohibited by the Civil Code to enter into a contract of Partnership.

x x x

Lim Tong Lim

Industries, Inc.,

vs.

Philippine

Fishing

Gear

G.R. No. 136448

November 3, 1999

FACTS:

On behalf of "Ocean Quest Fishing Corporation," Antonio Chua and Peter

Yao entered into a Contract for the purchase of fishing nets of various sizes from

the Philippine Fishing Gear Industries, Inc. They claimed that they were engaged

in a business venture with Petitioner Lim Tong Lim, who however was not a

signatory to the agreement. They, however, failed to pay for the fishing nets and

the floats, leading the respondent to file a collection suit against the three in their

capacities as General Partners with a prayer for a writ of preliminary attachment.

Chua filed a Manifestation admitting his liability and requesting a reasonable time

within which to pay and also turned over to respondent some of the nets which

were in his possession. Peter Yao filed an Answer, after which he was deemed

to have waived his right to cross-examine witnesses and to present evidence on

his behalf, because of his failure to appear in subsequent hearings. Lim Tong

Lim, on the other hand, filed an Answer with Counterclaim and Crossclaim and

moved for the lifting of the Writ of Attachment. The trial court maintained the Writ,

and upon motion of private respondent, ordered the sale of the fishing nets at a

public auction.

The trial court rendered its Decision ruling that, as general

partners, they were jointly liable to pay respondent.

ISSUES:

Page | 4

Partnership Cases

Was there Partnership between the three mentioned persons?

RULING:

Yes. It is stated in the A. 1767 of the Civil Code that By Contract of

Partnership two or more persons bind themselves to contribute money, property,

or industry to a common fund, with the intention of dividing the profits among

themselves. It is found from the findings of the court that Chua, Yao and Lim

had decided to engage in a fishing business, which they started by buying boats

financed by a loan secured from Jesus Lim. In their Compromise Agreement,

they subsequently revealed their intention to pay the loan with the proceeds of

the sale of the boats, and to divide equally among them the excess or loss.

These boats, nets, and floats, the purchase and the repair of which were

financed with borrowed money, fell under the term common fund under Article

1767. The contribution contemplated in the Article may be in the form of cash,

fixed assets, credit, or industry. Their agreement that any loss or profit from the

sale and operation of the boats would be divided equally among them also shows

that they had indeed formed a partnership.

(The case also appear under Article 1825 with a separate issue and ruling

relevant to said article)

x x x

Ortega, Del Castillo, Jr., and Bacorro vs. CA, SEC,

and Misa

G.R. No. 109248

July 3, 1995

FACTS:

The law firm of ROSS, LAWRENCE, SELPH and CARRASCOSO was

duly registered in the Mercantile Registry on 4 January 1937 and reconstituted

with the Securities and Exchange Commission on 4 August 1948. On 19

December 1980, appellees Jesus B. Bito and Mariano M. Lozada associated

themselves together, as senior partners with respondents-appellees Gregorio F.

Ortega, Tomas O. del Castillo, Jr., and Benjamin Bacorro, as junior partners. On

Page | 5

Partnership Cases

February 17, 1988, petitioner-appellant wrote the respondents-appellees a letter

stating that they are withdrawing and retiring from the firm and that liquidation be

made. On 30 June 1988, petitioner filed with this Commission's Securities

Investigation and Clearing Department (SICD) a petition for dissolution and

liquidation of partnership.

ISSUES

Was there a Partnership formed by the Firm?

RULING

Yes. According to the Paragraph 2 of A. 1767 of the Civil Code, Two or

more persons may also form a partnership for the exercise of a profession.

Bearing the case at hand, the Organization is a firm composed of Lawyers, all

whom are practicing the profession as a Lawyer. It can thus be said that, in

accordance with the whole of the mentioned article, there exist a Partnership

between the Petitioner and the Respondents. However, their Partnership is

formed only for the practice of law as a mere association only. It cannot be

likened to the Partnership contemplated in Par. 1 of the aforementioned Article,

which is carried out for the purpose of trade or business.

(The case also appear under Articles 1784 and 1830 with separate issues and

rulings relevant to said articles)

Charles F. Woodhouse vs. Fortunato F. Halili

G.R. No. L-4811

July 31, 1953

FACTS:

On November 29, 1947, Woodhouse entered into a written agreement

with Halili stating that: 1) that they shall organize a partnership for the bottling

and distribution of Mission soft drinks where the plaintiff to act as industrial

partner and the defendant a capitalist, and 2) that plaintiff was to secure its

franchise for and in behalf of the proposed partnership. Prior to entering into this

agreement, Woodhouse had informed the Mission Dry Corporation that he had

interested a prominent financier in the business in the bottling and distribution of

the said beverages and requested that the right to bottle and distribute be

Page | 6

Partnership Cases

granted him for a limited time under the condition that it will finally be transferred

to the corporation. He was given "a thirty-days" option on exclusive bottling and

distribution rights for the Philippines, thus formal negotiations ensued on

November 27, 1947. The contract was signed by the Plaintiff on December 3,

1947. The two returned to the Philippines in January 1948, while the operations

began on the first week of February 1948. Woodhouse then demanded Halili the

execution of the partnership papers, however, the latter made excuses and

wouldnt execute the agreement.

ISSUE:

Did the fraud by Woodhouse (Plaintiff) regarding his false representation

annul the Partnership Agreement between the two?

RULING:

No. In order for a fraud to vitiate consent in the Contract, the fraud must

be the Causal Inducement in the making of a Contract. It is noticeable in the case

that the principal consideration that induced Halili to enter into the partnership

with Woodhouse, was the latters ability to get the exclusive franchise to bottle

and distribute for the partnership and not something else. The supposed

ownership of an exclusive franchise, however, was actually the consideration or

price Woodhouse gave in exchange for the share of 30 per cent granted him in

the net profits of the partnership business.

x x x

Page | 7

Partnership Cases

Article 1768

Aguila Jr vs. Court of Appeals

G.R. No. 127347

November 25, 1999

FACTS:

In April 1991, the spouses Ruben and Felicidad Abrogar entered into a

loan agreement with a lending firm called A.C. Aguila & Sons, Co., a partnership.

The loan was for P200,000. To secure the loan, the spouses mortgaged their

house and lot located in a subdivision. The terms of the loan further stipulates

that in case of non-payment, the property shall be automatically appropriated to

the partnership and a deed of sale be readily executed in favor of the

partnership. She does have a 90-day redemption period.

Ruben died, and Felicidad failed to make payment. She refused to turn

over the property and so the firm filed an ejectment case against her (wherein

she lost). She also failed to redeem the property within the period stipulated. She

then filed a civil case against Alfredo Aguila, manager of the firm, seeking for the

Page | 8

Partnership Cases

declaration of nullity of the deed of sale. The RTC retained the validity of the

deed of sale. The Court of Appeals reversed the RTC. The CA ruled that the sale

is void for it is a pactum commissorium sale which is prohibited under Art. 2088

of the Civil Code (note the disparity of the purchase price, which is the loan

amount, with the actual value of the property, which is after all located in a

subdivision).

