Академический Документы

Профессиональный Документы

Культура Документы

CH 71

Загружено:

SomaSorrowОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CH 71

Загружено:

SomaSorrowАвторское право:

Доступные форматы

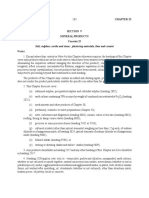

ITC (HS), 2012

SCHEDULE 1 IMPORT POLICY

Section XIV

Chapter-71

SECTION XIV

NATURAL OR CULTURED PEARLS, PRECIOUS OR SEMI-PRECIOUS

STONES, PRECIOUS METAL, METALS CLAD WITH PRECIOUS

METAL, AND ARTICLES THEREOF; IMITATION JEWELLERY; COIN

CHAPTER 71

NATURAL OR CULTURED PEARLS, PRECIOUS OR SEMI-PRECIOUS

STONES, PRECIOUS METAL, METALS CLAD WITH PRECIOUS

METAL, AND ARTICLES THEREOF; IMITATION JEWELLERY; COIN

NOTES:

1. Subjects to Note 1 (a) to Section VI and except as provided below, all articles

consisting wholly or partly:

(a) Of natural or cultured pearls or of precious of semi-precious stones

(natural, synthetic of reconstructed), or

(b) Of Precious metal or of metal clad with precious metal,

are to be classified in this Chapter.

2. (A) Headings 7113, 7114 and 7115 do not cover articles in which precious

metal or metal clad with precious metal is present as minor constituents only,

such as minor fittings or minor ornamentation (for example, monograms,

ferrules and rims) and paragraph (b) of the foregoing Note does not apply to

such articles.

(B) Heading 7116 does not cover articles containing precious metal or metal

clad with precious metal (other than as minor constituents).

3. This Chapter does not cover:

(a) Amalgams of precious metal, or colloidal precious metal (heading 2843);

(b) Sterile surgical suture materials, dental fillings or other goods of Chapter

30;

(c) Goods of Chapter 32 (for example, lusters);

(d) Supported catalysts (heading 3815);

(e) Articles of heading 4202 or 4203 referred to in Note 2 (B) to Chapter 42;

(f) Articles of heading 4303 or 4304;

(g) Goods of Section XI (textiles and textile articles);

(h) Footwear, headgear or other articles of Chapter 64 or 65

(ij) Umbrellas, walking sticks or other articles of Chapter 66;

(k) Abrasive goods of heading 6804 or 6805 or Chapter 82, containing dust or

powder of precious or semi-precious stones (natural or synthetic); articles

of Chapter 82 with a working part of precious or semi-precious stones

(natural, synthetic or reconstructed); machinery, mechanical appliances or

565

ITC (HS), 2012

SCHEDULE 1 IMPORT POLICY

Section XIV

Chapter-71

electrical goods, or parts thereof, of Section XVI. However, articles and

parts thereof, wholly of precious or semi-precious stones (natural,

synthetic or reconstructed) remain classified in this Chapter, except

unmounted worked sapphires and diamonds for styli (heading 8522);

(l) Articles of Chapter 90, 91 or 92 (scientific instruments, clocks and

watches, musical instruments);

(m) Arms or parts thereof (Chapter 93);

(n) Articles Covered by Note 2 to Chapter 95;

(o) Articles classified in Chapter 96 by virtue of Note 4 to that Chapter; or

(p) Original sculptures or statutory (heading 9703), collectors pieces (heading

9705) or antiques of an age exceeding one hundred years (heading 9706),

other than natural or cultured pearls or precious or semi-precious stones.

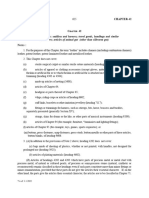

4. (A) The expression precious metal means silver, gold and platinum.

(B) The expression platinum means platinum, iridium, osmium, palladium,

rhodium and ruthenium.

(C) The expression precious or semi-precious stones does not include any of

the substances specified in Note 2 (b) to Chapter 96.

5. For the purpose of this Chapter, any alloy (including a sintered mixture and an

inter-metallic compound) containing precious metal is to be treated as an alloy

of precious metal if any one precious metal is to be treated as an alloy of

precious metal if any one precious metal constituents as much as 2% by

weight, of the alloy. Alloys of precious metal are to be classified according to

the following rules:

(a) An alloy containing 2% or more, by weight, of platinum is to be treated as

an alloy of platinum;

(b) An alloy containing 2% or more, by weight, of gold but no platinum, or

less than 2% by weight, of platinum, is to be treated as an alloy of gold;

(c) Other alloys containing 2% or more, by weight, of silver are to be treated

as alloys of silver.

