Академический Документы

Профессиональный Документы

Культура Документы

Investment Banking Deal Process

Загружено:

dkgrinderАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Investment Banking Deal Process

Загружено:

dkgrinderАвторское право:

Доступные форматы

FOUNDERS

INVESTMENT BANKING

A PRIMER ON HOW MIDDLE

MARKET COMPANIES ARE

BOUGHT AND SOLD

~ FROM THE PERSPECTIVE OF A SELLER ~

I NTRODUCTION

The steps to selling a middle market company1are generally not all that well

known,butthereisaprovenmethodologythat,whenfollowed,increasesthe

likelihoodofafirmobtainingapremiumvalueandgettingadealdone.Thereis

a large universe of potential buyers and investors. Owners of companies

typicallyseetheiruniverseofbuyersconsistingoffellowpartners,employees,

competitors, key customers, major suppliers, and perhaps local investors.

Whiletheseareallvalidoptions,professionaladvisorsarealsoabletotapinto

a vastly larger universe consisting of domestic and international public and

privatecompaniesaswellasprivateequityfirms.Thechallengeisnotfinding

potentialbuyers,butfindingtherightbuyerorinvestor.Attheoutset,itisnot

always obvious who the best buyer might be, and there is a high probability

thattheownerhasnevermetthebuyerbefore.Ittakesasystematicapproach

toidentifyandconnectwiththebestcandidates.

Letsfaceit.Mostofusareamateurswhenitcomestosellingourbusinesses,

since we tend to do it only once or twice. Institutional buyers2, on the other

hand,buyandinvestforaliving.Consequently,theyhavealotofexperience

getting deals done that are more in their favor. Financial buyers exist to buy

businesses for institutional and high net worth investors, and these shrewd

buyershaveinvestedover$2trillionbuyingcompanies.Strategicbuyershavea

preference for acquiring small to mediumsize firms and while these deals

happeneveryday,itisachallengefortheuninitiatedtogetintothismarket.If

you already know potential buyers because they are a customer, partner,

familymember,orcompetitor,youshouldaskyourselfiftheyarewillingand

abletopayfairmarketvalue.

How is fair market value determined? Lets first look at the definition of this

term.Fairmarketvalueisthemostlikelypriceatwhichabusinesswillchange

handswithinareasonableperiodoftimebetweenawillingbuyerandawilling

seller in an arms length transaction where both parties are motivated but

neither is under any particular compulsion to act. While this definition helps

somewhat,itdoesnotshedmuchlightonhowpriceisdetermined.Nordoes

this definition give much guidance on how owners can exert leverage when

dealing with professional institutional buyers and investors. The solution to

determining fair market value in a manner that also provides the seller with

leverage lies in making a market. How do you make a market? You make a

market by creating a competitive deal environment consisting of multiple

buyersandinvestors.

Middlemarketcompaniesaretypicallydefinedashavingannualrevenuesbetween$10million

and$500million.

2

Institutionalbuyersandinvestorsconsistofprivateequityfirms(i.e.,financialbuyers)and

largercorporations(i.e.,strategicbuyers").

FoundersInvestmentBanking

2012

Page1

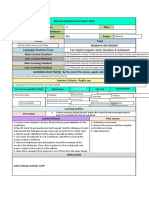

F IVE M AJOR

P HASES

Therearefivemajorphasestocreatingacompetitivedealenvironment:

I.

II.

III.

IV.

V.

PREPARATION&PACKAGING

BUYERRESEARCH&DEVELOPMENT

MARKETING&INVESTORCOMMUNICATIONS

ECONOMICNEGOTIATIONS&LETTEROFINTENT

DUEDILIGENCE&CLOSING

The PREPARATION & PACKAGING phase starts with an indepth analysis of the

companys business model, historical financial performance, and future

outlook. This information is then packaged into a set of documents that

conciselyandauthenticallytellsthecompanysstoryandformsthethesiswhy

the company would be a good acquisition or

investment.

The BUYER RESEARCH & DEVELOPMENT phase

systematically researches, identifies, and targets

potential buyers and investors culminating in a

specificlistofqualifiedbuyersandtheindividuals

tocontact.

The MARKETING & INVESTOR COMMUNICATIONS phase

directly engages potential buyers and obtains

indications of interest from the subset of firms

expressingastronginterestinthecompany.

The ECONOMIC NEGOTIATIONS & LETTER OF INTENT

phasestructuresandframesthedealculminating

inaLetterofIntent.

The DUE DILIGENCE & CLOSING phase allows the buyer to verify all the

representationsmadebytheseller,finalizesthedealstructure,andexecutesa

definitivepurchaseagreement.

Now lets dive into each of these phases in detail from the vantage point of

owners and CEOs who seek both a premium price and a high probability of

completingadealandarewillingtodowhatittakestoputtheircompaniesin

thebestpositiontoaccomplishthesetwinobjectives.

FoundersInvestmentBanking

2012

Page2

P HASE I:

P REPARATION

& P ACKAGING

BUSINESS REVIEW

Phase I starts with an indepth analysis of your company. The first step is to

conduct a thorough review of the business and to begin constructing a

company profile. An assessment of market and industry drivers reveals the

source of revenues and profits and the potential for future growth. A

comparisontoindustryandcompetitorbenchmarksassessesthesustainability

of the companys competitive advantage. The areas that distinguish the

companyfromitspeersareidentified,aswellasthoseareasthatmayinhibit

future performance, by candidly appraising the companys strengths,

weaknesses,opportunities,andthreats.

HISTORICAL

FINANCIAL

ANALYSIS

The companys historical performance is assessed by reviewing and analyzing

financial statements (income statements/profit & loss statements, balance

sheets,statementsofcashflows)forthepast35years.Auditedfinancialsarea

definite plus, but they are not required. While it is commonplace for private

companies to seek to minimize taxes and maximize personal benefits, this

approach tends to understate the earning potential of a firm. Historical

financial statements, consequently, often have several limitations when it

comes to portraying a firm in its best light. For instance, earnings may have

been suppressed due to tax minimization strategies and since financial

statements only deal with the past, they seldom do a good job illustrating a

companys potential going forward. Furthermore, the structure of financial

statements makes it difficult to spot trends and mine salient data. A single

offyear or an unusual onetime event may disproportionately distort the

companysperformance.Understandingthesepatternsandtheimplicationsof

keyfinancialandmarketratiosisanessentialsteptodocumentingthehistory

ofthefirmandestablishingthecompanysfoundationofvalue.