ISSUE:

Whether or not the case filed by Felicidad shall prosper.

RULING:

No. Unfortunately, the civil case was filed not against the real party in

interest. As pointed out by Aguila, he is not the real party in interest but rather it

was the partnership A.C. Aguila & Sons, Co. The Rules of Court provide that

every action must be prosecuted and defended in the name of the real party in

interest. A real party in interest is one who would be benefited or injured by the

judgment, or who is entitled to the avails of the suit. Any decision rendered

against a person who is not a real party in interest in the case cannot be

executed. Hence, a complaint filed against such a person should be dismissed

for failure to state a cause of action, as in the case at bar.

Under Article 1768 of the Civil Code, a partnership has a juridical

personality separate and distinct from that of each of the partners. The partners

cannot be held liable for the obligations of the partnership unless it is shown that

the legal fiction of a different juridical personality is being used for fraudulent,

unfair, or illegal purposes. In this case, Felicidad has not shown that A.C. Aguila

& Sons, Co., as a separate juridical entity, is being used for fraudulent, unfair, or

illegal purposes. Moreover, the title to the subject property is in the name of A.C.

Aguila & Sons, Co. It is the partnership, not its officers or agents, which should

be impleaded in any litigation involving property registered in its name. A violation

of this rule will result in the dismissal of the complaint.

(The case also appear under Article 1819)

x x x

Page | 9

Partnership Cases

Ang Pue & Co. vs. Sec. of Commerce and Industry

G.R. No. L-17295

July 30, 1962

FACTS:

Ang Pue and Tan Siong, both Chinese citizens, organized the partnership

Ang Pue & Company for a term of five years from May 1, 1953, extendible by

their mutual consent. The corresponding articles of partnership were registered in

the Office of the Securities & Exchange Commission on June 16, 1953. On June

19, 1954 RA No. 1180 was enacted to regulate the retail business. It provided,

among other things, that, after its enactment, a partnership not wholly formed by

Filipinos could continue to engage in the retail business until the expiration of its

term.

On April 15, 1958 prior to the expiration of the 5-year term of the

partnership, but after the enactment of the RA 1180, the partners amended the

original articles of partnership so as to extend the term of life of the partnership to

another 5 years. When the amended articles were presented for registration in

the Office of the SEC on April 16, 1958, registration was refused upon the ground

that the extension was in violation of the aforesaid Act.

ISSUE:

Whether or not a corporation or a partnership could claim a juridical

personality of its own as a matter of absolute right?

RULING:

To organize a corporation or a partnership that could claim a juridical

personality of its own and transact business as such, is not a matter of absolute

right but a privilege, which may be enjoyed only under such terms as the State,

may deem necessary to impose. That the State, through Congress, and in the

manner provided by law, had the right to enact Republic Act No. 1180 and to

provide therein that only Filipinos and concerns wholly owned by Filipinos may

engage in the retail business can not be seriously disputed. That this provision

was clearly intended to apply to partnership already existing at the time of the

enactment of the law is clearly showing by its provision giving them the right to

continue engaging in their retail business until the expiration of their term or life.

Page | 10

Partnership Cases

To argue that because the original articles of partnership provided that the

partners could extend the term of the partnership, the provisions of RA 1180

cannot be adversely affect appellants herein, is to erroneously assume that the

aforesaid provision constitute a property right of which the partners can not be

deprived without due process or without their consent. The agreement contain

therein must be deemed subject to the law existing at the time when the partners

came to agree regarding the extension. In the present case, as already stated,

when the partners amended the articles of partnership, the provisions of RA1180

were already in force, and there can be not the slightest doubt that the right

claimed by appellants to extend the original term of their partnership to another

five years would be in violation of the clear intent and purpose of the law

aforesaid.

x x x

Page | 11

Partnership Cases

Article 1769

Heirs of Tan Eng Kee vs. Court of Appeals

G.R. No.126881

October 3, 2000

FACTS:

Benguet Lumber has been around even before World War II but during

the war, its stocks were confiscated by the Japanese. After the war, the brothers

Tan Eng Lay and Tan Eng Kee pooled their resources in order to revive the

business. In 1981, Tan Eng Lay caused the conversion of Benguet Lumber into a

corporation called Benguet Lumber and Hardware Company, with him and his

family as the incorporators. In 1983, Tan Eng Kee died. Thereafter, the heirs of

Tan Eng Kee demanded for an accounting and the liquidation of the partnership.

Tan Eng Lay denied that there was a partnership between him and his

brother. He said that Tan Eng Kee was merely an employee of Benguet Lumber.

He showed evidence consisting of Tan Eng Kees payroll; his SSS as an

employee and Benguet Lumber being the employee. As a result of the

presentation of said evidence, the heirs of Tan Eng Kee filed a criminal case

against Tan Eng Lay for allegedly fabricating those evidence. Said criminal case

was however dismissed for lack of evidence.

ISSUE:

Whether or not Tan Eng Kee is a partner.

RULING:

Page | 12

Partnership Cases

No. There was no certificate of partnership between the brothers. The

heirs were not able to show what was the agreement between the brothers as to

the sharing of profits. All they presented were circumstantial evidence, which in

no way proved partnership.

It is obvious that there was no partnership whatsoever. Except for a firm

name, there was no firm account, no firm letterheads submitted as evidence, no

certificate of partnership, no agreement as to profits and losses, and no time

fixed for the duration of the partnership. There was even no attempt to submit an

accounting corresponding to the period after the war until Kees death in 1984. It

had no business book, no written account nor any memorandum for that matter

and no license mentioning the existence of a partnership.

In fact, Tan Eng Lay was able to show evidence that Benguet Lumber is a

sole proprietorship. He registered the same as such in 1954; that Kee was just

an employee based on the latters payroll and SSS coverage, and other records

indicating Tan Eng Lay as the proprietor. Also, the business definitely amounted

to more P3,000.00 hence if there was a partnership, it should have been made in

a public instrument.

But the business was started after the war (1945) prior to the publication

of the New Civil Code in 1950? Even so, nothing prevented the parties from

complying with this requirement.

Also, the Supreme Court emphasized that for 40 years, Tan Eng Kee

never asked for an accounting. The essence of a partnership is that the partners

share in the profits and losses. Each has the right to demand an accounting as

long as the partnership exists. Even if it can be speculated that a scenario

wherein if excellent relations exist among the partners at the start of the

business and all the partners are more interested in seeing the firm grow rather

than get immediate returns, a deferment of sharing in the profits is perfectly

plausible. But in the situation in the case at bar, the deferment, if any, had gone

on too long to be plausible. A person is presumed to take ordinary care of his

concerns. A demand for periodic accounting is evidence of a partnership which

Kee never did.