6. Except where the context otherwise requires, any reference in this Schedule to

precious metal or to any particular precious metal includes a reference to

alloys treated as alloys of precious metal or of the particular metal in

accordance with the rules in Note 5 above, but not to metal clad with precious

metal or to base metal or non-metals plated with precious metal.

7. Throughout this Schedule the expression metal clad with precious metal

means material made with a base of metal upon one or more surfaces of which

there is affixed by soldering, brazing, welding, hot-rolling or similar

mechanical means a covering of precious metal. Except where the context

otherwise requires, the expression also covers base metal inlaid with precious

metal.

566

ITC (HS), 2012

SCHEDULE 1 IMPORT POLICY

Section XIV

Chapter-71

8. Subject to Note 1 (a) to Section VI, goods answering to a description in

heading 7112 are to be classified in that heading and in no other heading of

this Schedule.

9. For the purpose of heading 7113, the expression articles of jewellery means:

(a) Any small objects of personal adornment (for example, rings, bracelets,

necklaces, brooches, ear-rings, watch-chains, fobs, pendants, tie-pins,

cuff-links, dress-studs, religious or other medals and insignia); and

(b) Articles of personal use of a kind normally carried in the pocket, in the

handbag or on the person (for example, cigar or cigarette cases, snuff

boxes, cachou or pill boxes, powder boxes, chain purses or prayer beads).

These articles may be combined or set, for example, with natural or cultured

pearls, precious or semiprecious stones, synthetic or reconstructed precious or

semi-precious stones, tortoise shell, mother-of-pearl, ivory, natural or

reconstituted amber, jet or coral.

10. For the purpose of heading 7114, the expression articles of goldsmiths or

silversmiths wares includes such articles as ornaments, table-ware, toiletware, smokers requisites and other articles of household, office or religious

use.

11. For the purposes of heading 7117, the expression imitation jewellery means

articles of jewellery within the meaning of paragraph (a) of Note 9 above (but

not including buttons or other articles of heading 9606, or dress-combs, hairsliders or the like, or hairpins, of heading 9615), not incorporating natural or

cultured pearls, precious or semi-precious stones (natural, synthetic or

reconstructed) nor (except as plating or as minor constituents) precious metal

or metal clad with precious metal.

SUB-HEADING NOTES:

1. For the purposes of sub-headings 7106 10, 7108 11, 7110 11, 7110 31 and

7110 41, the expressions powder and in powder form mean products of

which 90% or more by weight passes through a sieve having a mesh aperture

of 0.5 mm.

2. Notwithstanding the provisions of Chapter Note 4(B), for the purposes of subheadings 7110 11 and 7110 19, the expression platinum does not include

iridium, osmium, palladium, rhodium or ruthenium.

3. For the classification of alloy in the sub-heading of heading 7110, each alloy

is to be classified with that metal, platinum, palladium, rhodium, iridium

osmium or ruthenium which predominates by weight over each other of these

metals.

567

ITC (HS), 2012

SCHEDULE 1 IMPORT POLICY

Section XIV

Exim Code

Item Description

I.

7101

Chapter-71

Policy

NATURAL OR CULTURED PEARLS

AND PECIOUS OR SEMI-PRECIOUS

STONES

7101 10

7101 10 10

7101 10 20

PEARLS, NATURAL OR CULTURED,

WHETHER OR NOT WORKED OR GRADED

BUT NOT STRUNG, MOUNTED OR SET;

PEARLS, NATURAL OR CULTURED,

TEMPORARILY STRUNG FOR

CONVENIENCE OF TRANSPORT

Natural pearls:

Unworked

Free

Worked

Free

7101 21 00

Cultured pearls:

Unworked

Free

7101 22 00

Worked

Free

7102

7102 10 00

DIAMONDS, WHETHER OR NOT WORKED,

BUT NOT MOUNTED OR SET

Unsorted

Free

7102 21

7102 21 10

7102 21 20

Industrial:

Unworked or simply sawn, cleaved or bruted:

Sorted

Unsorted

Free

Free

7102 29

7102 29 10

7102 29 90

7102 31 00

7102 39

7102 39 10

7102 39 90

7103

Other:

Crushed

Other

Non-industrial:

Unworked or simply sawn, cleaved or bruted

Free

Free

Free

Other:

Diamond, cut or otherwise worked but not mounted Free

or set

Other

Free

PRECIOUS STONES (OTHER THAN

DIAMONDS) AND SEMI-PRECIOUS STONES,

WHETHER OR NOT WORKED OR GRADED

BUT NOT STRUNG, MOUNTED OR SET;

UNGRADED PRECIOUS STONES (OTHER

THAN DIAMONDS) AND SEMI-PRECIOUS

568

Policy Conditions

ITC (HS), 2012

SCHEDULE 1 IMPORT POLICY

Section XIV

Chapter-71

7103 10

STONES, TEMPORARILY STRUNG FOR

CONVENIENCE OF TRANSPORT

Unworked or simply sawn or roughly shaped:

7103 10 11

7103 10 12

7103 10 19

Precious stones:

Emerald

Ruby and Sapphire

Other

Free

Free

Free

7103 10 21

7103 10 22

7103 10 23

7103 10 24

7103 10 29

Semi-precious stones:

Feldspar (Moon stone)

Garnet

Agate

Green Aventurine

Other

Free

Free

Free

Free

Free

7103 91 00

Otherwise worked:

Ruby, sapphire and emerald

Free

7103 99

7103 99 10

7103 99 20

7103 99 30

7103 99 40

7103 99 90

Other:

Feldspar (Moon Stone)

Garnet

Agate

Chalcedony

Other

Free

Free

Free

Free

Free

7104

SYNTHETIC OR RECONSTRUCTED

PRECIOUS OR SEMI-PRECIOUS STONES,

WHETHER OR NOT WORKED OR GRADED

BUT NOT STRUNG, MOUNTED OR SET;

UNGRADED SYNTHETIC OR

RECONSTRUCTED PRECIOUS OR SEMIPRECIOUS STONES, TEMPORARILY

STRUNG FOR CONVENIENCE OF

TRANSPORT

Piezo-electric quartz

Free

Other, uncorked or simply sawn or roughly shaped Free

Other

Free

7104 10 00

7104 20 00

7104 90 00

7105

7105 10 00

7105 90 00

DUST AND POWDER OF NATURAL OR

SYNTHETIC PRECIOUS OR SEMI-PRECIOUS

STONES

Of diamond

Free

Other

Free

569

ITC (HS), 2012

SCHEDULE 1 IMPORT POLICY

Section XIV

II.

7106

Chapter-71

PRECIOUS METALS AND METALS

CLAD WITH PRECIOUS METAL

7106 10 00

SILVER (INCLUDING SILVER PLATED WITH

GOLD OR PLATINUM), UNWROUGHT OR IN

SEMI-MANUFACTURED FORMS, OR IN

POWDER FORM

Powder

Free

7106 91 00

Other:

Unwrought

Free

Subject to RBI

Regulations.

7106 92

7106 92 10

Semi-manufactured:

Sheets, plates, strips, tubes and pipes

Free

7106 92 90

Other

Free

Subject to RBI

Regulations.

Subject to RBI

Regulations.

7107 00 00

Base metals clad with silver, not further worked than Free

semi-manufactured

7108

7108 11 00

GOLD (INCLUDING GOLD PLATED WITH

PLATINUM) UNWROUGHT OR IN SEMIMANUFACTURED FORMS, OR IN POWDER

FORM

Non-Monetary:

Powder

Free

7108 12 00

Other unwrought forms

Free

7108 13 00

Other semi- manufactured forms

Free

7108 20 00

Monetary

Restricted

7109 00 00

Base metals or silver, clad with gold, not further

worked than semi-manufactured

Free

7110

PLATINUM, UNWROUGHT OR IN SEMIMANUFACTURED FORM, OR IN POWDER

FORM

Platinum:

Unwrought or in powder form:

Unwrought form

In powder form

7110 11

7110 11 10

7110 11 20

570

Free

Free

Subject to RBI

Regulations.

Subject to RBI

Regulations.

Subject to RBI

Regulations.

Subject to RBI

Regulations.