FoundersInvestmentBanking

2012

Page3

RECASTING

FINANCIALS

Publicly held companies like to please shareholders by showing the largest

bottomlinepossible.Privatecompanies,ontheotherhand,wanttomakeall

the money they can while showing the smallest amount of income that is

taxable.Tohelpbuyersandinvestorsbetterunderstandtheearningpotential

of the company, the next step is to recast financial statements as if your

companywasasubsidiaryofapubliccompany.ByadjustingtheP&Lstatement

to compensate for extraordinary spending or nonstandard accounting

practices,itisoftenpossibletoillustratehigherearningscomparedtohistorical

financialreports.Caremustbetaken,however,toensurethatalladjustments

arecredible,defensible,andproperlydocumented.Recastingisnotanexercise

in fantasy, but rather shows how your companys earnings would appear if

widely used management and accounting practices of public companies were

employed. For example, excess compensation that is well above the industry

average could be restated by reducing salaries to be more in line with the

industry. Likewise, country club dues, leases for highend automobiles, and

company loans at very favorable interest rates could be eliminated, which

wouldlowerexpensesandboostearnings.Recastingcutsbothways,however.

Ifacompanyhasunfundedorunderfundedobligations,insufficientinventory

levels,orinadequatecapitalexpenditurestokeeppacewiththecompetition,

then these savings should be recasted, which would increase expenditures

anddetrimentallyimpactearnings.

CommonadjustmentstoProfit&Lossstatementsare:

Sales:

CostofGoodsSold:

Costofsuppliesforinventoryitems

LIFOvs.FIFOaccountingadjustments

Depreciationandamortizationreclassification

Removenonperformingassets

Reclassifydepreciation&amortization

Operatingexpenses:

Adjustsalariestoindustrystandard

Familymembersonthepayroll

Nonrecurring(onetime/extraordinary)expenses

Discretionaryexpenses

Nonworkingfamilymembers'salaries

Perquisites(cars,clubs,insurance)

Flexibletravelandentertainmentpolicy

Adjustinterestexpense:

Interestexpense:relatedtodifferentcostofcapital

Removeinterestrelatedtononoperationalassets

Reclassifyinterestexpense/removefromoperatingexpense

Eliminateintercompany&relatedthirdpartytransactions

Cashtoaccrualbasedaccounting

GAAPrevenuerecognition

FoundersInvestmentBanking

2012

Page4

CommonadjustmentstoBalanceSheetsinclude:

Assets:

Liabilities:

Removedebttoshareholdersadditionalequity

Fairmarketvalueofdebt

Longtermdebtsettlementperiodamortization

Optimizedebtincapitalstructure

Optimizeinternalgrowthcapabilities

Toomuch/notenoughdebt

Removenoncoreassets

Excesscashandinvestments

Aircraft

Boats

Luxuryautomobiles

Automobilesprovidedtoselectpersonnelasperks

Realestate

Lifeinsurancecashvalue

Nontransferableintangibleassets(brandnames,

patents)

Inventory

Lowerofcostormarket

Inventorynotonbooks

Adjustfixedassetstofairmarketvalue

Equivalentreplacement/currentbookvalue

Inmanycases,theoutcomeofrecastingincreasesacompanysvaluation

comparedtoexaminingfinancialstatementsbasedsolelyontaxreturns.

FoundersInvestmentBanking

2012

Page5

M U L T I Y E AR

PRO FORMA &

VALUATION RANGE

Thenextstepbuildsuponrecastedfinancialsbyconstructingaproformathat

projectsrevenuesandexpenses,aswellasassetsandliabilities,overthenext

three to five years. The pro forma places the company in its best light and

reflects managements expectations for the future. As was the case when

recastingfinancialstatements,itisessentialtokeepassumptionsconservative

andcredibleandtoprovideindependentthirdpartyevidencewhenpossibleto

documenttherationalebehindanassumption.Sincetheindustryisthesource

of all profits, it is also important to forecast the growth rate for the industry

and to substantiate the companys relative performance in the industry (i.e.,

outperforms the industry, inline with industry performance, underperforms

theindustry)byanalyzingindustryperformanceratios.

The pro forma provides the mechanism to quantify growth opportunities

resultingfromstrategicinitiativesavailabletothecompany.Examplesofsuch

initiatives include expanding into new markets and geographies, rolling out

newproducts,andacquisitions.

The pro forma produces an integrated financial model for the company by

quantifying assumptions for future earnings. The Profit & Loss Statement

captures thepricing model and sales assumptions driving revenuesas well as

the corresponding cost structure necessary to develop, deliver, and support

productsandservices.TheBalanceSheetdocumentstheassetsusedtocreate

andsupportproducts,theworkingcapitalnecessarytoconductbusinessinan

orderlymanner,andthecapitalstructureofthefirm.TheCashFlowStatement

captures capital expenditures and demonstrates the companys ability to pay

itsbills.

The pro forma also provides the foundation for estimating your companys

valuation, known also as an enterprise value. Many factors and variables are

taken into consideration when determining a companys valuation. It is

importantnottorelyonsimpleformulasortouseindustryrulesofthumbto

valueyourcompany.Formiddlemarketcompanies,acombinationofvaluation

FoundersInvestmentBanking

2012

Page6

methods are used with each method producing a valuation range. The four

mostcommonmethodsare:

1. DiscountedCashFlow

2. FinancialReturnModel

3. ComparableCompany

4. PrecedentTransactions

By estimating the most likely valuation range using each method, while also

taking into consideration industry conditions, the macroeconomic

environment,andothertimingfactors,itispossibletoderiveavaluationrange

foryourcompanybyevaluatingwheretherangesintersect.

HIGH IMPACT

MARKETING

MATERIALS

ThefinalstepinPhaseIiscomposingandproducingmarketingmaterialsthat

authentically and succinctly tell the companys story with a high degree of

impact. Phase III will use these materials to solicit interest from buyers and

investors.

The Anonymous Profile is a one page overview of

the company sent to prospective buyers and

investors to gauge their initial interest. This profile

provides a brief description of the company, its

industry and product offerings, points of key

differentiation, and highlights of compelling

accomplishments. A financial recap and pro forma

alsomaybeincluded.Thecompanysidentityisnot

disclosedinthisdocument.

FoundersInvestmentBanking

2012

Page7

The Confidential Information Memorandum

summarizes the companys strategy, operations,

industry trends and conditions, and investment

considerations. The CIM communicates whom the

company serves, the problem the company solves,

howthecompanymakesmoneydoingso,andhow

the company will grow. Key sections of a CIM

include an overview of the company, its history,

management team, market assessment (industry

size, drivers, trends, and growth estimates),

competitive environment, products and services,

customerbase,marketshare,compellingpointsofdifferentiation(proprietary

technology and methods, patents, source code, engineering, R&D) and a

financial recap analyzing historical performance and projecting future

performanceintheformofaproforma.