The Supreme Court also noted:

Page | 13

Partnership Cases

In determining whether a partnership exists, these rules shall

apply:

(1) Except as provided by Article 1825, persons who are not partners as

to each other are not partners as to third persons;

(2) Co-ownership or co-possession does not of itself establish a

partnership, whether such co-owners or co-possessors do or do not share any

profits made by the use of the property;

(3) The sharing of gross returns does not of itself establish a partnership,

whether or not the persons sharing them have a joint or common right or interest

in any property, which the returns are derived;

(4) The receipt by a person of a share of the profits of a business is prima

facie evidence that he is a partner in the business, but no such inference shall be

drawn if such profits were received in payment:

(a) As a debt by installment or otherwise;

(b) As wages of an employee or rent to a landlord;

(c) As an annuity to a widow or representative of a deceased partner;

(d) As interest on a loan, though the amount of payment vary with the

profits of the business;

(e) As the consideration for the sale of a goodwill of a business or other

property by installments or otherwise.

x x x

Pascual vs. Commissioner of Internal Revenue

G.R. No. L-78133

October 18, 1988

FACTS:

Mariano Pascual and Renato Dragon bought two parcels of land from

Santiago Bernardino, et al. on June 22, 1965. On May 22, 1966, Pascual and

Dragon bought another three parcels of land from Juan Roque. The Bernardino

properties were sold in 1968 to Marenir Development Corporation, for a net profit

of P165,224.70. The Roque properties were sold to Erlinda Reyes and Maria

Samson in 1970 for a net profit of P60,000.00. Pascual and Dragon paid the

capital gains taxes in 1973 and 1974, availing of the tax amnesties granted in

those years. However, in March 31, 1979, the Acting Commissioner wrote to

Page | 14

Partnership Cases

Pascual and Dragon, demanding the amount of P107,101.70 representing their

deficiency income taxes for the years 1968 and 1970.Pascual and Dragon

contested this assessment, contending that they availed of the tax amnesties

of1973 and 1974 and should no longer have to pay their deficiency income taxes.

The Commissioner replied saying that because they derived profits from the sale

of properties that they co-owned, their co-ownership was actually an unregistered

partnership taxable for corporate income tax separate and distinct from that of

the partners under 20[b], NIRC and the profit that this corporation obtained was

subject to taxes prescribed under 24, NIRC. Although they did pay taxes in

1973 and 1974, what was paid was the tax due on their personal income from

the transaction, and not the tax due on the income derived from their de facto

partnership. Pascual and Dragon filed a Petition for Review with the CTA, which

affirmed the decision of the CIR. The CTA based its ruling on Evangelista vs.

Commissioner of Internal Revenue (102 Phil. 140 [1957]),where an unregistered

partnership was formed and was subjected to corporate income tax distinct from

that imposed on the partners. Pascual and Dragon elevated the case to the

Supreme Court, contending that there was insufficient evidence to show that they

had in fact created an unregistered partnership.

ISSUE:

Was there an unregistered partnership created by Pascual and Dragon

such that it could be subject to corporate income tax distinct from the income tax

of the partners?

RULING:

The Supreme Court found in favor of Pascual and Dragon, saying that the

case of Evangelista, used by the CTA in resolving the issue, differed significantly

from the case at bar. In Evangelista, the Supreme Court found that there was a

clear intention to invest money and to create profit from a series of real estate

transactions. In the case at bar, the purchase and sale of land were found to be

isolated incidents that did not show the character of habituality peculiar to

business transactions for the purpose of gain. The sharing of returns does not in

itself establish a partnership whether or not the persons sharing have a joint or

common right or interest in the property. The Court cited Justice Bautistas

concurring opinion in Evangelista, which noted that the mere fact of sharing of

profits from a transaction involving land held in co-ownership does not a

Page | 15

Partnership Cases

partnership make. An isolated transaction where two or more persons contribute

funds to buy certain real estate for profit in the absence of any other

circumstances showing a contrary intention cannot be considered a partnership.

x x x

Sardane vs. Court of Appeals

G.R. No. L-47045

November 22, 1988

FACTS:

Acojedo, herein private respondent brought an action for collection of a

sum of P5,217.25 based on promissory notes executed by the herein petitioner

Nobio Sardane in favor of the Acojedo. It has been established in the trial court

that on many occasions, Acojedo demanded the payment of the total amount of

P5,217.25. The failure of the petitioner to pay the said amount prompted Acojedo

to seek the services of lawyer who made a letter formally demanding the return

of the sum loaned. Because of the failure of the petitioner to heed the demands

extrajudicially made by Acojedo, the latter was constrained to bring an action for

collection of sum of money. In an oral testimony given by petitioner Sardane he

stated that a partnership existed between him and Acojedo which vary the

meaning of the abovementioned promissory notes, and that the said amount

taken by him from Acojedo was not his personal debt, but expenses of the

partnership between him and Acojedo. Consequently, said trial court concluded

that the promissory notes involved were merely receipts for the contributions to

said partnership.

ISSUE:

Whether there exists a partnership?

RULING:

No. The Court of Appeals held, and SC agrees, that even if evidence

aliunde other than the promissory notes may be admitted to alter the meaning

conveyed thereby, still the evidence is insufficient to prove that a partnership

existed between the private parties hereto. As manager of the basnig Sardane

naturally, some degree of control over the operations and maintenance thereof

Page | 16

Partnership Cases

had to be exercised by herein petitioner. The fact that he had received 50% of

the net profits does not conclusively establish that he was a partner of the private

respondent herein. Article 1769(4) of the Civil Code is explicit that while the

receipt by a person of a share of the profits of a business is prima facie evidence

that he is a partner in the business, no such inference shall be drawn if such

profits were received in payment as wages of an employee.

The same rule was reiterated in Bastida vs. Menzi & Co., Inc., et al. which

involved the same factual and legal milieu.

There are other considerations noted by respondent Court which negate

herein petitioner's pretension that he was a partner and not a mere employee

indebted to the present private respondent. Thus, in an action for damages filed

by herein private respondent against the North Zamboanga Timber Co., Inc.

arising from the operations of the business, herein petitioner did not ask to be

joined as a party plaintiff. Also, although he contends that herein private

respondent is the treasurer of the alleged partnership, yet it is the latter who is

demanding an accounting. The advertence of the Court of First Instance to the

fact that the casco bears the name of herein petitioner disregards the finding of

the respondent Court that it was just a concession since it was he who obtained

the engine used in the Sardaco from the Department of Local Government and

Community Development. Further, the use by the parties of the pronoun "our" in

referring to "our basnig, our catch", "our deposit", or "our boseros" was merely

indicative of the camaraderie and not evidentiary of a partnership, between

them.

Afisco Insurance vs. Court of Appeals

G.R. No.112675

January 25, 1999

FACTS:

Petitioners are 41 non-life insurance corporations that entered into a

reinsurance treaty with MUNICH a non-resident foreign insurance corporation.

Munich required these 41 companies to form a pool referred to as CLEARING

HOUSE in the case.

Page | 17

Partnership Cases

The pool then submitted an income tax return. BIR then assessed

(assessment was made beyond the allowable period of assessment) a deficiency

corporate income tax. This assessment was protested by petitioners through

SGV contending that they are not an unregistered partnership, that they have tax

exemption and that there is double taxation, and that the assessment made was

beyond the period allowed by law. BIR denied the protest. The case was then

elevated to the CA, which ruled that the pool was a partnership taxable as a

corporation and that the collection of the premiums from Munich form part of their

income, and thus considered as taxable income.