ITC (HS), 2012

SCHEDULE 1 IMPORT POLICY

Section XIV

Chapter-71

7110 19 00

Other

Free

7110 21 00

7110 29 00

Palladium:

Unwrought or in powder form

Other

Free

Free

7110 31 00

7110 39 00

Rhodium :

Unwrought or in powder form

Other

Free

Free

7110 41 00

7110 49 00

Iridium, osmium and ruthenium:

Unwrought or in powder from

Other

Free

Free

7111 00 00

Base metals, silver or gold, clad with platinum, not

further worked than semi-manufactured

7112

WASTE AND SCRAP OF PRECIOUS METAL

OR OF METAL CLAD WITH PRECIOUS

METAL; OTHER WASTE AND SCRAP

CONTAINING PRECIOUS METAL OR

PRECIOUS METAL COMPOUNDS, OF A

KIND USED PRINCIPALLY FOR THE

RECOVERY OF PRECIOUS METAL

Ash containing precious metal or precious metal

compounds

7112 30 00

7112 91 00

7112 92 00

7112 99

7112 99 10

7112 99 20

7112 99 90

Free

Other:

Of gold, including metal clad with gold but excluding Free

sweepings containing other precious metals

Of platinum, including metal clad with platinum but Free

excluding sweepings containing other precious

metals

Other:

Of silver, including metal clad with silver but

excluding sweepings containing other precious

metals

Sweepings containing gold or silver

Other

III.

7113

Free

JEWELLERY, GOLDSMITHS AND

SILVERSMITHS WARES AND OTHER

ARTICLES

ARTICLES OF JEWELLERY AND PARTS

THEREOF, OF PRECIOUS METAL OR OF

571

Free

Free

Free

ITC (HS), 2012

SCHEDULE 1 IMPORT POLICY

Section XIV

7113 11

7113 11 10

7113 11 20

7113 11 30

7113 11 90

7113 19

Chapter-71

METAL CLAD WITH PRECIOUS METAL

Of precious metal whether or not plated or clad with

precious metal:

Of silver, whether or not plated or clad with other

precious metal:

Jewellery with filigree work

Free

Jewellery studded with gems

Free

Other articles of Jewellery

Free

Parts

Free

7113 19 50

7113 19 60

7113 19 90

Of other precious metal, whether or not plated or

clad with precious metal:

Of gold, unstudded

Of gold, set with pearls

Of gold, set with diamonds

Of gold, set with other precious and semi-precious

stones

Of platinum, unstudded

Parts

Other

7113 20 00

Of base metal clad with precious metal

Free

7114

ARTICLES OF GOLDSMITHS OR

SILVERSMITHS WARES AND PARTS

THEREOF, OF PRECIOUS METAL OR OF

METAL CLAD WITH PRECIOUS METAL

Of precious metal, whether or not plated or clad

with precious metal:

Of silver, whether or not plated or clad with

precious metal:

Articles

Parts

Free

Free

7114 19 10

7114 19 20

7114 19 30

Of other precious metal, whether or not plated or

clad with precious metal:

Articles of gold

Articles of platinum

Parts

Free

Free

Free

7114 20

7114 20 10

7114 20 20

7114 20 30

Of base metal clad with precious metal:

Articles clad with gold

Other articles

Parts

Free

Free

Free

7115

OTHER ARTICLES OF PRECIOUS METAL

7113 19 10

7113 19 20

7113 19 30

7113 19 40

7114 11

7114 11 10

7114 11 20

7114 19

572

Free

Free

Free

Free

Free

Free

Free

ITC (HS), 2012

SCHEDULE 1 IMPORT POLICY

Section XIV

7115 10 00

Chapter-71

OR OF METAL CLAD WITH PRECIOUS

METAL

Catalysts in the form of wire cloth or grill, of

platinum

7115 90

7115 90 10

7115 90 20

7115 90 90

Other:

Laboratory and industrial articles of precious metal

Spinnerets made mainly of gold

Other

7116

ARTICLES OF NATURAL OR CULTURED

PEARLS, PRECIOUS OR SEMI-PRECIOUS

STONES (NATURAL, SYNTHETIC OR

RECONSTRUCTED)

Of natural or cultured pearls

Of precious or semi-precious stones (natural,

synthetic or reconstructed)

7116 10 00

7116 20 00

7117

Free

Free

Free

Free

Free

Free

7117 11 00

IMITATION JEWELLERY

Of base metal, whether or not plated with precious

metal:

Cuff-links and studs

Free

7117 19

7117 19 10

7117 19 20

7117 19 90

Other:

Bangles

German silver jewellery

Other

7117 90

7117 90 10

7117 90 90

Other:

Jewellery studded with imitation pearls or imitation

or synthetic stones

Other

7118

7118 10 00

7118 90 00

COIN

Coin (other than gold coin), not being legal tender

Other

Free

Free

Free

Free

Free

Free

Free

Subject to RBI

Regulations.