TheManagementPresentationisadynamic,hard

hittingpresentationrecappingthemostimportant

factorsforbuyerstoconsider.Thestructureofthe

presentationreflectsmanagementsapproachand

style and complements the Confidential

InformationMemorandum.

FoundersInvestmentBanking

2012

Page8

P HASE II:

B UYER

R ESEARCH &

D EVELOPMENT

PROSPECT LISTS

PhaseIIfocusesonidentifyingasubsetoffinancialbuyers(i.e.,privateequity

firms)andstrategicbuyers(i.e.,largercorporations)thathaveaninterestand

the financialmeans to complete a transaction. The process starts with a very

largeuniverseofpotentialbuyersandinvestors.

The number of domestic and international public and private companies,

including and private equity firms, total over 700,000. By using a systematic

andsurgicalprocess,itispossibletowinnowthislistdowntoasmallsubsetof

firms most likely to express an interest to learn more about your company.

AnalysisperformedinPhaseIistappedtoidentifytheindustrysegmentsand

players who form the business ecosystem and value chains surrounding your

company. Identifyingcurrent participants in the industry, however, is just the

startingpoint.Itisalsoimportanttoidentifycorporationswhomaybeseeking

to enter an industry segment. On the private equity front, firms specialize in

certainindustriesandseekcompaniesofacertainsizeandsetofcapabilities.

The initial screening is critical. Casting too broad of net results in a poor use

everybodystimefilteringoutunqualifiedcandidates.Castingtoonarrowofa

net, on the otherhand, risks potentially excludingthe best buyer or investor.

FoundersInvestmentBanking

2012

Page9

FINANCIAL BUYER

PROFILES

The method for screening private equity firms is different from the approach

used to screen strategic buyers. The initial screening concentrates on buyer

mandates, industry focus, company size in terms of revenue and EBITDA,

investmentsize,andgeographicpreference.

PrivateEquityGroups(PEGs)raisemoneyfrominstitutionalinvestors,suchas

pension funds, and qualified high net worth individuals and form a fund

structured as a limited partnership. These funds typically have a tenyear

horizon to give PEGs the opportunity to identify, acquire, grow, and sell

companies. Companies purchased by PEGs are referred to as portfolio

companies. In certain situations, PEGs will create platform companies and

acquire smallersized companies as addons to expand the capabilities of the

platform company as a whole. PEGs typically target the lifecycle stage of

companies in which they prefer to invest. For instance, some PEGs focus on

providing growth capital to early stage firms, others specialize in providing

expansion financing to established firms, while others target acquiring more

maturefirms.PEGsalsoliketotargetspecificindustriesgiventheirexperience

andexpertise.Finally,PEGsestablishguidelinesgoverninghowmuchtheyare

prepared to invest and the minimum size of company they are interested in

based on revenue and EBITDA. These criteria are used to perform the initial

screening. The next step is to peer more deeply into each PEG passing the

initialscreeningandisolatethosefirmsthatarethebestfitbasedoncurrent

investments (i.e., portfolio and platform companies already in the fund),

geographic preferences, investment size, industry focus, and track record for

FoundersInvestmentBanking

2012

Page10

successfully growing and exiting similar companies. From this evaluation, it is

possibletosegregatepotentialbuyersandinvestorsintotwocategories,TierA

and Tier B. Tier A firms have the strongest match based on publicly available

guidelines, proprietary research databases, and prior knowledge of the firm.

Tier B buyers and investors could still be viable candidates, but there are

several criterion that are not as strongly aligned when compared to Tier A

firms.ThefinalstepistouseatenpointscaletorankeachTierAfirmbasedon

overall fit and to provide a synopsis describing why the firm is a good fit. By

sortingTierAfirmsbasedonitsrank,itiseasytoidentifythefirmsproviding

thebestfit.

STRATEGIC BUYER

PROFILES

Searchingforstrategicbuyersrequiresdiligenceandcreativity.Employinga4

step iterative process is the best approach to systematically identify and

evaluatetargetcompanies.

Step 1: Evaluate forward and backward supply chain and

valuechainintegration.

Step2:Reviewmacrolevelacquisitionsacrossthebusiness

ecosystem.

Step3:Examinebusinessmodelsforcorporationsappearing

tobeagoodfittoidentifypotentialsynergies.

Step4:Compiletieredlistsandranktopcandidates.

Thesearchprocessisaniterative,ongoingprocessthatcontinuesthroughout

theMarketingPhase.Itisimportanttounderstandeachcandidatecorporation

frombothyourcompanysperspectiveaswellasfromthemarketsperspective

before finalizing the gotomarket list. Strong candidates are not always

readily apparent because they may not be in your industry segment, but are

looking for a company to acquire as the means to enter your segment.

Likewise,acorporationmaybeinterestedinemployingyouruniqueassetsor

technology in a different industry than the one you are currently in. For this

reason,itisimportanttoincorporatefeedbackcontinuouslyfromallcontacted

parties.Atthispointintheprocess,itisessentialtoguardagainstprematurely

disclosingthatyourcompanyisconsideringamarkettransaction.

Toachieveoptimalresults,thesearchprocessiscustomizedforeachcorporate

target. This customization requires developing an investment thesis for each

buyercategoryandincorporatingmicroeconomictrendsthatarefavorableto

your companys products, services, and capabilities. Researching and

understanding each corporations growth strategy and business model is

central to identifying potential synergies, which form the basis for

communications in the form of personal calls, tailored letters, customized

presentations,webinars,andfacetofacemeetings.

FoundersInvestmentBanking

2012

Page11

TARGETED LIST OF

QUALIFIED BUYERS

The objective of this extensive screening process is to narrow down the

numberofqualifiedbuyersandinvestorstoamanageablelistcontainingboth

financial and strategicbuyers with a high likelihood of wanting to learn more

about your company and who also have the wherewithal and resources to

complete a transaction in a timely manner. To ensure that competitive

sensitivities are given proper consideration, the final gotomarket list is

reviewed and approved by you before contacting any potential buyer or

investor.

FoundersInvestmentBanking

2012

Page12

P HASE III:

M ARKETING &

I NVESTORS

C OMMUNICA

TIONS

INITIAL CONTACT

CAMPAIGN

PhaseIIIdirectlyengagespotentialbuyers.Itstartswithanintensivecampaign

targetingspecificindividualsineachprivateequityfirmandcorporationonthe

gotomarketlist.Identifyingtherightpersontocontactataprivateequityfirm

is straightforward. For corporations, however, the preferred point of contact

may not be readily apparent and if they are, it still can be a challenge to get

them to engage. It is crucial to know what to say during the initial call to

stimulatetheirinterestandtoqualifyfurtherthatthefirmorcorporationisa

strong candidate. Tracking all communications (phone calls, emails,

correspondence)inaCustomerRelationshipManagementsystemisimportant.