Petitioners contend that they cannot be taxed as a corporation, because

(a) the reinsurance policies were written by them individually and separately, (b)

their liability was limited to the extent of their allocated share in the original risks

insured and not solidary, (c) there was no common fund, (d) the executive board

of the pool did not exercise control and management of its funds, unlike the

board of a corporation, (e) the pool or clearing house was not and could not

possibly have engaged in the business of reinsurance from which it could have

derived income for itself. They further contend that remittances to Munich are not

dividends and to subject it to tax would be tantamount to an illegal double

taxation, as it would result to taxing the same premium income twice in the hands

of the same taxpayer.

ISSUE:

May the insurance pool be deemed a partnership or an association that is

taxable as a corporation?

RULING:

The pool is taxable as a corporation.

In the present case, the ceding companies entered into a Pool Agreement

or an association that would handle all the insurance businesses covered under

their quota-sharing reinsurance treaty and surplus reinsurance treaty with

Munich. There are unmistakable indicators that it is a partnership or an

association covered by NIRC.

a. The pool has a common fund, consisting of money and other valuables

that are deposited in the name and credit of the pool.

Page | 18

Partnership Cases

b. The pool functions through an executive board which resembles the

BOD of a corporation.

c. Though the pool itself is not a reinsurer, its work is indispensable,

beneficial and economically useful to the business of the ceding companies and

Munich because without it they would not have received their premiums. Profit

motive or business is therefore the primordial reason for the pools formation.

The fact that the pool does not retain any profit or income does not

obliterate an antecedent fact that of the pool is being used in the transaction of

business for profit. It is apparent, and petitioners admit that their association or

co-action was indispensable to the transaction of the business. If together they

have conducted business, profit must have been the object as indeed, profit was

earned. Though the profit was apportioned among the members, this is one a

matter of consequence as it implies that profit actually resulted.

Petitioners' reliance on Pascual v. Commissioner is misplaced, because

the facts obtaining therein are not on all fours with the present case. In Pascual,

there was no unregistered partnership, but merely a co-ownership, which took up

only 2 isolated transactions. The CA did not err in applying Evangelista, which

involved a partnership that engaged in a series of transactions spanning more

than 10 years, as in the case before us.

x x x

Page | 19

Partnership Cases

Article 1770

Pioneer Insurance and Surety Corp. vs. Court of

Appeals

G.R. No. 84197; GR No. 84157

July 28, 1989

FACTS:

Herein petitioner (Jacob Lim) was engaged in airline business as owneroperator of Southern Air Lines (SAL) a single proprietorship. He entered into a

contract of sale with Japan Domestic Airlines, purchasing two aircrafts and one

set of necessary spare price to be paid in installments. Pioneer Insurance and

Surety Corporation as surety executed and issued its Surety Bond in favor of

JDA, in behalf of its principal, Lim, for the balance price of the aircrafts and spare

parts. It appears that Bormaheco, Francisco and Modesto Cervantes and

Constancio Maglana (respondents) contributed some funds used in the purchase

of the above aircrafts and spare parts. The funds were supposed to be their

Page | 20

Partnership Cases

contributions to a new corporation proposed by Lim to expand his airline

business. They executed two separate indemnity agreements in favor of Pioneer,

one signed by Maglana and the other jointly signed by Lim for SAL, Bormaheco

and the Cervanteses. The indemnity agreement contain that the parties bind

themselves to jointly and severally indemnify Pioneer in case of loss or damage

in consequence of having become the surety. Meanwhile, Lim doing business

under the name of SAL, executed chattel mortgage in favor of Pioneer. After

sometime, Lim defaulted in paying subsequent installments, thereby prompting

JDA to request payments from the surety. Pioneer was then obliged to pay, in

which he complied with. Thereafter, Pioneer filed extrajudicial foreclosure of

chattel mortgage before the Sheriff of Davao City. The Cervanteses and

Maglana, however, filed a third party claim alleging that they are co-owners of the

aircrafts. After trial on the merits, a decision was rendered holding Lim liable to

pay Pioneer but dismissed Pioneers complaint against all other defendants. CA

modified its decision plaintiffs complaint against all the defendants was

dismissed. In all other respects the trial courts decision was affirmed.

ISSUE:

How are losses to be treated in situations where there contributions to the

intended corporation where not invested through corporate form.

HELD:

These questions are premised on the petitioners theory that as a result of

the failure of respondents Bormaheco, Spouses Cervantes, Constancio Maglana

and petitioner Lim to incorporate, a de facto partnership among them was

created, and that as a consequence of such relationship all must share in the

losses and/or gains of the venture in proportion to their contribution. While it has

been held that as between themselves the rights of the stockholders in a

defectively incorporated association should be governed by the supposed charter

and the laws of the state relating thereto and not by the rules governing partners.

However, such a relation does not necessarily exist, for ordinarily persons cannot

be made to assume the relation of partners, as between themselves, when their

purpose is that no partnership shall exist and it should be implied only when

necessary to do justice between the parties; thus, one who takes no part except

to subscribe for stock in a proposed corporation which is never legally formed

does not become a partner with other subscribers who engage in business under

Page | 21

Partnership Cases

the name of the pretended corporation, so as to be liable as such in an action for

settlement of the alleged partnership and contribution. A partnership relation

between certain stockholders and other stockholders, who were also directors,

will not be implied in the absence of an agreement, so as to make the former

liable to contribute for payment of debts illegally contracted by the latter. No de

facto partnership was created among the parties, which would entitle the

petitioner to a reimbursement of the supposed losses of the proposed

corporation. The record shows that the petitioner was acting on his own and not

in behalf of his other would-be incorporators in transacting the sale of the

airplanes and spare parts.

x x x

Innocencia Deluao and Felipe Deluao v. Nicanor

Casteel

No. L-21906

December 24, 1968

FACTS:

Nicanor Casteel filed various fishpond application for a big tract of

swampy land, which was not approved several times. Meanwhile, during the

pendency of his fourth attempt for the application, few other persons also filed

fishpond application, one of those is herein petitioner. Due to the threat poised

upon his position by other applicants, Casteel then decided to occupy said area

by introducing improvements thereon. However, he lacks financial resources.

Hence he sought financial aid from his uncle, Felipe Deluao, who extended loans

to him. Thereafter, the parties executed contract of service of which they agreed

that Innocencia Deluao will hire Nicanor Casteel to render services and be the

manager and sole buyer of all the fish products of the said fishpond.

Subsequently, Deluaos pending fishpond application was rejected by the

Director of Fisheries on which he did not file any petition for reinvestigation. On

the other hand, Casteels application was approved and he was given permit to

exploit fishpond. As a result, Casteel forbade Innocencia Deluao from

Page | 22

Partnership Cases

administering further the fishpond. Alleging violations of the contract of service,

Deluao filed an action for specific performance before the Court of First Instance,

praying that Casteel should respect and abide with terms and condition of the

said contract, and that she should be allowed to continue administering said

fishpond and collecting the proceeds from the sale of the fishes caught.