Policy Conditions of this Chapter:

1.

Import of rough diamond from Cote dIvoire shall be Prohibited in

compliance to Paragraph 6 of UN Security Council Resolution (UNSCR)

1643(2005).

573

ITC (HS), 2012

SCHEDULE 1 IMPORT POLICY

Section XIV

Chapter-71

2.

Import of rough diamond (ITC HS Codes 7102 10, 7102 21 or 7102 31)

from Venezuela shall be Prohibited in view of voluntary separation of

Venezuela from the Kimberley Process Certification Scheme (KPCS). No

Kimberley Process Certificate shall be accepted / endorsed / issued for

import of rough diamonds from Venezuela.

3.

No import of rough diamonds shall be permitted unless accompanied by

Kimberley Process (KP) Certificate as specified by Gem & Jewellery EPC

(GJEPC).

574

Вам также может понравиться

- Pearls, Precious Stones and Metals ChapterДокумент18 страницPearls, Precious Stones and Metals ChapterRireОценок пока нет

- Chapter 71Документ20 страницChapter 71Kehra SongОценок пока нет

- AHTN2022 CHAPTER71 wNOTESДокумент7 страницAHTN2022 CHAPTER71 wNOTESdoookaОценок пока нет

- CN 15 en 14Документ5 страницCN 15 en 14Toni D.Оценок пока нет

- Section XV - Slides 2Документ37 страницSection XV - Slides 2BISEKOОценок пока нет

- Sensitive Cargo Commodities 2482020Документ5 страницSensitive Cargo Commodities 2482020Bunda NoorОценок пока нет

- USTR List 3 Precious MetalsДокумент3 страницыUSTR List 3 Precious MetalsPMANAОценок пока нет

- AHTN2022 CHAPTER96 wNOTESДокумент6 страницAHTN2022 CHAPTER96 wNOTESdoookaОценок пока нет

- Base Metals and Articles of Base Metal Notes: Section XVДокумент67 страницBase Metals and Articles of Base Metal Notes: Section XVToni D.Оценок пока нет

- Harmonized Tariff Schedule of The United States (2009) - Supplement 1 (Rev. 1)Документ40 страницHarmonized Tariff Schedule of The United States (2009) - Supplement 1 (Rev. 1)Kerem DemirbaşОценок пока нет

- (En 2017) Logam Tidak MuliaДокумент258 страниц(En 2017) Logam Tidak MuliaOlioz Novan RioОценок пока нет

- Section XX Chapter-95: ITC (HS), 2012 Schedule 1 - Import PolicyДокумент6 страницSection XX Chapter-95: ITC (HS), 2012 Schedule 1 - Import Policylahsivlahsiv684Оценок пока нет

- Tariff CodesДокумент31 страницаTariff Codesonetwo threefourОценок пока нет

- PGDT - 4 - Section XV - Base MetalДокумент39 страницPGDT - 4 - Section XV - Base MetalNuswaibahОценок пока нет

- AHTN2017Документ7 страницAHTN2017OwiОценок пока нет

- Top Indonesian Imports to India by Value 2015-2016Документ6 страницTop Indonesian Imports to India by Value 2015-2016AnjaliОценок пока нет

- Section VI Products of The Chemical or Allied Industries: NotesДокумент8 страницSection VI Products of The Chemical or Allied Industries: NotesSakib Ex-rccОценок пока нет

- Philippine National Standard: PNS 1314:1996 ICS 39.060Документ3 страницыPhilippine National Standard: PNS 1314:1996 ICS 39.060PetrovichОценок пока нет

- 2112 Revised - Silver and Its Alloys For JewelleryДокумент9 страниц2112 Revised - Silver and Its Alloys For JewelleryKaushik SenguptaОценок пока нет

- Previews 2068700 PreДокумент6 страницPreviews 2068700 PreBasel AlattabОценок пока нет

- AHTN2022 CHAPTER72 wNOTESДокумент21 страницаAHTN2022 CHAPTER72 wNOTESdoookaОценок пока нет

- Articles of Stone, Plaster, Cement, Asbestos, Mica or Similar MaterialsДокумент7 страницArticles of Stone, Plaster, Cement, Asbestos, Mica or Similar MaterialsRK VelagacherlaОценок пока нет