Using a CRM ensures every potential buyer or investor is contacted and all

follow up requests are responded to and documented in a timely manner.

Following a methodical process helps build deal momentum, establishes a

sense of competitive urgency, and conveys to buyers and investors that the

searchisbeingconductedinaprofessionalmanner.

Duringtheinitialcontact,yourcompanysnameisnotdisclosed.Theonepage

Anonymous Profile is used to depict your companys characteristics. Indepth

discussions are only conducted after a Confidentiality Agreement has been

executed.

CONFIDENTIALITY

AGREEMENT

Executing a confidentiality agreement reduces the chance that customers,

competitors, and employees prematurely discover you are considering a

market transaction. Confidentiality agreements are legal instruments and

should be drafted by an attorney. At minimum, the agreement should define

themeaningofconfidentialinformation,howconfidentialinformationmaybe

used, who has access to confidential information, restrictions on attempts to

reverseengineerorcopymaterialsforanypurposeotherthanevaluatingyour

company,andremediesintheeventofabreachofconfidentiality.

FoundersInvestmentBanking

2012

Page13

I N D E P T H

DISCUSSIONS

After executing the confidentiality agreement, the name of your company is

disclosedandtheConfidentialInformationMemorandumisshared.Thebuyer

profilesdevelopedinPhaseIIsteerinitialdiscussions,soitpossibletohighlight

quickly important facets of your company that should be appealing to the

specificbuyerorinvestor.Thecombinationoftargetingtherightfirmsfromthe

outset,craftingacompellingCIM,anddiscussingonpointthesalientfactorsof

high interest to a given PEG or corporation motivates them to pursue the

transactionandtoengageinternalteams.Thesediscussionscanbeextensive,

butyouandyourmanagementteamareshelteredfromthesecallssoyoucan

concentrate on running your business. The objective of these indepth

discussionsistoprovidesufficientdetailsandguidancesothebuyerorinvestor

can make an informed decision if there is strong fit between what they are

seekingandwhatyourcompanycanprovide.

INDICATION OF

INTEREST

An indication of interest is a nonbinding letter submitted by buyers or

investors who have a high degree of interest in seriously considering a

transaction. Indications of interest state the percentage of ownership sought

alongwithapreliminaryvaluation,expressedasarange,theyarepreparedto

pay subject to further discussions, negotiations, and due diligence. The

objective is to obtain multiple indications of interest as this is the path to

attainingnegotiatingleverageonbehalfoftheseller.

MANAGEMENT

MEETINGS

The stage is now set for you to meet with potential buyers and investors. By

employingasystematicprocesstoreachthispoint,youenterthesemeetings

understandingthemotivationsdrivingeachinterestedpartyandapreliminary

assessmentofhowyourcompanystacksupwithwhattheyarelookingfor.The

management presentation developed in Phase I is used to underscore your

companysgrowthpotentialandoperatingstrengthswhilealsomitigatingany

perceived weaknesses. These management meetings help to create an

environment for parties to get comfortable with each other and to establish

groundsforevaluatingafutureworkingrelationship.

FoundersInvestmentBanking

2012

Page14

P HASE IV:

E CONOMIC

N EGOTIATIONS

& L ETTER O F

I NTENT

BUSINESS TERMS

The purchase price for which a company is sold represents a composite of

several factors, terms, andconditions.Some of these factors are economic in

nature dealing, for instance, with the present value of future cash flows, fair

market value of assets and inventory, and the perception of the economic

valueforintangiblessuchaspatents,sourcecode,brands,andgoodwill.Other

factors are legalistic and deal with indemnification, warranties, contingent

liabilities, and the like. Operational and organizational factors also weigh in

concerning, for example, specifying which employees remain with the

company,divestingordiscontinuingproductlines,andrelocatingoperationsto

a different office or city. Many of these terms and conditions are negotiable

andtheirrelativeimportancewillvarywitheachbuyerorinvestor.

Taxes will play a big part depending on what is being bought or sold. If the

transaction is a stock sale, then the seller potentially may realize several

advantages:

Proceedsaretaxedatlongtermcapitalgainsrates

Seller is not responsible for the companys liabilities going

forward

Taxes may be deferred depending on the structure of the

deal

Thebuyer,ontheotherhand,facessomedisadvantages:

Assetscannotbewrittenuptofairmarketvalue

Buyerassumescontingentandunknownliabilities

Goodwillisnotdeductablefortaxes

Anotherwayofstructuringatransactionisasanassetsale.Thereareseveral

advantagesforbuyerswithassetsales:

Goodwillisdeductibleforincometaxpurposes

Assets are writtenup to fair market value, which increases

cashflow

Contingentandunknownliabilitiesarenotassumed

FoundersInvestmentBanking

2012

Page15

Theseller,however,facessomedisadvantages:

Proceeds may be taxed at ordinary income tax rates

dependingonthelegalstructureofthecompany

ForCcorpsthereisthepotentialofdoubletaxation

Sellerretainsliabilitiesandcontractsnotspecificallyassumed

Matterscangetcomplicatednegotiatingwhichmethodologies,standards,and

practices to use for determining the final purchase price. This is the realm of

experts and specialists, and it requires a multidisciplinary team of M&A

advisors, attorneys, and accountants who specialize in middlemarket

transactions to guide you through the deal process. For example, negotiating

whichliabilitiesareincludedorexcludedfromadeal,themethodusedtovalue

assets and remaining depreciation, providing sufficient funding for bonus,

profit sharing, andpensionplans, andappropriately valuing futurecash flows

based on current customers are all examples of business terms that have a

directeconomicimpactonprice.Theintegratedfinancialmodelconstructedin

PhaseIprovidesthefacilitytoquantitativelyanalyzetheeconomiceffectthese

variousbusinesstermswillhaveonyourcompanysvaluation.

D E A L S T R UC T U R E

Howadealisstructurediscritical.Itisnotjusthowmuchyougetpaidforyour

company that counts; its how much you ultimately put in the bank that

mattersthemost.Whichofthefollowingtwoscenariosisabetterdeal?