Injunction was also filed by Deluao, restraining Casteel from doing acts

complained of and that such injunction be made permanent. Casteel countered

such complaint by alleging that he was the owner and lawful occupant and

applicant of the said fishpond in dispute. The lower court decided in favor of

Deluao. Hence this instant appeal.

ISSUE:

Whether or not the contract of service executed by the parties created

co-ownership and partnership between the appellant and appellees.

HELD:

The court ruled that the evidence substantiate that the initial intention of

the parties was not to form co-ownership but to establish partnership Deluao as

the capitalist partner and Casteel as the industrial partner and the ultimate

undertaking of which is to divide into two equal parts the fishpond as might have

been developed by the amount extended by the plaintiff-appellees with the

further provision that Casteel should reimbursed the expenses incurred by the

appellees over one-half of the fishpond that would pertain to him. Although the

contract was denominated as contract of service, it was actually a

memorandum of their partnership agreement. Art.1830 of the Civil Code

enumerates as one of the causes of dissolution of the partnership is when any

event which makes it unlawful for the business of the partnership to be carried on

or for the members to carry it on in partnership. The Fisheries Act prohibits the

holder of a fishpond permit from transferring or subletting the fishpond granted to

him without the previous consent or approval of the Secretary of Agriculture and

Natural Resources. To that effect, since the partnership had for its object the

division into two equal parts of the fishpond between the appellees and the

appellant after it shall have been awarded to the latter, and therefore it envisage

an unauthorized transfer of one-half thereof to parties other than the applicant

Casteel, it was dissolved by the approval of his application and the award to him

of the fishpond. The approval of was an event which makes it unlawful for the

Page | 23

Partnership Cases

business of the partnership to be carried on in partnership. The case is

remanded to the lower court for reception of evidence as regards the accounting

of the profits realized by the partnership before the exploitation of the fishpond

was granted to Casteel.

(The case also appear under Articles 1811 and 1830 with separate issues and

rulings relevant to said articles)

x x x

Article 1771

Mauricio Agad vs. Severino Mabato, and Mabato

and Agad Co.

G.R. No. L-24193

June 28, 1968

FACTS:

Plaintiff Mauricio Agad alleging that he and defendant Severino Mabato

are partners in a fishpond business, filed a complaint for payment of sum of

money amounting to P14,000 as share of profits in the partnership from 1957 to

1963 and for the dissolution of partnership. Mabato, on the other hand, moved to

dismissed the complaint for lack of cause of cause of action alleging that the

contract had not been perfected because Agad had failed to give his P1,000

contribution to the partnership capital. Defendant also raised the ground of lack

of jurisdiction of the court because the case involves principally the determination

of rights over public lands. The court granted the dismissal of the case on the

ground of failure to state cause of action which was predicated on the theory that

the contract of partnership is null and void pursuant to Art. 1773 of the Civil Code,

because an inventory of the fishpond referred thereto has not been attached

thereto.

Page | 24

Partnership Cases

ISSUE:

Whether or not an immovable property or real rights has been contributed

to the partnership, which will render it null and void for non-compliance with the

inventory requirement as provided under Art. 1773, in connection with Art. 1711

of the Civil Code

RULING:

None of the partners contributed either a fishpond or real right to any

fishpond. Their contributions were limited to the sum of P1,000 each. It should be

noted that the partnership was established "to operate a fishpond" not "to engage

in fishpond business". The validity of the partnership was upheld.

A partnership may be constituted in any form, except where immovable

property or real rights are contributed thereto, in which case a public instrument

shall be necessary. (Art. 1771, Civil Code)

A contract of partnership is void, whenever immovable property is

contributed thereto, if inventory of said property is not made, signed by the

parties and attached to public instrument.

x x x

Page | 25

Partnership Cases

Article 1772

Commissioner of Internal Revenue vs. Ledesma

G.R. No. L-17509

January 30, 1970

FACTS:

On July 9, 1949 herein respondents, Carlos Ledesma, Julieta Ledesma

and the spouses Amparo Ledesma and Vicente Gustilo, Jr., purchased from their

parents, Julio Ledesma and Florentina de Ledesma, the sugar plantation known

as "Hacienda Fortuna." By virtue of the purchase, respondents acquired onethird each of the undivided portion of the plantation. In their individual income tax

returns for the year 1949 the respondents included as part of their income their

respective net profits derived from their individual sugar production from.

On July 11, 1949, the respondents organized themselves into a general

co-partnership under the firm name "Hacienda Fortuna." The articles of general

co-partnership were registered in the commercial register on July 14, 1949.

Paragraph 14 of the articles of general partnership provides that the agreement

shall have retroactive effect as of January 1, 1949. On March 22, 1959 the

Commissioner assessed against the partnership "Hacienda Fortuna" corporate

income tax for the calendar year 1949. The respondents contested the

assessment upon the ground that the "Hacienda Fortuna" was a registered

general co-partnership and requested for the cancellation of the assessment

Page | 26

Partnership Cases

based on the theory that the co-partnership "Hacienda Fortuna" was exempt from

the payment of corporate income tax on its income from the day its articles of

general co-partnership were registered in the mercantile registry. They were,

however, assessed for corporate income tax from January 1 to July 13, 1949.

Respondents, through counsel, wrote a letter to the Commissioner asking for the

reconsideration of his ruling upon the ground that during the period from January

1 to July 13, 1949 the respondents were operating merely as co-owners of the

plantation known as "Hacienda Fortuna", so that the case of the "Hacienda

Fortuna" was really one of co-ownership and not that of an unregistered copartnership which was subject to corporate tax. That request for reconsideration

was denied.

It is the position of the Commissioner that from January 1 to July 13, 1949

the partnership "Hacienda Fortune" should be considered still an unregistered

co-partnership for the purposes of the assessment of the corporate income tax,

notwithstanding the fact that paragraph 14 of its articles of co-partnership

provides that the partnership agreement should retroact to January 1, 1949.

Respondents contend that prior to July 14, 1949 they were operating the

sugar plantation under a system of co-ownership, and not as a partnership, so

that they were not under obligation to pay the corporate income tax. The

respondents further contend that even assuming that they were operating the

sugar plantation as a partnership the registration of the articles of general copartnership on July 14, 1949 had operated to exempt said partnership from

corporate income tax on its net income during the entire taxable year, from

January 1 to December 31, 1949.

ISSUE:

Whether or not the partnership known as "Hacienda Fortuna" should pay

corporate income tax as an unregistered partnership from January 1, 1949 to

July 13, 1949, the period in the year 1949 prior to the date of said registration?

RULING:

As early as 1924 the Bureau of Internal Revenue had applied the "statusat-the-end-of-the-taxable-year" rule in determining the income tax liability of a

partnership, such that a partnership is considered a registered partnership for the

entire taxable year even if its articles of co-partnership are registered only at the

Page | 27

Partnership Cases

middle of the taxable year, or in the last month of the taxable year. it is a fair and

sound application of Section 24 of the tax code that once a partnership is

registered during a taxable year that partnership should be considered as

registered "partnership exempt from the payment of corporate income tax during

that taxable year, and only the partners thereof should be made to pay income

tax on the profits of the partnership that were divided among them.