- RR 1-99Документ7 страницRR 1-99matinikkiОценок пока нет

- Chapter 96aДокумент7 страницChapter 96aANNALENE OLITОценок пока нет

- Chapter 72Документ51 страницаChapter 72tarun606Оценок пока нет

- Iso TC 174 SC N 235Документ9 страницIso TC 174 SC N 235Miruna PetriaОценок пока нет

- Chap 74 Customs TariffДокумент10 страницChap 74 Customs TariffRetvik M PОценок пока нет

- HS 1572 - 2022e - Iron & SteelДокумент11 страницHS 1572 - 2022e - Iron & SteelNeppa AssidiqiОценок пока нет

- Alchemy 2005Документ347 страницAlchemy 2005timop100% (4)

- The Essential Guide To The U.S. Trade in Gold and Silver JewelryДокумент10 страницThe Essential Guide To The U.S. Trade in Gold and Silver JewelryAFLAC ............Оценок пока нет

- EUROPEAN STEEL SCRAP SPECIFICATIONSДокумент5 страницEUROPEAN STEEL SCRAP SPECIFICATIONSdzizicОценок пока нет

- Chapter 72Документ11 страницChapter 72Vanderlei ConterОценок пока нет

- Section-V Chapter-25: Salt Sulphur Earths and Stone Plastering Materials, Lime and CementДокумент11 страницSection-V Chapter-25: Salt Sulphur Earths and Stone Plastering Materials, Lime and Cementabhishek sinhaОценок пока нет

- WOR8294 Assaying and Refining of GoldДокумент28 страницWOR8294 Assaying and Refining of GoldRehan Sheikh100% (2)

- Section-Xx Chapter-95 C 95: Toys, Games and Sports Requisites Parts and Accessories ThereofДокумент6 страницSection-Xx Chapter-95 C 95: Toys, Games and Sports Requisites Parts and Accessories ThereofHema JoshiОценок пока нет

- chap-42Документ6 страницchap-42Harsh BhattОценок пока нет

- Section XII Chapter-66: ITC (HS), 2012 Schedule 1 - Import PolicyДокумент1 страницаSection XII Chapter-66: ITC (HS), 2012 Schedule 1 - Import PolicydkhatriОценок пока нет

- Harmonized Tariff Schedule of The United States (2010) (Rev. 1)Документ36 страницHarmonized Tariff Schedule of The United States (2010) (Rev. 1)Max RodriguezОценок пока нет

- CADMIUM 23 3869 enДокумент4 страницыCADMIUM 23 3869 enThejaswiniОценок пока нет

- Chapter 72 - 2011Документ17 страницChapter 72 - 2011Piyush SharmaОценок пока нет

- LEATHER PRODUCTS LISTДокумент38 страницLEATHER PRODUCTS LISTSaurabh SharmaОценок пока нет

- Hazardous Wastes Rules EngДокумент9 страницHazardous Wastes Rules EngAnirudh GargОценок пока нет

- CH 67Документ2 страницыCH 67dkhatri100% (1)

- Updated Schedule A With Amendments Dated 3-3-2014Документ15 страницUpdated Schedule A With Amendments Dated 3-3-2014Pankaj GoyenkaОценок пока нет

- CIBJO 2008-1 Precious Metals Issue-2008Документ18 страницCIBJO 2008-1 Precious Metals Issue-2008H SОценок пока нет

- The EURO Currency Coins: Research atДокумент37 страницThe EURO Currency Coins: Research atSherif EltoukhiОценок пока нет

- Hallmarking Guidance Notes October 2016Документ20 страницHallmarking Guidance Notes October 2016Mary AОценок пока нет

- Hs Code Transformer MaterialДокумент27 страницHs Code Transformer MaterialJuli RokhmadОценок пока нет

- Tariff 1011 Eng FinalДокумент484 страницыTariff 1011 Eng FinalAkshay SthapitОценок пока нет

- UTV Mineralogical Study2Документ4 страницыUTV Mineralogical Study2William ThompsonОценок пока нет

- Inconel - Alloy 050 - UNS N06950Документ2 страницыInconel - Alloy 050 - UNS N06950Javeed A. KhanОценок пока нет

- Din 17100Документ7 страницDin 17100CoMaxno SimanDjuntak0% (1)

- MDMW Iron48Документ5 страницMDMW Iron48miningnovaОценок пока нет

- Qasd 838Документ47 страницQasd 838psicologoantonelliОценок пока нет

- (25452827 - Multidisciplinary Aspects of Production Engineering) Analysis of Selected Technologies of Precious Metal Recovery ProcessesДокумент9 страниц(25452827 - Multidisciplinary Aspects of Production Engineering) Analysis of Selected Technologies of Precious Metal Recovery ProcessesDavidОценок пока нет