Option#1:sellfor$40million

o $25millionincash

o $7millioninrestrictedstockwithalockupperiod

o $5millionsellernote

o $2millionearnout

Option#2:sellfor$33million

o $33millionallcashupfront

o 3yearemployment/consultingagreement

Atfirstglance,option#1lookstobethewaytogo.Afterall,$40millionbeats

$33 million and you also get the bragging rights that go with the higher

number. But if the acquiring company falls out of favor and the stock price

plummets, and payments on the seller note are suspended to preserve cash

becauselinesofcreditaredryingup,andinternalaccountingtransferscreated

an operating loss eliminating the earnout since it was tied to profits versus

revenue,thenoption#2wouldstarttolookverygood.Ofcourse,itcouldgo

the other way: the stock could appreciate in value while also providing tax

benefits because gains are taxed at the capital gains rate, the

FoundersInvestmentBanking

2012

Page16

interestrateonthesellernotecouldexceedwhatyouwouldreceiveinvesting

infixedincomesecuritiesprovidinganicestreamofmonthlyincome,andthe

company gladly pays the earnout because the acquisition exceeded revenue

targets.

Three broad categories can be used to influence the structure of a deal.

Recasting focuses on adjustments to EBITDA, valuing goodwill, employing

accounting standards, adopting realistic forecasts, addressing tax issues, and

otheritemsdirectlyaffectingfinancialstatements.

Sharing future risks allocates risk between both parties and addresses the

extentofprotectioneachpartyseeks.Trust,chemistry,flexibility,believability,

sharedvalues,andthedegreeandnatureofthepartiesinvolvementafterthe

saleallinfluencecredibilityandtheperceptionofthelikelihoodcertainevents

couldtranspireinthefuture.

Compensation concentrates on how you get paid. Several methods of

compensatingasellerareusedtosealadeal.

Cash:

As the saying goes, Cash is king. The benefits are readily

evident:zerorisk,instantliquidity,andtotalflexibilitywhenit

comes to structuring an investment portfolio. Without

planning,however,theordinaryversuscapitalgainstaxbite

maybedouble.Cashalsoeliminatesdeferredcompensation

strategies.

Gettingpaidtoworkafterthedeal:

There are two basic methods of getting paid to continue

workingafterthedealclosesemploymentagreementsand

earnouts.

Employmentagreementstypicallylastthreetofiveyears,but

theycanbeforshorterdurations.Compensationisusuallyin

the form of a base salary, incentive bonus, and company

benefits.Typicalprovisionsincludenoncompeteclausesthat

survive post termination, specific language addressing

conditions for termination, and perks beyond standard

company benefits. Compensation is taxed as ordinary

income.

Earnoutsareoftenusedtoclosethevaluationgapbetween

buyer and seller and typically span one to three years.

Compensationisbasedonperformanceandcanbeladdered.

Earnout targets can be indexed or structured as all or

nothing.Targetsshouldbetiedtorevenueinsteadofprofits.

Taxtreatmentcanbeeithercapitalgainsorordinaryincome

dependingonhowthedealisstructured.

FoundersInvestmentBanking

2012

Page17

Gettingpaidnottocompete:

A noncompete agreement protects both the buyer and the

seller.Ifthenoncompeteisnotproperlydocumented,itruns

the risk of judicial interpretation in the event of a conflict.

Fourelementsmakeanoncompeteagreementvalid:

1. Itmustbeinthesametypeofbusiness.

2. There must be some form of paid

compensation or consideration, which is

treatedasordinaryincome.

3. Reasonablelimitsongeography.

4. Reasonableperiodoftime.

Gettingpaidwithstock:

There are different types of stock with various features and

restrictions: common or preferred; voting or nonvoting,

convertible or nonconvertible. If the stock is issued by a

publiccorporationandisregistered,taxesmaybedeferrable

until the stock is sold. If the stock is unregistered, Rule 144

appliesrequiringthestocktobeheldforoneyearorlonger

(in this event, it is important to request piggyback rights).

To guard against a substantial drop in market value,

protectivemeasuresusingstockcollars,puts,andcallscanbe

employed. Private company stock is more difficult to value,

notasliquid,andhypothecation,transfer,sale,orassignment

maybeprohibited.

Otherformsofpayment:

Seller notes help buyers fill financing gaps, which can drive

higher valuations. Typical terms are 1260 month notes at a

definedinterestrateusingapredeterminedamortizationand

paymentschedule.Thesenotesareusuallysubordinatedand

are not collateralized by specific assets. Principal payments

are taxed at capital gains rates while interest payments are

taxedasordinaryincome.

Royalties are typically best suited for productdriven

businessesandcanbeusedduringnegotiationsasatradeoff

for goodwill. Royalties may qualify for favorable tax

treatments.

Warrantsgranttherighttobuystockfromanissueratapre

agreed upon price and are an effective tool to align

incentives.

FoundersInvestmentBanking

2012

Page18

LEGAL TERMS

Afterframingthebusinesstermsanddealstructure,itistimetodelveintothe

various legal issues associated with the transaction. The legal focus in this

phaseisondraftingandexecutingaLetterofIntent(LOI).TheLOIwillserveas

thefoundationfortheDefinitivePurchaseAgreement,whichisdraftedduring

Phase V and covers standard covenants, representations, warranties, closing

conditions,andprovisionsforindemnificationandsurvival.Atthisjuncture,the

partiesconcentrateondefiningthelegalaspectsofthedealandresolvingany

unusualorextraordinaryitemswhichmaysurfaceduringduediligence.

GOOD FAITH TERMS

Good faith terms form a bond of trust between the buyer and seller that all

partieswillrepresentfairlyandaccuratelywhatisbeingboughtandsoldand,

baring unusual and unforeseen circumstances, the parties commit to

completingthetransactioninareasonableperiodoftimeconsistentwiththe

termsoftheLOI.

LETTER OF INTENT

TheLOIdocumentsthebusinesstermsthathavebeenagreedto,describesthe

transaction, states the purchase price and compensation structure, and cites

other key terms and conditions, such as confidentiality provisions, continuing

to operate the company in much the same manner as it has been, and the

sellermakingavailableallinformationnecessaryforthebuyertocompletedue

diligence.An important provision ofthe LOI is grantinga period of exclusivity

duringwhichtimetheselleragreestodiscontinuenegotiationsandnotenter

into any agreement with another party. It is imperative at this point in the

process to have available quantitative and qualitative analyses to equip

shareholderstomakeafullyinformeddecisiononwhichbuyerorinvestorto

choose for negotiating the Letter of Intent. It is important to maintain

competitive pressure by keeping other interested parties as stalking horses

toassistinnegotiatingfavorabletermsandconditions

By implementing a wellstructured competitive deal process, it is possible to

movesystematicallyfromthemanytothemostinterestedtotheone.