It may thus be said that a premium is given to a partnership that is

registered by exempting it from the payment of corporate income tax, and making

only the individual partners pay income tax on the basis of their respective

shares in the partnership profits. On the other hand, the partnership that is not

registered is being penalized by making it pay corporate income tax on the profits

it realizes during a taxable year and at the same time making the partners thereof

pay their individual income tax based on their respective shares in the profits of

the partnership. In other words, there is double assessment of income tax

against the partners of the unregistered partnership, but only one assessment

against the partners of registered partnership.

The exclusion of a registered partnership from the entities subject to the

payment of corporate income tax under Section 24 of the tax code should be

made to cover the entire taxable year, regardless of whether the registration

takes place at the middle, or towards the last days, of the taxable year. This is so

because, after all, the taxable status of the taxpayer, for the purposes of the

payment of income tax, is determined as of the end of the taxable year, and the

income tax is collected after the end of the taxable year. Since it is the policy of

the government to encourage a partnership to register its articles of copartnership in order that the government can better ascertain the profits of the

partnership and the distribution of said profits among the partner, this benefit of

exclusion from paying corporate income tax arising from registration should be

liberally extended to registered, or registering, partnerships in order that the

purpose of the government may be attained.

x x x

Page | 28

Partnership Cases

Article 1773

Solis vs. Barroso

G.R. No. L-27939

October 30, 1928

FACTS:

The spouses Lambino and Barroso made a donation of propter nuptias of

lands in favor of their son Alejo Lambino and Fortunata Solis in a private

document in consideration of the marriage, which the latter were about to enter

into. One of the conditions of this donation is that in case of the death of one of

the donees, one-half of these lands thus donated would revert to the donors

while the surviving donee would retain the other half. On the 8th of the said

month of June 1919, Alejo Lambino and Fortunata Solis were married and

immediately thereafter the donors delivered the possession of the donated lands

to them. On August 3, 1919 donee, Alejo Lambino, died. In the same year donor

Juan Lambino also died. After the latter's death, his wife, Maxima Barroso,

recovered possession of the donated lands.

The surviving donee Fortunata Solis filed the action demanding of the

defendants the execution of the proper deed of donation according to law,

transferring one-half of the donated property, and moreover, to proceed to the

partition of the donated property and its fruits.

ISSUE:

Whether or not there is a valid donation?

RULING:

Donations for valuable consideration are such as compensate services

which constitute debts recoverable from the donor, or which impose a charge

equal to the amount of the donation upon the donee, neither of which is true of

Page | 29

Partnership Cases

the present donation, which was made only in consideration of marriage. The

lower court insists that, by the fact that this is a donation propter nuptias, it is

based upon the marriage as a consideration, and must be considered onerous.

Neither is this opinion well founded. In donations propter nuptias, the marriage is

really a consideration, but not in the sense of being necessary to give birth to the

obligation. This may be clearly inferred from article 1333, which makes the fact

that the marriage did not take place a cause for the revocation of such donations,

thus taking it for granted that there may be a valid donation propter nuptias, even

without marriage, since that which has not existed cannot be revoked. And such

a valid donation would be forever valid, even if the marriage never took place, if

the proper action for revocation were not instituted, or if it were instituted after the

lapse of the statutory period of prescription. This is, so because the marriage in a

donation propter nuptias is rather a resolutory condition which, as such,

presupposes the existence of the obligation, which may be resolved or revoked,

and it is not a condition necessary for the birth of the obligation.

x x x

Torres vs. Court of Appeals

G.R. No. 134559

December 9, 1999

FACTS:

In 1969, sisters Antonia Torres and Emeteria Baring entered into a joint

venture agreement with Manuel Torres. Under the agreement, the sisters agreed

to execute a deed of sale in favor Manuel over a parcel of land, the sisters

received no cash payment from Manuel but the promise of profits (60% for the

sisters and 40% for Manuel) said parcel of land is to be developed as a

subdivision.

Manuel then had the title of the land transferred in his name and he

subsequently mortgaged the property. He used the proceeds from the mortgage

to effect the survey and subdivision of the lots; approval of the subdivision

project; advertisement in the local newspaper; construction of roads, curbs and

gutters; and also contracted an engineering firm for the building of housing units.

Respondent claimed that the subdivision project failed, however, because

petitioners and their relatives had separately caused the annotations of adverse

Page | 30

Partnership Cases

claims on the title to the land, which eventually scared away prospective buyers.

Despite his requests, petitioners refused to cause the clearing of the claims,

thereby forcing him to give up on the project

The sisters then filed a civil case against Manuel for damages equivalent

to 60% of the value of the property, which according to the sisters is what is due

them as per the contract.

The lower court ruled in favor of Manuel and the Court of Appeals

affirmed the lower court. The sisters then appealed before the Supreme Court

where they argued that there is no partnership between them and Manuel

because the joint venture agreement is void.

ISSUE:

Whether or not there exists a partnership.

RULING:

Yes. The joint venture agreement the sisters entered into with Manuel is a

partnership agreement whereby they agreed to contribute property (their land)

which was to be developed as a subdivision. While on the other hand, though

Manuel did not contribute capital, he is an industrial partner for his contribution

for general expenses and other costs. Furthermore, the income from the said

project would be divided according to the stipulated percentage (60-40). Clearly,

the contract manifested the intention of the parties to form a partnership. Further

still, the sisters cannot invoke their right to the 60% value of the property and at

the same time deny the same contract which entitles them to it.

At any rate, the failure of the partnership cannot be blamed on the sisters,

nor can it be blamed to Manuel (the sisters on their appeal did not show evidence

as to Manuels fault in the failure of the partnership). The sisters must then bear

their loss (which is 60%). Manuel does not bear the loss of the other 40%

because as an industrial partner he is exempt from losses.

Article 1775

Smith vs. Lopez

G.R. No. 1472

Page | 31

Partnership Cases

September 30, 1905

FACTS:

Smith and Reyes, as proprietors of the Philippine Gas Light Company,

brought this action against the defendant sisters, Jacinta and Ignacia Lopez de

Pineda, to recover from them the sum of 3,270 pesos, Mexican currency, with

interest due thereon and costs of proceedings, for work performed in connection

with the installation of a water system, urinals, closets, shower baths, and drain

pipes in the house belonging to the defendants. The plaintiffs alleged that they

had complied with the agreement made with the father of the defendants, the

administrator of the property, and defendants having refused to pay the same as

agreed.

The court, after considering the allegations made and the evidence

introduced by both parties, on April 3, 1903, entered judgment against the

defendants and in favor of the plaintiffs. To this judgment defendants duly

excepted, having first moved for a new trial.

One of the errors assigned by counsel for defendants and appellants in

this court is that the court below erred in recognizing plaintiffs capacity to sue as

a partnership, there being no evidence to show that they were legally organized

as such.

ISSUE:

Whether or not plaintiffs as proprietors have capacity to sue.

RULING:

Messrs. Smith and Reyes executed the contract in their own individual

capacity and not in the name of any partnership. They acted as co-owners of the

Philippine Gas Light Company. In their complaint they sought to enforce a

legitimate right, which they had as such co-owners. (Arts. 392 et seq., and 1669

of the Civil Code.)