- Chapter 4Документ24 страницыChapter 4EcoConsciousEyeОценок пока нет

- Ceramic Products Chapter SummaryДокумент3 страницыCeramic Products Chapter SummaryMilind PatelОценок пока нет

- The Silversmith's Handbook: Containing full instructions for the alloying and working of silverОт EverandThe Silversmith's Handbook: Containing full instructions for the alloying and working of silverОценок пока нет

- Football Skills Development: Royal West FCДокумент1 страницаFootball Skills Development: Royal West FCSomaSorrowОценок пока нет

- GPPMДокумент3 страницыGPPMSomaSorrowОценок пока нет

- Section XIV PDFДокумент8 страницSection XIV PDFSomaSorrowОценок пока нет

- Prec Metals Dealers AppДокумент1 страницаPrec Metals Dealers AppSomaSorrowОценок пока нет

- Epithermal Precious Metal DepositsДокумент30 страницEpithermal Precious Metal DepositsLibAmau67% (3)

- Hageluecken 2009 R09Документ6 страницHageluecken 2009 R09SomaSorrowОценок пока нет

- Tanzanias Precious Minerals Boom Issues in Mining and MarketingДокумент164 страницыTanzanias Precious Minerals Boom Issues in Mining and MarketingSomaSorrowОценок пока нет

- Physical Precious Metals and The Individual InvestorДокумент12 страницPhysical Precious Metals and The Individual InvestorSomaSorrowОценок пока нет

- Precious Metals: What Are They, Why and How Are They Used, and How Are They Managed?Документ4 страницыPrecious Metals: What Are They, Why and How Are They Used, and How Are They Managed?Abhiyan Anala Arvind100% (1)

- Water A Precious CommodityДокумент3 страницыWater A Precious CommoditySomaSorrowОценок пока нет

- NC Precious Metals Dealers Act UpdatesДокумент7 страницNC Precious Metals Dealers Act UpdatesSomaSorrowОценок пока нет

- MKS Responsible Precious Metals Group Policy PDFДокумент2 страницыMKS Responsible Precious Metals Group Policy PDFSomaSorrowОценок пока нет

- 1207Документ9 страниц1207SomaSorrowОценок пока нет

- A37-05 0Документ15 страницA37-05 0SomaSorrowОценок пока нет

- Wheels NWSLTR Winter 2014 WebДокумент4 страницыWheels NWSLTR Winter 2014 WebSomaSorrowОценок пока нет

- Precious ND Web ExcerptДокумент14 страницPrecious ND Web ExcerptSomaSorrowОценок пока нет

- Perils of Precious MetalsДокумент10 страницPerils of Precious MetalsSomaSorrowОценок пока нет

- Precious Metal Eng100111Документ4 страницыPrecious Metal Eng100111SomaSorrowОценок пока нет

- Pawnbrokers and Precious Metal Dealers License ApplicationДокумент5 страницPawnbrokers and Precious Metal Dealers License ApplicationSomaSorrowОценок пока нет

- Sprott Precious Metals SolutionsДокумент2 страницыSprott Precious Metals SolutionsSomaSorrowОценок пока нет

- Precious Metals Brochure 2013 r1Документ4 страницыPrecious Metals Brochure 2013 r1SomaSorrowОценок пока нет

- P Psau PC 1 eДокумент2 страницыP Psau PC 1 eSomaSorrowОценок пока нет

- IO53Документ31 страницаIO53SomaSorrowОценок пока нет

- IB UK Risk Disclosure Precious Metals EnglishДокумент3 страницыIB UK Risk Disclosure Precious Metals EnglishSomaSorrowОценок пока нет

- The Most Precious Metal - Book ExcerptsДокумент0 страницThe Most Precious Metal - Book ExcerptsGold Silver WorldsОценок пока нет

- 037 0501Документ6 страниц037 0501SomaSorrowОценок пока нет

- Precious Metals IRA FlierДокумент2 страницыPrecious Metals IRA FlierSomaSorrowОценок пока нет

- Maxon RE16 Graphite Brushes 4.5wattДокумент2 страницыMaxon RE16 Graphite Brushes 4.5wattElectromateОценок пока нет