FoundersInvestmentBanking

2012

Page19

P HASE V:

D UE D ILIGENCE

& C LOSING

DUE DILIGENCE

Throughout the deal process, the seller makes representations and sets

expectations about the nature of the company. Due diligence provides the

buyer the opportunity to verify all that has been communicated, clarify any

pointsofconfusion,andvalidatethattheoperationsofthecompanyareinline

withwhatthebuyerisexpecting.Duediligenceevaluatesboththebenefitsand

therisksoftheacquisitionorinvestmentbyexaminingthepast,present,and

predictablefuture.SellersshouldstartpreparingforduediligenceinPhaseI.

Duediligencetypicallycoversfourbroadareas:

1.

2.

3.

4.

FinancialStatementsreview:examinestheassetsandliabilitiesonthe

balancesheetbyverifyingtheirexistenceandcurrentvalue;assesses

the income statement to appraise the general health and soundness

ofthecompanysoperations.

Management and Operations review: evaluates the companys

practices, procedures, and controls; assesses key staff members

critical to ongoing success; analyzes revenue streams, customer

concentration, and health of customer relationships; analyzes

products,services,andkeytechnologiesandmethods;reviewsquality

andstabilityofkeysuppliers.

Legal,HumanResources,andRegulatory&EnvironmentalCompliance

review: examines pending or potential litigation or other legal

problems; identifies current or potential human resources issues;

verifiescompanyisincompliancewithregulatoryandenvironmental

lawsandregulations.

Transaction review: verifies all documentation associated with the

transactionisinorder.

The scope of due diligence varies depending on the size and scale of the

company. Experienced buyers will agree to complete due diligence within a

specifiedtimeperiodandwillprovidethesellerwithachecklistofitemsthey

want to review. Many of these items are standard requests and can be

FoundersInvestmentBanking

2012

Page20

preparedinadvancetoexpeditecompletingtheduediligencestep.Examples

oftheseitemsinclude:

Documents

o

o

o

o

o

o

Companymanagement

o

o

o

Relativeprofitabilityofproductsandservices

Ownershipofcompany

Governanceinformation

o Litigation

Contracts

o

o

o

o

o

o

o

o

o

o

o

o

o

Corporatedocuments

Certificateofincorporation

Bylaws

Minutes

Financialstatements

Taxreturns

Assets

Receivables

Pension

ESOP

Environmentalreports

Marketstudies

Productdescriptionsandplans

Keyintangibles

Keytangibles

Mortgages

Titledocuments

Insurancepolicies

Supplyandsalesagreements

Employmentandconsultingagreements

Leases

Licenseandfranchiseagreements

Loanagreements

Shareholderagreements

Sponsorshipagreements

Laboragreements

Goldenparachutes

Deferredcompensation

Poisonpills

Securityagreements

Salesandproductwarranties

Outsidesources

o

o

o

o

o

o

Marketandcapitalinformation

Liensearch

Creditchecks

Backgroundchecks

Patentandtrademarksearches

Assetappraisals

These documents are typically stored in a virtual data room, which

facilitates 24/7 access and reduces the amount of work that has to be

performedatthecompanyslocation.

FoundersInvestmentBanking

2012

Page21

FINALIZE DEAL

STRUCTURE

Any remaining adjustments to structuring the deal are finalized at this point.

Common adjustments include balances for working capital, receivables,

payables, and other current assets and liabilities. Resolving any material

findings or surprises emerging out of due diligence may also affect the

structureofthedeal.

DEFINITIVE

PURCHASE

AGREEMENT

EXECUTE

AGREEMENT

DISBURSE FUNDS

The Definitive Purchase Agreement is the binding legal contract specifying all

terms and conditions of the transaction. All the elements in the LOI are

incorporated as well as the legal clauses and provisions attorneys from both

sidesbelievearenecessaryforthedeal.

The deal is not complete until both parties execute the Definitive Purchase

Agreement. All hands remain on deck until financing is secure and the

DefinitivePurchaseAgreementissigned.

The best part of the process is disbursing the proceeds from the transaction

accordingtothetermsoftheDefinitivePurchaseAgreement.Proceedsfrom

thesaleofmiddlemarketcompaniestypicallyareintheseventoninefigures.

Prudentownersprepareforthisdaywellinadvancebyworkingwithamulti

disciplinary team of wealth management advisors consisting of certified

financial planners, trust and estate attorneys, tax attorneys and accountants,

chartered financial analysts and portfolio managers, and insurance and

philanthropicspecialists.Planningforandaddressingyourpersonalobjectives

areofequalimportancetoplanningandaddressingyourcorporateobjectives.

Somesituationsaremorecomplexthanothersareandnotwocasesarealike.

Succession planning in particular requires careful forethought, consideration,

and coordination. Managing this level of wealth requires both customizing a

plantoyourspecificsituationandformingateamoftrustedadvisorswhowill

continuously place your interests ahead of theirs when the time comes for

implementingtheplanandmanagingyourwellearnedwealthfortheyearsto

come.

Thedealisnotcomplete,however,untiltheinkisdryandthemoneyisinthe

bank.Followingthroughtothecloseisessential.

FoundersInvestmentBanking

2012

Page22

T HE S TEPS O F

A C OMPETITIVE

D EAL P ROCESS

It takes a lot of work, energy, and skill to plan and execute a successful

transaction.Itisfairtoaskifallthesestepsarenecessary.Butwhichofthese

can youafford to skip? Unlocking the economic value ofyour company while

ensuringasmoothandorderlytransitiontoaqualifiedbuyerorinvestorthat

youselectbasedonbothyourcorporateandpersonalpreferencesisanevent

fewpeopleearntheprivilegetoperform.Givenallthatisatstake,followinga

proven methodology managed by a team of experienced advisors who

specializeinmiddlemarketcompaniesmakesalotofsense.

Workingwiththerightteamofadvisorsisthebestapproachtoaccomplishing

the twin objectives of obtaining a premium price with a high probability of

gettingadealdone.

FoundersInvestmentBanking

2012

Page23

A BOUT

F OUNDERS

I NVESTMENT

B ANKING

Founders Investment Banking is an independent investment banking firm,

headquartered in Birmingham, Alabama, that is committed to providing

customized corporate finance solutions for our clients. Our comprehensive

range of complementary, valueadded services include merger & acquisition,

capital market, strategic financial, and real estate investment advisory. We

continue to build our reputation by delivering creative and sophisticated

solutions, providing a superior level of customer service and personal

attention, producing a track record of successful results, and conducting

ourselves every day with the highest degree of personal and professional

integrity.