The plaintiffs were not seeking to enforce a right pertaining to a legal

entity. They were not obliged to register in the Mercantile Registry. They were

merely merchants having a common interest in the business. They were under

no obligation to register. (Arts. 16 and 17 of the Code of Commerce.)

x x x

Page | 32

Partnership Cases

Article 1776 1783

Lyons vs. Rosenstock

G.R. No. L-35469

March 17, 1932

FACTS:

Elser and Lyons are engaged in real estate. To secure the loan needed to

complete the amount for the first payment on the San Juan Estate, Elser

Page | 33

Partnership Cases

mortgage the equity of redemption in the property owned by himself and Lyons

on Carriedo Street. This mortgage was executed on June 30, 1920, at which time

Elser expected that Lyons would come in on the purchase of the San Juan

Estate. But when he learned from the letter from Lyons of July 21, 1920, that the

latter had determined not to come into this deal, Elser began to cast around for

means to relieve the Carriedo property of the encumbrance which he had placed

upon it. For this purpose, on September 9, 1920, he addressed a letter to the

Fidelity & Surety Co., asking it to permit him to substitute a property owned by

himself at 644 M. H. del Pilar Street, Manila, and 1,000 shares of the J. K.

Pickering & Company, in lieu of the Carriedo property, as security. The Fidelity &

Surety Co. agreed to the proposition; and on September 15, 1920, Elser

executed in favor of the Fidelity & Surety Co. a new mortgage on the M. H. del

Pillar property and delivered the same, with 1,000 shares of J. K. Pickering &

Company, to said company. The latter thereupon in turn executed a cancellation

of the mortgage on the Carriedo property and delivered it to Elser. But

notwithstanding the fact that these documents were executed and delivered, the

new mortgage and the release of the old were never registered; and on

September 25, 1920, thereafter, Elser returned the cancellation of the mortgage

on the Carriedo property and took back from the Fidelity & Surety Co. the new

mortgage on the M. H. del Pilar property, together with the 1,000 shares of the J.

K. Pickering & Company which he had delivered to it upon the consent of Lyons

for the mortgage to remain on the Carriedo property.

The development of the San Juan Estate was a success from the start,

the financing apart from the modest financial participation of his three associates

in the San Juan deal, was the work of Elser accomplished entirely upon his own

account. The case for the plaintiff supposes that, when Elser placed a mortgage

for P50,000 upon the equity of redemption in the Carriedo property, Lyons, as

half owner of said property, became, as it were, involuntarily the owner of an

undivided interest in the property acquired partly by that money; and it is insisted

for him that, in consideration of this fact, he is entitled to the four hundred fortysix and two-thirds shares of J. K. Pickering & Company, with the earnings

thereon, as claimed in his complaint.

ISSUE:

Page | 34

Partnership Cases

Whether or not Lyons is a partner of Elser and thus entitled to the profit of

the venture?

RULING:

No. Lyons himself did not want to participate in the development of the

project. No partnership was formed. The mortgage of the property is immaterial

to the issue of partnership existence.

In the purely legal aspect of the case, the position of the appellant is, in

our opinion, untenable. If Elser had used any money actually belonging to Lyons

in this deal, he would under article 1724 of the Civil Code and article 264 of the

Code of Commerce, be obligated to pay interest upon the money so applied to

his own use. Under the law prevailing in this jurisdiction a trust does not ordinarily

attach with respect to property acquired by a person who uses money belonging

to another. Of course, if an actual relation of partnership had existed in the

money used, the case might be difference; and much emphasis is laid in the

appellant's brief upon the relation of partnership which, it is claimed, existed. But

there was clearly no general relation of partnership, under article 1678 of the Civil

Code. It is clear that Elser, in buying the San Juan Estate, was not acting for any

partnership composed of himself and Lyons, and the law cannot be distorted into

a proposition which would make Lyons a participant in this deal contrary to his

express determination.

It seems to be supposed that the doctrines of equity worked out in the

jurisprudence of England and the United States with reference to trust supply a

basis for this action. The doctrines referred to operate, however, only where

money belonging to one person is used by another for the acquisition of property

which should belong to both; and it takes but little discernment to see that the

situation here involved is not one for the application of that doctrine, for no

money belonging to Lyons or any partnership composed of Elser and Lyons was

in fact used by Elser in the purchase of the San Juan Estate. Of course, if any

damage had been caused to Lyons by the placing of the mortgage upon the

equity of redemption in the Carriedo property, Elser's estate would be liable for

such damage. But it is evident that Lyons was not prejudice by that act.

x x x

Page | 35

Partnership Cases

Article 1784

Ortega, Del Castillo, Jr., and Bacorro vs. CA, SEC,

and Misa

G.R. No. 109248

July 3, 1995

FACTS:

The law firm of ROSS, LAWRENCE, SELPH and CARRASCOSO was

duly registered in the Mercantile Registry on 4 January 1937 and reconstituted

with the Securities and Exchange Commission on 4 August 1948. On 19

December 1980, appellees Jesus B. Bito and Mariano M. Lozada associated

themselves together, as senior partners with respondents-appellees Gregorio F.

Page | 36

Partnership Cases

Ortega, Tomas O. del Castillo, Jr., and Benjamin Bacorro, as junior partners. On

February 17, 1988, petitioner-appellant wrote the respondents-appellees a letter

stating that they are withdrawing and retiring from the firm and that liquidation be

made. On 30 June 1988, petitioner filed with this Commission's Securities

Investigation and Clearing Department (SICD) a petition for dissolution and

liquidation of partnership.

ISSUE

When did the Partnership of the Firm begin?

RULING

According to A. 1784 of the Civil Code, A Partnership begins from the

moment of the execution of the contract, unless it is otherwise stipulated. The

Partnership was born from the time it was mutually desired and consented by the

Parties involved in this case, the firm. Their registration both in the Mercantile

Registry as well as on the SEC merely helps any person with an interest against

them a chance to get their claims. Thus, the Petitioner may claim any obligation

due to him if any from the Partnership from the time he has joined up to the

time he dissolved his membership from the Firm in accordance with the

agreement between him and the Firm.

(The case also appear under Articles 1767 and 1830 with separate issues and

rulings relevant to said articles)

x x x

Page | 37

Partnership Cases

Article 1786

William Uy vs. Bartolome Puzon

No. L-19819

October 26, 1977

FACTS:

Defendant Bartolome Puzon had a contract of public works with the

government. He sought the financial assistance of the plaintiff William Uy, by

virtue of which a partnership was created, (U. P. Construction Company) which

became the subcontractor of the projects.

Due to financial constraints, the defendant promised to contribute his

share in the capital as soon as his loan with PNB shall be approved. However,

his application could only be acted upon if he will be able to clear his obligations

with the bank. With this, the plaintiff gave the defendant a certain amount as an

Page | 38

Partnership Cases

advance contribution of the former, to be used by the latter to pay his obligations

with the bank. The defendant thus applied the proceeds of the loan to the

partnership, a part thereof as reimbursement for the capital contribution of the

plaintiff and another part as his partial share contribution. However, to guarantee

said loan, defendant, without the knowledge and consent of the plaintiff, assigned

to the bank all the payments to be received on account of the projects, which he

did upon payment by the government.