- Flourokem - Sherwin WilliamsДокумент2 страницыFlourokem - Sherwin WilliamsOgbedande Awo OrunmilaОценок пока нет

- Chem 121-1Документ45 страницChem 121-1Zechariah NggitaОценок пока нет

- Percentage CompositionДокумент21 страницаPercentage CompositionALOHA ENCARQUEZОценок пока нет

- Formulation and Characterization of Sustained Release Dosage Form of Moisture Sensitive DrugДокумент10 страницFormulation and Characterization of Sustained Release Dosage Form of Moisture Sensitive DrugDIKAОценок пока нет

- Titration Laboratory Sodium Hydroxide and Hydrochloric AcidДокумент7 страницTitration Laboratory Sodium Hydroxide and Hydrochloric AcidFermin100% (1)

- Jindal Al SectionsДокумент14 страницJindal Al SectionsAMIT GUPTAОценок пока нет

- Paint Pigment Solvent Coating Emulsion Paint Additives and FormulationsДокумент9 страницPaint Pigment Solvent Coating Emulsion Paint Additives and FormulationschayanunОценок пока нет

- Thermal Efficiency Fired HeaterДокумент5 страницThermal Efficiency Fired Heatermuhammad_asim_10Оценок пока нет

- Order For SDIДокумент18 страницOrder For SDIحسن علي فالح حسنОценок пока нет

- Sr. No: CategoryДокумент42 страницыSr. No: CategoryMonti SainiОценок пока нет

- A - Level - Periodic - Table - CambridgeДокумент1 страницаA - Level - Periodic - Table - CambridgecrpОценок пока нет

- LED Flashlight Design for Circular EconomyДокумент12 страницLED Flashlight Design for Circular EconomyAlexander GhidellaОценок пока нет

- D1293, PHДокумент10 страницD1293, PHRonaldo SanchezОценок пока нет

- Chapter 5 PDFДокумент4 страницыChapter 5 PDFNiraj KhanalОценок пока нет

- Water For RayonДокумент51 страницаWater For RayonAditya ShrivastavaОценок пока нет

- Theory of Fusion Welds MetallurgyДокумент11 страницTheory of Fusion Welds Metallurgyডঃ শুভম চ্যাটার্জীОценок пока нет

- RE Wall Data As Per SDB-2019Документ5 страницRE Wall Data As Per SDB-2019CGM RO HYDОценок пока нет

- Xhmeia G Gymnasioy Theoria AskiseisДокумент237 страницXhmeia G Gymnasioy Theoria Askiseistaexeiola_blogspot80% (5)

- Assigning Oxidation NumberДокумент26 страницAssigning Oxidation NumberAndrea TancingcoОценок пока нет

- Weldability of Materials - Carbon Manganese and Low Alloy SteelsДокумент6 страницWeldability of Materials - Carbon Manganese and Low Alloy SteelsmanimaranОценок пока нет

- Chapter 3 - Exploring Diversity of Matter by Its Chemical CompositionsДокумент18 страницChapter 3 - Exploring Diversity of Matter by Its Chemical Compositionshau qi hongОценок пока нет

- Ionic Equilibrium ChemistryДокумент28 страницIonic Equilibrium ChemistryNILABH NANDANОценок пока нет

- Ml12229a225 PDFДокумент68 страницMl12229a225 PDFAmanda LaleyeОценок пока нет

- Biodiesel from Waste Canola Oil Reduces EmissionsДокумент36 страницBiodiesel from Waste Canola Oil Reduces EmissionsSherwin CruzОценок пока нет

- E. Testing Consumer Products For Some CationsДокумент6 страницE. Testing Consumer Products For Some CationsSaifullah KhawarОценок пока нет

- NCDC-Chemistry Sample Assessment Items-S1-S2-2022Документ6 страницNCDC-Chemistry Sample Assessment Items-S1-S2-2022walusimbimuzafar51100% (1)

- Metco 470AW 10-632Документ8 страницMetco 470AW 10-632JSH100Оценок пока нет

- Determination of The Acid Dissociation ConstantДокумент3 страницыDetermination of The Acid Dissociation ConstantJason Raquin RoqueОценок пока нет

- Offshore BrochureДокумент5 страницOffshore BrochureAhmed Ben Hmida0% (1)

- J. Electrochem. Soc.-1952-Loonam-295C-8CДокумент4 страницыJ. Electrochem. Soc.-1952-Loonam-295C-8CGeovanny JaenzОценок пока нет