At our core, our professionals are dedicated to connecting our clients to the

broader capital markets, both domestically and internationally, to accomplish

theirpersonalandstrategicobjectives,withanemphasison:

o

o

o

AchievingGrowth

BuildingValue

RealizingLiquidity

TolearnmoreaboutFoundersordiscusswayswemightbeofservice,please

contact:

DuaneDonnerat2059492043(ddonner@foundersib.com)

GeorgeMyersat2058217437(gmyers@foundersib.com)

ZaneTarenceat2055034013(ztarence@foundersib.com)

orvisitourwebsiteatwww.FoundersIB.com.

FoundersInvestmentBanking,LLC

LakeshoreParkPlaza

2204LakeshoreDrive,Suite425

Birmingham,Alabama35209

205.949.2043(office)

205.871.0010(fax)

www.FoundersIB.com

FoundersInvestmentBanking

2012

Page24

Вам также может понравиться

- Private Equity Unchained: Strategy Insights for the Institutional InvestorОт EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorОценок пока нет

- LBO ModellingДокумент22 страницыLBO ModellingRoshan PriyadarshiОценок пока нет

- LBO PowerpointДокумент36 страницLBO Powerpointfalarkys100% (1)

- The M&A Deal CycleДокумент17 страницThe M&A Deal Cycledarkmagician3839151Оценок пока нет

- How We Work Across Business PlaybookДокумент10 страницHow We Work Across Business PlaybookRavi Chaurasia100% (3)

- Ubs Investment Banking PitchbookДокумент19 страницUbs Investment Banking PitchbookTeresa Carter100% (1)

- Credit Swiss Pitch BookДокумент39 страницCredit Swiss Pitch BookAmit Soni100% (5)

- Morgan Stanley - Real Estate Pitch BookДокумент7 страницMorgan Stanley - Real Estate Pitch Booknandita_nandy100% (7)

- 2015 UBS IB Challenge Corporate Finance OverviewДокумент23 страницы2015 UBS IB Challenge Corporate Finance Overviewkevin100% (1)

- Bear Stearns NortelДокумент79 страницBear Stearns NortelTeresa Carter100% (1)

- Acquisition Leveraged Finance (한성원)Документ18 страницAcquisition Leveraged Finance (한성원)Claire Jingyi Li100% (5)

- WSO Resume - DemolishedДокумент1 страницаWSO Resume - DemolishedJack JacintoОценок пока нет

- Technical Interview Questions - IB and S&TДокумент5 страницTechnical Interview Questions - IB and S&TJack JacintoОценок пока нет

- UBS M&A PitchbookДокумент19 страницUBS M&A Pitchbookspuiszis100% (2)

- JPMorgan M&a BibleДокумент146 страницJPMorgan M&a Biblewallstreetprep100% (21)

- AAPL Buyside Pitchbook.Документ22 страницыAAPL Buyside Pitchbook.kn0q00100% (2)

- Paper LBO Model Example - Street of WallsДокумент6 страницPaper LBO Model Example - Street of WallsAndrewОценок пока нет

- Jonathan P Gertler MD Managing Director Head, Biopharma Investment BankingДокумент20 страницJonathan P Gertler MD Managing Director Head, Biopharma Investment BankingSotiri Fox0% (1)

- Discussion Materials, Dated May 20, 2010, of Goldman SachsДокумент29 страницDiscussion Materials, Dated May 20, 2010, of Goldman Sachsmayorlad100% (1)

- Introduction To Global Investment Banking - Merrill LynchДокумент28 страницIntroduction To Global Investment Banking - Merrill LynchAlexander Junior Huayana Espinoza100% (2)

- Work Sample - M&A Pitch - SKM Acquisition of Sprint (Pitch To SKM)Документ7 страницWork Sample - M&A Pitch - SKM Acquisition of Sprint (Pitch To SKM)sunnybrsrao0% (1)

- LBO Analysis - CompletedДокумент11 страницLBO Analysis - CompletedCuong NguyenОценок пока нет

- GSL Investment Memo and ModelДокумент12 страницGSL Investment Memo and ModelMarcos CostantiniОценок пока нет

- Ubs I Banking GuideДокумент47 страницUbs I Banking GuideMukund SinghОценок пока нет

- LBO Valuation Model PDFДокумент101 страницаLBO Valuation Model PDFAbhishek Singh100% (3)

- Goldman Sachs Sample Pitch BookДокумент3 страницыGoldman Sachs Sample Pitch BookJesse0% (2)

- M&A Pitch Deck ExampleДокумент18 страницM&A Pitch Deck ExampleMark Elakawi100% (1)

- David Wessels - Corporate Strategy and ValuationДокумент26 страницDavid Wessels - Corporate Strategy and Valuationesjacobsen100% (1)

- 1 PE and LBO A MUST Read ChicagoLBO-SyllabusAAДокумент16 страниц1 PE and LBO A MUST Read ChicagoLBO-SyllabusAAGeorge Triantis100% (1)

- The Tesla Acquisition - PitchbookДокумент18 страницThe Tesla Acquisition - PitchbookArchit Lohokare100% (1)

- Private Equity Case Studies in 3017 WordsДокумент7 страницPrivate Equity Case Studies in 3017 Wordsmayor78100% (1)

- Modelling in Excel: Leveraged Buyout Model + M&A Model (Accretion/ Dilution)Документ62 страницыModelling in Excel: Leveraged Buyout Model + M&A Model (Accretion/ Dilution)Tapas Sam100% (1)

- Investment Banking Interview Questions and Overview 2Документ9 страницInvestment Banking Interview Questions and Overview 2Rohan SaxenaОценок пока нет

- LBO In-Depth AnalysisДокумент12 страницLBO In-Depth Analysisricoman19890% (1)

- Technical Interview Questions - MenakaДокумент15 страницTechnical Interview Questions - Menakajohnathan_alexande_1Оценок пока нет

- Citigroup LBOДокумент32 страницыCitigroup LBOLindsey Santos88% (8)

- KKR Transaction PresentationДокумент41 страницаKKR Transaction PresentationKofikoduah96% (23)

- Alex Navab - Overview of Private EquityДокумент21 страницаAlex Navab - Overview of Private EquityAlyson Davis100% (16)

- 2017 UBS Investment Banking Challenge Heat Round Case StudyДокумент31 страница2017 UBS Investment Banking Challenge Heat Round Case StudyFay ManaziОценок пока нет

- DBLBOДокумент7 страницDBLBOc17r15100% (2)

- WMF Buyout KKR Hec PDFДокумент116 страницWMF Buyout KKR Hec PDFsukses100% (1)