As the financial demands of the projects increased, plaintiff made a

demand from the defendant to comply with his obligation to complete his capital

contribution, but to no avail. Failing to reach an agreement, the defendant, as

prime contractor, terminated the subcontract agreement with the firm. The plaintiff

instituted a complaint for the dissolution of the partnership and for payment of

damages. The trial court rendered a decision against the defendant.

ISSUE:

Whether the defendant is guilty of violating the terms of the partnership

agreement, hence liable to pay damages.

RULING:

Yes. The Court upheld the findings of the lower court as follows:

1. Defendant failed to contribute his share in the capital of the

partnership. The partners agreed that each shall contribute P50,000.

Out of the loan obtained, he actually contributed only P20,000 and

thereafter failed to make any further contribution.

2. Defendant misapplied partnership funds by assigning to PNB all

payments to be received on account of the contracts with the

government. He withheld and applied a large part of such payment

(over three hundred thousand pesos) to pay his personal loan with the

bank. The balance was deposited in his current account and only a

small amount of P27,820 was deposited in the current account of the

partnership.

Page | 39

Partnership Cases

3. Such assignment is prejudicial to the partnership. The amount paid by

the government (a little over 1 million pesos) rightfully and legally

belongs to the partnership by virtue of the subcontract agreements.

Should the defendant gave to the partnership all that were earned and

due it, the money would have been used as a safe reserve for the

discharge of all obligations of the firm and the partnership would have

been able to successfully and profitably carried out the projects it

subcontracted.

Since the defendant was at fault, he is liable to reimburse the plaintiff

whatever amount the latter had invested in or spent for the partnership on

account of the construction projects. In addition, under Article 2200 of the Civil

Code, indemnification for damages shall comprehend not only the value of the

loss suffered, but also that of the profits, which the obligee failed to obtain. The

defendant, therefore, is also liable to pay compensatory damages.

Article 1788

Liwanag vs. Court of Appeals

G.R. No. 114398

October 24, 1997

FACTS:

Petitioner Carmen Liwanag (Liwanag) and a certain Thelma Tabligan

went to the house of complainant Isidora Rosales (Rosales) and asked her to join

them in the business of buying and selling cigarettes. Convinced of the feasibility

of the venture, Rosales readily agreed. Under their agreement, Rosales would

give the money needed to buy the cigarettes while Liwanag and Tabligan would

act as her agents, with a corresponding 40% commission to her if the goods are

sold; otherwise the money would be returned to Rosales. Consequently, Rosales

gave several cash advances to Liwanag and Tabligan amounting to P633,

650.00. During the first two months, Liwanag and Tabligan made periodic visits to

Rosales to report on the progress of the transactions. The visits, however,

suddenly stopped, and all efforts by Rosales to obtain information regarding their

business proved futile. Alarmed by this development and believing that the

Page | 40

Partnership Cases

amounts she advanced were being misappropriated, Rosales filed a case of

estafa against Liwanag. After trial on the merits, the trial court rendered finding

Liwanag guilty as charged. Appeal to the CA was unavailing since Appellate

Court affirmed her conviction. On petition for review to the High Court, Liwanag

advances the theory that the intention of the parties was to enter into a contract

of partnership, wherein Rosales would contribute the funds while she would buy

and sell the cigarettes, and later divide the profits between them. She also

argues that the transaction can also be interpreted as a simple loan, with

Rosales lending to her the amount stated on an installment basis.

ISSUE:

Whether or not petitioners contention deserve merit.

RULING:

No. The receipt indicates that the money delivered to Liwanag was for a

specific purpose, that is, for the purchase of cigarettes, and in the event the

cigarettes cannot be sold, the money must be returned to Rosales. Thus, even

assuming that a contract of partnership was indeed entered into by and between

the parties, we have ruled that when money or property has been received by a

partner for a specific purpose (such as that obtaining in the instant case) and he

later misappropriated it, such partner is guilty of estafa. Neither can the

transaction be considered a loan, since in a contract of loan, once the money is

received by the debtor, ownership over the same is transferred. Being the owner,

the borrower can dispose of it for whatever purpose he may deem proper. In the

instant petition, however, it is evident that Liwanag could not dispose of the

money as she pleased because it was only delivered to her for a single purpose,

namely, for the purchase of cigarettes, and if this was not possible then to return

the money to Rosales. Since in this case there was no transfer of ownership of

the money delivered, Liwanag is liable for conversion under Art. 315, par. 1(b) of

the Revised Penal Code.

x x x

US vs. Clarin

G.R. No. 5840

September 17, 1910

Page | 41

Partnership Cases

FACTS:

Sometime before 1910, Pedro Larin formed a partnership with Pedro

Tarug, Eusebio Clarin and Carlos de Guzman. Larin, being the capitalist, agreed

to contribute P172.00 to the partnership and the three others shall use said fund

to trade mangoes. The three industrial partners bought mangoes and sell them

and they earned P203.00 but they failed to give Larins share of the profits. Larin

charged them with the crime of estafa, but the provincial fiscal filed an

information only against Eusebio Clarin in which he accused him of appropriating

to himself not only the P172 but also the share of the profits that belonged to

Larin, amounting to P15.50. Clarin was eventually convicted.

ISSUE:

Whether or not the conviction is correct.

RULING:

No. The P172.00 having been received by the partnership, the business

commenced and profits accrued, the action that lies with the partner who

furnished the capital for the recovery of his money is not a criminal action for

estafa, but a civil one arising from the partnership contract for a liquidation of the

partnership and a levy on its assets if there should be any.

The then Penal Code provides that those who are guilty of estafa are

those who, to the prejudice of another, shall appropriate or misapply any money,

goods, or any kind of personal property which they may have received as a

deposit on commission for administration or in any other producing the obligation

to deliver or return the same, (as, for example, in commodatum, precarium, and

other unilateral contracts which require the return of the same thing received)

does not include money received for a partnership; otherwise the result would be

that, if the partnership, instead of obtaining profits, suffered losses, as it could not

be held liable civilly for the share of the capitalist partner who reserved the

ownership of the money brought in by him, it would have to answer to the charge

of estafa, for which it would be sufficient to argue that the partnership had

received the money under obligation to return it.

x x x

Page | 42

Partnership Cases

Article 1789

Evangelista & Co., et al. vs. Estrella Abad Santos

No. L-31684

June 28, 1973

FACTS:

In the amended Articles of Co-partnership dated June 7, 1955,

respondent was included as an industrial partner in the petitioner co-partnership,

where the individual petitioners are the original capitalist partners. The amended

articles further provided that the profits and losses shall be divided in proportion

of 70% for the capitalist partners and 30% for the industrial partner.

On December 16, 1963, respondent initiated a suit against the petitioners,

alleging that the partnership had been paying dividends to the partners except to

her and that notwithstanding her demands had refused to give her information