- Term Sheet Private Equity Cross BorderДокумент9 страницTerm Sheet Private Equity Cross BorderJoão EirinhaОценок пока нет

- How Synergies Drive Successful AcquisitionsДокумент24 страницыHow Synergies Drive Successful AcquisitionsClaudiu OprescuОценок пока нет

- WSO Private Equity Prep Package PDFДокумент242 страницыWSO Private Equity Prep Package PDFBill Lee100% (2)

- Lehman Internal Memo On IBEX CapitalДокумент29 страницLehman Internal Memo On IBEX CapitalDealBook100% (2)

- Equity Research HANDBOOKДокумент29 страницEquity Research HANDBOOKbolsaovejuna100% (8)

- Analyst TrainingДокумент162 страницыAnalyst Traininggreenbanana100% (8)

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsОт EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsОценок пока нет

- The Private Equity Edge: How Private Equity Players and the World's Top Companies Build Value and WealthОт EverandThe Private Equity Edge: How Private Equity Players and the World's Top Companies Build Value and WealthОценок пока нет

- Private Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingОт EverandPrivate Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingОценок пока нет

- Beyond the Deal: A Revolutionary Framework for Successful Mergers & Acquisitions That Achieve Breakthrough Performance GainsОт EverandBeyond the Deal: A Revolutionary Framework for Successful Mergers & Acquisitions That Achieve Breakthrough Performance GainsОценок пока нет

- Private Equity Strategy A Complete Guide - 2020 EditionОт EverandPrivate Equity Strategy A Complete Guide - 2020 EditionРейтинг: 5 из 5 звезд5/5 (1)

- Venture Capital and Private Equity Contracting: An International PerspectiveОт EverandVenture Capital and Private Equity Contracting: An International PerspectiveРейтинг: 2.5 из 5 звезд2.5/5 (3)

- Private Equity Value Creation Analysis: Volume I: Theory: A Technical Handbook for the Analysis of Private Companies and PortfoliosОт EverandPrivate Equity Value Creation Analysis: Volume I: Theory: A Technical Handbook for the Analysis of Private Companies and PortfoliosОценок пока нет

- Assertiveness FinlandДокумент2 страницыAssertiveness FinlandDivyanshi ThakurОценок пока нет

- Tropical Design Reviewer (With Answers)Документ2 страницыTropical Design Reviewer (With Answers)Sheena Lou Sangalang100% (4)

- Ebook Essential Surgery Problems Diagnosis and Management 6E Feb 19 2020 - 0702076317 - Elsevier PDF Full Chapter PDFДокумент68 страницEbook Essential Surgery Problems Diagnosis and Management 6E Feb 19 2020 - 0702076317 - Elsevier PDF Full Chapter PDFmargarita.britt326100% (22)

- FAR09 Biological Assets - With AnswerДокумент9 страницFAR09 Biological Assets - With AnswerAJ Cresmundo50% (4)

- PT3 Liste PDFДокумент2 страницыPT3 Liste PDFSiti KamalОценок пока нет

- Crochet World October 2011Документ68 страницCrochet World October 2011Lydia Lakatos100% (15)

- Presbuteroi (Elders) and Episkopoi (Overseers) and Are Described in 1 Tim 3 and TitusДокумент15 страницPresbuteroi (Elders) and Episkopoi (Overseers) and Are Described in 1 Tim 3 and TitusNimaro Brenda100% (1)

- MigrationДокумент6 страницMigrationMaria Isabel PerezHernandezОценок пока нет

- Roger Dean Kiser Butterflies)Документ4 страницыRoger Dean Kiser Butterflies)joitangОценок пока нет

- AN6001-G16 Optical Line Terminal Equipment Product Overview Version AДокумент74 страницыAN6001-G16 Optical Line Terminal Equipment Product Overview Version AAdriano CostaОценок пока нет

- RMC No. 23-2007-Government Payments WithholdingДокумент7 страницRMC No. 23-2007-Government Payments WithholdingWizardche_13Оценок пока нет

- 08-20-2013 EditionДокумент32 страницы08-20-2013 EditionSan Mateo Daily JournalОценок пока нет

- OatДокумент46 страницOatHari BabuОценок пока нет

- John Wick 4 HD Free r6hjДокумент16 страницJohn Wick 4 HD Free r6hjafdal mahendraОценок пока нет

- Coaching Manual RTC 8Документ1 страницаCoaching Manual RTC 8You fitОценок пока нет

- Bhaja Govindham LyricsДокумент9 страницBhaja Govindham LyricssydnaxОценок пока нет

- Promises From The BibleДокумент16 страницPromises From The BiblePaul Barksdale100% (1)

- English Solution2 - Class 10 EnglishДокумент34 страницыEnglish Solution2 - Class 10 EnglishTaqi ShahОценок пока нет

- Anthem Harrison Bargeron EssayДокумент3 страницыAnthem Harrison Bargeron Essayapi-242741408Оценок пока нет

- Federal Ombudsman of Pakistan Complaints Resolution Mechanism For Overseas PakistanisДокумент41 страницаFederal Ombudsman of Pakistan Complaints Resolution Mechanism For Overseas PakistanisWaseem KhanОценок пока нет

- 008 Supply and Delivery of Grocery ItemsДокумент6 страниц008 Supply and Delivery of Grocery Itemsaldrin pabilonaОценок пока нет

- Ingrid Gross ResumeДокумент3 страницыIngrid Gross Resumeapi-438486704Оценок пока нет

- Profix SS: Product InformationДокумент4 страницыProfix SS: Product InformationRiyanОценок пока нет

- Lozada Vs MendozaДокумент4 страницыLozada Vs MendozaHarold EstacioОценок пока нет

- Proyecto San Cristrobal C-479 Iom Manual StatusДокумент18 страницProyecto San Cristrobal C-479 Iom Manual StatusAllen Marcelo Ballesteros LópezОценок пока нет

- Persian NamesДокумент27 страницPersian NamescekrikОценок пока нет

- Chapter 12 Financial Management and Financial Objectives: Answer 1Документ9 страницChapter 12 Financial Management and Financial Objectives: Answer 1PmОценок пока нет

- Correlation SecretДокумент23 страницыCorrelation SecretDavid100% (1)

- 3RD Last RPHДокумент5 страниц3RD Last RPHAdil Mohamad KadriОценок пока нет

- 11-03-25 PRESS RELEASE: The Riddle of Citizens United V Federal Election Commission... The Missing February 22, 2010 Judgment...Документ2 страницы11-03-25 PRESS RELEASE: The Riddle of Citizens United V Federal Election Commission... The Missing February 22, 2010 Judgment...Human Rights Alert - NGO (RA)Оценок пока нет